Abstract

This paper aims to explore the main determinants of environmental quality in Egypt by utilizing the data covering the years from 1971 to 2014. These dynamics were explored by utilizing the ARDL, wavelet coherence and Gradual shift causality approaches. The ARDL bounds test revealed cointegration among series. Findings based on the ARDL revealed; (i) positive and significant interaction between energy usage and CO2 emissions; (ii) no evidence of significant link was found between urbanization and CO2 emissions; (iii) no significant link was found between gross capital formation and CO2 emissions; and (iv) GDP growth impact CO2 emissions positively in Egypt. Furthermore, findings from the wavelet coherence technique provide supportive evidence for the ARDL estimate. The Gradual shift causality test revealed one-way causality from CO2 emissions to energy consumption and economic growth, while there is evidence of feedback causality between CO2 and gross capital formation. Based on these findings, policymakers in Egypt need to formulate environmental policies to promote sustainable urbanization and clean energy without undermining economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The industrial revolution has transformed global economies from organic human and animal-powered production techniques into inorganic production processes which are commonly based on non-renewable resources for energy use, such as fossil fuels which greatly accelerate global warming through trapping heat in the atmosphere via generating greenhouse gases (GHGs). Both for environmentalists and policymakers, global warming turned out to be one of the major environmental issues in the last couple of decades. The increase in the rate of GHGs emitted into the earth’s atmosphere around the globe arises from the increase in economic activities in both developed and developing countries, albeit human economic activities has a detrimental influence on the environment. The primary contents of GHGs trapped in the atmosphere are carbon dioxide (CO2), methane(CH4), nitrous oxide (N2O), chlorofluorocarbons (CFC), hydrofluorocarbons (HCFC) and sulphur hexafluoride (SF6). Among other GHGs, CO2 arising mainly from fossil-fuel combustion, cement production, and land-use conversion, has been ranked the number one source of global warming based on its strong heat-trapping ability, since it has the highest concentration in the earth’s atmosphere (World Bank 2018). Achieving higher living standards is the main target of developing countries, which can be attained by faster economic growth. Faster economic growth can be achieved through increased gross capital formation by increasing investment, creating job opportunities, and generating employment, which constitute higher savings bringing confidence for bigger investments to be undertaken, stimulating output production. This process generates a chain effect providing a continuous increase in the output production, thus, economic growth (Levine and Renelt 1992; Taraki and Arslan 2019; Al-Mulali and Ozturk 2015). Concurrently, faster economic growth indicates faster urbanization and increased energy use, which in turn stimulates CO2 emissions mostly in developing countries due to the overuse or misallocation of non-renewable energy sources. Therefore, this issue turned out to be of concern both for academics and policymakers. The effectiveness of decreasing CO2 emissions depends strongly on the dedication of major emitters worldwide. Regulating for CO2 emissions has become more complicated since it is a by-product of energy production; therefore preventive methods aimed at CO2 emissions would have a damaging consequence on growth in an economy, especially in developing countries.

Over the years, several studies (Ozturk and Acaravci 2010; Farhani and Ben Rejeb 2012; Saboori et al. 2012; Arouri et al. 2012; Saboori and Sulaiman 2013; Kivyiro and Arminen 2014; Odugbesan and Adebayo 2020; Ozturk and Acaravci 2010; Esso and Keho 2016; Bekun et al. 2019; Adedoyin et al. 2020; Khan et al. 2020; Wasti and Zaidi 2020; Siddique et al. 2016; Akinsola and Adebayo 2020; Adebayo et al. 2020; Kirikkaleli and Kalmaz 2020; Adebayo 2020; Umar et al. 2020) have been conducted on these interconnections. However, the findings of those studies achieved different outcomes. Based on this, the paper intends to examine the long-run and causal impact of energy consumption, gross capital formation, GDP growth and urbanization on CO2 emissions by asking fundamental questions such as: What is the impact of energy consumption, gross capital formation, GDP growth and urbanization CO2 emissions? Therefore, this paper explores the links between CO2 emissions and its determining factors (energy consumption, gross capital formation, GDP growth, and urbanization) in Egypt by deploying the ARDL techniques to catch the short and long-run dynamics. Furthermore, this study contributes to the literature by utilizing the novel wavelet coherence technique to analyze the interconnection and causality simultaneously between CO2 and its determinants. Utilizing the wavelet coherence is conducted for the first time in the case of Egypt in regards to CO2 emissions and its determinants at different frequencies and time periods. Additionally, a robustness check was conducted utilizing the FMOLS and the DOLS to catch the long-run influence of the GDP growth, urbanization, energy consumption, and gross capital formation on CO2 emissions in Egypt. The ARDL outcomes revealed that energy consumption and economic growth exert positive impact on CO2 emissions while urbanization and gross capital formation exerts an insignificant impact on CO2 emissions. In addition, the wavelet coherence test provide supportive evidence to the ARDL results. In order to capture the causal linkage between CO2 emissions and its regressors, we utilized Gradual shift causality test proposed by Nazlioglu et al. (2016). Unlike the traditional causality tests, Fourier Toda-Yamamoto causality takes into consideration the effect of structural break(s) using a Fourier approximation in a Granger causality analysis. The remaining sections of this paper is as follows: The next section discusses Egypt economy and trends in the economic indicators. Section 3 entails a synopsis of studies. The empirical methodology follows in the fourth section, which is accompanied by empirical findings in the fifth section, while the sixth section concludes the paper.

