Abstract

Greater trade integration, convergence in economic performance and a high level of employment among member states: this was why the Euro Area was created. In this respect, the paper analyses the sources of trade imbalances within the Euro Area, focusing on the direct trade relationship—intra-EA trade—between surplus and deficit countries. The econometric evidence based on a VAR/SVAR methodology suggests that asymmetric wage shocks determine asymmetric gains from intra-EA trade, resulting from opposing growth strategies. In addition, the empirical evidence shows that the Euro Area is divided into two economic regions representing different demand regimes: a northern region, which is profit-led and a southern region, which is wage-led. The paper suggests that wage coordination is an essential macroeconomic tool but is insufficient to achieve trade and economic integration given the current state of divergence. Thus, a trade-based transfer mechanism is proposed to restore convergence in the Euro Area.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The Community shall have as its task… to promote throughout the Community a harmonious and balanced development of economic activities, sustainable and non-inflationary growth respecting the environment, a high degree of convergence of economic performance, a high level of employment and of social protection, the raising of the standard of living and quality of life, and economic and social cohesion and solidarity among Member States. (Maastricht Treaty, Title II - Art. G2, 7 February 1992)

1 Introduction

Twenty-five years have gone by and the process of convergence has yet to take place. On the contrary, the principles at the very basis of the creation of the community have been left behind, and economic divergence has inexorably spread among founder members of the Euro Area (EA). The first important test the Euro Area faced—the Financial Crisis of 2008—clearly revealed the flaws in the European architecture, unable to cope cohesively with any of the three crises: economic, sovereign and banking crisis. Ultimately the three became one: a political crisis. Rising inequalities across countries brought a wind of change, but not as desired. Instead of establishing the basis for a new European Union (EU), i.e. by creating mechanisms able to achieve deeper economic integration and social cohesion, national interests prevailed, leading to a counter-revolution: more independence and inward-looking policies.

Since political tensions are the natural outcome of economic fragilities, in order to restore the common cohesive growth path established in the Treaty of Maastricht, it is necessary to tackle the sources of economic divergence between Euro Area members. By fixing the core of the European problems—the currency area—the European Union will be able once more to attract, to retain and integrate countries within its economic community and monetary union. Hence this paper aims to investigate the flaws in the European architecture by analysing the internal dimension of the diverging EA path, focusing on the dynamics of demand and trade flows between surplus (Austria, Belgium, Germany, and the Netherlands) and deficit countries (France, Italy, Spain, and Portugal).Footnote 1

Since the mercantilism view, it has been debated about the importance of acquiring foreign markets as a tool to sustain capital accumulation without hindering the growth rate of domestic demand (Kalecki 1954). Although, pre-crisis, trade integration was promoted as a win–win strategy by the WTO and IMF, and trade imbalances were thought to be temporary and negligible, after the crisis this view remarkably changed. Trade patterns started to be seen as structural, leading countries and institutions to implement policies to achieve trade surpluses, which became the solution for fighting an economic downturn and achieving long-lasting growth. The classification initially developed by Bhaduri and Marglin (1990) concerning wage-led and profit-led growth, was adapted for a new dichotomy: debt-led and an export-led growth (Stockhammer 2015). These three features—demand-regime, trade and debt patterns, as Stockhammer and Wildauer (2016) emphasises, are interlinked macroeconomic dimensions, in which Euro Area members are bounded together by a fixed exchange rate regime. According to this view, imbalances are the outcome of opposing growth strategies, where export-led economies benefit from the increasing indebtedness of deficit countries. The outcome is a diverging path and possible path-dependency due to hysteresis: lower actual and potential production capacity combined with higher structural unemployment (Ginzburg et al. 2013). The outcome of these structural effects have been also empirically documented by Belke et al. (2017), who found that countries belonging to the core of the Euro Area have faced an increased synchronization of their business cycles, whereas peripheral countries decreased synchronization with regards to the core countries.

In this macroeconomic context, given their wage-led nature, deficit countries, by implementing wage restraint policies, may improve their export competitiveness to the detriment of damaging their manufacturing base (Naastepad and Storm 2015). The differentials in the cumulative growth and unemployment rates among the two regions, 10 years after the crisis, are a clear proof of the long-lasting effects of negative demand shocks in wage-based economies (Stockhammer 2011a).

In this respect, the paper shows that although an extra-EA trade surplus was achieved after 2014 by deficit countries,Footnote 2 the intra-EA trade balance between deficit and surplus countries is far from being restored. It still accounts for two-fifth of the overall northern trade surplus, and it is, as share of GDP, 2% larger relatively to the period before the creation of the common currency. According to these stylized facts, the persistence in trade differentials within the Euro Area is counterintuitive if analysed through the mainstream lens of the ‘consensus view’ (Baldwin and Giavazzi 2015). The reversal in capital flows from core to periphery and deflationary adjustments in the peripheral region would have restored the intra-EA trade balance together with the rebalancing of the external position if they had been the key factors at work. This may suggest a latent process of hysteresis, in which current market shares are pre-determined by past factors. Hence, intra-EA trade imbalances can be interpreted in line with Myrdal’s cumulative and causation forces (1957): back-wash and spread effects as the driving force behind persistence in the asymmetric gains from trade.Footnote 3

On the one hand, one branch of research has attributed this structural change to wages rising in excess of productivity in deficit countries, thereby driving up unit labour costs, and in turn harming export performance and the trade balance of southern EA countries (Flassbeck and Lapavitsas 2013). On the other hand, another stream of literature has focused on the complementary role played by the German labour market reforms implemented in the early 90s and the German wage moderation also called Hartz reforms taken place in 2003 through relative price adjustments (improved competitiveness and deeper market penetration) and income effects (lower import demand) in building up trade surpluses vis-a-vis southern Europe and non-EU countries (Dustmann et al. 2014; Ginzburg et al. 2013; Naastepad and Storm 2015; Podkaminer 2017; Stockhammer 2011a).Footnote 4

In relation to the literature, the paper aims at analysing the consequences of these downward-wage adjustments taken place in the northern region at the inception of the EMU, rather than investigating the sources of these adjustments which are well covered in the existing literature. Especially, the empirical analysis aims at disentangling the propagation channels of those asymmetric and opposing wage variations, their impact on the trade balance among the two regions, and those region-specific factors reinforcing the structural differences, thereby creating a path-dependent process. On the one hand, the paper empirically tests via a VAR methodology the Bhaduri and Marglin (1990)'s hypothesis of wage-led and profit-led demand regimes in the Euro Area by subsetting it in two economic regions reflecting opposing wage, trade, and debt patterns. On the other hand, it quantifies via a SVAR methodology the asymmetric effects of domestic and foreign wage variations on the intra-EA trade balance among the two regions by disentangling the price and income effects. Overall, the paper studies the impact of wage variations on demand and trade linkages within a monetary union via vector autoregression methodologies.

In this respect, empirical evidence is brought to support how initial downward-wage adjustments in the northern countries, not only in Germany, contributed to the accumulation of trade imbalances in the Euro Area. A VAR methodology shows that the two blocks have opposing demand-regimes, profit-led in the northern region, and wage-led in the south. Moreover, a set of stylized facts and empirical evidence suggests that the southern and northern regions also match the categorization of debt-led and export-led economies, as defined by Stockhammer (2015) and Stockhammer and Wildauer (2016). In this respect, a stronger credit growth in the South and increasing export surpluses in the North are reinforcing factors exacerbating the impact of asymmetric wage adjustments between regions with opposing demand-regimes.

