Abstract

We examine the relationship between the risk premium markets demand to hold the Treasury Bonds of a given country and the sustainability of the public finances of the country. We inquire to what extent do markets use the dynamic evolution of the public-debt-to-gdp ratio as an indication of the likelihood of a public debt default. Specifically, our empirical research design involves the following steps: (i) we use the dynamic equation of the public-debt-to-gdp ratio to build forecasts of future values of this ratio in the eurozone countries; (ii) we then use these forecasts in a regression to see how important they are to explain the risk premium implicit in the treasury bond yields. We find that projections of future values of the public-debt-to-gdp ratio do impact current 10 year bond spreads. According to our regressions, markets seem to give more weight to forecasts with a horizon smaller than 10 years. Our results suggest that agents use a relatively simple mechanism to forecast the public debt-to-gdp ratio, a mechanism which can be used while updated forecasts from international organizations are not yet available. On the other hand, according to our estimations, euro area sovereign debt markets ceased to significantly discriminate countries based on their public debt prospects after the 2012 ‘Whatever It Takes” speech and the announcement of the Outright Monetary Transactions (OMT) program—suggesting that these events had a significant calming effect on the markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

If markets are forward looking—like we presume they are—when making judgements about the sustainability of the public finances of a given country they should consider not only the current public-debt-to-gdp ratio but also where this ratio is heading to (Is it growing? Is it steady? Is it falling? How quickly is it moving?). In this paper, we use the dynamic equation of the public-debt-to-gdp ratio to build a database with projections of future values of this ratio in euro area countries. We then estimate a regression to see if these projections can explain the risk premium markets are currently demanding to hold the public debt of the various countries.

The literature has used the public-debt-to-gdp ratio, the government’s budget deficit, real GDP growth and the inflation rate as explanatory variables in regressions that try to explain the risk premium of treasury bonds. Underlying these studies is the fact that the aforementioned four variables are key determinants of the evolution of the public-debt-to-gdp ratio. In the present article, instead of using those four variables as explanatory variables, we use them to make projections of future values of the public-debt-to-gdp ratio—via the dynamic equation—and we then use these projections as explanatory variables in a regression. The specificity of our approach therefore lies in that, before estimating the regression, we use the dynamic equation of the public-debt-to-gdp ratio to explore the precise nonlinear mathematics through which the four variables influence the future values of the ratio.

To perform our projections and estimations, we used annual data for the Euro Area members.

We find that, as expected, projections of future values of the public-debt-to-gdp ratio do impact current 10 year bond spreads, but markets seem to give more weight to forecasts with a horizon smaller than 10 years. These conclusions remain valid after robustness checks. Moreover, our results suggest that agents use a relatively simple mechanism to forecast the public debt-to-GDP ratio, a mechanism which can be used while updated forecasts from international organizations are not yet available. Finally, according with our estimations, euro area sovereign debt markets ceased to significantly discriminate countries based on their public debt prospects after the 2012 ‘Whatever It Takes” Mario Draghi speech and the announcement of the Outright Monetary Transactions (OMT) program—indicating that these events contributed to ease tensions in the market.

The structure of the article is as follows. Section 2 makes a review of the literature. Section 3 presents the methodology and the data. Section 4 shows the results we obtained and then analyses and interprets them. Section 5 concludes.

2 Literature review

The sustainability of a given country’s public finances is constantly being assessed by financial market participants, namely those operating in sovereign debt markets. An increase in the perceived unsustainability of the state of the public finances in the foreseeable future typically leads to an increase in the spreads over alternative safer government debt.

An important assumption supporting this paper’s contribution is related to the fact that higher levels of public debt are associated with a lesser degree of fiscal sustainability. This assumption is confirmed by the extant literature’s evolution on the topic of fiscal sustainability. Although there is no clear and consensual definition of fiscal sustainability, some promising concepts have been introduced in support thereof, namely the concepts of fiscal space and/or debt thresholds (Aizenman et al. 2013; Bi 2012; Fournier and Fall 2017; Ghosh et al. 2013).

These concepts constitute effective instruments to addressing fiscal sustainability, either from a theoretical or from an empirical perspective. For example, Aizenman et al. (2013) focuses on estimating a pricing model of sovereign risk for a large sample of countries using the concept of ‘fiscal space’ (i.e. debt/tax; deficit/tax), and by highlighting the role of future fundamentals (an approach related to our own research design); while Bi (2012) and Ghosh et al. (2013) develop theoretical approaches to address limits to public debt (i.e. the ‘fiscal fatigue’ hypothesis); and Fournier and Fall (2017) empirically investigate the said hypothesis. More importantly, the latter research points to the presence of nonlinearities in this space.

Moreover, it should be pointed that the search for a more efficient set of fiscal indicators has been an ongoing concern in the literature (e.g. Blanchard 1990). More recently, this literature has been taking into consideration the policy implications of high public debt under the Zero-Lower Bound, taking into account the differential in the growth-interest rate nexus (Blanchard 2019).

The literature pinpoints the fact that financial market participants typically break down sovereign risk by assessing several risk sources for government debt. According to Attinasi et al. (2009), the main determinants that impact a given country’s bond spreads are: (i) default risk; (ii) liquidity risk; (iii) the overall degree of international risk aversion.

First, default risk assesses a given debtor’s current and prospective fiscal sustainability prospects, and refers to the probability of debtor non-compliance (partial or total) relative to its obligations. According to Barrios et al. (2009), there is an interplay dynamics among: (a) default risk; (b) the spreads over safer government bonds; and (c) the likelihood of a ratings downgrade by a qualified credit ratings agency. This is clearly linked to the effects of macroeconomic announcements on spreads, as described in Afonso et al. (2011).

Second, liquidity risk is associated with the possibility that certain segments of the bond markets might face temporary liquidity shortages under certain market stress episodes. This is especially relevant in the context of the ”flight-to-safety” dynamics where investors discriminate among macroeconomic sustainability profiles. Notwithstanding, the importance of this determinant is ambivalent. For example, Beber et al. (2009) observe that during episodes of bond market distress leading to financial crashes/crisis, liquidity becomes increasingly important for bond pricing, as investors seek a ”safe haven”. On the opposite side, Favero et al. (2010) find that liquidity risk is not relevant by itself—although it might become statistically significant when addressed in conjunction with other determinants. On the other hand, Manganelli and Wolswijk (2009) find a link between liquidity premiums and the incompleteness of the euro area financial integration process in bonds markets. Although these bond markets are associated with a high degree of financial integration, the existence of liquidity premiums reveals that they are not fully integrated.

Third, the overall degree of international risk aversion is a major determinant, prompting investors to seek bonds from countries presenting the most sustainable fiscal profiles (e.g. Germany) in times of financial distress, thus impacting both supply and demand in the bond markets. Codogno et al. (2003) study the determinants of bond yield differentials in the euro area public debt markets. They provide insightful evidence which critically highlights the role of macroeconomic fundamentals and liquidity metrics on yield differentials. This constitutes an important contribution to the literature insofar as the credit and liquidity risk determinants are clearly impacted by exogenous international risk factors that ultimately lead to yield discrimination among the public debts of euro area economies. Furthermore, Sgherri and Zoli (2009) identify and estimate a time-varying common factor (over German Bunds) in the sovereign debt markets of the Euro Area. This common factor accounts for shifts in the risk appetite of bond investors. The time-varying common risk aversion factor is closely associated with the evolution of macroeconomic expectations. For their part, Barrios et al. (2009) observe that the subprime crisis and the euro area debt crisis have led to a global repricing of risk, strongly impacting sovereign spreads through increased international risk aversion. According to Barrios et al. (2009) international risk aversion reflects both global and country-specific factors. Besides, Bernoth and Erdogan (2012) examine the impact of fiscal policy-related variables and investors’ international risk aversion on sovereign bond yield spreads. They find that this link is not constant over time, again confirming the importance of incorporating time-varying coefficients in the models.

