Abstract

This paper investigates the impact of trade-related illicit financial flows (IFFs) on tropical deforestation. To adjust for pre-exposure differences in deforestation rates between countries exposed to IFFs and their counterfactuals, this study adopts propensity score matching and doubly robust weighted regression estimators. The results suggest substantial increases in forest loss in countries exposed to large IFFs. Specifically, the treated countries exposed to IFFs experience an annual increase in forest loss of approximately 10,344.167 hectares compared to their counterfactual controls. This finding is largely driven by macro-financial instability resulting from real currency depreciation and tax revenue losses due to illicit financial outflows. The results highlight the merit of capital controls and state ownership of assets in mitigating the impact of exposure to IFFs on forest loss.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Achieving sustainable development requires non-declining per capita wealth, where wealth is defined in the broadest sense to include both (hu)man-made capital and natural capital (Arrow et al. 2003). In essence, the neoclassical model predicts that capital flows where it is scarce because capital-scarce countries have a higher rate of return to capital than capital-abundant rich countries. Yet, prevailing economic rationality in low-income countries is far from encouraging an inclusive wealth accumulation pattern, and it actually propels illicit financial outflows, leading to grave sustainability concerns (UNCTAD 2020). The compensation of these financial outflows to sustain wealth accumulation might put unprecedented stress on the natural world.Footnote 1This study weighs on this argument and presents the first plausible causal evidence of the impact of rising illicit transactions on deforestation.

Over the last decades, tropical deforestation has reached critically high levels, with as much as 1.48 million km2 being cleared between 2001 and 2020 (Balboni et al. 2023a, b). This pattern of deforestation has been considered a significant cause of the biodiversity extinction crisis, climate change, human health, and food insecurity (Berazneva and Byker 2017; Lawrence and Vandecar 2014; Li et al. 2022a, b). Much of the early empirical economics research on tropical deforestation addresses a broad set of macroeconomic forces, including GDP, population growth, access to infrastructure, commodity trade (Amelung 1993; Barbier 2001; Barbier and Rauscher 1994; Carr et al. 2005), institutional and political factors (Araujo et al. 2009; Ferreira 2004; Mendelsohn 1994), and microeconomic and social behaviors (Angelsen and Kaimowitz 1999; Ehrhardt-Martinez 1998; Sunderlin et al. 2005) related to tropical deforestation levels. In the paradoxical setting of capital scarcity stemming from illicit outflows, one should question whether low- and middle-income countries make up the gap in their wealth accumulation through land use intensification.

As a foundational definition, illicit financial flows (IFFs) refer to illegal movements of money or capital from one country to another as a result of some factors such as corruption, crime, terrorism, tax evasion, abusive transfer pricing, and tax abuse (Global Financial Integrity 2019). As of 2020, according to the Global Financial Integrity (GFI) estimates, IFFs from developing countries totaled as much as 1–1.6 trillion dollars annually (Vanya 2023). The GFI attributes these financial flows to the engagement of developing countries in various forms of trade with developed economies (Global Financial Integrity 2019). With the interaction between trade openness and natural resource depletion, such as deforestation, evidenced in the literature (Abman and Lundberg 2020; Franklin and Pindyck 2018), there will likely be a positive relationship between IFFs and deforestation.

An inherent empirical challenge in identifying the effect of IFFs on deforestation is how to deal with selection bias and, more generally, the endogeneity of illicit financial flows. For example, because revenues from natural resource exploitation can finance illicit financial flows (Ndikumana and Sarr 2019), one may observe a substantial outflow of capital from natural resource-rich countries, making the exposure to IFFs endogenous through the selection bias problem. A significant part of the association between IFFs and deforestation can be explained by the over-reliance of low-income countries on natural resource wealth responsible for the financial resource curse (Beck 2012; Kassouri et al. 2020; Kinda et al. 2016). This is a severe form of selection bias, which means that the economic rationality in low-income countries may subject them to IFFs. Exposure to IFFs is likely influenced by unobservable characteristics that may be correlated to the outcome of interest (deforestation). Another identification concern is that unobserved changes and confounding correlated factors in local governance of forests, land tenure security, international partnerships, and institutions can be correlated with IFFs and deforestation, making it challenging to identify the causal effect of IFFs on deforestation.

To address the sample selection bias and determine whether IFFs cause increases in deforestation, it is essential first to identify countries exposed to larger IFFs and establish plausible counterfactuals against which one can compare subsequent changes in deforestation. This study relies on matching methods to tackle these two steps. The research design begins by identifying countries that experienced a significant and sustained increase in IFFs (the treatment), and later, I use a wide range of covariates to match these countries to a set of countries that were not treated to construct a plausible counterfactual or matched controls for each country. This identification strategy uses inverse probability weighting to create matched control groups. It uses a doubly robust weighted regression estimator to recover the average treatment effect on the treated (ATT).

Using satellite-derived deforestation and forest loss estimates across 60 tropical countries and data on illicit financial flows from 2009 to 2018, I report significant deforestation and forest loss increases in response to sustained exposure to IFFs. Reassuringly, this result is robust to various robustness checks, pre-trend, falsification, and placebo tests. I also demonstrate that the observed evidence is driven by macro-financial instability from IFFs exposure. Specifically, I document the influence of exchange rate misalignment, credit constraints, and limited tax revenue as potential channels through which sustained exposure to IFFs can impact deforestation.

Several empirical studies investigate the relationship between different forms of human-made capital and deforestation (Combes et al. 2018; Culas 2006; Galinato and Galinato 2016; Kahn and McDonald 1995). For example, Gullison and Losos (1993) demonstrate that economic deterioration linked to large foreign debt is likely to increase the use of marginal lands and cause deforestation. In the same vein, several authors argue that debt increases deforestation (Codjoe and Dzanku 2009; Culas 2006; Inman 2008; Marquart-Pyatt 2004; Zagonari 1998), while others find no evidence of the relationship between debt and deforestation (David et al. 1995; Neumayer 2005). Using funds transfers by migrants, Duval and Wolff (2009) document that remittances significantly decrease deforestation in developing countries. The following studies (Afawubo and Noglo 2019; Li et al. 2022a, b) cover similar effects of remittances on deforestation. Papers in related fields explore how access to human-made capital through government expenditure, foreign investments, and access to credit can affect deforestation rates. Combes et al. (2018) use theoretical models and empirical investigations to demonstrate that public spending and domestic credit fuel deforestation rates in developing countries. Similarly, AssunçAssunç et al. (2020) show that access to credit can lead to clearance activities in Brazil. As a critical source of human-made capital to boost economic development in low-income countries, foreign direct investments can lead to severe environmental costs with adverse consequences on forest stocks (Brack 2014; Li and Yan 2016). The present study advances the ongoing literature by providing the first evidence of how capital outflows can shape forest conditions in developing countries.

This study also builds on the literature examining the relationship between criminal activities and deforestation. It is well established that illegal logging constitutes the critical driver of deforestation in the tropics (Blum et al. 2022; Rajão et al. 2020). It represents nearly 90% of total deforestation in Central Africa (Alemagi and Kozak 2010; Lawson 2014), and around 60 and 80% in the Amazon (Boekhout van Solinge 2013). As documented in Bolton (2020), illegal logging can occur through various means, such as falsifying logging permits, logging outside of allowances, laundering illegal timber, and intermingling legal and illegal timber during transportation. Corrupt officials and criminal networks frequently participate in these activities, using complex financial structures to transfer their illicit funds across borders, perpetuating a cycle of illegal financial flows and deforestation. This study differs from previous ones as it explicitly explores the trade and economic dimensions of criminal activities captured by IFFs and their implications for conservation.

Overall, estimating the causal impact of exposure to IFFs on deforestation makes two critical contributions to applied economics and policy. First, this paper is important as it enriches the ongoing discourse on illicit finance by illuminating the challenges associated with the liberalization of capital flows within the context of conservation. Second, it provides a timely estimate of the impacts of financial crime on deforestation, a facet overlooked in earlier research. This is achieved by delving into an important policy-relevant dimension of transnational illicit transactions, IFFs, and by enhancing the causal understanding of IFFs in this context.

