Abstract

Prior research on firm behavior in emerging economies like China has highlighted the extensive building and use of political ties by business managers. However, there are mixed findings regarding the value of political ties on firm performance. In this study, we propose a task-contingency approach to explain when the investment in political ties will improve performance and when they will not. In particular, we study how the value of investing managerial time to cultivate political ties with local government officials may vary when firms engage in different types of technological innovation activities. We hypothesize that when a firm pursues exploratory innovation involving high institutional uncertainty, such time investment will improve firm performance. In contrast, when a firm undertakes exploitative innovation that involves low institutional uncertainty but requires high internal operational improvement such as marketing and sales, such time investment in political ties would distract managers’ attention from internal improvement, and hence may harm firm performance. Results based on a World Bank survey of 1,500 Chinese manufacturing firms confirm these hypotheses. Our findings offer fresh insights on how firm managers in emerging economies should manage their institutional environment when pursuing innovation activities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

One of the most prominent features of emerging economies where market institutions are still underdeveloped is the significant power and influence local government officials can exert on the activities and behavior of firms (Atuahene-Gima & Li, 2001; Eden, Eden, Hoskisson, Lau, & Wright, 2000; Tan & Litschert, 1994). When regulations are vague or incomplete and their enforcement is uncertain and subject to arbitrary interpretation by local government officials, firms are confronted with great uncertainty (Ahlstrom, Bruton, & Lui, 2000; Nee, 1992; Peng, 1997). To cope with this uncertainty, firm managers have been found to invest significant time to build political ties with government officials at various levels, not only political leaders but also lower officials and executives in regulatory and supporting organizations, such as tax bureaus, commercial administration bureaus, and state-owned enterprises (SOEs) (Ahlstrom, Bruton, & Yeh, 2008; Li & Zhang, 2007; Luo & Peng, 2000; Sheng, Zhou, & Li, 2011).

Empirical findings regarding the value of these and other political ties on firm performance, however, are mixed (Lin & Si, 2010). Some studies have found that political ties increase the chance of resource acquisition and help organizational learning while improving firm performance (e.g., Chen, Li, Liu, & Peng, 2014; Faccio, 2006; Hillman; 2005; Li & Zhang, 2007; Wu, Li, & Li, 2013). However, other studies have found no direct effect (e.g., Wang, Feng, Liu, & Zhang, 2009), and still others even found negative impacts (e.g., Cheung, Jing, Rau, & Stouraitis, 2005; Faccio, 2010; Fan, Wong, & Zhang, 2007).

More recently, researchers have sought to reconcile the mixed results by suggesting a contingent value of political ties (Hillman, 2005; Sheng et al., 2011; Wu & Cheng, 2011). Four sets of factors are identified that can individually and collectively give rise to the contingent value of political ties–market environment (industry characteristics and competition), nonmarket environment (institutional arrangement in national political systems and political stability), inter-organizational factors (strength, structure, type and composition of ties, rent bargaining and appropriation) and intra-organizational factors (organizational ownership, managers’ abilities and willingness to manipulate ties) (Sun, Mellahi, & Wright, 2012). Although extremely extensive and informative, this stream of research fails to answer the important question if the same managers can exploit political ties to improve firm performance when engaging in a range of different types of tasks (Acemoglu & Robinson, 2012). In other words, should managers spend an equal amount of time and effort to build and maintain political ties across a variety of different, unrelated tasks?

We seek to answer this question by examining the nature of tasks that affect the value of political ties in the context of technological innovation, an increasingly important activity undertaken by firms (Ahlstrom, 2010; McCloskey, 2013). Building upon the recommendations of the resource-based view (RBV) of the firm that research should consider how resources can be used in a particular environment context (Butler & Priem, 2001; Friesen & Miller, 1983; Katila & Shane, 2005), we propose a task-contingency approach. In particular, we hypothesize that the optimal level of time investment by firms’ managers in cultivating political ties with local government officials would vary according to the nature of the innovation activities in which the firms engage. When firms pursue exploratory innovation activities that are likely to confront high institutional uncertainties and potential regulatory concerns, large time investments in political ties should benefit firm performance. However, when the firm’s innovation activities are exploitative, the product is likely to continue to comply with existing regulatory approvals, and hence the major challenges the managers face would not be institutional uncertainty, but internal operation efficiency, in particular in marketing and sales. In this situation, the optimal time investments required in political ties would be lower, and as such a higher level of time investment would be wasteful and even harm firm performance by distracting managers’ attention to internal operation. We provide empirical support for the above hypotheses using data from a large sample survey of 1,500 manufacturing firms in China.

Our study contributes to the literature in four ways. First, this study is among the first efforts to examine how the effect of political ties on firm performance is contingent upon the firm innovation activities (Lu, Peng, & Tsang, 2008). Since one of the most important functions of political ties is to reduce institutional uncertainty (Leyden & Link, 1992), and such uncertainty varies significantly between different types of innovation activities (Benner & Tushman, 2002), it is imperative to understand how firms build and maintain political ties when pursuing different innovation tasks, such as getting explicit and tacit permission for new product/process (which require new regulatory approval) versus incremental improvement of an existing product/process (where no new approval is needed).

Second, by showing that the value of political ties depends on the task—a level of analysis different from that of nation, industry, organization, inter-organization, and individuals that have been studied in the previous research (Yu, Hao, Ahlstrom, Si, & Liang, 2014)—our study helps to unravel when the same managers in the same firm may achieve different firm performance using the same amount of time investment in political ties.

Third, our study also sheds fresh light on the literature on innovation management in emerging economics like China by suggesting how firms should manage their institutional environment when pursuing innovation activities (Lu et al., 2008). By taking China as our research context, we demonstrate the complex and active roles that firms play in conforming with or influencing institutions when those institutions are marked by high uncertainty (Tan & Litschert, 1994; Wang, Ahlstrom, Nair, & Hang, 2008). Except for a few studies, most literature on innovation uses evidence from mature market economies (Bruton, Dess, & Janney, 2007; Lu et al., 2008; Quer, Claver, & Rienda, 2007; Zhu, Wittmann, & Peng, 2012). We offer new insights into the roles of political ties in the process of technological innovation in an emerging economy. As technological innovation has been widely recognized to be of growing importance for firms in China and the other emerging economics to improve their competitiveness in the global market (Lu et al., 2008), an improved understanding of how firms manage their institutional environment when pursuing innovation activities has become even more critical (Ahlstrom, Law, Nair, & Young, 2003).

Last, but not least, this study provides important practical implications for firm managers in emerging economies like China, by highlighting the need for firms to determine an appropriate level of investment of managerial times to develop and maintain political ties, based on the type of innovation activities the firms are pursuing, so as to avoid ineffective under-investment or wasteful over-investment.

Research context

The research context is firm technological innovation in the manufacturing sectors in China. China has moved from total isolation to become the second-largest economy in the world in just about three decades; this rapid economic growth has been powered largely by her manufacturing sectors. Yet institutional reform has lagged economic reforms in China. The literature suggests that the influence of institutions on organizations is particularly strong in emerging economies with weak market institutions or those that are experiencing drastic institutional changes (Jiang, Peng, & Wang, 2008; Tan & Litschert, 1994). As more and more Chinese manufacturing firms transit away from emphasizing low-cost strategies to building differentiation competencies through innovation (Atuahene-Gima & Li, 2001; Eden et al., 2000), the Chinese government has adopted more flexible and pragmatic approaches to implement a wide range of institutional changes that seek to encourage firms to invest more in technological innovations (Canaves & Fong, 2008). Such rapid changes in innovation-related incentive policies and regulations, coupled with flexibility and discretion in implementation, are therefore likely to give rise to significant interdependencies between investments in political ties and innovation. This relatively fluid environmental context thus offers a fascinating setting in which to study the roles of political ties in the context of firm innovation activities (Young, Tsai, Wang, Liu, & Ahlstrom, 2014).

