Abstract

This paper considers the assignment of tradable permits—representing property rights of an environmental good—to community members who are harmed by pollution generated by firms. These community members can in turn sell permits to polluters according to their personal preferences. For a special case with a sole household, market transactions between the household and polluters achieve an efficient pollution level. However, for a group of households, the decentralized market solution fails to yield social efficiency because of competitive consumption of the environmental goods. We design a revenue-sharing mechanism akin to unitization, under which market transactions also achieve efficient resource allocation. Importantly, in some cases, efficiency can be achieved even when regulators are ignorant of the private valuation of the environmental good.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The basic problem in environmental economics is the inefficient use of environmental goods. People value these goods, but they are used without cost due to the absence of property rights. A substantial literature has studied the efficiency of alternative policy approaches, including emission taxes, tradable permits and subsidies for pollution abatement. However, the allocation of property rights to the agents actually harmed by the loss of the environmental good has received less attention.Footnote 1 Typically, when policy interventions are considered, the ownership of environmental goods is either “allocated” to the government or polluting firms. In other words, property rights are either implicitly held by the government when charging emission taxes or auctioning tradable permits to the polluters, or explicitly allocated to polluters when issuing free tradable permits (grandfathering) to firms. An alternative approach would be to assign property rights of the environmental goods, in the form of tradable permits, to the victims—the households that are harmed by pollution generated by firms. This paper considers the possibility of achieving efficient resource allocations by issuing tradable permits to a community.

If tradable permits, representing the property rights of an environmental good, are assigned to households, a market is created in which households are “suppliers” of the environmental good and polluting firms will be “demanders” of the environmental good as an input into production. In this market, households may sell permits to polluters and they may retire some permits according to their preferences over consumption of other goods and the environmental good. The resulting equilibrium could reflect any number of preferences of households, for example, the preference for the existence of clear waterways; concerns for future generations; choices between local economic development and environmental protection, etc. While the above argument suggests that an efficient pollution level may be achieved through the market transactions of permits between households and polluters, this paper will examine the conditions under which efficiency may or may not be achieved.

One may argue that allocating property rights is simply a distribution question about who will receive the surplus arising from trade, but does not affect the total value of society.Footnote 2 However, this is not necessarily true if there are multiple agents sharing an environmental good, or sharing the costs of producing a common good. For example, if a group of households considers paying for polluters to engage in abatement activities, each household has an incentive to under-provide payment and free ride on the contributions of others (Proost 1995).Footnote 3 As a result, the total welfare of society decreases because there will be less abatement than the optimal level.Footnote 4

By allocating tradable permits representing an environmental good to households, this free rider problem is not addressed directly. However, it is important to note that the problem is not simply assumed away, either. Rather, the free rider problem is transformed into a resource consumption problem through the assignment of tradable permits to households. Each rational household has an incentive to sell more permits than optimal to polluters because the individual household will receive the permit revenues but the incurred pollution will be shared by all other households. Thus, the individual household generates a negative externality to other households, as on the margin, individual household’s consider only their marginal cost associated with an additional unit of pollution, ignoring the external costs imposed on other households. As a result, there will be too much pollution and environmental goods will be overused. Whether or not this incentive to sell too many permits can be mitigated is a key consideration of this study.

A small literature has arisen that examines the participation of households in tradable permit systems, typically for national or global pollutants. The most closely related is Ahlheim and Schneider (2002), who consider a similar setup whereby households are allocated emissions permits. They note that if the emissions target is set too loose relative to the social optimum, household participation may in effect tighten the emissions target, potentially leading to a Pareto improvement.Footnote 5 However, such a welfare improvement hinges on whether or not individual households exhibit “impure altruism”—a warm glow from doing the right thing. Our point of departure is to examine the efficiency of a household permit system in the absence of impure altruism.

In a different context, Arnason (2009) examines the conflicting demands for total allowable catch (TAC) between two groups: fisherman and conservationists (non-extractive agents). He shows that the decentralized trading of individual transferable quotas (ITQs) will fail to achieve the efficient outcomes because of both the resource consumption problem in the fisherman group and the free rider problem in the conservationist group. However, Arnason concludes that if members in each group can (somehow) resolve their internal contradictions and organize themselves into a unit, ITQs can in principle lead to fully efficient resource allocation. Furthermore, regulators would not need to know the value that conservationists place on increasing stock sizes—by simply allocating a sufficiently large number of permits to agents, the efficient TAC will arise endogenously from transactions between fishermen and conservationists, each operating as a cohesive unit.Footnote 6

The question is of course, how to incentivize the self-interested individuals within a group to act as one unit? In the context considered here, each household ignores impacts on other community members and has an incentive to sell more permits than socially desirable, and as such the environmental good is overconsumed. In this paper, a revenue-sharing mechanism to resolve the externalities among the group of households is developed. If properly designed, the revenue-sharing mechanism can mitigate these externalities and lead to efficient resource allocation.Footnote 7 In addition, under homogeneous preferences, the mechanism does not require regulators to possess information about private preferences for environmental goods to achieve efficiency, nor do households need to exhibit impure altruism as in Ahlheim and Schneider (2002). Market transactions will lead to optimal pollution levels. And while the mechanism requires information about preferences to achieve efficiency when those preferences differ across individuals, near-efficiency can be achieved without such information.

