Abstract

Approximately 1.7 billion people in Asia live in poverty today. To date, efforts to address poverty in Asia have largely focused on subsistence entrepreneurship rather than on creating ventures that empower them to break out of poverty. That is, the mechanisms that have been used, such as microlending, generally lead entrepreneurs to create businesses providing basic life essentials rather than helping them build businesses that generate capital to improve the entrepreneur’s standard of living. This article initially reviews what we know about entrepreneurship as a solution to poverty in Asia. We then examine what we know about other major tools to address poverty in Asia. Next, we propose a research agenda on poverty in Asia. Finally, we introduce the articles in this Special Issue of the Asia Pacific Journal of Management, “Asia & Poverty: Closing the Great Divide through Entrepreneurship & Innovation,” on new approaches to entrepreneurship to help address the key issue of the alleviation of poverty.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Poverty remains a crucial issue in today’s world (Bruton, Ketchen, & Ireland, 2013). Despite steady and often impressive economic growth in much of Asia in recent decades, the region still holds 1.7 billion people who live on less than US $2 a day, which represents approximately two-thirds of the world’s poor (World Bank, 2012).Footnote 1 However, to date, the ways in which such grinding poverty in Asia impacts and is in turn impacted by business remains largely unexplored by business scholars. The understanding of business and poverty offers the potential to not only improve business actions and profitability in such markets, but also to offer a means to continue to move substantial numbers of people out of poverty (Ahlstrom, 2010; Bruton et al., 2013). Major government initiatives and charity solutions to poverty have not proved dramatically successful despite the spending of substantial efforts and money to solve the problem (Easterly, 2006, 2008). This Special Issue of the Asia Pacific Journal of Management addresses this gap by developing the foundation for examining poverty in Asia from the perspective of business.

Allied disciplines, such as development economics and economic history, have long sought explanations of poverty and its solution (e.g., Landes, 1998; McCloskey, 2010; Perkins, Radelet, Lindauer, & Block, 2013). To encourage economic growth and reduce poverty, research has often focused on scale and scope economies and maximizing production (Galbraith, 1967; Leff, 1979; Naim, 2013), increases in productivity (e.g., Jones & Romer, 2010), mere capital accumulation (Lucas, 2002; Van Zanden, 2009), and public sector or small scale enterprise job creation (Abzug, Simonoff, & Ahlstrom, 2000; Ogbuabor, Malaolu, & Elias, 2013). However, management scholars and economists increasingly recognize that entrepreneurship and new venture creation may offer a significant part of the solution to poverty around the world (Ahlstrom, 2010; Alvarez, Barney, & Newman, 2015; Baumol, Litan, & Schramm, 2009; Bruton, 2010; Bruton et al., 2013; McCloskey, 2010).Footnote 2 This view of the solution to poverty does not argue that the traditional view of many economists and government officials alike is incorrect. But research is increasingly clear that merely piling up more capital, implementing “big push” infrastructure projects, or investing in education without concern for entrepreneurship and its supporting institutions does not yield a strong impact on poverty (Godfrey, 2014; Greif, 2006; McCloskey, 2010). Schumpeter’s remark on the futility of the accumulation of capital, without entrepreneurship and innovation, illustrates this well: “Add successively as many mail coaches as you please, you will never get a railway…” (Schumpeter, 1912[1934]: 64n). The research seeded by the work of (Schumpeter 1912[1934]) and Sombart (1913) holds that innovation and new venture creation are central to economic growth and the reduction of poverty (Ahlstrom, 2010; Baumol et al., 2009; George, McGahan, & Prabhu, 2012; McCloskey, 2010; Wong, Ho, & Autio, 2005; Yu, Hao, Ahlstrom, Si, & Liang, 2014). The challenge is now to encourage that entrepreneurship and particularly, its most productive forms (Baumol et al., 2009).

This Special Issue in the Asia Pacific Journal of Management, “Asia & Poverty: Closing the Great Divide through Entrepreneurship & Innovation,” focuses on how those facing grinding poverty in Asia are exiting poverty through entrepreneurship. The goal of this Special Issue is to lay the foundation for a greater understanding and exploration by scholars of entrepreneurship as a solution to poverty in Asia. This Special Issue consists of this commentary and five exceptional papers. However, before we summarize those five papers, the editors will address a key concern for scholars in exploring poverty in Asia that is, moving beyond subsistence entrepreneurship. By subsistence entrepreneurship, we mean those entrepreneurial efforts that many individuals, non-profits, and governments are actually seeking to encourage in centers of extreme poverty which create little substantial value for the person and the society (Fischer, 2013; Viswanathan, Echambadi, Venugopal, & Sridharan, 2014). Not all people can become entrepreneurs, and if ventures are entrepreneurial they will not all be successful since there must be risk involved. The encouraging of a multitude of small ventures that create few new jobs or substantive value ties the entrepreneurs to subsistence entrepreneurship that generates little hope for more substantial improvement in their standards of living (Baumol et al., 2009). We will address the arguments that support this view before examining the articles in this Special Issue.

Background

Scholars that have examined research on poverty from a development economic perspective have tended to focus on capital endowments and returns, particularly improved productivity (Perkins et al., 2013). Typically, the research contends that more endowments in land, labor, education, resources, and infrastructure result in lower poverty (Leff, 1979; Lucas, 2002; Romer, 1986). Asian countries geared their development efforts particularly toward the expansion of heavy industry using many elements of the Soviet central planning model (Ahlstrom, 2014; Barone, 2004; Naughton, 1995). Scholars held that industrial and economic development hinged largely on capital, such as scale and scope economies (Chandler, 1990), and increasingly on human capital (Boyce, 1995), on maximizing production, or on conquest and luck (Diamond, 1997), not on new venture development (Galbraith, 1967; Leff, 1979; Naim, 2013). The resulting approaches, from an economics perspective, focus on how to generate and utilize human capital and increasingly on improving education (Baulch, 2011). Research in economics, and indeed in a good part of the social sciences, did not concern itself with entrepreneurship as a solution to poverty (Ahlstrom 2014; Leff, 1979; Nasar, 2012).

Earlier efforts to examine poverty often focused on the failure of firms to achieve scale economies and on over-specialization that hindered both firm development and national industrialization (Kaldor, 1966). These foci led Nathanial Leff (1979), in an influential review in the Journal of Economic Literature, to argue that the level of entrepreneurship was not a major concern in the pace of development in countries. In the decades after the Second World War, entrepreneurship also did not rate much notice in such mainstream social sciences as economics and management.Footnote 3 Even today, in spite of the attention entrepreneurs have garnered in popular culture in recent years, development economics has generally treated entrepreneurship and new ventures only briefly (e.g., Perkins et al., 2013; Rodrik & Rosenzweig, 2010), though more recently certain economists (e.g., Baumol et al., 2009; Baumol & Strom, 2007; Lerner, 2009), and finance scholars (e.g., Cumming, Fleming, & Schwienbacher, 2009; Cumming & Suret, 2011) have given more attention to the significance of entrepreneurship.

