Abstract

Can firms overcome credit constraints with a corporate culture of high integrity? We empirically address this question by studying their investment–cash flow sensitivities. We identify firms with a culture of integrity through textual analysis of public documents in a sample of Chinese listed firms and also through corporate culture statements. Our results show that firms with an integrity-focused culture have lower investment–cash flow sensitivity, even after we address endogeneity concerns. However, we also find that for the culture to reduce the investment–cash flow sensitivity, external stakeholders must be able to verify this culture through a low information asymmetry environment. Overall, our findings show that a corporate culture of high integrity can mitigate a firm’s external transaction costs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Corporate culture has received a tremendous amount of attention in the management literature and recently also in the economics and finance literatures. For example, Guiso et al. (2015) find that when employees perceive top managers to have integrity (i.e., to be trustworthy and ethical), then firm performance is stronger. Fiordelisi and Ricci (2014) find that different dimensions of corporate culture can influence CEO turnover. Hilary and Hui (2009) find that firms located in US counties with high degrees of religiosity, another important aspect of culture, engage in less risk-taking. However, while these papers, among others, are insightful, they focus only on firms’ internal transaction costs. That is, they show how corporate culture affects within-firm behavior and decision making. In this paper, we study whether corporate culture can influence external transaction costs. That is, can corporate culture influence the way outside stakeholders interact and engage with the firm? Specifically, we investigate whether firms with a culture of high integrity can overcome financial constraints and avoid high investment–cash flow sensitivity.

We study investment–cash flow sensitivity because it is a measure of the efficiency of its growth potential. Under contract theory, a firm is a nexus of explicit and implicit contracts among managers, owners, and investors (e.g., Alchian and Demsetz 1972; Coase 1937; Fama and Jensen 1983a, b; Jensen and Meckling 1976). Investors will provide capital to firms in exchange for claims on the firms’ value. As Modigliani and Miller (1958) stated, “In perfect and complete markets, investment decisions of a firm are independent from its financial situation.” Ideally, firms would receive capital anytime their investment opportunity set merits the new investment. In this case, their investment spending would be independent of their cash flow. However, because firms can suffer from agency problems and information asymmetry, investors may fail to provide the capital or require high returns on capital. This kind of credit friction can make it difficult for firms to raise the needed capital to grow (Stein 2003). To overcome such financial constraints, some firms will only invest from internally generated capital via cash flow. So investment spending and cash flow would be more highly correlated. Some firms may hoard internally generated cash to finance their ongoing and future investments (Fazzari et al. 1988). Indeed, empirical studies often find a positive relation between corporate investment and corporate cash holdings (e.g., Fazzari et al. 1988; Hoshi et al. 1991). However, and perhaps not surprisingly, research also finds that the positive relation between investment and cash holdings is weaker when firms have lower agency costs and lower information asymmetry (e.g., Attig et al. 2012, 2013). In other words, in some firms, investment is more sensitive to cash flow than it is in other firms.

How can a corporate culture of high integrity affect investment–cash flow sensitivities? Corporate culture can be described as a “set of norms and values that are widely shared and strongly held throughout the organization” (O’Reilly and Chatman 1996). Among various corporate values, one that is particularly emphasized is one of high integrity (e.g., Erhard et al. 2016; Guiso et al. 2015; Kreps 1990). Guiso et al. (2015) contend that integrity is the most important, and most often mentioned, aspect of corporate culture. We illustrate how corporate integrity may be able to mitigate credit frictions, and thus reduce firms’ investment–cash flow sensitivities. Firms with a culture of high integrity have employees and managers who are trustworthy, motivated, self-governing, and not self-serving. External stakeholders, including creditors, may perceive such firms as likely to honor contracts, adhere to regulations, and respect their needs and rights as stakeholders. Therefore, firms with a culture of high integrity may not need to hoard cash to finance their investments or only invest when cash flow is high. In our paper, we empirically test whether firms with a culture of high integrity have low investment–cash flow sensitivities (i.e., have a low positive correlation between investment activities and cash levels).

To conduct our study, we use data from China. It is well known that China is a large transition economy, moving from a planned economy to a market-oriented one. During this period, formal institutions, such as laws and enforcement, are maturing. But the overall ethical business environment is still far from those in developed Western economies. For example, the World Bank reports a variety of country-level governance indicators. One indicator, Control of Corruption, is a good measure of the level of integrity in the business environment. The Control of Corruption percentile rank lists the country with the most ethical environment at 100, while the lowest receives a 0. In 2008, the midpoint of our data range, China ranked only 35.4 in Control of Corruption. The Western countries, where most of the business ethics studies take place, rank much higher. For example, Guiso et al. (2015) study US firms, an environment with a percentile rank of 91.7. Aldohni (2016) examines the finance ethics in the UK, a country with a World Bank Control of Corruption percentile rank of 92.2. In these highly ethical business environments, building trust with stakeholders may be easier than in the much lower ethical environment in many other countries, like China. So a reputation for a high level of integrity is likely to be more important for a firm to overcome credit frictions in a lower ethical environment than in high ethical environments. In other words, our study is important because much of what we know about corporate integrity cultures is from countries with a relatively high ethical environment. China provides an ideal setting to learn about corporate integrity in a very large economy with a low level of business ethics.

