Abstract

We analyze whether audit partners suffered damage to their professional reputations with the demise of Zhongtianqin (ZTQ), formerly the largest audit firm in China, after an audit failure enabled a major client, Yinguangxia (YGX), to fraudulently exaggerate its earnings in a high-profile scandal resembling the Andersen–Enron events in the US. This involves evaluating whether the reputational damage sustained by partners implicated in the scandal spreads to other partners in the same audit firm. We isolate whether impaired reputation impedes partners who were not complicit in the ZTQ–YGX events from attracting new clients or keeping existing ones. Our evidence implies that the market shares of these partners fell after ZTQ’s collapse, supporting that guiltless partners’ reputations were tarnished. We also find that these partners are less likely to be employed by reputable audit firms. The clients of these partners tend to have lower earnings response coefficients, implying that investors downgrade the perceived quality of their audits. Moreover, compared to a matched sample, the former ZTQ partners tend to charge lower audit fees after the firm’s collapse. Finally, we exploit the unique structure of ZTQ to provide evidence consistent with the prediction that the former partners from the branch that handled the YGX audits experienced worse damage to their reputations. In a setting with minimal auditor discipline stemming from civil litigation, our results lend support to the intuition that partners’ reputation concerns motivate them to protect audit quality by closely monitoring other partners in the firm.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

We examine the importance of a high-profile audit failure committed by a large Chinese audit firm to the reputations of its partners who did not participate in the engagement. Our analysis helps to empirically resolve whether the reputational fallout from audit failure is confined to the complicit partners (narrow scope) or extends to the rest of the partners in the audit firm (wide scope). Auditors have a strong incentive to cross-monitor each other if they share reputation jointly with their partners, which should engender higher audit quality (e.g., Coffee Jr 2002; Lennox and Li 2012). In the other direction, if audit partners do not genuinely share their reputation, then partners may elect to largely avoid monitoring each other, translating into lower audit quality. Our research is constructive for clarifying whether reputation is shared jointly among partners. We gage the impact of the demise of Zhongtianqin (ZTQ), formerly the largest audit firm in China, on the reputation and practicing careers of guiltless partners who were not directly involved in this major scandal.Footnote 1 One of its clients, Yinguangxia (YGX), was found to have fabricated a profit of 745 million yuan—equivalent to almost US$126 million—by forging contracts and commercial notes. ZTQ, in turn, was held responsible for the misrepresentation, and the firm collapsed shortly after its practicing license was suspended by the Ministry of Finance (MOF) in 2001. Meanwhile, the MOF revoked the practicing licenses of the two partners who signed YGX’s audit report. Accordingly, the ZTQ–YGX scandal in China, in some ways, mirrors the Arthur Andersen–Enron scandal in the US.

We evaluate whether the reputational loss sustained by the partners after suffering sanctions, which routinely follow enforcement actions initiated by the Chinese Security Regulatory Commission (CSRC; Jia et al. 2009), spreads to the rest of the ZTQ partners. Partners’ personal exposure to reputational damage rises when other partners render clean opinions on materially misstated financial statements. It follows that individual partners have strong incentives to monitor each other’s work when they have valuable reputations at stake. Reputational concerns may motivate audit partners to actively monitor the performance of the firm’s other partners in order to avoid costly damage to their own reputations. We isolate whether the ZTQ–YGX events generate spillovers by undermining the professional reputations of partners who were not implicated in the audit failure that enabled YGX to fraudulently exaggerate its earnings.

Extant research continues to struggle with unraveling the importance of litigation and reputation incentives to persuading auditors to closely monitor the financial reporting process (e.g., Weber et al. 2008; Skinner and Srinivasan 2012). Indeed, Leuz (2001, p. 177) calls for evidence that helps settle: “… under which conditions exposure to litigation is sufficient, and when we can rely on reputation-based mechanisms” to elicit accounting transparency. Although both reputation protection and civil litigation shape the audit quality in the US (e.g., Mansi et al. 2004), it is largely left to reputation alone to compel auditors to prevent managers from excessively distorting reported earnings in jurisdictions where it is difficult for investors to recover damages from auditors for issuing an unqualified opinion on materially deficient financial statements (Guedhami and Pittman 2006; Coffee Jr 2007). Against this backdrop, we analyze whether audit partners in China—a country that imposes hardly any discipline on auditors from civil lawsuits—share their reputation jointly and severally with other partners in the same audit firm.Footnote 2 In contrast to recent research on reputational incentives at the audit firm level (e.g., Weber et al. 2008; Skinner and Srinivasan 2012), we provide evidence on the incentivizing role that partner reputation plays.

Data constraints are largely behind empirical research that examines the economic implications stemming from partners’ reputations remaining scarce. In fact, extant research mainly focuses on the importance of reputation and litigation to audit quality at the audit firm level. However, given that an audit firm usually comprised a group of audit partners, audit quality partly hinges on their underlying incentives (Kinney 1999; Coffee Jr 2002). The Public Company Accounting Oversight Board (PCAOB) in the US recently sought advice from various parties on whether to mandate the disclosure of engagement partner identity (PCAOB 2011). Other jurisdictions have begun to shift toward revealing the identities of the responsible engagement partners. For example, the Eighth Company Law Directive of the European Union compels the EU member countries to adopt a requirement for the audit report to be “signed by at least the statutory auditor(s) carrying out the statutory audit on behalf of the audit firm.” The primary argument for insisting on this disclosure is that this would lead to better audit quality. Divulging the engagement partner’s identity also implicitly acknowledges that a public company audit involves a substantial amount of work by highly skilled individual practitioners exercising their own professional judgment, and that each partner has a reputation to protect. At the same time, the PCAOB has stressed that the proposed rule would not affect either a firm’s or an individual partner’s legal liability for audit failure. In short, the individual partners’ interest in protecting their valuable professional reputations is the most likely be the economic reason for any increase in audit quality that ensues.

The Chinese audit market provides an opportune setting for analyzing our research questions for several reasons. First, at a practical level, listed companies in China are required to disclose the identities of signing partners. Consequently, we can observe the impact of the reputation damage caused by a partner on the rest of the firm’s partners by tracing the history of each partner’s practice and clients. Second, the implicit insurance coverage afforded by the investors in the event of audit failure is minimal in China, enabling us to reliably isolate the impact of reputation forces. This context is conducive to distinguishing between the reputation protection and litigation explanations since investors have almost no recourse against auditors when corporate misreporting occurs (e.g., Firth et al. 2005). In contrast, it remains hard to discriminate between these explanations in the US because of the extreme litigation exposure that prevails there (e.g., Leuz 2010).Footnote 3 Although investors in Chinese companies are entitled to recover losses sustained when auditors render a clean opinion on materially inaccurate financial statements, civil lawsuits against auditors seldom succeed.Footnote 4 Improving identification in our analysis, the insurance rationale is close to zero in China, putting us on more solid ground in attributing our evidence to reputational fallout. Third, increasing the power of our tests, recent evidence implies that auditors provide valuable external monitoring in the country’s capital markets that suffer from widespread diversion of corporate resources (e.g., Chen et al. 2007; Wang et al. 2008; Jiang et al. 2010). Accordingly, we respond to calls for empirical research that exploits the unique characteristics of the Chinese environment to provide insight on auditing issues; e.g., Simunic and Wu (2009).

In a series of tests integrating matched samples to improve identification, we examine whether the reputational damage spreads to audit partners who were not implicated in the ZTQ–YGX events.Footnote 5 We find that the number of former ZTQ partners who were hired by other auditing firms and who are still engaged in auditing listed clients decreased significantly after ZTQ’s demise. We also document that the number of listed clients of these auditors fell steeply. Another set of results indicate that prominent audit firms were reluctant to hire these auditors, reinforcing that damaged reputation extends to partners who were not directly involved in the scandal. Further, the clients of former ZTQ partners exhibit lower earnings response coefficients after the demise of the firm, implying that their audit quality had fallen according to investors' perceptions. Moreover, relative to a matched sample, the former ZTQ partners tended to charge lower audit fees after the firm’s collapse.

