Abstract

We conceptualize business group affiliation as institutional linkages by integrating the resource-based view and institutional perspective to examine its direct and moderating effects on firm value in emerging economies. In a sample of 1233 Chinese listed companies, we find that while business group affiliation has mixed direct effects, it moderates the effects of organizational traits and institutional conditions on firm value. Specifically, group affiliation aggravates old firms’ “liability of oldness,” but helps mitigate large firms’ “liability of bigness.” Besides, business group affiliation can reduce the liabilities that institutional voids bring about, as evidenced in its moderating effects on the relationship between regional under-development/industrial restriction and firm value. Our findings point to the moderating effects of business group affiliation in emerging economies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Business groups in emerging economies continue to be an important research topic in the literature (Carney, 2008; Chen & Jaw, 2014; Manikandan & Ramachandran, 2015; Ramaswamy, Li, & Petitt, 2012; Yabushita & Sehiro, 2014). In particular, it has long been debated as to whether group-affiliated firms outperform unaffiliated ones (Carney, Gedajlovic, Heugens, van Essen, & van Oosterhout, 2011). Theories have offered predictions both ways and empirical studies have found equivocal results (e.g., Chang & Hong, 2000; He, Mao, Rui, & Zha, 2013; Khanna & Palepu, 2000; Khanna & Yafeh, 2007; Khanna & Rivikin, 2001; Lee, Peng, & Lee, 2008), pointing to the need to look beyond the direct influence of business group affiliation on firm value.

As a response to this call, we develop a contingency framework and shift the focus from only scrutinizing the direct effect of group affiliation to identifying whether and how business group affiliation can moderate the effects of well-established internal and external drivers of firm value in emerging economies. The intention of this study is not only to argue that group affiliation matters in emerging economies (Carney et al., 2011), but also to “tackle the harder and more interesting issues of how it matters, under what circumstances, to what extent, and in what ways” (Powell, 1996: 297). Specifically, rather than treating all firms as similar to each other or seeing the institutional conditions homogeneous across a single emerging economy, our study addresses an important yet under-studied research question: How does business group affiliation moderate the relationships between organizational traits/institutional conditions and firm value in an emerging economy?

To address this question, we choose publicly listed companies in China as our empirical setting for the test our contingency framework for three reasons. First, China is an emerging economy where business groups have played critical roles for its economic development (Jia, Shi, & Wang, 2013; Keister, 2000; Yiu, Bruton, & Lu, 2005). Second, the coexistence of organizations with various characteristics can provide us with a better understanding of the moderating role played by business group affiliation across different firms. Lastly, China’s emerging economy embraces a variety of institutional characteristics that may serve as a unique laboratory for researchers to test theories established in developed markets (Peng, 2004).

Two major contributions are made in this study. First, it contributes to our understanding of the effect of business group affiliation on firm value in emerging economies. We conceptualize business group affiliation as institutional linkages and propose group affiliation as a moderator for firm value drivers such as the organizational characteristics and the institutional conditions. Systematically exploring the moderating effects of group affiliation on these important and relevant relationships is theoretically important, as it not only answers the call for looking beyond direct effect of group affiliations on firm value but also paves the way for future theoretical developments (Carney et al., 2011; Dubin, 1978; Oliver, 1997).

Second, we contribute to the resource-based view (RBV) and institutional perspective. Our theory development is grounded in the broader versions of the institutional perspective (North, 1990; Peng, 2003; Scott, 1995) and RBV (Barney, 1991; Barney, Ketchen, & Wright, 2011; Guillén, 2000; Priem & Butler, 2001). By combining these two theoretical perspectives (Oliver, 1997), we propose that business groups’ resources are created and developed under certain institutional contexts in emerging economies (Lu & Ma, 2008; Mahmood, Zajac, & Zhu, 2011; Peng, 2003). As a type of institutional linkages by nature (Baum & Oliver, 1991), business group affiliation may moderate the effects of internal and external drivers on firm value in the institutional context of an emerging economy.

Theory and hypotheses

Business groups in emerging economies

Emerging economies, featured as developing with a rapid pace, supported with government policies that favor economic liberalization, and adopting a free-market system, are playing an evidently and increasingly prominent role in the world (Hoskisson, Eden, Lau, & Wright, 2000; Wright, Filatotchev, Hoskisson, & Peng, 2005; Xu & Meyer, 2013). In particular, one of the remarkable features of many emerging economies is the prevalence of business groups (Carney et al., 2011; Guillén, 2000; He et al., 2013; Khanna & Rivikin, 2001).

Among all the theoretical perspectives and empirical topics, a key inquiry in research of business group is the relationship between group affiliation and firm value. It has been widely recognized that group affiliation may affect the economic value of the group-affiliated members. For instance, Chang and colleagues (Chang & Choi, 1988; Chang & Hong, 2000) found that firms under the Korean chaebol umbrella outperformed independent companies. Positive effect of business group on firm value in China has been found as well (Yu, Van Ees, & Lensink, 2009). However, another study by Khanna and Yafeh (2005) showed negative relationship between group affiliation and firm value in half of the ten emerging economies in their sample. Furthermore, it has also been found that in China, business group affiliation has little significant impact on firm accounting value (He et al., 2013). Indeed, the direction of the relationship between business group affiliation and firm value has been found to change over time (Lee et al., 2008). Business groups might be parasites that expropriate minority in the group or paragons that facilitate transactions and operations in and out of the group when facing difficult institutional and economic situations (Jia et al., 2013; Khanna & Yafeh, 2007).

The equivocal effect of group affiliation found in prior studies suggests that the relationship between group affiliation and firm value might be more complicated than what we have theoretically and empirically modeled (Carney et al., 2011). Therefore, we contend that while it is useful to examine whether group affiliation matters, it is perhaps more meaningful to study how group affiliation influences the strengths of important and relevant firm value drivers which are internal and external to firms. Such a shift in focus can contribute to the debate on the “whether” question and may yield richer insights for future studies as well. Bearing in mind these objectives, we integrate the RBV and institutional perspective to specify the direct and moderating effects of business group affiliation in an emerging economy.

Integration of the institutional perspective and resource-based view

The resource-based rationale emphasizes value maximization of a firm through structuring, bundling, and leveraging valuable, rare, imperfectly imitable, and non-substitutable resources to achieve sustainable competitive advantages (Barney, 1991; Sirmon, Hitt, & Ireland, 2007). In the context of business groups, the RBV of business groups examines whether entrepreneurs could accumulate an inimitable capability to combine different recourses (Guillén, 2000; Kock & Guillén, 2001), when member firms can benefit from various internal transactions (Chang & Hong, 2000), or how endowed and developed resources impose heterogeneous effects on firm value (Yiu et al., 2005). A recent study has discovered those business groups function as information resource in informing members of the market opportunities and signaling reputation to the external parties (Lamin 2013).

