Abstract

We study how state and market logics, which operate both internal and external to the firm, jointly influence firm strategy. In the context of the Chinese financial intermediary industry, we argue that the level of state ownership in a firm has an inverted U-shaped relationship with the firm’s financial portfolio diversification. This is because firms prioritize financial investment options that serve the dominant logic. As a result, their financial portfolios are more diversified when the multiple logics are balanced than when either logic dominates. This relationship is attenuated by the prevalence of market logic in the regional institutional environment and amplified by industry regulation aimed at correcting market failure. We test these arguments using panel data of Chinese trust companies during a period of de-regulation and re-regulation and find empirical support for the moderated curvilinear effect of state ownership. Our findings demonstrate the relevance of the institutional logics to analyzing firms in contemporary China and highlight how institutional logics at multiple levels jointly shape corporate strategy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Institutional logics underpin the appropriateness of organizational practices and thus guide organizational decision making (Greenwood, Raynard, Kodeih, Micelotta and Lounsbury, 2011; Thornton and Ocasio, 1999). Extensive research has investigated how organizations are influenced by, and respond to, multiple and potentially conflicting institutional logics – a situation referred to as institutional complexity (Besharov and Smith, 2014; Greenwood, Díaz, Li and Lorente, 2010; Pacheco, York, Dean and Sarasvathy, 2010). These studies primarily examine institutional complexity at a single level of the organizational environment (Bullough, Renko and Abdelzaher, 2017; Lee and Lounsbury, 2015), either within (e.g. Besharov & Smith, 2014) or external to the firm (e.g. Greenwood et al., 2010). Less explored is institutional complexity from multiple logics operating at various levels of the organizational environment.

However, institutional transition in emerging economies often results in the co-existence of state and market logics at different levels of their environment. Governments may promote market-oriented reforms (Hu and Sun, 2019) while at the same time maintaining strategic control over key economic infrastructure with cascading effects on economic actors through regulatory intervention (Klein, Mahoney, McGahan and Pitelis, 2013; Okhmatovskiy, 2010) or ownership (Mutlu, Essen, Peng, Saleh and Duran, 2018; Sun, Deng and Wright, 2020; Tihanyi et al., 2019). This, together with the uneven development of market institutions across subnational regions (Banalieva, Eddleston and Zellweger, 2015; Shi, Sun and Peng, 2012), has led to varying influence of state and market logics at the firm, regional and industry levels. Yet, we know little about how firms develop strategies in response to such multiple institutional logics operating at these different levels of their environment.

This study investigates firms’ strategies under state and market logics both internal and external to firms. The financial intermediary sector of China serves as an ideal context to study conflicting institutional logics. Key strategic decisions of financial intermediaries concern their financial portfolio diversification, which reflect the accumulation of investment decisions. Each investment decision depends on the firms’ risk and return considerations, which in turn depend on the firm’s ability to access and assess resources of investment targets, as well as the firm’s objectives and governance structures. These resourcing and governance mechanisms however vary under state and market logics introduced in particular by different types of owners. (Hu, Cui and Aulakh, 2019; Kohli, 2004; Musacchio and Lazzarini, 2014). However, this ownership effect is contingent on external variations of the dominant logic across regional (Banalieva et al., 2015; Shi et al., 2012; Sun, Qu and Liao, 2018) and industrial (Nee and Opper, 2007) domains. Thus, our study explicates the influence of state and market logics, manifested through ownership, regional marketization, and industry regulation, on corporate strategy.

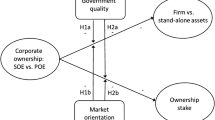

Applying institutional logics to the context of Chinese financial intermediary sector, we argue that the resourcing and governance mechanisms associated with different types of owners result in a non-linear relationship between state ownership and financial portfolio diversification of financial intermediary firms. This is because dominant state (non-state) ownership supports an investment strategy that prioritizes investment options aligned with the state (market) logic, whereas a diversified investment strategy utilizing a broader range of investment options allows firms to balance state and market logics. However, these resourcing and governance mechanisms are embedded in, and hence moderated by, the external institutional environment. Specifically, the market logic is promoted through pro-market reform at the regional level (Banalieva et al., 2015; Shi, Sun, Yan and Zhu, 2017) whereas the state logic is introduced through industry regulation (Aghion, 2011; Kohli, 2004; Nee & Opper, 2007).

Together, these effects create institutional variations across regions and time that alter the relative salience of market vis-à-vis state logic, thereby moderating the non-linear relationship between state ownership and portfolio diversification of financial intermediary firms. The relationship is more pronounced when market institutions are less developed in the firm’s home region, and when the industry more regulated. Empirically, we analyze panel data of the population of Chinese trust firms, a financial intermediary industry that experienced de-regulation and re-regulation in recent years. We find substantial support for the moderated non-linear relationship as hypothesized.

This study contributes novel and contextualized insights to the institutional logics literature in three ways. First, we enrich the understanding of institutional complexity by recognizing the coexistence of the state and market logics, and their joint influence on corporate strategy. Second, we highlight the multi-faced role of the state during an institutional transition. The seemingly contradicting efforts of the state to promote and constrain market coordination of the economy, through pro-market reform and market constraining regulations respectively, can lead to institutional variations across regions and time. Given the complex interfaces of market and state logics in many Asian economies, this theoretical insight is of great relevance to Asian management research. Our findings suggest that institutions external to the firm moderate the effect of state ownership on corporate strategy. Third, this study contributes new empirical evidence on investment strategies of the financial intermediary industry, a sector under regulatory spotlight in many countries.

Theoretical background and research hypotheses

Multiple institutional logics

Institutional logics are sets of principles that guide organizations on “how to interpret organizational reality, what constitutes appropriate behavior, and how to succeed” in social situations (Thornton, 2004: 70). Firms abide by institutional logics because those logics help them to comprehend the social world that they are embedded in and thus allow firms to perform within the world (Greenwood et al., 2011; Yiu, Hoskisson, Bruton and Lu, 2014; Zhang and Luo, 2013). It is common for firms to confront multiple institutional logics that may not be compatible with each other (Lee & Lounsbury, 2015; Luo, Jeong and Chung, 2019; Thornton & Ocasio, 1999). Yet, the coexistence of different logics potentially creates tensions for those firms (Besharov & Smith, 2014; Greenwood et al., 2011; Pacheco et al., 2010).

Firms are often exposed to multiple institutional logics during institutional transition, when different rules governing the behaviors of economic actors evolve continuously but do not replace one another overnight (Meyer and Peng, 2016; Peng, 2003). As institutional transition progresses, the previously dominant state logic evolves and is manifested in diverse ways. Meanwhile, the market logic is promoted through pro-market reforms and becomes increasingly influential for firms’ strategic behaviors (Kim, Kim and Hoskisson, 2010). As a result, the state and market logics not only co-exist, but are also manifested at various levels, internal and external to firms.

The logic of the state is not static but evolves with the process of institutional transition. In the Chinese context, for example, Greve and Zhang (2017) observe that, on the one hand, the state retains its socialism logic of maintaining state control of the economy to promote social welfare and economic stability; on the other hand, the state employs market-based mechanisms to drive economic efficiency. Accordingly, the state logic is manifested both inside and outside organizations.

The first type of state logic legitimizes the melding of the state’s political power with capitalist tools to promote economic development (Nee & Opper, 2007; Witt and Redding, 2014). This logic is reflected in direct commercial economic activities by the state through the means such as state-owned enterprises (SOEs), corporatized government agencies, public-private partnerships, hybrid ownership enterprises, and sovereign wealth funds (Bremmer, 2009; Wood and Wright, 2015). Prior studies have investigated state logic within organizations, manifested in the varieties of SOEs (Li, Cui and Lu, 2014; Musacchio, Lazzarini and Aguilera, 2015). Essentially, the level of state ownership indicates the dominance of state logic within firms, influencing firms’ resources and behaviors (Peng and Delios, 2006).

