Abstract

We examine the impact of the enforcement of financial regulations by the French Financial Market Authority on sanctioned firms. The early stages of the enforcement process are by law confidential, with an internal investigation and bilateral exchanges between the defendant and its regulator. The public hearing by the Enforcement Committee leads to a single publication of the decision, being the only public communication. Using an event study methodology, we find that the confidentiality of the initial steps of enforcement procedures is respected and that markets account for the publication of sanctions. Still, reactions are limited in absolute and relative terms, both compared to past studies and in terms of reputational penalty. Some parameters trigger a stronger reaction, but not the most straightforward (such as the cash fine or behavioral sanction). The results echo the reputation for leniency of sanctions (scarce procedures, lax verdicts, low fines, ending neglected by analysts and investors), despite consecutive regulatory tightenings and long procedures. They question the efficiency of enforcement.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Regulating financial markets targets diverse objectives: encourage sound and transparent financial markets; deter excessive risk-taking; foster market participants to act responsibly; and compensate for past wrongdoings; etc. Being budgetary constrained (Carvajal and Elliott 2007), regulators focus on the most severe uncovered regulatory breaches. Hence, sanctions are expected to be interpreted as a significant negative information regarding the firm and/or the individual being sanctioned, justifying a reputational cost imposed by market participants. If a potential sanction stands for a credible threat, its mere existence could complement financial regulation by incentivizing market players to abide by the law. Markets would be a channel complementary to enforcement to deter future misconducts and to induce firms, top managers, and individuals to act responsibly (Engelen 2011). All in all, what are the consequences of regulatory enforcement on sanctioned listed firms?

Due to data constraints, limited research was done to date on jurisdictions other than the United States (US) on this question. Regarding France in particular, previous studies focused on one type of regulatory breach (accounting frauds, Djama 2008; or insider trading, Fonteny 2017), or covered few sanctions (47 sanctions of listed companies, Kirat and Rezaee 2019).Footnote 1 The objective of this paper is to provide a comprehensive investigation of market reactions to sanctions of listed companies for the French market, by constructing and exploiting a unique dataset of all the sanctions and settlements made by the French Financial Market Authority (AMF). Our sample is improved compared to prior research as it covers exhaustively the sanctions of the AMF since its creation in 2003, until late 2016, based on public and confidential data.

Beyond its novelty, the use of a database pertaining to the French market is particularly relevant since the French enforcement process is highly compatible with an event study. Indeed, the dates of the consecutive steps of the sanction procedures are unique and available (publicly or confidentially). The initial steps of enforcement procedures are confidential, and should not lead to abnormal market reactions.Footnote 2 Conversely, the last two steps (Enforcement Committee hearing and publication of the decision) are public information, with the nature and the size of the penalty being precisely identified on the day of the publication. Hence, they are expected to influence market expectations, should the sanctions signal a negative assessment by the Regulator. Additionally, sanctions are not private information for the firms: they are revealed by the Regulator and exogenous to the firm’s agenda. Therefore, there is no self-selection nor optimization process made by the sanctioned companies: the AMF decides independently when to publish its decision.

Following the rich literature on the repercussions of corporate misconducts, an event study methodology investigates for abnormal returns following the milestones of sanction procedures (the “events”). Complementarily, the market value losses are estimated, questioning reputational penalties following the sanction. The results are complemented by cross-sectional multivariate analysis of the determinants of the abnormal returns. Investors should amend their investment strategies proportionally to the severity of the financial misconduct (Choi and Kahan 2007).

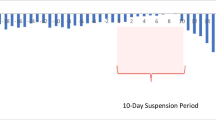

This article enriches the understanding of market reactions to enforcement by investigating how regulatory decisions are perceived by market players to the largest possible extent: depending on the procedure (sanction or settlement), on the verdict (sanction, acquittal, anonymization), on the offender’s characteristics, on the timing of the enforcement, on the media coverage, and on the legal environment. It questions, over a long and up-to-date time span, potential abnormal returns following the milestones of sanction procedures, from the investigation until the publication of the decision (see Fig. 1). Three reasons make it particularly interesting: (1) only the most serious regulatory breaches detected by the AMF end with a sanction procedure; (2) sanction procedures are long (close to 3 years on average); and (3) firms listed in a stock exchange are likely to be subject to a closer scrutiny by the Regulators and to receive more media attention.

The results indicate, on average, statistically significant abnormal reactions to sanctions. Guilty listed firms incur abnormal losses in returns after the sanction decision and its publication. Still, reactions are limited in absolute and relative terms and no reputational penalty is found. Conversely, no abnormal reaction follows either the ignition of the procedure, or the statement of objection, stressing a compliance with the confidentiality of enforcement procedures. Cross-sectional regressions show that abnormal returns are unrelated to the main features of the sanctions (cash fines, as in Armour et al. 2017, and disciplinary sanctions). Other aspects contribute to negative abnormal returns after the publication: procedures initiated with an investigation, longer procedures, the involvement of the top management (chairman, CEO, CFO, owner of the firm), higher media coverage, being a financial or technological firm, and better economic times. Complementary event studies conclude with no abnormal reaction following anonymized sanctions or settlements, in line with their confidential or less severe natures. Acquittal decisions do not trigger straightforward reactions.

This article hence contributes to the existing literature on the impact of enforcement by detailing the timing and transmission schemes of a sanction procedure into the French stock markets. The results contribute to improving the understanding of financial regulation, and of the reasons why French enforcement and sanctions can be said to be scarce and lenient.Footnote 3 The current framework can be questioned as: (1) the market reactions are limited in absolute and relative terms, (2) the most straightforward features of the sanctions (cash fines and disciplinary sanctions) do not matter, and (3) the fines remain extremely limited compared to maximum legal thresholds (despite consecutive increases along the period under review), though trending upwards (de Batz 2017a, b). The following policy recommendations can be made, under the assumption that a credible and efficient enforcement should be priced in by the markets: (1) more communication from the Regulator along the enforcement process, as done by the US SEC, to help market participants better and more rapidly assimilate the information on the misconducts being investigated and as a tool to educate and set example (“name and shame”, as enforced in the UK); (2) more severe and less frequent sanctions (significantly higher fines, closer to the legal maximum, and more disciplinary sanctions), if the Regulator believes that the credibility of a sanction should be measured in the market reactions, as in the US for example;Footnote 4 and (3) more sanctions of individuals (top managers in particular), in order to reinforce accountability and encourage best practices. Better enforcing financial regulations is all the more relevant that market participants are increasingly regulated, partly as a consequence of the Great Financial Crisis. In the end, regulation should support and accompany a healthy development of firms, and not suffocate them. It is a crucial parameter of the attractiveness and the strength of securities markets in terms of fund raising (La Porta et al. 2006), of market capitalization (Beny 2008), and of liquidity (Cumming et al. 2011).

The rest of the article is structured as follows. Section 2 presents a literature review. Section 3 outlines the institutional framework of enforcement in France and formulates the hypotheses. The subsequent Section 4 describes the methodologies of the event study and of the cross-sectional regression, and the data. Section 5 presents the results and Section 6 concludes.

2 Literature review

Securities regulation for capital markets and the subsequent enforcement aim at informing investors and at deterring and uncovering white collar crimes. Several tools are at the Regulator’s disposal: market surveillance, bilateral exchanges with regulated entities, settlements, and (monetary and/or non-monetary) sanctions, on which this article focusses. Alternative enforcement tools can also encourage best practices (Berger and Davies 1998; Barth et al. 2004; La Porta et al. 2006), such as private enforcement and disclosure of information, in particular in a context of imperfect information (Garoupa 1999).