Next, a SVAR methodology is deployed in order to study the impact of domestic and foreign wage shocks on Intra-Euro Area export and imports among the two regions. The results show that a 1% wage decrease in the northern region (negative wage shock) increases the intra-EA trade surplus with the southern region far more than a 1% wage increase in the southern region (positive wage shock), respectively by 10.63% and 3.99% in a 5-year horizon. Results are robust when the intra-EA trade balance is broken down into exports and imports, allowing the price and income effects of wage adjustments to be disentangled. On the one hand, in a 5-year period the cumulative price effect of a negative 1% wage adjustment in the northern region increases northern exports to the southern region by 2.08% compared to the cumulative income effect of a wage increase in the southern region, which increases them by 1.45%. On the other hand, the cumulative income effect of a wage decrease in the northern region decreases southern exports by 0.59% on impact and by 0.15% within 5 years, while the cumulative price effect of a wage increase in the southern region decreases them by 0.53% on impact and by 0.19% within a 5-year period. These findings are robust and estimates are qualitatively unchanged when the shock is set to domestic wages. In this latter case, the cumulative price effect of a 1% increase in domestic wages increases southern exports to the northern region by 2% within a 5-year period. Overall, the empirical evidence sheds light on the EMU’s trade imbalances controversy by clarifying the crucial role played by intra-EA trade imbalances which accounted for 2/3 of the overall northern trade surplus as of 2007. In this regard, the paper shows that: (1) downward-wage adjustments have helped northern exports to penetrate the southern market, since the negative price effect of an increase in northern wages is the most important factor among price and income effects affecting trade imbalances between the two regions. (2) Wage increases in the southern region tend to create a virtuous cycle of higher trade volumes, with imports increasing faster than exports, thereby contributing also to the trade deficit accumulation. (3) An expansion of the northern region’s aggregate demand through rising wages may not be sufficient to stimulate exports from the southern region, whose industrial structure has been weakened further by the crisis. Nevertheless, a coordinated policy of raising wages in both regions may be able to rebalance part of the current trade gap by restoring virtuous inter-linkages between demand and supply factors so as to restart the process of trade integration. In this respect, wage coordination is suggested in order to reduce the likelihood of asymmetric shocks within a monetary union.

Overall, the paper argues that a clear understanding of the demand regime experienced by a country/region can contribute considerably to policy effectiveness at the European level. Given the lack of automatic stabilizers at the national level and the Euro Area mandate to achieve homogeneous and balanced trade integration between its members, the paper concludes by proposing an intra-EA trade-based transfer mechanism to restore trade and economic convergence in the Euro Area.

The rest of the paper is organized as follows: Sect. 2 discusses the European divergence in the light of Bhaduri and Marglin’s theoretical framework and a set of stylized facts. Section 3 discusses the econometric method and presents the empirical results. Section 4 discusses the findings and provides policy implications. Section 5 concludes.

2 The European divergence: theory and evidence

2.1 The original flaws of a currency area

Before the creation of the Euro, it was already known that asymmetric shocks would be the main source of fragility in the Euro Area. Clear warnings were made by Meade (1957), Scitovsky (1958), Mundell (1961) and lastly by Obstfeld (1997) concerning the single currency and the process of European economic integration.Footnote 5 As pointed out by Mundell (1961, p. 664):

…an increase in foreign demand for the products of one of the regions would cause an appreciation of the exchange rate and therefore increased unemployment in the remaining regions, a process which could be corrected by a monetary policy which aggravated inflationary pressures in the first region; every change in demand for the products in one region is likely to induce opposite changes in other regions which cannot be entirely modified by national stabilization policies.

This is still the essence of the Euro problem. If higher inflationary pressures are not accommodated within the currency area, “this means that a potentially deficit member of the free-trade area such as France might have to make an undue share of the adjustment by a domestic deflation of its money incomes, prices and costs” (Meade 1957, p. 385). Given the clear mandate of the European Central Bank—price stability—the latter option was the one implemented, endogenously driving the Euro Area towards the current outcome: divergence. This was the reason why Meade argued for ‘national currency areas’ as a first step towards the single currency; the only way to deal with European balance of payments disequilibria without preventing free trade or destroying full employment (ivi., p. 396). In this respect, European policy makers restricted themselves to facilitating free trade, delegating the full-employment objective to individual nations.Footnote 6 Ironically, Meade’s proposal was made in the conviction that “full employment is more important than free trade for Europe” (ivi. p. 394).Footnote 7 This belief was based on the fact that governments at the time were “so wedded (and, in my opinion, rightly so wedded) to the idea that it is one of their duties to preserve full employment that the probable outcome of this solution would in fact be the breakdown of the free-trade-area arrangements” (ivi. p. 385).

Astonishingly, nowadays European governments seem to have lost track of their primary duties, or even more worrisome, believe that free trade and unrestricted capital mobility are more important than full employment. Meade’s theoretical explanation is further corroborated by the pragmatic proposal made by Keynes for an ‘International Clearing Union’ in the post-World-War II period. As was clear to Keynes, balance of payments disequilibria, and imbalances in international trade and capital movements are major sources of instability (Keynes 1980). This instability at the macro-level cannot be solved endogenously within the system since cumulative past forces tend to reinforce structural differences, while only an exogenous restructuring of the system itself can reverse those forces from preserving the pattern of specialization. The fundamental reason for this path-dependency was explained clearly by Kaldor (1971, p. 8):

…owing to the existence of increasing returns to scale in the manufacturing industries, any initial advantage in terms of export competitiveness tends to have a cumulative effect, since the country which is able to increase its manufactured exports faster than the others also tends to have a faster rate of growth in productivity in its export industries, which enhances its competitive advantage still further.

Hence, the primary focus of the analysis should be the so-called ‘initial advantage’—asymmetric wage adjustments—which triggered asymmetric intra-EA trade flows, and the subsequent divergent process. Nevertheless, a second important point needs to be addressed: what could have been done to prevent Myrdal’s (1957) circular and cumulative principle of cause and effect from taking place? As Kaldor says, fiscal union is the natural solution to trade imbalances in a political union: “a region which forms part of a political community, with a common scale of public services and a common basis of taxation, automatically gets ‘aid’ whenever its trading relations with the rest of the country deteriorates”, the so-called built-in fiscal stabiliser (1970, p. 345).Footnote 8

However, the Euro Area is only a monetary union, and it seems unreasonable now to imagine that the trade benefits acquired by surplus countries, low unemployment and faster growth, would be surrendered. Nevertheless, that is not the final statement on the Eurozone; a unified macroeconomic solution needs to be found, which goes beyond regional differences, and inclusively, aims to reinforce long-run growth potential. Keynes and Meade point to this direction: the need to set up the right macro system to allow micro behaviour by firms and households to work optimally within the system. Only with the right institutional set-up it is possible to achieve a high degree of convergence. Hence Meade’s suggestion of ‘national currency areas’ for EA members and Keynes recommendation of an ‘International Clearing Union’ for the world economy.

As we have seen, the original flaws in the European institutional design have led to impoverishment and social discontent within the Euro Area. If the European system cannot endogenously rectify the instability, given the current architectural design, divergence will lead to more divergence. If, on the other hand, we do not accept this outcome, and believe in the principles established by the Treaty of Maastricht, institutional arrangements need to be upgraded to enable the system to work for convergence and not against it. For this purpose, it is essential to shed light upon the current structural diversities the two core regions of the Eurozone are facing, clarifying the particular features of both growth strategies, and seeking to understand what institutional set-up promotes convergence. This could pragmatically shape a long-term, sustainable project for inclusive-growth within the Euro Area and create the premise to extend the monetary union to the European Union as a whole. To boost further integration into the single currency, and make the benefits of joining outweigh the costs of a loss of flexibility when adjusting to shocks, it is crucial to set up a macro mechanism able to promote complementarities between members, to stabilize intra-EA imbalances, and ultimately reach full employment. Creating such a mechanism is of vital importance for the prosperity of the single currency and its member states as much as Keynes’s proposal was a key factor in shaping the post-war period.