Theoretical background and hypotheses development

Exploratory and exploitative innovation

As the pace of technological change accelerates and market competition intensifies, firms need to constantly renew by investing in innovation (Teece, 1986; Van de Ven, 2004). The technological innovation literature has shown a burgeoning interest in two distinctive types of innovation—exploration and exploitation (Danneels, 2002; March, 1991; Rothaermel & Deeds, 2004). Following prior works (He & Wong, 2004; Voss, Sirdeshmukh, & Voss, 2008), we define exploratory innovation as a technological innovation that entails a shift away from a firm’s existing technological knowledge base, such that it enables the firm to enter new product-market domains. Exploitative innovation instead is a technological innovation that leverages current skills and capabilities, which enables the firm to improve existing product-market positions (Lavie, Stettner, & Tushman, 2010).

Prior studies have argued that exploratory and exploitative innovation requires different resource and skill sets (Auh & Menguc, 2005; Benner & Tushman, 2002; McGrath, 2001). Because exploratory innovation requires new technological and market knowledge that departs from the firm’s existing knowledge-base, it bears an inherently high uncertainty (March, 1991; Volberda & Lewin, 2003). Firms must overcome technological challenges and reduce uncertainties in the external environment to support the technological innovation process (Jansen, Van Den Bosch, & Volberda, 2006). Conversely, exploitative innovation builds on existing technological knowledge and reinforces existing technological skills and processes (Benner & Tushman, 2002; Carroll, Lewin, & Long, 1999), thus it involves much lower technological and external market uncertainty (Abernathy & Clark, 1985; Levinthal & March, 1993). Instead, exploitative innovation typically focuses on internal operations and downstream value chain activities (Rothaermel & Deeds, 2004); hence, the major challenge that managers confront would be how to improve the productivity of their existing operations (Auh & Menguc, 2005). In particular, prior study has suggested that firms must pursue a customer-oriented strategy and strengthen their marketing and sales skills in order to succeed in pursuing exploitative innovation (Atuahene-Gima, 2005).

Institutional context and political ties for technological innovation

Organization studies have for decades contended that institutions significantly shape firms strategy and behavior in all aspects (Ahuja & Yayavaram, 2011; Carney, Gedajlovic, & Yang, 2009; Nee, 1992; Oliver, 1991; Tan & Litschert, 1994). In the context of technological innovation activities, the institutional environment influences firm innovation and performance in multiple ways, as suggested by Lu et al. (2008). First, the outcome of innovation must be perceived as legitimate and has to fit institutional requirement (Ahlstrom et al., 2008). Legitimacy is granted by three systems: regulatory, normative, and cognitive (Scott, 1995). For instance, the Chinese government requires a firm to obtain a new Industrial Manufacturing Permit each time when it introduces a new product. Second, knowledge of how institutions work could improve the innovation process itself and hence serves as a source of competitive advantages (Jiang et al., 2008). For instance, a firm having a good knowledge of the regulatory approval process for new products will be able to navigate through the process faster to obtain the required certifications. Third, institutions allocate incentives (e.g., tax incentives for new product) and resources (e.g., government grants) for innovation (North, 1990). Firms that are better at taking advantages of these incentives and resources will be able to get better returns from their innovation investment. Prior studies suggest that firms are heterogeneous in their propensities and abilities to conform to and manipulate the institution in their innovation process (Oliver, 1991); consequently, firms that are better at adapting to and influencing their institutional environments will be more successful in materializing returns from their innovation activities.

A key means by which firms can adapt to and influence their institutional environment is to invest managerial time and effort to develop and exploit political ties with the relevant local and central government officials. Unlike advanced economies with mature institutions that are less susceptible to influence and manipulation by firms, China’s formal institutional environments governing private business activities in general and innovation activities in particular are still underdeveloped and in a state of flux. As an emerging economy, China has been experiencing the change from a centrally planned economy to a market-based economy through liberalization and privatization, accompanied by institutional transitions in political systems and legal frameworks (Child & Tse, 2001; Heath & Peng, 1996; Tan & Tan, 2005). Institutional changes are expected to foster more transparent rules of the game and increase market efficiency (Ahlstrom et al., 2003). However, the institutional transition is far from complete and formal institutions such as legal framework remain weak (Luo, 2007; Zhou & Poppo, 2010). As a result, informal institutions play a significant role in shaping firm behaviors (Li, Zhou, & Shao, 2009; Sheng et al., 2011). Managers were found to adopt a wide range of informal institutional arrangements, and among which building guanxi or social ties with the other organizations and individuals is the most popular and effective approach (e.g., Nee, 1992; Sheng et al., 2011; Tan, Yang, & Veliyath, 2009; Xin & Pearce, 1996). Through those social ties, firms can substantially reduce uncertainty, lower institutional compliance cost, and improve the speed and effectiveness of deploying other resources of the firm.

One of the most important types of social ties is political ties with local government officials (Luo & Peng, 2000). Since economic liberalization started in 1978, the Chinese central government has gradually delegated certain authority to lower-level government authorities, so provincial and local governments can formulate and implement policies to promote and regulate business operations (Nee, 1992). Such regional/local government institutions then can exert significant influences on firm technological innovation activities through a wide range of regulatory or promotional instruments, such as permits/licenses to operate, local content requirements, technical standards and safety inspections, or investment incentives such as tax reduction and research grants. Playing these instruments, the governments expect to achieve two purposes (Leyden & Link, 1992). First, to reduce external uncertainties for the firm’s operations by creating and maintaining a legal environment; and second, to provide sufficient stimuli to encourage firms to engage in a high level of innovation investment.

The implementation of the policies at the level of local government, however, has been far from achieving the goals. In particular, the governments create substantial uncertainties to firms, instead of reducing them. Governmental policies and regulations evolve over time, and substantial uncertainties exist regarding the interpretation and application of laws and regulations (Eden et al., 2000). As Tan and Litschert (1994) stated, the government regulatory regime is the most influential, most complex, and least predictable of all the external environmental factors in China. Moreover, arbitrary intervention from the local government entails great uncertainties to firm technological innovation (Nee, 1992; Peng, 1997; Tan, 1996). In a recent survey, Chinese executives reported that the complexity in the implementation of regulations is one of the most important barriers to innovation in SMEs in China (Zhu et al., 2012). Owing to the government’s influence, complexity, and unpredictability, firm managers must maintain a “disproportionately greater contact” with local government officials in order to minimize the uncertainty caused by arbitrary government intervention in innovation (Child, 1994: 154; Luo & Peng, 2000; Shi, Markóczy, & Stan, 2014).

To cultivate a good relationship with government officials, private business managers in China have to spend a significant amount of time to meet with local government officials (Child, 1994; Luo & Peng, 2000). Prior studies have found that a strong tie yields better economic returns in many cases, that is, Chinese entrepreneurs would be more likely to receive funds from potential investors with whom they have strong ties (Zhang, Soh, & Wong, 2010), and job seekers would be more likely to secure a new job through a strong tie (Bian, 1997). Similarly, a strong personal tie with local government officials in China has also been found to help in facilitating regulation approval and policy negotiation processes (Luo & Peng, 2000). However, a strong tie is costly to build and maintain, mainly because it requires lots of time for face-to-face interactions. Prior studies have suggested that the time spent on meetings can promote emotional intensity, intimacy, and reciprocal services; and hence building and maintaining a strong tie (Bian, 1997; Campbell & Marsden, 1984; Granovetter, 1973; Marsden, 1990; Zhang et al., 2010).

In summary, the argument above suggests that when firms engage in technological innovation, time investment in cultivating political ties with local government officials will give rise to strong personal ties between firm managers and government officials, which will reduce the uncertainty caused by arbitrary government intervention in innovation. In effect, “since political institutions and actors are among the most difficult environmental dependencies to control, firms may seek to co-opt political stakeholders by developing personal and organizational linkages, so that potentially hostile elements of environmental uncertainties can be neutralized and even absorbed into the firms” (Sun et al., 2012: 70–71).

