Abstract

We study whether it is socially desirable to hold a monopolistic firm liable for the harm its potentially judgment-proof consumers inflict on third parties. Consumers’ judgment-proofness limits potential product differentiation by pooling different consumer types with uniform liability exposure. The firm’s safety choices are distorted in both regimes under consideration: consumer-only liability and residual-manufacturer liability. We find that residual-manufacturer liability dominates consumer-only liability if the monopolistic firm can observe consumers’ types, or if consumers’ types are not observable but heterogeneity stems only from their asset levels. However, if the monopolistic firm cannot observe consumers’ types and heterogeneity stems from their harm levels, it is more difficult to make a case for residual-manufacturer liability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

When consumers’ use of a product may harm third parties, and potentially to the extent that consumers cannot fully compensate, the question arises whether the product’s manufacturer should be liable for the residual harm. Such an extension of liability may be likened to vicarious liability where a party related to the tortfeasor and with some control over the expected harm is (partly) liable for harm done.Footnote 1 The question about extended liability in the consumer context has long vexed courts in the United States where these issues are hotly debated in the legal and political arenas (Hay & Spier, 2005: 1700). However, the topic remains understudied. This comes even though consumers frequently harm others, and many consumers cannot undo the harm done entirely (i.e., they are judgment-proof).Footnote 2 Examples of the setting under scrutiny in our paper range from drivers harming pedestrians in a car accident to limited-liability firms harming other firms or individuals via accidental data loss. Three policy targets seem relevant in this context: The manufacturer’s product safety, the precautions consumers take while using the product, and the output level.

In a setting with a perfectly competitive product market and a representative consumer, Hay and Spier (2005) have shown that it is optimal to hold the consumer liable up to the level of their assets, and to hold the manufacturer liable for the residual harm. On a perfectly competitive market with homogeneous consumers, such a residual-manufacturer liability regime induces consumers to demand optimal safety from firms and exert a second-best level of precaution while ensuring that the combination of price and liability cost reflects the total social cost and, thus, induces socially optimal output.

We complement the analysis in Hay and Spier (2005) by investigating the effects of the liability regimes on market outcomes in a setting with consumer heterogeneity and market power on the manufacturer’s part. In particular, we analyze how (i) the manufacturer’s choices concerning the product’s safety and market coverage and (ii) the social surplus depends on the liability rule. In a setup in which the effects of safety and precaution are independent, we compare two possible liability regimes, consumer-only and residual-manufacturer liability.Footnote 3 In the former regime, only the consumer is held liable for the harm inflicted on the third party; in the latter regime, the consumer is again liable up to the own asset level, and the manufacturer is held liable for the residual harm that a consumer cannot compensate.

Even scholars with a skeptical attitude towards product liability vis-a-vis consumers recommend that firms be held liable when a product potentially harms third parties (Polinsky & Shavell, 2010). They also advocate product liability when market forces are less effective in promoting product safety. Our analysis will demonstrate that when third-party harm and market power both play a role, the question of whether the manufacturer should be held liable for (residual) harm is difficult to answer.

We find that if the monopolistic firm can (i) observe consumers’ types, or (ii) cannot observe the types of consumers who differ only in their asset level, residual-manufacturer liability dominates consumer-only liability. However, if the monopolistic firm cannot observe the types of consumers who differ in their harm level, it is more difficult to establish that residual-manufacturer liability always induces weakly better market outcomes. We can thus provide at least some policy guidance regarding the policy debates occurring in the United States by identifying circumstances in which residual-manufacturer liability is socially preferred to consumer-only liability.

In our analysis, we describe several distortions: first, judgment-proof consumers choose inefficiently low precaution levels in both regimes. Second, consumers with different harm or asset levels cannot be separated in an incentive-compatible manner when they have the same liability exposure. Third, product differentiation along the dimension of product safety can interfere with the manufacturer’s motive of rent extraction. Fourth, when different consumer types are pooled, the manufacturer’s safety investment targets the liability exposure of a product variety’s marginal consumer in the consumer-only liability regime and the harm caused by the marginal consumer in the residual-manufacturer liability regime while, from a social welfare perspective, the target should be the average harm inflicted by a product variety’s consumers. While we add new elements to the analysis in Hay and Spier (2005) with the second and third distortion, the fourth one differs as they consider consumers making continuous consumption choices, whereas we study binary consumption choices.

The firm’s liability cost from serving judgment-proof consumers is substantially smaller under consumer-only liability. This fact counteracts the firm’s motive to limit market coverage to extract higher rents from consumers being served. Thus, if it is socially desirable to serve judgment-proof consumers, consumer-only liability can produce better market outcomes than residual-manufacturer liability. However, in the consumer-only liability regime, the firm might invest insufficiently in the product’s safety due to the failure to internalize the harm that the consumer cannot compensate for.

When the firm markets more than one product safety variant, the incentive-compatibility constraints induce an inter-dependency between the product variants, which tends to cause excessive safety for the highest-safety product variant in both liability regimes. In the consumer-only liability regime, it partially counteracts the under-investment in safety due to uncompensated harm. Under residual-manufacturer liability, when considering the group of judgment-proof consumers in isolation, the firm internalizes all marginal welfare effects of its own choices. In this regime, the rent-extraction motive induces the firm to offer an excessively safe product variant to judgment-proof consumers when they are served.