However, the RBV has limited its insight on the properties of resources to explain firm performance heterogeneity (Oliver, 1997) and neglected the contexts from which these advantageous capabilities come (Mahmood et al., 2011). It has been revealed that the value of firm resource diverges within distinct contexts (Meyer, Estrin, Bhaumik, & Peng, 2009). In other words, although some resources and capabilities are standard across all economies, others are not, especially in emerging economies where institutions and factor markets are relatively munificent (Wan & Hoskisson, 2003). Incorporating the institution-based perspective with RBV, therefore, is necessary to uncover the veil of business group affiliation values.

According to the institutional perspective, “institutions are the rules of the game in a society,” including, specifically, both formal rules such as laws and regulations and informal constraints like norms and customs (North, 1990). The under-developed institutions in most emerging economies normally will result in higher costs of doing business, less efficiency of resource allocation, and weaker economic performance (North, 1990). Hence, business group in emerging economies plays the role of remedy for the immature institution and imperfect market. Moreover, as late development is a process driven by the states, some developing countries have used business groups through government intervention to “catch up” with more industrialized nations (Amsden, 1989; Chang & Hong, 2000; Evans, 1979; Guillén, 2000; Mahmood & Rufin, 2005; Yiu et al., 2005). Business groups arise as an outcome of government policies and subsequently, their internal social connectedness is embedded in the specific institutional context (Granovetter, 1995).

As such, the institutional perspective combined with RBV expects that business groups, endowed with valuable and rare resources, should step in to circumvent weak institutions, replace poorly performing or nonexistent institutions (Fisman & Khanna, 2004), or to fill the “institutional voids” including the lack of intermediaries for the exchange of capital, labor, raw materials, components, and technology in emerging economies (He et al., 2013; Khanna & Palepu, 1997). Meanwhile, the formation of business groups, the resources derived from the group affiliation, and the post-formation value of group-affiliated firms will, to a large extent, be affected by the institutional support and pressures from the three pillars of institutions—regulative, normative, and cognitive structures and activities (Scott, 1995). The embeddedness or interconnectedness of business groups with leading formal or informal institutions should confer resources and legitimacy to business groups and their affiliates in the institutional contexts of emerging economies (Peng, Lee, & Wang, 2005). This is consistent with the “institutional linkages” notion established in institutional theory (Baum & Oliver, 1991), which argues that an organization’s life chances and performance would be significantly improved by organizational demonstrations of conformity to the norms and social expectations of the institutional environment.

Thus, we combine the RBV (Barney 1991) with insights from a broader version of the institutional perspective (Peng, 2003)—new institutionalism in both economics (North, 1990) and organization theory (Oliver, 1997; Scott, 1995). Such integration is conducive to research on emerging economies (Hoskisson et al., 2000) and can help explain how business group affiliation affects firm value in these countries (Guillén, 2000). On the other hand, the integrative efforts will enable us to fold different views of business groups under the broader version of the institutional perspective and to better understand the group-related phenomena.

The value of business group affiliation in China: A general setting

Business groups are a set of legally independent firms bound together and distinguished by a constellation of formal and informal ties (Granovetter, 1995; Khanna & Rivikin, 2001). In the context of China, these ties include ownership, lending, trading, and social relations (Keister, 2000). Chinese business groups are a special type of enterprise system and distinguished by elaborate inter-firm networks of ties and relations (Keister, 2000), and like their counterparties in other emerging economies, these coalitions of firms have interacted over long periods of time and are accustomed to taking coordinated action (Khanna & Rivikin, 2001).

The above definition, on the one hand, indicates how Chinese group members may take advantage of business groups in that they can get access to and utilize group-based resources to overcome the “institutional voids” in emerging economies (Yiu et al., 2005). Due to the simultaneous operation of market-based system and the presence of the remaining state-controlled mechanism in China (Child, 1993), business groups rather than independent companies were “encouraged,” “administered” and “guided” by hierarchically structured governments in China (Keister, 2000; Walder, 1995). This institutional arrangement will exert significant impacts on business groups’ resource portfolio, capabilities, and competitiveness (Child, 1993; Yiu et al., 2005). As a result, business groups tend to have greater political, reputation, and social capital than independent firms in emerging economies (Keister, 2000; Peng et al., 2005), which will further enhance firm performance as a result of group affiliation.

On the other hand, this description points to the possibility of the spill-over of group-related problems to affiliated firms, which is prevalent in emerging economies (Chang, 2003; Chang & Hong, 2000; Khanna & Rivikin, 2001). There are various costs to be affiliated with a business group (Khanna & Rivikin, 2001) such as costs arising from internal trading (Chang & Hong, 2000; Keister, 2001; Lincoln, Gerlach, & Ahmadjian, 1996), costs to maintain relationship in the affiliation, or costs from the “tunneling” function in which a business group “steals” the value from minority member firms (Bertrand, Mehta, & Mullainathan, 2002; Chang & Hong, 2000; Jiang, Lee, & Yue, 2010; Khanna & Yafeh, 2005). Particularly, the weak institutions make it easier for the principal-principal problem to occur in the emerging markets (Gaur & Delios, 2015; Young, Peng, Ahlstrom, Bruton, & Jiang, 2008). Thus, one might predict that group affiliation could weaken the value of group members.

Given the diverging theoretical arguments and mixed empirical findings, we make two competing hypotheses for the direct effect of business group affiliation on firm value of publicly listeda companies in China.

Hypothesis 1a Business group affiliation has a positive effect on the firm value of a publicly listed company in China.

Hypothesis 1b Business group affiliation has a negative effect on the firm value of a publicly listed company in China.

We have discussed the plausible direct benefits and costs associated with business group affiliation in the above section. Nevertheless, the key focus of our study is not its direct impact on the value of affiliated firms in spite of the significance of the problem, but its moderating effects on firm value associated with certain internal and external features in an emerging economy. We contend that besides the direct impact on firm value, business group affiliation may serve as a moderator to exert influence on the strength of established effects. According to institutional perspective (Peng, 2003; Peng et al., 2005), both the nature of the organizational characteristics and that of broader political, economic, and social contexts (Newman, 2000; Oliver, 1997) are believed to have substantial influence on the value of group affiliations. Hence, it is worthwhile to study how business group affiliation serves as a contingent factor on existing relationships.

