Abstract

Scholars have long been interested in understanding organizational slack. Peng et al. (2010) is a landmark study examining the effect of slack on firm performance. We seek to advance our understanding of the topic in three ways. First, we replicate the core findings of Peng et al. (2010) by drawing on a major and yet less investigated economy in Asia—Taiwan. Second, we differentiate the effect of slack by investigating both short- and long–term performance. Third, in addition to CEO duality, our study also examines the moderating effects of business groups and family firms as two widespread governance factors in Asia. Our results suggest that the effect of organizational slack on firm performance is contingent on the short– versus long–term perspective. Furthermore, we find that the slack–performance relationship is shaped by boundary conditions. Overall, our findings contribute to the literatures on organizational slack, corporate governance, and research in Asia.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

How organizational slack influences firm performance has received increasing scholarly attention (Chiu & Liaw, 2009; Su et al., 2009; Tan & Peng, 2003; for a review see Daniel, Lohrke, Fornaciari, & Turner, 2004). Organizational slack refers to the existence of extra resources available for firms to use (Bourgeois, 1981). While possessing such discretionary resources may enhance firm adaptation and flexibility, researchers have two opposing views regarding slack. Opponents of slack argue that its availability can be subject to potential self–seeking behaviors by managers (Jensen & Meckling, 1976). Kim et al. (2009) show that managers may overstretch firm resources by diversifying into unrelated or even remote areas, potentially compromising firm performance. However, proponents of slack maintain that holding additional resources allows firms to better adapt to environmental changes. Researchers have been keen to understand how organizational slack affects performance (Daniel et al., 2004; George, 2005; Stan et al., 2014), as well as under what conditions this relationship may change (Wefald et al., 2010).

Among these studies, Peng et al. (2010) is a seminal work examining the effect of organizational slack on firm performance. Using a sample of 300 firms operating in China during the period from 2004 to 2005, Peng et al. (2010) develop a framework investigating the slack–performance association and its contingencies. They find that while slack can enhance firm performance, the impact of organizational slack on firm performance varies depending on contextual factors including CEO duality and firm ownership (state versus private ownership). Specifically, the interaction effect of slack and CEO duality on firm performance is negative for state–owned enterprises (SOEs), but positive for private–owned enterprises (POEs).

Despite the contributions, the findings by Peng et al. (2010) are based in China and results are limited to a specific period. It is less clear whether these findings hold for other economies operating within Asia or during different time frames. Whetten (1989) asserts that researchers “should be encouraged to think about whether their theoretical effects vary over time” (p. 492). Inspired by Whetten (1989), our study has three goals and contributions to the literature.

First, scholars have suggested the merits of replication studies (Bettis et al., 2016; Singh et al., 2003). Specifically, “it is the responsibility of all of us to make our research base as repeatable and cumulative as possible” (Bettis et al., 2016: 2193). However, replication remains rare in Asia-based research to our knowledge. We replicate Peng et al. (2010) using a unique sample of Taiwanese firms during a more recent period. As one of the major economies in Asia, Taiwan has gone through a series of social, political, and institutional changes over the past few decades (Chang et al., 2006; Chen & Chu, 2012). These shifting macro–environmental contexts provide an opportunity for further understanding how organizational slack affects firm performance.

Second, in their investigation of the slack–performance relationship, Peng et al. (2010) consider return on assets (ROA) as the primary outcome variable. While valid and useful, this measure may capture only short–term performance and may not fully capture future growth potential. Yet, the impact of slack on firm performance can differ in the short versus the long run as time may affect the degree to which firms adapt to their operating contexts (Mosakowski & Earley, 2000). Extant research has used both factors to capture both short– and long–term firm performance (Ben-Oz & Greve, 2015; Wang & Chen, 2010). Incorporating multiple performance variables not only enhances our understanding of organizational slack, but also provides useful implications for practitioners.

Third, in an effort to provide a replication with extension (Hubbard et al., 1998; Tsang & Kwan, 1999), we examine the moderating effects of business group versus family firm. On the one hand, theorists argue that a pure replication without new insights may not improve our knowledge on a topic significantly (Hubbard et al., 1998: 244; Tsang & Kwan 1999: 759). On the other hand, business group and family firms are two governance forms widely observed among emerging economies within Asia (Chang & Hong, 2000; Duran et al., 2019; Ma et al., 2006; Yiu et al., 2007), but few studies specifically examine whether or not these factors moderate the relationship between organizational slack and firm performance. Investigating these factors not only enhances our knowledge of the contexts when organizational slack would be more versus less relevant to firm performance, but also echoes authors’ point that extension is desired for replication studies (Hubbard et al., 1998; Tsang & Kwan, 1999).

The slack–performance relationship in developed versus emerging economies

Originating in the behavioral theory of the firm (Cyert & March, 1963), slack refers to the presence of unused resources preserved in organizations (Bourgeois, 1981; George, 2005; Singh, 1986). All firms need resources to ease their operations, but the amount of resources accessible for managers to mobilize, deploy, and utilize is not identical. At a given time point, some firms have resources that just meet their current operational needs. Possessing sufficient resources enables firms to perform their activities adequately. In contrast, other firms can have resources below their current operational requirements. These resource deficiencies create challenges for these firms to maintain their operations as planned. Furthermore, certain firms may hold resources beyond their current needs. Such extra resources are organizational slack.

Earlier studies suggest that slack can manifest in different forms including cash (Kim & Bettis, 2014), capacity (Kovach et al., 2015), and human resources (Vanacker et al., 2017). Hence, extra resources can be preserved among a firm’s main activities. Regardless of the form, slack can be broadly categorized into absorbed slack (e.g., underutilized capacity) versus unabsorbed slack (e.g., extra financial resources). Unabsorbed slack is less costly and more flexible for redeployment toward new projects relative to absorbed slack.

A key debate of slack is its impact on firm performance. Two opposing views emerge regarding organizational slack. Some researchers have contended that the presence of extra resources may be subject to top managers’ discretion or even private intent. For example, management may use these additional resources to increase personal welfare at the firm’s expense such as buying other entities (Iyer & Miller, 2008), building personal empires (Amihud & Lev, 1981; Kim et al., 2009), and fulfilling personal needs (Yermack, 2006). Such projects can help managers increase their compensation (Seo et al., 2015). These activities run the risks of overstretching firm resources as well as overusing managerial attention and energy, potentially compromising operational performance.

Nevertheless, the other view is that accumulating extra resources via slack can be instrumental to firm success. Central to this perspective is that crucial activities such as innovation projects and capital investment require steady and continuous input (Nohria & Gulati, 1996). By holding additional resources firms can ease, facilitate, and advance these activities (George, 2005). If firms do not accumulate sufficient extra resources, they may be forced to halt, discontinue, or even abandon these projects, particularly when the economy experiences unexpected downturns or when firms do not perform well. Hence, limited slack can hinder firms’ long–term competitiveness.

Within the literature on slack, Peng et al. (2010) is a landmark study. According to Peng et al. (2010), slack is a discretionary resource that managers may opt to accumulate. Consistent with institutional theory (Peng et al., 2009, 2010; Scott, 2014) suggest that having slack can be useful for firms based within emerging economies since less developed market-supporting institutions provide limited support for firm operations. Inadequate property rights, inefficient public services, and excessive government interventions may adversely affect market functioning in a country. A certain amount of slack can be useful to streamline firm operations. Building on this central argument, Peng et al. (2010) furthermore investigate the moderating effect of CEO duality and the distinction between state–owned versus private–owned firms. Peng et al. (2010) find that slack can enhance firm operational effectiveness. Also, this slack effect is contingent on whether a CEO also holds the board chair title, as well as whether a firm is owned by the state versus private investors.