2.2 Profit-led and wage-led regime

The Bhaduri and Marglin framework (1990) is a neo-Kaleckian model where the income distribution between wages and profits plays a central role on the accumulation of capital, and the rate of investment is an increasing function of the rate of profit. The economic growth approach of Cambridge economists like Robinson (1962) and Kaldor (1956) shares with Kalecki his central concern for distributive and conflicting shares between wages and profits, here modelled via a VAR system approach (Rima 2003). There are, of course, alternative heterodox approaches to Keynesian theories of growth. If the origin of this demand-led growth approach can be traced back to Garegnani (1978–1979), others early contributions are those of Vianello (1985), Ciccone (1986) and Kurz (1986). And the debate has been further enriched by Sraffian authors introducing a ‘Supermultiplier’ approach for demand-driven growth (Serrano 1995; Cesaratto et al. 2003).Footnote 9

However, this paper analyses the crisis of the Euro Area according to the B&M theoretical profit-wage framework since it fully matches the stylized facts presented in Sect. 2.3, and allows us to interpret consistently the current macroeconomic environment of the EA, its evolution, and to provide clear policy indications.

In this regards, the cornerstone of this theory is that investments may respond positively or negatively to a wage reduction depending on whether investors react strongly or weakly to an increase in the profit margin. In the former case, a decrease in wages may stimulate investments since the higher profit margin fully compensates the negative effect of a fall in consumption. The conceptual framework is that by increasing wages, enterprises face higher labour costs, which in turn reduce the profit margin per unit of output. However, the increase in wages increases consumption leading to an increase in corporate sales, and therefore boosts aggregate profits through an increase in the quantity of output sold. Depending on whether the former effect dominates the latter, the posture of the economy assumes a profit-led or a wage-led regime. Nevertheless, if this is true in a closed economy, i.e. the right balance may exist between wages and profit margins, in an open economy additional dynamics may change the overall outcome. Indeed, in an open economy, the ‘trade effect’ may enable profit-led growth to be fully effective and sustainable. Although a decrease in wages increases the profit margin—as in a closed economy—with a positive effect on investments, the negative effect of falling domestic consumption is compensated by increased foreign sales. In a closed economy, a trade-off is in place between a decrease in the wage share and an increase in the profit margin through higher investments and lower consumption, but in an open economy the two positive effects clearly outweigh the negative.

Moreover, provided trade interdependence increases, the greater the share of corporate sales from foreign markets, the more sustainable and effective is a wage restraint policy in producing growth. In this framework, “a wage-led expansion derived from the stagnationist logic may be given up in the pursuit of export surplus by following restrictive macroeconomic policies to keep down real wages (and inflation) for greater international price competitiveness” (Bhaduri and Marglin 1990, p. 388). Moreover, an export surplus cannot be achieved at the same time by all trading partners, thus trade imbalances and growth differentials develop endogenously, establishing winners and losers from trade.

Lastly, real-wage adjustments were initially thought of in this theoretical framework as a wage rate variation through the exogenous variation of the exchange rate. This would affect export prices, but also import prices such as raw materials, increasing aggregate profit through higher volumes of sales, and at the same time it would reduce the profit margin, with ambiguous effect. In the case of the Euro Area, no exchange rate divides the northern region from the southern region, and the wage-adjustment in the northern region directly depressed the northern wage share. In this macroeconomic context, four headwinds play against the southern region’s ability to respond to negative foreign wage adjustments: (1) without an exchange rate the southern region cannot devaluate to counterbalance the loss in competitiveness; (2) given intrinsic wage-stickiness, wages tend to rise in the southern region, producing and even wider wage-gap between the two regions; (3) curbing wages in the southern region may be counterproductive if its economic structure is in a wage-led regime; (4) the process induces divergence between the two regions, which becomes self-reinforcing given the lack of counterbalancing tools at the national and supranational level.

2.3 Two regions, two interconnected economic regimes

The first and crucial point the paper highlights is that a structural downward adjustment of the wage share (WS) took place not only in Germany, as focused on in the literature, but also in the Netherlands, Austria and Belgium.Footnote 10

As is clear from Table 1, the adjustment took place between 1996 and 2007 in all northern countries: the wage share in Austria decreased by 3.7% of GDP, in Belgium by 1.3%, in Germany and the Netherlands by 4.5%. Overall the northern region experienced a reduction in the wage share between 1996 and 2007 of 4.2%. During the same period, the southern region experienced a smooth increase in the wage-share of almost 0.8% over GDP10. Hence, the first stylized fact refers to the asymmetric and opposite-sign variation in the wage share. After the crisis, a positive adjustment took place in the northern region, which did not offset the initial reduction. Moreover, although wage-restraint policies were implemented in the Southern region, the wage share further increased by 0.8% of GDP due to a deep economic crisis (the denominator decreased faster than the numerator), thereby partially offsetting the adjustment in the northern region.

This structural change in wage policy in the northern region, in conjunction with multiple factors during the creation of the common currency, directly impacted on the trade balance with the rest of the world (TB), whose surplus increased by 5.5% over GDP between 1996 and 2007—Table 1. On the contrary, the southern region shifted from a trade surplus to a trade deficit, with a deterioration in its trade balance by 3.9% of GDP.

This opposing trade pattern is explained in the literature as the result of the interaction of multiple dimensions: the effects of eastward enlargement and the impoverishment of the production matrix in peripheral countries (Ginzburg et al. 2013); the strong trade relationships of Germany with fast-growing countries, and regionalized production in the export sector (Danninger and Joutz 2008); the strong non-EA demand for German products, and gains in competitiveness following German labour market reforms (Kollmann et al. 2015); growing debt levels in deficit countries boosting aggregate demand in the rest of the Euro Area and, in turn, import demand (Belke and Dreger 2013).

Overall, the focus in the literature was on Germany, southern Europe and the trade relationships between Germany and non-EU countries. Table 1 aims to complement the state of the literature by showing that in 2007 two-thirds of the northern surplus (4.2% of GDP) came from intra-EA trade with the southern region, and two-fifths directly with France, a country outside southern Europe but which perfectly mirrors the wage, trade and debt patterns of the so-called European periphery. All the more so, France in 2016 was the country with the largest trade deficit with non-EA countries, the northern region and other countries in the southern region.

The network charts in Fig. 1 summarize net export–import flows between countries of the two regions. Before the monetary union was created in 1999 (Fig. 1a), the export surpluses between regions were smaller (thickness of the arrow and size of the nodes) and more diversified between countries than after the Euro inception (Fig. 1b). In fact, net export flows especially from Germany and the Netherlands increased within and outside the northern region. Italy and Spain became net importers from the northern region, while France became the hub of export surpluses from both regions. After the crisis hit (Fig. 1c) and capital flows were reversed, intra-EA trade imbalances remained strong, and in some cases, such as France in relation to Germany, the Netherlands and Belgium deteriorated further. Hence, the second stylized fact refers to the drastic shift of barycentre in trade relationships within the EA, resulting in clear winners and losers from trade.

