Abstract

While asymmetric mixture models improve option pricing over generic pricing models, mispricing remains due to their inability to capture the effect of economic factors on price levels. This paper uses the hidden truncation normal \(\mathcal {(HTN)}\) distribution introduced by Arnold et al. (1993) and the NGARCH model of Engle and Ng (J Finance, 48:1749–1778, 1993) to price options. Compared to the Black–Scholes model, the\(\mathcal {HTN}\)-NGARCH option pricing model has extra parameters linked to economic dynamics and with economic interpretations. The model integrates some stylized facts underlying option prices such as a time-varying price of risk, non-normal innovations, asymmetry, and kurtosis. The model can be estimated by maximum likelihood. With an application to market data, we show that the \(\mathcal {HTN}\)-NGARCH model accurately prices index options and captures adequately the smirk of implied volatility.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Black–Scholes [BS, Black and Scholes (1973)] and Merton (1973) are pioneers in option pricing and many posterior models have been inspired by their works. The main criticisms of these seminal models are the assumptions of constant volatility and Gaussian returns, mis-pricing in- and out-of-the-money options. When implied volatility obtained from market data is plotted against moneyness, the smile or smirk of volatility reveals a moneyness-varying volatility. Many authors have made the volatility stochastic to incorporate the smile or smirk of volatility to option pricing: Hull and White (1987); Johnson and Shanno (1987); Scott (1987); Wiggins (1987); Stein and Stein (1991); Amin and Ng (1993) and Nandi (1996). A few authors such as Duan (1995) have introduced the generalized autoregressive conditional heteroskedasticity [GARCH, Bollerslev (1986)] model to option pricing to capture some attributes of the underlying asset of the option. GARCH models aim at capturing volatility clustering and heteroscedasticity of the underlying assets. The following authors have expanded Duan’s works: Christoffersen and Jacobs (2004); Heston and Nandi (2000), and Hsieh and Ritchken (2005); Christoffersen et al. (2008). The overwhelming success of GARCH models in option pricing and their consistent pricing accuracy explains our choice of the model described below and belonging to the GARCH family. Recently, authors looked at improving stochastic volatility models using jump-diffusion models such as Bates (2000), Bakshi et al. (2012), Barndorff-Nielsen and Shephard (2001); Pan (2002) and Eraker (2004); Carr and Wu (2007) and Bakshi et al. (2006). Other authors focused on improving GARCH models with jumps such as Duan et al. (2006); Christoffersen et al. (2008) or with skewed and/or leptokurtic distributions such as Duan (1999); Christoffersen et al. (2006, 2008) and Stentoft (2008). Bates (2003), Zhang and Zheng (2023) reviewed option pricing models and reiterated the pronounced volatility smirk implicit in options on stock indices or stock index futures, which implies strongly negatively skewed risk-neutral distributions, which may be explained by time-varying higher-order moments of the distribution. To capture this feature, Rombouts and Stentoft (2010, 2014) proposed a mixed normal heteroskedasticity (MN-NGARCH) model which allows the innovations to have time-varying higher-order moments. Their model can make some conditional variance processes weakly nonstationary during turbulent periods, while the overall conditional variance remains weakly stationary. Examples of proponents of these models are McLachlan and Peel (2000); Frühwirth-Schnatter (2006) and Durham (2007). The finite mixture models are convex combinations of densities. They offer a flexible specification of the distribution of the underlying random variable, which gives them a semiparametric flavor. In addition, each distribution in the mixture may have its own mean and conditional variance process.