Does scholars’ interest in organizational slack continue to grow after Peng et al. (2010)? We conduct a literature review to understand recent developments on this topic. Specifically, we locate studies published in journals listed on the Financial Times 50 in the management field including: Academy of Management Journal, Administrative Science Quarterly, Entrepreneurship Theory and Practice, Human Relations, Human Resource Management, Journal of Business Ethics, Journal of Business Venturing, Journal of International Business Studies, Journal of Management, Journal of Management Studies, Organization Science, Organizational Studies, Research Policy, Strategic Entrepreneurship Journal, and Strategic Management Journal. We omit theory-oriented (e.g., Academy of Management Review) and micro-oriented journals (e.g., Journal of Applied Psychology) since their publications may be less pertinent. In our search, we add two prominent journals: Asia Pacific Journal of Management and Management and Organization Review as they contribute substantially to research in the context of Asia. In searching recent works, we submit the key word “slack” in title and/or abstract, along with specific journal names to the ABI/Inform, EBSCO Premier Business, and Web of Science databases. We additionally apply the snowballing approach to track relevant papers citing Peng et al. (2010).

The Appendix lists the results of our literature review where we make three observations. First, organizational slack remains well-reviewed in the recent literature. From 2010 to 2021, there are 56 articles published by major management journals. The top five journals that publish research on slack are Strategic Management Journal (12), Asia Pacific Journal of Management (8), Entrepreneurship Theory and Practice (6), Journal of Management Studies (6), and Journal of Business Ethics (5). Second, in terms of framework, we find that studies predominantly consider slack as a contingency rather than a predictor as with Peng et al. (2010). Although some researchers have examined family firms in their investigations (Gentry et al., 2016; Liu et al., 2017; Xu & Hitt, 2020), no known works investigate the role of business group affiliations in the slack–performance relationship. Finally, in terms of research context approximately 60% of the articles are based in developed economies (mostly the United States). The relatively limited attention to emerging economies is a research gap that requires further scholarly effort.

Our study sets out to improve our understanding of the relationship between slack and firm performance based within emerging economies. To this end we develop our hypotheses in the next section. We begin by discussing how slack may have differential effects on short–term versus long–term firm performance. We then build on these arguments to investigate several contingencies that may alter the slack–performance association.

Hypotheses

Organizational slack hinders short–term performance

Although slack has been long studied, most research considers the effect of slack on firm strategies (e.g., innovation). We suggest that it is crucial to distinguish short–term from long–term performance in examining the slack–performance relationship. On the one hand, short–term performance such as ROA emphasizes immediate operational efficiency. These short–term operational results can be subject to unexpected contingencies. Relying entirely on short–term operational outcomes may not fully illuminate how slack impacts firm performance. On the other hand, long–term performance indicators such as firm market value are relatively more stable. A simultaneous examination of both short–term and long–term performance can accordingly provide a more complete understanding of the slack–performance relationship.

For two reasons, we maintain that organizational slack may not improve firm performance in the short run. First, slack resources can be subject to managerial decisions since top managers are agents hired to work (Eisenhardt, 1989; Jensen & Meckling, 1976). As managers’ personal goals and those of their organizations may not be perfectly aligned, top managers such as CEOs may not act solely toward the goal of enhancing firm performance. Thus, holding additional resources can serve these managers’ personal needs rather than their firms’. Second, politics among organizational divisions or members can erode the value of slack. Subunits and/or powerful individuals within a firm can have the motivation to compete for resources to ensure their own sustainability, potentially forming coalitions and demonstrating significant political behaviors (Cyert & March, 1963). These behaviors would become more pronounced when a firm has a certain level of slack. If organizational members use their time and energy in protecting their own interests, then the firm’s overall operational performance can be hindered.

Crucially, these tendencies are likely to be more salient in emerging economies. Regulators within many emerging economies have not yet established transparent reporting systems for firms due to a lack of effective corporate governance systems (Aguilera & Jackson, 2010; Globerman et al., 2011). Hence, firms will not have effective options available for holding their managers accountable (Tan & Peng, 2003). For example, while independent directors have been employed in developed countries such as the United States for some time, many emerging economies have not yet fully implemented this practice. More specifically, Taiwan did not formally introduce independent directors until 2010. This lack of effective corporate governance systems can provide opportunities for managers to (mis)use slack resources, hindering short–term operational performance. Therefore:

Hypothesis

1a Organizational slack will be negatively related to short–term firm performance.

Organizational slack helps long–term performance

While slack may impede short–term firm performance, we contend that organizational slack can improve performance in the longer run. First, firms with more slack have a greater capacity to support, sustain, and expand long–term investments such as innovation. Slack reduces pressure on managers, allowing them to initiate and continue projects for new products and innovation (Lawson, 2001; Nohria & Gulati, 1996). Second, formal institutions such as rule of law within emerging economies are not yet fully developed and may change over time (Majumdar & Bhattacharjee, 2014; Makhija 2003), in contrast with developed countries where such institutions are more established. Slack allows firms to cope with these potential institutional challenges. Third, emerging economies are increasingly competitive (Hermelo & Vassolo, 2010; Peng et al., 2018a). The removal of entry barriers and control over government corruption encourages entrepreneurs to join the market (Bowen & Wiersema, 2005; Katics & Petersen, 1994). To thrive within such a context, firms have incentive to hold additional resources. If firms have limited slack, they may not be able to effectively keep up with competitors. Finally, capital markets within emerging economies are less established than those operating within developed economies (Chacar et al., 2010; Singh et al., 2017), yet the high costs of obtaining capital can disrupt firm operations. Slack allows firms to reduce the costs of raising capital, enhancing flexibility and efficiency in their operations.

A firm’s long–term performance depends on how well the firm manages its external environment (Pfeffer & Salancik, 1978). Effective management of the external operational context leads to improved long–term performance, while less effective management may result in unsatisfactory outcomes. To the extent that slack enables firms to better cope with external environmental shifts and protect their core activities (Thompson, 1967), firms with greater slack are more likely to efficiently adapt to the changing operating contexts within emerging markets. Therefore:

Hypothesis

1b Organizational slack will be positively related to long–term firm performance.

Contingencies

Our first set of hypotheses contends that organizational slack affects firm performance in two distinctive ways. In the short run organizational slack can be subject to managers’ personal intentions (Hypothesis 1a). Yet in the longer run, slack can be instrumental for firms to launch, continue, and expand their strategic investments, facilitating value creation (Hypothesis 1b). These two predictions investigate slack effects by assuming that all firms have similar operating contexts. To improve our understanding of the slack–performance relationship, it is useful to examine certain boundary conditions. Indeed, “every theoretical model…must specify the boundaries within which the theory’s units interrelate lawfully” (Fry & Smith, 1987: 119). Investigating these contingencies not only uncovers the theoretical boundaries, but also validates researchers’ core logic. How firms within emerging economies utilize slack can be affected by: (1) managers’ influence, and (2) the presence of controlling shareholders. On the one hand, the extent to which top managers such as CEOs have substantial influence may amplify or dampen firms’ use of slack resources in enhancing operations. When a CEO also holds the board chair position—a practice known as CEO duality—then he or she will have greater influence over the firm (Krause et al., 2014; Peng et al., 2007). Thus, holding the board chair title may magnify a CEO’s influence, altering the slack–performance relationship. On the other hand, when a firm is controlled by external shareholders who have substantial ownership then CEO decisions—including those using a firm’s extra resources to serve certain objectives—can be scrutinized by these shareholders. Unlike firms operating within developed economies that are controlled by diverse shareholders with limited ownership, firms within emerging economies often have shareholders who have higher levels of ownership holding. These dominant shareholders can exert their influence over firms, leading to conflicts among principals (Li & Qian, 2013; Su et al., 2008; Young et al., 2008). Business groups are one such controlling shareholder faction. A sizeable percentage of firms within Asia are managed by business groups, such as Sony in Japan, Samsung in Korea, Acer in Taiwan, and Tata in India. The other notable controlling shareholders are families. Anderson and Reeb (2003) note that over 35% of their S&P 500 sample firms are owned by families. The presence of family firms is even more salient in emerging economies such as China, Korea, and Taiwan (Claessens et al., 2000; Khanna & Palepu, 2000). Such shareholder ownership can influence managers’ decisions, altering firms’ utilization of slack resources.

