Abstract

This paper presents a production inventory system with a manufacturer-retailer supply chain dealing with the non-instantaneous deteriorating products. The two-level supply chain model is analyzed with shortage and without shortage, considering the impact of business strategies in different sectors on the collaborating market system. Firstly, the integrated system and then the decentralized system under a retail fixed-mark-up strategy are studied. Further, we show that the retailer offers a fixed-mark-up policy as a signal to the manufacturer to resolve the gaming between channel members of the supply chain. This study’s prime objective is to determine the optimal retail price, wholesale price, and inventory schedules to maximize the overall supply chain’s profit. An analytical method is used to optimize the selling price and various time-length for maximum profit. The model is demonstrated through two numerical examples, and sensitivity analysis is conducted to study the behavior of parameters. It is observed from the numerical study that the supply chain system without shortage is beneficial compared to the shortage permitted supply chain. Manufacturer profit is improved after using RFM contract in contrast with integrate system.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Researchers and experts in manufacturing industries have given importance to establish inventory control issues in supply chain management. The competitive structure specifies that organizations highlight specific competitive measurements and develop production capacities to accomplish the chosen measures to upgrade their market position. The competitive measurements are cost, profit, flexibility, delivery, quality, etc. These measures relate to production process, control, planning, facility, capacity, workforce. This research estimates the impact of inventory level, production run time, selling price, idle time of the systems. In the traditional EOQ and EPQ model, all products are perfect. In industries, products undergo deterioration over time, such as food, vegetables, volatile liquids, medicine, etc. Deterioration is defined by decay, damage, evaporation, spoilage, loss of marginal values of the product, which decrease the usefulness of the product (Wee [41]). Ghare and Schrader [14] first considered deterioration in an inventory model. The deterioration of food items and vegetables; is not an accident but a natural process that decomposes from its harvesting. Some products have a minimal shelf-life period, and after that time period, products start to decompose. This time period is called the no-deterioration period. As far as stock level, during the no-deterioration time, stock decrease due to demand only. In a real-life situation, most of the items (for example, fresh vegetables, blood banks, electronic items, etc.) would have a time of maintaining quality or original condition; there is no deterioration occur during that period. Afterward, a portion of the products will begin to decay. This type of phenomenon is called non-instantaneous deterioration. In this paper, we have assumed non-instantaneous deterioration of products in retailer warehouse. One of the main objectives of the supply chain is to make coordination between its channel members. Coordination strategy is very relevant for the success of a business. In the globalized supply chain, coordination is very challenging, and several ways can do it. This paper considers the vertical integration and decentralized retail-fixed mark-up strategy for coordination between manufacturer and retailer. The goals of this study investigated the following questions:

-

(a)

What are the optimal sales prices and wholesale prices of the item in a price-competition marketing system?

-

(b)

What is the optimal inventory scheduling to overcome the risk of losses when market demand is not fully deterministic in nature?

-

(c)

What are the behavior of economic parameters on optimal profit of the manufacturer, retailer and whole supply chain system when a shortage occurs at the retailer warehouse?

To answer the above questions, we develop a two-echelon supply chain consisting of a manufacturer and a retailer. The manufacturer is responsible for producing finished products and makes them available to satisfy the retailer’s demand. The retailer has the responsibility to deliver the finished products to the customer. At the retailer warehouse, the products have deteriorated after a while. The problem is to coordinate pricing and replenishment decisions across the supply chain such that the total profit of the chain is maximized. We assume that the manufacturer faces a constant demand from the retailer, and the retailer faces an external price-dependent demand from the customer. The model is investigated for two cases, including (a) shortage is permitted (b) shortage is not permitted. Two main approaches are pursued in this paper; for the decision-making structure in which channel members decide independently, the term “decentralized” is used, and when the decisions are adopted in the supply chain as a whole, the term “Integrated” is used. In a decentralized case, the retailer has used a fixed mark upon the manufacture’s wholesale price.

2 Literature review

In the last few years, the researchers in the field of inventory management has an expedient contribution. In this section we have categorized the literature review as (i) Production inventory model with product deterioration (ii) Inventory model for non-instantaneous deteriorating item (iii) Supply chain coordination.

2.1 Production inventory model with product deterioration

For a manufacturing firm, the necessary thing is to make a decision on the optimal replenishment schedule and production plan of finished products. The method of obtaining an optimal production plan is to determine the optimal production time so that the finished products should be sold out at each cycle. This method can be seen in [45]. He et al. [19] provided a optimum solution procedure to find optimum production plan and optimum replenishment schedule for finished products where manufacturer sells the product to multiple markets in a deteriorating production inventory model. Production inventory for deteriorating item with stock-dependent demand under two-level trade credit policy [10], finished products inventory with multiple buyers and single manufacturer [15] economic model have been developed with supply chain co-ordination. Chan et al. [7] studied a production inventory model for deteriorated products to optimize production rate and replenishment schedule. Since the raw materials have also deteriorated, the next step is to find the optimal replenishment schedule of raw materials. Khakzad and Gholamian [22] proposed the inventory model to find replenishment time for raw materials considering deterioration. In this study, the replenishment schedule of the finished products in a production inventory model has been optimized. Mishra et al. [29] established an economic production quantity model and determined the optimum production policy for deteriorating items considering preservation technology investment to minimize system related cost.

