Abstract

Studying lifetime income inequality for individuals who belong to the same cohort can contribute valuable insights that cannot be obtained by usual analyses of annual incomes. Data from the social security system indicates that in West Germany, over the cohorts born between 1935 and 1972, lifetime earnings inequality has strongly increased. For male baby-boomers, lifetime inequality is predicted to be 85 % larger than in the case of their fathers. This is larger than the increase of inequality in the cross-section and points to dramatic intergenerational changes in the German labor market.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

These days it is common to hear politicians and pundits repeating that economic inequality is too large and that we should do something in order to reduce it, or at least to prevent it from growing further. Even institutions like the IMF—that in the past could not care less about inequality—currently warn about the bleak economic perspectives of societies that fall apart. Worldwide, fighting inequality is considered a hot issue again.

However, the empirical evidence on inequality that is brought to the fore stems almost invariably from distributions of annual incomes in some country. Such distributions are extracted from samples that include people at very different stages of their lifecycles and work careers. They include 20-years-old apprentices and their 60-years-old superiors; they include individuals who are on a steeply increasing wage path and individuals whose wage trajectories are completely flat; they include employees who in that particular year received extra bonuses and employees who in the very same year were temporarily put on reduced working time and reduced pay. Couldn’t it be that all those transitory inequality factors just wash out if you adopt a longer time horizon? Couldn’t it be that the alleged increase of inequality actually vanishes if you take a lifetime perspective?

These questions need to be addressed because we as economists are especially interested in the inequality of people’s opportunity sets. Those opportunity sets are usually conceived of as long-run opportunity sets, covering the bulk of people’s lives. And indeed, if it is the inequality of lifetime chances that pulls individuals and groups in a society apart from each other, it is lifetime inequality that we should be looking at.

The aim of this paper is to demonstrate that a lifetime perspective on inequality can contribute radically new insights that substantially add to the ones gained through analyses of annual incomes. In order to substantiate this claim I will first focus on lifetime inequality for individuals who belong to the same generation. Then, I will switch to the evolution of lifetime inequality across generations. In each part I will first present the main theoretical concepts and then discuss some empirical results from an ongoing research project concerning Germany.

The notion that lifetime income inequality may be the best way to gauge the inequality of people’s opportunity sets is an old one that goes back to seminal works by Franco Modigliani and Milton Friedman in the 1950s. However, the required data in order to study lifetime inequality is hard to come by, which explains why even most recent papers on lifetime inequality are usually based on simulated income biographies rather than on actual ones (Bowlus and Robin 2012; Heathcote et al. 2005; Hugget et al. 2011). Such simulations make use of a number of more or less heroic assumptions and should thus be seen more like educated guesses than factual descriptions of reality. In the current paper I will therefore concentrate on actual income biographies.Footnote 1

Once you have the data to answer the question about actual lifetime inequality, you can also use it to answer related questions like: how does annual income inequality evolve over the life cycle? How does mobility in the distribution of early income vary with age? What is the association of yearly and lifetime income over the life cycle? These are issues with far-reaching implications for economic theory and economic policy. For instance, take the very last one. It is still the case today that in much empirical work researchers employ some measures of short-term income although the theoretical relevant construct is long-run or permanent income. By assessing the empirical association between yearly and lifetime incomes you can evaluate the kind of bias entailed by the use of yearly income as a proxy of permanent income.

2 Concepts of lifetime inequality

A natural starting point to think about lifetime income is a stripped-down version of the well-known life-cycle model. Gauging the amount of resources to which individuals have access to during their lifetime boils down to evaluate the maximum present value that an individual can potentially spend on consumption goods. The standard life-cycle model portrays an individual that faces a number of per-period budget constraints, linked to each other by the saving and dissaving decisions of the individual. Substituting them out yields the individual’s intertemporal budget constraint. In its basic version, this can be written as:

On the left-hand side appears the present value of consumption which the individual enjoys from some initial date 0 to some final date T and discounts at the rate of interest r. On the right-hand side you find the corresponding present value of earnings. The latter can thus be used to measure the value of the opportunity set faced by the individual during his or her lifetime.

