Abstract

We formally model a Cournot duopoly market in which a corporate socially responsible (CSR) firm interacts with a profit-maximizing firm and where the market is regulated with an emission tax. We consider three different kinds of CSR firm behaviors: (i) consumer-friendly; (ii) environmentally-friendly; and (iii) consumer-environmentally friendly. Unlike most theoretical works within this literature, which typically use specific functional forms, we use general structures for the inverse demand function, the cost function, and for emission levels and damage functions. In terms of modeling strategy, we use two game-theoretic approaches: (i) a simultaneous game and (ii) a sequential three-stage ex-post game, in which decisions are time consistent. We found that the optimal emissions taxation rule is modified when considering different CSR motivations. We show that depending upon the CSR motivation and the price elasticity of demand in some cases we can obtain optimal emission tax rates higher, lower, or equal to marginal external emission. Finally, we also found that firms adopting consumer-friendly CSR behavior are more effective in improving the environment compared to environmentally friendly firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Firms are increasingly adopting voluntary corporate practices that pay attention to consumer welfare, environmental issues, and green production. This type of firm behavior is commonly referred to as Corporate Social Responsibility (CSR) in the academic literature and is widely reported as a common practice for large and mid-cap companies around the world. For instance, the KPMG Survey of Sustainability Reporting 2020 revealed that 80% of companies worldwide report on sustainability, about 40% of companies acknowledge the financial risks of climate change and the majority of firms surveyed have targets in place to reduce their carbon emissions.Footnote 1

While there are many definitions of CSR behavior (see for instance: Baron 2007; Bénabou and Tirole 2010; and Kitzmueller and Shimshack 2012) in this work we adopt an approach that can be better explained by two closely related models: (i) The triple bottom line model and (ii) the ESG approach. First, the model called: “the triple bottom line: People, Planet and Profit”, adds social (people) and environmental variables (planet) to the standard corporate approach to profit maximization (profits) (Elkington 2013). This accounting framework has in practice been adopted by many BCorp organizations that advocate considering in their balance sheets not only information relevant to their shareholders but also including details of their social and environmental impact. Second, the “Environmental, Social, and Governance” (ESG) norms are a set of standards designed to enhance transparency and accountability within a firm’s operations, guiding them towards improved governance, environmental-friendly practices, and social responsibility (United Nations Environment Programme 2004; United Nations Sustainable Developments Goals 2023). These standards have been put forward by the United Nations (UN) for the last 20 years, originally as a corporate social responsibility initiative, in recent years have become a global phenomenon, representing more than US$30 trillion in assets under management.Footnote 2 Specifically, this approach, when applied to financial investment practices, calls for global investors to become more socially conscious when making investment decisions as part of their fund engagement strategies (Friede et al. 2015). Hence, the triple bottom line and ESG approaches call for firms to worry beyond standard profit maximization, but also beyond environmental impacts concerning people and thus start also considering the social impact of business decisions.

Particularly, in this work, we study the impact of firms’ CSR behaviors on the design of optimal environmental regulations, particularly on an emission tax, and on total emissions. It is in this context that this work is aimed at contributing to the literature by addressing the following questions: how optimal emission taxation must address CSR motivations? and what CSR motivations are better for reducing environmental emissions? Unlike most theoretical works within this literature, which typically use specific functional forms, namely linear inverse demand functions, quadratic or linear cost functions, and linear or quadratic environmental emissions functions, for studying CSR behaviors in monopolistic and duopolistic settings (either à la Cournot or Bertrand), we use general structures for the inverse demand function, the cost function, and for emission levels and damage functions. The advantage of this more formal and general modeling strategy is that we can generalize results and regularities in a clearer way, recognizing explicitly what are the main assumptions behind the findings and what are the main results’ determinants and drivers, making explicit the relevance and impact of the assumed specific, functional structures.

A practical case that can be used to depict the relevance of these questions is the voluntary corporate decisions recently adopted by part of the automotive industry to put a stop to making cars that consume diesel in their vehicle range. This decision shows the car makers’ commitment to cutting emissions, helping to accelerate the transition to a zero-carbon transport future. Volvo, for instance, confirmed in 2019 the end of its diesel engines in favor of electrification and hybrid solutions to lower emissions.Footnote 3 In 2020, BMW also became committed to procuring 100% of its electricity from renewable sources for its operations by 2050. Mercedes-Benz is also committed to making its entire passenger car fleet carbon-neutral by the close of 2039. In 2019, Volkswagen also accelerated plans to electrify its fleet, committing to launch 70 fully electric models by 2028, up from an earlier pledge to sell 50 by 2025. Finally, EV-pioneer Tesla has now become the most valuable automaker by market cap.Footnote 4 A key question in this context is whether “going green” in the automotive industry will necessarily guarantee a cleaner environment, particularly when a car maker faces oligopolistic competition in the product market, incentives for strategic behavior and environmental regulation.

We address this issue using a novel, yet stylized, theoretical model of a duopoly market in which a CSR firm interacts with a profit-maximizing firm and where the market is under an emission tax aimed at encouraging firms to internalize the costs that the market price does not incorporate, so that they change their behavior and hence avoid the undesirable or inefficient market outcome. Particularly, we consider three different kinds of firm behaviors: (i) a consumer-friendly firm, which cares for not only its profits but also the consumer surplus, as a proxy of its concern for its “stakeholders” or consumers (ii) an environmentally-friendly firm for which its main objective is a combination of its own profit and the environment, caring for the environmental emissions produced by the market in which it interacts; (iii) a consumer-environmentally friendly firm which cares about its profit, a share of consumer surplus and also environmental emissions. Previous literature typically uses the definition of a CSR firm given by case (i), assuming that it maximizes profits plus a fraction of consumer surplus (see Appendix A). Adding these additional cases allows us to evaluate more recent trends in the CSR literature in which environmental concerns have also become a priority for stakeholders and consumers (see, inter alia, Barman 2018). As a benchmark, we also consider the case where the two duopoly firms are only concerned about material profits.

In this work, we compare different emission tax rules, that we derive in the context of a profit-maximizing firm competing with a CSR-firm, with the first best competitive market solution in which optimal tax rates equal marginal emissions damage (Pigou 1920; Baumol 1972) and the monopoly solution in which optimal tax rates may be less than marginal emissions damage (Barnett 1980). We use two approaches to model the game. Firstly, we propose a basic simultaneous Cournot game in which a profit-maximizing firm competes with a CSR-firm and where an emission tax is set by the regulator. Secondly, we put forward a sequential three-stage game, in which the firms in the Cournot duopoly first select their abatement efforts, then the regulator sets its emission tax level, and finally, the firms choose their output levels. The latter sequential three-stage game, also called “time-consistent (or ex-post) policy game” Footnote 5 emerges whenever the environmental policy is non-credible which proves to be in fact better for controlling emissions than under regulatory commitment.Footnote 6

Petrakis and Xepapadeas (2003) argue that the temporal structure of a problem involving short and long-term environmental decisions points towards considering output and abatement decisions not as simultaneous ones but as sequential ones. The economic rationality behind this assertion is that output adjustments can be regarded as short-term, easy to implement in a short period of time, while abatement effort decisions typically involve investment and sunk costs in abatement equipment, or investment in ‘cleaner’ technologies and therefore should be regarded as longer-term decisions, as they can take a while to implement and change. Hence, the timing structure of the environmental tax game followed in this work. Given the temporal dimension of the problem, combined with the regulator’s ability to change the emission tax level can leads to time consistency issues associated with environmental policy. In fact, it can be shown that it will always be in the regulator best interest to determine the emission tax level only after the private and CSR firms have made their abatement decisions. If this were not the case and the regulator decides an “ex ante” emission tax before the two firms decide their abatement efforts, once the two firms take their decisions and start polluting, the new “ex post” game will imply a different policy game equilibrium altogether. This is so as the ex post regulator utility function will not be the same as the ex ante one, given that the former considers only the gross profits of the two firms as abatement costs are already sunk. This is why the time consistent game is also called “ex post policy game”, ing. In this context, to the best of our knowledge, this work is the first to formally solve a Cournot duopoly analyzing different types of CSR behavior under a time consistent emission tax.

This paper is structured as follows. In Sect. 2, we review the related literature. In Sect. 3, we introduce the formal model of a duopoly market formed by a CSR firm and a profit maximizing firm, with an emissions tax. Particularly, we use two game theoretic modeling approaches: a “Simultaneous Game” and a “Three-Stage Ex-Post Game”, where we present welfare-maximizing emissions tax rules for the different CSR motivations analyzed. Section 4 presents a discussion of the results looking for policy implications, taking into consideration the strategic behavior of firms in the duopoly and different market structures. In Sect. 5, we conduct some model simulations in which we use specific functional forms for demand, costs, emissions, and environmental damage to better illustrate our theoretical results. Finally, in Sect. 6, we end the paper by summing up the main results and putting forward some suggestions for future extensions of our theoretical model.

2 Related Literature

There is a huge amount of literature on CSR.Footnote 7 While much of the papers have focused on the relationship between social performance and corporate financial performance (Besley and Ghatak 2007; Cheng et al. 2014; Flammer 2013; Orlitzky et al. 2003), there are also many other topics addressed by this literature such as, inter alia: managerial contracting (Baron 2008; Flammer 2015; Fanti and Buccella 2017; Flammer 2018); voluntary over-compliance and eco-labeling (Kirchhoff 2000); vertical supply chains (Goering 2014 and Brand and Grothe 2015); horizontal products differentiation (Matsumura and Ogawa 2014 and Kopel and Brand 2012); strategic tariff policy (Wang et al. 2012, and Liu et al. 2018) and consumers’ behavior (Mohr et al. 2001; Flammer and Luo 2017; Fiksel and Lal 2018).