The second type of state logic centers on the state’s “regulation of individual or organizational activities using a command-and-control framework based on law and bureaucratic hierarchy” (Lee & Lounsbury, 2015: 852). This logic is manifested at the industry level in the form of industry regulations which are imposed by the state to address actual or perceived imperfections in markets, and thus to correct market outcomes that are considered undesirable from a societal perspective (Hoskisson and Hitt, 1990; Jones and Hill, 1988). Such industry regulations emphasize policy goals of the government (Luo, Xue and Han, 2010) and may reduce the scope of possible organizational actions in favor of compliance behaviors.

Distinct from state logics, the market logic prescribes “a core set of ideas, practices, and policy prescriptions that protect the liberty of individuals to pursue their economic interests and embrace free-market solutions to economic and social problems” (Zhao and Lounsbury, 2016: 648). The market logic legitimizes organizational goals of profit seeking and business growth through market-based means such as strategies that enable firms to maximize scale and scope economies. This market logic is dominant among non-state enterprises and investors pursuing profit maximization (He, Eden and Hitt, 2016; Zhao & Lounsbury, 2016). The market logic is also embedded in market-supporting institutions (e.g., property rights protection and contract law), which are unevenly developed across subnational regions in large emerging economies such as China (Banalieva et al., 2015; Shi et al., 2012; Sun et al., 2018).

We utilize the context of institutional transition in China to demonstrate how multiple institutional logics influence firms’ strategies. Specifically, we examine how firms in China’s trust industry are affected by multiple institutional logics for financial portfolio diversification. We first analyze the state ownership-financial portfolio diversification relationship, which reflects the institutional logics promoted by different shareholders of the firm. On this basis, we then identify institutional logics manifested at the industry- and regional-levels and discuss how these moderate our baseline relationship.

Research context – Financial intermediaries in China

Financial infrastructure is key to stable economic growth (Claessens and Laeven, 2005; Clarke, Cull and Shirley, 2010). In particular, the development of financial intermediaries facilitates economic growth (Levine, Loayza and Beck, 2000) by channeling capital to productive use in private and public enterprises (Rajan and Zingales, 1998). Given its strategic importance of supporting industrial development and economic stability, the financial intermediary sector in China is subject to significant state influence in the forms of directive regulation and state ownership control, despite the ongoing trend of privatization of this sector worldwide (Caprio, Fiechter, Litan and Pomerleano, 2010).

State-owned financial intermediaries have historically played a major role in supporting economic development (Gerschenkron, 1962; Lewis, 1955) and in capital allocation to address market failures (Patel, 2010). Due to their role of fostering social and commercial objectives beyond the focal firm, state ownership in financial intermediaries remains dominant in China. Therefore, state logic continues to have a major impact on their risk management and investment decisions. Meanwhile, along with transitioning from a planned to a market economy, the market logic is gradually embedded both in the external institutional environment and in enterprises and investors (Yiu et al., 2014). With the gradual opening of the financial intermediary sector, non-state and market-driven actors have invested in previously state-owned financial intermediaries, thus introducing profit objectives (Levine et al., 2000; Patel, 2010), resulting in the coexistence of state and market logics in Chinese financial intermediaries.

State and market logics within Chinese financial intermediaries

Pro-market reform in China has created mixed state and non-state ownership within firms, leading to multiple logics operating at the firm level (Musacchio et al., 2015; Rao-Nicholson and Cai, 2020; Zhou, Gao and Zhao, 2017). Prior studies reveal two mechanisms through which owners influence firm strategy: a resourcing mechanism and a governance mechanism.

First, the resourcing mechanism arises when organizations with one type of logic access, assess, and integrate resources held by other organizations that follow a similar logic. For example, state ownership diffuses state logic to a given firm, and thereby facilitates access to resources by other entities – firms or government agencies – that are also dominated by a state logic (Benito, Rygh and Lunnan, 2016; Cuervo-Cazurra, Inkpen, Musacchio and Ramaswamy, 2014; Sun et al., 2020). Non-state owners, on the other hand, promote a market logic, and facilitate relationship with other entities operating under a market logic, and thus can easier access, assess and integrate resources controlled by such firms (Goldeng, Grunfeld and Benito, 2008; Millward, 2005). In the case of financial intermediaries, the assessment of resources of potential investment targets is critical for investment decisions, and such an assessment is facilitated by an understanding of the target’s institutional logic.

Thus, state owners, such as regional governments or government agencies, can leverage political connections to gain privileged access to resources held by other entities of the state (Aguilera et al., 2020; Li, Meyer, Zhang and Ding, 2018; Tihanyi et al., 2019). In contrast, non-state shareholders are better equipped to access and assess organizations with market-based competitive resources (Goldeng et al., 2008; Millward, 2005). As different logics facilitate access to different resources, firms that operate under both state and market logic are better able to assess investment targets with both state and market related assets. Firms with both state and market investors thus have access a wider range of investment options, creating opportunities for more portfolio diversification. Hence, compared to firms with dominant state or market logics, firms with balanced state and non-state ownership can better leverage the complementarity of these two logics, which strengthens their ability to capture value from a diversified financial investment portfolio.

Second, the governance mechanism relates to the objectives introduced by different types of shareholders to a firm (Mariotti and Marzano, 2019; Tihanyi et al., 2019). Prior studies show that at an aggregate level, firms abiding by the state logic tend to prioritize political and social objectives aligned with state mandates (Luo and Tung, 2007; Yiu et al., 2014); while firms operating under a dominant market logic typically prioritize commercial objectives that maximize shareholder value (Zhao and Wry, 2016). State shareholders thus are motivated to reinforce their institutional legitimacy by delivering public goods such as industry development (Arnoldi and Muratova, 2019) and employment and social welfare (Yiu et al., 2014) in areas prioritized by the state.

The relative power of owners representing different institutional logics in the governance of a firm, thus determines the influence of that logic on corporate decision-making (Dalton, Hitt, Certo and Dalton, 2008). Specifically, in the Chinese financial intermediary sector, firms abiding by the state logic will use different criteria to evaluate financial investment opportunities from firms following a market logic. When state ownership is dominant, state logic drives financial intermediaries to prioritize investments in industries where the “helping hand” of the state is required for their development, such as the “infant industries” or industries associated with national security (Caprio et al., 2010; Lardy, 2010; Patel, 2010). When non-state ownership is dominant, market logic prevails, shifting the criteria for financial investment decisions from societal or political objectives to commercial considerations such as risk-adjusted return and market growth potential (Aghion, 2011; Rodrik, 2007).

These state and market logic driven priorities are likely to diverge. The fact that state prioritized industries are in need of institutional support suggests that they are unlikely to be commercially viable by market terms, at least not in the short term. As a result, firms dominated by state or non-state ownership will use their governance power to promote investment strategies that serve their respective objectives. In contrast, firms with balanced influence of state and market logic in their governance structure are more likely to pursue both social and market objectives and thus aim for a larger financial portfolio diversification as no single group has a clear power advantage to impose its objectives upon others.

These resourcing and governance mechanisms drive the effect of state ownership on financial portfolio diversification of financial intermediaries. When state ownership is at a low level, access to political resources is limited while non-state shareholders facilitate access to competitive resources (Musacchio et al., 2015) and use their dominant ownership position to prioritize commercial criteria (Vaaler and Schrage, 2009). In contrast, when state ownership is at a high level, state shareholders will become dominant in shaping firms’ strategic objectives, and strengthen the firm’s ability to build relationships with other entities following a state logic. Therefore, with a very low or a very high level of state ownership, a financial intermediary will be dominated by either state logic or market logic and thus step away from financial portfolio diversification.

When state ownership is at a moderate level, both state and non-state shareholders have substantial interests and hence resource commitments towards the firm. This helps the firm to partner with others operating under market or state logic and create synergies between them. This integration enables the firm to capture investment opportunities in a wider range of sectors and assets. In addition, a balanced structure of ownership requires state and non-state shareholders to share control of a firm through negotiation and collaboration, as they are mutually dependent on each other. This mutual dependence suggests that the state and non-state shareholders are likely to negotiate strategies that advance their interests simultaneously, rather than imposing their priorities upon each other. As discussed above, a diversified financial portfolio serves the interests of both state and non-state shareholders.

