Abstract

As sea level rises and storm frequency and severity increase, communities worldwide are investing in coastline management projects to maintain beach widths and dunes that support recreational amenities and mitigate storm risks. These projects are costly, and differences in property owners’ returns from maintaining wide beaches will influence community-level support for investment in shoreline defense. One way to account for these differences is by funding the project through a tax instrument that imposes the heaviest cost on residents who benefit most from beach nourishment. Some communities along the US east coast have adopted this approach. We use an agent-based model to evaluate how the imposition of project costs affects coastline management over the long-term. Charging higher tax rates on oceanfront properties reduces desired beach width among those owners but increases desired width for owners of inland properties. The aggregate impact on beach width depends on coastline shape and development patterns that determine the balance between these two groups, heterogeneity of beach width preferences and climate change beliefs, and levels of participation in local politics. Overall, requiring property owners who benefit most from beach nourishment to bear the highest cost results in wider beaches. The result suggests that delineating tax rates to account for unequal benefits of local public goods across taxpayers could facilitate local investment in climate change adaptation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Increasing rates of shoreline erosion resulting from global climate change are an important threat to coastal economies. These increases can be caused by climate-induced regional anomalies in sea level (Theuerkauf et al. 2014), changing patterns of storm behavior (Slott et al. 2006; Moore et al. 2013), and global increases to the rate of sea level rise (Zhang et al. 2004). In response to these threats, a growing number of communities worldwide are investing in coastline management projects to maintain beach widths and dunes that support recreational amenities and mitigate storm risks (Dean 2003; Hinkel et al. 2013).

Coastline management often takes the form of beach nourishment, or the import of sand from another location—typically offshore—to rebuild an eroded beach. Nourishment is among a range of tools available to protect land and property from storm surge and wave activity; others include marsh restoration, elevation of buildings and infrastructure, construction of hard structures such as seawalls or groins, and property abandonment. These strategies vary in the extent to which they represent adaptation to changing sea levels versus coping with immediate risks of erosion and storm surge. Beach nourishment is unlikely to be the most effective strategy for increasing a community’s long-run resilience to climate change-induced vulnerabilities, and it may impose externalities in the form of ecological damage and shoreline change in neighboring communities (Speybroeck et al. 2006; Gopalakrishnan et al. 2017).

Despite potential drawbacks as a long-run adaptation strategy, beach nourishment remains an attractive option for communities to address short-run shoreline erosion. Local public officials have strong incentives to maintain beaches to sustain the tourist economy and prevent property damage and loss. But politicians may suffer electoral punishment for raising taxes to fund projects if voters do not perceive that benefits outweigh project costs. Heterogeneity in property owners’ returns from beach nourishment is likely to influence community-level support for investment in shoreline defense.

Recognizing this heterogeneity, many towns on the east coast of the USA turn to differential property tax rates as an instrument for funding beach nourishment. The benefits of beach nourishment accrue disproportionately to property owners with oceanfront parcels. Politicians can legally justify unequal tax rates based on the protective benefits that oceanfront owners receive from a wider beach and higher dunes. Differential rates also serve politicians’ reelection goals by imposing the burden of project costs on a small portion of the voting population, potentially allowing the median voter to receive more benefit from the project than she pays.

We evaluate how the within-community imposition of costs for nourishment projects influences long-term coastal management and a community’s ability to maintain the recreational and tourism benefits associated with wide beaches. Recognizing adaptation as a fundamentally political process (Javeline 2014), we use an agent-based model of political decision-making that treats investment in beach reinforcement as the collective choice of property owners with heterogeneous property values. Creating model scenarios based on typical low-lying, sandy coastline configurations, and spatial concentrations of property value along US east coast barrier island communities, we simulate the dynamics of investment under different tax instruments selected by local officials. We show that the effects of instrument choice on resulting beach width vary across community characteristics. Under most conditions, requiring property owners who benefit most from beach nourishment to bear the highest cost results in wider beaches. The results offer lessons for the provision of climate adaptation measures by suggesting that one politically acceptable pathway for financing those measures would be to delineate tax rates that account for the unequal benefits from risk reduction and amenity provision.

1 Political incentives in funding public goods

A wider beach is an impure public good (Gopalakrishnan et al. 2016). Beaches along most of the US coastline, including our study area of North Carolina, are public property. Beach amenities are legally non-excludable and—subject to the usual caveats about congestibility—non-rival. As is the case for local public goods, such as parks and transit, proximity affects amenity values such that oceanfront homes disproportionately benefit from wider beaches. Oceanfront homes also disproportionately gain a private benefit of storm protection from a wider beach. Thus, widening the beach conveys a mixture of private and public benefits that are heterogeneous across property types.

