Abstract

This paper evaluates the effectiveness of short-time work (STW) schemes for preserving jobs and reducing the segmentation between stable and unstable jobs observed in dual labour markets. For this purpose, we develop and simulate an equilibrium search and matching model considering the situation of the Spanish 2012 labour market reform as a benchmark. Our steady-state results show that the availability of STW schemes does not necessarily reduce unemployment and job destruction. The effectiveness of this measure depends on the degree of subsidization of payroll taxes it may entail: with a 33 % subsidy, we find that STW is quite beneficial for the Spanish economy because it reduces both unemployment and labour market segmentation. We also perform a cost-benefit analysis that shows that there is scope for Pareto improvements when STW is subsidized. Again, the STW scenario with a 33 % subsidy on payroll taxes seems the most beneficial because more than 57 % of workers improve. These workers also experience a significant increase in annual income that could be used to compensate the losers from this policy change and the State for the fiscal balance deterioration. This reform saves the highest number of jobs and has the lowest deadweight costs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is some consensus about the fact that some labour markets, with Germany as the best example, have coped reasonably well with what is now referred to as the “Great Recession” (see, e.g. Hijzen and Martin 2012; and Hijzen and Venn 2011). Part of the reason for this adjustment has to do with the availability by the beginning of the crisis of short-time work (STW) schemes that helped to preserve jobs and, more importantly, firms’ specific human capital. STW schemes also prevented aggregate demand from falling prey to a global decrease in production (see, e.g. Caliendo and Hogenacker 2012; Contesi and Li 2013; Möller 2010; and Rinne and Zimmermann 2012).

On the contrary, in countries such as Spain, modifying hours and wages was virtually impossible at the beginning of the crisis. This fact, together with the dual structure present in the Spanish labour market, has led to the highest rate of job destruction in the Euro Area (EA), particularly with regard to temporary jobs. This situation has also generated an enormous increase in unemployment, from \(8\,\%\) in 2007 to \(25\,\%\) in 2012.Footnote 1. Furthermore, the long-lasting duration of the crisis has generated a disproportionate rise in long-term unemployment with corresponding and worrisome deterioration in workers’ skills.

It was only in 2010 and, more importantly, in 2012 that the Spanish government introduced major changes concerning internal flexibility.Footnote 2 These reforms have allowed for an internal devaluation by facilitating the adjustment of hours and wages to changes in a firm’s economic conditions as an alternative to job destruction. In particular, STW mechanisms have been made easier to implement due to the elimination of administrative approval for working-week reductions due to economic reasons of between 10 and 70 %; these reductions have also been partially subsidized by the introduction of payroll taxes rebates for firms. In addition, the Unemployment Benefit System pays a subsidy to workers on STW so that their wage does not fall proportionally with the fall in hours.Footnote 3 These legal changes have generated an increase in the percentage of workers affected by STW mechanisms, especially from 2010 onwards (see Fig. 1). Moreover, these reforms have introduced important changes in the system of collective wage bargaining agreements that have improved the way firms adapt to changing economic conditions, thereby preserving their specific investment in human capital.Footnote 4

In García-Pérez and Osuna (2014), we evaluated the effects of the Spanish 2012 labour market reform on changes in employment protection. In this paper, we add the availability of STW schemes to evaluate the effectiveness of these policies for preserving jobs and reducing the segmentation in dual labour markets, using Spain as a benchmark.

The objective of this paper is twofold. First, we compute the steady-state effects on unemployment, job destruction and the tenure distribution of the 2012 Spanish labour market reform with regard to the reduction in severance costs and the availability of STW to illustrate the effectiveness of these schemes. Second, we perform a transition exercise to evaluate the changes in welfare and the costs of these policies to be able to talk about distributional issues.

Accordingly, we use an equilibrium model of job creation and destruction of the search and matching type that extends the one proposed in García-Pérez and Osuna (2014). The ingredients of that model, which intended to capture the specific features of the Spanish economy, were (i) the existence of a segmented labour market with two types of jobs (permanent and temporary) that differ in productivity, in the maximum length of the contract and in the associated severance costs; (ii) endogenous job conversion of TCs into PCs; (iii) severance costs modelled as a transfer from the firm to the worker and as a function of seniority; and (iv) downward wage rigidities such that severance costs have real effects.Footnote 5 In this paper, we add the possibility of reducing the number of hours worked using STW schemes. In this labour market, firms will be heterogeneous agents and use these two types of contracts as well as the number of hours worked to endogenously adjust their employment levels when facing idiosyncratic persistent shocks. We follow Mortensen and Pissarides (1994) by assuming one-job firms.

There are only a few papers that address the theoretical effects of STW mechanisms. In most of them, the presence of production technologies that allow for some substitutability between workers and hours worked per employee imply that in the absence of STW arrangements, shocks that temporarily reduce demand are typically accommodated by reducing the number of workers rather than by work-sharing, inducing excessive layoffs from an efficiency point of view (see Boeri and Bruecker 2011; Burdett and Wright 1989; FitzRoy and Hart 1985; and Rosen 1985). In addition, Abraham and Houseman (1994), Walsh et al. (2007) and Vroman and Brusentsev (2009) emphasize that STW schemes are more equitable because they distribute the adjustment burden over a large number of workers.

These studies also note that STW schemes are likely to have more of an impact in the presence of relatively large fixed costs per worker, such as strong employment protection or experience-rated unemployment benefits, which increase the relative costs of external adjustment, whereas generous unemployment benefits would operate in the opposite direction.

On the contrary, the empirical literature is large, and results are mixed. Most papers address the effectiveness of STW in stabilising employment focusing on the “Great Recession” and on how well Germany has coped with it in comparison with other countries (see, e.g, Arpaia et al. 2010). In contrast, Bellmann and Gerner (2011) for Germany and Calavrezo et al. (2010) for France find no evidence that STW increased labour hoarding by reducing layoffs. Boeri and Bruecker (2011) and Hijzen and Venn (2011) find that the number of jobs saved is smaller than the full-time equivalent jobs involved by these programmes, pointing, in some cases, to sizeable deadweight costs. In addition, Brenke et al. (2012) indicate that the astonishing results of the German case cannot be transferable to other countries due to differences in other labour market institutions, such as employment protection legislation (EPL) and collective bargaining, which interact with STW. Möller (2010) adds to this examination the different weight that German firms may attribute to the loss of human capital given their export-oriented character, the scarcity of high-skilled workers and the high training costs. On the contrary, Cahuc and Carcillo (2011) indicate that countries that do not have these programmes could benefit from their introduction and favour including an experience-rating component in their design to reduce inefficient reductions in working hours that could hinder the necessary reallocation and future growth and to eliminate the perverse consequences on the prospects of outsiders if used too intensively. Hijzen and Venn (2011) warn about the increase in labour market segmentation induced by these measures, whereas Scholz (2012) finds that fears that STW is mainly applied to a certain group of workers are not confirmed.

To our knowledge, the effectiveness of STW schemes has not been theoretically analyzed using a search and matching dynamic framework. The previously mentioned literature has emphasised the importance of the dynamic dimension to understand firms’ labour adjustment decisions in the face of temporary shocks to demand when dismissal costs and those associated with losing firms’ human capital are relevant. Furthermore, there is no consensus about the effects of these measures for outsiders in a dual labour market. Therefore, it is not straightforward that STW is beneficial for the Spanish labour market because of the significant labour segmentation between PCs and TCs,Footnote 6 which introduces interesting distributional considerations. It may be the case that the availability of STW makes firms more prone to convert TCs into PCs because of the possibility of adjusting hours instead of adjusting permanent employment, which is very costly. Alternately, as in Hijzen and Venn (2011), firms may end up using STW schemes only for workers on PCs and use TCs to adjust employment because they are very cheap. This is precisely where the dynamic considerations presented above play a central role. The answer may depend on the structural characteristics of a particular economy and on the nature of the crisis. In this paper, we address these distributional issues and analyze the extent to which the 2012 reform and other STW schemes are able to reduce the duality of the Spanish labour market.