2 Background of the study

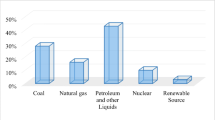

Egypt is a developing country that is ranked as the 3rd largest economy in Africa, following Nigeria and South Africa, with a GDP amounting $US302.256 billion, a population of 100 million, and a GDP per capita of $US 3046. Furthermore, Egypt is the largest oil-consuming country of Africa, with 41% electricity consumption and 45% oil sourced primary energy consumption (EIA 2014). Over the years from 1971 to 1985, there have been a continuous increase in the GDP followed by the oil price crash in 1986 which caused fiscal deficits of almost 15% of the GDP. Over the years between 1986 and 1991, GDP continued to decrease until the efficient and well-managed implementation of the Economic Reform and Structural Adjustment Programme (ERSAP) put in force, leading to a reduction in inflation, improvement of the current account balance and encouragement of large-scale infrastructure investment. The increase in GDP continued until 2000 and decreased due to external and internal economic and political factors, such as global economic slowdown and insecurities in the region arising from the Israeli-Palestinian political conflict. After 2000, the speed of economic reforms, such as monetary, tax, privatization, fiscal, tax and new enterprise legislation, has aided Egypt to move towards a more market-oriented economy and contributed to rising foreign direct investment. In 2004, the implementation of a well-functioning foreign exchange market removed formal and informal constraints on access to foreign exchange, which had long hindered business. These initiatives also revitalized the capital markets and insurance sector (IMF 2015). Since the removal of President Hosni Mubarak in 2011, the country has witnessed various economic turbulence. In 2016, Egypt witnessed a fall in the GDP which is due to the long-term supply-and-demand-side effect of the global economic crisis on the country’s economy (World Bank 2017). In 2018 and 2019, the country experienced a GDP growth rate of 5.3% and 5.6%, respectively (World Bank 2020). Also, energy consumption and urbanization dropped by 2.47% and 1%, respectively in 2014, while gross capital formation and trade increased by 15.71% and 6.6% in 2018 (World Bank 2020). CO2 emissions per capita in Egypt correspond to 2,32 tons per capita in 2016, a rise of 0.06 over the figure of 2,27 tons of CO2 per capita recorded in 2015; this symbolizes a 2.5% change in CO2 emissions per capita (World Bank 2020).

Recently, Egypt is categorized by rapid economic growth with an increasingly urban population, a rigid demand for energy, and increased CO2 emissions. It can be easily seen from the figures above representing the trends of GDP growth, energy consumption, gross capital formation, urbanization and CO2 emissions that breakpoints rise and fall at similar years. Egypt needs to reorganize national environmental policies, particularly those attributed to the reduction of CO2 emissions, which highlights the relevance of this paper. These similar series of trends make Egypt an interesting country to reinvestigate the main determinants of environmental degradation and interaction among the main indicators by utilizing recently developed techniques for the short run and long-run dynamics to serve as a source for the policy-makers to design sustainable and effective policies.