Using a sample of Chinese listed firms during 2002–2012, we first identify which firms have a culture of high integrity by using a textual analysis (we describe our identification strategy later in the paper). We characterize corporate culture as having two dimensions: type and strength. Type is the topic of the culture. We examine integrity, but other popular topics include entrepreneurship, innovation, team work, and market-focused. Corporate culture strength is how strongly the norms and values are shared throughout the firm (Sørensen 2002). We find that firms with a strong culture of high integrity have lower investment–cash flow sensitivities than other firms do. Of course, there is an endogeneity concern (whether or not a firm has a culture of high integrity is not random), but even after addressing it we find that our main finding stays intact. Some firms may falsely claim to have a culture of high integrity simply to obtain its benefits. Therefore, we test whether corporate integrity is associated with low investment–cash flow sensitivities only when outsiders can reliably identify which firms truly have a culture of high integrity, and we find evidence that this is so.

To the best of our knowledge, our paper is the first to empirically test whether a corporate culture of high integrity can reduce firms’ external transaction costs. Thus, our paper contributes importantly to the emerging literature on how corporate culture can benefit firms. In addition, we contribute to the very few papers that examine corporate integrity within a generally low business ethics environment.

The rest of our paper proceeds as follows. The next section provides overviews of corporate culture and corporate integrity, and presents our hypothesis. The third section describes our data and research design, while the fourth section presents results. Finally, we conclude the paper with some thoughts on the corporate ramifications of our findings.

Corporate Culture, Integrity, and Investment–Cash Flow Sensitivity

The idea that firms have, and can benefit from, corporate cultures has been around for a long time, especially in Western business circles. Although there are several different definitions of corporate culture, the conventional view is that corporate culture is a set of norms and values that are strongly held and widely shared throughout the organization (e.g., Flamholtz 2001; O’Reilly and Chatman 1996; Wilkins and Ouchi 1983). These shared values can play the role of “social control” and help solve coordination and incentive problems within the firm (see, e.g., Crémer 1993; Hermalin 2001; Lazear 1995; O’Reilly and Chatman 1996). Corporate culture can therefore complement more “traditional” control systems, such as written regulations, clocks for punching in and out of work, performance reviews, and detailed employee contracts. Many scholars have investigated the effect that corporate culture can have on firm efficiency, with most claiming that a positive corporate culture can improve firm performance (e.g., Crémer 1993; Denison 1984; Erhard et al. 2016; Hermalin 2001; Heskett and Kotter 1992).

While corporate culture has many dimensions, one commonly mentioned type is corporate integrity (Guiso et al. 2015; Kreps 1990). Not surprisingly, therefore, a growing body of research discusses the importance of integrity, and of its effect on employee and managerial behavior, to corporate performance. Erhard et al. (2016) model integrity as a factor of production that is just as important as knowledge and technology. Koehn (2005) finds that in firms with a culture of integrity, employees maintain non-myopic long-term views, maintain healthy relations with all stakeholders, and do not succumb to frustrations or other negative emotions. In this sense, a culture of high integrity serves as a guiding principle to enlighten, inspire, move, and motivate people. Guiso et al. (2015) argue that a culture of high integrity, primarily defined as “keeping your word,” helps ameliorate moral hazard problems inside the organization,Footnote 1 as employees self-govern according to high standards and principles, thus eliminating any hidden inefficiency costs (Erhard et al. 2016; Hsu 2007; Kreps 1990; O’Reilly and Chatman 1996). This discussion suggests that a corporate culture of integrity can lower firms’ internal transaction costs and thus improve their efficiency and performance (e.g., Erhard et al. 2016; Guiso et al. 2015).

Overall, existing studies seem to have reached a consensus view that a culture of high integrity has an important and positive influence on firms’ efficiency and profitability. However, all of these studies emphasize how corporate culture can lead to low internal transaction costs (e.g., in high-integrity firms, employees work harder and managers are fair and not self-serving), while no study that we are aware of examines the role that a corporate culture of integrity can have on external transaction costs. For example, whether firms with high integrity enjoy more trust from outside stakeholders.

In this paper, we focus on whether corporate culture of high integrity can influence external capital providers and whether it can affect them in a way that benefits firms. More specifically, we investigate whether corporate integrity helps companies improve their access to capital markets by reducing market imperfections and frictions and therefore reduces the firm’s need to hoard cash to finance investments. We investigate this through the mechanism of investment–cash flow sensitivity. As we have mentioned, the literature describes the positive investment–cash flow sensitivity as a consequence of imperfect or incomplete capital markets. The uncertainty about the validity of a firm’s investment opportunities leads to the cost of external capital exceeding the cost of internal financing. Pawlina and Renneboog (2005) examine the investment–cash flow sensitivity in UK firms and conclude that it is explained by agency costs. In other words, the incentive for managers to over-invest with external capital leads to caution by credit providers. In addition, the general information asymmetry between stakeholders and managers may also play a role (Ascioglu et al. 2008). This leads us to our hypothesis of how firms with a corporate culture of high integrity can overcome these credit constraints.

Hypothesis

Firms with a culture of high integrity have low investment–cash flow sensitivities.