To understand whether or not firms’ slack utilization is shaped by the influence of managers and key shareholders, we examine three contingencies including: (1) CEO duality, (2) business groups, and (3) family firms. The presence of these contextual factors can change the degree to which firms use additional resources more or less effectively, affecting both short–term and long–term performance.

CEO duality

CEO duality is one contextual factor that may alter the relationship between organizational slack and firm performance. Whether or not a CEO also holds the board chair title is pertinent since holding both titles can make the corporate governance system less effective (Boyd, 1995; Krause et al., 2014). Agency theory suggests that managers’ goals may not be perfectly aligned with firms’ goals (Eisenhardt, 1989; Jensen & Meckling, 1976). This self–seeking propensity can become more pronounced as consolidation of the CEO and board chair positions augments a CEO’s control over the firm.

We anticipate whether or not a CEO holds the board chair position alters the relationship between slack and firm short–term performance since the separation of these positions will make the CEO subject to additional board monitoring. For example, if a CEO proposes ambitious projects, then the board can ask the CEO to articulate his or her reasons for undertaking them. If the board is not convinced by the CEO’s justifications, it may urge the CEO to revise the proposal or even withdraw the project entirely. A CEO without the board chair title cannot easily override the board in making personal decisions. Hence, the lack of the board chair title will prompt the CEO to become more careful and cautious in utilizing slack resources toward certain firm operations. This accordingly can diminish the negative effect of organizational slack on short–term firm performance. Similarly, a CEO who does not hold the board chair title has relatively less influence over a firm’s strategic decisions. Under this condition, the CEO would be motivated to incorporate the board’s advice toward improving firm operations (Carpenter & Westphal, 2001; McDonald et al., 2008). This would help bring out organizational slack’s potential, enabling the firm to create value using its extra resources and enhancing long–term performance.

Alternatively, the relationship between organizational slack and firm performance would change when a CEO also holds the board chair title. When the CEO and board chair titles are consolidated, then a CEO will have greater influence over the firm. While independent directors may attempt to be vigilant in advising or even directly monitoring a CEO, the CEO can still find ways to manage the board. Indeed, having substantial influence over a firm can alleviate a CEO’s unemployment risk (Pi & Lowe, 2011), inducing him or her to put personal objectives first. As studies report, CEOs who also hold the board chair title can direct their firms in the direction they personally like (Chen et al., 2021). To the extent that holding both titles makes the agency issue more pronounced, a CEO who also serves as the board chair over a firm with significant slack may be less likely to do his or her best in achieving short–term firm performance. Similarly, when a CEO also holds the board chair title then the CEO will have a greater capacity to direct the firm’s extra resources toward personal goals. Such decision-making power can prevent the firm from fully realizing its potential for demonstrating optimal long–term performance.

Hypothesis

2a CEO duality will strengthen the negative relationship between organizational slack and short–term firm performance.

Hypothesis

2b CEO duality will weaken the positive relationship between organizational slack and long–term firm performance.

Business groups

A business group is a constellation of firms that share a collective corporate entity generally governed by certain controlling shareholders (Guillén, 2000; Khanna & Rivkin, 2001). Such interfirm relationships allow business owners to mobilize resources across organizational boundaries and is common within emerging economies (Doh et al., 2017; Khanna & Palepu, 1997). After all, inefficient government regulations, weak property rights protection, and under-developed capital markets create substantial challenges for firms. In response, individuals and firms may opt to operate collectively by forming business groups. Developing a portfolio of corporations operating among a wide range of businesses allows firms to ease their operations, and better utilize their entrepreneurial spirit as well as the resources available (Carney et al., 2011).

We expect that the effect of organizational slack on firm performance would change depending on whether or not firms are affiliated with a business group. First, a business group forms a constellation of firms through which group leaders coordinate via both formal and informal control mechanisms. Fundamentally, business groups “subject multiple firms with different though often overlapping, sets of owners and managers to common overarching control” (Dau et al., 2021: 1). Although it is good that an individual member firm has extra resources, from the business group leaders’ perspective it would be even more helpful if that slack can be used to support the whole group. As controlling shareholders orchestrate the resource allocation of the entire business group, it is imperative for member firms to assist each other. Chang and Hong (2000) document that resource sharing is common among firms operating within a business group. Khanna and Rivkin (2001) assert that firms affiliated with business groups will have more associated obligations. Ma et al. (2006) find that resource–sharing obligations due to business group affiliation can hurt rather than boost firm performance. Lefebvre (2021) shows that firms affiliated with a business group can exhibit reduced performance, particularly when they have substantial slack. For firms affiliated with a business group, such higher levels of slack imply that more resources will be transferred to support other firms within the group. Hence, resource “tunneling” can be prevalent within business groups (Bae et al., 2002; Bertrand et al., 2002). When such behaviors occur, focal firms with available slack can lose their own opportunities to create additional value. Worse, these firms may soon encounter challenges maintaining their current operations by compromising immediate operational effectiveness.

Second, it is common that business groups will impose certain control mechanisms on their affiliates. For example, a business group can lead its member firms by using ownership control, director interlocks, and staffing. The control that a business group exercises can lead to unintended consequences since numerous management tools are designed and imposed primarily to protect the dominant shareholders’ welfare (Claessens et al., 2000). These measures may eventually create abundant opportunities for business group managers to exploit the assets and resources of certain firms within the group (Yang & Schwarz, 2016). Under such conditions, firms with abundant slack may become vulnerable to an excessively bureaucratic process redirecting these resources to other firms. Likewise, this effect can be attenuated by business group affiliation since group managers can instruct or even force a firm to surrender its extra resources in the name of supporting the overall group. As business group members, managers must follow the guidance of group leaders. Deviating from these instructions can impair managers’ relationships with the group and ultimately their professional careers. When firms affiliated with a business group conform to the instructions of group leaders, then the potential value of slack can be compromised.

In contrast, the slack–performance relationship will behave differently in firms that are not affiliated with business groups. These firms do not need to consider the instructions of group shareholders and can operate more freely. Such independent firms can better realize the potential benefits of slack since they do not need to consider requests from sister firms. This discretion allows firms to make better use of their resources above immediate operational needs. Bradley et al. (2011) contend that slack can be instrumental for firms to identify and seize potential opportunities within their operating contexts. Following this logic, we suggest that the negative effect of organizational slack on short–term performance would be less detrimental to independent firms as these entities have less constrained decision autonomy. Likewise, the positive association between organizational slack and long–term performance can be amplified for firms not affiliated with business groups. Since independent firms have greater decision-making rights over utilizing slack toward improving their operational effectiveness, they would have a greater capacity to use preserved extra resources to streamline current activities and ongoing projects that ultimately strengthen long–term performance.

Hypothesis

3a Business group affiliation will strengthen the negative relationship between organizational slack and short–term firm performance.

Hypothesis

3b Business group affiliation will weaken the positive relationship between organizational slack and long–term firm performance.

Family Firms

Family firms as a governance mode are widely observed (Globerman et al., 2011; Jiang & Peng, 2011; Xu & Hitt, 2020). When a substantial proportion of ownership is held by a particular family, the firm can be regarded as being led by that family. This ownership holding can influence managers’ decisions since family shareholders emphasize socioemotional wealth (Gomez-Mejia et al., 2011; Peng et al., 2018b). Firms managed by families rather than professional managers are more motivated to maintain, protect, and improve the family name as well as the firm’s reputation (Berrone et al., 2012). Hence, firms owned and managed by families care about their reputations and demonstrate reduced self–seeking tendencies. Xu and Hitt (2020) demonstrate that firms managed by families pay more attention to managing reputation, and this tendency significantly affects firm strategic decisions such as internationalization. Family firm managers may be more prone to utilize available resources to support, streamline, and enhance firm operations, particularly when they have considerable slack. For example, managers at a family firm may be subject to greater scrutiny as family shareholders can closely evaluate major firm decisions. Under this condition, managers will have greater motivation to use extra resources wisely. This may weaken the negative association between organizational slack and short–term firm performance. Following a similar logic, we suggest that managers of firms controlled by a family would be more committed to their work since both the managers and controlling family share a common origin. Liu et al. (2017) show that firms controlled by families demonstrate a higher investment in research and development when these firms have significant slack resources. Alessandri et al. (2018) find that although family firms tend to engage less in risky activities such as internationalization, this inclination is alleviated by organizational slack. Indeed, slack can be particularly useful in pursuing long–term goals for family–controlled firms. Thus, we contend that a strong sense of belonging due to such family connections would encourage managers to use slack more effectively in improving long–term performance.

