Abstract

This paper begins by surveying recent economic studies of the relationships between technology transfer, intellectual property, innovation and diffusion in emerging countries. It applies this literature to the Indian case. India has been experiencing rapid growth and has several high technology sectors staffed by an absolutely large and highly educated middle class. At the same time an even larger share of its very big population is still working in low productivity agriculture and many of these people are living in extreme poverty. Thus it needs to innovate and grow to employ its vast army of unskilled workers. The second part of the paper outlines how industry structure and innovative performance were progressing in India following the economic reforms of the early 1990s and the changes to intellectual property law occasioned by the TRIPS agreement. In the third section the focus turns to recent science, technology and innovation policy in India. A study of the country’s potential for innovation by the World Bank in 2007 argued that India must proceed on two fronts. In addition to considering how India’s growth prospects can be enhanced by world leading innovations, this volume placed great emphasis on inclusive innovation. This involves mainly the diffusion and absorption of existing knowledge, but is designed to improve the lot of the poor. The World Bank report proposed a number of new policy directions aimed at speeding up innovation and technology diffusion in India. We record what changes have been made to innovation policy, foreign direct investment policy and diffusion policy in India in recent years and assess whether these are likely to be effective in enhancing India’s ability to innovate and achieve rapid growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Developing countries that aspire to become emerging economies and eventually advanced countries have to use all the options available to them to improve their technological performance. It is in their interest to adopt relevant techniques from existing best practice being used abroad for some areas of high-technology activity. At the same time, countries will expend effort and resources in developing their domestic innovation systems. This domestic R&D can be devoted to either (or both) inventions at the frontier of world best practice technology, or to the development of alternative simpler techniques that are more appropriate to their resources and skills. To promote rapid growth and relieve poverty new technologies from any source have to be diffused widely throughout the industries for which they can improve productivity and profitability, not confined to a few modern firms.

In this paper we first examine what the existing literature tells us about the factors conducive to technology transfer from advanced countries and the rapid adoption of new techniques in developing countries. We next examine the options for such countries to domestically generate relevant technology. Within these preliminary sections 2 to 5 we explore the role of intellectual property rights (IPRs), both in relation to the adoption of foreign technology and product design and in respect of the incentives to invent within the country. While examining relevant literature that has used data for many countries we shall also have a particular focus on India as a case study.

India is a potentially useful case study for several reasons. India has recently been experiencing rapid growth and has several high technology sectors staffed by an absolutely large and highly educated middle class. At the same time an even larger share of its very big population is still working in low productivity agriculture and many of these people are living in extreme poverty (for overviews see Panagariya 2008; Acharya and Mohan 2010). To reduce poverty and improve agricultural productivity India will need to create jobs in labour intensive manufacturing production and distribution sectors to employ its vast army of unskilled workers. The second major part of the paper (section 6) outlines how industry structure and innovative performance were progressing in India following the economic reforms of the early 1990s and the changes to intellectual property law occasioned by the TRIPS agreement and membership of the World Trade Organisation.

In the next section (7) the focus turns to recent science, technology and innovation policy in India. A study of the country’s potential for innovation by the World Bank in 2007 argued that India must proceed on two fronts. In addition to considering how India’s growth prospects can be enhanced by world leading innovations, this volume placed great emphasis on inclusive innovation. This may involve mainly the diffusion and absorption of existing knowledge, but is designed to improve the lot of the poor. The World Bank report proposed a number of new policy directions aimed at speeding up innovation and technology diffusion in India. We record what changes have been made to innovation policy, foreign direct investment policy and diffusion policy in India in recent years, as well as changes to the physical and human capital infrastructure. Finally (in section 8) we outline what further research is needed in order to assess whether these new policies are likely to be effective in enhancing India’s ability to innovate and achieve rapid growth.

2 Technology transfer and intellectual property rights

We begin by exploring problems of technology transfer to the Third World to promote more rapid economic development. The traditional routes for countries to acquire technology transfers include encouraging inward foreign direct investment (FDI), often with conditions for entry relating to the transfer of technology, training and investment in workforce skills and use of local suppliers.Footnote 1 A second route is that domestic firms can apply to license the inventions of multinational enterprises (MNEs), paying royalties and licence fees in return for access to process technology or acquiring the right to manufacture a patented product and supply it to their domestic market. Local firms can also engage in reverse engineering of imported goods and at the limit they may engage in imitation of final goods and component parts, regardless of any IPRs held by the supplier.

Today the continually improving worldwide communications system offers new opportunities for rapid learning and technology transfers. But debate is continuing about the benefits and costs for developing countries arising from the trade-related intellectual property rights (TRIPS) agreement, which has required countries that wish to be members of the World Trade Organisation (WTO) to implement or strengthen their systems of IPRs to minimal standards that are much closer to those normally in place in developed countries. Positive benefits for poorer countries can include a greater willingness to licence their advanced technology and design by foreign firms, who are now more confident that they can protect their knowledge assets from imitation. Even so, the spread of technical knowledge may be impeded by the increasingly restrictive intellectual property environment if firms in poorer countries cannot afford the licensing fees.

Hassan et al. (2009) have surveyed the prior literature on several important dimensions of the relationship between IPRs and developing countries. First they examine whether stronger IPRs lead to more inward FDI and/or more imports of high technology products into developing countries. They argue that inward FDI can lead to technology spillovers and vocational skills useful for R&D, while imports of advanced country high-tech products, particularly capital goods, permit countries to exploit natural resources and surplus labour. On both the dimensions of inward investment by MNEs and exports from advanced countries they conclude that there is some positive evidence that stronger IPRs increase these flows. At least this is true for developing countries with strong technical absorptive capabilities such as India, where the risk of imitation is high if IPRs are weak. In contrast in relation to the poorest countries, where the imitation risk is already weak, firms in the developed world are not influenced by changing levels of protection.

If FDI increases due to stronger IPRs, then we also need evidence that this rise in FDI will lead to improved technology. The wide-ranging review by Clark et al. (2011) offers a number of explanations of why FDI may lead to technology spillovers and enhance economic growth. These include both the mobility of trained workers from MNEs into domestic firms and the opportunity for domestic firms to imitate the production, management and marketing techniques of foreign firms. A third channel for improvement is that arising from the competitive effect within the domestic market, where local firms must adopt best practice techniques in order to survive. International trade can offer another broad channel for increasing productivity. This arises from a variety of trade linkages, including the use of local firms as suppliers of intermediate inputs facilitated by technical assistance and worker training from the foreign-owned purchaser. Clark et al. set out a number of reasons why this inward FDI may then lead to increasing income inequality, which for some observers may count as a negative effect.

Clark et al. (2011) survey the evidence from the latest statistical studies that have used panel data on host country firms to explore the impact of increased FDI in terms of technology spillovers. They deal separately with evidence of horizontal spillovers between foreign and domestic firms operating in parallel within a market, and vertical spillovers between firms operating at different points in the supply chain. The evidence drawn from a wide range of studies of firms in emerging and developing countries is rather mixed with several negative as well as a few positive results.Footnote 2 Larger positive spillovers are generally confined to situations where the host country is already industrial with a large proportion of high technology sectors. Again India appears to be well-placed in that it has several such sectors although the size of its manufacturing sector as a share of GDP remains rather low.

These same authors survey studies of income inequality in relation to FDI and they find an overall preponderance of results supporting the view that inequality widens as a result of this type of inward investment (Clark et al. Table 4). The authors posit that FDI into transition and developing countries may be motivated by the desire to access lower cost labour, while at the same time their investment leads to increasing wages for these selected workers and relatively little by way of a trickle down of technology. The authors call for more investigation of the motives of MNEs and the ability of domestic firms to absorb possible technology transfers more broadly.

