Abstract

We trace the contributions of Colin Clark from his first book and articles published in the mid-1970s to date and link them to the six papers contained in this Special Issue and the larger fisheries economics literature. We highlight the impacts of Clark’s contributions on the theory, empirical, policy and management of fisheries, ranging from particular fisheries applications right through to global studies of the economics of fishing. Our conclusion is that Colin Clark’s impact upon fisheries economics has been revolutionary and predict that 100 years from now, his classic contribution, Mathematical Bioeconomics will still be studied with care by economists.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Colin Clark’s impact upon fisheries economics, through his book Mathematical Bioeconomics: The Optimal Management of Renewable Resources (now in its third edition) and other writings, has taken two closely related forms. The first consists of firmly incorporating the economist’s closely linked theory of capital and the theory of investment into the economic model of the fishery.

This is not meant to suggest that the idea of placing fisheries economics in a capital theoretic context originated with Colin Clark. To the contrary, the idea can be traced back decades before the publication of the first edition of Mathematical Bioeconomics in 1976. Be that as it may, it will be argued that the capital theoretic aspects of fisheries economics tended to be pushed into the background, prior to the mid-1970s.

The second form consisted of establishing a clear and explicit link between the economist’s model of the fishery, and that of the biologist. Employing his skills as a professional mathematician, Colin Clark constructed a bridge between the two disciplines—bioeconomics. Once again, no claim is being made that Clark was the first to recognize the link between economics and biology in the theory of fisheries management. Indeed, it must be conceded that it was recognized from the inception of modern fisheries economics in the early 1950s that the economist’s fisheries model necessarily rested upon a biological foundation. Nevertheless, prior to Clark, the biological aspects of the fisheries tended to become shrouded in the economist’s analysis. All of this was to change following the appearance of Mathematical Bioeconomics.

The two aspects, or forms, of Colin Clark’s impact upon fisheries economics were (and are), of course, intimately linked. Once it became accepted that fisheries economics must be cast in a capital-theoretic framework, it then became obvious that the underlying biological model was in fact an integral part of one’s economic model of the fishery. Misspecify the biological model, and the economic model of the fishery was certain to be wrong.

What, if anything has happened since Mathematical Bioeconomics first appeared? It will be argued that the capital-theoretic based fisheries economics, which Colin Clark did so much to develop and promote, has, over the past few decades, been coming into its own. Major fisheries policy issues have arisen that can be analysed only with the aid of dynamics, i.e. capital theoretic, economic models of the fishery. Furthermore, while terms like “dynamic” and “capital theoretic” will seldom, if ever, cross the lips of fisheries policy makers, it is increasingly evident that capital-theoretic concepts are influencing their thinking.Footnote 1

Having said this, in order to be able to understand the impact of the Clarkian approach to fisheries economics, we must first briefly review the state of the art in fisheries economics prior to the early 1970s. It is to this subject that we now turn.

2 The State of the Art in Fisheries Economics: 1950–mid 1970s

We begin by first re-emphasizing the fact that the concept of a fishery resource constituting a form of “natural” capital, in the sense that it is a real asset capable of yielding a stream of economic returns to society, and that one can “invest” positively in such an asset by refraining from harvesting precedes Mathematical Bioeconomics by decades. Anthony Scott, one of the pioneers in natural resource economics, did, when writing about all natural resources (including fishery resources) in 1954, state the following:

The important thing ... is that natural resources are the capital of a region, just as man-made equipment is; and conservation [of natural resources] is investment, just as augmenting the supply of machines is investment (Scott 1954, p. 506).

Nonetheless, the economic model of the fishery, which was to capture the attention of economists, and which is seen by most to mark the advent of modern fisheries economics, was static, i.e. timeless, in nature. Capital theory, investment theory are expressly ignored in that article. The model is, of course, the famous 1954 model of Gordon (1954). Gordon’s economic model rests firmly on the foundation of the biological model developed by M.B. Schaefer. So close is the link that the model is commonly referred to in the literature as the Gordon–Schaefer model. The model continues to have an impact right up to the present day as is evident in the recent, and widely cited, World Bank-FAO publication: The Sunken Billions (World Bank 2009).

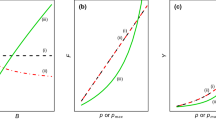

The Gordon–Schaefer model lays out very clearly the economic consequences of the fishery resource being what we would today call a “common pool” resource. Overallocation of labour and produced capital services to the fishery is inevitable. By implication this overallocation would lead to the fishery resource being overexploited from society’s point of view. In Fig. 1 denoting biomass by x, we compare the optimal biomass level, arising from the Gordon–Schafer model—that associated with Maximum Economic Yield (MEY), \(\hbox {x}_{\mathrm{MEY}}\), with that associated with the consequences of common pool conditions—Bionomic Equilibrium, the much lower \(\hbox {x}_{\mathrm{BE}}\).

The concept of Bionomic Equilibrium, arising from the model, has now come to be seen worldwide as a benchmark of fishery resource mismanagement. The model is, nonetheless, limited by its static nature.

Economists at the time were aware that what is really required is a capital theoretic approach. A year after Gordon’s seminal article was published, Anthony Scott published an article, “The Fishery: The Objectives of Sole Ownership” (Scott 1955), in which he attempted to re-cast the economic model of the fishery in a capital theoretic framework. The article is equationless, but several of the descriptive results were to be validated at a later point by formal models. First, if the sole owner cared only about the current season, i.e., if the sole owner discounts future seasons at a rate of infinity, the sole owner would head straight towards Bionomic Equilibrium.

If the sole owner’s rate of discount exceeds zero, but is less than infinity, then the sole owner should invest in the resource up to the point that marginal resource rent from current harvesting is equal to marginal user cost, the present value of future sustainable resource rent to be lost by a marginal reduction of the fishery “natural” capital (Scott 1955).

Gordon fully recognized the need for a capital theoretic framework for the economic model of the fishery as the following quote, taken from a paper written two years after his 1954 article, indicates. In the quote he refers to “conservation” of the fishery resource, which is to be understood as positive investment in the resource.

