Abstract

This paper examines how ties to large-scale state-owned enterprises and ties to banks affect firm performance in emerging economies. The findings, obtained from survey data collected from 208 firms in the Chinese manufacturing industry, indicate that both categories of ties improve firm performance. The value of the two categories of ties changes in organizational contexts that vary in terms of the moderators of size, age, and firm strategy. Specifically, ties to banks improve the performance of younger firms significantly more than that of older firms, while ties to large-scale state-owned enterprises improve the performance of smaller firms significantly more than that of larger firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Economic liberalization and the transition to a market system cause emerging economies (EEs) to experience rapid, fundamental changes in economic, social, and legal institutions (Hoskisson, Eden, Lau, & Wright, 2000; Peng, 2003; Sheng, Zhou, & Li, 2011; Zhou, Gao, Yang, & Zhou, 2005a). In such turbulent environments, informal social ties represent a critical instrument for securing business, in which support from formal market institutions is often weak (Acquaah, 2007; Peng & Luo, 2000; Sheng et al., 2011). Scholars have identified three major benefits of having social ties for EE firms, including the facilitation of access to resources (Xin & Pearce, 1996), the enhancement of legitimacy (Park & Luo, 2001), and the creation of business opportunities (Zhou, Zhao, Li, & Cai, 2003). Indeed, previous studies have documented a positive effect of social ties for firm performance in the contexts of EEs (Khwaja & Mian, 2005; Li, Poppo, & Zhou, 2008; Li & Zhang, 2007; Li, Zhou, & Shao, 2009; Peng & Luo, 2000; Sheng et al., 2011).

Among various types of ties for firms, the link to government is a prominent one (Ambler & Witzel, 2004; Sheng et al., 2011). A major reason for this is that EE governments are not only the regulators of national economies, but also the dominant economic actors (Okhmatovskiy, 2010). Building close ties to government, therefore, offers EE firms increased access to scarce business resources and regulatory resources. Various scholars have provided evidence of the strong value of having government ties for firm performance in EEs (Arnoldi & Villadsen, 2015; Guo, Xu, & Jacobs, 2014; Peng & Luo, 2000; Sheng et al., 2011). However, some scholars have also cautioned about the dark side to having such ties (Okhmatovskiy, 2010; Zheng, Singh, & Mitchell, 2015). Although the objective of firms in having close ties to the government is often to receive access to valuable resources, the ties also offer the government opportunities to exercise its control over these firms. Because governments tend to pursue their own political or socioeconomic goals, they often divert firms’ resources to achieve these goals (Shleifer & Vishny, 2002). Thus, the degree of closeness that firms should maintain with governments in EEs often presents a dilemma for them.

Scholars have suggested a solution to this dilemma. During the transition of EEs to market systems, governments often set up certain organizations to oversee valuable and scarce state-owned resources. Large-scale state-owned enterprises (SOEs) and banks are two types of organizations that they often choose. On the one hand, EE governments can set up large-scale SOEs in certain “strategically important areas” to ensure their control over entire national economies. On the other hand, they can set up banks to control financial resources. For example, the total assets of nonfinancial SOEs were worth RMB 91 trillion ($14.6 trillion) at the end of 2013, or 160% of Chinese GDP.Footnote 1 At the same time, Chinese governments control all domestic banks as the major shareholders of these banks. Thus, building ties to these organizations—that is, large-scale SOEs and banks—enables firms to avoid the negative effects of direct ties to government but still conserve their access to valuable resources (Okhmatovskiy, 2010). However, studies on the benefits of such ties are still limited when compared with the substantial academic efforts on benefits of ties to government. Therefore, this study aims to address the following question: what are the performance implications of ties to large-scale SOEs and banks in the contexts of EEs?

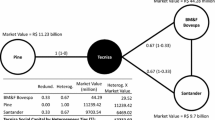

Although firms in EEs generally incline toward leveraging various categories of social ties, these ties might not be equally beneficial to all firms (Peng & Luo, 2000). Thus, it is important to recognize the heterogeneity among firms in the benefits they realize from various types of social ties. In this paper, we compare the relative value of having ties to large-scale SOEs and banks in various firm contexts, as defined by firm size, age, and strategic choice (i.e., flexibility versus efficiency strategies). On the one hand, young and small firms are usually prone to resorting to social ties to secure their performance. Obtaining further knowledge on which ties are most beneficial to young or small firms is not only of theoretical but also of practical importance. On the other hand, due to the liberalization of their economies, EE firms usually formulate and implement various strategies to survive the effects of fierce competition in marketplaces. Knowing which type of strategy might best realize the benefits of ties to large-scale SOEs or to banks can help clarify how to match firms’ social ties with their strategic choices. Given that flexibility and efficiency are the two primary strategies of firms in competitive markets, we examine how firms’ strategies in these areas moderate the effects of ties to large-scale SOEs and to banks on firm performance (see Fig. 1).

We selected China as our unit for empirical research for four reasons. First, China has a long tradition of relying on social ties (guanxi) to conduct business (Huang & Rice, 2012; Luo, 2002; Peng, 2003). Second, China’s dual approach to its market transition has led to the establishment of large-scale SOEs and state-controlled banks to operate in the marketplace (Luo, 2007; Peng, 2003). Third, firms in China are heterogeneous in size, age, and strategic choice. Therefore, we can compare the relative value of ties to large-scale SOEs and ties to banks across different organizational contexts. Fourth, China is the second-largest economy in the world, and understanding its unique characteristics is of interest to firms in both mature economies and EEs (Acquaah, 2007; Gu, Hung, & Tse, 2008; Huang & Rice, 2012).

Theory and hypotheses

Ties to large-scale SOEs and banks in EEs

When confronted with highly uncertain markets and weak institutional frameworks, EE firms often rely on social ties to initiate and safeguard their economic exchanges (Acquaah, 2007; Poppo & Zenger, 2002; Zhou, Poppo, & Yang, 2008; Zhou et al., 2003). In this direction, scholars have identified connections to government as a typical category of such social ties and explored their effects on business performance. However, there are inconsistent views on the value of such ties. Drawing on institutional theory, some scholars have argued that ties to government help firms obtain access to valuable state-owned resources (Xin & Pearce, 1996). However, others, taking a perspective of political embeddedness, suggest that close ties to government make firms vulnerable to government influence which may cause substantial costs to firms (e.g., Okhmatovskiy, 2010). They point out, for example, that governments might divert firm resources to pursue their political goals. In this respect, ties to government might not necessarily benefit, and can even impair, firm performance, especially in EEs, in which governments face fewer constraints in intervening in firm decisions.

Scholars have suggested an alternative that can help firms avoid the negative effect of ties to government but still preserve their opportunity to access valuable state-owned resources (e.g., Okhmatovskiy, 2010). When transitioning into market-oriented economies, EE governments gradually loosen their direct control over state-owned resources. Instead, they often create organizations under their control to manage state property. Valuable business resources such as scarce natural resources, land, and licenses to operate in strategically important areas are often managed by large-scale SOEs, while financial resources are usually managed by banks. Although governments are the ultimate controller of these state-owned resources, large-scale SOEs and banks have a significant degree of autonomy with which to allocate them. If EE firms can establish close ties with these two types of organizations, they can obtain rich access to state-owned resources but simultaneously avoid the costs associated with having a direct connection with the government.

