Abstract

We report stated-preference estimates of the value per statistical life (VSL) for Kuwaiti citizens obtained using an innovative test to identify respondents whose survey responses are consistent with economic theory. The consistency test requires that an individual report strictly positive willingness to pay (WTP) for mortality-risk reduction and that his responses to binary-choice valuation questions for two risk reductions be consistent with the theoretical requirement that WTP is less than but close to proportional to the change in risk reduction. Our estimates of VSL, $18–32 million, are approximately two to four times larger than values accepted for the United States. These values may reflect cultural factors as well as the substantially larger disposable income of Kuwaiti citizens.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The monetary value of a small reduction in mortality risk—the value per statistical life (VSL)—has been estimated by well over one hundred studies. The majority of studies have been conducted in the United States and other high-income Western countries, although a few have been conducted in lower-income Asian and Latin American countries. We are aware of no published estimates for a Middle Eastern, Arab, or Muslim population. We begin to fill that gap by reporting estimates from a study of Kuwaiti citizens.

Estimates of VSL are obtained using either revealed- or stated-preference methods (see Viscusi and Aldy 2003 and Lindhjem et al. 2011 for reviews). Revealed-preference methods have the advantage of relying on choices, such as of employment, with actual mortality risk and financial consequences. A disadvantage is that the researcher does not know what alternatives and information the individual considered. Stated-preference methods have the advantage that the researcher can control the alternatives and information presented to the individual, but the disadvantage that the individual faces little consequence from his response and has less incentive to choose carefully. In addition, some respondents may refuse to answer the question or may provide answers that are not responsive; e.g., an individual who values the intervention may nevertheless state that his WTP is zero because he believes someone else should pay for it (a phenomenon called scenario rejection).

A problem with stated-preference studies of health risk is that responses often exhibit inadequate sensitivity to risk reduction. This is an example of the problem of inadequate sensitivity to scope that has received much attention in the literature (see Hausman 2012 and Kling et al. 2012 for recent perspectives). In theory (developed in Sect. 2), an individual’s willingness to pay (WTP) for a small reduction in mortality risk should be strictly positive and nearly proportional to the magnitude of the risk reduction; i.e., he should be willing to pay almost three times as much to reduce current-year mortality risk by 3 in 10,000 as by 1 in 10,000 (Hammitt 2000). While some stated-preference studies find this degree of sensitivity (e.g., Corso et al. 2001; Hammitt and Haninger 2010), many others do not (e.g., Hammitt and Graham 1999; Alberini et al. 2004). When estimated WTP is not approximately proportional to the risk reduction, the inferred VSL is highly sensitive to the size of the risk reduction, which is inconsistent with the standard economic model of preferences.

One reason for the inadequate sensitivity of elicited WTP to risk reduction is that individuals may not understand the magnitude of a small risk change. Another is that respondents may be valuing not the risk reduction stated in the survey, but the personal risk reduction they perceive would be provided by the intervention described in the survey. The perceived risk reduction is informed by combining the risk reduction stated in the survey with prior beliefs and other information about the likely personal efficacy of the intervention (Viscusi 1985, 1989).

Several methods have been used to enhance the sensitivity of elicited WTP to risk reduction. Studies often provide training to respondents in understanding the risk change and valuation questions. In some cases, individuals whose responses to training questions suggest inadequate comprehension (such as choosing a dominated alternative) are excluded from the sample used for estimation (e.g., Alberini et al. 2004). Visual aids and verbal analogies for communicating small risk changes have been developed and tested, with some visual aids showing significant effects (Hammitt and Graham 1999; Corso et al. 2001). Cherry et al. (2003) found that respondents who participated in an experimental auction for an unrelated good improved performance on a subsequent stated-preference survey. Andersson and Svensson (2008) found that performance on a simple intelligence test could be used to predict which respondents provided answers that showed appropriate sensitivity to scope.

In this study, we include training questions, tests for comprehension and for rejection of the scenario, and visual aids. In addition, we incorporate an innovative consistency test. We ask each respondent to value two risk reductions, from which we determine which respondents’ answers are consistent with strictly positive WTP and appropriate sensitivity to risk magnitude. We include only respondents whose answers to the valuation questions are clearly consistent with economic theory and estimate VSL using only the first valuation question for each respondent. Hence we use within-respondent information to determine which respondents provided answers plausibly consistent with the valuation task but our empirical estimates of the effect of the magnitude of risk reduction on WTP reflect purely between-respondent variation (i.e., they constitute an “external” or between-respondent scope test, Mitchell and Carson 1989). Consistency with economic theory provides a necessary but not sufficient condition for the validity of the responses; e.g., even if respondents do not have a good understanding of the magnitudes of the risk changes or of their valuations (and hence do not provide valid information about WTP), they may recognize that their WTP for the second risk reduction should bear a logical relationship to their response to the first question and thus exhibit ‘coherent arbitrariness’ (Ariely et al. 2003). We examine the sensitivity of our results to including respondents who fail our consistency test and to using the results of both valuation questions for each respondent.

