Abstract

The ground-breaking research on the electricity sector and its effects on energy efficiency (EE) in advanced and emerging economies are crucial in developing a futuristic pathway, leading to self-sustainable energy use. Therefore, this research investigates the functions of sustainable investments to ensure EE in advanced and emerging economies in a decade, ranging from 2008 to 2018, by applying the data envelopment analysis (DEA) method. The findings reveal a lower degree of EE in advanced and emerging economies (0.44), discovering only seven nations, saving energy with DEA and the West Asia and North Africa groups as the top energy savers. Moreover, the mean EE ratio of the advanced and emerging countries plummeted, dating back to 2013, whereas financial investment positively impacts EE. Similarly, the study perceives how open structures in the nations' economic systems can advance ecological conditions by reducing pollution levels and graft enable EE and reduce pollution levels. Simultaneously, natural resources and technological advancements can accelerate the course of EE and ecological dimensions. Therefore, analysis of causality reinforce the response hypotheses between EE, Environmental carbon emissions levels, financial advancements, graft control, proceeds from mineral resources, technological creativity, commerce, and localization of industries, respectively.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A decrease in energy consumption with maintained and supercharged economic growth, and decreased carbon dioxide emissions reflect the benefits of increasing EE. Improved EE performance induces an increase in energy distribution for countries short on energy (Bertoldi and Mosconi 2020). Similarly, unlocking private investment for green finance ensures robust economic expansion, acting as a driver for sustainability and development of a nation (Malinauskaite et al. 2020). Similarly, the implementation of "first fuel" known as EE is the best way to promote sustainability and enhance the innovation for a less carbon-intensive economy (Malinauskaite et al. 2019). Moreover, research from the Internatiol Energy Agency in(2020) supports further assessment for policy formulators, and EE programs can invigorate economic programs incentivizing growth by assisting the pre-exiting labor force, creating new employment opportunities, expanding economic activities in a strategic labor-dominated sector and giving long run gains in the form of enhanced competitiveness of a country along with reduced invoices (Mohsin et al. 2020,2018b,2021). This enables EE to elevates self-maintaining competitiveness, which helps companies cut wasteful energy consumption, increasing energy saving. Similarly, reductions in expenditure cost on energy give a barrier on enterprises against unanticipated expenditures and thus channels financial resources into more productive capital advancements and on the labor force (Palm and Backman 2020). Therefore, EE advancements provide jobs via the entire economic system, placing additional financial earnings for consumers, which increases local demand (Wohlfarth et al. 2020).

In this context, several nations and regions increase EE performance standards due to its importance in elevating energy policy formulation, which handles the growing concerns over energy security and the issue faced by carbon dioxide emission reduction goals (Reuter et al. 2020). Therefore, the formulation of efficient and effectual policy encouraging EE is eminent to ensure the projects in future designed for energy use, instilling ecological sustainability (Mohsin et al. 2018a, b; Ikram et al. 2019).

Similarly, measuring EE indicators at the macro level is gaining traction, and several important researches provide data on the functions of several determinative causes (Yang et al. 2021; He et al. 2020; Mohsin et al. 2020). However, different issues regarding this topic, notwithstanding, are undergoing comprehensive research. In this context, existing studies use energy as a fractional expression in economic production or GDP to calculate EE (Ikram et al. 209; Shah et al. 2019), whereas considerable academic literature raises this argument (Taghizadeh-Hesary and Yoshino 2015; Taghizadeh-Hesary et al. 2021), denying energy intensity as a compatible replacement for EE. Similarly, the variations in the compositional makeup of the economic system are concealed by the variations in energy intensity, which denies the ability of EE to inflate with a better performance in EI (Koronen et al., 2020). Consequently, variations in EI are periodic signals of variations in EE.

Furthermore, transition to a less carbon-intensive economy is vital to cut greenhouse gas emissions and attain the Paris Accord of limiting temperature rise above 1.5 °C pre-industrial levels. In this context, reduction in EI acts as a significant source in cutting emission levels, which is attained by advancing EE. Similarly, universalization through the scale-up of renewables serves the same function. (Himeur et al. 2020) states how EE coupled with renewables can cut emission levels by 37% and 32%, correspondingly, and in the IEA's SDS. Nonetheless, this is achieved through sustained policy programs with an appropriate regulatory environment and strong institutions. Hence, reducing energy-linked pollution is crucial in the impacts of energy transition, energy savings, creating universal access, and policy-related plan of action (Annibaldi et al. 2020).

Hence, this study highlights the major issues in the assessment of EE, investigating the EE of BRI nations. It researches the effect of sustainable finance on EE through a non-static DEA approach and regression approaches, looking to arrive at some reasons for BRI nations to seize the unique opportunity to use the functions of financial advancement in EE and achieve the SDGs.

Moreover, studies related to EE that used energy-related indicators easily accessible, specifically for BRI nation. Although different papers apply the DEA to evaluate EE of the B & R, none of these studies consider the non-static ramifications of carry-forward signals. Nevertheless, this signal estimates the effectiveness of BRI nations on every single term and the aggregate time phase in long-term.

Moreover, the approaches applied previously over approximate efficiency marks, omit the non-static rationale. Therefore, an energy efficiency index is formulated, considering the vacillations. Similarly, the models are analyzed by examining the EE index and sustainability through OLS and the Tobit estimation approaches. Consequently, the findings reveal a direct mathematical effect and a universal composition impact and technological impact, respectively. In this context, the composition impact is more significant mathematically than the technological impact (Peña-Martel et al. 2018). Moreover, this study reveals the impact of potential sources of R&D on sustainable economic expansion, whereas the progressive education sector encourages human capital-based industrialization. Consequently, growing investment on R&D spurs technological advancements (Xing and Fuest 2018; Martínez-Moya et al. 2019).

