Abstract

The empirical finding that countries endowed with vast reserves of natural resources are expected to experience slower economic growth – the resource curse hypothesis – has sparked debate in the literature about whether natural resources are a curse or a boon. In this study, we re-investigate the natural resource, corruption and growth nexus by using a relatively longer dataset for a panel of countries. Unlike previous attempts, we take into account the potential endogeneity and asymmetric effect in our analysis by applying a recently developed panel quantile estimator. We also focus on the role of corruption in influencing the impact of natural resources on economic growth. Broadly the findings are indicative of an asymmetric effect of resources as the sign and magnitude of natural resources’ impact on economic growth varies over different income quantiles. Although the overall results are mixed, but the results based on fuel export and oil–gas rents as measures of resource endowment are consistent with the ‘resource curse’ hypothesis. Nonetheless, the findings suggest that corruption is critical in determining the marginal impact of natural resources on growth and in many cases, it has effectively transformed the negative effects of natural resources to positive effects in low-to-middle-income countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

While theoretically it is well established that natural resource endowment and efficient utilization of resources is critical for economic development (see Badeeb et al. 2017), the available empirical evidence suggests that resource endowment can be both a blessing, that can foster economic growth or a curse, that can hamper growth (Van der Ploeg 2011). The balance of theoretical models explaining the effects of resources on economic growth is undoubtedly in favour of a blessing effect of resources. But after the seminal contributions of Auty (1993, 2001) and Sachs and Warner (1995, 1999, 2001), the number of studies reporting negative coefficients or a detrimental effect of resource endowment on growth are also not very small that can be simply ignored as a statistical mirage (see Ross 2015; Badeeb et al. 2017; Vahabi 2018). This has resulted in a new strand of literature and a debate over the good and bad effects of natural resources on economic growth.

Pioneering contributions in this regard that offered initial evidence of an adverse impact of resource abundance on economic growth include Gelb (1988), Sachs and Warner (1995, 1999), Gylfason et al. (1999), among others. The main conclusion that emerged from the findings of these studies clearly contradicted the common economic conviction that the presence of considerably large natural resources reserves, such as oil, minerals, precious metals and agricultural resources, can bring great fortunes for countries and will help them in securing higher levels of growth over time (see Ross 2015; Papyrakis 2017).This possibility not only initiated a new strand of literature that aims to investigate the empirical validity of the resource curse hypothesis, but it also created a policy dilemma for both resource surplus countries, that spend billions in exploring, developing and extracting resources for export, and resource deficit countries, that spend billions for importing resources to provide for economic growth. If the resource curse is indeed true and not a pure statistical mirage, then the policy makers of both surplus and deficit resource countries need to rethink their development strategy to mitigate or avoid the resource curse in order to sustain stronger economic growth over time.

In this study, we aim to provide some further evidence on the role of natural resources and the quality of institutions, especially the level of corruption, in determining economic growth. In doing so, we attempt to contribute to the existing literature in the following ways. First, in order to investigate the most dominant channel of natural resource curse on economic growth, we consider different measures of resource endowments that aim to capture the dependence of countries on revenue generated from the export of resources, namely total resource rent, fuel, oil and gas, and minerals. Second, given the sensitivity of results on the use of indicators of natural resource wealth in regression (see Dauvin and Guerreiro 2017), we also consider two different measures of natural resource abundance (i.e., resource rent endowment and oil and gas endowment) to validate the robustness of our results. Three, several studies have highlighted the role of institutions in determining the effect of natural resources on economic growth (Yang 2010 and Lashitew et al. 2020). We consider the level of corruption as a possible channel for a significant positive or negative resource-growth nexus. We investigate the role of corruption specifically because it represents not only institutions and governance effectiveness but also represents the social behaviour of people (see Gatti 2003). Four, Wiens (2014) highlighted the consequences of ignoring the interplay of natural resources and the quality of intuitions. The one-way effect that resource-rich economies plagued with poor quality institutions are expected to face the resource curse, but countries with high-quality institutions are expected to avoid the same maybe half of the story. Wiens (2014) combined the exogenous and endogenous interplay of resource abundance and quality of institutions in a model and showed that while poor quality institutions can result in the resource curse, inflow of large revenue from resources can also determine the quality of institutions in a resource-rich country indicating the presence of a bidirectional relationship.Footnote 1 There are different channels by which resource endowment could hurt or determine the quality of institutions leading to endogeneity issues (see Ross 2015). Hence, estimation involving a measure of natural resource abundance and quality of institutions is likely to face endogeneity problems. In order to overcome this issue, we employ instrument variable based techniques for estimation purposes. Five, furthermore, some amount of heterogeneity is expected in terms of the distribution effect of resource curse across sample countries given the differences in the levels of development. It is expected that some countries may face the highly detrimental effect of resources, whereas some others may experience a positive impact of resources on growth. Given this possibility, the available empirical literature on determinants of growth is a bit suspicious about the use of the least square approach for estimation purposes which gives effects of natural resource endowment at the average country level (see, for example, Canarella and Pollard 2004; Hendersonet al. 2012; Young et al. 2013; Gerelmaa and Kotani 2016). It other words, this approach models the expected value of dependent variable (i.e. per capita income, a proxy of economic growth, in our case) as a function of a set of independent variables (i.e. measures of resource abundance and corruption) thereby giving a single set of coefficients for the entire sample which includes a heterogeneous group of countries in terms of levels of income or economic growth. In other words, the sample contains rich and poor, small and big, high and low growth countries. The growth pattern differs significantly across countries in general and across resource-rich countries in particular. In the light of this fact, the estimated average effect of natural resources on growth may not be an appropriate way to account for the existing heterogeneity in the sample and also may not be suitable to examine the impact of natural resources in a heterogeneous group of countries. Further, any estimation technique that assumes a linear cause and effect relationship will have the tendency to be influenced by extreme observation. Hence, the estimated impact of resource abundance on growth may be because of the highest income country in a given sample if the data is significantly positively skewed (see, e.g., Koenker and Hallock 2001; Canarella and Pollard 2004). In order to deal with the problems caused by highly skewed data, outliers, and the presence of asymmetry in the response of dependent variables at different levels of economic growth, we use the recently developed panel quantile regression method for estimation purposes. To the best of our knowledge, only a few studies, namely Gerelmaa and Kotani, (2016),Okada and Samreth (2017) and Wang et al., (2021)Footnote 2 have used the quantile regression method to examine the impact of resource abundance and quality of institutions on growth. We aim to provide further evidence in this regard. Finally, unlike most previous studies, we use a relatively large panel covering the time period from 1995 to 2018 for analysis purposes.

The rest of the paper is structured as follows. Section two presents a brief review of recent literature on resource curse. Section three presents a discussion on data, sample and empirical methodology. Section four provides a discussion on the empirical model and estimated results. And finally, section five presents the summary and conclusions based on the empirical results.