Default risk is related to the degree of indebtedness of the respective country, usually measured by the ratio (public debt / nominal GDP). So, the risk premium of treasury bonds should depend on this ratio and on the determinants of its evolution over time (government budget deficit; real GDP growth; inflation rate). Accordingly, the literature usually tries to explain the risk premium of treasury bonds using as explanatory variables the public-debt-to-gdp ratio and the government’s budget deficit ratio (e.g. Aβmann and Boysen-Hogrefe 2012; Afonso and Rault 2011; Aizenman et al. 2013; Baldacci and Kumar 2010; Caggiano and Greco 2012; Costantini et al. 2014; Stamatopoulos et al. 2017), real GDP growth (e.g. Caggiano and Greco 2012; Giordano et al. 2012; Poghosyan 2014; Rafiq 2015), and the inflation rate (e.g. Costantini et al. 2014; Poghosyan 2014; Stamatopoulos et al. 2017). We next summarize the main results obtained by the literature, looking first at the macroeconomic variables involved—real GDP growth and inflation rate—and then at the fiscal policy dimension.

Where macroeconomic performance is concerned, Poghosyan (2014) observes that there is a link between potential output growth and real bond spreads. Specifically, this author underlines the role of potential output growth as a long run determinant of real long-term treasury bond spreads in 22 advanced economies. Where actual economic growth is concerned, the empirical evidence sustaining a link between actual growth and bond spreads is rather mixed (Giordano et al. 2012). That is, the link between actual economic growth and bond spreads is not entirely conclusive. However, growth forecast expectations do constitute a potential sound determinant for sustainability assessment. This is confirmed by Rafiq (2015), who observes that future growth policies structurally influence long-term borrowing costs and bond yields. In the same vein, Caggiano and Greco (2012) conclude that, for the twelve original euro area countries, higher expected GDP growth in the next 3 to 5 years reduces interest rate spreads.

Another element of macroeconomic performance that might influence bond spreads is the inflation rate. Intuitively, higher inflation means faster nominal GDP growth and this acts to reduce the ratio (public debt /nominal GDP). Poghosyan (2014) finds that changes in inflation only have a short run impact on real long-term interest rates, due to the financial market participant’s difficulty in disentangling transitory from permanent inflationary shocks. Stamatopoulos et al. (2017) conclude that inflation does not impact sovereign debt spreads in the euro area. Costantini et al. (2014) stress the role of cumulative inflation differentials as indicators of competitiveness gaps, concluding that in the long-run they contribute to widen interest rate spreads.

Concerning fiscal performance, Baldacci and Kumar (2010) find that expressive fiscal deficits and public debts exert significant upward pressure on the sovereign bond spreads of advanced economies, especially over the medium term (sizeable increases in long-term interest rate spreads). In the same line, Afonso and Rault (2011) find that better government budget balances essentially reduce real sovereign bond spreads, while higher sovereign indebtedness increases spreads. In addition, these authors find that deteriorating current account balances increase sovereign spreads. Caggiano and Greco (2012) also conclude for the relevance of the government debt-to-gdp ratio in explaining the respective country’s interest rate spread, and add the relevance of the cyclically-adjusted budget deficit—with the impact of both variables becoming more relevant after the onset of the financial crisis. Aβmann and Boysen-Hogrefe (2012) use forecasts produced by the European Commission to study the time-varying impact of the determinants of government bond returns over Germany. They conclude that forecasts of the debt-to-gdp ratio are the most important variable over the period 2001-2010, with its relevance increasing considerably after October 2009. The forecast of the budget-balance-to-gdp ratio is insignificant between 2003 and 2009, regaining explanatory power from early 2009 onwards. Costantini et al. (2014) also use the forecasts of the European Commission and focus on the role of forecasts of the government deficit-to-gdp and debt-to-gdp ratios in explaining bond yield spreads relative to Germany. Both variables are relevant in the euro area, but the debt ratio is the most important as it corresponds to an accumulation of debt over time. Aizenman et al. (2013) take a slightly different approach. They normalize the fiscal variables using the tax base [i.e., they use the ratios (public debt/tax base) and (public deficit/ tax base)]. They conclude that in the south-west European periphery the two variables are relevant for explaining sovereign risk as measured by CDS spreads. Stamatopoulos et al. (2017) study the same two variables in 16 euro area countries but conclude that only the debt-to-tax-base ratio has a significant nonlinear role in explaining sovereign spreads.

It is important to understand the relationship between risk premia and government indebtedness because higher risk premia are probably one of the channels through which more government indebtedness negatively impacts economic growth (Reinhart and Rogoff 2010; Gómez-Puig and Sosvilla-Rivero 2017).

The macroeconomic and fiscal information that is relevant for public finance sustainability is examined by financial market participants both directly and indirectly (indirectly through the ratings assigned by credit rating agencies that summarize their overall assessment). In this respect, Afonso et al. (2011) conduct an event study for the 1995-2010 period which points to: (i) a statistically significant response of bond spreads to changes associated with credit rating announcements, especially for negative announcements; (ii) significant evidence of bidirectional causality between sovereign ratings and spreads; and (iii) significant statistical evidence in support of persistent spillover effects from rating announcements from lower rated countries to higher rated countries. Afonso et al. (2015) fully confirms the strong influence of macro-fundamental variables over bond yield spreads, especially since the onset of the Global Financial Crisis.

The following section addresses the methodology and data adopted by the present article.

3 Methodology and data

We focused our study on euro area countries and used annual data for the period 1999–2020.

Our aim is to see if the risk premium of the treasury bonds of a given euro area country can be explained by forecasts of the future values of the public-debt-to-gdp ratio of the respective country. The idea is to run a regression where:

-

(a)

The variable to be explained is the risk premium;

-

(b)

The main explanatory variable is the forecast of the future public debt ratio.

The underlying idea being that the more indebted the government of a country is, the more likely it is that this government will default in the future (totally or partially). Instead of a total default on its public debt, the government of a country may opt for a partial default. This involves announcing that it will only pay part of the debt and /or delaying the scheduled payments to later dates. The risk premium that markets demand to hold the public debt of a given country should incorporate these different types of default. If, for example, markets only consider the possibility of a partial default, then they will demand a lower risk premium than in the case where they think a total default is possible. In other words, the likelihood (probability) of each scenario should be reflected in the risk premiums demanded by the market participants.

Debt monetization is forbidden in the euro area. Therefore, under normal circumstances, the ECB will not step in to buy government bonds of a country in trouble. Only in periods of huge and widespread stress—such as those we witnessed in recent years—does the ECB intervene in sovereign bond markets (buying public debt securities in secondary markets).

3.1 Forecasts

To obtain forecasts (projections) for the future values of the public-debt-to-gdp ratio, we started from the following well known dynamic equation (for a derivation of this equation, please see Appendix 1):

where:

\(B_{t}=\) public debt in nominal terms at the end of year t

\(Y_{t}=\) GDP in nominal terms in year t

\(i_{t}=\) nominal interest rate of the public debt [nominal interest rate which when applied to the stock of public debt of the end of year \((t-1)\) gives the total amount of interest the government will have to pay during year t].

\(g_{t}=\) growth rate of nominal GDP between year \((t-1)\) and year t.

\(\overline{D}_{t}=\) primary government deficit in nominal terms in year t

Note that, in Eq. (1), \(\frac{B}{Y}\) is the public-debt-to-gdp ratio and \(\frac{\overline{D}}{B}\) is the primary deficit as a percentage of total public debt. Because \(B_{t}\) is a end year value and the primary deficit of year t is also only known at the end of year t , the ratios \(\frac{B}{Y}\) and \(\frac{\overline{D}}{B}\) are end year values.

