Abstract

The US Federal Reserve has been using quantitative easing as an unconventional monetary policy tool for providing liquidity and credit-market facilities to banks, and undertaking large-scale asset purchases in periods of crisis. This study carefully examines whether the US stock market has been responsive to the use of quantitative easing over time. A major contribution of this study to the extant literature is the introduction of the novel rolling windows nonparametric causality-in-quantiles approach to studying the reaction of the stock market to quantitative easing. This approach provides a means of investigating the time-varying causality between the variables across quantiles. The standard nonparametric causality-in-quantiles test results show that stock market performance is significantly predicted by quantitative easing, except at very low and very high levels of stock returns (volatility). The rolling windows nonparametric causality-in-quantiles test results indicate that the causal effect of quantitative easing on stock market volatility and returns becomes pronounced during periods of crisis. The reactions are most significant in periods corresponding to the Asian financial crisis, the global financial crisis and the COVID-19 pandemic outbreak. Overall, the causal effect of quantitative easing on both stock market returns and volatility changes through time; the effect on stock market returns is also greater than on stock market volatility.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In times of crisis or economic depression, an expansionary monetary policy may be required to boost economic activity and stabilize financial markets. A conventional monetary policy may be limited in performing this function. Thus, the central bank must utilize the non-conventional monetary policy called quantitative easing (QE), whereby it makes purchases of large-scale assets. This study postulates that the stock market is not independent of the quantitative easing policy implemented at certain times. It also postulates that the nature of the stock market’s response to quantitative easing is relative to structural changes. There are different economic reasons for implementing quantitative easing at different times; this dictates different patterns of uncertainty and the pattern of reaction that market participants would yield to the monetary policy. For instance, all four different forms of quantitative easing executed in the USA between 2008 and 2020 were not for the same purpose, neither did they achieve the same level of effectiveness. It is on this premise that an assumption that the response of stock markets to quantitative easing does not change over time is considered insufficient due to the structural changes that may influence investors’ decisions at different times. The study therefore aims to show the significant difference in the stock market’s reaction to quantitative easing across different quantiles through the development of a rolling windows nonparametric causality-in-quantiles approach.

The Federal Bank (Fed) of the United States of America (USA) has employed quantitative easing to address a series of economic problems created during critical periods (see Pastpipatkul et al., 2016). An example of such periods in which quantitative easing was employed was in the last quarter of 2008 till the third quarter of 2009 (Ricketts, 2011). This was implemented in response to the global financial crisis. Another round of quantitative easing was introduced in the last quarter of 2010 because the previous round did not achieve the targeted goal for economic improvement. In the third quarter of 2012, quantitative easing was again employed in response to the slow economic performance.Footnote 1 The most recent use of quantitative easing occurred in the year 2020, following the economic effects of the Coronavirus disease 2019 (COVID-19) pandemic. More central banks have also considered quantitative easing after the global financial crisis (Dahlhaus et al., 2014).

There are now controversies over the aggressive implementation of monetary policies (Hudepohl et al., 2021; Huston & Spencer, 2016, 2018). Although quantitative easing aims to boost the economy, it is transmitted through asset prices and portfolio effects (Benford et al., 2009). While it may have its economic benefits, such as GDP growth and unemployment reduction, it also has inadvertent consequences (Pastpipatkul et al., 2016). This is on the account that the financial liquidity provided by the outstanding increase in the number of assets sold can lead to asset price bubbles which result from explosive increases in asset prices (Huston & Spencer, 2018). While quantitative easing elicits investors’ confidence, it could also lead to irrational exuberance (Lima et al., 2016), overheating and inflated prices (Hudepohl et al., 2021). These are unfavorable to financial markets and their stability. Significant market volatility may emerge, leading to a worse impact on the financial markets and the general economy (Akinmade et al., 2020). As quantitative easing is aimed at improving economic conditions, an understanding of how the stock market responds to quantitative easing over time, particularly during critical periods, is vital. This is central to achieving a more stable financial market while stimulating the economy at the same time.

Several theoretical channels of transmitting quantitative easing policy to financial markets have been discussed in the literature (Benford et al., 2009; Bernanke, 2012; Bhar et al., 2015; Joyce et al., 2011a, 2020; Krishnamurthy & Vissing-Jorgensen, 2011; Nozawa & Qiu, 2021; Pastpipatkul et al., 2015a; Stefański, 2022). For instance, Joyce et al. (2020) build their framework on three main channels—macro/policy news, portfolio balance and liquidity premia. Stefański (2022) submits that the quantitative easing effects pass through the bank lending channel, price channel, portfolio rebalancing channel and signaling channel to the financial markets.

The bank lending channel becomes open through the increasing prices of assets purchased and the increasing volume of central bank reserves held in bank assets (Rodnyansk & Darmouni, 2017; Stefański, 2022). In other words, the Fed expands its balance sheet assets through quantitative easing as it purchases assets; this leads to reserves accretion in the commercial banks (Mishra et al., 2020). The commercial banks’ high level of liquidity induces bank lending and then economic growth activity, which in turn leads to stock market liquidity (Friedman, 1988; Rodnyansky & Darmouni, 2017). According to Stefański (2022), asset demand is increased through the price channel; however, the market supply of assets is limited. The gap between asset demand and supply would increase the market prices of purchased assets (see also D'Amico & King, 2013).

The portfolio rebalancing channel, according to Christensen and Krogstrup (2019), arises from the price channel. Through the portfolio rebalancing channel, as quantitative easing causes equity prices to increase, investors can rebalance their portfolios to include more equities. The decline in expected returns on assets purchased causes rational investors to gravitate towards the more attractive assets with rising prices (Joyce et al., 2011a; Stefański, 2022). Bernanke (2012) and Barbon and Gianinazzi (2019) opine that the portfolio balance proposed by Tobin (1969) naturally explains the quantitative easing transmission channels.

The signaling channel is perceived by how the quantitative easing policy announcement influences investors’ expectations. The increasing demand for assets sends a signal of future economic conditions amidst a loose monetary policy that leads to lower interest rates (Christensen & Rudebusch, 2012; Joyce et al., 2011a). Thus, information and economic indicators determine interest rates through changing market expectations (Stefański, 2022).