However, will such benefit from political ties improve firm performance? Prior studies have generated mixed findings with regards to the value of political ties in various contexts. While some found positive impacts (e.g., Faccio, 2006; Hillman; 2005; Li & Zhang, 2007; Wu et al., 2013), some studies have not found any direct effect (e.g., Wang et al., 2009), and others even found negative impacts (e.g., Cheung et al., 2005; Faccio, 2010; Fan et al., 2007). Taking the recommendation of the contingency of the RBV of the firm and following the work of Katila and Shane (2005), we do not predict direct effect of political ties; instead, we focus on examining the contingent value of political ties in technological innovation process in the next section.

The contingent value of political ties in technological innovation process

The RBV of the firm posits that firm-specific resources and capabilities increase the efficiency and effectiveness of firms, and thus create competitive advantages (Barney, 1991; Wernerfelt, 1984). As aforementioned, political ties between business and government give rise to political capital that can be enjoyed by firms, hence they are a type of important resources that may create firm competitive advantages (Hillman & Hitt, 1999), in particular in an emerging economy such as China (Li & Zhang, 2007).

One central area of recent investigation has been the contingent value of resources (Katila & Shane, 2005). For instance, Barney (1991) explained that the environmental context in which an asset is applied will influence whether or not the asset is a resource. In the context of technological innovation activities, where different levels of institutional uncertainties may be involved, building a strong political tie is more justifiable when there are greater needs to leverage the tie to reduce institutional uncertainties. In other words, whether the time investment in political ties would benefit the firms’ innovation activities depends on the nature of the innovation that the firm pursues. In particular, we believe it is useful to examine the contingent effect of political ties on firm performance when the firm is pursuing innovation activities that are exploratory versus exploitative in nature.

In exploratory innovation, the firm is pursuing the development of a new product or new production technology, so uncertainty may arise concerning the need for regulatory approval. For example, is the new product subject to licensing control or safety certification? Can it qualify for tax incentives? Is the new process subject to fire/building safety codes or environmental impact inspections? To shield the innovative activities from such regulatory intervention and interruption, managers need to cultivate ties with the relevant government officials and lobby for favorable decisions (Luo & Peng, 2000). As highlighted earlier, despite improvements in recent years, the regulatory and legal system in China for innovation remains subject to wide, discretionary interpretations by local government officials (Atuahene-Gima & Li, 2001; Eden et al., 2000; Sheng et al., 2011; Tan, 1996). This is particularly so for radically new products that exploratory innovation tends to generate. A firm must apply for a new Industrial Manufacturing Permit each time it makes a new product or introduces major changes to existing ones, and government regulatory agencies regularly inspect factories to approve applications. The arbitrary nature of the administrative process and the particularistic nature of interpersonal relationships in China (Tan et al., 2009) mean that a simple patent or permit application can take months or even years, or be rejected, if the firm lacks political ties. In a competitive market, a shorter lead time not only reduces costs but also increases sales revenue for new products, especially if a product is new to the market, because the short lead time creates first-mover advantages (Lieberman & Montgomery, 1988). Therefore, when the level of exploratory innovation is higher, the need for uncertainty reduction is greater; consequently the value of having political ties will become more prominent.

Taking the contingent view of resources, Bourgeois noted that “the central tenet in strategic management is that a match between environmental conditions and organizational capabilities and resources is critical to performance, and that a strategist’s job is to find or create this match” (Bourgeois, 1985: 548). Accordingly, we predict that a higher level of time investment in building and maintaining political ties with local government officials will lead to better firm performance when it is matched with a higher level of exploratory innovation:

Hypothesis 1

Managers’ time investment in building and maintaining political ties with local government officials will lead to better firm performance when the firm engages in a higher level of exploratory innovation.

In contrast, when a firm engages in exploitative innovation, the impact of time investment in cultivating political ties on firm performance is likely to differ. When a firm incrementally upgrades an existing product, the degree of uncertainty is much less than when it makes radical changes in exploratory innovation (March, 1991). The product is likely to remain in compliance with pre-existing regulatory approvals, and any ongoing inspection should be a routine matter that requires marginal compliance time and cost expenditures. For example, the firm may not need a new Industrial Manufacturing Permit if the new product features no major changes. In this situation, the benefits of a strong personal tie with local government officials would not be as significant; that is, time and effort spent to build political ties could still be substantial, but the net benefit is unlikely to increase proportionally. In this case, the substantial time invested by managers in maintaining political ties could become unproductive and wasteful.

Furthermore, the time spent on political ties could be more effectively utilized in other activities that yield higher returns to firm performance. Marketing studies have suggested that firms should take customer-oriented strategy and strengthen their marketing and sales activities when pursuing exploitative innovation (Atuahene-Gima, 2005; Day, 1994; Hult & Hurley, 1998). Because a higher level of exploitative innovation will improve work efficiency and productivity to a greater extent, managers now must endeavor to sell more by either penetrating the existing market or reaching new customers through expanding to other regional markets. Time investment in marketing and sales is especially important in China where relationship marketing is crucial (Simmons & Munch, 1996). Whether two firms can make a deal depends on how good the personal relationship between the managers in the two firms. There is a well-known saying that in China, “Business is done not in a conference room, but rather over the mah-jongg (a board game) table at home or dinner table in a restaurant” (Fang, 1999 230). As relationship marketing must require hours of face-to-face interactions, the managers could have better enhanced sales by having dinners with existing or potential customers rather than with the local government officials, if the innovation does not require new approval from the government. From a resource trade-off perspective, too much time/efforts spent on political ties could even have a negative effect on firm performance, as this would reduce management time investment in internal operational activities like sales and marketing that are critical for exploitative innovation activities. As a result, we predict that, at a higher level of exploitative innovation activities, more time investment in building and maintaining political ties with local government officials will adversely affect firm performance:

Hypothesis 2

Managers’ time investment in building and maintaining political ties with local government officials will reduce firm performance when the firm engages in a higher level of exploitative innovation.

Methods

Data

In 2003, the World Bank conducted a survey entitled “The study of competitiveness, technology, and firm ventures” in collaboration with the Enterprise Survey Organization of the Chinese National Bureau of Statistics. The survey used a standard questionnaire “Productivity and the Investment Climate Survey” (PICS) that had been designed and developed by the World Bank and used in 135 countries. This survey provided the data for our study.

The survey was conducted in Chinese. The unit of analysis was the firm, and the respondents were senior managers of the surveyed firms. The survey questionnaire covered financial statements and different aspects of corporate governance, financing, firm–government relations, innovation, technology, and labor, among other issues. Although no information on the response rate and data collection process is provided, the PICS is regarded as among the most authoritative and accurate surveys conducted in China (Wu & Pangarkar, 2010).

The survey sampled the universe of registered businesses and used stratified random sampling to obtain a predetermined distribution by size, city, and industry.Footnote 1 The Chinese survey covered 300 firms each in five major cities—Beijing, Chengdu, Guangzhou, Shanghai, and Tianjin—for a total of 1,500 firms. These cities are the most populous and most active regions in economic development. The surveyed firms were active in the following manufacturing industries: electronics (33 %), garments/apparel (22 %), food (4 %), metals and machinery (10 %), chemicals (6 %), and automotive and auto components (25 %). These industries are chosen at the two-digit ISIC level depending on the characteristics of Chinese economy as summarized in three variables: contribution to value added, employment, and number of firms. These industries together account for more than half of the entire manufacturing value and exports in China. On average, the sampled firms have been in business for 16 years, employed 120 people, and had sales of RMB 175 million (about US$28.5 million). Average R&D expenditures were RMB 12 million (about US$2 million).

Dependent variable

We used the logarithm of sales in the previous year as the measure of firm performance. Although firm performance is a multidimensional concept, we focused only on sales for several reasons. First, sales is the most common indicator of the firm performance in prior exploration and exploitation studies (e.g., He & Wong, 2004; Venkatraman, Lee, & Iyer, 2007). It is also a reliable proxy for other dimensions of superior firm performance, especially survival (Henderson, 1999; Timmons, 1999). Second, in China, sales revenue attracts the most attention from stakeholders (Jia, 2009). Third, sales are critical to the success of manufacturing firms, so sales estimations are more readily available and reliable than profitability estimates. Fourth, unlike profitability measures such as return on assets, sales do not suffer from accounting measurement problems (He & Wong, 2004).