“The economic justification of conservation is the same as that of any capital investment – by postponing utilization we hope to increase the quantity available for use at a future date. In the fishing industry we may allow our fish to grow and to reproduce so that the stock at a future date will be greater than it would if we attempted to catch as much as possible at the present time ... . In theoretical terms, this means that the optimum degree of exploitation of a fishery must be defined as a time function of some sort. That is to say, it is necessary to arrive at an optimum which is a catch per unit of time, and one must reach this objective through consideration of the interaction between the rate of catch, the dynamics of fish populations and the economic time preference schedule of the community or the interest rate on invested capital.” (Gordon 1956, p.67).

Gordon then went on to comment on the great difficulty of constructing a proper capital-theoretic model of the fishery, a point that was well taken in 1956 given the mathematical tools available at the time (Gordon 1956).

There were, in spite of the difficulties, attempts made to produce dynamic economic models of the fishery, with the first to appear in the Crutchfield and Zellner 1962 study on the Pacific halibut fishery (Crutchfield and Zellner 1962).Footnote 2 The study did, however, come up with a conclusion that Clark was later to dispute, namely that, if a fishery resource was saved from the fate of being a common pool resource, by being placed under the control of a private sole owner, the sole owner would never, ever, drive the resource below that associated with Maximum Sustainable Yield (MSY),Footnote 3 regardless of how high the private owner’s discount rate might be.Footnote 4

The Crutchfield and Zellner attempt to develop a dynamic economic model of the fishery was followed in the late 1960s and early 1970s by attempts to construct such models employing the relatively new optimal control theory.Footnote 5 The resulting dynamic economic models of the fishery (e.g., Quirk and Smith 1970) were impressive, formidable in their complexity, and, more often than not, defied interpretation. One could question whether these models served any purpose other than to provide amusement for academics. It should come as no surprise that the Gordon–Schafer static economic model of the fishery continued to hold sway. It may not have been prefect, but it was understandable and applicable.

3 Precursors to Mathematical Bioeconomics

In the early 1970s, Colin Clark was to undertake research that would lead him into conflict with the aforementioned Crutchfield and Zellner key conclusion. In 1971, Clark published an article in Mathematical Biosciences (Clark 1971) in which he argued that a rational private sole owner of a fishery resource could, if using a rate of interest greater than zero, reduce the resource below that associated with Maximum Sustainable Yield (MSY). If Clark was right then attempting to privatize fishery resources could carry with it serious risks.

Clark attempted to drive his point home in two articles appearing in 1973, one in Science, and the other in a leading economics journal, the Journal of Political Economy (Clark 1973a, b). In the two articles, Clark demonstrates that, under special circumstances, a rational sole owner of a fishery resource could deliberately drive the resource, not merely below the MSY level, but to the brink of extinction—what one might call the ultimate in asset stripping. The two articles caused something of a sensation. Still, it was not at all clear that his basic point had penetrated the minds of fisheries economists. The Clark result was “interesting”, but was best regarded as a theoretical curiosum, of little relevance to real world fisheries management policy. The static economic model of the fishery appeared to go on seemingly unscathed.

The establishment of the point that economics of fisheries management should and could be cast in a comprehensible dynamic or capital-theoretic framework was accomplished in an article in which Clark joined forces with the first author of this contribution. The article, which appeared in 1975 in the relatively new journal, Journal of Environmental Economics and Management (JEEM), had the title “The economics of fisheries management and modern capital theory: a simplified approach” (Clark and Munro 1975).

Ola Flaaten in his book Fisheries Economics and Management, maintains that the Clark and Munro 1975 article is “... one of the most quoted fisheries economics papers ever ...” (Flaaten 2011, p. 62). Be that as it may, when the Clark and Munro paper was completed, it was not eagerly welcomed by the economics profession. The authors had previously submitted the paper to the aforementioned leading journal in economics. The then editor of the journal rejected the paper with scorn. It would be wrong to suppose that the editor of JEEM, upon agreeing to publish the paper, did so with enthusiasm.

The article brings to bear optimal control theory. Having said this, the economic model of the fishery in its simplest form in Clark and Munro (1975), is essentially a dynamic version of the Gordon–Schaefer model. Clark and Munro (1975) bring forth explicit fishery resource investment rules, and produce three versions of the model: (i) linear, autonomous; (ii) non-linear, autonomous; and (iii) linear, non-autonomous.

Consider (i), the simplest version of the model. To begin, we have (from the Schafer model):

where \(x\) denotes the biomass, \(F(x)\) denotes the net natural growth of \(x\) and \(h(t)\) denotes the harvest rate.

For \(F(x)\), we have:

where \(r\), a constant, denotes the “intrinsic” percentage rate of growth of the fishery resource, and \(G\), a constant, denotes the equilibrium level of the resource, in the absence of harvesting. it is assumed that:\(\hbox {F}(0) =\hbox {F(G)} = 0, \hbox {F}'\hbox {(x)}>0\), for \(0 < \hbox {x} < \hbox {G}\) and \(\hbox {F}''\hbox {(x)}<0\).

The catch function is given by:

where \(q\), a constant, denotes the “catchability” coefficient, and where \(E\) denotes the combined flow of labour and produced capital services (along with ancillary services) constituting fishing effort. The exponents \(\alpha \) and \(\beta \) are, by assumption: \(\alpha = \beta =1\).

It is assumed that the price of harvested fish is constant, as is the unit cost of fishing effort. The resource rent from the fishery at a given moment in time can be expressed as:

where p denoted the price of harvested fish, where \(c(x)=\frac{b}{qx}\) and where b denotes the unit cost of fishing effort.

We think in terms of a social manager, whose objective functional can be expressed as:

Where \(\delta \) is the social rate of discount.

In solving the optimal control problem, it can be demonstrated that the optimal biomass level, \(x^{*}(t)\), is stationary, i.e. \(x^{*}(t)=x^{*}\). It can be shown further that \(x^{*}\) is given by the following equation:

Equation (6) can be seen as a straightforward resource investment decision rule. It states simply: invest in the resource up to the point that the “own rate of interest,” or yield, on the marginal resource investment is equal to the social rate of discount.