Our results show that the 2012 Spanish labour market reform, with regard to the reduction in severance costs, reduces steady-state unemployment and the aggregate job destruction rates by 11 and 6 %, respectively, and smoothes the tenure distribution. Adding the availability of a STW policy does not result in a higher reduction in both the unemployment and job destruction rates unless payroll taxes are subsidised because the reduction in the wage does not compensate for the loss in production. In fact, when firms have to pay full social security taxes irrespective of the reduction in hours of work unemployment does not decrease further than under the 2012 reduction in severance costs. Only when payroll taxes are subsidized, for instance by 33 %, unemployment in full-time equivalent terms and aggregate job destruction drop substantially, by 24 and 28 %, respectively, because now firms find profitable to use this additional margin of adjustment instead of firing workers. Furthermore, duality in the labour market, measured as the reduction in the temporary job destruction rate, strongly decreases, and the tenure distribution becomes much smoother than in the scenario where only the severance cost is reduced. Finally, the transition shows that all the reform scenarios are Pareto improving: when welfare decreases, a lump sum subsidy could be used to compensate for the welfare loss; when the fiscal balance deteriorates, a lump sum tax could be levied on individuals. In the STW scenario with a 33 % subsidy on payroll taxes, more than 57 % of workers improve. They also experience a significant increase in annual income that could be used to compensate the losers from this policy change and the State for the fiscal balance deterioration. This is the reform that saves the highest number of jobs and has the lowest deadweight costs.

The paper is organised as follows. In Sect. 2, we present the model. In Sect. 3, we discuss its calibration. In Sect. 4, we evaluate the reform. Finally, in Sect. 5, we draw some conclusions.

2 The Model

2.1 Population

The economy is populated by a continuum of workers with a unit mass and a continuum of firms. Workers can either be employed or unemployed. Hence, we do not consider being out of the labour force an additional state. Unemployed workers look for employment opportunities; employed workers produce and do not search for jobs. Firms post vacancies or produce. The cost of having a vacancy open is \(c_{v}\). Posting a vacancy is not job creation unless it is filled. Each firm is a one-job firm, and the job may be occupied and producing or vacant. We assume free entry.

The source of heterogeneity is due to the existence of matches with different quality levels and durations. Therefore, the state space that describes the situation of a particular worker is \(S=\{\{0,1\}\times {\mathscr {E}} \times D \}\), where \({\mathscr {E}}= \{{\varepsilon }_{1},...,{\varepsilon }_{n}\}\) is a discrete set for the quality levels and \(D=\{1,...,N\}\) is also a discrete set denoting the duration of a job (worker’s seniority). Each triple indicates whether the worker is unemployed (0) or employed (1), the quality and the duration of the match.

2.2 Preferences

Workers have identical preferences, live infinitely and maximise their utility, which is taken to be linear in consumption. We assume that they supply work inelastically, that is, they will accept any opportunity that arises. Thus, each worker has preferences defined by \(\sum _{t=1}^{\infty }\beta ^{t}c_{t}\), where \(\beta \) is the discount factor (\(0 \le \beta < 1\)) and \(c_{t}\) is individual consumption. Firms are further assumed to be risk neutral.

2.3 Technologies

Production Technology

Each job is characterised by an irreversible technology and produces one unit of a differentiated product per period whose price is \(y({\varepsilon }_{t})\), where \(\{{\varepsilon }_{t}\}\) is an idiosyncratic component, i.e., the quality of the match. This idiosyncratic component is modelled as a stationary and finite Markov chain. This process is the same for each match, and the realisations \({\varepsilon }_{t+1}\) are independent and identically distributed with conditional transition probabilities \(\Gamma ({\varepsilon }'|{\varepsilon })=Pr\{{\varepsilon }_{t+1}| {\varepsilon }_{t}\}\), where \({\varepsilon }\), \({\varepsilon }'\) \(\in {\mathscr {E}}=\{1,2,..., n_{{\varepsilon }}\}\). Each new match starts with the same entry level \({\varepsilon }_{e}\), and from this initial condition, the quality of the match evolves stochastically due to these idiosyncratic shocks. We assume that agents know the law of motion of the process and observe their realisations at the beginning of the period.

Matching Technology

In each period, vacancies and unemployed workers are stochastically matched. We assume the existence of a homogeneous of degree one matching function \(m=m(u,v)\), increasing and concave in both arguments, where v is the number of vacancies and u is the number of unemployed workers, both normalised by the fixed labour force. Given the properties of the matching function, the transition rates for vacancies, q, and unemployed workers, \(\alpha \), depend only on \(\theta =v/u\), a measure of tightness in the labour market. The vacancy transition rate, q, is defined as the probability of filling a vacancy, and the transition rate for unemployed workers, \(\alpha \), is defined as the probability of finding a job. These are given by

2.4 Equilibrium

The concept of equilibrium as used herein is recursive equilibrium. Before showing the problems that agents solve, it is convenient to explain the timing and the agents’ decisions. At the beginning of the period, firms’ idiosyncratic shocks are revealed for existing matches. Firms and workers then renegotiate wages. Given these wages, firms choose between three options: (i) to continue producing with the current match, working at standard hours, (ii) to continue producing with the current match at a reduced number of hours, or (iii) to terminate the match and dismiss the worker. The nature of the problem depends on whether the firm has a PC or a TC. PCs entail high severance costs that depend on the quality of the match and on the duration of the contract, whereas severance costs for TCs also depend on both dimensions but are, in comparison, very low. In addition, the problem is not the same for all firms with a TC. Let d denote the duration of the contract. We will assume that a TC cannot last more than \(d^{t}_{max}\) periods, and thus the maximum number of renewals is \(d^{t}_{max}- 1\). Therefore, firms whose TCs cannot be renewed decide between these three options: (i) to convert the TC into a full-time PC, taking into account the consequences regarding future severance costs, (ii) to convert the TC into a PC at a reduced number of hours, or (iii) to terminate the match. Once all these decisions have been made, production starts in firms where workers have not been fired during this period and in those that were matched with unemployed workers at the end of the last period. Finally, search decisions are made, and firms post vacancies for which unemployed workers apply. This search process generates new matches that will be productive over the next period. Accordingly, there follows a formal description of the problems faced by both firms and workers.

2.4.1 Vacancy Creation

Every job is created as a temporary job according to the following equation:

where V is the value of a vacant job, \(J^{tc}({\varepsilon }_{e},1)\) is the value function of a firm with a first-period TC, and \({\varepsilon }_{e}\) is the entry level match quality. All vacancies lead to TC jobs, which may later be transformed to PC jobs.

2.4.2 The Firm’s Problem

The problem of firms with TCs

The problem of a firm with a TC, whose length at the end of the last period was less than \(d^{t}_{max}\), is

where \(J^{tc}({\varepsilon }, d)\) and \(J^{tc}({\varepsilon }\prime , d\prime )\) are, respectively, the firm’s value function for this period and the next period when there is a TC, \(y({\varepsilon })(1-\gamma )\) is output, \(h_{ft}\) and \(h_{pt}\) are standard hours (full-time job) and reduced hours (part-time job), respectively, \(w^{tc}_{ft}({\varepsilon },d)\) and \(w^{tc}_{pt}({\varepsilon },d)\) are full-time and part-time wages, \(\xi ^{tc} (w^{tc}_{ft},w^{tc}_{pt})\) is a function that represents social security taxes paid by the firm in TCs, \(\Gamma ({\varepsilon }\prime | {\varepsilon })\) is the conditional transition probability for the match quality and \(s^{tc}({\varepsilon },d-1)\) is the severance cost. As in García-Pérez and Osuna (2014) and based on Spanish evidence Albert et al. (2005) or Dolado et al. (2012), we assume that temporary workers are less productive than permanent workers, and we introduce this feature through a productivity gap, \(\gamma \). Note that a greater value of the idiosyncratic productivity, \({\varepsilon }\), increases output, and that wages and severance costs are both increasing in \({\varepsilon }\) and in d.