The rest of the paper is structured as follows: We discuss the related literature in Sect. 2 and present the model in Sect. 3. Our analysis is contained in Sect. 4.

2 Literature

Our paper contributes to the literature on the economics of tort law [e.g., (Shavell, 2007)]. In our analysis, potentially judgment-proof injurers are crucial. Shavell (1986) provided the first formal analysis of the distortions arising from insufficient assets on behalf of the injurer and contributed to the discussion concerning instruments to amend the problem in Shavell (2005). Our framework does not consider minimum asset or mandatory-insurance requirements [e.g., (Polborn, 1998)]. Numerous contributions elaborated on the judgment-proof problem after (Shavell, 1986). These papers distinguished, for example, the impact of monetary and non-monetary care [e.g., (Miceli & Segerson, 2003)], different precaution technologies (Dari Mattiacci & de Geest, 2005), and different risk attitudes (Friehe, 2007).

Hay and Spier (2005) is the paper most closely related to ours. Their main analysis examines the scenario with competitive firms and homogeneous consumers with downward-sloping demand. In extensions, they first discuss results from a setting in which (i) consumers differ in both their price sensitivities and their harm levels, and (ii) safety and precaution are abstracted from; afterward, they turn to a case where some consumers have zero assets and others are fully solvent. Whereas residual-manufacturer liability is preferred in their main analysis, the two extensions show that this regime can introduce undesirable distortions with consumer heterogeneity. We consider a monopolistic firm that seeks to extract surplus from consumers who decide whether or not to buy a unit of output and continuous consumer heterogeneity either along the harm or the asset dimension where safety and precaution are always endogenous. The fact that there is only one firm on the supply side enables equilibria that cannot be reached with competitive firms, a fact particularly acute in product-differentiation scenarios. In its quest for rents, the monopolistic firm may seek to contract market coverage and distort product differentiation. This produces contrasting results: For example, when considering consumers differentiated only by their asset levels, Hay and Spier (2005) find that solvent consumers’ output is at the first-best level which does not hold in our framework.

Our focus on a firm with market power represents the most critical departure from Hay and Spier (2005). The previous literature has considered the incentives of a monopolistic firm when consumers are potential victims. For example, Baumann et al. (2016) analyze loss shifting when a monopolistic firm serves consumers with different harm levels by providing a product with a uniform safety level. It is explained that shifting more losses to the firm can signify lower product safety levels because the firm’s focus moves from the marginal consumer’s harm to average harm.

The firm’s focus on the marginal consumer type and the implied contrast to the average type is also relevant in our paper. This source of distortion has already been pointed out in Spence (1975). In our setting, when the level of assets is the same for all consumers and the level of harm varies from consumer to consumer, the consumer’s valuation of the firm’s marginal safety investment increases in the harm level that the consumer potentially imposes on others (up to the point where the consumer becomes judgment-proof). If a single product variant is offered, we can directly apply Proposition 1 in Spence (1975) to conclude that when the firm only serves solvent consumers, it oversupplies safety. When it also serves judgment-proof consumers, the firm in a residual liability regime has even stronger incentives to supply safety, whereas in the consumer-only liability regime, the firm neglects the social cost of uncompensated harm, which induces a distortion of safety provision in the opposite direction.

In contrast, for example, Endres and Lüdecke (1998) and Hua and Spier (2020) analyze the case in which a monopolist seeks to separate different consumer types by providing products with different safety attributes. We will also elaborate on product differentiation and emphasize that a uniform liability exposure of heterogeneous judgment-proof consumers implies that they cannot be disentangled in an incentive-compatible way. Whereas most papers consider consumers as possible victims, Rössler and Friehe (2020) find that the monopoly may yield greater welfare when individuals with moral or image concerns may harm third parties in product accidents. Regarding the implications of market power, Polinsky and Rogerson (1983) provide a contribution in which consumers misperceive product risk and firms interact in a Cournot oligopoly. They show that the optimal liability rule depends on the consumers’ risk misperception and the number of firms in the industry. We assume that consumers understand the risk and the firm’s safety level.

Many economic transactions are nowadays channeled via platforms. Hua and Spier (2023) analyze whether two-sided platforms should be (partly) liable for harm caused by potentially judgment-proof firms and imposed on users operating on the platform. This platform liability may be beneficial because the platform has some control over expected harm. It can use the interaction price to deter firms more likely to impose harm and invest resources to weed them out. Platform liability can be beneficial independent of whether users are bystanders or consumers internalizing the expected harm when entering transactions. In two other recent contributions on platform liability as a type of indirect liability, Buiten et al. (2020) discuss the e-commerce Directive of the European Union and Lefouili and Madio (2022) analyze the promises and pitfalls of platform liability as a means to stop online misconduct.