In the economics literature, most papers analyze firms assuming that the objective of private firms is reduced to profit maximization. Nevertheless, some papers have started arguing that CSR is an important business strategy and private firms may go beyond their legal requirements (see for instance Porter and Kramer 2006). We can divide the CSR economic modeling strategy into two strands: (i) CSR firms maximize profits and some share of the consumer surplus, representing the firm social concerns, and (ii) when the CSR firm is also worried about environmental damage, reflecting its commitment with sustainability.

The first branch of the literature, argues that the adoption of CSR is due to firms’ care about social concerns. Along this vein, Kopel and Brand (2012) analyzed a Cournot duopoly consisting of a socially concerned firm and a profit-maximizing firm. They concluded that the relationship between the share of consumer surplus considered by the socially concerned firm and its profit first increases and then decreases, allowing to the socially concerned firm to achieve higher profits under certain circumstances. Garcia et al. (2018), Xu and Lee (2018), Leal et al. (2018, 2019), and Bárcena-Ruiz and Sagasta (2021) studied CSR concerns through consumer-friendly firms, as a convex combination of the consumer surplus and its profit. However, the objective function does not consider their pollutant emissions, instead, they analyze how the fact that companies are concerned about consumer surplus affects the environmental policies of governments. Garcia et al. (2018) compared two regulatory instruments in which there is a consumer-friendly firm with abatement technology, tradable permits and emission tax regulations. When the government can credibly commit its policy, both policies are equivalent. However, when the policy is not credible, profit-maximizing firms abate less emissions and the consumer-friendly firm abates more emissions to reduce the tax rate under the tax policy. Similarly, Leal et al. (2018) studied a Cournot duopoly model with a consumer-friendly firm. They analyzed the interplay between the strategic choice of abatement technology and the timing of the government’s commitment to the environmental policy, arriving at conclusions very similar to those in Garcia et al. (2018). Xu and Lee (2018) investigated environmental policies in a free-entry market with ex-ante and ex-post taxation. They found that taxation can increase welfare, but ex-ante taxation always yields higher welfare than ex-post taxation. Bárcena-Ruiz and Sagasta (2021) analyzed environmental policies when polluting firms are consumer friendly. They found that firms’ concerns about CSR depend on the environmental policy implemented by the government, being the greatest concern reached under tradable emission permits and the lowest under emission standards. They also find that cross-ownership between firms affects the CSR level that they choose.

In the second strand of the literature, in which CSR firms also take into account environmental concerns in their decision-making process, Lambertini and Tampieri (2015) studied a Cournot oligopoly with pollution, with one CSR firm responsive to consumer surplus and pollution, in addition to profit. They showed that when the market is large enough, the CSR firm gets higher profits than its competitors, and induces a higher level of social welfare. Lee and Park (2019) investigated the strategic environmental corporate social responsibility (ECSR) of polluting firms in the presence of eco-firms. They showed that firms will adopt ECSR, however, the late adopter chooses lower ECSR and, as a result, obtains higher benefits. Hirose et al. (2020) formulated Cournot and Bertrand competition models to investigate the adoption of ECSR by firms competing in the market. They considered emission cap commitments and emission intensity commitments. Under emission cap commitments, ECRS is adopted in the Cournot competition only when joint-profit maximizing industry associations exist and under Bertrand competition, individual firms voluntarily adopt ECSR. Xu and Lee (2022) also examined emission taxes and environmental corporate social responsibility (ECSR) and compared Cournot and Bertrand competitions. They studied cooperative and non-cooperative scenarios, and their main conclusion is that the cooperative ECSR can not achieve socially desirable outcomes, whereas the non-cooperative ECSR is beneficial to society under low marginal damage. Fukuda and Ouchida (2020) developed a CSR model with a time-consistent emission tax in a monopoly market. They found that the promotion of CSR increases social welfare, however, CSR can yield an emission-increasing effect.

Finally, we put forward a summary of formal definitions of CSR-Firm’s objective functions found in the recent related literature, see Appendix A. In what follows we model a CSR-Firm that cares about its monetary profits, but also about the environmental damage produced by the market and it is also socially concerned, which we model as sensitive to consumers’ surplus. Hence, in comparison to previous works, we formally model a CSR firm with both social and environmental concerns, which provides a more general representation of how CSR firms have been considered in the economic theoretical literature.

3 The Model

Consider a single industry made up of two polluters: one CSR firm labeled 0 and a profit-maximizing private firm labeled 1, which competes à la Cournot, with homogeneous products (or perfect substitutes). Both firms have production levels of a single product output \(q_{i}\), for \(i=0,1\), with total output given by \(Q=q_{0}+q_{1}\) and an inverse demand function f(Q). The CSR firm and profit-maximizing private firm discharge pollution into the environment, which we denote by \(d_{i}\), generating \(D(d_0,d_1)\) in total environmental damage. Let total resource costs for the pollution-generating firm be represented by \(c_{i}=c(q_{i},w_{i})\), where \(w_{i}\) represents resources devoted to pollution treatment. Let us assume that the firm has two ways of reducing its emissions levels \(d_{i}\). It may either reduce output \(q_{i}\), or it may devote more resources \(w_{i}\) to the abatement of pollution, which implies that \(d_{i}=d_{i}(q_{i},w_{i})\), for \(i=0,1\). We also consider a tax on emissions, t, which works as a tax rate per unit of pollution discharged. Both firm’s profit functions are then given by:

We assume that the CSR firm, contrary to the purely profit-maximizing firm, cares for not only its profits but also for a fraction of the consumer surplus, CS, as a proxy of the firm’s concern for consumers. We also consider the case in which the CSR firm also cares for the environmental damage produced by the duopoly, D, as a proxy of the firm’s concern for the environment. Hence the objective of the CSR firm is a combination of consumer surplus, environmental emissions, and its own profit:

Let the parameter \(\theta \in [0,1]\) represent the fraction or percentage of total market consumer surplus that is of concern to the socially concerned firm’s stakeholders. When \(\theta =1\), all consumer’s welfare is of interest to this firm while, conversely, when \(\theta =0\) the firm is not consumer-friendly in our model. Similarly, the parameter \(\gamma \in \left[ 0,1\right]\) measures the CSR firm’s degree of concern on environmental emissions. When \(\gamma =1\), all emissions damage is of interest to the CSR firm while, conversely, when \(\gamma =0\) the firm is not environmentally friendly in our setting. We assume that \(\theta\) and \(\gamma\) are exogenously given. This definition of CSR implies the CSR firm is willing to accept less profits to act in a more socially and environmentally concerned way. In other words, in our setting, CSR is purely a costly activity (see, for instance, Fukuda and Ouchida 2020). It is important to note that since our model assumes a CSR firm that cares for profits, for a fraction of the consumer surplus, and for a share of the environmental emissions produced by the duopoly, there is a trade-off in terms of the total quantity produced by the firm. In fact, while being concerned about the environment implies cutting production down, so emissions go down and environmental damage is in turn reduced, the opposite effect on a firm’s strategy is caused when having social concerns. Hence, given our theoretical formulation, it could be the case that a CSR firm makes higher profits if the market is large enough. In addition, other CSR firm settings may necessarily imply lower profits. For example, Benabou and Tirole (2010) define CSR as: “about sacrificing profits in the social interest. For there to be a sacrifice, the firm must go beyond its legal and contractual obligations, on a voluntary basis”. On this view on CSR, Kitzmueller and Shimshack (2012) recall Gary S. Becker’s argument which points out that firms that combine profit motivation with a true nonprofit consideration (including CSR) can only prosper in a competitive environment:“if they are able to attract employees and customers that also value these other corporate goals”Footnote 8

In Definition 1, we formally define the different CSR motivations explored in this work.

Definition 1

Given (2) we put forward the following CSR firm’s motivations:

- i.:

-

Profit Maximizing Firm. The firm has only a profit maximizing objective \(\mathbf {(}\theta =0\) and \(\gamma =0)\);

- ii.:

-

Consumer friendly Firm. The objective of the CSR-firm is a combination of consumers surplus, and its own profit \(\mathbf {(}\theta >0\) and \(\gamma =0)\);

- iii.:

-

Environmentally friendly Firm. The CSR-firm maximizes its material profit minus environmental damage produced by the duopoly \(\mathbf {(}\theta =0\) and \(\gamma >0\mathbf {)}\);

- iv.:

-

Consumer-Environment friendly Firm. Consumer-environmentally friendly CSR-firm whose objective is a combination of consumer surplus, and its own profit minus environmental damage produced by the duopoly \(\mathbf {(}\theta >0\) and \(\gamma >0)\).

We define social welfare (SW) as the difference between the sum of the producer’s and consumer’s surplus and any technological external costs which are not accounted for in the producer’s surplus. Particularly, in this setting we assume that social welfare will be given by the sum of consumer surplus, CS, the profits of both firms, \(\pi _{0}+\pi _{1}\), and tax revenue \(T=(d(q_0,w_0)t+d(q_1,w_0)t)\), minus environmental damage, \(D(d_{0},d_{1})\)Footnote 9:

Hence, the pay-off that the CSR firm maximizes is as follows:

First, we address the problem following Barnett (1980), where firms and the regulator choose simultaneously their decisions, namely, production \(q_i\) and resources devoted to pollution treatment \(w_i\) for the firms, and for the regulator, the tax t. However, as pointed out by Petrakis and Xepapadeas (2003), there is a time inconsistency in the simultaneous formulation due to long-term decisions, such as abatement, versus short-term decisions such as production and the regulator’s ability to change tax policy. Therefore, a better modeling strategy for the problem is through a three-stage ex-post policy game, proposed by Petrakis and Xepapadeas (2003), which is time consistent.