If it is more profitable to continue with the actual match working standard hours (first row greater than second and third rows in Eq. 2), the decision rule will be \(g^{tc} ({\varepsilon },d)=h_{ft}\), and the full-time match will continue. If it is more profitable to continue with the actual match at a reduced number of hours, \(g^{tc} ({\varepsilon },d)=h_{pt}\). Otherwise, \(g^{tc}({\varepsilon }, d)=0\), and the worker will be fired, whereby the firm incurs the severance cost, \(s^{tc}({\varepsilon }, d-1)\), plus the vacancy cost. With probability \(q(\theta )\) at the end of this period, the firm will fill the vacant job with a TC that will be productive in the next period.

The problem of firms with prospective permanent contracts (PPCs)

The problem is slightly different for a firm whose TC has reached its maximum length at the end of the previous period. If the worker is not fired at the beginning of this period, the TC will be automatically transformed into a PC. Note that in this case, \(d=d^{t}_{max}+1\), where \(d^{t}_{max}+1\) denotes the first period in a PC, and severance costs are given by \(s^{tc}({\varepsilon }, d-1)\) because if the worker is not promoted, the severance cost corresponds to the period the worker has spent on a TC. As in García-Pérez and Osuna (2014), based on the evidence (see Albert et al. (2005), for example), we assume that firms incur a training cost, \(\tau \), in the first period of a PC that reduces the productivity of the job in that period. This problem can thus be written as

where \(J^{ppc}({\varepsilon }, d)\) and \(J^{pc}({\varepsilon }\prime , d\prime )\) are, respectively, the firm’s value function for this and the next period, \(y({\varepsilon })(1- \tau )\) is output, \(\xi ^{pc} (w^{ppc}_{ft},w^{ppc}_{pt})\) represents social security taxes paid by the firm and \(w^{ppc}({\varepsilon },d)\) is the wage. This equation has an analogous interpretation to the previous one. If it is more profitable to continue with the actual match working standard hours, the decision rule will be \(g^{ppc}({\varepsilon }, d)=h_{ft}\), and the TC will be converted to a full-time PC. If it is more profitable to continue with the actual match at a reduced number of hours, \(g^{ppc} ({\varepsilon },d)=h_{pt}\). Otherwise, \(g^{ppc}({\varepsilon },d)=0\), and the worker will be fired.

The Problem of Firms with Existing PCs

A firm with a PC must decide whether to continue with the actual match, either at the standard or reduced number of hours, or to dismiss the worker and search for a new one. This problem can be written as

where \(J^{pc}({\varepsilon }, d)\) and \(J^{pc}({\varepsilon }\prime , d\prime )\) are, respectively, the firm’s value function for this period and the next period when there is a PC, \(y({\varepsilon })\) is output, \(\Lambda (d)\) is an experience function, \(w^{pc}({\varepsilon },d)\) is the wage and \(s^{pc}({\varepsilon },d-1)\) is the severance cost. As in García-Pérez and Osuna (2014), based on the evidence (Albert et al. (2005), for example), it is assumed that permanent workers are more productive as tenure increases. This feature is introduced through the experience function \(\Lambda (d)\). Therefore, for a given value of \({\varepsilon }\), more tenure on the job makes the job even more productive. The interpretation of this equation is again analogous to the previous ones. If it is more profitable to continue with the actual full-time match, the decision rule will be \(g^{pc}({\varepsilon }, d)=h_{ft}\), and the match will continue. If it is more profitable to continue with the actual match but at a reduced number of hours, the decision rule will be \(g^{pc}({\varepsilon }, d)=h_{pt}\), and the match will continue. Otherwise, \(g^{pc}({\varepsilon },d)=0\), and the worker will be fired.

2.4.3 The Worker’s Problem

The value functions of workers in TCs, PPCs and PCs can be written as follows

where \(W^{tc}({\varepsilon }, d)\), \(W^{ppc}({\varepsilon }, d)\) and \(W^{pc}({\varepsilon }, d)\) denote workers’ value functions in TCs, PPCs and PCs, \(\tilde{\Phi }(x)\) is an indicator function that takes the value 1 if the assessment is true and zero otherwise, \(\omega \) is a subsidy to which workers on short time are entitled, and U is the value function of an unemployed worker, whose equation is

where \(W^{tc}({\varepsilon }_{e},1)\) is the value function of a worker in a first-period TC, and the parameter b can be interpreted as an unemployment subsidy. Hence, an unemployed worker receives b today, and, by the end of the period, the probability that the worker will find a job is \(\alpha (\theta )\), whereas the probability that the worker will remain unemployed is \(1-\alpha (\theta )\).

2.4.4 Law of Motion for Unemployment

Given the previously shown policy rules, the law of motion for unemployment is

where \(N_{t-1}^{pc}\), \(N_{t-1}^{ppc}\) and \(N_{t-1}^{tc}\) denote the beginning of period-t employment levels in PCs, PPCs and TCs, respectively, and \(U_{t}\) is the level of unemployment at the end of period t. The interpretation of the equation is the following: unemployment at the end of period t, \(U_{t}\), is given by the sum of the stock of unemployment at the beginning of period t, \(U_{t-1}\), plus the inflows into unemployment (the three terms with indicator functions) during period t minus the outflow from unemployment during period t, \(\alpha (\theta )U_{t-1}\). Note that the second RHS term sums up the values of the \(g_{i}^{pc}({\varepsilon }, d)\) for every worker holding a PC at the beginning of period t, when the decision to continue or to fire takes place. For instance, for those workers fired at the beginning of period t, \(g_{i}^{pc}({\varepsilon }, d)=0\); therefore, they will be part of the unemployment pool. The third and fourth RHS terms have a similar interpretation, but for workers with prospective PCs and TCs, respectively.

2.4.5 Wage Determination

Wages are the result of bilateral bargaining between the worker and the firm unless the legally imposed minimum wage, \(w_{min}\), is binding.Footnote 7 Bargaining is dynamic; that is, wages are revised for each period based upon the occurrence of new shocks. The assumption of bilateral bargaining is reasonable due to the existence of sunk costs (search costs) once the match has been produced. This creates local monopoly power and generates a surplus to be split among the participants in the match. In TCs, this surplus is defined as

Wages are the result of maximising the following Nash product with respect to the wage:

The first-order condition of this maximisation is such that the surplus is split into fixed proportions according to the worker’s bargaining power, \(\pi \)

By making the appropriate substitutions of firms’ and workers’ value functions, the wage in a full-time TC can be computed as

Following the same procedure, the wage in firms with full-time PPCs turns out to beFootnote 8

Finally, in firms with PCs,

Note that wages in PPCs are lower than those that prevail in the following periods because of the associated training costs and because, as in Osuna (2005), firms attempt to internalise higher future wages (due to higher future severance costs) by pushing down wages in first-period PCs. Moreover, for any given productivity level, wages in TCs are lower than in existing PCs because of the assumed productivity gap.

2.4.6 Definition of Equilibrium

A recursive equilibrium is a list of value functions \(J^{tc}({\varepsilon }, d)\), \(J^{ppc}({\varepsilon }, d)\), \(J^{pc}({\varepsilon }, d)\), \(W^{tc}({\varepsilon },d)\), \(W^{ppc}({\varepsilon },d)\), \(W^{pc}({\varepsilon }, d)\), V, U, transition rates \(q(\theta )\), \(\alpha (\theta )\), wages \(w^{tc}({\varepsilon }, d)\), \(w^{ppc}({\varepsilon }, d)\) and \(w^{pc}({\varepsilon }, d)\), and decision rules \(g^{tc}({\varepsilon }, d)\), \(g^{ppc}({\varepsilon }, d)\), \(g^{pc}({\varepsilon }, d)\) such thatFootnote 9

-

1.

Optimality: Given functions \(q(\theta )\), \(\alpha (\theta )\), \(w^{tc}({\varepsilon }, d)\), \(w^{ppc}({\varepsilon }, d)\) and \(w^{pc}({\varepsilon }, d)\) the value functions \(J^{tc}({\varepsilon },d)\), \(J^{ppc}({\varepsilon },d)\), \(J^{pc}({\varepsilon }, d)\), \(W^{tc}({\varepsilon },d)\), \(W^{ppc}({\varepsilon },d)\) and \(W^{pc}({\varepsilon }, d)\) satisfy the Bellman equations.