2 The Linkages between Illicit Outflows and Deforestation

The weak sustainability approach remains the prominent theoretical background to validate the relationship between illicit financial flows and deforestation. According to this approach, different forms of capital are substitutes: natural capital depletion can be used to replace the accumulation of human-made capital, leading to an unlimited economic growth perspective. Given that the depletion of natural resources is irreversible, it is evident that there are some limits to substitutability (Cohen et al. 2019; Drupp 2018).

Although there is no consensus on the degree of substitutability (Neumayer 2013; Quaas et al. 2020), the weak sustainability approach allows for substitution only when the total stock of different types of capital does not decline (Hartwick 1990). In the paradoxical context of illicit outflows, where it is difficult to maintain a critical level for all capital stocks, it is a moot point whether such outflows influence the stock of natural capital. Indeed, the decreasing level of human-made capital due to IFFs may lower the stock of natural capital, particularly in resource-abundant countries. This is driven by the comparative advantage that resource-abundant countries have in exploiting natural resources. Since these countries are not well endowed with different forms of human-made capital, there is a compelling comparative advantage for them to rely on the exploitation of natural resources to make up their capital gap due to illicit outflows.Footnote 2

While the sustainability discourse provides a valid theoretical background to empirically investigate the relationship between IFFs and deforestation, some analysts express concerns that environmental crimes, which encompass not just wildlife crime but also fuel smuggling and illicit mining of gold, diamonds, and other minerals and resources, account for 64% of illicit financial flows (World Atlas of illicit flows 2018). This is indicative that illicit outflows are largely fueled by environmental crimes such as illegal logging, illegal land clearing for mining or extractive activities, and illegal trade of forest commodities. Consequently, IFFs from developing countries can undermine the sustainability of global environmental commons, leading to serious sustainability threats. Given the environmental ramifications of IFFs, exploring the relationship between IFFs and deforestation remains a valid empirical question. Drawing on the preceding arguments, I introduce a broad discussion of potential mechanisms through which IFFs can influence deforestation by building the discussion around three primary mechanisms: credit markets, real exchange rate, and tax revenue.

First, IFFs can introduce instability and risks in the financial system, leading to the contraction of credit growth (Samarina and Bezemer 2016). Interest rate movements in response to the contraction of credits may reduce investments in intensive agricultural techniques that are less forest-consuming and discourage switching to clean cooking practices that conserve forest products (Combes et al. 2008). As evidenced by Berkouwer and Dean (2022), credit constraints prevent the adoption of energy-efficient cookstoves. In contrast, access to credit has a large positive effect on purchases of efficient charcoal stoves in Kenya. Jayachandran (2013) shows that liquidity constraints can hinder the success of conservation programs. The author demonstrates that in low-income countries with liquidity constraints, payments for ecosystem services (PES) can incentivize pro-environmental behaviors among forest owners to curb deforestation. However, if the payments are delayed compared to the compliance costs, credit constraints may hinder participation in the PES scheme. Another strand of the literature reveals that credit can be used to increase agricultural production by clearing forest areas (AssunçAssunç et al. 2020; Zwane 2007). Taking the positive and negative effects of credit on deforestation as plausible, it is likely that IFFs will shape deforestation activity via the credit channel.

Secondly, exchange rate misalignments may also be important in transmitting IFFs to deforestation activity. The extant literature shows that extensive financial outflows can lead to a depreciation of the domestic currency in the foreign exchange market, causing the value of local currency to decline relative to other currencies (Dornbusch 1976; Vos 1992). Similarly, the lack of financial resources to sustain economic development can push any nation into external borrowing, resulting in an unfavorable exchange rate position (Aizenman and Pasricha 2013). Concerning the relationship between deforestation and exchange rate, Arcand et al. (2008) show that the depreciation of the exchange rate by promoting exports can increase deforestation in least-developed countries. They argue that following the 50% devaluation of the CFA franc in 1994, heavy timber traffic increased in Gabon, Cote d’Ivoire, and Senegal. Similarly, the collapse of the Indonesian rupiah in 1997 boosted timber exports. Consequently, real exchange rate misalignments may be important in transmitting IFFs to deforestation activity. In the same vein, Damette and Delacote (2012) demonstrate that a large positive shock on the real exchange rate will likely increase the number of countries with high deforestation rates. Considering all these effects, it is reasonable to expect that exchange rate misalignments could be a valid transmission mechanism of the relationship between IFFs and deforestation.

Finally, it is well documented that exposure to IFFs may pose severe challenges for domestic tax revenue mobilization (Fofack and Ndikumana 2010; Ndiaye and Siri 2016; Ndikumana and Sarr 2019). Failure to accurately mobilize tax revenue can push public authorities in developing countries to increase deforestation revenues, i.e., from clearing forest land for perennial crops, exploitation of forest resources, and timber harvesting (Combes et al. 2015). Given the canonical fiscal identity of revenue causing expenditure, which means that raising tax revenues leads to more spending, it is likely that a poor mobilization of domestic revenue would reduce government expenditure in deforestation activities such as the construction of road and railroad networks, posing a severe trade-off between the expansion of government expenditure and land use changes (Damania et al. 2018; Deacon 2017; Galinato and Galinato 2016). Overall, considering tax revenue as a channel through which IFFs can affect forest losses will unpack the inconclusive evidence on the effect of tax revenue on deforestation.

In addition to the underlying mechanisms, the effects of illicit flows can be influenced by the ownership structure of capital and capital control policies. It is relevant to discuss the differential impacts of IFFs on deforestation and forest loss by considering the role of capital controls and state ownership of assets. The underlying intuition is very straightforward. I hypothesize that the restriction of the free flow of capital under strict capital control can reduce the probability of experiencing exposure to IFFs, which may thus affect the deforestation effect of the exposure to IFFs. Concerning state assets, different asset ownerships can play different roles in illicit financial practices. Several analysts emphasize the increasing role of multinational foreign corporations (private actors) in the natural resource sector in driving out capital from developing countries (Khanna 2017; Ndikumana and Sarr 2019; UNCTAD 2020).

On the one hand, it is rational to hypothesize that countries with greater state ownership over land and other financial assets may invest in strengthening legal frameworks, which can provide a framework to reduce IFFs. On the other hand, some predatory government authorities may use their positions and political pressures for personal interests, creating room for IFFs. Building on these arguments, one may claim state ownership of assets can either positively or negatively influence exposure to IFFs, resulting in a differential effect of the exposure to IFFs on deforestation.

3 Identification Strategy, Methodology, and Data

3.1 Identification Strategy

Before delving into the identification strategy of the causal effect of IFFs on deforestation and forest cover loss, it is worth explaining how I identify treated countries. This study operationalizes the treatment variable as any IFFs hike greater than or equal to the 50th percentile of the IFFs increase distribution for at least three consecutive years. There are two potential advantages of focusing on a sustained increase to define the treatment. First, forest conditions may lack responsiveness to short-lived, small-scale illicit financial flow changes, partly because of the opportunity cost of relying on deforestation revenues to compensate for short-lived IFFs. Second, the three-year window is used to characterize a prolonged or sustained increase, indicating the consideration of time-specificity to set out exposure to IFFs as an event.Footnote 3 Given that this study operationalizes the treatment as any sustained increase in IFFs, it is imperative to differentiate this approach from estimating a conventional linear relationship between IFFs and deforestation.

Having identified treated countries as those exposed to a sustained increase in IFFs, the biggest challenge to identify the causal effect of the exposure to IFFs on forest cover loss is to obtain a suitable control for untreated countries. Indeed, exposure to IFFs is not a random event. For example, it may depend on a country’s level of economic development, demographic structure, institutional quality, and macroeconomic characteristics. These factors, which can also drive deforestation, make the exposure to IFFs endogenous through the selection bias problem. Under such conditions, standard regression analysis will provide biased estimates of the effects of exposure to IFFs.

Matching methods have been introduced as an approach for causal inference in nonexperimental settings to handle selection bias problems (Rosenbaum and Rubin 1983). Basically, matching creates, for each treated unit, a control unit that is as similar as possible to the treated unit to identify the average treatment effect on the treated by the difference between the average outcome among the treated and the average outcome among the set of matched controls. To achieve this goal, this study uses inverse probability weights and creates a matched control group that mirrors the set of treated countries in terms of observable characteristics. The inverse probability weighting (IPW) approach involves two steps. First, the probability (propensity) of exposure to IFFs given observable characteristics is calculated, also called the propensity score. Second, weights for each unit are calculated as the inverse of the probability of being exposed to IFFs.