Using Eq. (1), we can forecast what values the public-debt-to-gdp ratio will likely display in future years. For example, to estimate a value for the ratio within 2 years, we proceed as follows. Equation (1) written 2 years ahead gives:

We next use Eq. (1) again to obtain the ratio \((B_{t+1}/Y_{t+1})\):

Using this last equation to replace \((B_{t+1}/Y_{t+1})\) in Eq. (2), we obtain:

Equation (4) tells us something which makes sense: the future value of the public-debt-to-gdp ratio depends on future government deficits, on future GDP growth and on future interest rates (as well as on the starting value of the ratio).

Note that—according to our notation described above and explained in Appendix 1—\((B_{t}/Y_{t})\) denotes the debt-to-gdp ratio at the end of year t. Likewise, \((B_{t+2}/Y_{t+2})\) denotes the value of the ratio at the end of year \((t+2)\).

Because the ratio \(\frac{B_{t}}{Y_{t}}\) in Eq. (4) is a year-end value and the data for public debt published by EUROSTAT are also year-end values, we find it convenient to assume that the forecast in Eq. (4) is made after the end of year t. Therefore \((B_{t}/Y_{t})\) is known at the time the forecast is being made. So, in order to obtain a forecast for the ratio within 2 years, all we need is to estimate values for \(i_{t+1},i_{t+2},g_{t+1},g_{t+2},\frac{ \overline{D}_{t+1}}{B_{t+1}}\) and \(\frac{\overline{D}_{t+2}}{B_{t+2}}\).

To perform the forecast—using Eq. (4)—in this article we assumed that:

\(i_{t+2}=i_{t+1}=i=\) average value of the interest rate in the current and past 2 years [i.e., a 3 year average using the values of \(i_{t},i_{t-1}\) and \(i_{t-2}\)]

\(g_{t+2}=g_{t+1}=g=\) average value of the growth rate of nominal GDP in the current and past 2 years [i.e., a 3 year average using the values of \(g_{t},g_{t-1}\) and \(g_{t-2}\)]

and

\(\frac{\overline{D}_{t+2}}{B_{t+2}}=\frac{\overline{D}_{t+1}}{ B_{t+1}}=\frac{\overline{D}}{B}=\) average value of the primary deficit as a percentage of public debt in the current and past 2 years [i.e., a 3 year average using the values of \(\frac{\overline{D}_{t}}{B_{t}}\), \(\frac{ \overline{D}_{t-1}}{B_{t-1}}\) and \(\frac{\overline{D}_{t-2}}{B_{t-2}}\) ]

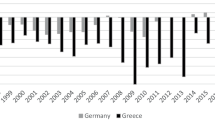

Figure 1 shows the values used to compute these averages.

Note that, for some types of variables, using their average past value is one possible way of trying to predict their future values. The variables which concern us here clearly belong to the group of variables which can be predicted in this wayFootnote 1.

With the three assumptions above, Eq. (4) becomes:

which is the forecast for the ratio within 2 years that we are looking for. This equation tells us that the forecast for the value of the ratio (B/Y) at the end of year \((t+2)\) is the value of the ratio at the end of year t multiplied by \(\left( \frac{1+i}{1+g-\frac{\overline{D}}{B}}\right) ^{2}\). Figure 2 illustrates this forecast.

Using similar derivations, we can obtain forecasts for any future year. For example, the forecast for the ratio at the end of year \((t+8)\) would be:

where \((B_{t}/Y_{t})\) is the value of the ratio at the end of year t.

So, in general, a forecast for the ratio at the end of year \((t+N)\) is given by:

where \((B_{t}/Y_{t})\) is the value of the ratio at the end of year t.

Taking into account the definitions of i, g and \(\frac{\overline{D}}{B}\) given above, Eq. (6) can be rewritten as:

where \((B_{t}/Y_{t})\) is the value of the ratio at the end of year t, N is the forecast horizon and \(i_{t}\), \(g_{t}\) and \(\frac{\overline{D}_{t}}{B_{t}}\) are as defined above.

To use Eq. (7) with the aim of obtaining forecasts, we need data for the variables on the right-hand side of the equation. We next explain how we obtained these data. The nominal interest rate for each year was computed dividing total interest payments made by the government during that year by total public debt at the beginning of the same year (end of the previous year), using EUROSTAT dataFootnote 2. The growth rate of nominal GDP in each year was also taken from the EUROSTAT database.Footnote 3 The primary deficit as a percentage of public debt was likewise retrieved from the EUROSTAT (year-end value).Footnote 4 As can be seen in Eq. (7), for each of these variables—nominal interest rate, nominal GDP growth and primary deficit ratio—we computed a 3 year average using the current year reading and the past 2 years values. Finally, the public-debt-to-gdp ratio used on the right-hand side of equation (7) was the year-end value extracted from the EUROSTAT.Footnote 5

Now, an important statistical detail. EUROSTAT data relative to year t are only published on October the 1st of year \((t+1)\). There is a flash estimate on April the 1st of year \((t+1)\) but the final (definitive) value only comes out on October the 1st of year \((t+1)\). This means that some of the variables in the right-hand side of equation (7)—specifically, \(i_{t}\), \(g_{t}\) and the ratios \(\frac{\overline{D}_{t}}{B_{t}}\) and \(\frac{B_{t}}{Y_{t}}\)—are only published on October the 1st of year \((t+1)\). As a consequence, only starting in October of year \((t+1)\) can markets use Eq. (7) to forecast the debt-to-gdp ratio for the end of year \((t+N)\).

3.2 Risk premium

The risk premium for each euro area country—i.e., the dependent variable in our estimation—was obtained by computing the spread between the country’s 10-year treasury bond yield and the yield of 10-year German treasury bonds. The yields we used were taken from the EUROSTAT.Footnote 6

According to the grades awarded by ratings agencies, Germany has very sound public finances and, as a consequence, the bonds issued by the German government involve a very low risk of default. In the context of the euro area, Germany is among the best in terms of ratings grades. And among the big economies of the euro area, Germany is the best in terms of ratings record. Therefore, it is common in the literature—and also among financial market participants—to compute the interest rate spread of each euro area country relative to Germany. We also adopt this approach.

Our final goal is to see if forecasts of the future debt-to-gdp ratio do influence the current risk premium of treasury bonds. Now, as explained in the previous sub-section, EUROSTAT data relative to year t are only published on October the 1st of year \((t+1)\)—implying that only from October the 1st of year \((t+1)\) can markets use Eq. (7) to compute the forecast of the debt-to-gdp ratio for the end of year \((t+N)\). Therefore, what makes sense is to test if this forecast for the end of year \((t+N)\) influences the spread after October the 1st of year \((t+1)\). In our work, we used the average spread of the last quarter of year \((t+1)\). We may summarize as follows: since the spread is a market variable and we are trying to see if it depends on the forecast of the public-debt-to-gdp ratio, we need to make sure that the spread is computed at a date when the information needed to make the forecast is already available to market participants. Figure 3 illustrates this idea.

By using the average spread of the last quarter of each year, we smooth out possible daily outliers thus giving us confidence that we are accurately measuring the market’s perception of risk. Another reason to be confident that our spreads appropriately describe risk is that, since its inception in 1999, the euro area has always been characterized by the free flow of financial capital. So, whenever irrational behaviour arises, it is quickly corrected. If, for example, the T-bonds interest rate of a certain country happened to be too high given the country’s sovereign risk profile, flows of capital towards this country would make the price of its bonds rise and the respective yields fall (Barrios et al. 2009; Arghyrou and Kontonikas 2012).