Independent variables

Time investment in political ties is measured based on the answers to the question, “On average, how many days last year were spent in inspections and meetings with officials of each of the following agencies in the context of regulations of your business: tax inspectorate, labor and social security, fire and building safety, sanitation/epidemiology, municipal police, and environmental agencies.” Factor analysis showed that the answers for all agencies except sanitation/epidemiology loaded on one factor. We therefore measured time investment in political ties as the logarithm of sum of these five answers excluding the sanitation/epidemiology response (α = .744).

One may argue that the time spent with officials may not be about building and maintaining political ties, but is simply the results of overall inefficiency of government regulatory processes that waste time. However, if that is the main reason, we would have found little variations of time spent among managers of different firms, which is not the case. In addition, we interviewed several managers in Beijing to better understand how and why they spent time with government officials. The interviews suggest that while some managers simply met the officials for mandatory purpose, many mangers took extra efforts to build political ties; and they spent time to meet officials in various situations outside office hours, such as having dinner together. More importantly, they counted the time on dinner tables as investment in building and maintaining ties, and thus considered such time as work time. For instance, one owner-manager said:

“I am not a person who likes to deal with people, but I have to do it myself, because I cannot afford to hire another guy. Another problem is I don’t have much time (to deal with the officials), what can I do? Everybody needs to have dinners, right? Very often after inspections and meetings (with the officials), I have lunch or supper with them. You know what? Sometimes a tricky problem could be solved during the dinner time. Is it a good investment?”

Overall, our interviews suggest that our measurement is a valid proxy for investment in political ties.

Following Ahuja and Katila (2002), Bierly and Daly (2001), and He and Wong (2004), we consider exploratory and exploitative innovation as two distinct dimensions of innovation behavior, rather than two ends of a continuous scale. We used two items to measure each variable. For exploratory innovation, the items asked are: “Has your company developed a major new product line in the last 3 years?” and “Has your company introduced new technology that has substantially changed the way that the main product is produced in the last 3 years?,” while for exploitative innovation, the two items are: “Has your company received ISO (e.g., 9000, 9002, or 14,000) certification in the last 3 years?” and “Has your company upgraded an existing product line in the last 3 years?.” For all questions, “yes” answers generated a value of 1 and “no” equaled 0. We measured each variable by calculating the average of the two values, as they both yield acceptable Cronbach-alpha reliability values (α = .724 and .711 respectively).

For the discriminant validity test, we used the command “DIFFTEST” in Mplus, because the four components are binary variables (Muthén & Muthén, 2007; Satorra & Bentler, 2001). This test compares an unrestricted model that estimates the correlation between a pair of constructs and a restricted model that fixes the value of the construct correlation to unity, and uses a robust weighted least squares estimator to account for categorical indicators. The difference in chi-square between the two models is a χ 2 variate with 1 degree of freedom. A significant chi-square difference implies that the unconstrained model fits the data better, in support of discriminant validity (Satorra & Bentler, 2001). In our case, the change in chi-square is 4.699 (p < .05), which suggests good discriminant validity. To confirm the reliability of the two measures, we calculate the correlations between exploratory/exploitative innovation and the answer to the question, “How many new products (i.e., those that involve a significant change in the production process) has your establishment introduced in the last 3 years?” which indicates exploratory innovation. The correlations are .235 (p < .01) for exploratory innovation and .047 (p > .10) for exploitative innovation, providing further evidence of the reliability and discriminant validity of the measures of the two types of innovation.

It is necessary to elaborate on the implications of ISO certification in exploitation. The ISO 9000 norms were developed as a set of international standards and guidelines to provide a basis for firms to establish quality management systems (ISO (International Organization for Standardization), 1998). Prior literature reports the technical benefits of compliance with these standards, and ISO certification reportedly helps companies improve information gathering and analysis, human resource development, supplier and customer relations, and overall quality levels (Guerin & Rice, 1996; Rao, Ragu-Nathan, & Solis, 1997; Simmons & White, 1999). Benner and Tushman (2002) studied process routines in ISO 9000 certification programs and found that they favor incremental innovations rather than ones that create new competencies. In China, ISO certification has grown rapidly since 1990s, mainly due to pressure from global competition (Guler, Guillén, & Macpherson, 2002), multinational ownership, and exports to developed countries (Christmann & Taylor, 2001). Earning ISO certification implies exploitative instead of exploratory innovation. To further verify the measurement, in robustness tests we use the single item of “Has your company upgraded an existing product line in the last 3 years?” to measure exploitative innovation, and the results remain similar.

Another concern about the methodology in this study is the common method variance problem, which could result from collecting the dependent and independent variables from the same respondent in the same survey. We check it using the Harman one-factor test (Atuahene-Gima & Li, 2001; Podsakoff & Organ, 1986). A factor analysis of the dependent and independent variables yielded four factors accounting for 74 % of the variance, and factor 1 accounted for 19 % of the variance. Since a single factor did not emerge and one general factor did not account for most of the variance, common method variance is unlikely to be serious problem in the data. Moreover, our main hypotheses dealing with interactions are insensitive to this problem, because strategy scholars (e.g., Dooley & Fryxell, 1999) and methodologists (e.g., Aiken & West, 1991) have observed that the complex data relationships shown by predicted interaction effects are not explained by common method bias because respondents cannot guess a researcher’s interaction hypotheses to respond in a socially desirable manner.

Control variables

We included five sets of control variables in the analysis. We first included five dummy variables to control for the industry: garments, food, machinery, chemicals, and automotive, with electronics as the reference group.

We controlled for firm size, because prior studies show that it has a positive impact on a firm performance (Eisenhardt & Schoonhoven, 1990). In addition, large firms are more likely to possess the necessary resources to commit to political activity (Meznar & Nigh, 1995). Firm size correlates with corporate political influence and activity in many industries (Salamon & Siegfried, 1977; Ungson, James, & Spicer, 1985). We measured it as the logarithm of the number of employees.

We controlled for state ownership by measuring the percentage of equity owned by the government/state. On the one hand, a high level of state ownership may imply strong guanxi with government officials, which should increase the chance of resource granted and purchases from the government, facilitate business exchanges and thus improve performance (Xin & Pearce, 1996). On the other hand, SOEs have relatively low productivity and thus are less competitive (Cai, Li, & Lin, 1998).

We included R&D expenditure, measured as the logarithm of the answer to the question, “How much did your company spend on design or R&D last year (spending includes wages and salaries of R&D personnel, such as scientists and engineers; materials, education costs and subcontracting costs)?” This aggregate measure controls for the total amount of innovation activities of the firm, regardless of its breakdown into exploratory and exploitative innovation activities. Aggregate R&D investment has been found to have a positive correlation with firm performance (Cohen & Levinthal, 1990).

Finally, we controlled for organizational slack, as previous studies have suggested that organizational slack is positively associated with sales (Waddock & Graves, 1997). Organizational slack has been broadly conceptualized along two dimensions (Sharfman, Wolf, Chase, & Tansik, 1988): Absorbed slack is tied up with factors of production and is not easy to redeploy, whereas unabsorbed slack corresponds to more liquid and uncommitted resources and can be redeployed more easily, allowing for greater managerial discretion (Tan & Peng, 2003). We measured absorbed slack with the following question: “What was the company’s average capacity utilization over the last year (Capacity utilization is the amount of output actually produced relative to the maximum amount that could be produced with your existing machinery and equipment and regular shifts)?” If a respondent answered 75 %, then organizational slack is .25. Following Chen, Su, and Tsai (2007), Cheng and Kesner (1997), and He, Ndofor, and Sirmon (2011), we measured unabsorbed slack by the current ratio (current assets/current liabilities), which indicates the firm’s ability to meet its immediate obligations with liquid resources.

Results

Table 1 shows the descriptive statistics and correlation matrix of the variables. The absence of high correlations between the variables of interest suggests that multicollinearity is not an issue. We confirmed that this is the case by calculating variance inflation factors, which are all less than 10 (Kutner, Neter, & Wasserman, 1990). We used mean-centered variables to ease the interpretation of main and interaction effects in moderated regression models (Echambadi & Hess, 2007; Irwin & McClelland, 2001).

