Abstract

Russia is one of the largest carbon emitters in the world, possessing huge resources of both fossil fuels and zero-carbon energy sources. The Paris Agreement targets require substantial efforts to limit global warming to “well below 2 °C”. Energy-economic modeling provides sound conclusions that continuation of existing energy and climate policy will lead to stabilization of energy carbon emissions in Russia at the current level in 2010–2050 (about 30% below 1990). Stronger mitigation policies could gradually reduce domestic energy CO2 emissions by 61% from 2010 to 2050 (75% below 1990). Deep decarbonization policies with even more ambitious commitments could ensure an 83% reduction in energy CO2 emissions from 2010 levels (88% below 1990) by 2050. All key sectors (energy, industries, transport, and buildings) can play a substantial role in decarbonizing the national economy. However Russia’s historical reliance on domestic consumption and exports of fossil fuels creates strong barriers to decarbonization. Emission reduction costs are expected to be below 29 USD/tCO2 by 2030, 55 USD/tCO2 by 2040, and 82 USD/tCO2 by 2050 in the most ambitious decarbonization scenario. The results of this study provide insights into how Russia can enhance its ambitions to implement the Paris Agreement and contribute to global efforts toward building a climate-neutral economy by 2050.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Russia’s importance for global mitigation efforts

Being the largest country by land area, Russia plays an extremely important role in global climate: its forests cover 871 million hectares (20% of the world's forests), agricultural land use occupies 221 million hectares (10% of the world's arable land), and its reserves of fossil fuels exceed 350 billion tons of oil equivalent (toe) or 14,653 EJ, about 0.4% of which is extracted annually for domestic consumption and exports.

Russia’s net greenhouse gas (GHG) emissions reached a peak in 1990, amounting to 3896 MtCO2e, or 17% of total emissions among the United Nations Framework Convention on Climate Change (UNFCCC) Annex I parties. However, from 1990 to 2000, GHG emissions declined by 53%, reaching 1829 MtCO2e by 2000. This was primarily due to a deep restructuring of the Russian economy after the political and economic crisis in the 1990s, structural and technological changes in industrial production (demilitarization of the economy, modernization of productive technologies), and growth in the low-carbon sectors (e.g. the service sector grew up from 20% to over 50% of GDP).

The economic recovery and fast GDP growth in 2000–2008 was largely driven by a six- to eightfold rise in world oil prices and increased revenues from exports of crude oil, gas, coal, metals, and chemicals. Despite the fast economic and industrial growth (7–12% per year), national carbon emissions grew by about 1% per year. The growth of export-oriented industries led to a decoupling of GDP and carbon emissions, which continued in 2009–2018. The total national GHG emissions reached 54% of 1990 levels, including land use, land-use change, and forestry (LULUCF), and 70% of 1990 levels excluding LULUCF (Table 1).

Russia is still among the world's leading carbon emitters, but with the rise in GHG emissions in developing countries in the past two decades, Russia is now fifth after China, the United States, the European Union (28), and India, and followed by Japan.Footnote 1

Since 1990, the structure of domestic GHG emissions has changed substantially. Following the changes in the Russian economy, emissions from fuel combustion declined by 38%, those from industrial processes by 30%, and those from agriculture by 58%. However, the fugitive emissions (mostly methane from oil, gas and coal production, and transportation) reached the baseline 1990 levels in 2015, which can be explained by a large share of exports in industries with high leakage of methane (50% of total production of coal and natural gas is exported nowadays).

The national GHG inventory (Table 1) provides a comprehensive overall picture of Russia’s current emissions, and enables priorities to be identified for mitigation policies and measures, as well as analysis of the low-carbon development options in the country:

-

Fuel combustion is responsible for the majority (54%) of total emissions (excl. LULUCF), located mainly in power and heat production, transport, and industries.

-

Fugitive emissions of methane contribute to 29% of total emissions, and they are localized in coal, oil, and gas industries.

-

Forestry and land use (LULUCF) provides about 650 MtCO2 net sink per year (20% of total GHG emissions), with significant potential for further growth, making this sector important for the national decarbonization strategy.