Accordingly, we propose an inverted U-shaped relationship between state ownership and financial portfolio diversification of financial intermediaries, as illustrated in Fig. 1. Financial portfolio diversification is high when state ownership is at a moderate level, allowing for resource synergy of heterogenous inputs and balanced governance power. Financial portfolio diversification is low when state ownership is at very low or very high levels, hindering resource synergy and power-balanced governance.

-

Hypothesis 1:

State ownership has an inverted U-shaped relationship with financial portfolio diversification of Chinese financial intermediaries.

Multiple institutional logics within a firm cannot be assessed in isolation from the dynamics in its institutional environment, where both state logic and market logic are embedded. These dynamics are captured in the notion of institutional transition, which encompasses concurrent processes of institutional change and the punctuated equilibrium caused by discontinuous transformation of formal institutions (Koremenos, Lipson and Snidal, 2001; Pierson, 2000).

The literature on institutional transition in emerging economies highlights two processes that create within-country institutional variations across regions and time that reflect different types of institutional logics. First, pro-market reform is promoted by the state to shift the responsibility of economic coordination from the central planning system to the market (Banalieva et al., 2015; Cuervo-Cazurra and Dau, 2009; Peng, 2003). Pro-market reform centers on the development of market institutions (e.g., property rights and contract laws), which often unfold at different rates across sub-national regions due to varying priorities of central and local government agencies (Hu & Sun, 2019; Li et al., 2014; Meyer and Nguyen, 2005). The strength of market logic is manifested in the development level of market-supporting institutions (Meyer, Estrin, Bhaumik and Peng, 2009).

Second, industry regulations are deployed, often discontinuously, to correct market failures and manifest the state logic. From time to time, the state imposes rules targeting specific industries to address actual or perceived market imperfections where market coordination is considered insufficient to avoid undesirable societal outcomes (Hoskisson & Hitt, 1990). Therefore, firms develop their capabilities and design strategies under consideration of the industry regulation in a given industry (Klein et al., 2013). We argue that these two processes of change, namely pro-market reform and industry regulation, promote external institutional logics that vary across sub-national regions and over time.

Pro-market reform and diffusion of market logic

Pro-market reform in China diffuses the market logic by developing market institutions such as property rights and contract laws (Peng, 2003). The development of market institutions is a gradual process. In most cases, the incumbent rules of the command economy are phased out but not replaced overnight. This process can be hindered by institutional legacies or resistance at local levels, which lead to uneven diffusion of market rules in a country (Sun et al., 2018). This is evident in sub-national variations in the development of market institutions within emerging economies (Banalieva et al., 2015; Meyer & Nguyen, 2005). Research on institutional logics suggests that organizations are perceptive and responsive to institutional logics manifested at a level proximate to their operations, such as local or community level, as opposed to national level (Lee & Lounsbury, 2015; Zhao & Wry, 2016). Accordingly, we expect that the market logic manifested by regional development of market-supporting institutions will influence firms’ strategies. In our research context, we argue that the impact of state ownership on firms’ financial portfolio diversification varies with the level of development of local market institutions for two main reasons.

First, the resourcing advantages of state ownership erode as market institutions develop. Better developed market institutions promote rule-based transactions by reducing information asymmetries and transaction costs (North, 1990). As market institutions facilitate better resource access from the open market (Shi et al., 2017, they substitute the resourcing channel of state ownership to the extent that critical productive resources are efficiently allocated by market mechanisms (Musacchio et al., 2015). From the firm’s perspective, with the development of market institutions that support the functioning of factor and product markets, the availability and accessibility of factor inputs and complementary resources are enhanced (Campbell and Pedersen, 2001; Sun, 2019), enabling firms to assemble competitive resource bundles without relying on the state for resources (Nee & Opper, 2007). Therefore, from the resourcing perspective, as the allocation of economic inputs becomes more marketized, state ownership becomes less distinguishable from non-state ownership in terms of resource access. Accordingly, variation in state ownership becomes a weaker explanatory factor of firm strategies, such as financial portfolio diversification.

Second, the governance role of state shareholders in SOEs also changes with the process of pro-market reform, which deepens market logic within state capitalism (Nee & Opper, 2007). SOEs are increasingly marketized to align their priorities with the overall objective of pro-market reform, which shifts the economic “rules of the game” from state coordination towards market principles (Li, Cui and Lu, 2017) and adapts their structure and behaviors to this external institutional change (Raynard, Lu and Jing, 2020). For example, in the Chinese context, as an integral part of its pro-market reform, the Chinese government has mandated SOEs to restructure their ownership structure, loosening its direct oversight on those firms while enhancing their corporate governance practices (Aguilera and Haxhi, 2019). Apart from a few large firms in infrastructure sectors, Chinese SOEs are implementing governance practices that incorporate market performance (Shen, Zhou and Lau, 2016; Wang, Hong, Kafouros and Wright, 2012). Managerial autonomy and the interests of non-state shareholders are also better protected by a legal framework operating on market principles (Estrin, Meyer, Nielsen and Nielsen, 2016; Nee & Opper, 2007). Therefore, as pro-market reform deepens, the objectives and behaviors the state and private shareholder become less distinguishable, rendering the variation in state ownership a weaker explanatory factor for firms’ strategies, such as their portfolio diversification.

To summarize, both the resourcing and governance mechanisms of state logic will be attenuated by marketization along with the deepening of market logic, making state and non-state ownership structures more alike in their resourcing and governance roles. As a result, variation in state ownership vis-à-vis non-state ownership becomes less influential in determining the strategic behaviors of SOEs.

-

Hypothesis 2:

The inverted U-shaped relationship between state ownership and financial portfolio diversification of Chinese financial intermediaries is weaker (i.e., a flattened curve) when market institutions are more developed.

Industry regulation channeling state logic

The overarching role of the state in securing social and political order is manifested in specific regulations and policies (Greenwood et al., 2010). Governments use industry regulations to prescribe appropriate actions or constrain the scope of permissible actions to prevent outcomes considered undesirable for the wider economy and society (Rodrik, 2004). For instance, the US government has used anti-trust policies and tax laws to influence firms to increase or decrease their level of diversification (Hoskisson & Hitt, 1990). Likewise, many governments in emerging economies employ regulatory instruments to align firm behavior with their national strategy of social and economic development, in order to facilitate industry restructuring and to correct behavioral deviation from state expectations (Kohli, 2004; Luo et al., 2010; Luo, Wang and Zhang, 2017). In particular, financial services are often subject to extensive regulations to reduce information asymmetries between financial intermediaries and investors (McLaughlin and Safieddine, 2008), and to prevent excessive risk-taking by investors or intermediaries (Laeven and Levine, 2008; Ofoeda, Abor and Adjasi, 2012). In our research context, for example, the Chinese government issued risk management regulations on trust companies in 2010 – three years after the deregulation of this industry – to prevent excessive growth at the expense of financial prudence (KPMG, 2011). Such regulations prescribe standards and constraints for firms in a given industry, thus leading to coercive isomorphism (Lee & Lounsbury, 2015; Luo et al., 2017) as organizations converge over prescribed practices (Oliver, 1997).

External to firms, the state logic is manifested as the regulator overrides market principles and uses policy measures to correct (perceived) market failures at the industry level. In politicized capitalism, the state shapes the regulatory framework (Amsden and Chu, 2003) and provides guidelines for industry reform through industry regulations (Nee & Opper, 2007). Not all industries are equally regulated: regulations evolve over time within an industry. When industry regulation becomes a dominant factor, firms are strongly incentivized to abide by such regulations. Compliance with regulatory regimes delivers benefits such as regulatory legitimacy and resource support from the government (Aghion, 2011; Sheng, Zhou and Li, 2011). Therefore, under industry regulations that aim to correct market failures, firms cannot solely depend on market channels for resources and may need to make strategic responses to regulatory expectations. This situation makes state ownership a more important resourcing channel and a stronger governance power in influencing firm strategies. Thus, regulatory intervention by the state at the industry level amplifies the impact of state ownership on firm strategy.