A few comments on the conditions where a revenue-sharing tradable permit system for households would be applicable are in order. First, it would likely not be applicable to the case of regional or global pollutants afflicting millions or billions of people such as \(\hbox {SO}_2\) or \(\hbox {CO}_2\), where regulators are likely to have better information regarding the external costs of environmental degradation. Nor is it likely to apply in “Coasian” cases where only a few agents are involved. Rather, it is likely to be most applicable in cases of localized pollution, where community members are much more likely to know their own preferences for recreation values, aesthetic values, and other values of the environmental good better than any regulatory agency.Footnote 8 In this case, community-based allocation of tradable permits may prove to be superior to alternative regulation methods.

2 One Firm, One Household Model

To illustrate the basic mechanics of the model, a simple model of a single firm and single household is developed to show that if permits representing the property rights of an environmental good are assigned to the sole household, the decentralized equilibrium supports social efficiency. Importantly, a social planner does not have to decide the optimal amount of permits issued. Market transactions of permits between the household and polluter endogenously determine the socially optimal level of pollution.

While the model is deliberately parsimonious, it captures the basic tradeoffs inherent in environmental protection. As a motivating example, consider a sole resident who lives along a river near a polluting firm and consumes two kind of goods: an environmental good, e, that depends on the quality of the river, and a composite good, x, that is produced by a firm near the resident. Let U(x, e) be a concave function representing this households utility, with the standard properties that \(U_x>0\) and \(U_e>0\). The household is assumed to provide a fixed amount of labor \(l=\bar{l}\) to the firm, for which they receive a wage of w.

The firm combines labor and the environmental good to produce the composite good according to \(x=f(l,z)\), where z is the pollution emitted by the firm through the usage of the environmental input.Footnote 9 Assume that in the absence of regulation, the firm would emit a pollutant at an amount of \(\bar{z}\) units into the river, which would damage the clean water, scenic beauty, biodiversity around the river, etc., that the resident enjoyed absent any pollution. To simplify things further, we assume that the firm is owned by the household, and that profits are equal to zero.Footnote 10

Now suppose property rights of the environmental goods are assigned by issuing \(\bar{z}\) units of permits to the sole household, whereby, the household determines the pollution level by selling some amount of permits \(z\; (0\le z\le \bar{z})\) to the firm and enjoying the remaining environmental goods.

The relationship between the environmental goods e and pollution (permits) z is such that one unit of pollution will destroy one unit of the environmental good:

For example, if the pre-policy emission level \(\bar{z}\) is 100 units of pollutant emitted into the river, the household would be issued 100 permits. If the household sells 40 permits to the firm, the firm can emit 40 units of the pollutant and the household would enjoy 60 units of the environmental good from the river. If the household sells all her permits, \(z=\bar{z}\), then pollution levels are \(\bar{z}\), and the environmental good is effectively destroyed, \(e=0\). We next derive the socially efficient outcome, and then compare it to the outcome under a decentralized market when permits are allocated to the single household.

2.1 Social Planner’s Problem

The social planner’s problem is to maximize utility based on consumption of the environmental good e and the composite good x. Per Eq. 1, this problem can be thought of as selecting the composite good and the amount of permits to sell:

The Lagrangian form for the above problem is:

The first order conditions yield an efficient resource allocation \(x^{*},\; e^{*},\; l^{*},\;z^{*}\) satisfying the following conditions:

At the social optimal solution, the marginal utilities of the environmental good \(U_{e}\) and the composite good \(U_{x}\), equal the shadow prices \(\mu \) and \(\theta \), respectively. The marginal product of labor \(f_{l}\) and marginal product of pollution permits \(f_{z}\) are represented by the shadow prices as shown in Eqs. (5) and (6).

2.2 Permit Allocation in a Decentralized Market

The above establishes the conditions for an efficient allocation, which we now compare to the decentralized decisions made by the firm and the sole household when \(\bar{z}\) permits are allocated by a regulator to the sole household. Beyond this allocation (which does not require any knowledge of the household’s preferences), the regulator plays no role.

2.2.1 Firm’s Problem

The firm’s problem is to maximize the profit from producing the composite good x:

given a wage rate of w and the market price of permits \(p_{z}\), reflecting the price of environmental goods that the firm “consumes” during production. From the first-order conditions:

2.2.2 Sole Household’s Problem

The sole household would select an amount of permits to sell to maximize her utility based on consumption of goods x and e, subject to the budget constraint including permit revenues:

As assumed above, the profit \(\pi \) is zero. As such, the Lagrangian form for the above problem is:

From the first order condition, we get:

Proposition 1

The decentralized equilibrium of the sole household’s problem supports the socially efficient resource allocation.

Proof

Setting \(p_{x}=\frac{\theta }{\mu }\), \(p_{z}=1,w=\frac{\phi }{\mu }\) generates a price vector \(p*=\{\frac{\theta }{\mu },1,\frac{\phi }{\mu }\}\) that satisfies the decentralized equilibrium. From Eqs. (12), (8) and (9), we get \(\frac{U_{x}}{U_{e}}=\frac{\theta }{\mu }\), \(f_{l}=\frac{\phi }{\theta }\), \(f_{z}=\frac{\mu }{\theta }\) respectively, which shows that the decentralized equilibrium supports the socially efficient resource allocation. \(\square \)

Thus, the efficient resource allocation for the sole household problem is proven. If the social planner issues permits to the sole household, the optimal pollution level will be achieved through market transactions between the household and the polluter. The total amount of permits \(\bar{z}\) issued to the sole household does not affect the efficiency results as the household would retire some amount of permits according to her preferences. Even if the regulator does not know the household’s preferences for consuming the composite good x versus the environmental good e (the values of \(U_{x}\) and \(U_{e})\), the efficient resource allocation will still be achieved. In addition, from the transaction price of the permits, the value of environmental goods will be revealed.