The “own rate of interest” consists of two components, the marginal change in sustainable harvests, \(F^{\prime }(x)\) and the so-called Marginal Stock Effect, reflecting the marginal impact of a change in \(x\) upon fishing costs. The denser the stock, the lower the fishing costs, caeteris paribus. The equation has come to be referred to as the Fundamental Equation (Rule) of Renewable Resource Exploitation (e.g., Pearce and Turner 1990), or alternatively as the “Golden Rule” for Fisheries ManagementFootnote 6 (Sandberg 2010).

Equation (6) can be re-expressed as

or as

The L.H.S. of Eq. (7a) can be seen as the marginal user cost of the resource, the marginal loss of future resource rents, expressed in present value terms, to be incurred by marginally depleting stock. As such, it is Scott’s 1955 investment rule expressed in equation form (Scott 1955).

Clark, in his insistence that we be explicit about the biological model providing the foundation for our economic model of the fishery, points out that there are many fisheries for which the Schaefer model does not strictly hold. One consequence may be that the Marginal Stock Effect—sensitivity of harvesting costs to the size of the biomass—may be very weak. Species, such as small pelagics with intense schooling characteristics, provide an example.

If fishing costs are not sensitive to the size of the biomass, the Schaefer model does indeed not strictly apply. In the case in which fishing costs are completely insensitive to the size of the biomass (given that \(x > 0\)), the Marginal Stock Effect vanishes and Eq. (6) reduces to

We have: \(\lim \limits _{x\rightarrow 0} {F}'(x)=r\). If it should be the case that \(\delta > r\), there is no solution to Eq. (8). If \(p-c(0) > 0\), i.e. the final amount of \(x\) can be fished profitably, then extinction becomes optimal.Footnote 7

If a private owner of the resource could heavily deplete the resource, then from what we have said, so could the social manager. Why not privatize? There are two responses to this. First, it is reasonable to suppose that the social rate of discount is below the private rate of discount. The second is existence value, which has entered into many pieces of national law and into international treaty law (CITES). We would expect existence value to be treated as a public good, and given very little weight by private interests for the usual reasons.Footnote 8 It is in fact straightforward to incorporate existence value into the Fundamental Equation, and to show such existence value can act as an effective brake on exploitation by the social manager, even if harvesting costs are completely insensitive to the size of the biomass (Clark et al. 2010a).

The question of whether, in fact, we can have \(x^{*}<x_{MSY} \) is by no means over. In 2007, an article appeared in Science claiming to present empirical evidence that in the real world we would find that \(x^{*}>x_{MSY} \) and that certainly the threat of resource extinction is non-existent, even with high rates of discount (Grafton et al. 2007). The article has been widely cited (see, for example: World Bank 2009), and has also elicited a strong response from Colin Clark and his colleagues (Clark et al. 2010a). A vigorous debate is now ongoing.

As an aside, consider the harvest production function: \(h=qE^{\alpha }x^{\beta }\). We referred earlier to schooling species, and weak Marginal Stock Effects. In terms of the above harvest production function, this is represented by \(\beta < 1\). In the extreme case of \(\beta = 0\), it can easily be shown that harvesting costs are completely independent of \(x\). In their response to Clark et al. (2010a), Grafton et al. maintained that the Clark et al. analysis was lacking in that Clark et al. continued to assume that \(\alpha = 1\). Grafton et al., in their empirical analysis had relaxed both the assumption that \(\beta = 1\) and the assumption that \(\alpha = 1\) (Grafton et al. 2010). In the response to the response, Clark demonstrates the following in the context of the Grafton et al. model. If \(\alpha +\beta > 1\), then it will never be optimal to drive the resource to extinction, regardless of the size of \(\delta \). If, on the other hand, \(\alpha +\beta \le 1\), there will exist a constellation of prices, costs and discount rates such that it will be optimal to drive the resource to extinction (Clark et al. 2010b). The Grafton et al. response focusses on their modelling of one of the fisheries discussed in their 2007 article. With respect to their model for that specific resource, we find that the estimated \(\alpha \) and \(\beta \) are such that \(\alpha +\beta = 1\) (Grafton et al. 2010). Relaxing the assumption that \(\alpha =1\) broadens the scope for extinction (in the absence of a minimum viable population).

If \(\alpha = 1\), then we can have \(\alpha +\beta = 1\), only if \(\beta = 0\)—an extreme case.

Up to this point, we have said nothing about the optimal approach path to \(x^{*}\), to use optimal control theory jargon. To economists, the optimal approach path is the theory of investment issue, i.e. what is the optimal rate of investment (disinvestment) in the resource, given that \(x(0) \ne x^{*}\). Continuing with the linear, autonomous model, we can express this optimal investment policy as follows, after first noting that for mathematical reasons there must be an upper bound on the harvest rate \(h=h_{\max }\). Then, denoting the optimal harvest rate as \(h^{*}(t)\), we have:

Observe that, if the resource is below the target level, \(x^{*}\) the appropriate management policy is apparently that of closing the fishery entirely. If the reader has a feeling of unease upon hearing the call for such a draconian resource management policy, the discomfort is justified. More will be said about this issue.

Be that as it may, with the appearance of the aforementioned 1975 article, the Clark version of the capital theoretic model of the fishery was now firmly in place. The model was to be elaborated upon and developed in his book Mathematical Bioeconomics, which appeared the following year—1976.

4 Mathematical Bioeconomics: The First Impact and the Resource Investment Issue

Mathematical Bioeconomics is now in its third edition—1976, 1990 and 2010. Jon Conrad, in reviewing the second edition of the book, remarked that the first edition rapidly achieved the status of a “classic” in the field of natural resource economics.Footnote 9 The book was written at least as much for biologists, as it was for economists. It was for this reason that the book was so effective in creating a bridge between the two disciplines.

From the point of view of the economist, the book explores at great length, and in great detail, the biology and mathematics underlying the capital-theoretic model of the fishery as set forth in the aforementioned 1975 article. Numerous extensions are made. For example, the 1975 article, as was typical of fisheries economics articles of the day, focussed on single species models exclusively. Multi-species fisheries are the norm in the real world. The book introduces a multi-species version of the model. In the context of the dynamic model, multi-species (and meta-populations, for that matter) can be readily accommodated conceptually, although not so easily in technical terms. Instead of thinking in terms of managing single natural capital assets, one thinks in terms of managing complex portfolios of such assets. The focus of any good portfolio manager is not on the yield of single assets, but rather on the yield of the portfolio.