Rational agents will break the law if the profits derived from their crimes exceed the expected costs. In a seminal contribution, Becker (1968) proposes a theoretical framework for the economics of crime to reach an optimal enforcement (deterrence of future crimes, compensation, and vengeance). In his model, sanctions will circumvent frauds and foster compliance with regulation depending on three parameters: (1) the expected profits from committing the fraud (i.e. the harm inflicted upon victims or the society, justifying a sanction); (2) the probability of being caught;Footnote 5 and (3) the subsequent the total cost for being caught (i.e. the cumulated costs of punishment including fines, disciplinary sanctions, jail, higher financing costs, reputational penalty, etc.). This article focusses on this third parameter. Indeed, for firms, sanction procedures are a major legal risk as they convey direct and indirect financial consequences: long and costly procedures, the cash fine set by the Regulator, second-round effects such as higher costs of funding and doing business,Footnote 6 and possibly a “reputational penalty” from the market. Hence, the share price is expected to contract after a sanction, though some contrarian forces may play. Some investors may fail to or decide not to react to the news, while risk-seeking investors could search for investments in firms more prone to play with the limits of the law, possibly synonym of higher returns. Most past literature concludes that the reputational penalty must be accounted both when setting policy standards and when making business decisions (Karpoff et al. 2008b). On the one hand, financial markets could complement enforcement as a channel to induce firms and market participants to behave responsibly (Engelen 2011). On the other hand, the threat of a reputational penalty from the market, exceeding by far the legal sanction, could deter regulatory breaches (for the US, Karpoff and Lott 1993; Karpoff et al. 2008a; for the UK, Armour et al. 2017). Otherwise, the perceived under-punishment of fraud might encourage financial misconduct. The question is then whether financial misconduct pays, if expected profits from regulatory breach(es) exceed the total cost of a sanction (monetary (fines) and non-monetary (reputation) costs), for a given probability of being caught.

The impact of regulatory sanctions on the behavior of financial investors was empirically studied by the literature for numerous jurisdictions,Footnote 7 and from different angles, either for given populations,Footnote 8 for specific regulatory breach(es),Footnote 9 or depending on the media coverage.Footnote 10 They echo a long literature on corporate regulatory breaches.Footnote 11 Some investigated the difference between first-time and repeated offenses, with higher market corrections (Gondhalekar et al. 2012). The most studied country is the US,Footnote 12 thanks to higher transparency from Regulators and defendants (along the enforcement procedures), the size of the market, and the easy availability of a wide range of data on financial fraud. The consecutive steps of the enforcement procedures were studied, typically with event studies.Footnote 13 Assuming financial markets are informationally efficient (Fama et al. 1969), all the available information (here the regulatory sanctions) should be reflected immediately by the market (in the stock prices of the sanctioned listed companies). Past researches show that US markets react significantly to sanctions, in particular to the earlier stages of the procedures (Feroz et al. 1991; Pritchard and Ferris 2001). Still, in an in-depth comparative study, Karpoff et al. (2014) stressed that the consecutive nature of the US enforcement process significantly biases abnormal returns estimates. Similar event studies were conducted following the news of a financial frauds and regulatory sanctions for other jurisdictions. They are scarcer, possibly due the data availability challenges. Whatever the country or region under review, these event studies conclude with negative, rapid,Footnote 14 and significant abnormal market reactions to such financial news from the Regulator. Still, the extent of the abnormal returns varies substantially, as well as the timing. There can also be some anticipation from the market, possibly resulting from rumors or private information regarding the sanction.Footnote 15

Beyond the impact of sanctions on returns (put it differently abnormal returns estimated using an event study methodology), some studies isolate the reputational penalty imposed by the market (if any) from the cost of the sanction.Footnote 16 To estimate this reputational penalty, a “residual approach” is typically used. The financial sanction (i.e. the fine, and possibly other related costs like financing costs, compensations, etc.) is deducted from the overall estimated abnormal market reaction following the news of the sanction (Jarrell and Peltzman 1985; Karpoff and Lott 1993; Karpoff et al. 2008a; Murphy et al. 2009; Armour et al. 2017). They conclude that the reputational penalty exceeds, by far, the financial sanction set by the Regulator.

Some articles distinguish misconducts depending on the relationship between the offender and the offended, to challenge whether it influences market reactions. The sanctions are split depending on whether the regulatory breach impacted related parties to the offender (investors, employees, customers, suppliers) or third parties (market participants, the public, etc.). They conclude that the reputational cost of wrongdoings against related parties is significantly higher (for the US, Alexander 1999; Karpoff et al. 2008a; Murphy et al. 2009; Tibbs et al. 2011; for the UK, Armour et al. 2017).

Finally, part of the literature discriminates the reactions depending on the content of the decision or the communication by the Regulator: being acquitted or being investigated for alleged financial regulatory breaches. This is particularly relevant to studies on the US, where Regulators and defendants are allowed to (and do) communicate along the enforcement process. Some studies found negative impacts on returns of allegations of financial misconduct (i.e. for being investigated by one’s authority), demonstrating a reputational penalty to the mere suspicion of misconduct (Feroz et al. 1991; Pritchard and Ferris 2001; Murphy et al. 2009; Nelson et al. 2009; Dyck et al. 2010; Tibbs et al. 2011; Haslem et al. 2017). The first announcement of an alleged (potentially sanctioned) regulatory breach triggers the highest and most significant negative market reaction.

3 The French institutional framework of enforcement and the research questions

3.1 Sanctioning powers of the AMF

As part of its mandate, the Enforcement Committee of the French Financial Market Authority (AMF EC) sanctions market players which infringe the sets of rules they are subjected to: the Monetary and Financial Code, and the AMF General Regulation. The goal of sanctions, from a regulatory point of view, is to strengthen the marketplace, by condemning wrongdoings and setting examples. Four main regulatory breaches are sanctioned by the AMF (see Table 1): three market abuses: (1) breaches of insider dealing regulations (the use and/or divulgence of insider information for investment decisions); (2) price manipulations (a deliberate misconduct to influence securities prices and fair price formation); (3) breaches of public disclosure requirements (a failure to comply with financial reporting laws and regulations); and (4) any breach of the Monetary and Financial Code and the AMF General Regulation (a failure to meet with professional obligations). From 2004, when the AMF first sanctioned after its creation in 2003, to 2016, 308 decisions were made and published on the AMF website. They stood for 196 million euros of cumulated fines.Footnote 17 Until late 2016, for a given regulatory breach(es), such administrative procedures could be conducted by the AMF, in parallel to criminal prosecutions. All procedures follow the same four milestones (see Fig. 1). A sanction decision can be comprised of cash fines,Footnote 18 disciplinary sanctions,Footnote 19 and its publication.Footnote 20 The offender (firm and/or individual) and/or the AMF Chairman of the Board can appeal the decision towards four different jurisdictions: the Court of Appeal of Paris, the Court of Cassation, via priority preliminary ruling on constitutionality, and the State Council.

An originality of this article is that it exploits a crucial feature of the French financial regulatory framework. All the enforcement process is, by law, confidential until the Enforcement Committee hearing and the subsequent publication of the sanction decision. Consequently, like in the UK until recently (Armour et al. 2017), there are no private litigation nor class action claims occurring over the enforcement process. Additionally, and contrary to the US, newspaper articles or a whistleblowing never triggered an enforcement procedure sanctioned by the AMF over the period under review. All (but one in 2017) sanctioned infringements were identified by the AMF.Footnote 21 Hence, a priori, no speculation on stock returns should be made regarding future financial penalties. Still, this article is an opportunity to investigate for potential leakages from part of the AMF (when the procedure starts) and of the defendants (after the statement of objection).

Within this framework, the AMF’s legal attributes to sanction have significantly evolved since 2004. On four occasions, its sanction powers were reformed, broadened and reinforced (de Batz 2017a, b). Additionally, an alternative procedure to sanctions, the settlement proceeding, was introduced in 2010, and first applied in 2012. The latter implies simpler and shorter procedures, initially only for the less serious regulatory breaches (failures to meet with professional obligations), without guilty plea from the offender or appeal possibility. Settlements reduce the costs and risks inherent to a trial, but dilute deterrence from an enforcement perspective. They are clearly preferred by firms (Bussmann and Werle 2006), when the Regulator offers the option. The two latest reforms were enforced in 2016 and have impacted enforcement since 2017.Footnote 22 They reorganized legal proceedings and reinforced the sanction powers of the AMF. Therefore, such evolutions make it particularly interesting to assess the impact of sanctions on investors from the first sanction pronounced in 2004 until late 2016, before a new set of tougher rules starts to apply.