2 Literature review and background

At present, EE promotion attracts a lot of attention from governments and the scholars. Therefore, a number of researchers suggest sustainable efficiency enhancement as a result of financial advancement, preferring the idea of EE, presenting four kinds of EE statistics (Bukarica and Tomšić 2017). However, such statistics are considered as unitary parameters, resulting in important disparities in EE estimated by variant values. Hence, EE estimation is initially done using the DEA approach estimating EE for the glass sector in US and the transport sector in India (Dhakouani et al. 2019), whereas the DEA model increases the one factor EE to an aggregate EE due to its features with different input and output functions (Pelenur 2018). Hence, the EE of different regions in China is assessed, and the findings are aligned with the real circumstance. Consequently, DEA is one of the main approaches in studying EE, and its application is constantly evolving. Moreover, scholars are always interested in green finance and energy policy studies, establishing a framework for green finance, considering certain academics and a definition of green finance. Chandio et al. (2020) and Sun et al. (2020) discuss the present state of green finance and how difficult it is to differentiate between green finance and climate financing, whereas Lindenberg (2014) describes climate finance as a subset of green finance inclined toward climate change and green finance, according to the official definition by the Chinese government, encompassing the following elements; defining the goal of green finance as offering financial assistance for environmental initiatives, addressing climate change-related issues, and increased energy efficiency. Secondly, green finance is divided into categories, such as green bonds, green loans, and green stock index. Finally, green finance encompasses green project funding, risk management, and carbon finance elements. Consequently, a precise definition of green finance through the "reputation impact," aids in labeling green financial products and attracts green businesses and investors to make additional green investments.

Moreover, the importance of green finance and energy policy in businesses and governments is obvious in the earlier academic research (Alemzero et al. 2020b,2020a; Sun et al. 2020) and national government reports. However, certain challenges in putting green finance and energy policy into practice, include (i) the lack of knowledge of green finance and awareness for establishing medium and long-term green finance objectives, (ii) the inability of green goods and services in the market for the finance industry to satisfy the practical requirements of the society, (iii) The lack of innovation, producing a singular structure of green financial products. Hence, this article examines the present state of research in this area and suggests some future research paths to understand how to address the problems and achieve sustainable development.

Furthermore, green economy is defined as resource-efficient, low-carbon (clean), and socially inclusive, where the rise of employment and income is fueled by public and private investment. Similarly, green investments fuel economic activity, including the construction of green energy infrastructure to decrease carbon emissions, increase energy and resource efficiency, and safeguard biodiversity and ecosystems (Agyekum et al. 2021; Zhang et al. 2021). Consequently, green economic development gains traction as a novel economic mechanism across the globe and is described clearly in the previous research. In this context, certain international organizations, such as the UNEP, a green economy is a strategic idea responsible for analyzing the notion and meaning of "green growth" (2011). Hence, Nieto et al. use the bibliometric analysis to investigate the connection between sustainable development, green economy, and green economy dimensional features (2018). Furthermore, public financing is insufficient to meet green development objectives and the United Nations' Sustainable Development Goals (SDGs) (2019), as stated by Yoshino et al. (2021) and Taghizadeh-Hesary and Yoshino (2020). Therefore, the government should permit green infrastructure projects to attract more private green financing and investment (Li et al. 2021; Chien et al. 2021; Iqbal et al. 2021).

The major findings from preexisting research state the casual influential analogous factors, such as energy costs, number of people living in an area, region size, weather conditions, trade directness, technological variation and public energy policies, measured in the initial category of the analysis. Secondly, effects on EE vary and lastly none of the third category of research studied analyzes the asymmetric reactions to energy costs, regardless of the preliminary indications from the initial cluster of the analysis. In this context, our technique expands on this research, making room for asymmetric impacts of energy costs variations, and we apply the DEA and the econometric approximation techniques to estimate EE for the BRI nations. Moreover, the application of diverse estimation approaches gives strength, accuracy, and sensitivity assessments for the sequential approximation, unable to find preeminence among the approximation approaches. Hence, a non-static longitudinal data equation is applied to evaluate the social-economic and global warming parameters impacting the variations on EE. Consequently, our analysis provides insights on the evolving variations of EE for the selected nations.

3 Data and methodology

In the estimation of EE of B&R nations, Lu and Lu (2019), and Xiao, Zhang and Lei (2019) opted input parameters, such as capital, energy consumption, and workforce. Similarly, Xiao, Zhang and Lei (2019) applied output parameters, such as GDP and CO2 to evaluate the EE, whereas Guo et al. (2017) opted to apply population, land size and energy use as input parameters. Furthermore, this study applies the ensuing parameters, such as aggregate capital development (current US$), cumulative primary energy consumption (Quadbits), workforce as an input parameter, CO2 (MM tons CO2) as an adverse output parameter, and GDP (current US $) as a desired output parameter, respectively. Tone and Tsutsui (2010) determined the good residues to match gains passed ahead of the forthcoming phase and bad residues comprising of deficits passed to the forthcoming years. Therefore, the static carry-overs cannot lead to correspondingly optional and non-optional alternatives, and this analysis applies energy supply as a carry-over parameter, correlating to the carry-forward location to the ensuing annum, considering the important function of carry-over parameters in efficiency estimation. Hence, the addition of energy acts as the linking parameter for input and output parameters reproducing the non-static effects of ecological parameters of manufacturing in achieving an equilibrium between energy production and consumption. Therefore, it is imperative to apply energy at no cost carry-over due to the ramifications of over distribution, such as capacity problems, and shortfalls in energy production, such as energy calamity. The selection of the energy supply as at no cost carry-over was linked to the inclination or monetary foundation for the BRI nations to be associated to the ensuing annum's time phase, and a good carry-over needs an expansion on its modification rates or prediction disparity, whereas a bad carry-over demands a reduction to achieve DEA Efficiency.

Nonetheless, several BRI nations need to cut down or grow their energy stockpile to handle the particular challenges of harmonizing energy production and energy use to attain EE. Therefore, the application of energy use acts as cost carry-over. Similarly, Guo et al. (2017) theorized the importance of energy stock for EE, embraced as a no cost carry-over parameter to classify the functioning disparity among choice formulating components. Moreover, energy stock is applied as a cost carry-over parameter by Guo et al. (2017).