Intra Euro Area export and import flows between deficit and surplus countries. Note: Arrows show the average trade surplus among countries in the specific time period. The amount of flow is represented by the thickness of the arrow. Countries are divided into two subsets: red for Austria, Belgium, Germany and the Netherlands (surplus countries), and blue for France, Italy, Portugal and Spain (deficit countries). Nodes’ size in the left panel reflect the sum of net exports, whereas in the right panel nodes’ size reflect the sum of net imports. The delta in node’s size between left and right panels represent trade surplus of each country

The change in trade relationships is increasingly structural in the way it affects the productive capacity of a country. Almost 80% of the value of intra-EA trade flows comprises manufactured goods classified in the Standard International Trade Classification (SITC) as chemicals (Sector 5), machinery and transport equipment (Sector 7), and other manufactured goods (Sectors 6, 8). A possible interpretation to assess the stylized facts presented necessarily reflects Kaldor’s summary of the role of increasing returns to scale: “success breeds further success and failure begets more failure” (1981, p. 596). The initial advantage in terms of export competitiveness derived from wage restraint policies has a cumulative effect. The existence of increasing returns to scale in manufacturing industries has allowed the export sector to achieve productivity gains, which further strengthened the initial competitive advantage. In this way, “free trade in the field of manufactured goods leads to a concentration of manufacturing production in certain areas—to a “polarisation process” which inhibits the growth of such activities in some areas and concentrates them in others” (ibid.). The thickness of the arrows—exports surpluses—in Fig. 1, their trend and persistence even after deflationary pressures hit deficit countries, indicates the production polarisation process within the EA.

Furthermore, a decrease in domestic wages not only improves net exports through lower unit labour costs, but negatively affects imports, i.e. the exports of foreign countries, due to a shrinking domestic aggregate demand. In this macroeconomic context, without supranational mechanisms—exchange rate adjustments, fiscal transfers, and any automatic counterbalancing stabilisers—the southern region became a chronic debtor to the northern region and the rest of the world. This represents the original flaw in Euro Area architecture: deficit countries underwent the effects of wage-policy adjustments in the northern region without any domestic policy tool to counteract the negative trade spiral. Kalecki describes neatly the dynamics of the macro mechanism at work (1954, p. 51):

The capitalists of a country which manages to capture foreign markets from other countries are able to increase their profits at the expense of the capitalists of the other countries…. The counterpart of the export surplus is an increase in the indebtedness of the foreign countries towards the country considered…. The counterpart of the budget deficit is an increase in the indebtedness of the government towards the private sector…. The above shows clearly the significance of ‘external’ markets (including those created by budget deficits) for a capitalist economy…. It is the export surplus and the budget deficit which enable the capitalists to make profits over and above their own purchases of goods and services.

Therefore, the interaction between wage adjustments and net export flows within a monetary union does not work in isolation, but impacts on a third dimension, the level of private and public debt. According to Table 1, the debt level of the non-financial sector (private and public) in the northern region increased between 1999 and 2016 by 23% over GDP, compared to a steady increase of 102% in the southern region.Footnote 11 The third dimension is the financial linkage between the two regions, and the continuity of its smooth functioning assures the viability of both the export- and debt-led growth models (Stockhammer 2015, 2011a).Footnote 12 Moreover, in this regard there is a substantial difference between the two regions: the debt overhang in the northern region is mainly the outcome of private debt decisions, while in the southern region, the public sector is an important driver of the country’s total debt.Footnote 13 This difference also exists in the private dimension with regard to household and non-financial corporation debt. Hence, the third stylized fact refers to the asymmetric dynamics of private and public debt levels in the two regions.

This reflects not only a structural weakness and an unsustainable process in the EA macro-mechanism, but also a potential economic and political constraint to restore convergence. Hence, it produces sticky path-dependency by impairing current growth as well as by constraining future growth. In this way, the existence of economic divergence becomes a chronic feature of the monetary union, and the economic costs of joining outweigh its benefits, while the political costs of leaving are smaller than would be the case under a harmonious and balanced development of economic activities.

In the next section, the empirical analysis assesses the impact of wage adjustments on economic activity defining the demand regime in both regions, as well as their effects on the trade balance between the two regions.

3 Empirical approach

The aim of the empirical investigation is twofold: to test the aggregate demand regime in both regions—the wage-led and profit-led hypothesis—and to evaluate the impact of wage variations on the trade balance between the two regions. In this respect, two different model specifications are used. A VAR model tests the demand regime and a SVAR quantifies the causes of the intra-EA trade surplus/deficit. The analysis focuses on short-term business cycle fluctuations, i.e. in a period of 2 to 5 years. No assumptions are made on long-term equilibrium, which would require a VEC model and a cointegration analysis.

A VAR system approach is implemented following the specification of Stockhammer and Onaran (2004), and Jump and Mendieta-Munoz (2017) so as to treat functional income distribution as endogenous, avoiding any endogeneity bias.Footnote 14 The analysis is performed in first differences since unit roots tests suggest that variables are integrated of order one.Footnote 15 Furthermore, the standard specification of Bhaduri and Marglin (1990) is augmented by including financial controls, which, according to the most recent literature (Stockhammer 2017), have important effects on demand dynamics and may help to overcome the omitted variable bias from which the results in the literature suffer. Overall, this modelling framework overcomes three important deficiencies of the current literature as clearly detailed by Onaran and Obst (2016) by adopting a VAR methodology augmented with financial control variables.Footnote 16

3.1 Data and methodology

The data are quarterly ranging from q1-1996 to q4-2016, totalling 84 observations. The data are aggregated at regional level weighted by the share of each country’s GDP. The variables used for the analysis are: (1) gross fixed capital formation \(\left[ I \right]\); (2) private consumption expenditure \(\left[ C \right]\); (3) exports and imports vis-à-vis the rest of the world \(\left[ {X, M} \right]\); (4) unemployment rate \(\left[ U \right]\); (5) unit labour cost \(\left[ {ulc} \right]\); (6) wages \(\left[ W \right]\); (7) private-non financial sector debt \(\left[ {PD} \right]\); (8) the real effective exchange rate—narrow index \(\left[ {reer} \right]\); (9) long-term interest rate \(\left[ {irl} \right]\); (10) intra-EA exports and imports in goods between the two regions \(\left[ {INT\_X INT\_M} \right]\). Variables from (1) to (3) were downloaded from OECD’ Main Economic Indicators (MEI) database and (4) to (6) from OECD’s Economic Outlook No 100, while (7) to (8) from Bank of International Settlements (BIS) database, and (9) to (10) from Eurostat. Definitions and data sources are provided in Table 7 in "Appendix".

Given the above, the CPI price deflator provided by the OECD database concerning variables (1) to (3) is applied to W, PD, and INT_X and INT_M, which are at current prices. Ultimately INT_X and INT_M, unadjusted data, are seasonally adjusted by regressing the original series on a set of quarterly dummies. Therefore, the overall dataset is at constant prices (base year 2010) and is seasonally adjusted.

The VAR was estimated with four lags and seasonal dummies.Footnote 17 This lag structure was used for the following reasons: (1) in a small sample the Akaike Information Criterion (AIC) selects the correct specification more often (Lutkepohl 2005); (2) to get rid of any serial correlation in the residuals in each specification, which is verified by an LM testFootnote 18; (3) economic variables such as gross fixed capital formation may take longer than one or two quarters to respond to changes in economic conditions.Footnote 19

A summary of the model specifications and LM tests is provided in Table 8 in "Appendix". The overall analysis is carried out on 79 data points, since 1 observation is lost on first-differences and 4 for the lag structure.

3.2 Model specification

3.2.1 Aggregate demand regime

Model one is set up to assess the impact of a wage share adjustment on the demand regime. The variables are entered into the vector \(\left[ { WS , I , C , TB , U } \right]\) and identification is based on a lower-triangular Cholesky decomposition according to this particular ordering. The underlying economic intuition for this selection is that a reduction (increase) in the wage share has two opposite effects: it increases (decreases) corporate profits, which in turn boost (impair) investments, GDP and so exports over imports; on the contrary, it decreases (increases) aggregate domestic demand through falling (rising) disposable income, which in turn negatively (positively) affects investment decisions and therefore aggregate demand. Depending on whether the former effect predominates the latter, the demand regime is profit- or wage-led (Bhaduri and Marglin 1990).