In some sense, this should not be a surprising result when there is a single household. That the socially efficient level of pollution is achieved in this simple setting when property rights are created and allocated simply reflects the intuition in Coase (1960), echoed by Arnason (2009).Footnote 11 However, in many real world cases of localized pollution there are likely multiple households harmed by the polluting firm.

3 Multiple Households Harmed by Pollution

While the above establishes the efficiency of assigning pollution permits in the case of a single household, we now consider the efficiency of allocating property rights for the environmental good to multiple households. Consider the case of a community where N residents live around a river into which the firm discharges the pollutant. We allow for heterogeneity both in terms of the physical loss of the environmental good per unit of pollution emitted by the firm, as well as the preferences that households have for the environmental good as opposed to the composite good.

In the context of residents along a river, the level of pollution for each household living around the river may be different in various locations. For example, the people who live near the emission point of the firm may suffer more than others who live further away as the level of the pollutant may disperse as the water flows down-stream. Thus, household i located along the river suffers a \(k_{i}\) fraction \((0\le k_{i}<1)\) of the total emissions of the pollutant (measured in physical units). Thus, prior to any regulation, household i would suffer an amount of \(k_{i}\bar{z}\) units of pollutant.Footnote 12

Suppose an individual household i was allocated a \(k_i\) portion of \(\bar{z}\) total permits, and sells a portion of her permits \(z_{i}\) \((0\le z_{i}\le k_{i}\bar{z})\). She would then suffer \(k_{i}z_{i}\) pollution from those sold permits and the other amount of pollutant \((1-k_{i})z_{i}\) will diffuse to all the other residents living around the river. On the other hand, household i would also suffer diffused pollution \((k_{i}z_{j})\) if household j sells his permits at an amount of \(z_{j}\).Footnote 13 Thus, the level of environmental good enjoyed by household i is:

Simplifying Eq. (13), we see that \(e_{i}=k_{i}(\bar{z}-z)\), where z is the total amount of permits sold by all households (including i), \(z=\sum _{j=1}^{N}z_{j}\).Footnote 14

As in the previous case, we first consider the efficient allocation of resources, and then compare the decentralized solution when permits are allocated to households with the socially efficient outcome.

3.1 Social Planner’s Problem

For the case of multiple households, the social planner’s problem is to maximize the sum of utility across the N households:

The first constraint is the market clearing condition for production of the composite good, the second constraint defines the level of the environmental good for household i given z, and the final constraint is the market clearing condition for the labor market. The Lagrangian form for the above problem is:

Taking first order conditions, the social optimal resource allocation satisfies:

Combining Eqs. (16) and (18) shows that at the efficient allocation, \(f_z=\frac{\sum _{i=1}^NU_{e_i}k_i}{U_{x_i}}\), reflecting the fact that the social planner trades off the benefits of another unit of pollution (in terms of increased composite good consumption) against the environmental costs to all households from that unit of pollution.Footnote 15 In the following, we will see whether a decentralized permit market can support this socially efficient allocation.

3.2 Decentralized Problem

Now suppose that the \(\bar{z}\) permits are allocated to the N households within the community. Similar to Arnason (2009), it is not important how that allocation is determined, nor is it necessary that the initial allocation be equal to \(\bar{z}\).Footnote 16

3.2.1 Decentralized Solution

Here, it is assumed that there is complete information distribution among the households. Each household knows how many permits have been sold out and at what prices, when making her decision whether to sell or to retire her permits, or to buy some permits to sell or retire.

In the decentralized case, a price-taking individual household i would maximize her utility based on her consumption of goods \(x_{i}\) and \(e_{i}\) and subject to her budget set constraint (including permit revenue):

The Lagrangian form for the above problem is:

The first order conditions yield,

Since the firm’s problem for the case of multiple households is the same as that in the sole household case, the first-order conditions again satisfy \(f_{l}=\frac{w}{p_{x}}\) and \(f_{z}=\frac{p_{z}}{p_{x}}\). Comparing the decentralized first order conditions against the social planner’s:

Proposition 2

The decentralized equilibrium for the multiple households’ problem does not support the socially efficient resource allocation.

Proof

Combining Eq. (21) with the firm’s first-order conditions, we get \(\frac{U_{x_{i}}}{U_{e_{i}}k_i}=\frac{1}{f_z}\) at the decentralized equilibrium. Compared to Eqs. (16–18), clearly the decentralized equilibrium does not support an efficient allocation. \(\square \)

Market failure results from the competitive consumption of environmental goods by the group of households. If household i sells one permit, she incurs \(k_{i}\) pollution to herself while the remaining \((1-k_{i})\) pollutant disperses to other households, imposing a negative externality on all other households. Similarly, if household i retires one permit, all the other households get a benefit from suffering less pollution. In this way, household i generates a positive externality for all other households. As a result, each household has an incentive to sell more permits to the firm as long as the benefits of the private revenue can cover her own private cost associated with increased pollution, no matter how great the external cost is for all other households. The competition within the households for selling their permits to the firms will thus generate too much pollution and the environmental goods will be overused.Footnote 17

If only one of the many households is harmed such that for some i, \(k_{i}=1\) and \(k_{j}=0\) for all \(j\ne i\), then Eq. (21) supports social efficiency as an obvious corollary to Proposition 1. In other words, the decentralized solutions with multiple households do not support the efficient resource allocation unless only one out of the multiple households is harmed (and only that household receives permits), or if the harmed households could be somehow considered a single unit. This result is similar to the marine resource case by Arnason (2009), who shows that if multiple members can somehow organize themselves into a single unit, efficient outcomes could be achieved. We now consider the use of a revenue-sharing mechanism to provide incentives for individual households to act as a single “unit.”