As this is the first stated-preference study of VSL conducted in a Muslim population, we face the additional challenge that some Muslims may take a fatalistic perspective toward mortality, believing their time of death is in the hands of Allah. To encourage respondents to take the valuation task seriously, we first ask about their fatalistic beliefs, measures they take to reduce mortality risk, and their perceptions of the efficacy of these measures.

The paper is organized as follows. In Sect. 2, we explain our consistency test. In Sect. 3, we describe the survey instrument. Section 4 describes how the sample was selected and the survey administered. Section 5 describes the results, including characteristics of the overall sample and the subsample selected by our consistency test, and estimates of VSL. Section 6 concludes.

2 Consistency Test

We elicit WTP to reduce current-year mortality risk using binary-choice questions. Binary-choice questions are viewed as incentive-compatible (because truth telling is a dominant strategy) and are cognitively easier than open-ended questions that ask a respondent to state his maximum WTP. A disadvantage is that binary-choice questions provide only a bound on the respondent’s WTP. If the respondent indicates he would purchase the risk reduction at the stated price, the price is a lower bound on his WTP; if he indicates he would not purchase it, the price is an upper bound.

Each respondent values two risk reductions: in one, he is offered an intervention to reduce his risk of dying this year by 1/10,000 at a price P; in the other, the risk reduction is 3/10,000 and the price is 3P. The order of questions is randomized; approximately half the respondents value the smaller risk reduction first and half value the larger risk reduction first. The price P is randomly varied across respondents.

Under conventional economic theory, WTP for a risk reduction of 3/10,000 should be slightly smaller than three times WTP for a risk reduction of 1/10,000 (the acceptable deviation from proportionality is quantified below). Let \(\textit{WTP}_{1}\) and \( \textit{WTP}_{3}\) denote an individual’s WTP for the 1/10,000 and 3/10,000 risk reductions, respectively. Two patterns of responses are clearly consistent with theory:Footnote 1 YY (\({ WTP}_{1} > P\) and \({ WTP}_{3} > 3P)\) and NN (\({ WTP}_{1} < P\) and \({ WTP}_{3} <3P\)). The pattern NY (\({ WTP}_{1} < P\) and \({ WTP}_{3}> 3P\)) implies that WTP is more than proportional to risk reduction, which violates conventional theory. The remaining pattern YN (\({ WTP}_{1} > P\) and \({ WTP}_{3}< 3P)\) is consistent with theory if \({ WTP}_{1}\) and \({ WTP}_{3}\) are sufficiently close to P and 3P, respectively, and inconsistent otherwise. We classify individuals whose responses fit this pattern as failing to satisfy our consistency test. Hence, only respondents whose answers exhibit the YY or NN pattern satisfy our consistency test.Footnote 2

Note that an individual whose WTP is zero for both risk reductions will respond NN. Under conventional theory, WTP is strictly positive and hence a respondent who reports zero WTP reveals either preferences that are inconsistent with theory or rejection of the scenario provided in the survey. To identify these respondents, we include an open-ended follow-up question for the second risk reduction; individuals who report zero WTP fail the consistency test.

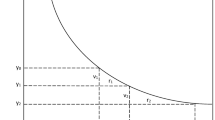

The logic of our consistency test is illustrated by Fig. 1. The figure shows an indifference curve between current-year income y and current-year survival probability s. VSL is defined as the marginal rate of substitution of y for s, i.e., (minus one times) the slope of the indifference curve. Beginning at the initial point (\(s_{0}, y_{0}), v_{1}\) is the WTP to reduce risk by the amount \(r_{1} (= s_{1} - s_{0})\). It satisfies

where \(VSL_{a}\) is minus the slope of the indifference curve somewhere between the initial point \((s_{0}, y_{0})\) and the terminal point \((s_{1}, y_{1})\). Similarly, \(v_{2}\), the WTP for an additional risk reduction \(r_{2}\), satisfies

where \(VSL_{b}\) is minus the slope of the indifference curve somewhere between \((s_{1}, y_{1})\) and \((s_{2}, y_{2})\).

Our consistency test compares the ratio between WTP amounts for different risk reductions beginning at the same point with the ratio of risk reductions. Specifically, we compare the WTP ratio \(V = (v_{1} + v_{2})/v_{1} = 1 + v_{2}/v_{1}\) with the risk-reduction ratio \(R = (r_{1} + r_{2})/r_{1} = 1 + r_{2}/r_{1}\).

Substitution from Eqs. (1) and (2) yields

Under standard assumptions described below, the indifference curve in Fig. 1 is downward sloping and convex, and hence

which implies

where \(VSL_{0}\) is VSL at the point \((s_{0}, y_{0})\) and \(VSL_{2}\) is VSL at the point \((s_{2}, y_{2})\). The extent to which the WTP ratio V can differ from the risk-reduction ratio R is determined by the ratio \(VSL_{2}/VSL_{0}\).