3.3 Regression equation

As explained in the previous sub-section, we will in practice test if the average spread of the last quarter of year \((t+1)\) is influenced by the forecast of the debt-to-gdp ratio for the end of year \((t+N)\). Because the spread is computed relative to Germany, we will use as explanatory variable the forecast of the debt ratio of each country minus the forecast of the debt ratio for Germany. Specifically, our variable to be explained will be:

And the main explanatory variable will be:

where:

\(FORECAST_{t|t+N,i}\) = forecast for the value of the public-debt-to-gdp ratio of country i at the end of year \((t+N)\), based on data relative to the end of year t but which are only published on October the 1st of year \((t+1)\)

\(FORECAST_{t|t+N,G}\) = forecast for the value of the public-debt-to-gdp ratio of Germany at the end of year \((t+N)\), based on data published on October the 1st of year \((t+1)\).

We have seen in Sect. 3.1 that the forecasts are given by Eq. ( 7). So, for each country the forecast is computed as:

where:

\(i_{t}=\frac{\text {interest payments made by the government during year }t}{ \text {total public debt at the end of year }(t-1)}\)

\(g_{t}\)= growth rate of nominal GDP between year \((t-1)\) and year t

\(\frac{\overline{D}_{t}}{B_{t}}=\) primary deficit as a percentage of public debt at the end of year t

N = forecast horizon

\(\frac{B_{t}}{Y_{t}}\)= public-debt-to-gdp ratio at the end of year t

Given that the euro area started at the beginning of 1999 and that we need 3 years to compute the averages in the right-hand side of this last equation, we could only make projections starting at the end of 2001 (= beginning of 2002). On the other hand, we use interest rate spreads up to the last quarter of 2020. The 2020’s spread reflects the markets’ view of the future trend of the debt-to-gdp ratio at the last quarter of 2020 and, as explained above, with our data this means it reflects forecasts made with data published on the 1st of October of 2020 but relative to the end of 2019. Therefore, we have a total of 19 forecasts of the public-debt-to-gdp ratio for each country (from 2001 to 2019).

We are going to conclude below that it is better to use the change in the public debt ratio, implying a reduction to 18 forecasts of that ratio. In total, for the founding countries of the euro area we have \(18x10=\) 180 observations (Germany does not count because the spreads are relative to Germany). As Greece only joined the euro area in 2001, we only have projections for the change in the debt ratio since 2004, implying a total of 16 observations. The countries joining the euro area after Greece yield a total of 41 observations for the public-debt-to-gdp ratio. Estonia was excluded because it has only one observation for the interest rate spread, the year 2020. Eight observations are lost due to missing values of Net International Investment Position (NIIP) for Belgium, the Netherlands and Ireland at the beginning of the sample. We end up with a total of 229 observations.

We ran regressions for different values of N (with \(N\le 10\)). The rationale for doing this is as follows. The spread we are trying to explain—our dependent variable—is the spread of 10-year bonds (i.e., bonds which still have 10 years until maturity). Now, the investor who buys these bonds can hold them until maturity or sell them before maturity. In the first case, the investor should be concerned about the likelihood of default during the next 10 years and, as is well known, the most common gauge for the likelihood of default is the public-debt-to-gdp ratio (which implies that the investor should take into account forecasts of the public-debt-to-gdp ratio for every year during the following 10 years). In the second case—i.e., for investors who consider it likely that they will sell before maturityFootnote 7—the anxiety about the possibility of default is more focused on an horizon shorter than 10 years. We conclude that what makes sense is to run several regressions testing as explanatory variables the forecasts for every year during the next 10 years (i.e., forecasts with \(N=1,2,3,...,10\)).

We end this sub-section with one note, to relate our work with the literature. We have seen in the literature review (Sect. 2) that to explain the spreads authors use as explanatory variables the public-debt-to-gdp ratio, the government budget deficit, real GDP growth and the inflation rate. In our regression equation we don’t have the inflation rate explicitly but we have nominal GDP growth, which includes the inflation rate (nominal GDP growth is approximately equal to real GDP growth plus the inflation rate). As mentioned in the Introduction (Sect. 1), the other difference between our work and the literature is that we use the dynamic equation to obtain forecasts of future values of the debt-to-gdp ratio.

4 Empirical findings

In this section, we report the empirical findings and then analyze them. In Sect. 4.1, we present the results obtained without using current information, i.e., assuming, as referred above, that the risk premium of the last quarter of year \((t+1)\) is influenced by the forecast of the public debt ratio based on final definitive data for year t [which are only published on October the 1st of year \((t+1)\)]. In Sect. 4.2, we look at the results with current information (we will explain what we mean by this in Sect. 4.2).

4.1 Results obtained without using current information

We start by estimating a regression where the variable to explain is the spread relative to Germany and the explanatory variable is the forecast of the debt-to-gdp ratio relative to Germany, with the addition of control variables. These variables include one to measure liquidity risk, one to assess the country dependence of external financing, and one more to take into account the impact of ECB quantitative easing policy. The first variable is the size of the government debt market as assessed by the gross issue of long-term bonds (see Attinasi et al. 2009, for example). For this, we use data from the ECB Statistical Data Warehouse. The size of each national market is taken as a proportion of the overall euro area market. It is expected that more liquid markets originate lower interest rate spreads, although the literature does not exclude the opposite effect (Attinasi et al. 2009; Barbosa and Costa 2010).

On the other hand, the net international investment position (NIIP) in percentage of GDP from Eurostat is taken to measure the net financial position towards the rest of the world, which results from the present and past path of the current account, and is deemed as an important variable, insofar as it signals the state of macroeconomic conditions/imbalances of a given country (Barbosa and Costa 2010). A large negative position indicates an imbalance and dependence of external finance, which may increase interest rate spreads. This is in line with Barbosa and Costa (2010) who conclude that weaker international investment positions before the crisis (late 2006) led to higher interest rate spreads latter on. Barrios et al. (2009) using the current account balance also conclude that external imbalances increase the country interest rate spread.

In order to assess the quantitative easing policy, we used the net acquisitions of each country’s public debt by the ECB (in the secondary market) under both the Public Securities Purchase Programme (PSPP), which started in 2015, and the Pandemic Emergence Purchasing Programme (PEPP), which started in 2020 – data from the ECB. The net acquisitions of public debt were divided by total public debt.

So far, the analysis assumed that GDP growth and inflation only relate to interest rate spreads through their impact on the debt-to-gdp projection. However, a direct effect may also exist, because, for instance, a higher GDP growth could be associated with optimism regarding the fiscal outlook. On the other hand, higher inflation may be linked with uncertainty leading to an increase in debt risk premiums. Additionally, some investors may not use the forecast equation and may instead analyze separately the variables of this equation (to obtain a perspective of the trend for the public debt-to-gdp ratio). To test if the direct effects are present, we added real GDP growth and CPI inflation to the control variables list.Footnote 8 All the control variables—and indeed all variables we tried—are expressed relative to Germany.

As a preliminary test, we assess the stationarity of the variables using three panel data unit root tests that assume individual unit root processes: Im, Pesaran and Shin (IPS); ADF and PP. We present results for three hypothesis regarding exogenous variables: none; individual effects; and individual effects and individual linear trends.

The 10 years forecast of public debt is non-stationary for all tests, except for the ADF and IPS with constant and linear trend (Table 5 in the Appendix).Footnote 9 As is common in the literature (e.g. Stamatopoulos et al. 2017), the unit root tests’ results for the two series of ”spreads” and ”debt issues” are not coincident—they depend on the assumption regarding exogenous variables and on the type of test used. The interest rate spread is stationary when individual effects are not present, but it is non-stationary when individual effects or individual effects and individual linear trends are considered. The majority of countries does not show a trend in the spread’s graph, suggesting that stationarity is the most probable conclusion for this series.

Debt issues are stationary when individual effects or individual effects and linear trends are included, but they are non-stationary when no individual effects are taken into account. Because the majority of countries’ graphs does not show a linear trend, non-stationarity seems the most plausible conclusion.

Results are more straightforward for NIIP, with all tests indicating the existence of a unit root in levels and stationarity in first differences. Finally, the tests clearly point to the stationarity of GDP growth, inflation and the quantitative easing variable. Due to the non-stationarity of some variables, notably of public debt forecast, we use the variables in first differences.