Equation (1) is just a first approximation. It can be improved upon by taking into account the fact that individuals also receive bequests that they can use for own consumption or for leaving bequests themselves—which may be interpreted as a special way the individual consumes his or her lifetime resources. Then, the intertemporal budget constraint becomes:

On its left-hand side there is the bequest that the individual leaves in the last period and on the right-hand side you find the bequest received by the individual at the beginning of the lifecycle.

A further improvement on the definition of lifetime income given by the right-hand-side of (2) obtains by incorporating the opportunity costs of the time that the individual uses for her leisure:

On the right hand side of (3) the present value of earnings has been replaced by the present value of full incomes, where w stands for the wage rate while H is the total time endowment of the individual. Correspondingly, on the other side of the equation you have h which denotes the working time of the individual.Footnote 2

Finally, one should take the impact of governmental redistribution on lifetime resources into account. This yields the following relationship:

The definition of lifetime income on the right-hand side now includes the net taxes that are paid by the individual over its life cycle, also computed in present-value terms.

From a theoretical point of view, the above concepts are straightforward. However, once you try to implement them empirically, several difficulties arise. Some are well-known from usual analyses of cross-sectional inequality. For instance, researchers must cope with the problem of choosing the reference unit, which can be the individual or the household or the tax unit. There is the issue of the appropriate equivalence scale, which means the way in which one adjusts for the size and composition of the household. You also have to find a reasonable method to evaluate in-kind benefits that individuals obtain from the government. In addition to all those issues, there are some that are distinctive of the lifetime approach and have to do with the intertemporal budget constraint.

In order to be able to write down the intertemporal budget constraint as in Eqs. (1–4), one has to assume perfect capital markets. In reality, capital markets are quite imperfect. Credit is rationed and the interest rate at which individuals can borrow money is higher than the interest rate that remunerates their savings. This means that the scope for averaging consumption over time is reduced, especially so for asset-poor individuals. This should have implications for the choice of the method of discounting. In a second-best world with imperfect capital markets the discount factor should represent the shadow price of the true opportunity cost of time, appropriately mirroring the distortions faced by the various groups of the population in the capital market. In practice, the information needed to establish those shadow prices is simply not there. Thus, in this type of empirical work we have to live with the assumption of perfect capital markets and to hope that our results do not hinge too much on that assumption. With this caveat in mind, I now turn to the extent of lifetime inequality in Germany.

3 Findings for West Germany

In what follows I will focus on intra-cohort lifetime earnings inequality—which is to say the least ambitious definition of lifetime income given above—in Germany, investigating inequality among people who were born in the same year. The results that I present are the fruit of an ongoing research project with Timm Bönke and Holger Lüthen, some of which are discussed in greater details in Bönke et al. (2015).

In this project we analyze waves of data from the German social security system known as Versicherungskontenstichprobe. This is a rich dataset that includes monthly information about earnings, employment status, sickness and other variables of interest for some 240.00 individuals per wave. Based on this administrative dataset we have built a sample that constitutes the main object of our investigation. Our sample includes West Germans only as we want to avoid the difficult issue of comparing earnings received in the FRG with earnings received in the GDR. We focus on mandatorily insured West Germans born in 1935 or later and exclude so-called fragmentary biographies. In this way we exclude from our sample people who have worked only for a short period as employees, typically because they became self-employed or civil servants, and for whom no complete earnings careers are available in our dataset. The resulting sample covers some 80 % of the West-German labor force.