3 The summary of previous studies

Energy is the primary source for economic growth. Nevertheless, the misuse of energy resources produces environmental degradation which is high as illustrated by the CO2 emission levels. A critical review of all studies linked with environmental degradation is not visible; thus, only literature that investigates the link among the CO2 emissions, growth, urbanization and energy consumption and gross capital formation are highlighted in this paper. The econometric procedures and techniques deployed to analyze the link between CO2 emissions and its determinants are found under studies on panel, cross-sectional and time series. Findings based on CO2 emissions and their determinants vary as a result of disparate methods employed, study periods covered, and the nation(s) in focus. The first academic study aiming to explore the causal interconnection between economic growth and environmental degradation is known to be the research of Grossman and Krueger (1995), which identifies an inverse U-shaped connection between growth, and environmental degradation. According to their findings, environmental degradation increases at the early phase of economic growth, and subsequently decreases as the level of economy reaches a threshold (Grossman and Krueger 1995). This finding corresponds with the environmental Kuznets curve (EKC) hypothesis. The EKC theory indicates that the interconnection between real output and CO2 emissions demonstrates an inverted U-shape, suggesting an increase in CO2 emissions as real GDP increases at the early stages of growth and a decline in pollution as the real output rises after improvement in environmental regulations both at an inter-governmental and international stage, while technological advancement and better public awareness reduce environmental pollution (Kirikkaleli and Kalmaz 2020). There are several studies based on the foundation laid by these researchers to examine the links between environmental degradation and economic growth. Some studies confirmed the inverse U-shape relation between economic growth and CO2 emissions, which is an indicator for environmental degradation (Narayan and Narayan 2010; Saboori et al. 2012; Lee and Lee 2009; Aeknarajindawat et al. 2020); while there are also studies which could not confirm the validity of the EKC hypothesis (Mikayilov et al. 2018; Wang et al. 2019; Adedoyin et al. 2020). Further studies have also included energy consumption to explore the interconnection between CO2 emissions, growth and energy consumption; despite the observed outcomes are different (Esso and Keho 2016; Bekun et al. 2019; Adedoyin et al. 2020; Khan et al. 2020; Wasti and Zaidi 2020; Siddique et al. 2016; Saboori and Sulaiman 2013). Recently, researchers have also included gross capital formation and urbanization in their framework to analyze the link between CO2 emission, growth, and energy consumption, gross capital formation and urbanization (Bekhet et al. 2017; Paramati et al. 2017; Rahman and Ahmad 2019; Raggad 2018; Raheem and Ogebe 2017; Zhu et al. 2018).

Recently, several studies have utilized the wavelet tools to investigate the interconnections between CO2 emissions and its determinants. For instance, for the case of Mexico, Adebayo (2020) explored the interconnection between CO2 emissions, economic growth, gross capital formation, energy usage and trade openness. The investigator used wavelet coherence, and findings show that an increase in energy consumption and economic growth triggers CO2 emissions. Furthermore, Kirikkaleli (2020), using wavelet coherence confirmed that energy consumption, economic growth, and trade openness increase CO2 emissions in Turkey. In China, Umar et al. (2020) explored the linkage between CO2 emissions, economic growth and financial development using Bayer and Hanck cointegration and wavelet coherence. The empirical outcomes show that financial development enhances environmental quality while economic growth has a negative impact on environmental quality. Odugbesan and Adebayo (2020) examined the long-run and causal impact of financial development, economic growth, and energy usage on CO2 emissions in South-Africa using wavelet tools. Their empirical outcomes show that financial development and economic growth deteriorate the quality of the environment. For the case of China, Kirikkaleli (2020) examined the linkage between CO2 emissions and economic growth using T-Y causality and wavelet coherence. The outcomes of the study reveal that increase in CO2 emissions is accompanied by an increase in economic growth. A summary of such research is portrayed in Table 1.

The summarized literature in Table 1 shows that there are several studies investigating the link between economic growth and environmental degradation in addition to the investigation of the determinants of environmental conditions, which pertains to the increasing recognition of environmental concerns. Despite there have been several studies in the academic literature, to the best of our knowledge, no past studies have combined these variables utilizing the wavelet coherence technique to explore the interconnection between CO2 emissions and its determining factors in the case of Egypt. Therefore, our study provides new insights into the academic literature. The main questions addressed here are what interconnection exists between CO2 emissions and its determinants and to verify the EKC theory concerning Egypt.

4 Data and methodology

The motive behind this research is to verify the impact of GDP growth, urbanization, energy consumption and gross capital formation between 1971 and 2014. Table 2 depicts a brief summary of the variables utilized. CO2 emissions and energy consumption were gathered from the OECD (2020) and the remaining variables from the World Bank (2020). The variables’ natural logarithm was taken to reduce skewness. The variables trend is depicted in Figs. 1, 2, 3, 4, and 5 correspondingly.

The GDP growth and energy consumption economic function is portrayed in Eq. 1 as follows 1:

Equation 2 depicts the econometric model as,

In Eq. 2, CO2, Y, ENE, GCF, URB illustrates Carbon emissions, economic growth, energy usage, gross capital formation and urbanization, where t denotes time and ε represents the error term. The unit root tests were utilized to verify the stationarity characteristics of the variables under consideration in our study. Therefore, the study deployed the ADF test introduced by Dickey and Fuller (1979), the PP test proposed by Phillips and Perron (1988), and the KPSS test suggested by Kwiatkowski et al. (1992). Furthermore, the effect of structural break was considered; thus, the ZA unit root test initiated by Zivot and Andrews (2002) and the LM test initiated by Lee and Strazicich (2003) were used. These unit root tests can detect one and two structural breaks, respectively.

