Abstract

Gender role congruity theory emphasizes the ubiquity of male-typed leadership schemas as barriers to female leaders’ career development (i.e., descriptive stereotypes); however, the expectation of female leaders’ fulfilling their gender role (i.e., prescriptive stereotypes) has received limited attention. Extending this line of research, we propose the concept of female-typed leadership schemas and suggest that the (mis)match between female CEOs’ gender-stereotyped behavioral differences (agentic vs. communal) and female-typed leadership stereotypes helps explain the prescriptive gender stereotypes that women face in the CEO post-succession stage. Using data from 251 female CEO succession events at publicly listed firms on the Shanghai and Shenzhen Stock Exchanges from 2007 to 2017 in China, we found that the risk-taking behaviors of new female CEOs may lead to a perceived mismatch between prescriptive gender-stereotyped expectations and the actual behaviors of female CEOs as top leaders, increasing their likelihood of being dismissed during the post-succession process. Moreover, gender inequality beliefs in local contexts and adverse selection at the time of succession amplify the gender-stereotyped attribution. This study contributes to the female leadership and ethics literature by developing a comprehensive theoretical framework to test how female-typed leadership stereotypes hinder the career development of women in top executive positions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Although women are increasingly advancing to leadership positions, progress is rather limited as they approach the highest levels of firms (CS Gender 3000 Report 2021). Even if they break the “glass ceiling” and occupy the highest executive position in the organizational hierarchy (i.e., the CEO position), the issue of the “glass cliff” still exists, as women are typically promoted during crises, which puts them in a precarious situation and makes them more vulnerable to failure (Ryan & Haslam, 2007; Ryan et al., 2016). Although the differences in the performance of firms led by female and male CEOs are unclear (Jeong & Harrison, 2017), female CEOs usually experience shorter tenures and are more likely to be dismissed than their male counterparts (Gupta et al., 2020). As shown in the study by Glass and Cook (2016), the median tenure for female CEOs in Fortune 500 companies through 2014 was just 42 months compared with 60 months for their male counterparts. Meanwhile, 32% of female CEOs were forced out and only 23% retired, in contrast to 13% of male CEOs who were forced out and 53% who retired. However, another line of the literature suggests the existence of a “female leadership advantage” (Paustian-Underdahl et al., 2014; Yukl & Chavez, 2002) due to a preference toward female traits, such as inclusiveness, cooperativeness, and compassion, in modern organizations or as a way to avoid negative publicity, leading to higher evaluations of and a lower likelihood of departure for female leaders (Elsaid & Ursel, 2018; Hill et al., 2015; Kulich et al., 2011; Rosette & Tost, 2010). Why are researchers finding conflicting results regarding how female CEOs are treated after their succession? In this study, we argue that the variance among female CEOs in their behaviors is largely overlooked in the extant research, which leads to a limited understanding of gender stereotypes in CEO positions.

Gender role congruity theory (GRCT) (Eagly & Karau, 2002) suggests that the perceived mismatch between the expected characteristics of women and leadership positions leads to bias against female leaders—so-called descriptive stereotypes. Specifically, leaders are expected to be agentic, whereas women are expected to be communal; thus, they are perceived as ill-equipped for leadership roles (Kulich et al., 2011; Rosette & Tost, 2010; Wrangham & Peterson, 1996). However, in reality, female leaders do not always exhibit communal traits, as they take different routes to reach the top; some are more aggressive, whereas others are more conservative and inclusive (Adams & Funk, 2012; Blau & Kahn, 2017). For instance, Dong Mingzhu, the CEO and chair of Gree Electric Appliances Inc., is recognized as an ambitious, narcissistic, risk-taking leader and was ranked as one of the most influential female leaders in China. Recent management studies have begun to notice the role of prescriptive stereotypes in evaluating female leaders, suggesting that female leaders who do not show communal traits can violate the prescriptive norms about how women should behave and are thus penalized (Heilman & Okimoto, 2007; Rudman et al., 2012). While the literature has exclusively focused on the role of descriptive stereotypes in explaining the obstacles faced by female leaders as they climb the career ladder (e.g., Koenig et al., 2011; Zhang & Qu, 2016), the role of prescriptive gender stereotypes in affecting their career development has received limited attention, especially in the post-succession stage. Moreover, the literature on both descriptive and prescriptive stereotypes has largely focused on corroborating the existence of differences in the treatment of female and male CEOs, barely considering the role of the display of gender-stereotyped behaviors. We suggest that considering these important variances among female leaders, including firms’ gender-stereotyped expectations of leaders (descriptive vs. prescriptive), their gender-stereotyped behavioral differences (agentic vs. communal) and the (mis)match between them, can enrich the understanding of gender bias against female leaders.

The CEO post-succession process is a period when CEOs are highly scrutinized and judged by the board and market investors (Ma et al., 2015). According to the adverse selection argument of agency theory (Zajac, 1990), information asymmetry between a firm and potential CEO candidates can lead to the poor selection of new CEOs. As the board obtains updated information to make a clearer evaluation of successors’ competence in their early tenures, those who do not meet expectations and are judged as incompetent are more likely to be fired during the post-succession period (Zhang, 2008). In this study, we combine the adverse selection argument of agency theory and GRCT to highlight the role of prescriptive gender stereotypes in evaluating the fit of female CEO competence with a firm during the post-succession process. Specifically, we propose the concept of female-typed leadership schemas—defined as the cognitive structures with stereotypic expectations or preferences toward the leadership roles that show communal traits—and develop a systematic framework to test the presence of and variance in female-typed leadership stereotypes in hindering the career development of CEO positions. First, we center on the risk-taking behaviors of female CEOs that are widely recognized as reflections of agentic qualities (Wang et al., 2019). We argue that these behaviors can serve as salient signals of an adverse selection problem involving noncompliance with board expectations of female successors and, thus, lead to their early dismissal. We further test the variations in this prescriptive gender-stereotyped attribution. We argue that the effect of female-typed leadership stereotypes during the CEO post-succession process is contingent on two sets of contextual factors (which are associated with the institutional context grounded in GRCT and the succession context grounded in agency theory): gender inequality beliefs in local contexts and adverse selection at the time of succession. We suggest that both factors may increase the level of gender-stereotyped attribution in the evaluation of female successors’ competence and, accordingly, exacerbate the impact of their risk-raking behaviors on early dismissal. Using data on 251 female CEO successions in Chinese-listed firms from 2007 to 2017, we find evidence to support our arguments.

We make three major contributions. First, we contribute to GRCT by providing new insights into gender stereotypes at the highest level of executive positions. Going beyond previous studies that have centered on the descriptive gender stereotypes that have arisen from male-type leadership schemas (Dezsö & Ross, 2012; Eagly & Karau, 2002; Helfat et al., 2006), we propose the presence of female-type leadership schemas and develop a theoretical framework to test the potential bias against female successors whose behaviors cannot meet the expectations reflected by these types of schemas, which extends the research on prescriptive gender stereotypes that has mostly been conducted in laboratory contexts and is underexplored in management settings (Heilman & Okimoto, 2007; Heilman et al., 2004; Rudman et al., 2012).

Second, we provide new insights into the debate over the display of agentic behaviors in affecting gender bias toward women. Some studies have emphasized the behavioral fit between female leaders’ risk-taking behaviors and the agentic requirements for leadership positions (Wang et al., 2019), whereas others have suggested a deviation in gender-stereotyped expectations of women’s success in male gender-typed tasks (Heilman et al., 2004). Selecting a sample of firms that appoint female CEOs and testing their risk-taking behaviors help figure out the cognitive process based on prescriptive gender stereotypes in the early-stage CEO evaluation. We posit that female CEOs’ behavioral misalignment in the fulfillment of the communal requirements for leadership positions can facilitate their undervaluation and early involuntary departure when female-typed leadership schemas are preferred, which contributes to the research on the behavioral antecedents of female CEOs’ dismissal during their early tenures.