Joyce et al. (2010) also note that the transmission mechanisms described above may be bound by long lags. Sometimes, portfolio flows and stock price responses may not be swift because decision-making and portfolio reallocation may be slow if liquidity is limited (Mamaysky, 2018). Furthermore, according to the behavioral assumption of Tobin (1969), wealth allocation and accumulation decisions of portfolio holders are independent of each other. People decide how much wealth they hold and how to distribute their portfolios. Hamilton and Wu (2012) argue that preferred habitat investors are rational investors who would demand assets that have the most attractive returns. As these investors shift to other assets which offer higher yields, this would also push up the prices of the other assets (Benford et al., 2009). However, by the nature of arbitrageurs, exchange is based on a simple trade-off between risk and expected returns (Hamilton & Wu, 2012). Therefore, the stock market responds to quantitative easing based on the nature of market participants and market efficiency.

The portfolio rebalancing channel creates an impact that can be persistent and sustained over time because investors take time to adjust their portfolios (Joyce et al., 2010). According to the theory of rational inattention by Sims (2003), the limited capacity of market players to process all available information also influences their decisions. By implication, it may sometimes take investors some time to interpret the implications of the Fed’s action, thereby resulting in a different market response from one time to another. Since investors’ expectations are influenced through the signaling channel, the changing expectations about future economic conditions influence their willingness to undertake risks at different times.

Since it cannot be assumed that the reaction of stock market to quantitative easing does not change over time, the instabilities induced by structural changes need to be observed. To this end, this study looks beyond the nonparametric causality-in-quantiles approach proposed by Balcilar et al. (2018) to develop the nonparametric causality-in-quantiles test via the rolling windows (or sub-samples). By the rolling windows approach, an investigation of the time-varying causality at various quantiles is made possible. This new method accounts for the instability that occurs as the coefficients of the variables change over time, thereby establishing that the causal relationship that exists between quantitative easing and the stock market changes over time. This study focuses on the USA’s stock market due to its dominant position among the global stock markets. Apart from being the richest and most influential economy in the world, the USA hosts the two largest stock exchanges in the world. The New York Stock Exchange (NYSE) has the highest market capitalization and share trading volume. This is followed by the National Association of Securities Dealers Automated Quotations (NASDAQ) Stock Exchange which has the second largest market capitalization in the world.Footnote 2 Therefore, the largest fraction of global investors is more concerned about the USA’s monetary policy action. This makes the USA’s stock market a key player in the global economy. This is significant because the effects of these investors’ behavior can be easily transmitted to other markets across the globe.

This study contributes to the literature by showing that the USA’s stock market does not react to quantitative easing the same way across different time periods through the application of a nonparametric causality-in-quantiles test via the rolling windows developed for this study. On this basis, the prediction of investors’ confidence and asset allocation during good or bad times are subject to the changing structure of the economy at that time. This sheds light on how market performance at different times may have varying effects on the aggregate propensity to save and invest, and thus, the national income. This study creates a pathway to understanding the effectiveness of quantitative easing on the general economy because the response of financial markets to quantitative easing at different time periods reveals the direct impact of quantitative easing on the economy per time.

The paper is planned as follows. Section 1 reviews channels whereby quantitative easing might influence the stock market. Section 2 reviews the empirical literature on the quantitative easing and stock market relationship, thereby revealing how this study contributes to the existing literature. Section 3 provides the details of the methodology for obtaining the time-varying relationship via the rolling windows. Section 4 presents the data set assembled for the study. Section 5 presents the analysis of the estimated equation and the discussion of its market and economic implications. Section 6 offers the conclusion, a general summary and a result-based recommendation.

2 Literature Review

A remarkable number of studies, such as Jensen et al. (1996), Patelis (1997), Thorbecke (1997), Rigobon and Sack (2004), Bernanke and Kuttner (2005) and Bjørnland and Leitemo (2009), provide explanations for the stock market’s reaction to changes in monetary policy. There is an increasing interest in exploring the magnitude of the diverse impacts of unconventional monetary policies in academia and among policymakers. Joyce et al. (2011b) provide evidence showing that quantitative easing has had significant effects on the economy at large, and particularly on the financial markets. One strand of the literature investigates the response of macroeconomic variables to quantitative easing policy (Dahlhaus et al., 2014, 2018; Hohberger et al., 2019; Lenza & Slacalek, 2018; Lin et al., 2018; Stefański, 2022). Balatti et al. (2016), Lin et al. (2018) and Stefański (2022) show that quantitative easing policy has a significant impact on stock markets among other macroeconomic variables. The outstanding decline in stock market volatility and significant increase in stock prices are indications of the non-negligible impact of quantitative easing on financial variables (Balatti et al., 2016). Stock markets also outperform other financial instruments, suggesting the deep role of capital markets in the economy (Stefański, 2022).

There is empirical evidence of the extended effects of quantitative easing operations beyond the target primary markets. Different methodologies have been used to measure the international spillover effects of the USA’s quantitative easing on other economies (Bhattarai et al., 2021; Meszaros & Olson, 2020; Pastpipatkul et al., 2015b) and on financial variables in other countries (Bouraoui, 2015; Pastpipatkul et al., 2015a, 2016). Pastpipatkul et al. (2015b) use the Bayesian Markov-switching vector autoregression (VAR) model, while Pastpipatkul et al. (2016) use the Markov-switching VAR model. Shogbuyi and Steeley (2017) employ the multivariate generalized autoregressive conditional heteroskedasticity (GARCH) estimation technique. Bhattarai et al. (2021) employ a Bayesian panel VAR, while Dahlhaus et al. (2014) employ a factor-augmented vector autoregression (FAVAR) model. Barroso et al. (2016) propose a new ‘channel identification’ method to test for abnormalities in the domestic variables during quantitative easing episodes. All of these studies find that the USA’s quantitative easing is fundamental as it caused a stock market boom in other economies. However, using a VAR model, Meszaros and Olson (2020) do not find any significant effect of USA’s quantitative easing on the South African stock market index and other variables examined.