2.2 Inventory model for non-instantaneous deteriorating item

In all of the literature mentioned above of deteriorating inventory model, researchers assumed that the products have deteriorated at the instant of their arrival in inventory. Wu et al. [42] first introduced “non-instantaneous deterioration” and established an optimal replenishment policy with stock-dependent demand under shortages. This model was further extended in [43] by coordinating pricing and replenishment policies under price-dependent demand. Chang et al. [8] revised the model of Wu et al. [42] by changing the objective function to maximizing total profit. Geetha and Uthayakumar [13] considered a permissible delay in payments in a non-instantaneous deteriorating inventory model. In this model, market demand and selling price are assumed to be constant, and the shortage is also allowed, which is partially backlogged. Ghoreishi et al. [16] developed an economic production quantity inventory model for price and time-dependent demand of non-instantaneous deteriorating products considering customer returns. Valliathal and Uthayakumar [40] studied an EOQ model for non- instantaneous deterioration in which replenishment policy starting without shortages. Maihami and Kamalabadi [26] proposed an EOQ model for the non- instantaneous phenomenon of deterioration with time and price- dependent demand under permissible delay in payments. Dye [12] explored the effect of investment on preservation against non-instantaneous deterioration of inventory. Palanivel and Uthayakumar [33] dealt with a non-instantaneous deteriorating EPQ model under price and advertisement sensitive demand with an inflation effect. Maihami and Karimi [27] used stochastic price-dependent demand in the problem of pricing and replenishment policy with the shortage. Jaggi et al. [21] proposed a two-storage EOQ model with non-instantaneous deterioration under the trade-credit policy. Li et al. [23] considered two cases of shortages in their EOQ model, which happen before and after non-deterioration of product, also preservation technology affects the rate of deterioration and length of non- deterioration period. Bardhan et al. [1] considered preservation technology investment for a non-instantaneous deteriorating inventory model with stock-dependent demand. A sustainable inventory model was developed for non-instantaneous deteriorating item with price-dependent demand utilizing green technology investment and preservation technology investment [28]. Das et al. [11] established a preservation technology based non-instantaneous deteriorating inventory model with selling price and inventory level dependent demand under trade credit policy.

2.3 Supply chain coordination

In general, an organization is always trying to coordinate and align the channel members’ business activities to improve the effectiveness and performance of the supply chain system. All steps of the production process of items up to delivery to the customer can be incorporated into a supply chain, connecting manufacturer, retailer, and finally, the consumer. Goyal and Gunasekaran [18] proposed integration of a production inventory model to determine economic order quantity (EOQ) and economic production quantity (EPQ) of deteriorating items in a multi-layer production system considering price and frequency of advertisement dependent demand. Boyaci and Gallego [3] developed a two-layer supply chain with multiple retailers to maximize the overall profit of the chain by focusing on inventory and pricing policies. Sana [34] developed a three-layer integrated production inventory model with perfect and imperfect quality of the product. Sarkar [35] proposed a cost minimization supply chain model considering probabilistic deterioration with two-channel members. Zhang et al. [46] discussed the coordination of one manufacturer- one retailer supply chain model with price-sensitive demand using preservation technology investment to reduce the rate of deterioration. Taleizadeh and Noori-daryan [38] studied the decentralized phenomenon of a three-echelon supply chain to minimize the system-related cost without considering shortage. Chakraborty et al. [6] discussed the integration of channel members of the supply chain for non-instantaneous deteriorating items under inflation and permissible delay in payments. Taghizadeh-Yazdi et al. [37] focused on an operational policy of a supply chain for deteriorated products to maximize the profit. Barman et al. [2] compared the profit of an integrated supply chain structure under linear and iso-elastic price-sensitive demand for deteriorated products. Huang et al. [20] optimized the ordering policy that should maximize the profit of the supply chain by establishing a quantity discount coordination mechanism.

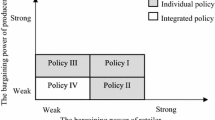

The retailer declares the fixed retail price mark up that he will impose over the manufacturer’s wholesale cost. This type of setting is named RFM policy (Linh et al. [24]). In practice, this policy exists in many industries. A very closed example of RFM contract the “Agency Model” of Apple company. The e-book publisher sets the price of the electronic books, and Apple company takes the 30% shares of the sales revenue (Catan and Trachtenberg [4]). Giri et al. [17] applied retail-fixed-mark up policy over supplier’s wholesale price in the decentralized case for a three-layer supply chain.

2.4 Research gap

By now, the concept of deteriorating production inventory model, non-instantaneous deteriorating inventory model, and supply chain coordination are frequently discussed in the literature review, but when it comes to the combination of these three phenomena in a single platform, no researchers have studied the coordination of channel members of the supply chain for non-instantaneous deteriorating production inventory model. There are lots of studies on deteriorating inventory models with supply chain coordination. In one of them, Sana [34] introduced an integrated production inventory model for a three-echelon supply chain consisting of a supplier, a manufacturer, and a retailer for perfect and imperfect quality of items. They considered the marketing system’s collaboration in various sectors incorporating the impact of business strategies such as production rate, optimal order quantity of raw materials, and idle time for maximum average expected profit. Pal et al. [32] extended the Sana [34] model in which the production system may undergo an “out of control” state from an “in control” state following a probability density function. The decision variables in these studies are replenishment lot size of supplier and manufacturer production rate. These two works are quantitative studies incorporated in the literature to address the model somehow similar to our study. However, the lack of thorough research, including non-instantaneous deterioration, shortage is evident. In this study, we address this problem and propose a two-echelon supply chain consisting of two-channel members. The closed study to our work is done by Tat et al. [39]. That study considers a two-echelon supply chain, including a supplier and a retailer with a single non-instantaneous deteriorating item. It addresses an economic order quantity model with and without shortage to explore the VMI system’s effect (Vendor managed inventory). In that work, the mechanism was considered to minimize the system-related cost. Our study has a few significant contributions, which is different from the previous study in this field. First, we introduce non-instantaneous deterioration in supply chain coordination considering the production inventory model, which is rarely investigated in supply chain coordination literature. Secondly, we also introduce a coordination mechanism for the mentioned supply chain structure to lead both the member of the chain and the whole supply chain toward a better situation, which has not been available in the literature. It is worth mentioning that we develop an economic production quantity model with and without shortages to maximize the supply chain profit. In addition, compared with the most significant article in the literature which underscores the premise of our study, Tat et al. [39], Sana [34], we consider the demand faced by the retailer as price-sensitive; whereas, in the mentioned work, this demand function is assumed to be constant. In the literature, a similar model has been analyzed by Tat et al. [39]. In their research, in order to minimize the system related cost of the supply chain system, Tat et al. [39] assumed that the production rate is infinite in their model. They calculated the total system related cost ignoring production rate and production cost. But assumption of production rate changes the model from EOQ (economic order quantity) model to a EPQ (economic production quantity model.) Tat et al. [39] established the idea of shortage when inventory level drops to zero. Their model will not result about selling price and fails to obtain the sales revenue of channel members.