3 The model

A risk-neutral monopolistic firm serves risk-neutral consumers who buy at most one product unit. When using the product, consumers may accidentally harm third parties. The accident probability \(\pi (x,y)\) decreases at a diminishing rate with the firm’s product safety and the consumer’s precaution investment (i.e., \(\partial ^2 \pi /\partial x^2>0>\partial \pi /\partial x\) and likewise for y). In order to simplify the exposure of our analysis, we assume that the marginal productivity of precaution in reducing the accident probability is independent of the firm’s safety level and vice versa (i.e., \(\partial ^2 \pi /\partial x \partial y=0\)).Footnote 4

A consumer of type i has a consumption value v, causes third-party harm \(h_i\) in an accident, and incurs precaution costs \(c\times y_i\) when choosing precaution level \(y_i\), which are assumed to be non-monetary (e.g., Beard, 1990; Friehe & Tabbach, 2014). The level of assets available for compensation in case of an accident amount to \(\omega _i>0\).

The monopolistic firm may offer only one kind of product with one price p and safety level x (due to external constraints) or may diversify and offer a product variety with safety level \(x_i\) to consumers of type i at a price \(p_i\). The firm incurs a safety cost \(x_i\) per unit of output of this product variety.

We consider two different liability regimes, namely residual-manufacturer and consumer-only liability (Hay & Spier, 2005). Consumer i is always legally responsible to compensate \(\delta _i^C=\min \{h_i,\omega _i\}\). Under residual-manufacturer liability, the firm is liable for \(\delta _i^{M}=\max \{0,h_i-\omega _i\}\). The consumer is legally responsible for the full harm when the private assets are weakly greater than the harm, and compensates the maximum amount possible (i.e., the level of assets) otherwise. We label a consumer of type i with liability exposure \(\delta _i^C<h_i\) as judgment-proof. In the residual-manufacturer liability regime, the firm compensates the difference between the consumer’s liability payment and the victim’s level of harm.

For a given level of product safety \(x_i\), the consumer of type i can attain the private product value of

by implementing the privately optimal precaution level

The privately optimal precaution level is equal to (less than) the socially optimal precaution level for financially unconstrained (potentially judgment-proof) consumers independent of the liability regime.Footnote 5 The consumer of type i buys a product if and only if the private product value exceeds the product’s price, that is, if \(V_i\ge p_i\).

We introduce two different social product values for consumer i conditional on the firm’s product safety choice \(x_i\). The maximum social product value supposes that the consumer’s precaution is at the first-best level,

and is given by

As privately optimal precaution is at the socially optimal level for financially unconstrained consumers, we obtain \(V_i=W_i\). However, for judgment-proof consumers (i.e., if \(\delta _i^C<h_i\)), the personal product value exceeds the maximum social product value, that is, we have \(V_i>W_i\). The second-best social product value amounts to

which is second-best (SB) in the sense that it takes as given that judgment-proof consumers implement a socially suboptimal precaution level. When the second-best social product value differs from the maximal one, the judgment-proof consumer type i perceives a product value above the socially relevant one, that is, we have

When added to the cost of product safety, we arrive at a social cost of producing private product value

The comparison of \(V_i\) and \(C_i\) is relevant for whether serving consumer type i is socially desirable. The monopolistic firm bears \(C_i\) when residual-manufacturer liability applies.

All constructs defined so far depend on product safety. Now, consider how a marginal change in \(x_i\) affects the values \(V_i\), \(W_i^{SB}\), and \(C_i\):

The marginal social benefit from greater product safety exceeds the marginal benefit for a judgment-proof consumer. The marginal social cost of increasing product safety for a judgment-proof consumer may be positive or negative, depending upon the difference between the level of harm and the consumer’s asset level.

Given that consumers choose precautions subject to either liability regime, the socially optimal level of product safety for consumer type i, if served, follows from \(\max _{x_i} W_i^{SB}-x_i= V_i-C_i\). It is socially optimal to serve consumers of type i only if \(W_i^{SB}>x_i\), that is, if \(V_i>C_i\).

4 Analysis

4.1 Benchmark: full differentiation

Suppose the firm can charge the private product value of each consumer type (i.e., \(p_i=V_i\)) and is subject to residual-manufacturer liability. In that case, it maximizes \(\int V_i-C_i\ di\) and thus has socially optimal incentives for product safety and market coverage.Footnote 6 When choosing product safety, the firm internalizes the total harm. In terms of which consumers to serve, the firm serves consumers of type i only if \(V_i\ge C_i\), which is consistent with the social criterion.

If consumer-only liability applies, the firm maximizes \(\int V_i-x_i\ di\) and thus has distorted safety and market coverage incentives as some consumers are judgment-proof. For judgment-proof consumers, the firm chooses safety because of the consumer’s liability exposure instead of the level of harm. In addition, the firm may serve consumers even though it reduces social welfare, which obtains when \(C_i>V_i>x_i\).

We summarize our finding for the benchmark case in Proposition 1:

Proposition 1

(Benchmark) Suppose the monopolistic firm can observe consumers’ types and offer its consumers individualized product varieties. A firm subject to residual-manufacturer liability implements product safety and market coverage choices that maximize second-best welfare. A firm subject to the consumer-only liability regime serves too many judgment-proof consumers and offers them varieties with a too low product safety level.