Given the prediction that business group affiliation may confer certain resources and serve as substitutes to institution voids based on the integration of the RBV and institution perspective, our analysis thus focuses, to a large extent, on how group affiliation may shape the effects of idiosyncratic characteristics of the firms (Baum & Oliver, 1991) as well as heterogeneous institutional contexts within a single emerging economy (Fisman & Khanna, 2004; Peng, 2003) on firm value. We elaborate these contingency situations in turn in the following sections in the context of publicly listed companies in China.

The interaction between organizational traits and business group affiliation

The insights from institutional theory of organizations have suggested two basic organizational characteristics on which the value of firms depends—firm age and firm size (Baum & Oliver 1991). China’s dynamic, turbulent, and uncertain institutional environment further necessitates the incorporation of these two variables (Peng, 2003; Peng & Heath, 1996). More specifically, we perceive group affiliation as an extension of institutional linkages and expect that its interaction with specified organizational traits would significantly influence the firm value in China.

Firm age: The liability of oldness

Age is one of the most important traits of organizations, which has drawn great attention from organizational theorists. However, the liability of newness (Aldrich & Auster, 1986; Baum & Oliver, 1991; Stinchcombe, 1965) might not be a serious problem among publicly listed companies in China, given the long preparation time of having an IPO in China’s stock market. On the contrary, Chinese publicly listed companies may suffer from a “liability of oldness” that decreases their value (Majumdar, 1997).

Firm age may serve as an inducer of firm deterioration (Agarwal & Gort, 2002) and the catalyst to the decay of firms (Loderer & Waelchli, 2010), similar to the ageing process of human beings. One reason for the liability of oldness might be organizational inertia or rigidity, which has been identified as a major internal factor leading to the collapse of many well-known companies. Another reason might be rent-seeking behaviors that are common in old firms (Loderer & Waelchli, 2010). This phenomenon is especially prevalent in China’s institutional context, which is known for inefficient enforcement of laws and regulations on bad corporate governance practices (Yu et al., 2009). As a result, the liability of oldness might impair the benefits that age brings to old firms and results in decreasing firm value.

We argue that being affiliated to a business group might worsen the liability of oldness for Chinese publicly listed firms for two reasons. On the one hand, the major benefits gained from business group affiliation are the institutional linkages, offering affiliates broad bases of influence, endorsement, legitimacy, and experience. Older organizations tend to codify their best-performed structures, processes, and behaviors, and are slow in identify and respond to changes in environment. Business groups often have deep pockets (Khanna & Palepu, 1997), which can make it even harder for group-affiliated firms to recognize valuable up-to-date information and fail to respond to the changing world consequently (Hannan & Freeman, 1984; Leonard-Barton, Schendel, & Channon, 1992; Staw, Sandelands, & Dutton, 1981).

On the other hand, affiliates of a business group are expected to share their resources with the rest of firms in the group (Chang, 2003; Chang & Hong, 2000; Khanna & Rivikin, 2001). If a firm is an affiliate of a Chinese business group, the group, or more specifically, old firms within the group, can provide the firm with legitimacy, stability and resources (Keister, 2000; Yiu et al., 2005). This is because business groups and their old affiliates are well-entrenched and embedded in state-related corporate networks and governmental relations (Boisot & Child, 1996; Peng & Heath, 1996). In other words, old firms are more likely to have the responsibility and bear the high costs to be “tunneled” by other firms so that the networks for the whole group can be maintained.

Hence, the liability of oldness becomes more serious for older firms with business group affiliation, while the independent status of old firms that are not affiliated to business groups will to some degree mitigate the rigidities as well as the side effect of bad corporate governance. Therefore:

Hypothesis 2 Business group affiliation will aggravate the effect of “liability of oldness” on the firm value of a publicly listed company in China.

Firm size: The liability of bigness

In addition to firm age, firm size is another organizational trait that can drive firm value (Baum & Oliver, 1991). As Chinese publicly listed companies are often not small ones, according to the definition of small enterprises by the Chinese government, they do not necessarily suffer from liability of smallness (Aldrich & Auster, 1986). Instead, they are likely to face two types of “liability of bigness.” They may become “too big to grow” or “too big to manage,” both of which can reduce the value of large firms (Banz, 1981; Rouwenhorst, 1999). We argue that business group affiliation may help mitigate the liability of bigness in China’s institutional context in two ways respectively.

First, group affiliation can provide too-big-to-grow firms with greater opportunities and space to grow in an emerging market. In addition to the financial and physical resources derived from business group affiliation, it also provides group members with political, social, and reputation capital (Peng et al., 2005), such as ties to government officials in “high place” (Peng & Luo, 2000), and unique market information (Lamin, 2013). Equipped with these tangible and intangible resources, large group affiliates will be more able to explore new opportunities in new markets.

Second, group affiliation can transfer the tacit knowledge needed to help too-big-to-manage firms in an emerging market. One prominent feature of liability of bigness is the lack of flexibility (Ebben & Johnson, 2005) and the complex structure (Graubner, 2006) which often makes big firms entrenched (Amabile, 1988). However, compared to independent firms in an emerging economy, business groups often have well-trained talent pool (Bamiatzi, Cavusgil, Jabbour, & Sinkovics, 2013) to conduct explorative search (Vissa, Greve, & Chen, 2010), and accumulated experience to handle the structural complexity (Keister, 2000), which may help solve the problem of inflexibility and complexity through the interactions and learning among key employees.

Taken together, business groups, rather than independent companies, help their affiliates with bigger size lessen liability of bigness in China’s emerging economy. Therefore:

Hypothesis 3 Business group affiliation will mitigate the effect of “liability of bigness” on the firm value of a publicly listed company in China.

The interaction between institutional conditions and business group affiliation

China, though a single emerging market, is likely to have “multiple emerging markets” because economic and social development stages differ greatly by regions while supply and demand functions are highly heterogeneous among different industries (Ma, Tong, & Fitza, 2013; Naughton, 1995). These two types of heterogeneity, originated from different regions and industries and characterized by diverse institutional conditions and policies, are common across emerging economies (Fisman & Khanna, 2004; Huang, 2003) and exert significant influence on how a firm performs. As such, we focus on the institutional conditions in terms of regional openness and industrial openness to investigate whether and how the effect of different locational and industrial settings on firm value may depend on the business group affiliation of the focal firm.

Regional openness: The liability of regional underdevelopment

No firm can be immune from institutional framework where it is embedded, which is the set of fundamental political, social, and legal ground rules that establishes the basis for production, exchange, and distribution (Davis & North, 1971). In addition to historical and natural reasons, the door to foreign and domestic private investors was opened gradually in China and the level of institutional development differs across regions (Peng & Heath, 1996). For instance, certain regions and cities were designated as developed areas from the beginning of its economic reform, and the economic activities in these areas were allowed to operate under a different institutional framework from the rest of China (Huang, 2003; Luo, 2002).