-

Agriculture, waste, and industrial processes (excl. energy use) are relatively marginal, but jointly amount to 17% of total GHG emissions and may have significant potential for decarbonization.

The Russian economy is dependent on fossil fuels and energy-intensive industries such as ferrous and non-ferrous metals, fertilizers, and other chemicals, as well as infrastructure support for transportation systems (transmission lines, railways, ports, pipeline networks, etc.), which poses challenges for switching to a low-carbon economy in the near and medium-term future.

The relatively cheap and abundant fossil fuel resources also create strong barriers to decarbonization of the national economyFootnote 2:

-

coal reserves – over 122 billion toe (5108 EJ);

-

crude oil and shale oil reserves – over 190 billion toe (7955 EJ);

-

natural gas and shale gas – over 27 billion toe (1130 EJ);

-

methane hydrates – over 913 billion toe (38,225 EJ).

The availability of these resources will depend on technologies and investments, especially in areas with difficult conditions for exploitation (Arctic, off-shore, and territories with lack of infrastructure). However, without strong political will and climate-oriented policy, acquisition of these resources will always be the most attractive path for domestic and international corporations and lobbyists.Footnote 3

At the same time, Russia possesses a huge abundance of renewable energy sources (RES)Footnote 4 that could become a carbon-neutral alternative to fossil fuels, in terms of both domestic energy use and exports. Recent studies show available technological potential for renewables reaching as high as 16,955 Mtoe (710 EJ) per year in electricity and heat production (Table 2). The major renewable energy sources include geothermal, solar, and wind energy, though small hydro, biomass, and low-temperature heat sources have impressive potential as well. This potential is underestimated in domestic energy policy, as renewables (excluding large hydro) contribute less than 1% to the national energy mix. Currently, large-scale “zero-emission” energy sources include nuclear and large hydropower plants (each approx. 20% of total power generation).

Utilization of the economically feasible potential of renewables could replace 30% of all types of fossil fuel resources produced in Russia, whereas the technological potential exceeds this amount by over 25 times. These estimates do not take into account the territorial location of the energy sources, access to the power grids and energy consumers, timing of energy supply and consumption, and other technical issues.

Investments in the renewable energy sector are becoming a higher priority for Russia. According to the National Energy Strategy–2030, the share of RES in electricity production should increase from 0.5% to 4.5%, which would require the installation of 23–33 GW of generation capacity. Though the progress in this direction is slow, a gradual switch to renewables is considered to be a major driving force for decarbonization in the long run.

2 Modeling methods

The TIMES-RUSSIA modelFootnote 5 was applied to analyze the key sectors of the Russian economy responsible for about 80% of total CO2 emissions, including power and heat generation, metallurgy, cement, chemical and petrochemical industries, residential and commercial buildings, and transportation.

TIMES is a bottom-up, partial equilibrium, technology-level, MARKAL-family model developed as a part of the IEA Energy Technology Systems Analysis Programme (ETSAP). It uses linear programming to generate a least-cost energy system, optimized according to exogenous assumptions over the long-term time horizon. The model encompasses all steps from primary resources, through the chain of processes that transform, transport, distribute, and convert energy, to the supply of energy services demanded by energy consumers. The model structure includes three basic entities: 1) technologies represented by physical devices (e.g. mining processes, conversion plants) that transform primary commodities into energy and other commodities; 2) commodities including fuels, energy services, materials, monetary flows, and emissions; and 3) commodity flows linking processes and commodities. These entities are the building blocks of a reference energy system, which is analyzed under various scenarios of transformation and impacts. The model assumes perfect foresight, which is to say that all investment decisions are made in each period with full knowledge of future events, and it optimizes both across sectors (horizontally) and across considered time periods (vertically). The model configures the production and consumption of fuels, materials, services, and their prices, matching supply with demand (equilibrium). The modeling results include a cost-optimal mix of technologies and fuels in each period, as well as associated emissions to meet the demand.Footnote 6

TIMES-Russia is focused on the national economy-wide carbon emission targets by 2050, translated into sectoral targets.Footnote 7 The technological targets and constraints were determined based on the strategies and plans of the national governmental bodies (ministries of economic development, industry and trade, energy, etc.Footnote 8) and large corporations (e.g. the state-controlled and private corporations involved in fossil fuel industries, nuclear, hydro-power, renewables, cement production and construction, etc.); however, most scenarios imply transformational changes beyond the strategic plans (usually determined until 2030–2035), so expert assumptions or international projections are used beyond 2035.