Furthermore, the book discusses capital theoretic models of other renewable resources, such as forests, and examined the links between the models of renewable resources and those of non-renewable resources. Numerous examples were provided to demonstrate that the models, be they of renewable or non-renewable resources, were directly applicable to the real world.

As an aside, the underlying biological models used by Clark that we have discussed up to this point have all been general production models, not allowing for age structure considerations. It must not be supposed that he was confined to employing general production models. He has demonstrated an ability to work effectively with underlying age structured biological models. An example is provided by his work with Geoffrey Kirkwood on a complex bioeconomic model of the Gulf of Carpentaria prawn fishery (Clark and Kirkwood 1979).

To return to Mathematical Bioeconomics, the 1975 article with the first author, made it apparent that the optimal biomass target specified by the static economic model of the fishery could prove to be inappropriate.Footnote 10 A careful reading of Mathematical Bioeconomics suggests, however, that the reassessment of the optimal biomass target is but a minor contribution of the dynamic model. A far more important contribution arises from the fact that the model compels the economist to focus on the adjustment or investment phase of resource management and the problems arising therefrom. Theory of investment questions become paramount.

The question of fisheries resource investment (positive) has, over the past several years, become a major policy issue in a way in which it was not in 1976. The World Bank-FAO publication The Sunken Billions (and other contributions, e.g., Costello et al. 2012 and Sumaila et al. 2012), talks in terms of rebuilding global fish capital, and doing so on a massive scale (World Bank 2009). The OECD Committee on Fisheries recently engaged in a project on the Economics of Rebuilding Fisheries (see: OECD 2010).

Let us start by recognizing the obvious fact that, almost by definition, static economic models of the fishery are incapable of addressing resource investment issues. This can be seen most clearly by returning to Eq. (7a). The R.H.S. of the equation \(\delta (\hbox {p}-\hbox {c}(\hbox {x}))\), can be seen as the marginal opportunity cost of investing, current resource rent at the margin, which if taken, could be invested at a rate of \(\delta \). Let us observe that the static model implicitly assumes that \(\delta = 0\),Footnote 11 and hence further assumes implicitly that the cost of investing in fish capital is zero (Clark and Munro 1975).

An important fishery resource that has been subject to heavy overexploitation is Southern Bluefin tuna, off Australia and New Zealand. Economists have estimated that, if the resource is to yield anything approaching its maximum economic potential, a resource investment program extending over 20 years would be called for (Bjørndal and Martin 2007). To talk about such an investment program in terms of zero investment costs is, as every policy maker would agree, an absurdity.

The theory of investment, to repeat, addresses itself to the question of the optimal rate of investment (positive or negative). A (common sense) rule of thumb is that one should approach the capital stock target as rapidly as possible, i.e. invest/disinvest at the maximum rate, unless there are penalties associated such rapid investment.

Return to Eq. (9), the optimal approach path in the context of the linear, autonomous model. Regarding this as a specification of the optimal resource investment policy, it is stating that, if \(x(0)\ne x^{*}\), the optimal rate of investment/disinvestment in the resource capital is indeed the maximum one. If \(x(0)\le x^{*}\), then according to Eq. (9), the optimal resource investment policy calls for setting an absolute and uncompromising fishing moratorium, until the target \(x^{*}\) is achieved. If this requires maintaining a harvest moratorium for 20 years, then so be it.

This draconian approach path comes up for discussion several times in the first edition of Mathematical Bioeconomics. In all honesty, the emphasis given to this draconian resource investment is a drawback of both Clark and Munro (1975), and of the first edition of Mathematical Bioeconomics. One has to recognize that much of the fisheries economics profession has seized upon Eq. (9) as the optimal resource investment rule. It is as if many in the fisheries economics profession have not advanced beyond the linear, autonomous dynamic economic model of the fishery.

To take but one example, the OECD, in the course of its project on the economics of rebuilding fisheries, held a major workshop. In the introduction to the workshop proceedings volume, Director of the Office of International Affairs, NOAA Fisheries, states the following: “... a basic bioeconomic model would generally indicate that the shortest time frame to rebuild a stock is ideal through cessation of fishing until the objective is reached” (Lent 2010, p. 20). The Director then goes on to give reasons why practical policy considerations might compel resource managers to deviate from this pur et dur optimal investment rule.

The fact of the matter, as has been realized, is that this draconian resource investment rule is optimal only under special circumstances. This was in fact indicated in Clark and Munro (1975) in the authors’ discussion of the non-linear version of the model. Suppose, for example, the model is non-linear by virtue of the fact that the demand for fish facing the industry exhibits finite price elasticity—the price of fish is a function of the catch rate. Suppose further that \(x(0)>x^{*}\). Resource disinvestment at the maximum rate would have obvious price consequences. There are penalties associated with rapid investment/disinvestment.

In the non-linear case, the optimal approach path to the target is an asymptotic one. Translation—the most rapid rate of investment/disinvestment is non-optimal. A more gradual, a slower, rate of investment/disinvestment is in order (Clark and Munro 1975).

The non-linear example pertaining to resource investment policies is, in point of fact, a minor one. There is a far more important example of penalties arising from maximum rates of resource investment/disinvestment associated with the “malleability” of produced and human capital in the fishery. One has reason to be grateful to Herbert Mohring, of the University of Minnesota, for forcing Clark to recognize this example. Although he is best known for his research in the area of transportation economics, Mohring did, prior to 1975, carry out research on certain Alaskan fisheries. After Clark and Munro (1975) made its appearance, Mohring wrote to Clark to ask, if he and his co-author had any conception of the chaos and destruction that an Eq. (9) type of fishery resource investment policy would cause, if applied in the real world. What Mohring had in mind was the inability of vessels, fishers and processing workers dependent upon a particular fishery, to shift to alternative means of employment, if a fishing moratorium were to be declared (Colin Clark, personal communication). Mohring was referring to what we now know today as non-malleable vessel and human capital.