There is a more detailed question of how countries might encourage inward FDI that is itself research intensive even though conducted in a developing nation. This can be explored by examining what factors encourage multinational enterprises (MNEs) to locate overseas R&D in one place or another. Kanwar (2012a) is particularly interested in whether firms are influenced by the strength of intellectual property rights in the host country. Using a database for US multinationals spanning the years 1977–2004, Kanwar discovers no statistically significant impact of strengthening IP protection in potential host countries, despite modelling this relationship using more than one variable. Instead the persistent explanatory factors are the size of the host country’s market and the level of school enrolment of its young people. While a developing country government cannot easily change the number of adult consumers, it can take steps to improve the future skills of its workforce and this seems to be an important attractor at least for the R&D of US MNEs.

The Hassan et al. (2009) survey investigated another major issue relating to technology transfer, that of whether stronger IPRs encourage more licensing of technology by developing countries from advanced countries. They found evidence from a small number of studies to support this hypothesis of a positive impact, again particularly in developing countries with higher absorptive capacity. Even so, not all the studies reviewed used recent evidence and some were not able to use the best estimation techniques to eliminate problems of possible spurious correlation.

An important new piece of empirical analysis on the effects of TRIPS on technology transfer has been recently conducted by Kanwar (2012b). Using a panel of 45 developing countries observed at three dates from 1995 to 2005, he investigates what impact the changing strength of IP protection has had on the level of royalty and license fee payments from these countries to multinational firms. This latter is taken as an index of technology transfer from advanced countries to the developing countries. His study shows that over the period of implementation of TRIPS average IP protection increased significantly and so did the level of royalties and licence fees. Using relevant panel data analysis techniques he finds a statistically significant impact of increased strength and coverage of IP protection on the level of technology transfer, ceteris paribus on variables such as country income per capita and population. This study suggests that, far from poorer countries being unable to afford royalties and licences, it was the unwillingness of firms with advanced technology to licence it that had been holding back the level of technology transfer before the TRIPS agreement.

3 Intellectual property rights and domestic innovation

We next consider the issue of whether having stronger IPRs encourages innovation within developing countries. Certainly in the wake of the TRIPS agreement many commentators thought that poorer countries would be impoverished by the need to strengthen their domestic systems of IPRs as they would not gain sufficient benefits from domestic innovation. To examine this issue Chen and Puttitanun (2005) develop a model of how the optimal level of IPRs might be determined for a developing country. Their theoretical approach outlines the benefits of a low level of IPRs in permitting the imitation of techniques and products invented in more advanced countries. These benefits will fall as IPRs rise, hopefully to be replaced by the benefits of higher IPRs if these rights encourage more local innovation. This model gives rise to the hypothesis that the optimal level of IPRs may be U-shaped, first falling when the loss of ability to imitate foreign technology counters any increased domestic innovation and then rising with the higher levels of domestic innovation that are possible as development proceeds.

Thus for the poorest countries the loss of ability to imitate due to their moves to higher IPRs post TRIPs may not be countered by any rise in domestic innovation, as this balance only becomes a net positive benefit at higher income per capita. Using data at five yearly intervals from 1975 to 2000 for 64 developing countries, Chen and Puttitanun’s empirical analysis confirms that domestic innovation increases with the level of IPRs. They also find empirical evidence for the U-shaped curve in the actual choice of IPRs as countries develop.

These authors report that the turning point for the curve corresponded to a level of about US$854 of real income per capita in 1995 prices. Using US inflation this converts to US$1286 by 2012, by which time Indian GDP per capita was estimated at $3650 in PPP terms, showing that India is now on the rising part of the curve, so it is optimal for it to be implementing stronger IP rights following TRIPS.

4 Intellectual property rights and diffusion

Another question to explore is whether there are possibilities for expanding or modifying the role of intellectual property as a policy tool, in order to give greater incentives to the types of innovation that have the highest social value and to ensure that socially valuable innovations are rapidly diffused worldwide. As well as improvements in goods and services valued by the poor within each society, such innovations include techniques and products relevant to green technology.

Avoiding an excessive waiting period is a particularly acute factor in respect of the adoption of green technology. Reducing carbon emissions and lowering the rate of global warming will have a much larger positive impact if it is done sooner. In this case there are thus huge social benefits (positive externalities) to speeding up rates of adoption of green technology and increasing the demand for and supply of green products. So the burning question is how to create and speedily execute much-needed new green technology worldwide. This is a big challenge as conventional R&D subsidy, private IP, and conventional licensing leading to gradual diffusion may be much too slow.

One key question is thus how to speed up the adoption of both existing leading-edge technology and of novel products that arise from innovation. Rapid diffusion can occur when a number of conditions are satisfied: (a) there is good knowledge about the existence of suitable products and processes; (b) the costs of acquiring these technologies, components or final products is relatively low; (c) there are no impediments to early adoption, such as patents which cannot be licensed.

Under the standard conditions of intellectual property rights (IPR) the law typically awards monopoly rights for a fixed period. In the case of process innovation the IPR then allows the owner of these rights to decide with whom, if anyone, to share use rights for their technology under licence. Equally the rights holder for a new product, new service or component, can set their price without fear of being undercut during the period of the IPR (assuming good enforcement conditions). Given that the basic features of IPRs are determined by international agreements it is unlikely that countries will individually or collectively decide to turn the clock back and abolish or substantially modify the basic legislation governing IPRs. The urgent question for policymakers is thus whether they can work within these laws to provide significant incentives to innovators and IP rights owners to speed up the processes of innovation and diffusion.

Several options can be considered as ways of working within the existing law. As well as standard R&D subsidies, some advanced countries have recently introduced further tax reliefs to companies generating revenues from patents. This type of ‘patent box’ subsidy could be adapted to provide higher rewards for some types of innovation over others. However Thomson and Webster (2010) argue that the key policy for green technology is to establish an appropriate carbon price and once this is in place there is no need to differentiate between different types of innovations using other policy instruments.

Accelerating rates of adoption of innovative products and processes in emerging economies and LDCs may be advanced by the use of differentiated pricing, whereby the rich pay more and the poor pay less. This can be encouraged if supported by strong restrictions on re-importation into high price locations. Dual pricing can occur through voluntary action by patent owners wishing to extend their markets and increase their profits (see The Economist Intelligence Unit 2011) or by supporting compulsory licensing in emerging countries, a strategy argued to be potentially useful by Leonard et al. (2009). Nevertheless this market segmentation is only possible if markets can be truly separated and the issue of re-importation is something of a minefield, as outlined in a useful survey by Maskus (2010).

5 Frugal innovation and alternative technology

Recently there has been a lot of discussion of ‘frugal innovation’ which relates to products and techniques that can deliver key modern product characteristics, but use less expensive materials and production techniques than their earlier high technology counterparts. In an article in The Economist (2012) this is strongly linked to ‘Asian Innovation’ although many items have been developed in advanced countries. In India this type of innovation is termed ‘Jugaad innovation’ using a Hindi word reflecting improvisation. Examples have emerged from a number of countries, both developing and developed, ranging from the Tata Nano car, launched as the cheapest car in the world, to a mobile phone that is rechargeable by solar power. The advantages of these products are that they can satisfy both the aims of greener production and greater equity by supplying goods that poorer people can afford.