As with other types of social ties, ties to large-scale SOEs and ties to banks both offer EE firms benefits in three primary respects, including supplying resources, enhancing legitimacy, and providing opportunities (Peng & Luo, 2000; Sheng et al., 2011). However, the two categories of ties also differ significantly in these three respects. First, although both categories of ties offer EE firms increased access to valuable resources, the resources which could be acquired by having ties to each are different. Because large-scale SOEs and banks both manage a significant portion of valuable state-owned resources (Faccio, 2006; Sheng et al., 2011), firms can obtain shortcuts to these resources by gaining close ties to either of the two types of organizations. However, the resources that could be obtained by establishing ties to large-scale SOEs and banks would be different because the two types of organizations manage different resources. Specifically, large-scale SOEs are usually major players in certain industrial sectors. Ties to these organizations can provide firms with business and market resources specific to fields the SOE is related to, such as advanced technological expertise, new product information, and pertinent changes in marketplaces (Okhmatovskiy, 2010). However, ties to banks may help firms obtain financial resources with lower costs, such as low-interest loans (Uzzi, 1999), because banks in EEs have significant autonomy in deciding how to allocate their financial assets.

Second, both types of ties can enhance EE firms’ legitimacy, but in the eyes of different institutional constituents. Legitimacy is the extent to which an actor is socially acceptable and desirable (Suchman, 1995). Because social ties embody a firm’s past behaviors and indicate their reputation, these ties can help firms obtain legitimacy in specific institutional fields. Firms having close ties to banks would obtain higher levels of network legitimacy in their business communities. Due to market-oriented transitions in EEs, banks are increasingly operating like profit-focused firms in the marketplace. Thus, they tend to carefully evaluate their partners before establishing close ties with them. Close ties to banks are therefore convincing indicators of firms’ reliability and trustworthiness. Such network legitimacy would help the firms attract business partners and facilitate transactions.

In contrast, close ties to large-scale SOEs can indicate a focal firm’s political legitimacy, or the extent to which the firm’s behaviors are desirable and proper in the opinion of government officials or agencies (Sheng et al., 2011). Because large-scale SOEs usually operate in strategically important areas in a country, their managers are assigned and closely supervised by government officials. Thus, these managers would prefer their partners to be politically legitimate. Having close ties to large-scale SOEs is therefore a sign that the focal firm has higher levels of political legitimacy. However, ties to SOEs might be less capable of increasing firms’ network legitimacy than ties to banks. Due to the monopolistic positions of large-scale SOEs in specific industries, they usually impose relaxed quality or cost requirements on their partners. Other members in business communities might therefore consider close ties to large-scale SOEs a sign that the focal firm has limited capacities to compete in open markets.

The third difference between ties to large-scale SOEs and banks is that though they both can create valuable business opportunities, it is usually in different ways. On the one end, close ties to large-scale SOEs can offer firms direct and lucrative business opportunities. Because large-scale SOEs are either monopoly or protected operations based on state ownership, they are usually of higher levels of profitability. In addition, government control is associated with a lack of incentives for managers to maximize firms’ profit (Okhmatovskiy, 2010). After firms establish close ties to managers of large-scale SOEs, they are more likely to receive lucrative contract conditions from these managers. On the other end, ties to banks can offer firms business opportunities by connecting them to more extensive networks. Banks usually lie at the intersection of many firms, industries, and regions and maintain extensive networks and ample external contacts (Zhang & Li, 2010). Thus, ties to banks enable firms to plug into the networks and become more capable of identifying and exploiting new business opportunities.

Performance implications of ties to large-scale SOEs and banks

In EEs, firms’ ties to large-scale SOEs can improve their performance in three ways. First, large-scale SOEs can provide EE firms with resources, including scarce state-owned resources, private information on policy, and valuable market sources. Large SOEs in EEs usually act as depositories and managers of state resources, such that they are endowed with unique assets that the government may be reluctant to privatize (e.g., natural resources, communication networks, and transportation infrastructures) (Okhmatovskiy, 2010). Although these SOEs are often controlled by governments, they also enjoy significant autonomy in allocating their resources, because in many ways they operate as businesses (Ralston, Terpstra-Tong, Terpstra, Wang, & Egri, 2006). They are also more versed than private firms on governmental policies. Having close ties to large-scale SOEs thus facilitates a firm’s access to regulatory resources, such as information on policy change. In addition, large-scale SOEs in EEs often have unique technologies and dominant positions in the market. Close ties to the organizations also facilitate a firm’s access to obtaining market resources, including technological knowledge, new products information, and pertinent changes in the market. The privileged access to these valuable regulatory and market resources can be an important source of competitive advantages (Arend & Lévesque, 2010).

Second, having close ties to large-scale SOEs can also be a sign of a firm’s compliance with state policy and government expectation. As a result, the firm would have increased political legitimacy, which can help it receive better treatment in regulatory frameworks. According to Sheng et al. (2011), politically legitimate firms are less vulnerable to opportunistic behavior because they can turn to government officials to enforce business contracts or stop unlawful behaviors.

Third, ties to large-scale SOEs offer firms valuable and stable business opportunities, in that SOEs also function as large customers that purchase products and services (Toninelli, 2000). With more ties to large-scale SOEs, firms can sell more products and perhaps earn greater profits. Insofar as state ownership often fails to motivate managers to maximize firm value in terms of efficiency or profitability (Aharoni, 2000; Okhmatovskiy, 2010), these SOEs also can offer their business partners favorable contract conditions that would be unavailable in transactions with privately owned enterprises. In addition, these ties can ensure long-term collaborations between the firm and the large-scale SOE. Compared with officials in government, managers in large-scale SOEs are more business minded and less likely to be rotated to other organizations (Sheng et al., 2011). Close ties with these managers can cultivate trust and cooperative norms that can stabilize existing collaborations. These direct, lucrative, and stable business opportunities are beneficial for firms’ performance. Thus:

-

Hypothesis 1 Ties to large-scale SOEs have positive effects on focal firms’ performance.

In EEs, governments maintain control over banks to ensure achievement of their economic and political goals. This has benefits and drawbacks. On the one hand, banks operate across the whole economy, providing governmental officials with increased opportunities to exert their control and influence on economic activities. On the other hand, the asymmetric information communicated between lending banks and outsiders about the quality of a specific loan makes it easy to conceal the political motivation behind a loan. The preference of government for controlling banks has been identified in existing studies. For example, La Porta et al. (2002) found that 42% of assets of 10 largest banks in 92 countries are controlled by the government. In addition, Okhmatovskiy (2010) found that in EEs, banks are given either monopoly or protected positions based on governmental ownership. Due to the critical role of banks in managing and allocating financial resources, EE firms are highly motivated to build and maintain social ties with bank managers.

Having ties to banks also might lead to several advantages for firms. First, the connection can be used to mitigate the firm’s resource constraints (Krahnen & Schmidt, 2004). In the underdeveloped financial markets of EEs, loans from banks represent a primary route to financial resources for firms (Le & Nguyen, 2009). Close ties to banks increase firms’ chances of a loan and simultaneously decrease the costs of financing (Peng & Luo, 2000; Uzzi, 1999). With sufficient financial support, the focal firms can buffer themselves against external shocks and buy other valuable resources from factor markets (Bradley, Aldrich, Shepherd, & Wiklund, 2011).

Second, ties to banks convey network legitimacy. To avoid potential loss, bank managers carefully evaluate each firm’s internal control processes, asset quality, and profitability before allowing close interactions (Uzzi, 1999). If a firm has established close ties with banks, it gains a convincing representation of reliability, quality, and business conduct, enabling the firm to gain a high level of network legitimacy in its business community. Such legitimacy is a strategic resource that can attract business partners, facilitate transactions, and offer economic benefits (Dacin, Oliver, & Roy, 2007; Sheng et al., 2011).

Third, ties to banks facilitate the identification and exploitation of new opportunities. Banks often interact with many firms and organizations, enabling them to create extensive networks of ties to various actors in the whole economic system. By establishing close connections with a bank, the focal firm plugs into the bank’s networks and thereby gains access to varied business opportunities in various sectors (Zhang & Li, 2010). Thereafter, the firm can better exploit these opportunities through its ties to banks, in that rich financial resources increase managers’ discretion and capacity for experimenting with new alternatives (Bierly, Damanpour, & Santoro, 2009; Bradley et al., 2011). Thus:

-

Hypothesis 2 Focal firms’ ties to banks have positive effects on focal firms’ performance.