In developed areas, local governments were explicitly delegated by the Chinese central government to offer favorable policies and new freedoms to investors (Luo, 2002). As a result, firms in these areas can have easier access to more resources, which has significance beyond simple availability (Keister, 2000). The mature institutions as well as the developed factor market contribute to greater performance for firms located in regions with higher level of development. On the contrary, the less-developed regions, more often than not, fall short in providing the infrastructure and factor markets necessary to support business operations (Wan & Hoskisson, 2003). Firms in these areas suffer from “liability of regional underdevelopment.”

Business group affiliation is of great importance in helping firms overcome market failures, particularly in areas where institutions and factors are under-developed (Belenzon & Berkovitz, 2010; Gopalan, Nanda, & Seru, 2007; Jian & Wong, 2010). Poor infrastructure provision and failures in labor and financial markets such as lack of transparency and information asymmetry may be mitigated by groups through the internalization of these markets (Lee et al., 2008). Moreover, compared to independent firms, business groups usually embrace broad bases of influence and endorsement, stable relationships with important external constituents, and the legitimacy, all of which are critical for firms to deal with the heightened “institutional voids” in less-developed regions (Khanna & Palepu, 1997).

Under this situation, group-based resources, supplied by business group affiliation, may put firms within less-developed areas in a better position to reshape the institutional conditions faced by these firms (Fisman & Khanna, 2004). We expect that business group affiliation can mitigate disadvantages firms have in less-developed locations. The heightened “institutional voids” (Fisman & Khanna, 2004; Khanna & Palepu, 1997) may be filled by group-based resources, which in turn should enhance the firm value in these locations and reduce the gap in firm efficiency between those located in developed and developing regions. On the other hand, the positive effect of developed areas on firm value might be weakened because the substituting role of business group affiliation to institutional environment becomes redundant in developed areas. Therefore:

Hypothesis 4 Business group affiliation will mitigate the effect of “liability of regional underdevelopment” on the firm value of a publicly listed company in China.

Industrial openness: The liability of industrial restriction

Within-country institutional heterogeneity can also come from the official protectionism of certain industries (Kock & Guillén, 2001). Specifically, with its economic liberalization and commitment to the WTO (Hoskisson et al., 2000), China had to figure out the requirement for foreign entry mode, the ceiling on the amount of FDI in a particular sector, and the set of state firms designated as potential local partners (Luo, 2002). The institutional differences between open and restricted industrial sectors were “created” by the state’s formal rule system and have been enforced by the government or their administrative agencies across different industries (Luo, 2002).

In restricted industrial segments, the state’s institutional deterrence obstructs market perfection and structural completeness, escalates the impediments of the environment, and increases the costs of obtaining, scanning, interpreting, and analyzing information for operations and management (Luo, 2002; Oliver, 1997). In these industries, it is difficult, if not impossible, for firms to find suitable suppliers, customers, and employees, and to access resources and markets. It is not surprising, therefore, that firms competing in these industries suffer from “liability of industrial restriction,” and they may underperform compared to those in industries with minimal restrictions.

As the dominant players and incumbents in these restricted industries, business groups embrace the political capital to lobby the state and industry policy makers (Mahmood & Rufin, 2005; Peng et al., 2005; Yiu et al., 2005). Group affiliates may access group-based production inputs, operational resources, and infrastructure, which are deterred by the distorted industrial structure and impeded by heightened “institutional voids” (Luo, 2002). Apart from the resource advantages, business groups, serving as institutional linkages, further provide legitimacy and social ties or guanxi to members, which are of great importance to business success in China (Lu & Ma, 2008; Xin & Pearce, 1996). In contrast, those independent firms suffering from industrial restriction can hardly overcome these barriers on their own.

We expect that business group affiliation may reduce the constraints in the restricted industries and thus help overcome “liability of industrial restriction” and improve firm value. In other words, the heightened “institutional voids” (Khanna & Palepu, 1997) in these industries may be replaced by business groups’ resources and political capital, which are not available to independent firms. Therefore:

Hypothesis 5 Business group affiliation will mitigate the effect of “liability of industrial restriction” on the firm value of a publicly listed company in China.

Methods

Sample and data sources

For the implementation of our investigation, we used a sample of China’s publicly listed companies. The sample of listed companies consist of different types of firms including group-affiliated and non-group-affiliated, small and large, and young and old companies, located in different locations and competing in different industries, which is a necessary source of variance to be able to construct a test of our hypotheses.

We derived the basic sample from the official websites of the Shanghai Stock Exchange and the Shenzhen Stock Exchange as well as listed companies’ annual report and websites. Furthermore, to complement the necessary variables of each company, such as the shareholder identity, regional spanning, and industrial scope, we also referred to other databases including CSMAR and WIND (Xia, Ma, Lu, & Yiu, 2014). We consulted these data sources when there was inconsistency or when there were missing data. By doing so, we were able to increase the data reliability and completeness.

We analyze data from annual reports of Chinese listed companies for three continuous years: 2002, 2003, and 2004. The time window used in our sample could capture the institutional conditions after China jointed the WTO in 2001, a critical institutional factor to our study about the effects on firm value. Moreover, as China started to conduct the split-share reform for its publicly listed companies in 2005, the mechanism to calculate firm value in the pre-reform era is different from that in the post-reform era (Liao, Liu, & Wang, 2011). By the end of 2004, there were 1377 publicly listed companies in the two domestic stock exchanges. By matching all the information to achieve a balanced panel data structure, we obtained a sample comprising 1233 Chinese listed companies.

We used two authoritative and complementary sources to identify whether a company belongs to a group. One source is from the lists provided by different levels of Chinese government agencies in charge of business groups. The other source is from different versions of China’s Largest Business Groups, published by the National Statistics Bureau of China (NSBC), which is equivalent to SEC in the US (Ma, Yiu, & Zhou, 2014).

Dependent variable

Tobin’s Q

We measured a firm’s value by using Tobin’s Q, which is defined as the ratio of the sum of the market value of equity and the book value of liabilities to the replacement value of a firm’s assets (Khanna & Palepu, 2000; Wernerfelt & Montgomery, 1988). As the estimation on the replacement value of a firm’s assets is unavailable in China, we substituted it with the book value of total assets (Ma, Yao, & Xi, 2006; Ma et al., 2014).

Independent and control variables

Group affiliation

We used an indicator variable to indicate whether a listed company is affiliated with a particular business group. The indicator variable took a value of 1 if the listed company’s largest shareholder is affiliated with a group.