Given that such products are not always using frontier technology, there are IP policy issues that arise in this field relating to both speeding up technology transfer and ensuring that efficient markets operate for the use of existing intellectual property via licences where the frugal innovation makes use of existing protected technology. In addition there may be a need to strengthen and improve systems of design rights, or petty patents, to protect frugal innovations that are insufficiently novel to attract full patents. There is perhaps also a need to promote the use of trademarks as another method of protection of new product types or brands. There may also be tensions that arise in parallel to the issues that have surrounded the area of indigenous knowledge. The original inventors may not have protected their ideas and so-called patent trolls may hoover up these unregistered rights and claim ownership. The creation of an equivalent system to an open source register with General Public Licences may offer a solution to some of these difficulties if appropriate in terms of the technology.

For the developing economy there is always tension over the choice between aspiring to become a country known for its mastery of appropriate technology (AT), as against trying to stay in the race to adopt, adapt and gain experience with first-world best-practice technology. Technological catch-up appears to offer a fast route to development, but the practical difficulties are many. Not least of these is that the input resources available in poor countries often do not match those in rich countries, making it hard to replicate their production processes. Stimulated by the foundation work of such authors as Schumacher (1973) and Stewart (1977), two distinct strands of the AT movement evolved, one focusing on how rich countries could contribute to solving environmental problems and another on how poorer countries could develop rapidly and eliminate poverty. However both strands have advocated the use of less capital- and energy-intensive techniques, substituting smaller scale and more labour-intensive technology. As time has passed these two strands could be said to be reuniting into a common cause as environmental pressure is exerted on the emerging economies and as the rich countries become more embarrassed by inequality within their borders and the lack of remunerative jobs for their unskilled workers.

6 India as a case study

All the above topics could be illustrated using a range of countries, but there is also an argument for detailed analysis relating to a single country’s experience through time, as recommended by Hassan et al. (2009). Although India’s economy was recently thought to be stagnating, The Economist Intelligence Unit (2015) reports (13/02/15) that, following statistical updates and revisions, India’s economic growth rate was 7.5 % year on year in autumn 2014 and was 6.9 % in the full fiscal year 2013/2014. The Economist Pocket World in Figures 2013 gives the share of Indian employment in agriculture as 51 %, compared with 22 % in industry and 27 % in services. For GDP shares these rankings are reversed with services generating 55 %, industry 26 % and agriculture only 19 %. These figures imply a very low rate of labour productivity in agriculture coupled with an absolutely very large agricultural labour force as around 380 million people work in agriculture to produce barely one fifth of GDP.Footnote 3 These workers are not obvious candidates to immediately move to either sophisticated services provision or to high technology manufacturing. To reduce poverty India will need to create jobs in labour intensive production and distribution sectors to employ its vast army of unskilled workers using appropriate industrial and technology policies.

6.1 Industrial policy pre and post 1991

In the post-independence decades before the 1990s Indian industrial policy was highly regulatory in very broad terms. There was an industrial policy of ‘self-reliance’, with high tariffs on imports and strong restrictions on the extent of FDI through limits on foreign equity shares of company ownership. The entry of new domestic firms into many sectors was also controlled and the size of the firms that gained entry licences was often capped to avoid firms from getting too large. In some sectors only government-owned firms could operate. This policy of encouraging small scale private enterprise was a legacy of the thinking of Gandhi, who wanted small scale cottage industries to support incomes and employment in villages, so that the traditional way of life of rural populations was not decimated by migration to urban centres.

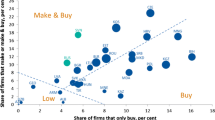

Since 1991 successive governments have recognised that these policies harboured inefficiency and also led to slow adoption of new technology in the majority of manufacturing sectors. A balance of payments crisis precipitated huge structural reforms with industrial policy being relaxed to permit more competition. The reforms of 1991 in India can be characterised as embodying both liberalisation and privatisation (Panagariya 2008). Even so a considerable number of strategic sectors especially those relating to minerals were reserved for state operation and not all consumer goods sectors were freed from stringent regulation. A detailed study of the changes in Indian firm populations since these reforms has been conducted by Alfaro and Chari (2012).Footnote 4 These authors compare the changing populations in the still regulated sectors with the deregulated industries. They show that as expected there was a surge of new firm registration in the newly liberated sectors leading to a greater presence of small firms in these sectors and to a better allocation of resources than in the previous regime. Even so, the dominance and growth of large incumbent firms was not challenged and they characterise the resultant size distributions of firms as a situation of the ‘missing middle’ in Indian manufacturing. Their study observes firms from 1991 to 2005 and they suggest there must be other factors inhibiting the growth of smaller firms over this period.

6.2 Cost competitiveness

One question to ask is whether middle-sized firms have faced rising labour costs that have disadvantaged their growth. Any changes in wages relative to actual or potential international competitors can lead to adverse consequences for domestic production and export. Certainly there have recently been fears that rising wages in China could be contributing to the slowdown in its growth. In a study of relative wages worldwide Ashenfelter (2012) gives us the data needed to compare India’s wage level and rates of wage inflation with several other emerging countries and with those of advanced countries. The author develops a methodology for evaluating labour costs using the wage for a standardised type of labour producing an identical product in many countries. This measure is free from biases that arise if either the worker or the product differs in quality. Ashenfelter’s calculations of real wages take account of differences in prices in each country as the real wage is expressed as the worker’s ability to buy their standardised product and reflects productivity in the workplace.

Over the growth period of the world economy from 2000 to 2007 Ashenfelter demonstrates that real wage rates in Russia, India and China rose during this period.Footnote 5 These rises were of the order of 9 % per annum in China and 8 % per annum in India and were considerably higher in Russia. Even so, as shown in Table 1, by 2007 Indian nominal wage rates remained very much lower than those in other emerging countries and were around one sixteenth of those in the developed US. More importantly the real wage in India (after adjusting these nominal wages for productivity) was still only about one seventh of that in the US. In addition, whereas real wages were still rising in China and Russia over the depression years 2007 to 2011, those in India were falling slightly and remained broadly constant in relation to the US. Thus in terms of its cost of labour India appears to have remained very cost competitive up to the present.

One reason why wages in India have remained low is the vast army of low skilled workers within its adult population. While India has more than 37 million graduates, seemingly an absolutely large number when compared with the populations of many European countries, these form quite a small percentage (close to 7 % overall) of the literate population, 55 % of whom gained education levels no higher than primary level and a further 30 % of whom reached only middle or secondary school (see Table 2).

Of course there are other factors affecting costs besides wages and human capital. India is renowned for its erratic electricity supply, poor road systems and old fashioned ports that often predate containerisation. Manufacturing processes are strongly inhibited by frequent interruptions to energy supply as it is harder and costlier to use alternative energy sources than in computer-based production of services output, where temporary power interruptions can be covered by generators or batteries. Poor physical transport services also affect exports of tangible manufactured products much more significantly.

6.3 Science and technology policy

The evolution of science and technology policy in India over the last 40 years shows considerable changes in attitudes and ambitions. From 1970 to 1990 in respect of technology the aim was to develop a degree of self-sufficiency in parallel with the objectives for production. The Patent Act 1970 favoured innovation in basic necessities, with protection limited to processes only—not products—in food, chemicals and pharmaceuticals, and in these sectors patent duration lasted only 7 years as compared with 14 years for other products.