Another strand of the literature shows how financial market variables react to quantitative easing in the same country (Christensen & Krogstrup, 2019; Joyce et al., 2010, 2011a; Matousek et al., 2019). Others examine the response of financial variables to quantitative easing during critical periods and events, such as the global financial crisis (Bhar et al., 2015; Mishra et al., 2020) and the COVID-19 pandemic (Aloui, 2021; Jelilov et al., 2020; Nozawa & Qiu, 2021). Quantitative easing policies are found to have a causal effect on equity prices in the study by Beck et al. (2019). Joyce et al. (2020) opine that quantitative easing policy brought about the recovery of UK asset prices, and thus significantly impacts the financial markets. Bhar et al. (2015) also link the USA’s stock market recovery after the financial crisis of 2007–09 to the quantitative easing undertaken at that time. Chortareas et al. (2019) provide evidence from an event-study framework that quantitative easing has a significant impact on UK stock market returns and volatility. Low-frequency data and VAR techniques show how quantitative easing generated an increase in equity prices (Huston & Spencer, 2016). With the use of Campbell–Shiller and generalized supremum augmented Dickey Fuller techniques, Huston and Spencer (2018) find evidence that stock prices were overvalued sequel to quantitative easing but with little indication of price bubbles.

Most related to this study are those studies that identify the variations in reactions of the stock market to quantitative easing over different time periods. Lima et al. (2016) focus only on the period after the subprime crisis (2008–2014) by employing the autoregressive distributed lag (ARDL) approach in probing the effects of quantitative easing on the stock markets of the USA, the UK and Japan.

There are shreds of evidence of the positive effects of quantitative easing on stock market indices within this period. A time-varying coefficient VAR model by Miyakoshi et al. (2017) reveals how quantitative easing policies in the United States, the European Union and Japan increased the stock prices of eight Asian emerging markets. The diverse effects of quantitative easing policies across different time periods were transmitted through financial integration and interest rate differentials. A non-linear assessment of the Japanese stock market by Nakazono and Ikeda (2016) shows that market response during recession differs from what is obtained during boom periods. Although the authors do not find a significant reaction of the stock market under quantitative easing as expected, they find a negative reaction, signifying a positive reaction to a contractionary policy. Mishra et al. (2020) observe an inconsistent impact of quantitative easing on stock market liquidity across different periods. While quantitative easing increased stock market liquidity in its first period, it was not effective in the subsequent periods. This is attributed to substantial excess reserves in the first period, which already led to asset developments. Mamaysky (2018) shows that both equity price and its implied volatility respond to quantitative easing; the reaction of equity markets begins a day prior to its announcement and continues for several weeks following the quantitative easing announcement.

Likewise, the impacts of quantitative easing policies and announcements on stock market volatility in countries with mature financial markets among the Central and Eastern Europe (CEE) economies are serious, especially on the day following the announcement (Albu et al., 2016). Hudepohl et al. (2021) also use the generalized supremum augmented Dickey Fuller test (GSADF) on a panel of ten Euro area stock markets and assess the persistence of bubbles over time through the dynamic probit model. Stock prices of most countries experience an exuberant increase in response to anticipation, announcement and the start of the quantitative easing. Observing the high-frequency changes in the USA’s stock market’s response to scheduled quantitative easing, Corbet et al. (2019) use GARCH and exponential GARCH (E-GARCH) models to show that stock market volatility peaks immediately after the announcement of quantitative easing. Although market returns increase, markets are seen to be more volatile in response to premonitions, while unexpected announcements only cause short-term volatility. However, the effects of quantitative easing on the domestic stock prices in Japan are positive and persistent, as found in a study by Barbon and Gianinazzi (2019).

There may be diversity in the magnitudes of the impact of quantitative easing on stock markets, but there is a consensus about the direction of the relationship between the two. There is however a substantial gap in the literature regarding the time-varying relationship between quantitative easing and the stock market, particularly at various quantiles. Due to the establishment of inconsistency in stock market response to quantitative easing at different periods, new methodologies are required to measure the magnitude of this variation. This study develops a new method for this measure that accounts for the structural changes.

3 Methodology

The conventional approach to detecting causality in financial analysis is the Granger (1969) causality test that generally indicates whether one variable predicts the other. A limitation of this approach, however, is that it focuses only on the conditional mean. The findings associated with the conditional mean are not very meaningful if the distributions of variables are non-elliptic or fat-tailed as is the case with several financial series (Balcilar et al., 2018). Moreover, tail area causal relations may differ significantly from causal relations at the center of the distribution (see Lee & Yang, 2012). As such, Granger causality outcomes might be misleading if causal relations can only be found in specific regions of the conditional joint distribution of the variables.

To deal with this challenge, Lee and Yang (2012) introduced the linear Granger test in quantile, which is capable of detecting causal relations in the tails of the conditional distribution. However, its inability to detect non-linear causal relations is also a problem, especially with financial variables such as in this study that often display non-linearity in the tails of the distribution. Nishiyama et al. (2011) thus introduced the non-linear nonparametric Granger causality tests to solve this problem. Jeong et al. (2012) further proposed a nonparametric test of Granger causality in quantile based on the kernel density method to address the issues of non-linearity and causality in the quantiles. Additional improvements to the methodology was made by Balcilar et al. (2018). The authors introduced an approach capable of detecting not only non-linear causalities in conditional mean and variance, but also the asymmetries of causalities under extreme market conditions (bullish vs. bearish states). This approach is thus preferred for our study, albeit with further improvements.

The nonparametric causality-in-quantiles test proposed by Balcilar et al. (2018) to detect non-linear causality is a hybrid approach and considers extreme values of the data series.Footnote 31 It combines the non-linear causality of k-th order approach of Nishiyama et al. (2011) and the causality-in-quantiles approach of Jeong et al. (2012).