In contrast to conventional matching techniques, the IPW offers several advantages. First, by employing IPW, units exposed to the treatment with a lower probability of exposure (and unexposed units with a higher probability of exposure) receive larger weights. Consequently, their relative influence on the comparison is increased, increasing the balance in observed covariates between treated and control subjects, which is a key assumption for the internal validity of the identification strategy. Second, including the weights in the analysis ensures that the “assignment” to either the exposed or unexposed group becomes independent of the variables included in the propensity score model, thus limiting specification and multicollinearity problems. Third, IPW combines the properties of the regression-based estimator and the inverse probability-weighted estimator, making it a doubly robust method as it requires only the propensity or outcome model to be correctly specified but not both (Kurz 2022). The doubly robust weighted regression estimators give the researcher two chances to get the estimates right provided the inverse probability weighted-estimating equation.

3.2 Methodology

The estimation approach followed in this study is based on the principle that exposure to IFFs is the treatment. The treatment effect of exposure to IFFs on forest cover loss (ATT) is defined as follows:

where, \({Y}_{i,t}\left(.\right)\) is the outcome variable measuring log forest cover loss in \(the country (i) and year (t)\). \(T\) the treatment indicator captures whether country is exposed to IFFs (\(T=1\)) or not (\(T=0\)). \(E\left[Y\left(1\right)\mid T=1\right]\) is the expected outcome for the treatment group (treated countries), and \(E\left[Y\left(0\right)\mid T=1\right]\) is the counterfactual outcome, which is forest cover loss in treated countries if they had not been exposed to IFFs.

The fundamental evaluation problem is that \(E\left[Y\left(0\right)\mid T=1\right]\) is not observable due to the non-random exposure to IFFs. In a random assignment setting, the ATT can be computed by taking the difference in means of the outcome variable between those exposed to IFFs and those non-exposed to IFFs. The estimation of the ATT relies on the identification of a suitable counterfactual or comparison group with a likelihood of exposure to IFFs similar to that of the treated countries based on observable characteristics. To estimate the treatment effect, one must ensure that any response differences between the exposed group and control group are due to the treatment itself and not to some intrinsic differences between groups unrelated to the treatment. One can rewrite Eq. (1) as follows:

where \(X=x\) is the vector of observable characteristics that can affect both countries' exposure to IFFs, and the outcome variables, and controlling for X makes the treatment unconfounded. The first component is the average deforestation and forest cover loss for countries exposed to IFFs, and the second component is the average deforestation and forest cover loss for countries non-exposed to IFFs (matched control group). The difference between these two components gives the ATT conditional on a vector of covariates.

This study employs the doubly robust weighted regression estimator, a class of estimators that concurrently models both the propensity score and the inverse probability weighted-outcome simultaneously within the same framework. This approach provides asymptotically unbiased estimates as long as either model (propensity score or outcomes) is correctly specified. First, it consists of fitting a propensity score model (i.e., the estimated probability of treatment assignment conditional on observed baseline characteristics), and weights for each unit are calculated as the inverse of the probability of receiving the actual exposure level. Secondly, it uses those weights in a regression to estimate the treatment effect. Effectively, it provides two opportunities, instead of only one, to derive unbiased treatment effects involving a two-step process.

3.3 Data and Descriptive Statistics

I compiled a database encompassing 60 countries and 1054 subnational districts, focusing on deforestation rate and forest cover loss from 2009 to 2018. The analysis covers tropical countries in Africa, Asia, and America. With this expanded geographic coverage, concerns about the study's generalizability are mitigated.

The database is derived from the Global Forest Change data, which offers global maps depicting forest cover and forest loss at an approximate resolution of 30 square meters using the year 2000 as a baseline (Hansen et al. 2013). Using the Google Earth Engine, a cloud platform for earth observation data, I extract these data by customizing the code developed by Morpurgo et al. (2023). The Global Forest Change data relies on a time-series analysis of Landsat images and defines forest areas as those with a crown cover of trees exceeding 50% and a height greater than 5 m. Forest cover loss is defined as the disappearance of a forest pixel within a given year (1 = loss, 0 = no loss). I use the available data on forest cover (baseline year 2000) to calculate deforestation over a given year within national boundaries relative to the forest cover in the baseline year. This study excludes the analysis of forest gain due to the limited availability of annual estimates of forest gain (afforestation) only until 2013. Another reason for omitting forest gain is that such gain results from plantation forestation rather than natural restoration (Tropek et al. 2014). The forest loss database constructed in this study represents a noteworthy enhancement over country-level deforestation data used in previous contributions. The visual inspection of Fig. 1 indicates that the largest area of forest loss occurred in Brazil, followed by Indonesia and the Democratic Republic of Congo.

The underlying database addresses potential measurement errors of forest cover loss pointed out in the literature. Furthermore, the construction of deforestation rate and forest cover loss measures at the subnational district level accommodates spatial heterogeneity in natural forest conditions at the local level. It estimates precisely instances where deforestation intensifies within a particular country. A local scale measure of deforestation and forest cover loss across 1054 subnational districts was employed for the sensitivity analysis. While the Global Forest Change data is accessible for over 180 countries, the decision to narrow the sample to 60 countries is justified by two considerations. First, I limit the sample to tropical countries with consistent data on IFFs without missing values over at least three consecutive years. This criterion is important for my research design, given that the exposure to IFFs (the treatment) is defined as a sustained increase in IFFs over at least three years, emphasizing the importance of considering countries with consistent time series data. Secondly, because tropical forests are renowned for their global significance in providing ecosystem services and are among the most biodiverse places on Earth, the drivers of tropical deforestation were widely investigated in several previous studies. Building on this contextual background, the present study focuses on tropical countries with a sample period dictated by the availability of IFFs data, spanning from 2009 to 2018. Tables 7 and 8 provide a complete description and sources of each variable and basic summary statistics.

The primary variable of interest used in formulating the treatment variable is the ratio of illicit financial flows to GDP in each country sourced from the Global Financial Integrity Database. Although, there is no data on different forms of IFFs, the analysis relies on trade-based illicit financial flows data from the Global Financial Integrity database. This data encompasses trade-embedded illicit transactions where trade activities are used as mechanisms to execute illicit transactions.

The benchmark definition of treatment is when a country experiences an increase greater than or equal to the fiftieth percentile of the IFF increase distribution. I required the growth to be sustained over at least three years to indicate that financial outflows are credible, not just noise or some measurement errors in the data. Table 9 shows the number of treated and untreated countries and subnational districts based on the benchmark definition of the exposure to IFFs and after implementing the matching procedure.

I check the robustness of the results to alternative definitions of the treatment variable in terms of the duration of the increase and the definition of the threshold for a slight rise in IFFs. Furthermore, I also check the robustness of the baseline results to alternative measures of financial outflows, namely capital flight, which consists of unrecorded financial outflows from a country.Footnote 4

In alignment with the literature on deforestation drivers (Galinato and Galinato 2016; Kassouri 2024a), I select the following control variables: GDP per capita growth, corruption control, year of schooling, agriculture as a share of GDP, net official development assistance, external debt, population size, forest rents, and the share of agricultural land. I use the lag of these variables by one period to mitigate potential reverse causality problems. In the heterogeneity analysis, I also examine whether the control of the movement of capital and the ownership structure of assets mediate the effects of exposure to IFFs on deforestation and forest loss cover.

Following the discussion in Sect. 2 on the route through which exposure to IFFs can influence deforestation rates and forest loss, I examine if macroeconomic instability captured by tax revenue losses, real exchange rate misalignments, and credit constraints can be considered as potential channels through which the exposure to IFFs influences deforestation and forest loss. To do this, I collect real effective exchange rate data, domestic credit to the private sector, and tax revenue. Overall, these data were collected from different sources, as pointed out in Table 7.

3.4 Identification Validity: Preliminary Tests

The identification of the causal effect of IFFs is made using the inverse probability weighting approach to construct a suitable counterfactual that closely mirrors countries experiencing an increase in IFFs in terms of a pre-determined set of characteristics. The first question in matching analysis is the selection of a set of covariates to match on.