From the resourcing perspective, regulatory constraints such as government’s directives on financial risk exposure are designed to limit the range of investments by specific financial intermediary firms. Thus, regulatory compliance becomes essential to retain institutional legitimacy and becomes particularly salient for accessing diverse funding sources and investment opportunities. In other words, the utility of state ownership as political capital is amplified by political hurdles of market access (Nee & Opper, 2007). Thus, the relevance of the distinction between state and non-state ownerships, in terms of their respective resourcing advantages, increase with regulatory constraints.

From the governance perspective, through industry regulations, the state overrides the market mechanism of economic coordination with bureaucratic fiat (Young, Peng, Ahlstrom, Bruton and Jiang, 2008), due to its concerns of market failures and excessive behaviors of firms within an industry. While the state is motivated to correct market failures, non-state capital is motivated to exploit them (Patel, 2010). This divergence of motivation heightens the tension between the social and commercial objectives of SOEs, rendering the power dynamics in governance a key determinant of firms’ strategic behaviors. In this situation, the balance of power between state and non-state owners is essential for firms to able to pursue synergies of market and state logics.

In summary, the presence of industry regulation makes state ownership more distinct from non-state ownership in terms of both resource advantages and governance power dynamics. As a result, variation in state ownership becomes more salient in determining the financial portfolio diversification of financial intermediaries in emerging economies.

-

Hypothesis 3:

The inverted U-shaped relationship between state ownership and financial portfolio diversification of Chinese financial intermediaries is stronger (i.e., a steepened curve) when regulatory intervention of the state is introduced in the industry than when industry regulation is absent.

Methodology

Empirical setting and data

The Chinese trust industry was deregulated in 2007 to allow for commercial operations. The industry has since then experienced rapid expansion as a growing number of trust companies actively and substantially increased the scale of entrusted assets and the development of new and innovative products to capture untapped market potentials (KPMG, 2015). By December 2013, a total of 67 trust companies were officially registered operators in China. Their combined assets under management reached RMB 13.98 trillion in 2014, making it the second largest industry in China’s financial sector second only to the banking industry (China Securities, 2015).

We compiled a panel dataset covering all 67 companies for the period from 2007 to 2013, with a one-year lag between the explanatory and dependent variables. Some trust companies began operating after 2007, while some have missing data for key variables in some years. This resulted in a six-year unbalanced panel with 336 firm-year observations. Firm-level data have been collected through annual reports submitted to the CBRC, the regulator of the Chinese trust industry.

Operationalization of variables

Dependent variable

For our dependent variable, financial portfolio diversification, we adopt the entropy measure of diversification (Jacquemin and Berry, 1979). Financial portfolio diversification is calculated by the formula ∑Pi × ln(1/Pi), where Pi is the share of Assets under Management in industry segment i, weighted by the logarithm of its inverse value. Chinese trust companies mainly invest entrusted assets into different industry segments through product design. Main industry segments of trust business include infrastructure industry (i = 1), commercial industry (i = 2), securities industry (i = 3), real estate industry (i = 4), financial institutions (i = 5), and others (i.e., assets entrusted with specific usage appointed by trustors) (i = 6), as reflected in annual reports. As an alternative measure, we group these six main industries based on the nature of the main risks involved – commercial or political. Industries such as infrastructure and other entrusted asset usage are heavily influenced by the government, dominated by state logic, and contain political risks. In comparison, other industries are less (directly) influenced by the government, dominated by market logic, and contain commercial risks. Accordingly, we calculate our alternative measure of financial portfolio diversification (FPD1) using this binary grouping of industry segments. Our hypothesis test results remain consistent when using this alternative measure.

Independent variable

Following prior studies, state ownership is measured by the total percentage of state-owned equity in a given firm (Cui and Jiang, 2012; Zou and Adams, 2008). We identify and calculate firms’ state ownership by ‘government owner’ based on the ownership identities proposed by Delios, Wu and Zhou (2006) for Chinese firms, that is, the ‘government owner’ and its agencies, including local governments, government ministries, government bureaus, industry companies, state asset investment bureaus, state asset management bureaus, state owned research institutions, and state-owned banks. Local, provincial or national-levels governments ultimately control these different types of owners (Delios et al., 2006). Our data shows that the sampled firms vary from non-state-owned to fully state-owned, with a mean value of state ownership at 58% and standard deviation of 32%. The variation in state ownership is largely between firms but not within firms across years. Specifically, during the six-year time window of this study, out of the 67 trust companies in our sample, 49 companies did not have any change in state shareholding; 13 companies had one instance of change in state ownership due to ownership transfer from local governments to newly-established local state assets management companies; and only five companies had multiple instances of changes in state ownership. The relatively stable share of state-owned equity in our sample firms is consistent with the argument that the state has long-term vested interests in SOEs (Musacchio et al., 2015) and do not alter its shareholding position frequently.

Moderators

Market institutions (MI) differ at the regional (sub-national) level in China. Its development is proxied by indicators from the National Economic Research Institute’s (NERI) marketization index of Chinese provinces (Fan, Wang and Zhu, 2012), which has been used widely for strategy research in the Chinese context (Banalieva et al., 2015; Shi et al., 2012; Wang, Wong and Xia, 2008). Marketization implies institutional environmental changes for a more efficient market in economic coordination along four dimensions: regulatory separation from the executive branch, depolitization on the regulatory authority, liberalization of product and factor markets, and privatization of SOEs (Shi et al., 2012, 2017). The indicators capture provincial-level government intervention in the economy, non-state business development, commodity and factor market development, and the development of market intermediaries, where a high value indicates a high level of institution development. For instance, the higher the value for the development of the non-state business, the greater the institutional change in transition economies (Bonnell and Gold, 2002). While the NERI index publications provide annual indices from 1997 to 2009, the raw data from the NERI firm survey has been updated to 2012 by Wang, Yu and Fan (2013). This enables us to calculate the indicators, following the NERI indexation formula for the full duration of our sample period 2007 to 2012. Principal component analysis indicates that the four indicators loaded on a single factor with an eigenvalue of 2.73, accounting for 68.28% of the variance and factor loadings ranging from 0.72 to 0.90. The Cronbach’s alpha for this scale is 0.86. We used the factor score to measure MI.

Industry regulation (IR) evolves over time, exposing firms to varying institutional pressures (Okhmatovskiy, Suhomlinova and Tihanyi, 2020). Specific to our empirical context, there was a vacuum of industry-specific regulation in the Chinese trust industry after its deregulation in 2007. The Chinese government re-introduced regulations of this industry in 2010, dividing its development into two distinct eras. Prior to 2010, the Chinese trust industry was unregulated. The lack of risk monitoring by industry regulators led to rapid growth of trust companies focusing on unsophisticated bank-trust cooperation products. To prevent trust companies from reckless scale expansion, which may create undue exposure to financial risks and undermine market stability, the 2010 regulation of trust industry, formally known as the Measures for the Administration of Net Capital of Trust Companies, established explicit criteria on net capital for the risk exposure of Chinese trust companies. Accordingly, to distinguish the presence and absence of state regulation for a particular industry over time, we follow the practice of Okhmatovskiy et al. (2020) by using a dummy variable, industry regulation (IR), to separate the time periods with and without regulation of risk exposure in the Chinese trust industry. This variable takes a value of 1 when industry regulation is in place (i.e., years 2010–2012) and a value of 0 when it is absent (i.e., year 2007–2009). To separate the industry regulation effect from other potential confounding effects of time-varying characteristics of our sample firms’ operating environment, we included a range of control variables in our analysis such as changes in economic development and openness, in addition to the time-varying measure of market institutional development as well as firm-level time-varying characteristics.