The standard model for VSL assumes the individual seeks to maximize the expected utility of income, where utility is dependent on whether he survives the current period or not. Specifically,

where \(u_{a}(y)\) and \(u_{d}(y)\) are the utility of income conditional on surviving and not surviving the current period, respectively, and primes denote derivatives. The standard assumptions are

i.e., survival is preferred to death, marginal utility of income is non-negative and greater if one survives than dies (leaving one’s income as a bequest), and weak risk aversion with respect to financial gambles conditional on survival and death (Drèze 1962; Jones-Lee 1974; Weinstein et al. 1980). These assumptions imply that VSL decreases with survival probability and increases with income, and hence the indifference curve is convex (as illustrated in Fig. 1).

To determine how much \(\textit{VSL}_{2}\) can differ from \(\textit{VSL}_{0}\), note that

where the two partial derivatives are evaluated at points (not necessarily the same) somewhere between \((s_{0}, y_{0})\) and \((s_{2}, y_{2})\). Hence \(VSL_{2}\) is equal to \(VSL_{0}\) minus an effect due to the increase in survival probability and an effect due to the reduction in disposable income.

From Eq. (6) and assumption (7b), the effect of the difference in risk is largest when \(u_{d}{'}(y) = 0\). In this case, the increase in survival probability from \(s_{0}\) to \(s_{2}\) decreases VSL (at any income y) by the factor

In our survey, respondents are told their baseline mortality risk (\(1 -s_{0})\) is 10/10,000 or 40/10,000 (depending on age) and \(r_{1}+r_{2} = 3/10,000\). These imply \(s_{0}/s_{2} =9990/9993\) or 9960/9963, and hence the effect of risk on VSL is negligible.

Theory provides less guidance about the effect of income on VSL. However, empirical estimates of the income elasticity of VSL range from about 0.1 to 2 (Hammitt and Robinson 2011). In this study, we estimate an income elasticity of 0.6–0.7 (see Sect. 5). The effect of the difference in income on VSL can be estimated as

where \(\eta \) is the average income elasticity over the range (\(y_{0}\), \(y_{2})\) and Y is the disposable-income ratio \(y_{2}/y_{0}\). In our sample, the median value of \(v_{1}+v_{2}\) is \(<\)2000 KD (Kuwaiti Dinars) and median income is about 1500 KD/month or 18000 KD/year.Footnote 3 Using these values, \(Y \approx 0.89\) and so the effect of income is to reduce VSL by a factor of between 0.99 and 0.79 for an income elasticity between 0.1 and 2 (0.93 for an elasticity of 0.65).

Combining the estimated effects of survival probability and income suggests that if WTP for a 1/10,000 risk reduction is exactly P, then WTP for a 3/10,000 risk reduction must be between 3P and about 2.4P. While some of the respondents whose responses fit the pattern YN might have WTP values that fit this narrow window, it seems unlikely that many do. Similarly, the ratio of estimates of VSL obtained by dividing estimated WTP by the corresponding risk reduction should differ by a factor between about 1 and 1.27 (= 1/0.79).

3 Survey Instrument

The survey was administered in Arabic by in-person interview to respondents aged 25–60 years old. The survey instrument includes several sections. After an introduction explaining that the purpose of the survey is to “understand how the citizens of the State of Kuwait would like to improve public health”Footnote 4 and that all responses are confidential, the interviewer elicited information about demographic and socioeconomic characteristics (level of education completed, household size and income), personal health habits (smoking, exercise frequency), and self-reported health status (excellent/very good/good/fair/poor and as a visual analog scale between equivalent to dead \(=\) 0 and perfect health \(=\) 100).

The subsequent questions were designed to encourage respondents to think about ways they could affect their mortality risk and to evaluate tradeoffs. These were included in part to identify any fatalistic attitudes that would prevent respondents from considering their willingness to trade money for increased survival probability. Respondents were asked whether they thought they could reduce their risk of dying in the next year (yes/no). Those who responded no were then asked if they thought measures such as exercising, eating healthful foods and quitting smoking would lower their risk (yes/no). All respondents were asked to provide examples of behaviors that could reduce their mortality risk.

Respondents were provided training for the valuation questions using a transportation example. They were asked to choose between two automobile routes to their destination. One route takes 45 min and the risk of a crash is 150/10,000; the other route takes 30 min and the crash risk is 50/10,000.Footnote 5 The risks were illustrated using charts with 10,000 dots, with 150 (or 50) red dots representing the chance of a crash and the remaining blue dots representing the chance of a safe journey. Those who chose the dominated alternative were asked whether they were sure they would take the slower, more dangerous route or would choose the alternative.

The section on valuing mortality risk began with information about baseline risk: “Kuwaiti [men/women] of your age die from many causes. Among the most common are heart attacks and cancer. For Kuwaitis [younger than 40/between 40 and 60 years old], the chance of dying in one year is [10/40] out of 10,000.” The baseline risk was illustrated using two visual aids: a card with 10,000 dots of which 10 (or 40) were red and the others were blue, and a “lottery box” said to contain 10,000 balls, of which 10 (or 40) were red and the others blue. Respondents were instructed to “assume that a single ball will be drawn from the box and its color will determine if you will survive the risk of dying during the coming year.”