For regression or matching methods to provide unbiased results, “the selection on observables” assumption must be held true (Basu et al. 2007). Practically, I select variables that are known from previous studies to influence both the treatment (IFFs) and the outcome (deforestation rates). Indeed, exposure to illicit financial flows is not a random occurrence. It can be influenced by several factors, including a country’s economic development, licit financial flows (external debt stock and net official aid), institutional structure, forest rents, population size, human capital, and the proportion of agricultural land. As demonstrated in previous studies, these factors play an important role as drivers of illicit financial flows (Brandt 2023; Ndikumana and Boyce 2003; Ndikumana and Sarr 2019). These factors, which can also shape deforestation activities, make exposure to IFFs endogenous due to selection bias. For example, Bhattarai and Hammig (2001) demonstrate that institutional and governance factors, economic development, and population size affect tropical deforestation.

Similarly, Combes et al. (2015) reveal the role of human capital, agricultural land, and institutions as determinants of deforestation. In a more comprehensive study, Balboni et al. (2023a, b) point out the role of macro-financial factors such as financial flows, human capital, and resource rents as drivers of tropical deforestation. In our analysis, selection bias may arise because countries exposed to illicit financial flows may share similar characteristics, such as weak governance, reliance on natural resources, low economic development, high population size, low human capital, or dependence on external debt. These characteristics can also make them prone to deforestation activities. To address this problem, we use the inverse probability weighting approach to construct a suitable counterfactual that closely mirrors countries exposed to IFFs in terms of a pre-determined set of characteristics. While the literature is mixed on what is recommended, here I match based on variables that determine the treatment (any increase greater than or equal to the median IFFs over three years) and variables that influence the outcome (deforestation).

By doing so, the matching rules out any confounding driving the treatment and the outcome variable simultaneously. Specifically, I match on covariates reflecting economic, demographic, institutional, and macroeconomic characteristics, including lagged real GDP per capita growth, lagged share of agriculture in GDP, lagged corruption in executive, lagged forest rents, lagged external debt, lagged agricultural land, lagged mean years of schooling, lagged net official development assistance, and lagged population. GDP, agricultural land, agriculture share of GDP, population, and forest rents are likely to be important determinants of deforestation and IFFs. At the same time, external debt, net official aid, years of schooling, and corruption are also included as potential determinants of exposure to IFFs.

Table 1 contains the estimated probit model I use to generate propensity scores in the inverse probability weighting approach. Unsurprisingly, GDP per capita growth, agricultural land, and net official aid are positive and significant predictors of the occurrence of IFFs, while schooling, corruption control, forest rents, population, and external debt are negative and significant predictors of IFFs.

A key assumption underlying the validity of the research design is that countries exposed to IFFs are statistically similar to their counterfactuals or controls in terms of economic, demographic, institutional, and macroeconomic characteristics. This assumption is essential to ensure that the occurrence of IFFs is not endogenous with respect to the underlying economic, demographic, institutional, and macro-financial characteristics.

Table 2 presents the performance of the inverse probability weighting based on the difference in the sample mean of the underlying covariates obtained before and after the IPW approach. One remarkable observation is that the difference between the treated and the counterfactual control groups obtained from IPW is no longer statistically significant. This implies that the IPW is a valid weighting approach to obtain plausible counterfactuals that perfectly mirror every country exposed to IFFs in terms of the mean values of observable characteristics, satisfying the internal validity. The matching approach, conditional on the identifying assumptions discussed above, reduces or eliminates selection bias arising from the potential endogeneity of IFFs, yielding a plausibly causal interpretation of the results.

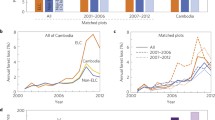

One can also scrutinize the relationship between deforestation and IFFs by comparing deforestation rate and forest cover loss in the treated group and their associated counterfactual group, as reported in Table 3. Table 3 indicates that treated countries are characterized by high deforestation rates and forest cover loss relative to their counterfactuals or matched controls, with a difference of 0.15 percentage points statistically significant at 1% for deforestation rate and 1163.9 Ha for forest loss, which is also significant at 1%. Figure 3 reinforces this correlational analysis. Only a formal causal analysis would elucidate the effects of IFFs on forest cover loss and deforestation rate.

4 Baseline Results

Table 4 presents the ATT of IFFs on deforestation rate (panel A) and forest loss (panel B) using the doubly robust weighted estimator. The treatment dummy “Exposure to IFFs” goes to 1 when changes in IFFs are greater than or equal to the 50th percentile of the IFF increase distribution over a 3-year window. The first columns of the table show the regression results without covariates. Column 1 excludes country and year fixed effects, columns 2–3 include year fixed effects and country fixed effects, respectively, and column 4 simultaneously includes year and country fixed effects. Columns 5–8 repeat the same exercise after controlling for the matching covariates, including GDP per capita growth, corruption, forest rents, external debt, and population.

Regardless of the underlying specifications, the results reveal a strong and significantly positive impact of exposure to IFFs on deforestation and forest loss. The point estimates are relatively stable across specifications (columns 4 & 8). For example, column 8 (saturated modelFootnote 5), which reports estimates from the preferred specification, suggests that, over a 3-year horizon, there is an increase in deforestation rate and forest cover loss of 0.08 and 0.2 percentage points higher in the treated countries exposed to IFFs compared to their matched controls. Put differently, a country would experience 0.08 percentage point increase in deforestation rate and 0.2 percentage point increase in forest loss from their exposure to a sustained increase in IFFs compared to what they otherwise would have experienced. Comparing the effect sizes, one may reveal a relatively higher effect size on forest cover loss relative to deforestation rate. At first glance, the estimated effects of IFFs may appear to be small. However, relative to the control group, on average, these coefficients indicate a nearly 10,344.167-hectare annual increase in forest loss.

4.1 Robustness Checks

Given the significant and sizeable effect of exposure to IFFs on deforestation, it is crucial to demonstrate that the estimated treatment effect is robust to different model specifications.

First, although the doubly weighted model finds support for the assumption of parallel trends (balance covariates between treated and matched controls), one may wonder about the ability of the IPW approach to accurately construct a suitably matched control when exposure to IFFs (treatment) changes dynamically (staggered exposure) across countries and over time. As demonstrated in Schmidheiny and Siegloch (2023), event studies are instrumental when treatment is not randomized to compare outcomes and trajectories before and after treatment, as well as across treated and matched control units. Using the weighted sample, I estimate the following event study model:

where, the independent variable of interest is a set of dummies \({D}_{i,t}^{j}\) indicating an event happening (any changes in IFFs greater than or equal to the 50th percentile of the IFF increase distribution over a 3-year window), X includes the pre-defined covariates. \({\mu }_{i}\) and \({\psi }_{t}\) represent countries and year fixed effects. \({\varepsilon }_{i,t}\) stands for the disturbance term. The event study tests both the presence of pre-trends and captures the evolution of the treatment effect over time.

Figures 2(a) and (b) summarize the results of the event study. The following insights stand out from these results. (i) Upon visual inspection, there is no evidence of pre-trends potentially affecting the estimation results. Although the visual inspection of the event study is a widely recognized and convincing way to analyze pre-treatment trends in empirical analysis, we have also included additional information on the joint test in the captions of Figs. 2(a) and (b).Footnote 6 Specifically, the Wald statistics are 3.99 for deforestation and 1.84 for log forest loss. Wald statistics for tests in which the leading estimates are jointly 0 are reported with a 10% critical value of 7.779; the null hypothesis cannot be rejected for either outcome variable. As expected, the test fails to reject the null hypothesis, confirming that the joint pre-treatment effects are not statistically different from 0 at the 10% significance level. (ii) The direction of the treatment effect aligns with those reported in the previous sections. (iii) Most of the results indicate that the effects of IFFs on deforestation and forest loss increase and persist over time, offering new evidence of the dynamic effects of IFFs. (iv) One may conclude from these figures that IPW provides a reliable matched control, reinforcing the validity of the doubly robust weighted regression estimator adopted in this study.