Based on the above discussions, there are at least two reasons to believe that firms with a culture of high integrity enjoy low investment–cash flow sensitivities. First, a culture of integrity can act as a bonding mechanism to curb opportunistic behaviors inside firms. According to Erhard et al. (2016) and Guiso et al. (2015), employees and managers in firms with high integrity are less likely to expropriate firm resources or engage in other self-serving activities. Given that employees and managers are agents working on behalf of outside investors, who are the firm’s principals, an integrity-oriented culture should mitigate agency cost and therefore lower the firm’s cost of borrowing capital and, in turn, its need to hoard cash to finance its investments. That is, firms with a culture of integrity should have lower investment–cash flow sensitivities.

Second, corporate integrity may help firms build social capital, and thus mitigate any agency problems between them and external investors. Social capital can help promote the exchange of a range of intangible yet highly valuable assets, such as knowledge, information, and support (e.g., McEvily et al. 2003). Hsu (2007) argues that companies that value integrity are more likely to build social capital, for example, trust. Specifically, a culture of integrity leads firms to respect honesty, fair dealing, laws, and the rights and needs of others, including external investors (Hsu 2007; Koehn 2005). Just as important, emphasizing integrity sends a signal that the company is willing to take responsibility for, and willing to repay, any social liability. Therefore, external stakeholders such as outside investors, including creditors, may be more likely to help, support, and provide capital to firms with integrity-oriented cultures (Hsu 2007). If such firms can more easily obtain outside capital (i.e., if they have low external transaction costs), they should have less need to hold cash—that is, they should have low investment–cash flow sensitivities.

Data and Research Design

Sample

To construct our sample, we start with all Chinese A-share exchange-listed firms between 2002 and 2012. We obtain financial statements data from the China Securities Market and Accounting Research (CSMAR) database and hand-collect information on corporate culture from companies’ publicly available official documents and channels, including annual reports, internal control self-assessment reports, official corporate Web sites, and media reports. Firms from the financial sector are excluded because disclosure requirements and accounting rules are significantly different for regulated industries. Firms with incomplete financial information and culture information are also excluded. Our final study sample includes 15,204 firm-year observations representing 2314 unique firms. We also winsorize our continuous variables at the 1 and 99% levels to mitigate the effect of outliers.

Identifying Firm Culture

It is a challenging task to identify and to measure corporate culture and integrity. Since the words used by members of an organization can convey the culture that they have developed over time (Levinson 2009), by analyzing documents produced by the firm, we should be able to infer distinctive features of its corporate culture. Textual analysis (Fiordelisi and Ricci 2014; Stone et al. 1966) has recently been implemented in the top journals of finance, accounting, and business ethics, including Antweiler and Murray (2004), Dhanani and Connolly (2015), Hoberg and Hanley (2010), Hoberg and Phillips (2010), Li (2008), Loughran and McDonald (2011), Tetlock (2007), and Tetlock et al. (2008). Textual analysis has specifically been used to examine the integrity of management communication (Balvers et al. 2016) and codes of conduct (Scheiber 2015). This method has also been found to be reliable for identifying corporate culture in China (e.g., Guo et al. 2014; Jiang et al. 2015).

A firm can reveal its corporate culture strength and type (intentionally or unintentionally) through its public communication conduits. This is especially important for a corporate culture of integrity because it impacts external constituents of the firm. Haniffa and Cooke (2002) show that voluntary disclosures are influenced by corporate governance and ethnic cultural factors. These factors also influence the extent to which firms provide social and environmental disclosures (Haniffa and Cooke 2005). Disclosures are an important method of communicating the firm’s values. Therefore, we examine the following four disclosure channels: (1) official company Web site, (2) annual reports, (3) internal control self-assessment reports, and (4) media reports. A company Web site usually has one or more sections to show the company’s vision, values, and working environment. Most official documents, such as annual reports and internal control self-assessment reports, also contain some material that may briefly introduce the firm’s corporate culture. Finally, firms can promote their corporate culture through mass media, as in interviews. When we cannot find any indications of culture using the first three public channels, we then search media reports to find interviews in which top managers have discussed their firms’ corporate culture.

To specifically identify firms with a culture of high integrity, we need to identify a set of key words. To do so, we follow the general approach of other researchers who have identified such firms (e.g., Erhard et al. 2016; Guiso et al. 2015). Guiso et al. (2015) use the terms honesty, ethics, trust, and accountability—all synonyms of integrity. Erhard et al. (2016) develop a positive model of integrity and start with the idea of being sincere. While a person may be sincere in their intentions, the model extends the original intention to on ongoing motivation to honor your word. We verify these keywords and phrases in The Concise Oxford English Dictionary and The Contemporary Chinese Dictionary to validate their appropriateness for Chinese companies. Therefore, we identify firms that use the following words and phrases in their public documents: “honesty,” “ethics,” “accountability,” “sincere,” “trust,” “keeping/honoring your word,” and “not lying.” Firms that use any of these words are considered to have a corporate culture of integrity. However, we need to measure the strength of the culture.

We use two measures to score the strength of the integrity culture of each company. As mentioned earlier, we have four sources of four public channels to search for the integrity culture, but some firms do not use all four public channels to disclose their integrity culture. We contend that the more channels the firms use to disclose their integrity culture, the more it is integrated into the systematic activities of the employees. Therefore, our first measure of integrity measure refers to the strength of the disclosure. If firms mention their integrity culture in all four public channels, then we assign them with an Integrity_channels variable equal to 7. If firms mention their integrity culture in three public channels, then we assign them with an Integrity_channels variable equal to 5. If firms mention their integrity culture in two public channels, then we assign them with an Integrity_channels variable equal to 3. If firms mention their integrity culture in only one public channel, then we assign them with an Integrity_channels variable equal to 1. Firms that do not have a culture of integrity are assigned an Integrity_channels variable equal to 0. Firms with a corporate culture of integrity will have an Integrity_channels variable of 1 or higher. The higher the value, the stronger the culture. Therefore, our Integrity_channels variable measures both dimensions of corporate culture, type, and strength.