Amending the non-realistic assumption of Gaussian returns embedded in the seminal papers of BS-Merton model Black and Scholes 1973, several authors proposed sophisticated distributions that capture skewness and time-varying higher-order moments of the risk neutral distribution. In that vein, we introduce an option pricing model comprising the hidden truncation normal (\(\mathcal {HTN}\)) Arnold et al. (1993) coupled with the NGARCH type (Engle & Ng, 1993) structure which allows for the conditional variance in \(\mathcal {HTN}\). The \(\mathcal {HTN-}\)NGARCH model extracts and identifies the observed (e.g. the S &P 500 returns) and the hidden truncated unobserved variable. The hidden truncated random variable could be interpreted as the state resulting from economic, political upheaval, government policies and market forces that shape the returns without explicit reasons. The state of the returns is the state of the variable when bad news is flowing into the market or good news is flooding the market. The conditional density of the \(~\mathcal {HTN}\) (1) has four parameters which could be linked to economic dynamics and depends on a hidden truncation. In addition, when the innovation terms are driven by the conditional \(\mathcal {HTN}\) distribution, then the dynamics of the conditional variance are modelled by the so-called NGARCH heteroskedastic model. The combined model offers a rich structure dynamics allowing us to capture the volatility spillovers between the observed and the hidden variable inherent in the \(~\mathcal {HTN}\) distribution. Moreover, this model specification captures the most important stylized facts in financial time series such as conditional skewness, kurtosis, leverage effect and volatility clustering. We investigate the ability of the \(\mathcal {HTN}\)-NGARCH model to price call and put options, especially to capture the smile of volatility embedded in premiums of exchange-traded options. This versatile and evolved model can be applied to changing market conditions which impact index options pricing and leads to accurate pricing and adequate modeling of the volatility smirk. The \(\mathcal {HTN}\)-NGARCH model may be seen as a model coming after the stochastic volatility and GARCH models that have improved the seminal BS-Merton model (1973). We also give an empirical application of the model to pricing index options which reveals the propensity of the \(\mathcal {HTN}\)-NGARCH model at pricing index options and at modeling the smirk of implied volatility. Index options are particularly sensitive to the smirk, which makes these options a relevant choice for testing the \(\mathcal {HTN}\)-NGARCH model.

The remainder of the paper is outlined as follows. The \(\mathcal {HTN}\) distribution is introduced in Sect. 2 along with its moment generating function and stochastic representation. Section 3 presents the theoretical framework for the \(\mathcal {HTN}\)-NGARCH option pricing model. An application to S &P 500 index options is presented in Sect. 4. Section 5 wraps up our findings.

2 The Mathematical Model

2.1 Definition

The random variable \(X\)follows a hidden truncation normal \(\mathcal {(HTN)~}\)distribution if its probability density function is defined by

where \(\phi (\)·\(),\Phi (\)·) denote, respectively, the density and cumulative distribution functions of the standard normal distribution. This is a family of densities parametrized by the four parameters \(\left( \mu _{1},\sigma _{1},\lambda _{0},\lambda _{1}\right)\), where x, \(\mu _{1}\in \, {\mathbb {R}},~\sigma _{1}>0~\)govern the location and the scale, while \(\lambda _{0}\)and \(\lambda _{1}\) are any real values that control the skewness in the density f(x). The density function of such hidden truncation models was discussed thoroughly in Arnold et al. (1993). In that paper, they considered X and Y to have a truncated bivariate normal distribution, where Y variable is truncated, but only the X values are observed. The marginal density of the nontruncated variable X is obtained and the distribution of X is skew-normal. Further, we will show in Sect. 4 that the parameter \(\sigma _{1}~\) captures the effects of the volatility, while \(\lambda _{0}~\)and \(\lambda _{1}\) capture the so-called leverage effect (Black, 1976), which is a stylized fact in equity index returns. The leverage effect may be thought of as negative asset returns having a greater influence on future volatility than do positive returns.

The \(\mathcal {HTN}\) distribution nests several well known families of distributions, namely, the normal distribution and the skew-normal family of Azzalini (1985). As expected, when the correlation between the variables in the original untruncated population is zero, i.e., when we set \(\lambda _{1}=0\) in (1), the \(\mathcal {HTN}\) density reduces to the normal distribution. When\(\lambda _{0}=0,\) (1) gives Azzalini’s skew-normal distribution.

2.2 The Moment Generating Function and Stochastic Representation

The moment generating function of (1) is given by

By differentiating (2), one obtains the expected value, variance and skewness of X. The derivation for the moment generating function of the \(\mathcal {HTN}\) distribution can be found in Arnold et al. (1993), and the formulas for the moments of X can be found in Arnold and Gomez (2009). We use (2) to derive the innovations under the risk-neutral measure.

In the case when \(\lambda _{0}=0\), Azzalini and Dalla Valle (1996); Henze (1986), gave the stochastic representation of the \(\mathcal {HTN}\), and the general case \(\lambda _{0}\in {\mathbb {R}}\) may be found in Arnold and Gomez (2009). Equation (3) allows us to generate data from the \(\mathcal {HTN}\) distribution by only simulating from the the truncated normal and normal distributions.

