Abstract

A country choosing to adopt border carbon adjustments based on embodied emissions is motivated by both environmental and strategic incentives. We argue that the strategic component is inconsistent with commitments under the General Agreement on Tariffs and Trade (GATT). We extend the theory of border adjustments to neutralize the strategic incentive, and consider the remaining environmental incentive in a simplified structure. The theory supports border adjustments on carbon content that are below the domestic carbon price, because price signals sent through border adjustments inadvertently encourage consumption of emissions intensive goods in unregulated regions. The theoretic intuition is supported in our applied numeric simulations. Countries imposing border adjustments at the domestic carbon price will be extracting rents from unregulated regions at the expense of efficient environmental policy and consistency with international trade law.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A common suggestion forwarded in the carbon policy debate is that emissions embodied in a country’s imports should be estimated and taxed just like domestic emissions. These border carbon adjustments purport to solve a number of problems associated with emissions restrictions that fail to coordinate at a global level. These problems include the adverse competitive effects for carbon-intensive sectors in regulated regions and the increase in emissions in unregulated regions (emissions leakage). In practice, border carbon adjustments face both legal and economic challenges. These border policies need special consideration under the General Agreement on Tariffs and Trade (GATT), as enforced through the World Trade Organization. We argue that a GATT (Article XX) exception is needed to the extent that the implied tariffs exceed negotiated rates (bindings) and violate the most-favored-nation principle. Economic theory also fails to provide a clear endorsement of border adjustments. In fact, a careful look at the 40 plus years of economic theory considering cross-border externalities rejects the suggestion that emissions embodied in trade should be treated the same as domestic emissions. Individual countries have both a strategic and environmental motivation to impose border adjustments and these need to be evaluated in the context of the GATT.

In this paper we demonstrate that environmentally motivated border carbon adjustments should be set below the domestic carbon charge. First, we use a transparent two-good two-country theoretic structure with emissions in only one sector to solidify the intuition behind differential pricing of domestic emissions and imported embodied emissions. We neutralize the inherent strategic, beggar-thy-neighbor, component of border carbon adjustments to isolate environmental incentives. In this context we highlight the fact that border carbon adjustments do discourage carbon-intensive production in unregulated foreign countries, but they inadvertently encourage carbon-intensive consumption in foreign countries. Second, we highlight the importance of these theoretic insights with a set of numeric simulations calibrated to data on global trade, production, and measured response parameters. The simulations indicate that environmentally motivated embodied-carbon border adjustments, in practice, should be set well below the domestic carbon price if the goal of the policy is truly environmental.

Our reexamination of the theory behind border adjustments and our measurement of optimal import carbon pricing in a transparent setting is motivated by our observation that suggestions to base embodied-carbon tariffs on the domestic carbon price have gained significant traction in the policy debate Mehling et al. (2018). Economists who have proposed equivalent pricing include Barrett and Stavins (2003), Aldy and Stavins (2008), Cosbey et al. (2012), and Stiglitz (2013). There is an allure of equivalent Pigouvian pricing of domestic and imported emissions based on the equimarginal principle, but the equimarginal principle turns out to be misleading in general equilibrium where trade distortions work through the terms of trade to impact both consuming and producing foreign agents.

The foundational theoretic work of Markusen (1975) shows that, in addition to a Pigouvian domestic tax, optimal policy in the presence of a cross-border externality includes environmental and strategic incentives to distort trade. It might follow then that removing the strategic incentive indicates an environmental trade distortion that simply taxes embodied emissions at the domestic Pigouvian rate. This is not the case. Generalized theoretic analysis as offered by Hoel (1996), Jakob et al. (2013), and in particular Keen and Kotsogiannis (2014) shows that the correct environmental trade adjustments are complex. An optimal set of environmental tariffs will differ by region and product in a way that balances the full set of foreign agent production and consumption responses. In this sense, in the real world, taxing embodied carbon is only narrowly responsive to the carbon intensity of imports, and this is a strained means of affecting foreign emissions. In fact, we might bring into question the whole notion of using emissions embodied in trade as the appropriate tax base, because this construct does not buy us out of the inherent complexity of the problem and will ultimately lead to a difficult and controversial measurement problem.Footnote 1

Despite the insights developed by the economists noted above, the inherent suboptimal nature of Pigouvian based border carbon adjustments seems to be underappreciated in the policy debate. Our contribution is to build some first-order intuition for why Pigouvian based border adjustments are suboptimal in the simplest of structures, and even under the constraint that the motivation is completely environmental. In contrast to the cited theoretic literature that followed Markusen (1975) we step back to his transparent two-good two-region framework with emissions from only one good. The theory we present is therefore devoid of the complexities associated with higher-dimensional trade theory [e.g., Keen and Kotsogiannis (2014)] and embodied emissions in both imports and exports [e.g., Jakob et al. (2013)]. These generalizations are, of course, important, but our purpose is to demonstrate a more fundamental source of suboptimality that is present in all of the models. First, we extend the Markusen model to include the constraint suggested by Böhringer et al. (2014), which effectively neutralizes strategic incentives as a potential source of deviations between the optimal border charge and the Pigouvian rate. In this clean theoretic setting we prove that the optimal border adjustment, motivated by purely environmental concerns, will tax emissions embodied in imports at a rate less than the appropriate Pigouvian domestic tax. The intuition is clear. While a carbon-based border tariff sends a price signal that discourages foreign emissions, it also encourages foreign consumption of the more carbon intensive goods.

The simple theory we develop indicates that Pigouvian based border adjustments are likely to be too high. This is a strong result, but is it valid in a more realistic model with multiple sectors and regions? More broadly, given that embodied-emissions border adjustments are a popular facet of real policy proposals, what is the optimal adjustment, conditional on using embodied emissions as the basis, and how does it relate to the Pigouvian rate? To answer these question we adopt a calibrated simulation model. We consider Annex-I carbon policy augmented with embodied-emissions border adjustments. The optimal environmentally motivated embodied-emissions border adjustment on the carbon content of aluminum and other nonferrous metals is about 40 percent of the domestic (Pigouvian) carbon price. We perform sensitivity analysis that establishes a link between our data-driven simulations and the transparent theory. As foreign producing agents become more responsive to the price signal sent through the border adjustment the higher is the optimal adjustment. In contrast, the more responsive foreign consuming agents are to the price signal the lower is the optimal adjustment, because the border adjustment further encourages foreign consumption of carbon intensive goods.

It is important to note that we assume that international law is administered under WTO rules as outlined in the GATT. A country’s membership in the WTO indicates a commitment to a set of tariff bindings and the most-favored-nations principle as well as a series of exceptions and rules related to trade disputes and their settlements. We generally adopt the premise that international law under the WTO is designed to favor a cooperative trade outcome, where countries are punished if they attempt to use trade restrictions to extract rents from trade partners.Footnote 2 For the purpose of this paper we have to make some assumptions about how border carbon adjustments will be viewed by the WTO because these have not yet been subject to the dispute settlement process. The optimal tariffs derived in this paper assume that Article XX is used to justify carbon tariffs, and if Articles II and III were used, the optimal tariff would be different (see “Appendix 3” for further discussion).

We proceed with the paper as follows: Sect. 2 provides additional discussion of prior literature and sets the context for our theoretical and empirical analysis of border adjustments. Section 3 presents the economic theory of optimal border policy, in which we focus on environmental objectives. Section 4 presents a set of numeric simulations that show the significance of our argument in the context of a model calibrated to data. Section 5 concludes.