Third, we contribute to the corporate governance and CEO succession literature, in which the role of cognitive processes such as gender stereotypes is largely overlooked (Dwivedi et al., 2021; Oliver et al., 2018). Previous studies on the CEO post-succession process have mainly focused on the drivers creating the fit between the new CEO, the firm, and the environment (Ma et al., 2015). Recent studies have begun to explore the issues of integration in firms faced by minority-status CEOs from cognitive perspectives, such as social identification (McDonald et al., 2018; Zhang & Qu, 2016). Incorporating GRCT into the CEO succession literature, our study explores the impacts of prescriptive gender stereotypes on female successors’ probability of dismissal, thereby contributing to the behavioral research on corporate governance (Shi et al., 2017; Westphal & Zajac, 2013) and raising awareness of the ethical issues involved during the critical processes of women’s career development.

Theory and Hypotheses

Theoretical Background

The Dismissal of New Female CEOs

The CEO post-succession process (the early tenure of a newly appointed CEO) is a sensitive period in which a new CEO is expected to lead the firm in a better way; thus, each of the CEO’s strategic moves is highly scrutinized by the board, market investors, and other stakeholders (Dwivedi et al., 2018; Ma et al., 2015). The adverse selection argument of agency theory suggests that information asymmetry between a firm and potential CEO candidates leads to adverse selection problems in CEO successions (Zajac, 1990). The board of directors is unable to fully possess information about CEO candidates’ true competence and may misjudge their fit with the firm, leading to a high risk of failure in selecting qualified CEOs (Zhang, 2008).

Although CEO dismissal is expected to act as an effective control mechanism by replacing a poorly performing CEO (Shen & Cannella, 2002), the literature has shown that more than half the variance in CEO dismissal is not explained by firm performance (Furtado & Karan, 1990; Hubbard et al., 2017). Consistent with this notion, some scholars have suggested that it is not poor performance per se but the attributions of firm performance and the perception of CEO efficacy in a successor’s early tenure that trigger the willingness of directors to retain or fire the successor (Farrell & Whidbee, 2003). If directors develop positive (or negative) efficacy beliefs about a new CEO’s competences, it will decrease (or increase) the likelihood of CEO dismissal (Bandura & Wood, 1989; Haleblian & Rajagopalan, 2006; Zhang, 2008).

Evaluations of female leaders’ competence may be based on the cognitive shortcut of using gender stereotypes (Eagly & Karau, 2002). For example, in a recent study, Gupta et al. (2020) suggest that the lack of fit between the feminine stereotype and the CEO role causes a higher likelihood of dismissal for female CEOs than for male CEOs. Moreover, they find that dismissal is sensitive to performance for male CEOs but not female CEOs. However, the existing research has mainly corroborated the existence of stereotypes toward female CEOs (McDonald et al., 2018; Oliver et al., 2018; Zhang & Qu, 2016) but has not delved deeply enough into the complexities of gender stereotypes. The cognitive process (e.g., the specific type of gender stereotype and how it is triggered) in the post-succession circumstances largely remains a “black box” in the current literature and fails to explain why some female CEOs are more likely to be evaluated as incompetent and fired during their early tenures.

Gender-Typed Leadership Stereotypes

GRCT (Eagly & Karau, 2002) suggests two forms of prejudice toward female leaders due to the perceived incongruity between the leadership role and the gender role, specifically descriptive stereotypes and prescriptive stereotypes. Descriptive stereotypes arising from the perception mismatch between women’s characteristics and male-typed leadership schemas have received wide attention in the literature on female leadership. Women are usually considered to display communal traits characterized by inclusiveness, cooperativeness, and compassion (Kulich et al., 2011; Rosette & Tost, 2010), whereas leaders are expected to have stereotypically masculine traits characterized by aggressiveness, competitiveness, and independence (Wrangham & Peterson, 1996). This perception mismatch leads to a variety of gender inequality phenomena in leadership roles, including underrepresentation (Kanter, 1977), higher scrutiny and negative evaluations (Jeong & Harrison, 2017; Luo et al., 2018), lower compensation (Elkinawy & Stater, 2011; Wang et al., 2019), and a higher probability of early departure (Glass & Cook, 2016; Zhang & Qu, 2016) of female leaders.

However, even if female leaders fulfill the agentic requirements of leadership roles or prove their success in the male-type leadership position, they may violate the prescriptive stereotypes that women should behave in communal ways and thus be negatively evaluated and penalized (Eddleston et al., 2016; Gupta et al., 2009; Rudman & Glick, 1999, 2001). Research on prescriptive gender stereotypes is rather limited and has mostly been conducted in laboratory contexts (Heilman & Okimoto, 2007; Heilman et al., 2004; Rudman et al., 2012; Smith et al., 2013). Recent studies have increasingly noted the advantages of female leaders in modern organizations, suggesting that traditionally feminine traits increasingly fit the needs of contemporary organizations and are recognized as effective leadership styles, leading to the erosion of female disadvantages in fulfilling the leadership role in masculine terms (Eagly & Carli, 2003a; Koenig et al., 2011; Rosette & Tost, 2010). However, the emphasis on the benefits of feminine leadership styles may reinforce the prescriptive stereotypes against female leaders, where women are penalized if they do not show femininity in top executive positions (Dwivedi et al., 2021). Extending this line of research, we argue that a direct test of female CEOs’ gender-stereotyped behavioral differences in explaining their dismissal consequences helps uncover the complicated cognitive process during the post-succession circumstances, specifically, dismissal decisions due to the perceived mismatch between new female CEOs’ agentic behaviors and firms’ prescriptive gender-stereotyped expectations of them.

A Systematic Framework of Female-Typed Leadership Stereotypes

To explore the cognitive process of prescriptive gender stereotypes in very top executive positions, we propose the concept of female-typed leadership schemas. In contrast to male-typed leadership schemas (Dwivedi et al., 2018), female-typed leadership schemas can be viewed as stereotypic expectations about feminine leadership styles that show communal traits (Dezsö & Ross, 2012; Zhang & Qu, 2016). Because traditional performance metrics (e.g., firm performance) are less diagnostic of CEOs’ quality in the first years of their tenure (Hannan & Freeman, 1977), directors may rely on decision-making heuristics to aid in early-stage CEO evaluation by identifying those executive characteristics that are indicators of CEO ability (Graffin et al., 2013), making the post-succession process an ideal setting to test the effect of the cognitive role of prescriptive gender stereotypes on female CEOs. Integrating GRCT and the adverse selection argument of agency theory, we develop a systematic framework to test the presence of and variance in female-typed leadership stereotypes during the CEO post-succession period. First, we suggest that in the continuous evaluation process after a new female CEO takes office, her display of agentic traits (i.e., risk-taking behaviors) enhances the perceived incongruity between expected and actual gender-stereotyped behaviors, leading to the underestimation of her competence and thus increasing her likelihood of early dismissal.

Moreover, we synthesize two sets of contextual factors grounded in GRCT and the adverse selection argument of agency theory to examine the variation in prescriptive gender-stereotyped attribution. Based on GRCT, gender stereotypes are socially constructed prescriptions that embody normative expectations of appropriate behaviors for each gender (Eagly, 1987; Malmström et al., 2017). The institutional heterogeneity of gender stereotypes across contexts, specifically, variances in gender-related social norms rooted in the macro institutional environment, can help explain gender differences in leadership positions (Zhao & Wry, 2016). Drawing on agency theory, the corporate governance literature has suggested that succession contexts that reflect the extent of information asymmetry and adverse selection in CEO selection may shape the strengths of the cognitive biases in the assessment of the fit between candidates and the firm (Karaevli, 2007), and the biases continue in the post-succession stage (Dwivedi et al., 2018, 2021). While institutional and succession environments are shown to contextualize the extent of gender stereotypes, the extant research is rather inadequate and segmented. The research based on GRCT has emphasized the institutional roots of gender stereotypes, but it has tended to neglect the succession context in which the opportunity of gender-stereotyped attribution varies, as a lower level of information asymmetry in the succession indicates lower necessity to use heuristics such as gender bias in decision making. Studies drawing on agency theory have emphasized information asymmetry as an obstacle to the objective assessment of leaders’ competence but have paid less attention to the behavioral explanations of corporate governance, as the accuracy of assessments keeps changing as a result of game and balance between the representativeness heuristics of gender bias and updated information regarding leaders’ competence (Tversky & Kahneman, 1974). While each theoretical perspective has inspired research on how cognitive bias affects top leaders’ career development, a joint consideration of insights from each stream can enhance our understanding of the cognitive role of prescriptive gender stereotypes in the CEO post-succession stage at different levels and in different contexts.