3.1 Slack-based DAE to measure energy efficiency

The DEA analyzes the Shepard input distance function to derive the topmost benchmark 'efficiency' frontier. However, DEA is a distribution-free approach, which applies a piecewise linear equation to approximate the EE, where stochastic terms are not included. Hence, an exclusive deterministic frontier for result-formulating groups/nations is presumed with no practical procedure in particular (Zhou and Ang 2008). In this context, the DEA approach is analyzed based on input/output-focused equations. For reliability with the distribution-free approach deliberated in those as mentioned earlier, and because we aim to estimate the efficiency of (energy) input, we apply the input-leaning DEA equation to approximate the Shepherd input distance equation and hence the whole economic system efficiency eGFI by resolving the ensuing statistical programming challenge. Consequently, the creation chance puts (PPS) of complex calculation from Tone's slack-focused method of significant efficacy fortitude, which signifies the component DMUj, (j \(=1, \ldots,\)n). Let x \(\in {R}_{mk}^{+}\), \(y \epsilon {R}_{sk}^{+}\) and \(z \epsilon {R}_{dk}^{+}\), considered as the corresponding vectors of the initial input and intermediate goods, with output in support of DMU lower than the evaluation K. Therefore, the creation opportunity conserve exists in a dual-level procedure composition, formulated as given below:

The PPS outstanding competence, applied on the DMUk, by a dual-step composition on the account of steady progression to survive a concept with the excluded efficient components, will survive an unstructured form because,

Similarly, previous system identifications are often signaled in more non-circular equations for evaluating DMUs with network composition. Hence, the topic of competent handling of the position DMUs via a connection structure is addressed in a number of previous researches, which imply a difference to analysis regarding the position capabilities of DMUs with SBM equations. Hence, X is usually the main vital vector applied to construct the provisional transaction Z, applying the provisional goods as an important vector to the succeeding end, to construct the closing output vector Y. Therefore, the scarcity in the central experiment might impact the total effect (Ringler et al. 2017; van de Ven and Fouquet 2017).

Moreover, power unit is unusable when the middle distribution is inadequate, considering the PPS as a typically dual-stage network. Hence, this incapability is identified by estimating the intermediary's equivalence slacks, whereas the influence of equidistant sustenance is vital in measuring the degree of efficiency and putting the capable component. Consequently, the author is pioneering the novel classification approach in a network formulation based on the findings of the central events.

For the function in Eq. 1, we presume n DMUs. They all apply m inputs xj = (x1j,…,xmj), together with power and non-energy supplies, to generate favorable outcomes gj = (g1j,…,gsj) and f surplus productions bj = (b1j,…,bfj) (Trotta 2018). The present RAM-DEA equation will approximate the power efficiency in the models in the illumination of infrequent off-the-cut circumstances for every DMU in the no subjective operation of the Eq. 2, whereas the limits in Eq. 1 and Eq. 2 elucidate the correlated and different characteristics.

3.2 The proposed super efficiency of network NSBM model

This aspect delves into the efficiency subject of the network to interest the predicted repetitive earnings given below and to stabilize for the less than approximated NSBM-capable DMU. Hence, the competent DMUs apply the dual-step equation to construct Eq. 3, whereas a stabilizing equation (ADD) is deployed to ascertain the likely valued equidistant events at the beginning. Following this, the topmost benchmarks in NSBM are used, giving a limiting situation for the equidistant procedure. (Salim and Rafiq 2012). These explanations are shown in Eq. 3 and Eq. 4, respectively.

Then the below Model is solved.

where \({s}_{i}^{-}\) and \({s}_{r}^{+}\) are extra inputs and the deficient of output,\({T}_{d}^{*}\) and \({R}_{d }^{*}\) are inadequatly manufactured in the initial part as output and extra supply of jobs in the ensuing phase of equidistant happenings, correspondingly. Moreover, the capability success of the DMUs beneath assessment is found by expounding Eq. 3, whereas the overall competence mark equivalent to one, Eq. 4 requires the operational association to stabilize them, considering the DMUs show. Similarly, PPSNSUP_EFF is applied to construct a super-efficiency equation to put the limitations on Eq. 4 and the NSBM super-efficiency model, also known as NSBM-SUP-EFF, is outlined below.

A similar approach (Krishnasamy and Balasubramanian 2019) is used to estimate electricity domain restructurings with bearings on economic advancement, whereas (Mukherjee 2008) applied the DEA approach to examine EE in the production domain of India. Moreover, the OLS approximation approach is widely recognized for approximating several economic systems and monetary equations, deployed by (Hansen 1982). However, a complete comprehension of data gathering is necessary, pertaining to the OLS, which is not analyzed, requiring a particular instance made from the initial equation (Lv et al. 2019). Moreover, OLS analysis can be challenging if the data gathering is certain, whereas the estimation of OLS is not daunting, including the equation for log-normal random term volatility. Similarly, the explicit course of equations constrained with instant form instant equation parameters constitutes one of the key differencing dimensions of the OLS approximation, and model (5) reveals a normal straight-estimation equation. In this context, the existence of independent variables correlates with the stochastic term issue in the non-static longitudinal equation, which makes conventional static approximation approaches cumbersome to execute. Consequently, we apply a separate OLS and Tobit regression approach, which gets rid of the biased estimates and endogeneity of the parameters via instrumenting approaches. Hence, Sovacool (2017) used a differencing approach to eliminate single effects prior to formulating a Tobit approximation, followed by the application of lag parameters as the instrumenting parameters which are formulated below:

where α stands for the intercept, and β, γ, and θ are the coefficients to be approximated. Similarly, \({\mathrm{PS}}_{it}\) stands for the per capita fiscal expenditure on R&D or education (PCRD: per capita research and development spending), where \({\mathrm{EFFI}}_{i, t-1}\) is the first lagging term of \({\mathrm{EFFI}}_{it}\), due to the certainty of the green performance index in the late period, which has a lively impact on the present performance expansion index \({X}_{it}\), depicting the control parameters set. Similarly, \({u}_{t}\) is fixed time effect, \({v}_{i}\) is a single fixed-effect, and \({\varepsilon }_{it}\) is a random error term.