The regression equation we use takes the form:

where \( {\mathbf{X}}_{t,i}\) is the vector of control variables, \(TD_{t+1}\) denotes the time dummies, \(\eta _{i}\) the unobserved country fixed effect and \(\epsilon _{t+1,i}\) a random error term. The estimation sample starts in 2003 and finishes in 2020, since we only have changes in debt projections from 2002 (descriptive statistics of the data can be seen in the Appendix, Table 6).Footnote 10

We use time dummies to capture events that in a given year affect all countries, such as shifts in international risk aversion. We also introduce country fixed effects to capture unobserved country characteristics that remain constant over time.

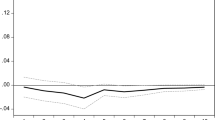

The correlations between the explanatory variables do not indicate multicollinearity, with the highest correlation being between NIIP and inflation (0.40)—Table 7 in Appendix 2. All the explanatory variables have a statistically significant correlation at 5% significance with the spread. The sign of the correlation is the expected for all variables, except for inflation which has a negative correlation, when we expected higher inflation to produce larger risk premiums.

After estimating the equation, we tested for the existence of autocorrelation of order one in the residuals, using the regression of the residuals on its lagged values. A Wald hypothesis test on the coefficient of the lagged residuals indicates absence of autocorrelation (p value of the F statistics = 0.0504).

Next, we tested the cross-section dependence of the residuals using the Pesaran CD test. We chose this test because it corrects the size distortion of the Breusch-Pagan LM and Pesaran scaled LM tests, and has good properties for small N and T. The test indicates no cross-section dependence of the residuals (p value = 0.2921). Therefore, the diagnostic tests do not indicate the need for corrections to the coefficients’ standard errors.

Afterwards, the redundancy of the two-way fixed effects was tested, showing that only period effects are statistically significant (F(17,189) p value = 0.0000). Thus, cross section effects are not statistically significant (F(16,189) p value = 1.0000), as expected in an equation in first differences. Accordingly, only the period effects were considered in the estimations.

Results indicate that the projection of the debt ratio in 10 years time is positively related with the spread but it is not statistically significant (Table 1, column 1). Taking this result into account, it may be reasonable to assume that investors have a forecast horizon smaller than 10 years, as explained above in Sect. 3.3. Accordingly, we tested, one at a time, public debt projections from 1 year to 9 years ahead, and concluded that the forecasts with horizons of 8 and 9 years are not statistically significant, but the forecasts with horizons of 1 to 7 years are statistically significant (Table 1, column 1). The forecast horizon that best fits the data, as indicated by the \(R^{2}\), is the 2-year horizon. The debt ratio of the previous period is also relevantly linked to the spreads, but with a slightly smaller \(R^{2}\) than that of the regression with the 1 year ahead forecast. Regarding debt projections, an increase by 1 p.p. in the public debt ratio differential 2 years ahead is associated with an increase in the spread by 2.0 basis points (b.p.), which is a relatively modest increase, but consistent with the literature. Costantini et al. (2014), using the expected debt-to-gdp ratio projected by the European Commission, find that a one percentage point (p.p.) increase in this ratio leads to a 7.5 b.p. impact on the interest rate spread. According to Baldacci and Kumar (2010), the literature finds an impact of the debt-to-gdp ratio on interest rates which ranges between 2 and 7 b.p.

In terms of control variables, only inflation has a statistically significant correlation with the interest rate spread, and its association is positive as expected (Table 2, column 2).

4.2 Results obtained using current information

So far we have considered that market participants can only compute the forecast of the debt ratio for the end of year \((t+N)\), based on year t data, when EUROSTAT publishes the final year t data values (something which only occurs on October the 1st of year \((t+1)\)). In this case, only the spreads of the last quarter of year \((t+1)\) could be influenced by the debt ratio forecast just mentioned.

Although the final definitive value for each year t variable is only published by EUROSTAT on October the 1st of year \((t+1)\), by using information from national statistics agencies, from the financial press and from other sources, markets can gradually build a perception during year t of what final year t values will be. Therefore, we now consider the possibility that markets use information which comes out during year t to guess what year t final data will be. If this is so, then during year t markets gradually gather enough data to allow them to compute an approximate forecast for the debt ratio at the end of year \((t+N)\). And, as a consequence, the average spread should be influenced by this forecast. In order to assess this possibility, we estimated the following regression equation:

Note that the only difference between this regression equation and the regression equation of Sect 4.1 is in the dependent variable: here the dependent variable is \(\Delta SPREAD_{t,i}\) whereas in Sect. 4.1 the dependent variable was \(\Delta SPREAD_{t+1,i}\). The right-hand side of the regression equation is the same here and in Sect. 4.1 because, in order to perform the estimation, here we assume that with the information obtained during year t markets end up making the same forecast that they will make on October the 1st of year \((t+1)\), after the definitive data for year t are published (i.e., we assume that during year t markets correctly predict the end-of-year t data).

In the new estimated equation the public debt projection for a 10 year horizon is statistically significant (Table 1, column 2). After testing the several projection horizons from 9 years to 1 year, we obtain that all the horizons are statistically significant. The horizon of projection that produces the best fit is the 4 years horizon, whereas in the model without current information was the 2 years horizon. The \(R^{2}\) also increased compared with the regression which assumes that debt forecasts in t only affect spreads in \((t+1)\). This shows that spreads in t react contemporaneously to information from period t even though this information is not the final version published by EUROSTAT. The preliminary disclosures arriving at the market during period t allows investors to react more quickly.

Debt issues are statistically significant at 10%, with a negative correlation with spreads as expected (Table 2, model 4). QE continues to be statistically non-significant, which can be explained by the fact public debt purchases by the ECB are proportional to the ECB capital held by each country, implying that there are acquisitions of both Germany and other countries bonds, probably reducing the level of interest rates for all countries, but with no effect on the spread relative to Germany.

Our above-mentioned conclusion indicates that inflation, GDP growth and QE are stationary, and so they could have been introduced in the model in levels. We tested the model using the levels of these variables instead of the first differences, and only the level of inflation produced a significant improvement to the regression, with inflation having a positive link with the interest rate spread. This led us to consider from now on all models with the level of inflation.

It may be argued that besides public debt ratio projections, the budget balance is an important explanatory variable to consider. We introduced in the equation the change in the budget balance as a percentage of GDP as an additional explanatory variable, but it turned out as non-significant (Table 2, model 5). This seems to indicate that the budget balance only influences spreads through its impact on debt projections.

Our analysis shows that the ability of longer term debt forecasts to explain the interest rate spread is weaker. This may be due to the fact that to compute the debt projections we used the 3 year averages of the inflation rate, nominal GDP growth and primary budget balance as a percentage of total debt. It may be argued that this approach is not appropriate when the aim is to forecast longer horizons. As such, we propose that for forecasting the 6 to 10 years horizons we use the average of the previous 7 years of the underlying variables, whereas for the horizons from 1 to 5 years we continue to use the 3 years’ average.

In the horizons from 6 to 10 years, we observed that the 6 years horizon is the one yielding the highest explanatory power (Table 1, column 2). Taking the 6 year horizon as example, we project debt using a 7 years’ average of the underlying variables, and use it to explain spreads. Results indicate that the explanatory power, compared with the regression where the 6 years projection was computed using the 3 years averages, decreases considerably (from 0.509 to 0.443)—Table 2, model 6. We take this as an indication that using the 3 years averages is a good compromise.