3.2.2 Revenue-Sharing

The market failure for the case of multiple households with tradable permits for the environmental good has been shown above. This resulted from the fact that the benefit of selling one permit is gained by one household but the costs of pollution are shared by the whole group—the classic externality problem. Now consider a revenue-sharing mechanism to redistribute the benefits of selling permits. Suppose that all revenues from selling permits to the firm are collected in a pool and then redistributed according to the share rule \(\gamma _i\) where \(\sum _{i=1}^N\gamma _i=1\). Household i receives a \(\gamma _{i}\) fraction of revenues from the pool for any permits she sells, and also receives a \(\gamma _{i}\) fraction of the revenue if any other household sell his permits.

The problem for household i then is to maximize her utility subject to her budget constraint, including her share of revenues from permits sold by the whole group:

The Lagrangian form for the above problem is:

From the first order conditions,

Clearly the efficiency of this equilibrium will depend on the (regulator’s) choice of the share rule \(\gamma _i\). As will become clear below, it also depends on whether environmental preferences are homogeneous \((U_{e_i}=U_{e_j}=U_e \quad \forall i,j)\) or heterogeneous \((U_{e_i}\ne U_{e_j} \quad \forall i,j)\). Comparing these first order conditions and considering the same first order condition for the firm as in the previous models:

Proposition 3

If environmental preferences are: i) homogeneous \((U_{e_i}=U_{e_j}=U_e) \quad \forall i,j)\), then setting each household’s share rule equal to the share of physical harm that she suffers, that is, \(\gamma _{i}=k_{i}\), yields an efficient decentralized equilibrium. No information regarding preferences is required by the regulator. ii) heterogeneous \((U_{e_i}\ne U_{e_j} \quad \forall i,j)\), then setting each household’s share rule such that \(\gamma _{i}=\frac{U_{e_i}k_i}{\sum _{j=1}^NU_{e_j}k_{j}}\), yields an efficient decentralized equilibrium. Achieving efficiency requires the regulator have information regarding each household’s environmental preferences.

Proof

Consider case (i). From Eq. (24) and the firm’s first order conditions, we see that if the share rule is set such that \(\gamma _{i}=k_{i}\), we have \(\frac{U_{x_{i}}}{U_{e}}=\frac{1}{f_{z}}\). From the efficient solution, if preferences are homogeneous, then \(f_z=\frac{\sum _{i=1}^NU_{e_i}k_i}{U_{x_i}}=\frac{U_{e}}{U_{x_i}}\), and thus the decentralized equilibrium is efficient. Furthermore the efficient share rule \(\gamma _i=k_i\) is independent of household preferences. Consider case (ii). From Eq. (24) and the firm’s first order conditions, we see that if the share rule is set such that \(\gamma _{i}=\frac{U_{e_i}k_i}{\sum _{j=1}^NU_{e_j}k_{j}}\), we have \(\frac{U_{x_{i}}\frac{U_{e_i}k_i}{\sum _{j=1}^NU_{e_j}k_{j}}}{U_{e_i}k_i}=\frac{1}{f_{z}}\), equal to the efficient condition \(f_z=\frac{\sum _{i=1}^NU_{e_i}k_i}{U_{x_i}}\). The efficient share rule requires knowledge of all \(U_{e_j}\). \(\square \)

Proposition 3 shows that under homogeneous preferences, the decentralized equilibrium under a simple revenue-sharing mechanism \((\gamma _i=k_i)\) can achieve the socially efficient resource allocation.Footnote 18 It should be noted that the information about an arbitrary household i’s marginal utilities of consuming goods x and e, \(U_{x_{i}}\) and \(U_{e_{i}}\) is not required to be known by the regulator to generate efficiency. By simply allocating a sufficient number of permits that exceeds the socially optimal level, the decentralized equilibrium will be achieved by market transactions. Furthermore, efficiency does not require the presence of impure altruism, as in Ahlheim and Schneider (2002).

From Eq. (24) it is clear that the share rule \(\gamma _{i}\) is crucial for the efficiency of the decentralized equilibrium. If the share rule is not in accordance with the physical share of damage from pollution, \(k_{i}\), the decentralized equilibrium will not support the social planner’s solution, and there will be market failure. If household i receives more from the permit revenue pool than the level of harm that she suffers, that is, \(\gamma _{i}>k_{i}\), she has incentives to sell more permits than the optimal amount, resulting in too little of the environmental good e relative to the composite good x. Similarly, if \(\gamma _{i}<k_{i}\), too few permits are sold by household i, resulting in too little composite good x relative to the environmental good. Note that this stands in sharp contrast to Kaffine and Costello (2011), who find that conditional on full unitization, any share rule is sufficient to achieve efficiency. As the above indicates, an arbitrary share rule will not generate efficiency in our context.Footnote 19

