Abstract

Motivated by a large literature on how firm-specific resources (such as leadership and management skills, strategies, organizational capabilities and intellectual properties) drive firm performance, we propose and find that heterogeneity in investor optimism regarding firm-specific attributes plays a very important role in influencing the managerial propensity to manipulate financial statements. When firm-level investor optimism is moderate, the incidence of accounting misconduct increases, but it decreases when investors are highly optimistic. Further, market reaction to the announcement of financial restatements is more negative when investors held more optimistic firm-specific beliefs at the time of initial misstatement. These findings are robust to alternative firm-specific optimism measures linked to analysts, general investors and unsophisticated individual investors, controls for market-wide consumer sentiment unexplained by macroeconomic factors, economy-wide and industry-level optimism, potential selection bias and reverse causality. Our analysis highlights the importance of firm-level investor optimism in predicting, preventing and detecting accounting misconduct.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the wake of the recent spate of corporate fraud, many studies have looked into factors that affect managerial incentives to engage in fraudulent behavior. An important strand of research on industrial organization focuses on the impact of economy-wide or industry-level investor optimism on misconduct.Footnote 1 However, a large body of literature demonstrates that, in addition to variations in industry structure in terms of concentration level, barriers to entry, degree of product differentiation and growth prospects, firm-specific differences in managerial abilities, strategies and policies, organizational capabilities, research and development, and intellectual capital drive firm profitability and performance (Porter 1991; Piotroski and Roulstone 2004; Gong et al. 2013). Assessing the relative importance of these two main drivers of a firm’s sustainable competitive advantage, McGahan and Porter (2002) conclude that firm-specific effects are much more important in shaping firm profitability, although industry- and market-level effects are influential. We expect investors to formulate expectations about these unique firm-specific resources in addition to industry- and economy-wide factors of these drivers in evaluating firm prospects and monitoring managerial performance.

Against this backdrop, we posit that when investors are optimistic about the unique attributes and prospects of an individual firm, along with their bullish outlook on specific industries or the general economy, they are less likely to monitor managerial performance as carefully, thus increasing the propensity of its managers to engage in fraudulent behavior. On the other hand, when investors are pessimistic about the future performance of the firm, despite their optimism about broader business conditions, we expect them to watch their managers more closely, which should dampen managerial incentives to misreport. Therefore, our objective is to investigate whether ex ante firm-level investor optimism (broadly defined to cover optimism, pessimism and sentiment, i.e., beliefs that are “unjustified” based on available information (e.g., Baker and Wurgler 2006) is an important driver of financial misconduct. In addition, we investigate whether investor disappointment with the announcement of financial restatements is deeper when they were optimistic about firm prospects at the time of initial manipulation of accounting records.

The fraud model of Povel et al. (2007) predicts that the likelihood of corporate fraud increases with investor beliefs about business conditions, as it decreases their monitoring intensity. Although the model focuses on investor expectations about macroeconomic conditions, they note that their predictions also hold if one replaces investor beliefs about business conditions with investor beliefs about the firm.Footnote 2 Moreover, the literature on corporate and behavioral finance suggests that strong investor optimism induces investor and executive overconfidence, stock misevaluation, weaker oversight by the board of directors, investment distortions, earnings management, costly external financing, asset price bubbles and excessive trading by individual investors (Barber and Odean 2001; Daniel et al. 2001; Scheinkman and Xiong 2003; Malmendier and Tate 2005; Baker and Wurgler 2006; Bradshaw et al. 2006; Simpson 2013; Brochet et al. 2016). However, whether firm-level investor optimism (broadly interpreted to include investor sentiment, i.e., excessive pessimism or optimism) plays an important role in explaining the likelihood of misconduct, on top of the effect of investor optimism about the state of the economy, remains unexplored. Motivated by these studies, we seek to conduct an empirical analysis of the role of heterogeneity in firm-level investor optimism in abetting firm-level accounting misconduct after controlling for general business outlook.

We use a sample of US firms that committed intentional accounting misstatements (i.e., irregularities) and restated their financial reports subsequently from 1996 to 2012. To proxy for ex ante firm-level investor optimism, we use (1) firm-level Tobin’s Q, (2) firm-level analyst forecast of annual EPS growth and (3) measures of sustained prior stock market performance (i.e., industry-adjusted annual buy-and-hold stock returns of the firm up to 5 years prior to the commission of accounting misstatements). Our first finding is that, even after controlling for investor beliefs about general business environment, the probability of committing irregularities is hump-shaped in firm-level investor optimism, first increasing as optimism improves to a moderate level and then decreasing when the level of optimism is sufficiently high.Footnote 3 Second, consistent with our predictions, we find that investor reactions to irregularities are more negative when investors were more optimistic about a firm’s future performance at the time of initial falsification of accounting records.

These findings are robust to a battery of tests to address potential empirical concerns. Specifically, our main results remain intact when we include alternative proxies for investor optimism such as consumer sentiment (Michigan Consumer Sentiment Index) about the state of the economy, its decomposition into justified fundamental component and unjustified sentiment component (following Hribar et al. 2017; Lemmon and Portniaguina 2006), overnight stock returns as a firm-level measure of unsophisticated investor optimism (Aboody et al. 2018), and alternative proxies of firm-level investor optimism such as analyst buy/sell recommendations and percentage recommendations of buys. In addition, we estimate a bivariate probit model to mitigate concerns that a simple binary estimation of fraud yields merely the probability of observed fraud and not of the underlying probability of fraud itself (which includes both detected and undisclosed frauds, Wang 2011). To address potential selection bias and reverse causality that firms might report artificially higher (lower) earnings and assets (costs and liabilities) to generate high growth expectations, we conduct tests based on pooled ordinary least squares (OLS) regressions with firm- and year-fixed effects, propensity score matching, panel regressions using abnormal accruals (as an alternative outcome variable) with firm- and year-fixed effects, and dynamic generalized method of moments (GMM).

This study makes the following noteworthy contributions. To the best of our knowledge, we are the first to document that firm-level investor optimism has a statistically significant and economically important effect on the likelihood of accounting misconduct even after controlling for investor expectations about the industry and the economy at large. There are a few studies consider the role of sentiment in earnings management. For example, Simpson (2013) finds that managers strategically exploit market-wide investor sentiment to inflate earnings in periods of higher sentiment, while reporting more conservatively during periods of low sentiment. Hribar and McInnis (2012) report that investor sentiment affects analyst earnings forecast errors and Hribar et al. (2017) find that macro-level managerial sentiment affects accrual estimates in the banking industry.Footnote 4 We contribute to these studies by identifying, developing and evaluating the effectiveness of a wide range of firm-specific indicators of investor optimism in predicting accounting misconduct.

We believe these firm-specific indicators would be very useful in designing and implementing more comprehensive and actionable programs on the prediction, prevention and detection of accounting manipulation than those based solely on measures of investor optimism about business conditions. They should aid the efforts of forensic accountants, activist investors, internal and external auditors, the board of directors, senior financial managers, compliance and ethics managers, judges and regulators seeking to gauge the heightened incentives of executives to opportunistically misreport during periods of moderate investor optimism about firm-specific prospects and manage the risk of fraudulent corporate accounting reports (Myers 2016). Our analysis of firm-specific investor optimism extends the work of Cohen et al. (2017) who study how bias in press coverage of corporate frauds perpetuates the divergence between the public’s and the profession’s conceptions of auditor’s duties. Unlike most existing studies (such as Crutchley et al. 2007; Harris and Bromiley 2006; Kedia and Philippon 2009; Hass et al. 2016), we focus on both linear and nonlinear relations between fraudulent accounting and ex ante firm-level investor optimism, which should prove more useful in identifying firms at high risk of accounting failures.Footnote 5

Accounting irregularities shake investor confidence in a firm’s management, leading to stock price declines and heightened return volatility. In contrast to many studies of market reaction to accounting restatements (Palmrose et al. 2004; Files et al. 2009), we examine how the strength of ex ante investor beliefs about firm performance (as of the initial date of misconduct) affects the direction and magnitude of investor reaction, while accounting for potential selection and endogenous nature of restatement announcements.