After 1994 the WTO membership and the TRIPS Agreement eventually forced changes in India’s IP regime. India signed TRIPS in 1994 with an obligation to comply fully by 2005, but even then its IP law did not change quickly and patent law was only changed to give all products full protection by this deadline. The reforms to patent law due to TRIPS after the WTO was established in 1994 can be seen in the following table which indicates more rapid convergence to global norms in both Brazil and China (Table 3).

An advisory report for British businesses who were thinking of investing in India was commissioned by UK Trade and Investment (2008). This report describes the nature of IP rights as at that date in respect of copyright, patents, designs and trademarks and provides a useful comparison between Indian and UK rights. While there are some differences in the initial terms that can be applied for in each country, Table 4 shows the overall picture is of considerable similarity in the total permitted length of rights (with the exception of design rights which are only 15 years in India compared with 25 years in the UK). Application fees are however generally much lower in India. While fees are also not very high in the UK for the initial period, these escalate significantly in respect of patents and designs with their renewal for longer durations.

Was there an increase in innovation and patenting in India following TRIPS? Dutta and Sharma (2008) have investigated changing levels of R&D and international patenting by Indian firms during the period of implementation of the TRIPs agreement. The analysis was based on a panel of Indian firms from 1989 to 2005 during which, as noted above, the strength of IP protection in India increased more than threefold. To avoid confusion with trends that might anyway have happened due to the liberalisation of industry and trade regulations, these authors compare the rates of growth of R&D and international patenting by firms in different industries that are ranked according to their initial innovation intensiveness. Their reasoning is that firms in those sectors with higher initial innovation intensity, and better standards of IPR protection and enforcement, will be the most responsive to the changes wrought by accession to TRIPS.

To classify industries Dutta and Sharma use an exogenous measure of industrial R&D intensity (R&D to sales) drawn from evidence the US in the years immediately prior to the TRIPS agreement of 1990-94. Their reasoning for doing this is to observe the technological nature of each industry when faced with a fully operational system of IPRs. They find that Indian firms in the more innovation intensive industries increased their R&D spending after TRIPS much more than firms in other sectors. For a firm in an industry that is one standard deviation above the mean level of innovation intensity, they estimate the rise in annual R&D spending to be 20 % points higher. Dutta and Sharma also test whether the rate of international patenting by Indian inventors rose relative to developed countries where TRIPs involved relatively minor changes to IP laws. Their find a relative increase in the number of patents by Indian nationals applied for in the US after TRIPS. All this suggests an improvement in innovation and the use of IPRs in India’s high technology sectors.

A recent paper by Ambrammal and Sharma (2014) explores in detail the R&D incidence, expenditure and number of Indian patents acquired by a sample of high and medium high technology Indian firms observed from 1995 to 2010. Within their sample they classify as ‘foreign’ any firm that has more than 10 % of its equity in foreign hands. While this seems a trifle drastic, it serves to distinguish wholly Indian firms from those with some degree of foreign ownership. They find that this foreign ownership measure and the increasing patent protection occasioned by TRIPS have both been important determinants of rising R&D and patenting over this period, indicating a difference of perceived opportunity of the tightening IPR regime by firms with at least partial foreign ownership.

6.4 Existing technology strengths

Among India’s leading technology sectors there are several that use a variety of IP rights. Indian capability in pharmaceutical production was developed before TRIPS when the Indian patent system had a limited range of coverage in pharmaceuticals, protecting only process but not products. Early success ensued in developing capability for both bulk drugs and formulations for delivery to patients during the 1970s to 1990s patent regime, when protection for process innovations focused attention on finding non-infringing methods of producing patented formulae as well as generics for expired foreign patents. By 2010 India’s volume was 10 % of global production and in value terms India ranked 14th in the world.

Once India adopted a broader patent regime under TRIPS it was expected that the Indian firms might become more involved in the development and marketing of drugs for the diseases of the poor. But as pointed out by Hassam et al. (2009) the Indian pharmaceutical sector has recently become more focused on developed country markets and, as Ray and Bhaduri (2012) have warned, world competition is increasing. Even so, India still plays a significant role in supplying preventative vaccines to poor countries. The formation of the Global Alliance for Vaccines and Immunisation (or GAVI Alliance) in 2000 has rapidly increased the volume of vaccines being delivered to poor children worldwide. A press release from the group on 18th April 2013 announced that an Indian firm, Biological E Ltd., has agreed to supply a composite vaccine against five diseases (pentavalent vaccine) for a considerably lower price than hitherto making it likely that volumes will increase further as health budgets stretch further.

A second area where India has strong technology and production capacity is that of developing wind turbines. India is largely reliant on imported fuels for creating energy and it badly needs to develop its own energy sources using green technologies. Lewis (2007) found that while the leading producers in India and China both initially obtained the basic technology by licensing, they also made substantial technical advances in a short time. Further, she argues that the leading Indian firm, Suzlon, enhanced its capacity for technology transfer by establishing a network of strategically positioned global subsidiaries. Even so, China has shown a capacity for overtaking India as by 2009 two companies Goldwind and Sinovel ranked above Suzlon in the top 10 world producers and a third Chinese firm, Dong Fang, was just behind (de Rassenfosse et al. 2013, Table 8).

In addition to these high technology strengths Indian manufacturers, such as the Tata car maker, often feature in examples of frugal innovation. Tata has grown to become an Indian MNE, taking over Jaguar and Land Rover in UK. At the same time this company developed and produced the Tata Nano car using frugal engineering to produce ‘the cheapest car in the world’, which in 2014 was selling at $2500 for a 624 cc two-cylinder engine. Even this price is too high for many Indians, who still drive motorbikes costing much less. Given India’s very large poor population the question arises—is there enough spontaneous frugal innovation or could more be induced? We explore this issue below.

India’s production capacity in IT services is well known and its links with ‘Non-Resident Indians’ living in ‘Silicon Valley’ California are renowned, as is the ‘Bollywood’ film sector. Regarding software patents and media copyright, there are significant battles being fought between advocates of the open source approach and those trying to defend more traditional approaches to IP rights. The US and China are clearly two of the main protagonists in this field with conflict about control of counterfeit media products continuing.

6.5 Areas of weakness

Despite these reports of particular areas of success and of increased innovative activity and funding for R&D in the private sector, it is still the case that Indian private sector R&D is very low in relation to its GDP and finance for R&D remains dominated by government expenditure, a point earlier noted by Dutz (2007). Gross Expenditure on R&D (GERD) has not yet risen above 1 % of GDP (compared with rates of 2.8 % in South Korea) and shares of GERD are 80 % publicly financed compared with only 20 % privately financed. Government spending is concentrated in non-profit research institutes and universities. Whilst the amount of scientific publications by these bodies is extensive, the country’s patenting record is very weak both in volume and in quality terms as measured by citations. Thus we can characterize the Indian investment in R&D as being too focused on basic science and too little on creating new technology and providing a platform for commercial innovation. When we compare the indicators of intellectual property activity in China and India in recent years the difference is quite amazing as shown in Table 5 below.

The other notable area of weakness in India over recent decades has been the low volume of FDI that is invested in its industries. During the pre-1991 period of industrial policy, with its emphasis on self-sufficiency and small scale production, this policy actively discouraged inward direct investment due to strict rules restricting foreign ownership of Indian based firms (Balasubramanyam and Mahambare 2003). These authors (henceforth B & M) report that as part of the industrial policy reforms in 1991 there was a considerable relaxation of these restrictions but even then the historical reputation of India as a hostile environment for FDI has cast a long shadow.Footnote 6 By the end of the 1990s despite rapid growth the amount of FDI into India had reached only one twentieth of the amount flowing into China (B & M, Table 5). This position has changed in the period following 2000 and we discuss recent events below.