4.2 Incentive compatible differentiation

If the firm cannot observe consumer types, it must respect incentive compatibility when offering a menu of varieties. A variety \(x_i\) meant for consumers of type i needs to be offered at a price \(p_i\) such that only consumers of type i (weakly) prefer to buy that variety over another one. As higher product safety increases the private product value for all consumer types, incentive compatibility requires that higher-safety varieties are offered at higher prices. For any pair of varieties \((x_i,p_i)\) and \((x_j,p_j)\) with \(x_i>x_j\), incentive compatibility for consumers of type i and type j requires:

The assumption \(\partial ^2 \pi /\partial x\partial y=0\) allows us to write the difference of consumer i’s product values at two different product safety levels asFootnote 7

Using the notation \(\Delta _\pi (x_i,x_j)=\pi (x_i,{\hat{y}}_i)-\pi (x_j,{\hat{y}}_i)\), we present the following restatement of the incentive compatibility constraints (4):

By charging a markup \(p_i-p_j\) for the product variety with safety level \(x_i\) instead of \(x_j\), the firm separates consumer types along the liability-exposure dimension \(\delta ^C\): Consumers with \(\delta _i^C\ge \frac{p_i-p_j}{\Delta _\pi (x_i,x_j)}\) prefer the safer variety, whereas consumers with a lower liability exposure prefer the less safe variant.

Imagine that a single variety is offered at first, and consider the effect of providing another variety with a marginally higher safety level. The marginal increase in the product valuation from higher safety is expressed in (1), and it is increasing in \(\delta _i^C\). Given the original variant’s price, a slightly higher price for the new variety exists that induces only consumers with the lowest liability exposure to remain with the original variety. Repeating these modifications to add further safety varieties to the product portfolio, a menu of varieties, one for each liability-exposure level, can be implemented with an incentive-compatible pricing scheme.

The incentive compatibility constraints (5) reveal that whenever some consumer i weakly prefers a safer product variety over a less safe variety (at its respective prices), any consumer type j with a greater liability exposure (i.e., all types \(j:\delta ^C_j>\delta ^C_i\)) strictly prefers the safer variety. Likewise, any consumer type j with a lower liability exposure (i.e., all types \(j:\delta ^C_j<\delta ^C_i\)) strictly prefers the less safe variety whenever i weakly prefers it.

Notably, the liability exposure \(\delta ^C\) along which separation may arise is fed by different consumer characteristics. Discrimination between solvent consumers (\(\delta _i^C=h_i\)) and judgment-proof consumers (\(\delta _i^C=\omega _i\)) is impossible if consumers differ concerning both, \(h_i\) and \(\omega _i\).

Consider any given portfolio of product variants \(\{x_i\}\) and their target consumers \(\{\delta ^C_i\}\), where safety variant \(x_1\) is designed for consumers \(i:\delta ^C_i\le \delta ^C_1\), safety variety \(x_2>x_1\) is designed for consumers \(j:\delta ^C_1<\delta ^C_j\le \delta ^C_2\) and so on. Using the binding constraints (5), the firm achieves maximum surplus extraction with such a product portfolio by chargingFootnote 8

where \(V_m(x_m)\) denotes the private valuation for product variety \(x_m=\max \{x_i\}\) of the marginal consumer i with \(\delta ^C_i=\delta ^C_m\). Product safety levels influence pricing (i.e., rent extraction) and thus will be distorted relative to the full-information benchmark.

The maximally feasible extent of product differentiation along the liability-exposure dimension \(\delta ^C\) is generally neither socially desirable nor privately optimal for the firm. The social planner wants a particular safety variety for the set of its consumers (i.e., in the case of maximal differentiation, those with a specific liability exposure) to optimally resolve the trade-off between the aggregate cost of harm caused by this group and the aggregate cost of avoiding the harm. The firm instead wants the safety level to strike a balance between the increase in the personal product value that she can extract from the consumers of the variety (plus the decrease in the firm’s expected liability under residual-manufacturer liability) and the cost of safety.

If consumer heterogeneity is multi-dimensional, consumer types with different private valuations for a product variety are necessarily pooled. This limits the firm’s ability to extract the surplus. Pooling of types also causes a divergence between the average and marginal harm caused by the consumers of the variety, which signifies a disconnect between profit-maximizing and socially optimal safety.

To gain some better understanding, we limit consumer heterogeneity concerning \(\delta _i^C\) to a single source in our analysis: We first look at varying levels of harm, assuming that consumers have symmetric asset levels, and then focus on heterogeneity concerning the assets available for compensating the harm \(\omega _i\), taking that the level of harm caused is the same for all consumer types.

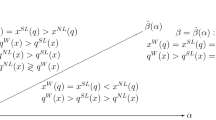

4.2.1 Heterogeneous harm levels but symmetric asset level

Figure 1 sketches how \(W_i,W_i^{SB},V_i,C_i\) are associated with the level of harm \(h_i\), assuming a fixed safety level. The liability exposure \(\delta _i^C\) increases with \(h_i\) up to the point where \(h_i=\omega\) and stays constant thereafter. Consumers i to the left of this threshold are solvent, and those to the right are judgment-proof.