The validity of inferences drawn from a before and after design with an untreated control group can be improved by relying on multiple treatment groups to help dispel concerns surrounding alternative explanations (e.g., Card and Krueger 1994). In our setting, we can exploit the structure of ZTQ to isolate treatment groups that are subject to different intensity levels for the reputation intervention. We expect that variation in the intensity of the treatment stemming from the YGX audit failure will exert a differential impact on the outcomes under study according to whether the partners were affiliated with the Zhongtian (ZT) or Tianqin (TQ) branch. ZTQ was formed through the merger of ZT and TQ, although the branches remained operationally independent afterward. Since this merger occurred in 2000, a year before YGX’s deceptive financial reporting surfaced, the TQ partners may have been more sheltered against the ensuing reputational fallout. Importantly, YGX was always audited by ZT. Consequently, we expect that former ZT partners, who are closer to the YGX audit failure, will have suffered more severe damage to their reputations relative to their counterparts at TQ. Consistent with this prediction, we find evidence that the audit failure tarnished the reputations of former ZT partners more than those of former TQ partners. Collectively, our results lend support to the intuition that audit partners share their reputation jointly and severally with other partners in the same audit firm, motivating them to protect their individual reputations by actively monitoring their fellow partners.

We primarily contribute to extant research in eight ways. First, rather than estimating the importance of reputation to audit quality at the audit firm level (e.g., de Castro et al. 2006; Weber et al. 2008; Skinner and Srinivasan 2012), we delve deeper by evaluating its impact at the partner level. Similarly, instead of analyzing the rehabilitation of corporate reputation (e.g., Sims 2009; Hillenbrand et al. 2012), we focus on the personal reputation implications in the aftermath of an ethical scandal. This involves isolating whether sharing reputation among audit partners represents another governance layer in the audit firm by inducing partners to closely monitor each other’s performance. Accordingly, we complement prior research inferring reputation damage from the market reaction to the clients of the collapsed audit firm by considering how such events influence individual partners’ professional reputations. Set against recent research having begun to shift from taking a firm-wide to an office-level perspective on audit firms (Ferguson et al. 2003; Francis et al. 2005; Francis and Yu 2009), we add a step in this progression by examining the links between individual auditor characteristics and economic outcomes. In fact, amid firm- and office-level analyses continuing to dominate archival audit quality research, we respond to calls for evidence at the individual auditor level (e.g., DeFond and Francis 2005; Francis 2011).

Second, we alleviate the identification complications plaguing research on the reputational implications of major audit failures (e.g., Baber et al. 1995; Menon and Williams 1994; Chaney and Philipich 2002; Nelson et al. 2008) by focusing on a country where civil litigation plays almost no role in motivating auditors and by applying a difference-in-differences design to control for contemporaneous events that can lead to spurious results.

Third, we complement Blouin et al. (2007), who rely on the demise of Arthur Andersen to analyze the determinants of auditor selection by their former clients. They estimate the importance of switching and agency costs to whether companies remain a client of the Andersen audit team that had handled their engagement when they join another audit firm. In contrast to Blouin et al.’s (2007) focus on the auditor selection by Andersen’s clients, we examine the fallout from audit firm dissolution for its partners.

Fourth, the PCAOB recently proposed mandating the disclosure of engagement partner names. This proposal is grounded in the expectation that partners’ incentives to protect their valuable professional reputations would engender higher quality. Conceptually, this rule would resemble the CFO and CEO signature requirement under SOX that underscores their responsibility for ensuring the veracity of the company’s financial statements. It follows that reputation is behind any ensuing increase in audit quality since the PCAOB has specifically argued that reporting engagement partner names will not raise individual liability. Although it would be premature to make firm policy conclusions at this early stage (especially when based on research from a different country), our evidence provides some empirical support to validate the PCAOB’s proposal to require audit firms to divulge engagement partner identity.

Fifth, recent evidence implies that the reputational implications stemming from fraudulent financial reporting far exceeds the costs of any formal sanctions imposed. For example, Karpoff et al. (2008) estimate that the average company subject to SEC enforcement for financial reporting violations incurs, for every dollar in misstated earnings, $0.36 in fines and class action settlements and another $2.71 in reputational loss. Our analysis reconciles with this research in that although regulators in China did not formally punish the ZTQ partners who did not work on the YGX engagement, these partners still suffered costly damage to their professional reputations.

Six, against the backdrop of prior research on corporate fraud in China primarily focusing on internal governance structures (e.g., Persons 2006; Jia et al. 2009), we contribute to emerging evidence on the role of information intermediation in the capital markets by external monitors (e.g., Chen et al. 2014).

Seven, we help close another gap in the literature by examining whether prior research implying that clients’ earnings response coefficients fall in the wake of damage to their audit firm’s reputation (Francis and Ke 2006) holds at the auditor partner level. This involves examining whether investor perceptions of companies’ earnings quality reflects that a high-profile audit failure undermines audit partner reputations for strictly monitoring the financial reporting process.

Finally, our analysis extends Sun and Zhang’s (2008) evidence on the career paths of persons involved—whether directly or indirectly—in financial reporting scandals in China to include individual auditors. In sharp contrast to their evidence that a large fraction of senior executives implicated in these scandals are later promoted to higher positions in corporate groups or governmental organizations, we find that partners in audit firms pay a heavy price in the form of reputational damage stemming from audit failure, even when they did not actually participate in the engagement.

It is important to stress that although China provides an opportune testing ground for our research questions, any analysis of a single country may raise doubts on whether its inferences can be validly generalized to other countries. However, in contrast to the impact of litigation institutions governing auditors that can vary extensively across jurisdictions (e.g., Guedhami and Pittman 2006; Francis and Wang 2008), reputational implications stemming from audit failure may cross borders. For example, some prior evidence implies that audit firms’ incentives to protect their valuable reputations lead to higher-quality audits in countries—similar to China—that impose hardly any discipline on auditors in the form of tough investor protection institutions (e.g., Fan and Wong 2005; Weber et al. 2008; Skinner and Srinivasan 2012). Nonetheless, we caution that focusing strictly on a single country is a limitation of our research since our results may not necessarily generalize to audit partners practicing in other countries.

The rest of this paper is organized as follows. In “Motivation” section, we profile the Chinese audit market, recount the events leading to ZTQ’s collapse, and outline prior research to develop our testable predictions. “Data and Sample” section describes the data and sample. “Empirical Results” section covers our empirical strategy and evidence. “Conclusions” section concludes.

Motivation

Audit Market in China

The audit market in China has undergone major reforms in the past two decades. All Chinese auditors were affiliated until recently with government agencies, government-sponsored bodies, or universities to the detriment of their independence. To facilitate auditors becoming financially and operationally independent, the Chinese Institute of Certified Public Accountants (CICPAs) and the MOF launched a disaffiliation program in 1996 that required all auditors to sever their links with their sponsoring bodies within 2 years. In striving to strengthen auditor independence, the MOF adopted a new set of Independent Auditing Standards in 1995, which are based on the International Standards on Auditing promulgated by the International Federation of Accountants. Over 20 Chinese auditing standards were issued between 1995 and 1999. DeFond et al. (2000) observe a higher frequency of qualified audit opinions after the release of the new auditing standards. However, the increase in modified reports has been followed by a decline in the audit market share held by large audit firms—in other words, those with the greatest propensity to issue modified reports—reinforcing that listed public companies in China have resisted improving their accounting transparency (e.g., Wang et al. 2008).