(a) This figure shows the event-study plots of the exposure to IFFs on deforestation rate as specified in Eq. 3. The vertical line indicates the year preceding exposure to IFFs. The shaded band represents 95 percent confidence intervals. The model includes year and country fixed effects with robust standard errors. The green dots represent the aggregation of the periods beyond the specified leads and lags. (b) This figure shows the event-study plots of the exposure to IFFs on forest loss as specified in Eq. 3. The vertical line indicates the year preceding exposure to IFFs. The shaded band represents 95 percent confidence intervals. The model includes year and country fixed effects with robust standard errors. The green dots represent the aggregation of the periods beyond the specified leads and lags

Considering some concerns about potential pre-trends over an extensive event window, I check the sensitivity of the event study results by estimating a saturated model that includes all possible leads and lags see Fig. 6 (in the appendix). Reassuringly, the baseline results do not show any significant pre-trends within this large event window, which underscores the robustness of the results. The cumulative lead estimates (green dots) perfectly lie on the horizontal line, suggesting the absence of pre-trends, which is critical for a plausible causal interpretation of the effect of IFFs on deforestation.

Second, even if IFFs affect deforestation and forest loss at the country level, the effects might be substantial at the local scale due to the heterogeneity within countries regarding deforestation and forest loss patterns. This observation has led recent studies to investigate the drivers of deforestation at the subnational level or even finer local scale (Lundberg and Abman 2022; Morpurgo et al. 2023; Salemi 2021). This study also looks into this avenue and assesses the sensitivity of the baseline results by extracting deforestation and forest loss for 1054 subnational districts in 60 tropical countries. The estimation results in Table 4 (in the appendix) suggest that higher exposure to IFFs leads to deforestation and forest loss at the subnational level, although the positive effects on deforestation become statistically insignificant when controlling for district fixed effects. Despite the advantage of the greater statistical power to detect a positive and significant effect on forest loss, one may argue that the significant effect on deforestation may be obscured by omitted variable bias at the local scale or may not be sufficiently large to be measurable at the district level as the magnitude of the point estimate become small and even close to zero as depicted in columns 2 and 4 (Table 10). Detecting the local effects of IFFs on deforestation and forest loss suggests the robustness of the baseline results to within-country heterogeneity in the deforestation and forest loss patterns. These findings provide new insights in favor of the potential cumulative effects of IFFs from the subnational to the country level and that the aggregate country level trends in deforestation and forest losses do not drive the results.

Third, the results thus far have been based on defining treatments in terms of a sustained increase in IFFs over three years. It is critical to ensure that the inference is not sensitive to the statistical definition of the treatment as a sustained higher increase in IFFs. One way to investigate this sensitivity is to re-estimate the baseline regression using a new treatment, defined as any changes in IFFs greater than or equal to the 50th percentile of the distribution of IFFs, without imposing restrictions on the duration. Table 11 in the appendix shows that the standard errors and the magnitudes of the point estimates obtained under the new treatment largely accord with those of the main specification of the study. This suggests that the main findings are robust to changes in the definition of the treatment.

Fourth, although it is typical to establish a cut-off around the median (50th percentile) in empirical analysis, there is some degree of arbitrariness in how the treatment is established, in particular, any increase greater than or equal to the 50th percentile of the distribution of IFFs. To check the sensitivity of the result to the definition of the treatment, I re-estimate the baseline specification using a new threshold around the 60th percentile of the distribution of IFFs. Treated countries are those experiencing a jump in IFFs greater than or equal to sixty percentiles of the distribution of IFFs. Tables 12 and 13 (in the appendix) report the results of the balance tests and the average treatment effect, respectively. Table 12 indicates that the inverse probability weighting approach yields reliable matched control groups that perfectly balance exposed countries to high IFFs with their counterfactuals, which is essential for the internal validity of the identification strategy. Table 13 shows that baseline results remain statistically unchanged to the introduction of a new treatment variable capturing a significant increase in IFFs, although there is a slight increase in the point estimates of the effects of IFF exposure on forest loss cover.

Fifth, I consider the robustness of the construction of the matched controls or counterfactual groups to alternative matching methods. To do so, I rely on three matching techniques: the nearest neighbor matching method, propensity score matching, and the entropy balancing procedure. Table 14 (in the appendix) reports the results across different matching methods. The ATT shows relatively larger positive effect sizes for forest loss relative to deforestation, consistent with the baseline results. This suggests that the alternative matching specifications are similar to the preferred baseline estimates in terms of precision.

Sixth, I conduct a placebo test to investigate if the likelihood of exposure to IFFs is identifying the causal effects of a sustained increase in IFFs on deforestation and forest losses or whether the effects I find are simply due to chance as a result of potentially confounding issues such as model misspecification or lack of power. To test this, I use the permutation test by comparing the preferred estimates to a distribution of pseudo-treatment effects. To conduct the permutation test, I define a placebo by randomly assigning treatment (exposure to IFFs) to the countries in the sample. After the random treatment assignment, I follow the doubly robust weighted regression approach as in the baseline specification. The distribution of results from the permutation test is illustrated in Fig. 4. It is clear that none of the placebo runs generated estimates close to the actual derived treatment effect, as denoted by the dashed line in Fig. 5. This suggests that the doubly robust weighted regression estimator is indeed powered to estimate causal exposure to IFFs.

Seventh, I also perform a falsification analysis using the share of terrestrial and marine protected areas as alternative dependent variables. The idea is to test whether the baseline treatment effect is not driven by a time-varying conservation policy correlated with deforestation rates and forest losses. As reported in Table 15, the absence of treatment effect in the falsification exercise provides strong evidence that land conservation policy or any land reforms cannot be a source of bias. Overall, the falsification tests indicate the validity of the research design and address potential confounding concerns related to land conservation policy.

Eighth, to assess whether the baseline results are sensitive to the doubly robust weighted estimator, I re-conduct the analysis using interactive fixed effect models (Bai Jushan 2009), along with panel fixed effects and unweighted least squares. One of the appealing features of the interactive effect model is that it facilitates the control for cross-section dependence caused by spatial correlation and spatial spillovers resulting from countries being exposed to a common set of shocks or global business cycle effects. Therefore, the interactive effects model uses factor model estimators, rather than OLS, to estimate the traditional two-way fixed effects specification so that it can accommodate unobservable common factors without having to make specific assumptions about the form of the unobserved common factors (Kim and Oka 2014).Footnote 7 Tables 16 and 17 in the appendix show that exposure to IFFs significantly increases deforestation and forest loss. Based on the IFE results, sustained exposure to IFFs significantly increases deforestation and forest loss by 0.131 percentage points and 0.285 percentage points, respectively (columns 2 & 4 in Table 17). This result for forest loss perfectly aligns in magnitude with the baseline ATT reported in Table 4. Overall, these findings show once again that exposure to IFFs increases deforestation and forest cover losses, implying the robustness of the doubly robust weighted regression estimator.

Ninth, one may argue that the underlying identification strategy is analogous to the standard two-way fixed effects regression model with a treatment dummy. However, recently, several scholars have pointed out the classic two-way fixed effects do not give the ATT in the presence of treatment effect heterogeneity (de Chaisemartin and D’Haultfœuille 2020; Wooldridge 2021). As such, the underlying identification strategy may not be tenable to recover ATT. To provide additional credibility, I apply the two-way Mundlak regression coined by (Wooldridge 2021) that allows for treatment effect heterogeneity over time and across groups. Table 18 shows that the ATT remains positive and statistically significant across the standard difference in difference (TWFE) and the heterogeneous/staggered difference-in-differences (DiD) specifications. However, the estimated effect is somewhat larger under the heterogeneous DiD specification. I corroborate this finding with Fig. 5 by plotting the coefficients on each calendar year across all groups.

Tenth, in the final robustness check, I re-estimate the baseline treatment effect using the alternative measure of IFF, namely capital flight provided by (Ndikumana and Boyce 2018). As the data on capital flight is only available for African countries and broadly used in the literature (Kassouri 2024b). This exercise can also be seen as a sensitivity analysis of the treatment effect to a subsample of African countries as capital flight costs African countries around $ 50 billion per year, outweighing the amount of official development assistance the continent receives annually (UNCTAD 2020). Using the same definition of the treatment and estimation approach as in the baseline specification, I re-estimate the deforestation impact of exposure to capital flight for 29 African countries. Table 19 shows that IPW provides a valid control group as covariates are, on average, balanced between treated units and their untreated matches. Table 20 reports the ATT across different specifications. Overall, the results support the baseline results that sustained outflows of capital increase deforestation rate and forest cover loss.