In Fig. 1, the first-best aggregate product value (conditional on x) is reached if any consumer type i is served if and only if \(h_i\le h^{FB}\), where \(h^{FB}\) is defined as the level of harm at which x is equal to \(W_i\). For the first-best outcome, all consumers served need to invest in precaution as if they were fully liable for the harm. With the actual precaution level, \({\hat{y}}_i\), the second-best aggregate product value (conditional on x) is reached if consumers are served if and only if \(h_i\le h^{SB}\), the level of harm where x and \(W_i^{SB}\) (and \(C_i\) and \(V_i\)) intersect. Because of the suboptimal precaution of judgment-proof consumers, we have that \(h^{SB}<h^{FB}\).

Judgment-proof consumers induce different harm levels but cannot be separated since their liability exposure is the same. This means that the second-best market coverage cannot be reached. The firm must either serve all judgment-proof consumers or none. For the parameter constellation depicted in Fig. 1, it is socially desirable not to serve judgment-proof consumers with the fixed product safety variety. The welfare gains from serving intermediate harm judgment-proof consumers are trumped by the losses from serving high-harm judgment-proof injurers, that is, as \(\int _{h_i\in (\omega ,h^{SB}]}W_i^{SB}-x\ di<\int _{h_i\in (h^{SB},{\bar{h}}]}x-W_i^{SB}\ di\). A smaller difference between \({\bar{h}}\) and \(\omega\) or a higher product safety level may revert that welfare assessment. Figure 2 exemplifies how an increase in safety to \(x^\prime\) affects the private and social product values such that full-market coverage is socially desirable.

Figure 2 depicts a constellation in which raising safety from x to \(x^\prime\) increases the private product value for the judgment-proof consumers (\(V_\omega ^\prime -V_\omega\)) precisely by the increase in the cost of safety (\(x^\prime -x)\). The increase in the social product value \(W_i^{SB}\) exceeds the increase in the personal product value \(V_\omega\). Thus, serving judgment-proof consumers is socially optimal when \(x=x'\). For solvent consumers, the cost of higher safety exceeds the private (and social) valuation of higher safety. It would be socially desirable to offer variants to them with lower safety than \(x^\prime\). Serving judgment-proof consumers limits the firm’s possibility to extract surplus from solvent consumers: They value any product variety x more highly than the judgment-proof consumers’ valuation \(V_\omega (x)\). Still, the firm can charge at most \(V_\omega (x_\omega )\) for the variety \(x_\omega\) that is meant for the judgment-proof types. The availability of the product variety \(x_\omega\) gives rise to a minimum rent of \(V_i(x_\omega )-V_\omega (x_\omega )>0\) for any solvent consumer i.

We do not fully characterize the firm’s optimal product portfolio. Instead, we explore the incentive to serve the judgment-proof consumers in either of the liability regimes and discuss the welfare implications.

Suppose the firm prefers not to serve judgment-proof consumers in either regime. In that case, the liability regime has no impact on the market outcome as the regime difference only pertains to judgment-proof consumers. If the firm serves judgment-proof consumers in both regimes, the product safety variety offered to them will depend on the liability regime. Under residual-manufacturer liability, the firm internalizes the social cost whereas under consumer-only liability, the firm internalizes the production cost and the harm only to the extent its consumers internalize it. In both cases, the firm internalizes the effects on the possibility of extracting rents with the remaining product portfolio. As the firm’s incentives to invest in the safety of the product variant offered to judgment-proof consumers differ between liability regimes, the entire product portfolio will depend on the regime. Finally, the firm may serve the judgment-proof consumers in the consumer-only liability regime but not in the regime with residual manufacturer liability because the incentive to serve the judgment-proof consumers is higher in the former than in the latter. The opposite case does not occur in the market equilibrium.

We find the following result (the proof is relegated to the appendix):

Proposition 2

(Many varieties with heterogeneous harm and symmetric asset levels)

-

(i)

If the mass of judgment-proof consumers is sufficiently small, or if judgment-proof consumers’ private valuation falls short of the safety cost for all relevant safety levels, both liability regimes yield the same market outcome.

-

(ii)

If judgment-proof consumers are served in both liability regimes, the firm offers them a product variety with a higher safety level when subject to residual-manufacturer liability.

-

(iii)

If the mass of judgment-proof consumers is sufficiently large and judgment-proof consumers’ private evaluation exceeds safety cost for at least one safety level, the firm serves judgment-proof consumers under consumer-only liability but may not do so under residual-manufacturer liability.

Which liability regime creates higher welfare? If Proposition 2(i) applies, the liability regime is irrelevant. Case (ii) of the proposition is difficult to evaluate. The firm produces the same output level in both liability regimes (yielding full-market coverage), but the product safety variants differ across regimes. When subject to residual-manufacturer liability, the firm is incentivized to provide an excessively safe product variety to the judgment-proof consumers if she offers other varieties to solvent consumers. While the firm faces the correct incentives for serving the group of judgment-proof consumers in isolation, the limitation on her rent-extraction possibilities as reflected in the incentive-compatible pricing scheme (6) pushes her beyond the efficient safety level. Still, even considering the distorted safety choice, serving the judgment-proof consumers increases social welfare (as compared to not serving them at all).