2 Prior Literature

The formal theoretic literature on optimal environmental tariffs begins with Markusen (1975), establishing the optimal unilateral domestic and trade instruments when facing a cross-border production externality. We choose to adopt Markusen’s transparent two-good two-country neoclassical general equilibrium model as an ideal setting in which to disentangle the strategic and environmental incentives to distort trade. One useful feature of Markusen’s setting is that it clearly highlights the role of relative international prices (the terms of trade) as a mechanism to signal foreign agents. A small country has neither a strategic nor an environmentally motivated incentive to distort trade because a lack of market power indicates an inability to affect foreign-agent behavior. Focusing specifically on unilateral carbon policy, theoretical analysis in Hoel (1996) reveals a set of conclusions on the first and second-best policy responses consistent with Markusen (1975) in the more general context of a model with any number of goods which may, or may not, be tradable. The central conclusion is that a country’s carbon tax should be uniform across sectors if a set of trade distortions are available. Hoel’s approach is slightly different than Markusen’s, however, in that foreign carbon emissions are simply modeled as a function of net imports. We emphasize the full chain, however, which includes the role of carbon tariffs in sending a price signal to foreign agents, both consumers and producers.Footnote 3

Both Hoel (1996) and Markusen (1975) establish an optimal tariff which includes a strategic term and additive environmental term, but the environmental term is inherently entwined with terms-of-trade adjustments. Other examples of studies that focus on the general setting of non-cooperative trade with cross-border externalities include Krutilla (1991), Ludema and Wooton (1994), Copeland (1996), and Jakob et al. (2013). Ludema and Wooton (1994) do consider the case of a cooperative trade restriction whereby a domestic environmental tax can be used to manipulate terms-of-trade in the absence of a tariff instrument. Copeland (1996) also shows that the rent shifting incentives to distort trade can be strengthened by foreign environmental regulation. We find that our addition of the Böhringer et al. (2014) constraint is a useful departure from the established trade and environment literature because it cleanly eliminates strategic incentives allowing us to focus on unilateral environmental incentives to distort trade. We argue in “Appendix 3” that the strategic component of the optimal tariff formulas is inconsistent with the GATT exceptions that provide for environmental protection.Footnote 4

An alternative approach to eliminating strategic incentives focuses on globally efficient policies. Keen and Kotsogiannis (2014) offer a critical theoretic contribution by considering a setting of globally coordinated trade and environmental policy, generalizing the partial-equilibrium analysis of Gros (2009). While the form of efficient border policy is generally complex, Keen and Kotsogiannis (2014) highlight a special case of conditions and restrictions under which it is optimal to impose a carbon border adjustment at the difference between the home and foreign carbon tax (their Proposition 4, p. 124). While these restrictions are likely untenable, the more general theory presented by Keen and Kotsogiannis (2014) is useful and consistent with our analysis; and the analysis of other authors who have argued that efficient border carbon pricing depends on the full general equilibrium responses of foreign producing and consuming agents.

In particular, the line of research exemplified by Jakob and Marschinski (2012), Jakob et al. (2013, 2014) emphasizes that measuring the emissions generated in traded goods does not indicate the impact of trade on emissions. Rather, we need to know how foreign emissions change, through shifts in both production and consumption patterns, in response to trade. Again, as Keen and Kotsogiannis (2014) point out, this indicates that efficient border policy is complex. In this paper we highlight the general-equilibrium response of foreign consuming agents as one key source of this complexity. This is not to say that the more general insights offered by Jakob and Marschinski (2012) and Keen and Kotsogiannis (2014), for example, should be overlooked. In more sophisticated models (with multiple goods, multiple factors, multiple regions each with different technologies, and indirect emissions through intermediate inputs) the sources of border adjustment complexity proliferates.Footnote 5 In particular, our contribution relative to these prior studies is to reconcile the constrained Pareto allocation with the real world legal and political situation, and to show that in this situation equal treatment of domestic emissions and embodied emissions in imports leads to border adjustments that are too high.

Recommendations to establish a border tariff by applying the domestic carbon price to emissions embodied in imports, or equivalently requiring forfeiture of an emissions permit upon importing embodied carbon, are common in the economic and policy literature. Examples of such advice include Stiglitz (2013), Cosbey et al. (2012), Aldy and Stavins (2008), Barrett and Stavins (2003) and Mehling et al. (2018). A presumption that border tariffs will tax embodied emissions at the domestic carbon price is adopted in much of the policy simulation literature.Footnote 6 A number of these studies and modeling groups are covered in Böhringer et al. (2012), which summarizes the Energy Modeling Forum study (number 29) on the role of border carbon adjustments in unilateral climate policy. Some authors consider border carbon adjustments as sanctions against non-participating countries [e.g., Böhringer et al. (2013b) and Aldy et al. (2001)]. Fully acknowledging the strategic value of import restrictions, Böhringer and Rutherford (2017) consider Nash-equilibrium trade wars based on carbon tariffs and question the credibility of carbon tariffs as an instrument that would entice the U.S. to return to the Paris agreement. We note for the reader that our analysis in this paper assumes a one-shot game without strategic retaliation. Our numeric simulations are informative to the extent that it is politically feasible for countries to impose optimal environmental border adjustments (below the domestic carbon price) and that there is no retaliation.Footnote 7

We extend our numeric simulations to consider so-called full border adjustment. Proponents of full border adjustment advise that, in addition to imposing embodied-carbon tariffs, regulated countries would impose embodied-carbon subsidies on exports. Elliott et al. (2010) argue that in an open economy, full border adjustment effectively transforms a domestic production tax on carbon emissions into a consumption tax on embodied emissions.Footnote 8 Jakob et al. (2013) use a generalized version of Markusen’s model (with emissions associated with both the imported and exported goods) to prove that full border adjustment is not optimal, as optimal trade restrictions should depend on the carbon-intensity differential between the foreign country’s export and non-export sectors, and that full border adjustment can actually exacerbate carbon leakage. In our simulations we find that, while applying carbon based export subsidies reduces the gap between the domestic Pigouvian tax and the trade adjustment, it does not eliminate the gap. Consistent with Jakob et al. (2013), full border adjustment based on the domestic carbon price is not optimal as a unilateral policy even when countries are constrained to their environmental objectives.Footnote 9

3 Theory

In this section we present our theoretical analysis. We build on the Markusen (1975) theory and extend it by introducing a constraint representing the GATT commitment, which effectively eliminates the non-environmental strategic incentive to distort trade. This framework allows us to analyze national incentives to distort trade for purely environmental objectives. We derive a simple closed-form relationship between the optimal environmental tariff and the optimal domestic (Pigouvian) emissions tax. The key insights provided here include a theoretic foundation for the optimal environmental tariff under cooperative trade and the divergence between optimal domestic environmental taxes and the optimal border adjustment. While there are a number of more complex mechanisms that can yield a divergence between the domestic tax and foreign tariff, our model is constructed to show that even in a simple setting, there is a first-order, intuitive reason as to why a Pigouvian tariff is suboptimal.

Consider a two-good two-country (North–South) trade model. Both countries, country N and country S, produce and trade the goods X and Y, and emissions are a function of the domestic and foreign production of good X. The emissions level, Z, is represented as follows:

The efficient transformation function that determines a country’s output of X and Y is given by:

where \(L_r(X_r)\) maps out the efficient frontier (PPF) in terms of \(Y_r\) as a function of \(X_r\). Letting \(C_{iN}\) represent the consumption of good i in country N, the welfare of the North is

We use Y as a numeraire so that all prices are ratios in terms of Y. Let q, p, and \(p^*\) denote the price ratio faced by consumers in the North, the price ratio faced by producers in the North, and world price ratio faced by consumers and producers in the South. The policy instruments considered are \(\tau\), an embodied emissions tariff rate set by the North, and \(t_X\), as the emissions tax rate in the North. While Markusen (1975) considers an ad valorem tax or tariff on production (X), we consider a specific unit tax or tariff on emissions (Z), which are more aligned with carbon policies under consideration.Footnote 10 Assuming no other distortions, the price relationships are

Emissions are not priced in the market equilibrium, but let us denote the marginal rate of substitution between emissions and good Y as \(q_Z = \frac{\partial U_N/\partial Z}{\partial U_N/\partial C_{YN}}\), where \(q_Z\) is negative, reflecting the negative impact of emissions on welfare.