The model projects the production of fossil fuels, power and heat generation, oil refining, energy consumption by buildings, transport (ground, aviation, and railways), and industry (first of all, ferrous metallurgy, cement); the final demand is determined endogenously and represented by power and heat consumption, transportation services, and industrial products. The main data sources include the Russian Federal Hydrometeorological Service on carbon emissions,Footnote 9 the Russian Federal State Statistics Service (Rosstat) data on socioeconomic indicators, energy production and consumption, IEA and World Bank reports on energy balances and technology perspectives,Footnote 10 official projections of socioeconomic development and energy demands,Footnote 11 and sectoral expert estimates provided by the leading Russian industrial institutions.Footnote 12 The fossil fuel exports are determined exogenously.

The model is a partial equilibrium model with exogenous demand for final products and does not account for potential response of demand as a feedback to the technological changes. The model provides aggregate costs of decarbonization represented by the following indicators: 1) losses from fossil fuel export reduction, 2) incremental costs of capital investments in power and heat sectors, and 3) costs in all other sectors.

3 Energy carbon emissions by 2050: modeling results

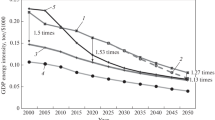

The main assumptions about long-term socioeconomic development in Russia by 2050 are presented in Table 3. The following three scenariosFootnote 13 were modeled for this paper (Fig. 1):

-

Scenario 1. “Intended Nationally Determined Contribution (INDC)”: Though Russia ratified the Paris Climate Agreement in 2019 and became a party, the nationally determined contribution (NDC) has not been submitted to the UNFCCC secretariat (by May 2020 when this paper was prepared), and no NDC targets have been determined, so the “INCD scenario” is focused on the Russian INDC target of 25–30% below 1990 levels by 2030, which has already been reached, and if continued would unlikely require any strong mitigation policies and measures through 2050. This scenario actually means that no additional policies will be in place to reduce emissions, and the current INDC target is reachable under business-as-usual (BAU) development. The current policies include some very ambitious targets, such as a 40% increase in energy efficiency by 2020 compared to 2007, increased share of renewables in the energy mix to 4.5% by 2020, utilization of associated petroleum gas up to 95%, and many others. Most of these policies may fail in the medium-term perspective; however, it is assumed they will continue after 2020 with compatible levels of ambition. Scenario 1 corresponds to the CD-LINKS project scenario of a national carbon budget of 58 GtCO2e (cumulative energy CO2 from 2011 to 2050).

-

Scenario 2. “INDC + enhanced ambition”: In addition to INDC targets by 2030, Russia may enhance its mitigation goals, aiming at 75% below 1990 by 2050. Stronger targets in utilization of renewables, biofuels, energy efficiency improvements, electrification of end use (in transport, buildings, etc.), and other measures can be envisaged. Scenario 2 corresponds to the CD-LINKS project scenario of a national carbon budget of 45 GtCO2e (cumulative energy CO2 from 2011 to 2050).

-

Scenario 3. “Active decarbonization”: A very ambitious target of 88% reduction of energy CO2 emissions by 2050 (compared to 1990 levels) is considered, aiming at the “well below 20 °C” target of the Paris Agreement. The scenario implies active and rapid – especially after 2030 – substitution of old technologies by more efficient and low (zero)-carbon alternatives in all sectors of the economy, switching from coal and gas to carbon-neutral energy sources (renewables, hydro, nuclear, carbon capture and storage [CCS], biofuels), as well as large-scale energy efficiency improvements and productivity enhancements in production and consumption (industries, commercial and residential buildings, transport, etc.). The energy CO2 emissions are assumed to decline from 1528 MtCO2 in 2010 to 266 MtCO2 in 2050. Scenario 3 corresponds to the CD-LINKS project scenario of a national carbon budget of 40 GtCO2e (cumulative energy CO2 from 2011 to 2050).