Under consumer-only liability, the firm ignores the part of the harm that the consumer externalizes due to limited assets, but the rent-extraction motive is also present. Without further assumptions about the parameter constellation, whether the firm’s safety choice is too high or too low cannot be assessed. The latter is more likely when the externalized harm is considerable relative to the other factors influencing the firm’s choice. Indeed, it may be socially preferable not to serve judgment-proof consumers with a sub-optimally low product safety level. Such a clear dominating force is necessary to assess which of the product safety choices for the judgment-proof consumers is socially more desirable. Moreover, the market segmentation and the product safety choices for the solvent consumers also differ across the regimes, with unclear welfare implications.

If Proposition 2(iii) applies, again, different scenarios are possible. For example, it may be that serving judgment-proof consumers is not socially desirable, implying that residual-manufacturer liability performs well in this regard. However, it may be that due to her rent-extraction motive, the firm is too restrictive in the output domain under residual-manufacturer liability; that is, the firm chooses to serve too few consumers in this regime. There may also be circumstances when Proposition 2(iii) applies such that full-market coverage is socially desirable and attainable only in the consumer-only liability regime. Finally, it may be socially desirable to serve the judgment-proof consumers only with a higher safety level than the firm is willing to offer. Still, this distortion may be acceptable from a social perspective if sufficiently many additional solvent consumers are served in the consumer-only liability regime.Footnote 9

To better understand the product safety distortions in the two liability regimes, we consider the case that the firm chooses a single product variety next.

4.2.2 Firm offers one product type

Suppose the firm offers only products with a uniform product safety level. In that case, the benchmark level of socially optimal product safety (conditional on market coverage up to consumer type \(h^\prime\)) is determined by

where \(E(h|h\le h^\prime )\) is the conditional expected value of third-party harm when \(h^\prime\) defines the marginal consumer.

The profit-maximizing product safety selected by the monopolist if \(h^\prime <\omega\) is determined by

and is independent of the regime. When the firm serves only solvent consumers, it will focus on the marginal instead of the average consumer when it selects safety to extract maximum rents, thereby inducing excessive product safety. Conditional on the safety choice and partial-market coverage, the firm serves fewer consumer types than is socially optimal.

The profit-maximizing product safety selected by the monopolist if full-market coverage results is determined by

under consumer-only liability and by

under residual-manufacturer liability, where we use F(h) as the cumulative density function on the interval \([\underline{h},{\bar{h}}]\). Whereas the firm’s safety incentives under residual-manufacturer liability are excessive, they are insufficient (excessive) under consumer-only liability if \(\omega <\;(>)\;E(h)\). Because it is clear that the firm’s safety level is always smaller under consumer-only liability, we can state the following result:

Proposition 3

(One variety with heterogeneous harm and symmetric asset levels) Suppose the monopolist offers only products with a uniform safety level. In that case, consumer-only liability dominates residual-manufacturer liability if the asset level weakly exceeds the unconditional expected value of harm and the firm chooses to serve the full market in both regimes.

While the motive to generate private product value is guided by the marginal consumer (instead of the socially relevant average one) in both regimes, the firm internalizes the total social cost only in the residual-manufacturer liability regime. The focus on the marginal type yields too strong incentives to invest in product safety. The lacking internalization delivers an opposing influence in the consumer-only liability regime. The larger the group of judgment-proof consumers, the weaker the first distortion and the stronger the second. Thus, the larger the group of judgment-proof consumers, the more advantageous the residual manufacturer liability regime (and the more relevant the case discussed here).

4.2.3 Heterogeneous asset levels but symmetric harm level

In this section, we discuss the role of heterogeneity concerning the asset level. Figure 3 sketches the relation between \(W_i,W_i^{SB},V_i,C_i\) for this case.

When consumers differ only in their asset level, the personal product value and the social product value are inversely related for the judgment-proof consumers. In Fig. 3, only consumers with asset levels above \(\omega ^{SB}\) should be served from a (second-best) welfare perspective because \(W_i^{SB}\ge x\) only holds for them. However, without minimum asset requirements, excluding consumers with lower asset levels is impossible. Their valuation for the product is the highest for any safety level. In the market equilibrium, either only judgment-proof or all consumers are served, or no output is produced. When subject to residual-manufacturer liability, the firm has strictly weaker incentives to serve the market than in the consumer-only liability regime. Judgment-proof consumers are the least attractive in the former and the most attractive in the latter regime. Thus, serving only judgment-proof consumers can be a market outcome only in the consumer-only liability regime. Under residual-manufacturer liability, the market will be served if and only if a safety level exists such that the aggregate private product value exceeds the aggregate social costs. The valuation of a marginal safety investment increases in the consumer’s asset level (for judgment-proof consumers). As the consumers with the lowest asset levels have the highest willingness to pay, Spence (1975) implies an underinvestment in safety for any market coverage in the consumer-only liability regime, which is exacerbated by the failure to fully internalize the social cost. The firm subject to residual-manufacturer liability selects the safety level which maximizes (second-best) social welfare.

Proposition 4

(Symmetric harm and heterogeneous asset levels) When consumers differ only concerning their asset levels, and asset levels exceed the level of harm for some consumer types, then market outcomes under residual-manufacturer liability are weakly preferred to market outcomes under consumer-only liability.