We assume the following conditions:

Assumption 1

The inverse demand function f(Q) is twice continuously differentiable, with \(\frac{\partial f(Q)}{\partial Q}<0\) (whenever \(f(Q)>0\)) and \(lim_{Q\rightarrow \infty }\) \(f(Q)=0\), with \(q_{0},q_{1}\ge 0\).

Assumption 2

Cost functions \(c=c(q_{i},w_{i})\) \((\forall i=0,1)\) are increasing and twice continuously differentiable.

Assumption 3

The emission level function \(d=d(q_{i},w_{i})\) \((\forall i=0,1)\) and the emission damage function \(D(d(q_0,w_0),d(q_1,w_1))\) are increasing in production, \(\frac{\partial d}{\partial q_{i}}>0\) and \(\frac{\partial D}{\partial q_{i}}>0\) and decreasing in abatement effort, \(\frac{\partial d}{\partial w_{i}}<0\) with \(\frac{\partial D}{\partial w_{i}}<0\) and twice continuously differentiable, with \(\frac{\partial ^2 D}{\partial q_{i}^2}>0\) and \(\frac{\partial ^2 D}{\partial w_{i}^2}>0\).

Under Assumption 1 both firms’ action sets are compact since the firms would never produce quantities larger than some upper-bound. Assumption 2 defines the cost function in terms of production levels and abatement effort levels. Assumption 3 is consistent with most of the literature, which defines environmental emissions as monotonically increasing in production and decreasing in abatement effort.

3.1 Simultaneous Game

In the simultaneous game, the regulator chooses the emission tax t that maximizes social welfare and firms choose their level of production (\(q_i\)) and pollution abatement (\(w_i\)). Definition 2 describes the game.

Definition 2

A strategy for the regulator is a tax amount \(t \ge 0\) and a strategy for the firms is \(\rho _i(q_i,w_i)\), where \(\rho _i(\cdot )\) is a mapping of the decisions \((q_i,w_i)\). An equilibrium of this simultaneous game is a triplet \((t^*,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1^*))\) such that:

-

(i)

\(\pi _1(t^*,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1^*)) \ge \pi _1(t^*,\rho (q_0^*,w_0^*),\rho (q_1,w_1^*))\)

-

(ii)

\(\pi _1(t^*,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1^*)) \ge \pi _1(t^*,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1))\)

-

(iii)

\(v_0(t^*,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1^*)) \ge v_0(t^*,\rho (q_0,w_0^*),\rho (q_1^*,w_1^*))\)

-

(iv)

\(v_0(t^*,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1^*)) \ge v_0(t^*,\rho (q_0^*,w_0),\rho (q_1^*,w_1^*))\)

-

(v)

\(SW(t^*,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1^*)) \ge SW(t,\rho (q_0^*,w_0^*),\rho (q_1^*,w_1^*))\)

An equilibrium in the simultaneous game imposes that: (i) the strategy of the firms be a single-valued selection from their best-response correspondences for \(q_{i}\) and \(w_{i}\) given a tax t; and (ii) the regulator chooses a tax that maximizes the social welfare function given the optimal strategy of the firms \((q_{i}^{*},w_{i}^{*})\) for \(i=0,1\).

The associate optimization problem faced by the private firm is given by:

Similarly, for the CSR-firm, the problem becomes:

The regulator chooses the tax rate per unit of emissions discharged, t, that maximizes the social welfare function, (Eq. 3):

Each firm maximizes its utility function, where the FOC are as follows:

Proposition 1

The first-order conditions for the maximization problem facing both firms, given by Eqs. 5and 6are as follows:

- i.:

-

\(\frac{\partial v_0}{\partial q_0}=f(Q)+q_{0}\frac{\partial f(Q)}{\partial q_{0}}-\frac{\partial c_{0}}{\partial q_{0}}-t\frac{\partial d_{0}}{\partial q_{0}}-\theta Q\frac{\partial f(Q)}{\partial q_{0}}-\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}}{ \partial q_{0}}=0\);

- ii.:

-

\(\frac{\partial v_0}{\partial w_0}=\frac{\partial c_{0}}{\partial w_{0}}+t\frac{\partial d_{0}}{\partial w_{0}}+\gamma \frac{\partial D}{\partial d_{0}}\frac{ \partial d_{0}}{\partial w_{0}}=0\);

- iii.:

-

\(\frac{\partial \pi _1}{\partial q_1}=f(Q)+q_{1}\frac{\partial f(Q)}{\partial q_{1}}-\frac{\partial c_{1}}{\partial q_{1}}-t\frac{\partial d_{1}}{\partial q_{1}}=0\);

- iv.:

-

\(\frac{\partial \pi _1}{\partial w_1}=\frac{\partial c_{1}}{\partial w_{1}}+t\frac{\partial d_{1}}{\partial w_{1}}=0\).

Proof

See Appendix. \(\square\)

Simultaneously, the regulator faces the problem pointed out in (7), which after totally differentiating SW leads to the following FOC:

Combining (8) with the FOCs highlighted in Proposition 1 we obtain the following result:

Proposition 2

The SPNE welfare-maximizing tax is given by:

where \(\frac{\partial d_{0}^{*}}{\partial t}=\frac{\partial d_{0}}{ \partial q_{0}}\frac{dq_{0}^{*}}{dt}+\frac{\partial d_{0}}{\partial w_{0} }\frac{dw_{0}^{*}}{dt}\) and \(\frac{\partial d_{1}^{*}}{\partial t}= \frac{\partial d_{1}}{\partial q_{1}}\frac{dq_{1}^{*}}{dt}+\frac{ \partial d_{1}}{\partial w_{1}}\frac{dw_{1}^{*}}{dt}\) are the impact of the tax on the CSR and private firms’ emissions.

Proof

See Appendix. \(\square\)

While Eq. (9) is not an explicit solution for t, because t is on both sides of the equation, Proposition 1 allows us to write q and w as functions of t. Substituting these terms into (9) then gives one equation with one unknown, t. From (9) we can get Corollary 1 below:

Corollary 1

An increase in parameter \(\theta\) , which represents the fraction of total consumer surplus that is of concern to the CSR firm , increases the equilibrium emissions tax: \(\frac{dt^{*}}{d\theta }=-\frac{Q^{*}\frac{dq_{0}^{*}}{dt}\frac{\partial f(Q^{*})}{\partial q_{0}}}{\frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial d_{1}^{*}}{\partial t}}>0\) , while an increase in parameter \(\gamma\) , which measures the CSR firm’s degree of concern on environmental emissions, decreases the equilibrium emission tax: \(\frac{dt^{*}}{d\gamma }=-\frac{\frac{\partial D^{*}}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}}{\left( \frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial d_{1}^{*}}{\partial t}\right) }<0\).

Proof

See Appendix. \(\square\)

The intuition behind the results of Corollary 1 is that the CSR firm has two competing objectives. On one hand, the firm is concerned about consumer surplus, which implies more production. On the other hand, the firm is also concerned about the environment, which implies less production. In this sense, there is a positive relation between \(q_0\) and \(\theta\) and a negative one between \(q_0\) and \(\gamma\). Since an increment in \(q_i\) implies an increment in the emissions, and then an increment in the tax, it’s clear that there is a positive relation between tax and \(\theta\) and a negative relation between tax and \(\gamma\), which are the results proposed in Corollary 1.

Given (9) and considering that Assumptions 1–3 hold, we can characterize the equilibrium by looking at the four different potential motivations that characterize the behavior of a CSR firm. See Corollary 2 below.

Corollary 2

The welfare-maximizing tax rule for the simultaneous game when assuming different CSR motivations is given by:

- i.:

-

Profit Maximizing Firm (\(\theta =0\) and \(\gamma =0\)):

$$\begin{aligned} t_{pm}^{*}=\frac{\frac{\partial D}{\partial d_{1}}\frac{\partial d_{1}^{*}}{\partial t}+\frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}}{\frac{\partial d_{0}^{*}}{\partial t}+\frac{ \partial d_{1}^{*}}{\partial t}}+\frac{q_{0}\frac{dq_{0}^{*}}{dt} \frac{\partial f(Q)}{\partial q_{0}}+q_{1}\frac{dq_{1}^{*}}{dt}\frac{ \partial f(Q)}{\partial q_{1}}}{\frac{\partial d_{0}^{*}}{\partial t}+ \frac{\partial d_{1}^{*}}{\partial t}}. \end{aligned}$$(10) - ii.:

-

Consumer friendly CSR Firm (\(\theta >0\) and \(\gamma =0\)):

$$\begin{aligned} t_{cf}^{*}=\frac{\frac{\partial D}{\partial d_{1}}\frac{\partial d_{1}^{*}}{\partial t}+\frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}}{\frac{\partial d_{0}^{*}}{\partial t}+\frac{ \partial d_{1}^{*}}{\partial t}}+\frac{\left( q_{0}-\theta Q\right) \frac{dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}+q_{1}\frac{ dq_{1}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{1}}}{\frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial d_{1}^{*}}{\partial t}}. \end{aligned}$$(11) - iii.:

-

Environmentally friendly CSR Firm (\(\theta =0\) and \(\gamma >0\)):

$$\begin{aligned} t_{ef}^{*}=\frac{\left( 1-\gamma \right) \frac{\partial D}{\partial d_{0} }\frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial D}{\partial d_{1}} \frac{\partial d_{1}^{*}}{\partial t}}{\frac{\partial d_{0}^{*}}{ \partial t}+\frac{\partial d_{1}^{*}}{\partial t}}+\frac{q_{0}\frac{ dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}+q_{1}\frac{ dq_{1}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{1}}}{\frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial d_{1}^{*}}{\partial t}}. \end{aligned}$$(12) - iv.:

-

Consumer-Environment friendly CSR Firm (\(\theta >0\) and \(\gamma >0\)):

$$\begin{aligned} t_{cef}^{*}=\frac{\left( 1-\gamma \right) \frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial D}{\partial d_{1}}\frac{\partial d_{1}^{*}}{\partial t}}{\frac{\partial d_{0}^{*} }{\partial t}+\frac{\partial d_{1}^{*}}{\partial t}}+\frac{\left( q_{0}-\theta Q\right) \frac{dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}+q_{1}\frac{dq_{1}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{1}}}{ \frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial d_{1}^{*}}{ \partial t}}. \end{aligned}$$(13)

Proof

See appendix \(\square\)

The different versions of emissions tax rules put forward in Corollary 2 reflect the alternative objectives of the CSR-firm (a combination of consumer surplus, environmental emissions, and its own profit). As the optimal emission taxation rule is modified when considering different CSR motivations, it transpires that behavioral biases, caused in this case by non-profit motives, must be taken into account when designing environmental policy. A formal general comparison of these alternative tax rules is presented in the result below:

Proposition 3

In the duopoly setting in which a CSR firm interacts with a profit-maximizing firm, tax comparison for different CSR motivations is as follows:

- i.:

-

\(t_{ef}^{*}\le t_{pm}^{*}\le t_{cf}^{*}\)

- ii.:

-

\(t_{ef}^{*}\le t_{pm}^{*}<t_{cef}^{*}\le t_{cf}^{*}\) whenever \(\theta Q\frac{\partial f(Q)}{\partial q_{0}}\frac{ dq_{0}^{*}}{dt}+\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}> 0\)

- iii.:

-

\(t_{ef}^{*}\le t_{cef}^{*}\le t_{pm}^{*}\le t_{cf}^{*}\) whenever \(\theta Q\frac{\partial f(Q)}{\partial q_{0}}\frac{ dq_{0}^{*}}{dt}+\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}\le 0\)

Proof

Follows from Corollary 1 and Corollary 2\(\square\)

The result put forward in Proposition 3 panel (i) is that the optimal pollution tax for a consumer-friendly firm, \(t_{cf}^*\), should be set equal or greater than that for a profit-maximizing firm, \(t_{pm}^*\), which is, in turn, equal or greater than that for an environmentally friendly firm, \(t_{ef}^{*}\), all this in the context of a duopoly in which these firms face a profit-maximizing firm. In other words, the optimal emission tax to be levied over a consumer-friendly firm, conforming a duopoly with a profit-maximizing firm, is higher than those charged over all other CSR behaviors analyzed for the same context, namely: profit-maximizing and, environmentally-friendly behaviors. This result makes sense, as the consumer-friendly firm cares for consumers, and so they will tend to produce higher levels of output and therefore higher emission levels than an environmentally friendly or a profit-maximizing firm, and hence higher emission taxes are in order.

When we introduce in the analysis a consumer-environment friendly CSR firm, the condition \(\theta Q\frac{\partial f(Q)}{\partial q_{0}}\frac{dq_{0}^{*}}{dt}+\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}\) starts playing a role in the relative size of optimal tax under the different CSR motivations explored in this work. This condition can be interpreted as the trade-off the CSR-firm faces between the welfare loss associated with the duopoly-restricted output by imposing environmental taxes and the environmental negative externalities. Proposition 3 panels (ii) and (iii) show that if the welfare losses due to restricted output are greater than those accrued by the environmental negative externality, that is: \(\theta Q\frac{\partial f(Q)}{\partial q_{0}}\frac{dq_{0}^{*}}{dt}>\) \(-\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_{0}^{*}}{\partial t}\), the tax levied upon the consumer-environment friendly CSR firm is higher than when the opposite is true \(\theta Q\frac{\partial f(Q)}{\partial q_{0}}\frac{dq_{0}^{*}}{dt}\le -\gamma \frac{\partial D}{\partial d_{0}}\frac{ \partial d_{0}^{*}}{\partial t}\)Footnote 10. While in the first case, we have that the optimal pollution tax for a consumer-friendly CSR firm, \(t_{cf}^{*}\), should be set equal or greater than that for a consumer-environment friendly CSR firm, \(t_{cef}^{*}\), that is greater than that for a profit-maximizing firm, \(t_{pm}^{*}\), which is, in turn, equal or greater than that for an environmentally friendly CSR firm, \(t_{ef}^{*}\), in the latter the optimal pollution tax for a profit-maximizing firm, \(t_{pm}^{*}\) is equal or greater than that for a consumer-environment friendly CSR firm, \(t_{cef}^{*}\).

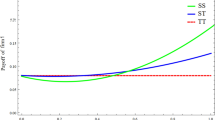

Using Corollary 1 and Proposition 3, we can depict graphically the emission tax rules for the different CSR motivations considered in the analysis, given by parameters \(\theta\) and \(\gamma\), see Fig. 1.

Figure 1 shows that as parameter \(\theta\) increases the equilibrium emission tax also increases. The benchmark tax rate is that of the profit-maximizing firm, \(t_{pm}^{*}\), for which we assume \(\theta =0\) and \(\gamma =0\), and therefore is invariant to changes in these parameters. Panel (a) depicts condition (ii) from Proposition 3 in which the optimal pollution tax for a consumer-friendly CSR firm, \(t_{cf}^{*}\) is higher than that for a consumer-environment friendly CSR firm, \(t_{cef}^{*}\), for which parameter \(\gamma\), which measures the CSR firm’s degree of concern on environmental emissions, is positive. We also can notice from Fig. 1, that as \(\gamma\) increases (from \(\gamma _{1}\) to \(\gamma _{2}\)) the lower the optimal emission tax for a consumer-environment friendly CSR firm, \(t_{cef}^{*}\), for every value of parameter \(\theta\). Finally, whenever parameters \(\theta\) and \(\gamma\) are equal to zero we have that \(t_{pm}^{*}=t_{cef}^{*}=t_{cf}^{*}\). Panel (b) shows condition (iii) from Proposition 3 in which the emission tax rule for a profit-maximizing firm, \(t_{pm}^{*}\) is higher than that for a consumer-environment friendly CSR firm, \(t_{cef}^{*}\), for any value of parameter \(\gamma\), but lower than that for a consumer-friendly CSR firm, \(t_{cf}^{*}\).

3.2 Three-Stage Ex-Post Game

Although the simultaneous game helps us to understand the dynamics among the three actors in the game (private firm, firm with CSR objectives, and the regulator), this game is not time consistent, as some decisions involve investment (abatement) and associated sunk costs and therefore these should be treated as sequential.

Following Petrakis and Xepapadeas (2003), we know that an emission tax level determined ex ante, that is, before the private and CSR firms make their abatement decisions, is not credible unless the regulator faces high costs from not committing to the announced policy. The reason behind this notion is that when the decision about abatement efforts have been taken by the two firms, the emission tax level chosen ex ante by the regulator is not in fact ex post optimal and therefore it is not time consistent. Clearly in this context, the ex post regulator utility function is not the same as the ex ante one, given that the former considers only the gross profits of the two firms as abatement costs are already sunk. Given this, both firms in the duopoly, acting as economically rational agents, can rightly anticipate an adjustment in the emission tax rate once the abatement efforts have been chosen.Footnote 11Hence, whenever the regulator is unable to commit to a specific emission tax level and therefore it can be expected that it will change it after abatement levels have been chosen, then an ex post, i.e. time consistent, policy regime emerges.

For this reason, we model the problem by means of a time-consistent (or ex-post) policy game and we restrict our attention to pure strategies. In the first stage, the firms decide simultaneously their abatement effort \(w_i\). Subsequently, in the second stage, the regulator imposes the tax t. Finally, the firms decide simultaneously their production level \(q_i\).

In this sequential game of perfect information, any stage is a sub-game and a strategy vector is a sub-game perfect Nash equilibrium (SPNE) only if it induces a Nash equilibrium in the strategic form of every sub-game. In this context, SPNE reduces to backward induction.

Definition 3

A strategy for the regulator is a tax amount \(t\ge 0\) and a strategy for the firms is \(\rho _{i}(q_{i},w_{i})\), where \(\rho _{i}(\cdot )\) is a mapping of the decisions \((q_{i},w_{i})\).

The firms are the first movers with their abatement decision, where an equilibrium is given by:

-

(i)

\(\pi _1(\rho _1(q_1^*,w_1^*))\ge \pi _1(\rho _1(q_1^*,w_1))\)

-

(ii)

\(v_0(\rho _0(q_0^*,w_0*))\ge v_0(\rho _0(q_0^*,w_0))\)

The regulator is a second-mover player, and the equilibrium is such that:

-

(i)

\(SW(t^*,\rho _i(q_i^*,w_i))\ge SW(t,\rho _i(q_i^*,w_i))\)

The firms are the third movers with the production decision, where an equilibrium is given by:

-

(i)

\(\pi _1(\rho _1(q_1^*,w_1))\ge \pi _1(\rho _1(q_1,w_1))\)

-

(ii)

\(v_0(\rho _0(q_0^*,w_0))\ge v_0(\rho _0(q_0,w_0))\)

Therefore, the stages of the game are as follows:

Stage 3: Production

Each firm determines \(q_i\) to maximize \(v_0\) and \(\pi _1\). The corresponding first-order conditions are given by Proposition 1-i and Proposition 1-iii. The equilibrium output level for each firm is:

where \(q_0^{(3)}(w_0,w_1,t)\) and \(q_1^{(3)}(w_0,w_1,t)\) are the best response equations that follow the optimization of stage three, and \(Q^{(3)}(w_0,w_1,t)=q_0^{(3)}(w_0,w_1,t)+q_1^{(3)}(w_0,w_1,t)\). Notice that \((\cdot )^{(3)}\) is notation only and refers to the results of stage 3 of the game, which depend on the abatement of both firms and the tax.