We tested the hypotheses by estimating ordinary least squares (OLS) regression models. In Table 2, we provide the OLS regression results, following the hierarchical regression analysis format: (1) control variables in Model 1; (2) add main effect variables in Model 2; and (3) add interaction terms in Model 3. We examine the hypothesis tests using the Model 3 results.

Hypothesis 1 predicts that when a firm engages in a higher level of exploratory innovation, a higher level of managers’ time investment in building and maintaining political ties with local government officials will be associated with better firm performance, while Hypothesis 2 predicts that when a firm engages in a higher level of exploitative innovation, a higher level of managers’ time investment in building and maintaining political ties with local government officials will be associated with lower firm performance. We find support for both hypotheses, because the coefficient of exploration × time investment in ties is positive and significant (β = .12, p < .01), while the coefficient of exploitation × time investment in ties is negative and significant (β = −.17, p < .01). It should be noted that while the bivariate correlations of both exploratory and exploitative innovation with sales are positive, the effect of exploratory innovation becomes insignificant in the regressions after inclusions of the control variables and other predictors.

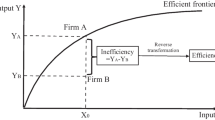

We graphically display these interactions in Fig. 1. The vertical axis represents the value of ln (sales). We use one standard deviation below and above the mean as the range for the level of exploratory/exploitative innovation, and we constrain the other variables to their mean values (Aiken & West, 1991). In Panel a, which depicts exploratory innovation, when firms engaged in low level of exploratory innovation, the amount of time investments in political ties has a negative relationship with sales. However, as exploratory innovation increases, the association between time investment in political ties and sales becomes less negative and, at some point, even begins to have a positive relationship. In Panel b regarding exploitative innovation, we find the opposite results: the association between time investment and sales is positive when exploitative innovation is low; however, it becomes less positive and even begins to have a negative effect as exploitative innovation increases.

Models that include the control variables show some interesting insights. First, state ownership has a negative effect on sales, which confirms the weak competitiveness of SOEs (Cai et al., 1998). Consistent with prior studies (e.g., Eisenhardt & Schoonhoven, 1990), firm size is positively associated with sales, and as we expected, high R&D expenditure has a positive relationship with sales. Organizational slack shows negative influences on sales, which is contradictory to the prior studies (Tan & Peng, 2003; Waddock & Graves, 1997). Finally, the results indicate the existence of industry effects.

In robustness tests, we first tested the hypotheses with new dependent variables, Sales (2 years ago), Sales (3 years ago), log of sales growth over last 3 years, and log of sales growth over last 3 years relative to sector’s average sales growth, and the results remained consistent. We use the single item of “Has your company upgraded an existing product line in the last 3 years?” to measure exploitative innovation, and the results remained. Finally, we excluded size and R&D expenditures from the models, because they are correlated with sales, but no substantial changes emerged.

Discussion

This study examines the extent to which the effect of firms’ time investment in cultivating political ties with government officials on firm performance may be contingent upon the kind of innovation activities that they pursue, in the context of an emerging economy such as China that, despite its rapid economic development, still lags in its institutional reforms. We have predicted that when firms pursue a higher level of exploratory innovation, mangers should match it with more time investment in political ties to help reduce the high institutional uncertainty involved in the innovation process and thus improving firm performance, but when firms pursue a higher level of exploitative innovation with low institutional uncertainty, mangers should invest more time on internal operation management, particularly sales and marketing, thus a higher level of time investment in political ties could be wasteful and even harm firm performance. Using data from a large sample survey of 1,500 manufacturing firms from China, our results lend empirical support to these hypotheses.

Contributions

Our study contributes to the literature in four ways. First, by highlighting the contingent effect of different types of innovation activities on the effect of political ties on firm performance, this study fills a major gap in the literature on the value of political ties for private businesses in emerging economies. Prior studies have investigated the impacts of political ties on financial and market performance (Boubakri, Cosset, & Saffar, 2008; Faccio, 2006, 2010; Fan et al., 2007; Li, Meng, Wang, & Zhou, 2008; Li & Zhang, 2007; Luo & Peng, 2000; Sheng et al., 2011), receiving government subsidies (Wu & Cheng, 2011), accessing bank finance (Claessens, Feijen, & Laeven, 2008; Faccio, 2006; Khwaja & Mian, 2005), being bailed out (Faccio, Masulis, & McConnell, 2006), IPO performance (Fan et al., 2007; Fisman, 2001; Wu et al., 2013), governance and board composition (Fan et al., 2007; Ahlstrom, Liu, & Yeh, 2006), and corporate diversification (He, Lan, Li, & Yiu, 2012). However, to our best knowledge, very few studies have focused on the effect of political ties on firm performance in the context of technological innovation activities, despite the growing importance of innovation activities in recent years (Ahlstrom, 2010). While there have been several prior studies on the roles of political ties in technological innovation in China, these studies have focused on the direct effect of political ties on the intention and efficiency of firm R&D investment, rather than on how the type of innovation activities may moderate the effect of political ties on firm performance. Moreover, the findings from these prior studies are conflicting. While several found negative impacts (Chen, Jing, Long, & Shao, 2010; Hu, Luo, & Ma, 2013; Li & Ma, 2011; Liu & Yang, 2012), some found positive effects (Cai, Huang, Li, & Liu, 2014). These conflicting findings suggest that the value of political ties is contingent on the types of innovation activities being pursued. This study not only offers theoretical arguments for the contingent value of political ties when firms are pursuing different types of technological innovation activities, (i.e., political ties help reduce institutional uncertainty), and also provides the empirical evidence that supports them.

Second, this study suggests that the value of political ties for firm performance depends on the task, a level of analysis that is different from that of nation, industry, organization, inter-organization and individuals that have been studied in the previous research of the contingent values of political ties in various research contexts (Sun et al., 2012). Our study suggests that the distinctly different nature of exploratory versus exploitative innovation gives rise to different challenges to managers; while high time investment in political ties may help exploratory innovation, it may be counter-productive for exploitative innovation. In other words, the different tasks involved in the different types of innovation demand different levels of support from political ties.

Third, our study fills a gap in the literature on innovation management which has largely ignored the need for firms to manage their institutional environment when pursuing innovation activities (Lu et al., 2008). Our findings further confirm that the need to invest managerial time in influencing the institutional environment is contingent upon the type of innovation activities being pursued (Ahlstrom et al., 2008). In this sense, our study answers the call for research on the contingency of innovation management (Katila & Shane, 2005). Because best practices in innovation management are contingent upon a range of environmental factors, our study highlights the need for innovation management scholars to pay greater attention to the differences in institutional environments in emerging economies versus mature markets. In mature markets, “regulatory environments constrain heterogeneity by prescribing uniform resource standards, competencies and ways of deploying resource across given industries and by defining what resources are socially acceptable or permissible as input (e.g., safety standards, use of nonhazardous materials)” (Oliver, 1997: 707), which makes firms similar (DiMaggio & Powell, 1983). In contrast, in emerging economies like China, the institutional environment does not impose similar resource rules and standards on all firms in the same industry. In emerging economies like China, where formal institutions are still immature and local government officials have discretionary power to interpret regulations and policies, firms do not face uniform regulatory standards, and firms that build more political ties with local government officials face relatively more “flexible” regulatory constraints than other firms. For example, pollution control standards applied to one firm could be weaker than is specified in the regulation—in Chinese, “zheng yi zhi yan, bi yi zhi yan” (open one eye while closing the other). In particular, firms in immature markets may be able to achieve competitive advantages via exploratory innovation by investing in building and maintaining a good institutional environment for such innovation.

Last, but not least, our findings also have important practical implications for managers. Although prior organizational studies have noted the need for managers operating in emerging markets to invest in personal ties with government officials to mitigate the risk and costs of uncertainties, a key managerial implication of our findings is that firms must determine an appropriate level of such investment, based on the type of innovation activities they seek to pursue. Firms that actively explore new business opportunities and markets should invest more in political ties, whereas firms focusing on exploiting incremental opportunities in existing markets require a lower level of investment. Unless these two forms of resource allocations are appropriately matched, firms run the risk of under- or over-investing in managing institutional environment.