How important are our firm-level red flags of accounting misconduct in comparison with investor beliefs about macroeconomic conditions and key firm characteristics? Based on marginal probabilities, a one-standard-deviation increase in firm-level Tobin’s Q (from its mean when holding all other variables at their means) increases average managerial incentives for engaging in accounting manipulation by 1.04%, which is significantly higher than 0.65% attributable to a similar increase in industry median Tobin’s Q. The overall effect of firm-level investor optimism is also statistically greater than that of investor optimism about industry prospects (based on Chi-squared tests). Similar comparisons based on other measures of optimism yield the same conclusion. These comparisons underscore our key finding that firm-level investor optimism and sustained prior abnormal positive performance are economically significant identifiers of at-risk firms for accounting failure.

Literature Review and Empirical Hypotheses

Investor Optimism and Managerial Propensity for Accounting Misconduct

Our analysis begins with a review of prior studies on the roles of firm-specific, industry-level and economy-wide factors in shaping firm performance as well as corporate investment, financing, dividend payout and executive compensation policies. Next, we establish the link between firm-level optimism and managerial propensity for accounting misconduct.

There is a large literature in management strategy and accounting on the main drivers of firm policies and performance and their relative importance. The resource-based model posits that firms create a sustainable competitive advantage by developing leadership capabilities, management skills, strategies, organization processes and routines, intellectual property and other unique resources that allow it to differentiate itself from competitors. By contrast, the industrial organization model posits that the unique strategies and resources of a firm are not important in determining its success because those assets can be acquired by competitors. Instead, it is the industry structure and the state of the economy at large, not of the firm itself, that drives firm performance (Schmalensee 1985). In other words, whereas the industrial organization perspective holds that firms do not matter much, the resource-based model emphasizes that firms matter more than industries (Barney 1991). Roll (1988) suggests that a significant portion of stock return is attributable to firm-specific information, not to common industry and market-wide movements. Carter and Lynch (2001) find that firms reprice executive stock options in response to poor firm-specific, not poor industry, performance. Lambrecht (2001) highlights differences between the impact of aggregate economic factors and firm-specific factors on corporate bankruptcies.

Reviewing and reconciling prior research, McGahan and Porter (2002) conclude that business-specific effects are much more important in shaping firm performance (as measured by ROA), although industry- and market-level effects are influential. However, Hawawini et al. (2003) find that variance in firm performance attributable to industry-level factors increases, while variance arising from firm-level factors decreases when they exclude exceptionally higher- and lower-performing ‘outlier’ firms in each industry to focus on ‘average’ firms in their sample. Assessing the relative importance of time-, firm-, industry- and country-level determinants of capital structure, Kayo and Kimura (2011) find that time and firm levels explain 78% of firm leverage. Amiram and Kalay (2017) find that industry-level characteristics influence debt pricing through risk premiums in addition to firm-level forces.

The foregoing review of the literature suggests firm-specific, industry-level and economy-wide factors shape investors’ and analysts’ expectations, beliefs and forecasts about firm performance. In the finance and accounting literature, a large body of research considers the role of market-wide sentiment in both asset pricing and corporate decision making. Baker and Wurgler (2006) find that market-wide investor sentiment affects the cross section of stock returns. Several studies suggest that analysts are likely to possess superior macro-level information (such commodity prices, business cycles, interest rates and energy prices) but have less access to firm-level info (such as expected operating loss, abnormal inventory buildup or excess capacity) related to earnings forecasts relative to the accuracy of management’s forecasts (Piotroski and Roulstone 2004; Hutton et al. 2012). However, focusing on stock returns around changes in analyst stock recommendations, Liu (2011) finds that analysts produce more firm-specific than industry-level information, especially for stocks with higher idiosyncratic return volatilities.

Prior research on behavioral bias indicates that overoptimism often feeds overconfidence, distorting most people’s beliefs (Russo and Schoemaker 1992). Excessive optimism or pessimism affects trading volume, stock misvaluation and volatility (Barber and Odean 2001; Hirshleifer 2001; Daniel et al. 2001) and generates asset price bubbles (Scheinkman and Xiong 2003). Strong firm-level investor optimism could promote CEO (Chief Executive Officer) overconfidence, leading corporations to overinvestment when they have abundant internal funds, but curtail investment when they require external financing (Malmendier and Tate 2005). While firm-level investor optimism leads to external financing (Bradshaw et al. 2006), investor pessimism about firm performance could lead to contentious annual shareholder meetings and governance changes (Brochet et al. 2016). Simpson (2013) reports that managers strategically boost earnings via accruals to meet overly optimistic analysts’ forecasts or to induce a short-term increase in stock price during periods of high aggregate investor sentiment. Apparently, all these behavioral biases are more likely to be specific to a firm, instead of the entire market or an industry.

Examining the effectiveness of corporate governance, Song and Thakor (2006) predict that the intensity of monitoring of projects and strategies by the board is greater when directors are pessimistic about business conditions but weaker when macroeconomic outlook is good. Povel et al. (2007) focus on the impact of investor optimism on corporate fraud commissions. In their model, the manager knows whether the firm has good or bad prospects and seeks external funding. Investors do not know firm quality, but discover it by incurring monitoring costs. The model predicts that the manager’s incentive to commit fraud increases with the level of investor optimism about business conditions, because strong beliefs weaken the intensity of monitoring by investors. However, when investor optimism is high, investors are willing to provide funding without monitoring, hence reducing the probability of fraud. Thus, the probability of fraud is hump-shaped in the prior beliefs of investors about macroeconomic conditions—it increases first until investor beliefs reach a moderate level, but decreases when investors turn highly optimistic about business conditions. Povel et al. (2007) also note that the same hump-shaped pattern of fraud obtains even if one defines the state of the economy (“bad times” or “good times”) in terms of the expected return to any given firm rather than investor beliefs about general business conditions.

The large literature reviewed above demonstrates that the degree of investor optimism and analyst forecasts of firm profitability are shaped not only by macroeconomic factors such as economic boom or bust, interest rates and inflation and variation in industry structure in terms of concentration level, barriers to entry, degree of product differentiation and growth prospects. Even firm-specific differences in managerial abilities, strategies, organizational capabilities, R&D, investment, financing and dividend drive investor expectations of firm performance. Given the weight of theoretical and empirical evidence, an empirical analysis of firm-level accounting misconduct that focuses only on industry-level and economy-wide investor beliefs and ignores the degree of firm-specific investor optimism suffers from a serious omitted variable problem. This concern can be mitigated by considering firm-level measures of investor optimism in addition to the industry-level and economy-wide measures. Another potential limitation of relying only on industry-level analysis is that the widely used method of defining industries by using the 48 industry groups in the Fama and French (1997) classification or the four-digit Standard Industrial Classification (SIC) code is crude. Such industry definitions are relatively fixed in time, identify mutually exclusive sets of firms while some firms diversify across many industries, and bear little relation to the list of competitors that firms disclose in their proxy statements (Li et al. 2012; Rauh and Sufi 2012).

Although the evidence on the impact of market-wide investor beliefs on accounting misconduct is large, few studies have examined the role of firm-level optimism. Motivated by this gap in the literature, we propose to investigate the role of investor optimism regarding firm-specific attributes in determining the likelihood of firm-level accounting misconduct. Our expectation is that when investors are pessimistic about the prospects of an individual firm due to its inefficient management, labor-management conflicts, lack of innovative products and services, etc. (regardless of their outlook on a particular industry or the overall economy), their monitoring intensity of investment projects, financing policies and corporate strategies would be higher, thus lowering the odds of misconduct. On the other hand, if investors feel moderately optimistic about the firm’s prospects on top of its industry conditions, it should further dampen their incentives to monitor the firm, thus escalating the managers’ incentives to commit fraud. However, a firm is less likely to issue fraudulent reports when investors are highly optimistic about firm performance regardless of broader economic outlook, because investors are still likely to offer funding without much scrutiny. Based on the above arguments, we formulate the following hypothesis:

Hypothesis 1

The likelihood of accounting misconduct would increase as ex ante firm-level investor optimism rises up to a moderate level, but decrease when investors are extremely optimistic.