In this section, \({QE}_{t}\) is denoted as the quantitative easing and \({r}_{t}\) as the returns. Also, \({R}_{t-1}\equiv {(r}_{t-1},\dots ,{r}_{t-p})\), \({QE}_{t-1}\equiv {(qe}_{t-1},\dots ,{qe}_{t-p})\), \({X}_{t}=\left({QE}_{t},{R}_{t}\right)\) and \(F_{{r_{t\left| \cdot \right.} }} \left( {r_{t} {|} \cdot } \right)\) are denoted as the conditional distribution of \({r}_{t}\) given as \(\cdot\). Defining \({Q}_{\theta }{(X}_{t-1})\equiv {Q}_{\theta }\left({r}_{t}|{X}_{t-1}\right)\) and \({Q}_{\theta }{(R}_{t-1})\equiv {Q}_{\theta }\left({r}_{t}|{R}_{t-1}\right)\) gives \({F}_{{r}_{t}\left|{X}_{t-1}\right.}\left\{{Q}_{\theta }{(X}_{t-1})\left|{X}_{t-1}\right.\right\}=\theta\) with probability one. According to Jeong et al. (2012), the null hypothesis of this study that \({QE}_{t}\) has no causal effect on \({r}_{t}\) in the \(\theta\)-th quantile can be tested with the alternative hypothesis as follows:

According to Jeong et al. (2012), the feasible kernel-based test statistics can be written as follows:

In Eq. (3), \(K\left( \cdot \right)\) is the kernel function with bandwidth h, T is the sample size, p is the lag order, and \({\widehat{\varepsilon }}_{t}=1\left\{{r}_{t}\le {\widehat{Q}}_{\theta }({R}_{t-1})\right\}-\theta\) is the regression error, where \({\widehat{Q}}_{\theta }\left({R}_{t-1}\right)\) is an estimate of the \(\theta\)th conditional quantile and \(1\left\{ \cdot \right\}\) is the indicator function. The Nadarya-Watson kernel estimator of \({\widehat{Q}}_{\theta }\left({R}_{t-1}\right)\) can be written as follows:

where \(L\left( \cdot \right)\) is the kernel function.

Since the method of Jeong et al. (2012) investigates causality only in the first moment, it was extended by Balcilar et al. (2018) with the method of Nishiyama et al. (2011) to investigate not only causality in first moments but also in second or higher moments. With the extension of Balcilar et al. (2018), the null hypothesis that \({QE}_{t}\) has no causal effect on \({r}_{t}\) in the \(\theta\)th quantile up to \(M\)-th moment can be tested with the alternative hypothesis as follows:

The approach of Balcilar et al. (2018) gives an opportunity to investigate the (non)causality in the \(\theta\)-th quantile only in mean (\(first moment, i.e., m=1\)) or variance (\(second moment, i.e., m=2\)) as well as the (non)causality in the mean and variance (\(m=1 and 2\)) successively. In sum, this approach calculates volatility by squaring returns.

As with many methods in the literature, the nonparametric causality-in-quantiles approach assumes that the causal relationship between the variables does not change over time. However, structural changes violate this assumption. As pointed out by Granger (1996), structural instability in data series is one of the common problems. According to Balcilar et al. (2010), structural changes may create shifts in the parameters, and the pattern of the causal relationship may change over time. To determine structural changes beforehand and incorporate them into the estimation, various methods such as sample splitting and the use of dummy variables can be used. However, these methods are prone to pre-test bias (Li et al., 2016). To overcome the aforementioned problems, the nonparametric causality-in-quantiles test via the rolling windows (or sub-samples) approachFootnote 42 was developed. To do this, the nonparametric causality-in-quantiles test is employed and test statistics for each window calculated instead of estimating a single causality test for full sample. Using test statistics of each window, the null (alternative) hypothesis that \(QE\) has no (has) causal effect on \(r\) in the \(\theta\)th quantile up to \(M\)th moment in Eqs. (5) and (6) for every window and quantile can be tested. In this way, the new hybrid approach, which is the rolling windows nonparametric causality-in-quantiles, allows the investigation of time-varying causality at various quantiles.

Finally, it should be noted that the empirical practice of the traditional nonparametric causality-in-quantiles approach requires determining the bandwidth, lag order and kernel types, and therefore, these values also need to be determined for each window of the rolling windows nonparametric causality-in-quantiles approach. Following Balcilar et al. (2021), the Schwarz information criterion (SIC), the leave-one-out least-squares cross validation method proposed by Racine and Li (2004) and Li and Racine (2004), and Gaussian kernels approaches are used to obtain optimal lag orders, bandwidths and kernel types for each window, respectively. It should also be noted that since the sub-samples of rolling windows approaches usually consist of relatively small sample size (in this study, 48, 60, and 72), 10% is preferred as the significance level, following the paper of Rahman et al. (2019).

4 Data

In this study, to empirically investigate stock market response to quantitative easing (QE), monthly time series data spanning 1984:M01 to 2022:M06 is used. The extent to which quantitative easing is employed is proxied by the size of the Fed’s balance sheet over the period sampled. Quantitative easing requires lowering the interest rate target to near-zero as well as acquiring large quantities of treasury bonds and mortgage-backed securities through the injection of reserves into the banking system. The outcome of these actions is reflected in the size of the balance sheet. This sort of balance sheet expansion is therefore used as a measure of quantitative easing. The NASDAQ Composite, S&P500 and RUSSELL 2000 indices, on the other hand, are used as measures of stock market performance over the sample period.

Since balance sheet size data is available on a quarterly frequency, quarterly data is first acquired from the balance sheet and the stock market indices and then converted to monthly data to obtain high-frequency data. To do this, similar to Shahbaz et al., (2018, 2021), the match-sum quadratic method is used, which automatically takes into account seasonal changes in the raw data while transforming quarterly data into monthly data in order to reach a sufficient number of observations for econometric analysis with the quadratic-match technique. This technique fits a local quadratic polynomial for each observation in the low frequency series which is then used to in fill the observations in the high frequency series for the particular period. The formula in Eq. (7) is used to obtain returns series of stock market indices and growth rate series of QE.

where \(ln\) denotes the natural logarithm, \({V}_{t}\) the value at time \(t\), and \({V}_{t-1}\) the value at time \(t-1\).

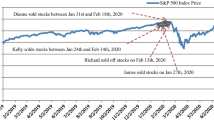

Level and percentage returns/growth rate data of QE and stock market indices are plotted in Fig. 1. When the graphs in Fig. 1 are examined, a rising trend is observed in the level data of both QE and stock market indices throughout the sample period. It is also seen that both returns and growth rate series fluctuate throughout the sample period and returns series have larger fluctuations than growth rate series.