-

2.

Free entry: This condition and the profit maximisation condition guarantee that, in equilibrium, the number of vacancies adjusts to eliminate all the rents associated with holding a vacancy; that is, \(V=0\), implying \(c_{v}=\beta q(\nu )J^{tc}({\varepsilon }_{e},1)\).

-

3.

Wage bargaining: The equilibrium conditions from maximising the surplus in existing TCs are given in Eqs. (12) and (13). Similar conditions hold for other types of contracts.

3 Calibration

In this section, we explain the data set, the procedure for assigning values to the model’s parameters and the selection of functional forms.

3.1 The Data Set and Model Period

To calibrate the main parameters of the model, Spanish administrative data from the “Muestra Continua de Vidas laborales” (MCVL) are used. The calibration sample comes from the 2006 to 2011 waves and includes the complete labour career for a sample of more than 700,000 workers for the 2004–2011 period, a reasonable time span for measuring job transitions in steady state given that it comprises four years of expansion (2004–2007) and another four years of crisis (2008–2011). All employment and unemployment spells lasting more than six months are used. The model period is chosen to be a year for consistency with these data and because this choice is reasonable from a computational perspective.

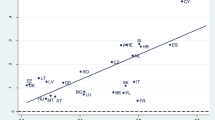

Figure 2 shows shows the yearly average probability of exiting from unemployment to temporary and permanent employment. These probabilities are computed by using the predictions of a discrete duration model estimated for the period 2004–2011 and including time dummies and a flexible specification for duration dependence. The exit from unemployment is highly decreasing on unemployment duration and much larger when the destination state is a temporary contract than when the worker exits to a permanent one. It is also striking how the exit from unemployment has decreased since the beginning of the crisis, that is, since 2008.

Figure 3 shows the yearly average probability of exiting from employment to unemployment, both for temporary and for permanent workers. As before, these probabilities are computed by using the predictions of a discrete duration model that controls for time and with a flexible specification for duration dependence. The exit from a temporary contract is much larger, at any employment duration, than the one from a permanent contract. These hazard rates have substantially increased since 2008, as a clear signal of the increasing firing risk during the recession.

3.2 Calibrated Parameters and Functional Forms

There are two types of calibrated parameters in our model: those that have a clear counterpart in the real economy and those that do not. For the former, we use the implied parameter values. For some of the latter, we use the values estimated in empirical studies, and for the rest, we use the simulated method of moments to calibrate their values.

Preferences

The utility function is linear in consumption, as is usual in this literature. The value of the discount factor, \(\beta =.97\), is fixed so that it is consistent with the mean annual real interest rate in the reference period, \(3\,\%\).

Production Technology

The production function is assumed to be linear in the idiosyncratic shock, \(y({\varepsilon })={\varepsilon }\). The idiosyncratic shock is modelled as a Markov chain, \(\Gamma [({\varepsilon }')|({\varepsilon })]\). In addition, we assume five possible quality levels. In general, these two assumptions would imply 20 restrictions to fix the values of the conditional transition probabilities between different quality levels. Assuming that the expected duration of good and bad idiosyncratic shocks coincides, \(\Gamma [({\varepsilon }_{1})|({\varepsilon }_{2})]=\Gamma [({\varepsilon }_{2})|({\varepsilon }_{1})]\), we need only estimate 15 transition probabilities. Given that we do not have direct information on the quality of the match, we use the procedure described in Tauchen (1986) to parameterise the five quality levels and the transition probabilities. To apply this procedure, we need to know the mean (\(\mu \)), the standard deviation (\(\upsigma \)) and the autocorrelation coefficient (\(\rho \)) of the underlying idiosyncratic process. We use wages for the 2004 to 2011 period to approximate this process. The values for these parameters are to be \(\mu =.33\), \(\upsigma =.11\) and \(\rho =.75\). We normalise \(\mu \) to the value of 1 to make the calibration more intuitive and more easily interpretable.

Using the calibration sample, the productivity gap parameter is set to \(13.5\,\%\) based on the ratio between wages for permanent and temporary workers with equal experience.Footnote 10 Finally, the positive experience effect on the productivity of permanent workers is parametrized through the function \(\Lambda (d)=(1+ \lambda (d-3))\) for \(d>3\).

Matching Technology

We assume a Cobb–Douglas homogeneous of degree one matching function, \(m=m(v,u)=Av^{\eta }u^{1-\eta }\), where A is the degree of mismatch and \(\eta \) is the value of the elasticity of the number of matches with respect to vacancies.

Unemployment Benefits

The parameter b is interpreted as the income flow of unemployment. We obtain \(b=.2\) as the product of unemployment benefits and coverage for the 2004–2011 period, normalised by average productivity.Footnote 11

Minimum Wage

The parameter \(w_{min}\) is set using information on the average minimum wage set in collective agreements (see Lacuesta et al. 2012). For the 2004–2011 period, this minimum wage is 860 Euros. Given a median wage of 1200 Euros, the ratio between the two is 0.72, which is the ratio that we impose in the model to parameterise \(w_{min}=.72\).

To summarise, the calibration exercise involves the assignment of values to two types of parameters. The discount rate, \(\beta \), the parameters of the idiosyncratic process, (\(\mu \), \(\upsigma \) and \(\rho \)), the productivity gap parameter, \(\gamma \), unemployment benefits, b, and the minimum wage, \(w_{min}\), are set independently from the rest as they have clear counterparts in the real economy (See Table 1). In contrast, the workers’ bargaining power, \(\pi \), the value for the elasticity of new matches with respect to the vacancy input, \(\eta \), and the cost of posting a vacancy, \(c_{v}\), are set using the values estimated in the empirical studies. Abowd and Lemieux (1993) estimate \(\pi =0.33\), the value for \(\eta \) usually lies in the range of (0.4–0.6), and we set \(c_{v}\) as \(26\,\%\) of the average worker productivity, which is roughly the midpoint of the estimates suggested in the literature (see Costain et al. 2010).

The three remaining parameters, training cost, \(\tau \), experience, \(\lambda \), and mismatch, A, are calibrated using the method of simulated moments. Table 2 displays the three conditions that are imposed to set these parameters. This calibration exercise shows that the initial steady state of the model (status quo) is a good starting point for investigating the behaviour of this economy because it matches the Spanish data fairly closely.

3.3 Severance Cost and Social Security Functions

Status Quo Severance Cost Function

To compute equilibrium, we need a severance cost function that represents the severance costs in Spain for the period under study. We use the following pieces of information to estimate the severance cost function in PCs: legal compensation in fair dismissals (20 days of wages p.y.o.s. with a maximum of 12 monthly wages) and unfair dismissals (45 days of wages p.y.o.s. with a maximum of 42 monthly wages), procedural wagesFootnote 12 of approximately two months, and the fact that, on average, \(74.3\,\%\) of all severance processes were declared unfair during the 2004–2011 period.Footnote 13 Regarding the dismissal distribution, on average, \(7\,\%\) were collective dismissals, \(20.9\,\%\) were agreed upon at the units of mediation, \(57.6\,\%\) followed the procedure specified in Spain’s Law 45/2002, and only \(14.5\,\%\) involved litigation.Footnote 14 Using these observations and after rearranging terms, we arrive at the following final expression of the severance cost function for PCs is \(s^{pc}=44.1\frac{w}{365}(d-1)+ 23.2\frac{w}{365}\), where d and w denote a worker’s seniority and annual wage, respectively.Footnote 15 Note, in particular, that the second additive term of the severance cost function displayed in the main text is not multiplied by tenure because this term reflects procedural wages, and legal severance costs depend on the wage. Because making the severance cost function depend on wages is computationally very difficult, we take the quality of the match as an approximation of the wage.