We focus on accounting irregularities which are similar to fraud in terms of a firm’s incentives to engage in accounting misconduct, but are not necessarily fraud. Hennes et al. (2008) highlight the importance of distinguishing between (unintentional) accounting errors and (intentional) irregularities. Since we are interested in studying a firm’s incentives to engage in a broader class of accounting misconduct, we examine intentional misstatements.Footnote 6 Both fraud and irregularities signify perverse incentives to misreport. However, fraud requires a higher burden of proof than is necessary to bring charges of financial misrepresentation. Accounting fraud is defined as a case in which the Securities and Exchange Commission (SEC) or Department of Justice (DOJ) files charges alleging the violation of: (1) Section 17(a) of the 1933 Securities Act for fraudulent interstate transactions related to the issuance of a security, or (2) Section 10(b) of the 1934 Securities Exchange Act for manipulative and deceptive devices related to the trading of an already issued security (Karpoff et al. 2017; Young and Peng 2013). Further, accounting irregularities are different from earnings management or abnormal accruals in that the former is illegal and has a far more severe impact on investor trust and a firm’s cost of capital. Managers’ propensity to commit irregularities is influenced by a variety of factors, one of which is discretionary accruals reversals coupled with decreased earnings management flexibility (Healy 1985; Beneish 1999). Accruals reverse over time; abnormal accruals are a common indicator of within-GAAP earnings management (Zhao and Chen 2008) and are a potential indication of irregularities (Dechow et al. 2011).

In our main empirical tests, we rely on institutional rather than individual investor optimism because the former have better ability and access to firm-specific information and greater incentives to monitor the firm. In addition, we will look at the impact of unsophisticated investor sentiment regarding macroeconomic conditions as well firm-specific prospects.

Market Reactions

There is a large body of literature indicating a negative market reaction to restatement announcements and an even more negative market reaction to irregularities or fraud (Palmrose et al. 2004; Hribar and Jenkins 2004; Carcello et al. 2011). Our first hypothesis considers investor optimism about firm prospects when misstatements are committed rather than detected. Consistent with this idea, when a firm announces a restatement we expect investors to reflect on the level of their optimistic beliefs about the firm not only as of the date of a restatement announcement (say, at time t) but also at the time when the firm first started falsifying accounting statements (say, time t − N). The time gap between these two critical event dates is typically 2 or more years. For example, a firm might intentionally overstate its revenue for year t − N and then disclose these reporting failures in year t. We expect investors to be more disappointed with the restatement announcement (at time t) the more optimistic they were about the prospects of the firm at time t − N (when misleading reports are issued for the first time). In other words, investor optimism about firm prospects and the subsequent disclosure of fraudulent accounting would cause a huge loss of investor trust in the firm, leading to a sharply negative market reaction to firm-specific optimism at the time of commission of accounting misconduct. There would also likely be an increased risk premium related to the impaired credibility of the financial statement numbers, which would further magnify the negative market reaction. These arguments lead us to the following hypothesis:

Hypothesis 2

Market reaction to the announcement of accounting irregularities would be more negative when investors hold more optimistic firm-specific beliefs at the time of manipulation of accounting statements.

Data and Sample Construction

Sample

Our misstatement sample is mainly from two sources, General Accounting Office (GAO) and Audit Analytics (AA). This sample is more comprehensive than GAO or AA (or both) used by most of the previous literature. GAO published two reports, one in 2002 and the other in 2006 (GAO 2002, 2006). The two GAO reports contain financial restatements from January 1997 to September 2006. AA includes restatements from January 2000. A small fraction of irregularities overlaps with the Federal Securities Regulation (FSR) database (see Karpoff et al. 2017).Footnote 7 The FSR data are based on any violations of 13(b) provisions of the Securities and Exchange Act of 1934, which we consider as relevant to our analysis of accounting irregularities.Footnote 8 We cross-check the three databases and delete duplicate cases and hand-collect the misstated period if needed.Footnote 9 As an individual irregularity may be associated with more than one public disclosure, we carefully investigate each case and keep only the earliest restatement.

Our test sample includes financial restatements (including both irregularities and errors) occurring between 1996 and 2012. We restrict our sample to misstatements after 1996 because the passage of the Private Securities Litigation Reform Act in 1995 might affect a firm’s incentives to engage in fraudulent behavior. For each misstatement, we collect information on both the dates of commission and detection. Since the median length of the misstated period (from commission to detection) in our combined sample of irregularities is about 2 years, our commission and detection subsamples terminate in years 2010 and 2012, respectively.Footnote 10 Following Hennes et al. (2008), we classify each case of misstatement into either an irregularity or an error.Footnote 11 Our sample of misstatements includes 830 firm-year irregularities and 4360 firm-year errors. Our control sample includes all firms in the COMPUSTAT-CRSP merged database (except those in the misstatement sample). The control sample includes 64,734 firm-year observations.Footnote 12

Proxies for Investor Optimism

Our baseline results are based on three time-varying measurements of the degree of investor optimism (negative values of which indicate pessimism) about future firm performance. The first two are the median analyst forecast of a firm’s annual EPS growth (Firm EPS Growth) and Tobin’s Q (Firm Q), both measured prior to the commission of misstatements. Moreover, Crutchley et al. (2007) find that firms subject to regulatory actions tend to have a significant growth before committing fraud. In light of this evidence, it seems reasonable to assume that investors use the sustained stock return history of the firm to form beliefs about its prospects. We label this third proxy as Prior Return N Yr., which represents the firm-level annual buy-and-hold return minus industry median annual buy-and-hold return, averaged over N years prior to the misstatement commission. We construct buy-and-hold stock returns in excess of the industry median for 3 and 5 years prior to the occurrence of misstatements.

In addition, following Aboody et al. (2018) we construct overnight stock returns (Overnight Stock Return) to capture the optimism of unsophisticated investors who are more susceptible to sentiment and likely to place orders outside of normal working hours (Berkman et al. 2012; Barber et al. 2009). We also check robustness using analyst buy/sell recommendations (Analyst Recommendation) and percentage of buy recommendations (% Buy). Our first hypothesis predicts positive coefficients on firm-level optimism and negative coefficients on their respective squared terms, controlling for market-wide and industry-level sentiment and beliefs.

To test our second hypothesis on market reaction, we construct the above measures preceding the detection of misconduct as a comparison to the effect of those preceding the commission of misconduct.

Control Variables in the Commission of Misconduct Model

We follow the literature on accounting misconduct and financial restatements and include the following ex ante control variables, measured prior to the starting date of misconduct: Leverage (Dichev and Skinner 2002), M&A Expenditure (Kinney et al. 2004), CAPX, R&D, Log Assets, and Analyst Coverage (Wang 2011; Wang and Winton 2014), Ext. Fin. Need and ROA (Dechow et al. 1996), Insider Ownership (Bhattacharya and Marshall 2012; Agrawal and Cooper 2015), BIGN and SOX. “Appendix A” provides the definitions of the all variables.

Results

Table 1 presents the mean and median of variables for the two subsamples, control (no-misstatements) and irregularities. If data on firm-level measures are missing, we delete those observations on industry-level measures in order to make fair comparisons. The test results on differences in means and medians of our test and control variables between two subsamples are shown in the last two columns. Overall, these univariate tests are supportive of our first hypothesis that, in addition to market-wide sentiment and industry-level optimism, firm-level investor beliefs are associated with higher incidence of accounting irregularities.Footnote 13 For example, Median Firm Q in the irregularities sample (1.56) is significantly higher relative to the control group (1.36). We observe a similar pattern using other firm-specific measures.