Clark acknowledged that Mohring had a very valid point and attempted to deal with it in the first edition of Mathematical Bioeconomics. The attempt was not successful. The mathematical problems posed were daunting to say the least. This led Clark to seek assistance from fellow mathematician, Francis Clarke, which in turn was to lead to the Clark et al. (1979) article: ”The Optimal Exploitation of Renewable Resource Stocks: Problems of Irreversible Investment” (Clark et al. 1979). The article focusses on vessel capital that is other than perfectly malleable (assuming implicitly that the relevant human capital is perfectly malleable). Let us be reminded, by the way, that perfectly malleable vessel capital is vessel capital that can be quickly and costlessly moved in, and importantly, out of the fishery. The concept is analogous to that of highly liquid assets in the realm of finance.

The model in the article (CCM 1979 hereafter) is linear, autonomous and deterministic. It is the linear, autonomous model of Clark and Munro (1975), modified to allow for non-malleable vessel capital.

The most interesting, and the most realistic, of the sub-cases considered in CCM (1979) is that in which the vessel capital is quasi-malleable. Either vessels acquired in the past can only be sold off at a capital loss, and/or net disinvestment in the vessels can only take place gradually over time through depreciation. Given such vessel capital, if a fishery resource is to be rebuilt, fishing moratoria are non-optimal, except in cases of extreme resource over-exploitation, and then for a very limited time. Otherwise, the existing, and diminishing, fleet should be employed “flat out.” The basic economic argument for such a policy is that the acquisition of the fleet capital occurred in the past, and the cost incurred thereby is thus a bygone. The resource manager is presented with what amounts to temporarily “cheap” vessel capital, which, on economic grounds, should not be abandoned.

The consequence is that, while positive investment in the resource should take place in the fishery resource, the rate of investment should be below the maximum. To invest in the resource at the maximum rate is to incur penalties.

The CCM (1979) article also reveals the following. The Clark and Munro (1975) model, in all of its variations, has underlying a key implicit assumption—an assumption that was universal among economic models of the fishery of that time. The assumption is that all produced capital and all human capital in the fishery are perfectly malleable. Hence, the Eq. (9) investment rule, applicable in the case of the linear version of the Clark and Munro (1975) model is optimal, since there are no penalties attached to maximum rates of resource investment.

The CCM (1979) analysis was to be developed and expanded in the years following the article’s publication. To begin, the CCM (1979) model takes the viewpoint of the social manager, and is strictly deterministic. Anthony Charles developed a stochastic version of the model (Charles 1983). Robert McKelvey applied the model to cases of Pure Open Access, demonstrating that existence of non-malleable vessel capital could result in the resource being driven down well below the Bionomic Equilibrium level (McKelvey 1985, 1987). An empirical application of the model to the whaling industry was given, demonstrating that, in a slow growing fishery, the adjustment process could be spread over several decades (Clark and Lamberson 1982). A final example is Sumaila (1995), which developed a simulation model for cod in the Barents Sea that took into account irreversibility in capital investments in the industry.

The non-malleability of produced/human capital does, in a sense, go right to the heart of the rebuilding of fishery resources problem. If the produced/human capital in a particular fishery is perfectly malleable, there will be a cost to investing in the fishery resource—foregone current resource rent—to be borne by society at large. There will, however, not be a sudden and heavy burden imposed upon the vessel owners, fishers, processors and processing workers. By definition, they will be no worse off than they were before the fish stock restoration program commenced. If the produced/human capital is non-malleable, the situation is entirely different. A major social, as well as economic problem arises, to which the CCM (1979) analysis, and the analyses of those expanding upon CCM (1979), are of direct relevance.

What the CCM (1979) analysis, and those following upon that analysis, does not do is to address the issue of non-malleable human capital, when a positive fishery resource investment program is in order. The need to explore this issue is urgent. Clark et al. in their 1979 article state in their conclusions that the existence of non-malleable human capital in the fishery will hold management implications similar to that of the existence of non-malleable produced capital in the fishery (CCM 1979, p. 74). While the statement is undoubtedly correct in broad general terms, the fact remains that there are obvious and important differences between produced and human capital.

5 Other Impacts of Mathematical Bioeconomics Upon Fisheries Management Policy

We have talked in very general terms about the relevance of Mathematical Bioeconomics to fisheries management policy. The following related questions remain. Are there any indications that fisheries managers are in fact listening? Secondly, is the dynamic capital-theoretic model relevant to current debates in fisheries management, over and beyond the questions of stock rebuilding?

The answer to the first question is yes, but this is still a very much ongoing process. There is an increasing willingness on the part of policy makers to regard fishery resources as capital assets, to be managed over time. We have already made reference to the World Bank/FAO publication The Sunken Billions. A second example can be taken, closer to Clark’s home. Over a decade ago, the Canadian Department of Fisheries and Oceans undertook an Atlantic Fisheries Policy Review and as part of the review process established an independent Panel on Access Criteria (IPAC) to deal with a particularly contentious inter-provincial fisheries policy issue. In its final report, released over a decade ago, the IPAC maintained that it was the objective of the Atlantic Fisheries Policy Review to create a “conservationist ethic” among fishers. The report goes on to state that:

... a conservationist ethic encourages participants to cease to regard fishery resources as resources to be mined for short-term gains, and instead to regard the resources as valuable assets to be maintained over time. It further implies a willingness, not only to forgo ongoing depletion of the resources, but also to make sacrifices required to rebuild—to “invest in” fishery resources overexploited in the past (Jackman et al. 2002, p. 8).

The Norwegian government presents an even sharper example. In a paper prepared for the OECD workshop on the economics of rebuilding fisheries, Per Sandberg of the Norwegian Directorate of Fisheries, discusses the collapse of the Norwegian Spring Spawning Herring resource in the early 1970s. The remnants of the resource were confined to Norwegian waters. The Norwegians implemented a harvest moratorium, which remained in place for 20 years.Footnote 12 Sandberg goes on to state that;

... the ban on the Norwegian fishery on small herring implied an economic cost in terms of a short term loss of the economic surplus that such a fishery could have given. ... the ban on the Norwegian fishery on small herring can be treated as an investment in the stock of herring. ... In their .. paper from 1975, Clark and Munro present what has later been known as the “Golden Rule” for fisheries management [see: Eq. (6)]. In relation to this criterion [“Golden Rule”], was the ban on the Norwegian fishery on small herring a sound investment decision? I will return to the question ... (Sandberg 2010, p. 225).