A key challenge confronting American local public officials is the ability to raise funds for projects that provide public good benefits. Orientation toward economic development is pervasive in local politics, driven by interjurisdictional competition as well as politicians’ own reelection goals (Peterson 1981; Stone 1989). Antigrowth interests sometimes mobilize to challenge expansionary policies (Gerber and Phillips 2003; Mullin 2009), but the protection of existing property values and economic activity through developmental policies, such as infrastructure improvement, is an overriding motivation even where antigrowth sentiment prevails (Fischel 2001). At the same time, raising taxes to fund these projects can exact electoral punishment. This challenge is amplified in the case of public good investment to meet future needs, such as projects for adaptation to climate change. The benefits of these projects accrue in the future and may never be visible to voters. Beach nourishment has an immediate and visible effect on beach amenities, so it is not surprising that public investments in nourishment are more common than longer-term local adaptation strategies.

Politicians employ various strategies to balance these competing incentives. They may time expenditures to occur before elections and postpone tax increases until after they have been safely returned to office (Rogoff 1990). They may use debt financing to avoid the political costs of capital investment, especially where electoral competition is high (Alesina and Tabellini 1990). They may enact land use exactions in order to shift the burden of paying for infrastructure from current to future residents (Altshuler and Gomez-Ibañez 2000). Or for goods that are easily divisible, they may turn to user fees as a way to limit payment obligation to those who directly benefit.

Differential property tax rates are similar to a user fee; they impose the heaviest cost burden of a project on residents who have highest demand. When public spending disproportionately benefits properties that can be identified and included in a tax district, such an instrument can reduce the distortionary impacts of taxation. If the funded project additionally offers public benefits that are enjoyed by the broader community, the instrument also can help serve a political goal of improving services while keeping taxes low for the majority of residents. The differential property tax for nourishment is similar to the value capture concept used in the transit and urban planning literature (Smith and Gihring 2006). In the current case, where the burden of higher tax rates falls on high-value oceanfront properties, the instrument avoids the regressive impact of many user fees. Here, the wealthy subsidize a benefit that the whole community enjoys. Since oceanfront parcels are often vacation homes or rental properties, those who pay most under this instrument may not even be voters in local elections and therefore have little opportunity to exercise voice. Scarcity of coastal real estate limits their exit options, especially if neighboring communities adopt similar tax instruments. It is little surprise, then, that the differential property tax is becoming a common method for funding beach nourishment along the US east coast.

2 Funding beach nourishment

By making decisions about land use regulation and infrastructure, local governments enable access to coastal amenities for residents and tourists. In many communities, infrastructure provision entails maintaining the beach itself. Because beach erosion is ongoing, and its rate may even be accelerated by coastal management activity (Smith et al. 2009; Gopalakrishnan et al. 2017), nourishment must be repeated periodically if some minimum beach width is to be maintained. Each project entails large fixed costs for design, permitting and construction, which reinforce the private under-provision of beach amenities. It would be infeasible for individual property owners to widen their own beaches, and property owners would more likely use private investments to raise up their homes, contributing nothing to public beach amenities.

Historically, nourishment projects in the USA were primarily funded and executed by the US Army Corps of Engineers, with states and localities contributing a share of project costs. Federal funding has diminished in recent years, just as more communities are confronting the reality of eroded beaches and deciding to take on nourishment projects (McNamara et al. 2015). States may have limited funds available to support beach stabilization, but in general these projects are being funded at the local level, with local oversight of project planning and implementation.

The costs of beach nourishment are substantial. Communities along the North Carolina coast have invested in nourishment projects repeatedly—as many as 28 times in one community—with project costs ranging from $300,000 to $37 million (Gopalakrishnan et al. 2016). With growing demand for shoreline protection, the cost of nourishment sand is on the rise (Gopalakrishnan et al. 2018). North Carolina towns have considered a variety of funding sources, including beach parking fees and occupancy and sales taxes, but most have settled on a property tax.

The property tax instrument reflects the capitalization of beach nourishment’s benefits—both storm protection and amenity values—into housing prices. These benefits are widely shared throughout the community but experienced disproportionately by owners of the highest value properties, which are those located closest to the water (Bin et al. 2008). With rare exception, residents in coastal communities support the goal of wider beaches, with some diminishing return at higher widths (Parsons, Massey, and Tomasi 1999; Whitehead et al. 2008). In considering any particular nourishment expenditure, however, variation in preferences will emerge from the heterogeneity in how individual property owners experience the costs of taxation and the property value increase that will result from project completion.

Recent decades have seen numerous beach nourishment projects on the North Carolina coast but also instances of public resistance to tax increases intended for shoreline management. Dare County first considered coastal intervention when erosion of Outer Banks beaches forced the condemnation of houses left standing in the water. After dedicating a 1% occupancy tax increase in 2002 to nourishment, the county board of commissioners (with state approval) in 2005 added to that fund an 8-year, 1% sales tax increase. The public outcry was immediate: newspapers editorialized against the tax, and a group formed to collect signatures for a referendum to repeal the tax. The tax was repealed with 78% of the vote (Lay 2014). Several Dare County towns subsequently moved forward with their own nourishment projects, funded with property tax increases that have differential oceanfront rates. Further south, North Topsail Beach in Onslow County benefited for many years from sand deposits that came from dredging conducted by the Army Corps of Engineers. As the Corps reduced the frequency of dredging, proposals for local funding of nourishment met with opposition from community members. Nourishment became the biggest issue in municipal elections, including one that came under court challenge for the participation of non-resident property owners (Pilkey and Neal 2009).