In spite of the somewhat limited attention given to entrepreneurship and small business, and their importance both in practice and in research by economists and finance scholars, many management scholars now believe that entrepreneurship and new venture creation offer the surest route to economic growth and development, including job creation (e.g., Ahlstrom, 2010; Du, Guariglia, & Newman, 2013; Ireland, Hitt, & Sirmon, 2003; Lu, Au, Peng, & Xu, 2013; Zahra, Sapienza, & Davidsson, 2006). The belief that entrepreneurship is central to economic development (e.g., Audretsch, Keilbach, & Lehmann, 2006; Baumol et al., 2009; Haltiwanger, Jarmin, & Miranda, 2011; Wong et al., 2005), and the alleviation of poverty (Bhagwati & Panagariya, 2013; Bruton et al., 2013) drives this increasing focus. As a result, The Economist magazine (2009), argued that entrepreneurship is an idea whose time has come.

Although there has been more research on entrepreneurship and new ventures in recent years, much of that research has focused on subsistence entrepreneurship (Viswanathan et al., 2014). Such entrepreneurship seeks to help people simply meet basic needs. We argue that this basic-needs focus substantially undervalues what entrepreneurship can really achieve in these environments. One of the key tools that management scholars see as a means to escape poverty is microlending (Bruton, Khavul, & Chavez, 2011). While practitioners still often argue that microlending offers a prime example of how entrepreneurship can solve poverty, we argue here that it instead helps to create an environment of subsistence entrepreneurship which tends to lock people into poverty, rather than enabling economic improvement. Therefore, we will both examine what microlending is and is not, according to the research, and the alternative tools that scholars and governments can employ. We then go further and examine another tool that economists have suggested as key to encouraging faster-growth in settings of poverty: Substantial entrepreneurship—the establishment of property rights and the encouragement of new ventures and growth opportunities—and also how scholars could potentially investigate and explain these efforts in the future. We then also examine a key central institutional setting that shapes entrepreneurship under conditions of extreme poverty, on which management scholars have focused—the informality of the business. For both the tools and informality, we will examine what we know about these domains specifically in terms of Asia and also how scholars can expand their research to increase our theoretical understanding of entrepreneurship as a solution to poverty. However, before getting to these substantive issues, we will first define what we mean by poverty, Asia, and subsistence poverty.

Defining poverty

Both scholars and practitioners define poverty largely by the level of real per capita annual income in a country. The most basic poverty level is a daily income of $1.25. The World Bank reports that the numbers of poor at this level of income have been dropping in recent years. For example, the $1.25 a day poverty rate has fallen in South Asia from 61 % of the total population to 36 % between 1981 and 2008 (Chen & Ravallion 2010). The definition of poverty is important to an understanding of poverty levels and an assessment of potential solutions to the problem (Garud & Ahlstrom, 1997a).

Scholars also increasingly argue that the $1.25 level is too low to indicate poverty. For example, Lant Pritchett of Harvard University and the Center for Global Development contends that the $1.25 poverty line is far too low. A more appropriate level to determine poverty, he argues, is over $10 a day (Sammon, 2013). The $1.25 a day figure is at best a level of income that offers only bare subsistence. Scholars more widely accept a poverty level of $2 a day (Sammon, 2013), the median poverty level for all developing economies (World Bank, 2012). At this income level the number of people in poverty stands at 1.7 billion people in Asia and 1.1 billion in South Asia (Chen & Ravallion, 2010).Footnote 4 Thus, a key to understanding how poverty levels are changing is how experts define poverty.Footnote 5 Here we will discuss poverty in terms of the $2 a day figure, which represents a better goal for entrepreneurship in terms of helping people move forward to where they can accumulate some capital, innovate and move beyond mere subsistence levels.Footnote 6

Defining subsistence entrepreneurship

As noted, subsistence entrepreneurship refers to ventures in settings of poverty in which a new venture offers little in terms of the potential to significantly improve the entrepreneur’s life or that of the entrepreneur’s family. This type of entrepreneurial firm is usually a small, lifestyle-business that rarely hires employees from outside of the immediate family, and generally does not experience much growth (Fischer, 2013).Footnote 7 While generating some revenue, such entrepreneurial ventures do not offer the potential for most poor individuals to substantially improve their life situation as they typically have limited scalability and potential for growth. Some evidence indicates that women can, through such entrepreneurship, improve their families’ daily calorie intakes (Todd, 1996). However, such entrepreneurship generally does not improve significantly the total lives of those who operate such businesses.

Poverty in Asia

In examining poverty in Asia, we take into account all of Asia, including Central and West Asia. However, two quite different Asian stories take place in the same region. China has seen dramatic reductions in poverty in recent years (Ahlstrom, 2014). After the upheavals of the Mao years, China was desperately poor with over 900 million people (about 90 % of China’s population at that time) living in on the equivalent of today’s $2 a day. The number of people in poverty in China has fallen to approximately 300 million since the start of China’s reforms (Clark, 2011). China is one of the great success stories in poverty reduction (Ahlstrom, 2010; Ahlstrom & Ding, 2014). If we exclude the impressive reduction in the number of Chinese citizens living in abject poverty below the $2 a day level, the decline in poverty in Asia has been less impressive. The number of people in poverty in China has largely stabilized as China’s economic growth has slowed, though the gap between the rich and poor has grown larger. Today China’s Gini Coefficient, as a measure of the income gap between the rich and poor, stands at 47, which places China in the top quartile in the world in terms of income disparity (CIA Factbook, 2014). For comparisons South Korea’s Gini Coefficient stands at a more equitable 31 (CIA Factbook, 2014).

South Asia, which consists of India, Pakistan, Bangladesh, Nepal, and Sri Lanka, has had a different experience over the last 35 years as this region has experienced far less poverty reduction than in China. Today, South Asia still has over one billion people living on less than $2 a day (Chen & Ravallion, 2010). The Gini Coefficient for the largest country in this region—India—is lower than China, 36.8, which makes per capita income far more equitably distributed between rich and poor than China.

Here we combine these two widely divergent areas of Asia as we discuss poverty. The editors recognize the existence of distinct cultural, political, religious, and economic conditions in different countries and regions in Asia (Ahlstrom, Levitas, Hitt, Dacin, & Zhu, 2014; Gong, Chow, & Ahlstrom, 2011); the articles in this Special Issue help to illustrate these rich differences. However, the large number of poor throughout this diverse setting should encourage additional research on the key topic of poverty and entrepreneurship.

Literature on poverty in Asia

The existing literature on addressing poverty in Asia is very limited. Using the Ebsco search engine and focusing on the Financial Times 45 top journals for the business school and the terms “poverty” and “Asia,” we found only one relevant article (i.e., Kistruck, Sutter, Lount, & Smith, 2013b).Footnote 8 To double check our results, we also used Ebsco to search the Financial Times 45 journal titles with the terms “Asia” and “base of the pyramid” (plus a separate search by BoP—the abbreviation for base of the pyramid). The subsequent searches identified no additional articles.

The authors acknowledge that such a review is not perfect. The Financial Times list does not include all relevant journals. For example, the Journal of Development Economics is not on the Financial Times 45 list, but it is a top journal in development economics and has a number of relevant articles. Even this journal, the Asia Pacific Journal of Management, despite its fairly high five-year impact factor of 3.0 is not on the Financial Times list; although we must note that before this Special Issue, APJM had published no articles directly addressing poverty and Asia.