Finally, TCs entail a severance cost of eight days of wages p.y.o.s and no procedural wages. Therefore, the severance cost function for TCs is \(s^{tc}=8\frac{w}{365}(d-1)\). Following Güell and Petrongolo (2007), we have set \(d^{t}_{max}=3\), which has been the usual practice in Spain since the introduction of TCs in 1984.

The 2012 Reform Severance Cost Function

The 2012 reform implies some changes both in the PC and in the TC severance cost function. The ordinary PC severance cost function must be adjusted in two dimensions. First, we replace 45 days with 33 days of wages p.y.o.s.; second, we eliminate procedural wages because the 2012 reform abolished them. This implies the following severance cost function in PCs: \(s^{pc}=33\frac{w}{365}(d-1)\).Footnote 16 In addition, the TC severance cost function must be adjusted to the current level of severance costs, that is, eleven days of wages p.y.o.s., because of the progressive increase in TC severance costs (one day a year until 12 days of wages p.y.o.s. in 2015), which was introduced in the 2010 reform. This implies the following severance cost function in TCs: \(s^{tc}=11\frac{w}{365}(d-1)\).

Social Security and Wage Subsidy Parameters

In the Status Quo, social security taxes in PCs and TCs are, respectively, 29.9 and 31.1 % of the wage. We will refer to the proportion of social security taxes that is used to pay for the health and the public pension system as “payroll taxes” (\(\xi _{cc}\)) to distinguish it from the rest, “unemployment taxes” (\(\xi _{u}\)), which are used to pay unemployment benefits. This distinction will matter when we consider STW schemes because only payroll taxes may be subsidized. The general function presented in the model section that is used to represent social security taxes, \(\xi ^{pc}(w^{pc}_{ft},w^{pc}_{pt})\) and \(\xi ^{tc}(w^{tc}_{ft},w^{tc}_{pt})\), will adopt a particular form depending on the availability and the amount of the subsidy to which firms are entitled (see Table 3).

To avoid drastic reductions in net income as a result of STW, workers are entitled to a wage subsidy, which in Spain amounts to \(50\,\%\) of the wage and is paid by the Unemployment Benefit System, implying \(\omega =0.5\). Firms under STW schemes, although getting a substantial reduction in wage costs, have to continue paying full social security taxes irrespective of the reduction in hours of work, unless a tax rebate from the Government is received.

4 Main Findings

This section reports the answers to the questions posed. Section 4.1 shows the status quo (SQ) values of the set of statistics of interest. Section 4.2 shows the predicted steady-state effects of the changes in EPL implied by the 2012 labour market reform. Section 4.3 combines these effects with those of STW schemes.Footnote 17 Finally, Sect. 4.4 shows the welfare implications and the cost of these policies.

4.1 The Status Quo

Table 4 shows the status quo values of the statistics of interest: the unemployment rate and tenure distribution. The unemployment rate, u, is slightly higher when compared with the actual data.Footnote 18 Regarding tenure distribution, the model reproduces reasonably well the average tenure for those employed with a tenure equal to or under six years, \(\bar{d}_{d\le 6}\), in the SQ. In fact, the model is able to reproduce quite accurately the proportion of workers, \(n_{d}\), with seniorities \(d=2\), \(d=3\), \(d=4\) and \(d=5\), but it underestimates the proportion of workers with a tenure equal to or under one year, \(n_{d=1}\).Footnote 19

4.2 Steady-state Effects of the 2012 Reform: EPL Changes

This section shows the steady-state effects of the 2012 reform concerning the changes in PCs and TCs employment protection, focusing on the effects on unemployment rates, job destruction and tenure distribution.

Column 3 in Table 5, referred to as Reform A, indicates that this reform reduces unemployment by \(11.2\,\%\), from 17.3 to \(15.4\,\%\). In contrast, aggregate job destruction, JD, decreases by \(6.2\,\%\) as a result of a simultaneous increase in the permanent job destruction rate (JDp) and a decrease in the temporary job destruction rate (JDt). In fact, the temporary job destruction rate decreases by \(17.1\,\%\), from 26.7 to 22.2 %, because the lower gap in severance costs makes firms more prone to convert TCs into PCs. The reduction in the severance cost gap diminishes the pervasive incentives to destroy jobs at the beginning of period four: the job destruction rate \(JD_{d=4}\) changes from 30.6 to \(10.6\,\%\). The opposite happens, however, for the permanent job destruction rate, which increases by \(8.4\,\%\), from 7.4 to \(8.0\,\%\), because firing permanent workers has become cheaper. These changes in job destruction rates have an impact on tenure distribution. The proportion of workers with tenure equal to or under one year, \(n_{d=1}\), is \(11\,\%\) lower, and the proportion of workers with tenure of more than three years, \(n_{d>3}\), increases by \(10\,\%\), from 52.7 to \(57.9\,\%\).

4.3 Steady-state Effects of the 2012 Reform: EPL Change and STW

In this section, we add the availability of STW schemes to prevent firings when firms are hit by negative idiosyncratic shocks. In particular, firms have the option of reducing hours worked by 10, 40 or \(70\,\%\) depending on the magnitude of the adverse shock. In Table 5, we show the effects of three different STW schemes. In the first one (Reform B), firms pay full social security taxes irrespective of the reduction in hours of work. In the second one (Reform C), payroll taxes are subsidised by \(33\,\%\). In the third one (Reform D), payroll taxes are reduced in the same proportion as hours worked. We simulate these three STW scenarios for the following reason. Reform B is the STW scheme that can be considered the rule for the Spanish economy. Reform C was introduced in the 2012 labour market reform, but only for the period of January 2012 to December 2013 as a response to the “Great Recession”. Finally, the extreme scenario, Reform D, has been implemented in a number of countries to provide more incentives to adopt these measures during the recent crisis (see Arpaia et al. 2010).

Table 5 shows that external and internal flexibility, when combined, do not necessarily induce a higher reduction in the unemployment rate than when only the increase in external flexibility is considered. This is true under Reform C and Reform D, that is, when STW is subsidised, but not under Reform B. Furthermore, in full-time equivalents, the unemployment rate under Reform B is higher than under Reform A, 16.6 versus 15.4, where only the change in EPL is considered. In fact, in the absence of the additional flexibility provided by Reform B, firms convert some TCs into PCs full-time jobs, whereas under Reform B, the same number of jobs are converted, but to part-time jobs instead. In the transition exercise, we show the amount of this deadweight loss.

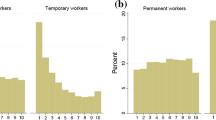

On the contrary, in scenarios where payroll taxes are partly subsidised (Reforms C and D), the unemployment and the temporary job destruction rates decrease substantially. In particular, under Reform C, the temporary job destruction rate decreases by \(54\,\%\) (\(66\,\%\) under Reform D) versus \(17\,\%\) when only external flexibility is considered (Reform A). In the status quo, the temporary job destruction rate is higher because of the larger gap in severance costs and because of the impossibility of reducing hours worked. The additional flexibility provided by these reforms makes firms more prone to continue with the matches, albeit at a reduced number of hours worked in some instances. With regard to the effects on job destruction rates in the early durations, \(JD_{d=2}\), \(JD_{d=3}\) and \(JD_{d=4}\) decrease dramatically to 6.6, 14.5 and \(5.2\,\%\) under Reform D. Consequently, the tenure distribution changes drastically, becoming much smoother (see Fig. 4). The proportion of workers with one year of tenure decreases from 20.4 to \(13.4\,\%\), and the proportion of workers with more than three years of tenure increases from 52.7 to \(63.5\,\%\). In contrast to what Hijzen and Venn (2011) find, the availability of STW seems to be beneficial for the Spanish economy because it reduces labour market segmentation.

At first sight, it would seem that unemployment decreases less under Reform C than under Reform D, 28 versus \(32\,\%\). However, the picture changes if we compare unemployment in full-time equivalents: the reduction in the unemployment rate is larger under Reform C, 24 versus \(18\,\%\) under Reform D. This result is due to the different incentives that these two STW schemes induce. Under Reform C, the reduction in payroll taxes is independent of the reduction in hours worked, whereas under Reform D, the reduction in payroll taxes is proportional to the reduction in hours worked, thereby creating an incentive to preserve more short-time jobs. In fact, both the temporary job destruction rate and the job destruction rate at the beginning of period four are lower under Reform D because job conversion is higher, but at the expense of significantly reducing the number of hours.