Theorem 1

Let \(\delta _{0}=\tfrac{\lambda _{0}}{\sqrt{1+\lambda _{1}^{2}}}\), \(\delta _{1}=\frac{\lambda _{1}}{\sqrt{1+\lambda _{1}^{2}}}\), and \(\delta _{2}=\frac{1}{\sqrt{1+\lambda _{1}^{2}}}\). Suppose that \(U ~\)and\(~ V\) are independent identically distributed \({\mathcal {N}}\left( 0,1\right)\), where U is truncated from below at \(-\delta _{0}\). If

Then

has a distribution with density function (1).

3 \(\mathcal {HTN}\)-NGARCH Option Pricing Model

3.1 The Stock Price and the Risk-Neutral Dynamics

Let \(S_{t}\) be the stock price at time t, and define the dynamics of the log-returns in period t as

where the conditional distribution of the error term\(~\varepsilon _{t}|{\mathcal {F}} _{t-1}\sim \mathcal {HTN}\left( \theta _{t}\right)\), \({\mathcal {F}} _{t-1}\)is the filtration (the information set at time \(t-1\)) generated by the bond and the stock process\(.~\theta _{t}=(\mu _{1,t},~\sigma _{1,t},~\lambda _{0,t},~\lambda _{1,t})\) is the parameter set of the \(\mathcal {HTN}\) defined in (1). We assume that conditional means \(\mu _{t}\) and conditional variances of the log-returns are \({\mathcal {F}} _{t-1}\) measurable. We note that the mean correction factor \(\gamma _{t}\) is defined so that the conditional expected rate of return \(E_{t-1}\left( \frac{S_{t}}{S_{t-1}}\right) =\exp (\mu _{t})\).

We adopt the approach by Christoffersen et al. (2010a, 2010b), where an equivalent martingale measure (EMM) \({\mathbb {Q}}\) is specified through a specification of a Radon-Nikodym derivative \(\dfrac{d {\mathbb {Q}} }{dP}\) which makes the discounted stock price process a martingale. This in turn leads, for example, to pricing a European call option as the discounted expected value of the payoff of the option under this risk neutral measure.

For a given sequence of numbers \(\{\nu _{t}\},\)we define a candidate Radon-Nykodym derivative as

where \(\Psi _{t}\left( u\right)\) is defined as the logarithm of the moment generating function

Also note that, since the mean correction factor \(\gamma _{t}=\Psi _{t}\left( -1\right) ,\) the return process may be written as

From Christoffersen et al. (2010a, 2010b), an EMM may be constructed by choosing a sequence \(\{\nu _{t}\}\)such that

By substituting \(\mu _{t}\) in (8) into the return Eq. (7), we obtain respectively the log-returns dynamics with respect to the actual probability P and the risk-neutral probability\({\mathbb {Q}},\) shown in Eqs. (9) and (10)

where \(\varepsilon _{t}^{ {\mathbb {Q}} }\) and\(R_{t}^{ {\mathbb {Q}} }\) are respectively the risk neutral innovation and the risk-neutral return process under the risk neutral measure \({\mathbb {Q}}\). When pricing options using Monte Carlo simulation, knowing the risk neutral distribution is valuable.

By using Eq. (10), we further note that under the risk neutral measure \({\mathbb {Q}}\), the expected rate of return of the stock price is the risk-free rate \(r_{t}\)as required, i.e.

As has been noted earlier, our analysis proceeds as described in Christoffersen et al. (2010a, 2010b). However, as mentioned there, the methodology undertaken in deriving the risk-neutral dynamics used for option pricing is not unique, i.e. markets are incomplete. Hence, in general no unique EMM exists as opposed to the case of BS model where volatility is assumed to be constant. In this case the market is complete, and it is possible to construct a portfolio containing combinations of the contingent claim and the underlying asset that make the resulting portfolio riskless. Note however that the obtained option prices are unique conditional on the choice of the Radon-Nikodym derivative.

We outline here a risk-neutralization methodology we adopt in the calibration of the \(\mathcal {HTN}\)-NGARCH model which we divide into four steps:

-

1.