The descriptive statistics of the data series are summarized in Table 1. The returns series of stock market indices have higher mean and standard deviation values than the growth rate series of QE. Growth rate series are positively skewed, while returns series are negatively skewed with excess kurtosis, indicating non-normal distributions for both series. The Jarque–Bera test statistics also demonstrate non-normality by rejecting the null hypothesis of normality at the 1% significance level. For stationarity, the augmented Dickey-Fuller (Dickey & Fuller, 1979) and Phillips and Perron (Phillips & Perron, 1988) unit root tests are employed, indicating that both returns and growth rate series are stationary during the sample period at the 1% significance level.

To detect (non)linearity in data series, the BDS test of Broock et al. (1996) is employed, with the outcomes presented in Table 2. Results show that the null hypothesis of linearity is rejected at the 1% significance level for both growth rate and returns series. This means that non-linearity exists in both series across embedded dimensions (m = 1 to m = 6).

The non-normality and non-linearity characteristics of the data series indicate that the nonparametric causality-in-quantiles test is suitable for this study.

5 Empirical Results

5.1 Full Sample Results

Since the nonparametric causality-in-quantiles approach includes model-free estimates of volatility of returns series using squared returns, the causal effect of quantitative easing (QE) on the stock market is examined through both returns and volatility series. Before the rolling windows nonparametric causality-in-quantiles test results are reported, for the sake of comparability, the standard nonparametric causality-in-quantiles test results are first presented. Figures 2 and 3 illustrate the nonparametric causality-in-quantiles test outputs for returns and volatility series, respectively. The graphs show that the null hypothesis of no causality is rejected for both returns and volatility series for the quantile range of 0.15 to 0.80, indicating that QE has a causal effect on the returns and volatilities of stock market indices for these quantiles. These findings generally align with the claims of Bhar et al. (2015), Joyce et al. (2020) and Karagiannopoulou et al. (2022).

Nonparametric causality-in-quantiles test outputs for returns series. Note The horizontal line represents 1.645, which is the critical value of the 10% significance level. Lines above (below) the horizontal line indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile. The distributions of the test outputs are provided in Fig. 10

Nonparametric causality-in-quantiles test outputs for volatility series. Note The horizontal line represents 1.645, which is the critical value of the 10% significance level. Lines above (below) the horizontal line indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile. The distributions of the test outputs are provided in Fig. 11

5.2 Rolling Windows Results

To investigate the time-varying causal effect of quantitative easing on the stock market, the rolling windows nonparametric causality-in-quantiles test is applied with a fixed window size of 60. Figures 4 and 5 show the rolling windows nonparametric causality-in-quantiles test outputs for returns and volatility series, respectively. At first glance, the null hypothesis that quantitative easing has no causal effect on stock market returns (volatility) is rejected for some quantiles and periods. The causal effect of quantitative easing on stock market volatility is observed especially during global financial crisis periods. On the other hand, the causal effect of quantitative easing on stock market returns is observed, especially during the Asian financial crisis, global financial crisis and COVID-19 periods. In general, the causal effect of quantitative easing on both stock market returns and volatility changes through time and the effect of quantitative easing on stock market returns is greater than on stock market volatility.

Rolling windows nonparametric causality-in-quantiles test outputs for returns series. Note The horizontal rectangle represents 1.645, which is the critical value of the 10% significance level. Areas above (below) the horizontal rectangle indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile and date. Window size is 60. The distributions of the test outputs for each quantile are provided in Fig. 12

Rolling windows nonparametric causality-in-quantiles test outputs for volatility series. Note The horizontal rectangle represents 1.645, which is the critical value of the 10% significance level. Areas above (below) the horizontal rectangle indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile and date. Window size is 60. The distributions of the test outputs for each quantile are provided in Fig. 13

5.3 Robustness Test Results

To check for robustness, the sensitivity of the results to the selection of rolling window sizes is examined by repeating the analysis using different window sizes i.e., 48 and 72. The rolling windows nonparametric causality-in-quantiles test is plotted with a fixed window size of 48 and 72 in Figs. 6, 7, 8 and 9, respectively. The graphs clearly demonstrate that the time-varying causal effect of quantitative easing on stock market is not changed significantly by the selected rolling window size, thus validating the findings of the initial empirical analysis.

Rolling windows nonparametric causality-in-quantiles test outputs for returns series. Note The horizontal rectangle represents 1.645, which is the critical value of the 10% significance level. Areas above (below) the horizontal rectangle indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile and date. Window size is 48. The distributions of the test outputs for each quantile are provided in Fig. 14

Rolling windows nonparametric causality-in-quantiles test outputs for volatility series. Note The horizontal rectangle represents 1.645, which is the critical value of the 10% significance level. Areas above (below) the horizontal rectangle indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile and date. Window size is 48. The distributions of the test outputs for each quantile are provided in Fig. 15

Rolling windows nonparametric causality-in-quantiles test outputs for returns series. Note The horizontal rectangle represents 1.645, which is the critical value of the 10% significance level. Areas above (below) the horizontal rectangle indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile and date. Window size is 72. The distributions of the test outputs for each quantile are provided in Fig. 16

Rolling windows nonparametric causality-in-quantiles test outputs for volatility series. Note The horizontal rectangle represents 1.645, which is the critical value of the 10% significance level. Areas above (below) the horizontal rectangle indicate the rejection (non-rejection) of the null hypothesis of no causality for a specific quantile and date. Window size is 72. The distributions of the test outputs for each quantile are provided in Fig. 17

6 Conclusion and Policy Recommendation

In an attempt to bring under control the recession that resulted from the 2007 global financial crisis, the US Federal Reserve introduced quantitative easing as a means to stabilize and inject liquidity into the financial markets. Since then, quantitative easing has been in use as an unconventional monetary policy tool for providing liquidity and credit-market facilities to banks and undertaking large-scale asset purchases. This study carefully examines whether the US stock market has been responsive to the use of quantitative easing over time.

A major contribution of this study to extant literature is that a novel approach—rolling windows nonparametric causality-in-quantiles—is introduced to study the reaction of the stock market to quantitative easing. This new method helps to account for the changes that occur in the causal relationship that may exist between quantitative easing and the stock market. An investigation of the time-varying causality at various quantiles is made possible by this approach.