The Auto-Regressive Distribution Lag (ARDL) is more suitable compared to other cointegrating tests. The ARDL works perfectly when the indicators deployed are I(0) or I(1) or both. This technique is appropriate since various lag lengths can be utilized, the problem of autocorrelation is solved and it can deal with small sample sizes, by estimating the ECT, which shows the adjusted speed from disequilibrium in the short run to the equilibrium in the long-run. As stated by Pesaran et al. (2001), the F-statistics is based on two critical values, and they are the lower bound I(0) and the upper bound critical values I(1). Whenever the computed F-stat is lower than the 1(0), or in between I(0) and I(1), there is no cointegration. Therefore, we accept the null hypothesis. However, for variables to be cointegrated in the long-run, the F-stat must be greater than the lower and upper bound critical values.

The Eq. (3) below depicts the ARDLFootnote 1 Bounds tests is premised on the approach of the ARDL which is depicted the following framework:

In Eq. 3, the variables’ short-run dynamic coefficients is depicted by θII, while the long-run are illustrated by ϑ′s and the lags lengths is depicted by t. The ECM was integrated into the short-run parameter of the ARDL framework, which converts Eqs. 3 into 4 as follows:

In Eq. 4, variables’ coefficients in the short-run is represented by \(m_{i} (i = 1 \ldots 4)\) error correction term is represented by ECTt−1, the coefficient of the ECT is illustrated by φ which must be statistically significant and also negative. To verify whether the model is fit, several diagnostic tests were carried out including serial correlation, Ramsey RESET, normality and heteroscedasticity tests. Furthermore, the stability of the models was tested utilizing CUSUM and the CUSUM of squares. Also, the study deploys the FMOLS and DOLS which were created by Phillips and Hansen (1990) and Stock and Watson (1993), respectively as a robustness check for the ARDL framework.

The time–frequency dependency information between the CO2 emissions (CO2) and GDP growth (Y), energy consumption (ENE),) gross capital formation and urbanization (URB) was explored by deploying the wavelet tools initiated by Goupillaud et al. (1984); thus, making it possible for this paper to simultaneously explore the correlation and causality between CO2, and URB, GCF, Y and ENE in the case of Egypt. According to Kalmaz and Kirikkaleli (2019) and Adebayo and Beton Kalmaz (2020), the main novelty of the wavelet techniques is the one-dimensional decomposition of time series data bidimensional time-frequency sphere. This makes the short run and long-run link between the time series identifiable. The current research utilizes a wavelet ϖ method, which is a portion of the family of the Morlet wavelet. The ϖ is illustrated by Eq. 5 as follows,

Where w stands for the frequency utilized on the restricted time series; p(t), n = 0, 1 2, 3….…N-1; and \(\sqrt { - 1}\) is portrayed by i. As stated by Kirikkaleli and Gokmenoglu (2019), there is transformation by the time into the time–frequency domain, which links to modification in wavelet.\(\varpi\) is transformed; thereby, advanced into \(\varpi_{k,f}\). Equation 6 illustrates this explanation;

p(t), which is the time-series data is added. Hence, Eq. 7 indicates the function of the continuous wavelet:

According to Mutascu (2018), after the addition of the coefficient ψ to the Eqs. 8, 9 is redeveloped.

In order to capture the vulnerability of GDP growth, energy consumption, urbanisation and CO2 emission, wavelet power spectrum (WPS) which is depicted in Eq. 9 is utilized.

In Eq. 10, the cross-wavelet transform (CWT) method changed the time-series variable;

where Wp(k,f) and Wq(k,f) portray the two time-series indicators. The squared wavelet coherence is illustrated in Eq. 11:

If the \(R^{2} \left( {k, f} \right)\) gets closer to 0, it designates zero correlation between both series. Nevertheless, at any time \(R^{2} \left( {k, f} \right)\) move closer to 1; showing that there is an indication of connection at a particular scale, which is demonstrated by a spherical, thick black line and also explained by a warmer color (red). Information about the collaboration sign is not provided by the \(R^{2} \left( {k, f} \right)\) values. Consequently, Torrence and Compo (1998) “offered a method by which Wavelet coherence can be captured applying differences via deferrals signs in two-time series wavering” (Pal and Mitra 2017). The WTC at different phases is shown by Eq. 12 as follows:

An imaginary operator and a real part operator are symbolized by L and O correspondingly.

In order to capture the causal interconnection between CO2 emissions and its determinants, we employed Fourier Toda–Yamamoto causality test is developed by Nazlioglu et al. (2016). This causality test is often referred to as the “gradual shift causality test.” Unlike the traditional causality tests, Fourier Toda-Yamamoto causality takes into consideration the effect of a structural break(s) using a Fourier approximation in a Granger causality analysis.

5 Empirical findings

Before exploring the impact of the determinants of CO2 emissions, the ADF, PP, KPSS, ZA and LM unit root tests were deployed to capture the integration order amongst the series of variables under consideration. Table 3 illustrates the conventional unit root tests at trend and intercept, while Table 4 reveals the unit root tests with a structural break(s) at trend and intercept. The outcomes of the conventional unit root tests reveal that all the variables are non-stationary at level. However, after taking the first difference, all the variables are stationary. Furthermore, after taking into account the effect of the structural break(s), all the indicators are non-stationary at level. However, after taking the first difference, all the variables are stationary.