3.2 Testable hypotheses

This article contributes to answering to a global research question, based on the chronology of sanction procedures: what are the consequences of regulatory enforcement on sanctioned listed companies? To do so, we investigate the informational content of sanction procedures by testing the following hypotheses:

Hypothesis H 1

The confidentiality of the first two steps of the procedures is respected. No abnormal returns follow the ignition of an investigation or a control (i.e. from part of the AMF) or the statement of objections (i.e. from part of the AMF or of the company/individual being investigated or controlled).

Hypothesis H 2

Financial markets matter about the negative signal sent by the Regulator when sanctioning financial misconduct. The sanction and its publication lead to negative abnormal returns for sanctioned firms, due to the fine imposed, the downward revision of forecasts, and possibly a reputational penalty.

Hypothesis H 3

Sanctioned firms undergo a reputational loss for being sentenced guilty. The publication of the sanction decision is associated with negative abnormal returns, exceeding the fine imposed by the Regulator.

Hypothesis H 4

The informational content of the regulatory decision and/or the characteristics of the sanctioned firms impact market reactions.

4 Methodology and data

4.1 Methodology

A standard event-study methodology (MacKinlay 1997; Kothari and Warner 2008) is used to investigate the information content of the four main steps of the AMF enforcement procedure (i.e. the “events”). The events are assumed exogenous to the firms: enforcement procedures are independent regulatory decisions, and unrelated to corporate agendas.Footnote 23 The impact of the event is measured as the daily Abnormal Returns (AR) of the company being sanctioned around the event, by comparing “actual” ex post returns with “normal” estimated returns. The abnormal returns are taken as unbiased estimates of the total financial consequences of the sanction (all expected uninsured future costs, including reputational losses). Under the null hypothesis \( H_{0} \), the “event” has no impact on the distribution of returns for the sanctioned firms (mean or variance effect). A market model, augmented with a sectoral index,Footnote 24 describes the behavior of returns. The model assumes a jointly multivariate normal and temporally independent distribution of returns. On every day t of the event window [− 10; + 120] including the event day (\( t = 0 \)), the deviation in an individual stock’s daily return from what is expected is taken as an unbiased estimate of the financial impact of the “event” on the stock i in t. This abnormal return \( AR_{i,t} \) is defined as:

where \( R_{i,t} \), \( R_{m,t} \) and \( R_{{s_{i} ,t}} \) are the returns on day t respectively on the stock i, on the market portfolio, and on the sector portfolio \( s_{i} \) of company i.Footnote 25,Footnote 26\( \hat{\alpha }_{i} , \)\( \hat{\beta }_{i} \) and \( \hat{\gamma }_{i} \) are the Ordinary Least Squares (OLS) estimates for every sanction i over the estimation window [− 120; − 11]. To draw overall inferences for the event of interest, abnormal returns are cumulated over time \( \left[ {t_{1} ;t_{2} } \right] \) and averaged across sanctions to get the Cumulative Average Abnormal Returns (\( CAAR_{{\left[ {t_{1} ;t_{2} } \right]}} \)), including the event (see specification (2)). All the sanctions are treated as a group.

Complementarily, for every sanctioned firm i, the shareholders’ loss (or gain) \( SL_{{i;\left[ {t_{1} ;t_{2} } \right]}} \) is estimated over \( \left[ {t_{1} ;t_{2} } \right] \) by multiplying the market capitalization of the firm i on the day preceding the event window (\( t_{1} - 1) \)\( MV_{{i,\left( {t_{1} - 1} \right)}} \) (in euros) by the \( CAR_{{i,\left[ {t_{1} ;t_{2} } \right]}} \). Shareholder losses are then averaged across the n sanctions (\( ASL_{{\left[ {t_{1} ;t_{2} } \right]}} ) \):

The (net) average reputational loss (or gain) \( RL_{{i,\left[ {t_{1} ;t_{2} } \right]}} \) for firm i is proxied with a residual approach (Jarrell and Peltzman 1985; Karpoff and Lott 1993; Karpoff et al. 2008a; Murphy et al. 2009; Armour et al. 2017). Sanctions are published long after the misconducts and their capitalization in prices, as enforcement procedures last for years. Hence, this wealth loss is not added to the regulatory fines (Armour et al. 2017).Footnote 27 The financial penalty \( FP_{i} \) for sanction i only equals the fine imposed by the Regulator. It is deducted from the abnormal shareholder loss (or gain) due to the event \( SL_{{i;\left[ {t_{1} ;t_{2} } \right]}} \):

Finally, cross-sectional tests investigate the link between the magnitude of the abnormal returns after the event (i.e. loss or gain incurred by shareholders) and the features of the events (see Table 2). It is particularly interesting given the multiple possible causes for abnormal returns: do higher fines, disciplinary sanctions, appeals, recidivism, higher media coverage, more liquid stocks, etc. lead to more negative abnormal returns? A cross-sectional regression for \( CAR_{{i;\left[ {t_{1} ;t_{2} } \right]}} \) on sanctions characteristics is estimated using the usual OLS, with White-corrected standard errors:

where \( x_{i,j} \), for j = 1, …, m, are the m characteristics of the ith observation, \( \delta_{j} \), for j = 0, …, m, are the m + 1 parameters of the model, and \( \mu_{i} \) is the zero-mean disturbance term, uncorrelated with the explanatory variables \( x_{i,j} \). Heteroskedasticity-consistent t-statistics will be derived using White-corrected standard errors (MacKinlay 1997).

4.2 Description of the data

A unique dataset was constructed covering the 308 publicly available sanction decisions published on the AMF website over the period 2004–2016. It was completed with a second dataset comprising the 32 settlement decisions made from 2012 to 2016. Most variables were extracted or created from the online sanction reports. They were supplemented by publicly available information and by confidential information, shared by the AMF. The latter covers the names of the entities, for anonymized sanction reports (either ex ante or ex post),Footnote 28 some missing dates of procedure, and information on sanctions dating back to before the AMF creation (such as sanctions by AMF’s forefathers). Finally, softwares were used for market data (Thomson Reuters), and for media coverage (Factiva).

The dataset includes more than 40 variables (see descriptive statistics in Table 2): (1) the characteristics of the sanction (or settlement) procedure (including the type of procedure at the origin with an investigation or a control, the sanctioned regulatory breaches,Footnote 29 the dates of four milestones of the procedureFootnote 30); (2) the main features of the verdict (acquittal, cash fine(s), disciplinary sanction(s), ban(s) on activity, anonymization of the sanction,Footnote 31 the chairman of the AMF EC, the length of the sanction report, appeal characteristics,Footnote 32 whether other listed companies were victims of the financial misconduct being sanctioned); (3) the attributes of the defendant (such as the moral form, whether an individual (employee, manager, other) was sanctioned, the top management involvement (chairman, CEO, CFO, owner of the company),Footnote 33 the survival of the firm to the sanction, recidivism before and/or after the AMF creation,Footnote 34 place of listing, stock market capitalization, business sectorFootnote 35); (4) the media coverage of the sanction (media exposure intensity before the sanction, the number of articles published between the decision and the publication and over the week following the publication, articles on the sanction published in top tier journals, L’Agéfi and Les Échos); and (5) some time and legal indicators (AMF chairmen of the board, financial regulations, real GDP growth rate). A comprehensive correlation analysis was carried the dataset.Footnote 36

The sample was restricted to sanctioned listed companies, which were historically the most frequently sanctioned population (42% of the sanctions), followed by asset management firms. The initial sample covered 134 cases, in which 129 sanctions impacted 105 companies. Some sanctions involve several listed companies. Some firms were repeatedly sanctioned (i.e. recidivism), when taking into account branches of groups. These repeat offenders were sanctioned on average three times, ranging from two up to nine sanctions. They were most frequently financial institutions.