Many firms specifically communicate that they have one or more types of corporate cultures directly through intended corporate culture statements. Searching for the term “corporate culture” on the companies’ public communication channels finds these firms. Thus, our second variable of an integrity culture refers to the order of the word “integrity” in corporate culture statements. Generally, firms have more than one, usually 3 to 6 culture types in their culture statements. For example, the listed company Shenhuakonggu has five types in their corporate culture statement in this order: “Integrity,” “Innovative,” “Talented,” “Outstanding,” and “Harmony.” Our second example, Lingyungufen, also has five types listed in their corporate culture statement: “Innovative,” “Responsibilities,” “Team work,” “Integrity,” and “Sharing.” Integrity is listed first in the prior example and fifth in the latter example. We contend that the order reflects the importance the firms place on each aspect of their corporate culture. Therefore, if a firm lists their integrity culture first, then we assign the variable, Integrity_order, with the strong culture value equal to 7. If a firm lists the integrity culture second or third, then we assign an Integrity_order variable equal to 5, a moderately high strength. If the firm lists the integrity as the fourth or fifth culture type, then we assign them with an Integrity_order variable equal to 3. Lastly, if a firm lists integrity after the fifth type of culture, then we assign them with an Integrity_order variable equal to 1, a weak strength. If firms do not have a culture of integrity, then we assign them with an Integrity_order variable equal to 0.

Our two measures of a corporate culture of integrity have some important similarities. They both indicate whether a firm has an integrity culture at all, and their magnitudes indicate the strength of that culture. They are both scaled from 0 to 7 for ease and consistency of interpretation and comparison. Nevertheless, the two variables are constructed quite differently. The channels variable uses the number of public communication changes the ethics key words are found, while the order variable uses the listing location of the word “integrity” within its corporate culture statement. The correlation between Integrity_channels and Integrity_order is 0.834.

How long has the firm implemented a corporate culture? Note that company Web sites continually change. Therefore, only current searches are possible. When company Web sites mention corporate culture or integrity, we assume the firms have had these values during the entire sample period. We admit that there may have been earlier years when these firms did not have corporate cultures or integrity. However, this assumption biases our results against the hypothesis. There are historical records for other public channels. Therefore, when corporate cultures or integrity are mentioned, we assume those firms had those values only during the year of the particular mention. We admit that there may be years when those firms had corporate cultures or integrity, but we were unable to identify them using those particular public channels. Again, this procedure biases the empirical results against us. That is, if we fail to identify firms with and without culture and integrity properly or accurately, then we should not be able to find any statistically significant results to support our hypothesis.

Empirical Specification

To analyze the impact of corporate integrity on investment–cash flow sensitivity, we augment the standard investment–cash flow regression model (e.g., see Attig et al. 2012, 2013; Francis et al. 2013) with an interaction term between cash flow and corporate integrity. Specifically, our baseline regression model is as follows:

where i indicates firms, t indicates years, Investment is capital expenditures, Assets is total assets, Cashflow is cash flow from operating activities, Integrity_channels measures the strength of integrity culture [0, 1, 3, 5, 7] as describe above, and X is an array of control variables, including Tobin’s Q (measured as market value of equity plus total assets minus book value of equity, all over total assets), Firm size (measured as the natural log of firm size, Leverage ratio (measured as total liabilities over total assets), Board size (measured as the natural log of the number of members on the board), and an Independence ratio (measured as the fraction of directors who are outsiders). We also control for industry and year fixed effects. Note that in some of the analysis, we substitute Integrity_order for Integrity_channels.

Panel A of Table 1 reports summary statistics for Integrity_channels and Integrity_order variables, by year. For the entire sample period, the two integrity culture measures increase over time, possibly suggesting that Chinese firms are increasingly recognizing the importance of an integrity culture. Panel B of Table 1 provides summary statistics for all other firm-specific variables used in our regression analyses. We can see that corporate investment (Investment/Assets) and cash flow (Cashflow/Assets) vary greatly across firms. For example, note that their standard deviations are almost twice as large as their means and medians. Our contention is that corporate culture may explain some of the covariation between investment and cash flow. Table 2 presents a correlation matrix. The correlation coefficients have expected signs, but none of the correlations seem to be large in absolute magnitude. The next section presents regression results.

Empirical Results

Table 3 reports our main regressions results using OLS, with standard errors clustered at the firm level. In Column (1), we report the typical investment–cash flow regression specification as a baseline. We note that the cash flow variable is positive and highly statistically significant. This is the well-known finding that has been documented in many prior papers (e.g., Fazzari et al. 1988; Hoshi et al. 1991). That is, firm investment expenditures are highly dependent on current cash flow from operating activities.