The remainder of the paper is structured as follows: The notations and assumptions of the model are provided in Section 3. Section 4 deals with the problem formulation and mathematical development of the model. In Section 5, the model’s solution methodology is discussed with “Integrated Policy” for two cases, i.e., with a shortage or without shortage. In Section 6, the model is discussed under the decentralized policy for shortage permitted retailer and without shortage. A numerical investigation is devoted in Section 7. In Section 8, sensitivity analysis and managerial implications are discussed. Conclusion and future research direction are presented in Section 9.

3 Fundamental assumptions and notations

3.1 Notations

The following notations are used to establish the model.

Decision Variables | |

p | Retailer’s selling price per unit item |

w | Manufacturer’s wholesale price per unit item |

T | Cycle duration |

Dependent Variables | |

Dc | customer demand per unit time |

\(T^{\prime }\) | shortage period in retailer’s inventory |

TPR | Retailer’s total profit |

TPM | Manufacturer’s total profit |

TPSC | Supply chain profit |

Parameters | |

Im(t) | Manufacturer’s inventory level at time t |

Ir(t) | Retailer’s inventory level at time t |

Dr | Retailer’s demand per unit time |

P | Production Rate per unit time |

q | backlogging size in retailer’s inventory |

Om | Manufacturer set up cost per cycle |

c | Manufacturer production cost per unit item |

hm | Manufacturer holding cost |

u | Manufacturer idle time cost |

Or | Retailer’s set up cost per cycle |

hr | Retailer’s holding cost |

d | Retailer’s deterioration cost per unit item |

s | Retailer’s shortage cost per unit item |

3.2 Assumptions

The following assumptions are considered to develop the model

-

1.

A single manufacturer and a single retailer supply chain with a non-instantaneous deteriorating item/ product is developed.

-

2.

The demand rate for the retailer (Dr) is considered to be constant. The demand rate for the customer (Dc) is price-dependent i.e., Dc = (a − bp) (where a > 0 primary demand and b > 0 is price elasticity, a >> b,Dc > 0), demand rate of customer decreases with increasing selling price of the retailer and vice-versa. Also, the retailer’s demand rate is much more than the customers’ demand, i.e., Dr > Dc.

-

3.

The manufacturer’s production rate (P) is assumed to be constant, and it is always greater than both the retailer and customer’s demand, i.e., P > Dr > Dc.

-

4.

Products have not deteriorated instantaneously at the manufacturer’s warehouse. Also, at the beginning of the retailer’s storage, the product has no deterioration up to the inventory period T3. After T3, the products are started to deteriorate with a deterioration rate 𝜃, (0 < 𝜃 < 1).

-

5.

In the retailer’s warehouse, the time-length of the products exhibit no deterioration is always greater than the deteriorating time-period i.e., T3 − 0 > T − T3.

-

6.

Deteriorated products are not replaced or repaired during the period under consideration.

-

7.

The joint effect of manufacturer and retailer is considered in supply chain management.

-

8.

The cost of idle time at the manufacturing level is also considered.

-

9.

Lead time is negligible.

Demand function

The demand for a certain product is the measure of that item purchasers are willing or ready to purchase at a specific price. One is the most important factor demand could be influenced by the product’s price, so the relationship between the demand quantity and price is known as the demand function. To evaluate the various cost and revenue of channel members in the supply chain; two applicable scenarios of the relationship between the demand and price are:

-

a)

Direct demand function: This demand curve is established as a mathematical expression of the relationship between the amount of an item demanded and those variables which influence the ability and willingness of people to purchase the product, which could be expressed as D = f(p); here D is the demand and p is the price of that item. In this paper, the demand of the customer is considered as Dc = a − bp. This demand function is widely utilized in many literature, e.g. [9, 36, 44, 47, 48]. In real-life, higher selling price drives away customer which is the reason of reducing of product demand. Therefore, the organizations have to settle a reasonable price which will provoke and attract buyers.