The reader will be relieved to learn that Sandberg does deem the herring investment decision to have been a sound one, although he remarks that a high degree of patience was demanded of the investors (Sandberg 2010, p. 228).

The best example comes from the farsighted Australians, who are applying the dynamic economic model to actual fisheries management. To quote from a paper also given at the OECD workshop on the economics of rebuilding fisheries “... AFMA [Australian Fisheries Management Authority] requires harvest strategies that seek to maintain fish stocks ... at a target biomass point equal to the stock size required to produce maximum economic yield” (Gooday et al. 2010, p. 117). MEY! But surely this is no more than MEY arising from the static economic model of the fishery.Footnote 13 Careful reading reveals, however, that Gooday et al. are referring to a “dynamic” MEYFootnote 14 (Gooday et al. 2010) (see as well: Kompas et al. 2009).

As of 2010, the Australians had developed for management purposes only one fully fledged dynamic bioeconomic model of the fishery, namely that for the Northern Prawn fishery (Gooday et al. 2010). Others are certain to follow. Moreover, one can also be confident that, in time, other fishing states will follow Australia’s progressive example.

With regards to the second question, the relevance, if any, of dynamic economic models of the fishery, to current specific debates on fisheries management policy we shall confine ourselves to two examples. These are vessel decommissioning/buyback schemes, and uncertainty in fisheries management.

Turning to the first issue, as is well known in the case of fisheries that can be characterized as Regulated Open Access (Wilen 1985) (in fact if not in law), excess fleet capacity is a chronic problem. A commonly proposed solution to the problem going back for over 40 years, is to implement government subsidized “buyback” (decommissioning) schemes, in which vessel owners are essentially bribed to leave the fishery (Curtis and Squires 2007). Buyback schemes have many times proven to be ineffective, because capacity has a tendency to seep back into the fishery.

If the “seepage” can be effectively curbed, then static economic analyses would lead us to conclude that “buyback” schemes are eminently sensible. A prominent World Bank study on fisheries subsidies maintains that fisheries buyback subsidies should be deemed beneficial contributing to sound fisheries management (Milazzo 1998).

The aforementioned study maintains that such subsidies are required because this vessel capital, more often than not, has no alternative uses (Milazzo 1998, p. 65). In other words, the vessel capital is non-malleable.

Now bring the dynamic economic model of the fishery to bear. Investors in non-malleable vessel capital must perforce make projections into the future. If the investors are rational in their expectations, then they will anticipate future buyback programs. What we are confronted with is a classic time consistency problem. It can be demonstrated that future buyback programs, which are anticipated by the industry, will act like a current subsidy to vessel acquisition, and hence will be decidedly non-beneficial (Clark et al. 2005, 2007).

With respect to uncertainty in fisheries management, the issue can be addressed in economic terms, only by applying dynamic models—by definition. After several resource management disasters, e.g. Northern Cod, far more attention is being devoted to uncertainty as exemplified by the Precautionary Approach embedded in international treaty law (UN 1995). We can note that the third edition of Mathematical Bioeconomics devotes a full chapter to uncertainty.

An example of the application of the dynamic economic analysis to questions of uncertainty arises with respect to the specific issue of marine protected areas (MPAs), an issue which is nothing if not controversial. If one applies, what is essentially a static type of analysis to MPAs, it is easy to reach the conclusion that MPAs are probably of little value.

In our view, the most powerful economic argument for MPAs is a portfolio balance type of argument, focussing on uncertainty. One maintains MPAs as a buffer against environmental uncertainty, and resource management errors arising from such uncertainty, in the same way that a risk averse financial portfolio holder will maintain a block of low yielding, but highly liquid assets in his or her portfolio. Developing this argument for MPAs in rigorous manner is a true exercise in dynamic bioeconomics (see: Lauck et al. 1998).

6 Pointers to the Future Influence of Colin Clark’s Contributions

The six papers in this Special Issue are pointers to some of the areas of future studies that would stand on the shoulders of Colin Clark. Climate change is the biggest environmental issue of our time. As discussed in (Miller et al. 2013), governing fisheries would be made even more difficult under climate change. The paper by Robert McKelvey and Peter Golubtsov (2014) models the evolution of a trans-boundary marine fishery, which is based on the targeting of a single “highly-migratory” stock that is being affected by regional oceanic-climate changes. The authors applied a dynamic investment model under uncertainty whose basic foundation can be traced to contributions by Colin Clark. Continuing the theme of climate change, Carol McAusland and Nouri Najjar (2014) studied whether a carbon consumption tax is logistically feasible in helping reduce the emission of greenhouse gases. The authors explored a Carbon Footprint Tax (CFT) that is modeled after a credit-method Value Added Tax. Their analysis suggests that a pure carbon footprint tax (CFT) that requires the calculation of the carbon footprint of every individual product, may be prohibitively costly. On the other hand, a hybrid CFT seems economically feasible.

The next paper in this volume by Marc Mangel, Natalie Dowling, and Juan Lopez Arriaza show that Colin Clark made seminal contributions not only to resource (fisheries) economics but also behavioral ecology. In the former, Clark showed how to connect biological and economic models to create mathematical bioeconomic models. In the latter, the authors note that Clark made major contributions to modeling the behavior and life history of organisms. Mangel et al. (2013) applied the methods of behavioral ecology, to which Colin Clark contributed significantly, to a problem in fisheries management. The authors showed that understanding fisher responses to quota decrements, according to fishing area, may be more effective for seabird conservation than closing areas.

The next two papers build on and extend Clark’s work on the economics of overexploitation published in 1973 in Science and the Journal of Political Economy. Colin W. Clark and Jin Yoshimura (2014) discuss the current global economic crisis as an analog of short-term harvesting of a biological resource where the motives of short-term profit over-ride sustainability considerations.

Louise SL Teh, Lydia CL Teh, U. Rashid Sumaila and William Cheung (2013) explored the incentive to overexploit coral reef fish stocks given the discount rates of reef fishers. The authors use a life history based method to derive fishery level intrinsic growth rates, and then apply fisheries economics to investigate how 2 different discount rates (official and private) may affect the exploitation status of reef fisheries. The authors find that official discount rates that are normally used for policy making appear to be too low to fully reflect the short term outlook of reef fishers.