“Appendix B2” presents correlations among market-wide, industry- and firm-level measures. Pairwise correlations between market-wide sentiment index and firm-level measures, industry-level measures and their corresponding firm-level counterparts do not appear to be strong, although most are statistically significant due to the large sample size. For example, the estimated Pearson correlation coefficients between market-wide sentiment index (industry-level measures) and firm-level measures range from 0.01 to 0.21 (0.01–0.24). These findings suggest that a large part of the variation of firm-level measures could not be explained by the variation of market-wide or industry measures and therefore provide additional explanatory power to the model. It is also noted that the correlations among different firm-level measures are low.

Investor Optimism and Managerial Propensity for Irregularities

Our first hypothesis posits that the likelihood of accounting irregularities would increase with investor optimism about future firm performance up to a moderate level, but it would decrease when investors are highly optimistic. We start our multivariate analyses by testing the following propensity for misconduct equation (P(M)) using binary response models:

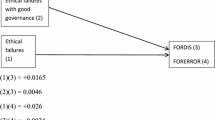

The dependent variable (P(M)) is equal to one for irregularity committed in a firm-year, zero otherwise (i.e., for a firm-year with no misstatement). We analyze investor sentiment about the firm at the time when misstatements begin (t − N), instead of the time when misstatements are detected or announced (t). Our results might be sensitive to alternative parametric binary choice models, so we report results based on both probit and logit regressions as our baseline tests. In Panel A of Table 2, our test variables are firm-level Tobin’s Q (proxy for investor optimism) and the corresponding squared terms. In Panel B (Panel C), we use analyst forecast of EPS growth (prior stock market performance) as a proxy for firm-level investor optimism.Footnote 14 Robust two-dimensional (firm and year) cluster-adjusted errors (in parentheses) are reported (Petersen 2009).

Panel A shows that the probability of an irregularity is positively related to the median industry Q, our proxy for prior investor beliefs about business conditions (with a coefficient estimate of 0.495 in Model (1) using probit and 1.209 in Model (4) using logit, significant at 10%). But it is negatively related to the squared median industry Q (− 0.106 in Model (1) and − 0.255 in Model (4), significant at 10%). The marginal effect of median industry Q holding other variables at their means is 0.0024 in the probit Model (1) and 0.0023 in the logit Model (4), respectively. The results suggest that one-standard-deviation increase in industry-level Q increases the probability of irregularity by about 0.23%.

When we replace median industry Q with firm Q (our proxy for firm-level investor optimism) in Models (2) and (5), we find a similar pattern. Based on probit Model (2), the coefficient estimate is 0.050 (significant at 1%) on Firm Q and − 0.001 (significant at 1%) on Firm Q Sq., respectively. Logit Model (5) shows consistent results. Based on Model (2), a one-standard-deviation increase in firm Q is associated with an increase of 0.56% in the probability of irregularity, which is more than twice as large as the effect of industry level Q (0.24%) in Model (1). Similarly, comparing marginal probabilities in Model (5) with Model (4), we confirm that firm-level Q (0.23%) has stronger effects than the industry Q (0.50%) based on the logit model.

To further examine the relative importance of firm-level and industry-level measures of investor optimism on the propensity of accounting irregularities, we include both of these test variables in Models (3) and (6). The estimates are fairly stable and statistically significant, highlighting the explanatory power of idiosyncratic variation of firm-level measures. Furthermore, consistent with our expectation, these estimates indicate that firm-level heterogeneity in investor optimism has an economic importance on the likelihood of misconduct even after controlling for the effects of industry-level outlook: a one-standard-deviation increase in industry median Q (firm Q) is associated with an increase of 0.12% (0.58%) in the probability of irregularity in probit Model (3). A Chi-square test of the difference between these two marginal probabilities (0.58% less 0.12%) has a p value of 0.012. The corresponding marginal effects in logit Model (6) are 0.12% (0.52%), and the Chi-square test of the difference has a p value of 0.016. They indicate that the predictive power of firm-level heterogeneity in investor optimism is statistically significant and economically greater than that of investor optimism about industry prospects.Footnote 15

In Panel B, we repeat the tests by using EPS growth to proxy for investor optimism. Panel C is based on measures of prior firm performance, constructed as buy-and-hold stock returns in excess of the industry median for 3 and 5 years prior to the occurrence of misstatements.Footnote 16 Control variables and constant are the same as Panel A and suppressed. These findings reinforce the preceding results that the incidence of irregularity is positively related to firm-level measures of investor optimism and negatively related to their squared terms, even when we control for the industry-level counterparts. Turning to the marginal effects, we find that, compared with industry-level proxies, a one-standard-deviation increase in the firm-level proxies for investor optimism is associated with a much larger increase in the incidence of irregularity (in Panel B). This conclusion is robust when we examine industry-level and firm-level outlook separately [Model (1) versus (2) and Model (4) versus (5)], and when we examine both of these measures together [in Model (3) and Model (6)]. Furthermore, the addition of firm-level investor optimism predictors to the industry-level explanatory variables appears to significantly improve the statistical power of the model in both probit and logit regressions. For example, comparing Models 1 and 3 in Panel A, the log likelihood changes from − 3108 to − 3095 when we add the firm-level predictors. The likelihood ratio test statistic is 26 and is significant at 1% (with two degrees of freedom), suggesting that the model with the firm-level predictors fits significantly better than the model with only the industry-level predictors.

As Petersen (2009) suggests, the use of two-way clustering may lead to higher t-statistics in certain cases, e.g., small samples. We rerun our baseline tests in Table 2 with standard errors clustered at firm-level only, rather than at both firm and year levels. As shown in Table B.3 in “Appendix B,” our results remain robust. The coefficient estimates on the three firm-specific investor optimism proxies—Firm Q, Firm EPS Growth and Prior Return 5 Yr., are all positive and significant and those on their squared values are all negative and significant, consistent with prediction in Hypothesis 1.

A potential concern with the above tests is that financial misstatements are partially observable since investors come to learn about them only when they are disclosed or detected (at time t), but they are unaware of the misdeeds at the time when they are actually committed ((t − N) < t). To address the incomplete detection problem, we follow Wang et al. (2010) and Wang (2011) and use a bivariate probit model consisting of the following detection equation along with the previous misconduct equationFootnote 17:

The dependent variable is a dummy variable P(D|M) = 1 if a firm committed an irregularity and then got caught later, zero otherwise (i.e., for control firms with no misreporting). It provides an estimate of the likelihood of irregularity detection conditional on misconduct. In Panel A of Table 3, we find that the probability of committing an irregularity is positively related to our measures of investor optimism at the industry level in Model 1. But it is negatively related to the squared median industry measures. When we replace the industry-level investor optimism proxies with the corresponding firm-level proxies in Model 2, we find similar results. In Model 3, we include all four variables and the results are still robust. In Panel C, the coefficient estimates of prior abnormal stock returns over 3 and 5 years are significant, indicating that firm-level investor optimism is positively correlated with its (sustained) performance.Footnote 18 Prior studies have typically focused on the linear effects of prior firm performance on propensity for manipulation using the standard probit model (Crutchley et al. 2007). We complement their findings by adopting the bivariate probit model and find that sustained prior outperformance of the firm has a strong negative nonlinear effect on the likelihood of misconduct on top of a significantly positive linear effect. Overall, the results in Table 3 are consistent with the probit results in Table 2, indicating that firm-level measures of investor optimism still matter even after controlling for industry-level proxies and partial observability.