The unit root test results confirm the existence of stationarity of the series under at mixed levels of either at level or first-order integration, I(0) or I(1), which is appropriate for utilizing the ARDL based bounds cointegration approach.

ARDL bounds test results to explore the cointegration link among the variables, in the long run, are depicted by Table 5 below.

In Table 5, the proof of cointegration between CO2 emissions and energy consumption, GDP growth, gross capital formation and urbanization surfaced. The model (1,1,1,1,0) is significant as the F-statistic (5.072*) is higher than the 1% level upper critical bounds (UCB). Furthermore, serial diagnostic tests were conducted on the model. It is clear from Table 5 that the model scale through these diagnostic tests. Thus, we fail to reject the null hypothesis in all the diagnostic tests (Serial correlation, Normality, Heteroscedasticity, and Ramsey) conducted. The CUSUM and CUSUMsq tests are depicted in Figs. 6 and 7 respectively. The outcomes show that at 5% level of significance, the CUSUM and CUSUMsq are stable.

This paper employs the Schwarz Criterion (SIC) in selecting the optimal lag because it produces results that are more parsimonious than the Akaike Information Criteria (AIC). Since the cointegration is present in at least two vectors, this study further investigates the long-run effect of energy consumption and urbanization on the GDP growth and gross capital formation on CO2 emissions in the case of Egypt, which is illustrated in Table 6 below.

The findings represented in Table 6 show that; (i) the GDP growth positively influences CO2 emissions. This implies that when other variables are held constant, a 3.9% increase in CO2 is the result of the 1% increase in GDP growth. Thus, increasing in economic expansion harms the quality of the environment. This finding aligns with past studies (Kalmaz and Kirikkaleli 2019; Mikayilov et al. 2018; Aeknarajindawat et al. 2020; Khan et al. 2020; Wasti and Zaidi 2020; Siddique et al. 2016; Adebayo et al. 2020). (ii) There is a positive and significant interaction between energy consumption and CO2 emissions. This means that a 0.92% increase in CO2 emissions is the result of a 1% increase in energy consumption. Therefore, energy consumption deteriorates the environmental quality in Egypt. This finding corresponds to previous studies (Khan et al. 2020; Wasti and Zaidi 2020; Adedoyin et al. 2020; Kalmaz and Kirikkaleli 2019). (iii) No evidence of a significant link was found between urbanization and CO2 emissions. This finding is in line with past studies (Fan et al. 2006; Martínez-Zarzoso and Maruotti 2011; Li and Lin 2015); but still there are some studies that found different results in the literature (Raheem and Ogebe 2017; Raggad, 2018; Zhu et al. 2018). (iv) CO2 emissions are not impacted by gross capital formation. This outcome does not correspond to past studies (Bekhet et al. 2017; Paramati et al. 2017; Rahman and Ahmad, 2019; Topcu et al. 2020). As anticipated, the ECM is statistically significant with the right signs, which is -0.90. This illustrates that short-run shocks can be adjusted back to the equilibrium in the long run by 90%.

In order to verify the consistency of the ARDL long run estimation, this study deployed the FMOLS and DOLS as a robustness check. Table 7 below illustrates the findings based on the FMOLS and DOLS. The findings from both the FMOLS and DOLS are consistent with the ARDL long run result.

In order to simultaneously capture both the correlation and causality between CO2 and its determining factors in Egypt between 1971 and 2014, this study utilized the wavelet coherence technique which is depicted in Figs. 8, 9, 10 and 11 respectively. This method is obtained from econophysics and it merges information regarding time and frequency domains. According to Kirikkaleli (2020), this technique is sourced from mathematics by combining information on both time and frequency domain causality methods to gather earlier unseen information. Hence, the current research enables correlation and causality in the short and long-run between the dependent variable, which is CO2 emissions and its determinants of GDP growth, energy consumption, gross capital formation and urbanization in Egypt to be explored. In Figs. 8, 9, 10 and 11, the cold color (blue) illustrates no link between the variables, whereas a high dependency among the variables is portrayed by the warmer color (yellow). The causality and correlation direction is portrayed by arrows enclosed by the thick black line in the wavelet coherence analysis. Furthermore, negative correlation is depicted by leftward arrows whilst positive correlation is illustrated by rightward arrows. Also, when arrows are rightward and up or leftward down, the second variable causes the first variable, whereas when there is rightward and down or leftward and up, the first variable causes the second variable. In Fig. 9, between 1972 and 1990, at different scales the arrows are pointing to the right, which shows a positive correlation between GDP growth and CO2 emissions. Also, the rightward and down arrows indicate that CO2 led GDP growth. In Fig. 9 between 1972 and 1976 at different scale, there is a positive correlation between CO2 and GCF. Also, between 1982 and 1984 at the short term (high-frequencies), there is evidence of positive correlation between CO2 and GCF. Rightward and down arrows in this period indicate that CO2 led GCF. In Fig. 10 between 1972 and 1983, at different scales, rightward arrows portray a positive correlation between energy usage and CO2 emission. The rightward and up arrows show that energy consumption led CO2 emissions during this timeframe. Also, between 1990 and 1993, and between 2003 and 2010 in the short term (high-frequencies), a positive correlation between energy consumption and CO2 emission surfaced. The rightward and up arrows shows that energy consumption causes CO2 emissions. Lastly, in Fig. 11, between 1993 and 2001, there is confirmation of a positive correlation between CO2 emission and urbanization; despite there is confirmation of a negative correlation between CO2 emissions and urbanization between 1972 and 1976. The rightward and down arrows between 1992 and 2001 indicate that C02 emissions causes URB.