\({EEF}_{i,t}={\alpha }_{1} + {\beta }_{1}{\mathrm{ln}GDP}_{it}+{\beta }_{2}{R\&D}_{it}+ {\beta }_{3}{GFinc}_{t}+ {\beta }_{4}{FD}_{it}+ {\beta }_{5}{GP}_{it}+ {\beta }_{6}{Indstr}_{it}+ {\varepsilon }_{i,t}\)

Moreover, GFinc represents green finance, GP represents public policy, and the industrial structure is given as Indstr. Nevertheless, certain difficulties might happen as a result of the differencing approach, including the elimination of the individual effect and time variable "T" posing as a large problem, with instrumental variables as the poor instrument's problems.

4 Results and discuss

The results for the varied assumption of EE for the topmost nations, such as Qatar, Saudi Arabia, and Singapore are shown in Table 1, securing consistent maximum marks on their efficiency of energy-efficient nations settings. However, Qatar and Saudi Arabia are the minimum energy saving nations in the key dataset, whereas a couple of nations are situated in-between energy saving circumstances. In this context, these figures are fascinating and concurrently important for emerging nations, particularly those in Asia, considering to pursue green EE in the forthcoming years. Therefore, these stated standards for EE with revolutionary measures selected set of indicators to implement restructures as stated before and consistently adhere to compactivity. Therefore, these nations have incorporated both circumstances: (a) Important steps for sustainable investment (b) reliable adherence to consequences for financial inclusion with high marks on EE.

As shown in Table 1, the mean total efficiency is 0.44 for the whole-time phase show wastefulness stages, implying 55.86% wastage in output, which show a huge variation of competencies in countries around the B&R. Therefore, the mean total efficiency outstripped the mean total inefficiencies beginning from 2013 to 2016, and Singapore, Israel, Qatar, and Kuwait are recorded as DEA energy saving countries with an efficiency score of 1, within the whole-time phase, striking an equilibrium between economic system expansion and CO2 pollution cuts. Consequently, 12.07% of BRI nations show outstanding energy-focused activities, enduring a steady implementation.

Figure 1 illustrates Energy efficiency of BRI countries. Moreover, Nepal is considered as an energy saving country from 2010 to 2015 and plummeted considerably in 2016, whereas Myanmar is considered energy resourceful for the initial stages of the study time, attaining an inefficiency in 2013, remaining constantly at that position. Similarly, Sri Lanka equally witnesses efficiency at the beginning of the study period, nosediving in 2014. In this context, Bosnia & Herzegovina attain energy resourcefulness for a single time phase in 2010, and Brunei Darussalam is considered efficient in only three phases, 2011 to 2013, whereas the rest of the BRI nations are approximated to be inefficient in all phases. Hence, the five nations with least total efficiency marks are (0.13), Bhutan (0.15), Uzbekistan 0.16), India (0.17), and Mongolia (0.17), respectively. Consequently, majority of the nations faced sporadic variations in energy EE within all the study years.

Hence, Table 2 highlights the mean EE score with the variations within the groups representing West Asia and North Africa group as maximum energy saving with a mean figure of 0.61, and the East Asia nations with the least EE ratio, recorded at a meager 0.18. In this context, the disparities within the groups show the alliance between West Asia and North Africa as energy saving, with a mean figure of 0.61, and the East Asia nations with the least EE ratio of the mean figure, recorded at 0.18. Consequently, the carry-over undertakings coupled with unfavorable productivity parameters in CO2 pollution induce ramifications on EE in BRI nations. Therefore, the cuts in CO2 pollution and the efficient application of different input parameters expand EE in BRI nations.

4.1 Econometric estimation

A percentage expansion in the R&D grows EE by early 0.17. Therefore, the elasticities of EE and electrification correlated with green finance are 0.73 and 0.23, correspondingly and the decomposition modeling outline of OLS in equation (ii) shows how energy-correlated parameters mostly impact EE. Hence, 1% growth in gross domestic product and green finance grows EE by 0.23% and 0.73%, whereas FDI further mostly ameliorates CO2 pollution by − 0.17% elasticity. Therefore, the findings are in line with Tobit's analysis, and the population and per head gross domestic product connoting economic system endeavors are classified as the furthermost elastic parameters, individually growing by 1% from the expansion of CO2 pollution by 1.13% and 1.07%, respectively. In this context, this elasticity is far above the stated standard in the preexisting surveys on OLS equation, pertaining to the scientific dataset for the analysis, which comprises of an extensive set of advanced and developing nations. Consequently, advanced nations tend to be a character used by comparatively smaller per head gross domestic product elasticity of CO2 pollution as compared to the emerging nations (Solà et al. 2021).

In Table 3, the assessment of proportion in the green zones shows that how the entire approximation methods reveal the proportion of green zones of the metropolis vicinities used for characterizing ecological strategies, excluding column 2 as mathematically optimistic and important with coefficients figures 0.066, 0.068, and 0.056 correspondingly. Moreover, Shahbaz et al. (2018) confirms the formulation of command and control systems with the ability to promote economic system advancements. Hence, GDPPL:, referred to as the GDP per land area, GDPPL shows how the OLS approximation reveals the measurement impact of productivity, which is validated by the GDPLA coefficient as mathematically progressive and vital at a 5% or more level. Jin et al. (2018) also validates land as a vital transporter for existing endeavors and anthropological manufacturing, whereas no economic expansion can take place without access to land. Furthermore, land asset typically grows national prosperity and reflects a peripheral effect on economic expansion, with a potentially opposite effect, despite consistent financing in technology. Meanwhile, apart from column two, the commerce's parameter openness analysis is discovered to be insignificant for all the scenarios. Furthermore, it capitulates the approximation analysis for the time lag of the explained parameter, which is discovered to be opposite and mathematically important at the lowest stage of 5%. Therefore, this finding portrays the varying disposition of the green economic system expansion occurrence.