WTP was elicited using the double-bounded binary-choice format (Hanemann et al. 1991). The first valuation question asked: “If you have the chance to turn r of the red balls into blue for a cost of P KD, would you spend that money to reduce your chance of dying next year or would you not spend the money and not reduce your chance of dying next year?” where \(r = 1\) or 3 and P is an amount randomly selected from the set of initial bids (described below). Respondents were presented with a follow-up binary-choice question, in which the cost was 2P (for those who indicated they would purchase the risk reduction) and 1 / 2P (for the others).

The second valuation question was identical in format. The other value of the risk reduction r was used and the initial price was 3P (for respondents whose second valuation question was for a risk reduction of 3/10,000) and 1/3P (for the others). After a follow-up binary-choice question (for which the price was doubled or halved, as before), respondents were asked in an open-ended question to state the price that would make them indifferent between spending the money to reduce the risk and refraining.

The survey concluded with measurement of the respondent’s height and weight, from which we calculate body mass index (BMI).

4 Sample Selection and Survey Administration

We used a stratified sampling approach designed to obtain a sample of approximately 600 individuals representative of the population of Kuwaiti citizensFootnote 6 aged 25–60 years old (on February 28th, 2011). We recruited subjects using a system of replicates to minimize oversampling individuals who were systematically easier to recruit, whether because of education, employment, or other factors.

From a list of all Kuwaiti citizens as of 1990,Footnote 7 we randomly selected 5000 names stratified equally by gender and two age categories (25–39 and 40–60 years old). These were randomly divided into 50 numbered replicates of 100, each containing 25 names in each of the four gender/age categories.

Replicates were opened sequentially. Prospective subjects were contacted by phone and invited to participate in the study (no compensation was provided). Written calling scripts were followed. If subjects could not be reached on the first call, two further attempts were made. Efforts to contact each prospective subject ended when it was determined that the subject was unavailable (because he or she had passed away, was imprisoned, seriously ill, or unable to communicate) or when the subject: (a) agreed to participate; (b) refused to participate; or (c) could not be reached on the third attempt. Each replicate was closed once such a determination had been made for each of its 100 prospective subjects.

Once a prospective subject agreed to participate, an interview was scheduled. Each subject was interviewed in person by one of 14 trained interviewers. The interviews normally took place at the subject’s home or workplace. If a subject failed to appear for the interview, an effort was made to reschedule. Subjects who could not be reached, asked for the interview to be rescheduled more than twice, or eventually refused to be interviewed, were excluded from the study. Recruitment and interviews continued until all potential subjects in all opened replicates had been interviewed or were excluded. The interviews were conducted between April 13 and October 27, 2011.

5 Results

In the first subsection below, we report descriptive statistics for the sample. These are followed by information on the distribution of elicited WTP, non-parametric estimates of WTP and VSL, and multivariate regression estimates.

5.1 Sample Characteristics

Once it became clear that at least 600 interviews would be completed by subjects recruited from the opened replicates, no further replicates were opened. This occurred after the \(32{\mathrm{nd}}\) replicate was opened. Of the 3200 names in the opened replicates, it was determined that 61 (2 %) were deceased, mentally ill, or otherwise ineligible. An additional 1462 (46 %) could not be contacted. Of the 1677 individuals contacted, 526 (31 %) refused and 524 (31 %) were travelling for extended periods or were otherwise unavailable. A total of 627 individuals agreed to participate of whom 623 were successfully interviewed, a response rate of 37 % of those contacted.

Table 1 compares the characteristics of the full sample, the restricted sample (respondents who satisfy the consistency test) and the Kuwaiti citizen population of the same age group (Kuwait Public Authority for Civil Information 2013; Kamel 2008). Our full sample is more educated, has higher income, and includes a larger share of older respondents and a smaller share of women than the Kuwaiti citizenry. Descriptive statistics for the groups defined by the initial risk reduction they valued are virtually identical, consistent with randomization of the initial risk reduction.

Respondents appeared to understand the survey and accept its premise. Only three indicated that they felt that they had no influence over their mortality risk and none of the subjects failed the training question, i.e., chose the route which took longer and had higher risk.

For the consistency test, 554 respondents (89 %) provided responses to the two mortality-risk-valuation questions that are clearly consistent with economic theory (YY or NN). Of the remainder, 40 fit the NY pattern (WTP more than proportional to risk), which is inconsistent with theory, and 29 fit the YN pattern, which could be consistent with theory if their WTP amounts are sufficiently close to the stated prices. Of the 554 respondents, 32 reported a WTP of zero in the open-ended valuation question for the second mortality-risk reduction, leaving 522 respondents who satisfy the consistency test (84 % of the full sample). As shown by Table 1, there is little difference in the descriptive statistics between the restricted and full samples.

5.2 Distribution of WTP and Non-parametric Estimates

Table 2 presents the initial prices and the fractions of respondents who indicated they would pay each price for the stated risk reduction, using results of only the first valuation question asked to each respondent (i.e., all comparisons in the table are “external” or between respondents). The fraction replying yes (i.e., indicating they would pay the stated price for the stated risk reduction) should decrease with the price and increase with the risk reduction. For the full sample (Panel A), the fraction responding yes decreases with the price for each risk reduction, except between the two largest prices (2100 and 3000 KD) for the 3/10,000 risk reduction. The fraction indicating they would pay each price does not, however, always increase with the risk reduction: for three of the six prices, the fraction is smaller among those offered a 3/10,000 risk reduction than those offered a 1/10,000 risk reduction.