Firm age

It was measured by the number of years since a company was founded.

Firm size

We measured firm size by using factor analysis of three variables (i.e., sales, assets, and number of employees) to derive a factor. This is similar to Baum and Oliver’s study (1991) and can capture different aspects of organizational size.

Locational development

Location is the main operation area of each listed company. We used the logarithm transformation of each province’s per capita GDP as a proxy for locational development. This information was collected from various versions of China Statistical Yearbook.

Industrial restriction

We used an indicator variable to identify restricted industries. Following Luo’s (2002) method, the coding of restricted industries was based on the latest version of the Industry Catalogue for Foreign Investment and the Guide for Foreign Investment Directions promulgated by the State Council. All the foreign investments conducted from early of 2002 till 2004 were regulated and administered based on this version of Catalogue and Guide. Consistent with Gomes-Casseres’ (1990) classification and prior studies (Lu & Ma, 2008), a restricted industry was coded one when a firm’s main industry was one where foreign investments were restricted or prohibited or required to use joint ventures as the entry mode.

Shanghai Stock Exchange

Consistent with prior studies (Xu & Wang, 1999), we used a dummy variable to control for the geographic stock exchange effect with 1 representing Shanghai Stock Exchange.

State ownership status

We used another indicator variable to identify whether a listed company’s largest shareholder is state-owned or non-state-owned. The indicator variable took a value of 1 if the listed company’s largest shareholder is state-owned.

A-shares only

A company may issue two types of shares on either the Shanghai or Shenzhen Securities Exchanges: A-shares and B-shares (Xu & Wang, 1999). It may also issue shares on overseas exchanges. According to China’s Securities Regulatory Commission (CSRC), A-shares are exclusively available to domestic investors. Since the presence of foreign shareholders would significantly influence a listed company’s corporate governance and performance in emerging economies (Khanna & Palepu, 2000), we introduced this variable—A-shares only—to capture this issue.

Largest shareholder’s stake

We used the percentage of stock owned by a listed company’s largest shareholder to measure this shareholder’s ownership stake.

Institutional ownership

We used the ratio of stock owned by institutional investors to the stock freely traded in the market. This is also a relative concentration ratio to capture the difference between non-traded and freely-trade shares in China (Xu & Wang, 1999).

Leverage

Since capital structure is found to be significantly correlated with firm performance and more importantly, the debt problem (e.g., triangular debt) is severe in China’s emerging economy, we introduced the leverage (i.e., the ratio of total debt to equity) as a proxy for capital structure (Chang, 2003).

Industry dummies

The existing literature shows that industry effects may be determinant to firm’s market value under some conditions and may account for the majority of explained variance of Tobin’s Q (Schmalansee, 1985). We included a set of dummy variables controlling for the 22 industries identified by CSRC.

Modeling procedures

We examined the firm value implications of group affiliation using a firm-year unit of analysis. Longitudinal data consisting of repeated observations of the covariates and outcomes for the same subjects can introduce bias due to correlation among the repeated observations (Zeger & Liang, 1986). We used generalized estimating equations (GEE) to estimate the model to correct for potential bias caused by such correlation. GEE adjusts for repeated observations by estimating within-subject correlation separately from the regression parameters, yielding consistent estimates of the regression coefficients without rigorous assumptions about the actual correlation among the subjects’ observations (Zeger & Liang, 1986).

Results

We utilized moderated regression analysis to test our hypotheses (Aiken & West, 1991). Table 1 presents the descriptive statistics for the study’s sample. The descriptive statistics show that 67% of these companies are affiliated to Chinese business groups. The average Tobin’s Q is 1.24, while the average firm age is 9.2 years. 35% of the companies’ main businesses are in restricted industries and the arithmetical averaged provincial GDP per capita is about US$1900.

We tested our hypotheses in seven GEE population-averaged panel-data models and reported the regression results in Table 2. All models were significant and the significant incremental Wald chi-squares suggested that the inclusions of the interaction terms were significant improvements on their baseline models.

Model 1 is the baseline model, including all the control variables. As presented in Model 1, institutional ownership and locational development had positive effects on firm value, while listed location in Shanghai Stock Exchange, leverage, firm age and firm size showed negative impacts.

Model 2 tested the direct relationship between business group affiliation and firm value. As shown in Model 2, group affiliation had a negative effect on firm value (b = −.04, p < .10). Although the coefficient remained negative in Model 6 (b = −.08, p < .05), it turned to be no significant in Model 4, and even positive in Model 3 (b = .11, p < .10), Model 5 (b = .82, p < .05), and Model 7 (b = 1.21, p < .001). Thus, either Hypothesis 1a or Hypothesis 1b has only received partial support.

Model 3 reported the result for Hypothesis 2, which tested interaction between firm age and group affiliation. The coefficient estimation of the interaction term was negative and statistically significant (b = −.02, p < .01), indicating that group affiliation worsens the negative effect of liability of oldness on firm value for older firms. Hence, Hypothesis 2 receives strong support.

Model 4 examined Hypothesis 3 about the interaction effect between firm size and group affiliation on firm value. Consistent to the prediction we have made, the coefficient estimation of the interaction term was positive and reached statistical significance (b = .17, p < .001), suggesting that group affiliation mitigates the effect of liability of bigness on firm value. Therefore, Hypothesis 3 is strongly supported.

On the basis of Model 2, Model 5 added the interaction term of group affiliation to locational development. As presented in Table 2, the coefficient estimation was negative and had statistical significance (b = −.09, p < .05), showing the weakening effect of group affiliation on the positive relationship between region development and firm performance. Thus, Hypothesis 4 is supported.

Model 6 tested Hypothesis 5 concerning the interaction between industrial restriction and group affiliation. The coefficient estimation indicated positive and moderately significant interaction (b = .08, p < .10), which shows the mitigating effect that group affiliation exerts on the negative relationship between industrial restriction and firm value. Hypothesis 5 receives moderate support consequently.

In the final step, we entered all the independent/control variables and their interaction terms in Model 7. All the signs of the interaction terms remained unchanged and were statistically significant, proving the consistency and stability of previously reported results.

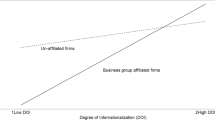

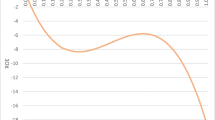

To gain insight into the significant moderating effects, we constructed Figs. 1 through 3 for the projected Tobin’s Q on the results of Models 3 through 5.