Although China’s publicly listed companies are attractive clients, the market is not yet open to all audit firms because the MOF and the CSRC require all listed companies to be audited by designated audit firms (Yang 2012). The central government is pushing to increase auditor size, including nurturing larger audit firms to eventually compete with the Big 4, which are allowed to audit A-share listed companies in China. To stimulate domestic audit firms toward increasing their size, the government has issued several regulations. Starting in 1997, an audit firm is only eligible to apply for a license to audit listed companies if it employs more than eight individual certified public accountants (CPAs) who have passed additional professional examinations and obtained a qualification from the CSRC permitting them to sign audit reports for listed companies. In 2000, the CSRC and the MOF issued a new regulation that increased the requisite number of CPA employees from 8 to 20. In 2005, the State-Owned Assets Supervision and Administration Commission also set minimum requirements for audit firms to handle engagements involving state-owned enterprises (SOEs) controlled by the central government. More specifically, an audit firm under these regulations must have at least 40 (60) full-time employees to audit a central SOE with total assets between 5 (50) billion yuan and 50 (100) billion yuan. The threshold rises to at least 100 employees for an audit firm to become eligible to audit a central SOE with total assets exceeding 100 billion yuan.

Merger Between ZT and TQ

The ZTQ audit firm was created from the merger of the Shenzhen ZT audit firm and the Shekou TQ audit firm in 2000. The predecessor of ZT was the Shenzhen Zhonghua audit firm, which was established on 4 December 1986. Its annual revenue in China was ranked first in 1993 and third in 1997. The predecessor of Shekou TQ was the Shekou Zhonghua audit firm. Established on 26 April 1984, its size was comparable to that of ZT. This firm was restructured into Shekou TQ in 1997. After the merger of ZT and TQ in 2000, ZTQ became one of the largest audit firms in China; e.g., at that time, it ranked first among audit firms with 57 A-share listed clients. ZTQ had annual revenue exceeding 60 million yuan and was widely regarded as the most successful domestic audit firm. During the period between the merger and the collapse of ZTQ, the two merged audit firms (ZT and TQ) continued to operate independently, including managing audit quality (Xu and Yin 2001). They had separate personnel and offices, and used different serial numbers in their audit reports, ZTQ A and ZTQ B. The YGX audit engagements were conducted by ZT. Accordingly, investors may have perceived the quality of audits performed by the two offices of ZTQ differently, so the collapse of ZTQ may have had distinct impacts on the auditors from the two branches. In our analysis, we exploit this unique audit firm structure to help dispel concerns that alternative explanations are responsible for our evidence on the importance of reputation to motivating partners.

ZTQ Audit Failure

In 2001, the financial fraud of YGX was exposed. In August 2001, Caijing, a well-known financial journal in China, alleged that the company had exaggerated its revenue by 1 billion yuan over the previous 2 years. Shortly afterward, YGX publicly admitted that its Tianjing subsidiary, the main source of its profits, had fraudulently reported its output of products, quantity of exports, amount of exchange settlement, and financial data. On 6 September 2001, the CSRC announced the results of its formal investigation. First, YGX had deliberately overstated profits of 745 million yuan during 1999–2000 by fabricating accounting documents, including purchase contracts, sales contracts, export documents, tax invoices, tax rebate slips, and bank notes. Second, ZTQ had violated the law by issuing severely misleading audit reports. The General Manager, CFO, and other relevant persons in charge of YGX were subjected to criminal detention. Meanwhile, the MOF, the CSRC, and the CICPA conducted a joint investigation of ZTQ, which affirmed that the two CPAs who had signed the company’s audit report, Liu Jiarong and Xu Linwen, had violated the Law of CPAs of the People’s Republic of China, Independent Auditing Criterion of Chinese CPAs, and Fundamental Principles of Professional Ethics of Chinese CPAs; had been grossly negligent; did not perform the necessary audit procedures; and had rendered false audit reports for YGX. ZTQ was held partly responsible for the misrepresentations. The MOF suspended the operating license of ZTQ, and the firm subsequently collapsed. The practicing licenses of the two partners were also canceled. However, the other partners at ZTQ were not formally punished.Footnote 6 For example, they could still work at other audit firms and audit listed clients.

The ZTQ scandal became known as the “Chinese Enron” because it not only involved a massive fraud that attracted widespread publicity, but also it exerted a significant impact on the audit market in China. In the aftermath of the scandal, regulators imposed stricter monitoring on the audit industry and implemented several major reforms to the audit market in China. For example, the CSRC since 2001 has required all firms operating in the financial industry and IPO firms issuing more than 300 million shares to hire an international accounting firm to provide an additional audit opinion. Moreover, the CSRC since 2001 has required all listed firms to divulge the audit fees that they pay. On 8 October 2003, the CSRC and the MOF jointly issued a policy requiring auditors who sign the audit report of a listed company in China to be rotated off after serving the client for 5 years. Reinforcing that the ZTQ–YGX events represent a major fault line shaping auditing in China, the period after 2001 is routinely labeled the “post-ZTQ” era there.

Prior Research

The value of an auditor’s report to investors in attesting to the veracity of their clients’ financial statements partly stems from their reputation (e.g., Jensen and Meckling 1976; Watts 1977; Watts and Zimmerman 1986). This is evident in audit firms suffering economic losses, including lower fees (e.g., Davis and Simon 1992) and client defections (e.g., Wilson and Grimlund 1990; Lennox and Pittman 2010), after compromising their reputations. This evidence lends support to seminal theory stressing that audit firms with valuable reputations at stake are more intent on identifying material misstatements and resisting client pressure to waive their correction (DeAngelo 1981a, b). We complement prior literature by examining how an ethical scandal affects individual partners’ professional reputations.

The Arthur Andersen–Enron events provide a fertile testing ground for studying the economic consequences of tarnished reputation among audit firms. Chaney and Philipich (2002) report that questions raised about Enron’s financial reporting during 2001–2002 and the damage to Andersen’s reputation resulted in a statistically significant market decline in the stock price of its audit clients. However, Nelson et al. (2008) find that confounding effects are spuriously responsible for Chaney and Philipich’s (2002) evidence, casting doubt on the reliability of their inferences on the role that reputation damage plays according to the investors' reactions. They argue that their study highlights the difficulty in estimating economic outcomes arising from the audit firm’s damaged reputation using an event study methodology that is vulnerable to confounding effects that can contaminate the analysis. In this study, we respond to Nelson et al.’s (2008) call for more rigorous empirical evidence on these issues using alternative research designs to help dispel concerns about competing explanations. However, rather than focus on audit firm reputation, we examine whether partners with valuable reputations are eager to protect the strong incentives to strictly monitor the performance of the rest of the firm’s partners.

Testable Predictions

Appointing a high-quality auditor enables clients to become better known in the capital markets according to prior theory (e.g., Titman and Trueman 1986; Datar et al. 1991). Consistent with this audit quality distinction partly hinging on auditors protecting their valuable reputations (DeAngelo 1981a, b), some prior research implies that damage to the reputation of one audit firm can spillover to others. For example, Asthana et al. (2003) document that the Enron events hurt the reputations of the non-Andersen Big 5 auditors. Similarly, Doogar et al. (2004) provide evidence that impairment to Andersen’s reputation had a significant spillover to other audit firms when the Enron–Andersen scandal unfolded. If the damaged reputation of some audit partners afflicts other partners within the same audit firm, then the damages sustained by audit partners complicit in these events will also undermine the reputations of their innocent colleagues.Footnote 7 In the case of ZTQ, such damage may have ruined the careers of its partners as CPAs since, for example, large audit firms may be reluctant to hire auditors with a poor reputation because this could tarnish their own brand names. It follows that the reputational fallout will include individual partners losing clients and possibly their careers as CPAs, which is behind our first pair of predictions (all hypotheses are stated in alternative form):

H1

Relative to other partners’ market shares, the number of former ZTQ partners’ clients fell after the scandal.

H2

Relative to other partners, former ZTQ partners are more likely to have switched to another career or started to work at smaller audit firms.