To consider the optimal environmental policy in a cooperative trade setting, we modify the Markusen model by adding an endogenous lump-sum transfer that, as demonstrated below, eliminates any non-environmental, strategic incentive to distort trade, per Böhringer et al. (2014).Footnote 11 The transfer payment T is determined such that the South is not made worse off by trade policy implemented in the North. Let \({\bar{U}}_S\) be the measure of welfare in the South in the absence of tariffs and let \(U_S=U_S(C_{XS},C_{YS})\) equal the South’s realized welfare.Footnote 12 A complementary slack condition is indicated that ensures GATT consistency of added trade distortions; where \(U_S - {\bar{U}}_S \ge 0\) and \(T \ge 0\), and \(T(U_S - {\bar{U}}_S)=0\). Under a set of border adjustments imposed by the North there is downward pressure on \(U_S\) and we can be sure that the following holds:

Let \(m_i\) indicate the North’s net imports of good i. The balance-of-payments equation with the transfer, T, is given by

We are primarily interested in the case where the North imports the good generating emissions (\(m_X > 0\)) to inform current climate policy debates. The theory, however, generalizes to either trade pattern.Footnote 13

We now consider the optimal policy as chosen in the North when environmental policy is noncooperative, but trade policy is subject to cooperative trade agreements. Given this transfer, the North sets its embodied emissions tariff \(\tau\) and emissions tax \(t_X\) unilaterally, but accounts for the fact that losses in the South’s welfare require compensation via the endogenous transfer.

Proposition 1

The optimal unilateral emissions embodied tariff and emissions tax in a cooperative trade setting are given by:

Proof

See “Appendix 1”. \(\square\)

The optimal emissions tax is the Pigouvian rate (\(-q_Z\)), which is consistent with Markusen (1975). However, there are two important points of distinction regarding the optimal tariff. First, whereas Markusen (1975) shows that the optimal tariff includes a strategic component (which is independent of emissions) in a noncooperative trade setting, we show that the addition of the transfer has effectively eliminated the strategic component in a cooperative trade setting. Second, although this isolates the environmental component of the optimal tariff, it is clear that the optimal tariff is not simply equal to the Pigouvian rate, and the level of the tariff critically depends on the North’s ability to affect international prices. That is, if \({dp^*}/{dm_X}=0\) the optimal environmental tariff is zero. A small country cannot send a price signal to foreign agents through a tariff and optimally chooses free trade.

We next consider how the optimal tariff derived above compares with the emissions tax rate, which is optimally set at the Pigouvian rate (\(-q_Z\)).

Proposition 2

In a cooperative trade setting, the optimal embodied emissions tariff is less than the (Pigouvian) domestic emissions tax rate (\(\tau <t_X)\).

Proof

In order to prove that the optimal tariff is less than the emissions tax rate, we derive the following equation from the supply and demand relationship [analogous to (6)] for the South (\(X_S=C_{SX}+m_X\)):

The left-hand term is positive, given convexity of the production set and the fact that \(\frac{dp^*}{dm_X}\) is positive.Footnote 14 The last term on the right-hand side is equal to unity, and the term \(\frac{dC_{SX}}{dp^*}\) must be negative under (5) as consumers in the South will substitute away from the more expensive good, noting that under (5) we only have a substitution effect for the South.Footnote 15 Taken together, the elements of (8) imply

Thus, \(\tau <t_X = -q_Z\). \(\square\)

The above proof reveals a key intuition behind the sub-optimality of Pigouvian tariffs. Although the optimal tariff includes the Pigouvian term \((-q_Z)\) to reflect the marginal environmental damage of emissions from the South, it is adjusted by two terms: (1) the ability of the North to influence prices in the South through changing import volumes (\(\frac{dp^*}{dm_X}\)), and (2) the impact of that price change on production in the South (\(\frac{dX_S}{dp^*}\)). The tariff decreases the price faced by producers in the South, and production of X is discouraged in the South. The lower price, however, also encourages consumption of X in the South. Thus, the decrease in environmental damage from decreased imports is partially offset by the increase in consumption in the South.

Intuitively, \(\tau\) is an imperfect instrument for influencing production in the South because the price change is limited by the negative \(\frac{dC_{SX}}{dp^*}\) term in Eq. (8). This is the unintended consumption effect of the environmental tariff. Consumption of the polluting good is encouraged in the South making the optimal tariff less than the Pigouvian rate that the North would like to impose on emissions of production in the South.Footnote 16 Notice that, in our model, to arrive at the restrictive case highlighted by Keen and Kotsogiannis (2014), where the optimal environmental tariff has the simple structure envisaged in the policy debate (\(\tau =-q_Z\)) one would need consuming agents in the South to be completely unresponsive to price changes (\(\frac{dC_{SX}}{dp^*}\)=0). This restriction is not easily defended, and as such we maintain our assumption of strictly negative substitution effects throughout the analysis in this paper.

Next, to understand the implications if the North did in fact set a Pigouvian tariff, we consider the optimal tariff and production tax in a noncooperative trade setting, as in Markusen (1975).

Proposition 3

The optimal unilateral tariff and production tax on embodied emissions in a noncooperative trade setting are given by:

Proof

See “Appendix 2”. \(\square\)

Consistent with Markusen (1975), the optimal noncooperative import tariff consists of the (non-environmental) strategic component as the first term and the environmental component as the second term. Although emissions are not explicitly traded, nonetheless the North’s optimal tariff contains a strategic component in a noncooperative setting.Footnote 17 This strategic incentive implies that the optimal noncooperative tariff will exceed the cooperative tariff.

Thus, a country setting a Pigouvian tariff rate in the cooperative trade setting will functionally have similar implications as the noncooperative tariff. That is, a Pigouvian tariff set by the North will exploit leverage over the terms-of-trade to extract rents from the South. This beggar-thy-neighbor aspect of the Pigouvian tariff comes at the expense of efficient environmental policy and consistency with the intent of international trade law.

Returning to the cooperative trade setting, Eq. (7) provides some empirical insight into determining which commodities potentially have large differences between optimal and Pigouvian tariff rates. If \(\frac{dp^*}{dm_X}\) is small, the optimal tariff becomes small and the gap with the Pigouvian rate becomes large. In other words, if changes in imports do not affect world prices significantly the price signal to foreign agents is weak, and the optimal tariff is close to zero. The amount of imports relative to world production (import share) can indicate whether \(\frac{dp^*}{dm_X}\) is small or large. For example, if the imports are a small share of the world market, it is likely that changing the import amount will not substantially affect world prices.

Also from (7) we see that if \(\frac{dX_S}{dp^*}\) is small, the optimal tariff becomes small. In this case, if the world price change does not affect production in non-regulated regions significantly, the optimal tariff is close to zero. The key responses come from both the consumption and the production sides of the foreign economy. In the case that consumers in the South are very responsive to price (high elasticities of substitution) the more negative is \(\frac{dC_{SX}}{dp^*}\), the smaller is the optimal tariff. On the production side, if production is relatively insensitive to the price changes (low elasticities of transformation) the smaller is the optimal tariff. Taken together, these indicators of smaller optimal tariffs imply a larger gap between the optimal domestic carbon price and the optimal trade adjustments. In the following section we explore the size of this gap, and illustrate its significance in a model calibrated to data.

4 Embodied-Carbon Border Adjustments on Nonferrous Metals

In this section, we use a specific, data driven, illustration of the potential difference between the optimal domestic carbon price and the embodied-emissions trade adjustment. The context for the illustration is Annex-I subglobal carbon abatement, where there is an option to impose border adjustments on trade in aluminum and other nonferrous metals. Nonferrous metals are a good choice for the empirical experiment because of their energy and trade intensity.Footnote 18 These characteristics make nonferrous metals a likely target of border carbon adjustments. Focusing on nonferrous metals also provides a relatively clean experimental setting for our illustration. As a sensitivity case we include all energy intensive goods (iron, steel, chemicals, rubber, plastic, and other nonmetallic mineral products) in the coverage of border adjustments. In this case, our conclusion that the optimal environmental border adjustment is well below the Pigouvian rate is maintained.Footnote 19

We first describe the model and calibration. Next, we calculate and compare the optimal tariff and domestic price in noncooperative and cooperative (GATT consistent) trade settings.Footnote 20 We also consider the proposed so-called full border adjustment, where an export rebate is placed on exported embodied carbon in addition to the import tariff placed on imported embodied carbon. We conclude with sensitivity analysis that links the simulations back to the basic lessons from the theory.