These examples demonstrate that despite general support for the benefits of wider beaches, local officials face political constraints in their efforts to raise revenue for nourishment projects. Recognizing the spatial heterogeneity in project benefits, the revenue package they increasingly turn to is the combination of a townwide property tax with a municipal service district that allows additional tax to be charged to properties on or near the oceanfront. Some of these policies dramatically concentrate the tax burden on oceanfront owners, with levies on oceanfront properties that are 10 to 15 times the rate of inland properties (e.g., $.011 townwide plus an additional $.162 oceanfront in Emerald Isle; $.03 plus $.32 in Kill Devil Hills).

In setting these tax ratios, public officials make a political calculation. To satisfy their short-term development and reelection goals, they seek to build a finance package that has the support of voters in the community (Kotchen and Powers 2006; Banzhaf, Oates, and Sanchirico 2010). Occasionally, this is necessary because of a prior commitment that has been made to bring nourishment proposals to voters for approval. More commonly, local officials want to avoid voter backlash in the form of a citizen-sponsored referendum on the project or opposition to their candidacy in the next election. Regardless, the aim is to avoid electoral costs in the short-term.

Unknown, however, are the longer-term consequences of such a revenue strategy for coastline stability and its associated economic benefits. All community members evaluating a nourishment project balance their share of the project costs against the public and private benefits that are capitalized into their property values. Under a highly differential tax, oceanfront owners absorb a higher share of project costs, but how high depends on the proportion of residents in oceanfront properties and the values of those properties as compared to inland. Project benefits also are distributed spatially, so oceanfront properties increase disproportionately in value and in tax obligation subsequent to nourishment. With ongoing coastal erosion, property owners continually trade off the value they receive from beach width with the costs they incur for maintaining that width. Our agent-based framework models property owners’ calculations of expected returns from nourishment and uses these calculations to simulate collective decision-making about coastal management under different tax ratios, coastal configurations, spatial distributions of property wealth, and heterogeneity of preferences and climate change beliefs.

3 Model

Our numerical agent-based model allows us to explore political outcomes in local jurisdictions that vote on financing beach nourishment using different property tax mechanisms. We can examine parameter differences that capture multiple features of our problem: physical configurations of a coastal community that reflect the placement of housing units (a thick community with a small relative share of oceanfront properties or a thin community with a large relative share of oceanfront properties); tax ratios (the oceanfront tax rate relative to inland tax rate); the share of owner-occupants to reflect voter eligibility; erosion rates; the costs of beach nourishment; the hedonic price of beach width (which reflects the value of storm protection and beach amenities capitalized into real estate prices and implicitly reflects future expectations about erosion); the spreads of baseline property values; and random assignment of owner-occupancy and oceanfront status.

As a starting place, a community’s beach erodes according to a state equation:

where wt is beach width in each year, γ is a constant annual erosion amount, μt is a binary control variable to capture whether nourishment takes place, \( {\mu}_t=\left\{\begin{array}{c}1\kern0.5em \mathrm{if}\kern0.5em \mathrm{nourish}\\ {}0\kern1em \mathrm{else}\end{array}\right. \), and θ is the increment that beach nourishment adds to the width. Width is the previous year’s width less erosion plus nourishment if it occurs.

In each community, there are N heterogeneous properties. The share of oceanfront properties is \( {s}_{\mathrm{OC}} \), and the share of non-oceanfront (inland) properties is simply 1 − sOC. Similarly, the share of owner-occupied properties is sOW, and the share of non-owner-occupied properties is 1 − sOW. Owner-occupied properties correspond to people eligible to vote for local political candidates and ballot initiatives, whereas the other properties can be thought of as vacation homes or rental properties for which owners live and vote in a different community. In the simulations, these shares determine which properties are oceanfront (IOC, i = 1) and which are owner-occupied (IOW, i = 1), where i indexes individual properties.

To study the effects of the share of oceanfront properties, we analyze two community types: thick and thin. A thick community has a small share of properties located on the oceanfront (5% in our simulations), whereas a thin community has a relatively larger share of properties facing the water (25% in our simulations). Figure 1 illustrates some examples of these types. A thin community may be the product of coastline configuration such as a barrier island, as shown in the figure, or simply a combination of political boundary and development patterns that results in a large proportion of ocean-facing properties. In that sense, what constitutes a thick or a thin community as well as which properties are assessed higher tax rates could be endogenously determined by the political process and not just a function of the physical geography. Because these differences in composition affect the level of cross-subsidization for beach nourishment under a differential tax, they may contribute to the political calculation in setting a tax ratio.