A fall in demand stemming from reputational deterioration would be evident in shrinking market shares for former ZTQ partners under H1, or by them resorting to charging lower audit fees in order to retain clients. In another way to measure client perceptions of the economic value of audits, we analyze audit fees to complement our other reputational fallout tests. Extant theory and evidence suggests that higher-quality audits occur when audit firms expend more effort on the engagement, which leads to higher audit fees (e.g., Dye 1993; Davis et al. 1993; Caramanis and Lennox 2008). Mapping into our focus on reputation, Davis and Simon (1992) document that the SEC leveling disciplinary sanctions against an audit firm adversely affects its audit fees. We expect to observe that impairment to their reputation will translate into cheaper pricing for audit services supplied by former ZTQ partners:

H3

Relative to other partners, the former ZTQ partners tend to charge lower audit fees after the firm’s collapse.

Highly publicized audit failures may undermine audit partners’ reputations for providing strict external monitoring of the financial reporting process, reducing their clients’ accounting transparency to investors. Prior empirical research routinely relies on earnings response coefficients to estimate the role that audit quality plays in shaping investor perceptions (e.g., Teoh and Wong 1993), including when examining Chinese listed companies (e.g., Haw et al. 2008). Relevant to our purposes, Francis and Ke (2006) find that clients’ earnings response coefficients subside after the audit firm’s reputation is damaged, helping to motivate our prediction that investors conclude that earnings quality is worse for the clients of former ZTQ partners:

H4

Relative to other partners, investors downgrade their perceptions of the quality of audits by former ZTQ partners according to clients’ earnings response coefficients.

Although Nelson et al. (2008) call into question their inferences, Chaney and Philipich (2002) find that the clients of Andersen’s Houston Office, which handled the Enron engagement, suffered more negative returns, implying that reputation implications are concentrated near the audit failure. ZT and TQ continued to operate separately after their merger to form ZTQ. ZT had audited YGX since its initial listing. Moreover, former TQ partners may have been fairly insulated from the reputational fallout since the merger in 2000 occurred shortly before the YGX–ZTQ events in 2001. If only partners directly involved in the engagement were culpable in the audit failure, then the clients audited by the other ZTQ partners may not have been materially affected. If audit partners share their reputations jointly and severally with other partners in the same firm, we would expect former ZT partners to have experienced more serious damage to their reputation than their counterparts at TQ under our final prediction:

H5

Former ZT partners suffered more severe damage to their reputations than former TQ partners.

More generally, examining multiple predictions is also constructive for identification purposes since finding supportive evidence on all of them would be hard to attribute to a competing explanation.

Data and Sample

In China, each listed firm is required to disclose the identities of the audit engagement partners. We cross check the data on listed firms’ engagement partners from CSMAR database and Wind database, the two major sources for capital market data on Chinese companies. If there is any inconsistency between these two databases, we double check the annual report to verify the engagement partners’ names. We rely on CSMAR database as the primary source for our financial statement and return data. Our sample period covers 1996–2009.Footnote 8 We exclude observations for the 2001 transition year when the fraud orchestrated by YGX surfaced and regulators imposed sanctions on ZTQ, although our core results are virtually identical when we keep these observations.Footnote 9 All of the continuous variables are winsorized by year at the 1st and 99th percentiles to reduce the impact of outliers and data coding errors, although this does not materially affect any of the evidence on our predictions.

ZTQ was ranked first in terms of the number of listed clients among all audit firms in 2000, 1 year before its license was revoked. It had a total of 19 partners and audited 57 A-share listed companies. Among these 19 partners, 8 were from the former ZT audit firm with 36 listed company clients, and 11 were from the former TQ audit firm with 17 listed company clients. Four (two) of ZT’s (TQ’s) clients did not disclose their engagement partners’ names. The remaining four listed companies did not disclose the names of their engagement partners, and we also cannot identify the branch name of their audit firm. To mitigate confounding effects, we specify the rest of the Top 10 audit firms as the matching sample with one exception: we discarded “Tongren” CPA firm which was ranked No. 5 in 2000 since it lost its license to audit listed firms after 2001.Footnote 10 The matching sample comprised 138 partners that collectively audit 259 A-share listed companies. Fifteen of the total clients only disclose their audit firm’s name, preventing us from identifying the engagement partners. For the 8 audit firms in the matching sample, the number of partners (listed clients) ranges from 11 (27) to 23 (45).

The presence of differential trends affecting the treatment and control groups is an internal validity threat to our inferences; i.e., the exclusion of such interactions is a standard identifying assumption in difference-in-differences designs. The untreated matching sample derived from other large audit firms is plausibly subjected to the same changes over time—for example, the influence of shifts in macroeconomic conditions or in how data are compiled on audit partners’ market shares—as the treatment sample except for the reputational impact of the ZTQ–YGX events. In other words, this empirical strategy is intended to neutralize trends that affect both the treatment and control groups.

Empirical Results

Impact of Reputation Damage on Audit Practice and Number of Clients

For the 1996–2009 period, Panel A of Table 1 reports statistics on the practicing status and number of clients of the former ZTQ partners as well as the matching sample. Since the practicing licenses of the two ZTQ partners who had signed the audit report rendering a clean opinion on YGX’s financial statements were later canceled, they could not work at other audit firms after 2001. Accordingly, to avoid biasing our results, we delete these two partners from our sample (to provide some perspective, they audited nine listed firms in 2000). The remaining 17 former ZTQ partners audited 38 listed firms in 2000.Footnote 11 Unreported evidence indicates that the majority of the 17 former ZTQ partners no longer engaged in auditing listed clients after the collapse of ZTQ, and only 5 were still auditing listed clients in 2009. In contrast, 69 of the matching sample’s 138 original partners (untabulated) continued to audit listed clients in 2009.Footnote 12 The evidence in Columns (1) and (2) indicates that the number of ZTQ partners engaged in auditing decreased from 71 before scandal to 50 afterward. For the matching sample, the number of partners engaged in auditing increased from 393 before scandal to 684 afterward. A χ 2 test supports at the 1 % level that the number of former ZTQ partners who were still auditing listed clients after 2000 was significantly less than the corresponding number for the matching sample.Footnote 13

In unreported analysis, we dig deeper into the data to consider the possibility that the 12 (69) of the 17 (138) ZTQ (matching sample) partners who are no longer auditing listed clients by 2009 left public practice to pursue better opportunities. Inspecting data from the CICPA website reveals that some of the partners do not audit listed firms, although they still work at audit firms that have the license to audit listed companies; some of them moved to audit firms that do not have the license to audit listed companies (i.e., very small audit firms); and some moved to another industry. More specifically, although 2 of the 17 former ZTQ partners left the audit industry by 2009, the rest are still in practice at this stage: 5 continue to audit listed companies while 10 do not. In contrast, 11 of the 138 partners in the matching sample left the audit industry by 2009. Sixty nine of the remaining 127 matching sample partners continue to audit listed clients by 2009; the other 58 do not have listed clients in 2009. Overall, the vast majority of the partners who left our sample because they no longer audit listed clients remain in public practice. However, almost all of them either join audit firms without a license to audit listed companies, or lose their listed clients although they continue to work at audit firms that have a license to audit listed companies. In short, there is no systematic evidence implying that they left for better jobs outside the audit industry. In additional data inspection, we merge the names of partners who no longer practice with the names of executives in listed firms. We find that none of the former ZTQ partners held an executive position after they left the audit industry. In comparison, 2 of the 11 partners from the matching sample who left the audit industry became CFOs of listed companies. Collectively, this analysis helps dispel any concern that the ZTQ partners who no longer audit listed companies in the wake of the YGX scandal actually enjoyed better career prospects afterward.Footnote 14

In Columns (3) and (4), we tabulate the number of listed clients of former ZTQ partners and the original partners of the matching sample from 1996 to 2009, respectively. The audit reports of Chinese listed companies are routinely signed by two or more auditors. We adopt two methods to measure the number of listed clients of an auditor. First, if a partner is one of the signing auditors of a listed company, then this company is counted as one client of the partner (Clients1). Second, if a partner is one of the signing auditors of a listed company, then the corresponding number of listed company clients is the reciprocal of the number of all of the signing auditors of the company (Clients2). For example, listed company A has two signing CPAs, one of whom was a former ZTQ partner. The number of clients assigned to the partner is 1 (0.5) under the first (second) approach.