Conversely, for non-family firms, the associations between organizational slack and short–term versus long–term firm performance would be different. Unlike family firms, non–family firms are led by professional managers. Despite their skills and experiences, these non–family firm managers may not be as strongly motivated to work as family firm managers. A lack of strong cognitive attachment to their firms can dissuade these managers from actively using slack toward enhancing firm operations. This may induce non–family managers to exhibit more self–seeking behaviors, particularly when enticed by considerable slack. At the same time, the relatively low psychological attachment of non–family managers may hinder firms’ operational efficiency. These managers may not make the best use of slack, but instead use such resources for non–productive or even personal purposes. Greater organizational slack can therefore lead to less satisfactory long–term performance.

Hypothesis

4a Family firms will weaken the negative relationship between organizational slack and short–term firm performance.

Hypothesis

4b Family firms will strengthen the positive relationship between organizational slack and long–term firm performance.

Methods

We test our predictions using a sample of publicly traded firms operating within Taiwan during the period from 2010 to 2016. Our data source is the Taiwan Economic Journal (TEJ), a credible business information provider akin to Compustat in North America. TEJ has been a reliable and prominent business information provider in Taiwan for several decades, and its data have been used widely among researchers (Chang et al., 2012; Chu, 2011; Schwarz et al., 2020). We focused on this period because formal institutions have increasingly improved during this time. After removing firms with incomplete information, we have a sample of 857 unique firms with 4,720 firm-year observations available for analysis.

Dependent variables

Our dependent variable is short–term versus long–term firm performance. Consistent with Peng et al. (2010) we measured firm short–term performance using return on assets (ROA). Following Ben-Oz and Greve (2015), we measured long–term performance using Tobin’s Q. ROA is a widely used indicator of firm operational outcomes (Iyer & Miller, 2008; Ju & Zhao, 2009), while Tobin’s Q determines long–term performance by capturing growth potential (Chrisman & Patel, 2012; Khanna & Palepu, 2000; Wang & Chen, 2010).

Independent and moderating variables

Our independent variable is organizational slack. In line with Peng et al. (2010), we measured this notion using two indicators: (1) (current assets – current liabilities) / total assets, and (2) debt / total assets (inversed). On the one hand, current assets are a resource that can be easily mobilized. The difference between current liabilities and current assets captures the extent of the net current assets that firms can readily use. On the other hand, the higher a firm’s debt ratio, the more obligations the firm must fulfill to its debt holders. This constrains a firm’s capacity to allocate resources toward achieving its goals. Exploratory factor analyses suggest that these two indicators were loaded on a single factor with satisfactory reliability (α = 0.71). We averaged these two indicators to measure organizational slack.

Aside from the main effect, we propose several boundary conditions that may alter the relationship between organizational slack and firm performance. Following Peng et al. (2007, 2010), one is CEO duality measured using a dichotomous variable (1 if a CEO also held the board chair position, and 0 otherwise). The other boundary condition is business group affiliation. Following Schwarz et al. (2020), business group was measured as a dummy variable taking the value of 1 if a focal firm was affiliated with a business group, and 0 otherwise. The other moderator family firm was measured as a binary variable (1 for firms managed by a family, and 0 otherwise). The TEJ researchers undertook great efforts to study both direct and indirect ownership of firms to determine whether or not the firms controlled by connected shareholders belong to the same group. In our data, approximately 62% of firms were affiliated with business groups and 51% were managed by families.

Control variables

Our models also included several control variables as per Peng et al. (2010). Firm size was included because larger firms may be more resourceful and therefore demonstrate better performance. In parallel, environmental munificence and environmental dynamism may be relevant because firms operating within more munificent environments may obtain additional external resources. Highly dynamic environments can create substantial challenges for firms in planning and preparing for the future. Firms operating within highly turbulent environments may accordingly have less satisfactory operational efficiency and effectiveness. Meanwhile, managers who have limited ownership also have reduced motivation to work toward firm goals (Jensen & Meckling, 1976). We thus added the variable of CEO ownership. Furthermore, a board with a higher proportion of outside directors may have a greater capacity for securing external resources (Pfeffer & Salancik, 1978). We accounted for this potential effect by using outside directors, a ratio variable capturing the proportion of outside directors appearing on a firm’s board during a given year. Finally, we included a battery of year and sector dummies to control for potential time and industry effects. Since there is no systematic standard industry code (SIC) in Taiwan, we instead used 34 industry dummies from the broad sectoral information available for firms listed on the stock market.

Analytic Models

Our sample firms were observed repeatedly during a period of time. For such a panel dataset either a random-effects or fixed-effects model can be considered. The fixed-effect model assumes that the firm effect is constant in contrast with the random-effects model. The Hausman test is significant, rejecting the null hypothesis that the coefficients of the random-effects and those of fixed-effects models are the same (χ2 = 162.61, p < 0.01). We consequently used the fixed-effects model for our estimations. We lagged all independent and control variables for one year, applying the “robust” command in Stata V14.1 to generate estimates for our models.

Results

Table 1 presents the descriptive statistics for the variables. Three observations emerge. First, organizational slack has a mean of 0.35 and SD of 0.71, suggesting that a reasonable distribution of organizational slack exists in our data. Second, bivariate correlations show that organizational slack is negatively related to ROA (γ = -0.02, p > 0.1) but positively related to Tobin’s Q (γ = 0.05, p < 0.05). This provides preliminary support for the argument that firms with extra resources may exhibit less satisfactory short–term performance but will exhibit improved long–term performance. Finally, organizational slack is positively related to CEO duality (γ = 0.06, p < 0.05), but negatively related to business group (γ = -0.07, p < 0.05). This implies that a CEO with the board chair title tends to preserve more slack resources than another CEO without. Alternatively, being affiliated with a business group can constrain a firm’s ability to accumulate such additional slack resources.

We present our estimation results in Tables 2 and 3. Table 2 examines ROA while Table 3 examines Tobin’s Q. Model 1 includes the control and moderating variables. From Models 2 to 5 we examine one predictor at a time. Model 6 is the full model. In all models, the highest variance inflation factor (VIFs) is 3.66, suggesting that multi-collinearity is not a major concern. According to Model 1 of Table 2 (the control-only model), both firms affiliated with business groups and larger firms would exhibit lower ROA. In contrast, firms with higher CEO ownership would demonstrate higher ROA.

Hypothesis 1a contends that organizational slack will be negatively related to short–term firm performance. In Model 2 of Table 2 we find that the estimate of organizational slack is negatively related to ROA (β = -0.35, p < 0.05). This estimate means that a one-standard-deviation increase of organizational slack will reduce firm ROA by 5.95%. Alternatively, Hypothesis 1b argues that organizational slack will be positively associated with long–term firm performance. Model 2 of Table 3 indicates that organizational slack is positively related to Tobin’s Q (β = 0.05, p < 0.01). This estimate suggests that a one-standard-deviation increase of organizational slack will enhance long–term firm performance by 3.25%. Hypothesis 1a and 1b are therefore supported.

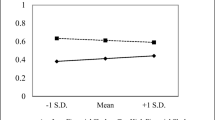

Hypothesis 2a predicts that CEO duality will strengthen the negative association between organizational slack and short–term firm performance. In Model 3 of Table 2, we find that the interaction of organizational slack and CEO duality is negative (β = -1.35, p < 0.01). This estimate suggests that CEO duality intensifies the negative association between organizational slack and firm ROA. We plot this effect in Fig. 1. While the slopes of organizational slack are negative for both the duality and non-duality groups, the slope of the duality group is steeper than that of the non-duality group. CEO duality is accordingly found to intensify the negative association between organizational slack and short–term firm performance, supporting Hypothesis 2a.