An alternative to using the 3 year averages for the variables needed to forecast the debt ratio is to turn to a more sophisticated forecasting method. We used exponential smoothing, namely the Error-Trend-Seasonal (ETS) state-space likelihood method (Hyndman et al. 2002) due to its simplicity and capacity to make forecasts with small samples. It is an approach where there are no fixed coefficients and the forecasts adjust to past forecasts.Footnote 11

In applying this method, the first forecast in 2002 uses 7 years of data (starting in 1996).Footnote 12 Using 3 years before the creation of the euro can be justified on the grounds that they were already years of nominal convergence towards the euro economic regime. As we advance in the year in which the forecast is made, the forecasting sample increases in size, with the initial year always being 1996. The 3 years-ahead forecasts of the primary budget balance relative to public debt, nominal GDP growth and average interest rate are then used to forecast the public debt ratio. We used the 4 years horizon forecast of the public debt ratio because proved to be the best in the previous method of forecast.

Results indicate that using the public debt ratio forecast based on ETS proves to be statistically significant for interest rate spreads, but the R2 is smaller than when using the debt ratio forecast based on 3 years averages (0.48 vs 0.51)—Table 3, model 1. This validates our approach in terms of using Eq. (7) to forecast debt ratios, including the use of the 3 years averages of the underlying variables.

Our next endeavour was to compare the results with a regression using the public debt ratio forecasts of the European Commission (EC), which are considered as relevant by the financial marketsFootnote 13. We use the 2 years horizon as it is the longest horizon available. The estimated equation with these forecasts shows a relevant association between the public debt-to-gdp ratio forecast and the interest rate spreads, and has a larger explanatory power (\(R^{\mathbf {2}}\)) than the equation with the 4 years’ predictions computed in the present paper (0.54 versus 0.51)—Table 3, model 2. Such result was expected as the EC forecasts use a larger amount of quantitative and qualitative information. Nevertheless, our forecasting methodology can be used when updated EC forecasts are unavailable.

Estimations of Eq. (9) may suffer from endogeneity notably because the forecasts are computed using the 3 year average interest rate paid by the government, which may be affected by the current bond’s interest rate included in the dependent variable. This phenomenon may not be very serious because the forecasts are computed using the annual average interest rate and the dependent variable uses the average interest rate of the last quarter of the year. Moreover, the new debt issued is usually a small fraction of total debt, meaning that the current interest rate has only a small effect on the debt’s average interest rate. Nevertheless, to account for the possibility of endogeneity and as a robustness check, we estimate the model with GMM assuming that projected debt is endogenous. The instruments used were the previous year changes in projected debt ratio, in primary budget balance, and in the other explanatory variables of the model.Footnote 14 The empirical findings confirm the significance of debt projections for current spreads, with a similar quantitative impact (Table 3, model 3). The J-statistics ensures the validity of the over-identifying restrictions (p value = 0.3890).

A question can be raised whether the results we obtain come from some nonlinear effect of the macroeconomic and fiscal variables. To address this question, we re-estimated the model including the squared terms of the explanatory variables, as follows:

We do not find non-linearities on the variables significant at the 5% level (Table 3, model 4). And, most importantly, the consideration of the squared terms does not compromise the relationship between public debt projections and interest rate spreads, meaning that our main result is not driven by non-linearities in the relationship between the variables.

Another possible form of non-linearity is that the relationship between the public debt ratio and the interest rate spread depends on the regime the economy is operating. This can be handled by a panel threshold model that allows several regimes depending on the values of a threshold variable (Hansen 1999; Wang 2015). The model takes the form:

where I(.) is an indicator variable taking value one when the condition inside brackets is fulfilled, \(q_{it}\) is the threshold variable, and \(\gamma\) the threshold parameter to be estimated.

In applying this method we considered only the original countries of the euro area plus Greece in order to obtain a balanced sample as demanded by the estimation method.Footnote 15 The estimation started in 2006 because the NIIP’s observations for Belgium start in that year. We assumed the possibility of two regimes depending on the forecasted level of debt ratio in relation to Germany. Our hypothesis is that above a given threshold of debt-to-gdp ratio projection the impact of debt ratio will be stronger. However, when testing the equality of the coefficients in the two regimes with a F-statistics, the threshold effect is rejected, as the equality of coefficients cannot be ruled out (F-statistic = 4.12, p value = 0.37)—Table 3 model 5. Another possibility for the threshold variable is the indicator of disequilibrium in the public debt ratio (in comparison with Germany)—the expression inside brackets in Eq. (7). The hypothesis is that the higher the disequilibrium indicator, the more the markets will penalise a country with higher debt. For instance, countries with a large debt may be less penalised by the markets if the disequilibrium condition is smaller than one. But once more the threshold effect test rejects the existence of this effect (F-statistic = 7.20, p value = 0.1000). Overall, the empirical evidence does not seem to support the existence of non-linearities.

There is evidence that with the deepening of the subprime crisis, in September 2008, sovereign debt markets became more sensible to macroeconomic fundamentals (see for example, Sgherri and Zoli 2009). To test this possibility, we allowed coefficients to be different from 2008 onwards, but the results do not confirm the hypothesis, as coefficients are not statistically different after that date.Footnote 16 Another possible break may have occurred in 2012, when the president of the ECB, Mario Draghi, not only stated that the institution would do whatever it was needed to save the euro, but also approved the Outright Monetary Transactions program.Footnote 17 This created the perception in bonds markets that countries in difficulty, with higher levels of public debt, would benefit from unconventional monetary policy, thus reducing their risk premiums. Indeed, we observe that public debt ratio becomes statistically irrelevant for the interest rate spread from 2012 onwards, while it was important before this date (Table 4).Footnote 18

5 Concluding remarks

The main goal of this paper is to assess the impact of public-debt-to-gdp ratio projections on the risk premium of 10 years treasury bonds. We used a dynamic equation to make projections of the debt-to-gdp ratio based on the current debt ratio and other macroeconomic data. With that equation, we have built a database with projections of the likely future path of the public-debt-to-gdp ratio in euro area countries.

Our results indicate that, indeed, projections of future values of the public-debt-to-gdp ratio are related with current 10 year bond spreads, but markets seem to give more weight to forecasts with a horizon smaller than 10 years, that is, they are more concerned with the short and medium-term prospects for the public debt. Moreover, investors seem to react to data on debt even before they are definitive, i.e., they seek to react fast to the flow of information in order to profit. Indeed, the results we obtained assuming that investors use current information were better than the results we got assuming investors do not use current information and rely only on the final definitive data of statistical agencies. Results are robust to both the assumption of endogeneity for the debt ratio and to different methodologies to compute debt forecast; and they are not driven by non-linearities in the data.

The results of our study therefore bring further support to the notion that bond markets are forward looking. Specifically, they seem to take into account not only the current public debt ratio but also projections of the likely course of this ratio in the future. Our results are in line with A \(\beta\)mann and Boysen-Hogrefe (2012) and Costantini et al. (2014) who conclude for the relevance of European Commission forecasts of the debt-to-gdp ratio in explaining bond yields. Our study adds to the existing literature that it makes sense to assume that agents use in their decisions a relatively simple forecast mechanism of the public debt ratio. This is relevant for moments in time in which updated forecasts from international organizations are not available. In other words, agents can make their own forecasts based on new information continuously arriving to the market.

Furthermore, our empirical results show that the impact of the expected public debt ratio on interest rate spreads was stronger before 2012. We attribute this result to both the 2012 Mario Draghi’s declaration that the ECB would do everything possible to save the euro, and the announcement of the Outright Monetary Transactions (OMT) program. Both events created in the markets the perception that countries in a weaker position would benefit from the support of unconventional monetary policy, thus reducing the pricing of sovereign risk—although the impact was somewhat heterogeneous across the euro area (Afonso and Verdial 2019).The two policy announcements worked their impact through agents’ expectations, just like unconventional monetary policy in general does (Joyce et al. 2011; Dell’Ariccia et al. 2018).

Thus, our findings support the view that central bank communication plays an important role in easing tensions in sovereign bond markets. The WIT speech and the announcement of the OMT framework reduced the impact of euro area news on sovereign yields, thus showing the calming effect of both events (Van Der Heijden et al. 2018).