Evidence for the strong and significant moderating effect of group affiliation is shown by different slopes of the value lines in Figs. 1 through 3. Firm age, size, and locational development in these figures took the values of one standard deviation below and above the means to represent younger/older firms, smaller/larger firms, and less-developed/developed regions respectively. In Fig. 1, group affiliation draws the value line down when the firm gets older, which provides further support for Hypotheses 2. In Fig. 2, group affiliation pulls up the value line when the firm gets bigger, presenting evidence in support of Hypothesis 3. In Fig. 3, the value line of group-affiliated firms has a much flatter slope, demonstrating that group affiliation weakens the positive link between development level of regions and firm value, further lending support for Hypothesis 4.

Discussion

In this paper, we make an important yet under-explored research inquiry: How does business group affiliation moderate the relationships between organizational traits/institutional conditions and firm value in an emerging economy? Drawing on the insights from the RBV and institutional perspective, we developed a new framework to theorize the potential moderating effect of group affiliation in an emerging economy. The empirical results from a sample of 1233 Chinese listed companies highlight the effect of business group affiliation in influencing extant drivers of firm value and lend support to our theoretical framework.

We first tested the main effect of group affiliation on firm value with two competing hypotheses. We found that group affiliation alone had direct negative impact on performance. However, such relationship became positive or non-significant when group affiliation served as a moderator and interaction terms were added to the models. The mixed results exposed the two sides of group affiliation and called for a contingency approach. Indeed, the most important findings here are the interaction effects between group affiliation and organizational traits as well as institutional conditions, through which business group affiliation influences firm value.

As expected, the effects of liability of bigness, liability of regional under-development and liability of industrial restriction on firm value were mitigated by business group affiliation while the effect of liability of oldness was aggravated. As argued, groups may create more value to larger firms by providing opportunity and space to grow, or by transferring tacit skills to support the bigness-related requirements, which cannot be easily achieved by independent firms through market transactions in China’s emerging economy (Bamiatzi et al., 2013; Khanna & Palepu, 1997). On the other hand, group affiliation will worsen the situation of old firms as the group-related advantages/disadvantages are more likely to strengthen the liability of oldness like rigidities and cross-subsidy costs. Since no organization can be properly understood apart from its wider social and cultural context (Scott, 1995), we further highlight the moderating effects of business group affiliation on the relationships between institutional conditions (by subnational regions and by industries) and firm value (Hoskisson et al., 2000).

Implications for business group research

Our study enriches business group literature in several ways. First, we contribute to the debate on the value of group affiliation by introducing firm size and age, two basic organizational characteristics (Baum & Oliver, 1991) to examine the moderating effect of business group affiliation on firm value, which helps explain the equivocal relationship between business group affiliation and firm value. Instead of focusing on the disadvantages of young firm and small firm which are of little relevance in our research context, we highlight the notions of “liability of oldness” and “liability of bigness” in the context of publicly listed companies in China. Group affiliation was found to help mitigate the liability of bigness while worsening the liability of oldness. The differentiation of business group affiliation effect on firm value with certain traits serves as an important step towards a more comprehensive and complete picture of the value of business group affiliation.

Second, modeling institutional conditions as another set of baseline factors confirms that institutions are more than context that firms are embedded but directly shape the firm value (North, 1990; Peng, 2003; Peng et al., 2005). Peng (2003) has developed a two-phase model of institutional transitions with a focus on a country’s longitudinal transition process to move from a command to a market economy. Our contingent framework goes a step further and extends the two-phase model (Peng, 2003) by looking into other dimensions such as locational development and industrial restrictions, rather than the temporal horizon, of a single emerging economy and by discovering the effect of business group affiliation as a moderator on such institutional factors.

Third, this study contributes to business group research by integrating the RBV and institutional perspective. The literature continues to see increasing convergence and integrative efforts among different theoretical approaches and these integrations have enabled us to better understand phenomena in various management areas (e.g., Oliver, 1997). Particularly, what we have done in this study is to use both the RBV and institutional perspective as the bedrock, beyond which we allowed for integration-based hypotheses to emerge by simultaneously taking into consideration the heterogeneity of organizational traits and institutional conditions.

Limitations and future research

The most notable limitation in this study is that we derived our empirical results from a sample of listed companies in China, giving rise to the concern on the generalizability of our findings. We believe that our findings are applicable to other emerging economies where business groups are playing a critical role. However, some measures of specific institutional conditions are likely to differ in different emerging economies. It would be particularly provocative for future studies to use samples from other countries to test and extend the generalizability of our findings.

One of the contributions of this study is the identification of group affiliation as a moderator. Even so, it is important for future research to explore more factors that might invoke the contingency value to provide a more complete picture. Further, future research should move forward to investigate other dimensions of firm value like innovation and productivity (Mahmood & Rufin, 2005; Manikandan & Ramachandran, 2015). Finally, we integrated the RBV and institutional perspective to inform business group research. Future studies may survey other theoretical approaches to enrich our understanding of business groups in emerging economies.

Conclusion

To conclude, we conceptualized business group affiliation as institutional linkages by combining the RBV with institutional perspective to investigate the moderating effect of business group affiliation in emerging economies. Our analyses demonstrate that the effect of the idiosyncrasy of the organizational traits and the heterogeneity of institutional conditions on firm performance is contingent on business group affiliation. While the liability of bigness, regional underdevelopment, or industrial restriction is mitigated by group affiliation, the liability of oldness can be augmented by group affiliation. Overall, we highlight the moderating role of business group affiliation on firm value in emerging economies, and our empirical findings confirm the explanatory power of the integrative framework developed in this study.

References

Agarwal, R., & Gort, M. 2002. Firm and product life cycles and firm survival. American Economic Review, 92(2): 184–190.

Aiken, L. S., & West, S. G. 1991. Multiple regression: Testing and interpreting interactions. Newbury Park: Sage.

Aldrich, H. E., & Auster, E. 1986. Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8: 165–198.

Amabile, T. M. 1988. A model of creativity and innovation in organizations. Research in Organizational Behavior, 10(1): 123–167.

Amsden, A. H. 1989. Asia’s next giant: South Korea and late industrialization. New York: Oxford University Press.

Bamiatzi, V., Cavusgil, S. T., Jabbour, L., & Sinkovics, R. R. 2013. Does business group affiliation help firms achieve superior performance during industrial downturns? An empirical examination. International Business Review, 23(1): 195–211.

Banz, R. 1981. The relationship between return and market value of common stocks. Journal of Financial Economics, 9(1): 3–18.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17(1): 99–120.

Barney, J. B., Ketchen, D. J., & Wright, M. 2011. The future of resource-based theory revitalization or decline?. Journal of Management, 37(5): 1299–1315.

Baum, J. A. C., & Oliver, C. 1991. Institutional linkages and organizational mortality. Administrative Science Quarterly, 36: 187–218.