A study of Indian potential for innovation by the World Bank, edited by Dutz (2007), argued that India must proceed on two fronts. In addition to considering how India’s growth prospects can be enhanced by world leading innovations, this volume places great emphasis on inclusive innovation, which involves mainly the diffusion and absorption of existing knowledge, but is designed to improve the lot of the poor. A three pronged strategy was recommended by the Dutz Report (2007): these were increasing competition and improving innovation infrastructure; strengthening the creation and communication of knowledge; and fostering more inclusive innovation by scaling up existing pro-poor initiatives.

For their first strategy they proposed the promotion of stronger competition between enterprises by removing nonessential regulations, releasing bottlenecks of limited skills and training, improving IT connectivity and increasing early-stage funding from venture capital for start-ups. For the second strategy they argued it was necessary to bring more enterprises up to national best practices in technology adoption and also try to increase R&D spending by private enterprises. At the same time it was necessary to promote commercialisation of domestic knowledge by supporting technology transfer offices in universities and developing technology parks. To ensure inclusive innovation, existing pro-poor initiatives needed to be scaled up through existing and new agencies, noting that the Council of Scientific and Industrial Research had already achieved successful rural technology applications and the National Innovation Foundation had a large repository of grassroots innovations and traditional knowledge. They also recommended that a cheaper intellectual property regime should be devised by an IP rights think tank.

7 Indian innovation policy since 2007

What has been happening in the last few years—have any of the Dutz recommendations been implemented to encourage the process of successful technological transformation? In assessing the actions of policymakers we shall be mindful that there are four avenues through which this can be achieved: (a) domestic innovation in the front line of world technology, (b) technology transfer from abroad, (c) frugal or Jugaad innovation, (d) diffusion of new technology to a wider range of users.

In 2009, the decade of 2010–2020 was declared the ‘Decade of Innovation’ by the Indian government, adopting this label after a speech by the President. A National Innovation Council was set up in 2010 charged with charting the way forward. Even so it took a further 3 years for the emergence of a new Science, Technology and Innovation Policy Statement to be published by Government of India (Ministry of Science and Technology 2013). This document begins by recognising ‘India has hitherto not accorded due importance to innovation as an instrument of policy.’ It determines that in future STI Policy should be ‘A New Paradigm of STI for the people’. It focuses on the integration of each of science, technology and innovation to create social good and economic wealth, and recognises Indian society as its major stakeholder. These are clearly good intentions, but how to make them work? Unfortunately this document was silent on what particular policies would be implemented.

The new Modi government has been more specific about monitoring the IPR system which is one key plank of STI policy. It set up an IPR Think Tank in October 2014 that is responsible for advising government in following areas:

-

1.

drafting a National IPR Policy,

-

2.

identifying areas in IPR where study is needed,

-

3.

explaining the implications of demands placed by negotiating partners,

-

4.

examining IPR legal cases impacting upon India’s IPR Policy,

-

5.

identifying best practices for Trademark Offices, Patent Offices, etc., dealing with IPR, to create an efficient and transparent system,

-

6.

reporting on best practice followed in foreign countries,

-

7.

highlighting anomalies in present IPR legislations,

-

8.

improving infrastructure in IP offices and Tribunals,

-

9.

responding to current issues raised by industry associations.

As Mani (2014) notes, India already has a well-developed IPR policy that evolved after lengthy debates during the implementation of TRIPS. Nevertheless there is a lot to be gained from ensuring that the system of processing applications for IPRs works as efficiently as possible while remaining within the terms allowed by TRIPS.

7.1 IPR issues under debate in India

There are several options that are allowed under TRIPS that have already been the subject of debate. The first is whether or not to introduce a ‘utility’ patent. This would have a shorter period of protection (often 10 years) than a full patent and be subject to less rigorous examination of novelty. It is seen as useful for protecting minor innovations by smaller firms. So far India does not have this, but many countries including China do have utility patents. Another allowable procedure under TRIPS is that of compulsory licensing for public interest reasons, e.g. if drugs are needed at a lower price to prolong the lives of those with life threatening illness. Indian courts have made some judgements of this type and this favours the domestic pharmaceutical industry but is of course unpopular with international firms holding the relevant patents.

A further source of debate is India’s restrictions to the coverage of its patent system. For a patent to be granted Indian authorities insist on a significant inventive step.Footnote 7 This prevents foreign firms from prolonging existing patents by patenting new variants that are very similar to existing products. The Office of the Controller General of Patents, Designs and Trademarks (2014), India, issued Guidelines for Examination of Patent Applications in the Field of Pharmaceuticals in October 2014. It contains very specific reference to the limits: “Section 3 specifies that the following are not patentable inventions within the meaning of the Act:” A long list of exclusions follows including in Section 3 (d): “the mere discovery of a new form of a known substance which does not result in the enhancement of the known efficacy of that substance or the mere discovery of any new property or new use for a known substance…..” The Office of the US Trade Representative has continued to pressure India by listing it on ‘Priority Watch List’ of countries with “serious intellectual property rights deficiencies” (Mani 2014). India’s requirement of significant inventive step in pharma is thus a continuing source of controversy with the US.

7.2 Domestic innovation: the science base

There has been growing recognition within India that the relatively strong public science sector has not been generating positive spillovers leading to new enterprise formation in the private sector. A Bayh Dole style act—‘The Protection and Utilisation of Publicly Funded Intellectual Property Bill 2008’—was drafted, but caused so much controversy that it has still not yet been passed into law (Ray and Saha 2011). This draft bill goes beyond the US act as includes patents, trademarks and copyrights. It envisages that researchers will have ownership of IP rights generated by their research (except in cases of national security), thus giving the university research team incentives to exploit any commercial potential of their scientific research findings. But it also places obligations on the researchers to set up their own IP management system and specifies they must not disclose any research findings before the relevant IP is in place (as this invalidates a potential patent). The new system would also set large financial penalties if the grantee does not comply with these rules and objectives.

The motivation for these legal changes could be inferred as being to increase licensing revenues for universities, to enhance the rate of technology transfer to industry and generally promote IP awareness in the scientific community. However it has attracted several types of criticisms: for example Sampat (2009a, b) was critical of this legislation as he argued that it risks inducing unnecessary IP that could be detrimental to potential users. Saha and Ray (2013)Footnote 8 argue that the motivation of academic researchers is not matched by the incentive structure assumed in this act. In their study they find that interest and productivity in research rises over the length of careers and is thus driven by a consumption motivation, not by an investment approach which would imply greater interest by younger workers.

7.3 Picking winners: A future in nanotechnology?

In many countries there have been attempts to pick future winners and back them with public investment and India is no exception. In India’s case there was sustained investment from 2001 of publicly funded R&D in the field of nanotechnology, documented by CSIR-NISTADS (2012a). The rate of investment was increasing in recent years with much more being spent during 2007–2012 than from 2001 to 2007. The total spending of 973.4 crores (1 crore is 10 m rupees) was about US$180 m, with major investments being made by the Department of Science & Technology and the Department of Information Technology. In addition there were minor investments by the Central Manufacturing Technology Institute and the Indian Council of Agricultural Research. The research programme has created a complex web of relationships between regulatory bodies, R&D institutes (including universities), firms, NGOs and some international actors with centres of excellence in ten different locations across India.