To summarize, with the exception of Reform B, adding internal flexibility implies lower unemployment, lower aggregate and temporary job destruction rates and a smoother tenure distribution. Without a measurement of welfare and of the cost of these policies, it is not possible to provide a policy recommendation. It seems clear that Reform B is the worst in terms of these statistics, even worse than the sole reduction in EPL. However, Reforms C and D are more difficult to judge because average hours worked are higher under the Reform C scenario, but more jobs are preserved under Reform D.

4.4 The Transition

As is well known, an assessment of a policy cannot be conducted based on steady-state comparisons. To assess the implications of the policies, we perform a transition exercise. For this purpose, we take a sub-sample of workers from the MCVL data set previously described in the year 2010 and who differ in several dimensions, such as whether they are employed or unemployed, the type of contract, tenure on the contract and productivity level (proxied by qualification), and we follow them for 12 years. We compare the convergence of this particular initial distribution, which is not in steady state, to five different steady states: the status quo, the 2012 reform with only external flexibility, and the 2012 reform with both external and internal flexibility with the three scenarios already discussed in the previous section. In every scenario, workers are subject to the same shocks, but their employment histories are different because the policy rules are different.

To gauge the welfare change induced by these reforms, we compute the equivalent variation (EV) expressed as an income annuity. For each individual, we rewrite his/her utility along the transition as an income annuity that generates the same welfare level along the same period. Then, we measure the “welfare change” induced by a particular reform simply as the difference in the individual annuity values in the two institutional settings (the annuity value in the status quo minus the annuity in the reform). A positive value implies a larger utility in the status quo. Furthermore, the change in welfare is expressed in euros, which allows for an easy comparison to the financial calculations discussed below. To obtain an aggregate welfare figure, we compute an average of the individual “welfare changes” across all the individuals in the sample.

To obtain a complete picture, we also compute the costs implied by the status quo and by the reform scenarios as a constant annuity to facilitate comparison with the welfare measurement defined above. We compute the net cost that each individual represents for the public system. This cost is assessed by computing the present discounted value of all payments that will be received along the transition, net of all contributions to be made in the same period. The calculation reflects the fact that workers can change their labour state in the future as a result of the exogenous sources of uncertainty in the model and takes into account that individuals will react optimally according to the institutional environment.

4.4.1 Reform A: EPL Change

This reforms seems to be Pareto improving because welfare increases due to the increase in average income, and the fiscal balance significantly improves. According to the EV measure, individuals will be willing to pay 105 euros to implement the reform.

Average income increases mainly as a result of the increase in the average wage, which is coherent with the Lazear result: the decrease in severance costs is compensated by higher wages.Footnote 20 In contrast, the amount of average unemployment benefits (State \(Cost_{u-benefits}\)) is lower because of the reduction in the unemployment rate, and the average indemnity is also lower both because severance costs are lower and because there are fewer firings.

Regarding the costs for the State, this reform is the cheapest because there are no wage subsidies paid to workers (\(State Cost_{wage-sub}\)) for the reductions in hours worked, as it is the case under Reforms B, C and D. In terms of unemployment benefits and social security contributions made by the State on the part of the unemployed, this reform is not very costly (although it is costlier than Reforms C and D). It is, in fact, cheaper than Reform B, despite having very similar statistics, because average unemployment duration is lower in this case. Finally, the amount of payroll taxes paid by firms (Firm \(Cost_{ss-cc}\)) is lower than under Reforms C and D because there is more unemployment and consequently less revenue.

4.4.2 Reform B: EPL Change and Short-time with No Subsidy

In this case, the small welfare loss could be compensated by the improvement in the fiscal balance. This reform is not very costly when compared to the other reforms that allow for STW because the average wage subsidy paid to workers under STW is relatively small despite the higher payments made by the State in terms of unemployment benefits and social security contributions.

However, this reform does not make much sense because it is worse in all dimensions than the reform that only changes EPL. As shown in Table 4, unemployment and the job destruction statistics are higher, average tenure is lower and the tenure distribution is not as smooth. In addition, welfare is lower, and the fiscal balance does not improve as much as in Reform A.

Moreover, Table 6 shows that STW take-up rate is very low (\(1.8\,\%\)) compared to STW take-up rates in Reforms C and D (8.1 and \(6.1\,\%\), respectively), and there are some deadweight costs in the job conversion decision. That is, in the absence of the policy concerning the reduction in hours worked, job conversion for some productivity levels would have still taken place, but to full-time jobs.

4.4.3 Reform C: EPL Change and Short-time with a \(33\,\%\) Subsidy

In this reform, the welfare improvement is greater than the fiscal balance deterioration. Therefore, a lump sum tax could be levied on individuals to compensate for the passing of the reform. However, this reform is very costly for the State. In terms of revenue, it is second after Reform D. The costs are enormous, mainly because of the wage subsidies paid to workers , which are quite substantial given the high STW take-up rate (\(8.1\,\%\)).

The other costs, the amount of unemployment benefits and the social security contributions made by the State on the part of the unemployed, are quite low because of the significant reduction in the unemployment rate. In fact, along the transition, the average number of jobs saved amounts to \(8\,\%\) of employment, and there are no deadweight costs.

4.4.4 Reform D: EPL Change and Short-time with a Proportional Subsidy

In this case, the negative welfare impact measured as the EV (329 euros) does not exceed the costs saved (403 euros). There are resources available to compensate for the losses created by the institutional change. Average income is lower in this case due to the lower wages in short-time jobs and the lower amount of unemployment benefits given the low unemployment rate. Furthermore, the average wage subsidy is relatively low because the reduction in hours worked is quite substantial in some cases.

Regarding the costs for the State, they are relatively low because of the low unemployment rate. The fact that firms receive a proportional reduction in the payroll tax when they put workers on short-time does not deteriorate the fiscal balance position because a significant amount of jobs are prevented from being destroyed, therefore, revenue is large.

To see who actually gains or loses from the implementation of these reforms, we provide additional information on the average increase/decrease in annual income, with respect to the status quo, once the transition has been completed. We perform this exercise for every worker in the sample and group them according to their employment status at the beginning of the transition (permanent, temporary or unemployed worker).

Table 7 shows the results for all the scenarios. Once the transition to Reform A is completed, \(50\,\%\) of the workers are better off in terms of income. In the transition to Reforms B and C, these percentages increase to 54.6 and \(57.7\,\%\), respectively. In the transition to Reform D, only \(38.2\,\%\) are better off and \(55\,\%\) are worse off due to the existence of jobs with very short durations and, therefore, very low wages.

For the winners, the average increase in annual income is greatest in scenario C (658 euros), as is the proportion of workers that are better off (\(57.7\,\%\)). For the losers, the average decrease in annual income is greatest in scenario D (896 euros), as is the proportion of workers that are worse off (\(55\,\%\)).

All worker types that experience an increase in average annual income are much better off in scenario C in terms of the average increase in income. Temporary workers experience the best performance in terms of the proportion of workers who improve (\(61.5\,\%\)) and in terms of the average increase in income (932 euros) because the probability of preserving a temporary job and that of promoting to a full-time job (or, at least, to a short-time job with a high number of hours worked) is the highest.

All worker types that lose after the transition are much worse off in scenario D, both in terms of the proportion of workers that are worse off and in terms of the average decrease in annual income. The worst performance is that of the unemployed: more than \(55\,\%\) experience a decrease in annual income of approximately 1032 euros.

Taking these distributional results into consideration as well as the previous results concerning the changes in welfare and the costs of these policies, it seems that Reform C shows the best performance. A majority of workers improve (\(57.7\,\%\)), and they experience a significant increase in annual income (658 euros) that could be used to compensate for the losses experienced by the \(35.3\,\%\) who are jeopardised. We also find that this is the reform that saves the highest number of jobs because there are no deadweight costs and the STW take-up rate is the highest among the STW reforms studied.