The results obtained indicate that stock performance is significantly predicted by quantitative easing, except at very low and very high levels of stock returns (volatility). To investigate the time-varying causal effect of quantitative easing on the stock market, the rolling windows nonparametric causality-in-quantiles test is again applied. It is found that the causal effect of quantitative easing on stock market volatility becomes pronounced during periods of crisis. The reactions were most significant in periods corresponding to the Asian financial crisis, the global financial crisis and the COVID-19 pandemic outbreak. These periods coincide with the periods during which quantitative easing was massively employed. In general, the causal effect of quantitative easing on both stock market returns and volatility changes through time and the effect of quantitative easing on stock market returns is greater than on stock market volatility.

The study shows that one of the important economic effects of quantitative easing occurs in the stock market. Quantitative easing has the ability to stimulate volatility in the stock market as well as cause changes in stock returns in the United States. Stock prices should be expected to rise and fall in response to the adoption of quantitative easing. İnterest rates reduce in response to quantitative easing. This in turn reduces the returns that savers and investors receive on relatively riskless investment vehicles. To receive stronger returns, savers and investors are thus tempted to consider relatively riskier investment vehicles. Such savers/investors therefore diversify their portfolios towards stocks, causing variations in stock market performance.

On the empirical front, the study outcome confirming the causality from quantitative easing to stock performance indicates the importance of conducting Granger causality testing within a time-varying framework. With this approach, different causal relationships across different sub-samples can be identified. This provides policymakers with the required information to formulate policies that are period-specific as new data on quantitative easing and stock performance become available. It gives policymakers the opportunity to design new policies that take into consideration new events that may affect the nature of the relationship between quantitative easing and stock performance. For instance, as it is, the careful use of quantitative easing as a substitute for conventional policy is encouraged, as it is not a perfect substitute. There are potential financial market risks associated with the use of quantitative easing in the form of stock returns risk and stock market volatility risk. Quantitive easing can therefore distort market functioning and financial stability in the United States.

İt is worthy of mention that challenges associated with the frequency alignment of rolling windows is a limitation to this study. The main challenge of frequency alignment is to transform the high-dimensional mixed-frequency data and historical data into the same frequency while preserving the important features and characteristics of the original data. Frequency alignment is not always straightforward and often requires careful consideration of the specific data set and research question. Also, given the irregularities and high-frequency associated with financial data such as the ones used in this study, proper noise filtering is often required (see Chen et al., 2018, 2019; Sun et al., 2018). These are therefore issues that may affect the reliability of the results. Thus, it may be useful to revist this topic as same frequency data becomes increasingly available as well as with alternative techniques.

Notes

For more details on these, visit (1) https://americandeposits.com/history-quantitative-easing-united-states/ (2) https://www.federalreserve.gov/newsevents/pressreleases/monetary20101103a.htm (3) https://www.federalreserve.gov/newsevents/pressreleases/monetary20120913a.htm (4) https://www.statista.com/topics/6441/quantitative-easing-in-the-us/.

1 For detailed information on the nonparametric causality-in-quantiles approach, see Balcilar et al. (2018).

2 There are two important justifications for the use of the rolling windows approach; (1) it adopts the view that the causal relationship between variables changes over time, and (2) it can detect instability across different sub-samples (or windows) that arises due to structural changes.

In this study, the rolling windows approach is utilized based on fixed-size windows rolling sequentially from the beginning to the end of the full sample. More specifically, assuming every fixed-size windows consist of \(\omega\) observations, the full sample is converted to a sequence of \(T-\omega\) windows (or sub-samples), that is, \(\tau -\omega +1, \tau -\omega , \dots , T\) for \(\tau =\omega , \omega +1,\dots ,T.\)

References

Akinmade, B., Adedoyin, F. F., & Bekun, F. V. (2020). The impact of stock market manipulation on Nigeria’s economic performance. Journal of Economic Structures, 9, 1–28.

Albu, L. L., Lupu, R., & Călin, A. C. (2016). Quantıtatıve easıng, taperıng and stock market ındıces. Economic Computation & Economic Cybernetics Studies & Research, 50(3).

Aloui, D. (2021). The COVID-19 pandemic haunting the transmission of the quantitative easing to the exchange rate. Finance Research Letters, 43, 102025.

Balatti, M., Brooks, C., Clements, M. P., & Kappou, K. (2016). Did quantitative easing only inflate stock prices? Macroeconomic evidence from the US and UK. Macroeconomic Evidence from the US and UK. Available at: https://ssrn.com/abstract=2838128

Balcilar, M., Bathia, D., Demirer, R., & Gupta, R. (2021). Credit ratings and predictability of stock return dynamics of the BRICS and the PIIGS: Evidence from a nonparametric causality-in-quantiles approach. The Quarterly Review of Economics and Finance, 79, 290–302.

Balcilar, M., Gupta, R., Nguyen, D. K., & Wohar, M. E. (2018). Causal effects of the United States and Japan on Pacific-Rim stock markets: Nonparametric quantile causality approach. Applied Economics, 50(53), 5712–5727.

Balcilar, M., Ozdemir, Z. A., & Arslanturk, Y. (2010). Economic growth and energy consumption causal nexus viewed through a bootstrap rolling window. Energy Economics, 32, 1398–1410.

Barbon, A., & Gianinazzi, V. (2019). Quantitative easing and equity prices: Evidence from the ETF program of the Bank of Japan. The Review of Asset Pricing Studies, 9(2), 210–255.

Barroso, J. B. R., Da Silva, L. A. P., & Sales, A. S. (2016). Quantitative easing and related capital flows into Brazil: Measuring its effects and transmission channels through a rigorous counterfactual evaluation. Journal of International Money and Finance, 67, 102–122.

Beck, R., Duca, I., & Stracca, L. (2019). Medium term treatment and side effects of quantitative easing: International evidence. ECB Working Paper No. 2229 (2019); ISBN 978-92-899-3491-6, Available at SSRN: https://ssrn.com/abstract=3325867 or https://doi.org/10.2139/ssrn.3325867

Benford, J., Berry, S., Nikolov, K., Young, C., & Robson, M. (2009). Quantitative easing. Bank of England. Quarterly Bulletin, 49(2), 90.