In contrast, Hypothesis 2b predicts that CEO duality will weaken the positive relationship between organizational slack and long–term firm performance. Model 3 in Table 3 indicates that the interaction between organizational slack and CEO duality is insignificant (β = -0.02, p > 0.1). Hypothesis 2b is therefore not supported.

Hypothesis 3a predicts that whether or not a firm is affiliated with a business group would strengthen the negative relationship between organizational slack and short–term performance. As shown in Model 4 of Table 2, the interaction of organizational slack and business group is negatively affecting ROA (β = -1.36, p < 0.01). We graphed this effect in Fig. 2. The slopes of organizational slack in affecting ROA are not identical across firms affiliated with a business group versus non-business-group firms. Specifically, Fig. 2 suggests that the slope of organizational slack in affecting firm ROA is more negative for firms affiliated with a business group than for firms without such an affiliation. Hypothesis 3a is accordingly supported.

Hypothesis 3b predicts that business group affiliation will weaken the positive relationship between organizational slack and long–term firm performance. In Model 4 of Table 3, we find that the interaction of organizational slack and business group bears a negative estimate (β = -0.10, p < 0.05) in affecting Tobin’s Q. This suggests that the positive association between organizational slack and Tobin’s Q is reduced for firms affiliated with business groups. According to Fig. 3, the set of business group firms exhibiting greater slack and resulting in lower performance is in contrast with the set of non-business-group firms where additional slack leads to higher performance. Hypothesis 3b is therefore supported.

Hypothesis 4a predicts that family firm association would weaken the negative relationship between organizational slack and short–term firm performance. In Model 5 of Table 2, we find that the interaction of organizational slack and family firm bears a positive and significant coefficient in predicting firm ROA (β = 1.39, p < 0.01). In Fig. 4 the slopes of organizational slack vary for family versus non-family firms, indicating that the presence of family controlling shareholders is a potent boundary condition altering the effect of organizational slack. Hypothesis 4a is therefore supported.

Finally, Hypothesis 4b predicts that being a family firm will strengthen the positive association between organizational slack and long–term firm performance. Model 5 in Table 3 shows that the interaction of organizational slack and family firm is positively significant in affecting Tobin’s Q (β = 0.34, p < 0.01). This pattern revealed in Fig. 5 shows that the slope of organizational slack is steeper for family versus non-family firms such that a family-controlled firm would demonstrate a more positive association between organizational slack and Tobin’s Q. Hypothesis 4b is consequently supported.

Discussion

How does organizational slack affect firm performance? Which boundary conditions moderate this proposed relationship? Peng et al. (2010) seminal work studied the above questions using a sample of firms based in China. While their findings substantially improve our knowledge regarding the relationship between organizational slack and firm performance, few subsequent studies replicate and expand these findings. Yet replications can substantially enhance scientific knowledge while making important contributions (Bettis et al., 2016; Hubbard et al., 1998; Singh et al., 2003; Tsang & Kwan, 1999). In this study, we seek to verify the key findings by Peng et al. (2010) using a less investigated economy within Asia—Taiwan. Specifically, we differentiate between short–term versus long–term firm performance. We furthermore examine several boundary conditions under which the effect of organizational slack would be altered. Amassing a sample of publicly traded firms based in Taiwan, we find that organizational slack impedes short–term performance but enhances long–term performance. Furthermore, the slack–performance relationship is contingent on certain boundary conditions including CEO duality, business groups, and family firms.

Our findings contribute to the literature in three ways. First, we demonstrate that it is important to replicate earlier studies to advance our knowledge of research topics. Empirical studies are crucial in furthering scientific knowledge. Many well-accepted frameworks are developed, yet the insights from these frameworks may not always hold since each empirical investigation has its boundaries and limitations. Thus, replications are needed to verify if our knowledge is contingent on or constrained by particular contextual factors such as time, industry, or other unobserved elements. In the management literature, researchers have begun to welcome and appreciate the value of replication (Bettis et al., 2016; Hubbard et al., 1998; Tsang & Kwan, 1999). As Hubbard et al. (1998) suggest, replications with extensions helps “go further by determining the scope and limits of initial findings” (p. 244). Nevertheless, studies specifically designed to replicate previous research are less common in Asia-based research to the best of our knowledge. In this study, we focus on the issue of organizational slack while leveraging Peng et al. (2010) to replicate their findings. Research on organizational slack continues to be vibrant as seen in the Appendix. The findings generated by recent research create significant room for scholars to further verify, refine, and explore this research stream. We hope that our study can spur additional research conversation within Asia as well as scholarly dialogue across continents in the form of replications.

Second, we show that it is crucial to differentiate between short–term and long–term firm performance in investigating the slack–performance relationship. The effect of organizational slack on firms has been debated among researchers, yet studies predominantly focus on short–term performance (e.g., ROA) (Peng et al., 2010). Whether slack can have a similar or different impact on long–term firm performance remains unverified. As an effort to reconcile this opposing view, our study examines both short– and long–term performance. We find that while organizational slack can hinder short–term performance, it can improve performance over the longer term. These differential impacts of organizational slack on firm performance are worth noting. According to the institution–based view (Elango & Dhandapani, 2020; Meyer & Peng, 2016; Peng et al., 2009), formal institutions can be improved, updated, and strengthened over time. Recent research asserts that governments can undertake reforms that make formal institutions more effective such as property rights, legal systems, and governance arrangements (Cuervo-Cazurra et al., 2019). We find that slack can enhance long–term firm performance, suggesting that slack allows firms to achieve expanded adaptation capacity within changing operating contexts. Indeed, when “rules of the game” are revised and modified, then firms must adjust their strategies and activities to maintain alignment (Tan & Peng, 2003). Having additional resources above the minimum level can ease these adjustments, helping firms better realize the value of slack. Thus, firms not preserving extra resources beyond their operating requirements can experience greater challenges when institutions are changing. From this view, the performance–enhancing effect of slack is closely intertwined with the institutional logic.

In contrast, the negative association between organizational slack and short–term performance implies that slack can obstruct rather than aid firms’ efforts in realizing the value of existing resources. The agency motive is particularly pertinent in this finding. Despite their qualifications and experiences, managers may have private intents. If this motive becomes salient and dominates, then organizational slack can be used to enhance managers’ personal welfare. This is particularly possible within emerging economies since these countries have not yet established sound formal institutions (Globerman et al., 2011). Managers can have a higher self–seeking tendency toward pursuing personal gains at the expense of organizational welfare in the absence of effective systems for monitoring managerial behaviors.

Finally, we find that business groups and family firms are novel contextual factors in the slack–performance relationship. Peng et al. (2010) investigate whether a firm is state– or private–owned as a contingency. Since privatization is undertaken by many emerging economies (Makhija, 2003; Syu, 1995), this distinction between state ownership and private ownership may diminish. Nevertheless, within the broad category of private sector, firms can have different majority shareholders. Although scholars have noted that business groups and families can hold substantial firm ownership, research on slack rarely investigates whether or not the two types of controlling shareholders affect firms’ utilization of extra resources in shaping performance. By recognizing these two types of shareholders, we show that business group and family shareholders can shape firms’ tendencies to use slack differently. Business group affiliations may exacerbate the downside of organizational slack on short–term versus long–term firm performance to the extent that business group shareholders emphasize the sharing of economic resources across firms. In contrast, family shareholders can encourage managers to show greater concern for both reputation and the pursuit of long–term goals. Such an orientation can induce managers to make better use of available resources, magnifying the positive effects of slack. Together, the distinctive orientations of these two controlling shareholders add to the research on slack by suggesting that managers are not the sole actors affecting the use of extra resources. Hence, it is imperative to move beyond managers by considering other controlling shareholders in seeking a more complete understanding of slack on firm performance.