Contingent values of ties to large-scale SOEs and banks

Although ties to large-scale SOEs and banks can improve firm performance, based on the heterogeneity among firms, the relative value of these two types of social ties might fluctuate. The study focuses on three firm-level moderators: size, age, and strategic choice as efficiency or flexibility. Whereas small firms might suffer the liability of their size, young firms might encounter the liability of newness and have impaired performance (Lu & Beamish, 2006). Different types of resources, legitimacy, and opportunities conferred by ties to large-scale SOEs and ties to banks may possess different values for small and young firms to overcome their disadvantages (Freeman, Carroll, & Hannan, 1983). Thus, it is necessary to examine how the relative values of the two categories of ties vary between firms of different age and size. Furthermore, flexibility and efficiency strategies have inconsistent capacities to leverage various types of resources, legitimacy, and business opportunities (Ebben & Johnson, 2005). Because ties to large-scale SOEs and ties to banks enable firms to obtain different types of resources, legitimacy, and business opportunities, the two types of ties can have inconsistent values for firms implementing flexibility or efficiency strategies. This study therefore further analyzes how strategic choices as efficiency or flexibility moderate the effect of ties to large-scale SOEs and banks on firm performance.

Firm age and the liability of newness

Empirical evidence indicates that young firms achieve lower performance and higher failure rates (Baum & Oliver, 1991; Mata & Portugal, 2002; Singh, House, & Tucker, 1986a; Singh, Tucker, & House 1986b). At least three explanations of this liability of newness exist in the literature. First, researchers suggest that new firms are less capable of exploiting new business opportunities, because they typically lack sufficient resources to accommodate diverse goals and options (Bradley et al., 2011; Raisch & Birkinshaw, 2008). Second, young firms typically lack network legitimacy, which managers need to build business relationships (Singh et al., 1986b). Third, young firms have difficulties finding new business opportunities because attracting business away from well-established competitors is difficult (Zhang & Li, 2010), and finding new external business opportunities is challenging for new firms that are relatively poorly embedded in local business networks (Ahuja, Polidoro, & Mitchell, 2009; Zhang & Li, 2010).

Ties to banks can help young firms overcome these disadvantages. The first reason is that the financial resources acquired through these ties can help young firms exploit new business opportunities. Most new firms must focus on taking advantage of new opportunities, rather than competing with existing firms for their customers (Fernhaber & Patel, 2012). Financial resources are highly relevant to young firms’ efforts to identify and pursue new opportunities (Bradley et al., 2011; Bierly et al., 2009). In particular, financial resources reduce the selective pressures facing new firms (Bradley et al., 2011), such that they can accommodate a greater diversity of goals, strategies, and organizational structures. Furthermore, new companies are particularly vulnerable to a lack of available capital (Khaire, 2010), such that managers often are required to face resource constraints when exploiting new opportunities (Raisch & Birkinshaw, 2008). If rich financial resources are available, managers can take more advantage of new opportunities and be more responsive to external changes (Bierly et al., 2009).

However, it is usually difficult for young firms to obtain financial resources from banks. Compared with mature firms, young firms are lacking of reliable performance records. Limited information will hinder banks’ willingness to issue loans to young firms. In the context, ties to banks may help young firms solve the problem. Close ties to banks increase social interaction between managers of young firms and banks, by which private information about young firms will be transmitted. In addition, social ties are usually viewed as a reliable source of information because social attachment exists. By mitigating information asymmetries between young firms and banks, ties to banks may increase possibility of young firms to obtain loans. In contrast, the value of ties to banks may fade in mature firms, because these firms have longer performance records by which banks can evaluate their reliability.

Second, young firms usually encounter difficulties in developing business relationships due to lower network legitimacy. According to Higgins and Gulati (2006), establishing ties to reputable entities is an important means for new ventures to gain network legitimacy. In China, banks are reputable because of their state-owned history and control over financial resources. In addition, banks provide favorable support to young firms by offering cautious evaluation in the process of selecting partners, with the goal of increasing the amount of profit-oriented organizations making market-oriented transitions in EEs. Close ties to banks, therefore, can enable external stakeholders to be more confident about the firm’s reliability, social desirability, and profitability. At that time, the young firm has increased levels of network legitimacy, which in turn enables it to obtain support in its business communities.

Third, young firms can find valuable business opportunities through these ties. Compared with mature firms, young firms usually have fewer external contacts and thus are restricted in searching for external opportunities (Ahuja et al., 2009; Zhang & Li, 2010). Ties to banks grant new firms a greater degree of quick access to the extensive business networks in various parts of the economic system. According to Ahuja et al. (2009), connecting with a partner that already has high network centrality enables poorly embedded, peripheral firms, such as newcomers, to gain ample access to business opportunities. In contrast, mature firms are often better embedded than young firms in business communities. Thus, younger firms may benefit more from ties to banks than do older firms.

However, the value of having ties to large-scale SOEs might not benefit younger firms to a greater degree than older firms for three reasons. First, close ties to large-scale SOEs offer a firm’s access to not only regulatory resources, but also business resources specific to areas of large-scale SOEs’ operations. However, young firms might be less capable for obtaining these resources from large-scale SOEs, even if close ties exist. Compared to private firms, large-scale SOEs are more subject to normative pressures from governments to collaborate with firms having high levels of reliability (Zhou et al., 2003). For young firms, their working routines may not be fully established (Wiklund, Baker, & Shepherd, 2010). Large-scale SOEs would be hence conservative towards exchanges with young firms, even if close ties exists. In contrast, banks might not be as sensitive as large-scale SOEs when it comes to a firm’s operation history. They would instead be more likely to focus on whether the focal firm currently has adequate capacities and valuable assets to pay off debts.

Second, ties to large-scale SOEs offer firms increased political legitimacy. However, a major disadvantage of less legitimate young firms is their difficulties in developing business relationships (Kor & Misangyi, 2008). Because of large-scale SOEs’ noncompetitive position in the market, close ties to these firms may not enhance young firms’ attractiveness in their business communities. Although market-oriented transitions make SOEs in EEs more profit driven, they might still be less sensitive to market pressure because of their monopolistic positions (Okhmatovskiy, 2010). Government control of SOEs also leads to a lack of monitoring and weak incentives for managers (Bruton, Peng, Ahlstrom, Stan, & Xu, 2015; Musacchio, Lazzarini, & Aguilera, 2015). In these contexts, managers of SOEs might not be fully motivated to pursue maximum profits. Instead, they might set favorable transaction conditions by imposing fewer quality or cost requirements on their partners. As evidence, the returns on assets (ROA) on Chinese SOEs are now about half the amount of those of their non-state-owned peers,Footnote 2 despite their monopolistic position in marketplaces. Thus, external business partners might not regard having close ties with large-scale SOEs as a convincing sign that the focal firm has adequate capabilities to operate independently in a complex business environment.

Third, though ties to large-scale SOEs may provide firms with direct and lucrative business opportunities, such opportunities may be less available to young firms. Large-scale SOEs usually prioritize stability over profitability (Ralston et al., 2006), and their managers might be reluctant to take risks by doing major business transactions with newcomers without reliable performance records (Li & Tang, 2010; Tan, 2001). Zhou et al. (2003) found that in China, it takes on average six to seven years for a firm to participate in major business dealings with a partner. The process usually takes even longer for large-scale SOEs, as they tend to be more conservative than common firms in the marketplace. As a result, when young firms obtain business opportunities from large-scale SOEs it is likely to be through an incremental and long-term process. Thus, ties to large-scale SOEs may not significantly improve young firms’ performance:

-

Hypothesis 3a Firm age negatively moderates the positive effect of ties to banks on firm performance, but not the effect of ties to large-scale SOEs.