In Column (3), we report that the total number of listed clients of former ZTQ partners from 1996 to 2000 was 176 with that number subsiding to 110 between 2002 and 2009. In comparison, the total number of listed clients of the original partners of the matching sample rose from 952 to 2002 between 2002 and 2009 according to Column (4). The results of a χ 2 test strongly suggest that the number of listed clients of the former ZTQ partners fell after 2000 compared with the number for the matching sample. We obtain corroborating evidence when we measure the number of listed clients of partners based on the second approach in Columns (5) and (6).Footnote 15 Collectively, the evidence in Table 1 is consistent with the prediction in H1 that the number of former ZTQ partners’ clients had fallen after the scandal.Footnote 16

ZTQ was created through the merger of ZT and TQ in 2000, although both branches remained operationally independent afterward, providing an opportune testing ground to examine reputational implications stemming from the YGX events. YGX was always audited by ZT. We expect to observe under the prediction in H5 that the collapse of ZTQ exerts a larger impact on the former partners of ZT than those of TQ, who were further removed from the scandal.

For the 1996–2009 timeframe, Panel B of Table 1 reports statistics after isolating the practicing status and number of clients of partners affiliated with ZT and TQ before the merger. Unreported analysis reveals that the number of guiltless ZT partners who continued to audit listed companies fell steeply after 2000: there were six partners in 2000, although none were still engaged in auditing listed companies in 2009. In stark contrast, 5 of the 11 partners who were affiliated with TQ in 2000 were still auditing listed companies in 2009. The evidence in Columns (1) and (2) indicates that the number of ZT partners engaged in auditing decreased from 30 before scandal to 13 after scandal, while that of TQ decreased from 41 to 37. More formally, a χ 2 test provides supportive evidence—albeit at only the 10 % level in these small samples that suffer from low power—that the reputational impact was concentrated in the former partners of ZT; i.e., the reputational damage incurred by the former TQ partners was smaller according to the fraction that continued to audit listed firms after the scandal.

We gage the shift in the number of clients of partners affiliated with the two branches over time in Columns (3)–(6). This evidence demonstrates that the number of clients of partners affiliated with ZT decreased dramatically from 101 in the 1996–2000 period to 29 in the 2002–2009 period, whereas the number of clients of partners affiliated with TQ increased slightly from 75 to 81 between these periods; predictably, a χ 2 test is statistically significant at the 1 % level.Footnote 17 Reinforcing this evidence, we find that the former ZT partners lose more clients than the former TQ partners when we rely on Clients2 to calibrate their market share. Altogether, the results in this section lend support to the prediction in H5 that, relative to the former TQ partners, the former ZT partners, who were closer to the YGX events, experienced worse damage to their reputations.

In Panel A of Table 2, we distinguish between the audit firms that hired former ZTQ partners after 2001 in order to provide evidence on their career paths in the aftermath of the YGX events. This involves ranking the audit firms according to the number of listed clients and then classifying the Top 10 audit firms or Big 4 as “large” audit firms; we label the rest of the audit firms as “small” firms. This partitioning reflects that the Chinese audit market is dominated by local Chinese auditors. Given the relatively small presence of Big 4 firms in the Chinese stock market, we combine the Big 4 with the Top 10 audit firms to form the “large” audit firm group.Footnote 18

Columns (1) and (2) report the cumulative frequencies of former ZTQ partners who work for the large audit firms and small audit firms in the 2002–2009 period. In this analysis, we find that half of all former ZTQ partners who were still engaged in auditing listed companies after 2001 were hired by “large” audit firms, whereas nearly 75 % of the partners from the matching sample continued to work at “large” audit firms. Consistent with the prediction in H2, the results of a χ 2 test show that the proportion of original partners of these two sets of audit firms (former ZTQ partners and partners belonging to the matching sample) who were still working in “large” audit firms after 2001 is significantly different at the 1 % level. This evidence implies that larger audit firms with their own valuable reputations to protect were reluctant to hire auditors with tarnished reputations. In other words, the audit failure by two ZTQ partners left a stain on the reputation of their innocent colleagues, reinforcing that audit partners have an incentive to monitor each other’s performance given their exposure to reputational loss.

Next, we analyze the proportion of partners who were affiliated with the two branches of ZTQ before the merger and who were still engaged in auditing listed companies after 2001. The results in Panel B of Table 2 include that the fraction of innocent partners affiliated with ZT who were still working for “large” audit firms from 2002 to 2009 is 3 out of 13 (23.1 %), whereas the fraction of former TQ partners who were still working in “large” audit firms is 22 out of 37 (59.5 %). Corroborating the results in Panel B of Table 1 that support the prediction in H5, a χ 2 test indicates that the two proportions are significantly different at the 5 % level.Footnote 19 This evidence implies that the reputations of former ZT partners suffered more damage than those of former TQ partners.Footnote 20

Impact of Reputation Damage on Audit Fees

The impairment to their reputation after the firm’s collapse will translate into cheaper pricing for assurance services supplied by former ZTQ partners under the intuition for the prediction in H3. To examine how any reputation damage influences their audit pricing, we follow recent empirical research in selecting and coding controls for potential audit fee determinants; e.g., Francis et al. (2005), Wang et al. (2008), and Lennox and Li (2012). This model reflects that audit fees are a function of client characteristics as well as auditor characteristics and reputation:

After prior research (e.g., Francis 1984; Ferguson et al. 2003), we specify the logarithmic transformation of audit fees (LAF) as a dependent variable, although our core results remain when we replace this variable with audit fees deflated by total assets (e.g., Simunic 1980). Given that the audit fee data only became available in 2001, we cannot conduct a difference-in-differences analysis for audit fees.Footnote 21 Rather, we can only compare the audit fee charged by the former ZTQ partners with that charged by the partners of the matching sample. We rely on ZTQ, TOP10, and BIG4 to capture auditor characteristics. ZTQ is a dummy variable that equals 1 if the partner was previously affiliated with ZTQ, and 0 otherwise. TOP10 is a dummy variable that equals 1 if the partner was affiliated with a Top10 audit firm, and 0 otherwise. BIG4 is a dummy variable that equals 1 if the partner was affiliated with a Big 4 international audit firm, and 0 otherwise. We specify the natural log of total assets (LTA) to measure firm size and total debt–total assets (LEVERAGE) to reflect financial leverage. We also include the following variables to capture other client characteristics such as liquidity, profitability, financial distress, and audit opinion. CURRENT is current assets–total assets. LOSS is a dummy variable that equals 1 if the current profit is negative, and 0 otherwise. ROA is net income–total assets. LIQ is current assets–current liabilities. OPINION is a dummy variable that equals 1 for modified opinions, and 0 otherwise. These are standard control variables according to extensive prior research on the determinants of audit fees (e.g., Francis et al. 2005; Gul 2006; Wang et al. 2008). We expect to observe higher audit fees for firms that appoint big auditors and larger, higher-risk clients. Panels A and B of Table 3 report the descriptive statistics and Pearson correlations of the main variables used in the audit fee regressions. We show that former ZTQ partners are less likely to be employed by Top 10 audit firms than their counterparts in the matching sample. Moreover, we find that the size of the clients of former ZTQ partners tends to be larger than that of the clients of matching sample. None of the variation inflation factors for the regression variables exceed five, suggesting that our analysis does not suffer from multicollinearity problems.