The WIT speech and the OMT program were important to stabilize the European sovereign bond market. Yet, they may have deviated investors’ focus from the countries’ fundamentals, incentivizing the building up of sovereign debt. Dell’Ariccia et al. (2018) highlights the risk that unconventional monetary policy may undermine financial stability by reducing the profitability of banks, thus leading financial intermediaries to riskier investments, something which may lead asset prices to deviate from fundamentals.

Before the 2008 crisis, the bond market also did not discriminate the euro area countries in terms of credit risk (Balli 2009). The underlying belief was that if one country was not able to pay its debts, the other countries would take its place and honour the payments. This was one of the causes of the excess public debt accumulation before 2008 in Spain, Portugal, Greece, and Italy, which led to the sovereign debt crisis of 2010 (Lane 2012). With the onset of the Great Financial Crisis, the yields started to reflect the economic position of each country (Sgherri and Zoli 2009; Barrios et al. 2009; Afonso et al. 2015).

Despite the potential dangers arising from the return to a new period of weak discrimination of sovereign credit risk—a period which according to our results started in 2012—the data for the euro area do not show a general increase in public debt ratios between 2012 and 2019. In fact, there was an average 7 pp. decrease in the debt-to-GDP ratio. Looking at individual countries with high public debt ratios, Greece 18.7 pp. increase stands out. Other countries with a more modest increase in the ratio were Cyprus (10.8 pp.), Spain (9.2 pp.), Italy (7.8 pp.), and France (6.9 pp.). For these countries, the bulk of the increase occurred in 2013, which was a year of recession demanding counter-cyclical fiscal policy. If instead we assess the evolution between 2013 and 2019, those five countries show a fall or stabilization of the public debt ratio. Note that we perform the analysis only up to 2019 because in 2020 the emergence of the COVID-19 pandemic led to a significant increase in public debt ratios.

Our suggestions for further research are as follows: (i) instead of using the spreads as the dependent variable, we could try using CDS (Credit Default Swaps) or sovereign ratings as the dependent variable; (ii) we used a very basic expectations process to obtain future expected government deficits (as percentage of public debt), future expected growth of nominal GDP and future expected nominal interest rates of public debt (see Sect. 3.1). One might want to try more sophisticated expectations processes to obtain the future expected values of these variables; (iii) in this article, we have used the dynamic equation of the public-debt-to-gdp ratio to explore the nonlinear way through which future expected public deficits, nominal GDP growth and nominal interest rate influence the future values of the debt ratio. Another approach to explore these nonlinear channels would be to estimate a nonlinear regression with the expected values of these three variables as explanatory variables; (iv) lastly, the literature on the determinants of bond spreads has been evolving quite dynamically since the onset of the Euro Area Sovereign Debt Crisis, thus encompassing other novel variables such as demographic factors, pension liabilities or the labour productivity growth rate (Afonso et al. 2015; Haugh et al. 2009; Ichiue and Shimizu 2015). It would be interesting to examine their potential long-term importance to fiscal sustainability.

Notes

Of course, this is not the only possible way of estimating the future values of these variables. However, more complex ways of predicting their future values are beyond the scope of this article.

Data obtained from the section GDP Government deficit/surplus, debt and associated data

Data obtained from the section GDP and main components (output, expenditure and income)

To the item Net lending (+) /net borrowing (−) was added interests paid. Data obtained from the section GDP Government deficit/surplus, debt and associated data

Data obtained from the section GDP Government deficit/surplus, debt and associated data

EMU convergence criterion series.

In truth, when they are buying bonds many investors don’t know for how long they will hold them. If, for example, the outlook for shares suddenly improves, they may want to sell the bonds in order to buy shares. Or it may be that the investor suddenly needs the money to explore a business opportunity or to address an unpredictable problem that comes up.

Both variables are from Eurostat. The former from the section GDP and main components (output, expenditure and income), and the latter from the data on HICP—annual data.

The unit root tests and the estimations were performed using Eviews.

The panel is unbalanced because the net international investment position (NIIP) is not available for some countries at the beginning of the sample.

We chose the additive model with no seasonality due to its simplicity, as we have a small sample.

Since we are working with the first differences of the variables, the first year of the estimation sample is 2003.

Data from the publications of European Economy, European Economic Forecasts, The Directorate-General for Economic and Financial Affairs.

A total of 25 instruments are used, which include the time dummies. A 2SLS instrument weighting matrix is used.

The estimation was performed using Stata.

As usual, we defined a dummy variable that takes value one before 2008, and multiplied it by all the other variables. The resulting variables were added to the regression in order to allow the coefficients to differ from 2008 onwards.

We thank the suggestion of this break to an anonymous referee.

The Wald test to the nullity of all coefficients of interaction with the dummy Before2012 has a F-statistic 6.73 (p value = 0.0000), showing the break is statistically significant.

References

Aβmann C, Boysen-Hogrefe J (2012) Determinants of government bond spreads in the euro area: in good times as in bad. Empirica 39:341–356

Afonso A, Rault C (2011) Long-run determinants of sovereign yields. Econ Bull 31(1):367–374

Afonso A, Arghyrou MG, Kontonikas A (2015) The determinants of sovereign bond yield spreads in the EMU. Working Paper 1781, Working Paper Series, European Central Bank

Afonso A, Furceri D , Gomes P (2011) Sovereign credit ratings and financial market linkages: application to European data. Working Paper 1347, Working Paper Series, European Central Bank

Afonso A, Verdial N (2019) Sovereign debt crisis in Portugal and Spain. REM Working Paper 112-2019, December. https://www.econstor.eu/bitstream/10419/219502/1/econpol-wp-40.pdf

Aizenman J, Hutchison M, Jinjarak Y (2013) What is the risk of European sovereign debt defaults? Fiscal space, CDS spreads and market pricing of risk. J Int Money Financ 34:37–59

Arghyrou M, Kontonikas A (2012) The EMU sovereign-debt crisis: fundamentals, expectations and contagion. J Int Financ Mark Inst Money 22:658–677

Attinasi M-G, Checherita C, Nickel C (2009) What explains the surge in euro area sovereign spreads during the financial crisis of 2007-2009? Working Paper 1131, Working Paper Series, European Central Bank

Baldacci E, Kumar M (2010) Fiscal deficits, public debt and sovereign bond yields. International Monetary Fund Working Paper WP/10/184

Balli F (2009) Spillover effects on government bond yields in euro zone: does full financial integration exist in European government bond markets? J Econ Financ 33:331–363

Barbosa L, Costa S (2010) Determinants of sovereign bond yield spreads in the euro area in the context of the economic and financial crisis. Economic Bulletin and Financial Stability Report Articles and Banco de Portugal Economic Studies

Barrios S, Iversen P, Lewandowska M, Setzer R (2009) Determinants of intra-Euro area government bond spreads during the financial crisis. Economic Paper 388. Directorate-General for Economic and Financial Affairs, European Commission

Beber A, Brandt MW, Kavajecz KA (2009) Flight-to-quality or flight-to-liquidity? Evidence from the euro area bond market. Rev Financ Stud 22(3):925–957

Bernoth K, Erdogan B (2012) Sovereign bond yield spreads: a time-varying coefficients approach. J Int Money Financ 31(3):639–656

Bi H (2012) Sovereign default risk premia, fiscal limits, and fiscal policy. Eur Econ Rev 56:389–410

Blanchard OJ (1990) Suggestions for a new set of fiscal indicators. OECD Economics Department Working Papers 79

Blanchard OJ (2019) Public debt and low interest rates. Am Econ Rev 109(4):1197–1229

Caggiano G, Greco L (2012) Fiscal and financial determinants of Eurozone sovereign spreads. Econ Lett 117:774–776

Codogno L, Favero C, Missale A (2003) Yield spreads on EMU government bonds. Econ Policy 18:503–532