Example of thin and thick coastal communities. The thin community is Kill Devil Hills, North Carolina on the Outer Banks (top panel). There is a large share of oceanfront properties. The thick community is Nags Head, North Carolina on the Outer Banks (bottom panel). There is a small share of oceanfront properties

Individual property value Vit follows the functional form used in Smith et al. (2009) and Gopalakrishnan et al. (2011) in which total value is proportional to a base value and value that is derived from the time-varying amenity:

where Ai captures all physical characteristics of the property (e.g. square footage, construction type, number of bedrooms and bathrooms, lot size) and locational amenities unrelated to beach width (e.g. local school district quality, crime, proximity to other amenities), and βi is the hedonic price of beach width. Note that because Ai scales the total value of a property, it also scales the marginal value of beach width. We also allow for the possibility that the hedonic price of beach width varies across properties, which affects the percentage of the property value associated with beach width.

To account for typical differences between oceanfront and inland property values as well as overall property value heterogeneity, we draw each property value baseline parameter from a uniform distribution with upper and lower limits that depend on whether the property is oceanfront. That is, for oceanfront, \( {A}_i\sim U\left[{A}_{\mathrm{OC}}^L,{A}_{\mathrm{OC}}^H\right] \), and for inland, \( {A}_i\sim U\left[{A}_N^L,{A}_N^H\right] \). By changing upper and lower bounds of these distributions, we can induce more separation or overlap between oceanfront and inland properties to capture variation in property wealth disparity across coastal communities. This approach is consistent with the empirical literature that estimates a premium for oceanfront after controlling for all other property characteristics and a constant hedonic price of beach width. The approach is also sufficiently flexible to capture differences in property characteristics, e.g. oceanfront houses may be larger on average than inland houses. Here we also assume a higher hedonic price for beach width among oceanfront property owners and allow for heterogeneity in the hedonic price to capture different preferences for beach amenities and/or different beliefs about climate and storm risks that influence future erosion. The range in prices varies between oceanfront, \( {\beta}_i\sim U\left[{\beta}_{\mathrm{OC}}^L,{\beta}_{\mathrm{OC}}^H\right] \), and inland, \( {\beta}_i\sim U\left[{\beta}_N^L,{\beta}_N^H\right] \).

We define the base tax rate as τt and the tax ratio for oceanfront to inland is ρ such that the additional property tax charged for a beach nourishment project on a property is:

An individual property’s tax burden is simply its own tax rate multiplied by the property value, and the tax rate depends on the location of the property and the policy choice. A nourishment project with a total cost of TC must equal the total tax collected:

The total tax collected simply adds up across all of the properties the product of individual tax rates and the associated property values. The model design is robust to including county, state, or federal assistance to support nourishment costs because these types of assistance do not change the calculation about tax instrument design for the local contribution to a project. From the community’s point of view, outside financial support simply lowers the total cost of the project.

For a proposed ρ, we can solve for the required base tax rate in each period that would pay for the project:

There is a unique base tax rate associated with any proposed tax ratio, project cost, and set of property values.

We assume that the decision to undertake nourishment or not is based on majority rule of the voters, and we further assume that voters will favor the tax proposal if they are economically better off with the project than without. The majority vote does not directly represent the mechanism for collective choice about nourishment but rather the public opinion constraint on local officials who might consider a project. Substituting the state equation, tax rate, and tax ratio, a voter will favor the proposal (yit = 1) if

That is, the gain in property value from the nourishment has to exceed the loss in tax paid. We note that this stylized decision rule does not allow for forward-looking behavior as in Smith et al. (2009). Implicitly, agents are sequentially myopic, which is typical in agent-based modeling but inconsistent with rational forward-looking behavior. Myopic decision-making is used in other modeling contexts to generate insights about the coupled economic-geomorphological coastline system (Slott, Smith, and Murray 2008; McNamara, Murray, and Smith 2011). Generalizing the model to account for forward-looking behavior would be a useful extension, but it would introduce the possibility of agents playing a dynamic game, strategic voting, and associated tractability problems.

The nourishment passes ut = 1 if the majority of voters approve it:

Baseline parameters are defined in Supplemental Table 1. To understand the importance of tax ratio, coastline configuration, and heterogeneity in beach width preference and climate belief, we simulate voting behavior in each community type for all combinations of beach widths (from 0 to w0) and tax ratios (from 1 to 15) using these baseline parameters. The model can also simulate temporal dynamics, but for our purposes, the t subscripts in Eqs. 1–7 can simply be used to index particular beach widths before and after nourishment decisions. Each simulation proceeds as follows:

-

1.

All parameters are set.

-

2.

Properties are randomly assigned to oceanfront or not based on the share oceanfront.

-

3.

Properties are randomly assigned to owner-occupied or not based on the share owner-occupied.

-

4.

The tax rate is computed (Eq. 5) based on the values of properties in the simulation.

-

5.

Property-specific tax bills are computed based on Eq. 3.

-

6.