Moreover, Table 4 shows the mean prediction figures for BRI nations, producing surplus, and unwanted output. Hence, (I) Capital: on mean, BRI nations decrease their capital by a mean figure of 21.94%, where 7 BRI countries (Singapore, Israel, Qatar, Kuwait, Greece, Cyprus, and Estonia) don't require modification on their capital, with assumed value of the forecast figures as zero. However, the rest of the BRI nations decrease their capital input to attain efficiency levels. Moreover, a mean forecast variance of more than 50% capital in the wastefulness figures is attained by countries, such as China, India, Bhutan, and the Kyrgyz Republic, Consequently, China, India, Bhutan, and the Kyrgyz Republic decrease their capital by over 50, whereas Croatia takes the lowest decrease in the capital with only a mean decrease of 2.06%, (II) Energy consumption: 17 nations own forecast variances in energy consumption, with more than the mean forecast variances of 51.54% for the entire study population. Hence, the five nations of energy use forecast, including Bhutan, Ukraine, Bahrain, Iran, and Uzbekistan show abysmal efficiency ratios from 2010 to 2016.

The parameters, mentioned above operate as the exploratory parameters to reveal the technology impact evaluated through the OLS methodology, and the approximation analysis is given in Table 4. Moreover, it is experiential how the coefficients of fiscal expenditure on research and development are directly attaining a 5% or more significance level for every examination. Moreover, financing in research and development mainly influences the territories with normal means for the scale-up of technology and invention.

As shown in Table 5, Nepal attains the lowest mean forecast wastefulness variance and needs energy consumption to plummet by 4.80%, (III) CO2 Pollution: CO2 pollution in BRI nations needs a cut by a margin of 43.33% on a mean, from 2010 to 2016, where only eight nations, including the nations with an efficiency ratio of one and Nepal don't need any modification in their CO2 pollution levels. Therefore, these B&R nations serve as model nations for different nations within the alliance to learn about the best practices concerning CO2 emission reduction. In this context, Ukraine, Kazakhstan, Mongolia, Uzbekistan, and Iran are within the worst performance nations regarding deep cuts in their CO2 pollution levels. Hence, this partially elucidates the rationale behind these nations attaining abysmal non-static marks.

However, considering advanced technology reforms, such financing is insignificant compared to the nations with sufficient natural endowments. Similarly, the Arellano-bond AR test findings show the exploratory variable in correlation with the error term, discovered by representing the relationship between the residual term and the independent variables. Correspondingly, the fixed-effect equation is more consistent and reliable than the random-effect approach for models I and II to ameliorate the endogeneity. Hence, the consistency analysis stated by Breusch and Pagan (1980) denies the null premise of zero variance for the unforeseen variations, hence showing that the unforeseen consistency ought to be contemplated for the binary equations.

4.2 Robustness analysis

Hence, China and Bangladesh attain a direct mean forecast variance figure depicting a shortfall in energy stock, showing why the BRI nations should expand energy stockpiles to improve efficiency. In this context, China obtained a direct energy stockpile forecast variance from 2010 to 2012, followed by negative figures. Furthermore, the remaining BRI nations need cut down their energy stockpile, and Vietnam represents the median range, reducing its energy stockpile to 355.92%, whereas Poland shows a reduction in its energy stock to 5.36%. Therefore, inefficiency in energy stockpile occurs due to the lack of or surplus energy stockpile. Consequently, wasteful BRI nations expand or decrease their energy stockpile to advance efficiency, and BRI nations can achieve the top carry-over efficiency mark by expanding their economies and reducing emissions levels.

This aspect of the analysis estimates the sensitivity analysis, and Table 6 highlights the energy forecast variation figures as opposite or direct in nature, apart from the DEA resourceful nations, such as Iran, Nepal, Egypt, Kyrgyz. Moreover, this observes the mean carry-over wastefulness rate as 45.36%, depicting a needful overall cut of energy stockpile by 45.36% in BRI nations.

Figure 2 defines Robustness analysis of Energy Efficiency from 2008 to 2018.

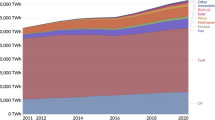

In Fig. 3, a nationwide sustainable finance portfolio is directly correlated with the territory EE for the economic system advancement zones and economic system retrogression zones. Nevertheless, the variations are quite conspicuous, specifically at an importance level of 1% and for each extra component of sustainable finance portfolio in advanced territories, territorial EE grows by 15.1%, whereas for a single extra component in a country ecological review in the least advanced territories, territorial EE grows by at a mere 1.1%, at a significance level of 5%. However, the impact of ecological review on enhancing EE in the advanced territories is nearly 8 times more than in the least advanced territories, and majority of the advanced countries show a certain level of marketization as seen in the territorial advancement reveals, where the indigenous government is inclined toward high end industrial advancement of the distribution chain, and the peripheral authority impact of country ecological review is noticeable. Conversely, the least advanced territories are mainly in the catching-up phase of the GDP magnitude and expansion level, where EE is comparatively minimal. Hence, the idea of commerce resources and ecological advancement is yet grave, and it is not startling the total peripheral controlling authority impact as maximum.

4.3 Discussion

The foreign direct investment gives the leeway for technology and management, diffused in manufacturing, which improves EE in the receiving nations. Hence, the analysis reveals 10% expansion in FDI, maintaining trade directness and different continuum variables, which causes a 0.002 marks fall in the EE indicator, and the importance level is not mathematically important. Moreover, the impact of composition of the manufacturing segment in economic systems on the EE index is discovered to be opposite and eco-statistically important. In this context, a 10% expansion in manufacturing value-added proportion, maintaining other variables as unchanged, is linked with a 0.381-point fall in the EE index. Therefore, the manufacturing valued-added proportion advances EE, which reflects an equal improvement in industrial development earnings and technology, regardless of an expansion in the manufacturing segment, which requires lots of energy to maintain manufacturing undertakings and EE via rivalry and price investment.

Furthermore, the effect of industrial makeup of the economic system due to the multiplication variable among foreign direct investment and manufacturing value-added proportion on the efficiency indicator as an opposite value, FDI is considered as changing manufacturing base of the economic system, culminating in EE advancement with no mathematical importance. Consequently, the mean yearly temperature attains an opposite impact on the efficiency index and the hotter the weather condition, the higher the BRI's EE levels.