A constant parameter \(\nu _{0}\) which satisfy (9) is determined using the numerical procedure Broyden–Fletcher–Goldfarb–Shanno (BFGS). Please see in Sect. 4 the procedure to carry out the BFGS algorithm. More details can be found in Nocedal and Wright (2006).

-

2.

Given the constant parameter \(\nu _{0}\), the risk-neutral distribution \(\varepsilon _{t}^{ {\mathbb {Q}} }\)is obtained using (10).It turns out that the distribution \(\varepsilon _{t}^{ {\mathbb {Q}} }\) is within the family of \(\mathcal {HTN}\) distributions as can be shown using results in Christoffersen et al. (2010a, 2010b).

-

3.

The conditional volatilities in Eqs. (15)–(17) are now defined in terms of \(\varepsilon _{t}^{ {\mathbb {Q}} }.\)

-

4.

Finally, the risk-neutral return process \(R_{t}^{ {\mathbb {Q}} }\) in (10) is used for pricing options.

3.2 Characterizing the Risk-Neutral Distribution

When pricing options using Monte Carlo simulation, knowing the risk neutral distribution is valuable. The next result shows that for the \(\mathcal {HTN}\) model, the risk neutral distribution is from the same family as the original physical distribution. More precisely,

If we let \(\mu _{1,t}^{*}=\mu _{1,t}-\nu _{t}\sigma _{1,t}^{2},\) and \(\lambda _{0,t}^{*}=\lambda _{0,t}-\lambda _{1,t}\nu _{t},~\)then the conditional cumulant generating function under the risk-neutral measure \({\mathbb {Q}}\) can easily be derived and is given by

From \(\left( 12\right) ~\)We note the following:

-

When \(\nu _{t}=0,\) (12) reduces to \(\Psi _{t}^{ {\mathbb {Q}} }\left( u\right) =\Psi _{t}\left( u\right) ,\) and hence the risk-neutral distribution coincides with the physical distribution. However, in general, the distribution of \(\varepsilon _{t}^{ {\mathbb {Q}} }\) will have shifted means and skewness.

-

When \(\lambda _{0,t}=\lambda _{1,t}=0{},\)we obtain\(~\Psi _{t}^{ {\mathbb {Q}} }\left( u\right) =-\mu _{1,t}^{*}u+u^{2}\tfrac{\sigma _{1,t}^{2}}{2}\), which we recognize as the conditional cumulant moment generating function of the normal distribution under the measure \({\mathbb {Q}}.\)

Because of the one-to-one mapping between moment generating functions and distribution functions, proposition 2 immediately gives the risk-neutral distribution of \(\varepsilon _{t}^{ {\mathbb {Q}} }~\)corresponding to the physical distribution of \(\varepsilon _{t}\). Therefore, the distribution of \(\varepsilon _{t}^{ {\mathbb {Q}} }\) remains within the family of \(\mathcal {HTN}\) distributions with parameters \(\left( \mu _{1,t}^{*},\sigma _{1,t},\lambda _{0,t}^{*},\lambda _{i,t}\right)\). The location parameter \(\mu _{1,t}^{*}~\)of the innovation \(\varepsilon _{t}^{ {\mathbb {Q}} }\)is shifted by \(\nu _{t}\sigma _{1,t}^{2}\) and the skewness parameter\(~\lambda _{0,t}^{*}\) is shifted by \(\lambda _{1,t}\nu _{t}\). In the Gaussian case, \(\nu _{t}\) may be equated with the unit risk premium, so that the shift in the mean with respect to the risk-neutral measure is interpreted as a compensation for positive risk premium. In Sect. 4 below, we estimate that \(\nu _{0}\) \(>1\) which may also be interpreted as the risk premium in the \(\mathcal {HTN}\)-NGARCH model as explained in Christoffersen et al. (2010a, 2010b).