Limitations and future research

The findings of this study are subject to certain limitations, which also represent fertile avenues for further research. First, we included sales as the dependent variable to measure firm performance, because it is the most common indicator in prior exploration-exploitation studies that examine firm performance (e.g., He & Wong, 2004; Venkatraman et al., 2007). Our choice is also reasonable for our research, because marketing and sales are the major challenges that managers have to confront when engaging in exploitative innovation (Atuahene-Gima, 2005; Day, 1994; Hult & Hurley, 1998). In addition, we are limited by the availability of data, as profit and market share information are unavailable in the database. One of the main limitations of using sales as the dependent variable is that the relatively short time period used to capture various firm activities and performance (“in the last 3 years” or “last year” in the survey) cannot support research on the determinants of long-term performance. Prior studies suggest exploration and exploitation may have different impacts on long-term versus short-term performances. For instance, Auh and Menguc (2005) found that exploration is positively associated with effective firm performance (growth in sales, profits, and market share) over several years, whereas exploitation relates positively to efficient firm performance (returns on investment, sales, and assets) over shorter time periods. Therefore, though the research design serves our research need, it represents an unfortunate limitation, and we hope that future research can capture longitudinal data to examine the same research question over a longer timeframe.

Second, although the roles of political ties in firm innovation process include both reducing institutional uncertainty and offering resources (e.g., research grants, government purchase) to the firms (Leyden & Link, 1992), this study focuses primarily on the former for two reasons. First, prior studies have examined the role of political ties on acquiring resources, though not in the context of technological innovation. For instance, studies have examined how political ties help in securing government subsidy (Wu & Cheng, 2011), access bank finance (Claessens et al., 2008; Faccio, 2006; Khwaja & Mian, 2005), and being bailed out (Faccio et al., 2006). Second, we are limited by the given database. The questionnaire only addressed regulatory agents which are not involved in distributing resources to firm for innovation activities directly. To test whether political ties with these agents may entail resource awarding, we checked the correlation between time spent on political ties and “government purchase,” measured by percentage of sales to the government, and the correlation was insignificant (β = .010, p = .715). We also included “government purchase” in the regressions. The variable did not show any significant impacts on sales. These test results suggest that time investment in political ties did not facilitate resource acquisition in our research context. To further examine this issue, future studies may explore the roles of political ties with the officials in the resource-allocating authorities, such as industrial development or innovation promotion bureaus, in firm innovation process.

Finally, we argued in this study that the time spent on meeting local government officials is an investment in building and maintaining political ties, which will lead to stronger ties and thus help in reducing institutional uncertainty. We justified the logic using the social network theory and our interviews. Future research may seek to collect data to measure political ties directly with other methods, such as an in-depth survey of the strength of ties between managers and various officials in government or other influential organizations (Young, Peng, Ahlstrom, Bruton, & Jiang, 2008).

Conclusion

This study extends the contingent resource-based view to the world of firms that aspire to improve performance by using political ties to facilitate their technological innovation process. We found that firms in emerging economies such as China should invest more time to cultivate political ties with local government officials when they undertake exploratory than exploitative innovation. By highlighting the contingent value of political ties in the specific context of innovation, our study adds to the growing empirical literature on how firms can manage their institutional contexts to build influence with respect to the innovation process (Ahuja & Yayavaram, 2011; Carney et al., 2009). As technological innovation has become an increasingly important factor for Chinese firms to compete in the increasingly competitive global market (Wang et al., 2008; Yu et al., 2014), our study offers important insights for Chinese business scholars and managers on how Chinese firms can manage the institutional environment more effectively when pursuing innovation activities.

Notes

More information on the methodology is available at www.enterprisesurveys.org.

References

Abernathy, W. J., & Clark, K. B. 1985. Innovation: Mapping the winds of creative destruction. Research Policy, 14(1): 3–22.

Acemoglu, D., & Robinson, J. 2012. Why nations fail: The origins of power, prosperity, and poverty. New York: Crown Business.

Ahlstrom, D. 2010. Innovation and growth: How business contributes to society. Academy of Management Perspectives, 24(3): 10–23.

Ahlstrom, D., Bruton, G. D., & Lui, S. S. Y. 2000. Navigating China’s changing economy: Strategies for private firms. Business Horizons, 43(1): 5–15.

Ahlstrom, D., Bruton, G. D., & Yeh, K. S. 2008. Private firms in China: Building legitimacy in an emerging economy. Journal of World Business, 43(4): 385–399.

Ahlstrom, D., Law, P., Nair, A., & Young, M. N. 2003. Managing the institutional environment: Challenges for foreign firms in post-WTO China. SAM Advanced Management Journal, 68(1): 41–49.

Ahlstrom, D., Liu, Y., & Yeh, K. S. 2006. The separation of ownership and management in Taiwan’s public companies: An empirical study. International Business Review, 15(4): 415–435.

Ahuja, G., & Katila, R. 2002. Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal, 45(6): 1183–1194.

Ahuja, G., & Yayavaram, S. 2011. Explaining influence rents: The case for an institutions-based view of strategy. Organization Science, 22(6): 1631–1652.

Aiken, L. S., & West, S. G. 1991. Multiple regression: Testing and interpreting interactions. Newbury Park: Sage.

Atuahene-Gima, K. 2005. Resolving the capability–rigidity paradox in new product innovation. Journal of Marketing, 69(4): 61–83.

Atuahene-Gima, K., & Li, H. Y. 2001. Product innovation strategy and the performance of new technology ventures in China. Academy of Management Journal, 44(6): 1123–1134.

Auh, S., & Menguc, B. 2005. Balancing exploration and exploitation: The moderating role of competitive intensity. Journal of Business Research, 58(12): 1652–1661.

Barney, J. B. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17: 99–120.

Benner, M. J., & Tushman, M. 2002. Process management and technological innovation: A longitudinal study of the photography and paint industries. Administrative Science Quarterly, 47(4): 676–707.

Bian, Y. 1997. Bringing strong ties back in: Indirect ties, network bridges, and job searches in China. American Sociological Review, 1: 366–385.

Bierly, P., & Daly, P. S. 2001. Exploration and exploitation in small manufacturing firms: 3–8. Presented at the 61st Annual Academy of Management Meeting, Washington.

Boubakri, N., Cosset, J. C., & Saffar, W. 2008. Political connections of newly privatized firms. Journal of Corporate Finance, 14(5): 654–673.

Bourgeois, L. J. 1985. Strategic goals, perceived uncertainty, and economic performance in volatile environments. Academy of Management Journal, 28(3): 548–573.

Bruton, G. D., Dess, G. G., & Janney, J. J. 2007. Knowledge management in technology-focused firms in emerging economies: Caveats on capabilities, networks, and real options. Asia Pacific Journal of Management, 24(2): 115–130.

Butler, J. E., & Priem, R. L. 2001. Is the resource-based “view” a useful perspective for strategic management research?. Academy of Management Review, 26(1): 22–40.

Cai, D., Huang, J. S., Li, C. M., & Liu, H. 2014. Political ties of private firms and technological innovation. Economic Review, 2: 65–76 (in Chinese).

Cai, F., Li, Z., & Lin, J. Y. 1998. Competition, policy burdens, and state-owned enterprise reform. American Economic Review, 88(2): 422–427.

Campbell, K. E., & Marsden, P. V. 1984. Measuring tie strength. Social Forces, 63(2): 482–501.

Canaves, S., & Fong, M. 2008. Factories on China’s south coast lose their edge. Wall Street Journal, Feb: A9.

Carney, M., Gedajlovic, E., & Yang, X. 2009. Varieties of Asian capitalism: Toward an institutional theory of Asian enterprise. Asia Pacific Journal of Management, 26(3): 361–380.

Carroll, T. N., Lewin, A. Y., & Long, C. P. 1999. The coevolution of new organizational forms. Organization Science, 10(5): 535–550.