Costantini M, Fragetta M, Melina G (2014) Determinants of sovereign bond yield spreads in the EMU: an optimal currency area perspective. Eur Econ Rev 70:337–349

Dell’Ariccia G, Rabanal P, Sandri D (2018) Unconventional monetary policies in the Euro Area, Japan, and the United Kingdom. J Econ Perspect 32(4):147–172

Favero C, Pagano M, von Thadden E-L (2010) How does liquidity affect government bond yields? J Financ Quant Anal 45(1):107–134

Fournier J-M, Fall F (2017) Limits to government debt sustainability in OECD countries. Econ Modell 66:30–41

Ghosh AR, Kim JI, Mendoza EG, Ostry JD, Qureshi MS (2013) Fiscal fatigue, fiscal space and debt sustainability in advanced economies. Econ J 123:F4–F30

Giordano L, Linciano N, Soccorso P (2012) The determinants of government yield spreads in the euro area. Quaderni di Finanza 71:CONSOB

Gómez-Puig M, Sosvilla-Rivero S (2017) Heterogeneity in the debt-growth nexus: evidence from EMU countries. Int Rev Econ Financ 51:470–486

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econom 93:345–368

Haugh D, Ollivaud P, Turner D (2009) What drives sovereign risk premiums? An analysis of recent evidence from the Euro Area. OECD Economics Department, Working Papers, No 718

Hyndman Rob J, Koehler Anne B, Snyder Ralph D, Grose Simone (2002) A state space framework for automatic forecasting using exponential smoothing methods. Int J Forecast 18:439–454

Ichiue H, Shimizu Y (2015) Determinants of long-term yields: a panel data analysis of major countries. Jpn World Econ 34–35:44–55

Joyce M, Tong M, Woods R (2011) The United Kingdom’s quantitative easing policy: design, operation and impact. Bank Engl Q Bull Q3:200–212

Lane PR (2012) The European sovereign debt crisis. J Econ Perspect 26(3):49–68

Manganelli S, Wolswijk G (2009) What drives spreads in the Euro Area government bond market? Econ Policy 58:191–240

Poghosyan T (2014) Long-run and short-run determinants of sovereign bond yields in advanced economies. Econ Syst 38(1):100–114

Rafiq S (2015) How important are debt and growth expectations for interest rates? International Monetary Fund Working Paper WP/15/94

Reinhart R, Rogoff K (2010) Growth in a time of debt. Am Econ Rev 100:573–578

Sgherri S , Zoli E (2009) Euro area sovereign risk during the crisis. International Monetary Fund Working Paper WP/09/222, International Monetary Fund

Stamatopoulos T, Arvanitis S, Terzakis D (2017) The risk of sovereign default: the Eurozone crisis 2008–2013. Appl Econ 49(38):3782–3796

Van Der Heijden M, Beetsma R, Romp W (2018) “Whatever it takes’’ and the role of Eurozone news. Appl Econ Lett 25(16):1166–1169

Wang Q (2015) Fixed-effect panel threshold model using Stata. Stata J 13(1):121–134

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Julia Wörz.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix 1

In this appendix, we derive the dynamic equation which was used in the main text to estimate the future evolution of the public-debt-to-gdp ratio, i.e., Eq. (1) of the main text.

Let \(B_{t}\) denote the stock of public debt at the end of year t (”B” from ”Borrowing by the government”) and \(Y_{t}\) denote nominal GDP in year t.

The dynamic equation that relates \(\frac{B_{t}}{Y_{t}}\) and \(\frac{ B_{t-1}}{Y_{t-1}}\) can be derived as follows.

In each year t, the government faces the following budget constraint:

where \(G_{t}\) denotes government expenditure in year t; \(T_{t\text { }}\) denotes taxes collected during year t; \(\Delta B_{t}=B_{t}-B_{t-1}\), where, as mentioned above, \(B_{t}\) denotes government debt at the end of year t (here we include both bonds issued by the government and bank loans obtained by the government). Thus, \(\Delta B_{t}\) is the increase in government debt which occurs during year t. Finally, \(\Delta H_{t}=H_{t}-H_{t-1}\), where \(H_{t}\) is the debt of the government vis-a-vis the central bank at the end of year t (this only applies in countries where loans from the central bank to the government are not forbidden). \(\Delta H_{t}\) thus represents the increase which occurred in the debt of the government vis-a-vis the central bank during year t.

Figure 4 illustrates the relationship described by Eq. (12).

Taking into account that loans from the central bank to the government are forbidden in the European Union, we have \(\Delta H_{t}=0\). Therefore, the previous equation can be written as:

Because we are studying the dynamics of the public debt, it is important to make visible the amount of interest paid by the government in each year. So, we split total government expenditure into two components: ”primary expenditure” (expenditure excluding interest payments) and ”interest payments”:

where \(\overline{G}_{t}\) denotes ”primary government expenditure” in year t and \(i_{t}\) denotes the nominal interest rate of the public debt [nominal interest rate which when applied to the stock of public debt of the end of year \((t-1)\) gives the total amount of interest the government will have to pay during year t]. So, \(i_{t}B_{t-1}\) corresponds to the interest payments the government has to make in year t because of the stock of debt it carries over from the previous year. Note that the stock of debt \(B_{t-1}\) includes debt issued at different moments in time and hence with different interest rate conditions. Therefore, \(i_{t}\) is a rate which captures the average rate embodied in all those loans obtained by the government in the past.

Using Eq. (14) to replace \(G_{t}\) in Eq. (13), we obtain:

Figure 5 illustrates the relationship described by Eq. (15).

Equation (15) can be rewritten as:

Rearranging the terms on the left hand side of this equation, we obtain:

If we define a new variable \(\overline{D}_{t}=\overline{G}_{t}-T_{t}\), then the previous equation becomes:

(note that the new variable \(\overline{D}_{t}\) corresponds to what is commonly referred to as the”Government primary deficit”)

Equation (17) simply tells us that public debt at the end of year t equals the stock of public debt coming from the end of the previous year plus interest payments on it plus the primary deficit of year t.

Equation (17) can be rewritten as:

Again, this equation is easy to interpret: debt at the end of year t equals debt at the end of year \((t-1)\) plus interest plus the primary deficit of year t.

We are trying to derive an equation that relates \(\frac{B_{t}}{Y_{t}}\) and \(\frac{B_{t-1}}{Y_{t-1}}\). We will therefore try to make either \(\frac{B_{t}}{ Y_{t}}\) or \(\frac{B_{t-1}}{Y_{t-1}}\) appear in each of the three terms of Eq. (18). To make \(\frac{B_{t}}{Y_{t}}\) appear in the left hand side of the equation, we divide both sides of the equation by \(Y_{t}\):

On the right hand side of the equation, we can make \(\frac{B_{t-1}}{Y_{t-1}}\) appear in the first term and \(\frac{B_{t}}{Y_{t}}\) appear in the second term :

If we denote by \(g_{t}\) the growth rate of nominal GDP between year \((t-1)\) and year t, we can write:

Since \(\frac{\overline{D}_{t}}{B_{t}}\) and \(g_{t}\) are normally very small numbers in the case of euro area economies, the product \(\frac{ \overline{D}_{t}}{B_{t}}g_{t}\) will in general be a number very close to zero (as an example, try multiplying 0.1 by 0.05). So, the previous equation becomes:

This is the dynamic equation we used in the main text to forecast the value that the public-debt-to-gdp ratio will likely display in future years [Eq. (1)].

Appendix 2

Rights and permissions

About this article

Cite this article

Lagoa, S.C., Leão, E.R. & Bhimjee, D.P. Dynamics of the public-debt-to-gdp ratio: can it explain the risk premium of treasury bonds?. Empirica 49, 1089–1122 (2022). https://doi.org/10.1007/s10663-022-09547-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-022-09547-8