The final sample covers less than half of the initial sample: 52 sanctions (i.e. on average 4 sanctions per year) against 40 daily listed companies. 6 of them are no longer listed, following mergers and acquisitions (M&As) or bankruptcies. The sample is comprised of all the firms which were daily listed on the Paris stock-markets,Footnote 37 from the 120 trading days before ignition of the procedure, until 120 trading days after the publication of the sanction (i.e. daily listed on average over 3.4 years). The reasons for exclusion from the sample include: early delisting, late listing, temporary suspension, or lower-than-daily quotation frequency.Footnote 38 Such companies could be already ailing, experiencing financial difficulties (announcing a delisting or a failure in the near future), less traded (hence less liquid, questioning the price formation mechanism around the events), or undergo exceptional events justifying a temporary suspension (such as M&As). All these reasons are likely to interfere with the event and to bias (to the down- or up-side) the market responses to the news of a sanction. Additionally, four sanctions on a multinational bank daily traded in Euronext Paris were excluded, due to the limited share of activities in France.Footnote 39 Acquittal decisions (11 cases) were also removed from the initial sample, given the different nature of the verdict. To avoid overlap and enable data clustering, two concomitant sanction procedures were merged (cash fines and disciplinary sanctions), to assess the cumulated severity of the regulatory decisions. Finally, five sanctions were dropped due to major confounding events, such as the outcome of a major lawsuit, the start of a safeguard procedure, or changes of name. The risk of introduction of biases through the sample selection is tamed by the comprehensiveness of the sample of sanctioned listed companies. Complementarily, some initially excluded sanctions were included in complementary robustness analyses, as well as settlements with listed companies.

Table 3 compares the descriptive statistics of the initial and the final samples of sanctioned listed companies. For the final sample, sanctions massively followed investigations (81% in the sample), which target the most serious regulatory breaches (i.e. the three market abuses). 1.4 regulatory breaches were committed per sanction on average, the most frequent being dissemination of false information (63%), failures to meet with professional obligations (38%), and insider trading (29%). The great majority of companies were large, as 56% of them were listed on the Compartment A and 17% on the Compartment B of Euronext. The average market capitalization amounted to 9.8 billion euros (on the day preceding the sanction), ranging from 8 million up to 69 billion euros, with a standard deviation of 15.5 billion euros. 48% of the decisions were appealed, with an 84% confirmation rate of the AMF EC’s decision.

Most of the divergences between the sample and the average for listed sanctioned companies derive from the higher share of financial companies in the sample (38%, against 25%). These sanctions targeted top tier universal banks, with higher-than-average market capitalizations (by 42%),Footnote 40 and a lower likelihood of bankruptcy (the Central Bank being the lender of last resort). The gap in market capitalizations can also be explained by the fact that smaller companies are more frequently not daily quoted (hence excluded from the sample), or experience financial difficulties. It can lead to quotation suspension or bankruptcy shortly after the sanction, which adds to the reasons for being excluded from the sample. Financial firms are also the most likely to reoffend (de Batz 2017a, b). All in all, the sample cash fines are 28% higher-than-average, as recidivism and size are two of the few regulatory determinants of cash fines.

5 Impact of sanctions on listed companies

5.1 Impact on stock returns

Four event studies are conducted for each step of the enforcement (see Fig. 1). Step 1 is the beginning of the (AMF internal) procedure, with the approval of an investigation (for alleged market abuses) or a control (for breaches to professional obligations). Step 2 is the statement of objection, when the incriminated firm is notified by the Board of the AMF that it is being investigated for characterized regulatory breach(es) and asked for additional information. Given these elements, the Board may transfer the case to the AMF EC, initiating the “judicial part” of the procedure. Step 3 is the sanction decision made after the AMF EC hearing (i.e. the trial), followed by the (possibly anonymized) publication of the sanction report on the AMF website (step 4). Since 2010, the AMF EC hearings have been opened to the public, without naming ex ante the case(s) under review. Top-tier financial journalists typically attend them. Hence, newspaper articles can be written over the 50-trading-day average lag between the decision and its publication (42% of the sample). The echo of sanctions in the press is even greater after the publication (85% of the sample). Hence, returns can be expected to react to the anticipated publication of the sanction.

As described in the methodology, for every step of the procedure, “abnormal” returns are calculated over the event window [− 10; + 120] with respect to the event in \( t = 0 \) from the “normal” parameters estimated over the estimation window [− 120; − 11] (see specification (1)).Footnote 41 Including days before the event investigates for anticipation following leakages or speculation. Abnormal returns are then cumulated along time and averaged across sanctions to draw some inferences on the abnormal reactions following the milestones of the proceeding (see specification (2)). Figure 2a–c and Table 4 report, for every step of the procedure, Average Abnormal Returns (\( AAR_{t} \)), and Cumulative Average Abnormal Returns (\( CAAR_{{\left[ {t_{1} ;t_{2} } \right]}} \)) for the whole sample (\( n = 52 \)). Complementarily, a set of cumulative abnormal returns for sanctioned firms and for every step is presented in Fig. 3a–e. They demonstrate adverse and genuine effects of some steps of the sanction procedure on returns of sanctioned listed firms over the period under review.

Average abnormal returns and cumulative average abnormal returns for the different milestones of the sanction procedures. Abnormal returns are computed given the market model parameters estimated with OLS with White-corrected standard errors, through the period [− 120; − 11] in event time (see specification (1)). Event time is days relative to the step of the sanction procedure under review. The sample is composed of 52 sanctions of daily-listed companies over the period 2004–2016. Average abnormal returns \( {\text{AAR}}_{\text{t}} \) and \( CAAR_{{\left[ {t_{1} ;t_{2} } \right]}} \) are calculated using the specification (2).

Cumulative average abnormal returns and cumulative abnormal returns for some sanction procedures. Abnormal returns are computed given the market model parameters estimated with OLS with White-corrected standard errors, through the period [− 120; − 11] in event time, using specification (1). They are then cumulated along time. The figures depict abnormal price developments (on average or specific sanctioned firms), rebased 100 on the day of the event. Event time is days relative to the step of the sanction procedure under review. The sample is composed of 52 sanctions of daily-listed companies over the period 2004–2016. Sanctions are numbered chronologically.

On the one hand, shareholders do not react significantly to the early steps of the procedure: no significant abnormal return follows either the beginning of the procedure, or the statement of objection. We fail to reject the hypothesis \( H_{1} \), in line with expectations. This result for the beginning of the procedure rejects any breach of confidentiality from part of the AMF teams in charge of internal procedures. Leakages to market players or use of insider information could have caused a reaction in stock returns. Secondly, the absence of abnormal returns following the statement of objection demonstrates the lack of insider trading from part of the AMF and of the investigated company, after learning about a procedure that can end up with a sanction.

On the other hand, as expected (see hypothesis \( {{H}}_{2} \)), the last two steps of the procedure trigger statistically significant reactions: shareholders suffer abnormal losses following the sanction decision, and its publication. The regulatory decision on the guiltiness of a given listed firms is negative information to the market: on average, returns contract by a cumulated abnormal 0.9% over the period [− 1; + 3] in event time (significant at the 10% level). Additionally, they lose 0.8% over the period [− 1; 0] following the publication of the decision (significant at the 1% level) and 1.1% over the period [− 1; + 3] (significant at the 10% level). Interestingly, there is some anticipation in the reaction, before the publication, as in previous studies: abnormal returns turn significantly negative, possibly anticipating the outcome of the decisions and newspaper article, or due to leakages of information to insiders, as seen in other jurisdictions.Footnote 42 62% of the guilty companies exhibit negative abnormal returns on the day of the publication of the sanction, ranging from − 5.3 to + 5.0% (with a 1.5% standard deviation). Three days after the publication, 63% of the companies suffer cumulated losses, ranging from − 12.1% to gains of + 7.8% (4.4% standard deviation). The contraction peaks 6 days after the publication (\( CAAR_{{\left[ { - 1; + 6} \right]}} = - 1.3\% \), significant at the 5% level). In the longer run, cumulative average abnormal returns following the sanction decision remain negative though statistically insignificantly (\( CAAR_{{\left[ { - 1; + 60} \right]}} = - 3.7\% \)). This higher contraction echoes the lag between the AMF EC hearing and the publication of the decision: 50 trading days on average in the sample (de Batz 2017a). Hence, the cumulated contraction 60 days after the sanction would incorporate the compounded abnormal reactions to the sanction and to its publication, estimated over a window excluding the sanction decision and its publication.