Bernanke, B. S. (2012). Opening remarks: monetary policy since the onset of the crisis. In Proceedings: economic policy symposium Jackson hole (Vol. 1, p. 22).

Bernanke, B. S., & Kuttner, K. N. (2005). What explains the stock market’s reaction to Federal Reserve policy? The Journal of Finance, 60(3), 1221–1257.

Bhar, R., Malliaris, A. G., & Malliaris, M. (2015). Quantitative easing and the US stock market: A decision tree analysis. Review of Economic Analysis, 7(2), 135–156.

Bhattarai, S., Chatterjee, A., & Park, W. Y. (2021). Effects of US quantitative easing on emerging market economies. Journal of Economic Dynamics and Control, 122, 104031.

Bjørnland, H. C., & Leitemo, K. (2009). Identifying the interdependence between US monetary policy and the stock market. Journal of Monetary Economics, 56(2), 275–282.

Bouraoui, T. (2015). The effect of reducing quantitative easing on emerging markets. Applied Economics, 47(15), 1562–1573.

Broock, W. A., Scheinkman, J. A., Dechert, W. D., & LeBaron, B. (1996). A test for independence based on the correlation dimension. Econometric Reviews, 15(3), 197–235.

Chen, Y. T., Lai, W. N., & Sun, E. W. (2019). Jump detection and noise separation by a singular wavelet method for predictive analytics of high-frequency data. Computational Economics, 54, 809–844.

Chen, Y. T., Sun, E. W., & Yu, M. T. (2018). Risk assessment with wavelet feature engineering for high-frequency portfolio trading. Computational Economics, 52, 653–684.

Chortareas, G., Karanasos, M., & Noikokyris, E. (2019). Quantitative easing and the UK stock market: Does the Bank of England information dissemination strategy matter? Economic Inquiry, 57(1), 569–583.

Christensen, J. H., & Krogstrup, S. (2019). Transmission of quantitative easing: The role of central bank reserves. The Economic Journal, 129(617), 249–272.

Christensen, J. H., & Rudebusch, G. D. (2012). The response of interest rates to US and UK quantitative easing. The Economic Journal, 122(564), F385–F414.

Corbet, S., Dunne, J. J., & Larkin, C. (2019). Quantitative easing announcements and high-frequency stock market volatility: Evidence from the United States. Research in International Business and Finance, 48, 321–334.

D’Amico, S., & King, T. B. (2013). Flow and stock effects of large-scale treasury purchases: Evidence on the importance of local supply. Journal of Financial Economics, 108(2), 425–448.

Dahlhaus, T., Hess, K., & Reza, A. (2014). International transmission channels of US quantitative easing: evidence from Canada (No. 2014–43). Bank of Canada working paper.

Dahlhaus, T., Hess, K., & Reza, A. (2018). International transmission channels of US quantitative easing: Evidence from Canada. Journal of Money, Credit and Banking, 50(2–3), 545–563.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366a), 427–431.

Friedman, M. (1988). Money and the stock market. Journal of Political Economy, 96(2), 221–245.

Granger, C. W. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society, 37, 424–438.

Granger, C. W. J. (1996). Can we improve the perceived quality of economic forecasts? Journal of Applied Econometrics, 11, 455–473.

Hamilton, J. D., & Wu, J. C. (2012). The effectiveness of alternative monetary policy tools in a zero lower bound environment. Journal of Money, Credit and Banking, 44, 3–46.

Hohberger, S., Priftis, R., & Vogel, L. (2019). The macroeconomic effects of quantitative easing in the euro area: Evidence from an estimated DSGE model. Journal of Economic Dynamics and Control, 108, 103756.

Hudepohl, T., van Lamoen, R., & de Vette, N. (2021). Quantitative easing and exuberance in stock markets: Evidence from the euro area. Journal of International Money and Finance, 118, 102471.

Huston, J. H., & Spencer, R. W. (2016). The wealth effects of quantitative easing. Atlantic Economic Journal, 44(4), 471–486.

Huston, J. H., & Spencer, R. W. (2018). Quantitative easing and asset bubbles. Applied Economics Letters, 25(6), 369–374.

Jelilov, G., Iorember, P. T., Usman, O., & Yua, P. M. (2020). Testing the nexus between stock market returns and inflation in Nigeria: Does the effect of COVID-19 pandemic matter? Journal of Public Affairs, 20(4), e2289.

Jensen, G. R., Mercer, J. M., & Johnson, R. R. (1996). Business conditions, monetary policy, and expected security returns. Journal of Financial Economics, 40(2), 213–237.

Jeong, K., Härdle, W. K., & Song, S. (2012). A consistent nonparametric test for causality in quantile. Econometric Theory, 28(04), 861–887.

Joyce, M. A., Lasaosa, A., Stevens, I., & Tong, M. (2020). The financial market impact of quantitative easing in the United Kingdom. 26th issue (September 2011) of the International Journal of Central Banking.

Joyce, M., Lasaosa, A., Stevens, I., & Tong, M. (2010). The financial market impact of quantitative easing. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1638986

Joyce, M. A., Lasaosa, A., Stevens, I., & Tong, M. (2011a). The financial market impact of quantitative easing in the United Kingdom. International Journal of Central Banking, 7(3), 113–161.

Joyce, M., Tong, M., & Woods, R. (2011b). The United Kingdom’s quantitative easing policy: design, operation and impact. Bank of England Quarterly Bulletin.

Karagiannopoulou, S., Patsis, P., & Sariannidis, N. (2022, September). The ımpact of quantitative easing on stock market: evidence from Greece. In Business Development and Economic Governance in Southeastern Europe: 13th International Conference on the Economies of the Balkan and Eastern European Countries (EBEEC), Pafos, Cyprus, 2021 (pp. 297–313). Cham: Springer International Publishing.

Krishnamurthy, A., & Vissing-Jorgensen, A. (2011). The effects of quantitative easing on interest rates: channels and implications for policy (No. w17555). National Bureau of Economic Research.

Lee, T. H., & Yang, W. (2012). Money–income Granger-causality in quantiles. In 30th Anniversary Edition (Vol. 30, pp. 385–409). Emerald Group Publishing Limited.