2 Theoretical Background and a Brief Review of Literature

2.1 Theoretical Background

In the available literature on natural resource and economic growth nexus, different studies have offered multiple economic, social and political reasons for a possible negative relationship between natural resources and economic growth. These explanations range from Dutch disease (Matsuyama 1992; Sachs and Warner 1999), rise in social conflict (Collier and Hoeffler 2009), overconfidence and a misplaced sense of economic security (Gylfason, 2001), reduced incentive to invest in human capital formation (Gylfason, 2001), highly volatile natural resource prices (Shaxson, 2005), quality of institutions, (Lane and Tornell 1996; Tornell and Lane 1999; Torvik 2002 and Mehlum et al. 2006, Robinson et al. 2006) and rent-seeking behaviour and corruption (Stijns, 2005 and Brunnschweiler 2008). All these factors lead to different economic and socio-political channels through which growth hampering effects of natural resources cause slower economic growth.Footnote 3

While the early studies have focused on the role of macroeconomic mechanisms, such as Dutch disease, in propagating the growth hampering effect of resource endowments, the political economy based explanations of resource curse have become the centre of attention in recent studies (see Deacon 2011; Deacon and Rode 2015; Ross 2015). These studies have attempted to highlight the role of institutions in magnifying or mitigating the detrimental impact of resources on growth. For example, Mehlum et al. (2006) show that the quality of regulatory and governance institutions plays a critical role in deciding whether a resource-rich country will avoid resource curse or become a victim of it. They show that resource abundance in the presence of ‘grabber friendly institutions’ leads to lower economic growth. Whereas ‘producer friendly institutions’ mitigate the negative impact of resource curse as they are instrumental in harvesting maximum benefit of natural resources for economic growth. It is noteworthy that while Mehlum et al. (2006) focused on private sector institutions, Robinson et al. (2006) focused on the incentive generated by natural resource endowments for politicians to win elections through patronage. Within this model, a resource boom increases the probability of securing elections (or staying in power). However, it also leads to inefficiency in the rest of the economy as it encourages political agents to redistribute resources inefficiently to influence election outcomes. The negative impact of resources on overall economic growth is controlled by institutions that restrict the ability of political agents to influence election outcomes. In the absence of institutions that can restrict politicians from securing re-election through clientelism, a resource boom decreases income and leads to a resource curse (see Robinson et al. 2006 for further discussion). Hence, institutions and their quality play an important role in determining the strength and direction of the impact of natural resources on economic growth. Poor quality institutions or a high degree of corruption create economic circumstances that can increase or decrease the impact of natural resources on growth.

In short, the available literature on institutional quality, especially corruption and economic growth, suggests that the presence of corruption can increase as well as hamper economic growth. These impacts of corruption are generally described using two empirically verifiable hypotheses, namely ‘sand the wheel’’ (i.e., negative or bad effect of corruption) and ‘grease the wheel’’ (i.e., positive or good effect of corruption) hypotheses (Bardhan, 1997; Méon and Sekkat 2005; Aidt 2009). In fact, the balance of argument is more favourable for a negative impact of corruption on economic growth (Saha and Sen, 2021). The advocates of the ‘sand the wheel’’ hypothesis (also called ‘sanders’) argue that corruption creates obstacles for economic growth and makes the transition of countries from underdeveloped to developed nations somewhat difficult. They view corruption as the prime cause for widespread poverty and low income (Andvig and Moene, 1990; Aidt 2009 and Blackburn et al. 2008). Nevertheless, the advocates of the ‘grease the wheel’ hypothesis (also called the ‘greasers’) argue that corruption helps in achieving faster economic growth by facilitating profitable trade between parties and promoting efficiency. The ‘speed money’ paid by firms and entrepreneurs to corrupt government officials helps in speeding up the otherwise rusted wheels of bureaucratic process (see Leff 1964; Myrdal 1968; Bardhan 1997; Méon and Sekkat 2005; Aidt 2009).

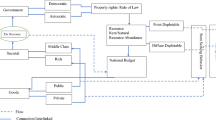

Hence, given the critical role played by corruption, and the quality of institutions, in influencing the level of economic development, any investigation of the impact of natural resources on growth in isolation may be incomplete. This is mainly for the reason that there are two potential channels, namely direct and indirect, by which natural resources can influence economic growth. Figure 1 summarizes the dynamic interlinkages between natural resources, corruption and economic growth by highlighting the three possible channels by which resource endowments and corruption can affect economic growth directly and indirectly. The first channel highlights the direct effect of resource endowments, including good and bad components. On the one hand, natural resources can be a blessing as they generate rent income that can be utilized for making public provisions such as infrastructure building and other productive purposes. While on the other hand, they could be a curse as the uncertainties associated with volatile terms of trade for commodities could undermine public finance and discourage investment (see Ross 2015 and Badeeb et al. 2017). Similarly, institutions or corruption can also directly affect economic growth, which is not dependent on the resource endowment of a country. It is argued that poor quality institutions in general and corruption, in particular, can either sand (negative effect) or grease (positive effect) the wheels of the economy (see Bardhan 1997 and Aidt 2009). Finally, the positive and negative effects of resources can be conditioned by the level of corruption in the economy. For instance, corruption can nullify the positive effect of resource endowments or mitigate the adverse effects of resources dependence (see Brunnschweiler 2008; Lashitew and Werker 2020).

Further, the role of natural resources in determining the quality of institutions cannot be completely ruled out. Available evidence suggests that more flow of rent from oil and other minerals can also lead to more corruption (see Brunnscheiler 2008; Yang 2010; Okada and Samreth 2017; Lashitew and Werker 2020). Thus, the presence of corruption (or the joint effect of resource abundance and corruption) can play a conditioning role by mitigating or magnifying the negative impact of natural resources on economic growth. Therefore, it is pertinent to investigate the role of natural resources and quality of resources simultaneously in a single empirical framework in order to uncover the interplay and true nature of natural resource–corruption–growth nexus. Keeping the space constraint in mind, in what follows, we provided a brief review of the findings of some recent empirical studies.

2.2 Empirical Evidence

Sachs and Warner (1995) provide the initial empirical support for the resource curse hypothesis that led to the further accumulation of a wealth of literature on the topic. Their findings suggested that dependence of countries on oil and mineral resources is significantly correlated with slower economic growth, even after controlling for some important structural attributes, such as initial income, trade policy, the efficiency of government and investment, among others, which are considered to be critical in influencing the growth of countries. The negative impact of natural resources remained valid and insensitive to the use of different measures of resource abundance and binary variables to account for regional differences in the estimation process. Taking the debate a step further, Sachs and Warner (2001), Sala-i-Martin and Subramanian (2003), Smith (2004), Kaldor et al. (2007) and Kim and Lin (2017) provided statistical confirmation that natural resource-rich countries observed slower growth over time compared to their resource deficit counterparts.

However, despite the above theoretical explanations and early empirical support for an adverse effect of resources on growth, the debate is still far from settled and a clear universal consensus has not emerged either for a negative or positive effect of natural resources on growth (Van der Ploeg 2011; Zhang, and Brouwer 2020). Studies such as Gylfason (2001), Papyrakis and Gerlagh (2007), Apergis et al. (2014), Bhattacharyya and Hodler (2014), Eregha and Mesagan (2016), Cockx and Francken (2016), Wang et al., (2021) and Sharma and Pal, (2021) provided evidence in support of the resource curse. While some others, such as Stijns (2005), Steinberg (2017) showed a positive effect of resource abundance on the economy. And some other studies, for example, Bond and Malik (2009), Blanco and Grier (2012), Arin and Braunfels (2018), Sharma and Mitra (2019) and Lashitew and Werker (2020) reported mixed or no effect of resources on growth.

Recent studies on the issue have raised concerns on the validity and robustness of results indicating an inverse relationship on the following grounds. First, negative correlation between resources and growth may be conditional on a number of factors, especially the measure of resource endowment used in regression, level of human capital, and quality of institutions, especially corruption, which play a critical role in mitigating (or magnifying) the growth hampering impact of resource endowments (see Ross 2015; Badeeba et al., 2017; Vahabi 2018, among others, for a detailed review). For example, it has been observed that the use of a measure of resource abundance (i.e., natural capital indicators such as geology, soil condition, availability of water, size of livestock and resource reserves) has indicated that resources have a positive impact on economic growth. In contrast, measures of resource intensity (or resource dependence), as proxied by the ratio of commodity exports to GDP or total exports, lead to a negative impact on growth (Dauvin and Guerreiro, 2017). Second, the negative effect of resources appears to be observable in the case of point resources such as oil and minerals but statistically weak in the case of diffuse resources such as land (see Leite and Weidmann 1999; Sala-i-Martin and Subramanian 2003; Kolstad 2009). Three, the interplay of natural resource abundance with other factors, such as human capital and quality of institutions, is critical in deciding the nature and strength of the resource curse. It has been observed that countries plagued with poor quality institutions and high levels of corruption may experience resource cruse owing to the rent-seeking tendencies and suboptimal allocation of resources in the economy, leading to lower growth over time (see Stijns 2005; Brunnschweiler 2008; Kolstad 2009; Yang 2010; Okada and Samreth 2017; Lashitew and Werker 2020).