In this context, a shock to the wage share \(\left[ {WS} \right]\) affects all variables simultaneously. This implies that wages do not react to GDP components or unemployment within a quarter. This assumption, though not always satisfied, is in line with the literature on wage-led aggregate demand (Druant et al. 2012; Jump and Mendieta-Munoz 2017).Footnote 20 Moreover, placing first the wage share is consistent with the stream of literature and the stylized fact emphasising that the downward wage adjustment in the northern region was the response to structural reforms implemented in the labour market which slowed-down wage growth relative to GDP growth (Kollmann et al. 2015; Naastepad and Storm 2015). This allows us to isolate the wage shock with a good level of approximation since it was the results of an exogenous policy decision, and therefore assess how a shock to wages and the wage share may impact the GDP components and the unemployment rate. Overall, the benefit of deploying this identification strategy is to treat the shock to wages to be exogenous to the rest of the variables of the system. Therefore the implicit assumption is that the shock to wages is not contemporaneously affected by other shocks. In the robustness section, this assumption is relaxed, and the wage share is allowed to contemporaneously react to other variables.

Observe that, since the focus is on the impulse responses to a wage share shock only, the ordering of the variables after the wage share does not affect the impulse responses (Christiano et al. 1999).

To sum up, the baseline model is a five-variable VAR, which is increased gradually to an eight-variable VAR by controlling for the real effective exchange rate \(\left[ {reer} \right]\), the long term interest rate \(\left[ {irl} \right]\) and private non-financial sector debt \(\left[ {PD} \right]\).

3.2.2 Intra-EA trade balance

Model two is fine-tuned to assess the impact of wage variations on net exports between the northern and southern region. All the variables are transformed into growth rates by taking the natural logarithm and then the first differences. This differs from model one because wages and net exports are not treated as share of GDP. The advantage is the good fit of the model, which better captures the effects of domestic and foreign wage variations on net export flows between the two regions.Footnote 21 The identification scheme is based on the lower-triangular Cholesky decomposition, and the vector of endogenous variables become: \(\left[ { W^{*} , W , I , C , INT\_NX, ULC } \right],\) where \(W^{*} and W\) represent respectively wages in the foreign and home region, and \(INT\_NX\) the net exports between the home and the foreign region.Footnote 22

Given that throughout it is assumed that \(W\) does not simultaneously react to \(\left[ { I , C , INT\_NX, ULC } \right]\) it seems reasonable also to assume that it does not simultaneously react to \(W^{*}\). This is achieved by imposing a zero restriction on the response of \(W\) to \(W^{*}\). Moreover, it also reasonable to think that the effects of foreign wage variations are transmitted to the domestic market through the export and import channel, i.e. through a change in net exports. Accordingly, a zero restriction on the response of \(\left[ { I , C , ULC} \right]\) to \(W^{*}\) is imposed. Therefore \(W^{*}\) is allowed to have a simultaneous relationship only with \(\left[ {INT\_NX} \right].\) Thus, a structural over-identified VAR (SVAR) is estimated.

Furthermore, since the model aims to explain trade flows which are not subject to exchange rate variations—intra EA—the real effective exchange rate is dropped from the model and replaced with the unit labour cost.Footnote 23 In addition, to avoid making the SVAR too large and so run out of degrees of freedom, the debt ratio and interest rate are also dropped. To sum up, the baseline model is a six-variable SVAR, which becomes a seven-variable VAR by separating the trade balance into its components, exports \(\left[ {INT\_X} \right]\) and imports \(\left[ {INT\_M} \right]\). This helps to trace the sources of intra-trade imbalance movements, and to interpret the income and price effects of wage variations.Footnote 24

3.3 Empirical results

3.3.1 Impulse response function analysis: aggregate demand regime

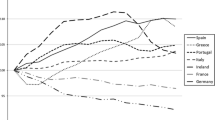

Figure 2 shows the baseline cumulative orthogonalized impulse responses to a unit standard deviation wage share adjustment and 90% confidence bands, respectively for the northern region (left panel) and the southern region (right panel).Footnote 25

Cumulative orthogonalized impulse response functions to a wage share shock. Note: The Shock is the first in the Cholesky decomposition (unit standard deviation). The solid line refers to point estimates, dotted lines to 90% confidence region. The responses are expressed as a percentage of the underlying variable, except for the unemployment rate, which is in basis points, and the wage share and trade balance, which are shown as a percentage of GDP

It is evident that an increase in the wage share has remarkably different effects in the two regions. First, investments tend to fall in both regions within 1 year, but more sharply and with greater persistence in the northern region than in the south. Overall, after 20 quarters, an increase in the wage share increases investments in the southern region and decreases them in the northern region, although only for the latter the effect is strongly significant at 90%. Regarding the southern region, statistical significance at 60% holds only on impact and after 20 quarter (Table 2). Consistently, consumption tends to fall in the northern region and rises in the southern region, while the trade balance falls in both regions. In this case, results show statistical significance at 90% for the impulse response of the trade balance, whereas the consumption response is statistically significant at 60%. Remarkably, the effect on the trade balance in the northern region is much stronger than in the southern region, with a sharp effect on impact. Lastly, the unemployment rate, which can be interpreted as a proxy for the overall economic activity and labour market dynamics, increases in the northern region and decreases after 1 year in the southern region, though in the latter is not statistically significant. All in all, the northern region demand regime can be classified as profit-led, while the southern region is in a wage-led regime.

This result underlines the role played by functional income distribution on aggregate demand, i.e. the relationship between output—investment, consumption, trade balance—and unemployment. The sequence of causal relationships among endogenous variables can be divided into three steps: (1) the positive adjustment of the wage share decreases investments on impact and the trade balance, causing investments to fall further; (2) the fall in investments increases unemployment, which in turn offsets the positive effect on consumption of the initial increase in the wage share; (3) falling consumption negatively affects investments giving rise to a vicious circle.

On the first point, Stockhammer (2008) emphasize that the degree of openness is crucial in determining the overall regime. The sharper fall in the trade balance on impact in the northern region is consistent with the difference in the degree of openness between the two regions: in 2016, the sum of exports and imports in the northern region amounted to 113% of GDP, compared to 63% in the southern region. To be precise, as a share of GDP exports and consumption account respectively for 60% and 52% in the northern region, against 32% and 57% in the southern region.

Clearly exports weigh more than consumption in the northern region, therefore the shocks affecting the international competitiveness of products tend to have more negative effects on output than shocks affecting domestic demand. Conversely, domestic shocks have a stronger negative effect on output in the southern region, since consumption is undoubtedly the most important component of aggregate demand. This difference underlines the transmission channel through which a wage share increase/decrease propagates within the economy, and the nature of the demand regime.

Moreover, a fall in investments, given they are the key variable explaining aggregate unemployment across countries and over time (Stockhammer 2011b), affects the current and future level of unemployment. Indeed, the unemployment rate increases faster in the northern region than in the southern region consistently with a sharper fall in the investment rate. This amplifies the negative effects of an increase in the wage share in the northern region, resulting in a lower level of consumption, which in turn negatively affects investments, and thus creates a vicious circle of unemployment and low investments. On the contrary, the rise in consumption expenditure in the southern region—the engine of a wage-led regime—is able to counterbalance the fall in the trade balance, pulling investments out of the negative territory after 6 quarters. Unemployment decreases after 8 quarters, consumption further increases, as do investments.