What has this investment effort produced? According to a recent report (CSIR-NISTADS 2012b) there were very different degrees of success in the output of science publications, relevant patents, and commercial products. In terms of scientific papers the world country ranks by 2011 were: China, US, Japan, Germany, South Korea, India. Thus India was ranking 6th and had the fastest growth rate from 2001 to 2011, albeit from a low base. When looking at the citations of these papers however India ranks lower. For the top 1 % of cited papers India ranks 14th and for the top 10 % of cited papers it ranks 9th. This indicates that the country’s scientific output was not as much in the frontier domain as the simple volume indicator might have led us to believe.

Turning to patents, in respect of those taken out via the USPTO, the top six countries ranked by applications and grants in 2011 were as follows: US, Japan, South Korea, Taiwan, China, Germany. Here it is notable that South Korea which ranked only just above India in scientific papers is now up to third place, whereas India is not present in this ranking. A similar story emerges for commercial nanotechnology products, where the top five countries ranked in the Woodrow Wilson database of globally available products to 2011 were: US, Germany, South Korea, China, and Japan, each with significant numbers of products, whereas India had only two products recorded in this list. Thus so far India stands to make very little from either royalties derived from licensing patent rights or revenues from direct sales of nanotechnology based products despite large amounts of public scientific R&D investment.

7.4 Domestic innovation: the private sector

What are the prospects for increasing private sector R&D? Fiscal incentives for private sector R&D are already quite extensive and it is hard to see how they could easily be extended, unless to broaden some of the options away from certain selected sectors and allow all to benefit. At present policies include: 100 % write offs for current and capital expenditure on R&D; 200 % weighted tax deduction on expenditure in an approved in-house R&D facility in selected manufacturing sectors; also 200 % weighted deduction for privately sponsored research in national laboratories, universities and institutes of technology. For commercial R&D companies there is a 10 year tax holiday. Companies can use 40 % accelerated depreciation allowances on plant and machinery that is based on indigenous technology. Customs duty exemptions exist for imports needed for R&D and there are excise duty waivers for indigenous goods used for R&D. A further incentive to use IP is the existence of a 3 year excise duty waiver for specific goods developed by an Indian company or laboratory and patented in any two countries from among India, the US, Japan, or the EU.

If nevertheless there is a lack of willingness to invest in private R&D then we might ask is there a problem of absence of information? Helmers and Patnam (2012) examined the effects of a reform to corporate governance in 2003 that required some Indian listed firms to increase their board size, adding numbers of non-executive directors, thus often increasing their network size, while other firms were not affected. By comparing the R&D expenditures and patenting records of each type of firm, they found that wider networks induce both an innovative effect (increased R&D) and a strategic effect (increased rates of patenting). They conclude that shared directors serve as a channel for the transmission of information across companies.

7.5 Technology transfer from abroad

The Dutz report recommended expanding links with non-resident Indians (NRIs) as about 20 m Indians live abroad. We note that in California’s ‘Silicon Valley’ the nationalities of engineering and scientific workers are: 40 % from the US, 28 % Indian, 32 % all other. Clearly the Indian software sector has been hugely successful due to links from this San Francisco Bay Area to Bangalore. A detailed study by Lorenzen and Mudambi (2013) contrasting the Bangalore IT cluster and the Bollywood film industry of Mumbai claims that both of these successful Indian industries have benefitted from links with NRIs residing in the US and the EU areas. However they have done this in different ways and via contrasting linkages—in the case of Bollywood the key links were personal relationships with producers, directors, actors and film distributors. This is in sharp contrast with organisational pipelines for knowledge transfers via subsidiaries created by MNEs that were very significant in the Bangalore IT services sector. The question is can either of these patterns be replicated for other high technology sectors? Do any other geographical clusters of NRIs exist who share common interests in honing India’s high tech industry skills? If not then Indian firms will have to work harder to identify scattered Indian businesses abroad with which they may interact to enhance their innovation.

This issue has not been lost on the Indian authorities: following the High Level Committee on Indian Diaspora in 2000–2002, the Indian government set up the Ministry of Overseas Indian Affairs. Together with the Department of Science and Technology and the Ministry of External Affairs, this agency tries to monitor scientists and technologists based abroad who are non-resident Indians (NRIs) or persons of Indian origin (PIOs). It encourages this extensive overseas population to contribute to India’s needs for investment, technology, training and entrepreneurship. One focus for the future may be to identify some key strategic areas of R&D and assist firms in looking for the relevant overseas personnel—for example helping India to build on its capability in ‘green technology’ with the help of NRIs and PIOs.

As well as encouraging links based on ethnicity there are gains to be had from increasing the attractiveness of India to foreign direct investors. Malik (2015) has established (using Indian data) that there are productivity gains for all firms that supply their output to foreign-owned firms (backward spillovers) and further gains for high technology domestic firms when they operate in an industry in which foreign-owned firms are present (horizontal spillovers). Certainly the rate of inward FDI has been increasing over the last decade. A recent Annual Report of the Department of Industrial Policy and Promotion (DIPP) (see Government of India Ministry of Commerce and Industry 2014) reports annual inflows of FDI equity for 2013–2014 as US$24.3bn, an 8 % increase on the previous year. Compared with inflows of just US$2-3bn in the late 1990s reported by Balasubramanyam and Mahambare (2003), it appears that India has begun to shake off its reputation for shunning FDI. The Annual Report also notes that several international financial organisations and consultancies have recently rated India among the top three of desirable locations for FDI investment.

Recent policy changes are continuing to encourage inward investment by allowing foreign ownership of up to 100 % in a wide range of sectors. In 2012 the government relaxed its limitations on foreign ownership in multi-brand and single-brand retail, commodity exchanges, power exchanges, broadcasting, non-banking financial institutions and asset reconstruction companies. Yet the government had by then still not given up directing businesses—for example, if the foreign ownership in a retail proposal went above 51 % then the business was required to source at least 30 % of the value of sales from India’s small village industries and craftsmen.Footnote 9

In September 2014 the new Modi government launched a strong appeal to foreign investors to invest in Indian manufacturing and services by launching its ‘Make in India’ campaign (see http://www.makeinindia.com). This website contains detailed information about existing production and investment opportunities in 25 sectors as well as listing a number of general initiatives including significantly reducing the bureaucracy surrounding setting up in business in India. For each sector there is a clear statement of the FDI policy relating to permitted shares of investment, routes for project approval, and other issues such as repatriation of profits. In 19 sectors the new provisions allow automatic approval for projects with up to 100 % FDI for some or all products, which represents a very considerable degree of relaxation of earlier rules. Even so, there is still a significant list of products, including parts of aviation, defence, media, mining, oil and gas, and space, in which shares of foreign ownership are still very restricted, in some cases to zero. The scheme includes ambitious plans to improve basic transport, IT and energy infrastructure while creating a series of ‘Smart Cities’ along a Delhi–Mumbai Industrial Corridor in the North West of the country, covering a distance of about 1500 km and involving six states.

7.6 Frugal or Jugaad innovation: assisting small enterprises

The Jugaad innovation (frugal innovation) tradition certainly exists in India and can be extended and developed. One of the earliest recognitions of the potential of this type of innovation was the Honey Bee project. This was a network set up 1986–1987 by Prof. Anil Gupta at Indian Institute of Management, Ahmedabad, as an online creative commons for Jugaad innovations. The aim was to seek out inexpensive new designs that are pro-poor, preferably use green technology and then help to spread the knowledge of these across India to expand their use. This initiative was adopted by the government after more than a decade.