In this regard, for example, Norman (2009) confirmed a significant interplay between natural resources, the rule of law and economic growth. Kolstad (2009) suggests that better private sector institutions help in reducing the impact of the resource curse. Ji et al. (2014) find a positive effect of resource abundance on economic growth for China, where the impact nonlinearly depends on the quality of institutions. But Yang (2010) fails to find any strong role of institutional quality. Okada and Samreth (2017) highlight the existence of a significant interplay between natural resource rent and corruption and conclude that large oil rent leads to more corruption. Most recently, Lashitew and Werker (2020) found that while resource abundance is a stimulator of economic growth, but resource dependence has a dampening effect on growth via institutional quality. Finally, the empirical findings are also divergent based on the estimation methods used by different studies. For instance, analysis of Sachs and Warner (1995) is criticized for ignoring the time effect in their models. The subsequent empirical literature employed homogenous panel data techniques, such as fixed and random effect models (e.g., Bhattacharyya and Hodler 2014), the instrumental variable techniques, or the generalized methods of moments (e.g., Tsui 2011). It is observed that estimation outcomes are sensitive to the choice of estimation techniques in a significant way. Some recent studies, such as Kim and Lin (2017), Henry (2019), Damette and Seghir (2018) and Sharma and Pal (2021) take advantage of recent advancements in panel data techniques that take care of issues such as common correlation, unit root etc. Findings of these studies by and large support the ‘resource curse hypothesis’. However, Bonet-Morón et al. (2020) show that institutional reforms and public investment is likely to prevent the country from witnessing the resource curse.

Further, the findings of some studies suggest that conditional-mean models are not suitable for resources growth models as distributions are heavily skewed. Therefore, the quantile regression is more suitable for the analysis. Using the quantile regression, Gerelmaa and Kotani, (2016) show that the estimated coefficients at 25th, 50th and 75th quantiles support the curse hypothesis. Okada and Samreth (2017) find that although oil rents increase corruption significantly, but the effect is comparatively lower for the higher quartile. It is noteworthy that both of these studies use traditional quantile regression in cross-section context and time-effect is overlooked. Recently, Wang et al., (2021) have employed the Quantile Autoregressive distributed Lag method in a time-series context to investigate the linkage between resources and financial development. Their results suggest an inverted U-shaped long-run linkage between financial development and resources in the USA. The results also reveal that the inverse effect is more intense for higher quantile.

Therefore, in light of these findings, it is crucial to study the interplay of natural resources with the quality of institutions in a single empirical framework to uncover the true nature of the impact of natural resources on economic growth. In this study, we aim to provide some further empirical evidence in this regard.

3 Empirical Model, Data and Methodology

3.1 Empirical Model

In order to examine the effect of natural resources, corruption and their joint effect on economic growth, we adopt the following benchmark model for the estimation:

where lgdpcap, lns and lcorrupt are per-capita income, resource indicator, corruption, respectively, for country i and year t. X is a matrix of other control variables included in the model. \({\beta }_{s}\) are coefficients to be estimated. To assess the joint effect of resource endowment and corruption on income, we also include their interaction term (i.e., \({ns}_{it}\times {lcorrupt}_{it}\)) in the model. A statistically significant and negative \({\beta }_{1}\) is indicative of the ‘resource curse’ effect of natural resources on economic growth. Further, a significant and negative (positive) value of \({\beta }_{2}\) is indicative of favourable evidence for the ‘sand the wheel’ (‘grease the wheel’) hypothesis and hence captures the impact of corruption on economic growth.

Most importantly, our centre of attention is the size, sign and significance of the interaction coefficient \({\beta }_{3}\) which is included to capture the joint impact of natural resource endowment and level of corruption. In other words, it will capture the impact of natural resources on economic growth, which is conditional on the quality of institutions, i.e., level of corruption. For example, if \({\beta }_{3}\) is positive and larger than negative \({\beta }_{1}\), then it will be indicative of evidence that the good quality institutions, i.e., low levels of corruption, help in reversing or mitigating the negative (or resource curse) impact of resources on economic growth. This implies that the marginal impact of resource endowment on growth depends on corruption and to the extent a country faces low levels of corruption, it will witness growth fostering the impact of natural resources.

Since the interaction of resource indicator and corruption index along with their individual values is included in the model, we need to compute the marginal effect from estimated coefficients. The marginal impact in the presence of interaction term in a specification helps in capturing the direct impact of the variable of interest (i.e., natural resources) on the dependent variable (i.e., per capita income) and indirect effects due to the other variable (i.e., corruption) included in the interaction term.

In our empirical model, the marginal effect of resource can be computed as:

Similarly, the marginal effect of corruption can also be computed as:

The marginal effect of corruption on growth is also important, as discussed in Sects. 1 and 2.1 that institutional quality, i.e., corruption, plays an important role in determining economic growth (see Bardhan 1997; Méon and Sekkat 2005; Aidt 2009). In this study, however, we will limit our scope and mainly focus on the marginal impact of natural resources on economic growth. In other words, we focus on the conditional effect of corruption in mitigating or aggravating the curse effect of resources on growth.

Further, in order to estimate the effect of natural resources on economic growth in the presence of its other determinants, we also include a set of control variables that have been identified as critical determinants of economic growth in the available literature. The standard growth theories demonstrate that a variety of factors influence economic growth. Endogenous growth theories, for example, show that economies that are open to the rest of the world have a much greater ability to absorb new technology developed in advanced countries. Empirical evidence also suggests that higher openness leads to growth and development (e.g., Edwards 1998; Nannicini and Billmeier 2011). Human and physical capitals are considered to be other important determinants of economic performance in the neoclassical and endogenous growth models (see Funke and Strulik 2000). These theoretical arguments have been validated and supported by numerous empirical studies (e.g., see Barro 2003). For example, Lee et al. (1994) show that the accumulation of physical and human capital, as measured by attainment of education, plays a critical role in determining economic development. Building on these findings, previous studies on natural resource curse have widely used trade openness, capital formation and human capital as control variables in their empirical models (see Sachs, and Warner 2001; Papyrakis, and Gerlagh 2007). Therefore, we also include three important and widely used indicators as control variables in our models. In particular, we use trade to GDP ratio as a measure of openness. Gross capital formation (GCF) is used to account for physical capital, which comprises outlays on additions to the economy's fixed assets as well as net changes in the stock of inventories. Finally, we use the gross secondary school enrollment as a percentage of total enrolment to measure human capital (see Sachs and Warner 1995; Gylfason 2001; Douangngeune et al. 2005; Brunnschweiler 2008).