Belenzon, S., & Berkovitz, T. 2010. Innovation in business groups. Management Science, 56(3): 519–535.

Bertrand, M., Mehta, P., & Mullainathan, S. 2002. Ferreting out tunneling: An application to Indian business groups. Quarterly Journal of Economics, 117(1): 121–148.

Boisot, M., & Child, J. 1996. From fiefs to clans and network capitalism: Explaining China’s emerging economic order. Administrative Science Quarterly, 41: 600–628.

Carney, M. 2008. The many faces of Asian business groups. Asia Pacific Journal of Management, 25(4): 595–613.

Carney, M., Gedajlovic, E. R., Heugens, P. P. M. A. R., van Essen, M. A., & van Oosterhout, J. 2011. Business group affiliation, performance, context, and strategy: A meta-analysis. Academy of Management Journal, 54(3): 437–460.

Chang, S. 2003. Ownership structure, expropriation, and performance of group-affiliated companies in Korea. Academy of Management Journal, 46(2): 238–253.

Chang, S. J., & Choi, U. 1988. Strategy, structure and performance of Korean business groups: A transactions cost approach. Journal of Industrial Economics, 37(2): 141–158.

Chang, S., & Hong, J. 2000. Economic performance of group-affiliated companies in Korea: Intra-group resource sharing and internal business transactions. Academy of Management Journal, 43(3): 429–448.

Chen, Y., & Jaw, Y. 2014. How do business groups’ small world networks effect diversification, innovation, and internationalization?. Asia Pacific Journal of Management, 31(4): 1019–1044.

Child, J. 1993. Society and enterprise between hierarchy and market. In J. Child, M. Crozier, & R. Mayntz (Eds.). Societal change between market and organization: 203–226. Aldershot: Averbury.

Davis, L., & North, D. 1971. Institutional change and American economic growth. Cambridge: Cambridge University Press.

Dubin, R. 1978. Theory building. New York: Free Press.

Ebben, J. J., & Johnson, A. C. 2005. Efficiency, flexibility, or both? Evidence linking strategy to performance in small firms. Strategic Management Journal, 26(13): 1249–1259.

Evans, P. 1979. Dependent development. Princeton: Princeton University Press.

Fisman, R., & Khanna, T. 2004. Facilitating development: The role of business groups. World Development, 32: 609–628.

Gaur, A., & Delios, A. 2015. International diversification of emerging market firms: The role of ownership structure and group affiliation. Management International Review, 55(2): 235.

Gomes-Casseres, B. 1990. Firm ownership preferences and host government restrictions: An integrated approach. Journal of International Business Studies, 21(1): 1–22.

Gopalan, R., Nanda, V., & Seru, A. 2007. Affiliated firms and financial support: Evidence from Indian business groups. Journal of Financial Economics, 86(3): 759–795.

Granovetter, M. 1995. Coase revisited: Business groups in the modern economy. Industrial and Corporate Change, 4: 93–130.

Graubner, M. 2006. Task, firm size, and organizational structure in management consulting: An empirical analysis from a contingency perspective. Wiesbaden: DUV.

Guillén, M. 2000. Business groups in emerging economies: A resource-based view. Academy of Management Journal, 43(3): 362–380.

Hannan, M., & Freeman, J. 1984. Structural inertia and organizational change. American Sociological Review, 49(5): 149.

He, J., Mao, X., Rui, O., & Zha, X. 2013. Business groups in China. Journal of Corporate Finance, 22: 166.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249–267.

Huang, Y. 2003. Selling China: Foreign direct investment during the reform era. New York: Cambridge University Press.

Jia, N., Shi, J., & Wang, Y. 2013. Coinsurance within business groups: Evidence from related party transactions in an emerging market. Management Science, 59(10): 2295–2313.

Jian, M., & Wong, T. J. 2010. Propping through related party transactions. Review of Accounting Studies, 15(1): 70–105.

Jiang, G., Lee, C. M., & Yue, H. 2010. Tunneling through intercorporate loans: The China experience. Journal of Financial Economics, 98(1): 1–20.

Keister, L. 2000. Chinese business groups: The structure and impact of interfirm relations during economic development. Oxford: Oxford University Press.

Keister, L. 2001. Exchange structures in transition: Lending and trade relations in Chinese business groups. American Sociological Review, 336–360.

Khanna, T., & Palepu, K. 1997. Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4): 41–51.

Khanna, T., & Palepu, K. 2000. Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. Journal of Finance, 55: 867–891.

Khanna, T., & Rivikin, J. 2001. Estimating the performance of business groups in emerging markets. Strategic Management Journal, 22: 45–74.

Khanna, T., & Yafeh, Y. 2005. Business groups and risk sharing around the world. Journal of Business, 78(1): 301–340.

Khanna, T., & Yafeh, Y. 2007. Business groups in emerging markets: Paragons or parasites?. Journal of Economic Literature, 45(2): 331–372.

Kock, C., & Guillén, M. F. 2001. Strategy and structure in developing countries: Business groups as an evolutionary response to opportunities for unrelated diversification. Industrial and Corporate Change, 10(1): 77–113.

Lamin, A. 2013. Business groups as information resource: An investigation of business group affiliation in the Indian software services industry. Academy of Management Journal, 56(5): 1487.

Lee, K., Peng, M. W., & Lee, K. 2008. From diversification premium to diversification discount during institutional transitions. Journal of World Business, 43(1): 47–65.

Leonard-Barton, D., Schendel, D., & Channon, D. 1992. Core capabilities and core rigidities: A paradox in managing new product development. Strategic Management Journal, 13(S1): 111–125.

Liao, L., Liu, B., & Wang, H. 2011. Information discovery in share lockups: Evidence from the split-share structure reform in China: 1001–1027. Winter: Financial Management.

Lincoln, J., Gerlach, M., & Ahmadjian, C. 1996. Keiretsu networks and corporate performance in Japan. American Sociological Review, 1996: 67–88.

Loderer, C., & Waelchli, U. 2010. Firm age and performance. IDEAS working paper series from RePEc, MPRA paper no. 26450, University Library of Munich, Germany.

Lu, J. W., & Ma, X. 2008. The contingent value of local partners’ business group affiliations. Academy of Management Journal, 51(2): 295–314.

Luo, Y. 2002. Product diversification in international joint ventures: Performance implications in an emerging market. Strategic Management Journal, 23: 1–20.

Ma, X., Tong, T. W., & Fitza, M. 2013. How much does subnational region matter to foreign subsidiary performance? Evidence from Fortune Global 500 Corporations’ investment in China. Journal of International Business Studies, 44(1): 66–87.