4.1 Model and Calibration

Our numeric model is a multi-commodity multi-region static general-equilibrium representation of the global economy with detailed carbon accounting.Footnote 21 The full algebraic structure of the model is presented in “Appendix 4”. We follow the model structure employed by Rutherford (2010) in his examination of carbon tariffs. We also follow Rutherford (2010) and Böhringer et al. (2013a) in calculating carbon embodied in trade using the multi-region input-output (MRIO) technique. For every trade flow, a carbon coefficient is calculated that includes the direct and indirect carbon content, as well as the carbon associated with transport.Footnote 22

We augment the Rutherford (2010) model to include an explicit representation of environmental valuation. We include a preference for the environment (disutility from global emissions) in the Annex-I expenditure system. We use a simple formulation that assumes environmental quality is separable from consumption with a constant elasticity of substitution between environmental quality and private consumption of 0.5.Footnote 23 We calibrate Annex-I environmental preference to be roughly consistent with contemporary proposals on climate policy. The model is used to compute a carbon cap that yields a carbon price of $35 per ton of \(\hbox {CO}_2\) in the Annex-I region (approximately an 80% cap relative to business as usual). With this reference equilibrium established we recalibrate the Annex-I expenditure function such that this is the money-metric marginal utility of (separable) emissions abatement. Therefore, in the calibrated reference case, the Annex-I region is pursuing optimal unilateral abatement with $35 per ton emissions pricing, conditional on no border adjustments. With targeted border adjustments, Annex-I can improve its welfare, because, on the margin, emissions reductions achieved through border adjustments on nonferrous metals are less costly than domestic abatement.

We also modify the Rutherford (2010) model to include the Böhringer et al. (2014) complementary slack condition, which under border adjustments is given by Eq. (5). This eliminates the strategic incentive for the Annex-I coalition to extract rents from other regions. In this context carbon-based border adjustments are only used to achieve the environmental objective, per the preceding theory.

To calibrate the model we use GTAP 7.1 data (Narayanan and Walmsley 2008), which represents global production and trade with 113 countries/regions, 57 commodities, and five factors of production.Footnote 24 For our purpose, we aggregate the data into three regions, nine commodities (one of which is nonferrous metals), and three factors of production. To explore targeted border adjustments on aluminum we split out the primary and secondary aluminum industry from the nonferrous metals accounts using data from Allen (2010) and the United States Geological Survey report on aluminum (Bray 2010).Footnote 25 Table 1 summarizes the aggregate regions, commodities, and factors of production represented in the model. Annex-I parties to the United Nations Framework Convention on Climate Change (UNFCCC) except Russia are aggregated as carbon-regulated regions. The rest of the world is divided into two aggregate regions according to World Bank income classifications.

4.2 Optimal Carbon Tariffs

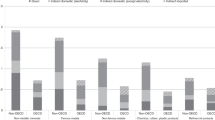

We begin by first considering the optimal border adjustment in a noncooperative trade setting, which shows that the Annex-I coalition has a relatively large incentive to impose tariffs on aluminum and nonferrous metal imports. In this noncooperative setting, Annex-I countries are motivated by both strategic and environmental objectives, and the optimal pricing of embodied carbon associated with imports is $101 per ton \(\hbox {CO}_2\) as illustrated in Fig. 1. This is nearly three times the domestic carbon price. Translating the $101 per ton embodied carbon price into an ad valorem tariff equivalent results in a 31% tariff on MIC aluminum imports and a 44% tariff on LIC aluminum imports. The ad valorem rates are lower on other nonferrous metals (23% for MIC imports and 33% for LIC imports). The differences in these rates across products and trade partners reflect different carbon intensities.

With the optimal embodied-carbon trade policy established, we now consider a comparison of embodied-carbon pricing and the domestic carbon price when the border objective is purely environmental. With the GATT constraint imposed, Fig. 2 shows that the optimal trade distortion drops dramatically to $14 per ton. This is less than half of the domestic carbon price at the optimal. As such, following the prescription of imposing the domestic carbon price on embodied carbon imports indicates that over half of the trade distortion is a hidden beggar-thy-neighbour policy. At $14 per ton of \(\hbox {CO}_2\), the ad valorem equivalents are modest: 4% on aluminum from MIC, 6% on aluminum from LIC, 3% on other nonferrous metals from MIC, and 5% on other nonferrous metals from LIC. Thus, in these relatively transparent numeric simulations, we find substantially lower optimal border adjustments, on the order of 60% lower than the domestic price.

4.3 Full Border Adjustment

We now consider the proposal of full border adjustments. In Fig. 3 we plot Annex-I welfare as a function of the carbon price imposed on imports, as well as exports, of aluminum and other nonferrous metals (full border adjustment). Two results are of note. First, optimal carbon pricing of trade is much closer to the domestic carbon price. The optimal pricing on embodied carbon in trade is $28 per ton, which is about 80% of the domestic carbon price. As highlighted by Yonezawa et al. (2012), a version of Lerner’s symmetry (Lerner 1936) applies, in that import tariffs are offset by export subsidies. In this sense, a higher overall pricing of carbon on imports is optimal as long as there is a counteracting export subsidy. Second, comparing Fig. 2 with Fig. 3, optimal welfare in Annex-I is higher under full border adjustments relative to an import-only policy. This reflects the cost savings due to driving world nonferrous metal consumption toward relatively low emissions intensive sources.Footnote 26

The above simulations reinforce the findings of our theoretical analysis that the optimal border adjustment on carbon is less than the domestic carbon price under a GATT constraint. Furthermore, the simulations show that this difference may be of first-order importance, such that border adjustments set at the domestic price may be substantially excessive relative to the optimal. Table 2 summarizes the above results for the three scenarios considered. The final column reports the ratio of the optimal embodied \(\hbox {CO}_2\) price relative to the domestic carbon price at the optimal. An alternative, but equivalent, interpretation of our analysis is that it would be optimal to reduce the amount of embodied carbon on each trade flow according to the ratio in the final column of Table 2 if the embodied carbon price were equal to the domestic price. That is, the specific tariff is simply the product of the applied carbon price and the carbon coefficient so there are any number of combinations that can result in the optimal. Our point is that the optimal specific tariff is substantially below an application of the full carbon price on measured embodied carbon.

A central focus of the simulation literature is the leakage rate and the effects of border adjustments on the leakage rate. It is well known that in most applied simulation model border adjustments reduce leakage rates, but have a relatively small impact (Böhringer et al. 2012). We see a similar pattern in our results. Table 3 reports the leakage rates for our central scenarios. Leakage is defined as in the literature. It is the ratio of gained emissions in the unregulated regions to the reduced emissions in the regulated regions. In our central scenario with no border adjustments leakage is 18.3%. The lowest leakage rate, 16.0%, is attained with the highest pricing of embodied carbon imports. It is important to consider, however, that rent extraction accompanies the reduced emissions in unregulated regions. Under the GATT constrained scenarios the marginal value of emissions reductions are balanced with the efficiency cost of the border distortions, as outlined in the theory.

4.4 Sensitivity Analysis

We conclude our numeric simulations with a set of model runs that draw the applied model back to the theory. We focus on piecemeal parametric changes that impact the important determinants of the optimal tariff in the formulas derived in Sect. 3. First, Proposition 1 shows that the optimal tariff is increasing in market power. We adjust the trade elasticities in the model to illustrate this effect. Second, the optimal tariff is decreasing in the foreign consumption response. We alter the elasticity of substitution between the focus goods (aluminum and other nonferrous metals) and other goods to illustrate this effect. Third, the optimal tariff is increasing in the foreign production response. We alter the elasticity of substitution between energy and other inputs, and the elasticity of substitution between sector-specific energy resources and other inputs, to illustrate this effect. Finally, we change the coverage of the tariffs relative to our central case. We decrease the coverage to only include aluminum, and increase the coverage to include all energy intensive imports. Table 4 shows the impact on the ratio of the optimal embodied carbon tariff and optimal domestic carbon pricing across these sensitivity runs.