This study also explores the causal linkage between CO2 emissions and their determinants (energy consumption, economic growth, urbanization, and gross capital formation). The outcomes of the Gradual Shift Causality Test is revealed in Table 8. The outcomes revealed; (i) one-way causality from CO2 emissions to economic growth; (ii) unidirectional causality from CO2 emissions energy consumption; (iii) bidirectional causality between CO2 emissions and gross capital formation.

6 Conclusion

Utilizing Egypt as a case study, the investigators explored the interconnections between CO2 emissions and energy consumption, gross capital formation, and urbanization by deploying time series data stretching over 44 years (1971–2014). The study used the ARDL based bounds tests to analyze the long-run cointegration since the variables are integrated at mixed level, i.e., I(0) and I(1). A cointegration between the dependent and independent variables is confirmed by the bounds test. After the cointegration is verified, the ARDL technique was deployed to examine the long-run interaction between CO2 emissions and its determinants. Furthermore, the FMOLS and DOLS are employed as a robustness check for the ARDL in the long-run. Findings from the ARDL reveals that both energy consumption and economic deteriorates environmental quality. Additionally, the wavelet coherence technique, which is a current technique in econophysics, was utilized to examine both the correlation between CO2 emissions and its determinants. The outcomes of the wavelet coherence revealed positive correlation between CO2 emissions, and energy consumption, gross capital formation and economic growth while no significant correlation was found between CO2 emissions and urbanization. In order to capture the causal linkage between CO2 emissions and its regressors, we utilized Gradual shift causality test proposed by Nazlioglu et al. (2016). Unlike the traditional causality tests, Fourier Toda-Yamamoto causality takes into consideration the effect of structural break(s) using a Fourier approximation in a Granger causality analysis. Findings from the Gradual shift causality test revealed one-way causality from CO2 emissions to economic growth. Furthermore, there is unidirectional causality from CO2 emissions energy consumption while there is evidence of bidirectional causality between CO2 emissions and gross capital formation. Based on the findings, the energy policy in Egypt has a vital role to play in raising both the environmental issues induced by CO2 emissions and the economic circumstances. The proportion of production of renewable energy in total energy production with suitable energy policies can be increased in Egypt since it is an advantaged nation for renewable energy sources, including biomass, solar, wind, and hydropower produced from large dams over the Nile. High levels of CO2 emissions in Egypt are caused by two main factors. Firstly, due to the inefficiency of Egypt’s energy usage, the intensity of energy is high. Secondly, the total energy output relies on non-renewable sources rather than renewable sources. Carbon intensity should be minimized with a higher share of renewable energy sources for energy generation so that CO2 emissions can be lessened by effective energy policies, including carbon taxes increment for the manufacturing industry; because those taxes can in turn offer financial support to the manufacturing industry, research and development for technological developments aimed at decreasing intensity of energy and/or for the creation of renewable energy sources. In addition, in order to promote sustainable urbanization in Egypt, clean energy, economic and environmental policies must be formulated to steer urban development growth in Egypt without undermining economic growth and maintaining a reduction in carbon emissions to achieve better environmental quality. Lastly, policymakers may also suggest mechanisms such as carbon taxes, emissions trading systems, carbon capture and storage etc. The limitation faced in this study is the non-availability of data beyond the study period; while this research allows for the identification of strong research evidence utilizing ARDL, DOLS, FMOLS, and wavelet coherence techniques. Additional research should be conducted in other developing nations around the globe by using different proxies of environmental degradation.

Notes

In ARDL testing, five different cases usually surface. The first scenario is the application of the bound test with trend and intercept, the second case is the application of bounds test with restricted intercept and without trend, the third case is without unconstrained determinist interception and trend, the fourth scenario is the application of the bounds test with an unconstrained determinist interception and limited trend, and the fifth scenario is the application of the bounds test with an unconstrained interception and limited trend.