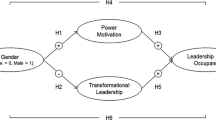

Therefore, we synthesize views from these disparate streams to test the most theoretically salient factors of institutional and succession contexts that may affect the dismissal consequences of new female CEOs’ agentic behaviors. Specifically, we propose that the gender-stereotyped attribution of female successors’ early dismissal can be strengthened by the extent of (1) gender inequality belief in local contexts, reflected by a lower level of female leader representation in a province and in a firm, and (2) adverse selection at the time of succession, reflected by CEOs’ outside origin and poor performance (Fig. 1). Considering these contextual factors, we try to explain the variations in gender-stereotyped attribution, i.e., the extent to which the competence of female successors is more subjectively assessed based on prescriptive gender stereotypes or more objectively assessed based on their task-related capabilities, instead of discussing the preference for female- or male-typed leadership schemas. We suggest that prescriptive and descriptive gender stereotypes are not directly opposite but are conceptually distinct and subject to different dynamics (Eagly & Karau, 2002). A person can be simultaneously subject to both gender stereotypes, and low gender-stereotyped attribution can minimize both gender stereotypes (Fitzsimmons & Callan, 2016). In this study, we focus on the presence of and variance in prescriptive gender-stereotyped attributions. The theoretical model is shown in Fig. 2, which presents the hypotheses developed in the next section.

Hypothesis development

Female CEOs’ Risk-Taking Behaviors and Early Dismissal

We suggest that during the early tenure of a new female CEO, a perceived incongruity between the successor’s risk-taking behaviors and female-typed leadership schemas may increase the likelihood of dismissal. First, new female CEOs who exhibit risk-taking behaviors may be poorly evaluated because they fail to display the expected feminine management style. Female CEOs are perceived to have their own way of managing (Ashcraft, 1999; Dixon-Fowler et al., 2013; Manner, 2010), characterized by strong interpersonal skills, emotional sensitivity, and morale-building abilities (Bruckmüller & Branscombe, 2010; Ryan & Haslam, 2007). Given the changing environmental requirements (Eagly & Carli, 2003a), female-typed leadership styles are increasingly preferred to fulfill the diversified needs of firms, such as the achievement of social goals (Cook & Glass, 2018; Francoeur et al., 2019), the enhancement of diversity to address the increasing pressure for gender equality from the public (Hillman et al., 2007; Kogut et al., 2014), and meeting the need for leaders to possess communal traits in certain stages of firm development or in the performance of specific organizational tasks (Dezsö & Ross, 2012). For example, female leaders are proven to be more capable of dealing with networking issues (Daily et al., 1999; Davis et al., 2010), creating mentoring and relationship-building benefits both inside and outside firms (Ho et al., 2015; Rosette & Tost, 2010). In such cases, to prove their competence as leaders, female successors should behaviorally align with female-typed leadership schemas as expected.

In addition, a CEO’s leadership style can determine the norms and patterns of interactions among top managers and create a certain climate among all members of a firm (Zhang & Qu, 2016). For example, Oliver et al. (2018) suggest that a firm’s board forms initial stereotype-driven impressions about CEOs based on their gender. Because women are typically portrayed as warm but incompetent and in need of support, the board chair is more likely to adopt a collaboration orientation rather than a control orientation after the appointment of a female CEO. However, the display of agentic behaviors shows a deviation from expected female-typed leadership schemas and leads to a negative evaluation of the female successor. For instance, Dwivedi and Colleagues (2021) suggest that leadership endorsements in female CEOs’ succession announcements that highlight their past achievements and competence can violate stakeholders’ prescriptive stereotypes and thus decrease their longevity in the CEO role. Overall, by behaviorally aligning with female-typed leadership schemas and showcasing communal qualities, female CEOs may be positively evaluated as leaders. Therefore, we suggest the following:

Hypothesis 1

The risk-taking behaviors of a female CEO increase the likelihood of dismissal during the CEO post-succession process.

The Moderating Effect of Gender Inequality Beliefs

We further argue that the prescriptive gender-stereotyped attribution can be amplified or mitigated depending on the institutional context in which the female successor is embedded at different levels. A firm subject to stronger gender inequality beliefs is more likely to be influenced by gender stereotypes when evaluating the competence of its leaders (Malmström et al., 2017). To test the institutional contingency of prescriptive gender stereotypes, we focus on the proportion of female CEOs in a province and the proportion of female directors of a firm as reflections of gender inequality beliefs at the regional and firm levels to explore their moderating effects on our main argument.

The Proportion of Female CEOs in a Region

We argue that a higher proportion of female CEOs in a region indicates a lower level of gender inequality beliefs, which weakens the prescriptive gender-stereotyped attribution and, thus, the relationship between female CEOs’ risk-taking behaviors and early dismissal. Although the status of women has increased considerably in China in recent years, gender stereotypes still persist (Jiang, 2006; Zhao & Yang, 2021). Women and men are expected to play different roles in Chinese society (Eagly & Wood, 2011). For instance, women are expected to make the family their top priority and be virtuous housewives, whereas men should be breadwinners who support their families (Ning, 2008; Sun, 2012). These gender beliefs are deeply rooted in Chinese society, but their strength varies significantly among the different regions of China (Kalnins & Williams, 2021; Zhao & Yang, 2021). It has been shown that gender inequality beliefs are strongest in the northern, northwestern, and southern regions of China and are weakest in eastern, central, and southwestern China (Du & Zhao, 2017; Gu & Xu, 1994). Previous studies have found that gender inequality beliefs in local contexts can affect individual identification with gender-based social roles and, thus, shape gender stereotypes in local people’s daily lives (Xiong et al., 2018). For instance, Zhao and Yang (2021) suggest that stronger gender inequality beliefs in a province lead to more evident gender stereotypes and more constraints on women’s entrepreneurial pursuits. Gender beliefs in each province can have a strong impact on local firms’ gender stereotypes, with a high proportion of female CEOs in a province suggesting a low level of gender inequality beliefs in the local context. Female leaders in local firms’ gender-equal environment may face less bias and constraints in their career development process. In this case, the perceived incongruity between the risk-taking behaviors of a female CEO successor and female-typed leadership stereotypes may be weaker in provinces with a higher proportion of female CEOs, contributing to a lower likelihood of the successor being fired early in her tenure. Accordingly, we suggest the following:

Hypothesis 2

The proportion of female CEOs in a province weakens the positive relationship between the risk-taking behaviors of a female CEO and the likelihood of dismissal during the CEO post-succession process.

The Proportion of Female Directors of a Firm

A similar argument holds for gender inequality beliefs at the firm level. We suggest that a firm’s female board representation may weaken the impact of the risk-taking behaviors of a new female CEO on the likelihood of her dismissal during the post-succession process. A higher proportion of female directors enables less discrimination based on gender stereotypes (Cook & Glass, 2018; You, 2021). According to the similarity-attraction paradigm (Byrne, 1961), when there are more female top managers, the attraction between a female CEO and other female managers enables a more favorable evaluation of the CEO and a lower level of turnover-performance sensitivity (Ma, 2022; Westphal & Zajac, 1995). For example, Zhang and Qu (2016) suggest that a firm with more women in its upper echelon shows less gender bias against a new female CEO, which leads to less of a status differential between female and male leaders (Blalock, 1967; Chattopadhyay et al., 2004). In this case, the female successor is less likely to be viewed as an “out-group” member who causes low-level disruption, contributing to better post-succession firm performance and a lower likelihood of early departure after a male-to-female succession. Similarly, greater female representation on the board can lead to more inclusiveness toward female leaders’ various strategic decisions and behaviors rather than the mere expectation of female leaders’ behaviors being consistent with female-typed leadership schemas. As suggested by Dwivedi et al. (2021), the presence of other female executives in a firm leads to a more gender-inclusive context in which gender stereotypes are less likely to be activated and used as the primary frame of reference toward a female CEO and, therefore, reduces the stereotype threat experienced by the female CEO.