The trade structure in our model is based on the standard formulation of differentiated regional goods (the Armington assumption). Under this structure each region’s absorption is in a nested constant-elasticity-of-substitution composite of imported and domestically produced output. The trade responses are controlled through the assumed elasticities. In the central cases we use the elasticities as provided by GTAP, and their weighted averages for aggregates. In the first row of Table 4 we scale all of these elasticities for the non-regulated regions down by 50% (low) and then up by 100% (high). As these trade elasticities are scaled down, the Annex-I region gains market power, because the other regions are not as easily able to substitute out of Annex-I exports. As expected, the optimal environmental tariff falls with higher elasticities. When the elasticities are doubled, the ratio of the optimal embodied-carbon tariff drops to 23% of domestic carbon pricing.

In the second row of Table 4 we change the demand response in the middle income and low income countries by increasing the elasticity of substitution between intermediate materials. In the production functions, adopted from Rutherford (2010), the composite of non-energy and non-value-added inputs substitute at the top level for materials. In our case, materials include aluminum (ALU), other nonferrous metals (NFM), other energy intensive goods (EIT), and all other goods (AOG). The central elasticity of substitution between materials and the composite of energy and value-added inputs is 0.5. To explore the model’s sensitivity to this parameter we scale it down to Leontief (0.0) and up to Cobb-Douglas (1.0) in the non-regulated regions. As predicted by the theory, the more responsive is the foreign demand, the lower is the optimal environmental tariff. This is the key general equilibrium effect that we highlight in this paper. Environmental tariffs, while discouraging foreign production of the dirty good, inevitably encourage foreign consumption of the dirty good. In the numeric simulations, agents in the middle and low income countries react to the tariffs by intensifying their own use of aluminum and other nonferrous metals. As we increase the elasticity of substitution for materials, this reaction is larger and the resulting optimal Annex-I environmental tariff is smaller.

In the third and fourth rows of Table 4 we consider the foreign production response. We expect higher optimal Annex-I tariffs the easier it is for non-regulated regions to substitute out of energy intensive production. We manipulate two different elasticities to capture this response. First, we scale the elasticity of substitution between energy and value-added inputs (row 3 of Table 4). We show that higher elasticities indicate higher Annex-I optimal environmental tariffs, but noticeable responses require large changes in this elasticity, likely due to the fact that this is an indirect method of manipulating the production response. In the central case the energy elasticity is 0.5, and we consider a low value of 0.05 and a high value of 5.0. Even at an elasticity of 5.0 (making energy a close substitute for value-added in the non-regulated regions) the optimal environmental tariff only rises to 43% of the domestic tax relative to 40% in the central case. For nonferrous metals, changing the energy substitution elasticity often has to work through primary fuels used in electricity generation and then downstream to electricity used in smelting (the most energy intensive stage of production). This is on top of the fact that the tariff itself only acts on firms through an industry-wide price effect. Taken together our simulations reinforces a robust finding in the literature [see Böhringer et al. (2012)] that carbon tariffs are a blunt instrument for affecting foreign energy intensity.Footnote 27

To explore the foreign response of energy-intensive production from a different angle, in row 4 of Table 4, we manipulate the elasticity of substitution between the sector-specific resource in primary energy (COL, GAS, and CRU) and other inputs. In our model, following Rutherford (2010), this elasticity of substitution is calibrated to yield specific, local, supply-elasticity targets in the central case (\(\eta _{COL}=1\), \(\eta _{GAS}=0.5\) and \(\eta _{CRU}=0.5\), where \(\eta _i\) is the local price elasticity of supply). We scale the elasticity of substitution down by 50% and up by 100%. This has a direct impact on quantity responses for fuel production in non-regulated regions. As the theory predicts, greater response indicates higher optimal environmental tariffs.

In our final set of model runs we consider decreasing the embodied tariff coverage to only aluminum, and then increasing the coverage to include all energy intensive sectors (ALU, NFM, and EIT). In the case of just aluminum, the ratio of the optimal carbon tariff to the domestic tax rises to 55%, and when broadening the coverage to all energy intensive goods the ratio rises even further to 59%. Given that these sectors have a number of data-driven differences in the simulation model, it is difficult to obtain a clear prediction from the theory. The Annex-I global share of consumption is increasing as we increase the coverage, indicating higher optimal environmental tariffs, but aluminum production and consumption is more concentrated in the LIC region, also indicating more effective environmental tariffs. Overall, the results are consistent with our central argument that the GATT consistent environmental border adjustment is below the domestic carbon price across a broad range of energy-intensive products.

5 Conclusion

In this paper, we argue that proposals to tax the embodied carbon content of trade at the domestic carbon price are inconsistent with established theories of optimal trade adjustments. The equimarginal principle does not apply for embodied emissions. The case against applying the equimarginal principle appears in a literature that spans over forty years, from Markusen (1975) to Jakob et al. (2014), yet this point seems to be overlooked in the policy debate. In our theoretic analysis we abstract away from complicating factors: namely beggar-thy-neighbor incentives, multidimensional issues, and embodied emissions in both imports and exports. We show in this transparent setting that the optimal environmental border adjustment taxes embodied carbon at a rate below the domestic carbon charge.

The intuition behind our theoretic analysis is clear. The wedge between the domestic carbon price and the optimal border adjustment arises in general equilibrium, because border adjustments inadvertently drive up consumption of emissions-intensive goods in unregulated regions. We feel this point should be brought into focus for the policy debate. Corollary to our central finding, adopting embodied carbon charges at the domestic carbon price is (to some degree) de facto a beggar-thy-neighbor policy. This, in turn, runs contrary to commitments under the General Agreement on Tariffs and Trade (GATT) when the policy is justified under an environmental-protection exception.

Our numerical simulations of Annex-I carbon policy illustrate that this is not simply a theoretical concern. We find an optimal import tariff on the carbon content of aluminum and nonferrous metals that is on the order of 40% of the domestic carbon price. The numeric simulations support the theoretic findings that optimal environmental tariffs are sensitive to the regulated region’s international market power and the unregulated region’s consumption and production responses. We caution that optimal border carbon adjustments are below the domestic carbon price under cooperative trade. Countries that impose border carbon adjustments at the domestic carbon price will be extracting rents from unregulated regions at the expense of efficient environmental policy and consistency with international law.

Notes

Jakob and Marschinski (2012) point out that observing high carbon intensity of a country’s exports relative to its imports need not even indicate that the country specializes in carbon intensive goods. Following, Leamer (1980), who considers the classic Leontief Paradox, Jakob and Marschinski (2012) explain that the appropriate indicator of specialization is the carbon content of exports relative to the country’s average carbon intensity of total production. This need not map directly into a measure of net trade in embodied emissions, because the productivity of emissions in different countries is different.

In addition, it can be argued that the WTO commitments helps a country avoid the temptation to adopt inefficient, Grossman and Helpman (1994) type, income transfers that benefit specific interest groups at the expense of aggregate welfare.

Hoel (1996) argues (on page 25) that countries with little market power might still have significant carbon tariffs. His theory [consistent with Markusen (1975)] shows, however, that the optimal tariff must approach zero as international market power approaches zero. The distortion cannot be beneficial unless it changes foreign behavior.

The Chapeau of Article XX of the GATT requires that the excepted border measure not be “a disguised restriction on international trade.” If the argument for the restriction is environmental (under Article XX), any restriction beyond what is justified on environmental grounds is a disguised restriction that is not GATT consistent.

Our analysis might be cast as a special case of the fully cooperative model considered by Keen and Kotsogiannis (2014). In particular, we analyze one (relevant) globally efficient allocation where the regulating country is maximizing welfare subject to holding welfare in the unregulated country fixed. This is a relevant allocation because it is consistent with the compensatory action that the unregulated country would be entitled to under international trade law. Gros (2009) also adopts the fully cooperative setting and comes to similar conclusions: the optimal border carbon adjustment is less than the optimally set domestic carbon price. Thus, we can place our analysis within the literature that looks at fully cooperative settings in that we generalize the partial equilibrium work of Gros (2009) and we look at a salient special case of Keen and Kotsogiannis (2014).