Chen, H., Li, Y., Liu, Y., & Peng, M. W. 2014. Managerial ties, organizational learning, and opportunity capture: A social capital perspective. Asia Pacific Journal of Management, 31(1): 271–291.

Chen, M. J., Su, K. H., & Tsai, W. 2007. Competitive tension: The awareness-motivation-capability perspective. Academy of Management Journal, 50(1): 101–118.

Chen, S. Y., Jing, R. T., Long, X. N., & Shao, Y. F. 2010. An empirical study on the influence of social ties of entrepreneurs in private firms on their R&D investment decision. Management World, 1: 88–97 (in Chinese).

Cheng, J. L., & Kesner, I. F. 1997. Organizational slack and response to environmental shifts: The impact of resource allocation patterns. Journal of Management, 23(1): 1–18.

Cheung, Y. L., Jing, L., Rau, P. R., & Stouraitis, A. 2005. Guanxi, political connections, and expropriation: The dark side of state ownership in Chinese listed companies. Unpublished working paper, City University of Hong Kong and Purdue University

Child, J. 1994. Management in China during the Age of Reform. Cambridge: Cambridge University Press.

Child, J., & Tse, D. K. 2001. China’s transition and its implications for international business. Journal of International Business Studies, 32(1): 5–21.

Christmann, P., & Taylor, G. 2001. Globalization and the environment: Determinants of firm self-regulation in China. Journal of International Business Studies, 32: 439–458.

Claessens, S., Feijen, E., & Laeven, L. 2008. Political connections and preferential access to finance: The role of campaign contributions. Journal of Financial Economics, 88(3): 554–580.

Cohen, W. M., & Levinthal, D. A. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35: 128–152.

Danneels, E. 2002. The dynamics of product innovation and firm competences. Strategic Management Journal, 23(12): 1095–1121.

Day, G. S. 1994. The capabilities of market-driven organizations. Journal of Marketing, 58(Oct.): 37–52.

DiMaggio, P., & Powell, W. W. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2): 147–160.

Dooley, R. S., & Fryxell, G. E. 1999. Attaining decision quality and commitment from dissent: The moderating effects of loyalty and competence in strategic decision-making teams. Academy of Management Journal, 42(4): 389–402.

Echambadi, R., & Hess, J. D. 2007. Mean-centering does not alleviate collinearity problems in moderated multiple regression models. Marketing Science, 26(3): 438–445.

Eden, L., Eden, L., Hoskisson, R. E., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249–267.

Eisenhardt, K. M., & Schoonhoven, C. B. 1990. Organizational growth: Linking founding team, strategy, environment, and growth among US semiconductor ventures, 1978–1988. Administrative Science Quarterly, 35(3): 504–529.

Faccio, M. 2006. Politically connected firms. American Economic Review, 96(1): 369–386.

Faccio, M. 2010. Differences between politically connected and nonconnected firms: A cross‐country analysis. Financial Management, 39(3): 905–928.

Faccio, M., Masulis, R. W., & McConnell, J. 2006. Political connections and corporate bailouts. Journal of Finance, 61(6): 2597–2635.

Fan, J. P., Wong, T. J., & Zhang, T. 2007. Politically connected CEOs, corporate governance, and post-IPO performance of China’s newly partially privatized firms. Journal of Financial Economics, 84(2): 330–357.

Fang, T. 1999. Chinese business negotiating style. Thousand Oaks: Sage.

Fisman, R. 2001. Estimating the value of political connections. American Economic Review, 91(4): 1095–1102.

Friesen, P. H., & Miller, D. 1983. Strategy‐making and environment: The third link. Strategic Management Journal, 4(3): 221–235.

Granovetter, M. S. 1973. The strength of weak ties. American Journal of Sociology, 78: 1360–1380.

Guerin, J., & Rice, R. W. 1996. Perceptions of importers in the United Kingdom, Germany, and the Netherlands regarding the competitive advantages of ISO 9000. Forest Products Journal, 46(4): 27–31.

Guler, I., Guillén, M. F., & Macpherson, J. M. 2002. Global competition, institutions, and the diffusion of organizational practices: The international spread of ISO 9000 quality certificates. Administrative Science Quarterly, 47(2): 207–232.

He, A., Lan, H., Li, W., & Yiu, D. 2012. Political connections and corporate diversification in emerging economies: Evidence from China. Asia Pacific Journal of Management, 29(3): 799–818.

He, X., Ndofor, H. A., & Sirmon, D. G. 2011. Firm resources, competitive actions and performance: Investigating a mediated model with evidence from the in-vitro diagnostics industry. Strategic Management Journal, 32(6): 640–657.

He, Z. L., & Wong, P. K. 2004. Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organization Science, 15(4): 481–494.

Heath, P. S., & Peng, M. W. 1996. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Academy of Management Review, 21(2): 492–528.

Henderson, A. D. 1999. Firm strategy and age dependence: A contingent view of the liabilities of newness, adolescence, and obsolescence. Administrative Science Quarterly, 44: 281–314.

Hillman, A. J. 2005. Politicians on the board of directors: Do connections affect the bottom line?. Journal of Management, 31(3): 464–481.

Hillman, A. J., & Hitt, M. A. 1999. Corporate political strategy formulation: A model of approach, participation, and strategy decisions. Academy of Management Review, 24(4): 825–842.

Hu, Y. B., Luo, X. M., & Ma, Q. H. 2013. Political connection and firm technological innovation performance—A study on the mediating role of R&D investment. Studies in Science of Science, 31(6): 938–947 (in Chinese).

Hult, T. M., & Hurley, R. F. 1998. Innovation, market orientation, and organizational learning: An integration and empirical examination. Journal of Marketing, 62(July): 42–54.

Irwin, J., & McClelland, G. 2001. Misleading heuristics for moderated multiple regression models. Journal of Marketing Research, 38: 100–109.

ISO (International Organization for Standardization). 1998. Selection and use of ISO 9000. Geneva: ISO.

Jansen, J. J., Van Den Bosch, F. A., & Volberda, H. W. 2006. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Management Science, 52(11): 1661–1674.

Jia, C. 2009. Overview of China’s enterprise innovation: Process, challenges and policy recommendations. In Q. Fan, K. Li, D. Z. Zeng, Y. Dong, & R. Peng (Eds.). Innovation for development and the role of government: A perspective from the East Asia and Pacific Region: 121–148. Washington, DC: The World Bank.

Jiang, Y., Peng, M. W., & Wang, D. Y. 2008. An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies, 39(5): 920–936.

Katila, R., & Shane, S. 2005. When does lack of resources make new firms innovative?. Academy of Management Journal, 48(5): 814–829.

Khwaja, A. I., & Mian, A. 2005. Do lenders favor politically connected firms? Rent provision in an emerging financial market. Quarterly Journal of Economics, 120(4): 1371–1411.

Kutner, M. H., Neter, J., & Wasserman, W. 1990. Applied linear statistical models: regression, analysis of variance, and experimental designs. Homewood: Irwin.

Lavie, D., Stettner, U., & Tushman, M. L. 2010. Exploration and exploitation within and across organizations. Academy of Management Annals, 4(1): 109–155.

Levinthal, D. A., & March, J. G. 1993. The myopia of learning. Strategic Management Journal, 14(S2): 95–112.

Leyden, D. P., & Link, A. N. 1992. Government’s role in innovation. Dordrecht: Kluwer.

Li, H., Meng, L., Wang, Q., & Zhou, L. A. 2008. Political connections, financing and firm performance: Evidence from Chinese private firms. Journal of Development Economics, 87(2): 283–299.

Li, H. Y., & Zhang, Y. 2007. The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strategic Management Journal, 28(8): 791–804.

Li, J. J., Zhou, K. Z., & Shao, A. T. 2009. Competitive position, managerial ties, and profitability of foreign firms in China: An interactive perspective. Journal of International Business Studies, 40(2): 339–352.

Li, Y. P., & Ma, F. P. 2011. Senior managers’ social capital, resource acquisition and technological innovation. Economic Management Journal, 8: 51–59 (in Chinese).