Control variables in the commission model (P(M)) have qualitatively similar estimates as in the simple probit and logit regressions. Also, control variables in the detection model (P(D|M)) have the expected signs. Abnormal Restatement Risk is positive and significant, implying that high industry restatement intensity increases the probability of detection. Disastrous Stock Returns and Abnormal Return Volatility are both significant determinants of the conditional probability of detection of misstatements. A lower probability of detection implies a lower cost of engaging in misconduct, leading to a higher incentive to falsify accounting reports.Footnote 19

It is worth noting that in all the Models in Table 3, the log pseudo-likelihood attains the lowest value when we add firm-level measures of investor optimism (the 5-year average prior abnormal stock returns). Moreover, the log likelihood ratio tests suggest that the model with firm-level predictors fits significantly better than the model with only industry-level predictors. Together, these findings confirm that firm-level investor optimism is a very important determinant of the propensity for accounting misconduct, even after controlling for industry-level investor beliefs.

To shed light on the incremental value of our firm-level indicators when we account for partial observability, we turn to their marginal effects on the probabilities of misconduct. Consistent with simple probit results, the marginal effect of firm-level Q (0.0122, see Panel A) is higher than that of industry-level Q (0.0086), suggesting the importance of firm-level heterogeneity of investor optimism on the incidence of accounting misconduct. Controlling for partial observability, the marginal effects of one-standard-deviation change in our test variables in Table 3 are larger than those in Table 2. Further, we compare the marginal effects of the measures of investor optimism with other variables. Consistent with prior work of Wang (2011), the marginal effect of capital expenditure intensity, by far the most significant firm characteristics in our bivariate probit model, suggests that a one-standard-deviation increase in capital expenditure increases the propensity for accounting misconduct by 0.72% from its mean when holding all other variables at their respective means. By comparison, a one-standard-deviation increase in each of industry median Tobin’s Q and firm-level Tobin’s Q increases incentives for engaging in accounting manipulation by 0.65 and 1.04%, respectively, from its mean when holding all other variables at their means [in Model (3)]. A Chi-square test of the difference between these two marginal probabilities has a p value of 0.045, suggesting that the predictive power of firm-level investor optimism is statistically significant and economically greater than that of investor optimism about industry prospects. We find similar results in favor of the importance of firm-level investor optimism in both Panels B and C. These comparisons underscore two important insights. First, investor optimism is far stronger in instigating accounting misrepresentation than capital expenditure. Second, firm-level investor optimism measures seem significantly more important in identifying at-risk firms for accounting failure than the industry median Tobin’s Q and EPS growth rate used in prior studies.

The forgoing analysis has not controlled for managerial compensation, which is known to affect executives’ incentives for misrepresentation. Hertzberg (2005) posits that positive investor beliefs lead to more short-term executive compensation, which, in turn, increases the likelihood of fraud. Burns and Kedia (2006) report that the sensitivity of the CEO’s option portfolio to stock price is significantly positively related to the propensity to misreport. Wang et al. (2010) find that more optimistic beliefs lead to more short-term compensation. To scrutinize whether compensation is the dominant mechanism, we run a two-stage regression by examining the relationship between investor beliefs and the structure of executive pay in the first stage and then use the predicted compensation in the second stage (Wang et al. 2010). We construct the following two executive compensation variables: ST Compensation (industry median short-term incentive defined as (salary + bonus + other annual compensation)/(total expected compensation) and LT Compensation (industry median long-term incentive measured as (restricted stock grants + option awards)/total expected compensation). Total expected compensation is the total of short-term compensation, long-term compensation, long-term incentive payouts and all other total income. In the first stage, we regress the firm-level short- and long-term executive compensation against firm median investor beliefs (Firm EPS Growth) for the entire ExecuComp database and calculate the predicted firm-level short- and long-term compensation. We then calculate median Ind. Predicted ST Compensation and median Ind. Predicted LT Compensation and use them in the commission equation of the bivariate probit analysis in the second stage.

We suppress the first-stage estimates (relegated to Table B.4 in “Appendix B”) for brevity and report the second-stage results in Table 4.Footnote 20 Even after controlling for executive compensation, we observe a hump-shaped relation between firm-level investor optimism and irregularity propensity, consistent with our first hypothesis. In particular, our test variables (Firm Q, and Firm Q Squared, Firm EPS Growth, Firm EPS Growth Squared, Prior Return 3/5 Yr. and Prior Return 3/5 Yr. Squared) remain significant. Chi-square tests show the differences in marginal probabilities associated with proxies for firm- and industry-level prospects are significant with p values of 0.038 and 0.025.Footnote 21 The industry median predicted ST compensation is positive and significant in two of the four specifications and the industry median predicted LT compensation is negative and significant in all regressions.

While we mitigate the concern of partial observability of accounting failures by examining the channel through executive compensation in a two-stage bivariate probit framework, there might be endogeneity and reverse causality because it is possible that executives use earnings management as a tool to meet or beat analyst growth projections and promote investor optimism, reversing the causality from firm-level investor optimism to financial misconduct. To address this issue, we perform several robustness tests. First, we repeat tests in Table 2 to examine the relation between the likelihood of irregularity and the lagged, current and leading measures of firm-level investor optimism. In unreported results, we find that the likelihood of irregularity is significantly related to the lagged, but unrelated to the current or leading measures of optimism.

Second, financial restatements tend to cluster by time, especially business cycles (see, for example, Ball 2009). Loughran and Ritter (2000) note that time clusters are common in initial public offerings of equity and point out that in such situations placing equal weight on each period is associated with reduced statistical power because of significant correlations in residuals across firms on given dates. Since our prior logit and probit regressions treat different periods as independent observations in a cross-sectional setting, they are likely to inflate reported test statistics. A fixed-effect model could help mitigate this problem and control for unobserved heterogeneity. We run a set of pooled OLS regressions of the (linear) probability of irregularity on firm-level investor optimism and control variables with year-fixed effects. This correction accounts for the block-diagonal structure in the error covariance matrix (Huber 1967 and Rogers 1993). In Panel A of Table 5, the dependent variable equals one if a firm commits an irregularity, zero otherwise (for control firms with no misreporting). The independent variables are the same as those in P(M) of Table 2. For each proxy of investor optimism, we separately examine industry-fixed effects, year-fixed effects and both. The robust results in Table 5 support our hypothesis that the likelihood of accounting irregularities increases with firm-level investor optimism up to a moderate level but decrease when investors are highly optimistic.

Third, due to insufficient variation within firms (i.e., most of firms committed irregularity only once in our sample period), we are unable to include firm-level fixed effects in the preceding linear probability tests. Consequently, the error term is likely to be correlated over time for a given individual firm (Cameron and Trivedi 2005). To mitigate this concern, we replace the binary dependent variable with abnormal accruals, which are a common measure of earnings management and a potential indicator of irregularities (Dechow et al. 2012; Simpson 2013; Zhao and Chen 2008). The methodological advantage of using abnormal accruals, a continuous dependent variable, is that we can perform analyses using panel data with firm-fixed effects and a dynamic GMM Arellano and Bond (1991) regression as shown in Table 6 (Erickson and Whited 2012; Erickson et al. 2014).Footnote 22 In Panel B of Table 5, the dependent variables are abnormal accruals based on modified Jones model (Kothari et al. 2005) and independent variables are the same as those in P(M) of Table 2.Footnote 23 To conserve space, we present only the results using Tobin’s Q. Results using EPS Growth and Prior Returns are statistically and qualitatively similar. In all the models, the coefficient estimates on firm-level Tobin’s Q and its squared term are quite stable and statistically significant. The p value of the AR(2) test suggests that there is no serial correlation at the second difference level. The p value of the Hansen test suggests that the instruments are valid. In addition, unreported results based on Wald χ2 tests suggest that the direction of causality is from investor’s optimism to abnormal accrual and not the reverse.Footnote 24

In addition, we conduct two-stage bivariate probit regressions based on EPS Growth Residual that is unexplained by earnings management (proxied by abnormal accruals), see Table B.6 in “Appendix B.”Footnote 25 Next we perform analyses based on propensity score matching on high firm-level investor optimism to address potential selection bias due to observable heterogeneity. Propensity scores are estimated using probit models with High Firm Q = 1 (treated) as the dependent variable for firms with Tobin’s Q greater than the industry median, 0 otherwise (control), and independent variables include lagged earnings management and a set of controls. Our tests use (1) nearest neighbor 1:1 with replacement, (2) nearest-neighbor 1:4 without replacement and (3) a sample including all firms within the region of common support of their propensity scores. Results in Table B.7 in “Appendix B” (based on nearest-neighbor 1:1 with replacement) suggest that our results are still robust and consistent with previous findings.