Control variables

We include several control variables that can influence financial portfolio diversification. At the firm level, we first control for firm size as measured by the natural log of the total value of actively managed assets by the firm. Second, we control for firm leverage in terms of the debt to assets ratio. Third, we control for past performance, as it often influences a firm’s strategic choice and future performance (Hitt, Ahlstrom, Dacin, Levitas and Svobodina, 2004). Past performance is calculated as return on assets under management. Fourth, we control for firm age, defined as the number of years since the firm’s founding and transformed into its natural logarithm. Fifth, we control for both foreign experience (i.e., 1 with foreign experience; 0 with no foreign experience) and functional experience (i.e., 1 with functional experience in finance; 0 with no functional experience in finance) of the top management team (TMT), which may affect firm strategic decisions (Sambharya, 1996; Su, Fan and Rao-Nicholson, 2019) determined by a dummy variable. Lastly, we control for ownership type of the ultimate owner according to Delios et al. (2006)‘s ownership identities. Specifically, ownership type is categorized into three groups (i.e., government, marketized corporate, and private) with 16 ownership identities.

At the sub-national location level, economic conditions of the local operating environment can influence firms’ strategies (Barkema and Drogendijk, 2007; Wooster, 2006). We include provincial level macroeconomic controls using data from the China Statistics Bureau (Zickar and Slaughter, 1999). First, GDP is used as a proxy for the size of the provincial economy, transformed into its natural logarithm (Vaaler & Schrage, 2009). Larger provincial economies provide more local market opportunities for firms to explore diversification benefits. Apart from the size, GDP per capita (GDP/capita), also transformed into its natural logarithm, is used to control for the level of regional economic development (Cuervo-Cazurra & Dau, 2009). Third, we considered import and export data as proxies of the openness of the local economy to the international market, transformed into their natural logarithm.

Tests for Endogeneity

State ownership is not randomly assigned to firms and can be a consequence of deliberate design by the state to maintain strategic control of the financial intermediary sector (Caprio et al., 2010). This strategic consideration of the state may be an omitted variable, influencing both the allocation of state ownership in financial intermediaries and their investment strategies simultaneously. Accordingly, we conducted a two-stage least square (2SLS) test to investigate potential endogeneity of state ownership. The instrumental variables we chose were three dummy variables that distinguish the founding condition of the trust companies in our sample. As discussed above (in the variable measurement section), for the majority of our sample firms, we do not observe meaningful change in their levels of state ownership during the time window of this study. Therefore, the variation of state ownership in our data is largely between firms, and the funding conditions of the trust companies are significant determinants of their ownership structure, represented by the type of their ultimate owners at the time of founding. There are generally four types of ultimate owners: 1) local governments; 2) SOEs controlled by the local government or its agencies; 3) SOEs controlled by the central government; 4) others. We used three dummy variables to distinguish them as our instrument variables.

Semadeni, Withers and Certo (2014) recommended researchers to test for the strength (i.e., relevance) and validity (i.e., exogeneity) of instrument variables before interpreting the results of 2SLS models. We thus conducted the Wald test (F-statistics) of instrument strength and found that these instruments were jointly strong predictors of the suspected endogenous variable (state ownership), evidenced by an F statistic (F = 28.265, p = 0.000) above the Stock-Yogo critical value (22.30 for 3 IVs) (Stock and Yogo, 2005). Furthermore, Hansen’s J test returned non-significant results, suggesting that the instruments were not correlated with the error term of the second stage equation. Hence, the excludability of these instruments in the second stage model is tenable. Overall, the results support the strength and exogeneity of the instruments (Semadeni et al., 2014).

Implementing the 2SLS procedure with all control variables for both stages, we found that in the first stage all the three dummies were significant (i.e., 𝛽 local government = 0.693 (p = 0.000), 𝛽 local SOEs = 0.593 (p = 0.000), 𝛽 central SOEs = 0.704 (p = 0.000)) predictors of state ownership. However, in the second stage, while the coefficient for the state ownership squared remained significantly negative, all the three dummies did not directly affect the variance of financial portfolio diversification (specifically, 𝛽 local government = 0.040 (p = 0.778), 𝛽 local SOEs = −0.057 (p = 0.660), 𝛽 central SOEs = 0.033 (p = 0.796)). Using these valid instruments in the 2SLS procedure, the Hausman’s test of endogeneity was non-significant, suggesting that the regressor (state ownership) was exogenous. Therefore, we conclude that there was no evidence of endogeneity.

Analytical technique

Our panel of firms is nested in sub-national regions (i.e. provinces). Thus, we first checked provincial level variation of sample firms’ financial portfolio diversification. We obtained an intra-class correlation (ICC) of 0.06, indicating that only 6% of the variation in our dependent variable could be attributed to unobserved provincial level heterogeneities. Accordingly, we adopted Generalized Estimating Equation (GEE) to test our hypotheses. GEE model is suited for correlated within-subject observations in time-series cross-sectional data (Hardin and Hilbe, 2003). When auto-correlation due to non-independence is present, GEE can produce more consistent and robust estimation results than fixed or random models (Liang and Zeger, 1986). The estimated correlation is derived from within-cluster residuals.

GEE offers two advantages for this study compared to using fixed- or random-effect models. First, in GEE, the dependent variable is not assumed to be normally distributed (Harrison, 2002). This fits our data which show a skewed distribution of financial portfolio diversification among the firm-year observations. Second, compared to other panel data methodologies, GEE is more robust because it generates multiple correlation matrix structures, which best matches the data (Liang & Zeger, 1986). Our dataset contains an imbalanced panel because some firms were established after 2007 and thus do not have data beginning from 2007. To deal with imbalanced longitudinal data as a result of missing data or different observation times, GEE is an appropriate technique since it can provide “consistent estimators of the regression coefficients and of their variances under weak assumptions about the actual correlation among a subject’s observations” (Zenger and Liang, 1986: 122).

Results

Table 1 presents the descriptive statistics and correlations. We also conducted VIF tests to check the potential multi-collinearity problems. The highest VIF score was 5.38 for logged imports, suggesting that multi-collinearity was not a concern.

Hypothesis tests

Results of hypothesis tests are presented in Table 2. Results of Model 1 in Table 2 show the influence of control variables. We report our results following the empirical research guidelines promoted by Lewin et al. (2016) and by Meyer, van Witteloostuijn and Beugelsdijk (2017), especially in terms of avoiding artificial cut-offs of statistical significance and explicit discussion of effect size.

Hypothesis 1 suggests that state ownership affects a company’s financial portfolio diversification level in a non-linear way. We test this effect following the three-step approach suggested by Haans, Pieters and He (2016). First, as shown in Model 2 of Table 2, the squared term of state ownership has a negative and significant coefficient as expected (−0.560, p = 0.004). Second, we examine the slopes of the state ownership effect at both ends of the data range. We find that when state ownership equals 0% (minimum), the slope is 0.625 (p = 0.038) and when state ownership equals 100% (maximum), the slope is −0.495 (p = 0.099). Both slopes are sufficiently steep. Third, the turning point of state ownership is 56%, which is well within the data range from 0% to 100%. Hence, hypothesis 1 receives support.

Hypothesis 2 proposes that the development of market institutions attenuates the state ownership–financial portfolio diversification relationship. Based on Haans et al. (2016), there are two common types of moderating effects on an inverted U-shaped relationship: a moderating effect that shifts the tipping point of the inverted U and a moderating effect that steepens or flattens the inverted U. Our Hypothesis 2 predicts a moderating effect of the second type, that is, the development of market institutions flattens the inverted U-shaped relationship between state ownership and financial portfolio diversification. Statistically, a flattening occurs for inverted U-shaped relationships when 𝛽4 [the coefficient of the interaction term] is positive (Haans et al., 2016: 1187). The results of Model 3 return a positive regression coefficient of the interaction term of market institutions and state ownership squared (0.280, p = 0.043), thereby providing evidence for the flattening of the inverted U. Hypothesis 2 is therefore supported. A plot of this moderating effect is presented in Fig. 2, demonstrating the relationship between state ownership and financial portfolio diversification when the level of market institutions is at one standard deviation above and below its mean value. Consistent with the regression results of Model 3, the inverted U is flatter when market institution is at a high value than when it is at a low value, illustrating that the curvilinear effect of state ownership on financial portfolio diversification is attenuated by market institution development.