Lieberman, M. B., & Montgomery, D. B. 1988. First-mover advantages. Strategic Management Journal, 9(S1): 41–58.

Lin, J., & Si, S. X. 2010. Can guanxi be a problem? Contexts, ties, and some unfavorable consequences of social capital in China. Asia Pacific Journal of Management, 27(3): 561–581.

Liu, Q., & Yang, D. W. 2012. An empirical study on the influences of political ties of private firms on R&D investment: The evidence from the SME board in Shenzhen stock market. Public Finance Research, 5: 61–65 (in Chinese).

Lu, Y., Peng, M. W., & Tsang, E. W. K. 2008. Knowledge management and innovation strategy in the Asia Pacific: Toward an institution-based view. Asia Pacific Journal of Management, 25(3): 361–374.

Luo, Y. 2007. From foreign investors to strategic insiders: Shifting parameters, prescriptions and paradigms for MNCs in China. Journal of World Business, 42(1): 14–34.

Luo, Y., & Peng, M. W. 2000. Managerial ties and firm performance in a transition economy: The nature of a micro–macro link. Academy of Management Journal, 43(3): 486–501.

March, J. G. 1991. Exploration and exploitation in organizational learning. Organization Science, 2: 71–87.

Marsden, P. V. 1990. Network data and measurement. Annual Review of Sociology, 16: 435–463.

McCloskey, D. N. 2013. Tunzelmann, Schumpeter, and the hockey stick. Research Policy, 42(10): 1706–1715.

McGrath, R. G. 2001. Exploratory learning, innovative capacity, and managerial oversight. Academy of Management Journal, 44: 118–131.

Meznar, M. B., & Nigh, D. 1995. Buffer or bridge? Environmental and organizational determinants of public affairs activities in American firms. Academy of Management Journal, 38(4): 975–996.

Muthén, L. K., & Muthén, B. O. 2007. Mplus user’s guide. Los Angeles: Muthén & Muthén.

Nee, V. 1992. Organizational dynamics of market transition: Hybrid forms, property rights, and mixed economy in China. Administrative Science Quarterly, 37(1): 1–27.

North, D. C. 1990. Institutions, institutional change and economic performance. Cambridge: Cambridge University Press.

Oliver, C. 1991. Strategic responses to institutional processes. Academy of Management Review, 16: 145–179.

Oliver, C. 1997. Sustainable competitive advantage: Combining institutional and resource-based views. Strategic Management Journal, 18(9): 679–713.

Peng, M. W. 1997. Firm growth in transitional economies: Three longitudinal studies from China, 1989–1996. Organization Studies, 18(3): 385–413.

Podsakoff, P. M., & Organ, D. W. 1986. Self-reports in organizational research: Problems and prospects. Journal of Management, 12(4): 531–544.

Quer, D., Claver, E., & Rienda, L. 2007. Business and management in China: A review of empirical research in leading international journals. Asia Pacific Journal of Management, 24(3): 359–384.

Rao, S. S., Ragu-Nathan, T. S., & Solis, L. E. 1997. Does ISO 9000 have an effect on quality management practices? An international empirical study. Total Quality Management, 8(6): 335–346.

Rothaermel, F. T., & Deeds, D. L. 2004. Exploration and exploitation alliances in biotechnology: A system of new product development. Strategic Management Journal, 25(3): 201–221.

Salamon, L. M., & Siegfried, J. J. 1977. Economic power and political influence: The impact of industry structure on public policy. American Political Science Review, 71(3): 1026–1043.

Satorra, A., & Bentler, P. M. 2001. A scaled difference chi-square test statistic for moment structure analysis. Psychometrika, 66(4): 507–514.

Scott, W. R. 1995. Institutions and organizations. Thousand Oaks: Sage.

Sharfman, M. P., Wolf, G., Chase, R. B., & Tansik, D. A. 1988. Antecedents of organizational slack. Academy of Management Review, 13(4): 601–614.

Sheng, S., Zhou, K. Z., & Li, J. J. 2011. The effects of business and political ties on firm performance: Evidence from China. Journal of Marketing, 75(1): 1–15.

Shi, W. S., Markóczy, L., & Stan, C. V. 2014. The continuing importance of political ties in China. Academy of Management Perspectives, 28(1): 57–75.

Simmons, B. L., & White, M. A. 1999. The relationship between ISO 9000 and business performance: Does registration really matter? Journal of Managerial Issues, 11: 330–343.

Simmons, L. C., & Munch, J. M. 1996. Is relationship marketing culturally bound: A look at guanxi in China. Advance in Consumer Research, 23:92–96.

Sun, P., Mellahi, K., & Wright, M. 2012. The contingent value of corporate political ties. Academy of Management Perspectives, 26(Aug.): 68–82.

Tan, J. 1996. Regulatory environment and strategic orientations in a transitional economy: A study of Chinese private enterprises. Entrepreneurship Theory and Practice: 31–44.

Tan, J., & Litschert, R. J. 1994. Environment‐strategy relationship and its performance implications: An empirical study of the Chinese electronics industry. Strategic Management Journal, 15(1): 1–20.

Tan, J., & Peng, M. W. 2003. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strategic Management Journal, 24(13): 1249–1263.

Tan, J., & Tan, D. 2005. Environment—strategy coevolution and coalignment: A staged-model of Chinese SOEs under transition. Strategic Management Journal, 26(2): 141–157.

Tan, J., Yang, J., & Veliyath, R. 2009. Particularistic and system trust among small and medium enterprises: A comparative study in China’s transition economy. Journal of Business Venturing, 24(6): 544–557.

Teece, D. 1986. Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15(6): 285–305.

Timmons, J. A. 1999. New venture creation: Entrepreneurship for 21st century, 5th ed. Homewood: Irwin.

Ungson, G. R., James, C., & Spicer, B. H. 1985. The effects of regulatory agencies on organizations in wood products and high technology/electronics industries. Academy of Management Journal, 28(2): 426–445.

Van de Ven, A. H. 2004. The context-specific nature of competence and corporate development. Asia Pacific Journal of Management, 21(1–2): 123–147.

Venkatraman, N., Lee, C. H., & Iyer, B. 2007. Strategic ambidexterity and sales growth: A longitudinal test in the software sector. Unpublished manuscript (earlier version presented at the Academy of Management Meetings, 2005).

Volberda, H. W., & Lewin, A. Y. 2003. Co‐evolutionary dynamics within and between firms: From evolution to co‐evolution. Journal of Management Studies, 40(8): 2111–2136.

Voss, G. B., Sirdeshmukh, D., & Voss, Z. G. 2008. The effects of slack resources and environmental threat on product exploration and exploitation. Academy of Management Journal, 51(1): 147–164.

Waddock, S. A., & Graves, S. B. 1997. The corporate social performance. Strategic Management Journal, 8(4): 303–319.

Wang, H., Feng, J., Liu, X., & Zhang, R. 2009. What is the benefit of TMT’s governmental experience to private-owned enterprise? Evidence from China. Asia Pacific Journal of Management, 28(3): 555–572.

Wang, L. C., Ahlstrom, D., Nair, A., & Hang, R. Z. 2008. Creating globally competitive and innovative products: China’s next olympic challenge. SAM Advanced Management Journal, 73(3): 4–14.

Wernerfelt, B. 1984. A resource-based view of the firm. Strategic Management Journal, 5(2): 171–180.

Wu, J., & Cheng, M. L. 2011. The impact of managerial political connections and quality on government subsidies: Evidence from Chinese listed firms. Chinese Management Studies, 5(2): 207–226.

Wu, J., Li, S., & Li, Z. 2013. The contingent value of CEO political connections: A study on IPO performance in China. Asia Pacific Journal of Management, 30(4): 1087–1114.

Wu, J., & Pangarkar, N. 2010. The bidirectional relationship between competitive intensity and collaboration: Evidence from China. Asia Pacific Journal of Management, 27(3): 503–522.

Xin, K. R., & Pearce, J. L. 1996. Guanxi: Connections as substitutes for formal institutional support. Academy of Management Journal, 39(6): 1641–1658.