Of course, some research examines key issues of poverty without specifically addressing Asia. Therefore, we also examined Ebsco articles that concerned poverty and a list of 49 nations that broadly could be considered as Asia (an approach consistent APJM’s view of Asia). A total of 41 potential articles were identified. Of these 16 articles were found to be non-relevant such as book reviews, editorials, and the like. The remaining 25 articles are listed in Table 1. What is notable among these articles is that even as we look deeper for potential articles that could provide foundations for scholars to build on as they examine poverty in Asia only a single article addresses the issue of entrepreneurship. Mair and Marti (2009) examined institutional voids in Bangladesh and how entrepreneurship can develop in such a setting. The other articles on specific countries are often old and typically offer limited insight on how entrepreneurship in Asia can help provide a solution to poverty.

While the editors recognize there are limitations to our review of poverty and how entrepreneurship can help address this problem, we believe that there are few (if any) overlooked relevant articles in the leading business journals. Thus, one thing that seems clear: The research related to Asia and poverty in leading business journals, especially around entrepreneurship, remains very rudimentary.

Tools for entrepreneurship

As noted earlier, one of the key means that exists today to encourage entrepreneurship in settings of extreme poverty on which management scholars focus is microlending. We will first examine what the evidence reveals and does not reveal about microlending in successfully encouraging entrepreneurship. We will then look at another key tool that economists have identified as central to encouraging entrepreneurship: legal status of property.

Microlending

As we think of the key tools often cited as ways to encourage entrepreneurship among the poor, perhaps the most common is microlending (Bruton et al., 2011). It was estimated at the beginning of the prior decade that there were 3.6 billion individuals who did not have access to banking services, and of this group 1.8 billion needed access to capital (Robinson, 2001). The outcome of this belief was the drive to develop programs to provide capital to a wide range of people. Microloans are very small loans, sometimes as small as $5, designed to help fund new businesses (Khavul, 2010). It is estimated that lenders annually now make some 200 million microloans worldwide (Lützenkirchen & Weistroffer, 2012). Microloans are an intellectually compelling approach to starting entrepreneurial ventures in that the poor have no capital and such loans can give them capital they need to start small scale businesses (Ogbuabor et al., 2013). However, while an attractive concept, the evidence clearly indicates that microloans have little positive impact in terms of reducing poverty (Bruton et al., 2011). In fact, the majority of evidence from a growing body of sophisticated research is that microloans have a near-zero impact in terms of poverty reduction (Duvendack et al., 2011). Such an outcome should not be a surprise. From a simple business point of view, one can see that 95 % repayment rates offer prima facia evidence that the entrepreneurial ventures took limited risks. Thus, most microloans do not enhance the ability of these ventures to generate excess capital that can be pooled for other activities, such as capital investment and the hiring of individuals outside of the family, both actions critical to move beyond subsistence entrepreneurship

Microfinance has generated numerous articles and news stories, supported by an ever expanding industry of NGOs and government programs. These stories commonly focus on a single person who is able to take the financing and expand to employ others and create a substantial business. But on inspection, such stories are rare and represent only a small subset of the large number of ventures funded. David Roodman in his 2012 book, Due diligence: An impertinent inquiry into microfinance, called attention to the lack of evidence demonstrating microlending’s positive impact on poverty. Roodman (2012) went on to argue that that in terms of social goals, microlending also has mixed evidence. For example, mirolending is often supported by government and NGOs as a means to create greater independence for women. However, he noted that while microlending creates independence for some women through its network of inter-relationships, microlending also confines others. However, Roodman (2012) emphasized that for many micro lenders the goal is not to break poverty so much as to act upon lenders’ social values. For example, to some microlenders the act of helping the poor is part of their religious philosophy. Thus, they make the loan not so much to break the hold of poverty as to meet a religious goal.

Property rights

While microlending has taken the dominant role in the management domain, economists have focused on another key tool to encourage entrepreneurship in settings of extreme poverty, the improvement of property rights. In developing countries, few of the poor own formally titled property (de Soto, 2000). While the majority of residents in poorer countries may be de facto owners of a small house or a farm, the ownership of the property is informal. The ownership comes through neighborhood associations, shadow businesses, or even criminal organizations that maintain order in the region (de Soto, 2000; Young, Ahlstrom, Bruton, & Rubanik, 2011) rather than through formal titles. The lack of formal titles prevents them from using the land as collateral, thus preventing the “unlocking” of capital from the assets.

Lacking formal titles, squatters, housing organizations, shadow and criminal organizations, and even primitive tribes manage to protect their assets (de Soto, 2000). The main problem with informal enforcement is not security of ownership. The problem is that landholders cannot use the property for collateral in starting a business, nor is it easy to borrow money or get permits to improve the land, mine it, or build on it, as the owner and the lender fear easy appropriation by governments or large organizations that may suddenly lay claim to the land (de Soto, 2000; Ross, 1911). For individuals to use land as collateral, either for a loan or in support of a business transaction, its legal status must be secure.

A considerable body of research examines the outcomes of previous titling programs (Deininger & Binswanger, 1999). The effect of titling shows that the gains from formal titling envisioned by Hernando de Soto depend on the outcome of three separate transformations. There needs to be the ability to transform property into collateral, collateral into credit, and finally credit into income. Economics generally supports the ideas that such titling leads to the access to credit and in turn entrepreneurship. Management researchers would be well served to expand our own understanding of such titling programs and their actual impact on entrepreneurship efforts. The economists typically look at such macro levels, and management scholars could fill this need by making deeper, more specific firm-level examinations, particularly in Asia.

Key institutional setting: Informality

As the poor seek financing through microcredit and the slow process of improving formal institution and property rights, debates continue about financing and other important accelerators of entrepreneurship (Hubbard & Duggan, 2009; Manders, 2004). Such is true particularly of Asia, whose poverty differs from that in other regions, such as parts of the United States, South America, and Africa that scholars have examined more carefully in terms of property rights and financing (Manders, 2004). A key institutional parameter that entrepreneurs seek to manage in developing countries is informal businesses, which do not register with the government and establish property rights (Young et al., 2011). Informal businesses sell legal products and conduct legal services, but do not register with the government which can severely limit their growth (Webb, Bruton, Tihanyi, & Ireland, 2013). It is important to emphasize that informal firms do not sell things that the government prohibits, like drugs or guns, but do not register with the government in order to avoid taxes or regulation. The level of informality can be extensive. For example, in India, informal firms conduct 90 % of the economic activity and employ 90 % of the working population (Iyer, Khanna, & Varshney, 2013).

While the investigation of firm-informality is relatively well established, scholars have conducted only limited research in Asia. In conducting a similar review of relevant literature for those articles concerned with informal firms or informality and Asia for each of the Financial Times 45 journals, we found no articles specifically on Asian firms. Thus, while the vast majority of firms by those living in poverty are informal, virtually no research focuses specifically on the Asian context. As a result, scholars need to not only understand informality in Asia but how informality affects entrepreneurial businesses particularly as they seek to grow and create capital for the entrepreneur and employment for the society.

Future research

Clearly, though poverty is still a major problem in Asia, scholars have conducted only limited research into understanding and alleviating poverty through entrepreneurship, particularly in that region. Considering the topics that scholars should examine first is the need to build a greater understanding of how those in poverty can form businesses that go beyond subsistence entrepreneurship. In a manner consistent with Fischer’s (2013) arguments, entrepreneurs need to do more than simply form a business, earn a bare-bones living and repay loans. Entrepreneurial firms have a bigger impact when they enable entrepreneurs to gather capital, hire additional people, and create innovate products and services (Ahlstrom, 2010; Hart & Christensen, 2002). Research in Latin America has recognized that one of the keys to the success of an entrepreneurial business is to hire outside the family (Bruton et al., 2011). Scholars in Asia need to bring a similar recognition to our investigations in this region.