We use the conditional \(\mathcal {HTN}\) and NGARCH model proposed in Engle and Ng (1993), The innovations \(\varepsilon _{t}\) are generated by a \(\mathcal {HTN}\) NGARCH process, or, in short, \(\mathcal {HTN}\)-NGARCH, if the conditional distribution \(\varepsilon _{t}\) is a \(\mathcal {HTN}\) with zero mean. Assume \(\varepsilon _{t}|~ {\mathcal {F}} _{t-1}\sim \mathcal {HTN}\left( \mu _{1,t},~\sigma _{1,t},~\lambda _{0,t},~\lambda _{1,t}\right)\) with specifications for the parameters of (1) are as follows:

where the location parameters \(\mu _{1,t}\)(set as a constant \(\theta _{0}\)), \(\theta _{1}\), \(\beta _{1k}\), \(\beta _{2k}\) \(\left( k=0,1,2,3\right)\) and \(\gamma _{10}\), \(\gamma _{11}\), \(\gamma _{12}\) are to be estimated using the maximum likelihood estimator (ML). Notice that the paramater\(\gamma _{1}\) in the NGARCH variance specification allows for an asymmetric variance response to positive versus negative shocks, \(\varepsilon _{t-1}\). This captures the so-called leverage effect, which is another important empirical regularity in daily equity index returns.

4 Applications to S & P 500 Index Options

4.1 Methodology

We examine the ability of the \(\mathcal {HTN}\)-NGARCH model to price call and put options, especially to capture the smile of volatility embedded in premiums of exchange-traded options. We choose European index options traded on the Chicago Mercantile Exchange (CME) during 61 months from January 2009 to January 2014. The total number of quotations of calls and puts is 59, 086. We benchmark the \(\mathcal {HTN}\)-NGARCH model to the standard BS Black and Scholes 1973 analytical solution.

We compute the options premiums using the following three steps:

-

1)

We calibrate \(\mathcal {HTN}\)-NGARCH models with daily financial data. The inputs of the calibration extend over 10 years from November 1998 to December\(2008\) which includes crisis and non-crisis periods and contain the following data obtained from Datastream and from the Federal Reserve U.S. interest rates web page (H15):

-

S &P 500 Composite - price index

-

S &P 500 Composite – dividend yield

-

US Eurodollar deposit 1-month Bid used as proxy of the risk-free rate.

-

-

2)

Once calibrated, we generate random numbers from the distribution which feed a basic Monte Carlo simulation model that simulates trajectories of the S &P 500 Composite index. These random numbers calibrated from the 10-year in-sample daily data will be used for the whole 61-month out-of-sample. In order to simulate the S &P 500 Composite index, we use as initial value of the simulation the quotation of the S &P 500 Composite index read on the day of option pricing and as proxy of the short-term interest rate the US Eurodollar deposit 1-month Bid, London, also observed on the day of pricing.

The S &P 500 Composite index price \(S_{T}\) at option maturity T is obtained with the following process:

With\(r\) \(=~\)US Eurodollar deposit 1-month Bid as proxy of the risk-free rate, q = dividend of S &P 500 Composite index,\(t\) = number of calendar days until option expiry and \(R_{i}=~\)terms of innovation generated from the \(\mathcal {HTN}\)-NGARCH model distribution;\(R_{i}\) are randomly drawn from a sample of 458, 115 R; we use the same sample of innovations \(R_{i}\) for the pricing of call and put options.

We compute today’s option call price \(C_{0}\) with Eq. (19):

And today’s option put price\(P_{0}\) with Eq. (20):

Where K is the strike price of the option and r the US Eurodollar deposit 1-month Bid observed at the time of the option pricing.

3) We compare our computed option prices to mid-quotes obtained on Datastream. We discard options with a premium lower than 50 cents. After filtration, we gather 28, 530 quotations of calls and 30, 556 quotations of puts with a total of 59, 086 options. We consider these quotations as the ‘true’ option prices to test the \(\mathcal {HTN}\)-NGARCH model and its benchmark the standard BS Black and Scholes 1973 closed-form solution. The latter model has the same inputs as the former except for the volatility, which is a simple equally-weighted historical volatility of the past 12 months.

The moneyness of puts and calls ranges from deep-out-of the money to deep-in-the money with strike prices spreading from \(100\)to 3000, and maturities from very short to very long-term, extending from 21 days to 627 days.