5 Conclusion

This paper has evaluated the effectiveness of STW schemes in preserving jobs and reducing the segmentation in dual labour markets. For this purpose, we used an equilibrium search and matching model and the Spanish 2012 labour market reform as a benchmark. This rich structural model allows us to understand firms’ labour adjustment decisions in the face of temporary shocks to demand when dismissal costs and those associated with losing firms’ human capital are relevant. The steady-state results have shown that the availability of STW schemes does not necessarily reduce unemployment and job destruction. The effectiveness depends on the degree of subsidisation of payroll taxes it may entail. In contrast, the cost-benefit analysis has shown that STW creates some welfare costs, but there is scope for Pareto improvements. However, in some cases, a lump sum subsidy is necessary to compensate for the welfare loss caused by the reform.

Overall, STW with 33 % subsidies for payroll taxes with the approved change in EPL in the 2012 labour market reform (Reform C) seems to be the best option. Both the steady-state and the transition analysis point in this direction for several reasons. First, the reduction in the unemployment rate in equivalent terms is the highest; that is, there are no deadweight costs. Second, it reduces the duality in the labour market, measured as the reduction in the temporary job destruction rate, and it smoothes the tenure distribution to a substantial degree. Third, a majority of workers improve and experience a significant increase in annual income that could be used to compensate the losers and the State for the fiscal balance deterioration. It turns out that this reform is the most similar to the one that was implemented in Germany by the beginning of the “Great Recession”.

We believe that this paper makes important contributions to the debate on the effectiveness of this type of reform. First, the possibility of studying the functioning of STW schemes using a dynamic general equilibrium search and matching model has allowed us to test some of the hypotheses suggested by this growing literature. For instance, Boeri and Bruecker (2011) have mentioned that a possible interpretation for the higher numbers found in the micro estimates is that the latter do not take into account the general equilibrium effects of STW in the sense that STW also acts on the job creation margin by reducing hiring rates. We are able to confirm this presumption. We find that STW schemes increase unemployment duration despite the increase in the value of the job given the additional flexibility margin. However, we disagree with these authors on the following issue: they find a negative correlation between STW take-up and the share of fixed-term contracts, which they attribute to the low employment protection in TCs. Based on this result, they argue that the problem of dualism should be addressed by other reforms, such as the graded employment security scheme, the so-called “single contract” (SC).

Interestingly, we find that once we add the availability of STW schemes, particularly under Reform C, the steady-state results are better than the ones we obtained for the SC in García-Pérez and Osuna (2014) in terms of the reduction in unemployment and in the degree of segmentation in the labour market. Of course, this conclusion hinges upon the particular SC that is implemented; a SC with severance payments increasing in a more gradual way (See García-Pérez and Osuna 2011) than the one we studied in García-Pérez and Osuna (2014) delivers better results that are more similar to the ones we found for Reform C. It is true that Reform C is costly for the State, but from a political economy perspective, it is easier to implement than the SC. In fact, it has been already in place (from January 1, 2012 to December 31, 2013), and the incidence of STW has been substantial (see Fig. 1). We believe that the main reason for the discrepancy between Boeri and Bruecker (2011) and our paper may lie in the way training costs and experience effects are modelled, which, in this model, attempts to replicate the pattern observed for the Spanish economy (see Albert et al. 2005). The fact that temporary workers are expected to be more productive in the near future (especially once they are promoted to a PC) in addition to the possibility of adjusting through STW in the face of a temporary fall in demand makes firms more prone to keep these workers on bill.

Finally, there are certain caveats to our findings. Unfortunately, within this framework, we cannot perfectly test the hypothesis suggested by Eichhorst and Marx (2009) and Contesi and Li (2013) in the sense that the implementation of STW is a way to make standard jobs more cost attractive and to reduce the demand for alternative types of employment. It is true that job conversion increases, but it is also true that in the model, firms do not have the choice of the type of contract in the first place (every worker starts as a temporary worker). Another interesting question that is out of the scope of this paper, but that could alter its conclusions, is the modelling of the human capital investment decision as an endogenous variable. The line of reasoning is similar to the one in García-Pérez and Osuna (2014). One could argue that the availability of STW schemes may induce firms to invest in human capital earlier, which may lead to an increase in productivity and lower unemployment and may contribute to preventing aggregate demand from falling in the face of a temporary shock.

Notes

In fact, the gap between the severance payments of workers with PCs (45 days of wages per year of seniority (p.y.o.s.) for unfair dismissal) and temporary workers (8 days of wages p.y.o.s.) accounts for almost 61 % of total job destruction over the 2008-2012 period, when temporary contracts (TCs) were used as the basic adjustment mechanism (see Bentolila et al. 2012).

External flexibility also increased in 2012 through a reduction in the severance cost gap for unfair dismissals, from 37 to 21 days of wages p.y.o.s. The indemnity of workers with PCs decreased from 45 to 33 days of wages p.y.o.s. and became closer to the mean OECD compensation, which is 21 days of wages p.y.o.s (see OECD 2013), whereas the indemnity of workers with TCs increased from 8 to 12 days of wages p.y.o.s.

Other flexibility measures introduced by these reforms involved the possibility of unilaterally modifying working conditions, such as hours worked and wages for economic, technical or productivity reasons, and redistributing \(10\,\%\) of weekly hours on a yearly basis.

First, priority has been given to firms’ own collective agreements; second, opt-out clauses have been introduced for firms experiencing economic difficulties; and third, the automatic extension of collective agreements once they expire has been reduced to one year.

Lazear (1990) notes that if contracts were perfect, severance payments would be neutral. If the government forced employers to make payments to workers in the case of dismissal, perfect contracts would undo those transfers by specifying opposite payments from workers to employers. Thus, for severance pay to have an effect, some form of incompleteness is needed. Most studies have avoided this problem by modelling dismissal costs as firing taxes; thus, the effects cannot be undone by private arrangements.

According to the European Labour Force Survey, the share of temporary workers over total employment in the last decade was 32.1 % in Spain, whereas it was only 14.4 % in the European Union.

Downward wage rigidity is modelled here as a lower bound on the outcome of the wage negotiations. We need to impose a wage floor to prevent too much internalisation of severance payments.

Part-time wages are adjusted accordingly, that is, they are reduced in the same proportion as hours worked.

Cole and Rogerson (1999) show that an equilibrium always exists when wages do not depend on the unemployment rate but only on the idiosyncratic shock. The intuition is that, given free entry, vacancies adjust to the number of unemployed, and the relevant variable becomes the ratio of unemployed workers to vacancies.

See García-Pérez and Osuna (2014) for a discussion on the robustness of this choice.

In the 2004–2011 period, the monthly average unemployment benefits and coverages are, respectively, 758 euros and 31 %. The sources of these data are the Bulletin of Labour Statistics edited by the Ministry of Labour and Social Affairs, the Spanish Labour Force Survey, and the National Employment Office.

Procedural wages are those wages associated with the interim period between a workers dismissal, contested in court, and the judges decision declaring it unfair.

The distribution of dismissals is taken from the Bulletin of Labour Statistics.

The number of days actually agreed upon is not made public, but this number is presumed to be very close to the legal limit. In contrast, the 2002 reform (Law 45/2002) abolished the firm’s obligation to pay procedural wages when dismissed workers appeal to labour courts as long as the firm acknowledges the dismissal as unfair and deposits the corresponding severance pay within two days of the dismissal.

To obtain the equation displayed in the text, one needs to rearrange terms in the following expression: \(s^{pc}=7\,\% \left[ 45\frac{w}{365}(d-1)+ 60\frac{w}{365}\right] + 20.9\,\%\left[ 45\frac{w}{365}(d-1) + 60\frac{w}{365}\right] + 57.6\,\%\left[ 45\frac{w}{365}(d-1)\right] + 14.5\,\% \left[ 74.3\,\% (45\frac{w}{365}(d-1) +60\frac{w}{365}) + 25.7\,\% (20\frac{w}{365}(d-1)\right] \), which takes into account all the information provided above.