One exception is offered by Böhringer et al. (2013a) where a set of scenarios are considered in a Computable General Equilibrium model that approximate the optimal border adjustments. These are approximations because they use a set of reference scenarios to establish trade responses and do not explicitly include a valuation for the environment (which is endogenous to abatement).

In fact, our argument is that there would be no legal justification for retaliation under the WTO, because the border adjustments are environmentally motivated. Related to this point is the fact that our theory, and numeric simulations, rely on a set of transfers from regulated to unregulated countries in order to reveal optimal pricing of carbon embodied in imports. These income transfers are, to a degree, a convenient construct that allows us to look at a pure case of cooperative trade. In reality, the compensatory measures offered by the WTO are a set of distortionary retaliations that erode global efficiency.

Full border adjustment proposals also have some political advantages as they are favored by domestic producers of energy intensive goods, and consumption based policies might have broader normative or moral appeal. These are not, however, arguments that appeal to the efficiency properties.

Apart from the discussion in the economic literature, full border adjustment could face international legal problems. The carbon rebate on exports could be viewed as a per se violation of GATT rules on export subsidies. Cosbey et al. (2012) argue that export adjustments are not recommended because they clash with trade laws and their administration is otherwise problematic.

Copeland (1996) makes a similar extension to the theory to look at strategic motives to extract international rents through environmental policy. The pollution-content tariff introduced by Copeland (1996), however, is slightly different in that it allows for a direct identification of the exporting firm’s emissions on the units exported. The tariff varies with the amount of pollution during the production of the traded output. This sets up an incentive for firms to use different processes for domestic versus export markets, and gives Copeland a relatively sharp policy instrument to target the crossborder externality. In contrast, we assume the tariff is based on the average emissions rate for the foreign industry as a whole, which is probably more realistic from an administrative perspective. Even industry-wide measures are ambitious in the context of carbon emissions. With carbon, indirect emissions associated with intermediate non-fossil inputs—like electricity—are important. See Cosbey et al. (2012) for a discussion of the practical challenges of setting up embodied carbon tariffs, and Böhringer et al. (2013a) for technical details on how one might use (imperfect) input-output techniques for calculating the full carbon content by good and country.

There are alternative ways to represent the constraints imposed by cooperative trade agreements, such as the potential for retaliatory tariffs. Our formulation of the endogenous lump-sum transfer, however, captures the purest (transparent) instrument which perfectly neutralizes the strategic trade incentives (what we call cooperative trade). Distortional retaliation available under WTO rules would have additional general equilibrium effects and therefore are not considered.

Note that we only include private consumption in the South’s utility function. This should not be read as an argument that the South does not value the environment. It is simply an assumption that the WTO-consistent compensatory action is restricted to lost private consumption.

In the case that \(m_X < 0\), where the North exports the good generating emissions, \(\tau\) is interpreted as the North’s export subsidy (or equivalently \(-\tau\) is the export tax). Thus, the general pricing equation (4) is preserved in any case.

An increase in North imports (\(m_X\)) drives up the international price (\(p^*\)).

If the South were not compensated the sign of \(\frac{dC_{SX}}{dp^*}\) is ambiguous, given the possibility of being on a backward-bending portion of the offer curve.

In the case of taxes and tariffs on emissions Z, we have shown that the optimal tariff on emissions is strictly less than the domestic Pigouvian tax on emissions. However, this does not necessarily hold when considering an optimal tariff/tax on production X as in Markusen (1975) and Jakob et al. (2013). In that setting, it can be shown that the optimal tariff on X may exceed the domestic production tax on X, see Proposition 2.iii in Balistreri et al. (2015).

Notice that in the absence of the environmental externality (where \(q_z=0\)) the standard neo-classical trade result is obtained, where the domestic emissions tax is zero and the trade distortion is purely a strategic optimal tariff. Notice also that the form of environmental term in the optimal trade distortion is exactly the same in Eqs. (7) and (10). This confirms a common assertion made by other authors that the environmental and strategic terms are independent. While it is obvious that the strategic term is unaltered when we remove the environmental externality (\(q_z=0\)), it is not so obvious (for us anyway) that the environmental term is unaltered under cooperative trade without adding the endogenous transfer payment (T) and proving Proposition 1.

We also explored experiments with a broader coverage on non-energy intensive goods. In these cases the optimal environmental border adjustment was zero for most parameter settings. While in the simple theory presented above we can be sure that the marginal environmental benefit of a small tariff exceeds the international compensation costs (at the reference case of a Pigouvian domestic policy), this will not necessarily be the case in the data-driven simulation model.

We use the terms “GATT consistent” to indicate a cooperative trade setting. We note for the reader, however, that an individual country’s GATT commitments do not amount to a commitment to fully cooperative trade. As mentioned above WTO membership indicates a commitment to a set of tariff bindings and the most-favored-nations principle, as well as a series of exceptions and rules related to trade disputes and their settlements. The point is that border carbon adjustments would most likely need to be justified under an Article XX exception, which we argue precludes new tariffs that extract rents beyond their environmental objective.

There is an extensive literature utilizing similar numeric simulation models to analyze border carbon adjustments and climate policy more generally. A recent special issue of Energy Economics was specifically focused on border carbon adjustments. This issue included 12 papers from different teams studying different aspects of border adjustments. An overview of the special issue and a set of model comparison exercises is provided by Böhringer et al. (2012).

When calculating the carbon content of Annex-I exports for the case of full border adjustments below, we do not include the carbon associated with transport. It is the carbon content at the border that is of interest. Embodied imported carbon is gross of transport carbon, whereas embodied export carbon is net.

Non-separabilities could be important in the context of climate change as emphasized by Carbone and Smith (2013), but this consideration is beyond the theory we illustrate.

Updated versions of GTAP (version 9) are now available, but these have not yet been incorporated into this particular modeling system. The social accounts that we use for this analysis are those developed by Yonezawa (2012) to include a separate representation of aluminum and a specific environmental externality associated with carbon emissions. These accounts permit us to consider sensitivity over border adjustments that hit direct and indirect emissions associated with the narrow commodity aluminum, more broadly on all nonferrous metals, and near the practical limit of all energy intensive sectors. The model used to illustrate that the optimal environmental border adjustment is below the domestic carbon price was developed under a donation to the Colorado School of Mines by the Alcoa Foundation, and hence aluminum was of interest.

A full description of the augmentation to the GTAP data to include aluminum (and the computer code used) is offered in Yonezawa (2012).

Aluminum and other nonferrous metals produced in Annex-I countries have a relatively lower carbon intensity (reflected in the embodied carbon coefficients calculated using the MRIO method), and thus Annex-I can improve welfare through export subsidies which displace high carbon intensive aluminum in other countries.

A targeted firm-specific tariff as suggested by Copeland (1996) and applied to carbon tariffs by Winchester (2012) and Böhringer et al. (2017) would have a more direct impact. These authors consider instruments that are based on the emissions intensity of the firm (or the specific facility within a firm) that exports, rather than applying a tariff based on industry-average emissions intensity. In this case the unregulated region’s industry would split into higher-cost abating firms that export, and firms that do not abate but serve only unregulated markets. Targeted tariffs would more effectively reduce the emissions embodied in trade and reduce leakage while mitigating the problem highlighted in this paper. Given the opportunity to abate and intensify exports (relative to a tariff based on industry average emissions) the export segment expands. This acts to increase marginal cost (and price) in the non-export segment. Relative to a regular border carbon adjustment a targeted firm-specific emissions tariff would mitigate the price reduction of energy intensive goods and subsequent consumption response.