To investigate whether a culture of integrity has any effect on firms’ investment–cash flow sensitivities, we next run the regression model with the Integrity_channels variable and its interaction with Cashflow/assets. The results are reported in Column (2). The Integrity_channels coefficient is positive, indicating that firms that cultivate a corporate culture of high integrity actively invest, suggesting that they have strong intentions to grow their firms. More importantly, at least from the perspective of our paper, the interaction between Integrity_channels and Cashflow/assets is significantly negative, indicating that firms with a culture of integrity do indeed have lower investment–cash flow sensitivities and thus have good access to capital. We then repeat the analysis by replacing Integrity_channels with our second integrity variable, Integrity_order. These results are reported in Column (3). Again, the integrity variable coefficient is significantly positive and the interaction term is significantly negative. Analysis using both integrity variables provides evidence that firms with a stronger corporate culture of integrity have lower investment–cash flow sensitivities, consistent with our hypothesis.

Before proceeding further, we should mention that the findings for the control variables are mostly as expected and are consistent across all three regression models. Firms with higher valuations (i.e., Tobin’s Q) invest more, which is not surprising. A high level of investment can drive high corporate valuations. We also see that larger firms invest more. This finding is somewhat unexpected. We usually tend to think that small firms are more growth-oriented than large firms, but this is not the case in our sample. And firms with a higher fraction of independent directors invest more. This finding hints that outside directors may be able to influence their firms to invest more.

Addressing Endogeneity Concerns

So far, our results have shown that a strong corporate culture of high integrity can decrease a firm’s investment–cash flow sensitivity. However, potential endogeneity may bias our results. We use several approaches to mitigate endogeneity concerns.

The first concern with our main regressions is that the corporate culture of integrity may not be exogenous and some unobserved firm characteristics could link the culture of integrity and investment–cash flow sensitivity, leading the OLS coefficients to be biased. To address this concern, we use 2SLS instrumental variable models. We seek instruments that proxy for a firm’s culture that are not related to the potential unobserved firm characteristics. A common practice is to use a category average of the explanatory variable where the category seems likely to represent the firm. For social responsibility, El Ghoul et al. (2011) and Benlemlih and Bitar (2016) suggest that social performance varies by industry, and thus industry averages make for a good instrument. It seems reasonable that a firm’s ethics culture might also be related to the firm’s industry, so we use the industry–year average of Integrity_channels or Integrity_order (denoted Integrity_Industry) as our first instrumental variable. This method is motivated by the notion that when firms operate in industries with a higher proportion of firms with a culture of integrity, then a given firm is more likely to regard integrity as a useful economic attitude and therefore be more likely to build a culture of integrity. In addition, China is very geographically large and its regions vary in ethnic makeup, economic strengths, access to resources, etc. Just as engaging in socially responsible activities varies between countries in the world (El Ghoul et al. 2016), a firm’s ethics culture is likely to depend on it location. Thus, we use the province–year average of these integrity variables (denoted Integrity_Province) as our second instrumental variable. A firms’ incentive to build to a culture of integrity is influenced by that of their neighbors, since firms in the same area may face similar social culture and are more likely to share a same belief. These two instrumental variables capture the “natural” tendency of a culture of integrity to be present, but are less likely to be correlated with unobservable factors that affect the outcome variable, which is investment–cash flow sensitivity in our case.

We regress our integrity variable on the two instruments and control variables from the baseline model. The estimated coefficients using Integrity_channels and Integrity_order as the dependent variables are reported in Column (1) and Column (6) of Table 4, respectively. We find that the p values for the Cragg–Donald test are less than 0.001 in both columns, rejecting the null hypothesis that each endogenous variable is weakly identified. We retain the predicted values of these integrity variables and then interact Cashflow/assets and these predicted values in our second regression reported in Column (2) and Column (7). Not surprisingly, the coefficient on the interaction between firm cash flow and the predicted value of the integrity measure is significantly negative. We then perform Hansen’s (1982) over-identification test for the null hypothesis that our instrumental variables are uncorrelated with the error term. This test provides a p value of 0.8984 and 0.6660 for each instrumental variable, suggesting that our instrumental variables are exogenous. Overall, these results in Table 4 suggest that our findings are robust to the use of two-stage least squares.

A second concern is that it may be possible that our results, so far, suffer from a self-selection bias. That is, whether firms have a culture of high integrity may not be a random outcome, but instead the decision to adopt a culture of integrity may be endogenous. To address this concern, we employ a Heckman two-stage self-selection model (Heckman 1979; Heckman and Robb 1986). We first estimate a probit model and regress a dummy variable Integrity on the same firm-specific control variables used in our regression models, as well as an exogenous instrument. The Integrity dummy value has a value of 1 if Integrity_channels (Integrity_order) is greater than 0, and 0 otherwise in Panel A (Panel B) of Table 4. We use the Integrity_Industry and Integrity_Province variables as our exogenous instrument. The resulting fitted values from this probit model are then used to compute the inverse Mills ratio. In the second-stage regression, the inverse Mills ratio (i.e., Lambda) is included in the regression model to test the relation between corporate integrity and investment–cash flow sensitivity. The results in Columns (4) and (9) continue to suggest that high integrity firms have lower investment–cash flow sensitivity.