-

b)

Inverse demand function: The price function or the inverse demand function expressed as p = f(D) i.e., price as a function of quantity ordered. To evaluate the inverse demand function, solve p from demand function D.(these studies has used this strategy for example [5, 25, 30, 31])

The inverse demand function was initially established when economies were primarily dependent on horticulture. Farmers cultivated as much crop as possible, and the price of the product at the market was decided by what amount of crop was produced. This is the reason in inverse demand function; quantity is considered as an independent variable. Nowadays, the production of the item is driven mostly by price. Organizations find out the idea of the price of the item, and this defines their goals of production. It might more sense to utilize the direct demand function for organizations, as this is a more practical relationship for today. As numerous investigates today based on the direct demand curve, this paper has used the direct demand function. But, exploring the effect of utilizing the inverse demand function and solving the equations of profit function of channel members of the supply chain, and comparing the result will be beneficial and interesting.

4 Problem formulation and mathematical model development

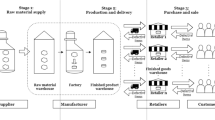

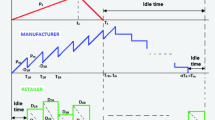

Manufacturer supply the finished products to the retailer facing a constant demand rate from the retailer side. Retailer directly deals with the customer and sells the product to the customer with a price-dependent demand rate shown in Fig. 1. This section first develops the retailer’s profit functions under two different scenarios (I) when the shortage is not permitted (II) shortage is permitted at the retailer’s inventory. Then, the profit function of the manufacturer has been calculated. The pictorial description of inventory without shortage are shown in Fig. 2 and with shortage are shown in Fig. 3 respectively. The inventory system of the retailer is discussed in two cases in Section 4.1. The manufacturer inventory system has been discussed in Section 4.2, and the joint profit of the supply chain system is discussed in Section 4.3.

4.1 Retailer’s profit

Retailer’s profit is calculated under two different phenomena. a) In case-1, the shortage is not permitted in the retailer’s inventory described in Fig. 2. b) In case-2, the shortage is permitted in the retailer’s inventory, followed by Fig. 3.

4.1.1 Case 1: Shortage is not permitted

The manufacturer supplies the finished products to the retailer at a demand rate Dr, which continued up to time T2. The demand of the customers met by the retailer with a demand rate Dc and stock at the retailer piles up with a demand rate (Dr − Dc) up to time T2. During the time-interval (T2,T3), the inventory decreases due to demand only. And during the time-interval (T3,T), the inventory level decreases and drops to zero because of demand and deterioration. The governing differential equations are

with the boundary condition Ir(0) = Ir(T) = 0.

From equation (4.1.1), (4.1.1) and (4.1.1), using boundary conditions, we have

Using equations (4.1.1) and (4.1.1), equating level of inventory at time t = T3, we get,

Now, different inventory costs of the retailer’s are

-

1.

Set up cost = Or

-

2.

Purchasing cost = \(w \displaystyle \int \limits _{0}^{T_{2}} D_{r} dt\)=wDrT2

-

3.

Holding cost = \(h_{r} \left [ \displaystyle \int \limits _{0}^{T_{2}}(D_{r}-D_{c})t dt \right .\)

\(\left .+\int \limits _{T_{2}}^{T_{3}} (D_{r} T_{2}-D_{c} t)dt +\int \limits _{T_{3}}^{T} \frac {D_{c}}{\theta } \left \{ e^{\theta (T-t)}-1 \right \} dt \right ]\)

$$ \begin{array}{@{}rcl@{}} &&=h_{r} \left[ D_{r} T_{2} T_{3} -D_{r}\frac{{T_{2}^{2}}}{2} -D_{c} \frac{{T_{3}^{2}}}{2} -\frac{D_{c}}{\theta} \left\{ \frac{1-e^{\theta (T-T_{3})}}{\theta}+(T-T_{3}) \right\}\right] \end{array} $$(8) -

4.

Deterioration cost = \(d \left [ \frac {D_{c}}{\theta } \left \{ e^{\theta (T-T_{3})}-1 \right \}-D_{c}(T-T_{3}) \right ] \)

-

5.

Sales Revenue = \(p {\displaystyle \int \limits _{0}^{T}} D_{c} dt\) = pDcT

Therefore, using Dc = a − bp and equation (7), we have got the simplest form of the retailer’s profit as follows

4.1.2 Case 2: Shortage is permitted

This section develops the retailer’s inventory with a different supposition that shortage is allowed at the retailer warehouse and fully backlogged. At the beginning of the retailer warehouse cycle, there is no on-hand inventory of the retailer. Retailer starts his cycle with a shortage of amount q at the beginning of the inventory. The supply of the finished product from the manufacturer is started instantaneously. Up to time \((0, T^{\prime } )\), retailer fill the shortage than a positive inventory will build up in retailer’s warehouse up to T2 with a demand rate Dr. During this time-interval \((T^{\prime },T_{2})\), customer demand met by the retailer with a demand rate Dc. The accumulated inventory up to time T2 is (Dr − Dc)T2. The products’ stock decreases with a customer demand rate Dc during (T2,T3). Finally, at the time-interval (T3,T), the inventory goes to zero due to both demand and deterioration. The governing differential equation of retailer with shortages are

with the boundary condition Ir(0) = −q and \(I_{r}(T^{\prime })= I_{r}(T)=0\).

From equations (4.1.2), (4.1.2), (4.1.2) and (4.1.2), using the above boundary conditions, we get

From the boundary condition \(I_{r}(T^{\prime })=0\), we get

From equations (4.1.2) and (4.1.2), equating the level of inventory at time t = T3, we get,

Different costs of the retailer’s are:

-

1.

Set up cost = Or

-

2.

Purchasing cost = \(w \displaystyle \int \limits _{0}^{T_{2}} D_{r} dt\)=wDrT2

-

3.