We classify put and call options in five categories of maturity from very short term (VST) to very long term (VLT) options and five categories of moneyness from deep-in-the-money (DITM) to deep-out-of-the-money (DOTM) options. The categories of maturity measured in trading days, T, and moneyness measured as \(M=\dfrac{S}{Ke^{-rT}}\), where S is the value of the underlying, K is the strike price, and \(r\)is the risk free interest rate. The maturity categories are divided into very short term (VST), with \(T<22\), short term (ST), with \(22\le T<43\), medium term (MT), with \(43\le T<85\), long term (LT), with \(85\le T<169,\) and very long term (VLT), with \(T\ge 169\). For call options, the moneyness categories are divided into deep out of the money (DOTM), with \(M<0.95\), out of the money (OTM), with\(0.95\le M<0.98\), at the money (ATM), with \(0.98\le M<1.02\), in the money (ITM), with \(1.02\le M<1.05\), and deep in the money (DITM), with \(M\ge 1.05\). Table 3 presents the statistics for the call options in terms of average price of the premiums, average implied volatility obtained with the Black–Scholes Black and Scholes (1973) model and count in each category of option contracts.

Concerning put options, the moneyness categories are inverted. For example, DITM put options have \(M<0.95\).

4.2 Data Analysis and Results

The outputs of the \(\mathcal {HTN}\)-NGARCH model from our in-sample are presented in Table 1. The reported coefficients shown in each row of Table 1 are the Maximum likelihood estimates of the \(\mathcal {HTN}\)-NGARCH model. The model has been estimated using the BFGS algorithm. We briefly define the BFGS Optimization Algorithm. We refer the reader to Nocedal and Wright (2006) for a thorough discussion of the BFGS algorithm.

-

BFGS is an acronym; named after the four co-founders of the algorithm: Broyden, Fletcher, Goldfarb, and Shanno.

-

BFGS is a second-order optimization algorithm.

-

BFGS is a local search algorithm, aimed for convex optimization problems with a single optima.

-

BFGS approximate the inverse Hessian, which can then be used to determine the direction to move by using a line search in the chosen direction to determine how far to move in that direction.

Since the parameter \(\nu _{0}=3.1695\), as explained above, \(\nu _{0}\) may be interpreted as the risk premium. As it is shown, the persistence in the conditional volatilities as measured by the parameters \({\small \beta }_{11}\) and \({\small \beta }_{12}\) is high and significant. In addition, the leverage effects measured by the parameter \(\gamma _{1}\) is also high and significant.

Tables 2 and 3 presents the statistics for call and put options respectively.

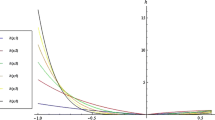

As observed in Tables 4 and 5, our database does not contain any short-term options with maturity T in the range \(22\le T<43\) days. Finally, as illustrated in Figs. 1 and 2, we observe the volatility smirk for both call and put options. DITM call options are overrepresented (\(14,611\)contracts) and ITM call options are underrepresented (1, 882 contracts). DOTM put options are overrepresented (14, 674 contracts) and OTM put options are underrepresented (1, 883 contracts). The mean premiums vary from \(\$2.22\) to \(\$359.19\) for call options and from \(\$2.76\) to \(\$313.69\) for put options.

Our results are based on the criteria of root mean square error (RMSE) given by (21):

We compare the RMSE computed between call prices obtained with \(\mathcal {HTN}\)-NGRCH and BS model with the observed calls prices compiled with Datastream.

Table 4 illustrates the RMSE in dollar losses of call options premiums computed with \(\mathcal {HTN}\)-NGARCH model. Calls are classified by Time to Maturity versus Moneyness. Table 7 illustrates the RMSE computed with BS model. The RMSE average is weighted by the number of observations of call options.

Based on Tables 4 and 5 gathering the results of RMSE of call options, although the overall RMSE is 13 for \(\mathcal {HTN}\)-NGARCH and lower than for BS model 17, the \(\mathcal {HTN}\)-NGARCH has lower RMSE for all levels of moneyness. Based on the option maturity criteria, the \(\mathcal {HTN}\)-NGARCH model is better than the BS model. Compared to BS model, the \(\mathcal {HTN}\)-NGARCH model has a clear advantage at capturing the volatility smile illustrated by figure\(1\). We observe an asymmetric smile skewed on the DITM and ITM options side and of course the \(\mathcal {HTN}\)-NGARCH model shows more robust results of RMSE for these options than the BS model.

In addition, we compare the RMSE computed between put prices obtained with \(\mathcal {HTN}\)-NGARCH and BS model with the observed put prices compiled with Datastream.