Firm size and the liability of smallness

Small firms tend to suffer from poorer performance and higher failure rates (Baum & Oliver, 1991; Freeman et al., 1983; Singh et al., 1986b). This occurs for three reasons. First, limited resources make it difficult for small firms to compete with large-scale rivals (Park & Luo, 2001). Second, small firms lack sufficient levels of political legitimacy to buffer against the regulatory pressures in the environment. Compared with large firms, small firms usually have multiple levels of governments, which impose heavy regulatory pressures on business dealings (Singh & Lumsden, 1990). Third, it is difficult for small firms to obtain profitable business opportunities, because their weaker bargaining power and lacking of scale impair their profitability (Dobrev & Carroll, 2003).

Having ties to large-scale SOEs can help small firms overcome these disadvantages. First, small firms can gain valuable resources and thus acquire better positions in the market. Their lack of scale economics makes it difficult for small firms to win head-to-head competition against large rivals. To avoid such competition, small firms need to differentiate themselves from rivals (Dobrev & Carroll, 2003; Ebben & Johnson, 2005; Porter, 1980). In EEs, SOEs largely control the supply of unique, scarce resources (e.g., monopoly resources, export quotas, entry licenses, advanced technologies). Thus, by establishing ties with them, small firms can increase their chances of acquiring important, state-owned resources that will enable them to achieve differentiation in the marketplace. In this way, smaller firms might benefit more from ties to large-scale SOEs than do larger firms.

Second, since having close ties to large-scale SOEs is a sign of a firm’s compliance with state policy and government expectation, the close ties can likely help small firms overcome disadvantages caused by lower legitimacy. As a result, the firm can obtain increased political legitimacy, which can help it receive better treatment in regulatory frameworks. Small firms usually face substantial administrative overhead expenses because they have multiple levels of governments (Singh & Lumsden, 1996). In China, there are county, city, province, and state. Governmental regulations hence have more impact on small firms. By obtaining political legitimacy via their ties to large-scale SOEs, small firms can better adapt to regulatory pressures.

Third, these ties can enhance small firms’ profitability by offering stable, remunerative business opportunities. Although small firms usually suffer from limited bargaining power and rarely can structure deals to their full advantage (Jiang, Chua, Kotabe, & Murray, 2011; Pfeffer & Salancik, 1978), managers of large-scale SOEs have less incentive to maximize firm profits (Aharoni, 2000), so they might be more willing to offer favorable transactional conditions to the small firms to which they have ties. Furthermore, business-minded managers of large-scale SOEs have interests in pursuing economic returns for their firms (Okhmatovskiy, 2010). Thus, they would be motivated to work together with their business partners to coordinate exchanges. Ongoing interactions and collaborations may cultivate trust, commitment, and mutual dependence between them (Sheng et al., 2011). Such relational norms might constrain opportunism and cultivate long-term orientation toward cooperation. Thus, ties to large-scale SOEs can cultivate collaborative partnerships that lead to lucrative business opportunities, which could significantly improve small firms’ profitability.

In contrast, ties to banks might have less significant benefits for small firms. The first reason for this is that close ties to banks may not provide small firms with access to financial resources. Although small firms have strong needs for financial resources, banks in EEs are often reluctant to provide loans to small firms that lack adequate assets, to ensure that they will pay off debts. Due to market-oriented transitions in EEs, banks become more-profit-driven corporate enterprises. Thus, they emphasize avoiding bad loans. To maximize their profits and minimize their risks, the banks usually favor large borrowers over small firms.

Second, ties to banks have limited values for small firms to overcome disadvantages caused by lower legitimacy. A major disadvantage of small firms is substantial regulatory pressure. However, having close ties to banks may mainly improve firms’ network legitimacy, which indicates firms’ quality and reliability in business activities. Even such ties may not improve small firms’ political legitimacy. These firms may hence have to experience intervention from multiple levels of governments, which are detrimental for firm performance.

Third, business opportunities obtained via ties to banks may not significantly benefit small firms. Having close ties to banks enable firms to plug into extensive networks and become more capable of identifying new business opportunities (Zhang & Li, 2010). However, weaker bargaining power and lack of scale impair small firms’ capabilities to structure deals to their full advantage (Dobrev & Carroll, 2003). Thus, the value of having ties to banks might not benefit smaller firms to a greater degree than larger firms:

-

Hypothesis 3b Firm size negatively moderates the positive effect of ties to large-scale SOEs on firm performance, but not the effect of ties to banks.

Firm strategy: Flexibility versus efficiency

Management literature has established a primary typology for firm strategy (Eisenhardt, Furr, & Bingham, 2010), which suggests that an efficiency strategy focuses on providing standard products to fulfill stable, mass demands, whereas a flexibility strategy emphasizes made-to-order products that appeal uniquely to individual customers or groups (Swink, Narasimhan, & Kim, 2005). Although both strategies are able to improve firm performance (Ebben & Johnson, 2005), they have different capacities in leveraging specific resources, opportunities, and legitimacy for better performance. Given that ties to large-scale SOEs and banks offer firms different categories of these capacities, the relative benefits of ties to these two entities also are contingent on firms’ strategies. In particular, we predict that ties to large-scale SOEs are more valuable for firms pursuing an efficiency strategy, whereas ties to banks offer more benefits for firms pursuing a flexibility strategy.

First, ties to large-scale SOEs often provide the focal firm with resources specific to fields related to the enterprise’s business and activities. The efficiency strategy is more capable of leveraging specialized resources, because the strategy emphasizes the improvement of firms’ efficiency in conducting routine and repetitive tasks (Lowson, 2001; Möller & Svahn, 2006; Zhou & Li, 2010; Zhou, Yim, & Tse, 2005b). In contrast, ties to banks often help the focal firm obtain loans or other financial assets. These general purpose resources would be better leveraged by firms adopting the flexibility strategy, because the resources are more valuable in supporting the nonroutine and exploratory tasks emphasized by the strategy (Danneels, 2007).

Second, efficiency and flexibility strategies have different capacities to realize the values derived from opportunities created by the two categories of ties. Large-scale SOEs in EEs typically operate in monopoly industries and request massive amounts of standardized products and services. Ties to large-scale SOEs therefore can provide the focal firm with opportunities to concentrate on executing routine, repetitive, and exploitative tasks. Adopting an efficiency strategy enables firms to focus on the efficient execution of these tasks and thus can help them achieve better performance. In contrast, ties to banks offer the focal firm richer access to new and diverse business opportunities (Zhang & Li, 2010). Due to their control over financial resources, banks are often part of extensive business networks. Close ties to banks can thus become a firm’s shortcut into these networks and thereby offer diverse information, knowledge, and expertise. Adopting a flexibility strategy provides firms more capability in exploiting these advantages, because the strategy emphasizes the fulfillment of inconsistent demands (Bradley et al., 2011).

Third, the values of legitimacy that firms acquire through their respective ties to large-scale SOEs and banks depend on firms’ strategy in terms of flexibility and efficiency. Compared with having ties to large-scale SOEs, having ties to banks better increases a firm’s capacity for network legitimacy. To avoid risk, banks in EEs take caution in evaluating their business partners in terms of internal control processes, asset quality, and profitability before allowing close interactions (Uzzi, 1999). Thus, having close ties to banks is indicative of a firm’s reliability, integrity, and business conduct. Because of their enhanced attractiveness and trustworthiness, firms having close ties to banks have more capacity to establish collaborations with external partners (Dacin et al., 2007; Sheng et al., 2011). This advantage would be better exploited by using a flexibility strategy. Extensive collaboration networks not only benefit firms in terms of identifying diverse demands but also enable firms to integrate external expertise to fulfill these demands.