Table 3 Selected key indicators of economic development in Russia: assumptions by 2050

In all scenarios, the targeted CO2 emission reductions are achieved by direct carbon constraints (carbon caps determined by scenario) and sectoral policy measures (mostly technological targets such as energy efficiency improvement, renewables share of power generation, and others).

The key assumptions regarding world economic development, technologies, and export of Russian energy resources include the following:

-

The socioeconomic and technological changes (availability of different technologies, their costs) and dynamics of sectoral development in the world are compatible with the IEA, BP, and OECD projections by 2050Footnote 14.

-

Global fossil fuel prices and demand for Russian exports are accounted for exogenously based on the projections by OPEC, IEA, and own expert estimates up to 2050Footnote 15.

-

The assumptions about availability of technologies and access to capital for oil and gas extraction do not include the impact of sectoral sanctions imposed on supply of drilling technologies for the Russian Arctic region.

-

The meaningful external impacts on the Russian energy sector include ongoing reduction in the costs of solar and wind energy technologies and low-carbon transportation, rising demand for biofuels, decline in demand for coal (gas and oil demand is considered differently by scenario), nearly no change in the costs of nuclear and hydropower technologies, and an expected high cost of CCS/bioenergy with carbon capture and storage (BECCS) technologies.

-

The global carbon pricing mechanisms are expected to influence the demand for fossil fuels, technological costs, divestment/investment processes, and access to capital; these effects are analyzed using the assumptions of a substantial decline in fossil fuel exports in scenarios 2 and 3.

-

Coal and oil exports (in natural terms) are similar to the current levels in 2050, while gas exports will gradually rise by 50% from now to 2050 in scenarios 1 and 2. In scenario 3, coal exports are expected to gradually decline to zero, oil will fall by 75%, and gas will rise by 25% by 2050. The fossil fuel exports are assumed to decline in scenarios 2 and 3 due to the global mitigation efforts under the Paris Agreement, which will likely dramatically affect coal, oil, and gas export markets.Footnote 16

It can be noted that emissions from all sources will decline by 2030 and 2050, with the most significant reductions in the active decarbonization scenario (Fig. 1) These emission reductions are achievable through expanded use of low-carbon technologies in energy production, specifically biomass, CCS, and renewables, as shown in Fig. 2.

In all scenarios, gas, oil, and coal supplies will still be playing the leading role in the domestic energy mix in 2030. The situation is substantially different in the longer-term perspective (during 2030–2050). The most impressive results are demonstrated in the active decarbonization scenario, which by 2050 is showing a dramatic restructuring of energy supplies in the country, leading to about 50% reduction in gas production (40% of which is to be used with CCS) and 70% reduction in coal consumption compared to 2010, as well as a boost in biofuel use and solar and wind energy supplies. In all other scenarios, gas may still be a preferable energy source, as the low level of ambition provides it with a competitive advantage compared to other fossil fuels, costly CCS, and insufficient incentives for renewables.

The conservative estimates of economic impacts of different scenarios are based on 1) the investment and operational (mostly fuel use) costs of decarbonization in power and heat, industrial, and other relevant sectors, and 2) loss of revenue from fossil fuel exports. The estimates of incremental annual costs according to the three scenarios are illustrated in Figs. 3 and 4. The decarbonization costs rise dramatically after 2030 in scenarios of enhanced ambition and active decarbonization, which can be explained by increasing costs of modernization and switching to low-carbon technologies, as well as higher loss of revenue from fossil fuel exports (when the world is expected to transition to a decarbonizing economy, demand for hydrocarbons would gradually and substantially decline).