Hypothesis 3 proposes that when the state tightens industry regulation, the relationship between state ownership and financial portfolio diversification becomes more pronounced, resulting in a steeper inverted U-shaped relationship. We split our sample based on the moderator (i.e., IR = 0 for the pre-regulation period, that is, before year 2010; IR = 1 for the post-regulation period, that is, from year 2010 onward) and run our main effect analysis on these sub-samples separately (results presented in Model 4 and Model 5 of Table 2). Following the technique suggested by Cohen, Cohen, West and Aiken (2002) and used by Hitt et al. (2004), we compare the coefficients of the state ownership squared, which is in turn obtained in these two models by adjusting the standard errors of coefficients (ADJ STE) using the formula: ADJ STE = (STD DV / STD IV) × STE IV, where STD refers to standard deviation, STE refers to standard error, state ownership is the independent variable (IV), and financial portfolio diversification is the dependent variable (DV). The Z score compares coefficients across the two sub-groups using the following formula (where BEFORE (IR = 0) represents sample firms for the period 2007–2010 before the 2010 regulation announcement and AFTER (IR = 1) represents sample firms for the period 2010–2013 after the 2010 regulation announcement):

The relevant z statistic is positive and statistically significant (z = −2.09; p = 0.036), suggesting that the effect of state ownership on financial portfolio diversification is more pronounced during the post-regulation period than the pre-regulation period. Hypothesis 3 is therefore supported. A plot of this moderating effect is presented in Fig. 3. Consistent with the regression results above, the inverted U is steeper when industry regulation is present than when it is absent, signaling that the curvilinear effect of state ownership on financial portfolio diversification is strengthen by government intervention through industry regulation.

Robustness tests

We conducted further analyses to see if the results are robust against alternative measures of key variable and model specification. First, we adopted FPD1 as an alternative measure of the dependent variable, financial portfolio diversification. Results show that 1) when testing for the non-linear relationship between state ownership and FPD1, the squared term of state ownership has a negative and significant coefficient (−0.256, p = 0.006); 2) there is a positive regression coefficient of the interaction term of market institutions and state ownership squared (0.163, p = 0.005), suggesting a flattening effect on the inverted-U shape; 3) the coefficient difference of the two subgroups is significant (z = 1.897, p = 0.058). These results provide additional support to our main hypotheses.

Second, rather than measuring state ownership by the percentage of total equity owned by the state, we measured state ownership by categories (i.e., 5 state full control (SO = 100%); 4 state majority owned (100% > SO>50%); 3 state controlled (SO<50% but the state is the largest shareholder (e.g., Liang, Ren, & Sun, 2015); 2 state minority ownership (0% < SO<50% and the state is not the ultimate owner); 1 (SO = 0% and thus fully private)). We also ran additional analyses for hypothesis 1. The coefficient for the state ownership squared is significant with expected negative sign (−0.039, p = 0.086), suggesting an inverted U relationship between categorized state ownership and financial portfolio diversification. As such, our alternative analysis provides consistent results with that reported in our main hypothesis.

Third, rather than using the index composed of the five dimensions of marketization index (Fan et al., 2012; Shi et al., 2012), we adopted only the indicator ‘government and market forces’ which explains the connection of the government and the market (Shi et al., 2012: 13) to proxy market institutions. Since this study investigates the role of government ownership in shaping firm behavior in the financial intermediary sector, which is itself contingent on institutional contexts during institutional transitions (i.e., pro-market reform and industry regulation), it examines the role of the state in economic coordination on the road to market economy. Hence, the indicator ‘government and market forces’ captures one dimension of marketization in the institutional environmental changes, namely liberalization of product and factor markets (Shi et al., 2012). We found that the moderating effect of market institutions is still significant with the coefficient for the MI*SO2 at 0.158 (p = 0.001), while the coefficient for SO2 sits at −2.951 (p = 0.000), thereby yielding consistent results.

Fourth, we checked whether other exogenous events may have affected financial portfolio diversification, such as the 2008 global financial crisis as well as a 2012 regulatory change in China which allowed a wider range of financial service firms beyond the trust industry to manage entrusted assets and intensified competition within this sector (China Securities, 2015). We further controlled for the two events in the models for our hypotheses, using indicator variables (i.e., for the 2008 event, 1 for the years from 2009 to 2013 and 0 otherwise; for the 2012 event, 1 for the year 2012 and 0 otherwise). We did not find significant effects for the two events on financial portfolio diversification.Footnote 1

Last, because data of our sample firms are gathered from one single industry, i.e., Chinese trust industry, a firm-level fixed-effects examination is important in order to control for unobserved and time-invariant factors. Thus, we conducted panel data analysis by adopting fixed-effects models. Results are consistent with those of GEE analysis. Therefore, we conclude on the robustness of our results.

Discussion and conclusions

This research aims to investigate how the coexistence of state and market logics both internal and external to firms jointly influence corporate strategy. Contextualized in the Chinese trust industry, we have argued that the state and market logics operate and interact at different levels to affect financial portfolio diversification of trust companies. We have found empirical support for our argument that, through its resourcing and governance mechanisms, state ownership in the financial intermediary sector has a non-linear effect on financial portfolio diversification as a result of balancing the state and market logics within firms. This effect is contingent on the context of institutional transition, during which the prevalence of market logic attenuates (via developing market institutions), while regulatory constraints, as the manifestation of the state logic at the industry level, amplifies (via correcting market failures) the influence of state control on financial portfolio diversification.

Contributions of research

This study makes several contributions to the institutional logics literature. First, it enriches the institutional logics literature by examining the dynamics of multiple institutional logics both internal and external to firms. Prior studies mostly focus on the influence of multiple institutional logics at the same level of organizational environments (e.g., Luo, Jeong and Chung, 2019; Yiu, Wan and Xu, 2019; Zhao & Wry, 2016). Extending this literature, we highlight the interactions of the state and market logics embedded in state ownership at the firm level, industry regulation at the industry level and market institutions at the regional level. Our study shows that these multiple institutional logics play their roles at different levels, which are all reasonably proximate to organizations. As a result, the influence of multilevel institutional logics on organizational behaviors is not channeled in a hierarchical order; rather, the multilevel logics influence organizational decision-making in a multi-faceted manner. Facing such multilevel institutional logics, firms are influenced not by a single most proximate level of institutional logics, but by multiple levels simultaneously both inside and outside firms. Our findings thus advance the understanding of the role of institutional logics in shaping corporate strategy during institutional transition. Therefore, this study contributes to the notion of institutional complexity by extending it to a multilevel conceptualization, and by exploring how multiple logics interact across levels to jointly affect corporate strategy.

Moreover, the institutional logics perspectives in particular explicates the paradoxical role of the state during institutional transition that leads to institutional complexity, which has been clearly demonstrated in the Chinese context (e.g. Witt & Redding, 2014; Yiu et al., 2019; Zhou, 2020). At the 19th National Congress of the Communist Party of China (CPC) in 2017, the Chinese leadership made explicit reference to the significance of both market and state logics in the future path of the Chinese economy. On the one hand, through “accelerating the improvement of the socialist market economy”, a more efficient market system is expected to be established with free flow of factors, flexible response of pricing and fair competition (China Daily, 2017), promoting the market logic. On the other hand, “adhering to the leadership of the party towards all tasks” remains an overarching principle of political and economic system in China. The Chinese government continues to enhance its capability of chartering the development direction and formulating relevant policies (Chang, 2020), reflecting the state logic in shaping industrial regulations and subsequent development in China. It is evident that the seemingly contradicting efforts of the state to promote and constrain market coordination of the economy, through pro-market reform and market constraining regulations respectively, continue to result in institutional variations across regions and time. Therefore, the multiple institutional logics perspective provides a powerful theoretical lens to analyze firms in contemporary China, beyond the initial phases of economic transition as well as offering a valuable theoretical insight to analyze firms in many Asian countries, where the market and state logics coexist with similar complex interfaces.