For the restricted sample of respondents satisfying the consistency test (Panel B), the fraction indicating they would accept the price decreases with the initial price except (as for Panel A) between the two highest prices for the larger risk reduction. The fraction accepting each price is larger for the larger risk reduction.

From Table 2, we calculate single-boundedFootnote 8 central-tendency estimates of WTP and VSL. Median WTP is calculated by linear interpolation between adjacent bids for which the fractions accepting the bid are larger and smaller than one half. For the full sample, median WTP for the smaller and larger risk reductions are 1259 and 1085 KD, respectively. The larger median for the smaller risk reduction violates conventional theory. For the restricted sample, median WTP for the smaller risk reduction is smaller (900 KD) and for the larger risk reduction is larger (1853 KD) than for the full sample. The ratio of median WTP for the larger risk reduction to median WTP for the smaller risk reduction is 0.9 for the full sample and 2.0 for the restricted sample, suggesting that aggregate results from the subsample of respondents who individually satisfy the consistency test are more consistent with theory. However, even for this group the ratio falls short of the range of 2.4–3.0 derived in Sect. 2.

The Turnbull lower-bound-mean estimate is based on the conservative assumption that each respondent’s WTP is equal to the largest price for which he reports acceptance. For example, for the 1/10,000 risk reduction in the full sample, 38 % of respondents are assumed to have WTP \(=\) 3000 KD, 1 % (\(=\)39–38) to have WTP \(=\) 2100 KD, and 12 % (\(=\)51–39) to have WTP \(=\) 1200 KD. The Turnbull lower-bound-mean requires that the probability of acceptance is monotone decreasing in the price; when this condition is violated, one adjusts the empirical WTP distributions using the pooled adjusted violators algorithm (PAVA, Turnbull 1976). In our data, we must pool the results for the two highest prices for the 3/10,000 risk reduction. To maintain comparability in our estimates of WTP between the two risk reductions, we also pool results for the two highest prices for the 1/10,000 risk reduction.Footnote 9 Turnbull lower-bound means are roughly comparable to estimated medians. In the full sample, Turnbull lower bounds are approximately 1050 KD for both risk reductions. In the restricted sample, they are about 1000 KD for the 1/10,000 risk reduction and modestly larger, 1260 KD, for the 3/10,000 risk reduction. Note that because Turnbull lower-bound-mean estimates are not unbiased estimates of the mean, their ratio need not be nearly proportional to the risk reduction.

Estimates of VSL are obtained by dividing estimated WTP (median or Turnbull-lower-bound mean) by the corresponding risk reduction and converting to US dollars using the exchange rate of 1 KD \(=\) $3.50. For the full sample, the estimates are \(\$37-\$44\) million for the small risk reduction and \(\$12-\$13\) million for the large reduction. For the restricted sample, the estimates are \(\$32 - \$35\) million for the small and \(\$15-\$22\) million for the large risk reduction. The inverse relationship between risk reduction and estimated VSL reflects the fact that the estimated central WTP values vary much less than in proportion to the risk reduction.

5.3 Regression Estimates

We estimate regression models to characterize WTP as a function of risk reduction and individual characteristics. Specifically, we estimate functions of the form

where \({ WTP}_{i}\) is respondent i’s WTP, \(r_{i}\) is the stated risk reduction, \(X_{i}\) is a vector of individual characteristics (including an intercept), \(\gamma \) and \(\beta \) are coefficients to be estimated, and \(\varepsilon _{i}\) is an error term assumed to be independently, identically, and normally distributed across respondents. The dependent variable \({ WTP}_{i}\) is interval censored; it is bounded below by the largest price the respondent indicated he would accept (zero if the respondent rejected both prices he was offered) and above by the smallest price he rejected (unbounded if he accepted both prices). Using the logarithm accommodates the skewed distribution. We estimate equation (11) using maximum-likelihood methods (Alberini 1995). In most of the specifications considered, we include responses to only one risk reduction for each respondent, so observations are independent and the estimated coefficient on log(r) reflects differences between respondents. In these models we report robust standard errors. In models with two responses per respondent, we report standard errors clustered by respondent.

Results are presented in Table 3. The models in columns (1) and (2) are estimated using the restricted set of respondents who satisfy our consistency test. These models include only an intercept and the variable log(r), the log of the risk reduction, which equals ln(3) (\(\approx 1.1\)) if the respondent’s valuation response is for the 3/10,000 risk reduction and ln(1) = 0 otherwise. The coefficient \(\gamma \) estimates the elasticity of WTP with respect to risk reduction; if WTP for the 3/10,000 risk reduction is between 2.4 and 3.0 times as large as WTP for the 1/10,000 risk reduction (as derived in Sect. 2), \(\gamma \) should be between ln(2.4)/ln(3) \(\approx 0.80\) and 1.