Table 2 summarizes at specific moments after the shock the results of the baseline responses to an increase of 1% of the wage share in the two regions according to two different Cholesky orders. Although consumption slightly increases in the northern region both when the wage share is placed as third and last variable in the vector of endogenous, the overall effect on GDP is negative. This is due to the fact that the weight of consumption as share of GDP, almost 54% through the entire period of the analysis, is not enough to compensate for the decline in investments and the trade balance weighting respectively almost 20.8% and 4.3% of GDP. Moreover, we need to emphasize that the positive impact on consumption in the northern region is never statistically significant. Overall, results for the northern region are driven by the strong negative responses of investments and the trade balance.

To what may concern the southern region, results are quantitatively unchanged, while qualitatively they improve when the wage share is place third in the vector of endogenous. Precisely, the impulse response of investments becomes positive and statistically significant after the first year. These robustness checks confirm that the southern region is wage-led, while the northern region is profit-led.

Table 3 summarizes at specific moments after the shock the results of the baseline responses—panel (a)—to an increase of 1% of the wage share in the two regions. For the real effective exchange rate, private non-financial sector debt and the long-term interest rate the impulse responses are quantitatively similar to those reported in panel (a). Furthermore, the results for the aggregate demand regime, i.e. the wage-led hypothesis for the southern region and the profit-led hypothesis for the northern region are confirmed. In addition, the results of the baseline model are also quantitatively consistent with the stylized facts specified in the previous section. As shown in Table 1, a decrease in the wage share of 4.2% of GDP in the northern region led between 1996 and 2007 to a surplus in the trade balance of 5.5% of GDP. According to the baseline estimates—panel (a)—a decrease in the wage share of 4.2% of GDP would increase the trade balance in the northern region by 5.9% of GDP.Footnote 26 Results for unemployment, investment and consumption are also consistent with the stylized facts, though not as precisely as for the trade balance.

Lastly, it is important to stress that if the results vary little in the northern region for different model specifications, i.e. the control variables neither qualitatively or quantitatively affect the impulse responses, in the southern region the introduction of the private non-financial sector debt—panel (c)—quantitatively produces an amplification effect compared to panel (b). Moreover, this amplification effect is exacerbated when the private non-financial sector debt interacts with the long-term interest rate—panel (d). It is important to note that augmenting the model with financial controls (private debt and the interest rate) leads to a strong improvement in statistical significance of the impulse responses in the southern region.

Although in both regions an increase in the wage share has a positive effect on the debt level as a share of GDP, this effect is six times larger in the southern region. Faced with a reduction in the long-term interest rate on impact, an economy with a wage-led aggregate demand experiences strong positive spillovers. Although investments fall on impact probably due to higher labour costs, they recover within a year due to the simultaneous fall in interest rates, easier access to debt-financing, and increased consumption expenditure. This initial shock sets in motion a complex set of interactions à la Minsky (1982), in which financial effects work as an amplifier of business cycle fluctuations. In fact, if unemployment is the key variable reinforcing the consumption pattern and hence the investment rate in a wage-led regime—as previously described—the interaction of private debt with the interest rate directly influences the size of investments and thus the unemployment rate. Therefore, financial variables have a stronger amplification effect in a wage-led than in a profit-led regime.

This result provides additional evidence of the role played by private debt as the key driver of aggregate demand (Stockhammer and Wildauer 2016) and new insights into the relationships between debt-led and export-led economies within the EMU (Stockhammer 2015).

3.3.2 Impulse response function analysis: intra-EA trade imbalances

The impulse response analysis of the second model is based on a 1% increase to the growth rate of wages, and not on an increase of 1% of GDP in the wage share. Table 4 shows the results of the model specification to a 1% increase in wages.Footnote 27 Moreover, in this model, the trade balance is replaced by the trade balance between the two regions, which is defined as intra net-exports \(\left[ {INT\_NX} \right].\)

As we can see, the demand regime is unchanged. Investments and consumption respond negatively to a wage decrease in the northern region and positively in the southern region. Moreover, intra net-exports respond negatively in both regions. In line with the previous results, the inclusion of private non-financial sector debt and interest rates in the set of endogenous variables produces financial amplification effects in the southern region. These variables have negligible effects in the northern region. Furthermore, when adding financial controls, statistical significance of the results strongly improves. After 5 years, all variables in both regions are statistically significant at 90%, except consumption in the northern region, which holds significance at 60%.

After showing the consistency of the baseline results for both model specifications, the focus now moves to the impact of wage variations on net exports between the northern and southern region. This second part of the investigation aims to test whether intra trade imbalances are the result of different growth models so as to clarify their origin and causes. Moreover, the advantage of focusing on the intra trade balance is twofold: net exports between the two regions are the outcome of interaction between a narrower set of factors internal to the monetary union, and do not depend directly on supply and demand factors outside the Euro Area. This gives the model a better performance in terms of goodness of fit and therefore increases the reliability and comparability of the results between the two regions.

A 1% wage increase in the northern region has a much stronger negative impact on net exports to the southern region than a 1% wage increase in the southern region. This result is qualitatively and almost quantitatively unchanged when the model is augmented with private debt and interest rates and by taking into consideration the relative magnitude of the wage increase—column ‘as if 1%’.Footnote 28 From this first insight, wage restraint policies implemented in the northern region seem to be a relevant factor affecting trade imbalances within the Euro Area.

Nevertheless, the baseline model (a) and the augmented baseline (b) work in isolation; there is no interaction between the northern and southern region, and intra net-exports are the result of the interplay of solely domestic variables and domestic shocks. Obviously, this is not the case. In this respect, wages of the opposite region \(\left[ { W^{*} } \right]\) are added to the set of endogenous variables as the most exogenous variable—first in Cholesky ordering. This allows us to overcome an omitted variable bias and to improve the overall fit of the intra net exports equation. By including foreign wages in the model, simultaneous relationships must also be modelled. This is achieved—as previously discussed—by imposing a set of zero restrictions on the response of \(\left[ { W, I , C , ULC} \right]\) to \(W^{*}\). This implies that an over-identified SVAR is estimated.

Table 5 reports the results of the cumulative structural impulse responses of intra net exports \(\left[ {INT\_NX} \right]\) to a 1% increase in foreign wages \(\left[ {W^{*} } \right]\)—panel (a)—and domestic wages \(\left[ W \right]\)—panel (b). A shock to foreign wages \(\left[ {W^{*} } \right]\) in the ‘South column’ represents the effect of a 1% increase in northern wages on intra net exports in the southern model. This effect should be the mirror image of a 1% increase in domestic wages on intra net exports in the northern region.

A 1% shock to southern wages \(\left[ {W^{*} } \right]\) increases northern intra net-exports to the southern region by 8.30%, while a 1% shock to northern wages increases southern intra-net exports to the northern region by 12.54%. This result consolidates the evidence shown in Table 4 for the closed economy model. Results are even stronger if the relative size of the wage shock after 5 years is taken into consideration—column ‘as if 1%’. Moreover, the result of a foreign wage shock \(\left[ {W^{*} } \right]\)—panel (a)—is qualitatively similar to the results of a domestic wage shock \(\left[ W \right]\)—panel (b). Quantitatively, impulse responses to a domestic wage shock \(\left[ W \right]\)—panel (b)—are larger due to interaction with domestic variables. Overall, the results show the important contribution of wage adjustments in the northern region to the creation of trade imbalances with the southern region. Overall, all variables are statistically significant at either 90% or 60% threshold. In "Appendix", Figs. 3 and 4 report the structural impulse response functions for the northern and southern regions to a foreign and domestic wage shock, respectively.

Next, the specification separating net exports into its export and import components enables the model to capture the income and price effects of wage variations. This specification is important in light of the recent literature which asks whether the price or income effects of wage variations contributed most to the growing deficits in the Euro Area (Ginzburg et al. 2013, p. 662).Footnote 29 To be precise, the impact of a 1% increase in foreign wages on exports reflects the income effect of stronger foreign demand, while the impact on imports reflects the price effect of higher unit labour costs. Vice versa, the impact of a 1% increase in domestic wages on exports reflects the price effect of higher unit labour costs, while the impact on imports reflects the income effects of stronger domestic demand.