If the documented positive relation between the likelihood of intentional accounting misconduct and investor optimism (at both industry and firm levels) is indeed true rather than merely a spurious correlation, then we would expect no relation between the incidence of unintentional misstatements (i.e., random errors) and investor optimism. On the other hand, if there are unobservable factors that explain inadvertent errors in financial reporting and also are correlated with our measures of investor optimism, then we also would expect a positive relation between the likelihood of errors and investor optimism. To scrutinize these arguments, we conduct falsification tests by treating accounting errors as the dependent variable and find none of the proxies for investor optimism statistically significant. For brevity, we do not tabulate these results.

Alternative Proxies for Investor Optimism

In this section, we examine the robustness of our results to market-wide sentiment, measured by the Michigan Consumer Sentiment Index (ICS), as well as to additional proxies for firm-specific investor optimism: overnight firm-level stock returns for unsophisticated individual investors and analyst stock recommendations.

The ICS is based on a monthly national survey of consumer expectations and is widely regarded as an indicator of the average consumer’s confidence in the future state of the economy.Footnote 26 We follow prior literature (e.g., Baker and Wurgler 2006; Lemmon and Portniaguina 2006) and use OLS to decompose the quarterly ICS into two components: (1) a component explained by macroeconomic factors and (2) a component that is not explained by macroeconomic factors. In the first step, we obtain the predicted value (ICS (Fundamental)) and the residual (ICS (Sentiment)) of ICS by regressing the quarterly ICS on the contemporaneous, leading and lagged values of the following macroeconomic variables: return on the CRSP value-weighted index including distributions, default spread (difference between yields to maturity on Baa- and Aaa-rated bonds), yield on the 3-month Treasury bill, GDP growth, personal consumption growth, labor income growth, unemployment rate, consumer price index inflation rate and consumption-to-wealth ratio (Hribar et al. 2017; Lemmon and Portniaguina 2006; see “Appendix A” for definitions of these variables). Our expectation is that ICS (Sentiment) component captures aggregate firm-level “unjustified” investor optimism.Footnote 27 Then we regress accounting irregularities as of year t on the preceding quarter’s ICS (Fundamental) component, ICS (Fundamental) component squared, ICS (Sentiment) and (ICS Sentiment) squared, as well as on all controls used in Eq. (1), and industry- and firm-fixed effects. As before, standard errors are double-clustered at the firm and year levels.Footnote 28 We suppress all control variables for brevity.

As reported in column 1 of Panel A of Table 6, the estimated coefficient on ICS is positive and that on its squared value is negative (both highly significant), consistent with our expectation. When we decompose ICS, the fundamental component (its squared value) is positive (negative) and highly significant, see column 2. More to the point, the sentiment component is positive and its squared value negative, both highly significant. These results indicate that the incidence of accounting irregularities increases as firm-level investor optimism increases up to a moderate level but decreases at high levels of optimism even after controlling for macroeconomic factors is robust to using market-wide sentiment rather than analyst-based earnings growth.Footnote 29

As an added robustness test, we select overnight stock returns as another proxy for firm-level investor optimism. Prior studies show that retail investors are generally less sophisticated in investment analysis and more susceptible to sentiment than are institutional investors. They tend to place orders outside of normal trading hours, which are executed at the start of the next trading day (Barber et al. 2009; Berkman et al. 2012). Aboody et al. (2018) presents evidence indicating that overnight (close-to-open) stock return on individual stocks can serve as a measure of firm-specific investor sentiment.

We calculate average annual overnight return by averaging monthly average overnight returns adjusted for stock splits, stock dividends and cash dividends taken from CRSP for the year prior to the commission of accounting irregularities. We use the probit regression specification presented in column 3, Panel A of Table 2, but replace Firm Q and Firm Q Sq. with Overnight Return and its squared value.Footnote 30 As shown in both columns 1 and 2 of Panel B of Table 6, the estimated coefficients on Overnight Return are positive and those on its squared value are negative (both significant at 5%), after controlling for industry-level and economy-wide measures of optimism. These results suggest that firm-level unsophisticated investor optimism as reflected by overnight stock returns is an important driver of the incidence of accounting irregularities.

Our final proxies for investor optimism are derived from analyst recommendations for buying and selling individual stocks.Footnote 31 We gather data on the IBES standardized numerical ratings of 1 through 5 to represent strong buy, buy, hold, underperform and sell, respectively. To facilitate comparison of regression estimates with other proxies based on analyst EPS growth forecasts, we reverse the IBES ratings to 1 through 5 to represent sell, underperform, hold, buy and strong buy, respectively. In addition, we select % Buy provided by IBES which denotes percentage of Buy recommendations made by brokerage house analysts. From these inputs, we construct the following industry-level and firm-level recommendations: Ind. Analyst Recommendation, Ind. Analyst Recommendation Sq., Firm Analyst Recommendation and Firm Analyst Recommendation Sq.Footnote 32 The number of firm-year observations drops to 26,691 because many firms do not have data on firm-level analyst recommendations. The probit regression estimates using these proxies for investor optimism are presented in Panels A and B of Table 7. The estimates on all firm-level test variables (Firm Recommendation and Firm Recommendation Sq. in Panel A and Firm % Buy and Firm % Buy Sq. in Panel B) are significant and have the expected signs, offering support to our hypothesis that firm-level investor optimism matters in driving accounting misconduct.Footnote 33

Overall, our results are consistent with the first hypothesis that the likelihood of accounting irregularities is a concave function of ex ante firm-level investor optimism, first increasing up to a moderate level, but then decreasing once optimism is sufficiently high, even after controlling for corresponding industry-level and economy-wide optimism measures. Moreover, based on the explanatory power (log likelihood ratio test) and marginal effects, the models including firm-level optimism measures outperform those including only industry-level measures examined by prior studies in predicting accounting misconduct. A battery of robustness tests offers strong support for the power of firm-level investor optimism in predicting the incidence of accounting irregularities.

Market Reactions

Our second hypothesis predicts that firm-specific investor optimism at the time of initial misstatement is more negatively associated with stock returns on the announcement of accounting restatements. To investigate this hypothesis, we estimate market reactions to the disclosure of restatements as measured by cumulative abnormal returns (CAR) for each firm over the 3-day event window (− 1,1). Our sample of market reactions includes 490 firm-year observations on accounting irregularities and 3010 firm-year accounting errors drawn from the COMPUSTAT_CRSP merged database from 1996 to 2012 (see Table B.10 in “Appendix B”).Footnote 34 We subtract the CRSP market index return (equally weighted, with dividends) from a company’s daily stock return to estimate its daily abnormal return. The average 3-day CAR over (− 1,1) is − 9% for irregularities, compared with − 1.9% for errors. The differences in both means and medians are highly significant, consistent with prior studies (Collins et al. 1987; El-Gazzar, 1998).

To test our hypothesis on investor reaction, we create an indicator variable, IRR, which takes a value of one for accounting irregularities and zero for errors. Our prior discussion has treated IRR as an endogenous variable, since firms choose whether to manipulate accounting statements and when to disclose it to the public. However, consistent with the literature on investor reaction to financial restatements, we begin our analysis by assuming IRR is exogenous and later address endogeneity concerns. Next we interact IRR with the proxies for firm-specific investor optimism about firm prospects to investigate whether investors react more negatively the more positive their outlook was about firm performance.