The model in column (1) is estimated using only the response to the first valuation question. The estimated coefficient of log(r), 0.492, is significantly different from zero (p = 0.02). It is not significantly different from 0.80 (p = 0.14). Hence for the sample of respondents who satisfy our consistency test, we reject the hypothesis that WTP is insensitive to risk reduction and not the hypothesis that WTP is sufficiently sensitive to risk. The model in column (2), estimated using responses to both valuation questions, yields a slightly larger estimate of \(\gamma \), 0.508, which is significantly different from both zero and 0.80.

The model in column (3) is estimated for the full sample. In addition to an intercept and log(r), the model includes an indicator variable, Inconsistent, equal to 1 for the 101 respondents who failed our consistency test and an interaction between this indicator and log(r). The estimated coefficient of Inconsistent is insignificantly negative but the coefficient of the interaction of Inconsistent with log(r) is significantly less than zero, which implies that WTP is significantly less sensitive to risk reduction among the respondents who failed the consistency test. The estimate of \(\gamma \), 0.470, is similar to the estimate in column (1) and is significantly different from both zero (p = 0.02) and 0.80 (p = 0.10). Hence this specification also provides evidence that WTP is sensitive to risk reduction but insufficiently so among respondents who satisfy the consistency test.

The model in column (4) is similar to that in column (3), except the respondents who fail the consistency test are segregated into three groups described by the indicator variables NY (\(=\)1 for respondents who answered no to the small risk reduction and yes to the large one), YN (\(=\)1 for respondents who answered yes to the small risk reduction and no to the large one), and NN0 (\(=\)1 for respondents who reported their WTP is zero in the open-ended follow-up). The regression includes these three indicator variables plus their interactions with log(r). The estimated coefficient on log(r) is similar to its value in regressions (1)–(3) and is significantly different from both zero (p \(=\) 0.02) and 0.80 (p \(=\) 0.07). None of the estimated coefficients of the interactions with log(r) for respondents who fail the consistency test are significantly different from zero. The coefficients on NY and NN0 are significantly less than zero and large in absolute value, suggesting much smaller WTP among these groups than among those who satisfy the consistency test.

The models in columns (5) and (6) supplement the previous full-sample models (columns (3) and (4)) by including socio-demographic covariates. Adding these covariates increases the estimated coefficient of log(r). Estimated coefficients of the covariates are similar in both models. The estimated income elasticity is roughly 0.65. (No income is an indicator variable equal to one for respondents who reported no income.) WTP is estimated to be substantially smaller for women than men, to increase with age, and to increase with education (the omitted category is college graduates). Adding health-related characteristics to these models (self-reported health, exercise frequency, smoking status, and BMI calculated from height and weight measured at the interview) has little effect on the coefficients reported in Table 3 and yields no statistically significant effects.

The last two columns report models using responses to both valuation questions for all respondents. We include an indicator variable 2d question (= 1 for the second risk reduction the respondent valued, 0 otherwise) and its interactions with log(r) and Inconsistent plus the interaction with both of these variables. Estimates of the coefficient of 2d question and of its interaction with log(r) suggest there is no systematic difference between responses to the first and second valuation questions. In contrast, respondents who failed our consistency test have on average smaller WTP for the small risk reduction and larger sensitivity to risk reduction when answering the second rather than the first valuation question. The estimated coefficients of log(r) and of the socio-demographic covariates are similar to their values in the other specifications, supporting the previous results.

Estimates of VSL are reported at the bottom of Table 3. These are calculated for the regression models that exclude socio-demographic characteristics and are for the respondents who satisfy the consistency test. VSL is calculated separately for the smaller and larger risk reductions. It is calculated as estimated median WTP divided by the stated risk reduction and converted to US dollars.Footnote 10

Estimated VSL for the 1/10,000 risk reduction is substantially larger than for the 3/10,000 risk reduction; the ratio between these values is 1.7–1.8, larger than the theoretical range of 1–1.27 derived in Sect. 2. This follows because the estimated elasticity of WTP with respect to risk reduction is smaller than the theoretical range of 0.79–1 derived in Sect. 2.

The estimates of VSL are approximately $18 million for the large risk reduction and $32 million for the small reduction. These values are similar to the non-parametric estimates reported in Table 2. They are roughly two to four times larger than values accepted for the US. For example, the US Department of Transportation (2013) and US Environmental Protection Agency (2010) use central values of $9.1 and $9.2 million (2012 dollars). However, the difference in average discretionary income between Kuwaiti citizens and Americans is more than a factor of two, so much of the difference between these estimates and American estimates may be explained by the difference in income if the income elasticity is on the order of 0.65 as we estimate. Differences in culture and religion may also contribute to the difference.

Mean household income of Kuwaiti citizens is almost twice the comparable value for Americans, $140,700 compared with $72,600.Footnote 11 The difference in discretionary spending between Kuwaiti resident citizens and US residents is substantially larger than this, because in Kuwait there is no personal income or sales tax and goods and services that comprise important shares of US household spending, including health care, education, housing, energy, and retirement savings,Footnote 12 are provided by the government or at highly subsidized prices. For Kuwaiti citizens, health care and education (including university) are free and housing is subsidized via a no-interest loan of $250,000. Energy prices are heavily subsidized, resulting in gasoline prices that have been fixed at $0.80 per gallon and electricity prices at $0.0067 per kwh for more than 20 years [US prices averaged $3.44 per gallon (2014) and $0.1212 per kwhFootnote 13 (2013)].