We define lifetime earnings as social security earnings received by the individual between age 17 and 60. In this paper I will not deal with the lifetime earnings of women. In Germany there has been a huge change with respect to their labor market participation during the investigated period, which is from 1951 onwards. Results for female workers can however be found in the appendix of Bönke et al. (2015); they are similar to the ones obtained for men, albeit less stable. This may be due to the large incidence of part-time employment among women and the fact that working time is not accurately measured in our dataset. Furthermore, I will focus on German citizens, excluding also immigrated ethnic Germans, so as to avoid picking up effects due to changes in the composition of the sample over time. Thus, the results to be presented here refer to a relatively homogeneous group: male German natives who always worked as mandatorily insured employees in West Germany.Footnote 3

Our first finding concerns the magnitude of lifetime earnings inequality. For the cohorts born between 1935 and 1952 we can observe the earnings that were received by the individuals up to age 60 and hence we can compute their lifetime earnings. Table 1 presents our findings about intra-cohort inequality, measured by the Gini-coefficient of lifetime earnings. In order to discount earnings we use an average of nominal interest rates on federal governmental bonds.Footnote 4 The corresponding results appear in column (1) of Table 1. We find it instructive also to discount earnings by means of the consumer price index, which yields the second column of that table.

As shown by columns (1) and (2), the choice of the discounting method affects the level of inequality, but not its pattern. The level of measured inequality is higher if we use lower discount rates (i.e. inflation rates rather than nominal interest rates) because people with higher lifetime earnings tend to receive proportionately more earnings in the later part of their life cycle. According to our preferred discounting method (1), the Gini-coefficient of the intra-cohort distribution of lifetime earnings varies somewhat between 16 and 22 %.

How does lifetime inequality compare with annual inequality? Column (3) in Table 1 displays the average Gini-coefficient of the distributions of annual earnings for every cohort during its life cycle. It turns out that lifetime earnings inequality is somewhat less than 2/3 of annual inequality. The difference between the two is due to the mobility of the individuals during their life cycle in the yearly distribution of earnings, e.g. poor university students becoming well-paid managers when they grow older. This makes lifetime distributions much more compressed than annual distributions.

Although lifetime inequality is less severe than annual inequality, it is not negligible. In order to see it, recall that the Gini-coefficient is equal to one half of the mean relative difference. This means that a Gini-coefficient of 20 % corresponds to a mean relative difference of 40 % which is not negligible by any standard.

In order to better understand the role played by earnings mobility, we have scrutinized the evolution of the distribution of annual earnings within cohorts, starting when the cohort is 17-years-old and following it until it becomes 60-years-old. As shown in Bönke et al. (2015), the annual Gini-coefficients display a U-shaped pattern over the life cycle. Intra-cohort earnings inequality is large both at the beginning and at the end of the life cycle for the simple reason that at both extremes many people don’t participate in the labor market and have therefore zero earnings. Just after age 17, inequality of annual earnings goes down quite rapidly with age, reaches a minimum when the individuals are entering their thirties and then inequality grows again. This second part of the evolution of intra-cohort inequality during the life cycle is in line with stochastic models of earnings dynamics that stress the role of learning ability and idiosyncratic human capital shocks. According to the theory, individuals with higher learning ability are predicted to invest more in education at the beginning of their life cycle and to have steeper age-earnings profiles. Human-capital shocks can be shown to produce persistent differences in earnings even if they occur independently over time because of their compounding effects.

Further insights into the pattern of earnings mobility can be gained by computing the cohort-specific earnings rank correlation between two consecutive years. This measure is inversely related to short-term mobility: the higher is that coefficient, the smaller is the mobility. As we show in Bönke et al. (2015), in the beginning of the life cycle there is lot of short-term mobility going on, with many people substantially changing their rank in the cohort-specific income distribution from one year to the next. But when the cohort grows older, mobility becomes smaller and the rank coefficient stabilizes at 0.9 by the time the cohort gets in its forties.

Mobility has noticeable implications for the correlation between annual and lifetime income. As shown in Bönke et al. (2015), at the beginning of the life cycle annual earnings contain virtually no information about lifetime earnings. Their coefficient of correlation is close to zero or even negative. Then, it rapidly increases with age. We find that between age 35 and age 55 the correlation between annual and lifetime income is very high; after age 55 it goes down again because early retirement begins to set in. For researchers conducting empirical investigations this means that if you have no measure of long-run income but you have annual income, then you can be confident that the latter is an acceptable proxy for long-run income if the individuals are in the age range 35–55.