Table 6 illustrates the RMSE in dollar losses of put options premiums obtained with \(\mathcal {HTN}\)-NGARCH model. Puts are classified by Time to Maturity versus Moneyness. Table 7 illustrates the RMSE computed with BS model. The RMSE average is weighted by the number of observations of put options.

Based on Tables 5, 6 and 7, the ability of the \(\mathcal {HTN}\)-NGARCH model to price index put options is more flagrant than for call options. With an overall RMSE average of \(14\)versus 16 for BS, we demonstrate the consistency and robustness of the \(\mathcal {HTN}\)-NGARCH model across the board. This consistency is underpinned by the fact that the samples of innovations R generated by the \(\mathcal {HTN}\)-NGARCH are identical for call and put options. The smile of volatility represented in Fig. 2 is clearly skewed on the side of DOTM and OTM put options. These DOTM and OTM put options are the ones accurately priced by the \(\mathcal {HTN}\)-NGARCH model whereas its benchmark BS model lacks accuracy.

5 Conclusion

The \(\mathcal {HTN}\)-NGARCH model is applied to the pricing of European index options trading on the Chicago Mercantile Exchange. Since index option prices are particularly sensitive to the smirk of volatility, the main challenge of index option pricing is to model the smirk. We adopted the so-called \(\mathcal {HTN}\)-NGARCH model structure for the evolution captures the most important stylized facts observed in financial time series such as conditional skewness, kurtosis, leverage effect and volatility clustering. Once calibrated with daily financial data, the distribution generates random numbers that feed a plain Monte Carlo simulation model to price S &P 500 index options. We benchmark our model to BS models. We reveal the propensity of the \(\mathcal {HTN}\) distribution at pricing index options and at modeling the smirk of volatility. The \(\mathcal {HTN}\)-NGARCH model may be seen as a model coming after the stochastic volatility and the GARCH models which have improved the seminal BS-Merton model Black and Scholes 1973. Further research will explore applications of the \(\mathcal {HTN}\)-NGARCH models to the pricing of other contingent claims related to distinct financial markets such as bonds or foreign exchange which have unique dynamics in their conditional moments.

References

Amin, K. I., & Ng, V. K. (1993). Option valuation with systematic stochastic volatility. Journal of Finance, 48(3), 881–910.

Arnold, B. C., Beaver, R. J., Groeneveld, R. A., et al. (1993). The non- truncated marginal of a truncated bivariate normal distribution. Psychometrika, 58, 471–8.

Arnold, B. C., & Gomez, H. W. (2009). Hidden truncation and additive components: Two alternative skewing paradigms. Calcutta Statistical Association Bulletin, 61, 241–244.

Azzalini, A. (1985). A class of distributions which includes the normal ones. Scandinavian Journal of Statistics, 12, 171–8.

Azzalini, A., & Dalla Valle, A. (1996). The multivariate skew-normal distribution. Biometrika, 83, 715–726.

Bakshi, G., Cao, C., & Chen, Z. (2012). Empirical performance of alternative option pricing models. Journal of Finance, 52, 2003–49.

Bakshi, G., Carr, P., & Wu, L. (2006). Stochastic risk premiums, stochastic skewness in currency options, and stochastic discount factors in international economies. Journal of Financial Economics, 87, 132–56.

Barndorff-Nielsen, O., & Shephard, N. (2001). Non-Gaussian Ornstein-Uhlenbeck based models and some of their uses in financial economics. Journal of the Royal Statistical Society- Series B, 63, 167–241.

Bates, D. (2000). Post-87 Crash Fears in the S &P 500 Futures Option Market. Journal of Econometrics, 94, 181–238.

Bates, D. (2003). Empirical option pricing: A retrospection. Journal of Econometrics, 116, 387–404.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(6), 37–654.

Black, F. (1976) Studies of Stock Market Volatility Changes, In Proceedings of the American Statistical Association, Business and Economic Statistics Section, 177-181.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307–27.

Carr, P., & Wu, L. (2007). Stochastic skew in currency options. Journal of Financial Economics, 86, 213–47.

Christoffersen, P., Elkamhi, R., Feunou, B., et al. (2010a). Option valuation with conditional heteroskedasticity and non-normality. Review of Financial Studies, 23, 2139–2183.

Christoffersen, P., Heston, S., & Jacobs, K. (2006). Option valuation with conditional skewness. Journal of Econometrics, 131, 253–84.