3.2 Data and Sample

To measure resource endowment, we utilize a wide range of indicators, which include natural resource rent, oil and gas rent, mineral rent, fuel export, and ores and mineral export. In the standard literature, it is demonstrated that the impact of natural resources on growth, whether negative or positive, is sensitive to the measure of resource endowment used in the empirical estimation of natural resource endowment (see Ross 2015; Badeeb et al 2017; Vahabi 2018). It is expected that the use of measures of resource dependence and resource abundance will have a different impact on growth. As a result, we employ a variety of indicators that cover resource abundance directly as well as resource abundance indirectly (i.e., be measuring dependence of countries on resource rent). We take into consideration three indicators based on resource rents that are scaled by the gross domestic product: Total natural resource rents expressed as a percentage of GDP, Gas and Oil rents expressed as a percentage of GDP, and Mineral rents expressed as a percentage of GDP. Also, two indicators of resource exports are taken into account, and they are scaled by total merchandise exports, they are: fuel exports as a percentage of total merchandise exports and ore and metal exports as a percentage of total merchandise exports. However, since resource rent includes rent received from all natural resources, out of four rent related indicators, we mainly focus on total natural resource rent to GDP. While out of two resource export indicators, our discussion is more focused on fuel exports. Finally, we also include two indicators that measure resource capital on a per-capita basis, namely total natural resource rents per capita and total gas and oil rents per capita. It is critical to make use of these indicators because they cover different aspects of natural resources and related products. Additionally, using these indicators in an alternative setup will assist us in better understanding the sensitivity of the estimated coefficient of resource indicators. In this study, the concept of a country being resource-rich or resource-poor is understood in a relative sense.Footnote 4

As a measure of corruption, we consider the corruption index from ICRG.Footnote 5 It is noteworthy that ICRG provides control on the corruption index, e.g., a higher value means less corruption. We reversed it to obtain corruption index, e.g., a higher value means more corruption. We also consider a set of control variables in our empirical models, namely investment, openness and human resource proxied by gross enrolment in secondary schooling. Data used for empirical analysis are mostly collected from the World Development Indicators (WDI) provided by the World Bank. The sample period spans from 1995 to 2018. Table 1 provides details of variables included in empirical analysis and their sources. WDI provides more than 200 countries' information, while ICRG covers 140 countries only. Therefore, we cover around 140 countries in our analysis. The list of countries is presented in Table 5 of the appendix. While descriptive statistics and correlation matrix is presented in Tables 6 and 7 of the appendix, respectively.

Several previous studies have used fixed or random effect method to estimate the impact of resource endowment on economic growth. The fixed effect model incorporates country-specific heterogeneity in the model. However, it is likely that the variables included in the model have some endogenous interplay in nature, and therefore, endogeneity problem is likely to exist in the estimation. To overcome this problem, we employ a two-stage system GMM (sys‐GMM) estimator. This estimator is developed to have greater finite sample properties (Arellano and Bover, 1995; Blundell and Bond, 1998).

Further, the quantile regression method is suitable when the variables have an asymmetric impact at different points of the conditional distribution of the dependent variable. This problem is highly likely in our case as the sample contains countries with different levels of growth and income. Hence, the response of the dependent variable is expected to differ across countries. Figure 2 shows the symmetric plot of per-capita income. The dotted line is the reference line, if distribution is along the line, it can be inferred that distribution is symmetrically plotted. However, countries that have lower income than the median value are located above the reference line, while nations that have a higher income than the median income are distributed below that line. This indicates that low income countries are skewed to the right, while high-income countries are skewed to the left. Therefore, the plot clearly shows that the distribution of per-capita income is asymmetrically distributed. For such distributed samples, linear models, such as panel OLS fixed or random, or instrument variables based linear models might not be appropriate for the analysis. There are two critical problems we may experience if linear models are used for the estimation. First, linear models report coefficients at the conditional mean, which is problematic in our case as distribution is asymmetrical; thus, estimated coefficients at conditional mean will not make sense. Second, one of the critical underlying assumptions for linear regression is that the error term—and the dependent variable—should be normally distributed. This assumption will be clearly violated in our case. Thus, linear estimation may yield unreliable estimates if applied to our model. A quantile estimator is suitable in this case as it will yield a coefficient for each quantile. In addition, it does not require normal distribution assumption for error term. We, therefore, use the recently developed quantile regression technique designed for panel data (see Powell 2020). This model is called quantile regression with non-additive fixed effects of panel individuals. The model includes an estimator that makes use of within-group deviation for identification purposes but continues with the non-separable disturbance features, which naturally encourages us to utilize a quantile estimator. The estimated coefficients are interpreted in the same way as quantile estimates of a cross-sectional analysis. The benchmark model to be estimated to address the conditional quantile function of the panel data is as follows:

where \({y}_{it}\left(\tau {x}_{it}\right)\) is \(\tau\) quantile of the dependent variable. \({x}_{it}\) represents vector of explanatory variables. It is quite possible that high income economies are utilizing more natural resources and in a more efficient way. This is because such economies have much better technologies for extraction and use of resource. Thus, there is a possibility of endogeneity problems in the model as the effects could flow from both ends. In fact, all our explanatory variables can be considered endogenous as economic shocks affect all these variables, including corruption (e.g., Swaleheen 2011). Panel quantile model of Powell, (2020) does offer option to use instruments to break error and endogenous variables relationship. We specifically used a two-stage method of quantile regression for overcoming possible endogeneity problems and one-lag is used as an instrument.

Quantile plot of GDP per-capita Note Each value of per-cap GDP is plotted against the portion of the data that have values lesser than that portion. The diagonal line is considered the reference line. If per-cap GDP were distributed rectangularly, all the points of data will appear along the reference line. As it is observable that the some of the data points are located above and below the reference line, it can be concluded that the distribution is skewed left and right, respectively.

Further, in order to understand the relationship between resource endowment and income in our data, we attempt to create scatter plots of resource rent and income. For this purpose, we make use of 5-year average data from 1995 to 2018. Figure 3 shows the relationship between resource rent as a share of GDP and per-capita GDP. The regression line clearly demonstrates a negative slope indicating the negative effects of resource rent on income. Figure 4 repeats the analysis, but at this time, resource rent is used in per-capita term. The regression line again is clearly indicative of a negative association, confirming the negative effects of resource capital on income. Although these results are without any control, but they do provide us an early signal for a potential negative effect of resources on per-capita income, and hence, some early evidence in favour of the resource curse hypothesis.

4 Empirical Results

4.1 Resource Dependence, Corruption and Economic Growth

We begin our empirical analysis of natural resource and economic growth nexus by first focusing on the impact of total natural resource rent (percent of GDP) as a measure of resource dependence. The results are presented in Table 2. For the sake of comparison and robustness check, we present results using two different estimators. Further to address the issue of endogeneity, we employ sys-GMM and the related results are presented in column 1. The results of panel quantile regression are presented in columns 2 to 5. As discussed in the methodology section, we employ the panel quantile technique developed by Powell (2020). This approach of analysis describes the entire conditional distribution of the dependent variable (per capita income). This model can estimate the impact of resources endowment on the conditional distribution of per capita income at different quantiles (e.g., 0.25, 0.50, 0.75 and 0.90) of income. It is noteworthy that the sys-GMM and panel quantile method take care of the possible endogeneity issues in the model, which is highly likely in our case, given the fact that we are using natural resources, corruption and indicator of economic growth in a single empirical framework.

After controlling for some important factors such as School enrolment (lschool), openness of the economy (lopen), the impact of natural resources rents on GDP (per capita) appears to be mixed. Results based on the sys-GMM are suggestive of a negative impact of resource rent on GDP, supporting the resource curse hypothesis. Some early evidence of asymmetryFootnote 6 in the impact of resource rent is visible in terms of size of countries across different quantiles of dependent variable (i.e., income). Results based on the quantile regression (column 2 – 5) suggest that while less developed and developed countries, in terms of per-capita income (at the lower quantile—0.25 and 0.90 quantile, respectively), benefit from the resource abundance (more specifically, resource dependence as measured by the resource rent); countries in middle and upper-middle quantile (i.e., 0.5 and 0.75 quantile, respectively) of per capita income face the growth hampering negative impact of natural resources. The impact of corruption on the measure of growth, per capita GDP, is consistently negative at all quantiles of income distribution, indicating a favourable evidence for the ‘sand the wheel’ hypothesis, which says that corruption is detrimental to economic growth.