Stage 2: Taxation

Introducing the results of stage 3, Eqs. 14 and 15 into Eq. 3, the FOC for the regulator is given by:

where \(\frac{\partial Q^{(3)}}{\partial t}=\frac{\partial q_0^{(3)}}{\partial t}+\frac{\partial q_1^{(3)}}{\partial t}\). From Eq. 16, we find \(t^{(2)}(w_0,w_1)\). We also obtain \(q_0^{(2)}(w_0,w_1)\), \(q_1^{(2)}(w_0,w_1)\) and \(Q^{(2)}(w_0,w_1)\). Again, \((\cdot )^{(2)}\) refers to the results obtained in stage 2 of the game, which depend on \(w_0\) and \(w_1\).

Stage 1: Abatement effort

The results from stage 2 must be introduced into \(\pi _1\) and \(v_0\). Once introduced in the utility functions, the FOC are as follows:

Combining Eqs. (17) and (18) with the results of stage 2 we obtain the following result:

Proposition 4

The SPNE welfare-maximizing tax for the three-stage ex-post game is given by:

Proof

See appendix \(\square\)

As well as in the simultaneous game, Eq. (19) is not an explicit solution for t. However, stage 2 allows us to write q and t as functions of \((w_0,w_1)\), which leads to the following Corollary.

Corollary 3

Whenever \(\frac{\frac{\partial q_1}{\partial w_1}}{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}}>0\) , an increase in the fraction of consumer surplus that is a concern to the CSR-firm, \(\theta\) , will increase the equilibrium emission tax, that is \(\frac{\partial t}{\partial \theta }=\frac{Q\frac{\partial q_1}{\partial w_1}\frac{\partial f(Q)}{\partial w_0}}{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}}>0\) only when \(\frac{\partial f(Q)}{\partial w_0}>0\). On the other hand, an increase in parameter \(\gamma\) , the degree of concern on environmental emissions, decreases the equilibrium emission tax, which means \(\frac{\partial t}{\partial \gamma }=\frac{\frac{\partial q_1}{\partial w_1}\frac{\partial D}{\partial w_0}}{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}}<0\).

Proof

See Appendix. \(\square\)

The intuition behind Corollary 3 is similar to that of Corollary 1, in the sense that the CSR firm has two conflicting objectives. On the one hand, it is concerned about the environment, which leads it to produce less output, while, on the other hand, it is also concerned about consumer surplus, which leads it to produce more. It is in this sense that, the greater its concern for the environment (increase in \(\gamma\)), the lower the tax, and the greater its concern for consumer surplus (increase in \(\theta\)), the higher the tax. However, in this 3-stage game, abatement plays an important role that could moderate or even change the conclusions of Corollary 1 (it is only fulfilled if the condition is met). Rewriting the condition of Corollary 3, we conclude that \(\frac{\frac{\partial q_0}{\partial w_0}}{\frac{\partial q_1}{\partial w_1}}\frac{\partial d_1}{\partial w_1}-\frac{\partial d_0}{\partial w_0}>0\). From this it is easy to see that the condition is only satisfied when the sign of \(\frac{\partial q_0}{\partial w_0}\) and the sign of \(\frac{\partial q_1}{\partial w_1}\) are different or when the sign of \(\frac{\partial q_0}{\partial w_0}\) and the sign of \(\frac{\partial q_1}{\partial w_1}\) are the same, but the effect \(\frac{\frac{\partial q_0}{\partial w_0}}{\frac{\partial q_1}{\partial w_1}}\frac{\partial d_1}{\partial w_1}\) is less than the reduction of emissions of the CSR firm when increase its abatement effort, \(\frac{\partial d_0}{\partial w_0}\).

In addition, Eq. 19, lets us characterize the behavior of a CSR-firm for different motivations, which points to the corollary below.

Corollary 4

The welfare-maximizing environmental tax rule for the three-stage ex-post game when assuming different CSR motivations is given by:

- i.:

-

Profit Maximizing Firm (\(\theta =0\) and \(\gamma =0\)):

$$\begin{aligned} t_{pm}^*=\frac{\frac{\partial q_1}{\partial w_1}\left( \frac{\partial c_0}{\partial w_0}+d_0\frac{\partial t}{\partial w_0}-q_0\frac{\partial f(Q)}{\partial w_0}\right) -\frac{\partial q_0}{\partial w_0}\left( \frac{\partial c_1}{\partial w_1}+d_1\frac{\partial t}{\partial w_1}-q_1\frac{\partial f(Q)}{\partial w_1}\right) }{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}} \end{aligned}$$(20) - ii.:

-

Consumer friendly CSR Firm (\(\theta >0\) and \(\gamma =0\)):

$$\begin{aligned} t_{cf}^*=\frac{\frac{\partial q_1}{\partial w_1}\left( \frac{\partial c_0}{\partial w_0}+d_0\frac{\partial t}{\partial w_0}+\theta Q\frac{\partial f(Q)}{\partial w_0}-q_0\frac{\partial f(Q)}{\partial w_0}\right) -\frac{\partial q_0}{\partial w_0}\left( \frac{\partial c_1}{\partial w_1}+d_1\frac{\partial t}{\partial w_1}-q_1\frac{\partial f(Q)}{\partial w_1}\right) }{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}} \end{aligned}$$(21) - iii.:

-

Environmentally friendly CSR Firm (\(\theta =0\) and \(\gamma >0\)):

$$\begin{aligned} t_{ef}^*=\frac{\frac{\partial q_1}{\partial w_1}\left( \frac{\partial c_0}{\partial w_0}+d_0\frac{\partial t}{\partial w_0}+\gamma \frac{\partial D}{\partial w_0}-q_0\frac{\partial f(Q)}{\partial w_0}\right) -\frac{\partial q_0}{\partial w_0}\left( \frac{\partial c_1}{\partial w_1}+d_1\frac{\partial t}{\partial w_1}-q_1\frac{\partial f(Q)}{\partial w_1}\right) }{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}} \end{aligned}$$(22) - iv.:

-

Consumer-Environment friendly CSR Firm (\(\theta >0\) and \(\gamma >0\)):

$$\begin{aligned} t_{cef}^*=\frac{\frac{\partial q_1}{\partial w_1}\left( \frac{\partial c_0}{\partial w_0}+d_0\frac{\partial t}{\partial w_0}+\theta Q\frac{\partial f(Q)}{\partial w_0}+\gamma \frac{\partial D}{\partial w_0}-q_0\frac{\partial f(Q)}{\partial w_0}\right) -\frac{\partial q_0}{\partial w_0}\left( \frac{\partial c_1}{\partial w_1}+d_1\frac{\partial t}{\partial w_1}-q_1\frac{\partial f(Q)}{\partial w_1}\right) }{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}} \end{aligned}$$(23)

Proof

See appendix \(\square\)

From Corollary 4, we conclude similar relations for taxes for different CSR motivations than in Proposition 3 from the simultaneous game. This comparison among these alternative tax rules is presented in the proposition that follows.

Proposition 5

Whenever \(\frac{\partial q_1}{\partial w_1}>0\), \(\frac{\partial f(Q)}{\partial w_0}>0\) and \(\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}>0\) , in the three-stage ex-post game in which a CSR firm interacts with a profit-maximizing firm, taxes comparison for different CSR motivations is as follows:

- i.:

-

\(t_{ef}^*\le t_{pm}^*\le t_{cf}^*\)

- ii.:

-

\(t_{ef}^*\le t_{pm}^*\le t_{cef}^* \le t_{cf}^*\) whenever \(\theta Q\frac{\partial f(Q)}{\partial w_0}+\gamma \frac{\partial D}{\partial w_0}>0\)

- iii.:

-

\(t_{ef}^* \le t_{cef}^* \le t_{pm}^* \le t_{cf}^*\) whenever \(\theta Q\frac{\partial f(Q)}{\partial w_0}+\gamma \frac{\partial D}{\partial w_0}<0\)

Proof

Follows from Corollary 3 and Corollary 4\(\square\)

The results of Proposition 5 are similar to those found in the simultaneous game (Proposition 3). Proposition 5 panel (i) is that the optimal pollution tax for a consumer-friendly CSR-firm, \(t_{cf}^*\), should be set equal to or greater than that for a profit-maximizing firm, \(t_{pm}^*\), which is in turn equal or greater than that for an environmentally friendly CSR firm, \(t_{ef}^*\).

When we introduce in the analysis a consumer-environment friendly CSR firm, the condition \(\theta Q\frac{\partial f(Q)}{\partial w_0}+\gamma \frac{\partial D}{\partial w_0}\) starts playing a role in the relative size of optimal emission taxes under the different CSR motivations explored in this work. This condition can be interpreted as the trade-off this firm faces between the environmental negative externality and the welfare loss associated with the duopoly-restricted output, which in this case is compensated by \(\theta\), which implies a higher output. Notice that Fig. 1 is also valid for the tree-stage ex-post game.

4 Policy Implications

4.1 Strategic Behavior

To emphasize some features of our model, let us review the best response functions of both firms analyzing if we are in the presence of a game that supports Strategic Substitutes or Strategic Complements,Footnote 12 see definition below.

Definition 4

(Bulow et al. 1985) After totally differentiating the first-order conditions (see Proposition 1), we have that:

-

Substitutes implies that \(\frac{\partial \pi _1}{\partial q_0}< 0\) \((\frac{\partial v_0}{\partial q_1}< 0)\), that is, firm’s 1 (firm’s 0) profitability is less when firm 0 (firm 1) increases its output, \(q_{1}\) (\(q_{0}\)), (or acts more aggressively ) and that strategic substitutes in turn are defined as \(\frac{\partial ^2\pi _1}{\partial q_1\partial q_0}<0\) \((\frac{\partial ^2\ v_0}{\partial q_0\partial q_1}<0)\), meaning that the marginal profit of firm 1 is less when firm 0 acts more aggressively.