Limitations and avenues for future research

Our study has several limitations that provide avenues for future refinement. First, we rely on archival data to examine how organizational slack affects firm performance. While this allows us to address our research question, it does not fully illuminate insights regarding how managers accumulate and utilize slack. In our literature review (please see the Appendix), we find no recent studies that draw on qualitative methods to investigate organizational slack. Hence, we encourage researchers to apply other methods such as questionnaires and case studies in future endeavors. In his interviews with managers, Bowen (2002) finds that despite the benefits such as facilitating workflow and resolving conflicts, slack can also provoke more political behaviors within a firm, prompting managers to become complacent regarding the status quo. By employing case studies, Richtner et al. (2014) observe that slack can engender a higher level of socialization for organizational members, guiding individuals to internalize organizational goals while facilitating new product development. We welcome researchers to apply these methods to enhance our knowledge of slack.

Second, in elucidating the effect of slack on short–term firm performance we draw on agency theory to predict whether top managers would demonstrate value–creating versus value–destroying behaviors. Some other theories can also be relevant. One plausible perspective is organizational learning (Li et al., 2014; Pu & Soh, 2018), since firms cannot utilize resources to their fullest potential without a gradual process to build and improve on internal procedures. Yet how such a process operates via slack utilization remains unclear in the current literature. Moreover, the process by which slack affects firm operations can be further examined. Do managers use extra resources to streamline internal resource allocation? Do managers instead mobilize additional resources to build and strengthen government relationships? Does the presence of slack yield greater benefits on exploration or exploitation? These questions are important inquiries for researchers to pursue.

Finally, our findings are based on a sample of firms operating within Taiwan. According to the institution–based view, both formal and informal institutions matter (Peng et al., 2009, 2018a, b). Following this insight, there are several avenues that scholars can further investigate. One is institutional development, denoting the extent to which a country has efficient market mechanisms supporting economic exchanges within the labor, product, and finance areas. Existing studies have shown that institutional environments can affect subsidiaries’ performance (Chan et al., 2008). Nevertheless, more developed institutional environments can also create greater challenges for firms to maintain superior performance over time (Hermelo & Vassolo, 2010). It would be interesting to know whether local institutions may help or hinder a firm’s use of slack. The other possible variable is pro–market reforms, referring to a country’s efforts in improving and strengthening main factor markets and public services (Banalieva et al., 2018; Cuervo-Cazurra & Dau, 2009; Weng et al., 2021). Recent studies maintain that governments can establish and mobilize policies that make a country’s key markets more or less efficient (Dau, 2013). Unlike most institutional change that is gradual and incremental, reforms are more substantial and can directly affect firm performance. It would be exciting to learn how firms utilize slack to operate in this era of reforms.

Regarding informal institutions we believe that (1) government corruption and (2) family business legitimacy would also be pertinent. The government corruption issue—the extent to which government officials misuse their authority to ask for extra payment from individuals and firms—has been observed in the global market (Rodriguez et al., 2005; Lee & Weng, 2013) and Asia (Lee & Hong, 2012). When corruption is salient, officials may feel that it is acceptable or even well–justified to use their power to improve their personal welfare. While the government corruption issue has been under control, the corruption norm can affect how managers may (mis)use firm resources in achieving their personal goals. Similarly, family business legitimacy that describes the extent to which family business ownership is widely accepted within a country is also promising. To operate within the business world firms must establish legitimate images (Zimmerman & Zeitz, 2002). In a recent meta–analysis study, Berrone et al. (2020) introduce the notion of family business legitimacy. Researchers can draw on the insight of Berrone et al. (2020) in advancing our knowledge of family firms and their use of slack.

Conclusion

Organizational slack has been an important topic in the management literature. Among numerous studies, Peng et al. (2010) is a prominent work examining the slack–performance relationship. Yet limited studies build on Peng et al. (2010) to improve our knowledge regarding how slack affects firm performance. Our study replicates the core findings by Peng et al. (2010) using a more novel and recent dataset of firms from another economy operating within Asia. We not only differentiate between short–term and long–term firm performance, but also investigate the contingencies through which the slack–performance association would be altered. Our results suggest that the core findings by Peng et al. (2010) are credible and reliable. The impact of organizational slack also diverges depending on whether firm performance is relatively short– versus long–term. Critical boundary conditions including CEO duality, business groups, and family firms operate to moderate the effect of organizational slack on firm performance. These findings not only suggest the relevance of conducting replications to confirm scholars’ findings, but also indicate the importance of uncovering novel contextual variables. We hope our study can spur further research applying the replication approach to better understand Asian firms’ strategies, corporate governance, and performance.

References

Aguilera, R. V., & Jackson, G. (2010). Comparative and international corporate governance. The Academy of Management Annals, 4(1), 485–556.

Alessandri, T. M., Cerrato, D., & Eddleston, K. A. (2018). The mixed gamble of internationalization in family and nonfamily firms: The moderating role of organizational slack. Global Strategy Journal, 8(1), 46–72.

Amihud, Y., & Lev, B. (1981). Risk reduction as a managerial motive for conglomerate mergers. Bell Journal of Economics, 12(2), 605–617.

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. Journal of Finance, 58(3), 1301–1328.

Banalieva, E. R., Cuervo-Cazurra, A., & Sarathy, R. (2018). Dynamics of pro-market institutions and firm performance. Journal of International Business Studies, 49(7), 858–880.

Bae, K. H., Kang, J. K., & Kim, J. M. (2002). Tunneling or value added? Evidence from mergers by Korean business groups. Journal of Finance, 57(6), 2695–2740.

Ben-Oz, C., & Greve, H. R. (2015). Short– and long–term performance feedback and absorptive capacity. Journal of Management, 41(7), 1827–1853.

Berrone, P., Cruz, C., & Gomez-Mejia, L. R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review, 25(3), 258–279.

Berrone, P. B., Duran, P., Gomez-Mejia, L., Heugens, P. P. M. A. R., Kostova, T., & van Essen, M. (2020). Impact of informal institutions on the prevalence, strategy, and performance: A meta-analysis. Journal of International Business Studies, forthcoming.

Bertrand, B., Mehta, M., & Mullainathan, S. (2002). Ferreting out tunnels: An application to Indian business groups. Quarterly Journal of Economics, 117(1), 121–148.

Bettis, R. A., Helfat, C. E., & Shaver, J. M. (2016). The necessity, logic, and forms of replication. Strategic Management Journal, 37(11), 2193–2203.

Bourgeois, L. J. (1981). On the measurement of organizational slack. Academy of Management Review, 6(1), 29–39.

Bowen, F. E. (2002). Does size matter? Organizational slack and visibility as alternative explanations for environmental responsiveness. Business and Society, 41(1), 118–124.

Bowen, H. P., & Wiersema, M. F. (2005). Foreign–based competition and corporate diversification strategy. Strategic Management Journal, 26(12), 1153–1171.

Boyd, B. K. (1995). CEO duality and firm performance: A contingency model. Strategic Management Journal, 16(4), 301–312.

Bradley, S. W., Shepherd, D. A., & Wiklund, J. (2011). The importance of slack for new organizations facing ‘tough’ environments. Journal of Management Studies, 48(5), 1071–1097.

Carney, M., Gedajlovic, E. R., van Essen, P. P. M. A. R., & van Oosterhout, J. (2011). Business group affiliation, performance, context, and strategy: A meta-analysis. Academy of Management Journal, 54(3), 437–460.

Carpenter, M. A., & Westphal, J. D. (2001). The strategic context of external network ties: Examining the impact of director appointments on board involvement in strategic decision making. Academy of Management Journal, 44(4), 649–660.

Chacar, A., Newburry, W., & Vissa, B. (2010). Bringing institutions into performance persistence research: Exploring the impact of product, financial, and labor market institutions. Journal of International Business Studies, 41(7), 1119–1140.

Chan, C. M., Isobe, T., & Makino, S. (2008). Which country matters? Institutional development and foreign affiliate performance. Strategic Management Journal, 29(11), 1179–1205.