Each voter decides whether to vote for the nourishment tax by comparing the property’s tax bill to the difference in property value with nourishment \( \left({A}_i{\left(w-\gamma +\theta \right)}^{\beta_i}\right) \) and without nourishment \( \left({A}_i{\left(w-\gamma \right)}^{\beta_i}\right) \).

-

7.

The vote outcome is determined based on Eq. 7, and vote tallies are recorded by property type (oceanfront or inland).

4 Results

In the model, nourishment projects produce property value gains that vary with property location and starting beach width. Agents have complete information and balance these gains against the price of the tax for the project, while in the absence of nourishment property values experience ongoing decline from beach erosion. We examine the equilibrium beach widths that emerge from different community configurations and tax policy choices.

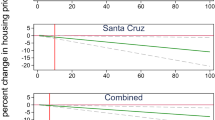

We find that in both thick and thin communities, tax policies that impose disproportionate project costs on beachfront owners produce wider beaches (Fig. 2). These voting equilibria emerge from oceanfront voters preferring wider beaches at low tax ratios and inland voters preferring wider beaches at high tax ratios. The points in the figure represent the maximum beach width at which majorities of oceanfront (solid circles) and inland (hollow triangles) owners will support a nourishment project of a fixed cost at the given tax ratio. Shifting more tax burden to oceanfront properties reduces desired beach width among oceanfront owners. Oceanfront support for nourishment is highest under a flat tax and drops off substantially under tax ratios greater than one. This result is intuitive because the flat tax rate charges oceanfront owners less for the wider beach than the graduated tax rate. Among inland owners, the relationship between tax ratio and beach width preference is reversed: higher ratios increase desired beach width. Under our baseline parameter values, inland owners are willing to allow considerable beach erosion before supporting a nourishment project, unless that project’s costs are borne substantially more by the owners of properties on the beach. If tax policy does lay the burden on oceanfront owners, their inland neighbors support maintaining much wider beaches.

Oceanfront and inland voting with homogenous preferences for beach width. The maximum width preferred by the median oceanfront voter (circles) decreases as the tax ratio (oceanfront relative to inland) increases for both thick (a) and thin (b) communities. The maximum width preferred by the median inland voter (triangles) increases as the tax ratio increases for both thick (a) and thin (b) communities. The resulting equilibrium beach width (solid line) increases as the tax ratio increases for both thick (a) and thin (b) communities and depends on the share of oceanfront voters

The distribution of a community’s properties between oceanfront and inland determines the share of project cost borne by individual property owners and the levels of beach width the two groups are willing to support. Comparing communities with equal numbers of properties, thicker development with fewer high-value oceanfront properties will require a higher tax rate to raise revenue for a project of the same total cost. Consequently, regardless of tax ratio, oceanfront voters support wider beaches in thin rather than thick communities. This result rests on the assumption that project costs are the same between community types. However, it is likely that for two communities with the same population size, the one with a smaller share of oceanfront properties has a shorter shoreline on average, because development extends further inland rather than along the coast. If that is the case, nourishment project costs in a thick community will be lower and oceanfront voters will support maintaining somewhat wider beaches, similar to their counterparts in thin communities.

Community composition has an even bigger impact on inland voters’ behavior. Disproportionate taxes allow inland owners to free ride on oceanfront owners, and that opportunity escalates with a larger share of oceanfront owners to absorb project costs. Thus, the median beach width preference among inland owners rises sharply with increasing tax ratio, reaching the maximum width we set of 45 m while the tax ratio remains under five. Composition (thick or thin) still affects voting behavior of oceanfront owners but to a lesser extent because they are unable to free ride on the inland owners.

In both community types, combining oceanfront and inland preferences leads to wider beaches as the tax ratio increases. This is our most important result. Solid lines show how political support from the two groups combines under different combinations of beach width and tax ratio (Fig. 2). Built into our model is the assumption that majorities rule. Because inland voters substantially outnumber oceanfront voters in both community types, inland preferences dominate in election outcomes. Under the parameters used in Fig. 2, preferences among voters within each group vary little. We fix the hedonic value of beach width at 0.35 for oceanfront and 0.2 for inland; a weighted average of these values approximately matches the hedonic coefficient estimated in Gopalakrishnan et al. (2011) for a community with 40% oceanfront properties (a thinner community than our 25% oceanfront assumption). Other differences among property owners of each type produce minimal variation in voting behavior because their tax bills scale with their property values; in voting, differences between oceanfront and inland values of the beach dominate the variation in property values within each group due to characteristics such as square footage.