Table 6, which maintains the same structure of Table 5, reports the results of the cumulative structural impulse responses of intra exports \(\left[ {INT\_X} \right]\) and imports \(\left[ {INT\_M} \right]\) to a 1% increase in foreign wages \(\left[ {W^{*} } \right]\)—panel (a)—and domestic wages \(\left[ W \right]\)—panel (b).Footnote 30 Almost all variables are statistically significant at either 90% or 60% threshold. In "Appendix", Figs. 5 and 6 report the structural impulse response functions for the northern and southern regions to a foreign and domestic wage shock, respectively.

The first important result to be noticed is that the price and income effects tend to be stronger in relation to northern exports (southern imports), than to southern exports (northern imports). More specifically, a 1% shock to southern wages increases northern exports after 5 years by 4.22%—income effect—and decreases northern imports by 0.56%—price effect; conversely a 1% shock to northern wages increases southern exports by 0.17%—income effect—and decreases northern exports by 2.41%—price effect. Regarding the latter, the estimates (panel a) of the price effect in the northern region are corroborated by the results of panel (b), with a relatively stronger effect after 5-years of − 3.91%. These estimates are in contrast with those of Naastepad and Storm (2015) who find that German exports are not price elastic.Footnote 31

Contrary, the income effect seems to be only slightly significant at 60% in panel (a), whereas in panel (b) it loses its statistical significance. These empirical estimates back up Ginzburg et al. (2013)’s main argument both quantitatively and qualitatively, i.e., the export base in the southern region is too narrow to sustain development driven only by external demand (2013, p. 662). This means that, even if the northern import demand expands, exports from the southern region would benefit only marginally.

A second important point that sheds light on the origin and persistence of intra-trade imbalances is that wage restraint policies in the northern region played and still play a crucial role in terms of price competition and export penetration.Footnote 32 This is the most important factor if the relative magnitude of the wage shock after 5 years is taken into consideration. In fact, a 1% increase in northern wages in a 5-year period—column ‘as if 1%’—reduces southern imports by 2.08%, against a 1% increase in southern wages which increases northern exports by 1.45%. This result is corroborated by the impulse response of the domestic wage shock shown in panel (b). In this case, both in absolute and relative terms, a 1% shock to domestic wages in the northern region has a stronger negative effect on northern exports than the positive effect of an equivalent increase in domestic wages in the southern region.

Furthermore, a positive shock to foreign wages in the northern region—panel (a)—has only a small negative price effect of − 0.19% on northern imports, meaning that cost competitiveness is not crucial for southern export performance. Nevertheless, as is evident from panel (b) this estimate is not consistent with the effect of an increase in the domestic wages in the southern region. In fact, a 1% increase in domestic wages in the southern region tends to increase—not reduce—exports to the northern region by 2.03%. Although there are opposing effects, one interpretation is that the foreign wage shock interacts only with variables in the opposite region and is not affected by the positive spillovers that a wage shock may have on domestic investment and productivity. It mainly captures the negative price effect on domestic imports. Estimating the effect of a domestic wage shock on exports, the model is likely to capture positive interactions between wage, aggregate demand, investments, and productivity. This explanation and result is consistent with the main argument of Naastepad and Storm (2015, p. 972) who underline how lower wage growth in the southern region is reflected in lower labour productivity growth and thus in weaker export performance.Footnote 33

3.3.3 Robustness

The robustness of the results was ensured by performing a series of tests throughout the empirical analysis. The first check was to see whether the results were sensitive to omitted variables, therefore additional controls such as the real effective exchange rate, private non-financial sector debt, and the long-term interest rate were included in both specifications, as suggested by Stockhammer (2017).Footnote 34 Second, evidence was provided that results concerning the demand regimes are not sensitive to variable specification, i.e. a 1% increase to the wage share or 1% increase in wages and to reverse Cholesky ordering when the wage share is place third and last in the vector of endogenous variables (Table 2) and for all specifications of Table 3. This robustness check also implies that results are robust when investments are considered the most exogenous variable in the system of equations. Moreover, the effects of a wage share increase are consistent with both the responses of the GDP components and the unemployment rate. Third, results are robust when the model is estimated for sub-periods.Footnote 35 Fourth, results are robust to a different selection of the lag-length. Four lags were chosen to tackle residual autocorrelations across the model specifications to avoid changing the lag-length here and there, and complicate the comparability of results. Fifth, results are region-specific, and each country may respond differently to internal and external shocks. In this analysis, it has been prioritized the opposition of the two regions by grouping the countries according to a common trade pattern. Wage and debt patterns are also consistent, although Portugal and Belgium differ respectively in the wage share pattern—decreasing—and the debt pattern—increasing. Sixth, the results on intra-EA net exports are robust when they are estimated in isolation—solely domestic wage increases—and when foreign shocks are added to the model. Moreover, the impulse responses do not change qualitatively and quantitatively when estimated for the northern or the southern region. Seventh, the results are also consistent when net exports are broken down into exports and imports.Footnote 36 The conclusion is that the results are robust to the time dimension, variable selection, model specification, region estimation, and in particular, they do not seem to be due to omitted variables or specific proxies.

4 Policy implications

These empirical findings show some similarities and differences to the existing literature, although comparability is limited due to remarkable differences in the empirical methodology, sample selection, model specification, and country aggregation.Footnote 37 Keeping in mind these differences, Naastepad and Storm (2006) found wage-led demand regimes in all European countries, while Ederer and Stockhammer (2007) among others, found consistently with this sample splitting, Austria and the Netherlands to follow a profit-led demand regime, and France to be in a wage-led stance. However, contrary to the findings of this paper, Germany follows a wage-led demand regime. If on the one hand, the empirical findings of this paper for wage-led economies are in line with the literature, this is not always true for all countries belonging to the norther region. As already discussed, differences in the approach are remarkable, but among these differences, the sample of analysis is the most relevant. In fact, as pointed out in the section stylized facts, Table 1 and Fig. 1 show that not considering (as it is the case in previous studies) the post-crisis persistence of German trade surplus within and outside the Euro Area, may likely lead to biased estimates for this country. The importance of net exports in driving the overall regime of a country is undisputable, and this is precisely where this paper aims to contribute.

The analysis has revealed that the Euro Area, albeit with a wage-led demand regime as a whole (Ederer et al. 2009; Onaran and Obst 2016), can be divided into two regions with clearly different wage, trade, and debt patterns. The specific patterns of each region proved to be the result of two opposing demand regimes: the wage-led southern region and profit-led northern region. Although, as documented by Belke et al. (2010) structural reforms overall tend to improve Intra-Euro Area current accounts as evident for Germany and the northern region, wage restraint policies, via the domestic-demand channel, may be also self-defeating if applied to a demand-led southern region. Structural reforms aimed at restoring price competitiveness through wage moderation or neoliberal policies in wage-led regime countries may produce a painful internal devaluation, which tends to reinforce divergence, and increase deflationary pressures. In this macroeconomic context, “a current account deficit can look like a major asymmetric shock” (Obstfeld 2012, p. 17).