4.2 Differential Analysis: the Role of Capital Control and Asset Ownership

Table 5 reports the results of the differential analysis by separately including two interaction terms, one between lag capital control and exposure to IFFs and another one between lag state asset and exposure to IFFs.Footnote 8 Columns 1 and 3 show that state assets positively and significantly increase deforestation and forest loss, suggesting that countries with a significant state ownership of assets would experience an overexploitation of forest resources. However, the negative and statistically significant interaction terms show that countries with strong state ownership of assets tend to mitigate the positive influence of exposure to IFFs on the depletion of forest resources. As capital control is negatively and significantly associated with deforestation and forest losses in columns 2 and 4, one may claim that controls over the movements of capital can reduce the exploitation of forest resources. Interestingly, the interaction effect shows that capital control significantly reduces the deforestation and forest loss effects of exposure to IFFs. Overall, these findings indicate that countries with greater state ownership of assets and strict capital control can reverse the depletion of forest stocks stemming from exposure to IFFs.

4.3 Underlying Channels

I examine the role of real effective exchange rates, access to credit, and tax revenue as possible channels through which exposure to IFFs could potentially influence deforestation rate and forest cover loss. The results in Table 6 show that exposure to IFFs is associated with a significant decrease in access to credit and tax revenue losses and an increase in real effective exchange rate (real currency depreciation). This suggests that exposure to IFFs increases deforestation through currency depreciation, credit constraints, and lower tax revenue.

5 Discussion and Policy Implications

This paper explores the effect of exposure to large illicit financial outflows on deforestation and forest cover loss, bringing several contributions to the literature on this issue. First, I have broadly established that exposure to a sustained increase in IFFs leads to deforestation and the loss of forest coverage. This finding is consistent with the intuition from previous studies that under conditions of insufficient human-made capital in low- and middle-income countries, forest resources do and can contribute to substituting other forms of capital (Razafindratsima et al. 2021; Sunderlin et al. 2005). One could argue that the lack of human-made capital due to IFFs presents barriers to unlocking investments in new technologies to manage forest resources. By reducing the pool of money available to invest in sustainable forest-agriculture landscapes, IFFs can severely undermine investment towards climate risk management required to mitigate the effects of climate shocks on forested land. In addition, the disappearance of capital for domestic sustainable investment due to IFFs can push governments in the tropics to rely heavily on the exploitation of the relatively more abundant natural resource (tropical forest products) as a source of external revenues to make up the financial gaps needed to support economic development. As a result of these macroeconomic factors, exposure to IFFs can positively influence deforestation and forest loss. This study expands previous studies related to the macro-financial impact of illicit financial flows and capital flight (Ashman et al. 2011; Leonce et al. 2014; Moulemvo 2016; Muchai and Muchai 2016; Yalta 2010), by providing the first evidence on the land use changes associated with IFFs.

Secondly, this study unpacks the literature on the political economy of deforestation (Burgess et al. 2012; Larcom et al. 2016) by documenting the merit of capital controls and state ownership of assets to mitigate the positive influence of the exposure to IFFs on forest loss. However, unlike capital controls, it is documented that state ownership over land and assets can be detrimental to the preservation of forest resources. This finding is consistent with the argument that state ownership can sometimes conflict with customary ownership rights, encouraging rent-seeking and the overexploitation of forest resources (Burgess et al. 2012). The finding that capital controls enhance forest conversation implies that restrictions over capital movements may lead to greater efficiency by shifting capital flows towards sustainable ends beneficial for conservation and lowering financial outflows in tropical countries.

Thirdly, the channel analysis reveals that real exchange rate, access to credits, and tax revenue losses are essential channels through which exposure to IFFs can lead to deforestation and forest cover loss. The results indicate that exposure to IFFs is associated with real currency devaluations (higher real exchange rate), making exporting agricultural and forest products more profitable. This leads to severe concerns over inappropriate forestland conversion to agriculture and encourages deforestation. The channel of real exchange rate misalignments seems consistent with several previous contributions (Arcand et al. 2008; Damette and Delacote 2012). Access to credit plays a crucial role in driving the influence of IFFs on deforestation. I document that exposure to IFFs reduces the availability of credit, preventing capital expenditures required to improve agricultural technology and productivity, which may actually increase deforestation. Looking at the tax revenue channel, it is documented that the contraction of tax revenue resulting from the exposure to IFFs mitigates public resources available to monitor and invest in the sustainable use of forest resources, suggesting that domestic revenue leakage from IFFs could pose severe threats to existing forest resources. This provides new insights into the argument that an effective mobilization of resources can substantially reduce forest cover loss in resource-rich countries (Kinda and Thiombiano 2021).

This study offers important implications for curbing financial crimes and preserving forest resources. The findings imply that national governments must intensify their efforts in the fight against capital flight by, among others, establishing the conditions for better-quality institutions with stronger stakeholder accountability and corruption control to mitigate the adverse effects of capital flight on deforestation. Another important implication is the need for international financial reforms in the fight against IFFs. While the Global Forum's information-sharing mechanisms have been effectively used to combat illicit transactions (Langenmayr and Zyska 2023), it is essential to consider the ecological impacts of these illicit flows when setting new cross-border financial information exchange policies. Since pressures on forest resources and land degradation in tropical countries can accelerate the ongoing worldwide biodiversity and ecological crises, conservation policy debates must consider the environmental and land use ramifications of financial crimes, which have been overlooked in the current policy discourse.

While this study is the first to characterize the impact of financial crimes on tropical deforestation, it still faces some limitations that provide a direction for future investigations. Although I explore the potential channels through which exposure to IFFs can influence forest conservation in an empirical framework, one can design a very stylized theoretical model to capture the relationship between capital outflows and natural resource depletion in a resource-abundant setting, though this will be the subject of future work. Additionally, future studies could employ continuous treatment models or leverage exogenous variations through an instrumental variable approach to further investigate the relationship between illicit financial flows (IFFs) and environmental outcomes.

Notes

In developing countries endowed with forest resources, the conversion of forested land into crop and pasture land, subsistence logging, and timber harvesting can be seen as ways of using natural capital to alleviate poverty and capital scarcity (Leblois et al. 2017).

Given that this study focuses on low—and middle-income countries located in the tropics, it is reasonable to acknowledge that these regions' primary abundant capital stock is their forest resources.

An event is defined as one where there is a sustained increase in IFFs over a 3-year window. This is quite appealing as it ensures that financial outflows are credible and not just noise or measurement errors due to statistical errors in computing/reporting IFFs. This minimizes potential bias from the measurement of IFFs. Additionally, the 3-year window allows me to recover the long-run impact of IFFs on deforestation.

The literature often uses the terms capital flight and illicit financial flows interchangeably (Léonce Ndikumana and James K. Boyce, 2018).

Conditioning on the matching covariates corrects bias due to observed time-varying confounders with potential time-varying effects on the outcome.

I also provide pre-trend estimates for periods beyond the specified leads and lags in the green dots in Fig. 2. They confirm the lack of significant pre-treatment trends for periods beyond the specified leads.

As suggested by Moon and Weidner (2017), parameter estimates tend to stabilize after the true number of factors has been reached. Building on this argument, I report the IFE results with two common factors: the number of common factors beyond which the point estimates remain relatively stable.

It is essential to clarify that the interaction of IFFs with capital control/ownership cannot necessarily be interpreted causally, as capital control could be correlated with other variables that also could plausibly moderate IFFs-deforestation relationships. Instead, these interactions approximate how the causal effects of IFFs differ in countries with different levels of capital controls. However, to minimize endogeneity concerns in the differential analysis, we interact IFFs with lagged (one-year lag) capital control and asset ownership.