In addition, a higher level of female board representation enables better interaction between the new female CEO and the directors, leading to higher recognition and appreciation of the value of female leaders. For example, Amore et al. (2014) suggest that more female directors can facilitate the financial performance of firms led by female CEOs due to the benefits of female interactions at the top. Overall, in a firm with more female directors, a new female CEO is more likely to be judged based on her task-related capabilities, and the display of masculine behaviors is unlikely to cause the low evaluation of her post-succession performance as a result of weaker gender stereotypes. Therefore, we suggest the following:

Hypothesis 3

The proportion of female directors of a firm weakens the positive relationship between the risk-taking behaviors of a female CEO and the likelihood of early dismissal during the CEO post-succession process.

The Moderating Effect of Adverse Selection

A higher level of adverse selection problems at the time of succession suggests higher uncertainty regarding the competence of a successor (Karaevli, 2007; Zhang, 2008). Therefore, the extent of prescriptive gender-stereotyped attributions may increase when a firm encounters a higher level of information asymmetry and adverse selection problems. Specifically, we focus on the female successor’s outside origin and poor performance as reflections of a higher adverse selection to explore their moderating effects on our main argument.

CEO Outside Origin

We suggest that the origin of a female successor from either inside or outside the firm determines the level of information asymmetry at the time of succession and, thus, affects the extent of perceived gender-based incongruity during the post-succession period. In the case of an inside female successor who was a member of the firm’s upper echelon prior to the succession and who possesses a history of social interaction and joint work experience with other top leaders (Zajac, 1990), there is a lower level of perceived differences based on gender stereotypes (Dwivedi et al., 2021; Zhang & Qu, 2016). Furthermore, the female successor’s insider origin indicates a gender-inclusive context of the focal firm and thereby a lower likelihood of gender-stereotyped evaluations of the female successor (Dwivedi et al., 2018). In contrast, the board of directors usually lacks detailed information on the competence of CEO candidates from outside the firm and their fit with the firm compared to inside candidates, and they tend to make judgments about the successor’s competence by drawing on representativeness heuristics (Barkema & Shvyrkov, 2007; Harrison et al., 2002; Tversky & Kahneman, 1974). Similarly, hiring a female CEO from outside the firm may cause greater uncertainty over the successor’s competence, leading to higher dependence on gendered expectations to evaluate her leadership ability (Dwivedi et al., 2018; Zhang & Qu, 2016). Consequently, the gender-biased evaluation of an outside female successor may lead to the perception of a greater mismatch between the expected and actual behaviors of the successor, increasing her likelihood of early dismissal.

In addition, a higher risk of adverse selection in outsider successions causes an ineffective assessment of the fit between outsider female candidates and the firm and enables poor CEO selections (Karaevli, 2007; Zajac, 1990), leading to inferior firm performance and a higher likelihood of CEO dismissal (Shen & Cannella, 2002; Zhang, 2008; Zhang & Qu, 2016). Thus, the risk-taking behaviors displayed by the successor deviate from female-type leadership schemas and cause a negative evaluation of the competence of the successor. As directors obtain updated information regarding the mismatch between a female successor’s actual and expected leadership styles, they may dismiss the successor at an early point in her tenure. Therefore, we suggest the following:

Hypothesis 4

The outside origin of a CEO strengthens the positive relationship between the risk-taking behaviors of a female CEO and the likelihood of early dismissal during the CEO post-succession process.

Firm Performance

We suggest that a female successor’s underperformance may violate the board’s expectations and show a greater adverse selection problem, which further enhances the extent of gender-stereotyped attribution and, thus, leads to a higher likelihood of early dismissal for the female successor who displays risk-taking behaviors.

Firm performance is a strong indicator by which the directors assess a CEO (Gupta et al., 2020), but its objectivity has been questioned due to its inertial and path dependent nature in the early tenure of a CEO (Graffin et al., 2013). Extending previous studies that have suggested that firm performance can explain the variance in CEO dismissals as a result of providing updated information regarding adverse selection but only to a small degree (Finkelstein et al., 2009; Hubbard et al., 2017), we argue that firm performance can contribute an important effect on the degree to which the evaluation of a female successor’s competence is based on cognitive processes instead of a direct influence on the successor’s dismissal.

Previous studies have suggested that poor performance indicates an inappropriate way of operating and signals the misalignment among the leader, the firm, and the environment, which acts as a catalyst for organizational reflection and restructuring (Boeker & Goodstein, 1993; Karaevli, 2007; Tushman & Romanelli, 1985). The inferior firm performance after a female successor takes office results in the recognition of an adverse selection by the directors, motivates them to search for clues and reevaluate the competence of the successor, and increases their evaluation of the successor based on gender stereotypes if inconsistent gender-stereotyped behaviors are observed. In this case, the gender-stereotyped attribution is amplified, leading to higher perceived incongruity between a female successor’s risk-taking behaviors and female-typed leadership schemas as expected. In contrast, good performance can provide strong evidence that the board has made the right CEO selection decision and that the new CEO is of high quality (Hubbard et al., 2017), lessening the judgments of the female successor’s competences based on gender stereotypes. Therefore, we suggest:

Hypothesis 5

Firm performance weakens the positive relationship between the risk-taking behaviors of a female CEO and the likelihood of early dismissal during the CEO post-succession process.

Method

Sample and Data

We examined our hypotheses using a sample of publicly listed firms in China from 2007 to 2017. We obtained data on CEO and firm characteristics from the China Stock Market and Accounting Research (CSMAR) database and collected proxy statements about CEO dismissals from the Wind database. We identified 6935 CEO successions that occurred between 2007 and 2017, among which only 409 CEO successions involved a female successor. Because our study seeks to explore the variance in female successors’ risk-taking behaviors when determining their likelihood of early dismissal, we developed our final sample based on female CEO succession events. Our observations for each succession event followed the event-history format and considered the period from the year of appointing a female CEO to the year of dismissal (within three years or the third year). After excluding missing data, the final sample included 251 female CEO succession events from 495 firm-year observations representing 134 listed firms.

Measures

Dependent Variable: New Female CEO Dismissal

Dismissals of new female CEOs reveal that they are dismissed within a short time after taking office (Yi et al., 2020; Zhang, 2008). Following previous studies (e.g., Cowen & Marcel, 2011; Srinivasan, 2005; Zhang, 2008), we adopted a three-year time horizon to identify the new female CEO’s dismissal, which can fully capture the early tenure of a new CEO and the effects of the succession event (Schepker et al., 2018) while avoiding the confounding effects of other factors (Zhang & Qu, 2016) because directors can obtain more accurate information for later-stage CEO evaluation rather than basing it on gender stereotypes (Graffin et al., 2013). We relied on both CEO turnover information from the CSMAR database and corporate proxy statements from the Wind database on CEO turnover to identify whether the new female CEOs were dismissed or were still in office three years after succession. Following previous studies (Shen & Cannella, 2002; Zhang, 2008), we first excluded new female CEO turnovers due to health issues, sudden death, normal retirement, or taking a similar position within the firm or elsewhere, which were identified as voluntary turnovers. For the remaining situations, the new CEOs were considered to be dismissed early if (a) they were directly reported to be fired, (b) they were reported to have resigned for undisclosed personal reasons, (c) they took early retirement under the age of 60, or (d) they were reported to be investigated or involved in illegal cases within three years. Because we employed an event-history format (Xia et al., 2022), time was the major concern when addressing why some new female CEOs were dismissed during their early tenures. We thus tracked each sample firm from the year it appointed a new female CEO to the year the successor was dismissed, and we split the time for each firm into annual spells within the three-year window. The dependent variable, new female CEO dismissal, was coded as 1 in a year if a new female CEO was dismissed and 0 otherwise.Footnote 1

Independent Variable: Risk-Taking Behaviors

Following prior studies (Devers et al., 2008; Martin et al., 2013; Miller & Bromiley, 1990), we first captured risk-taking behaviors by using the sum of three major forms of risk-taking expenditures, including research and development (R&D) spending, capital expenditures, and long-term debt. Accounting for the potential impact of industry affiliations on risk-taking behaviors (Zhu & Chen, 2015), we then subtracted each firm’s risk-taking behaviors from the average industry value in the same year to calculate this variable.