All findings about mobility that I have reported above are quite in line with what standard theory of human capital accumulation predicts. This applies also to age-earnings profiles. In Bönke et al. (2015) we have pulled together the cohorts born between 1935 and 1949 and subdivided their members into three groups according to their educational attainment: those who have received a college degree, those who have received a vocational degree, and those who have only received a high-school degree. More educated individuals are found to receive on average higher lifetime earnings. Logarithmic earnings are increasing and concave in age. Moreover, people with higher educational attainment have a steeper age-earnings profile, as predicted by theory.

4 The evolution of lifetime inequality

In order to pinpoint our results about the evolution of lifetime inequality it is useful to contrast them with the thrust of analyses of annual inequality in West Germany. With respect to the inequality of earnings, the literature on West-German male full-time employees has found that inequality at the bottom of the distribution was rather stable until the recession of 1993 and rose after that (Dustmann et al. 2009; Fitzenberger 1999; Fuchs-Schündeln et al. 2010; Gernandt and Pfeiffer 2007; Prasad 2004; Steiner and Wagner 1998). Overall earnings inequality seems to have increased a bit already before reunification: as measured by the percentile ratios of the 85/15 percentile, there was an increase by about 25 % from 1975 to 2001 (Dustmann et al. 2009); as measured by the standard deviation of log wages, there was an increase by about 40 % between 1985 and 2009 (Card et al. 2013). Similar results have been obtained for the distribution of equivalized gross household incomes. That distribution was pretty stable from the mid-eighties to the recession of 1993 and inequality started to rise after that. The Gini coefficient increased by some 12 % from 1986 to 2010 (Corneo et al. 2014).

How does the evolution of intra-cohort lifetime inequality compare to the evolution of annual inequality in Germany? Table 1 suggests that lifetime inequality increased somewhat for the cohorts born between 1935 and 1952, but the number of cohorts is too small to identify a clear trend. The problem, of course, is that we cannot measure lifetime earnings inequality for the cohorts born after 1952 because they have not yet completed their active life cycle.

In order to cope with that limitation we have generalized the concept of lifetime earnings to one of up-to-age-X earnings. Lifetime earnings were defined as the present value of earnings received until age 60 and discounted to the year when the individual turned 17. Up-to-age-X earnings (UAX) are defined as the present value of earnings received until some age X and discounted to the year when the individual turned age 17. Thus, lifetime earnings are a special case of UAX for X equal to 60.

The concept of up-to-age-X earnings lends itself to the following assessment of lifetime inequality. Suppose to consider also many cohorts that are still in their working career and to trace out the evolution of inequality of the cohort-specific UAX distributions. If we find that over the birth year of cohorts the Gini-coefficient of a selected UAX distribution is increasing and if we find this upward trend of the Gini coefficient for every X, this would indicate that a secular trend of increasing lifetime earnings inequality is underway. In contrast, if we do not find such an upward trend or if we find contrasting evolutions for different definitions of X, then we could not derive such a striking conclusion.

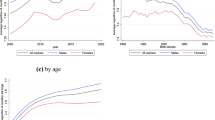

The main result from applying that concept can be seen in Fig. 1. On the vertical axis you have the Gini-coefficient of the UAX distribution for all cohorts in our sample, the youngest being born in 1972. On the horizontal axis you have the years of birth of the cohorts, starting with 1935. The first curve from above represents the evolution of the Gini-coefficient of lifetime earnings, i.e. UA-60. A little below that curve there is the one that portrays the Gini-coefficients of the UA-55, which allows us to include five more cohorts. The same procedure applies to the UA-50, UA-45 and UA-40 distributions. We stop at age 40 because, as mentioned in the previous section, before age 40 there is a lot of intra-cohort mobility going on, so that at those early ages accumulated earnings are relatively weak indicators of lifetime earnings.