A principal tool for encouraging entrepreneurship in developing economies in recent years has been microlending (Bruton et al., 2011). But the results of this tool have been mixed at best (Roodman, 2012). Research needs to help examine market-based solutions to encourage entrepreneurship. One of the mistakes in microlending is the belief that every person can be an entrepreneur. Mature economies acknowledge that not all people can be entrepreneurs; it is unclear why so many believe it will be different in settings of extreme poverty. Investigations need to focus on how to encourage entrepreneurship among people willing to take significant risks in order to create ventures that employ others. For example, in a program in Africa the fund seeks to provide far greater capital than typically occurs in microlending and actually create businesses that can actually hire others and perhaps grow (Khavul, Bruton, & Wood, 2009). This means fewer will be funded, but the economic impact would be greater. But creating such businesses requires different models in which the objective function (Jensen, 2001) in terms of measures of success should change from how many loans are made (and repaid) to willingness to take risks that can lead to the capability to employ others.

Finally, the evidence here highlights important related topics such as informal firms which are developing a strong literature. While this literature on informality is now well established, in Asia we argue that informality should not be separated from the consideration of poverty where each domain cannot gather insight from the other. One key driver of the informality of firms in emerging economies that dominate Asia is poverty of the founders and the need to take many informal or grey market actions to conduct business (Young et al., 2011). The examination of informal firms should not become so sterile and narrowly focused that ultimately it becomes divorced from an understanding of how informality and poverty interact. Scholars should draw insight from each of these intertwined domains to understand the other.

Methodologically-speaking, Asia offers tremendous opportunities to conduct natural experiments that examine the impacts of changes in economic conditions (Hitt, Ahlstrom, Dacin, Levitas, & Svobodina, 2004). The recent work of Kistruck, Beamish, Qureshi, and Sutter (2013a) helps to demonstrate the ability to conduct natural experiments in Latin America. NGOs and governments have ample motivation to help change the shape of poverty in their country. Such settings create the opportunity for rich experiments in which conditions can be changed for different groups and their impact examined by scholars.

Overview of Special Issue

This Special Issue is the result of a 2012 call for papers. We must note that some of the authors in this Special Issue are leading scholars in the world, and we hope their inclusion signals the legitimacy of this domain in Asia. We selected the papers in this Special Issue from a large number of submissions. The papers in this Special Issue also benefited from attending a conference of authors in 2013 in Shanghai in which substantive discussion was held on how to improve each paper. The papers in this Special Issue are summarized in Table 2.

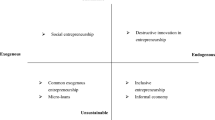

The papers cover a wide range of topics from commentaries, qualitative research, and quantitative research. The diverse methods are appropriate as scholars begin to examine poverty in Asia. In many ways, the Alvarez et al. (2015) paper in this Special Issue confirms the arguments in this introduction that scholars need a new approach to study poverty in Asia. That paper has conceptually examined poverty alleviation through five approaches, including foreign aid, microfinance, social entrepreneurship, base of the pyramid (BoP) initiatives, and the establishment of property rights among the abjectly poor, and examines the strengths and limitations and effect of these approaches. Industrialization efforts through entrepreneurship has had a much more important impact on economic development than many other activities. As we look at nations such as China and South Korea, it is industrialization and entrepreneurship that has led to success in reducing poverty (Nair, Ahlstrom, & Filer, 2007; von Tunzelmann, Bogdanowicz, & Bianchi, 2014). Societies must address multiple market failures in poor countries, and this article holds that creating conditions whereby entrepreneurial businesses are created and grow will best address poverty.

The qualitative article by George, Rao-Nicholson, Corbishley, and Bansal (2015) argues that such business solutions to poverty will require changes in both the institutions and in the belief structure of the people and the society. Employing an in-depth organizational level case study of an Indian public–private partnership (PPP) the authors highlight the need for innovation in organizational design and governance modes to create a new opportunity that connects state actors, private healthcare providers, and the public at large. The paper considers the role of open innovation and novel business models in creating these service platforms. This paper discusses entrepreneurial opportunities related with organizations and investigates how the organization established itself through institutional entrepreneurship using a process conceptualized as opportunity framing, entrenchment, and propagation.

Autio and Fu (2015) study the influence of economic and political institutions on formal and informal entrepreneurship across countries in the Asia Pacific region. The authors report that institutions exercise a substantial influence over both formal and informal entrepreneurship. The economic and political institutions have a complementary effect on driving entry into formal entrepreneurship, whereas only direct effects are observed for informal entry. Autio and Fu (2015) further address the important institutional setting of informal firms and the factors that encourage businesses to move from an informal to a formal status.

The empirical study by Im and Sun (2015) supports the importance of the belief structure in the success of a business model as the authors highlight that among microfinance institutions financial success depends on the underlying logic that underpins the organization. Im and Sun (2015) study how microfinance institutions (MFIs) reach the social goal such as outreach to the poor. Based on the institutional logics perspective, this study predicts that if MFIs follow commercial logic, they are more likely to pursue high profitability rather than to increase outreach; however, if MFIs follow social-welfare logic, they tend to tolerate relatively low profitability and try their best to extend outreach. Therefore, the distribution curve of MFIs’ profitability reveals an inverted U-shaped relationship between MFIs’ profitability and outreach to the poor. A key state-level institution that impacts this relationship is shown to be the rule of law.

The Si et al. (2015) paper argues that industrialization may take a long time, and that at this stage poor people need to pursue immediate poverty reduction. This paper employs an in-depth case study in looking more deeply into the Chinese experience in terms of poverty reduction through entrepreneurship and innovation in Yiwu, China. This paper verifies that poverty alleviation does not merely result from the efforts of governments or large firms, but emerges from internal elements such as disruptive innovation and new venture creation that involve multiple internal actors (Hart & Christensen, 2002). The fundamental and key elements for poverty reduction from the case study of Yiwu include a change from passive to active attitudes and behavior towards fighting poverty and poverty reduction through disruptive business models that shed new light on the emerging topic of the roles of entrepreneurship in poverty reduction. It is interesting to note the similarities in the study by Si et al. (2015) and George et al. (2015). Both studies use qualitative cases to study the implications of institutional entrepreneurship, inclusive and open innovation, and organizational design in base of the pyramid contexts to shed light on the emerging topic of the different aspects of entrepreneurial process.

Overall, these articles represent a rich range of articles on poverty in Asia. However, as we have highlighted through an examination of the literature on poverty in Asia among the leading business journals, to date scholars have written few articles on this topic despite those living on approximately $2 a day representing over half Asia’s total population. Scholars need to pursue additional research on entrepreneurship and poverty, as well as related topics such as venture capital (Burton, Dattani, Fung, Chow, & Ahlstrom, 1999; Bruton et al., 2009) and the encouragement of innovation (Wang, Ahlstrom, Nair, & Hang, 2008) in Asia if poverty is to be further reduced. We hope that these articles will lay the foundation for future examination of these key topics.