-

Complements implies that \(\frac{\partial \pi _1}{\partial q_0} > 0\) \((\frac{\partial v_0}{\partial q_1} > 0)\), that is, firm’s 1 (firm’s 0) profitability is more when firm 0 (firm 1) increases its output, \(q_{1}\) (\(q_{0}\)), (or acts more aggressively) and that strategic complements in turn are defined as \(\frac{\partial ^2\pi _1}{\partial q_1\partial q_0} > 0\) \((\frac{\partial ^2\ v_0}{\partial q_0\partial q_1} > 0)\), meaning that the marginal profit of firm 1 is more when firm 0 acts more aggressively.

First, note that \(\frac{\partial v_0}{\partial q_0}\) and \(\frac{\partial \pi _1}{\partial q_1}\) are the same for both simultaneous and three-stage ex-post game and therefore, the findings are equivalent in both cases.

From Proposition 1, panels i and iii, we know that \(q_0=\frac{\frac{\partial c_0}{\partial q_0}+t\frac{\partial d_0}{\partial q_0}+\gamma \frac{\partial D}{\partial d_0}-f(Q)}{(1-\theta )\frac{\partial f(Q)}{\partial q_0}}+\frac{\theta }{1-\theta }q_1\) and \(q_1=\frac{\frac{\partial c_1}{\partial q_1}+t\frac{\partial d_1}{\partial q_1}-f(Q)}{\frac{\partial f(Q)}{\partial q_1}}\). When comparing the reaction functions of firm 0 when \(\theta = 0\) and \(\gamma = 0\) versus \(\theta >0\) and \(\gamma >0\), it is clear that the firm’s output in the first case is higher than in the second case (see Appendix J), which means that:

Equation (24) implies that the CSR firm produces less than it would if it were only maximizing its profit.

The response of firm 1 to the behavior of firm 0 is to increase its production since the slope of the best response function is negative, that is:

Equation (25) implies that a decrease in production of firm 0 causes the best output choice of firm 1 to increase. When the CSR-firm decreases its output, the residual demand for the profit-maximizing firm increases and also its marginal revenue, and then, the profit-maximizing response by firm 1 is to increase its production. Therefore, the quantities chosen by the two firms are strategic substitutes (see Definition 4).

The consequences of the firms’ production being strategic substitutes could lead to unintended consequences for the CSR firm. All of the CSR firm’s efforts to try to reduce emissions increase the profit-maximizing firm incentives to produce more and thus produce an increase in emissions and environmental damage. Therefore, if abatement efforts are insufficient, total emissions and thus environmental damage may be higher than if there were no firms with CSR incentives.

4.2 Price Elasticity of Demand

In order to better interpret the results put forward in Eqs. (9) and (19), let us use the concept of price elasticity of demand, which is defined as follows:

Definition 5

The price elasticity of demand \(\eta _{i}\), for \(i=0,1\), is given by: \(\eta _{i}=-\frac{f(Q^{*})}{q_{i}^{*}}\frac{\partial q_{i}^{*}}{ \partial f(Q^{*})}\).

From Eq. (9) and using the fact that \(q_{i}\frac{\partial f(Q)}{\partial q_i}=-\frac{f(Q)}{\eta _{i}}\), we can obtain the following expression for the optimal tax rate of the simultaneous game:

From Eq. (19) and using the fact that \(\frac{\partial f(Q)}{\partial w_i}=\frac{\partial f(Q)}{\partial q_i}\frac{\partial q_i}{\partial w_i}\) and \(\frac{\partial D}{\partial w_i}=\frac{\partial D}{\partial d_i}\frac{\partial d_i}{\partial w_i}\), \(\forall i=0,1\), we can obtain the following expression for the optimal tax rate of the three-stage ex-post game:

Next, we will analyze the cases of elastic and inelastic demands associated with the optimal tax obtained in Eqs. (26) and (27). Unlike Barnett (1980), we show that, in these games, even if the price elasticity of demand is perfectly elastic, the optimal tax rate, in this setting, does not necessarily equal marginal external damages, it depends upon the values of parameters \(\theta\) and \(\gamma\).

Perfectly Elastic Demands Considering the case in which both firms have a profit maximizing objective \(\mathbf {(}\theta =0\) and \(\gamma =0)\), for the simultaneous game we obtain that the optimal tax rate equals the marginal emissions damage of one of the two symmetric firms, that is \(t^*_{sim}=\frac{\partial D}{\partial d_0}\).

Nevertheless, in the case of a consumer friendly firm that maximizes a fraction of consumer surplus, and its own profit (\(\theta >0\) and \(\gamma =0\)), for the simultaneous game from Eq. (26) we get that \(t_{sim}^*=\frac{\partial D}{\partial d_{0}}-\frac{\theta Q\frac{dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}}{\frac{\partial d_{0}^*}{\partial t}+ \frac{\partial d_{1}^{*}}{\partial t}}\). It is clear that the first term is positive. Given that \(\theta Q\ge 0\), \(\frac{\partial f(Q)}{\partial q_{0}}<0\),\(\frac{dq_{i}^{*}}{dt}<0\) and \(\frac{\partial d_{i}^{*}}{\partial t}<0\), \(\forall i=0,1\), we know that \(-\frac{\theta Q\frac{dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}}{\frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial d_{1}^{*}}{\partial t}}\ge 0\). Hence, as demand approaches the perfectly elastic state, the value of the optimal tax rate can be higher than marginal external damages when a consumer-friendly firm competes with a profit-maximizing firm. However, if we assume that emissions treatment is the only means of emissions abatement, then \(\frac{dq_{0}^{*}}{dt}=0\), and we also get that the optimal tax is given by \(t^{*}=\frac{\partial D}{\partial d_{0}}\) i.e. the optimal tax rate equals the marginal emissions damage of one of the two symmetric firms.

However, for the three-stage game, from Eq. (27), we obtain that the tax is the same when both firms are profit maximizing or in the case of a consumer friendly firm, that is: \(t^*_{3stage}=\frac{\frac{\partial q_1}{\partial w_1}\left( \frac{\partial c_0}{\partial w_0}+d_0\frac{\partial t}{\partial w_0}\right) -\frac{\partial q_0}{\partial w_0}\left( \frac{\partial c_1}{\partial w_1}+d_1\frac{\partial t}{\partial w_1} \right) }{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}}\). In these cases, the tax does not depend directly on the damage, but rather on emissions, marginal abatement cost, and the effect of abatement on tax and production.

When considering the case of an environmentally friendly firm that maximizes its material profit minus the environmental emissions produced by the whole duopoly, that is: \(\theta =0\) and \(\gamma >0\), in the case of the simultaneous game we obtain: \(t_{sim}^*=\frac{\partial D}{\partial d_{0}} - \frac{\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_0^*}{\partial t}}{\frac{\partial d_0^*}{\partial t}+\frac{\partial d_1^*}{\partial t}}\). Since \(\frac{\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_0^*}{\partial t}}{\frac{\partial d_0^*}{\partial t}+\frac{\partial d_1^*}{\partial t}}>0\), the value of the optimal tax rate is lower than marginal external damages. However, when \(\gamma =1\) in the case that \(\vert \frac{\partial d_{0}^{*}}{\partial t}\vert \ll \vert \frac{\partial d_{1}^{*}}{\partial t}\vert\), which imply that \(\frac{\frac{\partial d_{0}^{*}}{\partial t}}{\frac{\partial d_{1}^{*}}{\partial t}}\rightarrow 0\), we obtain an optimal tax rule that equals the marginal emissions damage of the private firm. Given that the CSR firm is perfectly environmentally friendly, its abatement effort and production reduction are already high. Therefore, in the context of a change in taxes, it is most likely that this firm will vary its production and abatement levels, and therefore, its emissions levels, only minimally. On the other hand, if emissions of the profit-maximizing firm are very sensitive to a change in taxes, it is possible in this case, to make taxes equal to the marginal damage of the private firm’s emissions.

A consumer-environment friendly firm, with \(\theta >0\) and \(\gamma >0\), in a simultaneous game leads to: \(t^*_{sim}= \frac{\partial D}{\partial d_{0}} - \frac{\gamma \frac{\partial D}{\partial d_{0}}\frac{\partial d_0^*}{\partial t}+\theta Q\frac{dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}}{\frac{\partial d_{0}^{*}}{\partial t}+\frac{\partial d_{1}^{*}}{\partial t}}\). The value of the optimal tax rate can be higher than marginal external damages. This will depend on the values of \(\theta\) and \(\gamma\). The closer the firm is to the consumer-friendly case (\(\gamma\) close to 0 and \(\theta\) close to 1), the higher the optimal tax rate will be. Nevertheless, the closer the firm’s objectives are to the environmentally friendly case (\(\gamma\) close to 1 and \(\theta\) close to 0), the lower the taxation rate, being lower than the marginal external damages the firm incurs.

Finally, in the three-stage ex-post game, both a environmentally friendly firm or a consumer-environmentally friendly firm lead us to the same optimal tax: \(t^*_{3stage}=\frac{\frac{\partial q_1}{\partial w_1}\left( \frac{\partial c_0}{\partial w_0}+d_0\frac{\partial t}{\partial w_0}+\gamma \frac{\partial D}{\partial d_0}\frac{\partial d_0}{\partial w_0}\right) -\frac{\partial q_0}{\partial w_0}\left( \frac{\partial c_1}{\partial w_1}+d_1\frac{\partial t}{\partial w_1}\right) }{\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}}\). If \(\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}>0\) and \(\frac{\partial q_0}{\partial w_0}\frac{\partial d_1}{\partial w_1}-\frac{\partial q_1}{\partial w_1}\frac{\partial d_0}{\partial w_0}>\gamma \frac{\partial d_0}{\partial w_0}\frac{\partial q_1}{\partial w_1}\), then optimal tax is greater than the environmental emissions.