Having ties to large-scale SOEs, however, might do less in terms of enhancing the social judgment of a firm’s quality and capabilities in its business communities. SOEs are usually nearly monopolistic and therefore less sensitive to market pressure (Okhmatovskiy, 2010). Control from governments also leads to ineffective incentives and supervision in SOEs (Bruton et al., 2015; Musacchio et al., 2015). For example, Chinese governments have issued a policy mandating that total pay for executives appointed by the state should not exceed seven to eight times the average income of employees.Footnote 3 As a result managers of SOEs might be less motivated to pursue maximum profits and therefore impose relaxed quality or cost requirements on their partners. Thus, having close ties to SOEs might not be a convincing sign that the focal firm has adequate capabilities and flexibility to compete in open markets. Rather, the ties might be indicative of a firm’s political legitimacy. Because managers of large-scale SOEs usually are selected by governments, these managers would be inclined to establish and maintain close ties with firms whose behavior is desirable and proper in the eyes of government officials or agencies. Thus, firms having close ties to large-scale SOEs are more capable of establishing close ties to other SOEs, which would help the firms gain similar or repetitive business. Using an efficiency strategy rather than a flexibility strategy would confer a firm with more capacity to exploit these opportunities. Thus:

-

Hypothesis 4a Having ties to large-scale SOEs improves the performance of firms pursuing an efficiency strategy significantly more than that of firms pursuing a flexibility strategy.

-

Hypothesis 4b Having ties to banks improves the performance of firms pursuing a flexibility strategy significantly more than that of firms pursuing an efficiency strategy.

Methodology

Data collection

We collected our survey data in three phases. In the first phase, partner faculty members at three Chinese universities provided directories for 350 manufacturing firms, which they randomly selected from lists of local chemical and machinery firms in China. By using purposive sampling on the directories, we identified potential respondents. Large-scale and centralized firms embody different characteristics than other firms competing in the marketplace; accordingly, we chose prospective firms that (1) were not controlled by the central government and (2) had been in existence for at least two years. We made the latter choice so that we could impose a one-year lag between the dependent and independent variables in the survey to test for causality.

In the next phase, we organized telephone conversations with representatives from each firm to outline the study briefly and encourage their participation. As an incentive, we promised to provide respondents customized reports. The sampling frame thus consisted of 232 firms.

Finally, face-to-face interviews took place with respondents from the identified firms. Despite its intensive resource requirements, the face-to-face method enabled the interviewers to address any doubts or questions immediately, and it prevented the risk that busy managers might just hand over the questionnaires to their assistants. Thus, we could ensure that the data were complete and usable. One or two interviewers covered each geographical area in China; these interviewers were mostly faculty members and graduate students as well as some professional consultants, who received extensive advance training in the survey background, exact meaning of the questionnaires, and interview skills. After the training, we conducted a pilot study of 10 firms, in the presence of a trainer, to provide additional insights that we shared during a debriefing of the interviewers. We did this to improve their data collection techniques and clarify some vague wording in the survey instruments.

Most of the respondents were managers or executives of the sample firms. At the start of each interview, we provided them with a letter explaining the purpose of the survey and promising their information would be kept confidential. The interviews usually lasted between one and one-and-a-half hours. We eliminated 24 incomplete responses and kept complete data from 208 firms, for a 59.4% overall response rate. Our sample consists of 169 firms in coastal areas of China and 39 firms in central or western regions. Half the firms were small (300 or fewer employees), 39% were medium sized (300–2000 employees), and 10% were large (2000+ employees).

Measurement

When possible, we used validated instruments from prior literature (see the Appendix 1). To ensure the data would support our test of proposed causality, we asked all informants to answer the firm performance questions (i.e., our dependent variable) in relation to their situation in the current year, but for the questions related to the firm’s ties to large-scale SOEs and banks (i.e., the independent variables), we asked them to answer on the basis of their situations in the previous year.

The measure of ties to banks comes from Peng and Luo (2000). It captures the extent to which firms had good relationships with bank officials in the prior year, with a scale reliability of α = .81. The measure of ties to SOEs, adapted from Baum and Oliver (1991) and Sheng et al. (2011), consists of one item that indicates the number of large-scale, central-government-controlled SOEs with which the firm built long-term and deep connections. These measures of ties to banks and ties to SOEs reflect the distinct networking practice of Chinese managers. That is, a firm typically establishes close ties to only one bank, because Chinese banks tend to be very large in scale. Thus, the measure for ties to banks emphasizes how close the ties are between the manager and the officials at his or her bank. In contrast, a firm can collaborate with multiple large-scale SOEs simultaneously and leverage these ties to improve its performance, so this measure assesses the extent to which the firm has good relations with managers of large-scale SOEs.

The measure of firm age involves the number of years the firm had been in business up to 2007; the measure of firm size reflects the number of employees at the firm. We relied on China’s official classification of firm size and used a three-point ordinal scale: 1 = small (fewer than 300 employees), 2 = medium (300–2000 employees), and 3 = large (more than 2000 employees).Footnote 4 We followed the three-step procedure developed by Ebben and Johnson (2005) to measure firm strategy. First, we adopted a seven-item measure of firm strategy; its Cronbach’s alpha was .87. The measure focuses on product, operational, and labor aspects of firms that employ efficiency and flexibility strategies. Prior studies have identified these three aspects as the most important elements of firms’ flexibility and efficiency strategies (Swink et al., 2005). Second, we calculated the average scores of all sampled firms on these seven items and then conducted a cluster analysis based on the average scores, which yielded two clusters. The low-score cluster encompasses firms pursuing an efficiency strategy (=1), and the high-score cluster consists of firms pursuing a flexibility strategy (=0).Footnote 5 Last, for the measure of firm performance, derived from Peng and York (2001), we asked informants to evaluate their firm’s performance in terms of return on assets, net profits, return on sales, and sales growth. The value of Cronbach’s alpha for this measure was .89.

We also controlled for location, R&D investment, demand uncertainty, technological uncertainty, and government support. In China, significant differences exist among various regions of the country in levels of economic development, completeness of the institutional framework, and munificence of resources. All these criteria can differentiate firm performance. In addition, we controlled for firms’ R&D investment as a proxy of their technological capabilities, which may affect firm performance. For the measure of R&D, we used a ratio of R&D investment to total sales. Because market environment can also affect firm performance (Bourgeois, 1985), we added demand uncertainty and technological uncertainty as control variables. For demand uncertainty, we used Chen and Paulraj’s (2004) measure, in which three items reflect the degree of fluctuation in the firm’s demand (Cronbach’s α = .73). We adapted a two-item measure of technological uncertainty from Jaworski and Kohli (1993), which indicates the degree to which technology changes in the firm’s industry (Cronbach’s α = .83). Because other relational variables can also affect firm performance, we controlled for government support, or the extent to which a firm could obtain various form of support from the government. Using a single-item scale, we asked our respondents to evaluate the extent to which their firms receive support from government. In Table 1, we summarize all the descriptive statistics for the variables in our study.

Survey scale testing

We assessed the scales using the complete responses to our survey (N = 208). The satisfactory reliabilities achieved by all the scales showed that our study is statistically reliable and logical (see the Appendix). We also performed exploratory factor analyses using principal component methods on all the scales separately. The high loadings (>.5) and insubstantial cross loadings (<.5) confirm convergent validity. We thus did not need to drop any items from the scales.

In a confirmatory factor analysis to test for convergent and discriminant validity, we found that all factor loadings were statistically significant (p < .001), and the model fit our data well (goodness-of-fit index = .90, confirmatory fit index = .96, root mean square error of approximation = .05). The average variances extracted (AVE) of all constructs were greater than .50, and the composite reliabilities (CR) of all constructs were also greater than .70. The indexes showed adequate reliability and convergent validity (Fornell & Larcker, 1981). In chi-square difference tests for all constructs in pairs, we fixed the correlations between constructs to one in a constrained model but freely estimated the parameters in the unconstrained model. The results show that all the chi-square differences were highly significant (p < .05), such that the unconstrained model fit significantly better than the constrained one. Each construct’s AVE also was higher than its highest shared variance (HSV) with any other constructs. These results indicate adequate discriminant validity, as we show in the Appendix 1.