In Fig. 3, we allow the hedonic price of beach width to vary uniformly within each group such that the values in Fig. 2 are the median values for each range: [0.2, 0.5] for oceanfront and [0.1, 0.3] for inland. Our central result—that beach width increases in the tax ratio—continues to hold. Estimates of median beach width preference within each group are similar to those under an assumption of homogeneous beach width value, but hedonic price heterogeneity creates more variation in voting behavior (Fig. 3a, b). Heat maps allow us to view the share of “yes” votes for every combination of beach width and tax ratio in the two community types (Fig. 3c, d, e, f). Here, because property owners within each group do not all value beach width equally, the equilibrium beach width reflects some mixing among voters across groups. The preferences of inland owners still dominate, especially in thick communities where the share of oceanfront is small (Fig. 3a). But in thin communities, if tax ratios are relatively low then oceanfront owners have an opportunity to influence vote outcomes (Fig. 3b).

Oceanfront and inland voting with heterogeneous preferences for beach width. The maximum width preferred by the median oceanfront voter (circles) decreases as the tax ratio (oceanfront relative to other) increases for both thick (a) and thin (b) communities. The maximum width preferred by the median inland voter (triangles) increases as the tax ratio increases for both thick (a) and thin (b) communities. The resulting equilibrium beach width (solid line) increases as the tax ratio increases for both thick (a) and thin (b) communities and depends on the share of oceanfront voters. The share of “yes” votes among oceanfront voters (color shading from black representing 0% to white representing 100%) shows substantial variation for each tax ratio both in thick (c) and thin (d) communities. The share of “yes” votes also shows substantial variation among inland voters for each tax ratio in both thick (e) and thin (f) communities, especially at higher tax ratios

Heterogeneity in beach width valuation also introduces the possibility of non-monotonicity in the response of equilibrium beach width to the tax ratio. When tax rates are set nearly equally townwide (low tax ratios), preference mixing across groups can increase support for nourishment. At somewhat higher ratios the mixing serves to reduce equilibrium beach width. For the parameters in our model, the overall response of width to the tax ratio is fairly flat at low ratios. The most disproportionate tax plans unify inland preferences such that they overwhelm oceanfront opposition to nourishment. As a result, the response of width to tax ratio increases sharply at high tax ratios.

This preference mixing highlights the potential for political coalition building if tax ratios are not set too high. It also demonstrates the importance of political participation. These results assume that the two groups of property owners participate equally in local politics. Equal participation is unlikely in any individual community, but the disparity in participation across communities is difficult to predict. On the one hand, in communities with active tourist industries, those who own oceanfront properties may be less likely to be residents who can vote in local elections. In that case, preferences of inland owners will dominate to a greater degree, and a high tax ratio could yield frequent nourishment activity that is heavily subsidized by those with little opportunity to influence political outcomes. Alternatively, high tax ratios may increase the salience of local elections for oceanfront owners in a way that spurs participation—through higher levels of turnout in our majority voting rule model, or more generally through exercising political influence in a variety forms, including campaign contributions, community organizing, and direct appeals to local office holders. If turnout or other political activity is higher among the oceanfront owners who experience the heaviest costs of beach nourishment under a differential tax ratio, our model predicts that equilibrium beach widths will be narrower, shifting closer to oceanfront preferences.

An important caveat is that our model does not incorporate real estate market response to changing beach width and the tax obligations that result from ongoing nourishment. At high tax ratios, where nourishment takes place more frequently than oceanfront property owners prefer, market response may be to lower the value of those oceanfront properties, which would shift more of the tax obligation for nourishment projects to inland property owners. Consequently, the task for local officials who seek to maximize political support from both types of property owners and to minimize real estate market distortions is to find a tax ratio where preferences of oceanfront and inland owners overlap. The threat of real estate market response is also a reminder that there are ultimate limits to the project scale; there is only so much property value that can be captured by the tax system.

5 Discussion

Coastal communities are on the front line of climate change adaptation in the USA (Hinkel et al. 2014). Many communities are already responding, engaging in more frequent shoreline management even as federal support for shoreline stabilization is becoming scarce. In the long run, individual property owners and local decision makers may need to grapple with coastline retreat or abandonment, as nourishment is not a viable strategy to combat projected sea level rise over the 50–100 year time scale (Yohe, Neumann, and Ameden 1995; Neal, Bush, and Pilkey 2005; McNamara and Keeler 2013). For now and in the near future, localities can invest in beach nourishment as a defensive measure to protect private property and infrastructure.

Hurricane Sandy demonstrated that there were measurable protective benefits in communities that chose to nourish their beaches (Dundas 2017). However, nourishment alone would not have fully prevented the extensive damage from wind and flooding. As we begin to confront the aftermath of Hurricane Harvey and its effects on the Houston area, it is difficult to imagine that nourishment could have mitigated the vast majority of the disaster’s impacts. Nevertheless, beach nourishment plays an important role in addressing more continuous erosion and elevation changes along sandy coastlines that are associated with changing wave climates and sea level rise (Slott et al. 2006). Perhaps most importantly, the study of beach nourishment and its local public finance provides a microcosm for understanding how adaptation strategies in general are decided and financed at the local level.