The National Innovation Foundation (NIF) was established in 2000 in Ahmadabad using government funds with Honey Bee as a partner. This is reported to have a repository of more than 200,000 grassroots innovations and records of traditional knowledge practices. The Foundation aims to assess the commercial potential of such innovations and develop IP rights for inventors. It then offers prospects for matching ideas to venture capital. But the NIF has been criticised for being too slow and adding costs to inventions so that they fail in the market place.Footnote 10

Spreading the ability of individuals and small entrepreneurs to participate in the modern innovative economy is a prerequisite of increasing frugal innovation. Today a major initiative is in progress to include poor members of the population in the modern economy by the awarding of identities to those who may have no record of their birth. The Unique Identification Authority of India (UIDAI) commenced in 2010 and is headed by Chairman Nandan Nilekani. This programme is making progress towards each citizen having a 12-digit ID (or AADHAAR) with their photo, iris scans and fingerprints being electronically recorded. According to the Chairman, by April 2013 around 270 million people had already been registered on this scheme.Footnote 11 As of today (16/02/15) the official website records 766 million registrations. While the immediate focus of the scheme is to make it easier for individuals to claim benefits or engage in simple contracts, ultimately this should also make it easier for any citizen to register their ownership of any small designs or inventions that they create, to register a trade mark for their business, or to engage in licensing technology.

The Dutz report (2007) posited that there was a pressing need to change the education and skills of rural and urban poor so that they can work with and adopt innovations. This is another area in which the Indian government has already made some attempts to change the status quo. There is recognition that the Indian labour market is highly polarised with its large absolute number of graduates and a much larger number of very unskilled people and the education system has continued to supply too many academic courses and too few vocational courses that would permit middle ability people to fill jobs in manufacturing or services. In 2008 the National Skills Development Council of India was set up to promote vocational education and training. The NSDC works in partnership with private for-profit training enterprises, but it faces a massive skills deficit in the country. A report by the National Sample Survey Office (2013) analysing data for 2009–2010 showed very low rates of formal vocational training received by both young people entering work (2 % for ages 15–19) and the existing total stock of workers (1.6 % for ages 15–59). Adults were more likely to have trained using informal methods—classed as hereditary learning, self–learning and learning on the job. Even so, the total having ever received any training in the 15–59 age range was below 7 %.

One difficulty in making plans for assisting small enterprises (SMEs) is that until now there has been very little information about their innovation activities. The first need is thus to document domestic innovation by SMEs and see what use, if any, these firms make of IP and what factors constrain their innovation. If it is found that they lack knowledge about IP then it would be appropriate to pursue strategies for enhancing frugal innovation by offering education and training to managers of SMEs and encourage them to use IP and technology markets.

Here again the Indian government has perceived this need and has gone ahead with generating new information. A novel database of innovation for micro and small or medium enterprises (MSMEs) has been collected and is currently being analysed. The survey covers production units in Agriculture, Industry, and Services, using the factory or production site as the unit of analysis. This sample survey uses as its basis the Annual Survey of Enterprises (running since 1960) covering all factories/production units employing more than 10 workers if working with power or more than 20 without power. It was rolled out nationally in 2011 to 31 states and union territories (such as Delhi).

The survey is an advance on our ignorance but is not perfect as of course the smallest micro firms are not in this sample. Also confusingly the preliminary reports refer to ‘firms’ whereas these data refer to establishments, not all of which may be independent (see CSIR-NISTADS 2011–2012). The sample is skewed towards industry, especially to manufacturing, which makes it less than perfectly representative of employment, but usefully so, as it is manufacturing that is seen as a possible engine for future growth. The study surveyed 9001 reporting units in 2012 using a wide questionnaire. In all three sectors the majority of reporting units employed fewer than 100 workers: Agriculture 93 %, Industry 89 %, Services 97 % (see NSTMIS 2014 Annexure II Figure 4).

The definition of innovation is broadly drawn for this survey. ‘Innovation’ can be the development of a new product, a new process, a change in product quality or standards, more efficient input use, use of alternative materials, use of new machines, or of some other type. Importantly for economic analysis the survey does ask respondents to distinguish ‘new to firm’ (which would qualify as catching up or diffusion) from ‘new to market’ (which identifies economic innovation), but so far this distinction appears not to be tabulated frequently in the preliminary reports. Due to the broad definition of innovation allowed, the share of ‘innovative firms’ (actually establishments) reported in the sample is high at approximately 35 % overall. This percentage varies by state from highs of 56 % in Andhra Pradesh and 54 % in Delhi, to lows of 13 % in Gujarat, and 8 % in Bihar (see NSTMIS 2014 Table 9.1). It varies by sector from 50 % in motor vehicles to 20 % in crop production.Footnote 12

8 Conclusions

So far in this review we have seen that several important preconditions are in place for India to develop as a rapidly growing innovative economy. Evidence relating to the changes induced by the TRIPs agreement points to India having an appropriate system of IP rights in place, permitting the licensing of overseas inventions and stimulating both inward FDI and domestic innovation. Recent policies to loosen the grip of government regulation on industry that had previously been inhibiting inward FDI, the promotion of links with non-resident Indians, and the increased investment in energy, infrastructure and vocational training all appear to be improving the capacity of the economy to provide income and jobs, at least to urban populations. Even so, there are several areas where the innovation and diffusion systems still appear to be failing and there have been few changes since these problems were identified by the Dutz report of 2007.

The most obvious difficulties are in the following areas:

-

insufficient spillovers from publicly funded science to private industry,

-

low volumes of private sector investment in R&D,

-

low levels of patenting relative to other emerging countries,

-

problems with scaling up Jugaad innovation to share benefits across small enterprises.

There is clearly a need for new research by academics and government statistical agencies to investigate the continuing causes of these weaknesses and draw out recommendations for new policies.

To improve the science–industry interface Dutz (2007) recommended support for technology transfer offices (TTOs) in universities and the creation of technology parks and incubators. Bhattacharya (2005) outlined the management of one successful TTO in Delhi (indicating there were only seven more at that date) and touched on how government can help such offices. Policies to support TTOs might find more support in the science community than the blunt instrument of a ‘Bayh-Dole-plus’ law that has been under discussion to pressurise individual academic researchers into obtaining patents on their scientific discoveries and manage their own licensing.

Low rates of patenting lead to the question: does the IP system function effectively to protect IP rights in India? An area for useful research by the new IP Think Tank would thus be to explore IP enforcement issues by surveying firms to examine whether the law is enacted in a way that supports IP rights owners. The recent National Innovation Survey should yield some results on what factors enhance the probability of technology adoption and innovation, leading to a better understanding of how small enterprises currently manage these processes. On sharing Jugaad innovation, a review of the work of the National Innovation Foundation commissioned by either the National Innovation Council or the IPR Think Tank would also be appropriate to assess its successes/failures and determine if it can become more effective.

A partnership between academic researchers in the field of the economics of innovation and intellectual property and the Indian statistical authorities could also yield a lot of information for the design of future policy. Database development for analysing the impact of patents, designs and trademarks on firm performance within India could be achieved by matching domestic and international records of these IP assets to financial data for firms. Helmers and Patnam (2012) and Ambrammal and Sharma (2014) have demonstrated this is possible for patenting by firms that are recorded in the PROWESS large firm database. What is now needed is a concerted effort to monitor the use of patents, trademarks and designs by these large firms and also by MSME enterprises in the new innovation survey. In this way it will become possible to explore firm survival and profitability in relation to IP use and innovation once several years of data have been created.

Notes

Countries also send young people for higher education abroad to take courses involving business and engineering placements in the host country, where they hope to learn about best practice technology.