Table 8 reports the results of cross-sectional multivariate regressions sorted by four sets of proxies for prior investor optimism about the state of the firm and of the industry. As noted previously, in our combined sample of irregularities and errors the median (mean) time gap between the beginning of misconduct and its subsequent detection is 2.64 (2) years. For irregularities, the upper quartile is 4 years. Given this wide window, investor expectations can vary between the date of commission and the subsequent detection of misconduct. Moreover, leakage of information about alleged misconduct is likely during this time interval, which would lower the level of investor optimism as well as the sensitivity of market reaction to the eventual detection of manipulation. Therefore, we sort these investor optimism proxies by the date when firms begin misreporting their accounts (date of commission) and the date of disclosure (date of detection). All our optimism proxies are measured prior to either the date of commission or of detection as noted in the following discussion. This scheme results in eight test variables (one for each of the four proxies for optimism measured at 2 years—year of commission and of detection): Ind. Q_detect, Firm Q_detect, Ind. EPS Growth_detect, Firm EPS Growth_detect, Ind. Q_commit, Firm Q_commit, Ind. EPS Growth_commit and Firm EPS Growth_ commit. As an example, the variable Firm Q_commit represents firm-level investor optimism as proxied by Tobin’s Q as of the date of commission of misconduct. Then, we interact these optimism indicators with IRR. Our second hypothesis focuses on investor optimism about the state of the firm, so we are mainly concerned with firm-related test variables listed above and their interactions with IRR.

In Panel A, our results indicate that investors react more negatively to intentional misstatements. For example, the coefficient estimates on IRR [ranging from − 0.030 in column (3)] to − 0.045 [in column (1)], significant at the 5% level show negative average CAR of 3.00–4.5%. Of the interaction terms, only the coefficient on Firm Q_commit*IRR is negative [− 0.010 in column (3)] and significant (at 5%). The standard deviation of Firm Q_commit is 3.86. So, a one-standard-deviation increase in firm-level investor optimism as of the date of commission is estimated to reduce market reaction to irregularities further by 3.86% (3.86 * − 0.010), resulting in a total drop in mean CAR of 3.86%. This finding is consistent with the prediction of our second hypothesis that more optimistic beliefs about firm prospects at the time of occurrence (commission) of misconduct would cause greater loss of investor trust in the firm, leading to more negative market reaction. In terms of economic significance, the size of the impact is huge (3.86%) compared with the impact of IRR (ranges from 3 to 4.5%). By comparison, the incremental effect of industry-level investor beliefs (Ind. Q_commit*IRR) is insignificant. Further, we find that investor optimism as of the date of disclosure of misbehavior, both at industry and at firm levels, has an insignificant effect on average abnormal returns, consistent with our conjecture about leakage of suspected misconduct before detection of irregularities. The coefficient estimates on control variables are consistent with those reported by the previous literature, see Collins et al. (1987), El-Gazzar (1998), Palmrose et al. (2004) and Burks (2011).

In Panel B, the coefficient estimate on Firm EPS Growth_commit (0.001) is positive and highly significant. The standard deviation of Firm EPS Growth_commit is 7.41, indicating that a one-standard-deviation increase in firm-level investor optimism as of the date of commission produces an average market reaction to accounting misstatements (both irregularities and errors) of 0.74% (0.001 * 7.41).Footnote 35 However, the estimate of the interaction term Firm EPS Growth_commit*IRR is negative (− 0.001) and significant at 5%, in addition to the negative estimate of IRR (− 0.047). So the announcement of accounting failures depresses mean abnormal returns by 5.44% (− 0.74–4.7%) for a one-standard-deviation increase in firm EPS growth. In Panel C, the coefficient estimates on both interaction variables—Prior Return 3Yr_commit*IRR and Prior Return 5 Yr_commit*IRR, are negative and significant (at 10% or better).

Our tests in Table 8 follow the literature (e.g., Burks 2011; Petersen 2009; Nguyen et al. 2016) and use heteroscedasticity-consistent standard errors (White 1980). As a robustness check, we repeat the above tests by including industry- and year-fixed effects. The estimates are shown in Panel A of Table 9. We include Analyst Recommendation and % Buy recommendations as added proxies for firm-specific optimism in the last two columns. All control variables are suppressed for brevity, and all standard errors are double-clustered at the firm and year levels. Consistent with our Hypothesis 2, all coefficient estimates on the interaction term Firm IO_commit*IRR are negative and significant at 5% or better.

In Panel B, we include both ICS (Sentiment), which is a market-wide proxy for consumer sentiment (unexplained by macroeconomic factors) that remains constant across all firms in a given year, and Overnight Stock Return that is firm-specific (i.e., varies across firms in a given year) and their interactions with IRR. Both of these proxies are measured as of the time of commission of IRR. Consistent with prediction, both interaction coefficients are negative and significant.Footnote 36

Overall, the above results offer strong support for our second hypothesis that investor reaction would be more negative when the commission of accounting misconduct is preceded by firm-level investor optimism. By comparison, the sensitivity of market reaction to investor views at the time of disclosure of misconduct as well as about the state of the industry appears more muted. This evidence appears to be robust to alternative measures of firm-level investor optimism as well as potential sample selection problems (as indicated by tests based on propensity score matched samples reported in Table B.11 and Table B.12 in “Appendix B”).Footnote 37,Footnote 38

Conclusion

The causes and consequences of accounting misconduct have been widely studied, but our understanding of what factors influence a firm’s incentives to issue misleading reports and the effectiveness of various monitoring, prevention and detection mechanisms is rather limited. Extant theoretical and empirical work in corporate and behavioral finance suggests that the degree of firm-specific investor optimism including the psychological biases of investors and managers should play a very important role in influencing investor behavior, asset returns and managerial decisions. Motivated by this literature, we emphasize the role of ex ante firm-level measures of investor optimism in predicting accounting failures, which is in contrast to the focus on economy-wide and industry-level measures in the prior studies.

Based on a sample of financial restatements by US firms from 1996 to 2012, we find that the probability of accounting misconduct is hump-shaped in investor beliefs about firm-specific prospect. The incidence of misconduct is first increasing in investor optimism up to a moderate level and then decreasing when beliefs are highly positive. In addition, investors exhibit greater disappointment when their optimistic beliefs about firm prospects as of the time of manipulation are shocked by the disclosure of accounting misconduct, resulting in more pronounced negative abnormal stock returns. Our evidence appears robust to a variety of tests to probe potential concerns about measures of firm-specific investor optimism, reverse causality and endogeneity. Thus, our investigation establishes that firm-level measures of investor optimism constitute statistically significant and economically important red flags for corporate white collar crimes.

Accounting misrepresentations shake investor confidence in management and capital markets, leading to stock price declines and heightened volatility. Moreover, accounting misconduct is challenging to investigate, detect and prevent. Our analysis highlights that forensic analysts, auditors, the board of directors and regulators should be on alert for misleading accounting reports when firm-level overnight stock returns, analyst buy/sell recommendations and EPS growth forecasts, Tobin’s Q and economy-wide sentiment index indicate that investors are fairly optimistic about future firm performance.

Notes

In this paper, we use “optimism” to refer to investor beliefs and sentiment because the upside is one of the main drivers of a rash of financial misconduct along business cycles (Ball 2009). Our test variables are continuous variables which captures both optimism and pessimism.

Povel et al. (2007) note “Thus, even if one defines “bad times” and “good times” in terms of the expected return to any given firm rather than the relative numbers of good and bad firms, our predictions still hold.” (p. 1337).

Although there is no strict definition or an exact threshold, a moderate level could be a one standard deviation around the mean. For example, results in Table 2 column (3) suggest that, based on the first-order condition, the predicted likelihood of irregularity peaks at firm-level Q is equal to 2.4. As the mean firm-level Q equals 1.97 and the standard deviation of firm-level Q equals 1.73, the peak of the predicted likelihood of irregularity falls within one-standard-deviation range from the mean firm-level Q. Calculations based on firm-level EPS suggest a similar pattern.