Further, in order to test the role of institutions in aggravating or mitigating the effect of natural resources on growth, we include the interaction term of resource rent and corruption (lrent × lcorrupt) in our empirical specification. The results based on sys-GMM suggest that resource rich countries with corrupt institutions witness a positive impact of resources on growth. This highlights the role of quality of institutions (corruption) in mitigating the negative impact of resources or enhancing the growth fostering impact of resources. The joint effect of resource rent and corruption becomes mixed when we consider the quantile regression based results presented in columns 2 to 5 of Table 2. While the results suggest that low-income and high income economies (at quantile 0.25 and 0.90, respectively) with relatively corrupt institutions are likely to witness negative impact of dependence on natural resources leading to the ‘resource curse’, but middle-income countries with corrupt institutions (at quantile 0.50) are likely to face a positive or growth fostering impact of natural resources. This provides some evidence in favour of the ‘grease the wheel’ hypothesis of corruption, which states that under some circumstances, especially when the country is in the grip of a highly rigid and inefficient bureaucratic system, corruption leads to positive economic growth. It is noteworthy that the individual average effect of resource rent on economic growth for all countries (estimated using Sys-GMM) and varying effect on countries at 0.75 quantile of income distribution is negative for middle and upper-middle income countries. But even though the joint effect of resource rent and corruption remains the same as per sys-GMM, it displays significant heterogeneity in the response of dependent variable (GDP per capita) over different quantiles of income. This asymmetry in the response of dependant variable is not captured by sys-GMM that provide a single coefficient or average impact for the entire sample, but it is clearly highlighted and captured by the quantile regression.

Further, our results also show that the resource and income relationship is non-linear and complex. Specifically, the linkage is concave for low- and high income countries and convex for middle-income countries. Further, the marginal effect of corruption depends on level of rent. For instance, the marginal effect of corruption can be computed for 0.90 percentile as \(\frac{\partial \mathrm{lgdpcap}}{\partial \mathrm{lcorrupt}}=-0.722+0.15\times \mathrm{lrrent}\). This implies that when corruption increases, it has a negative effect on income, and for a higher rent, the marginal effect of corruption will turn positive as it depends on level of rent value. Similarly, the marginal effect of resource rent is conditional on the level of corruption and we are primarily interested in the sign and magnitude of this coefficient. For instance, the marginal effect of rent can be computed for 0.90 percentile as \(\frac{\partial \mathrm{lgdpcap}}{\partial \mathrm{lrrent}}=-0.572+0.15\times \mathrm{lcorrupt}\). The result implies that the marginal effect of rent is negative for a low level of corruption and it will turn positive for more corrupt countries when the values of corruption index is higher (see Table 8 of appendix for a summary of marginal effects). Thus, our results show that for low and high income countries (i.e., countries at income quantile 0.25 and 0.90, respectively); the marginal effect of rent is positive provided corruption level is at low-level. In other words, a lower value of interaction term, implying lower levels of corruption, will not outweigh the positive effect of natural resources (i.e. \({\beta }_{1})\) even if the sign of interaction coefficient is negative. And hence, low and high income countries with low levels of corruption, or better-quality institutions in general, will witness the overall positive effect of natural resources on income or economic growth. Further, the nature of the marginal effect of resource for middle and upper-income countries (at quantile 0.50 and 0.75) is reversed to negative, implying a resource curse phenomenon. The sign and significance of control variables, namely education and openness, align with theoretical expectation. It is also noteworthy that the sign of gross fixed capital formation is sometimes negative for no obvious reason at some income quantiles.

Thus, our results broadly suggest the effect of resource rent on income is conditional and it depends on the stage of development and level of corruption prevailing in the sample countries. This clearly highlights the role of corruption in determining the impact of natural resources on growth. Studies that ignore this conditioning effect or interplay of corruption with natural resources may falsely conclude either in favour of a resource curse whereas actually the impact is changing depending on level of income (or economic growth) and corruption.

We next attempt to investigate the impact of natural resources and quality of institutions on economic growth by using export of fuel as a measure of resource abundance. Many previous studies have confirmed the presence of resource curse while using this indicator of natural resource dependence (see Ross 2015; Badeeb et al. 2017). The results based on GMM and quantile regression (column 1–5), as presented in Table 3, suggest that resource dependence, as captured by fuel export, has a consistently negative and significant impact on economic growth, except for the high income countries. The negative impact of fuel export is more dominant for upper-middle and low income countries. This is clearly very strong evidence in favour of the resource curse hypothesis and indicates that countries rich in fuel related natural resources and dependent on revenues received from export of those fuel resources are likely to experience growth slowdown. Similarly, the direct or partial impact of corruption is also consistently negative indicating the presence of ‘sand the wheel’ effect of corruption. However, contrary to this, the combined effect of fuel export and corruption (lfuelexp × lcorrupt) is consistently positive and significant across income quantiles leading to the inference that countries involved in export of fuel related resources and also plagued by corruption are expected to avoid resource curse and are likely to experience a positive impact of natural resource (fuel) on economic growth. This provides further evidence to the argument and possibility that some amount of corruption acts as efficient grease to smooth the otherwise rusted wheels of rigid and rent seeking public institutions. It makes the system a bit efficient by providing incentives to the rent seeking or highly inefficient bureaucratic system and helps in transforming rigid governance and regulatory system into a more producer-friendly system. This may result in better output and revenue realization from the export of natural resources, and hence, a positive or ‘grease the wheel’ effect of corruption (see Leff 1964; Myrdal 1968; Bardhan 1997; Méonand Sekkat 2005; Aidt 2009; Méon and Weill 2010). However, the same effect is not observed for the high income countries as the joint impact is negative in this case.

Further, a positive joint effect of resources and corruption may be an incomplete inference if we ignore the actual marginal impact of resources which takes into account the direct impact of resources on growth and its indirect impact on growth due to a second variable, i.e., corruption, as captured by the interaction term. The summary of marginal impact reported in Table 12 suggests that although for all income group countries, except high income, the marginal effect of resources confirms the presence of resource curse, but only when they also have good quality institutions or low level of corruption. A close observation of marginal effect suggests that this negative effect of resource curse critically depends on the level of corruption. As pointed by Méon and Weill, (2010) that there is a difference between the moral consequence and economic consequence of corruption; even though corruption may be bad on moral grounds but it appears to be an efficient grease leading to either a weak effect of resource curse or resource boon in the case of countries dependent on rent from export of fuel and are expected to face the resources curse. This again clearly highlights the role of corruption in determining the final impact of natural resources on economic growth.

We also utilize some other indicators of resource richness, such as oil and gas rent, mineral resources rent and export of ores and mineral resources. Results based on oil and gas rent is presented in Table 8 of appendix. The results based on GMM estimates (column 1) suggest that dependence on oil and gas rent has a statistically significant but negative impact on economic growth. Hence, results indicate toward growth hampering effect of oil and gas rent on growth leading to resource curse. Further, quantile regression results suggest that the negative impact of resources is also visible for the low, upper-middle and high-income countries (at income quantile 0.25, 0.75 and 0.90, respectively). The negative impact of resources on upper-middle and high income countries is relatively stronger compared to the effect witnessed by low income countries. The individual impact of corruption is consistently negative on growth across all income quantile of countries (indicating favourable evidence for the ‘sand the wheel’ hypothesis). The joint effect of oil–gas rent and quality of institutions (loilgasr × lcorrupt) is again highlights the role of corruption in reversing the impact of resource curse on countries. Results broadly suggest that poor quality institutions or corruption appear to be beneficial for some countries in avoiding the resource curse. More specifically, low and middle income countries with corrupt institutions are expected to witness the positive impact of natural resources. This may be indicative of the possibility that the public institutions in these countries may be in the grip of a rigid, inefficient and rent-seeking bureaucratic system, and hence, some level of corruption might be acting as efficient grease to speed up the system.