Empirically, this study demonstrates the efficacy of the institutional logics perspective in understanding firms’ strategic behaviors in an industry under regulatory spotlight – the financial service industry. In so doing, we validate and extend existing insights in this literature. Drawing upon the institutional logics literature, we integrate the resourcing and governance roles of state and non-state owners to suggest that, in the resourcing role, each type of shareholder can facilitate access to resources controlled by other organizations following a similar institutional logic, the combination of these two enables resource synergies; and in the governance role, state and non-state shareholders represent their respective objectives, while a balance of power between them facilitates access to a diversity of resources and thus financial portfolio diversification.

Applying multiple logics arguments to the financial service industry, we find that the regulatory force in the financial industry as well as the general pro-market reform efforts of the state serve as key contingencies for the state ownership effect on corporate strategy in this industry. Overall, by applying the institutional logic perspective, this study contributes new empirical evidence for the various mechanisms through which multiple institutional logics influence corporate strategy.

Managerial and policy implications

Findings of this study provide rich implications for business managers and policy makers, especially those in emerging economies such as China. On the one hand, business managers should be aware how the state and market logics embedded within firms can shape their strategic decisions. Specifically, they need to acknowledge their firms’ strategic goals, which help to decide what type of resources they may prefer or how to negotiate with state and non-state shareholders on strategic implementation to achieve their strategic objectives. Managers should further acknowledge that market and state logics are also manifested externally the institutional contexts in terms of pro-market reform and industry regulation during institutional transition. They create contingency factors on the influence of ownership involvement (i.e., inside-firm manifestation of market and state logics) on corporate strategy. Therefore, managers need to pay attention to institutional variations across regions and time when firms make strategic decisions.

Policy makers may take advantage of state ownership and embedded institutional contexts when they exert control over the economic development of their countries. During institutional transitions, policy makers should be aware of the coexistence of market and state logics both within and outside firms at multiple levels and their interactions that influence firm behaviors. With different ownership structure, the relative dominance of market and state logics differ. For instance, a balanced ownership structure between state and non-state owners may achieve resourcing synergy and balanced governance power. Moreover, institutional contexts with regional and time variations during institutional transition, such as pro-market reform and industry regulation, are manifestations of state and market logics outside firms in external environment that play together with the institutional logics inside firms to influence firm behaviors. Thus, with an understanding of the effects of state and non-state ownership on firm strategies and the moderating effects of institutional contexts on the influence of state ownership, policy makers should be clear about their expectation of the role of the state in firms’ strategic decisions, as well as institutional variations across regions and time, to realize their objectives in shaping their countries’ economic development.

Limitations and future research

Our empirical analysis focuses on the financial services industry, which is particularly sensitive to formal and informal institutions (e.g. Luo, Rong, Yang, Guo and Zou, 2019). In particular, the Chinese trust industry allows us to capture the changes in industry regulation and influence of institutional logics both within and outside firms and its moderating role in the effect of market and state logics on firm strategies. The nature of industry regulation may differ substantially across industries, as the government assigns different priorities to industry developments in different sectors, and as the severity of potential excesses of market-driven behaviors are highly industry-specific. Therefore, our focus on the financial service industry potentially limits the generalizability of our findings. Theoretically, we expect that our findings can be generally applied to other industrial contexts, especially the newly evolving industries that are prone to information asymmetry in the market, which incentivizes speculative risk-taking behavior of market participants. Nevertheless, this expectation will be determined by empirical examinations in future research. The boundary of our theoretical prediction will need to be identified by extending this study to other institutional, industrial and historical settings.

Conceptually, another important avenue for future research is to investigate decision-making processes at more micro-levels. We have constructed our empirical study around a historical event for which firm-level data are readily available. However, we do not have more micro-level data on decision-making processes within the management teams of the firms studied here. It would be fruitful to investigate decision-making in top management teams under multiple sets of internal and external institutional logics, using either qualitative case studies or multi-level quantitative models which incorporate the characteristics of relevant decision-making bodies.

Notes

Detailed results of endogeneity and robustness tests are available upon request to the authors.

References

Aghion, P. 2011. ‘Some thoughts on industrial policy and growth’. In O. Falck, C. Gollier and L. Woessmann (Eds.), Industrial Policy for National Champions. Cambridge: MIT Press: 13-30.

Aguilera, R., Duran, P., Heugens, P., Sauerwald, S., Roxana, T., & VanEssen, M. 2020. State ownership, political ideology, and firm performance around the world. Journal of World Business. https://doi.org/10.1016/j.jwb.2020.101113.

Aguilera, R., & Haxhi, I. 2019. Comparative corporate governance in emerging markets. In Grosse, R., and Meyer, K.E. (Eds) The Oxford handbook of management in emerging markets (p. 185-218). Oxford: Oxford University Press.

Amsden, A.H., & Chu, W.W. 2003. Beyond late development: Taiwan’s upgrading policies. The MIT Press, MT.

Arnoldi, J., & Muratova, Y. 2019. ‘Unrelated acquisitions in China: The role of political ownership and political connections’. Asia Pacific Journal of Management, 36: 113-134.

Banalieva, E.R., Eddleston, K.A. & Zellweger, T.M. 2015. ‘When do family firms have an advantage in transitioning economies? Toward a dynamic institution-based view’. Strategic Management Journal, 36: 1358-1377.

Barkema, H.G., & Drogendijk, R. 2007. Internationalising in small, incremental or larger steps? Journal of International Business Studies, 38, 1132-1148.

Benito, G.R.G., Rygh, A., & Lunnan, R. 2016. The benefits of internationalization for state-owned enterprises. Global Strategy Journal, 6(4): 269–288.

Besharov, M.L., & Smith, W.K. 2014. Multiple institutional logics in organizations: Explaining their varied nature and implications. Academy of Management Review, 39(3): 364-381.

Bonnell, V.E., & Gold, T.B. 2002. The new entrepreneurs of Europe and Asia: Patterns of business development in Russia, Eastern Europe, and China. Economics of Transition, 10: 803-806.

Bremmer, I. 2009. State capitalism comes of age: The end of the free market? Foreign Affairs, 88: 40-55.

Bullough, A., Renko, M., & Abdelzaher, D. 2017. Women’s business ownership: Operating within the context of institutional and in-group collectivism. Journal of Management, 43: 2037-2064.

Campbell, J.L., & Pedersen, O.K. 2001. The Rise of Neoliberalism and Institutional Analysis. Princeton University Press: Princeton, NJ.

Caprio, G., Fiechter, J., Litan, R.E., & Pomerleano, M. 2010. The future of state-owned financial institutions. Washington, US: Brookings Institution Press.

Chang, Q. 2020. Strengthening the centralized and unified leadership by CPC on economic development. (in Chinese) Guangming Daily, http://epaper.gmw.cn/gmrb/html/2020-01/23/nw.D110000gmrb_20200123_1-06.htm [Accessed on August 31st, 2020]

China Daily. 2017. How to accelerate the improvement of the socialist market economy? (in Chinese). http://politics.people.com.cn/n1/2017/1109/c1001-29635589.html. [Accessed on August 31st, 2020]

China Securities. 2015. AUM of the Chinese trust industry had reached 13.98 trillion by 2014. (in Chinese). http://finance.ce.cn/rolling/201508/25/t20150825_6314349.shtml [Accessed on August 31st, 2020]

Claessens, S., & Laeven, L. 2005. Financial dependence, banking sector competition, and economic growth. Journal of the European Economic Association, 3: 179-207.

Clarke, G.R.G., Cull, R., & Shirley, M. 2010. Empirical studies. In The future of state-owned financial institutions. edited by Caprio, G., Fiechter, J., Litan, R.E., and Pomerleano, M. Part VI: achieving privatization. Washington, US: Brookings Institution Press.

Cohen, P., Cohen, J., West, S.J. & Aiken, L.S. 2002. Applied Multiple Regression/ Correlation Analysis for the Behavioral Sciences. Erlbaum Hillsdale: NJ.