References

Abman R, Lundberg C (2020) Does free trade increase deforestation? The effects of regional trade agreements. J Assoc Environ Resour Econ 7:35–72. https://doi.org/10.1086/705787

Afawubo K, Noglo YA (2019) Remittances and deforestation in developing countries: is institutional quality paramount? Res Econ. https://doi.org/10.1016/j.rie.2019.10.001

Aizenman J, Pasricha GK (2013) Why do emerging markets liberalize capital outflow controls? Fiscal versus net capital flow concerns. J Int Money Financ 39:28–64. https://doi.org/10.1016/J.JIMONFIN.2013.06.018

Alemagi D, Kozak RA (2010) Illegal logging in Cameroon: causes and the path forward. For Policy Econ 12:554–561. https://doi.org/10.1016/J.FORPOL.2010.07.008

Amelung T (1993) Tropical deforestation as an international economic problem. Econ Prog Environ Concerns. https://doi.org/10.1007/978-3-642-78074-5_10

Angelsen A, Kaimowitz D (1999) Rethinking the causes of deforestation: lessons from economic models. World Bank Res Obs 14:73–98. https://doi.org/10.1093/wbro/14.1.73

Araujo C, Bonjean CA, Combes JL, Combes Motel P, Reis EJ (2009) Property rights and deforestation in the Brazilian Amazon. Ecol Econ 68:2461–2468. https://doi.org/10.1016/J.ECOLECON.2008.12.015

Arcand JL, Guillaumont P, Jeanneney SG (2008) Deforestation and the real exchange rate. J Dev Econ 86:242–262. https://doi.org/10.1016/j.jdeveco.2007.02.004

Arrow KJ, Dasgupta P, Mäler KG (2003) Evaluating projects and assessing sustainable development in imperfect economies. Environ Resour Econ 26:647–685. https://doi.org/10.1023/B:EARE.0000007353.78828.98

Ashman S, Fine B, Newman S (2011) Amnesty international? The nature, scale and impact of capital flight from South Africa. J South Afr Stud 37:7–25. https://doi.org/10.1080/03057070.2011.555155

AssunçAssunç J, Gandour C, Rocha R, Rocha R, Bragança A, Felipe Brandão L, Dahis R, Pessoa P (2020) The effect of rural credit on deforestation: evidence from the Brazilian Amazon. Econ J 130:290–330. https://doi.org/10.1093/EJ/UEZ060

Balboni C, Berman A, Burgess R, Olken AB (2023a) The economics of tropical deforestation. Annu Rev Econom 20:55–58. https://doi.org/10.1146/annurev-economics-090622-024705

Balboni C, Berman A, Burgess R, Olken BA (2023b) The economics of tropical deforestation. Annu Rev Econom 15:723–754. https://doi.org/10.1146/ANNUREV-ECONOMICS-090622-024705/1

Barbier E (2001) The economics tropical deforestation and land use: an introduction to special issue. Land Econ 77:155–171. https://doi.org/10.2307/3147087

Barbier EB, Rauscher M (1994) Trade, tropical deforestation and policy interventions. Environ Resour Econ 4:75–90. https://doi.org/10.1007/BF00691933/METRICS

Basu A, Heckman JJ, Navarro-Lozano S, Urzua S (2007) Use of instrumental variables in the presence of heterogeneity and self‐selection: an application to treatments of breast cancer patients. Wiley Online Libr. Basu, JJ Heckman, S Navarro‐Lozano, S UrzuaHealth Econ. 2007 Wiley Online Libr. 16: 1133–1157. https://doi.org/10.1002/hec.1291

Beck T (2012) Finance and oil: is there a resource curse in financial development? SSRN Electron J https://doi.org/10.2139/ssrn.1769803

Berazneva J, Byker TS (2017) Does forest loss increase human disease? evidence from Nigeria. Am Econ Rev 107:516–521. https://doi.org/10.1257/AER.P20171132

Berkouwer SB, Dean JT (2022) Credit, attention, and externalities in the adoption of energy efficient technologies by low-income households. Am Econ Rev 112:3291–3330. https://doi.org/10.1257/AER.20210766

Bhattarai M, Hammig M (2001) Institutions and the environmental Kuznets Curve for deforestation: a crosscountry analysis for Latin America. Africa and Asia World Dev 29:995–1010. https://doi.org/10.1016/S0305-750X(01)00019-5

Blum D, Aguiar S, Sun Z, Müller D, Alvarez A, Aguirre I, Domingo S, Mastrangelo M (2022) Subnational institutions and power of landholders drive illegal deforestation in a major commodity production frontier. Glob Environ Chang 74:102511. https://doi.org/10.1016/J.GLOENVCHA.2022.102511

Boekhout van Solinge T (2013) The illegal exploitation of natural resources. https://doi.org/10.1093/OXFORDHB/9780199730445.013.024

Bolton L (2020) Criminal activity and deforestation in Latin America. Report. K4D Help. Rep. 918. Bright. UK Inst. Dev. Stud

Brack D (2014) Chinese overseas investment in forestry and industries with high impact on forests:official guidelines and credit policies for Chinese enterprises operating and investing abroad

Brandt K (2023) Illicit financial flows and developing countries: a review of methods and evidence. J Econ Surv 37:789–820. https://doi.org/10.1111/joes.12518

Burgess R, Hansen M, Olken BA, Potapov P, Sieber S (2012) The political economy of deforestation in the tropics. Q J Econ 127:1707–1754. https://doi.org/10.1093/qje/qjs034

Carr DL, Suter L, Barbieri A (2005) Population dynamics and tropical deforestation: state of the debate and conceptual challenges. Popul Environ 27:89–113. https://doi.org/10.1007/S11111-005-0014-X/METRICS

Codjoe SNA, Dzanku FM (2009) Long-term determinants of deforestation in Ghana: the role of structural adjustment policies. African Dev Rev 21:558–588. https://doi.org/10.1111/J.1467-8268.2009.00223.X

Cohen F, Hepburn CJ, Teytelboym A (2019) Annual review of environment and resources is natural capital really substitutable? Annual Rev Environ Resour. https://doi.org/10.1146/annurev-environ-101718

Combes JL, Combes Motel P, Minea A, Villieu P (2015) Deforestation and seigniorage in developing countries: a tradeoff? Ecol Econ 116:220–230. https://doi.org/10.1016/J.ECOLECON.2015.03.029

Combes JL, Delacote P, Combes Motel P, Yogo TU (2018) Public spending, credit and natural capital: does access to capital foster deforestation? Econ Model 73:306–316. https://doi.org/10.1016/j.econmod.2018.04.006

Combes JL, Guérineau S, Motel PC (2008) Deforestation and credit cycles in Latin American countries 1–38

Culas RJ (2006) Debt and deforestation: a review of causes and empirical evidence. J Develop Soc. https://doi.org/10.1177/0169796X06071524

Damania R, Russ J, Wheeler D, Barra AF (2018) The road to growth: measuring the tradeoffs between economic growth and ecological destruction. World Dev 101:351–376. https://doi.org/10.1016/J.WORLDDEV.2017.06.001

Damette O, Delacote P (2012) On the economic factors of deforestation: what can we learn from quantile analysis? Econ Model 29:2427–2434. https://doi.org/10.1016/j.econmod.2012.06.015

David P, Neil A, David M, Dominic M (1995) Debt and the Environment. Sci Am 52–56

de Chaisemartin C, D’Haultfœuille X (2020) Two-way fixed effects estimators with heterogeneous treatment effects. Am Econ Rev 110:2964–2996. https://doi.org/10.1257/AER.20181169

Deacon R (2017) Assessing the relationship between government policy and deforestation. Econ L Use. https://doi.org/10.4324/9781315240114-30

Dornbusch R (1976) Exchange rate expectations and monetary policy. J Int Econ 6:231–244. https://doi.org/10.1016/0022-1996(76)90001-5

Drupp MA (2018) Limits to substitution between ecosystem services and manufactured goods and implications for social discounting. Environ Resour Econ 69:135–158. https://doi.org/10.1007/S10640-016-0068-5/FIGURES/3

Duval L, Wolff FC (2009) L’effet des transferts des migrants sur la déforestation dans les pays en développement. Rev Econ Dev 23:109–135. https://doi.org/10.3917/edd.233.0109

Ehrhardt-Martinez K (1998) Social determinants of deforestation in developing countries: a cross-national study. Soc Forces 77:567–586. https://doi.org/10.1093/sf/77.2.567

Ferreira S (2004) Deforestation, property rights, and international trade. Land Econ 80:174–193. https://doi.org/10.2307/3654737

Fofack H, Ndikumana L (2010) Capital flight repatriation: investigation of its potential gains for Sub-Saharan African countries. African Dev Rev 22:4–22. https://doi.org/10.1111/J.1467-8268.2009.00226.X