Moderators

The proportion of female CEOs in a province was measured by dividing the number of female CEOs by the total number of firms in the same province.Footnote 2

The proportion of female directors of a firm was captured by dividing the number of female directors by the total number of directors on the board (Gul et al., 2011; Isidro & Sobral, 2015).Footnote 3

CEO outside origin was coded as 0 if the new CEO was promoted from within the focal firm and 1 if the new CEO was hired from an external organization (Zhang & Qu, 2016).Footnote 4 Thus, a new CEO is considered an insider if the successor served as an executive of the focal firm in the previous year.

Firm performance was measured using Tobin’s Q calculated as the ratio of the market value of a firm’s total assets to its replacement value (Wolfe & Sauaia, 2003).Footnote 5 A higher Tobin’s Q value indicates better market performance. We used this market-based performance measure because it captures the extent to which the firm is valued by the stock market for potential growth opportunities and future operating performance (Nekhili et al., 2018; Tayeh et al., 2015). Thus, directors tend to draw on market performance to assess a successor’s competence to lead the firm now and in the future, suggesting variations in gender-stereotyped attribution in dismissal decisions based on firm market performance.

Control Variables

We controlled for several variables that have been shown to influence CEO dismissal. At the firm level, we controlled for firm size (the logarithm of sales revenue; Lee & Sung, 2005), firm age (the number of years since the founding of a firm; Sanders & Boivie, 2004), state ownership (the proportion of state-owned shares in total shares; Attia et al., 2021), ownership concentration (the shareholding ratio of the largest shareholder; Xia et al., 2022) and sales growth (the relative change in sales revenue; Rodríguez & Nieto, 2016). At the top executive level, we controlled for CEO age (Engel et al., 2003) and TMT gender (the proportion of female managers on the top management team; Zhang & Qu, 2016). Since not all female leaders are equally influential (Wang et al., 2023), we also controlled for CEO power using CEO duality (which takes a value of 1 if the CEO of a firm also holds the position of chairperson and 0 otherwise; Muttakin et al., 2018) and CEO external appointment (the number of directorships in other listed companies concurrently held by the CEO; Flickinger et al., 2016). For board-level factors, we controlled for board size (the number of directors on the board), board age (the sum of the age of the directors on the board), board independence (proportion of dependent directors), and board stock ownership (the total share of the directors on the board; Perry, 2000). Regarding industry-level factors, we controlled for industry munificence and industry dynamism to capture the uncertainty and unpredictability of the industrial environment (Dess & Beard, 1984; Lester et al., 2006). Following prior literature (Keats & Hitt, 1988), we regressed sales in each industry (three-digit SIC code) and used the coefficient from the regression equations to measure industry munificence and standard errors to measure industry dynamism. Regional market development reflects the institutional differences of the regions where firms are located and may shape the degree of gender stereotypes (Zhao & Yang, 2021). Therefore, we controlled for regional market development by the marketization index in a province. Finally, year and industry dummies were also included to fix any unobservable year and industry effects. All predictor variables were lagged by one year.

Estimation Method

Because our study focuses on the dismissal of new female CEOs and concerns a discrete dismissal event, we used a discrete-time event history analysis to test our hypotheses (Allison, 1999). Event history analysis is an estimation method that can effectively analyze censoring data and model the probability of the early dismissal of female CEOs. Our estimations used the Cox proportional hazards regression model (Cox, 1972) to estimate the hazard rate, which reflects the likelihood that a firm dismisses a new female CEO within three years. A positive coefficient denotes that the independent variable increases the hazard of the early dismissal of new CEOs, and a negative coefficient reveals that the independent variable can increase the hazard rate. Furthermore, because our study centers on the succession and dismissal of female CEOs, we used the Heckman two-stage model to solve the potential selection bias (Heckman, 1979). In the first stage, we predicted whether a firm would appoint a female CEO based on the sample of all firms (n = 20,551) during the study period. We used the proportion of female CEOs in the same industry where the focal firm is located as the instrumental variable in the first-stage model. Then, we calculated the inverse Mills’ ratio based on the probit regression results in the first stage and included it as a control variable in the second-stage model to estimate early dismissal. We clustered observations at the firm level in the model estimations to address the potential problems of autocorrelation and heteroskedasticity (Wooldridge, 2002). Furthermore, to reduce potential multicollinearity problems, we mean centered the independent variables and moderating variables while creating the interaction terms (Wu & Tu, 2007).

Results

Regression Findings

Table 1 presents the descriptive statistics and correlations for all variables. Variance inflation factors (VIFs) were calculated to assess multicollinearity among the variables. The mean VIF was 1.35, and the VIF of each variable was below the conventional criterion (VIF < 10) that indicates no serious multicollinearity issues (Belsley et al., 1980). Table 2 presents the results of the Cox regressions. Model 1 shows the results with only control variables. Model 2 reveals the independent variable (risk-taking behaviors) for new female CEO dismissal. Models 3, 4, 5, and 6 add the interaction terms of proportion of female CEOs in a province, proportion of female directors of a firm, outside origin of a CEO, and firm performance. Model 7 shows the full model with all variables and interaction terms.

Hypothesis 1 predicts that risk-taking behaviors positively affect the likelihood of new female CEO dismissal. In Model 2, the odds ratio of risk-taking behaviors is 1.50 and significant (z = 2.64, p < 0.01), which shows that a one-unit increase in risk-taking is related to a 72% increase in the hazard rate of CEO dismissal (1.72–1); thus, H1 is supported.

Hypothesis 2 predicts that the proportion of female CEOs in a province negatively moderates the relationship between risk-taking behaviors and new female CEO dismissal. Model 3 reveals that the odds ratio for the interaction term between the proportion of female CEOs in a province and risk-taking behaviors is 0.57 and significant (z = − 3.22, p < 0.001), supporting H2. As shown in Fig. 3, firms with risk-taking behaviors in regions with a higher proportion of female CEOs are less likely to dismiss new female CEOs (the dotted line) than are firms in regions with a lower proportion of female CEOs (the solid line).

Hypothesis 3 posits that the effect of risk-taking behaviors is weaker when more female directors are on the board. The odds ratio for the interaction between the proportion of female directors of a firm and risk-taking behaviors is 0.45 and significant (z = − 2.92, p < 0.001) in Model 4, which supports H3, as shown in Fig. 4.

Hypothesis 4 predicts that risk-taking behaviors can have a stronger effect on female CEO dismissal when the new CEO is an outsider. As shown in Model 5, the odds ratio for the interaction term between a CEO’s outside origin and risk-taking behaviors is 3.53 and significant (z = 3.34, p < 0.001); thus, H4 is supported, as shown in Fig. 5.

Hypothesis 5 posits that firm performance negatively moderates the relationship between risk-taking behaviors and new female CEO dismissal. In Model 6, the odds ratio of the interaction term is 0.49 and significant (z = − 2.25, p < 0.05), supporting H5, as shown in Fig. 6.

Robustness Analyses

We conducted several additional tests to examine the robustness of the results.

Endogeneity Check

Endogeneity may be a concern in our study because omitted variables may affect the choice of appointing female CEOs and risk-taking behaviors. Thus, we used two-stage least squares regression with instrumental variables to correct for endogeneity. In the first stage, we used the mean value of firms’ risk-taking behaviors in the same region and the mean value of firms’ risk-taking behaviors within the same industry as the instrumental variables. The Cragg–Donald Wald F or Stock-Wright statistics show no weak-instrument issue, and the Sargan statistics reveal no overidentification issue (Stock & Yogo, 2005). The results in Appendix 6 are consistent with those of Table 2.

Clustering Robust Standard Errors at Different Levels

We also clustered observations based on industry or province and obtained consistent results (see Appendix 7).