Figure 1 clearly shows an upward trend of lifetime inequality, with a secular rise from the cohorts born in the mid-1930s to those born in the early 1970s. This finding of a rise of intra-generational inequality of lifetime earnings is a novel and intriguing one.Footnote 5

Our main finding is not simply the mirror image of the increase in cross-sectional inequality. The orders of magnitude are quite different: the rise of intra-cohort lifetime inequality is not just moderate, it is substantial. As an example, consider two cohorts, the one born in 1935 and the cohort born in 1963, which may be seen as respectively statistical fathers and statistical sons. The Gini-coefficient of the UA-45 distribution for the fathers equals 12.6 %. The Gini-coefficient of the UA-45 distribution for the sons equals 23.3 %. This implies a rise of inequality by 85 %. This is a much bigger order of magnitude than in case of the rise of annual earnings inequality.Footnote 6

As we show in Bönke et al. (2015), the increase of lifetime inequality hit both the top and the bottom of the distribution. But the increase has been stronger at the bottom, especially for generations born after the end of the Second World War. This is mirrored in the evolution of the absolute level of accumulated earnings at various percentiles of the distribution. Figure 2 shows the evolution of UA-40 measured in real terms for the P20, the median, and the P80. The corresponding UA-40 of the oldest cohort have been normalized to one. As shown in the figure, at the level of the P20 the youngest generation received before age 40 earnings that in real terms were only 23 % higher than the earnings received by the P20 of the oldest cohort before that cohort became 40-years-old. The real UA-40 of the P20 have even declined over the younger cohorts. Instead, the median of the youngest cohort, born in 1972, received earnings until that cohort was 40-years-old that were 59 % higher in real terms than the earnings received by the median of the oldest cohort until age 40. In the case of the P80, the increase of real UA-40 has been by almost 80 %. This shows that the rise of lifetime inequality is mainly hitting those in the lower half of the distribution.

5 Drivers

A first pass in order to pin down the drivers of the rise of German lifetime inequality is to decompose it into two parts: the increase due to changes in wage dispersion (i.e. changes affecting the distribution of strictly positive earnings) and the one due to the unequal evolution of unemployment spells (during which individuals receive zero earnings). The interest of this decomposition derives from the peculiar evolution of unemployment in West Germany. Before the first oil shock, a situation of almost full employment prevailed there. After the first oil shock, a long-lived stepwise increase of the unemployment rate set in. The low-skilled were severely hit, as their rate of unemployment was about twice the overall unemployment rate. Since unemployment entails zero earnings, one may conjecture that unemployment has been a proximate cause for the rise of lifetime earnings inequality in Germany.

As a matter of fact, our dataset reveals a very heterogeneous life-long incidence of unemployment across cohorts at different parts of the distributions. If we rank individuals according to the UA-40, we find that the upper part of the distribution is hardly affected by unemployment, and this applies to all cohorts. Things are very different in the lower half of the distribution, especially so for the lowest quartile. For that group, the incidence of unemployment was very different across cohorts. In case of the oldest cohorts in our sample, before reaching age 40 individuals in the lowest quartile had spent on average some 5 months as unemployed. This is not very different from the average unemployment spell for the entire cohort. In case of the youngest cohorts instead, before reaching age 40 individuals in the lowest quartile had spent on average more than 40 months as unemployed—eight times as much.Footnote 7

In order to quantify the effect from unemployment on the rise of lifetime earnings inequality we have imputed wages to the unemployed. It turns out that the unequal evolution of unemployment spells contributes to explain only some 20–40 % of the total increase of lifetime earnings inequality. Furthermore, the evolution of unemployment does contribute to explain the inequality rise at the bottom of distribution, but not at the top.

As a consequence, some 60–80 % of the increase of lifetime earnings inequality in Germany is due to increased cohort-specific wage inequality. Why has lifetime wage inequality increased so much? While we still do not have a definite answer, it may be useful to formulate a couple of hypotheses in order to guide future empirical work.