The results related to rent from mineral resources are presented in Table 9 of the appendix. The results based on quantile regression again highlight the asymmetrical response of the dependent variable to change in natural resources and confirm the role of corruption in determining the impact of resources on growth. Low income countries dependent on rent mineral resource rent are expected to face the resource curse but the middle and high income countries (at income quantile 0.50 and 0.-90, respectively) are expected to witness positive impact of natural resources on growth. The direct impact of corruption is consistently negative at all income quantiles supporting the ‘sand the wheel’ effect of corruption on growth. The quantile based results also suggest that co-existence of natural resources and corruption is detrimental for middle and high income countries.

The estimated results based on the export of ores and mineral are reported in Table 10 of appendix. It is observable that while the positive effect of ore and mineral export is visible only in the case of middle-income countries (at quantile 0.50, column 4), statistically significant and negative impact is observed in the case of low-income and high-income countries, indicating the presence of resource curse. The direct partial impact of corruption is consistently negative and significant across different specifications and estimation techniques. The combined effect of export of ores and mineral resources and corruption is somewhat mixed across the estimated models. While the marginal impact of resources on growth is negative for low and high-income countries, middle-income countries are expected to face a positive effect of resources on growth (see Table 12). However, the negative effect of resources for low and high-income countries and the positive effect for middle-income countries will hold true only for a very low level of corruption or good-quality institutions. Again the role of corruption in conditioning the marginal impact of natural resources on economic growth is confirmed and studies ignoring this interplay of natural resources and corruption will falsely conclude only in favour of a resource curse.

4.2 Resource Abundance, Corruption and Economic Growth

So far, we have focused on different measures of resource dependence to investigate the impact of natural resources on growth. However, findings in the available literature suggest that impact of natural resources on growth, whether negative or positive, are sensitive to the measure of resource endowment used in empirical estimation (see Ross 2015; Badeeb et al., 2017; Vahabi 2018). The use of measures of resource dependence and resource abundance is expected to produce a different impact on growth. Hence, to test the sensitivity of results, we now attempt to investigate the impact of resource abundance and corruption on economic growth.

We first consider the resource rent for investigating the presence or absence of resource curse (see Table 4). Even after controlling for some crucial factors such as capital formation, schooling, international trade, the GMM based estimates indicate the presence of resource curse. Hence, countries endowed with vast reserves of natural resources (captured by rent per capita) are likely to experience poor economic growth performance. However, the quantile regression based results differ significantly. While the middle income countries are expected to face the resources curse, the high income countries are expected to face positive impact of resource boon. The estimated coefficients are insignificant for low and upper-middle income countries. The partial impact of corruption on growth is observed to be negative at all quantiles of income. Now coming to the question of what happens to the economic growth of countries endowed with huge reserves of natural resources and are also facing poor-quality institutions? In this regard, the estimated joint impact of resource abundance and corruption (lrrentpercap × lcorrupt), based on GMM and quantile regression for middle income countries, suggest that the co-existence of corruption and resources abundance is somewhat beneficial for countries. This provides support for ‘resource blessing’ and ‘grease the wheel’ hypotheses indicating the positive impact of resources and corruption on economic growth. However, the same effect is not observed for high-income countries. In this case, the negative joint effect is suggestive of growth hampering the effect of resources and corruption.

Nevertheless, the weight of evidence is in favour of a negative impact resource rent endowment on growth if the focus is on the marginal impact, as reported in Table 12. The analysis of the marginal effect of resources suggests that it has a strong negative impact on the economic growth of countries (in income group 0.25, 0.50 0.90 quantiles). The negative impact of resources is expected to be observed only when they have low levels of corruption, or good quality institutions. Our results again confirm the role of the quality of institutions in mitigating or aggravating the negative impact of resources on growth.

Finally, we use another measure of resource abundance, i.e., oil and gas rent per-capita, to investigate the effect of stock of natural resources on economic growth. The results are presented in Table 11 of appendix. Results estimated using the Sys-GMM estimator suggest that oil and gas endowment negatively impacts economic growth. However, there is considerable asymmetry in the distribution of impact over different income quantiles of countries (columns 2 – 5). While middle-income countries with rich oil and gas endowment are likely to face resource curse or slower economic growth, the same is not observed for low, and higher-income countries, which are likely to witness growth fostering positive impact of resources. The impact of poor quality institutions, as captured by level of corruption, is largely negative on growth, supporting ‘sand the wheel’ hypothesis. Similarly, the joint impact of resources and corruption is also mixed. The analysis of the marginal effect of resources on economic growth provides a clearer picture. Results reported in Table 12 (see the last row) suggest that the countries in the low and high income group with low levels of corruption are expected to witness the positive effect of resources on growth. But the middle-income countries with low levels of corruption or high quality institutions are expected to face the burden of the resource curse. Further, it is noteworthy that the positive effects of resources are clearly conditional on the levels of corruption. A high level of corruption in the presence of a negative interaction coefficient will produce a large negative effect of resources on growth for low and high income countries and may reverse the positive effect of resources for these countries. Hence, the level of corruption clearly plays a critical role in reversing the negative or strengthening the positive effect of resource endowments on the economic growth of countries.

Overall, our findings using abundance indicators differ from those of dependency indicators. This may be due to two prime reasons: first, more GDP or export dependency on natural resources or primary commodities indicates a high reliance and overspecialization on the natural resource or primary sector, which generally grows at a slower pace and is less technology-intensive. Thus, findings the inverse effect of resource dependency on growth reflects over-reliance phenomenon rather than a direct natural resource curse. Second, over-reliance on resources such as oil, gas and mineral is often problematic because of the excess volatility in their prices that is not favourable for robust growth and stability. Nevertheless, unlike some previous studies, e.g., Lashitew and Werker (2020), our abundance-based indicators also yield mixed results. Notably, results indicated positive or negative outcomes conditioned on the level of development and prevailing corruption level in the economy. Thus, the use of dependence or abundance indicators in the empirical models does not guarantee a negative or positive effect on growth.

5 Summary and Conclusion

The main objective of the study was to investigate the impact of natural resources on growth along with examining the role of corruption in magnifying or mitigating the negative impact of resource endowment on economic growth. In other words, we aimed to investigate the presence or absence of natural resource curse using the most recent data. In addition, we also attempted to examine the role of quality of institutions, especially corruption, on economic growth through its interaction effect with natural resources. For this purpose, we utilized data on different measures of resource endowment covering both resource dependence and resource abundance to provide a comprehensive overview of the nature of the effect of natural resources.

Given the fact that we have used five different measures of resource dependence and two measures of resource abundance, our overall results are somewhat mixed. However, the following major conclusions emerge clearly despite the mixed findings across empirical specifications and quantiles of income considered in the analysis. First, our results are suggestive of an asymmetric impact of natural resources on economic growth. In other words, the estimates based on the quantile regression suggest that the impact of natural resources (negative or positive) is conditional and varies across different income groups of sample countries, which is generally not captured by the linear estimators (e.g., least square, fixed effect or GMM). Second, while our results are broadly mixed and they provide evidence in favour of both negative and positive effect of resources on growth, but the computation of marginal effect of resources suggests that the weight of evidence is in favour of a negative or curse effect of resources on economic growth. Three, our findings suggest that corruption plays a critical role in conditioning or determining the impact of natural resources on economic growth. In many cases, the role of corruption, or quality of institutions, is so decisive that the positive impact of natural resources indicating the presence of growth fostering impact has been reversed to negative impact over some income groups of countries. Four, the partial impact of corruption on growth is consistently negative, excluding a few exceptions, supporting the view that corruption hampers, or ‘sands the wheel’’, economic growth. Five, dependence on the rent from Oil–gas and export of fuel as measures of resource abundance have produced a negative impact of natural resources (partial impact) on growth and completely reversed (i.e., positive) joint impact with corruption on economic growth for resource rich countries. The impact, in this case, remained consistent and robust across different quantiles of income and estimation methods, respectively. Finally, while in most of the cases, the low levels of corruption found to be favourable for a positive effect of natural resources on economic growth, in the case of countries dependent on the revenue from export of fuel related resources, a high level of corruption appear to be a boon for reversing the resource curse.