References

Aldy JE, Stavins RN (2008) Designing the post-kyoto climate regime: lessons from the harvard project on international climate agreements. Report, Harvard Kennedy School, Belfer Center for Science and International Affairs, November

Aldy JE, Orszag PR, Stiglitz JE (2001) Climate change: an agenda for global collective action. Conference Paper, Pew Center on Global Climate Change, October

Allen D (2010) OECD global forum on environment focusing on sustainable materials management: materials case study 2: aluminum. OECD Working Document, OECD Environment Directorate

Balistreri EJ, Kaffine DT, Yonezawa H (2015) Optimal environmental border adjustments under the general agreement on tariffs and trade. Center of Economic Research at ETH Zurich, Economics Working Paper Series 16/235

Barrett S, Stavins R (2003) Increasing participation and compliance in international climate change agreements. Int Environ Agreem 3(4):349–376

Böhringer C, Rutherford TF (2017) US withdrawal from the Paris agreement: economic implications of carbon-tariff conflicts. Working Paper, Harvard Project on Climate Agreements (August, 2017)

Böhringer C, Löschel A, Rutherford TF (2014) Optimal emission pricing in the presence of international spillovers: decomposing leakage and terms-of-trade motives. J Public Econ 110(1):101–111

Böhringer C, Bye B, Fæhn T, Rosendahl KE (2017) Targeted carbon tariffs: export response, leakage and welfare. Resour Energy Econ 50:51–73

Böhringer C, Balistreri EJ, Rutherford TF (2012) The role of border carbon adjustment in unilateral climate policy: overview of an energy modeling forum study (EMF 29). Energy Economics 34, Supplement 2(0), S97–S110

Böhringer C, Carbone JC, Rutherford TF (2013a) Embodied carbon tariffs. Working Papers, University of Calgary, August

Böhringer C, Carbone JC, Rutherford TF (2013b) The strategic value of carbon tariffs. Working Papers 4482, Center for Economic Studies and the IFO Institute (CESifo), November

Bray EL (2010) 2008 minerals yearbook: Aluminum. U.S. Geological Survey annual publication, U.S. Geological Survey

Carbone JC, Smith VK (2013) Valuing nature in a general equilibrium. J Environ Econ Manag 66(1):72–89

Copeland BR (1996) Pollution content tariffs, environmental rent shifting, and the control of cross-border pollution. J Int Econ 40(3–4):459–476

Cosbey A, Droege S, Fischer C, Reinaud J, Stephenson J, Weischer L, Wooders P (2012) A guide for the concerned: guidance on the elaboration and implementation of border carbon adjustments. Entwined Policy Report 03, Entwined

de Cendra J (2006) Can emissions trading schemes be coupled with border tax adjustments? an analysis vis-à-vis WTO law. Rev Eur Commun Int Environ Law 15(2):131–145

Elliott J, Foster I, Kortum S, Munson T, Cervantes FP, Weisbach D (2010) Trade and carbon taxes. Am Econ Rev 100(2):465–469

Ferris MC, Munson TS (2000) Complementarity problems in gams and the path solver. J Econ Dyn Control 24(2):165–188

GAMS Development Corporation (2017) General algebraic modeling system (GAMS) release 24.9. Washington, DC, USA

GATT (1970) Working party report on border tax adjustments. GATT Working Party Report, WTO

Gros D (2009) Global welfare implications of carbon border taxes. CEPS Working Document No. 315

Grossman GM, Helpman E (1994) Protection for sale. Am Econ Rev 84(4):833–850

Hoel M (1996) Should a carbon tax be differentiated across sectors? J Public Econ 59(1):17–32

Horn H, Mavroidis PC (2011) To B(TA) or Not to B(TA)? on the legality and desirability of border tax adjustments from a trade perspective. World Econ 34(11):1911–1937

Jakob M, Marschinski R (2012) Interpreting trade-related \(\text{ co }_2\) emission transfers. Nat Clim Chang 3:19–23

Jakob M, Steckel JC, Edenhofer O (2014) Consumption- versus production-based emission policies. Ann Rev Resour Econ 6(1):297–318

Jakob M, Marschinski R, Hübler M (2013) Between a rock and a hard place: a trade-theory analysis of leakage under production- and consumption-based policies. Environ Resour Econ 56(1):47–72

Keen M, Kotsogiannis C (2014) Coordinating climate and trade policies: pareto efficiency and the role of border tax adjustments. J Int Econ 94(1):119–128

Krutilla K (1991) Environmental regulation in an open economy. J Environ Econ Manag 20(2):127–142

Lanz B, Rutherford TF (2016) GTAPinGAMS: multiregional and small open economy models. J Global Econ Anal 1(2):1–77

Leamer EE (1980) The Leontief paradox, reconsidered. J Political Econ 88:495–503

Lerner AP (1936) The symmetry between import and export taxes. Economica 3(11):306–313

Ludema RD, Wooton I (1994) Cross-border externalities and trade liberalization: the strategic control of pollution. Can J Econ 27(4):950–966

Markusen JR (1975) International externalities and optimal tax structures. J Int Econ 5(1):15–29

Mehling MA, van Asselt H, Das K, Droege S (2018) Beat protectionism and emissions at a stroke. Nature 559:321–324

Narayanan GB, Walmsley TL (2008) Global trade, assistance, and production: the GTAP 7 data base (Center for Global Trade Analysis: Purdue University)

Pauwelyn J (2013) Carbon leakage measures and border tax adjustments under WTO law. In: Research handbook on environment, health and the WTO, ed. Geert Van Calster and Denise Prévost Research Handbooks on the WTO series (Cheltenham, UK: Edward Elgar Publishing, Inc.) chapter 15, pp 448–506

Rutherford TF (2010) Climate-linked tariffs: Practical issues. In: Thinking ahead on international trade (TAIT) second conference climate change, trade and competitiveness: issues for the WTO

Stiglitz JE (2013) Sharing the burden of saving the planet: global social justice for sustainable development. In: M Kaldor, JE Stiglitz (eds) The quest for security: protection without protectionism and the challenge of global governance, Columbia University Press, New York, pp 161–190

Tamiotti L (2011) The legal interface between carbon border measures and trade rules. Clim Policy 11(5):1202–1211

van Asselt H, Brewer TL, Mehling MA (2009) Addressing leakage and competitiveness in US climate policy: issues concerning border adjustment measures. Working Papers, Climate Strategies

Vandendorpe AL (1972) Optimal tax structures in a model with traded and non-traded goods. J Int Econ 2(3):235–256

Winchester N (2012) The impact of border carbon adjustments under alternative producer responses. Am J Agric Econ 94(2):354–359

Yonezawa H (2012) Theoretic and empirical issues related to border carbon adjustments (Ph.D. Thesis: Colorado School of Mines)

Yonezawa H, Balistreri EJ, Kaffine DT (2012) The suboptimal nature of applying Pigouvian rates as border adjustments. Working Paper 2012-02, Colorado School of Mines: Division of Economics and Business

Acknowledgements

The authors thank Harrison Fell, Carolyn Fischer, Alan Fox, Michael Jakob, James R. Markusen, Aaditya Mattoo, Thomas F. Rutherford and participants of seminars at Iowa State University, The World Bank, and the Western Economic Association meetings for helpful comments and discussion. A portion of this research was completed while the authors were supported through a donation to the Colorado School of Mines by the Alcoa Foundation.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Proof of Proposition 1

We derive one equation from (6) and two equations from (2), and we substitute those equations into the welfare change equations in the following pages. First, if a domestic import quantity and the transfer payment are associated with world price ratio, from the balance-of-payments constraint (6), we can specify the world price ratio as a function of the import quantity and the transfer as follows:

Second, as Vandendorpe (1972) derives from (2), the supply relationships are

Third, totally differentiating (2) and dividing by \(\frac{\partial F_r}{\partial Y_r}\) yields

and at equilibrium, \(\frac{\partial F_r/\partial X_r}{\partial F_r/\partial Y_r}\) equals \(p_r\), where \(p_N=p\) and \(p_S=p^*\). Totally differentiating (3) and dividing by \(\frac{\partial U_N}{\partial C_{YN}}\) yields the change in the North welfare in terms of consumption good Y, \(\frac{dU_N}{\partial U_N/\partial C_{YN}}\). Since the welfare in N is maximized when \(\frac{dU_N}{\partial U_N/\partial C_{YN}}=0\), we find the conditions to make this true. The welfare change is as follows:

where \(q = \frac{\partial U_N/\partial C_{XN}}{\partial U_N/\partial C_{YN}}\) is the marginal rate of substitution between goods X and Y, and \(q_Z = \frac{\partial U_N/\partial Z}{\partial U_N/\partial C_{YN}}\) is the marginal rate of substitution between emissions Z and good Y. Again note that \(q_Z\) is negative because the emissions level Z has a negative impact on the welfare (\(\partial U_N/\partial Z\) is negative). We make several substitutions to derive the optimal policy conditions. First, using \(dC_{iN}=di_N + dm_i\) from (6) yields