Conclusion

Scholars have offered many explanations regarding how and what leads to growing firms and subsequently, economic growth (Coad, 2009; Hubbard & Duggan, 2009). These explanations include institutional reform (Acemoglu & Robinson, 2012; North, 1990), improved property rights and reduced bureaucracy (de Soto, 1989, 2000), capital accumulation (Swan, 1956), technological change (Mokyr, 2004; Solow, 1956, 1957), and cultural and other changes increasing the acceptance of innovation and entrepreneurship (Ahlstrom, 2010; Greif & Laitin, 2004; McCloskey, 2010; Ogilvie, 2004, 2011). Although these explanations differ in their emphasis, they all provide some helpful explanation of economic growth and reductions in poverty.

However, in practical terms, we see as an underlying connection between these ideas the fact that significant improvement in living standards of the poor is often linked to the improvement of formal institutions. de Soto (1989, 2000) has emphasized in this domain the primary role of property rights’ impact on financing, and the simplification of business start-ups. This work helped to inspire work on the importance of property and ease of doing business. This research inspired the World Bank to launch its popular “Doing Business” series in 2004 that provides data for over 175 countries worldwide on opening and closing businesses, obtaining credit, labor laws, and fulfilling contract and property right protection. Countries now strive to raise their position in the list, and are embarrassed if they are too low. China has improved steadily since the start of the list a decade ago. Similarly, the papers in this Special Issue deal with issues regarding financing, the process of starting a business, microcredit, and the economics of entrepreneurship, with the importance of institutional change and reform present in many accounts.

This Special Issue discusses the process of how reforms occur to encourage entrepreneurship. Papers in this Special Issue argue that things need to happen from the bottom up for poverty to be addressed. Specifically, informal institutional change has to come first, or at least around the same time of more formal, top-down institutional reform (Godfrey, 2014; McCloskey, 2010). The authors identify important topics, and while researchers debate about their relative importance and the order in which they are addressed (Manders, 2004; Perkins et al., 2013), these reforms are a major tool for helping the poor build sustainable businesses that have growth potential, concentrate capital, and generate funds for innovation and productivity improvement. Whether innovation involves entrepreneurs developing a patentable product or a new service process to serve a previous clientele, as George et al. (2015) discuss in their paper on India, poverty reduction is often facilitated by the building of new ventures that have growth potential (Ahlstrom, 2010; Birch & Medoff, 1994).

A good deal of research on entrepreneurship has occurred in the past decade. This growth in research reflects the importance of entrepreneurs in spurring economic growth through new ventures and innovation (Ahlstrom, 2010; Alvarez et al., 2015). This Special Issue, squarely positioned in this exciting and dynamic literature, helps build our understanding of this important phenomenon of entrepreneurship in developing economies in particular for the reduction of poverty.

Entrepreneurship makes an important contribution to economic growth, and creating an entrepreneurial economy is becoming a primary tool of poverty reduction and a goal of public policy. This important topic, as addressed in this Special Issue of the Asia Pacific Journal of Management, has helped to provide answers to two simple but profound questions: why does entrepreneurship matter, and how does it matter? And in particular how are these questions answered in Asia? The authors in this Special Issue have provided convincing evidence that incumbent firms and other organizations are often unable to realize fully the returns to their own knowledge investments (Bloom & Van Reenen, 2010; Liu, Wang, Zhao, & Ahlstrom, 2013), and that entrepreneurship provides a conduit for the spillover of knowledge that leads to the shifting of resources toward more productive activities and providing the poor with opportunities that might otherwise have remained unappropriated (Bruton, 2010).

These articles offer a compelling rationale for the emergence of a new approach to economic development policy. While reforming institutions, simplifying bureaucracy, and providing financing are all important (de Soto, 1989, 2000; Young, Tsai, Wang, Liu, & Ahlstrom, 2014), it is important to remember that entrepreneurship—the formation and growth of economically viable businesses—is a fundamental engine of economic growth (Ahlstrom, 2010; Baumol et al., 2009). Good entrepreneurship policy focuses not only on financing and the ease of business formation, but also on the encouragement of companies and management practices that convert investment into returns and achieve a level of growth (Ahlstrom, 2014; Alvarez et al., 2015; Bloom & Van Reenen, 2010; Wong et al., 2005). The compelling argument of the authors of this Special Issue is that countries’ (and regions’) new entrepreneurship policy with respect to the promotion of growth entrepreneurship may have far more promise and potential than previous approaches to poverty reduction in an increasingly global, knowledge-intensive era.

Notes

These figures from the most recent comprehensive World Bank survey are from 2008.

There are also comprehensive lines of research in both entrepreneurship and economics that examine how venture capital and private equity can strengthen a country’s entrepreneurial sector (see Ahlstrom, Bruton, & Chan, 2000; Brown, Haltiwanger, & Lane, 2006; Bruton & Ahlstrom, 2003; Bruton, Ahlstrom, & Singh, 2002; Bruton, Ahlstrom, & Yeh, 2004; Cumming & Suret, 2011; Hargadon & Kenney, 2012; Kenney, 2011; Lerner, 2009). This Special Issue is more directly focused on entrepreneurship.

The work of Joseph Schumpeter is a notable exception, though Schumpeter wrote more about entrepreneurs in his early work and focused more on larger firms and their research and development in the interwar period and the Second World War (McCraw, 2010).

It should be noted that poverty defined by income is used here since it is more easily quantified and can clearly be addressed. There are several ways that poverty is defined and measured, including different levels of income or consumption. See Chen and Ravallion (2010) for a discussion.

This is consistent with research in technology assessment and evaluation. Assessment routines are crucial to what technologies and techniques are selected, funded, and promoted (Garud & Ahlstrom, 1997b).

While poverty is difficult to define precisely, it should be recognized that concepts such as base of the pyramid (BoP) are much harder to define. The result is that BOP is conceptually appealing but has largely gone unoperationalized for the purposes of empirical research (Ahlstrom, Bruton, & Zhao, 2013; Economist, 2010).

Some marketing scholars use the term subsistence entrepreneurship to describe entrepreneurship in settings of poverty (i.e., Viswanathan et al., 2014). While these authors imply there is little opportunity for sustained capital growth they do not specifically limits for the future as they use the term.

We limit this search also to academic journals and articles published since 2000. Harvard Business Review is not included here as it is generally not considered to be a peer-reviewed academic journal.

References

Abzug, R., Simonoff, J., & Ahlstrom, D. 2000. Nonprofits as large employers: A city-level geographical inquiry. Nonprofit and Voluntary Sector Quarterly, 29(3): 455–470.

Acemoglu, D., & Robinson, J. 2012. Why nations fail: The origins of power, prosperity, and poverty. New York: Crown Business.

Ahlstrom, D. 2010. Innovation and growth: How business contributes to society. Academy of Management Perspectives, 24(3): 10–23.

Ahlstrom, D. 2014. The hidden reason why the First World War matters today: The development and spread of modern management. Brown Journal of World Affairs, 21(1): 201–218.

Ahlstrom, D., Bruton, G. D., & Chan, E. S. 2000. Venture capital in China: Ground-level challenges for high technology investing. Journal of Private Equity, 3(2): 45–54.