Our results suggest that a differential tax instrument can be an effective tool for boosting investment in adaptation. By imposing the heaviest costs on those who benefit most from an adaptation measure, this type of fiscal policy promotes provision at higher levels than would be the case under a flat property tax rate. The investment offers coastal defense and economic development benefits to the broader community without creating tax burden beyond what can be capitalized into house values. The challenge for local policy makers is to find the ratio that is high enough to stimulate this additional investment but not so high that beaches grow wider than what the capitalized oceanfront property values can support. The ideal ratio will depend on the degree of overlap in property values and beach width price between those in the taxing district and those outside it, as well as coastal configuration that determines tax district size.

The local political processes that drive nourishment outcomes are similar to those that could influence the adoption of alternative adaptation strategies such as building seawalls, passing setback rules, and changing zoning and building codes. Our findings about the impacts of differential property taxation may be relevant to the provision of a wide range of impure local public goods. Its application is likely to depend on the balance of public and private benefits that accrue from a local investment. An example is the emerging adaptation challenge presented by wastewater treatment. In low-lying coastal areas, sea level rise and warming temperatures threaten soil-based septic systems that process sewage. Most coastal properties in North Carolina and many other low-density coastal regions use such individual septic systems, and there is growing evidence that climate change is increasing septic failures (Schneeberger et al. 2015; Cooper, Loomis, and Amador 2016). When septic systems fail, they diminish local public goods by compromising groundwater and creating sanitation hazards and offensive odors, potentially decreasing local quality of life and tourism demand. Septic failures also create acute private losses for homes attached to condemned systems. Moreover, the public and private risks are heterogeneous and reflect elevation and proximity to the coast.

Centralized collection and treatment facilities that replace septic systems are likely to be more resilient to climate change, but they are extremely costly and like nourishment require substantial public funding. Voters with short-time horizons may oppose tax increases necessary to pay for them. The differentiated property tax thus may be a politically attractive instrument for local politicians to deliver a sewer project without paying an electoral price. However, for its application to fit our decision-making model, authority over funding a sewer investment must reside in a city-wide decision making process that can impose costs on a minority of residents. In addition, project benefits must be capitalized in property values with little delay. Comparing wastewater treatment to nourishment also raises the question of time scale. Both nourishment and building a centralized wastewater treatment facility require municipal financing over decades. The timing of capital investments over multiple decades differs; a treatment plant would be built all at once, and nourishments would be periodic. Ultimately, consideration of private and public benefits as well as time scale from investment in centralized wastewater treatment will affect whether municipalities can successfully configure tax instruments to raise sufficient funds. As with a beach nourishment project, the investment could offer little value in the very long run if abandonment becomes necessary.

The findings may be instructive for other impure public goods that provide disproportionate benefits to some community members. Critical to this model, however, are the higher values of properties located near the beach. On average, higher property values benefit more from nourishment, so we might expect that wealthier property owners benefit more. This alignment of wealth and benefit may apply similarly to financing coastal wastewater treatment but may not always be the case. Using a differential tax instrument to fund a public good close to a neighborhood with low relative property values, even if the good would subsequently raise those values, does not produce the same results and could raise important equity concerns.

References

Alesina A, Tabellini G (1990) A positive theory of fiscal deficits and government debt. Rev Econ Stud 57:403–414

Altshuler AA, Gomez-Ibañez JA (2000) Regulation for revenue: the political economy of land use exactions. Brookings Institution Press, Washington, DC

Banzhaf HS, Oates WE, Sanchirico JN (2010) Success and design of local referenda for land conservation. J Pol Anal Manag 29:769–798

Bin O, Crawford TW, Kruse JB, Landry CE (2008) Viewscapes and flood hazard: coastal housing market response to amenities and risk. Land Econ 84:434–448

Dean RG (2003) Beach nourishment: theory and practice, vol 18 World Scientific, Singapore

Dundas SJ (2017) Benefits and ancillary costs of natural infrastructure: evidence from the New Jersey coast. J Environ Econ Manag 85:62–80

Fischel WA (2001) The homevoter hypothesis: how home values influence local government taxation, school finances, and land-use policies. Harvard University Press, Cambridge, MA

Gerber ER, Phillips JH (2003) Development ballot measures, interest group endorsements, and the political geography of growth preferences. Am J Polit Sci 47:625–639

Gopalakrishnan S, Smith MD, Slott JM, Murray AB (2011) The value of disappearing beaches: a hedonic pricing model with endogenous beach width. J Environ Econ Manag 61:297–310

Gopalakrishnan S, Landry CE, Smith MD, Whitehead JC (2016) Economics of coastal erosion and adaptation to sea level rise. Annu Rev Resour Econ 8:119–139

Gopalakrishnan S, McNamara D, Smith MD, Murray AB (2017) Decentralized management hinders coastal climate adaptation: the spatial-dynamics of beach nourishment. Environ Resour Econ 67:761–787

Gopalakrishnan S, Landry CE, Smith MD (2018) Climate change adaptation in coastal environments: modeling challenges for resource and environmental economists. Rev Environ Econ Pol 12:48–68