The costs of carbon emission reduction are expected to rise depending on the ambition and decarbonization targets, as shown in Fig. 5. In the INDC scenario, emission reductions are unlikely to generate any meaningful costs per 1 tCO2 by 2030, which actually means a continuation of weak mitigation targets and mostly business-as-usual development. In the more ambitious scenarios, the reduction costs can reach 33–50 USD/tCO2 by 2030, rising to 19–110 USD/tCO2 by 2040 and to 20–145 USD/tCO2 by 2050, depending on the scenario.

4 Sectoral policy implications

The modeling provides quantitative estimates of decomposition of CO2 emissions from energy use by the main sectors, including electricity,Footnote 17 industry, buildings, and transport in three scenarios (Fig. 5). The overall CO2 emissions decline at different speeds depending on the ambition of the scenarios in 2010–2050: slow and gradual reduction of emissions in the INDC scenario, with a similar structure of emissions throughout the period; more rapid reductions in the INDC/enhanced ambition scenario, mostly in the electricity, industry, and transportation sectors; and a sharp decrease by 88% in the active decarbonization scenario, in which all sectors reduce emissions dramatically.

The electric power sector is a key to decarbonization of the national economy. The Russian electric power sector has about 700 heat and power plants. The total installed capacity accounts for over 255 GW, of which zero-emission capacities include 46 GW from hydropower and 23 GW from nuclear power plants. However, only 200 GW of that capacity is used at the peak demand, and the remaining 55 GW is “reserved”.

The envisaged retirement of the majority of natural gas and coal-fired power plants and boiler houses (70% of which are over 40 years old) in the coming decades constitutes a huge challenge for the industry, as well as a unique opportunity. Modernization based on up-to-date, highly efficient technologies, primarily with carbon-free options, would not only improve energy efficiency, but would also substantially reduce GHG emissions in the sector in the long-term perspective. Otherwise, Russia may fall into a carbon lock-in situation, wherein the newly installed fossil fuel-based energy facilities would have to operate for 40–50 years, sustaining the industry’s high carbon footprint.

A range of long-term development options that may decarbonize the domestic power sector is considered, including a possible increase in the shares of nuclear power and large-scale hydropower (planned by the RosAtom and RusHydro corporations), as well as growth of renewables’ share in the energy mix. The analysis showed that growth of renewables can be achieved primarily in wind and solar photovoltaic (PV), with dramatically declining costs of power generation and large-scale applicability of these technologies, while the solutions in small-scale hydropower, tidal, low-heat energy, and geothermal power may play a more modest role in the overall national energy mix (although being very important for local energy supplies).

Based on the IEA Energy Technology Perspectives review (IEA, 2014), it is assumed that CCS can be commercially feasible and applicable in the power sector beyond 2030. Most of the fossil fuel-fired power plants may use CCS technology by 2050 to reach the deep decarbonization target in Russia. The energy CO2 emission reduction potential in the Russian electricity sector (including both power and heat production) by 2050 is demonstrated in Fig. 6.

Buildings

The commercial and residential buildings sector in Russia has enormous potential for energy efficiency improvement. Seventy-five percent of the heating supply is provided by centralized heat pipeline networks, 70–80% of which are currently fully amortized. The decarbonization scenario assumes 30% growth in living space area per capita by 2050 (to approach the EU average living space). The decline in population by 2050 will be an important factor in this sector. The energy consumption of buildings is assumed to decline by at least 15%, while the energy mix should change in favor of biomass, electrification and extensive use of heat pumps. The energy CO2 emission reduction potential in the Russian commercial and residential buildings sector by 2050 is demonstrated in Fig. 7.

Transport

The low-carbon technology options for transport include liquefied petroleum gas (LPG) engines in the midterm and increasing biofuel use in the long term. Electric vehicles are experiencing a much slower expansion in Russian regions with cold conditions, although they may get a boost if the technology improves. Plug-in hybrids with internal combustion engines using LPG or biofuel may be more competitive.Footnote 18 Aviation can benefit from biofuel use and energy efficiency improvement. Innovative technologies for domestic production of second-generation liquid biofuels are available but still not commercialized. Freight transportation is expected to rise by 80% by 2050, and could be decarbonized using liquefied gas in the medium term and biofuels in the long term, as well as hybrid and electric engines. The largest GHG emitter in this sector is pipeline transport, due to technological energy consumption and fugitive methane emissions. The energy CO2 emission reduction potential in the Russian commercial and residential buildings sector by 2050 is demonstrated in Figs. 8 and 9.