Given the limited (though exhaustive) number of observations, and to ensure that the presence of outliers does not bias the results, two complementary robustness checks were conducted. A bootstrapped analysis of the robustness of standard errors was conducted 1000 times, with a confidence interval of 95%. Complementarily, abnormal returns were winsorized before estimating the test statistics, as in Armour et al. (2017): all abnormal returns outliers to a 90th percentile were excluded from the data, meaning that all data below the 5th percentile are set to the 5th percentile, and data above the 95th percentile are set to the 95th percentile. The magnitudes of the \( CAAR \) were confirmed and turned out to be slightly more significant and persistent in time with winsorized abnormal returns.Footnote 43

All in all, in the short run, these sequential event studies confirm the reactions observed in previous research. They also contribute to improving the quality of the assessment of the spillovers of sanctions in France. In fact, the exhaustive sample of daily listed guilty companies implies a broader scope of analysis and a higher granularity. No abnormal reaction was measured through the early stages of the enforcement procedure, rejecting breaches of confidentiality either by the Regulator and the defendant(s). Subsequently, the results are coherent with past studies on the French sanctions, though to a lower extent: sanction decisions and their publications convey information and impact negatively returns of listed companies in the short run.Footnote 44 As in the literature, some anticipation in the outcome was measured, with the negative correction in prices. Additionally, contrary to the efficient market hypothesis, investors’ reactions tend to be scaled in time: the spillovers of sanctions on the stock returns take some time to fully materialize. Some investors will react immediately after learning the sanction. Conversely, various reasons can contribute to this inefficiency of financial markets, leading to no or postponed reactions: the time to access information (initially unaware, herd behaviors), the poor financial education (misunderstanding of regulatory breaches), or the avoidance of financial consequences (fees due to portfolio rebalancing, deterring fiscal consequences, no investment alternative, etc.).

In the longer run, past literature estimates a large range of impacts, from positiveFootnote 45 to very negative.Footnote 46 Some studies conclude that a fraud durably affects returns, up to three years after the news, when using lower frequency data (Leng et al. 2011; Dyck et al. 2010). Such estimates must be taken with caution as the further from the event, the more likely confounding events will interfere with abnormal returns. The impact of French sanctions on guilty daily-listed companies in the longer run remains limited compared with international estimates. Our results demonstrate that, over the six months following the sanction (either decision or publication), \( CAAR_{t} \) remain negative, even though they are not significantly different from zero. That could be explained by the higher volatility in the long run. Finally, it is likely that the reaction following the sanction decision is partly confounded with the reaction following the publication.Footnote 47 When cumulating the impacts of the last two steps of the procedure, the magnitude of average abnormal returns becomes more substantial: − 3 to − 4% cumulated losses 60 trading days after the sanction, estimated over an estimation window excluding any event related to the sanction.

5.2 Complementary results and information content of the sanction decisions

Robustness checks with larger or sub-samples and complementary analysis were conducted to test the sensitivity of the results to the hypotheses. Results are robust and complementary with conclusions previously described.Footnote 48 They show that the French enforcement actions are not trivial.

Firstly, including into the initial sample the four sanctions pronounced against a major international bank leads to similar impacts with the central event study. Still, abnormal returns are lower and less significant, supporting the hypotheses which led to their initial exclusion.

Secondly, the impact of the Great Financial Crisis was tested, given its magnitude and spillovers. Financial firms, which were at its origin and its main victims, are the most frequently sanctioned listed companies. The crisis also led to a tightening of financial regulation and supervision, in particular regarding sanction powers at the European and French levels (de Batz 2017b). The sample was split by publication dates, either before or after the crisis.Footnote 49 The re-estimated event studies show that the information content of the publication of sanctions seems to have increased since June 2007, with significant and more negative abnormal returns. They suggest a reinforced market awareness and risk sensitiveness to sanctions and regulatory interventions.

Thirdly, following past literature, offenses were sorted into two main categories: whether they hit related parties or not (i.e. third parties), based on the AMF split of regulatory breaches.29 The event studies demonstrate that the three breaches impacting related parties lead to higher abnormal negative returns after the publication (by declining order of magnitude and significance): (1) insider trading; (2) dissemination of false information (vis-à-vis investors or the Regulator); and (3) not complying with one’s professional obligations. Conversely, price manipulation (i.e. hitting third parties) does not cast significant abnormal returns (though with a limited sample size). Such results confirm past studies as investors tend to react more when they are impacted by the financial misconduct (i.e. by being a related party).

Fourthly, the event studies were re-estimated for two subsamples based on the “seriousness” of the verdict,Footnote 50 capitalizing on the guidelines given by the AMF on how to set the sanction.18 The results demonstrate that the mere cash fine is uncorrelated to the magnitude of abnormal returns. That may be explained by low level of average cash fines (in absolute and relative terms).Footnote 51 Some cumulated dimensions of the seriousness of the decision (subsample “3 factors”)50 point to a more severe financial misconduct, leading to more negative abnormal returns. That confirms the initial hypothesis \( H_{4} \) that not only will the mere fact of being sanctioned be priced in abnormal returns, but the nature of the sanction will also negatively influence the results.

Fifthly, no significant abnormal returns followed the 7 decisions for which the identities of the sanctioned firms were anonymized when first published, whatever the step of the procedure. This confirms the lack of breaches to confidentiality through the whole enforcement process.

Finally, two complementary samples of decisions were subjected to the event study methodology: (1) the 11 acquittals of listed companies, and (2) the 5 settlement decisions involving subsidiaries of daily listed companies (three French financial groups).Footnote 52 For both samples, the expected information content of the decisions was not straightforward, under the assumption that sanctions convey information to investors. Firstly, acquittals can mean innocence and no fine has to be paid (positive signal). Conversely, they signal serious doubts from the Regulator regarding a firm (negative signal), as only the most severe alleged financial wrongdoings are brought to the AMF EC. Other breaches are dealt with confidentially and bilaterally, between the AMF and the regulated entity. Additionally, acquittals frequently result from procedural irregularities, or prescription limit of the incriminated regulatory breach(es), which do not exonerate the entity from any liability. Secondly, settlements are alternative lighter procedures, dedicated to less serious regulatory breaches than sanctions. They do not imply guilt recognition from part of the defendant. Still, they result from significant financial misconducts. Under the rationality of investors and efficient market hypotheses, abnormal returns following settlements are expected to be negative, though lower than for the sample of guilty sanctions.

Acquittal decisions convey mixed signals: positive statistically significant abnormal returns on the day of the sanction (\( AAR_{0} = + 1.1{\text{\% }} \), at the 10% level), followed by a negative one after the publication (\( CAAR_{{\left[ {0; + 3} \right]}} = - 3.1{\text{\% }} \), at the 10% level). The results could be explained by the limited sample size. They also echo the divergent conclusions on the impacts of allegation of financial misconduct (i.e. the mere fact of being investigated) as well as on acquittal decisions, in other jurisdictions.

For the small sample of settlements, no significant abnormal returns followed any step of the proceeding. The markets do not price in the additional information on the firm’s compliance with regulation. Similarly, Haslem et al. (2017) found market reactions to settlements being the least negative and negligible, whatever the outcome. The lack of reaction to settlements questions the information content of such procedures, and the credibility of the AMF communication and decisions vis-à-vis investors.