In other words, broadly, the results of the study provide more favorable evidence for resource curse (i.e., the negative impact of resources) over most income quantiles. But it is more consistently visible when fuel export and oil–gas rent is used as a measure of resource endowments. The impact of natural resources as captured through the dependence on resource rent, Oil–gas rent and Mineral rent also has confirmed the presence of resource curse effect but with the exception of some income quantiles, mostly high income, where the impact was estimated to be positive. Further, while using natural resource endowment, for low-and middle-income countries, evidence of negative impact leading to resource curse is visible when we used total natural resources rents per capita as a measure of resource endowment. Finally, in both of the above cases where we have some evidence of resource curse, it has been clearly observable from the analysis of the marginal impact that level of corruption does play critical role in determining the final impact of natural resources on growth (see Table 12). Contrary to general conviction, our findings indicate that corruption efficiently greases the wheels of economies and can convert a curse into a blessing. Although it is difficult to suggest corruption as a tool to reverse the resource curse, the positive effect of corruption in reversing the resources curse points towards the presence of other issues in the economy which it might be greasing. In some sense, it indicates the presence of rigidities or inefficiencies in the economy, leading to the suboptimal realization of benefits from the use of natural resource endowments, and hence, a negative impact of resources on growth. Moreover, in the absence of suitable policy interventions, corruption might be helping in dealing with these rigidities and inefficiencies, finally leading to a positive effect on growth. For example, a positive impact of corruption points towards the possibility of a cumbersome bureaucratic process, rigid regulations, political instability and wide spread red tape in the country (Mauro 1995; Méon and Weill 2010). As a result, even though the countries are endowed with huge reserves of resources, but they are not able to optimally realize the benefits of natural resources. Thus, the obvious policy recommendation is that countries facing resource curse with poor quality institutions leading to positive effects, as indicated by our results, need to simplify bureaucratic regulations and reduce the dominance of red tape by introducing suitable regulatory reforms.

Our findings reveal that the curse or blessing of a specific natural resource is dependent on a variety of circumstances, including the level of development, corruption, and the abundance or dependence on that resource. As a result, it is difficult to recommend a common policy for all countries facing resource curse. The policy response should be tailored according to the conditioning effect of other factors. For example, the low and middle-income countries exhibit a 'U'-shaped phenomenon that may represent institutions' initial lack of preparation or rigidity. Reforms must be implemented in those countries experiencing this occurrence in order to take advantage of the growth opportunities provided by the abundance of natural resources. While the developed world appears to take advantage in the early stages of development, the curse phenomenon becomes realistic if corruption or institutional inefficiency rises. It is imperative for developed countries to pay special attention to curbing rent-seeking and improving the quality of their institutions when the resource sector is flourishing. Oil and gas-rich nations fare worse on growth than mineral-rich nations; as a result, these nations should pay particular attention to reforming their institutions.

Hence, it can be concluded that a large part of the answer to the questions that whether the wealth of natural resources that resource-rich countries have will hamper or foster economic growth is dependent, among others, on two important factors: level of corruption (or quality of institutions) and differences in the economic growth of countries as measured by the distribution of per capita income. Ignoring the influence of corruption in determining the impact of natural resources on growth may lead to a false conclusion that the resource curse will hamper the growth of a country forever. In contrast, our findings suggest that the marginal negative or positive impact of resources is strongly dependent on the quality of the institution.

Finally, this study is not without shortcomings. Our analysis heavily relied on resources rent and export intensity of resources. Despite our best efforts to modified them so that they can measure resource abundance, they do suffer to some extent to fulfil the real intent. Future research may use resource wealth indicators to examine the effect as they capture the abundance in a more effective way. Moreover, our findings show that the curse or blessing phenomenon depends on the prevalence of corruption in the country. However, corruption itself is a reflection of institutional weakness, therefore, the role of political, regulatory, and policy related indicators in conditioning the impact of natural resources on economic growth might also be examined in future research. This will shed more empirical light on the most dominant channels by which the quality of institutions influences resource impact on growth. Finally, considering the very mixed results of our findings, a robustness check through an alternative method can be conducted. Recently, Machado and Silva (2019) proposed a panel quantile regression through method of moments way, which may be used for this purpose.

Notes

For example, in a recent study Okada and Samreth (2017) find that more oil rent leads to significantly high levels of corruption.

It is worth noting that whereas Gerelmaa and Kotani (2016) and Okada and Samreth (2017) used cross-section quantile regression, Wang et al. (2021) applied the technique to time series data. To our knowledge, no attempt has been made previously to analyse the issue using a panel quantile methodology.

Keeping the space constraint in mind, we only provide a brief discussion on the available theoretical literature. See, for example, Van der Ploeg (2011), Dauvin and Guerrerio (2017), Badeeb et. al. (2017), Papyrakis (2017),Vahabi (2018) and Zhang, and Brouwer, (2020) for a detailed and systematic review of literature.

According to IMF (2012), a country is resource-rich if its natural resources generate at least 20% of its merchandise exports or government revenues from oil, gas, or minerals. According to the World Bank (2014), countries with average rents from natural resources (excluding forests) that exceed 5 percent of GDP are considered resource wealthy.

We consider ICRG based corruption index over WGI and Transparency International due to two considerations. First, ICRG data method has remained unchanged over the period. Second, the definition of corruption of ICRG matches our requirement for this study.

We call the relation ‘asymmetry’ when the sign and size of estimated coefficients vary across the quantile.

References

Aidt TS (2009) Corruption, institutions, and economic development. Oxford Rev Econ Policy 25(2):271–291

Andvig JC, Moene KO (1990) How corruption may corrupt. J Econ Behav Organization 13(1):63–76

Apergis N, El-Montasser G, Sekyere E, Ajmi AN, Gupta R (2014) Dutch disease effect of oil rents on agriculture value added in Middle East and North African (MENA) countries. Energy Econ 45:485–490

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Arin KP, Braunfels E (2018) The resource curse revisited: a Bayesian model averaging approach. Energy Econ 70:170–178

Auty R (1993) Sustaining development in mineral economies: the resource curse thesis, Oxford University Press, New York

Auty R (2001) Resource abundance and economic development, World Institute for Development Economics Research, Oxford University Press, New York

Badeeb RA, Lean HH, Clark J (2017) The evolution of the natural resource curse thesis: a critical literature survey. Resour Policy 51:123–134

Bardhan P (1997) Corruption and development: a review of issues. J Econ Literature 35:1320–1346

Barro RJ (2003) Determinants of economic growth in a panel of countries. Ann Econ Financ 4:231–274

Bhattacharyya S, Hodler R (2014) Do natural resource revenues hinder financial development? the role of political institutions. World Dev 57:101–113

Blackburn K, Bose N, Haque EM (2006) The incidence and persistence of corruption in economic development. J Econ Dyn Control 30:2447–2467

Blackburn K, Bose N, Haque EM (2008) ‘Endogenous corruption in economic development’, Unpublished Working Paper, Department of Economics, University of Wisconsin

Blanco L, Grier R (2012) Natural resource dependence and the accumulation of physical and human capital in Latin America. Resour Policy 37(3):281–295

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Bond SR, Malik A (2009) Natural resources, export structure, and investment. Oxf Econ Pap 61(4):675–702

Bonet-Morón J, Pérez-Valbuena GJ, Marín-Llanes L (2020) Oil shocks and subnational public investment: the role of institutions in regional resource curse. Energy Econ 92:105002