Accounting for risk-taking behaviors prior to succession. We included risk-taking behaviors before the succession of a new female CEO as a control variable to reduce the potential effect of prior strategic risk-taking behaviors and obtained consistent results (see Appendix 8).

Testing the Industrial Variations in Gender-Stereotyped Attribution

An industry dominated by women is another context that is expected to be supportive of women. It has been shown that gender differences in CEO positions can be narrowed when the prerequisites for leaders incorporate communal needs, such as female CEOs’ presence in female-dominated industries (Wang et al., 2019). However, some studies find that the gender gap is larger in female-dominated industries than in male-dominated industries, with a higher failure rate for businesses led by women (Yang & del Carmen Triana, 2019). We used the proportion of female CEOs in the industry to capture the industrial variation and tested its moderating effect. As shown in Appendix 9, a higher proportion of female CEOs in the industry weakens the positive relationship between female successors’ risk-taking behaviors and the likelihood of early dismissal, suggesting a lower level of prescriptive gender-stereotyped attribution in predominantly women-led industries.

Post Hoc Analysis

We sought to understand whether the gender-typed leadership stereotype applies to men. Therefore, we conducted a post hoc analysis to test the effect of the risk-taking behaviors of a male CEO on the likelihood of dismissal during the CEO post-succession process based on a matched sample of men. Specifically, we employed a propensity score matching procedure to identify a matched sample of firms run by new male CEOs. Following prior studies (Adhikari, 2012; Arthaud-Day et al., 2006), we first calculated the propensity score of each firm-year observation and then matched each female CEO's firm-year observation with a male CEO’s firm-year observation based on firm size, financial performance, ownership concentration, CEO stock ownership, province, industry, and year. As such, we obtained a matched sample including comparable male CEOs for a given industry year and finally identified 307 firm-year observations.

The results of the post hoc analysis are presented in Table 3. As shown in Model 2, the risk-taking behaviors of new male CEOs negatively affect the likelihood of early dismissal (z = − 3.23, p < 0.001), indicating the perceived alignment between the male successors’ masculine behaviors and male-typed leadership schemas. Models 3 and 4 show that the proportion of female CEOs in a province and the proportion of female directors both weaken the negative relationship between male successors’ risk-taking behaviors and early dismissal (z = 3.50, p < 0.001; z = 1.94, p < 0.05), suggesting decreased male-typed leadership stereotypes against male successors in local contexts with lower gender inequality beliefs. Model 6 shows that better firm performance decreases the negative relationship between male successors’ risk-taking behaviors and early dismissal (z = 3.75, p < 0.001), which suggests the perception of lower adverse selection during the CEO post-succession process. However, we did not find significant moderating effects of CEO outside origin. This is likely because the decision to appoint a male CEO from outside is less dependent on gender-stereotyped expectations and judgments at the time of succession than is the appointment of a female CEO, and thus, the outside origin cannot explain the variations in gender-stereotyped attribution in a significant way. In summary, these findings reveal that men are also subjected to gender stereotypes as top leaders but in different ways than women. Specifically, the deviation of men from male-typed stereotypes may lead to a low evaluation of them as capable leaders and, thus, increase the likelihood that they are dismissed in the early stage of recruitment.

Discussion

The role of gender stereotypes in leadership positions has received much attention from scholars and the public, suggesting the widespread identity of male-typed leadership schemas as barriers to female leaders’ career development. However, the preference for feminine traits in leadership positions and the individual behavioral differences of female leaders have been largely overlooked in the literature, leading to a limited understanding of gender bias against female leaders. Integrating GRCT with the adverse selection argument of agency theory, we proposed the concept of female-typed leadership schemas and explored how the (mis)match between new female CEOs’ agentic behaviors and female-typed leadership stereotypes affects their dismissal during their early tenures. Using data from 251 female CEO succession events at Chinese publicly listed firms, we found that the risk-taking behaviors of female CEOs increase their likelihood of being dismissed during the post-succession process, and this effect is strengthened by gender inequality beliefs in local contexts (reflected as the lower proportion of female CEOs in a province and female directors in a firm) and adverse selection at the time of succession (reflected as a CEO with an outside origin and inferior firm performance).

Theoretical Implications

First, our study contributes to GRCT by developing a comprehensive framework to explain how female-typed leadership stereotypes hinder female leaders’ career development. GRCT has mainly focused on the descriptive gender bias arising from male-typed leadership schemas that value agentic traits (Dwivedi et al., 2018; Wang et al., 2019), which overlooks the expectation of female traits in leadership positions and leads to a limited understanding of the evaluation of new leaders. In fact, corporate directors’ (and other organizational stakeholders’) expectations and evaluations of top leaders are not simply position-based but are also personal and based on their specific individual styles and abilities. The literature on female leadership has noted the changing demand for the leadership role (Eagly & Carli, 2003a) and has emphasized the fulfillment of the diversified needs of firms and the general public at different development stages (Campopiano et al., 2023; Dezsö & Ross, 2012). However, this line of research is rather fragmented, resulting in the lack of a systematic understanding of the possible gender bias it may bring. By showing that female leaders’ agentic behaviors in a leadership position can deviate from the expectations of female-typed leadership schemas and increase their likelihood of early dismissal, our study extends the research on prescriptive gender stereotypes that has mostly been conducted in laboratory contexts and underexplored in high-rank management settings (Heilman & Okimoto, 2007; Heilman et al., 2004). To further support our main argument regarding female-typed leadership stereotypes, we identified key boundary conditions when determining the variations in the gender-stereotyped attribution of female leaders’ effectiveness through a contextualized approach. Although gender stereotypes are deeply rooted in culture and vary across different contexts, limited research has focused on the institutional effects of gender stereotypes (Zhao & Yang, 2021). By exploring the institutional-level contingencies of female-typed leadership stereotypes, our study not only extends previous studies that have explored the gender gap from an individualistic perspective (Ahl, 2006) but also complements the traditional view of emphasizing the ubiquity of masculine preferences in leadership roles (Campopiano et al., 2023). The findings show that female-typed leadership stereotypes are more severe in regions with fewer female CEOs and in firms with less female board representation, suggesting that the adverse impact of a preference for female traits also exists for the careers of female leaders in gender-imbalanced contexts. In addition, the literature on CEO succession has emphasized the risk of adverse selection in appointing new CEOs and has explored the effect of the succession context in determining the evaluation of a new CEO’s competence and subsequent departure, such as the successor’s origin, power, and succession planning process (Schepker et al., 2018; Shen & Cannella, 2002; Wiersema et al., 2018). However, the role of social-cognitive gender stereotypes in this process is unclear. Considering its variations in determining the behavioral unalignment of female successors’ agentic behaviors with female-type leadership schemas (i.e., the contingent role of successors outside origin and firm performance) helps uncover the underlying gender-stereotyped attribution process (Dwivedi et al., 2018). Our findings also support Kanze et al. (2018)’s conjecture that stereotype-driven implicit bias can be posed toward women when they are significantly underrepresented and when there is a high degree of uncertainty. Overall, the integration of the behavioral drivers of female successors and these key institutional and succession contextual factors into our model helps open the “black box” of the CEO evaluation process from a gender perspective and develop a full picture of female-typed leadership stereotypes during the CEO post-succession process.

Second, our study provides new insights into how agentic behaviors affect the application of gender stereotypes in decisions involving female leaders (Wang et al., 2019). While most studies have focused on the mere occurrence of gender bias against women in leadership roles, recent studies have begun to note the variation in leaders’ gender-stereotyped behaviors in driving the gender gap. These limited studies have obtained conflicting findings on the outcomes of female leaders’ agentic behaviors. Studies that hinge on male-type leadership schemas have suggested a positive attitude toward female leaders’ agentic behaviors in fulfilling the agentic requirements for leadership roles (Balachandra et al., 2019), whereas others have suggested the possibility of a negative attitude in contexts that value communal traits (Wang et al., 2019). By proposing a comprehensive framework of female-typed leadership stereotypes and considering the fit between gender-stereotyped behaviors and expectations, our study shows that during the post-succession process of a female CEO, the agentic behaviors of the female successor can result in unalignment in the fulfillment of female-typed leadership schemas, leading to negative evaluations of her as a qualified CEO. Thus, our study extends previous studies on gender bias that have focused either on uniform discrimination toward women as leaders or solely on the role of gender-stereotyped behaviors by exploring how the match between gender-stereotyped behavior and gender as a reflection of the expected gender-typed leadership schemas affects how a new CEO is evaluated. Moreover, by testing the effect of the risk-taking behaviors of a new female CEO on the likelihood of early dismissal, we can obtain a clue about the exact type of gender stereotypes (i.e., prescriptive) that hinder new female CEOs’ career development during the post-succession stage.