Similarly, trade concentration directly affects EE indicator, where trade directness does not result in EE advancements, which varies with the anticipation of rivalry from abroad enterprise. This propels indigenous companies from becoming inventive and embracing resourceful technologies to cut their energy consumption levels, manufacturing expenditure and making room for fixing viable charges. Conversely, trade directness, improves technological pass-on through foreign direct investment FDI, such as the interface term between trade directness and foreign direct investment, decreasing efficiency index as it makes room for imports in the form of technologies promoting EE in the receiving nations. Hence, the absorptive competence of the economic system is a vital cause of how technology spillover through FDI affects EE. The physical locations of the BRI nations grow their efficiency index. Although their approximated impacts are insignificant, this implies the BRI nations with bigger land sizes as less likely to be energy saving.

Moreover, the undermentioned results are vigorous applying energy costs, such as power, natural gas and hydrocarbon costs, deprived of biases to the small parameters seen in disproportionate costs reactions. In this context, the disproportionate effects of variations are validated by energy-focused costs, such as power and crude costs, attaining disproportionate impacts on EE levels. Moreover, natural gas costs show a partially disproportionate impact, whereas the proof of unbalanced impacts of coal cost is comparatively fragile. Hence, the inability to constraint for unbalanced whereas applying energy-focused costs culminate in subjective approximates. Consequently, application of different energy cost decomposition approach for sensitivity analysis, introduced by Dorsey-Palmateer and Niu (2020) does not add to the findings considerably. Therefore, the undermentioned analysis are considerably reliable crosswise with the varied cost decomposition approaches.

In this context, the public takes significant steps to advance the course of EE and to decrease energy consumptions and encourage green development. However, the portfolio of sustainable investment is an effective peripheral authority instrument, whereas an environmental review can effectually advance EE deprived of interrupting with marketplace fundamentals. Hence, the under-listed illumination is derived, considering the deduction from this study. Firstly, a portfolio of sustainable investment can encourage the advancement of EE, which requires the authorities to formulate sustainable finance portfolios. This is potentially applied to expand the amount of review staff and portfolio of sustainable investment to exploit the progress of environmental review on EE. Secondly, countries' authorities must embrace a portfolio of the sustainable investment plan of actions, considering the prevailing indigenous settings. Hence, sustainable investment portfolio is required frequently without interruptions in territories with the consummate functional environment and advanced territories, integrating the peripheral control authorities' function of the sustainable investment portfolio on EE advancement. However, in less advanced territories and areas with flawed institutional terrain, the environmental review of a country requires integrating industrial tariffs, and invention programs to encourage sustainable advancement collectively. Finally, EE is enhanced by the ecological review of a country by stimulating technological improvements and a regular expansion in the invention devices and inducement programs, which aids in invention implementation review, assured technological advancements, and achieving the upgrading of EE underpin by technological advancements.

5 Conclusion and policy implication

The studies on the electricity sector, done by different countries are crucial in developing a self-sustainable model for energy us in future. This study evaluates EE through the electricity segment restructuring, considering the case study of the BRI by applying the famous DEA approach from 2008 to 2018. Hence, the findings reveal how the restructuring of electricity segment coupled with vibrant managerial control style and clean energy directly affects EE and concentration. Hence, this study provides a series of measures perused by the nation sunder assessment, enhancing EE, considering the finding of this analysis, which decrease EI through the implementation and formulation of sustainable investment solutions. Consequently, the electricity domain of emerging economies should be restructured via the unbundling of the sector to make it competitive and viable, reflecting advance regulations, upgrade transmission and distributions systems to avoid system losses, which will achieve health rivalry in the sector.

Moreover, this research recorded the total EE of BRI nations at a low value (0.38) from 2011 to 2015; while the aggregate EE of the West Asia & North Africa bloc of B & R nations was recorded at 0.59, which is above the 0.38 for South Asia BRI nations and different nations within the East Asian alliance, recording the most depressed ratio for EE. The yearly EE of the B&R nations vacillated skyward from 2012 to 2014, recording a fall from 2 to 13. Similarly, 7 BRI countries, including Singapore, Israel, Qatar, and Kuwait need no capital modification and assume their forecast figures as zero. These nations found a steady-state between economic expansion and energy decrease, whereas Nepal showed the minimal mean forecast variance, necessitating energy consumption to be cut by 4.80%. Furthermore, CO2 in BRI nations necessitates a cut in energy consumption levels by 43.33% on the median basis from 2010 to 2016, whereas only Singapore, Israel, Qatar, Kuwait, and Nepal did not demand alteration in their pollution levels. Subsequently, these nations can function as model nations for different nations in the alliance regarding CO2 reduction. The impact of investment increase on EE within the study period considered for the analysis is anchored on the degree of financial advancement. However, there is a direct and important impact of investment increase on EE, whereas the effects of investment progress on EE are insignificant for nations at a higher peak of financial development positions. Consequently, technological advancements encourage EE, within the constraint parameters, where the land size and urban sprawling inhibit EE.

Although the three approaches reveal diverse EE points, the longitudinal data analysis applying the Arellano and Bond (1991) OLS and Tobit regression approximations is relatively fitting to the approximated effects of the theorized causal variables of variations in EE. Consequently, we discovered an expansion in sustainable finance, stimulating EE advancement with insignificant proof of disproportionate R&D impacts.

Furthermore, growth in FDI uninterrupted influxes, manufacturing worth-added, trade directness (that improves technological pass-on through FDI), and the number of people living in an area are directly correlated to the increase in EE, whereas bigger regional area decreases EE. Hence, the limited variations from the findings are due to excessive cost reactions and the effects of mean yearly weather conditions on EE stages, where small discrepancies are perceived crosswise with the varied EE approximates.

In this context, the experimental findings showed EE functions acting as a catalyst for CO2 reduction, which expedites energy consumption management and functions as a less carbon-intensive reduction source. Moreover, EE as the "first fuel," is a global accord supported by analysis applying the two instruments of command and control, and experimental data equations. Hence, the vindication impacts of EE coupled with EE advancements are decreased because EE's objective is to attain renewables consumption. However, financing in EE advancement will result in added worth, which can creates an impossible scenario for EE improvement.