5.3 Impact on market values and reputational penalty, following the publication of the sanction

This section investigates the hypothesis \( H_{3} \): does a reputational penalty explain part of the abnormal returns following the sanctions of listed firms? The focus is limited to the step of the procedure triggering the biggest and most significant reactions in \( CAAR \): the publication of the sanction. From specification (3), the impact on market capitalizations \( SL_{{\left[ { - 1; + t} \right]}} \) is estimated from the \( CAR_{{\left[ { - 1; + t} \right]}} \), from the day preceding the event until t days after in event time. On average, sanctioned firms lost in equity \( ASL_{{\left[ { - 1;0} \right]}} = - 45,200\;{\text{euros}} \), \( ASL_{{\left[ { - 1; + 1} \right]}} = - 74,600\;{\text{euros }} \), and \( ASL_{{\left[ { - 1; + 6} \right]}} = - 32,000\;{\text{euros}} \) respectively. There is a wide range of reactions, suggesting that not all frauds are equally important to shareholders. For example, over the event window [− 1; + 1], \( SL_{{\left[ { - 1; + 1} \right]}} \) range from losses of 2.2 million euros (− 6% loss in value) up to gains of 870,900 euros (+ 2.7% in value), with a standard deviation of 363,000 euros.

Hence, markets do integrate the information of the sanction sent by the Regulator as a negative signal, but only to a limited extent (see Table 5). The impact on the market capitalizations is small in absolute, as well as in relative terms. On average, for the sample, the cash fine is 12 times bigger than the abnormal market correction. Put it differently, on average, the reputational impact for being sanctioned \( RL \) is positive, after subtracting the cash fine from the estimated abnormal market reaction (see specification (4)). One gains from being sanctioned. Still, the dispersion is very high. Market efficiency, in that sense, is limited. This result questions the credibility of AMF’s sanctions. We fail to reject the null hypothesis \( H_{3} \) that there is no reputational penalty subsequent to the publication of a regulatory sanction. It is all the more striking that the regulatory fines are already perceived as low compared to the legal authorized maximums (100-million-euro threshold for any professional under the AMF supervision, see Table 1), as well as in relative terms (standing for 0.01% of the market capitalization on average) and in international standards.Footnote 53

Sanctioned financial misconduct implies statistically significant market penalties but no reputational penalty. One would expect that such regulatory decisions impact negatively the perception by shareholders, stakeholders, etc., as it is the case in other jurisdictions (US and UK in particular). The “reputational gain” for French listed firms from being sanctioned questions the severity of the verdict (in particular the levied financial penalties) and, more broadly, the credibility of the Regulator. In sharp contrast, in the US, the reputational penalty represents 90% of the equity loss, according to Karpoff and Lott (1993). In Karpoff et al. (2008a), the reputational penalty for cooking the books in the US stands for 7.5 times all penalties. Firms lose 38% of their market values when their misconduct is reported, 2/3 of which being a pure reputational penalty. In the UK, the reputational penalty exceeds by 9 times the cash fine, according to Armour et al. (2017).

5.4 Cross-sectional determinants of the stock market’s reaction

In this section, we use a cross-sectional regression to explain the determinants of the abnormal returns incurred by each sanctioned firm in the aftermath of the publication of the sanction (i.e. the most significant results). The dependent variables are the \( CAR_{{i,\left[ { - 1; + t} \right]}} \), as defined in specification (2). For a cross-section of sanctions, we run OLS regressions with robust White-corrected standard errors of \( CAR_{{i,\left[ { - 1; + t} \right]}} \) against all the explanatory variables from the dataset (firm, sanction, and environment characteristics, see Table 3), based on specification (5). The results for three following models are presented, robust with the exhaustive cross-sectional test.

Model 1 is estimated from the day preceding the publication until t days \(({t = 0}\;and\;{+ 6}) \), for each sanction i, with the following explanatory variables: a dummy for sanctions following an investigation (i.e. the most serious regulatory breaches); a variable for the length of the procedure from the beginning until the sanction decision (synonym of complexity); a dummy for sanctions anonymized by the AMF; a dummy for the rejection or dismissal of the appeal (confirmation of the AMF verdict); a dummy for the media attention, when articles are published following the sanction publication of the top-tier financial journals (L’Agéfi or Les Échos); a dummy for firms which “survived” the sanction (i.e. are still listed); a dummy for the largest firms (i.e. listed on the Euronext Compartment A); a dummy for Euronext industrial firms; a dummy for Euronext technological firms; and the real quarterly French GDP year-on-year growth rate when the sanction was published (synonym of the economic conditions);

Two alternative models (models 2 and 3) were estimated for the peak in significant cumulative abnormal returns (\( CAR_{{i,\left[ { - 1; + 6} \right]}} \)), with the following alternative variables: a dummy if the top management of the firm was involved in the regulatory breach(es) (chairman, CEO, CFO, owner of the firm); a media intensity variable before the sanction (ratio of articles mentioning the firm over the 20 days preceding the sanction to the number over the preceding year); a variable for the number of articles mentioning the sanction published over the week following the publication; a dummy for Euronext consumer goods or services firms; a dummy for Euronext financial firms; and a dummy for the sanctions published under the financial law LME (2008 to 2010).Footnote 54

Table 6 reports the strongly robust results. The fits of the models over the period [− 1; + 6] are particularly interesting given their robustness, and the fact that more time is given to market players to react to the news of the sanction (i.e. inefficient markets). The following takeaways can be drawn regarding the information content of sanctions and their interpretation by the market.

Four aspects of the sanction contribute to significantly more negative abnormal returns: being investigated (versus controlled), longer procedure, the top management’s involvement in the regulatory breach(es), and a higher media coverage. Interestingly, negative abnormal returns appear higher in better economic times, possibly as stronger forces than sanctions may play during an economic crisis and lead to global negative trends.

Regarding the sanctioned firms, size (being listed in the Euronext Compartment A, which is also positively correlated with recidivism) curbs negative abnormal returns. In terms of sectors, as expected, model 3 shows that financial firms will endure more negative abnormal returns for being sanctioned. This sector is the most frequently sanctioned, and the most prone to recidivism. Being a technological firm will also contribute to more negative abnormal returns, conversely to being a consumer goods or services firm.Footnote 55

Surprisingly, appealing a decision, which could stand for a positive signal (claiming for one’s innocence), sends mixed and limitedly significant information: positive in the very short run, before turning negative, at the 10% level. It could be accounted for by the historically low probability of success of appeals. Additionally, anonymization leads to significantly more negative abnormal returns, though only in the short run. The consecutive regulatory tightenings did not impact significantly returns.

The last two takeaways can be drawn from insignificant variables. Firstly, the three variables controlling for the most straightforward features of the sanction decision (cash fine, warning, and blame) do not statistically significantly influence market reactions.Footnote 56 The fine and disciplinary sanctions do not serve as signals of the seriousness of the misconduct. Nor do the regulatory breaches committed by the sanctioned company, and recidivism (either before or after the creation of the AMF), despite being key parameters considered by the Enforcement Committee to set its verdict. This can be partly accounted for by the fact that the survival to sanctions of listed firms (i.e. still being listed) is significantly negatively correlated with abnormal returns. Secondly, the consecutive Chairmen of the AMF, named by Government decree, and the EC AMF chairmen do not appear to have influenced the information content of the sanctions, as perceived by market players. This supports the regulatory independence of the regulatory actions.