Results

To mitigate the latent threat of multicollinearity, we ran multiple ordinary least square (OLS) regression models to test our hypotheses, after mean-centering the scales we used to construct the interaction terms (Aiken & West, 1991). To check for multicollinearity, we inspected the variance inflation factors (VIFs) among the explanatory variables and found that the highest VIF was 1.41 in Model 3—well below the threshold of 10. Thus, multicollinearity did not appear to be a concern (Neter et al., 1990). We ran the multiple OLS regression models (Table 2) to test the main and moderating effects.

In Table 2, we report the results of these multiple OLS regression tests for the main effects of ties to large-scale SOEs and ties to banks and the moderating effects of firm characteristics. Model 1 contains only the control variables. In Model 2, we added main effects of ties to banks and ties to large-scale SOEs. In Models 3–5, we progressively added onto the previous items the moderating effects of firm age, firm size, and efficiency strategy. Model 6 includes all the control variables, the main and moderating effects, and the interactions. All the models were significant at p < .001, with adjusted R-square values ranging from .20 to .29. We can observe that our results remain stable across various models. We used results in Model 2 to test main effects and used those in Model 6 to test interaction effects.

In Model 2, the regression coefficient of ties to large-scale SOEs on performance was positive and significant (Model 2: β = .17, p < .01) in support of our prediction in H1 that these ties improve firm performance. In addition, the positive effect of ties to banks on firm performance was highly significant (Model 2: β = .18, p < .01) in support of our claim in H2 that ties to banks improve firm performance.

In H3, we proposed that the value of ties to large-scale SOEs and to banks change in different organizational contexts. In Model 6, we determined that firm age negatively moderated the effect of ties to banks on firm performance (Model 6: β = −.13, p < .05) in support of H3a. In addition, firm age did not moderate the effect of ties to large-scale SOEs on firm performance (Model 6: β = .06, p > .05). That is, ties to large-scale SOEs did not improve the performance of young firms significantly more than that of old firms.

As we show in Model 6, the interaction between firms’ ties to large-scale SOEs and their size was negative and significant (Model 6: β = −.16, p < .05), such that the benefits of ties to large-scale SOEs were more prominent for smaller firms, in support of H3b. Furthermore, the interaction between firms’ ties to banks and their size was insignificant (Model 6: β = .08, p > .05); as we predicted, ties to banks did not improve the performance of small firms significantly more than that of large firms.

The benefits of ties to large-scale SOEs were more valuable for firms pursuing an efficiency strategy than for firms following a flexibility strategy, as we show in Table 2, in that the interaction between an efficiency strategy and ties to large-scale SOEs had a positive and significant effect on performance (Model 6: β = .22, p < .001), in support of H4a. The interaction between an efficiency strategy and ties to banks was negative and significant (Model 6: β = −.11, p < .05). Because flexibility and efficiency represent two ends on a strategic continuum,Footnote 6 these results indicate that ties to banks are more valuable for firms pursuing a flexibility strategy than an efficiency strategy, in support of H4b.

Discussion

Contributions

In our view, this study makes three contributions to existing literature. First, the study offers possible solutions to the dilemma of firms in dealing with business-government relationships in the contexts of EEs. Although building close social ties to governments is an important means of improving performance for EE firms, the ties also offer governments opportunities to exploit firms (Okhmatovskiy, 2010). Because governmental officials are generally less business minded and tend to consume firms’ resources to pursue their political or socioeconomic goals, ties to governments may impair firm performance (Shleifer & Vishny, 2002). How much distance firms should keep from their governments therefore represents a dilemma for managers in EEs. By highlighting and testing the performance implications of firms’ ties to large-scale SOEs and banks in EEs, the study offers a possible solution to the dilemma: EE firms should consider pursuing the alternative of building social ties to large-scale SOEs and banks, which would enable them to conserve their access to valuable state-owned resources while avoiding the risks of governmental officials diverting the firm’s resources to achieve their nonbusiness goals.

Second, our findings provide nuanced understandings of how values of ties to large-scale SOEs and ties to banks change in different organizational contexts characterized by size, age, and strategy. We find that ties to banks improve the performance of young firms significantly more than that of old firms; ties to large-scale SOEs benefit small firms more than large firms. Although researchers have long asserted that social ties are particularly valuable for small and young firms (Baum & Oliver, 1991; Khaire, 2010; Park & Luo, 2001; Peng & Luo, 2000; Rao, Chandy, & Prabhu, 2008), we help clarify which categories of social ties are the most relevant. In addition, we show that while ties to SOEs have a greater benefit for efficient firms, ties to banks have a greater benefit for flexible firms. We also extend research that suggests that the benefits of social ties depend on firms’ strategic activities (Burt, 1997; Park & Luo, 2001) by specifying which firm strategies lead social ties to be more valuable for firm performance (Acquaah, 2007). By detailing the generic typology of firm strategy, we provide nuanced insights into how firm strategy can change the value of ties to large-scale SOEs and banks in EEs.

Third, a contingent approach to assessing the value of social ties to organizations is common (Acquaah, 2007; Park & Luo, 2001; Peng & Luo, 2000); yet our study still makes two additional contributions to this stream of research. On the one hand, we highlight the explanatory and predictive power of a contingent approach for examining the value of social ties, by extending existing research to two important, but long-overlooked categories of social ties, including ties to large-scale SOEs and ties to banks. On the other hand, whereas prior studies have identified certain contingency variables associated with task and institutional environments (e.g., Adler & Kwon, 2002; Gu et al., 2008; Sheng et al., 2011; Zhou et al., 2008; Zhou & Li, 2007), we focus on three primary firm-level factors. This is a direct response to Peng and Luo’s (2000) call for more rigorous research on whether and how heterogeneous organizational circumstance affects the benefits of social ties for firm performance.

Managerial implications

Our results have two important implications for managers of firms in EEs. First, our findings suggest that managers need to pay more attention to establishing ties to large-scale SOEs and banks. Building these two categories of ties enables firms to avoid the risks and costs inherent in ties to governmental officials but to still conserve their access to valuable state-owned resources. Second, managers need to recognize that ties to large-scale SOEs and ties to banks do not benefit all firms to the same extent. Rather, the values of these ties change with firms’ size, age, and strategic choices. We recommend that managers of small firms should establish ties to large-scale SOEs while managers of new firms should pursue ties with banks. Ties to SOEs are particularly beneficial for firms pursuing efficiency strategies, and ties to banks can help firms identify and respond flexibly to unique customer demands.

Future research directions

This study highlights at least three directions for future research. First, our sample is confined to China, and though all EEs share some common features, they differ significantly in terms of the overall environment and level of economic development. Thus, additional studies might test our model by collecting data in other EEs, such as Brazil, Russia, and India. Second, we used data collected in a one-year time framework, but a longer time framework would provide better information for scholars to test how ties to large-scale SOEs and ties to banks affect firm performance, as one year’s performance might not be a good indicator of the overall performance of the firm. Another direction for research would be to collect data on ties and performance at two points in time, which would avoid requiring managers to recall managerial situations in previous periods. Last, we used managers’ subjective evaluations as the measure of performance, though objective measure would be better than these subjective perceptions. In addition, we used general questions to measure firms’ ties to large-scale SOEs and ties to banks. Although the concept of social ties is well known in China and we were able to obtain reliable responses using it, a more sophisticated network analysis with a name and position generator approach would produce additional insights into the topic. Future studies might also explore how to adopt more reliable measures when probing the effects of ties to large-scale SOEs and banks on performance.