A first hypothesis is that the same factors that led to increased cross-sectional wage inequality also led to increased lifetime wage inequality. Research on cross-sectional wage inequality for West German men has put forward three main drivers: (1) skill-biased technological change is deemed to be an important factor of increasing inequality in the upper part of the distribution; (2) declining union power and vanishing coverage through collective wage agreements are considered to be key factors of increased inequality at the bottom part of the distribution; (3) immigration waves, especially in the early nineties, may have played a role for increased inequality at the bottom.Footnote 8

All those three factors could have also increased lifetime wage inequality if firms consider workers from young cohorts to be imperfect substitutes for workers from older cohorts. An obvious reason for this would be hiring, training and firing costs. This would imply that incumbent old workers have a relatively strong bargaining position vis-à-vis their employers and therefore could avoid carrying much of the burden of adjusting the labor market to the heavy demand and supply shocks that hit the German labor market since the 1970s. According to this hypothesis, this burden was mainly carried by the less skilled of the younger cohorts—whence the rise of intra-cohort lifetime wage inequality.

A second hypothesis is that the rise of lifetime wage inequality was generated by changes in the intra-cohort distribution of lifetime work effort. I refer to work effort rather than simply working time because lifetime wages are not only determined by the number of hours an individual works, but by several additional individual decisions. Those include educational effort and occupational choice—for instance the choice to avoid unsafe, risky, unpleasant occupations even if they would allow one to earn more. Lifetime work effort also includes work intensity, which may determine the level of performance-related pay received by an individual and the likelihood of getting promoted and climbing a firm’s hierarchy.

Lifetime work effort is a multi-dimensional concept which is hard to measure empirically. Still, it should be taken into account. If changes in work effort were driving the rise of lifetime wage inequality, its policy implications would be very different from the ones that may be derived if factors like skill-biased technological change, union decline and immigration were the main culprits. Whereas the latter are circumstances beyond the control of individuals, effort has a volitional component, so that to some extent the inequality increase may be considered legitimate and acceptable.

I would like to put forward two possible ways how a change in the distribution of lifetime work effort could have generated a rise of lifetime wage inequality. The first channel is the evolution of social benefits and wage taxes in West Germany. After the 1960s, the German tax-transfer system has become more progressive as compared to the two previous decades. On the one hand, social transfers have become more generous in terms of replacement rates and new social rights have been granted. On the other hand, the marginal tax rates on wage incomes have increased for the bulk of the workforce, especially so if one takes the tax component of social contributions into account.

That long-run increase of progressivity in the tax-transfer system is likely to have generated different work incentives for people at different skill levels. For the low-skilled, both the substitution and the income effect may have pushed towards a reduction of work effort. For the high-skilled, the income effect is instead likely to have increased work effort. Hence, changes in taxes and transfers might have led to a stronger decrease in lifetime work effort for those in the lower part of the skill distribution and hence to more wage dispersion.

The second possible explanation is based on an effect from sustained economic growth upon a population endowed with heterogeneous preferences for money versus leisure. Anecdotal evidence abounds in suggesting that people significantly differ with respect to the importance they attach to purchasing power. Some individuals endorse materialistic values, e.g. they especially like to drive luxury cars and to spend holidays in exclusive, and expensive, places. Others have instead post-materialistic priorities, e.g. like to read books, play soccer or chess with friends, and spend time with their children. They do not believe to need a lot of money in order to realize their life goals.

Those different types of people may have always existed. However, it is conceivable that within the older cohorts, those with cheap tastes chose nevertheless to exert much work effort because their earning ability was low—because of a generally low level of productivity at the time. Subsequent economic growth increased the earning potential of everybody, including people with cheap tastes. But in contrast to people with expensive tastes, those with cheap ones decided to devote part of that productivity gain to enjoy more leisure time with family, friends and so on.