5.5 Discussion of results

The event studies and the cross-sectional regressions demonstrate that, over the period under review, the markets do price in the information of the sanction, but to a moderate extent. The results on \( CAAR \) are limited but consistent with most past studies. They are supported by a precise unique identification of the announcement date and the exhaustivity of the data set. Additionally, they show that the most classical seriousness determinants of sanctions were hardly taken into account by the market: cash fines, disciplinary sanctions, regulatory breaches being sanctioned, and recidivism. Still, some complementary signs of seriousness are incorporated into prices, such as being investigated (not controlled), longer procedures, or the involvement of the top management of the firm. It may be due to the fact that the fines set by the Regulator and echoed by the market (i.e. “reputational penalty”) are limited in absolute and relative terms, when compared with the legal maximums, with other French regulatory authorities, or with other jurisdictions. Indeed, in the US, the use of financial fines is less common than in France (8% of the sample in Karpoff et al. 2008a), but the amounts are much more significant (average of 107 million dollars, in Karpoff et al. 2008a). That could plead for scarcer and much more severe sanctions in France, though Armour et al. (2017) concluded, for the UK, that the reputational penalty is unrelated to the size of the financial penalties levied (0.26% of the market capitalization on average). The results for France are all the more surprising that studies (on the US and other jurisdictions) concluded that financial and accounting issues—which are investigated by the article—triggered the strongest stock market reactions.Footnote 57 The reputational gain from being sanctioned echoes the initial statement that AMF sanctions seem misunderstood and neglected by analysts, investors, and shareholders. All in all, this article questions the information content of the sanctions, the credibility, usefulness, and efficiency of cash fines, and, more generally, of the current regulatory enforcement framework in France. Reputational penalties subsequent to sanctions could enhance enforcement, like in other jurisdictions. They could complement regulatory sanctions, if they were large enough to stand for a credible threat to offenders, without endangering the firms’ solvency. The limited market reactions to AMF sanctions could also be due to the “person” being sanctioned: mostly companies, despite the frequent involvement of the top management in the regulatory breaches (which would send a negative signal, according to the cross-sectional test results). Recent research suggests focusing more on top managers to gain in credibility and efficiency in deterring future crime (Jones 2013; Kay 2015; Cullen 2017). In the US, past research stressed how enforcement impacts carriers and reputations of top managers. Karpoff et al. (2008b) demonstrated that, in the US, 93% of top managers involved in financial misrepresentation lose their jobs before the end of the regulatory enforcement period, mostly explicitly fired. Complementarily, class-actions securities litigations will penalize directors’ reputation only if initiated by the US SEC (Helland 2006). In the case of AMF sanctions, no top manager was fired, despite being involved in half of enforcement procedures of the sample.

Additional takeaways derive from the event-study analyses. The results confirmed past studies (Nourayi 1994; Alexander 1999; Murphy et al. 2009; Tibbs et al. 2011; Armour et al. 2017) in that financial wrongdoings linked to related parties induce stronger abnormal market reactions, in particular insider trading, and breaches to information obligations. It illustrates the key role played by trust in investment relationships. Sanctions seem to have gained in echo in the market since the Great Financial Crisis, implying higher abnormal returns, in line with Armour et al. (2017) in the UK, but contrary to Kirat and Rezaee (2019) for France.

Three remarks concern the transmission of the news of a regulatory sanction. Firstly, anonymizing the sanction report, when publishing it, appears to protect the sanctioned entity from suffering abnormal returns. Secondly, in line with past studies, a higher media coverage of the published sanction will trigger stronger abnormal negative returns. Thirdly, the cross-sectional results stress that the independence from governmental and political process (a key challenge for Regulators for Carvajal and Elliott (2007)) seems to be overcome. The successive chairmen of the AMF and of the AMF EC did not impact significantly market reactions.

In light of these results, some policy recommendations can be made in order to improve the credibility and the efficiency of the enforcement of financial regulation: (1) to increase transparency from part of the Regulator by communicating more on regulatory breaches, possibly before the sanction itself as done by the US SEC, as a tool to educate and set example (“name and shame”); (2) to sanction more severely (significantly higher fines, closer to the legal maximum), possibly less frequently, and to resort more disciplinary sanctions, if the Regulator believes that the credibility of a sanction should be measured in the market reactions; and (3) to focus more on individuals (top managers in particular), as a way to question their competences and integrity, possibly with higher fines or resorting to (temporary) bans on activity.

6 Conclusion

This work aimed at investigating the information content of sanctions of listed companies for financial misconducts, as enforced in France, to better understand how enforcement influences markets. It challenges the common view is that financial misconduct and regulatory breaches can be lightly punished by the French Regulator and consequently neglected by investors. It analyzes reactions in listed companies returns to the news of a sanction. The results are put into perspective depending on the content of the decision and on the characteristics of the convicts and compared with other jurisdictions. More precisely, this paper details the reactions of investors and stakeholders along the sanction proceeding by searching for abnormal returns after the four milestones of sanction procedures. It also strives to understand how the features of the sanctions, and of the sanctioned entities could explain such reactions. To do so, an original dataset was built for the 52 sanction decisions impacting 40 daily-listed companies from 2004 to 2016, completed with similar complementary datasets for acquittal decisions and settlements.

The results first show that the confidentiality of the early stages of the proceeding is respected, by the AMF and the investigated firms: no significant abnormal returns were detected. Investors then react significantly negatively to the news of a guilty sanction, and to its publication. Such negative abnormal returns are limited in absolute or relative terms, compared to past studies on France and on other jurisdictions. No reputational penalty is assorted to sanctions. Settlements do not trigger abnormal returns. Some features of the sanction and of the defendant will influence the reaction, but not the most straightforward (cash fine, behavioral sanction, and recidivism).

Overall, the results echo the reputation for leniency of AMF sanctions (scarce procedures, lax verdicts, low fines, ending neglected by investors), despite consecutive regulatory tightenings and long and costly procedures. They question the enforcement efficiency, bearing in mind that the goal of regulation is to support and accompany a healthy development of firms, and not to impose an unnecessary regulatory burden. The following policy recommendations can be made to improve the credibility of enforcement: (1) increasing the communication from the Regulator with more transparency on sanctions or with a name and shame of financial crime, for the market to quicker, better, and more comprehensively price the information; (2) sanctioning less frequently and more severely, with higher cash fines, and possibly completed with more frequent disciplinary sanctionsFootnote 58; and (3) sanctioning more individuals, and in particular top managers.

Notes

This gap in the literature can be accounted for by the (increasingly) limited open access to data. Indeed, sanction reports are frequently published anonymized (part of the sanction decision of the Enforcement Committee (AMF EC), i.e. ex ante) or anonymized ex post at the EC AMF Chairman’s discretion. The compounded anonymization rate is 57% (de Batz 2017a, b). Additionally, some dates can be missing in sanction reports. Lastly, in 2018, a regulatory change led to an anonymization of most of the sanctions from 2004 to 2013.

Like in the United Kingdom (UK, Armour et al. 2017). Conversely, in the US, the trigger event can be early communication by the Regulator and/or the defendant.

Sanctions by the AMF suffer from a reputation of being scarce (i.e. low probability of being caught) and lenient (i.e. lax verdicts with low fines). They do not receive a straightforward coverage by the media nor by financial analysts: most identified misconducts are dealt with bilaterally and confidentially between the AMF and the regulated entity. Even the highest sanction in history (35 million euros sentenced in July 2017) did not cast an unequivocal analysis. In fact, financial penalties are low in absolute and relative terms, despite four-consecutive reinforcements of AMF’s enforcement powers since its creation in 2003. For example, the maximum legal fines were repeatedly increased (up to 100 million euros, or 10 times the gains realized for firms, see Table 1). In the end, the translation of sanctions into returns of listed companies is a priori unclear. This marks a sharp difference with other jurisdictions (Anglo-Saxon countries in particular) or with sanctions by other French Regulatory Authorities (such as the Competition Authority).

For example, in Karpoff et al. (2008a), only 8% of the 585 firms received a fine from their regulatory agencies over the period 1978–2002. The mean was 107 million dollars (60 million when excluding an exceptional case).

The (actual or perceived, Garoupa 1999) detection rate by the Regulator (or by other market participants) is low, even though misconducts on financial markets are frequent. The probability of being caught depends on the public expenditures on enforcement, courts, police, etc. They are by nature constrained. No data exists on frauds which went undetected. Bussmann and Werle (2006) estimated, in the global survey, that only 4% of the detected economic crimes were identified by law Enforcement Agencies, most of them being detected by the firms themselves. On average, only 2 to 5% of the American listed companies are investigated per year by the Securities and Exchange Commission (US SEC), according to Cumming and Johan (2013). Drake et al. (2014) stressed that, from 1996 to 2004, out of the 15% of large American publicly traded firms engaged in fraud each year, only 4% are in the end detected.

Similarly, the detection rates for cartels are low, despite being larger in terms of scope and duration. In the US, Bryant and Eckard (1991) estimated the annual probability of being caught for a cartel from 13 to 17%. In Europe, Combe et al. (2008) estimated it from 12.9 to 13.1% from 1969 to 2008, based on European Commission data.