Ahlstrom, D., Bruton, G. D., & Zhao, L. 2013. Turning good research into good publications. Nankai Business Review International, 4(2): 92–106.

Ahlstrom, D., & Ding, Z. 2014. Entrepreneurship in China: An overview. International Small Business Journal, 32(6): 610–618.

Ahlstrom, D., Levitas, E., Hitt, M. A., Dacin, M. T., & Zhu, H. 2014. The three faces of China: Strategic alliance partner selection in three ethnic Chinese economies. Journal of World Business, 49(4): 572–585.

Alatas, V., Banerjee, A., Hanna, R., Olken, B. A., & Tobias, J. 2010. Targeting the poor: Evidence from a field experiment in Indonesia. National Bureau of Economic Research working paper no. w15980, Cambridge.

Alvarez, S. A., Barney, J. B., & Newman, A. M. B. 2015. The poverty problem and the industrialization solution. Asia Pacific Journal of Management, this issue.

Anand, S., & Harris, C. J. 1994. Choosing a welfare indicator. American Economic Review, 84(2): 226–231.

Ashraf, N., Karlan, D., & Yin, W. 2006. Tying Odysseus to the mast: Evidence from a commitment savings product in the Philippines. Quarterly Journal of Economics, 121(2): 635–672.

Aturupane, H., Glewwe, P., & Isenman, P. 1994. Poverty, human development, and growth: An emerging consensus?. American Economic Review, 84(2): 244–249.

Audretsch, D. B., Keilbach, M. C., & Lehmann, E. E. 2006. Entrepreneurship and economic growth. Oxford: Oxford University Press.

Autio, E., & Fu, K. 2015. Economic and political institutions and entry into formal and informal entrepreneurship. Asia Pacific Journal of Management, this issue.

Banerjee, A., Cole, S., Duflo, E., & Linden, L. 2005. Remedying education: Evidence from two randomized experiments in India. National Bureau of Economic Research working paper no. w11904, Cambridge.

Barone, M. 2004. Hard America, soft America: Competition vs. coddling and the battle for the nation’s future. New York: Crown Forum.

Bauer, M., Chytilová, J., & Morduch, J. 2012. Behavioral foundations of microcredit: Experimental and survey evidence from rural India. American Economic Review, 102(2): 1118–1139.

Baulch, B. (Ed.). 2011. Why poverty persists: Poverty dynamics in Asia and Africa. Cheltenham, UK: Edward Elgar.

Baumol, W. J., Litan, R. E., & Schramm, C. J. 2009. Good capitalism, bad capitalism, and the economics of growth and prosperity. New Haven, CT: Yale University Press.

Baumol, W. J., & Strom, R. 2007. Entrepreneurship and economic growth. Strategic Entrepreneurship Journal, 1(3–4): 233–237.

Besley, T., & Burgess, R. 2000. Land reform, poverty reduction, and growth: Evidence from India. Quarterly Journal of Economics, 115(2): 389–430.

Besley, T., & Burgess, R. 2004. Can labor regulation hinder economic performance? Evidence from India. Quarterly Journal of Economics, 119(1): 91–134.

Bhagwati, J., & Panagariya, A. 2013. Why growth matters: How economic growth in India reduced poverty and the lessons for other developing countries. New York: PublicAffairs.

Birch, D. L., & Medoff, J. 1994. Gazelles. In L. C. Solmon & A. R. Levenson (Eds.). Labor markets, employment policy and job creation: 159–167. Boulder, CO: Westview Press.

Bloom, N. & Van Reenen, J. 2010. Why do management practices differ across firms and countries? Journal of Economic Perspectives, 24(1): 203–224.

Boyce, G. 1995. Information, mediation and institutional development: The rise of large-scale enterprise in British shipping, 1870–1919. Manchester: Manchester University Press.

Brown, C., Haltiwanger, J., & Lane, J. 2006. Economic turbulence: Is a volatile economy good for America?. Chicago: University of Chicago Press.

Bruton, G. D. 2010. Business and the world’s poorest billion: The need for an expanded examination by management scholars. Academy of Management Perspectives, 24(3): 6–10.

Bruton, G. D., & Ahlstrom, D. 2003. An institutional view of China’s venture capital industry: Explaining the differences between China and the West. Journal of Business Venturing, 18(2): 233–259.

Bruton, G. D., Ahlstrom, D., & Puky, T. 2009. Institutional differences and the development of entrepreneurial ventures: A comparison of the venture capital industries in Latin America and Asia. Journal of International Business Studies, 40: 762–778.

Bruton, G. D., Ahlstrom, D., & Singh, K. 2002. The impact of the institutional environment on the venture capital industry in Singapore. Venture Capital: An International Journal of Entrepreneurial Finance, 4(3): 197–218.

Bruton, G. D., Ahlstrom, D., & Yeh, K. S. 2004. Understanding venture capital in East Asia: The impact of institutions on the industry today and tomorrow. Journal of World Business, 39(1): 72–88.

Bruton, G. D., Dattani, M., Fung, M., Chow, C. & Ahlstrom, D. 1999. Private equity in China: Differences and similarities with the western model. Journal of Private Equity, 2(2): 7–14.

Bruton, G. D., Ketchen, D., & Ireland, D. 2013. Entrepreneurship as a solution to poverty. Journal of Business Venturing, 28(6): 683–689.

Bruton, G. D., Khavul, S., & Chavez, H. 2011. Microfinance in emerging markets: Building a new line of inquiry from the ground up. Journal of International Business Studies, 42: 718–739.

Burgess, R., & Pande, R. 2003. Do rural banks matter? Evidence from the Indian social banking experiment. American Economic Review, 95(3): 780–795.

Chandler, A. D. 1990. Scale and scope: The dynamics of industrial capitalism. Cambridge, MA: Belknap Press.

Chen, S., & Ravallion, M. 2010. The developing world is poorer than we thought, but no less successful in the fight against poverty. Quarterly Journal of Economics, 125(4): 1577–1625.

CIA Factbook. 2014. https://www.cia.gov/library/publications/the-world-factbook/rankorder/2172rank.html, Accessed July 25, 2014.

Clark, H. 2011. Accelerating poverty reduction and sustainable human development. UNDP 2011 Global Poverty Reduction and Development Forum, Beijing, China.

Coad, A. 2009. The growth of firms: A survey of theories and empirical evidence. Cheltenham, UK: Edward Elgar.

Cumming, D., Fleming, G., & Schwienbacher, A. 2009. Corporate relocation in venture capital finance. Entrepreneurship Theory and Practice, 33(5): 1121–1155.

Cumming, D. J., & Suret, J. M. 2011. Entrepreneurial finance and venture capital markets. European Financial Management, 17(3): 420–422.

Deininger, K., & Binswanger, H. 1999. The evolution of the World Bank’s land policy: Principles, experience, and future challenges. World Bank Research Observer, 14(2): 247–276.

de Soto, H. 1989. The other path. New York: Harper & Row.

de Soto, H. 2000. The mystery of capital: Why capitalism triumphs in the West and fails everywhere else. New York: Basic Books.

Diamond, J. M. 1997. Guns, germs, and steel: The fates of human societies. New York: W. W. Norton.

Du, J., Guariglia, A., & Newman, A. 2013. Do social capital building strategies influence the financing behavior of Chinese private small and medium-sized enterprises?. Entrepreneurship Theory and Practice. doi:10.1111/etap.12051.