Christoffersen, P., & Jacobs, K. (2004). Which GARCH model for option valuation? Management Science, 50, 1204–1221.

Christoffersen, P., Jacobs, K., Dorion, C., et al. (2010b). Volatility components, affine restrictions and non-normal innovations. Journal of Business and Economic Statistics, 28, 483–502.

Christoffersen, P., Jacobs, K., Ornthanalai, C., et al. (2008). Option valuation with long-run and short-run volatility components. Journal of Financial Economics, 90, 272–97.

Durham, G. (2007). SV mixture models with application to S &P 500 index returns. Journal of Financial Economics, 85, 822–56.

Duan, J. (1995). The GARCH option pricing model. Mathematical Finance, 5, 13–32.

Duan, J. (1999). Conditionally fat-tailed distributions and the volatility smile in options. Hong Kong University of Science and Technology.

Duan, J., Ritchken, C. P., & Sun, Z. (2006). Approximating GARCH-jump models, jump-diffusion process, and option pricing. Mathematical Finance, 16(1), 21–52.

Engle, R. F., & Ng, G. (1993). Measuring and testing the impact of news on volatility. Journal of Finance, 48, 1749–78.

Eraker, B. (2004). Do stock prices and volatility jump? reconciling evidence from spot and option prices. Journal of Finance, 59, 1367–1403.

Frühwirth-Schnatter, S. (2006). Finite mixture and markov switching models. New York: Springer.

Henze, N. (1986). A probabilistic representation of the skew-normal distribution. Scandinavian Journal of Statistics, 13, 271–275.

Hsieh, K. C., & Ritchken, P. (2005). An Empirical Comparison of GARCH Option Pricing Models. Review of Derivatives Research, 8, 129–50.

Heston, S. L., & Nandi, S. (2000). A closed-Form GARCH option valuation model. Review of Financial Studies, 13(3), 585–625.

Hull, J., & White, A. (1987). The pricing of options on assets with stochastic volatilities. Journal of Finance, 42(2), 281–300.

Johnson, H., & Shanno, D. (1987). Option pricing when the variance is changing. Journal of Financial and Quantitative Analysis, 22(2), 143–51.

Nocedal, J. , & Wright S.(2006) Numerical Optimization. Springer Series in Operations Research and Financial Engineering) 2nd Edn.

McLachlan, G., & Peel, D. (2000). Finite mixture models. New York: Wiley Interscience.

Merton, R. C. (1973). Theory of rational option pricing. Bell Journal of Economics and Management Science, 4(1), 141–83.

Nandi, S., ( 1996) Pricing and hedging index options under stochastic volatility: An empirical examination, Federal Reserve Bank of Atlanta, 96-99.

Pan, J. (2002). The jump-risk premia implicit in options: Evidence from an integrated time series study. Journal of Financial Economics, 63, 3–50.

Rombouts, J., & Stentoft, L. (2010). Option pricing with asymmetric heteroskedastic normal mixture models. CREATES, 44, 1–48.

Rombouts, J., & Stentoft, L. (2014). Bayesian option pricing using mixed normal heteroskedasticity model. Computational Statistics & Data Analysis, 76, 588−605.

Scott, L. O. (1987). Option pricing when the variance changes randomly: Theory, estimation, and an application. Journal of Financial and Quantitative Analysis, 22(4), 419–438.

Stein, E. M., & Stein, J. C. (1991). Stock price distributions with stochastic volatility: An analytical approach. Review of Financial Studies, 4(4), 727–52.

Stentoft, L. (2008). American option pricing using GARCH models and the normal inverse gaussian distribution. Journal of Financial Econometrics, 6(4), 540–82.

Wiggins, J. B. (1987). Option values under stochastic volatility: Theory and empirical estimates. Journal of Financial Economics, 19, 351–72.

Zhang, M., & Zheng, X. (2023). Numerical approximation to a variable-order time-fractional Black–Scholes model with applications in option pricing. Computational Economics, 62, 1155–1175.

Funding

The authors have not disclosed any funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflcit of interest

The authors declare that they have no conflcit of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Belhachemi, R. Option Valuation with Conditional Heteroskedastic Hidden Truncation Models. Comput Econ 63, 2585–2601 (2024). https://doi.org/10.1007/s10614-023-10480-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-023-10480-6