Moreover, proof of EE advancements correlated to growth in energy costs are reflected through policy standpoint, giving a scientific basis for the nations to decrease grants on energy services to encourage EE and energy preservation. Hence, applying certain energy costs in evaluating variations in EE and framing energy policies is highly fitting, consistent, and educative than applying total energy costs. Consequently, an expansion in the public tariffs on energy inputs (excluding coal) causes a bigger inducement for industries to embrace EE technologies and make house owners energy-conserving for the long run. Moreover, our analysis reveals how BRI policy formulators should target an economic system that is highly open for FDI uninterrupted influxes and stimulates energy conservation through EE enhancement. It instills ion the economic system. Public grants such as minimal or no taxes, tariffs reprieve, if spent on FDI uninterrupted influxes that underlined improved technologies, will enhance EE and asset abate energy-related pollution.

Finally, this research revealed the variation in public spending on green economic development country-wise. Therefore, governments should develop a country-specific strategic strategy to reap more advantages instead of relying on a generic concept, and government should provide more public funding to local businesses for the development of green energy technology. Hence, the expected results should tightly control this kind of financing from frequently financing without project milestones, which causes projects to deviate from their original goals acting as a critical factor for the interests of public and the nation. Consequently, improving communication between government funding organizations and the green energy industry may help both parties better understand each other's requirements and expectations.

References

Agyekum EB, Amjad F, Mohsin M, Ansah MNS (2021) A bird’s eye view of Ghana’s renewable energy sector environment: a multi-criteria decision-making approach. Util Policy. https://doi.org/10.1016/j.jup.2021.101219

Alemzero DA, Iqbal N, Iqbal S et al (2020a) Assessing the perceived impact of exploration and production of hydrocarbons on households perspective of environmental regulation in Ghana. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10880-3

Alemzero DA, Sun H, Mohsin M et al (2020b) Assessing energy security in Africa based on multi-dimensional approach of principal composite analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10554-0

Annibaldi V, Cucchiella F, De Berardinis P et al (2020) An integrated sustainable and profitable approach of energy efficiency in heritage buildings. J Clean Prod. https://doi.org/10.1016/j.jclepro.2019.119516

Bertoldi P, Mosconi R (2020) Do energy efficiency policies save energy? A new approach based on energy policy indicators (in the EU Member States). Energy Policy. https://doi.org/10.1016/j.enpol.2020.111320

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. The review of economic studies, 47(1):239–253

Bukarica V, Tomšić Ž (2017) Energy efficiency policy evaluation by moving from techno-economic towards whole society perspective on energy efficiency market. Renew Sustain Energy Rev 70:968–975

Chandio AA, Jiang Y, Rehman A et al (2020) Determinants of demand for credit by smallholder farmers’: a farm level analysis based on survey in Sindh, Pakistan. J Asian Bus Econ Stud. https://doi.org/10.1108/jabes-01-2020-0004

Chien F, Pantamee AA, Hussain MS et al (2021) Nexus between financial innovation and bankruptcy: evidence from information, communication and technology (ICT) sector. Singapore Econ Rev. https://doi.org/10.1142/S0217590821500181

Dhakouani A, Znouda E, Bouden C (2019) Impacts of energy efficiency policies on the integration of renewable energy. Energy Policy. https://doi.org/10.1016/j.enpol.2019.110922

Dorsey-Palmateer R, Niu B (2020) The effect of carbon taxation on cross-border competition and energy efficiency investments. Energy Econ. https://doi.org/10.1016/j.eneco.2019.104602

Guo C, Pleiss G, Sun Y, Weinberger KQ (2017) On calibration of modern neural networks. In International Conference on Machine Learning Guo PMLR. pp. 1321–1330

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50:1029. https://doi.org/10.2307/1912775

He W, Abbas Q, Alharthi M et al (2020) Integration of renewable hydrogen in light-duty vehicle: nexus between energy security and low carbon emission resources. Int J Hydrogen Energy. https://doi.org/10.1016/j.ijhydene.2020.06.177

Himeur Y, Alsalemi A, Al-Kababji A et al (2020) Data fusion strategies for energy efficiency in buildings: overview, challenges and novel orientations. Inf Fusion. https://doi.org/10.1016/j.inffus.2020.07.003

Ikram M, Mahmoudi A, Shah SZA, Mohsin M (2019) Forecasting number of ISO 14001 certifications of selected countries: application of even GM (1,1), DGM, and NDGM models. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-04534-2

Iqbal W, Tang YM, Chau KY et al (2021) Nexus between air pollution and NCOV-2019 in China: application of negative binomial regression analysis. Process Saf Environ Prot. https://doi.org/10.1016/j.psep.2021.04.039

Jin W, Zhou C, Luo L (2018) Impact of land input on economic growth at different stages of development in Chinese cities and regions. Sustain 10:2847. https://doi.org/10.3390/SU10082847

Koronen C, Åhman M, Nilsson LJ (2020) Data centres in future European energy systems—energy efficiency, integration and policy. Energy Effic. https://doi.org/10.1007/s12053-019-09833-8

Krishnasamy K, & Balasubramanian A (2019) A Holistic Security Progress in Palmprint Recognition System: Forthcoming Techniques. International Journal of Applied Engineering Research. 14(24):4397–4405

Li W, Chien F, Hsu CC et al (2021) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy. https://doi.org/10.1016/j.resourpol.2021.102063

Lindenberg, N. (2014). Definition of green finance. German Development Institute/Deutsches Institut für Entwicklungspolitik (DIE). DIE mimeo, 2014. https://papers.ssrn.com/sol3/papers.cfm

Lu Y, Yang L, & Liu L (2019) Volatility spillovers between crude oil and agricultural commodity markets since the financial crisis. Sustainability. 11(2): 396

Lv K, Feng X, Kelly S et al (2019) A study on embodied carbon transfer at the provincial level of China from a social network perspective. J Clean Prod 225:1089–1104. https://doi.org/10.1016/j.jclepro.2019.03.233

Malinauskaite J, Jouhara H, Ahmad L et al (2019) Energy efficiency in industry: EU and national policies in Italy and the UK. Energy. https://doi.org/10.1016/j.energy.2019.01.130