Duvendack, M., Palmer-Jones, R., Copestake, J. G., Hooper, L., Loke, Y., & Rao, N. 2011. What is the evidence of the impact of microfinance on the well-being of poor people?. London: EPPI-Centre, Social Science Research Unit, Institute of Education, University of London.

Easterly, W. 2006. The white man’s burden: Why the West’s efforts to aid the rest have done so much ill and so little good. New York: Penguin Press.

Easterly, W. (Ed.). 2008. Reinventing foreign aid. Cambridge: MIT Press.

Economist. 2010. The guru of the bottom of the pyramid. April, 22: 51–52.

Enderle, G. 2010. Wealth creation in China and some lessons for development ethics. Journal of Business Ethics, 96(1): 1–15.

Enke, S. 1963. Population and development: A general model. Quarterly Journal of Economics, 77(1): 55–70.

Fields, G. S. 1979. A welfare economic approach to growth and distribution in the dual economy. Quarterly Journal of Economics, 93(3): 325–353.

Fischer, G. 2013. Contract structure, risk-sharing, and investment choice. Econometrica, 81(3): 883–939.

Galbraith, J. K. 1967. The new industrial state. Boston: Houghton Mifflin.

Garud, R., & Ahlstrom, D. 1997a. Researchers’ roles in negotiating the institutional fabric of technologies. American Behavioral Scientist, 40: 523–538.

Garud, R., & Ahlstrom, D. 1997b. Technology assessment: A socio-cognitive perspective. Journal of Engineering and Technology Management, 14: 25–48.

George, G., McGahan, A. M., & Prabhu, J. 2012. Innovation for inclusive growth: Towards a theoretical framework and research agenda. Journal of Management Studies, 49(4): 661–683.

George, G., Rao-Nicholson, R., Corbishley, C., & Bansal, R. 2015. Institutional entrepreneurship, governance, and poverty: Insights from emergency medical response services in India. Asia Pacific Journal of Management, this issue.

Godfrey, P. 2014. More than money: Five forms of capital to create wealth and eliminate poverty. Stanford: Stanford Business Books.

Gong, Y., Chow, I. H.-S., & Ahlstrom, D. 2011. Cultural diversity in China: Dialect, job embeddedness, and turnover. Asia Pacific Journal of Management, 28(2): 221–238.

Greif, A. 2006. Institutions and the path to the modern economy: Lessons from Medieval trade. New York: Cambridge University Press.

Greif, A., & Laitin, D. 2004. A theory of endogenous institutional change. American Political Science Review, 98: 633–652.

Haltiwanger, J., Jarmin, R., & Miranda, J. 2011. Historically large decline in job creation from startup and existing firms in the 2008–2009 recession. Washington, DC: US Census Bureau’s Business Dynamics Statistics.

Hargadon, A. B., & Kenney, M. 2012. Misguided policy? Following venture capital into clean technology. California Management Review, 54(2): 118–139.

Hart, S. L., & Christensen, C. M. 2002. The great leap: Driving innovation from the base of the pyramid. MIT Sloan Management Review, Fall: 51–56.

Hitt, M. A., Ahlstrom, D., Dacin, M. T., Levitas, E., & Svobodina, L. 2004. The institutional effects on strategic alliance partner selection in transition economies: China vs. Russia. Organization Science, 15(2): 173–185.

Hubbard, R. G., & Duggan, W. 2009. The aid trap: Hard truths about ending poverty. New York: Columbia Business School Publishing.

Im, J., & Sun, S. L. 2015. Profits and outreach to the poor: The institutional logics of microfinance institutions. Asia Pacific Journal of Management, this issue.

Ireland, R. D., Hitt, M. A., & Sirmon, D. G. 2003. A model of strategic entrepreneurship: The construct and its dimensions. Journal of Management, 29(6): 963–989.

Iyer, L., Khanna, T., & Varshney, A. 2013. Caste and entrepreneurship in India. Economic & Political Weekly, 48(6): 52–60.

Jensen, M. C. 2001. Value maximization, stakeholder theory, and the corporate objective function. European Financial Management, 7(3): 297–317.

Jensen, R. T., & Miller, N. H. 2008. Giffen behavior and subsistence consumption. American Economic Review, 98(4): 1553–1577.

Jones, C. I., & Romer, P. M. 2010. The new Kaldor facts: Ideas, institutions, population, and human capital. American Economic Journal: Macroeconomics, 2(1): 224–245.

Kaldor, N. 1966. Strategic factors in economic development. New York: New York State School of Industrial and Labor Relations.

Kenney, M. 2011. How venture capital became a component of the US national system of innovation. Industrial and Corporate Change, 20(6): 1677–1723.

Khan, A. R., Griffin, K., & Riskin, C. 1999. Income distribution in urban China during the period of economic reform and globalization. American Economic Review, 89(2): 296–300.

Khavul, S. 2010. Microfinance: Creating opportunities for the poor?. Academy of Management Perspectives, 24(3): 58–72.

Khavul, S., Bruton, G. D., & Wood, E. 2009. Informal family business in Africa. Entrepreneurship Theory and Practice, 33(6): 1219–1238.

Kistruck, G. M., Beamish, P. W., Qureshi, I., & Sutter, C. J. 2013a. Social intermediation in the base of the pyramid markets. Journal of Management Studies, 50(1): 31–66.

Kistruck, G. M., Sutter, C. J., Lount, J. R., & Smith, B. R. 2013b. Mitigating principal-agent problems in base of the pyramid markets. An identity spillover perspective. Academy of Management Journal, 56(3): 659–682.

Kochar, A. 1995. Explaining household vulnerability to idiosyncratic income shocks. American Economic Review, 85(2): 159–164.

Kumar, G. 2013. Child labour: Determinants, dimensions and policies in India. Economic Affairs, 58(4): 417–429.

Landes, D. S. 1998. The wealth and poverty of nations: Why some are so rich and some so poor. New York: W.W. Norton & Company.

Leff, N. H. 1979. Entrepreneurship and economic development: The problem revisited. Journal of Economic Literature, 17(1): 46–64.

Lerner, J. 2009. Boulevard of broken dreams: Why public efforts to boost entrepreneurship and venture capital have failed—and what to do about it. Princeton: Princeton University Press.

Liu, Y., Wang, L.C., Zhao, L. & Ahlstrom, D. 2013. Board turnover in Taiwan’s public firms: An empirical study. Asia Pacific Journal of Management, 30(4): 1059–1086.

Lu, Y., Au, K., Peng, M. W., & Xu, E. 2013. Strategic management in private and family business. Asia Pacific Journal of Management, 30(3): 633–639.

Lucas, R. E. 2002. Lectures on economic growth. Cambridge, MA: Harvard University Press.

Lützenkirchen, C., & Weistroffer, C. 2012. Microfinance in evolution. Frankfurt: Deutsche Bank.

Mair, J., & Marti, I. 2009. Entrepreneurship in and around institutional voids: A case study from Bangladesh. Journal of Business Venturing, 24(5): 419–435.

Mair, J., Marti, I., & Ventresca, M. 2011. Building inclusive markets in rural Bangladesh: How intermediaries work institutional voids. Academy of Management Journal. doi:10.5465/amj.2010.0627.