The sanctioned entity can face higher insurance premia, more expensive funding conditions, tougher client relationships, and additional investments to compensate for the demonstrated market failure (IT, process improvements, marketing, and communication, etc.).

Such as Canada, China, France, Germany, Japan, Luxembourg, Malaysia, the Netherlands, and the UK.

This article focusses on the role of dissemination of information of the press, and not on the creation (Drake et al. 2014). The coverage by mass media can alleviate information problems for listed firms (Fang and Peress 2009), in particular for individual investors (Fang et al. 2014). Miller (2006) demonstrated that an accounting fraud is more likely to be echoed in the press for firms which already receive more attention from the press. (Past researches typically conclude with higher market reactions. Rogers et al. (2016) showed that the media plays an economically important role in price formation in securities markets, by widening the dissemination of insider trading disclosures.

A wide range of regulatory breaches can damage one’s reputation: financial fraud, corporate malfeasance (anti-trust violation, bribery, tax evasion, illegal political contributions, employer discrimination, etc.), false or misleading advertising, product recalls, airplane accidents, environmental violations, illicit allegations, etc. Their impacts are typically investigated with an event study methodology.

Accounting and Auditing Enforcement (AAER), US SEC formal or informal investigations, Wells Notice issuance, sanctions, and class action filing.

Lin and Rozeff (1995), for example, demonstrated that 85 to 88% of private information is incorporated into prices within one trading day.

For shorter term reactions, out of an extensive literature review of 55 similar studies (details are available on demand), the following averages for Cumulative Average Abnormal Returns were estimated:

For the most frequently used event window (55% of the sampled studies, most frequently US), \( CAAR_{{\left[ { - 1; + 1} \right]}} = - 7.7\% \), ranging from − 25 up to − 0.5%, with a standard error of 7.6%;

For shorter event windows: \( CAAR_{{\left[ {0; + 1} \right]}} = - 7.6\% \), ranging from − 20.6 up to − 0.7%, with a standard error of 7.6%; \( CAAR_{{\left[ { - 1;0} \right]}} = - 3.2\% \), ranging from − 6.3 up to − 0.8%, with a standard error of 2.3%;

For longer short term event windows ([− 2; + 2], [− 3; + 3], [− 5; + 5], and [− 7; + 7]), \( CAAR_{{\left[ { - {\text{i}}; + {\text{i}}} \right]}} = - 9.4\% \), ranging from − 19 up to − 1%, with a standard error of 7.6%.

These averages are higher with the two past studies on France (\( CAAR_{{\left[ { - 1; + 1} \right]}} = - 1.05\% \) and \( CAAR_{{\left[ { - 1; + 1} \right]}} = - 2.98\% \), not statistically significant), as well as short-term estimates on Europe, the UK, and Germany (− 1.55% in \( CAAR \)).

24 sanctions were made per year on average, to which add 6 settlements per year since 2012, when this new procedure was first concluded. When excluding the 9% acquittals, 94% of the guilty sanctions included a cash fine, for an average 688,320 euros, paid to the French Treasury (or to the guarantee fund to which the professional belongs).

There is neither binding rule nor clear guidelines on how to value fines. Time consistency and the maximums set legally are the two key objective parameters to set a fine, to which add specificities of the respondent (gravity and duration of the financial misconduct(s), financial situation of the defendant, magnitude of the obtained gains or advantages, losses by third parties, etc.). Maximum fines were increased three times over the period under review and can amount up to 100 million euros for market abuses committed by professionals, or 10 times any profit.

(1) Warning and/or blame, depending on the seriousness of the wrongdoing(s); and (2) “ban on activity”, covering temporary or permanent ban on providing some or all services, suspension or withdrawal of professional license, and temporary or permanent ban on conducting some or all businesses.

Most sanctions are published, in particular in recent years, except if such disclosure would seriously jeopardize the financial markets or cause disproportionate damage to the parties involved. The EC decides whether to publish its decision, where to publish it (mostly on the French Official Journal for Legal Notices (BALO) and on the website of the AMF, possibly in a given set of magazines, at their expenses) and whether to anonymize it (entirely or partially).

In the USA a significant share of financial scandals are revealed by the press (Choi and Kahan 2007), associated with a statistically significant impact on prices (Miller 2006).

Conversely, in France, the press is mostly a re-broadcaster of scandal news detected by the regulator (and not a producer of news), hence improving the dissemination of information among actual stakeholders and potential investors and contributing to the efficiency of stock markets (Fang and Peress 2009; Fang et al. 2014).

Law on market abuses of 21, June 2016 (Law no. 2016-819) and Law on transparency, the fight against corruption and modernized business life, of 9, December 2016 (Law no. 2016-1691, IV Art. 42-46)

The main changes include: (1) The maximum fine remains 100 million euros but can stand for up to 15% of the annual turnover for a legal entity and has been increased up to 15 million euros or ten times any profit earned for an individual failing to meet his professional obligations. (2) The ban from activity can now exceed 10 years. (3) The powers of the Enforcement Committee have also been broadened to public offerings of unlisted financial instruments (without prospectus) and to crowdfunding. (4) The scope of regulatory breaches eligible to settlement procedures has been widened to all market abuses (insider dealing, price manipulation and dissemination of false information), and no longer only the failures of regulated professions to meet professional obligations. (5) Finally, any decision published on the AMF website should remain online at least for 5 years (which was already the case), but any reference to personal data should be anonymized after 5 years (which was only partially the case).

Contrary to events such as annual and quarterly publication, or profit warnings. The exogeneity is also supported by the fact that some sanctions were, in the end, excluded from the sample due to confounding events such as the publication of the results from another judicial procedure or M&As.

The results of the event studies are robust when using a market model not adjusted for the sectors, though lower. Detailed results are available in de Batz (2018). Controlling for the sector is supported by the long period under review (2004–2016, including the Great Financial Crisis), and the wide range of sectors of the sanctioned firms.

Equity returns are defined as the daily log difference in value of the equity (including reinvested dividends).

Given the wide range of size of sanctioned companies, the broadest benchmark index for the French stock markets (CAC All Shares) proxies the market portfolio. Euronext main sectors are used for each firm. The 10 main sectors are: financials (38% of the sample); industrials (15%); technology (13%); consumer goods (8%); consumer services (8%); health care (6%); basic materials (6%); telecoms (2%); utilities (2%); oil and gas (2%).

Conversely, in Karpoff et al. (2008a), the reputational penalty equals the expected loss in present value of future cash flows, due to lower sales and higher contracting and financing costs.

AMF classification: insider trading, price manipulation, failure to meet with the information regulatory requirements vis-à-vis investors or the Regulator, failure to meet with professional obligations, proceedings, and takeovers.

Complementary variables were built: the duration of the procedure from ignition to the sanction decision, in years, as in Karpoff et al. (2008b), and the lag between the decision and its publication, in months.

Three dummies were used to control for the impact of the anonymization: anonymized when first published, partial anonymization, and ex post anonymization, at the AMF EC Chairmen’s discretion.

Several variables characterize the appeals: whether the decision was appealed or not by the sanctioned entities, as in Karpoff et al. (2008b); whether the AMF appealed the decision of the AMF EC; the number of courts appealed to; whether the decision was confirmed or not; and the duration of the appeal procedure.

Generally speaking, a focus is made on the individuals within an organization convicted of crime, as recommended by Cohen (1996), either employees (with a principal-agent relationship derived from the employer-employee contract) or top managers. From an investor’s perspective, the top management involvement in a fraud could be particularly detrimental, demonstrating the improper management of the firm and questioning the capacity of the management to handle future challenges. Karpoff et al. (2008b) showed how financial mis-presentation can prejudice careers of top managers: more than 90% of them lose their jobs by the end of the US SEC enforcement procedure.

Recidivism is one of key aggravating factor regularly stated by the AMF to define the size of the sanction. Repeat offenders are sanctioned more severely than first-time offenders.