Conclusion

Whereas many studies emphasize the value of having direct ties to governmental officials for firm performance in EEs, this study finds that these ties may also impair firm performance in that they provide less-business-minded governmental officials opportunities to divert firms’ resources to pursue their own political goals. Determining how close to stay with the government therefore presents a dilemma for firms in EEs. The study suggests building ties to large-scale SOEs and ties to banks as solutions to the dilemma, because these types of ties enable EE firms to gain access to state-owned resources while avoiding being exploited by governmental officials. Our findings indicate that ties to large-scale SOEs and ties to banks indeed have positive effects on firm performance in China. More important, the benefits of having ties to large-scale SOEs and banks are contingent on firms’ traits, including size, age, and strategy as flexibility or efficiency.

Notes

The National Bureau of Statistics of China put the criteria into effect in 2003.

This study adopts the view that Chinese firms use either a flexibility or an efficiency strategy. According Gupta, Smith, and Shalley (2006), whether firms can simultaneously achieve flexibility and efficiency depends on their resource profile. Firms need to possess sufficient resources to achieve ambidexterity of efficiency and flexibility. Despite rapid development in recent decades, Chinese firms generally do not possess adequate resources to implement complicated strategies. Furthermore, because both flexibility and efficiency strategies are related to how firms offer products to markets, simultaneous adopting the two strategies is more difficult (Gupta et al., 2006). Empirical results from Ebben and Johnson (2005) also show a negative effect of mixing efficiency and flexibility on small firms’ performance. Thus, it might be less likely for Chinese firms to adopt flexibility and efficiency strategies simultaneously.

Recent studies suggest the potential benefits of balancing efficiency and flexibility strategies (e.g., Eisenhardt et al., 2010). However, other research considers the strategies diametrically opposed, in that they create conflicting demands in terms of technologies, expertise, labor, control systems, and organizational structures (Fiegenbaum & Karnani, 1991; Filley & Aldag, 1980). Ebben and Johnson (2005) assert that firms that combine the two strategies underperform those that focus on one or the other.

References

Acquaah, M. 2007. Managerial social capital, strategic orientation, and organizational performance in an emerging economy. Strategic Management Journal, 28(12): 1235–1255.

Adler, P. S., & Kwon, S. 2002. Social capital: prospects for a new concept. Academy of Management Review, 27(1): 17–40.

Aharoni, Y. 2000. Review of the origins of the international competitiveness of firms by L. Nachum. Journal of Economics, 71(1): 91–94.

Ahuja, G., Polidoro, F., Jr., & Mitchell, W. 2009. Structural homophily or social asymmetry? The formation of alliances by poorly embedded firms. Strategic Management Journal, 30(9): 941–958.

Aiken, L. S., & West, S. G. 1991. Multiple regression: Testing and interpreting interactions. Newbury Park: Sage.

Ambler, T., & Witzel, M. 2004. Doing business in China. London: Routledge.

Arend, R. J., & Lévesque, M. 2010. Is the resource-based view a practical organizational theory?. Organization Science, 21(4): 913–930.

Arnoldi, J., & Villadsen, A. R. 2015. Political ties of listed Chinese companies, performance effects, and moderating institutional factors. Management and Organization Review, 11(2): 217–236.

Baum, J. A. C., & Oliver, C. 1991. Institutional linkages and organizational mortality. Administrative Science Quarterly, 36(2): 187–218.

Bierly, P. E., III, Damanpour, F., & Santoro, M. D. 2009. The application of external knowledge: Organizational conditions for exploration and exploitation. Journal of Management Studies, 46(3): 481–509.

Bourgeois, L. J. 1985. Strategic goals, perceived uncertainty, and economic performance in volatile environments. Academy of Management Journal, 28(3): 548–573.

Bradley, S., Aldrich, H., Shepherd, D., & Wiklund, J. 2011. Resources, environmental change and survival: Asymmetric paths of young independent and subsidiary organizations. Strategic Management Journal, 32(5): 486–509.

Bruton, G. D., Peng, M. W., Ahlstrom, D., Stan, C., & Xu, K. 2015. Stated owned enterprises around the world as hybrid organizations. Academy of Management Perspectives, 29(1): 92–114.

Burt, R. S. 1997. The contingent value of social capital. Administrative Science Quarterly, 42(2): 339–365.

Chen, I. J., & Paulraj, A. 2004. Understanding supply chain management: Critical research and a theoretical framework. International Journal of Production Research, 42(1): 131–163.

China National Bureau of Statistics. 2007. Statistics yearbook of China. Beijing: CNBS.

Dacin, M. T., Oliver, C., & Roy, J. P. 2007. The legitimacy of strategic alliances: An institutional perspective. Strategic Management Journal, 28(2): 169–187.

Danneels, E. 2007. The process of technological competence leveraging. Strategic Management Journal, 28(5): 511–533.

Dobrev, S. D., & Carroll, G. R. 2003. Size (and competition) among organizations: Modeling scale-based selection among automobile producers in four major countries. Strategic Management Journal, 24(6): 541–558.

Ebben, J. J., & Johnson, A. C. 2005. Efficiency, flexibility, or both? Evidence linking strategy to performance in small firms. Strategic Management Journal, 26(13): 1249–1259.

Eisenhardt, K. M., Furr, N. R., & Bingham, C. B. 2010. CROSSROADS—Microfoundations of performance: Balancing efficiency and flexibility in dynamic environments. Organization Science, 21(6): 1263–1273.

Faccio, M. 2006. Politically connected firms. American Economic Review, 96(1): 369–386.

Fernhaber, S. A., & Patel, P. C. 2012. How do young firms manage product portfolio complexity? The role of absorptive capability and ambidexterity. Strategic Management Journal, 33(13): 1516–1539.

Fiegenbaum, A., & Karnani, A. 1991. Output flexibility—A competitive advantage for small firms. Strategic Management Journal, 12(2): 101–114.

Filley, A. C., & Aldag, R. J. 1980. Organizational growth and types: Lessons from small institutions. Research in Organizational Behavior, 2: 279–320.

Fornell, C., & Larcker, D. F. 1981. Structural equation models with unobservable variables and measurement error: Algebra and statistics. Journal of Marketing Research, 18(1): 382–388.

Freeman, J., Carroll, G. R., & Hannan, M. T. 1983. The liability of newness: Age dependence in organizational death rates. American Sociological Review, 48(5): 692–710.

Gu, F. F., Hung, K., & Tse, D. K. 2008. When does guanxi matter? Issues of capitalization and its dark sides. Journal of Marketing, 72(4): 12–28.

Guo, H., Xu, E., & Jacobs, M. 2014. Managerial political ties and firm performance during institutional transitions. Journal of Business Research, 67(2): 116–127.

Gupta, A., Smith, K., & Shalley, C. 2006. The interplay between exploration and exploitation. Academy of Management Journal, 49(4): 693–706.

Higgins, M. C., & Gulati, R. 2006. Stacking the deck: the effects of top management backgrounds on investor decisions. Strategic Management Journal, 27(1): 1–25.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249–267.

Huang, F., & Rice, J. 2012. Firm networking and bribery in China: Assessing some potential negative consequences of firm openness. Journal of Business Ethics, 107(4): 533–545.

Jaworski, B. J., & Kohli, A. K. 1993. Market orientation: Antecedents and consequences. Journal of Marketing, 57(3): 53–70.

Jiang, C., Chua, R., Kotabe, M., & Murray, J. 2011. Effects of cultural ethnicity, firm size, and firm age on senior executives’ trust in their overseas business partners: Evidence from China. Journal of International Business Studies, 42(9): 1150–1173.

Khaire, M. 2010. Young and no money? Never mind: The material impact of social resources on new venture growth. Organization Science, 21(1): 168–185.

Khwaja, A. I., & Mian, A. 2005. Do lenders favor politically connected firms? Rent provision in an emerging financial market. Quarterly Journal of Economics, 120(4): 1371–1411.