Holding cost = \(h_{r} \left [\displaystyle \int \limits _{T^{\prime }}^{T_{2}} \left \{(D_{r}-D_{c})t-q \right \} dt\right .\)\(\left .+\displaystyle {\int \limits }_{T_{2}}^{T_{3}} (D_{r} T_{2} - D_{c} t-q)dt + \displaystyle \int \limits _{T_{3}}^{T} \frac {D_{c}}{\theta } \left \{ e^{\theta (T-t)}-1 \right \} dt \right ]\)

$$ \begin{array}{@{}rcl@{}} & & =h_{r} \left[ D_{r} T_{2} T_{3} -D_{r}\frac{{T_{2}^{2}}}{2} -D_{c} \frac{{T_{3}^{2}}}{2} +\frac{q^{2}}{2(D_{r}-D_{c})} -q T_{3} -\frac{D_{c}}{\theta} \left\{ \frac{1-e^{\theta (T-T_{3})}}{\theta} +(T-T_{3}) \right\} \right] \end{array} $$(20) -

4.

Deterioration cost = \(d \left [ \frac {D_{c}}{\theta } \left \{ e^{\theta (T-T_{3})}-1 \right \}-D_{c}(T-T_{3}) \right ] \)

-

5.

Shortage cost = \(s \displaystyle \int \limits _{0}^{T^{\prime }} [-I_{r}(t)] dt\) = \(\frac {s q^{2}}{2(D_{r}-D_{c})}\)

-

6.

Sales Revenue = \(p {\displaystyle \int \limits _{0}^{T}} D_{c} dt\) = pDcT

Therefore, using Dc = a − bp and equation (19), the simplest form of the retailer’s profit is as follows

4.2 Manufacturer’s profit

In the proposed model, the manufacturer produces the finished products at a rate P up to production run time T1. The manufacturer meets the demand of the retailer at a rate Dr up to time T2. During the production run time (0,T1), the inventory of finished products piles up with a rate (P − Dr). The accumulated inventory (P − Dr)T1 satisfies the demand of the retailer during (T1,T2). The inventory system of the manufacturer at time t is represented by the following equations

with the boundary conditions Im(0) = 0,Im(T2) = 0.

From equation (4.2) and (4.2), using the boundary conditions, we have

At t = T1, equation (4.2) and (4.2) implies the following

Now, different inventory costs of the manufacturer are

-

1.

Set up cost = Om

-

2.

Production cost = \(c \displaystyle \int \limits _{0}^{T_{1}} P dt\)=cPT1

-

3.

Idle time cost = u(T − T2)

-

4.

Holding cost =\(h_{m}\left [\displaystyle \int \limits _{0}^{T_{1}} \left \{(P-D_{r})t \right \} dt + \displaystyle \int \limits _{T_{1}}^{T_{2}} \left \{ D_{r}(T_{2}-t) \right \} dt\right ] =h_{m} \left [ P\frac {{T_{1}^{2}}}{2}+D_{r}\frac {{T_{2}^{2}}}{2}-D_{r} T_{1} T_{2} \right ]\)

-

5.

Sales Revenue = \(w \displaystyle \int \limits _{0}^{T_{2}} D_{r} dt\) = wDrT2

Therefore, the total profit of the manufacturer is calculated as:

4.2.1 When retailer shortage is not permitted

When the retailer shortage are not allowed, then the value of T1 is obtained from (26). In equation (26), replacing T2 from (7), we get

Thereafter, using equation (7), (28) and replacing Dc = (a − bp), the manufacturer’s profit is formulated as

4.2.2 When retailer shortage is permitted

Similarly, when the retailer shortage are allowed, then the value of T1 is obtained from (26). In equation (26), replacing T2 from (19), we get

Thereafter, using equation (19) and (30), the manufacturer’s profit is formulated as

4.3 Joint profit of the supply chain system

4.3.1 When shortage is not permitted at the retailer inventory

Now, the joint total profit of the system without shortage

4.3.2 When shortage is permitted at the retailer inventory

Joint total profit of the system with shortage

Different solution methodology of the model are discussed in Sections 5 and 6. A pictorial description of the solution of the model in various situation are described in Fig. 4.

5 Integrated policy (Model 1)

We start with a benchmark where the manufacturer and the retailer are vertically integrated as a whole. The main objective of this integrated supply chain is to determine the optimal retail price as well as the duration of the cycle while maximizing the total profit. We discuss the integrated supply chain model without shortage and with the shortage. For the integrated scenario, we have the following results. All proofs for ensuing lemmas, propositions are described in Appendix A. The corresponding joint optimization problem can be formulated as

5.1 Shortage is not permitted at the retailer inventory (Model 1-A)

Lemma 1

When cycle duration T is fixed, total profit of the supply chain TPSC in (32) is concave of retail price p if (54) holds.

Proof

Proof are in Appendix A. □

The following proposition distinguishes the optimum retail price for any given T.

Proposition 1

For any given T, the optimum retail price p can be evaluated from \(\frac {\partial TP_{SC} }{\partial p}=0\). i.e.,

Proof

Differentiation of TPSC with respect to p are shown in equation (52). □

Lemma 2

When retail price p is fixed, total profit of the supply chain TPSC in (32) is concave in cycle duration T if (57) holds.

Proof

Proof are in Appendix A. □

According to the lemma 2, the following proposition has been obtained.

Proposition 2

For any given p, the optimum cycle duration T has been established from \(\frac {\partial TP_{SC} }{\partial T}=0\). i.e.,

Proof

Differentiation of TPSC with respect to T are shown in equation (55). □

The optimum solutions have presented in the numerical investigation section.