Perfectly Inelastic Demands It is easy to see from Eq. (26) that when \(\eta _{0}\rightarrow 0\) and \(\eta _{1}\rightarrow 0\), the marginal emissions will be always greater than the optimal emission tax. In fact, for the simultaneous game, mathematically \(t^*_{sim}\rightarrow -\infty\), independently of the CSR motivations of the firms, which in practice means no taxes (\(t^*_{sim}=0\)) or even a subsidy. In the three-stage ex-post game \(t^*_{3stage}\rightarrow 0\). These results are consistent with Barnett (1980).

Finite Elasticity of Demand By contrast, if the demands of the profit-maximizing and CSR-firms are finite, unlike Barnett (1980), it is not always the case that the optimal emission tax will be lower than the marginal emissions damage. For instance, when analyzing the simultaneous game, when one of the firms in the duopoly has consumer-friendly motivations, the amount by which optimal tax rates fall short of marginal damages will depend upon the following inequality:

Whenever (28) holds, the optimal tax rate may be less than marginal external damages. If the opposite occurs, then the optimal tax rate will be higher than marginal external damages.

When the profit-maximizing firm competes with an environmentally friendly firm, regardless of how elastic or inelastic the market is, the optimal tax will always be below the marginal emissions emitted by the firms. These results comes from the fact that \(t_{ef}^{*}=\frac{\partial D}{\partial d_{0}}-\frac{\gamma \frac{\partial d_{0}^{*}}{\partial t}+f(Q^{*})\left( \frac{1}{\eta _{0}}\frac{dq_{0}}{dt}+\frac{1}{\eta _{1}}\frac{dq_{1}}{dt}\right) }{\frac{\partial d_{0}}{\partial t}+\frac{\partial d_{1}}{\partial t}}\). Since the second term of \(t_{ef}^{*}\) is always negative, \(t_{ef}^{*}<\frac{\partial D}{\partial d_{0}}\).

Finally, when one of the firms in the duopoly is a consumer-environmentally friendly firm, as in the case of a perfectly elastic demand, the value of the optimal tax rate can be higher or lower than marginal external damages, depending on the values of \(\eta _{0}\), \(\eta _{1}\), \(\gamma\) and \(\theta\).

To sum up, Proposition 6 puts forward the main results obtained from the analysis of Eq. 26. The results summarized in this proposition show the trade-off between the environmental negative externality and the welfare loss associated with the duopoly-restricted output in each case, which in this setting is compensated by \(\theta\), which shows the concern of the firm with its stakeholders, taking into account the total market consumer surplus in its decision-making process, and so also implies a higher output. This trade-off explains why in some cases we can obtain optimal tax rates higher than marginal emissions in some cases or lower, depending on which effect is stronger.

Proposition 6

In the simultaneous game setting, optimal environmental tax rules for the different CSR motivations depends on the price elasticity of demand of the good market as follows:

-

i. Profit Maximizing Firm (\(\theta =0\) and \(\gamma =0\) ):

-

Finite elasticity of demand: \(\frac{\partial D}{ \partial d_{0}}>t_{pm}^{*}\)

-

Perfectly elastic demand: \(\frac{\partial D}{ \partial d_{0}}=t_{pm}^{*}\)

-

-

ii. Consumer friendly CSR Firm (\(\theta >0\) and \(\gamma =0\)):

-

Finite elasticity of demand: \(\frac{\partial D}{ \partial d_{0}}\le t_{cf}^{*}\) whenever \(\left| f(Q^{*})\left( \frac{1}{\eta _{0}}\frac{dq_{0}^{*}}{dt}+\frac{1}{\eta _{1}} \frac{dq_{1}^{*}}{dt}\right) \right| <\left| \theta Q\frac{ dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}\right|\)

-

Perfectly elastic demand: \(\frac{\partial D}{ \partial d_{0}}\le t_{cf}^{*}\)

-

-

iii. Environmentally friendly CSR Firm (\(\theta =0\) and \(\gamma >0\)):

-

For any elasticity of demand we obtain: \(\frac{ \partial D}{\partial d_{0}}\ge t_{ef}^{*}\)

-

-

iv. Consumer-Environment friendly CSR Firm (\(\theta >0\) and \(\gamma >0\)):

-

Finite elasticity of demand: \(\frac{\partial D}{ \partial d_{0}}\ge t_{cef}^{*}\) whenever \(\frac{\partial D}{ \partial d_{0}}>-\frac{f(Q^{*})\left( \frac{1}{\eta _{0}}\frac{ dq_{0}^{*}}{dt}+\frac{1}{\eta _{1}}\frac{dq_{1}^{*}}{dt}\right) +\theta Q\frac{dq_{0}^{*}}{dt}\frac{\partial f(Q)}{\partial q_{0}}}{ \gamma \frac{\partial d_{1}^{*}}{\partial t}}\)

-

Perfectly elastic demand: \(\frac{\partial D}{ \partial d_{0}}\ge t_{cef}^{*}\) whenever \(\frac{\partial D}{ \partial d_{0}}>\frac{\theta Q\frac{dq_{0}^{*}}{dt}\frac{\partial f(Q^{*})}{\partial q_{0}}}{\gamma \frac{\partial d_{1}^{*}}{\partial t}}\)

-

Proof

Follows from the analysis above. \(\square\)

5 Model Simulations

To further explore the models developed in the previous sections, we analyze and compare the simultaneous game with the ex-post three-stage game for two polluters (private firm and CSR-firm) competing in quantities using the model specification described in Sect. 3.

For this numerical exercise, we use standard function specifications found in the related literature (see for instance Petrakis and Xepapadeas 2003 and Fukuda and Ouchida 2020). The total output is given by \(Q=q_0+q_1\) and the inverse demand function is given by \(f(Q)=a-Q\), with \(a>0\) representing the market size. The emissions are represented by \(d_i=q_i-w_i\) and the cost function for the firms in the duopoly is given by \(c(q_i,w_i)=cq_i+w_i^2/2\). Finally, we assume a quadratic damage function, i.e. \(D(q_i,w_i)=d(q_i,w_i)^2/2=(q_i-w_i)^2/2\), \(\forall i=0,1\)

The utility function for the profit-maximizing firm is:

The utility function for the CSR firm is:

The SW is given by:

Differentiating the profit functions of both firms with respect to the quantity levels, i.e. \(\frac{\partial v_o}{\partial q_0}\) and \(\frac{\partial \pi _1}{\partial q_1}\), we obtain the response functions of production for firms 0 and 1 (regardless of the setting of the game): \(q_0=\frac{(-1-\gamma +\theta )q_1+\gamma w_0+\gamma w_1-t+a-c}{2+\gamma -\theta }\) and \(q_1=\frac{a-c-q_0-t}{2}\).

It is clear that the \(q_0\) and \(q_1\) can be defined as strategic substitutes, since \(\frac{\partial q_0}{\partial q_1}<0\) and \(\frac{\partial q_1}{\partial q_0}<0\) (see Definition 4). This means that a decrease in the production of the CSR firm will imply an increase in the production of the profit-maximizing firm and vice versa. Therefore, the social and environmental concerns of firm 0 would not necessarily have the desired effect of a reduction in emissions. In addition, \(\frac{\partial q_0}{\partial w_0}=\frac{\partial q_0}{\partial w_1}=\frac{\gamma }{2-\gamma -\theta }>0\), which means that the CSR firm will increase its production whenever the abatement efforts are positive, either its own or those of the profit-maximizing firm. On the other hand, \(\frac{\partial q_1}{\partial w_0}=\frac{\partial q_1}{\partial w_1}=0\).

In the simultaneous game, when solving the system of equations given by i–iv from Proposition 1, and Eq. 9 we get the following firm equilibria outputs and emission levels:

Given the results by firm, the aggregate results can be summarized as follows:

Corollary 5

By solving the simultaneous game, the aggregate results for the CSR behaviors under study are as follows:

- i.:

-

When both firms only have profit maximizing objective, that is \(\theta =0\) and \(\gamma =0\) , the aggregate results are: \(Q^*_{sim}=\frac{24(a-c)}{43}\) , \(W^*_{sim}=\frac{14(a-c)}{43}\) , \(t^*_{sim}=\frac{7(a-c)}{43}\) , \(D^*_{sim}=\frac{25(a-c)^2}{3698}\) and \(SW^*_{sim}=\frac{15(a-c)}{43}\).

- ii.:

-

When the objective of the CSR firm is a combination of consumer surplus and its own profit, that is \(\theta >0\) and \(\gamma =0\) , the aggregate results are: \(Q^*_{sim}=\frac{6(a-c)(4-\theta )}{3\theta ^2-22\theta +43}\) , \(W^*_{sim}=\frac{2(a-c))(7-\theta )}{3\theta ^2-22\theta +43}\) , \(t^*_{sim}=\frac{(a-c)(7-\theta )}{3\theta ^2-22\theta +43}\) , \(D^*_{sim}=\frac{2(a-c)^2(2\theta -5)^2}{(3\theta ^2-22\theta +43)^2}\) and \(SW^*_{sim}=\frac{3(a-c)^2(5-2\theta )}{3\theta ^2-22\theta +43}\).