Hinkel J, Nicholls RJ, Tol RS, Wang ZB, Hamilton JM, Boot G et al (2013) A global analysis of erosion of sandy beaches and sea-level rise: an application of DIVA. Glob Planet Chang 111:150–158

Hinkel J, Lincke D, Vafeidis AT, Perrette M, Nicholls RJ, Tol RS et al (2014) Coastal flood damage and adaptation costs under 21st century sea-level rise. P Natl Acad Sci USA 111:3292–3297

Javeline D (2014) The most important topic political scientists are not studying: adapting to climate change. Perspect Polit 12:420–434

Kotchen MJ, Powers SM (2006) Explaining the appearance and success of voter referenda for open-space conservation. J Environ Econ Manag 52:373–390

Lay R (2014) “Sand tax” would have helped cover full cost of nourishment. Outer Banks Voice (September 22)

McNamara DE, Gopalakrishnan S, Smith MD, Murray AB (2015) Climate adaptation and policy-induced inflation of coastal property value. PLoS One 10:e0121278

McNamara DE, Keeler A (2013) A coupled physical and economic model of the response of coastal real estate to climate risk. Nat Clim Chang 3:559–562

McNamara DE, Murray AB, Smith MD (2011) Coastal sustainability depends on how economic and coastline responses to climate change affect each other. Geophys Res Lett 38:L07401

Moore LJ, McNamara DE, Murray AB, Brenner O (2013) Observed changes in hurricane-driven waves explain the dynamics of modern cuspate shorelines. Geophys Res Lett 40:5867–5871

Mullin M (2009) Governing the tap: special district governance and the new local politics of water. MIT Press, Cambridge, MA

Neal WJ, Bush DM, Pilkey OH (2005) Managed retreat. In: Schwartz ML (ed) Encyclopedia of coastal science. Springer, Netherlands, pp 602–606

Parsons GR, Massey DM, Tomasi T (1999) Familiar and favorite sites in a random utility model of beach recreation. Mar Resour Econ 14:299–315

Peterson P (1981) City limits. University of Chicago Press, Chicago, IL

Pilkey OH, Neal WJ (2009) North Topsail Beach, North Carolina: a model for maximizing coastal hazard vulnerability. In: Kelley JT, Pilkey OH, Cooper JAG (eds) America’s most vulnerable coastal communities. Geol S Am S 460:73–90

Rogoff K (1990) Equilibrium political budget cycles. Am Econ Rev 80:21–36

Slott JM, Murray AB, Ashton AD, Crowley TJ (2006) Coastline responses to changing storm patterns. Geophys Res Lett 33:L18404

Slott JM, Smith MD, Murray AB (2008) Synergies between adjacent beach-nourishing communities in a morpho-economic coupled coastline model. Coast Manage 36:374–391

Smith JJ, Gihring TA (2006) Financing transit systems through value capture: an annotated bibliography. Am J Econ Soc 65:751–786

Smith MD, Slott JM, McNamara D, Murray AB (2009) Beach nourishment as a dynamic capital accumulation problem. J Environ Econ Manag 58:58–71

Speybroeck J, Bonte D, Courtens W, Gheskiere T, Grootaert P, Maelfait J-P, Mathys M, Provoost S, Sabbe K, Stienen WM, Van Lancker V, Vincx M, Degraer S (2006) Beach nourishment: an ecologically sound coastal defence alternative? A review. Aquat Conserv 16:419–435

Stone C (1989) Regime politics: governing Atlanta, 1946–1988. University Press of Kansas, Lawrence

Whitehead JC, Dumas CF, Herstine J, Hill J, Buerger B (2008) Valuing beach access and width with revealed and stated preference data. Mar Resour Econ 23:119–135

Yohe G, Neumann J, Ameden H (1995) Assessing the economic cost of greenhouse-induced sea level rise: methods and application in support of a national survey. J Environ Econ Manag 29:S78–S97

Zhang K, Douglas BC, Leatherman SP (2004) Global warming and coastal erosion. Climat Change 64:41–58

Acknowledgments

We thank Debra Javeline, Aseem Prakash, Nives Dolsak, two anonymous reviewers, and discussants and participants at the Vanderbilt Urban Political Economy Conference, the Adapting to Climate Change Workshop at University of Notre Dame, and the mini-conference on collaboration at the 2017 American Political Science Association annual meeting for helpful feedback.

Funding

This research was supported by the National Science Foundation grant CNH 1715638.

Author information

Authors and Affiliations

Corresponding author

Additional information

This article is part of a Special Issue on “Adapting to Water Impacts of Climate Change” edited by Debra Javeline, Nives Dolšak, and Aseem Prakash.

Electronic supplementary material

Supplemental Table 1

(DOCX 50 kb)

Rights and permissions

About this article

Cite this article

Mullin, M., Smith, M.D. & McNamara, D.E. Paying to save the beach: effects of local finance decisions on coastal management. Climatic Change 152, 275–289 (2019). https://doi.org/10.1007/s10584-018-2191-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-018-2191-5