Lastly, we utilize the propensity score matching (PSM) procedure proposed by Rosenbaum and Rubin (1983) to alleviate the selection bias concern. By using the PSM procedure, we can test the effect of the corporate culture of integrity measures on investment–cash flow sensitivity using a matched sample that has similar firm characteristics. To implement PSM, we use the Integrity dummy variable and estimate a probit model where we regress Integrity on the prior instruments and all control variables. We use the estimated score to match each observation with an integrity dummy that equals 1 to an observation with an integrity dummy that equals 0. The procedure is conducted through a one-to-one matching without replacement. The regression results in the sample of firms with a corporate culture of integrity and their matching firms are reported in Columns (5) and (10) of Table 4. The estimated model continues to show a negative and statistically significant coefficient on the interaction of the integrity measure and cash flow, suggesting a culture of high integrity is associated with lower investment–cash flow sensitivity.

Due to potential endogeneity issues, we employ three techniques commonly used to overcome these concerns. Specifically, we use a 2SLS instrumental variable model, a Heckman two-stage self-selection model, and a propensity score matching procedure. In all three cases, the findings are consistent with our hypothesis that firms with a corporate culture of high integrity have lower investment–cash flow sensitivity.

Stakeholder Identification of Firms that Truly have a Culture of Integrity

How can outsiders reliably identify, ex ante, which firms truly have a culture of high integrity and which firms do not? After all, it is easy for any firm to falsely claim that it has a culture of high integrity. However, for firms with low information asymmetry (i.e., with high transparency), it should also be relatively easy for outsiders to tell which of the claimants truly do have a culture of high integrity and which do not. To test this proposition, we identify two kinds of firms with low information asymmetry, measured as those firms that are followed by analysts and those firms with low degrees of corporate diversification.

Existing empirical evidence indicates that analysts play a beneficial and informative role and suggests that analyst following is negatively correlated with information asymmetry (e.g., Bowen et al. 2003; Chung et al. 1995; Hong et al. 2000). Financial analysts aggregate complex information and synthesize it in a form that is more easily understandable by less sophisticated investors. They provide information that is not widely known by market participants (Chang et al. 2006). Therefore, firms covered by analysts should have a low degree of information asymmetry. For our study sample, we find that over one-third of firms have no analyst following. Our subsample of firms with no analyst following should have high information asymmetry (low transparency), while our subsample of firms with analyst following should have low information asymmetry (high transparency). We expect that firms with a strong culture of integrity and a low level of information asymmetry (i.e., an analyst following) will have lower investment–cash flow sensitivities than other firms because capital providers can verify the culture.

Why are firms with low degrees of corporate diversification considered to have low information asymmetry? Many studies suggest that diversified firms are less transparent than focused firms. First, the consolidation of divisional accounting figures can be noisy, especially to outsiders, so accounting statements of diversified firms may convey less value-relevant information than those of focused firms (Thomas 2002). Second, a firm can be so broadly diversified that some dimension of its operations may be outside an analyst’s area of expertise (Thomas 2002), so that outside investors can get far less information than inside managers (see, e.g., Dunn and Nathan 1998; Thomas 2002). To identify firms with high and low degrees of corporate diversification, we measure their “entropy” as follows: \(\sum\nolimits_{1}^{n} {P_{i} \times \ln \left( {\frac{1}{{P_{i} }}} \right)}\), where Pi is the ratio of the firm’s total sales within the ith industry segment and n is the number of industry segments in which the firm participates. We create subsamples of firms with entropy values higher and lower than the median. We assume that firms with high entropy have high information asymmetry and firms with low entropy have low information asymmetry. Again, we expect that firms with a strong culture of integrity and a low level of information asymmetry (i.e., low entropy) will have lower investment–cash flow sensitivities. We conduct regression tests on all subsamples and report the results in Table 5.

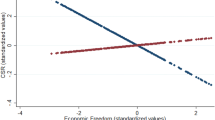

In Table 5, the interaction terms between the Integrity variable and Cashflow/assets are significantly negative only for firms with analyst followings and those with low corporate diversification. The coefficients are insignificantly positive in the two subsamples without analyst coverage (Columns 2 and 6) and insignificantly negative in the two high diversification subsamples (Columns 4 and 8). These results suggest that a firm’s claimed culture of integrity can be reliably verified by outsiders only when that firm has low information asymmetry. We argue that the firms with a corporate culture of integrity can access capital when they have good investment opportunities because they are trusted by the credit market. Thus, they are not as dependent on current cash flow from operations as less trusted firms. The firms that suffer from credit frictions are therefore more dependent on their own cash flow for their investment expenditures.

Conclusion

For some time now, corporate culture has been viewed as an integral feature of organizations, with conventional wisdom suggesting that firms with strong corporate cultures can be more productive and thus more profitable. Not surprisingly, therefore, scholars have studied the value of corporate culture and its effect on firm productivity and performance. Most of these studies emphasize how a strong corporate culture can lower internal transaction costs (e.g., they focus on employee and managerial behavior and their firms’ performance outcomes). We examine whether a corporate culture of high integrity can reduce a firm’s credit constraints.

Corporate culture can be categorized by both its level of strength and its type. A firm could focus on anyone of a variety of cultures, like innovation, market orientation, etc. We examine the culture of high integrity because it has ramifications for how the firm interacts with its external constituents. We argue that firms with a corporate culture of high integrity can build trust with capital providers, like banks, to overcome credit frictions from the asymmetric information and agency problems. The literature shows that firms with high credit frictions have a positive investment–cash flow sensitivity. This means that those firms make investments when their cash flow is high; otherwise, they need to hoard cash for future investment activities. We identify firms with a culture of integrity to see whether they have lower investment–cash flow sensitivities.