Based on the fact that most firings in the past reached an amount very close to the legal limit, we have set 33 days of wages p.y.o.s, for every firing regardless of whether the dismissal is fair or unfair.

For a robustness exercise concerning parameter values the interested reader can look at the FEDEA Working Paper (http://documentos.fedea.net/pubs/eee/eee2015-06).

For comparability with the data, which include only workers affiliated with social security, we have computed the unemployment rate by excluding from the employment series public servants who do not contribute to social security (those affiliated with MUFACE, the special regime for public servants).

This underestimation may be because, in reality, some low productivity matches may be destroyed immediately once their productivity is realised and not after one year, as assumed in our model.

These effects are probably an upper bound because the model does not allow for changes in bargaining power once the policy is implemented.

References

Abowd, J. M., & Lemieux, T. (1993). The effects of product market competition on collective bargaining agreements: The case of foreign competition in Canada. The Quarterly Journal of Economics, 108(4), 983–1014.

Abraham, K., & Houseman, S. (1994). Does employment protection inhibit labor market flexibility? Lessons from Germany, France, and Belgium. In R. Blank (Ed.), Social protection versus economic flexibility: Is there a trade-off? (pp. 59–94). Chicago: University of Chicago Press.

Albert, C., García-Serrano, C., & Hernanz, V. (2005). Firm-provided training and temporary contracts. Spanish Economic Review, 7(1), 67–88.

Arpaia, A., Curci, N., Meyermans, E., Peschner, J., & Pierini, F. (2010). Short time working arrangements as response to cyclical fluctuations. European Economy Occasional Papers, No. 64, Brussels: Publications Office of the European Union.

Bellmann, L., & Gerner, H. D. (2011). Reversed roles? Wage and employment effects of the current crisis. Research in Labor Economics, 32, 181206.

Bentolila, S., Cahuc, P., Dolado, J. J., & Le Barbanchon, T. (2012). Two-tier labour markets in the great recession: France versus Spain. Economic Journal, 122, F155F187.

Boeri, T., & Bruecker, H. (2011). Short-time work benefits revisited: Some lessons from the great recession. Economic Policy, 26(66), 697–766.

Brenke, K., Rinne, U., & Zimmermann, K. F. (2012). Desempleo parcial, la respuesta alemana a la Gran Recesin. Revista Internacional del Trabajo, 132–2, 325–344.

Burdett, K., & Wright, R. (1989). Unemployment insurance and short-time compensation: The effects on layoffs, hours per worker, and wages. Journal of Political Economy, 97(6), 1479–1496.

Cahuc, P., & Carcillo, S. (2011). Is short-time work a good method to keep unemployment down? Nordic Economic Policy Review, 1(1), 133–165.

Calavrezo, O., Duhautois, R., & Walkowiak, E. (2010). Short-time compensation and establishment exit: An empirical analysis with French data, IZA Discussion Paper No. 4989.

Caliendo, M., & Hogenacker, J. (2012). The German labor market after the Great Recession: successful reforms and future challenges, IZA Journal of European Labor Studies, 1:3, pp. 1–24, http://www.izajoels.com/content/1/1/3

Cole, H., & Rogerson, R. (1999). Can the Mortensen-Pissarides matching model match the business-cycle facts? International Economic Review, 40, 933–959.

Contesi, S., & Li, L. (2013). Translating Kurzarbeit. Louis, Economic Synopses No: Federal Reserve Bank of St. 17.

Costain, Jimeno, J. F., & Thomas, C. (2010). Employment fluctuations in a dual labour market, Documento de trabajo 1013, Banco de España.

Dolado, J. J., Ortigueira, S., & Stucchi, R. (2012). Do temporary contracts affect TFP? Evidence from Spanish manufacturing firms, CEPR Discussion Paper No. 8763.

Eichhorst, W., & Marx, P. (2009). Reforming German labor market institutions: A dual path to flexibility, IZA Discussion Paper No. 4100.

FitzRoy, F., & Hart, R. (1985). Hours, layoffs and unemployment insurance funding: Theory and practice in an international perspective. Economic Journal, Royal Economic Society, 95(379), 700–713.

García-Pérez, J. I., & Osuna, V. (2011). The effects of introducing a single open-ended contract in the Spanish labour market, UPO Working Paper Series, WP 11-07.

García-Pérez, J. I., & Osuna, V. (2014). Dual labour markets and the tenure distribution: Reducing severance pay or introducing a single contract. Labour Economics, 29, 1–13.

Güell, M., & Petrongolo, B. (2007). How binding are legal limits? Transitions from temporary to permanent work in Spain. Labour Economics, 14–2, 153–183.

Hijzen, A., & Martin, S. (2012). The role of short-time working schemes during the global financial crisis and early recovery: A cross-country analysis, OECD Social, employment and migration working papers, No. 144, OECD Publishing. http://dx.doi.org/10.1787/5k8x7gvx7247-en

Hijzen, A., & Venn, D. (2011). The role of short-time work schemes during the 2008–2009 recession, OECD social, employment and migration working papers, No. 115, OECD Publishing. http://dx.doi.org/10.1787/5kgkd0bbwvxp-en

Lacuesta, A., Puente, S., & Villanueva, E. (2012). The schooling response to a sustained increase in low-skill wages: Evidence from Spain 1989–2009, Bank of Spain Working Paper No. 1208.

Lazear, E. (1990). Job security provisions and employment. Quarterly Journal of Economics, 105, 699–726.

Möller, J. (2010). The German labor market response in the world recession: De-mystifying a miracle. Journal for Labor Market Research, 42, 325336.

Mortensen, D., & Pissarides, C. (1994). Job creation and job destruction in the theory of unemployment. Review of Economic Studies, 61, 397–415.

OECD. (2013). The 2012 labour market reform in Spain: A preliminary assessment, http://www.oecd.org/els/emp/SpainLabourMarketReform-Report

OECD. (2014). OECD economic surveys: Spain 2014. OECD Publishing. doi:10.1787/eco_surveys-esp-2014-en.

Osuna, V. (2005). The effects of reducing firing costs in Spain. In Contributions to macroeconomics (Vol. 5(1), pp. 1–29). The B.E. Journal of Macroeconomics, Berkeley Electronic Press.

Rinne, U., & Zimmermann, K. F. (2012). Another economic miracle? The German labor market and the great recession, IZA Journal of Labor Policy, 1:3, pp. 1-21, http://www.izajoelp.com/content/1/1/3

Rosen, S. (1985). Implicit contract: A survey. Journal of Economic Literature, 23, 1144–1175.

Scholz, T. (2012). Employers selection behavior during short-time work, IAB Discussion Paper No. 18/2012.

Tauchen, (1986). Statistical properties of generalized method-of-moments estimators of structural parameters obtained from financial market data. Journal of Business and Economic Statistics, American Statistical Association, 4(4), 397–416.

Vroman, W., & Brusentsev, V. (2009). Short-time compensation as a policy to stabilise, Department of Economics, University of Delaware Working Paper, Vol. 2009-10.

Walsh, S., London, R., McCanne, D., Needels, K., Nicholson, W., & Kerachsky, S. (2007). Evaluation of short-time compensation programs, Berkeley Planning Associates / Mathematica Policy Research Inc., Final Report for the U.S. Department of Labor, March 2007.

Author information

Authors and Affiliations

Corresponding author

Additional information

We gratefully acknowledge the support from research projects PAI-SEJ513, PAI-SEJ479, P09-SEJ4546, ECO2012-35430, P09-SEJ688 and ECO2013-43526-R. The usual disclaimer applies.

Rights and permissions

About this article

Cite this article

Osuna, V., García-Pérez, J.I. On the Effectiveness of Short-time Work Schemes in Dual Labor Markets. De Economist 163, 323–351 (2015). https://doi.org/10.1007/s10645-015-9256-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10645-015-9256-x

Keywords

- Permanent and temporary contracts

- Duality

- Severance costs

- Short-time work

- Unemployment

- Tenure distribution

- Job destruction