Theorem 1

When retailer shortage is not allowed, the profit function (TPSC) in (32) will be maximum and uniquely exist.

Proof

Proof are in Appendix A. □

5.2 Shortage is permitted at the retailer inventory (Model 1-B)

Lemma 3

When the retailer shortage are included, for cycle duration T, total profit of the supply chain TPSC in (33) is concave in retail price p.

Proof

Proof are in Appendix B. □

The above lemma 3 distinguishes the following proposition 3.

Proposition 3

For cycle duration T, the retail price p can be calculated from \(\frac {\partial TP_{SC} }{\partial p}=0\). i.e.,

Proof

Differentiation of TPSC with respect to p are shown in equation (60). □

Lemma 4

When retail price p is fixed, total profit of the supply chain TPSC is concave with respect to cycle duration T if (64) holds.

Proof

Proof are in Appendix B. □

Proposition 4

For any given p, the cycle duration T can be obtained from \(\frac {\partial TP_{SC} }{\partial T}=0\). i.e.,

Proof

Differentiation of TPSC with respect to T are shown in equation (62). The optimum solutions are presented in numerical section. □

Theorem 2

When retailer shortage is allowed, the profit function (TPSC) in (33) will be maximum and uniquely exist.

Proof

Proof are in Appendix B. □

6 Decentralized policy (Model 2)

In the decentralized structure, we use RFM contract, i.e., the retailer applies a fixed marked up given upon the manufacturer’s wholesale price to determine the retail price. We assume that retailer fixed mark-up as α such that w = (1 − α)p. We start our examination by assuming the price mark-up α is fixed and discuss the decision-making process. The objective function of the manufacturer and the retailer under RFM are as follows:

Under the RFM contract the profit function of the manufacturer is formulated as

Similarly, when the shortage is not allowed then the profit function of the retailer under RFM contract is as follows

And when the shortage is allowed then the profit function of the retailer under RFM contract is as follows

In the decentralized supply chain, each player chooses his best strategy. Since both the channel members of the supply chain possesses full and symmetric information regarding demand and various costs, this method is a Stackelberg game in which the manufacturer is the leader, and the retailer is the follower. We have started to solve the decision-making problem of the retailer by applying the backward induction process. The manufacturer’s wholesale price depends on the retailer’s sales price under the RFM contract. The manufacturer determines the sales price first, and according to the sales price manufacturer gets a fixed mark upon the retailer’s sales price. Then, the retailer sets its optimal cycle duration. The methodology of decentralized policy without shortage and with shortage are discussed in Sections 6.1 and 6.2.

6.1 When shortage is not permitted at the retailer inventory (Model 2-A)

Proposition 5

Under the RFM contract, when shortage at the retailer’s inventory is not permitted, then there exists a unique optimal T that maximizes the retailer’s profit if (44) holds.

Proof

Taking the first and second order derivatives of TPR with respect to T

The solution obtains from equation (42) by \(\frac {\partial TP_{R} }{ \partial T}=0\) and this solution is optimal if \(\frac {\partial ^{2} TP_{R}}{\partial T^{2}}<0\). Here,

Clearly, \(\frac {\partial ^{2} TP_{R}}{\partial T^{2}}<0\) when

holds. □

Proposition 6

Under the retailer’s reaction function, for a unique wholesale price w, there exist a optimal retail price p that maximizes the overall manufacturer’s profit.

Proof

First and second order partial derivative of TPM with respect to p

The solutions obtains from equation (45) by \(\frac {\partial TP_{M} }{ \partial p}=0\) and this solution is optimal if \(\frac {\partial ^{2} TP_{M}}{\partial p^{2}}< 0\).

Clearly, \(\frac {\partial ^{2} TP_{M}}{\partial p^{2}}<0\), since P > Dr.

The resulting wholesale price is w = (1 − α)p. □

6.2 When shortage is permitted at the retailer inventory (Model 2-B)

Proposition 7

Under RFM contract, when shortage at the retailer’s inventory is permitted, then there exists a unique optimal cycle duration T that maximizes the retailer’s profit with shortage if (49) holds.

Proof

Taking the first and second order derivatives of TPR with respect to T □

The solution obtains from equation (47) by \( \frac {\partial TP_{R} }{ \partial T}=0\).

Similarly, \(\frac {\partial ^{2} TP_{R}}{\partial T^{2}}< 0\) when the following condition holds. i.e.,

Then, the optimality condition of the equation (41) is also satisfied.

Proposition 8

Under the retailer’s reaction function, for a unique wholesale price w there exist a optimal retail price p that maximizes the manufacturer profit when shortage are allowed (Tables 1 and 2).

Proof

First and second order derivative of TPM with respect to p, we have □

The retail price p is obtained from \(\frac {\partial TP_{M}}{\partial p}=0\).

Therefore,

Clearly, \(\frac {\partial ^{2} TP_{M}}{\partial p^{2}}<0\) since P > Dr and α < 0.

7 Numerical investigation

In this section, we illustrate the developed models by using two numerical examples. Some of the input parameters’ value are taken from [2] and some values are hypothetically chosen based on assumptions. In order to examine the capability of the current model to the changes in the parameters, a sensitivity analysis is conducted.In the first example, we obtain the optimal result of the integrated and decentralized model without shortage. In the second example, the shortage is allowed and completely backlogged. We have also used retail markup parameter to find the optimal solutions under decentralized mode. In Tables 3, 4, 5, 6, the sensitivity of the model’s parameters are presented. The remaining parameters are not introduced here as the model shows affect-ability just one percent or less to any changes made to them.