Turning now to heterogeneous preferences, Proposition 3 shows that again it is possible for a revenue-sharing mechanism to generate an efficient resource allocation. However, the determination of the share rule \(\gamma _i\) required to achieve that efficient allocation requires information regarding the environmental preferences of each household. Nonetheless, provided that heterogeneity is not too extreme, intuitively the regulator may be able to achieve a near-efficient solution by setting a share rule \(\gamma _i=k_i\), which again requires no information about preferences. This can be seen by examining the efficient share rule of \(\gamma _{i}=\left( \frac{U_{e_i}}{\sum _{j=1}^NU_{e_j}k_{j}}\right) k_i\), and noting that the term in parenthesis can be thought of as a “modifier” of \(k_i\) depending on the household’s preferences.Footnote 20 For some households, a share rule of \(\gamma _i=k_i\) will be too high leading to too many permits sold, but this will be offset to an extent by the fact that for others, the share rule will be too low. Because the level of the environmental good depends on the total number of permits sold, the resulting level of the environmental good may be close to the efficient level. We return to this point in a numerical exercise below.

4 Partial Versus Full Revenue-Sharing

In this section, we consider the efficiency of partial revenue-sharing. Under the previous setup, households are required to surrender all of their permit revenues to the pool, equivalent to full unitization in Kaffine and Costello (2011). Kaffine and Costello (2011) show that this full unitization is necessary in order for efficiency to be achieved. We consider whether or not this is true in our context. Suppose that households engage in partial revenue-sharing, akin to partial unitization, where \(\alpha \) is the share of permit revenues that are contributed to the revenue pool, while \((1-\alpha )\) is retained by the permit seller \((0<\alpha <1)\). It turns out that under homogeneous preferences, there exists a feasible share rule \((\gamma _i>0\) and \(\sum _{i=1}^N\gamma _i \le 1)\) such that efficiency can be achieved in some cases:

Proposition 4

If each household contributes \(\alpha \) to the revenue pool and retains a \((1-\alpha )\) share of the revenue from selling her permits, the feasible share rule \(\gamma _{i}^{'}(\alpha )=\frac{k_i-(1-\alpha )}{\alpha }\) yields an efficient resource allocation, provided \(k_i>(1-\alpha )\).

Proof

Given partial unitization governed by \(\alpha \), the budget constraint for households is given by \(p_{x}x_{i}=wl_{i}+\pi _{i}+(1-\alpha )p_zz_i+\gamma _{i}\alpha \sum _{j=1}p_{z}z_{j}\). The first-order conditions are \(\frac{U_{x_{i}}}{U_{e}}=\frac{k_{i}p_{x}}{((1-\alpha )+\gamma _i\alpha )p_{z}}\). Setting the term in parenthesis in the denominator equal to \(k_i\) will yield an efficient allocation. This occurs when the share rule is such that \(\gamma _{i}^{'}(\alpha )=\frac{k_i-(1-\alpha )}{\alpha }\). Clearly the sharing rule will be greater than zero if \(k_i>(1-\alpha )\). Finally, these shares in aggregate must be feasible (less than 1). Summing over the share rule, \(\sum _{i=1}^N\gamma _{i}^{'}(\alpha )=\frac{1-N(1-\alpha )}{a}\). Suppose this were not feasible, such that \(\frac{1-N(1-\alpha )}{a}>1\). Then \(1-\alpha >N(1-\alpha )\), yielding a contradiction as \(N>1\) and \(0<\alpha <1\), ensuring that the share rule is feasible. \(\square \)

The above demonstrates that it is possible to design an efficient share rule under partial revenue-sharing, provided that the contributed share is sufficiently large relative to \(k_i\). Such a share rule also has the property that it does not require information regarding household preferences. This stands in contrast to the result of Kaffine and Costello (2011), where anything less than full unitization resulted in overharvest relative to the efficient level. This difference is driven by the fact that resource users always have an incentive to overharvest in Kaffine and Costello (2011), while here households may oversell or undersell permits depending on the relationship between the share of pollution they personally receive \((k_i)\), and the share of every permit dollar they receive \((((1-\alpha )+\gamma _i\alpha )p_{z})\). That said, as the number of households (N) grows, presumably \(k_i\) shrinks, and as such the feasible condition requires that \(\alpha \) must approach 1 (full unitization). In the numerical example that follows, we consider the efficiency properties of partial revenue-sharing, compared to the cases of no revenue-sharing and full revenue-sharing.

5 Numerical Example

The preceding sections have developed an analytical model to show that a tradable permit scheme coupled with a revenue-sharing mechanism could achieve an efficient allocation of pollution in some cases. We now illustrate those results with a numerical example. While we explore a wide range of preference specifications, the emphasis of this exercise is on the qualitative implications. In particular, we focus on demonstrating the efficiency of (full) revenue-sharing under homogeneous preferences when \(\gamma _i=k_i\), as well as considering the efficiency of a revenue-sharing scheme with \(\gamma _i=k_i\) under heterogeneous preferences.Footnote 21