References

Adebayo TS (2020) Revisiting the EKC hypothesis in an emerging market: an application of ARDL-based bounds and wavelet coherence approaches. SN Appl Sci. https://doi.org/10.1007/s42452-020-03705-y

Adebayo TS, Beton Kalmaz D (2020) Ongoing debate between foreign aid and economic growth in Nigeria: a wavelet analysis. Soc Sci Quart 101(5):2032–2051

Adebayo TS, Awosusi AA, Adeshola I (2020) Determinants of CO2 emissions in emerging markets: an empirical evidence from MINT economies. Int J Renew Energy Dev 9(3):411–422

Adedoyin FF, Gumede MI, Bekun FV, Etokakpan MU, Balsalobre-lorente D (2020) Modelling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284

Aeknarajindawat N, Suteerachai B, Suksod P (2020) The impact of natural resources, renewable energy, economic growth on carbon dioxide emission in Malaysia. Int j Energy Econom Policy 10(3):211–218

Akinsola GD, Adebayo TS (2020) Investigating the causal linkage among economic growth, energy consumption and CO2 emissions in Thailand: an application of the wavelet coherence approach. Int J Renew Energy Dev 10(1):17–26

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy 84:382–389

Arouri MEH, Youssef AB, M’henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Bekhet HA, Yasmin T, Al-Smadi RW (2017) Dynamic linkages among financial development, economic growth, energy consumption, CO2 emissions and gross fixed capital formation patterns in Malaysia. Int J Bus Globalisat 18(4):493–523

Bekun FV, Emir F, Sarkodie SA (2019) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765

Cai Y, Sam CY, Chang T (2018) Nexus between clean energy consumption, economic growth and CO2 emissions. J Clean Prod 182:1001–1011

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

EIA U (2014) Energy Information Administration. 2013. International Energy Outlook. US Department of Energy. https://www.eia.gov/outlooks/ieo/pdf/0484(2014).pdf. Accessed 15 July 2020

Esso LJ, Keho Y (2016) Energy consumption, economic growth and carbon emissions: cointegration and causality evidence from selected African countries. Energy 114:492–497

Fan Y, Liu LC, Wu G, Wei YM (2006) Analyzing impact factors of CO2 emissions using the STIRPAT model. Environ Impact Assess Rev 26(4):377–395

Farhani S, Ben Rejeb J (2012) Energy consumption, economic growth and CO2 emissions: evidence from panel data for MENA region. Int J Energy Econom Policy (IJEEP) 2(2):71–81

Goupillaud P, Grossmann A, Morlet J (1984) Cycle-octave and related transforms in seismic signal analysis. Geoexploration 23(1):85–102

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

International Monetary Fund (IMF) (2015) https://www.imf.org/en/News/Articles/2015/09/28/04/53/socar021308a. Accessed 8 July 2020

Kalmaz DB, Kirikkaleli D (2019) Modeling CO2 emissions in an emerging market: empirical finding from ARDL-based bounds and wavelet coherence approaches. Environ Sci Pollut Res 26(5):5210–5220. https://doi.org/10.1007/s11356-018-3920-z

Khan MK, Khan MI, Rehan M (2020) The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financial Innovation 6(1):1–13

Kirikkaleli D (2020) New insights into an old issue: exploring the nexus between economic growth and CO2 emissions in China. Environ Sci Pollut Res 27:1–10

Kirikkaleli D, Gokmenoglu KK (2019) Sovereign credit risk and economic risk in Turkey: empirical evidence from a wavelet coherence approach. Borsa Istanb Rev. https://doi.org/10.1016/j.bir.2019.06.003

Kirikkaleli D, Kalmaz DB (2020) Testing the moderating role of urbanization on the environmental Kuznets curve: empirical evidence from an emerging market. Environ Sci Pollut Res 5:1–12

Kivyiro P, Arminen H (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: causality analysis for Sub-Saharan Africa. Energy 74:595–606

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. J Econom 54:159–178

Lee CC, Lee JD (2009) Income and CO2 emissions: evidence from panel unit root and cointegration tests. Energy Policy 37(2):413–423

Lee J, Strazicich MC (2003) Minimum Lagrange multiplier unit root test with two structural breaks. Rev Econ Stat 85(4):1082–1089

Levine R, Renelt D (1992) A sensitivity analysis of cross-countries growth regressions. Am Econom Rev 82:942–963

Li K, Lin B (2015) Impacts of urbanization and industrialization on energy consumption/CO2 emissions: does the level of development matter? Renew Sustain Energy Rev 52:1107–1122

Maji IK, Habibullaha MS (2015) Impact of economic growth, energy consumption and foreign direct investment on CO2 emissions: evidence from Nigeria. World Appl Sci J 33(4):640–645. https://doi.org/10.5829/idosi.wasj.2015.33.04.93