Chang, S. J., & Hong, J. (2000). Economic performance of group–affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Academy of Management Journal, 43(3), 429–448.

Chang, S. J., Chung, C. N., & Mahmood, I. P. (2006). When and how does business group affiliation promote firm innovation? A tale of two emerging economies. Organization Science, 17(5), 637–656.

Chang, Y. Y., Gong, Y., & Peng, M. W. (2012). Expatriate knowledge transfer, subsidiary absorptive capacity, and subsidiary performance. Academy of Management Journal, 55(4), 927–948.

Chen, C. N., & Chu, W. (2012). Diversification, resource concentration, and business group performance: Evidence from Taiwan. Asia Pacific Journal of Management, 29(4), 1045–1061.

Chen, J., Zhang, Z., & Jia, M. (2021). How CEO narcissism affects corporate responsibility choice? Asia Pacific Journal of Management, 38(3), 897–924.

Chiu, Y. C., & Liaw, Y. C. (2009). Organizational slack: Is more or less better? Journal of Organizational Change Management, 22(3), 321–342.

Chrisman, J. J., & Patel, P. C. (2012). Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. Academy of Management Journal, 55(4), 976–997.

Chu, W. (2011). Family ownership and firm performance: Influence of family management, family control, and firm size. Asia Pacific Journal of Management, 28(4), 833–851.

Claessens, S., Djankov, S., & Lang, L. H. P. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58(1–2), 81–112.

Cuervo-Cazurra, A., & Dau, L. A. (2009). Promarket reforms and firm profitability in developing countries. Academy of Management Journal, 52(6), 1348–1368.

Cuervo-Cazurra, A., Gaur, A., & Singh, D. (2019). Pro-market institutions and global strategy: The pendulum of pro-market reforms and reversals. Journal of International Business Studies, 50(4), 598–632.

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm. Prentice Hall.

Daniel, F., Lohrke, F. T., Fornaciar, C. J., & Turner, R. A. (2004). Slack resources and firm performance: A meta-analysis. Journal of Business Research, 57(6), 565–574.

Dau, L. A. (2013). Learning across geographic space: Pro-market reforms, multinationalization strategy, and profitability. Journal of International Business Studies, 44(3), 235–262.

Dau, L. A., Morck, R., & Yeung, B. Y. (2021). Business groups and the study of international business: A Coasean synthesis and extension. Journal of International Business Studies, 52(2), 161–211.

Doh, J. P., Rodriguez, S. S. B., Saka-Helmhout, A., & Makhija, M. (2017). International business responses to institutional voids. Journal of International Business Studies, 48(3), 293–307.

Duran, P., van Essen, M., Heugens, P. M. A. R., Kostova, T., & Peng, M. W. (2019). The impact of institutions on the competitive advantage of publicly-listed family firms in emerging markets. Global Strategy Journal, 9(2), 243–274.

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57–74.

Elango, B., & Dhandapani, K. (2020). Does institutional industry context matter to performance? An extension of the institution-based view. Journal of Business Research, 115, 139–148.

Fry, L., & Smith, D. A. (1987). Congruency, continency, and theory building. Academy of Management Review, 12(1), 117–132.

Gentry, R., Dibrell, C., & Kim, J. (2016). Long–term orientation in publicly traded family businesses: Evidence of a dominant logic. Entrepreneurship Theory and Practice, 40(4), 733–757.

George, G. (2005). Slack resources and the performance of privately held firms. Academy of Management, 48(4), 661–676.

Globerman, S., Peng, M. W., & Shapiro, D. M. (2011). Corporate governance and Asian companies. Asia Pacific Journal of Management, 28(1), 1–14.

Gomez-Mejia, L. R., Cruz, C., Berrone, P., & De Castro, J. (2011). The bind that ties: Socioemotional wealth preservation in family firms. Academy of Management Annals, 5(1), 653–707.

Guillén, M. F. (2000). Business groups in emerging economies: A resource–based view. Academy of Management Journal, 43(3), 362–380.

Hermelo, F. D., & Vassolo, R. (2010). Institutional development and hypercompetition in emerging economies. Strategic Management Journal, 31(13), 1457–1473.

Hubbard, R., Vetter, D. E., & Little, E. L. (1998). Replication in strategic management: Scientific testing for validity, generalizability, and usefulness. Strategic Management Journal, 19(3), 243–254.

Iyer, D. H., & Miller, K. D. (2008). Performance feedback, slack, and the timing of acquisitions. Academy of Management Journal, 51(4), 808–822.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jiang, Y., & Peng, P. W. (2011). Are family ownership and control in large firms good, bad, or irrelevant? Asia Pacific Journal of Management, 28(1), 15–39.

Ju, M., & Zhao, H. (2009). Behind organizational slack and firm performance in China: The moderating roles of ownership and competitive intensity. Asia Pacific Journal of Management, 26(4), 701–717.

Katics, M. M., & Petersen, B. C. (1994). The effect of rising import competition on market power: A panel data study of U.S. manufacturing. Journal of Industrial Economics, 42(3), 277–286.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–51.

Khanna, T., & Palepu, K. (2000). The future of business groups in emerging markets: Long–run evidence from Chile. Academy of Management Journal, 43(3), 268–285.

Khanna, T., & Rivkin, J. W. (2001). Estimating the performance effects of business groups in emerging markets. Strategic Management Journal, 22(1), 45–74.

Kim, C., & Bettis, R. A. (2014). Cash is surprisingly valuable as a strategic asset. Strategic Management Journal, 35(13), 2053–2063.

Kim, K. H., Al-Shammari, H., Kim, A., B., & Lee, S. H. (2009). CEO duality leadership and corporate diversification behavior. Journal of Business Research, 62(11), 1173–1180.

Kovach, J. J., Hora, M., Manikas, A., & Patel, P. C. (2015). Firm performance in dynamic environments: The role of operational slack and operational scope. Journal of Operational Management, 37(1), 1–12.

Krause, R., Semadeni, M., & Cannella, A. A. Jr. (2014). CEO duality: A review and research agenda. Journal of Management, 40(1), 256–286.

Lawson, M. B. (2001). In praise of slack: Time is of the essence. Academy of Management Perspectives, 15(3), 125–135.

Lee, S. H., & Hong, S. (2012). Corruption and subsidiary profitability: US MNC subsidiary in the Asia Pacific region. Asia Pacific Journal of Management, 29(4), 949–964.

Lee, S. H., & Weng, D. H. (2013). Does bribery in the home country promote or dampen firm exports? Strategic Management Journal, 34(12), 1472–1487.

Lefebvre, V. (2021). A bird in the hand is better than two in the bush: Investigating the relationship between financial slack and profitability in business groups. Business Research Quarterly, forthcoming.

Li, J., & Qian, C. (2013). Principal-principal conflicts under weak institutions: A study of corporate takeovers in China. Strategic Management Journal, 34(4), 498–508.

Li, Y., Chen, H., Liu, Y., & Peng, M. W. (2014). Managerial ties, organizational learning, and opportunity capture: A social capital perspective. Asia Pacific Journal of Management, 31(1), 271–291.

Liu, Y., Chen, Y. J., & Wang, L. C. (2017). Family business, innovation and organizational slack in Taiwan. Asia Pacific Journal of Management, 34(1), 193–213.

Ma, X., Yao, X., & Xi, Y. (2006). Business group affiliation and firm performance in a transition economy: A focus on ownership voids. Asia Pacific Journal of Management, 23(4), 467–483.

Majumdar, S. K., & Bhattacharjee, A. (2014). Firms, markets, and the state: Institutional change and manufacturing sector profitability variances in India. Organization Science, 25(2), 509–528.

Makhija, M. (2003). Comparing the resource–based and market–based views of the firm: Empirical evidence from Czech privatization. Strategic Management Journal, 24(5), 433–451.

McDonald, M. L., Westphal, J. D., & Graebner, M. E. (2008). What do they know? The effects of outside director acquisition experience on firm acquisition performance. Strategic Management Journal, 29(11), 1155–1177.