Lenza, M., & Slacalek, J. (2018). How does monetary policy affect income and wealth inequality? Evidence from quantitative easing in the euro area. Lenza, ECB Working Paper No. 2190, Available at SSRN: https://ssrn.com/abstract=3275976 or https://doi.org/10.2139/ssrn.3275976

Li, Q., & Racine, J. (2004). Cross-validated local linear nonparametric regression. Statistica Sinica, 14(2), 485–512.

Li, X.-l, Balcilar, M., Gupta, R., & Chang, T. (2016). The causal relationship between economic policy uncertainty and stock returns in China and India: Evidence from a bootstrap rolling window approach. Emerging Markets Finance and Trade, 53(3), 674–689.

Lima, L., Vasconcelos, C. F., Simão, J., & de Mendonça, H. F. (2016). The quantitative easing effect on the stock market of the USA, the UK and Japan: An ARDL approach for the crisis period. Journal of Economic Studies., 43(6), 1006–1021.

Lin, J. Y., Batmunkh, M. U. J., Moslehpour, M., Lin, C. Y., & Lei, K. M. (2018). Impact analysis of US quantitative easing policy on emerging markets. International Journal of Emerging Markets., 13(1), 185–202.

Mamaysky, H. (2018). The time horizon of price responses to quantitative easing. Journal of Banking & Finance, 90, 32–49.

Matousek, R., Papadamou, S. Τ, Šević, A., & Tzeremes, N. G. (2019). The effectiveness of quantitative easing: Evidence from Japan. Journal of International Money and Finance, 99, 102068.

Meszaros, J., & Olson, E. (2020). The effects of US quantitative easing on South Africa. Review of Financial Economics, 38(2), 321–331.

Mishra, A. K., Parikh, B., & Spahr, R. W. (2020). Stock market liquidity, funding liquidity, financial crises and quantitative easing. International Review of Economics & Finance, 70, 456–478.

Miyakoshi, T., Shimada, J., & Li, K. W. (2017). The dynamic effects of quantitative easing on stock price: Evidence from Asian emerging markets, 2001–2016. International Review of Economics & Finance, 49, 548–567.

Nakazono, Y., & Ikeda, S. (2016). Stock market responses under quantitative easing: State dependence and transparency in monetary policy. Pacific Economic Review, 21(5), 560–580.

Nishiyama, Y., Hitomi, K., Kawasaki, Y., & Jeong, K. (2011). A consistent nonparametric test for nonlinear causality-specification in time series regression. Journal of Econometrics, 165(1), 112–127.

Nozawa, Y., & Qiu, Y. (2021). Corporate bond market reactions to quantitative easing during the COVID-19 pandemic. Journal of Banking & Finance, 133, 106153.

Pastpipatkul, P., Yamaka, W., Wiboonpongse, A., & Sriboonchitta, S. (2015b). Spillovers of quantitative easing on financial markets of Thailand, Indonesia, and the Philippines. In International Symposium on Integrated Uncertainty in Knowledge Modelling and Decision Making (pp. 374–388). Springer, Cham.

Pastpipatkul, P., Ruankham, W., Wiboonpongse, A., & Sriboonchitta, S. (2015a). Impacts of quantitative easing policy of United States of America on Thai economy by MS-SFABVAR. In International Symposium on Integrated Uncertainty in Knowledge Modelling and Decision Making (pp. 389–402). Springer, Cham.

Pastpipatkul, P., Yamaka, W., & Sriboonchitta, S. (2016). Effect of quantitative easing on ASEAN-5 financial markets. Causal Inference in Econometrics (pp. 525–543). Cham: Springer.

Patelis, A. D. (1997). Stock return predictability and the role of monetary policy. The Journal of Finance, 52(5), 1951–1972.

Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346.

Racine, J., & Li, Q. (2004). Nonparametric estimation of regression functions with both categorical and continuous data. Journal of Econometrics, 119(1), 99–130.

Rahman, Md. L., Shamsuddin, A., & Lee, D. (2019). Predictive power of dividend yields and interest rates for stock returns in South Asia: Evidence from a bias-corrected estimator. International Review of Economics & Finance, 62, 267–286.

Ricketts, L. R. (2011). Quantitative easing explained. Liber8 Economic Information Newsletter, (April).

Rigobon, R., & Sack, B. (2004). The impact of monetary policy on asset prices. Journal of Monetary Economics, 51(8), 1553–1575.

Rodnyansky, A., & Darmouni, O. M. (2017). The effects of quantitative easing on bank lending behavior. The Review of Financial Studies, 30(11), 3858–3887.

Shahbaz, M., Balcilar, M., Mahalik, M. K., & Akadiri, S. S. (2021). Is causality between globalization and energy consumption bidirectional or unidirectional in top and bottom globalized economies? International Journal of Finance and Economics. https://doi.org/10.1002/ijfe.2519

Shahbaz, M., Shahzad, S. J. H., Mahalik, M. K., & Sadorsky, P. (2018). How strong is the causal relationship between globalization and energy consumption in developed economies? A country-specific time-series and panel analysis. Applied Economics, 50, 1479–1494.

Shogbuyi, A., & Steeley, J. M. (2017). The effect of quantitative easing on the variance and covariance of the UK and US equity markets. International Review of Financial Analysis, 52, 281–291.

Sims, C. A. (2003). Implications of rational inattention. Journal of Monetary Economics, 50(3), 665–690.

Stefański, M. (2022). Macroeconomic effects and transmission channels of quantitative easing. Economic Modelling, 114, 105943.

Sun, E. W., Wang, Y. J., & Yu, M. T. (2018). Integrated portfolio risk measure: Estimation and asymptotics of multivariate geometric quantiles. Computational Economics, 52, 627–652.

Thorbecke, W. (1997). On stock market returns and monetary policy. The Journal of Finance, 52(2), 635–654.

Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of Money, Credit and Banking, 1(1), 15–29.

Funding

The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception, design, material preparation, data collection and analysis. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Olasehinde-Williams, G., Olanipekun, I. & Özkan, O. Stock Market Response to Quantitative Easing: Evidence from the Novel Rolling Windows Nonparametric Causality-in-Quantiles Approach. Comput Econ 64, 947–977 (2024). https://doi.org/10.1007/s10614-023-10450-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-023-10450-y