Clark et al. (2011) note that the majority of these studies were conducted on data that were by then 10–20 years old.

The total population is 1.2bn and the share of population aged 15–60 is close to 62 %, of whom 51 % work in agriculture.

See Alfaro and Chari (2012) Annexes I and II for the lists of reserved and restricted industries.

See Ashenfelter (2012) Tables 3, 5, 6 and Figure 10 for the evidence quoted here.

Balasubramanyam and Mahambare (2003), report that the principal changes in the foreign investment regime included automatic approval of FDI up to 51 % of equity ownership by foreign firms in a group of 34 technology intensive industries, a case by case by consideration of applications for foreign equity ownership up to 75 % in nine sectors, mostly relating to infrastructure, and the streamlining of procedures relating to approval of investment applications in general.

Moir and Hsu (2013) have argued strongly that this is the optimal design of patents for developing countries to ensure that their patent system does not become a tool for incumbents to suppress competition.

Revised version of Saha (2011)

Note that this could intensify the spillovers identified by Malik (2015), so even if such a local content policy slightly discourages FDI there may be compensation in regard to the productivity growth of domestic firms.

Nandan Nilekani interviewed by Peter Day on the BBC Radio4 programme ‘In Business’ on April 18, 2013.

References

Acharya S, Mohan R (2010) India’s economy: performance and challenges. Oxford University Press, New Delhi

Alfaro L, Chari A (2012) Deregulation, misallocation and size: evidence from India. Harvard Business School working paper 13-056, December

Ambrammal SK, Sharma R (2014) R&D and patenting by firms in Indian high- and medium-high-technology industries. J Chin Econ Bus Stud 12(2):181–207

Arora P (2011) Innovation in Indian firms: evidence from the pilot National Innovation Survey. ASCI J Manag 41(1):75–90

Ashenfelter O (2012) Comparing real wage rates. NBER working paper 18006, April

Balasubramanyam VN, Mahambare V (2003) Foreign direct investment in India. Lancaster University Management School, working paper 2003/001

Bhattacharya P (2005) Technology transfer from a technical university: a case study of IIT Delhi. J Intellect Prop Rights 10:413–416

Chen Y, Puttitanun T (2005) Intellectual property rights and innovation in developing countries. J Dev Econ 78(2):474–493

Clark DP, Highfill J, de Oliveira Campino J, Rehman SS (2011) FDI, technology spillovers, growth, and income inequality: a selective survey. Glob Econ J 11(2)

CSIR-NISTADS (2011–12) Understanding innovation: the Indian context. Bulletins relating to the Innovation Survey, Nov., June, Aug., Oct

CSIR-NISTADS (2012a) Nanotechnology development in India: investigating ten years of India’s efforts in capacity building. Strategy paper I July

CSIR-NISTADS (2012b) Nanotechnology research and innovation in India: drawing insights from bibliometric and innovation indicators. Strategy paper II, July

de Rassenfosse G, Dernis H, Guellec D, Picci L, van Pottelsberghe de la Potterie B (2013) The worldwide count of priority patents: a new indicator of inventive activity. Res Policy 42:720–737

Dutta A, Sharma S (2008) Intellectual property rights in developing countries: evidence from India. World Bank working paper 47524

Dutz M (ed) (2007) Unleashing India’s innovation: towards sustainable and inclusive growth. The World Bank, Washington DC

Government of India, Ministry of Commerce and Industry, Department of Industrial Policy and Promotion (2014) 2013-14 annual report, chapter 9 foreign direct investment. http://dipp.nic.in/English/Publications/Annual_Reports/AnnualReport_Eng_2013-14.pdf

Government of India, Ministry of Science and Technology (2013) Science, Technology and Innovation Policy 2013, New Delhi

Hassan E, Yakub O, Diepeveen S (2009) Intellectual property and developing countries—a review of the literature. A Rand Europe report for UK Intellectual Property Office and UK Department for International Development

Helmers C, Patnam M (2012) The effect of corporate networks on innovation and patenting: evidence from India. Working paper Universidad Carlos III de Madrid, January

Kanwar S (2012a) The location of overseas research and development and intellectual property protection. J Dev Stud 48(10):1453–1469

Kanwar S (2012b) Intellectual property protection and technology licensing: the case of developing countries. J Law Econ 55(3):539–564

Leonard P et al (2009) The economics of intellectual property rights and climate change; a position paper of the London Intellectual Property Institute, sent to the Copenhagen meetings on Climate Change, November

Lewis JI (2007) Technology acquisition and innovation in the developing world: wind turbine development in China and India. Studies in comparative international development, vol 42, numbers 3–4, issue entitled “Greening development: the role of the developing-country private sector”

Lorenzen M, Mudambi R (2013) Clusters, connectivity and catch-up: Bollywood and Bangalore in the global economy. J Econ Geogr 13(3):501–534

Malik SK (2015) Conditional technology spillovers from foreign direct investment: evidence from Indian manufacturing industries. J Product Anal 43(2):183–198

Mani S (2014) Doesn’t India already have an IPR policy? Econ Polit Wkly XLIX (47):10–13

Maskus K (2010) The curious economics of parallel imports. WIPO J 2(1):123–132

Moir H, Hsu P-K (2013) Tailoring patent policy for developing countries. Paper presented at 4th Asia-Pacific Innovation Conference, National Taiwan University, Taipei

National Sample Survey Office (2013) Status of education and vocational training in India, Report No. 551, March

NSTMIS (2014) Understanding innovation: Indian national innovation survey. Department of Science and Technology, Government of India. New Delhi

Office of the Controller General of Patents, Designs and Trademarks (2014) Guidelines for examination of patent applications in the field of pharmaceuticals, October

Panagariya A (2008) India: the emerging giant. Oxford University Press, New York

Park WG (2008) International patent protection, 1960–2005. Res Policy 37(4):761–766

Ray AS, Bhaduri S (2012) Competing through technological capability: the Indian pharmaceutical industry in a changing global landscape. JNU CSSP electronic working paper series, paper no. 3, September

Ray AS, Saha S (2011) Patenting public-funded research for technology transfer: a conceptual-empirical synthesis of US evidence and lessons for India. J World Intellect Prop 14(1):75–101

Saha S (2011) Drivers of university research and patenting in India: econometric estimation of a research production function. Proceedings of the Second Asia Pacific Innovation Conference, Singapore

Saha S, Ray AS (2013) Research and knowledge creation in Indian universities. March, revised version of previous item

Sampat BN (2009a) Academic patents and access to medicines in developing countries. Am J Public Health 99(1):9–17

Sampat BN (2009b) The Bayh-Dole model in developing countries: reflections on the Indian bill on publicly funded intellectual property. UNCTAD-ICTSD policy brief no. 5 October

Schumacher EF (1973) Small is beautiful: a study of economics as if people mattered. Blond and Briggs, London

Stewart F (1977) Technology and underdevelopment. Westview Press, Boulder

The Economist (2012) Schumpeter column: Asian Innovation, March 24th

The Economist Intelligence Unit (2011) World Pharma: Cheaper Jabs, June 8th, viewswire.eiu.com

The Economist Intelligence Unit (2015) India: economy expands by 7.5%. http://country.eiu.com

Thomson R, Webster E (2010) The role of intellectual property rights in addressing climate change: the case of agriculture. WIPO J 2(1):133–141

UK Trade and Investment (2008) Intellectual property rights primer for India: a guide for UK companies. HMSO June, London

Acknowledgments