Third, our study contributes to the literature on corporate governance and CEO succession by examining the dismissal consequences of prescriptive gender stereotypes during the CEO post-succession process. Previous studies have shown an unclear dismissal-performance link and, thus, have cast doubt on the use of top executive dismissal as an effective governance mechanism (Hilger et al., 2013), suggesting the significance of identifying the irrational antecedents of dismissal. The corporate governance literature has typically explained why boards protect or fire CEOs based on agency-centered arguments but has paid limited attention to the critical role of directors’ beliefs or thought processes in shaping these decisions (Graffin et al., 2013; Park et al., 2020). Very few studies have considered gender as a contributing factor to CEO dismissal (Gupta et al., 2020). Our findings revealed that the evaluation of a new female CEO is not a uniform procedure that hinges on an objective appraisal of post-succession firm outcomes such as performance but rather is a complex cognitive process depending on an ongoing assessment of the matching of subjective expectations of the female successor and her behaviors after taking office. By identifying risk-taking behaviors as a key driver in determining the dismissal probability of new female CEOs, our study answers the recent call of Gupta et al. (2020) to explore “the gendered nature of CEO dismissal” and “the drivers of the higher likelihood of dismissal among female CEOs” and contributes to research that integrates behavioral consideration into agency theory’s predictions about corporate governance (Shi et al., 2017; Westphal & Zajac, 2013).

Fourth, our study contributes to the leadership literature on gender equality by positing the presence of gender stereotypes for both female and male leaders. Extending previous studies that have mainly emphasized discrimination against feminine traits and behaviors (Dwivedi et al., 2018), this study shows that it is not gender per se but rather the perceived incongruity between gender and displayed gender-stereotyped behaviors that may lead to poor performance evaluations of leaders’ effectiveness, potentially leading to an early dismissal during the critical phase of evaluation and career development. A comparison with a matched sample of male CEO succession events in the post hoc analysis shows that the alignment between male successors’ agentic behaviors and male-typed leadership schemas decreases the likelihood of male CEOs’ early dismissal. Overall, our findings revealed that women and men are both subjected to gender stereotypes as leaders but in different ways. A deviation of women’s agentic behaviors from female-typed leadership stereotypes and a deviation of men’s communal behaviors from male-typed stereotypes may lead to poor evaluations of them as capable leaders and, thus, increase the likelihood of their dismissal in the early stage of recruitment. The incongruity between gender-stereotyped behaviors and gender-typed leadership schemas is what matters in the post-succession process, leading to both men and women being penalized for displaying behaviors that deviate from their gender roles. By separating gender from specific behaviors and considering their combined effects (Balachandra et al., 2019), our study also extends prior research that has focused on the uniform impact of gender bias on women to raise the potential bias caused by the mismatch between gender and leaders’ gender-stereotyped behaviors.

Ethical Implications

Our study on the issue of the dismissal of female CEOs enriches the ethics literature on gender inequality in female leaders’ career development (Dwivedi et al., 2018). The appointment of a female CEO is by no means an indication that gender inequality has been eliminated, as women still face gender stereotypes and role conflicts in the CEO position (McDonald et al., 2018; Zhang & Qu, 2016). Some studies have indicated that the descriptive stereotypes of “think manager, think male” have diminished, and women’s managerial competence is more welcomed and viewed as an advantage to their leadership abilities (Dezsö & Ross, 2012; Eagly, 2007; Eagly & Carli, 2003a, 2003b). The change in the leader role of emphasizing qualities that are more consistent with the female gender role than the traditional features of male-type leadership schemas leads to an increased preference for feminine leadership styles and a recognition of their effectiveness (Adler, 1999). However, our exploration of female-typed leadership stereotypes reveals the dark side, suggesting potential bias against women who fail to fulfill the requirements of female-typed leadership schemas. Although selecting a female CEO may symbolize a departure from the male-typed leadership schemas, it implies the existence of prescriptive gender stereotypes with more prevalent stereotypic expectations for women to play to their female strengths. Actually, the bias against women is not diminishing but may transfer from one type to another, specifically, from bias that arises from descriptive stereotypes to bias that arises from prescriptive stereotypes. Our investigation of institutional and succession contingencies shows that the ethical issue is even more severe in gender-imbalanced contexts and in firms that face greater adverse selection problems. A higher level of prescriptive gender-stereotyped attribution can lead to a biased evaluation of female leaders’ effectiveness. Therefore, in addition to promoting gender diversity at the top, it is also necessary to create a gender-inclusive environment that embraces diverse behaviors and styles rather than being judged by gender.

Practical Implications

Our study also yields important practical implications for both board of directors and policy-makers in addressing gender bias in leadership positions. Boards of directors should carefully evaluate the competences of CEO candidates and their fit with a firm’s current task conditions based on a detailed investigation and assessment of their previous strategic decisions, actions, and performance rather than on gender stereotypes. Efforts should be made to alleviate gender stereotypes toward both men and women and adverse selection at the time of succession depending on gender-based cognitive processes, which could cause major losses to firm development. On the one hand, firms should formulate a comprehensive evaluation system to select and assess qualified leaders. To make proper appointment and dismissal decisions, performance indicators of different dimensions and their alignment with the specific circumstances of firms at the current stage of development should be considered. Reducing information asymmetry by establishing effective communication channels is essential, especially for the evaluation of CEOs in their early tenures. On the other hand, firms should establish supportive policies and procedures to enhance gender diversity and shape an organizational culture of gender equality. As our findings show that a higher proportion of female directors facilitates a more gender-equal environment, firms could develop gender-diverse boards that can reduce the salience of gender to organizational processes, provide mentorship, resources, organizational and network support to other women leaders, and create gender-equal norms and cultures (Cook & Glass, 2018; You, 2021). An inclusive atmosphere enables the abandonment of stereotypical views of both men and women, allows both female and male leaders to explore more possibilities and make full use of their strengths, and fosters collaboration between them.

For policy-makers, the government should be aware of different types of gender bias against women in the business world and take action to reduce them. Because changing individual perceptions of gender stereotypes can be difficult and require long periods to realize, which also put women in an awkward situation for addressing different types of gender stereotypes by simply urging them to lean in (You, 2021), governments should make more structural and institutional changes to help women overcome deeply rooted stereotypes. On the one hand, governments should put forward relevant policies at the institutional level (e.g., family support policies) to alleviate societal gender inequality beliefs, which could help cultivate a friendlier and more equal culture for women workers. On the other hand, illuminating the gender discrimination against women in top executive positions is very meaningful, as gender equality beliefs can spill over into other levels of business systems (McGuinness, 2018). Regulations and policies that promote the involvement of women at the top can be necessary but not sufficient to creating a female-friendly environment that ensures equal opportunities for well-qualified women.

Moreover, promoting gender equality is a global ethical challenge that requires a multistakeholder effort (Young, 2006). Other than the endeavors of the key actors mentioned above, other stakeholders, such as local communities, media, relevant associations, and the general public, should be involved in the process of identifying institutionalized inequality patterns and finding solutions collectively (Böhm et al., 2022).