Ma, X., Yao, X., & Xi, Y. 2006. Business group affiliation and firm performance in a transition economy: A focus on ownership voids. Asia Pacific Journal of Management, 23(4): 467–483.

Ma, X., Yiu, D. W., & Zhou, N. 2014. Facing global economic crisis: Foreign sales, ownership groups, and corporate value. Journal of World Business, 49(1): 87–100.

Mahmood, I., & Rufin, C. 2005. Government’s dilemma: The institutional framework for imitation and innovation. Academy of Management Review, 30(2): 338–360.

Mahmood, I., Zajac, E. J., & Zhu, H. 2011. Where can capabilities come from? Network ties and capability acquisition in business groups. Strategic Management Journal, 32(8): 820–848.

Majumdar, S. 1997. The impact of size and age on firm-level performance: Some evidence from India. Review of Industrial Organization, 12(2): 231–241.

Manikandan, K. S., & Ramachandran, J. 2015. Beyond institutional voids: Business groups, incomplete markets, and organizational form. Strategic Management Journal, 36(4): 598–617.

Meyer, K., Estrin, S., Bhaumik, S., & Peng, M. 2009. Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1): 61–80.

Naughton, B. 1995. Growing out of the plan: Chinese Economic Reform 1878–1993. New York: Cambridge University Press.

Newman, K. 2000. Organizational transformation during institutional upheaval. Academy of Management Review, 25: 602–619.

North, D. 1990. Institutions, institutional change, and economic performance. New York: Norton.

Oliver, C. 1997. Sustainable competitive advantage: Combining institutional and resource-based views. Strategic Management Journal, 18(9): 697–713.

Peng, M. W. 2003. Institutional transitions and strategic choices. Academy of Management Review, 28: 275–296.

Peng, M. W. 2004. Outside directors and firm performance during institutional transitions. Strategic Management Journal, 25(5): 453–471.

Peng, M. W., & Heath, P. 1996. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choices. Academy of Management Review, 21(2): 492–528.

Peng, M. W., & Luo, Y. 2000. Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Academy of Management Journal, 43(3): 486–501.

Peng, M. W., Lee, S., & Wang, D. 2005. What determines the scope of the firm over time? A focus on institutional relatedness. Academy of Management Review, 30(3): 622–633.

Powell, W. 1996. Commentary on the nature of institutional embeddedness. Advances in Strategic Management, 13: 293–300.

Priem, R., & Butler, J. 2001. Is the resource-based “view” a useful perspective for strategic management research. Academy of Management Review, 26(1): 22–41.

Ramaswamy, K., Li, M., & Petitt, B. 2012. Why do business groups continue to matter? A study of market failure and performance among Indian manufacturers. Asia Pacific Journal of Management, 29(3): 643–658.

Rouwenhorst, K. 1999. Local return factors and turnover in emerging stock markets. Journal of Finance, 54(4): 1439–1464.

Schmalansee, R. 1985. Do markets differ much?. American Economic Review, 75: 341–351.

Scott, W. R. 1995. Institutions and organizations. Thousand Oaks: Sage.

Sirmon, D. G., Hitt, M. A., & Ireland, R. D. 2007. Managing firm resources in dynamic environments to create value: Looking inside the black box. Academy of Management Review, 32(1): 273.

Staw, B. M., Sandelands, L. E., & Dutton, J. E. 1981. Threat rigidity effects in organizational behavior: A multilevel analysis. Administrative Science Quarterly: 501–524.

Stinchcombe, A. L. 1965. Social structure and organizations. In J. G. March (Ed.). Handbook of organizations: 142–193. Chicago: Rand McNally.

Vissa, B., Greve, H. R., & Chen, W. R. 2010. Business group affiliation and firm search behavior in India: Responsiveness and focus of attention. Organization Science, 21(3): 696–712.

Walder, A. G. 1995. Local governments as industrial firms: An organizational analysis of China’s transition economy. American Journal of Sociology, 101: 263–301.

Wan, W. P., & Hoskisson, R. E. 2003. Home country environments, corporate diversification strategies, and firm performance. Academy of Management Journal, 46(1): 27–45.

Wernerfelt, B., & Montgomery, C. 1988. Tobin’s q and the importance of focus in firm performance. American Economic Review, 78(1): 246–250.

Wright, M., Filatotchev, I., Hoskisson, R., & Peng, M. 2005. Strategy research in emerging economies: Challenging the conventional wisdom*. Journal of Management Studies, 42(1): 1–33.

Xia, J., Ma, X., Lu, J. W., & Yiu, D. W. 2014. Outward foreign direct investment by emerging market firms: A resource dependence logic. Strategic Management Journal, 35(9): 1343–1363.

Xin, K., & Pearce, J. 1996. Guanxi: Connections as substitutes for formal institutional support. Academy of Management Journal, 39(6): 1641–1658.

Xu, D. E., & Meyer, K. 2013. Linking theory and context: ‘Strategy research in emerging economies’after Wright et al. (2005). Journal of Management Studies, 50(7): 1322–1346.

Xu, X., & Wang, Y. 1999. Ownership structure and corporate governance in Chinese stock companies. China Economic Review, 10(1): 75–98.

Yabushita, N., & Sehiro, A. 2014. Family business groups in Thailand: Coping with management critical points. Asia Pacific Journal of Management, 31(4): 997–1018.

Yiu, D., Bruton, G., & Lu, Y. 2005. Understanding business group performance in an emerging economy: Acquiring resources and capabilities in order to prosper. Journal of Management Studies, 42(1): 183–296.

Young, M., Peng, M., Ahlstrom, D., Bruton, G., & Jiang, Y. 2008. Corporate governance in emerging economies: a review of the principal–principal perspective. Journal of Management Studies, 45(1): 196–220.

Yu, H., Van Ees, H., & Lensink, R. 2009. Does group affiliation improve firm performance? The case of Chinese state-owned firms. Journal of Development Studies, 45(10): 1615–1632.

Zeger, S. L., & Liang, K. 1986. Longitudinal data analysis for discrete and continuous outcomes. Biometrics, 42: 121–130.

Acknowledgements

We would like to thank APJM Senior Editor, Professor Michael Carney, and an anonymous reviewer for valuable comments in the review process. The authors acknowledge the support of grants from the Research Grants Council of the Hong Kong Special Administrative Region (No. 14501714 and No. 14504715) and the National Natural Science Foundation of China (No. 71402097).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ma, X., Lu, J.W. Business group affiliation as institutional linkages in China’s emerging economy: A focus on organizational traits and institutional conditions. Asia Pac J Manag 34, 675–697 (2017). https://doi.org/10.1007/s10490-017-9517-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-017-9517-0