A simple model with \(N=5\) households is considered, where we allow preferences to be homogeneous or have varying degrees of heterogeneity—“low” preference heterogeneity and “high” preference heterogeneity. For the production side, a simple Cobb-Douglas form is assumed, such that \(f(l,z)=l^{0.5}z^{0.5}\). For households, a CES utility function is assumed, such that \(U_i(x_i,e_i)=\left( \beta _ix_i^{\rho }+(1-\beta _i)e_i^{\rho }\right) ^\frac{1}{\rho }\), where \(\sigma = \frac{1}{1-\rho }\) is the elasticity of substitution. For the case of homogeneous preferences, preferences are given by the vector \(\beta =\{0.5,0.5,0.5,0.5,0.5\}\), for the case of low preference heterogeneity, \(\beta =\{0.6,0.55,0.5,0.45,0.4\}\), and for the case of high preference heterogeneity, \(\beta =\{0.7,0.6,0.5,0.4,0.3\}\). The base case considers an elasticity of substitution of \(\sigma =1\), with additional exercises considering \(\sigma =0.5\) and \(\sigma =2\). Finally, damages \((k_i)\) are heterogeneous, given by the vector \(k=\{0.2,0.25,0.2,0.15,0.2\}\).Footnote 22

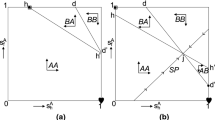

For different assumptions about heterogeneity, Table 1 reports total utility \((\sum _{i=1}^5U_i(x_i,e_i))\) and pollution levels \((\sum _{i=1}^5z_i)\) relative to the first-best efficient solution for the cases of decentralized permits with 1) no revenue-sharing, 2) partial revenue-sharing \((\alpha =0.5)\), and 3) full profit-sharing. As noted above, for all profit-sharing cases, it is assumed that \(\gamma _i=k_i\). Note that under the assumptions above (with the exception when \(\sigma =2\)), the laissez-faire (no permits) solution yields 0 utility as pollution is equal to \(\bar{z}\) and thus \(e_i=0\). While extreme, this provides convenient bounds for comparison in the sense that utility under the decentralized market relative to the efficient solution is bounded above by 1 and below by 0.

Table 1 reveals a number of interesting findings. First, simply allocating permits without any revenue-sharing yields a substantial increase in utility and decrease in pollution relative to laissez-faire.Footnote 23 Second, utility is increasing and pollution is decreasing as revenue-sharing increases. Third, per Proposition 3, full revenue-sharing achieves the efficient allocation under homogeneous preferences, while under heterogeneous preferences, full revenue-sharing is inefficient. Fourth, under heterogeneous preferences and across revenue-sharing schemes, the degree of inefficiency is increasing in the elasticity of substitution.Footnote 24

While the above exercise is intended for illustrative purposes, nonetheless the small degree of inefficiency under full revenue-sharing across specifications with heterogeneous preferences is striking. This suggests that the first-order efficiency loss arises from households not accounting for their spillovers, and that ignoring differences in preferences when setting the share rule is a smaller concern. This also implies that even if preferences are heterogeneous, regulators could still achieve near first-best efficiency by allocating permits and setting \(\gamma _i=k_i\) as long as preference heterogeneity and the elasticity of substitution are not exceptionally large.Footnote 25 Alternative share rules such as \(\gamma _i=1/N\) were also considered (despite heterogeneous damages given by k above), however they resulted in only slight quantitative differences and no qualitative differences. This suggests that even if regulators cannot precisely determine \(k_i\), the efficiency of permit allocation is not substantially reduced. Thus, in summary, the results above suggest that some form of permit allocation yields substantial improvements in efficiency, and that a full revenue-sharing scheme associated with those permits can yield efficient or nearly efficient outcomes.Footnote 26

6 Conclusion

Environmental goods are used inefficiently because of absent property rights. Some market-based solutions to this inefficiency, including emission taxes, subsidies, and tradable permits, allocate the property rights of the environmental goods to either government or polluters. However, such policies may require detailed information regarding private valuations of the environmental goods. Often, regulators may lack the information to determine these optimal control levels.

By contrast, in some cases local households may know their preferences better than any regulator. This paper considers the assignment of property rights representing environmental goods to households that are suffering from pollution generated by firms. As shown above, for the special case with a sole household, market transactions of permits between the household and the polluting firm can lead to an optimal pollution level. However, with multiple households, simply assigning permits is inefficient. Simply put, one household can receive benefits from selling her permits to the polluting firm, but the sale of this permit generates pollution suffered by all households. To eliminate these externalities within the group of households, it is shown that a revenue-sharing mechanism that requires no knowledge of private preferences can be designed to achieve efficient or near-efficient outcomes.Footnote 27

Some caveats and context are required. First, the efficiency of the community-based permits for environmental goods is limited by information distribution. In some cases, government agencies may have advantages in comparing the aggregated costs and benefits to design efficient policies. For example, government can collect and process information to obtain statistical relationships between disease rates and \(\hbox {SO}_{2}\) levels, while households might not know the social costs of health damage by \(\hbox {SO}_{2}\) pollution. In these situations, it might be better to rely on regulators to make decisions on efficient emission levels. In other situations however, such as localized damages associated with recreation loss or aesthetic values, households are likely more familiar with their circumstances and preferences to make efficient tradeoffs.

Notes

While a vast literature has arisen to consider mechanisms such as a Pigovian tax, grandfathering permits, permit auctions, abatement subsidies, etc., simply assigning property rights in the form of tradable permits to the victims has been considered less frequently. This is surprising in some sense, as the absence of a market generated by the lack of property rights is the key source of inefficiency (Baumol and Oates 1988). On the other hand, as discussed in more detail below, this may simply reflect the fact that distributing permits to multiple victims of pollution raises obvious free-rider issues, as discussed by Proost (1995). For examples of literature considering the myriad of environmental policy instruments, see Montgomery (1972), Hahn and Hester (1989), Goulder (2013), Fisher-Vanden and Olmstead (2013), Schmalensee and Stavins (2013), Newell et al. (2013) , Baumol (1972), Buchanan and Tullock (1975), Polinsky (1979), Tietenberg (1990), and Hahn (2000).