Malinauskaite J, Jouhara H, Egilegor B et al (2020) Energy efficiency in the industrial sector in the EU, Slovenia, and Spain. Energy. https://doi.org/10.1016/j.energy.2020.118398

Martínez-Moya J, Vazquez-Paja B, Gimenez Maldonado JA (2019) Energy efficiency and CO2 emissions of port container terminal equipment: evidence from the Port of Valencia. Energy Policy. https://doi.org/10.1016/j.enpol.2019.04.044

Mohsin M, Rasheed AK, Saidur R (2018a) Economic viability and production capacity of wind generated renewable hydrogen. Int J Hydrogen Energy 43:2621–2630. https://doi.org/10.1016/j.ijhydene.2017.12.113

Mohsin M, Zhou P, Iqbal N, Shah SAA (2018b) Assessing oil supply security of South Asia. Energy 155:438–447. https://doi.org/10.1016/j.energy.2018.04.116

Mohsin M, Taghizadeh-Hesary F, Panthamit N et al (2020) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett. https://doi.org/10.1016/j.frl.2020.101520

Mohsin M, Hanif I, Taghizadeh-Hesary F et al (2021) Nexus between energy efficiency and electricity reforms: A DEA-Based way forward for clean power development. Energy Policy. https://doi.org/10.1016/j.enpol.2020.112052

Mukherjee K (2008) Energy use efficiency in the Indian manufacturing sector: an interstate analysis. Energy Policy. https://doi.org/10.1016/j.enpol.2007.10.015

Palm J, Backman F (2020) Energy efficiency in SMEs: overcoming the communication barrier. Energy Effic. https://doi.org/10.1007/s12053-020-09839-7

Pelenur M (2018) Household energy use: a study investigating viewpoints towards energy efficiency technologies and behaviour. Energy Effic. https://doi.org/10.1007/s12053-018-9624-x

Peña-Martel D, Pérez-Alemán J, Santana-Martín DJ (2018) The role of the media in creating earnings informativeness: evidence from Spain. BRQ Bus Res Q 21:168–179. https://doi.org/10.1016/j.brq.2018.03.004

Reuter M, Patel MK, Eichhammer W et al (2020) A comprehensive indicator set for measuring multiple benefits of energy efficiency. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111284

Ringler P, Keles D, Fichtner W (2017) How to benefit from a common European electricity market design. Energy Policy. https://doi.org/10.1016/j.enpol.2016.11.011

Salim RA, Rafiq S (2012) Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ. https://doi.org/10.1016/j.eneco.2011.08.015

Shah SAA, Zhou P, Walasai GD, Mohsin M (2019) Energy security and environmental sustainability index of South Asian countries: a composite index approach. Ecol Indic 106:105507. https://doi.org/10.1016/j.ecolind.2019.105507

Shahbaz M, Lahiani A, Abosedra S, Hammoudeh S (2018) The role of globalization in energy consumption: A quantile cointegrating regression approach. Energy Econ 71:161–170. https://doi.org/10.1016/j.eneco.2018.02.009

Solà M del M, de Ayala A, Galarraga I, Escapa M (2021) Promoting energy efficiency at household level: a literature review. Energy Efficiency, 14(1):1–22

Sovacool BK (2017) Contestation, contingency, and justice in the Nordic low-carbon energy transition. Energy Policy 102:569–582. https://doi.org/10.1016/j.enpol.2016.12.045

Sun H, Pofoura AK, Adjei Mensah I et al (2020) The role of environmental entrepreneurship for sustainable development: Evidence from 35 countries in Sub-Saharan Africa. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140132

Taghizadeh-Hesary F, Yoshino N (2015) Macroeconomic effects of oil price fluctuations on emerging and developed economies in a model incorporating monetary variables. Econ Policy Energy Environ. https://doi.org/10.3280/EFE2015-002005

Taghizadeh-Hesary F, & Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies. 13(4):788

Taghizadeh-Hesary F, Rasoulinezhad E, Yoshino N et al (2021) The energy-pollution-health nexus: a panel data analysis of low-and middle-income Asian countries. Singapore Econ Rev. https://doi.org/10.1142/S0217590820430043

Tone K, & Tsutsui M (2010) Dynamic DEA: a slacks-based measure approach. Omega. 38(3-4):145–156

Trotta G (2018) Factors affecting energy-saving behaviours and energy efficiency investments in British households. Energy Policy. https://doi.org/10.1016/j.enpol.2017.12.042

van de Ven DJ, Fouquet R (2017) Historical energy price shocks and their changing effects on the economy. Energy Econ. https://doi.org/10.1016/j.eneco.2016.12.009

Wohlfarth K, Worrell E, Eichhammer W (2020) Energy efficiency and demand response: Two sides of the same coin? Energy Policy. https://doi.org/10.1016/j.enpol.2019.111070

Xing J, Fuest C (2018) Central-local government fiscal relations and cyclicality of public spending: evidence from China. Int Tax Public Financ 25:946–980. https://doi.org/10.1007/s10797-017-9478-8

Xiao H, Ma Z, Zhang P, & Liu M (2019) Study of the impact of energy consumption structure on carbon emission intensity in China from the perspective of spatial effects. Natural Hazards. 99(3):1365–1380

Yang Z, Abbas Q, Hanif I et al (2021) Short- and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew Energy. https://doi.org/10.1016/j.renene.2020.10.141

Yoshino N, Taghizadeh-Hesary F, & Otsuka M (2021) Covid-19 and optimal portfolio selection for investment in sustainable development goals. Finance research letters. 38:101695

Zhang D, Mohsin M, Rasheed AK et al (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112256

Zhou P, & Ang BW (2008) Linear programming models for measuring economy-wide energy efficiency performance. Energy Policy. 36(8):2911–2916

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yu, M., Zhou, Q., Cheok, M.Y. et al. Does green finance improve energy efficiency? New evidence from developing and developed economies. Econ Change Restruct 55, 485–509 (2022). https://doi.org/10.1007/s10644-021-09355-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-021-09355-3