- iii.:

-

When the objective of the CSR firm is to maximize its own profit minus environmental damage produced by the duopoly, that is \(\theta =0\) and \(\gamma >0\) , the aggregate results are: \(Q^*_{sim}=\frac{8(a-c)(\gamma ^2+3)}{16\gamma ^2+43}\) , \(W^*_{sim}=\frac{2(a-c)(4\gamma ^2+7)}{16\gamma ^2+43}\) , \(t^*_{sim}=\frac{(a-c)(4\gamma ^2-5\gamma +7)}{16\gamma ^2+43}\) , \(D^*_{sim}=\frac{50(a-c)^2}{(16\gamma ^2+43)^2}\) and \(SW^*_{sim}=\frac{5(a-c)^2(\gamma ^2+3)}{16\gamma ^2+43}\).

- iv.:

-

When the objective of the CSR firm is a combination of its own profit plus the consumer surplus minus environmental damage produced by the duopoly, that is \(\theta >0\) and \(\gamma >0\) , the aggregate results are: \(Q^*_{sim}=\frac{2(a-c)(\gamma ^2+3)(4-\theta )}{\gamma ^2\theta ^2-8\gamma ^2\theta +16\gamma ^2+3\theta ^2-22\theta +43}\) , \(W^*_{sim}=\frac{2(a-c)(\gamma ^2(4-\theta )+7-\theta )}{\gamma ^2\theta ^2-8\gamma ^2\theta +16\gamma ^2+3\theta ^2-22\theta +43}\) , \(t^*_{sim}=\frac{(a-c)((4-\theta )\gamma ^2+(2\theta -5)\gamma -\theta +7)}{\gamma ^2\theta ^2-8\gamma ^2\theta +16\gamma ^2+3\theta ^2-22\theta +43}\) , \(D^*_{sim}=\frac{2(a-c)^2(2\theta -5)^2}{(\gamma ^2\theta ^2-8\gamma ^2\theta +16\gamma ^2+3\theta ^2-22\theta +43)^2}\) and \(SW^*_{sim}=\frac{(a-c)^2(\gamma ^2+3)(5-2\theta )}{\gamma ^2\theta ^2-8\gamma ^2\theta +16\gamma ^2+3\theta ^2-22\theta +43}\).

where \(Q^*_{sim}=q_0^*+q_1^*\) and \(W^*_{sim}=w_0^*+w_1^*\).

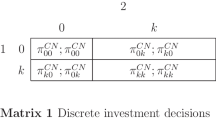

Following the results from Corollary 5, we use some specific parameters of \(\theta\) and \(\gamma\) to compare tax rates, total production, total abatement, total emissions, total damage, and social welfare. The results are presented in Table 1.

When solving the three-stage ex-post game in Sect. 3.2, we get the following firm equilibria and emission levels:

Given the results by firm, the aggregate results can be summarized in the following corollary:

Corollary 6

By solving the three-stage ex-post game, the aggregate results for the CSR behaviors under study are as follows:

- i.:

-

When both firms only have profit maximizing objective, that is \(\theta =0\) and \(\gamma =0\) , the aggregate results are: \(Q^*_{3stage}=\frac{5(a-c)}{8}\) , \(W^*_{3stage}=\frac{a-c}{4}\) , \(t^*_{3stage}=\frac{a-c}{16}\) , \(D^*_{3stage}=\frac{9(a-c)^2}{128}\) and \(SW^*_{3stage}=\frac{11(a-c)^2}{32}\).

- ii.:

-

When the objective of the CSR firm is a combination of consumer surplus and its own profit, that is \(\theta >0\) and \(\gamma =0\) , the aggregate results are: \(Q^*_{3stage}=\frac{(a-c)(15-\theta )}{24-6\theta }\) , \(W^*_{3stage}=\frac{(a-c)(2\theta +3)}{12-3\theta }\) , \(t^*_{3stage}=\frac{(a-c)(\theta ^2-6\theta -3)}{6\theta -24}\) , \(D^*_{3stage}=\frac{(a-c)^2(5\theta -9)^2}{72(\theta -4)^2}\) and \(SW^*_{3stage}=\frac{(a-c)^2(-\theta ^6+34\theta ^5-360\theta ^4+1108\theta ^3-317\theta ^2-6006\theta +9702)}{36(\theta -4)^2(\theta -7)^2}\).

- iii.:

-

When the objective of the CSR firm is to maximize its own profit minus environmental damage produced by the duopoly, that is \(\theta =0\) and \(\gamma >0\) , the aggregate results are: \(Q^*_{3stage}=\frac{(a-c)(15-2\gamma )}{24-2\gamma }\) , \(W^*_{3stage}=\frac{(a-c)(3-\gamma )}{12-\gamma }\) , \(t^*_{3stage}=\frac{(a-c)(3-7\gamma )}{48-4\gamma }\) , \(D^*_{3stage}=\frac{81(a-c)^2}{8(12-\gamma )^2}\) and \(SW^*_{3stage}=\frac{(a-c)^2(-63\gamma ^4-248\gamma ^3+691\gamma ^2-4830\gamma +9702)}{4(12-\gamma )^2(7-\gamma )^2}\).

- iv.:

-

When the objective of the CSR firm is a combination of its own profit plus the consumer surplus minus environmental damage produced by the duopoly, that is \(\theta >0\) and \(\gamma >0\) , the aggregate results are: \(Q^*_{3stage}=\frac{(a-c)(2\gamma +\theta -15)}{2(3\theta +\gamma -12)}\), \(W^*_{3stage}=\frac{(a-c)(\gamma -2\theta -3)}{3\theta +\gamma -12}\), \(t^*_{3stage}=\frac{(a-c)(\theta ^2+(-3\gamma -6)\theta +7\gamma -3)}{4(3\theta +\gamma -12)}\), \(D^*_{3stage}=\frac{(a-c)^2(5\theta -9)^2}{8(3\theta +\gamma -12)^2}\) and \(SW^*_{3stage}=\frac{(a-c)^2(\theta ^6-(4\gamma +34)\theta ^5 -(2\gamma ^2-42\gamma -360)\theta ^4+(12\gamma ^3+170\gamma ^2 +352\gamma -1108)\theta ^3+(9\gamma ^4+46\gamma ^3-353\gamma ^2-944\gamma +317)\theta ^2}{4(3\theta +\gamma -12)^2(\theta +\gamma -7)^2}\) \(+\frac{(a-c)^2(-(48\gamma ^4+298\gamma ^3-556\gamma ^2+1972\gamma +6006) \theta +63\gamma ^4+248\gamma ^3-691\gamma ^2+4830\gamma -9702)}{4(3\theta +\gamma -12)^2(\theta +\gamma -7)^2}\).

where \(Q^*_{3stage}=q_0^*+q_1^*\) and \(W^*_{3stage}=w_0^*+w_1^*\).

Following the results from Corollary 6, we use some specific parameters for \(\theta\) and \(\gamma\) to compare tax rates, total production, total abatement, total emissions, total damage, and social welfare. The results are shown in Table 2.

The results presented in Tables 1 and 2 show that, for both games, the tax will always be lower when one of the firms is environmentally friendly, even becoming a subsidy instead of a tax in the case of the three-stage game. By contrast, when one of the firms is consumer-friendly, the emissions tax is the highest. In terms of production, similar to taxes, the lowest production occurs when one of the firms is environmentally friendly and the highest quantity of the good produced is when one of the firms is consumer friendly. In terms of abatement, the results are different for both games, but in neither case is the abatement effort greater when one of the firms is environmentally friendly. The conclusions associated with environmental damage are opposite in both games for environmentally friendly and consumer-friendly firms. In the simultaneous game, the lowest damage is for the environmentally friendly firm and the highest for the consumer-friendly firm, whereas, the results of the 3-stage game are the opposite. Finally, for both settings, the highest social welfare is achieved when one of the firms is consumer-friendly, while the lowest social welfare occurs when one of the firms is environmentally friendly.

Figure 2 shows the results for Proposition 3 and Proposition 5, in which panel (a) and panel (b) represent the simultaneous and the three-stage ex-post games respectively for \((a-c)=1\), \(\theta \in [0,1]\), and \(\gamma = 0\), 0.3, 0.7, 1. Emission taxes increase as the CSR firm increases its concern for consumer surplus and decrease as the CSR firm increases its concern for the environment. However, Fig. 3 shows very different results, depending on whether the game is simultaneous (panel a) or a three-stage ex-post game (panel b), using \((a-c)=1\), \(\theta \in [0,1]\), and \(\gamma = 0\), 0.3, 0.7, 1. The simultaneous game shows the same conclusions as those obtained for the emission taxes, i.e., emissions increase as the CSR firm increases its concern for consumer surplus and decrease as the CSR firm increases its concern for the environment. However, the three-stage ex-post game –which is time consistent– shows that emissions decrease as the CSR firm increases its concern for consumer surplus and controversially increase as the CSR firm increases its concern for the environment. This is consistent with some of the conclusions of the Policy Implications section, where we find that the firms’ production is strategic substitutes in nature (see Definition 4).

5.1 An Extension of the Model: A Market with Only CSR Firms

Let us consider an industry with two polluting firms with CSR objectives,Footnote 13 which means that in this extended setting, each firm maximizes the following equation:

The remainder of the model is consistent with the model specification described in Sect. 3.

In this new scenario, we only discuss the results for some examples using the same specific functions presented in Sect. 5 above. In particular, we analyze the case where (a) both firms are profit-maximizing, with \(\theta _0=\theta _1=0\) and \(\gamma _0=\gamma _1=0\), in which case the results are equivalent to those in the first column of Tables 1 and 2; (b) both firms are consumer friendly, with \(\theta _0=\theta _1=1\) and \(\gamma _0=\gamma _1=0\); (c) both firms are environmentally friendly, with \(\theta _0=\theta _1=0\) and \(\gamma _0=\gamma _1=1\); and (d) both firms and consumer-environmentally friendly, with \(\theta _0=\theta _1=1\) and \(\gamma _0=\gamma _1=1\). We also present the results given by a duopoly consisting of two profit-maximizing firms as a benchmark.