Second, using \(dm_Y=-dT-m_Xdp^*-p^*dm_X\) from (6) and \(dY_N=-pdX_N\) from (13) yields

Differentiating (1), and noting that the supply response in S [see (12)] is driven by a change in the international price (\(p^*\)), yields

Third, by using \(q-p^*=\tau \frac{\partial Z}{\partial X_S}\) and \(q-p=t_X \frac{\partial Z}{\partial X_N}\) from (4) and replacing dZ from (17) and \(dp^*\) from (11), (16) becomes

We still need to determine dT, or the change in the transfer required to hold the South’s welfare constant. Let \(E_S(p^*,{\bar{U}}_S)\) indicate the expenditure function of the representative agent in the South. At the solution, this equals income, which is the value of production at world prices plus the transfer. Thus we have the following:

and solving for T we have

Differentiating (20) and noting that \(p^*dX_S + dY_S = 0\) from (13) gives

Applying Shephard’s lemma yields

Replacing \(dp^*\) by using (11) gives us

Now substituting (23) into (18) yields

Furthermore, we substitute \(\frac{G_{m_X}}{1+m_X G_T}\) out as follows. From (11) we have

Thus, (24) becomes

Since the welfare change is zero at the optimum, the optimal cooperative tariff and production tax are

Appendix 2: Proof of Proposition 3

The proof is similar to that of Proposition 1, but without the transfer. From Eq. (18), setting \(dT=0\) and noting \(G_{m_X}=\frac{dp^*}{dm_X}\), we have:

Since the welfare change is zero at the optimum, the optimal noncooperative tariff and production tax are

Appendix 3: Legal Context

In this appendix we make a specific argument for our interpretation that border adjustments will need to be justified under the general exceptions offered under Article XX. While there have been attempts to reconcile carbon based tariffs as a tax adjustment under Articles II and III of the GATT (and Article XVI for carbon based export rebates), as reviewed below, the general view is that carbon-based border policies would most easily be legitimized under the General Exceptions offered under Article XX. In particular, a case can be made that border carbon adjustments are policy measures covered under either paragraph (b): “necessary to protect human, animal or plant life or health,” or paragraph (g): “relating to the conservation of exhaustible natural resources if such measures are made effective in conjunction with restrictions on domestic production or consumption.” While Article XX offers an opportunity to utilize border carbon adjustments as a compliment to subglobal action, its preamble clearly sets some limits. The policy measures cannot be “applied in a manner which would constitute a means of arbitrary or unjustifiable discrimination between countries” and cannot be a “disguised restriction on international trade.” In this context we argue that carbon adjustments should be limited by their environmental objectives.

There are several good reviews of legal issues related to border carbon adjustments. Tamiotti (2011), Pauwelyn (2013) and Horn and Mavroidis (2011) cover legal issues for carbon regulation in the US and/or Europe in general. van Asselt et al. (2009) focuses on the US Climate Security Act (Lieberman-Warner bill), whereas de Cendra (2006) focuses on the EU ETS. A comprehensive look at the prospects for border adjustments is offered by Cosbey et al. (2012). In this report the authors consider a general set of rules for guiding the design of border adjustments. The literature focuses on some central questions. First, is carbon regulation eligible for border tax adjustments? Second, are imported products treated less favorably than “like” domestic products? Third, does discrimination between like imported products from different countries occur because of the country of origin? Fourth, if border carbon adjustments are not compatible with WTO rules, can we consider the adjustments an exception?

Border carbon adjustments might be thought of as a type of border tax adjustment, in the same sense that other indirect taxes are adjusted to account for differences in international treatment. Under this interpretation, border adjustments may be useful in extending the reach of domestic policy by filling the gap between domestic taxes and foreign taxes. GATT Article II.2(a) allows WTO members to impose border tax adjustments as “a charge equivalent to an internal tax ...in respect of the like domestic product”. GATT Article III.2 also states that foreign products shall not be subject “to internal taxes or other internal charge of any kind in excess of those applied, directly or indirectly, to like domestic products.” Border tax adjustments are permitted as long as they are not in excess of internal domestic taxes. In the simplest example, a sales tax on a foreign automobile is permitted to the extent that this sales tax does not exceed the sales tax applied to a “like” domestic automobile. While the sales tax on the foreign automobile is not technically collected at the border, this is defined as a border tax adjustment under international law, because it brings the tax treatment of the imported good up to the domestic level under what is termed the “destination principle” [see GATT (1970)].

Both GATT Article II.2(a) and GATT Article III.2 limit the use of border tax adjustments to “products.” Taxes on products (indirect taxes) are eligible for tax adjustments, whereas taxes on factors (direct taxes) are not. The question is whether a carbon tax is an indirect tax or not, and this interpretation could be contingent on the actual administration of the domestic carbon policy. For example, a crude oil well-head carbon tax could be viewed differently than a carbon tax on gasoline, even if they have (conceptually) the same economic implications.

Another issue related to GATT Article II.2(a) is how to interpret “in respect of an article from which the imported product has been manufactured or produced in whole or in part.” The question is whether inputs have to be physically incorporated into the final product. Article II.2(a) may not permit the application of Article II to energy inputs or fossil fuels used in production. In the 1987 GATT Superfund case, however, the GATT panel found that US taxes on certain imported chemicals were consistent border tax adjustments, because these chemicals were manufactured using feedstocks subject to a US environmental tax. This is cited as an opportunity to justify border carbon adjustments under the same logic.

The legal administration of the carbon policy is also of critical legal importance. Although economists tend to think that carbon taxes and cap-and-trade schemes are similar (in theory they can be equivalent), WTO rules are likely to see them differently. Pauwelyn (2013) points out that a cap-and-trade scheme may not be eligible for border tax adjustment, even if a largely equivalent carbon tax is eligible. As de Cendra (2006) points out, the permit allocation mechanism matters. In general, tax adjustments must be an adjustment for a tax, which entails a payment to the government. Emissions permits that are freely allocated do not directly impact government revenues, and therefore fall outside the definition of a tax. Auctioned permit schemes do generate revenues and could more easily fit, legally, under the border tax adjustment provisions.

The key challenge faced by border carbon adjustment as justified under the border tax adjustment provision is that they will be discriminatory. The national treatment principle (GATT Article III) requires that imported products should not be discriminated against when compared to “like” domestic products. The most-favoured nation treatment principle (GATT Article I) requires that “like” imported products from different countries should not be discriminated against because of the country of origin. But, what are like products? Some products are considered identical as final products, although the production methods are different. Accordingly, the energy consumption and embodied carbon can be different for what are traditionally considered “like” products. Given that carbon (or carbon emissions) is the physical measure of the tax base and embodied carbon is the basis of border adjustments, it is hard to imagine that the adjustments would meet the non-discriminatory requirements.

It would seem, therefore, that Article XX would need to be used to legitimize any WTO compliant border carbon adjustments. Once the border carbon adjustments are adopted under at least one of the exceptions outlined in Article XX, policy must satisfy the requirements in the preamble. In other words, the border carbon adjustments must pursue the environmental objective. In Sect. 3 we modify the theory on optimal tariffs under cross-border externalities to isolate the environmental objective. This is done by adopting a constraint that is consistent with fully cooperative trade, where any unilateral action that extracts rents from trade partners is directly negated by a compensating transfer back to the harmed trade partner. We thus look at an ideal world where we have cooperative trade with the exception that unilateral environmental actions to correct cross-border externalities are allowed. These assumptions are, in spirit, consistent with the WTO’s overall objective of cooperative trade outcomes with the general exceptions for environmental protection provided in Article XX.

Appendix 4: Simulation Model: Algebraic Formulation