Example 1 (For Model 1-A and Model 2-A)

we take the parametric values in appropriate units as following: Dr = 200,P = 360,a = 220,α = 0.4,b = 1.8,𝜃 = 0.08,hm = $3,hr = $5,Om = $250,Or = $300,d = $3,u = $100,M = $20,T3 = 8 weeks.

Following the theoretical results presented in Sections 5.1 and 6.1, we have summarized the result in Table 1.

Example 2 (For Model 1-B and Model 2-B)

In this example, we have used the data same as given in Example 1. The only exception is that we use the shortage at the retailer warehouse and assume shortage cost s = $10 and backlogged order amount q = 100 units.

Following the theoretical result of Sections 5.2 and 6.2., we solve the model with shortage and presents the result in Table 2.

Tables 1 and 2 compare the values of the decision variables and profit functions obtained from integrated and decentralized models with and without shortage. The result shows that the product’s selling price is much higher when manufacturer and retailer perform as two separate entities. The supply chain system’s total profit in the integrated model is higher compared to the decentralized model. In the decentralized model, the manufacturer’s profit is increased, but the retailer loses its money. On the other hand, considering shortage improves the manufacturer’s profit but fails to guarantee a better joint profit of the framework.

7.1 Comparisons on prices

When both the supply chain members adopt an integrated approach, the retailer should sell the finished products at a higher price in case of without shortage compare to shortage. Whereas the retailer selling price is higher in both the cases with shortage and without shortage in decentralized mode compared to an integrated approach. In a decentralized case, the wholesale price is comparatively lower in case of without shortage. When shortage arises at the inventory, the manufacturer urges a higher wholesale price; hence, in order to get a tolerable profit margin, the retailer sets a higher sales price.

7.2 Comparison on optimal time-length of inventory

Considering the summarized solutions obtained in Tables 1 and 2, the highest duration of processing cycle inventory is made in the integrated approach with shortage, and lower occurs in the decentralized model without shortage. In the integrated approach, production cycle length, manufacturer stock time length, and total cycle length all are lengthier compared to the decentralized approach. When shortage arises at the retailer inventory, all these time lengths are increases than that of without shortage.

7.3 Comparison on total profit

The profit is the most significant performance measure of supply chain system. Manufacturer achieves highest profit in decentralized approach with shortage. Manufacturer profit always increases in shortage allowable supply chain model in both the cases i.e. integrated and decentralized approach. But rate of increase is more in decentralized mode. The retailer profit is highest in integrated mode without shortage. When shortage arises retailer profit is simultaneously decreases and this rate of decrease of profit is more in decentralized mode. Considering all these phenomena overall profit of the system is highest in integrated approach without shortage and lowest in decentralized mode with shortage.

To verify the optimality of example 1 (without shortage), the concavity of optimum integrated profit has shown graphically in Fig. (5a). For decentralized case, it is found that the total profit of the manufacturer (TPM) is concave with respect to cycle duration T and total profit of the retailer(TPR) is concave with respect to the selling price (p) shown in Fig. (6a) and (b). Furthermore, to verify the optimality of example 2 (with shortage), the concavity graph of optimum integrated profit with the shortage is shown in Fig. (5b). For the decentralized case with shortage, the concavity graph of the total profit of the manufacturer (TPM) with respect to cycle duration with shortage period (T) shown in Fig. (6c) and the concavity of the total profit of the retailer (TPR) with respect to the selling price (p) is shown in Fig. (6d).

The robustness of the RFM policy is examined by varying the value of α. From Fig. (7b), when α varies, the profit of the retailer increases, and the profit of the manufacturer decreases with increase in α. But the rate of decrease of profit of the manufacturer is slightly lower than that of the rate of increase of retailer profit. Increase in α causes an increase in retailer’s margin as well as profit and decrease in wholesale price of the manufacturer (from Fig. 7a) which ultimately reduces the profit of the manufacturer. The large value of α has a positive impact on the selling price of the retailer Fig. (7a). From this analysis, we have concluded that the manufacturer is always beneficial by offering a lower fixed mark up, and the retailer is beneficial by offering a large value of fixed mark up to capture more demand.

8 Sensitivity analysis

In this section, the sensitivity analysis examines the effect of demand elasticity parameters, holding cost, and manufacturing cost. This investigation is relevant when just a single parameter has varied at a time, and other parameters have kept at their original values. All the computed results are presented in Tables 3–5 for both the example 1 and example 2. All outcomes have deduced chosen on the maximization of profit. The sensitivity analysis will permit some beneficial managerial implications.

Impact of demand elasticity parameter a and b

The impact of changes in the values of the parameters a,b in selling price, each channel member profit in decentralized case, total supply chain profit in integrated case are depicted in Figs. 8 and 9. Suppose we fix b and change a. In that case, the demand as well as selling price and system profit increases linearly and with the changes in b keeping parameter a fixed,the demand as well as selling price and system profit decreases simultaneously. Increasing market potential indicates the growth in order amount having lengthier cycle duration. So, increasing the selling price is beneficial for the supply chain system in this situation. The retail shop will bring down its order amount and retail price for increasing price-sensitivity parameter b. Exactly an opposite phenomenon is seen compared to a for the increasing value of b, and the retail shop faces a loss in profit.

Impact of holding cost (h m,h r)

Retailer holding cost is always greater than the manufacturer holding cost. In Table 4, we assume that the retailer holding cost is lower and greater than the manufacturer’s holding cost. When the holding cost of the manufacturer increases, the selling price of the retailer also increases. But when retailer invests more amount on holding, in our numeric setting, the retail price will decrease. The total profit of the supply chain system decreases for increasing holding costs of both the members.