Krahnen, J. P., & Schmidt, R. H. 2004. German financial system. New York: Oxford University Press.

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. 2002. Government ownership of banks. Journal of Finance, 57(1): 265–301.

Le, N., & Nguyen, T. 2009. The impact of networking on bank financing: The case of small and medium-sized enterprises in Vietnam. Entrepreneurship: Theory and Practice, 33(4): 867–887.

Li, H., & Zhang, Y. 2007. The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strategic Management Journal, 28(8): 791–804.

Li, J., & Tang, Y. 2010. CEO hubris and firm risk taking in China: The moderating role of managerial discretion. Academy of Management Journal, 53(1): 45–68.

Li, J. J., Poppo, L., & Zhou, K. Z. 2008. Do managerial ties in China always produce value? Competition, uncertainty, and domestic vs. foreign firms. Strategic Management Journal, 29(4): 383–400.

Li, J. J., Zhou, K. Z., & Shao, A. T. 2009. Competitive position, managerial ties, and profitability of foreign firms in China: An interactive perspective. Journal of International Business Studies, 40(2): 339–352.

Lowson, R. 2001. Customized operational strategies for retailers in fast-moving consumer industries. International Review of Retail, Distribution and Consumer Research, 11(2): 201–224.

Lu, J. W., & Beamish, P. W. 2006. Partnering strategies and performance of SMEs’ international joint ventures. Journal of Business Venturing, 21(4): 461–486.

Luo, Y. 2002. Contract, cooperation, and performance in international joint ventures. Strategic Management Journal, 23(10): 903–919.

Luo, Y. 2007. An integrated anti-opportunism system in international exchange. Journal of International Business Studies, 38(6): 855–877.

Mata, J., & Portugal, P. 2002. The survival of new domestic and foreign-owned firms. Strategic Management Journal, 23(4): 323–343.

Möller, K., & Svahn, S. 2006. Role of knowledge in value creation in business nets. Journal of Management Studies, 43(5): 985–1007.

Musacchio, A., Lazzarini, S. G., & Aguilera, R. V. 2015. New varieties of state capitalism: Strategic and governance implications. Academy of Management Perspectives, 29(1): 115–131.

Neter, J., Wasserman, W., & Kutner, M. H. 1990. Applied linear statistical models, 3rd ed. Irwin: Homewood.

Okhmatovskiy, I. 2010. Performance implications of ties to the government and SOEs: A political embeddedness perspective. Journal of Management Studies, 47(6): 1020–1047.

Park, S. H., & Luo, Y. 2001. Guanxi and organizational dynamics: Organizational networking in Chinese firms. Strategic Management Journal, 22(5): 455–477.

Peng, M. W. 2003. Institutional transitions and strategic choices. Academy of Management Review, 28(2): 275–296.

Peng, M. W., & Luo, Y. 2000. Managerial ties and firm performance in a transition economy: The nature of a micro–macro link. Academy of Management Journal, 43(3): 486–501.

Peng, M. W., & York, A. S. 2001. Behind intermediary performance in export trade: Transactions, agents, and resources. Journal of International Business Studies, 32(2): 327–346.

Pfeffer, J., & Salancik, G. R. 1978. The external control of organizations: A resource dependence approach. New York: Harper & Row.

Poppo, L., & Zenger, T. 2002. Do formal contracts and relational governance function as substitutes or complements?. Strategic Management Journal, 23(8): 707–725.

Porter, M. E. 1980. Competitive strategy. New York: Free Press.

Raisch, S., & Birkinshaw, J. 2008. Organizational ambidexterity: Antecedents, outcomes, and moderators. Journal of Management, 34(3): 375–409.

Ralston, D. A., Terpstra-Tong, J., Terpstra, R. H., Wang, X., & Egri, C. 2006. Today’s state-owned enterprises of China: Are they dying dinosaurs or dynamic dynamos?. Strategic Management Journal, 27(9): 825–843.

Rao, R. S., Chandy, R. K., & Prabhu, J. C. 2008. The fruits of legitimacy: Why some new ventures gain more from innovation than others. Journal of Marketing, 72(4): 58–75.

Sheng, S., Zhou, K. Z., & Li, J. J. 2011. The effects of business and political ties on firm performance: evidence from China. Journal of Marketing, 75(1): 1–15.

Shleifer, A., & Vishny, R. W. 2002. The grabbing hand: Government pathologies and their cues. Cambridge: Harvard University Press.

Singh, J. V., House, R. J., & Tucker, D. J. 1986a. Organizational change and organizational mortality. Administrative Science Quarterly, 31(4): 587–611.

Singh, J. V., & Lumsden, C. J. 1990. Theory and research in organizational ecology. Annual Review of Sociology, 16: 161–95.

Singh, J. V., Tucker, D. J., & House, R. J. 1986b. Organizational legitimacy and the liability of newness. Administrative Science Quarterly, 31(2): 171–193.

Suchman, M. C. 1995. Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20(3): 571–610.

Swink, M., Narasimhan, R., & Kim, S. W. 2005. Manufacturing practices and strategy integration: Effects on cost efficiency, flexibility, and market-based performance. Decision Sciences, 36(3): 427–457.

Tan, J. 2001. Innovation and risk-taking in a transitional economy: A comparative study of Chinese managers and entrepreneurs. Journal of Business Venturing, 16(4): 359–376.

Toninelli, P. A. 2000. The rise and fall of state-owned enterprise in the western world. Cambridge: Cambridge University Press.

Uzzi, B. 1999. Embeddedness in the making of financial capital: How social relations and networks benefit firms seeking financing. American Sociological Review, 64(4): 481–505.

Wiklund, J., Baker, T., & Shepherd, D. 2010. The age-effect of financial indicators as buffers against the liability of newness. Journal of Business Venturing, 25(4): 423–437.

Xin, K. R., & Pearce, J. L. 1996. Guanxi: Connections as substitutes for formal institutional support. Academy of Management Journal, 39(6): 1641–1658.

Zhang, Y., & Li, H. 2010. Innovation search of new ventures in a technology cluster: The role of ties with service intermediaries. Strategic Management Journal, 31(1): 88–109.

Zheng, W., Singh, K., & Mitchell, W. 2015. Buffering and enabling: The impact of interlocking political ties on firm survival and sales growth. Strategic Management Journal, 36(1): 1615–1636.

Zhou, K. Z., Gao, G. Y., Yang, Z., & Zhou, N. 2005a. Developing strategic orientation in China: antecedents and consequences of market and innovation orientations. Journal of Business Research, 58(8): 1049–1058.

Zhou, K. Z., & Li, C. B. 2007. How does strategic orientation matter in Chinese firms?. Asia Pacific Journal of Management, 24(4): 447–466.

Zhou, K. Z., & Li, C. B. 2010. How strategic orientations influence the building of dynamic capability in emerging economies. Journal of Business Research, 63(3): 224–231.

Zhou, K. Z., Poppo, L., & Yang, Z. 2008. Relational ties or customized contracts? An examination of alternative governance choices in China. Journal of International Business Studies, 39(3): 526–534.

Zhou, K. Z., Yim, C. K., & Tse, D. K. 2005b. The effects of strategic orientations on technology- and market-based breakthrough innovations. Journal of Marketing, 69(2): 42–60.

Zhou, X., Zhao, W., Li, Q., & Cai, H. 2003. Embeddedness and contractual relationships in China’s transitional economy. American Sociological Review, 68(1): 75–102.

Acknowledgments

This paper is supported by the National Natural Science Foundation of China (No. 71302144 and No. 71172185) and National Natural Science Fund for Outstanding Young Fund of China (No. 71222202)

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Xie, E., Huang, Y., Shen, H. et al. Performance implications of ties to large-scale state-owned enterprises and banks in an emerging economy. Asia Pac J Manag 34, 97–121 (2017). https://doi.org/10.1007/s10490-016-9473-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-016-9473-0