We study a sample of 15,204 firm-year observations from China during the period 2002–2012, which is a business environment ranked poorly in ethics by the World Bank. In this environment, we find that firms with a culture of high integrity have lower investment–cash flow sensitivities than other firms. However, we also find that firms must have low information asymmetry to obtain this benefit. That is, external stakeholders must be able to reliably identify which firms truly have a culture of integrity. In this way, our paper importantly contributes to the expanding literature on corporate culture and corporate finance.

Our research has important implications for managers. Developing a strong corporate culture of high integrity helps improve their access to external finance, and thus reduce capital market frictions and lower external transaction costs. The better access to capital can lead to higher growth rates, and thus higher values, because investment spending is less dependent on cash flow and more reliant on the quality of the opportunities. Also, because of the lower investment–cash flow sensitivity, high integrity firms do not need to hoard cash, so the firms will use its short term assets more efficiently. A corporate culture of integrity may be especially important in low ethical business environments. Indeed, it may be especially difficult to stand out as a high integrity firm when all firms have a high standard of ethics. But standing out as a high integrity firm when other firms have a low standard of ethics is likely to have a higher impact. We leave this conjecture for future research.

Notes

According to Guiso et al. (2015), moral hazard in organizations is twofold. There is moral hazard at the top of the organization: Managers are tempted to renege on their commitments to reward firm-specific investments made by their employees. There is also moral hazard inside the organization: Employees are tempted to slack off because they perceive they do not fully internalize the benefits that their effort brings to the organization.

References

Alchian, A. A., & Demsetz, H. (1972). Production, information costs, and economic organization. American Economic Review, 62, 777–795.

Aldohni, A. K. (2016). Is ethical finance the answer to the ills of the UK financial market? A post-crisis analysis. Journal of Business Ethics. doi:10.1007/s10551-016-3269-5.

Antweiler, W., & Murray, Z. F. (2004). Is all that talk just noise? The information content of internet stock message boards. Journal of Finance, 59, 1259–1293.

Ascioglu, A., Hegde, S. P., & McDermott, J. B. (2008). Information asymmetry and investment-cash flow sensitivity. Journal of Banking and Finance, 32(6), 1036–1048.

Attig, N., Cleary, S., El Ghoul, S., & Guedhami, O. (2012). Institutional investment horizon and investment-cashflow sensitivity. Journal of Banking and Finance, 36, 1164–1180.

Attig, N., El Ghoul, S., Guedhami, O., & Suh, J. (2013). Corporate social responsibility and credit ratings. Journal of Business Ethics, 117, 679–694.

Balvers, R. J., Gaski, J. F., & McDonald, B. (2016). Financial disclosure and customer satisfaction: Do companies talking the talk actually walk the walk? Journal of Business Ethics, 139, 29–45.

Benlemlih, M., & Bitar, M. (2016). Corporate social responsibility and investment efficiency. Journal of Business Ethics. doi:10.1007/s10551-016-3020-2.

Bowen, R. M., Chen, X., & Cheng, Q. (2003). Information asymmetry, analyst coverage and underpricing of seasoned equity offerings. University of Washington working paper.

Chang, X., Dasgupta, S., & Hilary, G. (2006). Analyst coverage and financing decisions. Journal of Finance, 61, 3009–3048.

Chung, K. H., McInish, T. H., Wood, R. A., & Wyhowski, D. J. (1995). Production of information, information asymmetry, and the bid-ask spread: Empirical evidence from analysts’ forecasts. Journal of Banking and Finance, 19, 1025–1046.

Coase, R. H. (1937). The nature of the firm. Economica, 4, 386–405.

Crémer, J. (1993). Corporate culture and shared knowledge. Industrial and Corporate Change, 2, 351–386.

Denison, D. R. (1984). Bringing corporate culture to the bottom line. Organizational Dynamics, 13(2), 5–22.

Dhanani, A., & Connolly, C. (2015). Non-governmental organizational accountability: Talking the talk and walking the walk? Journal of Business Ethics, 129(3), 613–637.

Dunn, K., & Nathan, S. (1998). The effect of industry diversification on consensus and individual analysts’ earnings forecasts. Georgia State University working paper.

El Ghoul, S., Guedhami, O., Kwok, C. C. Y., & Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking and Finance, 35(9), 2388–2406.

El Ghoul, S., Guedhami, O., Nash, R., & Patel, A., (2016). New evidence on the role of the media in corporate social responsibility. Journal of Business Ethics. doi:10.1007/s10551-016-3354-9.

Erhard, W., Jensen, M. C., & Zaffron, S. (2016). Integrity: A positive model that incorporates the normative phenomena of morality, ethics, and legality-abridged. Harvard University working paper.

Fama, E. F., & Jensen, M. C. (1983a). Separation of ownership and control. Journal of Law and Economics, 26, 301–325.

Fama, E. F., & Jensen, M. C. (1983b). Agency problems and residual claims. Journal of Law and Economics, 26, 327–349.

Fazzari, S., Hubbard, R. G., & Petersen, B. (1988). Investment, financing decisions, and tax policy. American Economic Review, 78, 200–205.

Fiordelisi, F., & Ricci, O. (2014). Corporate culture and CEO turnover. Journal of Corporate Finance, 28, 66–82.

Flamholtz, E. (2001). Corporate culture and the bottom line. European Management Journal, 19, 268–275.