Limitations and Future Research

Our study has some limitations that create opportunities for future research. First, we explore the variations in gender-stereotyped attribution by suggesting that a lower level of gender inequality beliefs and adverse selection can weaken prescriptive gender-stereotyped attribution. In this case, a new female CEO is more likely to be judged objectively based on her task-related capabilities, and the display of agentic behaviors is unlikely to cause a low evaluation of her post-succession performance as a result of weaker gender stereotypes. We aim to explain the variations in gender-stereotyped attribution instead of discussing the preference for female- or male-typed leadership schemas or the transition between them. For example, the results show attenuated gender-stereotyped attribution in firms with a higher proportion of female directors, which is consistent with the results of previous studies that suggest a female-friendly culture and less stereotypical views of women in firms with or exposed to more female top leaders (Cook & Glass, 2018; Dwivedi et al., 2021; You, 2021; Zhang & Qu, 2016). However, data limitations prevent us from testing whether the effects are specific to prescriptive gender stereotypes or can be generalized to descriptive gender stereotypes. Future research could further explain the underlying mechanisms of variations in descriptive and prescriptive gender-stereotyped attribution by exploring the different contingencies of unified attribution or preference for female- or male-typed leadership schemas, their coexistence and the presence, conditions and pathways of transitions between them.

Second, our study is based on a sample of Chinese publicly listed firms that had succession events with female CEOs. Although there is an increasing number of female leaders—including CEOs—in China and there is increasing pressure to achieve gender equality in the general public, which makes China a suitable context to test our hypotheses, we are not certain whether our findings can be generalizable to other contexts. For example, are there comparable requirements for female-typed leadership styles across different countries or regions? Do female leaders display risk-taking preferences to similar extents across different countries or regions? Although the focus on gender bias in the Chinese context can greatly enrich the understanding of ethical issues in the female leadership literature, future studies could test the hypotheses in other contexts to increase the generalizability of the findings.

Data availability

All data will be shared upon reasonable request.

Notes

We used two sets of alternative measures of the dependent variable to test our hypotheses. First, we used different ages, 65 years old and 55 years old, as retirement judgments in measuring CEO dismissal. Second, we changed the time window of early dismissal to both shorter and longer periods and classified departures within two years and four years after succession as female CEOs’ early dismissal. As shown in Appendix 1, the results remain consistent.

We used the number of female CEOs in a province as an alternative measure and obtained consistent results (see Appendix 2).

We used the presence of female directors on the board with a binary variable that takes the value of 1 if a firm appoints at least one female director and 0 otherwise as an alternative measure and obtained consistent results (see Appendix 3).

We used a dummy variable that takes the value of 1 if the new female CEO served as an executive of the focal firm for at least 24 months before succession and 0 otherwise as an alternative measure. The results are consistent (see Appendix 4).

We used return on assets (ROA) as an alternative measure and obtained consistent results (see Appendix 5).

References

Adams, R. B., & Funk, P. (2012). Beyond the glass ceiling: Does gender matter? Management Science, 58(2), 219–235.

Adhikari, B. (2012). Gender differences in corporate financial decisions and performance. Available at SSRN 2011088.

Adler, N. J. (1999). Global leaders: Women of influence. In G. N. Powell (Ed.), Handbook of gender and work (pp. 239–261). Sage Publications.

Ahl, H. (2006). Why research on women entrepreneurs needs new directions. Entrepreneurship Theory and Practice, 30(5), 595–621.

Allison, P. D. (1999). Multiple regression: A primer. Pine Forge Press.

Amore, M. D., Garofalo, O., & Minichilli, A. (2014). Gender interactions within the family firm. Management Science, 60(5), 1083–1097.

Arthaud-Day, M. L., Certo, S. T., Dalton, C. M., & Dalton, D. R. (2006). A changing of the guard: Executive and director turnover following corporate financial restatements. Academy of Management Journal, 49(6), 1119–1136.

Attia, M., Yousfi, O., Loukil, N., & Omri, A. (2021). Do directors’ attributes influence innovation? Empirical evidence from France. International Journal of Innovation Management, 25(01), 2150010.

Ashcraft, K. L. (1999). Managing maternity leave: A qualitative analysis of temporary executive succession. Administrative Science Quarterly, 44(2), 240–280.

Balachandra, L., Briggs, T., Eddleston, K., & Brush, C. (2019). Don’t pitch like a girl!: How gender stereotypes influence investor decisions. Entrepreneurship Theory and Practice, 43(1), 116–137.

Bandura, A., & Wood, R. (1989). Effect of perceived controllability and performance standards on self–regulation of complex decision making. Journal of Personality and Social Psychology, 56(5), 805–814.

Barkema, H. G., & Shvyrkov, O. (2007). Does top management team diversity promote or hamper foreign expansion? Strategic Management Journal, 28(7), 663–680.

Belsley, D. A., Kuh, E., & Welsch, R. E. (1980). Regression diagnostics: Identifying influential data and sources of collinearity. Wiley-Interscience.

Blalock, H. M. (1967). Toward a theory of minority–group relations. Wiley.

Blau, F. D., & Kahn, L. M. (2017). The gender wage gap: Extent, trends, and explanations. Journal of Economic Literature, 55(3), 789–865.

Boeker, W., & Goodstein, J. (1993). Performance and successor choice: The moderating effects of governance and ownership. Academy of Management Journal, 36(1), 172–186.

Böhm, S., Carrington, M., Cornelius, N., et al. (2022). Ethics at the centre of global and local challenges: Thoughts on the future of business ethics. Journal of Business Ethics, 180(3), 835–861.

Bruckmüller, S., & Branscombe, N. R. (2010). The glass cliff: When and why women are selected as leaders in crisis contexts. British Journal of Social Psychology, 49(3), 433–451.

Byrne, D. (1961). Interpersonal attraction and attitude similarity. The Journal of Abnormal and Social Psychology, 62(3), 713.

Campopiano, G., Gabaldón, P., & Gimenez-Jimenez, D. (2023). Women directors and corporate social performance: An integrative review of the literature and a future research agenda. Journal of Business Ethics, 182, 717–746.

Chattopadhyay, P., Tluchowska, M., & George, E. (2004). Identifying the ingroup: A closer look at the influence of demographic dissimilarity on employee social identity. Academy of Management Review, 29(2), 180–202.

Cook, A., & Glass, C. (2018). Women on corporate boards: Do they advance corporate social responsibility? Human Relations, 71(7), 897–924.

Cox, D. R. (1972). Regression models and life–tables. Journal of the Royal Statistical Society, 34(2), 187–200.

Cowen, A. P., & Marcel, J. J. (2011). Damaged goods: Board decisions to dismiss reputationally compromised directors. Academy of Management Journal, 54(3), 509–527.

CS Gender 3000 Report. (2021). Retrieved September 2021, from https://www.credit-suisse.com/ about-us/en/reports–research/csri.html

Daily, C. M., Certo, S. T., & Dalton, D. R. (1999). A decade of corporate women: Some progress in the boardroom, none in the executive suite. Strategic Management Journal, 20(1), 93–100.

Davis, P. S., Babakus, E., Englis, P. D., & Pett, T. (2010). The influence of CEO gender on market orientation and performance in service small and medium-sized service businesses. Journal of Small Business Management, 48(4), 475–496.

Dess, G. G., & Beard, D. W. (1984). Dimensions of organizational task environments. Administrative Science Quarterly, 29(1), 52–73.

Dezsö, C. L., & Ross, D. G. (2012). Does female representation in top management improve firm performance? A panel data investigation. Strategic Management Journal, 33(9), 1072–1089.

Devers, C. E., McNamara, G., Wiseman, R. M., & Arrfelt, M. (2008). Moving closer to the action: Examining compensation design effects on firm risk. Organization Science, 19(4), 548–566.

Dixon-Fowler, H. R., Ellstrand, A. E., & Johnson, J. L. (2013). Strength in numbers or guilt by association? Intragroup effects of female chief executive announcements. Strategic Management Journal, 34(12), 1488–1501.

Du, Y., & Zhao, M. (2017). The gender inequality in China is declining, but unevenly. China Youth Daily. Retrieved 9 Mar 2017, from http://www.chinanews.com/sh/2017/03-09/8169152.Shtml

Dwivedi, P., Joshi, A., & Misangyi, V. F. (2018). Gender–inclusive gatekeeping: How (mostly male) predecessors influence the success of female CEOs. Academy of Management Journal, 61(2), 379–404.