Martínez-Zarzoso I, Maruotti A (2011) The impact of urbanization on CO2 emissions: evidence from developing countries. Ecol Econ 70(7):1344–1353

Mikayilov JI, Galeotti M, Hasanov FJ (2018) The impact of economic growth on CO2 emissions in Azerbaijan. J Clean Product 197:1558–1572

Mutascu M (2018) A time-frequency analysis of trade openness and CO2 emissions in France. Energy Policy 115:443–455

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: panel data evidence from developing countries. Energy Policy 38(1):661–666

Nazlioglu S, Gormus NA, Soytas U (2016) Oil prices and real estate investment trusts (REITs): gradual-shift causality and volatility transmission analysis. Energy Econ 60:168–175

Odugbesan JA, Adebayo TS (2020) Modeling CO2 emissions in South Africa: empirical evidence from ARDL based bounds and wavelet coherence techniques. Environ Sci Pollut Res 315:1–13

Ozturk I, Acaravci A (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35:5412–5420

Pal D, Mitra SK (2017) Time-frequency contained co-movement of crude oil and world food prices: a wavelet-based analysis. Energy Econom 62:230–239

Paramati SR, Alam MS, Chen CF (2017) The effects of tourism on economic growth and CO2 emissions: a comparison between developed and developing economies. J Travel Res 56(6):712–724

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Phillips PC, Hansen BE (1990) Statistical inference in instrumental variables regression with I (1) processes. Rev Econom Stud 57(1):99–125

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Raggad B (2018) Carbon dioxide emissions, economic growth, energy use, and urbanization in Saudi Arabia: evidence from the ARDL approach and impulse saturation break tests. Environ Sci Pollut Res 25(15):14882–14898

Raheem ID, Ogebe JO (2017) CO2 emissions, urbanization and industrialization. Manage Environ Qual 56:20–27

Rahman ZU, Ahmad M (2019) Modeling the relationship between gross capital formation and CO2 (a) symmetrically in the case of Pakistan: an empirical analysis through NARDL approach. Environ Sci Pollut Res 26(8):8111–8124

Rauf A, Zhang J, Li J, Amin W (2018) Structural changes, energy consumption and Carbon emissions in China: empirical evidence from ARDL bound testing model. Struct Change Econom Dynam 47:194–206

Saboori B, Sulaiman J (2013) Environmental degradation, economic growth and energy consumption: evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60:892–905

Saboori B, Sulaiman J, Mohd S (2012) Economic growth and CO2 emissions in Malaysia: a cointegration analysis of the environmental Kuznets curve. Energy policy 51:184–191

Siddique HMA, Majeed MT, Ahmad HK (2016) The impact of urbanization and energy consumption on CO2 emissions in South Asia. South Asian Stud 31(2):745–757

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 784:783–820

Taraki SA, Arslan MM (2019) Capital formation and economic development. Int J Sci Res 8:772–780

Topcu E, Altinoz B, Aslan A (2020) Global evidence from the link between economic growth, natural resources, energy consumption, and gross capital formation. Resour Policy 66:101622

Torrence C, Compo GP (1998) A practical guide to wavelet analysis. Bull Am Meteor Soc 79(1):61–78

Umar M, Ji X, Kirikkaleli D, Xu Q (2020) COP21 Roadmap: do innovation, financial development, and transportation infrastructure matter for environmental sustainability in China? J Environ Manage 271:111026

Wang S, Li Q, Fang C, Zhou C (2016) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371

Wang Z, Asghar MM, Zaidi SAH, Wang B (2019) Dynamic linkages among CO2 emissions, health expenditures, and economic growth: empirical evidence from Pakistan. Environ Sci Pollut Res 26(15):15285–15299

Wasti SKA, Zaidi SW (2020) An empirical investigation between CO2 emission, energy consumption, trade liberalization and economic growth: a case of Kuwait. J Build Eng 28:101–104

World Bank (2017) World development indicators. http://data.worldbank.org/(retrieved 21 March 2020)

World Bank (2018) World development indicators. http://data.worldbank.org/. Accessed 25 March 2020

World Bank, (2020). World development indicators. http://data.worldbank.org/. Accessed 5 April 2020

Zhu H, Xia H, Guo Y, Peng C (2018) The heterogeneous effects of urbanization and income inequality on CO2 emissions in BRICS economies: evidence from panel quantile regression. Environ Sci Pollut Res 25(17):17176–17193

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econom Stat 20(1):25–44

Author information

Authors and Affiliations

Corresponding author

Additional information

Handling editor: Luiz Duczmal.

Rights and permissions

About this article

Cite this article

Adebayo, T.S., Beton Kalmaz, D. Determinants of CO2 emissions: empirical evidence from Egypt. Environ Ecol Stat 28, 239–262 (2021). https://doi.org/10.1007/s10651-020-00482-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10651-020-00482-0