On the one hand, the analysis shows that this major asymmetric shock endogenously and silently developed within the Euro Area, has created trade imbalances and in turn an accumulation of debt for more than a decade. On the other hand, it has also been shown how the northern intra-EA trade balance was forced out of balance vis-à-vis the southern region, reaching a surplus of 4.2% of GDP in 2007. The exogenous wage adjustments in the northern region may be interpreted as Kaldor’s initial advantage.Footnote 38 The structural change took place at the inception of the Euro Area, when the northern economies started to adjust their wage share downwards. In the context of the monetary union, the southern and northern regions faced a sharp asymmetric shock to their level of relative prices and wages. The cumulative results of price and income effects are reflected in the trade balance between the two regions. Intra-EA trade imbalances have become a chronic feature of the monetary union to the point of being perceived as the result of the normal functioning of efficient markets: the optimum allocation of capital and production of goods. Capital flows, the illusory and temporary convergence in interest rates, and easy credit from the banking system gave the system apparent stability and prosperity (Borio and Disyiatat 2015). Nevertheless, what guaranteed stability at first, later became the source of fragility. Debt-overhang became the major source of economic and financial instability, not because of the 2008 Financial Crisis, but due to negative spillovers between the sovereign, banking and economic systems, which impair and constrain current and future growth (Shambaugh 2012). Thus, path dependency is the outcome of a cumulative process, in which current and future output is pre-determined by the initial conditions. Current deflationary forces haven’t substantially reduced southern import-dependency on northern countries, nor increased southern exports to the northern region. The clear outcome is a polarisation process in terms of trade flows, industrial production, growth rates, unemployment and the ability of a country to respond to shocks, which reflects the divergence between the two regions in their productive base (Ginzburg et al. 2013; Naastepad and Storm 2015).

The tragedy of the Euro Area consists in the lack of countercyclical tools at the national and supranational level able to tackle the endogenous source of instability. In the absence of fiscal transfers from surplus to deficit regions, the macro-mechanism of the Euro Area is naturally flawed and trapped into a divergent and politically self-destructive trajectory. By referring to Myrdal’s cumulative causation theory, Blankemburg et al. (2013, p. 466) emphasize that dynamic elements of trade trigger backwash and spread effects, resulting in uneven economic development. Empirical analysis tries to quantify the negative effects of uncoordinated wage policy on trade relationships within the Euro Area, and explains how unemployment and the level of debt are both an outcome and an amplifying factor of the initial shock, ultimately creating winners and losers from trade.

In this regard, it is important to stress that, as already argued by Ginzburg et al. (2013), the economies of the southern region are very different between and within themselves, and therefore they would require different supportive policies, incentive structures and institutional arrangements in order to break this path-dependent process. Nonetheless, if country and industry-specific policies are important tools able to address some of these negative externalities, there is a clear necessity of tackling this issue in its macroeconomic dimension. It is on this latter work stream that the paper wants to contribute by providing and strengthening few key policy recommendations.

Many authors have expressed their scepticism regarding the capability of the EA and wide EU institutional framework in reforming itself to cope with these rising challenges (Grahl and Teague 2013). The political will is little and engaging with this complexity seems to be necessary but at the same time requires a common view of the causes, which seems far to be reached, and a common ground of political consensus (North 2016). The latter is further destabilized by the evidence brought by this paper, i.e., the two core regions of the Euro Area—northern and southern countries—by experiencing two opposing demand-regimes and growth strategies, and different phases of the business cycle, face different economic interests and political priorities (Bibow 2013). In this regard, it is paramount to recall the actual reasons that induced EA countries to join the common currency. These reasons are clearly stated in the Treaty of Maastricht, so as in the incipit of this paper.

If on the one hand, the prevailing doctrine of austerity in the fiscal domain and the continued uncertainty in the process of policy coordination may not bode well for chances of substantial institutional and economic reforms in the Eurozone (Panico and Puricato 2013), according to Boyer (2013), a more democratic reconfiguration of national and central policy processes within the EMU may be still on the cards. On this line, this paper also agrees with Grahl and Teague (2013) ‘s solidarity principle, that is, a fresh and ambitious approach to social policy is essential for a successful resolution of the crisis, both in socio-economic as well as political terms. According to these common points, it is here provided a hybrid solution which may combine the interests of both regions so as to set a mechanism of incentives which acts counter-cyclically to Myrdal’s cumulative and causation forces without needing a fully-fledge fiscal union in place.

In this respect, it seems clear that wage coordination should become a macroeconomic priority within a monetary union with fiscal and political independence (Stockhammer 2008, 2011a; Laski and Podkaminer 2012; Onaran and Obst 2016). Furthermore, wage coordination by indexing wage growth to productivity growth may act as an automatic-countercyclical policy tool so that countries experiencing a boom may play the role of pullers by stimulating aggregate demand and aggregate exports from neighbour countries (Stockhammer 2007; Toporowski 2013). A supranational European institution in charge of supervising and coordinating the Euro Area macroeconomic strategy would be useful to prevent national policies, taken in aggregate, destabilizing the objective of the single currency: trade integration and economic convergence. In order to reach these two objectives however, policymakers need to tackle the current divergence in a coordinated manner. From this perspective, wage coordination is just one ingredient in the policy mix, whose priority is to restore a process of convergence within the Euro Area. Because trade asymmetries are the outcome of a polarisation process between the southern and northern regions, and unemployment differentials are the outcome of an investment gap, these factors being mutually reinforcing, the practical task is to rebalance the productive base. Moreover, since convergence cannot be achieved through endogenous forces, which tend to preserve the specialisation pattern, exogenous forces—an ad-hoc investment package—are needed to shock the current state of the system. The Stability and Growth pact does not give the necessary fiscal flexibility to counteract a debt-deflation process, and a deterioration of the fiscal stance may foster financial speculation over sovereign default, exacerbating recession due to growing uncertainty and a weakened fiscal position. Overall, the institutional design of the EMU plays a key role in exacerbating pro-cyclical outcomes, leaving each individual country with the task of implementing policies to restore convergence, without full flexibility. Moreover, political independence includes fiscal independence, so fiscal transfers can only be achieved on the basis of a political union.

Therefore, this paper proposes a transfer mechanism based on intra-EA trade, in order to overcome the political impasse and provide automatic countercyclical stabilisers within the EMU. In this respect, this mechanism should be able to relax fiscal policy constraints and provide an alternative to the austerity rules and deflationary prescriptions of the Berlin–Washington Consensus (Fitoussi and Saraceno 2013). The mechanism should track trade imbalances among EA member states, so that surplus countries contribute to building up a European fund for countercyclical investments. The mechanism should work as follows: each deficit country draws from the fund according to their deficit quota, incentivizing local public and private investments, which in turn attract foreign capital. This mechanism increases long-term productivity in deficit countries by rebuilding the productive base, necessary to rebalance trade asymmetries as well as for sustainable and inclusive convergence. This countercyclical investment package should act as supply side policy, while wage coordination plays the complementary role of demand side policy, in order to guarantee a rising level of consumption and imports in the EMU. Strategically, the fund can be integrated into the scope of the European Investment Bank to avoid the mismanagement of funds by local government. This proposal expands further the suggestion of Arestis et al. (2001) and Sawyer (2013) by giving a precise countercyclical role to the EIB, which should seek to smooth asymmetric shocks and reduce persistent trade differentials through an active European industrial policy (Mazzucato 2013; Ginzburg et al. 2013; Naastepad and Storm 2015). The virtues of this mechanism comprise the following features: (1) Flexible: it overcomes the loss in flexibility due to the lack of a national exchange rate system. (2) Attractive: it creates new incentives to join the monetary union for countries in the common market; (3) Countercyclical: it assures a direct (in the country of origin) countercyclical industrial policy at the Euro Area level—the macro stabilisers needed in a monetary union with political and fiscal autonomy; (4) Fair: the countries that benefit most from EA trade need to contribute to the EA fund, while those that contribute most in terms of import demand should be rewarded; (5) Inclusive: sooner or later, each member state will be in surplus or deficit and hence he will be a net contributor or net receiver. Moreover, the fund would be of the on–off type, since a parity of the trade balance does not involve any transfer.

5 Conclusion