Franklin SL, Pindyck RS (2018) Tropical forests, tipping points, and the social cost of deforestation. Ecol Econ 153:161–171. https://doi.org/10.1016/J.ECOLECON.2018.06.003

Galinato GI, Galinato SP (2016) The effects of government spending on deforestation due to agricultural land expansion and CO2 related emissions. Ecol Econ 122:43–53. https://doi.org/10.1016/J.ECOLECON.2015.10.025

Global Financial Integrity (2019) Illicit financial flows to and from 148 developing countries: 2006–2015, Global Financial Integrity

Gullison RE, Losos EC (1993) The role of foreign debt in deforestation in Latin America. Conserv Biol 7:140–147. https://doi.org/10.1046/J.1523-1739.1993.07010140.X

Hansen MC et al (2013) High-resolution global maps of 21st-century forest cover change. Science 342(80):850–853. https://doi.org/10.1126/SCIENCE.1244693

Hartwick JM (1990) Natural resources, national accounting and economic depreciation. J Public Econ 43:291–304. https://doi.org/10.1016/0047-2727(90)90002-Y

Inman K (2008) Fueling expansion in the third world: population, development, debt, and the global decline of forests. Soc Nat Resour. https://doi.org/10.1080/08941929309380805

Jayachandran S (2013) Liquidity constraints and deforestation: the limitations of payments for ecosystem services. Am Econ Rev 103:309–313. https://doi.org/10.1257/AER.103.3.309

Jushan B (2009) Panel data models with interactive fixed effects. Econometrica 77:1229–1279. https://doi.org/10.3982/ecta6135

Kahn JR, McDonald JA (1995) Third-world debt and tropical deforestation. Ecol Econ 12:107–123. https://doi.org/10.1016/0921-8009(94)00024-P

Kassouri Y (2024a) Fertilizer prices and deforestation in Africa. Food Policy 126:102674. https://doi.org/10.1016/J.FOODPOL.2024.102674

Kassouri Y (2024b) Capital flight and public health outcomes in Africa. Health Econ 33:576–593. https://doi.org/10.1002/HEC.4789

Kassouri Y, Altıntaş H, Bilgili F (2020) An investigation of the financial resource curse hypothesis in oil-exporting countries: the threshold effect of democratic accountability. J Multinatl Financ Manag. https://doi.org/10.1016/j.mulfin.2020.100639

Khanna AA (2017) Revisiting the oil curse: does ownership matter? World Dev 99:214–229. https://doi.org/10.1016/J.WORLDDEV.2017.05.026

Kim D, Oka T (2014) Divorce law reforms and divorce rates in the USA: an interactive fixed-effects approach. J Appl Econom 29:231–245. https://doi.org/10.1002/jae.2310

Kinda H, Thiombiano N (2021) The effects of extractive industries rent on deforestation in developing countries. Resour Policy 73:102203. https://doi.org/10.1016/j.resourpol.2021.102203

Kinda T, Mlachila M, Ouedraogo R (2016) Commodity price shocks and financial sector fragility. IMF Work Pap 16:1. https://doi.org/10.5089/9781498328722.001

Kurz CF (2022) Augmented inverse probability weighting and the double robustness property. Med Decis Mak 42:156–167. https://doi.org/10.1177/0272989X211027181

Langenmayr D, Zyska L (2023) Escaping the exchange of information: tax evasion via citizenship-by-investment. J Public Econ 221:104865. https://doi.org/10.1016/J.JPUBECO.2023.104865

Larcom S, van Gevelt T, Zabala A (2016) Precolonial institutions and deforestation in Africa. Land Use Policy 51:150–161. https://doi.org/10.1016/j.landusepol.2015.10.030

Lawrence D, Vandecar K (2014) Effects of tropical deforestation on climate and agriculture. Nat Clim Chang 51(5):27–36. https://doi.org/10.1038/nclimate2430

Lawson S (2014) Illegal logging in the democratic republic of the Congo. Chatham House 29

Leblois A, Damette O, Wolfersberger J (2017) What has driven deforestation in developing countries since the 2000s? evidence from new remote-sensing data. World Dev 92:82–102. https://doi.org/10.1016/J.WORLDDEV.2016.11.012

Leonce N, James KB, Ameth SN (2014) Capital flight from Africa: causes, effects, and policy issues

Li M, Zhang W, Guo Z, Bhandary P (2022a) Deforestation and smallholder income: evidence from remittances to Nepal. Land Econ 98:376–398. https://doi.org/10.3368/le.98.2.090220-0139R

Li Y, Brando PM, Morton DC, Lawrence DM, Yang H, Randerson JT (2022b) Deforestation-induced climate change reduces carbon storage in remaining tropical forests. Nat Commun 131(13):1–13. https://doi.org/10.1038/s41467-022-29601-0

Li B, Yan Y (2016) How does China’s growing overseas investment affect Africa’s forests? 5 Things to Know

Lundberg C, Abman R (2022) Maize price volatility and deforestation. Am J Agric Econ 104:693–716. https://doi.org/10.1111/AJAE.12246

Marquart-Pyatt S (2004) A cross-national investigation of deforestation, debt, state fiscal capacity, and the environmental Kuznets curve. Int J Sociol 34:33–51. https://doi.org/10.1080/00207659.2004.11043128

Mendelsohn R (1994) Property rights and tropical deforestation. Oxf Econ Pap 46:750–756. https://doi.org/10.1093/OEP/46.SUPPLEMENT_1.750

Moon HR, Weidner M (2017) Dynamic linear panel regression models with interactive fixed effects. Econom Theory 33:158–195. https://doi.org/10.1017/S0266466615000328

Morpurgo J, Kissling WD, Tyrrell P, Negret PJ, van Bodegom PM, Allan JR (2023) The role of elections as drivers of tropical deforestation. Biol Conserv 279:109832. https://doi.org/10.1016/J.BIOCON.2022.109832

Moulemvo A (2016) Impact of capital flight on public social expenditure in Congo-Brazzaville. African Dev Rev 28:113–123. https://doi.org/10.1111/1467-8268.12185

Muchai DN, Muchai J (2016) Fiscal policy and capital flight in Kenya. African Dev Rev 28:8–21. https://doi.org/10.1111/1467-8268.12178

Ndiaye AS, Siri A (2016) Capital flight from Burkina Faso: drivers and impact on tax revenue. African Dev Rev 28:100–112. https://doi.org/10.1111/1467-8268.12184

Ndikumana L , Boyce JK (2018) Capital flight from Africa updated methodology and new estimates. Polit Econ Res Inst 1–15

Ndikumana L, Boyce JK (2003) Public debts and private assets: explaining capital flight from Sub-Saharan African countries. World Dev 31:107–130. https://doi.org/10.1016/S0305-750X(02)00181-X

Ndikumana L, Sarr M (2019) Capital flight, foreign direct investment and natural resources in Africa. Resour Policy 63:101427. https://doi.org/10.1016/j.resourpol.2019.101427

Neumayer E (2005) Does high indebtedness increase natural resource exploitation? Environ Dev Econ 10:127–141. https://doi.org/10.1017/S1355770X04001901

Neumayer E (2013) Weak versus strong sustainability: exploring the limits of two opposing paradigms, weak versus strong sustainability: exploring the limits of two opposing paradigms. Edward Elgar Publishing Ltd. https://doi.org/10.4337/9781781007082

Quaas MF, Baumgärtner S, Drupp MA, Meya JN (2020) Intertemporal utility with heterogeneous goods and constant elasticity of substitution. Econ Lett 191:109092. https://doi.org/10.1016/j.econlet.2020.109092

Rajão R (2020) The rotten apples of Brazil’s agribusiness. Science 369(80):246–248. https://doi.org/10.1126/SCIENCE.ABA6646/SUPPL_FILE/ABA6646_RAJAO_SM.PDF

Razafindratsima OH et al (2021) Reviewing the evidence on the roles of forests and tree-based systems in poverty dynamics. For Policy Econ. https://doi.org/10.1016/j.forpol.2021.102576

Rosenbaum PR, Rubin DB (1983) The central role of the propensity score in observational studies for causal effects. In: Matched sampling for causal effects. pp 170–184. https://doi.org/10.1017/CBO9780511810725.016