We report the results of estimating Eq. (1) in Panel C of Table 3 where the t-statistics in parentheses correct for serial correlation and heteroscedasticity with the Huber/White/sandwich estimator (clustered) for variance.Footnote 22 In Column (1), the coefficient on ZTQ is negative and statistically significant at the 5 % level, implying that the former ZTQ partners tend to charge lower audit fees after the firm’s collapse, consistent with the prediction in H3.Footnote 23 This is a fairly compelling evidence since lower demand for audits by former ZTQ partners could manifest as either lower market shares under H1 or clients requiring compensation in the form of lower audit fees under H3; our results support that both outcomes occur.Footnote 24 We also find that the Top 10 auditors tend to generate higher audit fees, potentially reflecting their superior expertise.

Next, we sharpen the analysis by re-running this regression after distinguishing between former ZT and TQ partners within ZTQ. In Column (2), we find that the coefficient on ZT loads negatively at the 10 % level, while TQ is statistically indistinguishable from zero. Moreover, the magnitude of the coefficient on ZT (−0.185) is more than double that on TQ (−0.082).Footnote 25 Corroborating our earlier results supporting the prediction in H5, this evidence implies that reputation damage evident in audit fees is concentrated in the former ZT partners that were in closer proximity to the YGX audit failure.

Impact of Reputation Damage on Perceived Audit Quality

The identities of the engagement partners are observable to the users of the financial statements in China, potentially shaping investor's perceptions of audit quality. Teoh and Wong (1993) attribute their evidence that, relative to other audit firms’ clients, companies that appoint Big 8 audit firms enjoy higher earnings response coefficients to market participants concluding that financial reporting becomes more credible in their presence. The collapse of ZTQ may have resulted in a reduction in the assessed audit quality that affected the perceived credibility of the earnings numbers of its clients. This, in turn, is expected to have decreased the earnings/returns association, or earnings response coefficients, of their clients. We closely follow Francis and Ke (2006) and Nelson et al. (2008) in specifying this regression model to analyze the earnings response coefficients of clients audited by the original partners of ZTQ and the matching sample before and after the scandal (subscripts omitted for notational convenience):

where CAR is the market-model adjusted abnormal return over the (−1, 1) window around the annual report announcement. The estimation period is (−203, −4), with a required minimum of 50 non-missing daily returns. UE is unexpected earnings, defined as the return on assets (ROAs) of the current year minus the ROA of the previous year. POST is a dummy variable that equals 1 if it is in the period 2002–2009, and 0 otherwise. LNMV is the natural logarithm of the market value at the end of the current year. MB is the ratio of the market value at the end of the current year to its book value. LOSS is a dummy variable that equals 1 if the current profit is negative, and 0 otherwise. STDRET is the standard deviation of daily stock returns over the (−203, −4) window prior to the earnings announcement date, with a required minimum of 50 non-missing daily returns. LEVERAGE is total debt–total assets. For this analysis, we exclude firms with missing variables as well as firms receiving qualified audit opinions since their financial statements are quite different.Footnote 26 In Panels A and B of Table 4, we report the descriptive statistics and Pearson correlations for the main variables, respectively. We find that the size of the clients of the former ZTQ partners are larger than that of the clients of the matching sample. None of the VIFs exceed five, dispelling concerns surrounding potential multicollinearity.

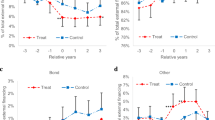

Panel C reports the results from estimating Eq. (2) using ordinary least squares with the t-statistics in parentheses based on the Huber/White/sandwich heteroscedastic consistent standard errors that are also corrected for correlation across observations for a given firm.Footnote 27 Most relevant to our purposes, Column (1) shows that the earnings response coefficients for the clients of former ZTQ partners sank dramatically after the firm’s collapse with the coefficient on UE * POST loading negatively at the 1 % level. In contrast, UE * POST is not significant in Column (2) when we re-estimate the regression on the matching sample.Footnote 28 More formally, we rely on seemingly unrelated estimation (SUEST) to test whether the coefficients on UE * POST are statistically different between the models for former ZTQ partners and the partners in the matching sample.Footnote 29 In this analysis, we find evidence at the 5 % level that the coefficient on UE * POST in Column (1) is larger than that in Column (2), implying that the earnings response coefficients for clients of the former ZTQ partners fell after the scandal compared with clients of the partners in the matching sample.Footnote 30 This suggests that investors more heavily discount the perceived quality of the audits performed by former ZTQ partners, consistent with the prediction in H4.

Next, we evaluate the shift in the earnings response coefficients of the clients audited by original partners of the two branches of ZTQ before and after the scandal. We report in Columns (3) and (4) the results from separately re-estimating Eq. (2) for the ZT and TQ subsamples. We find that the earnings response coefficients for clients of former ZT and TQ partners declined significantly after the scandal. Moreover, in low power analysis involving 218 observations, the SUEST test supports at the 10 % level that the coefficient on UE * POST is larger (more negative) in Column (3) relative to Column (4), implying that former ZT partners suffer perceptibly worse damage to their reputations than former TQ partners. Additionally, in comparing the UE * POST coefficient between the ZT partners [−0.784 in Column (3)] and the matched sample [−0.093 in Column (2)], we find that the difference is statistically significant at the 5 % level. In contrast, there is no statistical difference in the UE * POST coefficient estimate between the TQ partners [−0.236 in Column (4)] and the matched sample [−0.093 in Column (2)], providing more evidence consistent with the prediction in H5.

CAR is the market-model adjusted abnormal return over the (−1, 1) window around the annual report announcement. The estimation period is (−203, −4), with a required minimum of 50 non-missing daily returns. In sensitivity tests reported in Panel A of Table 5, we find that our core evidence persists when we replicate these tests with the alternative event windows of (−1, 0), (−1, 2), (−1, 3), (−2, 2), and (−3, 3). Similarly, our inferences hold when we analyze the cumulative abnormal return using the Fama–French three-factor model instead of the market-model adjusted abnormal return. These results are shown in Panel B of Table 5.

Conclusions

We analyze whether audit partners suffered damage to their reputations with the demise of ZTQ, formerly the largest audit firm in China, after an audit failure enabled a major client, YGX, to fraudulently exaggerate its earnings in a highly publicized scandal resembling the Andersen–Enron events in the US. Our research helps settle whether the reputational fallout in the aftermath of an audit failure is restricted to the complicit partners (narrow scope) or extends to the rest of the partners in the audit firm (wide scope). In a country where litigation institutions play hardly any role in shaping audit quality—in China, investors in listed companies are afforded almost no implicit insurance coverage against losses sustained when auditors issue a clean opinion on materially deficient financial statements—we examine whether reputational damage incurred by ZTQ partners implicated in the scandal spreads to other partners in the same firm who were not directly involved in the YGX engagement.

We find that the number of clients of former ZTQ partners—despite that they were not complicit in the YGX events—fell after the scandal. These partners are also less likely to be affiliated with reputable audit firms. The clients of these partners exhibit lower earnings response coefficients, implying that investors downgrade the perceived quality of their audits. Moreover, compared to a matched sample, the former ZTQ partners tend to charge lower audit fees after the firm’s demise. ZTQ was created through the merger of ZT and TQ, although both branches remained operationally independent afterward. YGX was always audited by ZT. Additionally, only about a year elapsed between the merger and the exposure of the YGX fraud, suggesting that former TQ partners would be more sheltered from the reputational impact. We find evidence that the collapse of ZTQ undermined the reputations of former ZT partners more than that of former TQ partners, indicating that reputational damage is concentrated near the audit failure. Collectively, our results suggest that audit partners share reputation jointly and severally with other partners in the same audit firm.