6 Conclusions

This paper makes two contributions, one substantive and one methodological. First, we report what we believe to be the first estimates of VSL for a Middle Eastern, Arab, or Muslim population. Moreover, these pertain to a population with much higher income and discretionary spending than the US and European populations for whom most VSL estimates have been obtained. The estimates are obtained from a stated-preference survey conducted using in-person interviews for a random sample of Kuwaiti citizens residing in that country. Our estimated values, $18–32 million, are two to four times larger than values used by regulatory agencies for the US. In part, this difference from US values is likely to reflect Kuwaiti citizens’ financial advantage compared with Americans: household income is twice as large, there is no personal income tax, and important goods and services are highly subsidized or provided by the government and not paid from household income. Differences in culture, religion, or other factors may also contribute. These estimates may be relevant for estimating the benefits of public-health interventions that affect the citizens of other Gulf countries with cultures and incomes similar to Kuwait.

Second, we introduce a novel consistency test for stated-preference studies. We elicit WTP for two reductions in mortality risk from each respondent and include in our restricted sample only respondents whose answers for the two risk reductions are consistent with the standard theoretical result that WTP should be strictly positive and nearly proportional to the reduction in mortality probability. This consistency test provides a necessary but not sufficient condition for the validity of respondents’ answers to our valuation questions and hence our estimates of VSL. External (between-respondent) scope tests show that WTP does vary significantly with the magnitude of the stated risk reduction. The variation is, however, not as large as predicted by standard theory. This consistency test may be useful for estimating economic values of health-risk reductions in other contexts.

Notes

Response-pattern labels YY, NN, YN, and NY denote responses yes (would purchase the intervention) or no (would not purchase) for the smaller and larger risk reductions, respectively, regardless of the order in which the questions were asked.

Note that consistency with theory is a sufficient but not necessary condition for responses YY or NN. For example, a respondent might value the two risk reductions equally; if this common value is greater than the prices offered for both risk reductions, he would respond YY.

1 KD is worth approximately US$3.50. Since 2007, its value has been pegged to a basket of international currencies of Kuwait’s major trade and financial partners (Central Bank of Kuwait, www.cbk.gov.kw/en/monetary-policy/exchange-rate-policy.jsp, accessed August 26, 2015.

All quotations from the survey are translations.

The crash would not necessarily cause any injury.

Kuwaiti citizens represent a minority of Kuwaiti residents (about 32 % of all ages and 19 % of those aged 25–60 years). Many non-citizen residents are workers of Arab or Asian origin.

The list was developed to prepare a claim for public-health damages in Kuwait associated with the Gulf War (Sand and Hammitt 2011).

I.e., these results use only the response to the first binary-choice question.

If we did not pool results for the smaller risk reduction, we would count some respondents as having WTP \(=\) 3000 for the smaller risk reduction but none as having WTP more than 2100 for the larger risk reduction, creating an artifactual bias in the comparison.

Estimated median WTP \(=\) exp(intercept) for the 1/10,000 risk reduction and exp(intercept + \(\gamma \cdot \) ln(3)) for the 3/10,000 risk reduction.

In the US, consumer expenditures on health care, education, utilities, and gasoline average 18 % of pre-tax income while pensions and social security average an additional 8 % (authors’ calculations using BLS 2015, Table A). Federal taxes average 18 % of pre-tax income overall and 11 % for the median-income household (authors’ calculations using CBO 2014, Table 1).

The gasoline price is the average retail price in 2014, US Energy Information Administration, Weekly Retail Diesel and Gasoline Prices, http://www.eia.gov/dnav/pet/pet_pri_gnd_dcus_nus_a.htm. The electricity price is the average residential price in 2013, US Energy Information Administration, Table 2.10. Average Retail Price of Electricity to Ultimate Customers by End Use Sector, by State, 2013 and 2012, http://www.eia.gov/electricity/annual/html/epa_02_10.html.

References

Alberini A (1995) Efficiency vs bias of willingness-to-pay estimates: bivariate and interval-data models. J Environ Econ Manag 29:169–180

Alberini A, Cropper M, Krupnick A, Simon N (2004) Does the value of a statistical life vary with age and health status? evidence from the US and Canada. J Environ Econ Manag 48:769–792

ALSHALL Consulting Co. (2014) (Salhiya, Kuwait City), Income and Household Spending in 2013. ALSHALL Weekly Economic Report 24(2):2-4, 2 November 2014 (http://www.alshall.com/wp-content/uploads/2015/01/20141102-KE.pdf)

Andersson H, Svensson M (2008) Cognitive ability and scale bias in the contingent valuation method. Environ Resour Econ 39:481–495

Ariely D, Loewenstein G, Prelec D (2003) Coherent arbitrariness: stable demand curves without stable preferences. Q J Econ 118:73–105