Brunnschweiler CN (2008) Cursing the blessings? natural resource abundance, institutions, and economic growth. World Develop 36(3):399–419

Canarella G, Pollard S (2004) Parameter hetetrogeneity in the neoclassical growth model: a quantile regression approach. J Econ Dev 29:1–31

Cockx L, Francken N (2016) Natural resources: a curse on education spending? Energy Policy 92:394–408

Collier P, Hoeffler A (2009) Testing the neocon agenda: democracy in resource-rich societies. Eur Econ Rev 53(3):293–308

Damette O, Seghir M (2018) Natural resource curse in oil exporting countries: a nonlinear approach. Int Econ 156:231–246

Dauvin M, Guerreiro D (2017) The paradox of plenty: a meta-analysis. World Dev 94:212–231

Deacon R (2011) The political economy of the natural resource curse: a survey of theory and evidence. Found Trends (r) Microecon 7(2):111–208

Deacon R, Rode A (2015) Rent seeking and the resource curse. Companion Political Econ Rent Seek 227(14):227–247

Douangngeune B, Hayami Y, Godo Y (2005) Education and natural resources in economic development: Thailand compared with Japan and Korea. J Asian Econ 16(2):179–204

Edwards S (1998) Openness, productivity and growth: what do we really know? Econ J 108(447):383–398

Eregha PB, Mesagan EP (2016) Oil resource abundance, institutions and growth: evidence from oil producing African countries. J Policy Model 38(3):603–619

Funke M, Strulik H (2000) On endogenous growth with physical capital, human capital and product variety. Eur Econ Rev 44(3):491–515

Gatti R, Paternostro S, Rigolini J (2003) Individual attitudes toward corruption: do social effects matter? The World Bank

Gelb AH (1988) Oil windfalls: blessing or curse? Oxford University Press, New York

Gerelmaa L, Kotani K (2016) Further investigation of natural resources and economic growth: do natural resources depress economic growth? Resour Policy 50:312–321

Gylfason T (2001) Natural resources, education, and economic development. Eur Econ Rev 45:847–859

Gylfason T, Herbertsson TT, Gylfi G (1999) A Mixed blesing: natural resources and economic growth. Macroecon Dyn 3:204–225

Henderson DJ, Papageorgiou C, Parmeter CF (2012) Growth empirics without parameters. Econ J 122(559):125–154

Henry A (2019) Transmission channels of the resource curse in Africa: a time perspective. Econ Model 82:13–20

IMF (2012) macroeconomic policy frameworks for resource rich developing countries—background paper 1—supplement 1. International Monetary Fund, Washington, DC

Isham J, Woolcock M, Pritchett L, Busby G (2005) The varieties of resource experience: natural resource export structures and the political economy of economic growth. World Bank Econ Rev 19(2):141–174

Ji K, Magnus JR, Wang W (2014) Natural resources, institutional quality, and economic growth in China. Environ Resour Econ 57:323–343

Kaldor M, Karl TL, Said Y (2007) Oil wars. Pluto, London

Kim D-H, Lin S-C (2017) Natural resources and economic development: new panel evidence. Environ Resour Econ 66:363–391

Koenker R, Hallock KF (2001) Quantile regression. J Econ Perspect 15(4):143–156

Kolstad I (2009) The resource curse: which institutions matter? Appl Econ Lett 16(4):439–442

Lane P, Tornell A (1996) Power, growth, and the voracity effect. J Econ Growth 1:213–241

Lashitew AA, Werker E (2020) Do natural resources help or hinder development? resource abundance, dependence, and the role of institutions. Resour Energy Econ 61:1–21

Lee ML, Liu BC, Wang P (1994) Education, human capital enhancement and economic development: comparison between Korea and Taiwan. Econ Educ Rev 13(4):275–288

Leff N (1964) Economic development through bureaucratic corruption. Am Behav Sci 8(3):8–14

Leite C and Weidmann J (1999) Does Mother Nature corrupt? Natural resources, corruption, and economic growth Tech Rep WP/99/85 Int Monet Fund, Washington, DC.

Machado JA, Silva JS (2019) Quantiles via moments. J Econ 213(1):145–173

Matsuyama K (1992) Agricultural productivity, comparative advantage, and economic growth. J Econ Theory 58:317–334

Mauro P (1995) Corruption and growth. Q J Econ 110(3):681–712

Mehlum H, Moene K, Torvik R (2006) Institutions and the resource curse. Econ J 116:1–20

Méon PG, Sekkat K (2005) Does corruption grease or sand the wheels of growth? Public Choice 122(1):69–97

Méon PG, Weill L (2010) Is corruption an efficient grease?. World Dev 38(3):244–259

Myrdal G (1968) Asian drama: an inquiry into the poverty of nations. Pantheon, New York

Nannicini T, Billmeier A (2011) Economies in transition: how important is trade openness for growth? Oxford Bull Econ Stat 73(3):287–314

Norman CS (2009) Rule of law and the resource curse: abundance versus intensity. Environ Resour Econ 43:183–207

Okada K, Samreth S (2017) Corruption and natural resource rents: evidence from quantile regression. Appl Econ Lett 24(20):1490–1493

Papyrakis E (2017) The resource curse - what have we learned from two decades of intensive research: introduction to the special issue. J Develop Stud 53(2):175–185

Papyrakis E, Gerlagh R (2007) Resource abundance and economic growth in the United States. Eur Econ Rev 51(4):1011–1039

Powell D (2020) Quantile treatment effects in the presence of covariates Available at: https://sites.google.com/site/davidmatthewpowell/quantile-regression-with-nonadditive-fixed-effects

Robinson J, Torvik R, Verdier T (2006) Political foundations of the resource curse. J Dev Econ 79:447–468

Ross ML (2015) What have we learned about the resource curse? Annu Rev Polit Sci 18:239–259

Sachs J, Warner AM (1995) Natural Resources Abundance and economic growth. National bureau for Economic Research. NBER, (Working Paper 5398), NBER. Cambridge

Sachs JD, Warner AM (1999) The big push, natural resource booms and growth. J Dev Econ 59:43–76

Sachs JD, Warner AM (2001) The curse of natural resources. Eur Econ Rev 45:827–838

Saha S, Sen K (2021) The corruption–growth relationship: does the political regime matter? J Inst Econ 17(2):243–266

Salai-I-Martin X, Subramanian A (2003) Addressing the natural resource curse: an illustration from Nigeria Working paper 9804, NBER Cambridge

Sharma C, Mitra A (2019) Corruption and economic growth: some new empirical evidence from a global sample. J Int Dev 31(8):691–719

Sharma C, Pal D (2021) Revisiting resource curse puzzle: new evidence from heterogeneous panel analysis. Appl Econ 53(8):897–912

Shaxson N (2005) New approaches to volatility: dealing with the “Resource Curse” in sub-Saharan Africa. Int Aff 81(2):311–324

Smith B (2004) Oil wealth and regime survival in the developing world, 1960–1999. Am J Political Sci 48(2):232–246

Steinberg D (2017) Resource shocks and human capital stocks–brain drain or brain gain? J Dev Econ 127:250–268

Stijns JPC (2005) Natural resource abundance and economic growth revisited. Resour Policy 30(2):107–130

Swaleheen M (2011) Economic growth with endogenous corruption: an empirical study. Public Choice 146(1–2):23–41

Tornell A, Lane PR (1999) The voracity effect. Am Econ Rev 89(1):22–46

Torvik R (2002) Natural resources, rent seeking and welfare. J Dev Econ 67:455–470

Tsui KK (2011) More oil, less democracy: evidence from worldwide crude oil discoveries. Econ J 121(551):89–115

Vahabi M (2018) The resource curse literature as seen through the appropriability lens: a critical survey. Public Choice 175(3):393–428

Van der Ploeg F (2011) Natural resources: curse or blessing? J Econ Literature 49:366–420