Wang et al. (2010) focus on IPO fraud and find a nonlinear relation between corporate fraud and investor prior beliefs about business conditions (also see and Wang 2011). We complement their work by showing that firm-level heterogeneity in optimism matters, even after controlling for industry-wide beliefs, in explaining the incidence of intentional accounting misstatements as well as shareholder wealth losses following the detection of questionable reports. Many studies focus on fraud detections, while our study focuses on fraud commissions. For example, Dechow et al. (2011) capture a set of characteristics of misstating firms (i.e., firms have already admitted “mistakes”). Similarly, Dyck et al. (2010) analyze whistleblowers’ incentives on the revelation of the fraud (i.e., fraud detections).

We examine accounting errors (unintentional misstatements defined in Hennes et al. 2008) while conducting falsification tests. To conserve space, results on errors are suppressed but are available upon request.

We are grateful to Jonathan M. Karpoff, Allison Koester, D. Scott Lee and Gerald S. Martin who generously shared with us the FSR database they used in their paper, Karpoff et al. (2017).

Karpoff et al. (2017) find that 87.5% of cases in GAO and 97.8% of cases in AA are non-misconduct cases, compared with 0% in FSR.

FSR and AA report the date when misstatements start while GAO does not. So we hand-collect the information on the year of commission if the case is unique in the GAO dataset.

In the irregularities sample, the median (mean) length from commission to detection is 2.64 (2) years and the upper (lower) quartile is 4 (1) years. In the errors sample, the median (mean) length from commission to detection is 2.17 (2) years and the upper (lower) quartile is 3 (1) years.

The GAO data on the classification of errors versus irregularities were generously provided by Professor Andrew J. Leone (http://sbaleone.bus.miami.edu/). Our classification of irregularities from the Audit Analytic (AA) data follows Badertscher et al. (2011). In the AA dataset, two variables help us distinguish irregularity from errors. One is “Res_fraud,” which equals 1 if the restatement identified financial fraud, irregularities and misrepresentations. The other is “Res_sec_investigation,” which equals 1 if the restatement disclosure identified that the SEC, PCAOB or other regulatory body is investigating the registrant (pp. 1494 of Hennes et al. 2008).

We delete firms with negative book value of equity and firms with the two-digit SIC code equal to 99 indicating shell holding companies and acquisition vehicles whose characteristics change dramatically after acquisition. Since our control sample is based on the population of COMPUSTAT firms for which data are available, we address the concern over matched sample problem raised by Jones et al. (2008) and Burns et al. (2010). As a large set of variables in regression analyses imposes further reduction in sample size, we provide a detailed description on sample construction in Panel B of “Appendix A.” The distributions of the commission and detection of irregularities over our sample period 1996–2012 and across industry groups are shown in Table B.1 in “Appendix B.”

Standard deviations for firm-level investor optimism are 1.173 for Firm Q and 1.464 Firm EPS Growth. Consistent with our expectation, these are much higher than the respective standard deviations for the industry-level optimism measures, 0.561 for Ind. Q and 0.168 for Ind. EPS Growth.

The estimated Pearson correlation coefficient between median Ind Q (Ind. EPS Growth) and Firm Q (Firm EPS Growth) is 0.24 (0.01), significant at 5% (see Table B.2 in “Appendix B”).

Williams (2012) points out that assessing the marginal effects of the squared terms is not meaningful because one cannot change a squared term without changing the variable itself. Therefore, it is impossible to explain the effect of the squared term in isolation of the variable itself.

We stress that all specifications in Table 2 control for annual return on assets (ROA) for the year preceding the beginning of accounting misstatements to control for (short-term) prior firm performance.

The bivariate probit model contains two separate equations, one for fraud commission and the other for detection of a fraud that was committed earlier. The probit model commonly used in prior studies focuses only on fraud detection; it is not capable of estimating the probability of fraud commission.

In unreported results, we construct excess firm-level Tobin’s Q and excess firm-level EPS Growth (both measured in excess of industry median). Further, we estimate firm-level buy-and-hold stock returns in excess of the industry median for 3 and 5 years prior to the occurrence of misstatements. The coefficient estimates for all these firm-level measures of investor beliefs are significant.

Consistent with this argument, Log Assets is negative and significant in the P(M) regression (− 0.079) in Table 3, suggesting that small firms are more susceptible to accounting misdeeds. But they are less likely to face intense investor monitoring, resulting in a significantly lower likelihood of detection of their accounting failures (0.115). Wang (2011) argues that new investment opportunities tend to decrease investors’ ability to detect misrepresentation of cash flows from existing assets, thus increasing a firm’s incentives to manipulate accounting reports. In line with this argument, we find a positive and highly significant coefficient on CAPX (0.905) in the misconduct regression and a significantly negative coefficient (− 1.205) in the detection regression. By contrast, investor protection laws enacted by SOX appear to have reduced the propensity for accounting misrepresentation (− 2.608) and increased the likelihood of disclosure of misconduct (6.007). When we examine firm-level proxies in Model (2) and both industry-level and firm-level proxies in Model (3), these control variables have comparable magnitude of size and statistical significance.

In unreported results, we include ST and LT compensation directly in the misconduct equation and find that the coefficient estimates of our test variables are still robust.

Panel regressions with firm-fixed effects further capture unobserved heterogeneity at the firm level. The GMM accounts for unobserved heterogeneity (i.e., unobservable variables affect both the dependent and independent variables) as well as simultaneity (i.e., independent variables are functions of the dependent variables). Dynamic GMM is so far one of the most powerful econometric tools to address the endogeneity of Tobin’s Q (Erickson and Whited 2012).

We calculate abnormal accruals as the error term for firm i in year t by regressing total accruals for firm i in year t on the inverse of total assets in year t − 1, changes in revenue in year t (scaled by total assets in year t − 1) minus changes in receivables in year t (scaled by total assets in year t − 1) and gross property, plant and equipment in year t (scaled by total assets in year t − 1). The modified Jones model is estimated for each Fama and French (1997) 48-industry and year group.

Furthermore, we use the Erickson and Whited (2012) estimator to address potential concerns about measurement error in firm-level Q with a within-firm transformation to account for firm-fixed effects and find that the coefficient estimates on firm-level Q are larger. For example, using the third-order estimator in Erickson and Whited (2012), the coefficient estimates of firm Q is 0.082 and that of firm Q squared is − 0.0032. These positive and significant coefficient for firm-level Q and negative and significant coefficient for firm-level Q squared (std. error of firm Q is 0.017 and std. error of firm Q squared is 0.0001, both with p values equal to 0.000) offer support for a causal relation between the incidence of accounting misconduct and firm-level investor optimism. Also, see Table B.5 in “Appendix B.”

In the first stage, firm-level EPS growth is regressed on earnings management with firm- and year-fixed effects. Residual Firm EPS Growth is calculated as actual firm-level EPS growth minus the predicted level of EPS growth. In the second stage, we estimate the previous bivariate probit model.

We are grateful to an anonymous referee for suggesting consumer sentiment as an alternative proxy for investor optimism. The term sentiment refers to “feelings or beliefs about a situation, state of affairs, or event” (Hribar et al. 2017, p. 26). Most of studies in finance and accounting focus on beliefs that are “unjustified” based on available information (e.g., Baker and Wurgler 2006; Lemmon and Portniaguina 2006). The focus of our study is firm-level investor optimism, which refers to investors’ belief about firm perspectives. It includes both “justified” and “unjustified” beliefs. Differentiating “unjustified” sentiment from “justified” part is beyond the scope of this paper. However, we believe the “unjustified” part is important in examining the roles of different players in the market. In the revised version, we apply a variety of measures to capture both aspects.