As Coase (1960) notes, economic efficiency is independent of the assignment of property rights if there are no transaction costs.

Some may argue that the free rider problem can be solved through thorough negotiation among the parties and thus is a transaction cost problem. For the purpose of this paper, it is assumed that these transaction costs exist and the free rider problem is not negotiated away.

This inefficiency arising from the free rider problem is also seen in the failure of Lindahl pricing if individuals underreport their preferences for public goods. The Groves-Ledyard mechanism provides a possible solution by formulating an ingenious allocation-taxation scheme, which requires the assumption of Nash behavior by all households (Groves and Ledyard 1977). This poses significant difficulties for practical implementation of the mechanism because of the information required by households.

Other related papers on household participation in permit markets include Smith and Yates (2003a, b), and English and Yates (2007), who note the problem of free-riding and consider the optimal policy response to it, Shrestha (1998) and Malueg and Yates (2006) who essentially take the existence of environmental groups as a given and ignore the underlying collective action problem, and Boyd and Conley (1997) and Conley and Smith (2005) who consider personalized prices.

Note that this is in sharp contrast to “traditional” tradeable permit systems, where the determination of the quantity of permits to be allocated (the “cap”) is a key component of optimal policy design. Note also that this result regarding tradable permits in fisheries is analogous to the point made by Shrestha (1998), Ahlheim and Schneider (2002), Rousse (2008), and others that household participation in emissions trading can lead to an efficient, endogenous emissions cap.

This mechanism is similar to unitization, which has been used to resolve the externalities in common pool resources, for example, an oil or gas field shared by multiple landowners (Libecap and Wiggins 1984). For renewable common pool resources, Kaffine and Costello (2011) develop a comprehensive theory for internalizing externalities across spatial owners in a fishery example. They generalize the notion of unitization and find that a profit-sharing mechanism can yield first-best outcomes, even when the self-interested agents voluntarily participate in the unitization scheme. This paper extends the concept of unitization to environmental protection issues. While Kaffine and Costello (2011) find that full unitization with an arbitrary return-share from the profit pool is both necessary and sufficient for an efficient outcome, we find that such a design is neither necessary nor sufficient for an efficient household tradable permit system.

Due to the lack of markets, methods such as contingent valuation and travel cost analysis have been developed to determine how people value environmental goods. However, the costs of obtaining this information may be prohibitively high due to the costly nature of employing these methods, and as such regulators may lack the information required for efficient regulation.

The relationship between the environmental good e and pollution z is defined below.

While these simplifications may seem extreme, they serve the purpose of focusing on the tradeoff faced by the household in terms of selling or retaining pollution permits z. A number of extensions of this basic setup are certainly possible, however the underlying insight of the model developed below is likely to continue to hold.

Indeed, the optimal pollution level could also be achieved if permits are issued to polluters. In that case, the household would buy some amount of permits from the polluters to achieve social efficiency. While the distribution of benefits may differ, in the absence of transaction costs, efficiency will be achieved.

The total amount of pollution suffered by all households in the absence is again \(\bar{z}\), as \({\textstyle }\sum _{i=1}^{N}k_{i}\bar{z}=\bar{z}\).

This idea is similar to the fishery with spatial connectivity example in Kaffine and Costello (2011), where patch owner i has fish dispersal to other patches while also receiving dispersal from other patches.

Again, in a special situation where all the permits are sold out, we would have \(z=\bar{z}\). In this case all the environmental good e would be destroyed, \(e=\sum _{i=1}^{N}e_{i}=0\).

Note that from the first order conditions, \(U_{x_i} = U_{x_j} \forall i,j\).

As Arnason (2009) notes “...it doesn’t matter for the eventual harvesting outcome to which party the initial allocation of quota shares, or more generally fishing rights, is made,” and that “...it doesn’t matter what TAC [the cap] the authorities set (as long as it exceeds the efficient one).”

Note that this does not imply that allocating the permits in such a fashion has no impact on welfare. Each household has some incentive to withhold permits according to the damage they personally receive; however, this incentive to withhold permits is too small relative to the efficient case. Of course, this private incentive is diminishing as N increases and \(k_i\) falls.

The fact that revenue-sharing in a tradable permit system amongst households can achieve efficiency shares some similarities with the literature on free-riding and International Environmental Agreements (Barrett 1994). For example, Barrett (2001) shows that side payments can, in some circumstances, overcome the free rider problem to increase participation in cooperative agreements.

In brief, full unitization in Kaffine and Costello (2011) leads each fisherman to maximize total fishery profits, equivalent to the objective of the sole owner, regardless if they receive a 1 or 10 % share of the total profits. Here, the efficient unitization scheme plays a more nuanced role, as it balances the marginal benefits that a household receives from selling a permit (via \(\gamma _i)\) against the marginal cost they incur (via \(k_i)\) from the sale of that permit.

Households with a relatively high (low) valuation for the environmental good will receive a larger (smaller) modifier. This is most clear when \(k_i=1/N\), in which case the modifier is simply the ratio of the household’s marginal utility divided by the average marginal utility, and the average modifier is simply equal to 1.