Mosakowski, E., & Earley, P. C. (2000). A selective review of time in strategy research. Academy of Management Review, 25(4), 796–812.

Meyer, K. E., & Peng, M. W. (2016). Theoretical foundations of emerging economy business research. Journal of International Business Studies, 47(1), 3–22.

Nohria, N., & Gulati, R. (1996). Is slack good or bad for innovation? Academy of Management Journal, 39(5), 1245–1264.

Peng, M. W., Lebedev, S., Vlas, C. O., Wang, J. C., & Shay, J. S. (2018a). The growth of the firm in (and out of) emerging economies. Asia Pacific Journal of Management, 35(4), 829–857.

Peng, M. W., Li, Y. L., Xie, E., & Su, Z. (2010). CEO duality, organizational slack, and firm performance in China. Asia Pacific Journal of Management, 27(4), 611–624.

Peng, M. W., Sun, S. L., Pinkham, B. C., & Chen, H. (2009). The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives, 23(3), 63–81.

Peng, M. W., Sun, W., Vlas, C., Minichilli, A., & Corbetta, G. (2018b). An institution–based view of large family firms: A recap and overview. Entrepreneurship Theory and Practice, 42(2), 187–205.

Peng, M. W., Zhang, S., & Li, X. (2007). CEO duality and firm performance during China’s institutional transitions. Management and Organization Review, 3(2), 205–225.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. New York: Harper & Row.

Pi, L., & Lowe, J. (2011). Can a powerful CEO avoid involuntary replacement? An empirical study from China. Asia Pacific Journal of Management, 28(4), 775–805.

Pu, M., & Soh, P. H. (2018). The role of dual embeddedness and organizational learning in subsidiary development. Asia Pacific Journal of Management, 35(2), 373–397.

Richtner, A., Ahlstrom, A., & Goffin, K. (2014). “Squeezing R&D”: A study of organizational slack and knowledge creation in NPD, using the SECI model. Journal of Product Innovation Management, 31(6), 1268–1290.

Rodriguez, P., Uhlenbruck, K., & Eden, L. (2005). Governance corruption and the entry strategies of multinationals. Academy of Management Review, 30(2), 383–396.

Schwarz, G., Yang, K. P., Chou, C., & Chiu, Y. J. (2020). A classification of structural inertia: Variations in structural response. Asia Pacific Journal of Management, 37(1), 33–63.

Scott, W. R. (2014). Institutions and organizations: Ideas, interests, and identities. London: Sage.

Seo, J., Gamache, D. L., Devers, C. E., & Carpenter, M. A. (2015). The role of CEO relative standing in acquisition behavior and CEO pay. Strategic Management Journal, 36(12), 1877–1894.

Singh, J. V. (1986). Performance, slack, and risk taking in organizational decision making. Academy of Management Journal, 29(3), 562–585.

Singh, K., Ang, S. H., & Long, S. M. (2003). Increasing replication for knowledge accumulation in strategy research. Journal of Management, 29(4), 533–549.

Singh, K., Mahmood, I. P., & Natarajan, S. (2017). Capital market development and firm restructuring during an economic shock. Organization Science, 28(3), 552–573.

Stan, C. V., Peng, M. W., & Bruton, G. D. (2014). Slack and the performance of state–owned enterprises. Asia Pacific Journal of Management, 31(2), 473–495.

Su, Z., Xie, E., & Li, Y. (2009). Organizational slack and firm performance during institutional transitions. Asia Pacific Journal of Management, 26(1), 75–91.

Su, Y., Xu, D., & Phan, P. H. (2008). Principal-principal conflict in the governance of the Chinese public corporation. Management and Organization Review, 4(1), 17–38.

Syu, A. (1995). From economic miracle to privatization success: Initial stages of the privatization of process in two SOEs on Taiwan. Philadelphia: University Press of America, Carmelite Monastery.

Tan, J., & Peng, M. W. (2003). Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strategic Management Journal, 24(13), 1249–1263.

Thompson, J. D. (1967). Organizations in action. New York: McGraw-Hill.

Tsang, E. W. K., & Kwan, K. M. (1999). Replication and theory development in organizational science: A critical realist perspective. Academy of Management Review, 24(1), 759–780.

Vanacker, T., Collewaert, V., & Zahra, S. A. (2017). Slack resources, firm performance, and the institutional context: Evidence from privately held European firms. Strategic Management Journal, 38(6), 1305–1326.

Wang, H., & Chen, W. R. (2010). Is firm-specific innovation associated with greater value appropriation? The roles of environmental dynamism and technological diversity. Research Policy, 39(1), 141–154.

Wefald, A. J., Katz, J. P., Downey, R. G., & Rust, K. G. (2010). Organization slack, firm performance, and the role of industry. Journal of Management Issues, 22(1), 70–87.

Weng, D. H., Lee, S. H., & Yamakawa, Y. (2021). Time to change lanes: How pro-market reforms affect informal ventures’ formalization speed. Global Strategy Journal, 11(4), 767–795.

Whetten, D. A. (1989). What constitutes a theoretical contribution? Academy of Management Review, 14(4), 490–495.

Xu, K., & Hitt, M. A. (2020). The international expansion of family firms: The moderating role of internal financial slack and external capital availability. Asia Pacific Journal of Management, 37(1), 127–153.

Yang, K. P., & Schwarz, G. M. (2016). A multilevel analysis of the performance implications of excess control in business groups. Organization Science, 27(5), 1219–1236.

Yermack, D. (2006). Flights of fancy: Corporate jets, CEO perquisites, and inferior shareholder returns. Journal of Financial Economics, 80(1), 211–242.

Yiu, D. W., Lu, Y., Bruton, G. D., & Hoskisson, R. E. (2007). Business groups: An integrated model to focus future research. Journal of Management Studies, 44(8), 1551–1579.

Young, M. N., Peng, M. W., Ahlstrom, D., Bruton, G. D., & Jiang, Y. (2008). Corporate governance in emerging economies: A review of the principal-principal perspective. Journal of Management Studies, 45(1), 196–220.

Zimmerman, M. A., & Zeitz, G. J. (2002). Beyond survival: Achieving new venture growth by building legitimacy. Academy of Management Review, 27(3), 414–431.

Acknowledgements

The authors would like to thank the Consulting Editor and reviewer for their constructive feedback, as well as California State University Fullerton (Project number: 0356621) and Taiwan’s Ministry of Science and Technology (MOST 107-2410-H-259-054-MY2) for financial support.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Recent Research on Organizational Slack (2010–2021)

Authors | Year | Journal | Context | Major Findings |

|---|---|---|---|---|

Ahsan et al. | 2020 | MOR | EE | Financial slack does not affect firm internationalization. |

Arrfelt et al. | 2013 | AMJ | DE | Slack moderates the relationship between firm performance aspiration and investment. |

Bentley and Kehoe | 2020 | AMJ | DE | Human resource slack is more positively related to performance in firms embracing strategic change, and this relationship is strengthened by financial slack. |

Bradley et al. | 2011 | JBV | DE | Resource slack can stimulate growth but hamper the entrepreneurial tendency. |

Bradley et al. | 2011 | JMS | DE | While slack improves ventures’ adaptation, this effect holds only in a low discretion environment. |

Breton-Miller and Miller | 2015 | ETP | NA | Family firms would be more committed to building and maintaining slack resources than non-family firms. |

Buckley et al. | 2018 | JIBS | EE | Organizational slack reduces firms’ tendencies to invest in risky foreign markets. |

Cabral et al. | 2021 | SEJ | DE | Financial slack amplifies the positive effect of antitakeover protection on firms’ corporate venture capital programs. |

Chakrabarti | 2015 | SMJ | EE | Financial slack can ameliorate the effect of economic shock on growth configuration and firm performance. |

Chen et al. | 2012 | RP | EE | Slack weakens the S-shaped relationship between R&D internationalization and innovation performance. |

Chiu and Sharfman | 2011 | JOM | DE | Organizational slack enhances corporate social performance. |