Francis, B., Hasan, I., Song, L., & Waisman, M. (2013). Corporate governance and investment-cashflow sensitivity: Evidence from emerging markets. Emerging Markets Review, 15, 57–71.

Guiso, L., Sapienza, P., & Zingales, L. (2015). The value of corporate culture. Journal of Financial Economics, 117, 60–76.

Guo, Z., Chan, K. C., & Xue, Y. (2014). The impact of corporate culture on performance: A quasi-quantitative approach. Available at http://ssrn.com/abstract=2381520.

Haniffa, R. M., & Cooke, T. E. (2002). Culture, corporate governance and disclosure in Malaysian corporations. Abacus, 38(3), 317–349.

Haniffa, R. M., & Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391–430.

Hansen, L. (1982). Large sample properties of generalized method of moments estimators. Econometrica, 50(4), 1029–1054.

Heckman, J. J. (1979). Sample selection bias as a specification error. Journal of the Econometric Society, 47, 153–161.

Heckman, J., & Robb, R. (1986). Alternative identifying assumptions in econometric models of selection bias. Advances in Econometrics, 5, 243–287.

Hermalin, B. (2001). Economics and corporate culture. The Handbook of Organizational Culture and Climate. Chichester: Wiley.

Heskett, J. L., & Kotter, J. P. (1992). Corporate culture and performance. Business Review, 2, 83–93.

Hilary, G., & Hui, K. W. (2009). Does religion matter in corporate decision making in America? Journal of Financial Economics, 93, 455–473.

Hoberg, G., & Hanley, K. (2010). The information content of IPO prospectuses. Review of Financial Studies, 23, 2821–2864.

Hoberg, G., & Phillips, G. (2010). Product market synergies and competition in mergers and acquisitions: A text-based analysis. Review of Financial Studies, 23, 3773–3811.

Hong, H., Lim, T., & Stein, J. C. (2000). Bad news travels slowly: Size, analyst coverage, and the profitability of momentum strategies. Journal of Finance, 55, 265–295.

Hoshi, T., Kashyap, A., & Scharfstein, D. (1991). Corporate structure, liquidity, and investment: Evidence from Japanese industrial groups. Quarterly Journal of Economics, 106, 33–60.

Hsu, S. H. (2007). A new business excellence model with business integrity from ancient confucian thinking. Total Quality Management and Business Excellence, 18, 413–423.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305–360.

Jiang, F. X., Shi, B. B., & Li, X. T. (2015). Do integrity-oriented firms behave honestly? Evidence from earnings management. Accounting Research, 8, 16–23.

Koehn, D. (2005). Integrity as a business asset. Journal of Business Ethics, 58, 125–136.

Kreps, D. M. (1990). Corporate culture and economic theory. In J. E. Alt & K. A. Shepsle (Eds.), Perspectives on positive political economy. Cambridge: Cambridge University Press.

Lazear, E. P. (1995). Culture and language. Journal of Political Economy, 107, 95–126.

Levinson, S. C. (2009). Let’s get the issues straight! In D. Genter & S. Goldin-Meadow (Eds.), Language in mind. Cambridge: MIT Press.

Li, F. (2008). Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics, 45, 221–247.

Loughran, T., & McDonald, B. (2011). When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. Journal of Finance, 66, 35–65.

McEvily, B., Perrone, V., & Zaheer, A. (2003). Trust as an organizing principle. Organization Science, 14, 91–103.

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261–297.

O’Reilly, C. A., & Chatman, J. A. (1996). Culture as social control: Corporations, cults, and commitment. Research in Organizational Behavior, 18, 157–200.

Pawlina, G., & Renneboog, L. (2005). Is investment-cash flow sensitivity caused by agency costs or asymmetric information? Evidence from the UK. European Financial Management, 11(4), 483–513.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55.

Scheiber, F. (2015). Dressing up for diffusion: Codes of conduct in the German textile and apparel industry, 1997–2010. Journal of Business Ethics, 126(4), 559–580.

Sørensen, J. B. (2002). The strength of corporate culture and the reliability of firm performance. Administrative Science Quarterly, 47(1), 70–91.

Stein, J. C. (2003). Agency, information and corporate investment. Handbook of the Economics of Finance, 1, 111–165.

Stone, P. J., Dunphy, D. C., Smith, M. S., & Ogilvie, D. M. (1966). The general inquirer: A computer approach to content analysis. Oxford: MIT Press.

Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. Journal of Finance, 62, 1139–1168.

Tetlock, P. C., Saar-Tsechansky, M., & Mackassy, S. (2008). More than words: Quantifying language to measure firms’ fundamentals. Journal of Finance, 63, 1437–1467.

Thomas, S. (2002). Firm diversification and asymmetric information: Evidence from analysts’ forecasts and earnings announcements. Journal of Financial Economics, 64, 373–396.

Wilkins, A. L., & Ouchi, W. G. (1983). Efficient cultures: Exploring the relationship between culture and organizational performance. Administrative Science Quarterly, 28, 468–481.

Acknowledgements

Fuxiu Jiang acknowledges the financial support from the China National Natural Science Foundation (Nos. 71432008 and 71172179).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

Jiang, F., Kim, K.A., Ma, Y. et al. Corporate Culture and Investment–Cash Flow Sensitivity. J Bus Ethics 154, 425–439 (2019). https://doi.org/10.1007/s10551-017-3444-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-017-3444-3