Bureau of Labor Statistics (BLS) (2015) Consumer Expenditures in 2013. BLS Reports, Report 1053: February 2015

Congressional Budget Office (CBO) (2014) Congress of the United States, The Distribution of Household Income and Federal Taxes, 2011. www.cbo.gov/publication/49440 Washington, D.C., November 2014

Cherry TL, Crocker TD, Shogren JF (2003) Rationality spillovers. J Environ Econ Manag 45:63–84

Corso PS, Hammitt JK, Graham JD (2001) Valuing mortality-risk reduction: using visual aids to improve the validity of contingent valuation. J Risk Uncertain 23:165–184

DeNavas-Walt C, Proctor BD (2014) Income and Poverty in the United States (2013) Current Population Reports, P60–249. US Census Bureau, 2014

Drèze J (1962) L’Utilité sociale d’une vie humaine. Revue Française de Recherche Opérationelle 6:93–118

Hammitt JK (2000) Valuing mortality risk: theory and practice. Environ Sci Technol 34:1396–1400

Hammitt JK, Graham JD (1999) Willingness to pay for health protection: inadequate sensitivity to probability? J Risk Uncertain 18:33–62

Hammitt JK, Haninger K (2010) Valuing fatal risks to children and adults: effects of disease, latency, and risk aversion. J Risk Uncertain 40:57–83

Hammitt JK, Robinson LA (2011) The income elasticity of the value per statistical life: transferring estimates between high and low income populations. J Benefit-Cost Anal 2(1):Article 1, doi:10.2202/2152-2812.1009

Hanemann WM, Loomis J, Kanninen B (1991) Statistical efficiency of double-bounded dichotomous choice contingent valuation. Am J Agric Econ 73:1255–1261

Hausman J (2012) Contingent valuation: from dubious to hopeless. J Econ Perspect 26:43–56

Jones-Lee MW (1974) The value of changes in the probability of death or injury. J Politi Econ 82:835–849

Kamel MI (2008) Risk factors of communicable disease in the state of Kuwait. Ministry of health in state of Kuwait, Kuwait

Kling C, Phaneuf DJ, Zhao J (2012) From Exxon to BP: has some number become better than no number? J Econ Perspect 26:3–26

Kuwait Public Authority for Civil Information (2013) www.paci.gov.kw

Lindhjem H, Navrud S, Braathen NA, Biausque V (2011) Valuing mortality risk reductions from environmental, transport, and health policies: a global meta-analysis of stated preference studies. Risk Anal 31:1381–1407

Mitchell RC, Carson RT (1989) Using surveys to value public goods: the contingent valuation method. Resources for the Future, Washington: DC

Sand PH, Hammitt JK (2011) Public health claims, Chapter 8 (193–217). In: Payne C, Sand PH (eds) Gulf war reparations and the UN compensation commission. Oxford University Press, Oxford

Turnbull BW (1976) The empirical distribution function with arbitrarily grouped, censored, and truncated data. J R Stat Soc 38(B):290–295

US Department of Transportation (2013) Guidance on treatment of the economic value of a statistical life (VSL) in departmental analyses. Memorandum to secretarial officers and modal administrators from P, Trottenberg, Under Secretary for Policy, and R. Rivkin, General Counsel

US Environmental Protection Agency (2010) Guidelines for preparing economic analysis. EPA 240-R-10-001

Viscusi WK (1985) A Bayesian perspective on biases in risk perception. Econ Lett 17:59–62

Viscusi WK (1989) Prospective reference theory: toward an explanation of the paradoxes. J Risk Uncertain 2:235–263

Viscusi WK, Aldy JE (2003) The value of a statistical life: a critical review of market estimates throughout the world. J Risk Uncertain 27:5–76

Weinstein MC, Shepard DS, Pliskin JS (1980) The economic value of changing mortality probabilities: a decision-theoretic approach. Q J Econ 94:373–396

Acknowledgments

We acknowledge the generous support of the Dasman Diabetes Institute, its Director Kazem Behbehani, and its head of field operations Ayah Ahmed. The Dasman Institute and its parent organization, the Kuwait Foundation for the Advancement of Science, provided the in-kind support necessary to field this study. Ms. Ahmed coordinated the development and pilot testing of the questionnaire; supervised the training of the callers and interviewers; and managed the team of interviewers and data-entry personnel responsible for conducting the interviews, collecting and editing the data. JKH acknowledges financial support from INRA (the French national institute for agricultural research) and the European Research Council under the European Community’s Seventh Framework Programme (FP7/2007–2013) Grant Agreement no. 230589. JSE acknowledges financial support from the Government of the Republic of Cyprus through their 2009 agreement with the Harvard School of Public Health to create and operate the Cyprus International Institute for Environment and Public Health. We thank Daniel Herrera for programming the econometric models and two anonymous referees for their valuable suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Alolayan, M.A., Evans, J.S. & Hammitt, J.K. Valuing Mortality Risk in Kuwait: Stated-Preference with a New Consistency Test. Environ Resource Econ 66, 629–646 (2017). https://doi.org/10.1007/s10640-015-9958-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9958-1