Industry

The output of energy-intensive industries is expected to grow significantly over the next four decades, by 26% for iron and steel production (from 66 Mt to 83 Mt), by 41% for cement (from 49 Mt to 69 Mt), and by 10% for others. Improvements in iron and steel production can lead to a 33% or more increase in energy efficiency, mainly due to the adoption of blast-furnace gas-recycling technologies to directly reduce iron with natural gas. The processes of other energy-intensive industries are very diverse, and a moderate decarbonization potential for the remaining industries is considered mainly by means of electrification of the industries and increased energy efficiency.

5 Conclusions

Russia plays an important role in mitigation of climate change: it has huge potential for reducing carbon emissions and enhancing the capacity of boreal forests in carbon sequestration. However, the current policies do not provide sufficient incentives to effectively pursue its low-carbon development pathways.

The “INDC continued” scenario (compatible with BAU) would ensure stabilization of energy carbon emissions at the current levels (about 30% below 1990) by 2030 and up to 2050. The existing potential for renewable and energy efficiency improvement would not be fully utilized, while production and export of fossil fuels would be maintained at the current levels.

The “INDC + enhanced ambition” scenario leads to a significant reduction of energy carbon emissions by 2030 and 2050. Emissions could reach 61% below 2010 levels (about 75% below 1990 levels) by 2050.

The “active decarbonization” scenario is feasible from a technological perspective, with carbon emissions reduced by 83% from 2010 levels (88% below 1990 levels) by 2050. There are multiple options for decarbonizing the national economy via the large-scale utilization of renewables, hydropower, nuclear, and CCS technologies, and huge energy efficiency improvements in the industrial and building sectors.

The decarbonization scenarios require large upfront investments in infrastructure and research and development (R&D). They assume substitution of fossil fuels by investing in climate-neutral solutions on both the production and consumption sides, and rising demand for innovations and technological improvements. Russia can benefit from such an increase in demand for science-intensive and intellectual assets in the long-term.

The alternative strategy is to myopically adjust to the changes, missing the benefits of leadership and imposing additional risks on businesses related to global carbon regulations, border carbon adjustment taxes, shrinking demand for fossil fuels, divestment processes, and carbon lock-ins, with stranded assets in fossil fuel infrastructure.

Without intensive international cooperation in technological development and carbon regulation, the potential in deep decarbonization cannot be fully realized, and Russia’s transition to a low-carbon economy would be delayed.

Notes

Boden, T.A., Marland, G., and Andres, R.J. (2017). National CO2 Emissions from Fossil-Fuel Burning, Cement Manufacture, and Gas Flaring: 1751–2014, Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy, https://doi.org/10.3334/CDIAC/00001_V2017.

Estimates based on data from the International Energy Agency (IEA) and the US Energy Information Administration (EIA).

For example, Japan’s Methane Hydrate R&D Program launched the Research Consortium for Methane Hydrate Resources in Japan (MH21), an industry–government–academia collaboration established to undertake scientific research on technologies for methane hydrate use. The first practical results were reported in 2014, and the technology was to be commercialized in 2017. China also declared a breakthrough in gas-hydrate technology in 2017.

The renewable energy sources in this study exclude large hydropower plants.

The model was developed by a research team from the Russian Presidential Academy of National Economy and Public Administration (RANEPA) with analytical support from the National Research University Higher School of Economics (HSE).