Figure 3 illustrates the idea. On the horizontal axis is measured lifetime leisure (a constant minus lifetime work effort), on the vertical axis lifetime consumption. The lifetime budget constraint delimits the lifetime opportunity set. Economic growth entails higher labor productivity which makes the lifetime budget constraint rotate clockwise. Behavior is represented by the expansion path, one for each type of agents. The blue path corresponds to those with expensive tastes and the red one to those with cheap tastes (i.e. steeper indifference curves). When economic growth provides people with higher earnings ability, materialists keep working a lot and end up earning a lot. In contrast, post-materialists are characterized by a backward-bending labor-supply curve. When their productivity increases, they choose to devote more time to other things rather than market work. Thus, their lifetime work effort decreases and their earnings grow less rapidly. In this way the divergence between the two types of agents in terms of work effort brings about a divergence in terms of wage income.

6 Concluding remarks

Over the last 60 years, intra-cohort earnings inequality has hugely increased in Germany. This marks a deep difference between the working class that came out of the baby-boom generation and the one that came out of its parents’ one. Earnings inequality is not the only dimension that marks a substantial intergenerational change from one working class to the other. In order to illustrate it, compare once again the fathers-cohort born in 1935 with the sons-cohort born in 1963. As I mentioned above, from fathers to sons lifetime earnings inequality has increased by some 85 %. A similar change occurred with respect to pay uncertainty for those in employment. This can be seen by computing the transitory variance of wages measured when the cohort was 40-years-old. As it turns out, pay uncertainty so measured has doubled from one generation to the next. Another crucial element of comparison is the extent of exclusion from the labor market. This can be captured by the fraction of a cohort that experienced more than 12 months of unemployment before reaching age 40. For those born in 1935, only 2.3 % of them experienced more than 1 year of unemployment before they turned 40. For the cohort born in 1963, 28.2 % made that experience—which means that, in contrast to their fathers, a substantial fraction of the baby-boom cohort lacked a full integration in the labor market.

Another striking intergenerational difference may be called—in want for a better term—a difference in “class imprinting”. It refers to workers’ perception to be in a very different income category as compared to their bosses, which may have a strong impact on the formation of their class consciousness. The intensity of that perception may be measured by the ratio of capitalists’ per-capita income to workers’ per-capita income when the latter are in the initial years of their working life and make up their mind about the nature of industrial relations. Somewhat arbitrarily, I define capitalists’ income as the P99.9 of the income distribution, as obtained from administrative income-tax data.Footnote 9 The ratio of this income to the median wage, both taken when the cohort was 30-years-old, is thus my proxy measure of class imprinting. Comparing the baby-boomers with their parents, it turns out that this ratio has declined by 34 %. The very high income concentration that prevailed in West Germany in the mid-1960s may thus have fostered the formation of a stronger class consciousness for the older generation as compared to their children—that were socialized in their workplace in the early 1990s, a time at which income concentration was substantially lower.

This comparison suggests that from one generation to the next, Germany has moved from having a quite homogeneous workforce, facing business owners that were much wealthier than workers, to having a very heterogeneous workforce, facing business owners that were not so incredibly wealthier than workers—at least at the time when workers were at the beginning of their careers. Arguably, such an evolution has considerably lowered the cohesion of the workforce and its members’ feeling of sharing a common fate—with potentially far-reaching social and political implications.

A lifetime perspective can thus reveal the existence of long-run inequality trends that deeply affect our societies—trends that may remain unnoticed if one limits the attention to short-term inequality. Worldwide, several national pension systems are, like the German one, of the Bismarckian variety and make therefore use of longitudinal earnings data, often covering several generations. It would be useful to harmonize the existing administrative information from those countries and assemble it into an international database. That would enable researchers to draw cross-country comparisons and to detect worldwide trends of lifetime inequality.

Notes

The pioneering paper on actual income biographies is Björklund (1993). He investigated lifetime incomes for a sample of Swedish men born between 1924 and 1936. Differently from the research that I present in this paper, his study uses register data on tax-assessed income and the samples for each cohort are small. However, some findings related to the difference between lifetime and annual inequality and to the pattern of mobility in the distribution of annual incomes are quite similar to the ones I report below.