5 Conclusion

Consumers may harm third parties while using their products and may be unable to compensate victims fully. Holding the products’ manufacturers (partially) liable for the harm done by their consumers represents a potential policy. We have compared consumer-only liability with residual-manufacturer liability when the producer is a monopolistic firm, complementing earlier work done for competitive firms.

The co-existence of several distortions in our framework complicates a general regime comparison. For example, the monopolistic firm focuses on the marginal consumer when assessing safety. This may mean that the firm’s internalization of harm under residual-manufacturer liability is socially undesirable concerning safety incentives because consumer-only liability can already induce excessive safety in some circumstances. In contrast, the firm’s internalization of harm under residual-manufacturer liability tends to provide for a better alignment of privately optimal and socially optimal output but, interestingly, also doesn’t have to.

In our paper, we assess the issues at stake and identify circumstances in which consumer-only liability performs better than residual-manufacturer liability and instances where the reverse is true. Given the importance of the matter and the limitations of our framework, we think that future research is warranted.

Notes

Vicarious liability can take very different forms. For example, parents may be liable for harms caused by their children, contractors for harms caused by subcontractors, and firms for the harms caused by their employees. (Shavell, 2007). For environmental risk, Pitchford (1995) analyzes the optimal lender liability when the tortfeasor is a borrower. Arlen and MacLeod (2005) show that managed care organizations liable for medical malpractice by their physicians can be beneficial, that is, they find thatextending liabilityis preferred to the current treatment of physicians as independent contractors.

Shavell (1986) was probably the first to denote an injurer unable to fully compensate the victim after an accident as judgment-proof. We will also employ this terminology.

This simplifying assumption allows us to avoid qualifications in our statements. For example, when allowing for an interdependence between the firm’s safety and the consumer’s precaution choices, the comparison of the consumer’s choice to the socially optimal precaution level could only be made conditional on the firm’s safety investment. It would also be less clear how to evaluate an over-investment in safety from a social perspective, if, due to strategic complementarity, it is accompanied by an increase in the level of precaution of a consumer who tends to under-invest.

The level \({\hat{y}}_i\) is independent of the firm’s level of safety \(x_i\) by our assumption that the decrease of \(\pi\) with safety is independent of precaution, and vice versa.

We do not impose a specific assumption on the distribution.

In general, the difference of the personal product values of a consumer of type i at two different product safety levels follows as \(V_i(x_i)-V_i(x_j)= -\delta _i^C \Delta _\pi (x_i,x_j)-c({\hat{y}}_i(\delta _i^C,x_i)-{\hat{y}}_i(\delta _i^C,x_j)).\)

We resolve indifference in favor of the less safe product variant for the sake of concreteness.

To see the latter subtlety more clearly, abstract from the firm’s product safety choice (e.g., because the highest reachable product safety level is the optimal one for consumers with the lowest possible harm levels) to distinguish two cases: (i) it is socially desirable to serve judgment-proof consumers, or (ii) it is not. In the former case, consumer-only liability is (weakly) preferred due to the firm’s more substantial incentives to serve the judgment-proof consumers. Whenever the firm serves judgment-proof consumers when subject to residual-manufacturer liability, it does so in the consumer-only liability regime, but not vice versa. In case (ii), it may be preferable to tolerate that judgment-proof consumers are served when the market outcome without them would mean that some solvent consumers are not served. The firm will not serve the judgment-proof consumers when subject to residual-manufacturer liability. Instead, it will choose the profit-maximizing market-coverage \(h^*<\omega\) on the downward-sloping part of the private product value, as depicted in Fig. 1. Under consumer-only liability, the firm’s profit function has a local maximum at the same level of market coverage \(h^*\). If it has its global maximum at full-market coverage, the outcomes in the two regimes differ. Consumer-only liability yields a market outcome associated with a higher level of welfare if \(\int _{h^*}^{{\bar{h}}}V_i\ di>\int _{h^*}^{{\bar{h}}}C_i\ di\), and (weakly) lower welfare, else.

References

Arlen, J., & MacLeod, W. B. (2005). Torts, expertise, and authority: Liability of physicians and managed care organization. Rand Journal of Economics, 36, 494–515.

Baumann, F., Friehe, T., & Rasch, A. (2016). Why product liability may lower product safety. Economics Letters, 147, 55–58.

Beard, T. R. (1990). Bankruptcy and care choice. Rand Journal of Economics, 21, 626–634.

Buiten, M. C., de Streel, A., & Peitz, M. (2020). Rethinking liability rules for online hosting platforms. International Journal of Law and Information Technology, 28, 139–166.

Chen, Y., & Hua, X. (2017). Competition, product safety, and product liability. Journal of Law, Economics, & Organization, 33, 237–267.

Dari Mattiacci, G., & de Geest, G. (2005). Judgment proofness under four different precaution technologies. Journal of Institutional and Theoretical Economics, 161, 38–56.

Endres, A., & Lüdecke, A. (1998). Incomplete strict liability: Effects on product differentiation and information provision. International Review of Law and Economics, 18, 511–528.

Friehe, T. (2007). A note on judgment proofness and risk aversion. European Journal of Law and Economics, 24, 109–118.

Friehe, T., & Tabbach, A. (2014). Judgment proofness and the choice between monetary and nonmonetary care. Journal of Institutional and Theoretical Economics, 170, 249–274.