While the previous sections have analytically determined what the efficient share rule \(\gamma _i\) should be, here we are more concerned with how the “simple” rule of \(\gamma _i=k_i\) performs under a variety of scenarios. Because this rule requires no knowledge of individual preferences, we consider it the most relevant case to analyze.

We also considered the case of homogeneous damages, simply \(k_i=1/N\), as well as various permutations of k. Results were extremely similar to those presented below (both qualitatively and quantitatively) and we thus do not report them.

Of course, increasing the number of agents N harmed will decrease the welfare gain from simply allocating permits without revenue-sharing.

A larger elasticity of substitution increases the non-linearity of the household permit supply function with respect to the share rule \(\gamma _i\), such that the sales from the households who sell too many permits relative to the efficient level are offset less by the households who sell too few.

Even in the extreme case where \(\beta =\{0.9,0.7,0.5,0.3,0.1\}\) and \(\sigma =2\), total utility was 0.919 relative to the efficient solution.

With the caveat that the degree of “near-efficiency” will be eroded in the case of substantial heterogeneity of preferences.

Nor does efficiency require impure altruism, as in Ahlheim and Schneider (2002).

References

Ahlheim M, Schneider F (2002) Allowing for household preferences in emission trading-a contribution to the climate policy debate. Environ Resour Econ 21(4):317–342

Arnason R (2009) Conflicting uses of marine resources: can ITQs promote an efficient solution? Aust J Agric Resour Econ 53:145–174

Barrett S (1994) Self-enforcing international environmental agreements. Oxford Economic Papers, Oxford, pp 878–894

Barrett S (2001) International cooperation for sale. Eur Econo Rev 45(10):1835–1850

Baumol WJ (1972) On taxation and the control of externalities. Am Econ Rev 62(3):307–322

Baumol WJ, Oates WE (1988) The theory of environmental policy, 2nd edn. Cambridge University Press, New York

Boyd JH, Conley JP (1997) Fundamental nonconvexities in arrovian markets and a coasian solution to the problem of externalities. J Econ Theory 72(2):388–407

Buchanan JM, Tullock G (1975) Polluters’ profits and political response: direct controls versus taxes. Am Econ Rev 65(1):139–147

Coase RH (1960) The problem of social cost. J Law Econ 3:1–44

Conley JP, Smith SC (2005) Coasian equilibrium. J Math Econ 41(6):687–704

English D, Yates A (2007) Citizens’ demand for permits and kwerel’s incentive compatible mechanism for pollution control. Econ Bull 17(4):1–9

Fisher-Vanden K, Olmstead S (2013) Moving pollution trading from air to water: potential, problems, and prognosis. J Econ Perspect 27(1):147–172

Goulder LH (2013) Markets for pollution allowances: what are the (new) lessons? J Econ Perspect 27(1):87–102

Groves T, Ledyard J (1977) Optimal allocation of public goods: a solution to the “free rider” problem. Econometrica 45(4):783–809

Hahn RW (2000) The impact of economics on environmental policy. J Environ Econ Manag 39:375–399

Hahn RW, Hester G (1989) Where did all the markets go? An analysis of EPA’s emissions trading program. Yale J Regul 6(1):109–153

Kaffine D, Costello C (2011) Unitization of spatially connected renewable resources. B E J Econ Anal Policy 11(1). doi:10.2202/1935-1682.2714

Libecap GD, Wiggins SN (1984) Contractual responses to the common pool: prorationing of crude oil production. Am Econ Rev 74(1):87–97

Malueg DA, Yates AJ (2006) Citizen participation in pollution permit markets. J Environ Econ Manag 51(2):205–217

Montgomery W (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5(3):395–418

Newell RG, Pizer WA, Raimi D (2013) Carbon markets 15 years after Kyoto: lessons learned, new challenges. J Econ Perspect 27(1):123–146

Polinsky AM (1979) Notes on the symmetry of taxes and subsidies in pollution control. Can J Econ 12(1):75–83

Proost S (1995) Public policies and externalities. In: Folmer H, Gabel HL, Opschoor H (eds) Principles of environmental and resource economics: a guide for students and decision-makers. Edward Elgar Publishing Ltd, Cheltenham, pp 47–66

Rousse O (2008) Environmental and economic benefits resulting from citizens’ participation in \(\text{ CO }_2\) emissions trading: an efficient alternative solution to the voluntary compensation of CO\(_2\) emissions. Energy Policy 36(1):388–397

Schmalensee R, Stavins RN (2013) The \(\text{ SO }_2\) allowance trading system: the ironic history of a grand policy experiment. J Econ Perspect 27(1):103–122

Shrestha RK (1998) Uncertainty and the choice of policy instruments: a note on Baumol and Oates propositions. Environ Resour Econ 12(4):497–505

Smith SC, Yates AJ (2003a) Optimal pollution permit endowments in markets with endogenous emissions. J Environ Econ Manag 46(3):425–445

Smith SC, Yates AJ (2003b) Should consumers be priced out of pollution-permit markets? J Econ Educ 34(2):181–189

Tietenberg T (1990) Economic instruments for environmental regulation. Oxford Review of Economic Policy 6(1)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, P., Kaffine, D.T. Community-Based Tradable Permits for Localized Pollution. Environ Resource Econ 65, 773–788 (2016). https://doi.org/10.1007/s10640-015-9925-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9925-x