Cuervo-Cazurra, A. & Dau, L.A. 2009. Promarket reform and firm profitability in developing countries. Academy of Management Journal, 52: 1348-1368.

Cuervo-Cazurra, A., Inkpen, A., Musacchio, A., & Ramaswamy, K. 2014. Governments as owners: State-owned multinational companies. Journal of International Business Studies, 45: 919-942.

Cui, L., & Jiang, F. M. 2012. State ownership effect on firms' FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. Journal of International Business Studies, 43: 264-284.

Dalton, D.R., Hitt, M.A., Certo, T.S., & Dalton, C.M. 2008. The fundamental agency problem and its mitigation: Independence, equity, and the market for corporate control. Academy of Management Annals, 1: 1-64.

Delios, A., Wu, Z.J., & Zhou, N. 2006. A new perspective on ownership identities in China's listed companies. Management and Organization Review, 2: 319-343.

Estrin, S., Meyer, K.E., Nielsen, B.B., & Nielsen, S.T. 2016. Home country institutions and the internationalization of state-owned enterprises: A cross-country analysis. Journal of World Business, 51: 294-307.

Fan, G., Wang, X., & Zhu, H. 2012. NERI Index of Marketization of China’s Provinces. Economic Science Press (in Chinese): Beijing.

Gerschenkron, A. 1962. Economic backwardness in historical perspective. Cambridge: Belknap Press.

Goldeng, E., Grunfeld, L.A., & Benito, G.R.G. 2008. The performance differential between private and state-owned enterprises: the roles of ownership, management and market structure. Journal of Management Studies, 45: 1244-1273.

Greenwood, R., Díaz, A.M., Li, S.X., & Lorente, J.C. 2010. The multiplicity of institutional logics and the heterogeneity of organizational responses. Organization Science, 21: 521-539.

Greenwood, R., Raynard, M., Kodeih, F., Micelotta, E.R., & Lounsbury, M. 2011. Institutional complexity and organizational responses. Academy of Management Annals, 5: 317-371.

Greve, H.R., & Zhang, C.M. 2017. Institutional logics and power sources: Merger and acquisition decisions. Academy of Management Journal, 60: 671-694.

Haans, R.F.J., Pieters, C., & He, Z.L. 2016. Thinking about U: Theorizing and testing U- and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37: 1177-1195.

Hardin, G.W., & Hilbe, J.M. 2003. Generalized Estimating Equations. Chapman and Hall/CRC: Boca Raton, FL.

Harrison, D.A. 2002. Structure and timing in limited range dependent variables: Regression models for predicting if and when. In Drasgow, F. and Schmitt, N. (eds.), Measuring and Analyzing Behavior in Organizations: Advances in Measurement and Data Analysis. Jossey-Bass: San Francisco, 446- 497.

He, X., Eden, L., & Hitt, M.A., 2016. The renaissance of state-owned multinationals. Thunderbird International Business Review, 58: 117-129.

Hitt, M., Ahlstrom, D., Dacin, T., Levitas, E. & Svobodina, L. 2004. The institutional effects on strategic alliance partner selection in transition economies: China vs. Russia. Organization Science, 15: 173-185.

Hoskisson, R., & Hitt, M. 1990. Antecedents and performance outcomes of diversification: A review and critique of theoretical perspectives. Journal of Management, 16: 461-509.

Hu, H.W., Cui, L., & Aulakh, P.S. 2019. State capitalism and performance persistence of business group-affiliated firms: A comparative study of China and India. Journal of International Business Studies, 50: 193-222.

Hu, H.W., & Sun, P. 2019. What determines the severity of tunneling in China. Asia Pacific Journal of Management, 36: 161-184.

Jacquemin, A.P., & Berry, C.H. 1979. Entropy measure of diversification and corporate growth. Journal of Industrial Economics, 27: 359-369.

Jones, G.R., & Hill, C.W., 1988. Transaction cost analysis of strategy-structure choice. Strategic Management Journal, 9: 159-172.

Kim, H., Kim, H., & Hoskisson, R.E. 2010. Does market-oriented institutional change in an emerging economy make business-group-affiliated multinationals perform better? An institution-based view. Journal of International Business Studies, 41: 1141-1160.

Klein, P.G., Mahoney, J.T., McGahan, A.M., & Pitelis, C.N. 2013. Capabilities and strategic enterpreneurship in public organizations. Strategic Entrepreneurship Journal, 7: 70-91.

Kohli, A. 2004. State Directed Development, Political Power and Industrialization in the Global Periphery. Cambridge University Press: Cambridge, U.K.

Koremenos, B., Lipson, C., & Snidal, D. 2001. The rational design of international institutions. International Organization, 55: 761-799.

KPMG. 2011. Mainland China Trust Survey 2011-Extending the Reach of China’s Financial Sector. Beijing: KPMG.

KPMG. 2015. 2015 China Trust Survey. Beijing : KPMG.

Laeven, L., & Levine, R. 2008. Bank governance, regulation, and risk taking. Journal of Financial Economics, 93: 259-275.

Lardy, N.R. 2010. State-owned banks in China. In The future of state-owned financial institutions, edited by Caprio, G., Fiechter, J., Litan, R.E., & Pomerleano, M. Part VI: achieving privatization. Washington, US: Brookings Institution Press.

Lee, M.D.P., & Lounsbury, M. 2015. Filtering institutional logics: Community logic variation and differential responses to the institutional complexity of toxic waste. Organization Science, 26: 847-866.

Levine, R., Loayza, N., & Beck, T. 2000. Financial intermediation and growth: causality and causes. Journal of Monetary Economics, 46: 31-77.

Lewin, A.Y., Chiu, C.Y., Fey, C.F., Levine, S.S., McDermott, G., Murmann, J.P., & Tsang, E. 2016. The critique of empirical social science: New policies at Management and Organization Review. Management and Organization Review, 12, 649-658.

Lewis, A. 1955. The theory of economic growth. Homewood, Ill.: Richard D. Irwin.

Li, J., Meyer, K.E., Zhang, H., & Ding, Y. 2018. Diplomatic and corporate networks: Bridges to foreign locations, Journal of International Business Studies, 49: 659-683.

Li, M.H., Cui, L. & Lu, J. 2014. Varieties in state capitalism: Outward FDI strategies of central and local state-owned enterprises from emerging economy countries. Journal of International Business Studies, 45: 980-1004.

Li, M.H., Cui, L., & Lu, J. 2017. Marketized state ownership and foreign expansion of emerging market multinationals: Leveraging institutional competitive advantages. Asia Pacific Journal of Management, 34: 19-46.

Liang, K., & Zeger, S. 1986. Longitudinal data analysis using generalized linear models. Biometrika, 73: 13-22.

Liang, H., Ren, B., & Sun, S. L. 2015. An anatomy of state control in the globalization of state-owned enterprises. Journal of International Business Studies, 46(2): 223-240.

Luo, J.D., Rong, K., Yang, K.H., Guo, R., & Zou, Y.Q. 2019. Syndication through social embeddedness: A comparison of foreign, private and state-owned venture capital (VC) firms. Asia Pacific Journal of Management, 36: 499-527.

Luo, X.R., Jeong, Y., & Chung, C. 2019. In the eye of the beholder: global analysts’ coverage of family firms in an emerging market. Journal of Management, 45: 1830-1857.

Luo, X.R., Wang, D.Q., & Zhang, J.J. 2017. Whose call to answer: Institutional complexity and firms' CSR reporting. Academy of Management Journal, 60: 321-344.

Luo, Y., & Tung, R. 2007. International expansion of emerging market enterprises: A springboard approach. Journal of International Business Studies, 38: 481-498.

Luo, Y., Xue, Q., & Han, B. 2010. How emerging market governments promote outward FDI: Experience from China. Journal of World Business, 45: 68-79.

Mariotti, S., & Marzano, R. 2019. Varieties of capitalism and the internationalization of state-owned enterprises. Journal of International Business Studies, 50: 669-691.