The last but the not the least in this collection of papers is by Daniel Gordon (2013) who highlights some serious problems that exist in econometric application of fisheries economic models such as those developed by Colin Clark. Gordon argues that these problems in application are serious enough to the point of impeding the ability of fisheries economics to inform policy work. Gordon focused on two areas of econometric application: (1) the violation of the fundamental condition for applied econometrics (i) = 0, where (i) is a stochastic error term and X is a matrix of right-hand-side explanatory variables, and (2) the inappropriate use of data that is available for analysis. Both problems deal with the econometric issues of omitted and proxy variable. Gordon also comments on the data necessary to carry out proper fisheries econometric research and policy analysis.

7 Conclusions

It has been argued that the primary impact of Mathematical Bioeconomics and the other works of Colin Clark, upon the economics of fisheries management have been two parts in nature. First, Colin Clark established an effective bridge between the disciplines of economics and marine biology. Secondly, his work led to the firm incorporation of the theories of capital and investment into the economic model of the fishery.

No one would suggest that Colin Clark was the first to recognize the need for a sound biological foundation for economic models of the fishery, or the first to recognize the importance of the theories of capital and investment to fisheries economics. Such recognition has existed long before the mid-1970s. What Colin Clark did do, by drawing upon his skills as a mathematician, was to make both dynamic economic models of the fishery and the underlying biology accessible to fisheries economists at large. At the time when the first edition of Mathematical Bioeconomics was published, the dominant model of the fishery in economics was strictly static, with the underlying biology pushed firmly into the background and largely ignored (Munro 1992).

It can be argued that Colin Clark’s contribution to fisheries economics, the dynamic—capital theoretic—economic models of the fishery that Colin Clark did so much to develop have come into their own. While fisheries policy makers, for the most part, eschew all capital theory jargon, capital-theoretic concepts have obviously penetrated their thinking. There are now many major fisheries management issues that are inescapably dynamic in nature, with the rebuilding of hitherto overexploited fish stocks and uncertainty being but two examples.

In 1992, upon reviewing Colin Clark’s work up to that point, Munro stated that it was up to history to determine whether Colin Clark’s impact upon fisheries economics could be described as revolutionary (Munro 1992). In 2015, we can give history a helping hand by maintaining that, in retrospect, Colin Clark’s impact upon fisheries economics has indeed been revolutionary. As demonstrated by the six papers in this volume, we can go on to predict that, in 2115, Mathematical Bioeconomics will still be built upon and studied with care by economists.

Notes

Thus, for example, a recently published fisheries economics text, by Trond Bjørndal and Gordon Munro, The Economics and Management of World Fisheries, designed for academic students and practitioners, employs a capital-theoretic framework throughout (Bjørndal and Munro 2012).

This study was re-published, along with a set of comments from prominent fisheries economists, in 2003 (Crutchfield and Zellner 2003).

See Fig. 1.

“... it should be clear that the biological overfishing case, in which [fishing] effort is pushed to the point where physical yield actually declines, could not arise under private ownership of the resource” (Crutchfield and Zellner 2003, p. 19).

Optimal control theory was then coming into vogue among economists, particularly those specializing in capital theory.

The term “Golden rule” arises from the fact that Eq. (6) can be seen as a version of the Modified Golden Rule of Capital Accumulation from capital theory.

Although there are admittedly exceptions to the rule.

According to Google scholar as at December 27, 2014, this book has been cited more than 4,800 times!

See: n. 10.

The produced and human capital employed in the fishery was highly malleable with respect to the fishery (Gréboval and Munro 1999).

See Fig. 1.

References

Bjørndal T, Martin S (2007) The relevance of bioeconomic modelling to RFMO resources: a survey of the literature. Recommended best practices for regional fisheries management organizations: technical study no 3, Chatham House, London

Bjørndal T, Munro GR (2012) The economics and management of world fisheries. Oxford University Press, Oxford

Charles AT (1983) Optimal fisheries investment under uncertainty. Can J Fish Aquat Sci 40:2080–2091

Clark CW (1971) Economically optimal policies for the utilization of biologically renewable resources. Math Biosci 12:245–260

Clark CW (1973a) The economics of overexploitation. Science 181:630–634

Clark CW (1973b) Profit maximization and the extinction of animal species. J Polit Econ 81:950–961

Clark CW (1976) Mathematical bioeconomics; the optimal management of renewable resources. Wiley-Interscience, New York

Clark CW (1990) Mathematical bioeconomics; the optimal management of renewable resources, 2nd edn. Wiley, New York

Clark CW (2010) Mathematical bioeconomics; the optimal management of renewable resources, 3rd edn. Wiley, New York

Clark CW, Kirkwood G (1979) Bioeconomic model of the Gulf of Carpentaria prawn fishery. J Fish Res Board Can 36:1304–1312

Clark CW, Lamberson R (1982) An economic history and analysis of pelagic whaling. Mar Policy 6:103–120

Clark CW, Munro GR (1975) The economics of fishing and modern capital theory; a simplified approach. J Environ Econ Manag 2:92–106

Clark CW, Yoshimura J (2014) The economic incentives underlying resource and environmental depletion. Environ Resour Econ. doi:10.1007/s10640-014-9763-2

Clark CW, Clarke FH, Munro G (1979) The optimal management of renewable resource stocks: problems of irreversible investment. Econometrica 47:25–47

Clark CW, Munro G, Sumaila UR (2005) Subsidies, buybacks and sustainable fisheries. J Environ Econ Manag 50:47–58

Clark CW, Munro G, Sumaila UR (2007) Buyback subsidies and the ITQ alternative. Land Econ 83:50–58

Clark CW, Munro G, Sumaila UR (2010a) Limits to the privatization of fishery resources. Land Econ 86:209–218

Clark CW, Munro G, Sumaila UR (2010b) Limits to the privatization of fishery resources; reply. Land Econ 86:614–618

Costello C, Kinlan BP, Lester SE, Gaines SD (2012) The economic value of rebuilding fisheries, OECD Food, Agriculture and fisheries working papers, no 55. OECD Publishing, Paris