Our research has several preliminary policy implications, including that our evidence lends support to the intuition that reputation concerns at the partner level help motivate them to more closely monitor the performance of the firm’s other partners. Additionally, our results may be relevant to the discourse on the PCAOB’s (2011) proposal calling for the disclosure of audit partner identity in the US, although research on another country’s auditing institutions naturally should be interpreted with caution from a policy perspective. Complementing our analysis, future research could examine how reputational damage in the event of a financial reporting failure affects partners in audit firms operating in countries with strict private and public institutions governing auditor discipline. For example, recent evidence implies that the US Securities and Exchange Commission tends to target its enforcement at audit partners, rather than audit firms, implicated in fraudulent financial reporting (Kedia et al. 2014). It would be interesting for future research to analyze whether audit partner reputational forces play a disciplinary role in countries such as Australia that both require partners to divulge their identities in their audit reports and, relative to China, impose far tougher investor protection institutions that hold auditors more responsible for rendering an unqualified opinion on materially inaccurate financial statements.

Additionally, we call for research that examines whether various forms of social ties shape the importance of audit partner reputation forces. Liu et al. (2011) report that guanxi—social ties that enable firms to secure resources and support according to extensive prior research (e.g., Au and Wong 2000; Dunfee and Warren 2001)—in China undermines auditor independence there. Despite the fact that recent research implies that social links among audit partners, executives at client firms, and audit committee members play a major corporate governance role (e.g., Hwang and Kim 2012; Kwon and Yi 2012; He et al. 2014), evidence on whether the links between audit partner reputation and economic outcomes hinge on the presence of such social ties remains scarce.

Notes

In a major upside, focusing on a large audit firm generates power for the analysis since the negligence of a single partner threatens each individual partner’s reputation with the risk magnified in larger audit firms that have more partners signing audit reports (Lennox and Li 2012). In other words, a partner’s worries about the degree of care exercised by other partners increases with their number; i.e., partners’ cross-monitoring incentives are stronger in larger audit firms.

It is important to note that litigation against auditors in Hong Kong is an exception (Ferguson and Majid 2003).

El Ghoul et al. (2012) provide equity pricing evidence that subjecting auditors to intense litigation exposure is responsible for the major fault line that distinguishes the US from the rest of the world on the performance gap between Big 4 and non-Big 4 auditors. In fact, prior evidence casts doubt on whether researchers can reliably gage the separate impact of auditors’ incentives with event studies on the collapse of a large US public accounting firm. For example, Menon and Williams (1994) report evidence implying that the negative share price reaction that clients of the public accounting firm Laventhol and Horwath suffered after its bankruptcy in 1991 reflects the insurance explanation, although Baber et al. (1995) find that both the reputation and insurance explanations were responsible. More recently, Chaney and Philipich (2002) attribute the negative stock returns incurred by Arthur Andersen’s clients surrounding when investors learned about its apparent complicity in the Enron scandal to reputational implications. However, Nelson et al. (2008) provide evidence that calls this interpretation into question.

Moreover, China does not permit class action lawsuits that can have a sobering impact on auditors’ incentives to constrain firms against manipulating their financial statements (Ball 2009; Mahoney 2009). As far as we know, there have been no successful civil lawsuits against auditors of listed firms in China. More generally, minority investors in modern China have hardly had any legal recourse against tunneling by insiders, who are frequently politically connected, and security regulators have minimal jurisdiction over controlling entities (e.g., Allen et al. 2005; Fan et al. 2007; Jia et al. 2009; Jiang et al. 2010; Chen et al. 2014).

Studies like ours are frequently labeled “natural experiments” in that we analyze outcome measures for observations in treatment and control groups that have not been randomly assigned. We explain in more detail later in the paper that our treatment group comprised ZTQ partners who were not implicated in the YGX audit failure and our control group comprised partners in other large audit firms. We compare differences in outcomes before and after the ZTQ–YGX events in 2001 between the groups to identify the importance of partners’ incentives to protect their reputations by monitoring their fellow partners. Major advantages of implementing a difference-in-differences design include its simplicity for narrowing the range of plausible competing explanations for the results along with its potential to bypass many of the endogeneity complications that routinely arise when making comparisons between heterogeneous individuals (e.g., Bertrand et al. 2004). Although we assume that the reputations of non-ZTQ partners in the control group are immune to the YGX audit failure, any damage to their reputations (contagion effects) would work against our tests rejecting the null hypotheses.

Guedhami and Pittman (2006) find evidence implying that investor perceptions of audit quality rise when countries impose tough criminal enforcement against auditors. In China, discipline from sanctions leveled by regulators plays a role in the country evident in the two ZTQ partners having their licenses revoked. However, we isolate the reputational impact on the former ZTQ partners who were not implicated in the scandal according to the government; i.e., we specifically exclude from our analysis the two ZTQ partners who were later prohibited from auditing listed companies.

For expositional convenience, we label partners not directly involved in the YGX audit failure as “innocent” or “guiltless” since the country’s regulator did not impose any sanctions on them. However, it is important to stress that under a broader interpretation these partners may shoulder some blame for failing, for example, to closely monitor the two partners implicated in the scandal and to develop rigorous quality control systems (e.g., training programs, policies designed to attract and retain capable personnel, etc.) that are intended to ensure that all partners uniformly supply high-quality audits.

Regulatory events prevent us from extending our sample period beyond the 1996–2009 timeframe. In December 1995, the CICPA issued the first batch of China’s Independent Auditing Standards of the Certified Public Accountants (CIAS’s), which specify the responsibilities of auditors as well as the content and format of audit reports. DeFond et al. (2000) find that auditor independence improved after 1995. The National Development and Reform Commission and the Ministry of Finance constituted “The measures for the administration of Certified Public Accountants service charges” on 27 January 2010. It formulates guidelines on audit fees. In addition, the Ministry of Finance and the State Administration for Industry and Commerce issued “Interim provisions on promoting large scale accounting firms adopt the special general partnership” on 21 July 2010. Under the special general partnership, a complicit partner or partners should bear unlimited liability or unlimited liability jointly and severally if the liability is incurred due to intentional or gross negligence, while the other partners should bear limited liabilities up to their share in the partnership. Under the interim provisions, audit partners not only share reputation, but also the liabilities stemming from audit failure. We narrow our focus to the 1996–2009 period to avoid providing spurious results on the predictions arising from regime shifts distorting our evidence. In addition, it follows that the reputational impact will subside as the scandal becomes more distant, an issue that we discuss in more detail later in the paper. To show how our findings provide implications for future practice and make further contributions to extant research, we extend the sample period to 2013 and add a dummy variable indicating whether an observation was before or after 2009 to the analysis. The results of the perceived audit quality tests show that reputational effects decreased after 2009. However, the results for the audit fee analysis are mixed. It is important to exercise caution in interpreting these results given the regime shift after 2009.

Also, to avoid biasing the analysis toward supporting our predictions, we exclude data for 2001 because it routinely took the former ZTQ partners some time to find a new employer. Moreover, even for those that managed to quickly join another audit firm, they experienced delays in becoming signing partners given the continuous nature of auditing. In China, the fiscal year end is 31 December while audit reports must be completed by 30 April, leaving the former ZTQ partners a short window to become signing partners on 2001 audit engagements for listed clients at their new firm. In fact, only two former ZTQ partners became signing partners in 2001. All of the major events in the ZTQ–YGX audit failure from the initial fraud allegations to the eventual punishment leveled against the audit firm and two of its partners occurred in 2001, ensuring that the surrounding years under study were not contaminated.

In untabulated analysis, all of our core results are materially insensitive to including “Tongren” CPA firm in our sample. Moreover, our evidence persists when we exclude “DH” CPA firm, which had the second most listed clients in 2000 and merged with Ernst and Young in early 2002. Chen et al. (2010) report that many of DH’s clients switched to other audit firms during the 2002–2004 timeframe. Finally, the evidence on our predictions remains when we specify the rest of the Top 8 audit firms as the matching sample after Chen et al. (2011).

This 38 equals the 57 clients of ZTQ in 2000 minus the 6 listed clients which did not disclose their engagement partners’ names, 4 listed companies which did not disclose the names of their engagement partners and the branch name of their audit firm, and 9 listed firms audited by the 2 ZTQ partners whose practicing licenses were later canceled.