Full documentation of TIMES model is provided in Loulou, R., Remne, U., Kanudia, A., Lehtila, A., Goldstein, G., 2005. Documentation for the TIMES Model - PART I 1–78. https://iea-etsap.org/index.php/etsap-tools/model-generators/times

The model is described in more detail in Potashnikov V., Lugovoy O. (2015) DDPP Analysis Using 15-Sector Input-Output Analysis of the Russian Economy. Institute of Applied Economic Research, Moscow [in Russian]; Lugovoy O., V. Potashnikov, D. Gordeev, Projections of energy balance and greenhouse gas emissions based on RU-TIMES model by 2050, in Scientific Vestnik of Gaidar Institute of Economic Policy, Vol. 5, 2014, pp. 39–43 [in Russian].

For example, the Ministry of Economic Development of Russia (2018) “Economic Development and Innovation Economy” Program; Ministry of Energy of Russia (2017), Energy Strategy of Russian Federation by 2035 (Draft).

Roshydromet (2018), Russian national inventory of greenhouse gases.

IEA, Energy Statistics, https://www.iea.org; WB & IFC (2008), Energy efficiency in Russia: Untapped reserves.

Government of Russian Federation (2018), Concept of long-term socio-economic development of Russian Federation up to 2020.

Bezrukikh P. et al. (2007), The reference book on resources of renewable energy sources in Russia and local types of fuel/ indicators by territories. Moscow, IAC “Energia”, 272 pp. [in Russian]; Costs and benefits of low-carbon transformation in Russia. Perspectives by 2050 and beyond, Ed. I. Bashmakov, Moscow, CENEF, Russia, 2014 [in Russian].

The scenarios in this paper correspond to the CD-LINKS project scenarios for the following national carbon budgets: scenario 1 for 58 GtCO2e, scenario 2 for 45 GtCO2e, and scenario 3 for 40 GtCO2e.

SDSN-IRRDI (2015), DDPP Synthesis 2015 Report, Paris.

Both power and heat production are included in the electricity sector.

Miotti et al. (2016) Personal vehicles evaluated against climate change mitigation targets, Environ. Sci. Technol., 2016, 50 (20), pp. 10795–10804, https://doi.org/10.1021/acs.est.6b00177

References

Bezrukikh P et al (2007) The reference book on resources of renewable energy sources in Russia and local types of fuel/ indicators by territories. Moscow, IAC “Energia”, 272 pp

Boden TA, Marland G, Andres RJ (2017) National CO2 emissions from fossil-fuel burning, cement manufacture, and gas flaring: 1751–2014, Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy, https://doi.org/10.3334/CDIAC/00001_V2017

BP Energy Outlook (2018) edition

IEA (2014) Energy Technology Perspectives 2014

IEA (2015) Energy Technology Perspectives 2015 Mobilising innovation to accelerate climate action. Paris

IEA (2017) World energy outlook 2017. France, Paris

Loulou R, Remne U, Kanudia A, Lehtila A, Goldstein G (2005) Documentation for the TIMES Model - PART I 1–78. https://iea-etsap.org/index.php/etsap-tools/model-generators/times

Ministry of Economic Development of Russia (2018) “Economic development and innovation economy” Program

Miotti et al (2016) Personal Vehicles Evaluated against Climate Change Mitigation Targets. Environ Sci Technol 50(20):10795–10804

OECD (2018) The long view: scenarios for the world economy to 2060

OPEC (2017) World Oil Outlook 2017

Potashnikov V, Lugovoy O (2015) DDPP analysis using 15-sector input-output analysis of the Russian economy. Institute of Applied Economic Research, Moscow

SDSN-IDDRI (2015) Deep Decarbonization Pathways Project. Pathways to deep decarbonization 2015 report - executive summary, Paris

WB & IFC (2008) Energy efficiency in Russia: Untapped Reserves

Acknowledgements

The authors gratefully acknowledge the contributions and comments provided by M. Saparov, H. Waissman, K. Riahi, V. Krey, and many others, including participants of the expert meetings organized by IIASA, HSE, RANEPA and other institutions in 2015–2020. This work is part of a project that has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement no. 642147 (CD-LINKS).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Safonov, G., Potashnikov, V., Lugovoy, O. et al. The low carbon development options for Russia. Climatic Change 162, 1929–1945 (2020). https://doi.org/10.1007/s10584-020-02780-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-020-02780-9