Crutchfield JA, Zellner A (1962) Economic aspects of the Pacific halibut fishery. Department of the Interior, Washington

Crutchfield JA, Zellner A (eds) (2003) The economics of marine resources and conservation policy. The Pacific halibut case study with commentary. University of Chicago Press, Chicago

Curtis R, Squires D (2007) Fisheries buybacks. Blackwell, Oxford

Flaaten O (2011) Fisheries economics and management. Norwegian College of Fishery Science, University of Tromsø, Tromsø. http://www.ub.vit.no/mmvnin/bitstream/handle/10037/2509/book.pdf?sequence=1. Cited 20 Dec 2014

Gooday P, Kompas T, Che N, Curtotti R (2010) Harvest strategy policy and stock rebuilding for commonwealth fisheries in Australia. In: The economics of rebuilding fisheries: workshop proceedings. OECD, Paris, pp 113–139

Gordon D (2013) The endogeneity problem in applied fisheries econometrics: a critical review. Environ Resour Econ. doi:10.1007/s10640-013-9740-1

Gordon HS (1954) The economic theory of a common property resource: the fishery. J Polit Econ 62:124–142

Gordon HS (1956) Obstacles to agreement on control of the fishing industry. In: Turvey R, Wiseman J (eds) The economics of fisheries. FAO, Rome, pp 65–72

Grafton RQ, Kompas T, Hilborn R (2007) Economic of overexploitation revisited. Science 318:1601

Grafton RQ, Kompas T, Hilborn R (2010) Limits to the privatization of fishery resources: comment. Land Econ 86:609–613

Gréboval D, Munro G (1999) Overexploitation and excess capacity in world fisheries: underlying economics and methods of control. In: Gréboval D (ed) Managing fishing capacity: selected papers on underlying concepts and issues. FAO fisheries technical paper no 386. FAO, Rome, pp 1–48

Jackman M, LeBlond P, Munro G, Newhouse DL (2002) Independent panel on access criteria for the atlantic commercial fishery, report of the independent panel on access criteria. Department of Fisheries and Oceans, Ottawa

Kompas T, Grafton RQ, Che N, Goody P (2009) Development of methods and information to support the assessment of economic performance in commonwealth fisheries. ABARE, Canberra

Lauck T, Clark CW, Mangel M, Munro GR (1998) Implementing the precautionary principle in fisheries management through marine reserves. J Appl Ecol 8(Suppl):S72–S78

Lent R (2010) Introduction. In: The economics of rebuilding fisheries: workshop proceedings. OECD, Paris, pp 17–29

Mangel M, Dowling N, Arriaza JL (2013) The behavioral ecology of fishing vessels: achieving conservation objectives through understanding the behavior of fishing vessels. Environ Resour Econ. doi:10.1007/s10640-013-9739-7

McAusland C, Najjar N (2014) Carbon footprint taxes. Environ Resour Econ. doi:10.1007/s10640-013-9749-5

McKelvey R (1985) Decentralized regulation of a common property renewable resource industry with irreversible investment. J Environ Econ Manag 12:287–307

McKelvey R (1987) Fur seal and blue whales: the bioeconomics of extinction. In: Cohen Y (ed) Applications of control theory in ecology. Springer, Heidelberg, pp 52–82

McKelvey R, Golubtsov P (2014) Restoration of a depleted transboundary fishery subject to climate change: a dynamic investment under uncertainty with information updates. Environ Resour Econ. doi:10.1007/s10640-014-9854-0

Milazzo M (1998) Subsidies in world fisheries: a reexamination. World Bank technical paper no 406, Fisheries Series. World Bank, Washington, DC

Miller KA, Munro GR, Sumaila UR, Cheung WWL (2013) Governing marine fisheries in a changing climate: a game-theoretic perspective. Can J Agric Econ 61(2):309–334

Munro GR (1992) Mathematical bioeconomics and the evolution of modern fisheries economics. Bull Math Biol 54:163–184

OECD (2010) The economics of rebuilding fisheries: workshop proceedings. OECD, Paris

Pearce DW, Turner RK (1990) Economics of natural resources and the environment. BPCC Wheatsons Ltd, Exeter

Quirk JP, Smith VL (1970) Dynamic Economic Models of Fishing. In: Scott AD (ed) Economics of Fisheries Management - A Symposium. University of British Columbia Institute of Animal Resource Ecology, Vancouver, pp 3–22

Sandberg P (2010) Rebuilding the stock of Norwegian spring spawning herring: lessons learned. In: The economics of rebuilding fisheries; Workshop proceedings. OECD, Paris, pp 219–233

Scott AD (1954) Conservation policy and capital theory. Can J Econ Polit Sci 20:504–513

Scott AD (1955) The fishery: the objectives of sole-ownership. J Polit Econ 63:116–124

Sumaila UR (1995) Irreversible capital investment in a two-stage bimatrix fishery game model. Mar Resour Econ 10(3):263–283

Sumaila UR, Cheung WWL, Dyck A, Gueye K, Huang L, Lam VWY, Pauly D, Srinivasan T, Swartz W, Pauly D, Zeller D (2012) Benefits of rebuilding global marine fisheries outweigh costs. PLoS ONE 7(7):e40542. doi:10.1371/journal.pone.0040542

Teh LSL, Teh LCL, Sumaila UR, Cheung WWL (2013) Time discounting and the overexploitation of coral reefs. Environ Resour Econ. doi:10.1007/s10640-013-9674-7

United Nations (1995) United Nations conference on straddling fish stocks and highly migratory fish stocks. Agreement for the implementation of provisions of the United Nations Convention on the Law of the Sea of 10 December 1982 Relating to the Conservation and Management of Straddling Fish Stocks and Highly Migratory Fish Stocks. UN Doc. A/Conf./164/37

Wilen JE (1985) Towards a Theory of the Regulated Fishery. Mar Resour Econ 1:369–388

World Bank (2009) The sunken billions: the economic justification for fisheries reform. World Bank, Washington

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Munro, G.R., Sumaila, U.R. On the Contributions of Colin Clark to Fisheries Economics. Environ Resource Econ 61, 1–17 (2015). https://doi.org/10.1007/s10640-015-9910-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9910-4