Hay, B., & Spier, K. E. (2005). Manufacturer liability for harms caused by consumers to others. American Economic Review, 95, 1700–1711.

Hua, X., & Spier, K. E. (2020). Product safety, contracts, and liability. Rand Journal of Economics, 51, 233–259.

Hua, X., & Spier, K. E. (2023). Holding platforms liable. https://doi.org/10.2139/ssrn.3985066

Lefouili, Y., & Madio, L. (2022). The economics of platform liability. European Journal of Law and Economics, 53, 319–351.

Miceli, T. J., & Segerson, K. (2003). A note on optimal care by wealth-constrained injurers. International Review of Law and Economics, 23, 273–284.

Pitchford, R. (1995). How liable should a lender be? The case of judgment-proof firms and environmental risk. American Economic Review, 85, 1171–1186.

Polborn, M. K. (1998). Mandatory insurance and the judgement-proof problem. International Review of Law and Economics, 18, 141–146.

Polinsky, A. M., & Rogerson, W. P. (1983). Products liability, consumer misperceptions, and market power. Bell Journal of Economics, 14, 581–589.

Polinsky, A. M., & Shavell, S. (2010). The uneasy case for product liability. Harvard Law Review, 123, 1436–1492.

Rössler, C., & Friehe, T. (2020). Liability, morality, and image concerns in product accidents with third parties. European Journal of Law and Economics, 50, 295–313.

Shavell, S. (1986). The judgment proof problem. International Review of Law and Economics, 6, 45–58.

Shavell, S. (2005). Minimum asset requirements and compulsory liability insurance as solutions to the judgment-proof problem. Rand Journal of Economics, 36, 63–77.

Shavell, S. (2007). Liability for accidents. In: A. M. Polinsky & S. Shavell (Eds.), Handbook of Law and Economics (Vol. 1). Elsevier.

Spence, A. M. (1975). Monopoly, quality, and regulation. Bell Journal of Economics, 6, 417–429.

Funding

Open Access funding enabled and organized by Projekt DEAL. The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Proof of Proposition 2

Appendix: Proof of Proposition 2

-

(i)

Suppose that \(V_\omega (x)<x\ \forall x\), but the firm serves the judgment-proof consumers, i.e., the safest product variety sells at a price \(p_m\le V_\omega (x_m)<x_m\). The firm makes losses with the judgment-proof consumers in either regime. Raising the price of this variety to \(x_m\), and adjusting all prices according to the incentive-compatible pricing scheme (6) deters only those consumers from buying the product with whom the firm makes losses and raises the profits earned with all consumers who still buy the product. Hence, the adjusted pricing scheme constitutes a profitable deviation for the firm. Next, suppose that the judgment-proof consumers are served despite their small mass. Denote the mass of judgment-proof consumers with \(m_j\). Accordingly, the mass of solvent consumers is \(1-m_j\). The firm adheres to the incentive-compatible pricing scheme (6)—or gains from deviating to it. Increase the price \(p_m\) of product variety \(x_m\) to \(p_m^\prime =V_{\omega }(x_m)+\varepsilon ,\ \varepsilon \in (0,\Delta _\pi (x_m,x_{m-1}))h_{m-1}\), and adjust all other prices according to the pricing rule (6) by \(\varepsilon\). If \(x_m\) is the only product variety, set \(p_m^\prime\) just slightly above \(V_{\omega }(x_m)\). The judgment-proof consumers now abstain from consumption, while for all other consumers, prices have increased by \(\varepsilon\), which is still below the rent they previously obtained. Hence, they continue to buy their original product variety. Profits have changed by \(-m_j(V_m-x_m)+(1-m_j)\varepsilon\), which is positive if \(m_j\) is sufficiently small.

-

(ii)

The statement follows from the fact that the safety investment has the additional benefit of reducing the firm’s expected liability cost so that the optimal product safety that is offered by the firm when not held liable for residual harm is sub-optimally low from the point of view of the firm that is subject to residual manufacturer liability.

-

(iii)

In the consumer-only liability regime, the firm can earn a rent \(V_\omega (x_\omega )-x_\omega >0\) with each judgment-proof consumer by offering the product variety \(x_\omega\) at a price \(V_\omega (x_\omega )\). Still, she has to grant a rent to the solvent consumers. If the mass of judgment-proof consumers is sufficiently high, the former effect dominates the latter. When subject to residual manufacturer liability, the firm faces additional costs \(\int _{\omega }^{{\bar{h}}} C_i-x_\omega ^\prime\) when serving the judgment-proof consumers with (a possibly different) product variety \(x_\omega ^\prime\), earning a strictly lower rent (possibly negative) with each of them. Thus, when the mass of judgment-proof consumers surpasses the threshold, it becomes profitable for the firm in the consumer-only liability regime to serve them, when subject to residual manufacturer liability, the firm strictly prefers not to serve them.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Friehe, T., Rössler, C. & Schulte, E. Probing the case for manufacturer liability for harms caused by judgment-proof consumers to others. Eur J Law Econ 56, 443–460 (2023). https://doi.org/10.1007/s10657-023-09786-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10657-023-09786-5