Manders, J. 2004. Sequencing property rights in the context of development: A critique of the writings of Hernando de Soto. Cornell International Law Journal, 37: 177–198.

McCloskey, D. N. 2010. Bourgeois dignity: Why economics can’t explain the modern world. Chicago: University of Chicago Press.

McCraw, T. K. 2010. Prophet of innovation: Joseph Schumpeter and creative destruction. Cambridge: Belknap.

Mokyr, J. 2004. The gifts of Athena: Historical origins of the knowledge economy. Princeton: Princeton University Press.

Naim, M. 2013. The end of power: From boardrooms to battlefields and churches to states, why being in charge isn’t what it used to be. New York: Basic Books.

Nair, A., Ahlstrom, D., & Filer, L. 2007. Localized advantage in a global economy: The case of Bangalore. Thunderbird International Business Review, 49(5): 591–618.

Nasar, S. 2012. Grand pursuit: The story of economic genius. New York: Simon & Schuster.

Naughton, B. 1995. Growing out of the plan: Chinese economic reform, 1978–1993. New York: Cambridge University Press.

North, D. C. 1990. Institutions, institutional change and economic performance. Cambridge: Cambridge University Press.

Ogbuabor, J. E., Malaolu, V. A., & Elias, T. I. 2013. Small scale enterprises, poverty alleviation and job creation in Nigeria: Lessons from burnt bricklayers in Benue State. Journal of Economics and Sustainable Development, 4(18): 120–133.

Ogilvie, S. 2004. Guilds, efficiency, and social capital: Evidence from German proto-industry. Economic History Review, 57(May): 286–333.

Ogilvie, S. 2011. Institutions and European trade: Merchant guilds, 1000–1800. Cambridge: Cambridge University Press.

Perkins, D. H., Radelet, S., Lindauer, D. L., & Block, S. A. 2013. Economics of development, 7th ed. New York: W.W. Norton.

Ravallion, M., & Jalan, J. 1999. China’s lagging poor areas. American Economic Review, 89: 301–305.

Riskin, C. 1994. Chinese rural poverty: Marginalized or dispersed?. American Economic Review, 84(2): 281–284.

Robinson, M. 2001. The microfinance revolution: Sustainable finance for the poor. Washington, DC: The World Bank.

Rodrik, D., & Rosenzweig, M. R. (Eds.). 2010. Handbook of development economics, Vol. 5. Kidlington, UK: North Holland/Elsevier.

Romer, P. 1986. Increasing returns and long run growth. Journal of Political Economy, 94(5): 1002–1037.

Roodman, D. 2012. Due diligence: An impertinent inquiry into microfinance. Washington, DC: Center for Global Development.

Ross, E. A. 1911. The changing Chinese: The conflict of oriental and Western cultures in China. New York: Century Co.

Sammon, E. 2013. Eradicating global poverty: A noble goal, but how do we measure it?. Development Progress working paper no. 2, London.

Schumpeter, J. A. 1912. The theory of economic development. Cambridge: Harvard University Press.

Si, S., Yu, X., Wu, A., Chen, S., Chen, S., & Su, Y. 2015. Entrepreneurship and poverty reduction: A case study of Yiwu, China. Asia Pacific Journal of Management, this issue.

Singh, K. M., Singh, R. K. P., Jha, A. K., & Kumar, A. 2013. Fodder market in Bihar: An exploratory study. Economic Affairs, 58(4): 357–365.

Solow, R. M. 1956. A contribution to the theory of economic growth. Quarterly Journal of Economics, 70(1): 65–94.

Solow, R. M. 1957. Technical change and the aggregate production function. Review of Economics and Statistics, 39(3): 312–320.

Sombart, W. 1913. Krieg und kapitalismus (War and capitalism). Leipzig: Duncker & Humblot.

Suresh, A., & Raju, S. S. 2014. Poverty and sustainability implications of groundwater based irrigation: Insights from Indian experience. Economic Affairs, 59(2): 311–320.

Swamy, V. 2011. Financial inclusion in India: An evaluation of the coverage, progress and trends. IUP Journal of Financial Economics, 9(2): 7–26.

Swan, T. W. 1956. Economic growth and capital accumulation. Economic Record, 32(2): 334–361.

Tavanti, M. 2013. Before microfinance: The social value of microsavings in Vincentian poverty reduction. Journal of Business Ethics, 112(4): 697–706.

Taylor, L., & Bacha, E. L. 1976. The unequalizing spiral: A first growth model for Belindia. Quarterly Journal of Economics, 90: 197–218.

Todd, H. 1996. Women at the center. Boulder: Westview Press.

Van Zanden, J. L. 2009. The long road to the industrial revolution. Boston: Brill.

Viswanathan, M., Echambadi, R., Venugopal, S., & Sridharan, S. 2014. Subsistence entrepreneurship, value creation, and community exchange systems: A social capital explanation. Journal of Macromarketing, 34(2): 213–226.

von Tunzelmann, N., Bogdanowicz, M., & Bianchi, A. 2014. The new dynamics of growth and change in Asia. Singapore: World Scientific.

Wang, L. C., Ahlstrom, D., Nair, A., & Hang, R. Z. 2008. Creating globally competitive and innovative products: China’s next Olympic challenge. SAM Advanced Management Journal, 73(3): 4–14.

Webb, J. W., Bruton, G. D., Tihanyi, L., & Ireland, R. D. 2013. Research on entrepreneurship in the informal economy: Framing a research agenda. Journal of Business Venturing, 28(5): 598–614.

Wong, P. K., Ho, Y. P., & Autio, E. 2005. Entrepreneurship, innovation and economic growth: Evidence from GEM data. Small Business Economics, 24: 335–350.

World Bank. 2012. An update to the World Bank’s estimates of consumption poverty in the developing world http://siteresources.worldbank.org/INTPOVCALNET/Resources/Global_Poverty_Update_2012_02-29-12.pdf, accessed 15 Nov 2014.

Young, M. N., Ahlstrom, D., Bruton, G. D., & Rubanik, Y. 2011. What do firms from transition economies want from their strategic alliance partners?. Business Horizons, 54(2): 163–174.

Young, M. N., Tsai, T., Wang, X., Liu, S., & Ahlstrom, D. 2014. Strategy in emerging economies and the theory of the firm. Asia Pacific Journal of Management, 31(2): 331–354.

Yu, B., Hao, S., Ahlstrom, D., Si, S., & Liang, D. 2014. Entrepreneurial firms’ network competence, technological capability, and new product development performance. Asia Pacific Journal of Management, 31(3): 687–704.

Zahra, S. A., Sapienza, H. J., & Davidsson, P. 2006. Entrepreneurship and dynamic capabilities: A review, model and research agenda. Journal of Management Studies, 43(4): 917–955.

Acknowledgments

The work in this article was substantially supported by a grant from the RGC Research Grant Direct Allocation Scheme (Project no. 2070465, 2011-2012) of The Chinese University of Hong Kong, Hong Kong Special Administrative Region. The authors would also like to thank Marc Ahlstrom of Burlington County College for his editorial assistance.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bruton, G.D., Ahlstrom, D. & Si, S. Entrepreneurship, poverty, and Asia: Moving beyond subsistence entrepreneurship. Asia Pac J Manag 32, 1–22 (2015). https://doi.org/10.1007/s10490-014-9404-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-014-9404-x