In case of household production, h should be thought of as the sum of time devoted to market work and household work, while C would incorporate the value of goods produced within the household.

Several further details on our data, sample and definitions can be found in Bönke et al. (2015).

The corresponding time series is provided by the Bundesbank.

Kopczuk et al. (2010) have computed Gini-coefficients of cohort-specific long-term earnings distributions for the US. Long-term earnings merely refer to a 12-year period. They find that the cohorts born after the mid-1930s have experienced an increasing inequality of such long-term earnings. This points to a likely common evolution in the US and Germany.

This underscores the importance of the age composition of the workforce in determining the inequality of short-term measures of income. Cohort size rapidly increased in Germany between the birth years 1945 and 1964. As younger cohorts are characterized by a relatively compressed distribution of annual earnings, this compositional change may have generated the impression of a rather stable level of inequality in Germany until the early 1990s.

See Bönke et al. (2015, Fig. 12).

Globalization, in particular outsourcing, and privatizations could be added to this list, but the corresponding empirical evidence is less clear.

References

Bach S, Corneo G, Steiner V (2009) From bottom to top: the entire income distribution in Germany, 1992–2003. Rev Income Wealth 55:303–330

Björklund A (1993) A comparison between actual distributions of annual and lifetime income: Sweden 1951–89. Rev Income Wealth 39:377–386

Bönke T, Corneo G, Lüthen H (2015) Lifetime earnings inequality in Germany. J Labor Econ 33:171–208

Bowlus A, Robin J-M (2012) An international comparison of lifetime inequality: how continental Europe resembles North America. J Euro Econ Assoc 10:1236–1262

Card D, Heining J, Kline P (2013) Workplace heterogeneity and the rise of West German wage inequality. Q J Econ 128:967–1015

Corneo G, Zmerli S, Pollak R (2014) Germany: rising inequality and the transformation of Rhine capitalism. In: Nolan (ed) Changing inequalities and societal impacts in rich countries. Oxford University Press, Oxford

Dell S (2008) L’Allemagne Inégale, Dissertation Thesis, EHESS, Paris

Dustmann C, Ludsteck J, Schönberg U (2009) Revisiting the German wage structure. Q J Econ 124:843–881

Fitzenberger B (1999) Wages and employment across skill groups: an analysis for West Germany. Physica-Verlag, Heidelberg

Fuchs-Schündeln N, Krueger D, Sommer M (2010) Inequality trends for Germany in the last two decades: a tale of two countries. Rev Econ Dyn 13:103–132

Gernandt J, Pfeiffer F (2007) Rising wage inequality in Germany. J Econ Stat 227:358–380

Heatcote J, Violante G, Storesletten K (2005) Two views of inequality over the life cycle. J Euro Econ Assoc 3:765–775

Huggett M, Ventura G, Yaron A (2011) Sources of lifetime inequality. Am Econ Rev 101:2923–2954

Kopczuk W, Saez E, Song J (2010) Earnings inequality and mobility in the United States: evidence from social security data since 1937. Q J Econ 125:91–128

Prasad E (2004) The unbearable stability of the German wage structure: evidence and interpretation. IMF Staff Pap 51:354–385

Steiner V, Wagner K (1998) Has earnings inequality in Germany changed in the 1980s? Zeitschrift für Wirtschafts- und Sozialwissenschaften 118:29–54

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper builds on the keynote lecture that I delivered at the Annual Meeting of the Austrian Economic Association in Vienna on May 30, 2014. It owes much to several discussions and joint work with Timm Bönke and Holger Lüthen. The responsibility for remaining shortcomings is only mine.

Rights and permissions

About this article

Cite this article

Corneo, G. Income inequality from a lifetime perspective. Empirica 42, 225–239 (2015). https://doi.org/10.1007/s10663-015-9283-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-015-9283-5