Our matching sample is the original partners of the rest of the Top 10 audit firms in 2000. Naturally, the sample size decreases over time for several reasons: some of them no longer audit listed firms, although they still work at audit firms that have the license to audit listed firms; some moved to audit firms that do not have the license to audit listed firms (very small audit firms); and some moved to other industries.

Besides the univariate tests, we also conduct regression analysis. In the first regression, the dependent variable is ZTQ_client, which equals 1 if the listed firm is audited by former ZTQ auditors, and 0 otherwise. In the second regression, the dependent variable is ZT, which equals 1 if the listed firm is audited by former ZT auditors, and 0 if the listed firm is audited by former TQ auditors. In both regressions, we find that the coefficients on POST are negative and statistically significant at the 1 % level, lending additional support to our predictions.

Moreover, additional data inspection reveals that none of the former ZTQ partners and partners from the matching sample became fund managers or investment bankers after they left the audit industry.

This analysis involves 13 years of data with repeated annual observations for each company. However, after applying firm-level clustering to address the lack of independence, the results in Columns (3)–(6) hold at the 1 % level.

All of the evidence reported in Panel B persists at the 1 % level when we narrow the period under study to the 10 years surrounding the ZTQ–YGX events, 1996–2006: in order to reflect that the reputational impact may be concentrated nearer the audit failure—or restrict the matching sample to audit partners that have at least five clients to address potential mean reversion in the number of ZTQ partners per client after the YGX scandal. Similarly, our results are also robust to excluding existing clients (i.e., clients that were with ZTQ before 2001) from the analysis to sharpen the focus to strictly new clients.

The results in Columns (3)–(6) remain statistically significant at the 1 % level when we apply firm-level clustering.

DeFond et al. (2000) and Wang et al. (2008) identify large audit firms according to whether they are among the 10 largest auditors in China based on clients’ assets. Reinforcing their auditor choice specification, Gul et al. (2010) find that Big 4 audit firms increase the amount of firm-specific information impounded into share prices of listed firms in China. More generally, prior research routinely gages audit quality with the presence of a Big 4 audit firm (e.g., Mansi et al. 2004; Kim et al. 2011).

We also evaluate whether this evidence persists in a regression framework. In this analysis, we specify the dependent variable as BIG_audit, which equals 1 if an auditor is hired by a “large” audit firm, and 0 otherwise. We rank the audit firms based on the number of listed clients and then classify the Top 10 audit firms or Big 4 as “large” audit firms and other audit firms as “small” audit firms. ZTQ is a dummy variable, which equals 1 if the auditor is a former ZTQ auditor, and 0 otherwise. ZT is a dummy variable, which equals 1 if the auditor is a former ZT auditor, and 0 if the auditor is a former TQ auditor. After He and Ke (2014), we include four control variables in the model to capture individual auditor characteristics: (i) Experience is the natural logarithm of the number of years since the first year when an auditor served as a signing auditor for a publicly listed firm, (ii) Modified is the mean fraction of an auditor’s clients who were issued a non-clean audit opinion over the past 5 years t − 5 to t – 1, (iii) Enforcement is the mean fraction of an auditor’s clients that violated financial reporting and disclosure regulations over the past 5 years t − 5 to t – 1, and (iv) Specialist is the mean value of SPEC over the past 5 years t – 5 to t – 1. SPEC is a dummy variable indicating auditor specialization in one or more economically important industry sectors. An industry sector is considered economically important if it represents at least 1 % of total assets of all Chinese listed companies. An auditor is designated as an industry specialist if the size of her within-industry clientele in terms of audited total assets belongs to the highest decile of its annual distribution (Knechel et al. 2013). Reinforcing our other evidence consistent with the prediction in H2, we find in successive regressions that the coefficients on ZTQ and ZT are negative and statistically significant at the 1 % level.

The CSRC began to require listed firms to disclose their audit fees in 2001.

In unreported sensitivity analysis, we control for two other variables in the audit fee model: total receivables and inventory, each scaled by total assets. All of our core results hold in these regressions with adjusted R 2 increasing trivially to 0.468. Also, we cannot control for the number of subsidiaries and the proportion of subsidiaries that are foreign because of poor data availability (in another study focusing on Chinese firms, Wang et al. 2008 also do not control for these potential determinants). Although the explanatory power of our audit fee model is slightly lower than in prior research on US firms, it exceeds that observed in recent evidence on Chinese firms. For example, the Adj. R 2 in Panel C of Table 3 is 0.463, which is higher than the 0.377 that Wang et al. (2008) report.

The sample size of the matching sample is much larger than the ZTQ sample. As a sensitivity test, we specify the rest of the Top 3 audit firms in 2000 as the matching sample (ZTQ was ranked first in terms of the number of listed clients among all audit firms in 2000). The sample size of matching sample is reduced. In both the audit fee and perceived audit quality tests, our core evidence persists.

Given that it is conceivable that the reputational fallout that partners experience will subside as the scandal becomes more distant, we run additional tests to examine this issue. First, for the audit fee analysis, we include a dummy variable POST in the model, which equals 1 if it is in the period 2002–2004, and 0 otherwise. In untabulated results, we find that the coefficient on ZTQ * POST is statistically indistinguishable from zero. Second, for the perceived audit quality analysis, we include two dummy variables, POST1 and POST2, in the model. POST1 is a dummy variable that equals 1 if it is in the period 2002–2004, and 0 otherwise. POST2 is a dummy variable that equals 1 if it is in the period 2005–2009, and 0 otherwise. In these estimations, we find that the coefficient on UE * POST1 fails to load, while the coefficient on UE * POST2 is statistically significant. However, the difference between these two coefficients is not statistically significant. Consequently, there is no clear evidence implying that the reputational impacts dissipate over time during the 8-year period under study. We find similar evidence when we specify 2005 or 2006 as alternative cutoff points for identifying the post periods. Overall, we only find some suggestive supporting that the partner reputational impacts gradually fall over the 2002–2009 timeframe.

After re-estimating the tests on the ZT and TQ subsamples, we find virtually identical evidence supporting our predictions.

We continue to find almost identical evidence on our predictions when we follow Nelson et al. (2008) by removing from all regression observations with studentized residuals exceeding 2 in absolute value, and when we control for the extent of marketization with an index that reflects the depth of advances in market-oriented institutional transformation and economic development in the province (Chen et al. 2011).

Our core inferences in this section hold when we interact each control variable with UE. However, including these interactions engenders serious multicollinearity problems in the small sample. More specifically, we find that the variance inflation factor (VIF) for each regression exceeds 40 after including the interaction terms. In contrast, the VIFs are the vicinity of 3.5 in the specifications without the interactions between the control variables and UE. Accordingly, we follow Nelson et al. (2008) by excluding these interactions from the estimations.

We find that the ERCs of the matching sample decline in the post period. One possible explanation is that the ERCs of all of the firms subside in the post period (from the period 2002 to 2009) since listed firms were required to disclose quarterly reports after 2002. We did not calculate unexpected earnings based on the quarterly ROAs because we did not have access to quarterly earnings data before 2002.

Recent research applies SUEST, which was originally proposed by Zellner (1962) as an econometric technique for testing cross-model hypotheses; e.g., Hayes et al. (2012) and Price et al. (2011). In an important upside, this approach does not assume that the two regression models share the same residual.

We also re-estimate the regressions on the full sample after adding the dummy variable ZTQ (or ZT). In results not reported in tables, we find qualitatively similar evidence.

References

Allen, F., Qian, J., & Qian, M. (2005). Law, finance, and economic growth in China. Journal of Financial Economics, 77(1), 57–116.

Asthana, S., Balsam, S., & Krishnan, J. (2003). Audit firm reputation and client stock price reactions: Evidence from the Enron experience. Working paper, Temple University.

Au, A., & Wong, D. (2000). The impact of guanxi on the ethical decision-making process of auditors: An exploratory study on Chinese CPAs in Hong Kong. Journal of Business Ethics, 28(1), 87–93.