Impact of manufacturing cost (M)

Increasing manufacturing cost increases the product’s wholesale price. Retailer raises its retail price, but cycle duration is shortened. All the channel members profit except retailer’s profit in an integrated system, and total profit of the supply chain system is reduced shown in Table 5 and Fig. 10. The retailer’s total profit in an integrated system is increasing for an increasing value of M. Increasing retail price leads to a very low demand from customer which has a negative impact on the system profit.

Impact of Production rate (P)

Table 6 shows that as production rate (P) increases, selling price (p) increases in all the models as well as wholesale price (w) in the decentralized case and total profit of the retailer in the integrated scenario with and without shortage increases; and T1,T2,T,TPM,TPSC decreases in all the models. Increasing production rate shortens the production time, which lengthens the storage time of the finished product, leading to a high investment in holding, idle time cost, which reduces manufacturer profit. In a decentralized case, the manufacturer prefers to slightly increase the wholesale price for increasing production rate and try to sell the product as soon as possible, but this leads to a lower profit. Retailer demand is fixed, but the selling price is pushed up; thus, customer demand decreases. Profit of the supply chain system decreases in all the scenarios. So, the production rate should be taken carefully in order to increase the supply chain profit.

8.1 Managerial implication

To effectively maintain a business firm, a retailer needs to choose a few significant aspects. Setting selling price of the product, various time-length of channel members of inventory among them. To remain ahead in the business, organizations need to perceive the importance of these elements and utilize them as a competitive weapon. The cycle duration of inventory and various time-lengths are very influential for a firm manager. That’s why a business firm has to decide it specifically. Another significant perspective is the price of the product since it has a direct effect on the buyer’s demand. To make the item more attractive to buyers, a firm administrator needs to set the pricing strategy of the system. To comprise this issue, we use price-sensitive demand in our model and discover the supply chain system’s optimal pricing policy. The outcomes we got from this study will help the inventory managers for better understanding the situation, take significant decisions on time-length of inventory, and improve supply chain performance however much as expected.

9 Conclusion

The objective of this paper is to develop a two-layer supply chain model involving a manufacturer and a retailer. The supply chain model has considered a non-instantaneous deteriorating item to evaluate the total profit, the optimal selling price, and the optimal time length of the inventory cycle as the performance measure. We consider that at each stage in manufacturer and retailer inventory, the cycle duration is equal. The cost of idle time at the manufacturer is considered. The stock at each stage is shipped off the adjoining downstream stage. Shipments are sent as soon as they are accessible, and there is no reason to wait until an entire parcel is accessible. The production rate of the manufacturer which is a given constant is always greater than the demand from the retailer and demand from the customer side. The retailer demand is assumed to be constant, and he directly deals with the manufacturer. Also, customer demand is linear price-dependent. Two EPQ models for a single non-instantaneous deteriorating item, with and without shortage have been developed to calculate the system profit. First, the optimum decisions under the integrated scenario have been evaluated and then discussed the decentralized scenario via RFM strategy to improve the profitability. In RFM strategy, the retailer offers a fixed markup that he will charge over the manufacturer’s announced wholesale price. Two numerical examples and sensitivity analysis of both the models are provided to illustrate the distinction in the total profit and optimal decision variables of both the models under integrated and decentralized decisions. It has been exhibited from the numerical result that the model without shortage is more beneficial for the supply chain manager and delivers lower cost in the decentralized decision. In general, when the manufacturer and retailer jointly take decision; the profit is always higher than the decentralized scenario, the retailer’s selling price drops drastically in a joint decision. Manufacturer always set a higher wholesale price in case of decentralized scenario when shortage arises at the retailer warehouse. Production time-length should be lengthier if shortage of the product arises and then simultaneously shortage period, manufacturer inventory cycle length, total cycle duration of the supply chain system are increases. Our analysis shows that decentralized model with RFM agreements can lead to a greater channel improvement. RFM does not always beneficial for the retailer but this strategy improves the profit of the manufacturer. Also, from the markup parameter’s sensitivity, neither the manufacturer nor the retailer carries the best improvement to the whole supply chain if one chooses the markup unilaterally.

The new major contribution of the proposed model is the non-instantaneous deterioration of the product, the shortage at the beginning of the retailer inventory, price-dependent demand of the customer, decentralized scenario under RFM contract compared to the existing literature.

The limitation of this study is that at each stage, the stock-out situation is neglected, which are occur due to uncertainties of the production, delivery, and customer demand. The proposed analytical solution method fails to maximize the profit for an arbitrary set of data, while the genetic algorithm can be used to solve the problem by random search technique. Several possible extensions of the present model could comprise future attempts in this area. Unequal cycle length and multi-supplier and multi-retailer could be considered. The immediate extension of the model is the consideration of stochastic demand and production at each stage of the supply chain.

References

Bardhan S, Pal H, Giri BC (2019) Optimal replenishment policy and preservation technology investment for a non-instantaneous deteriorating item with stock-dependent demand. Oper Res 19(2):347–368

Barman A, Das R, De PK (2020) An analysis of retailer’s inventory in a two-echelon centralized supply chain co-ordination under price-sensitive demand. SN Applied Sciences 2(12):1–15

Boyacı T, Gallego G (2002) Coordinating pricing and inventory replenishment policies for one wholesaler and one or more geographically dispersed retailers. Int J Prod Econ 77(2):95–111

Catan T, Trachtenberg JA (2012) Talks quicken over e-book pricing. The Wall Street Journal

Chakraborty A, Mandal P (2021) Channel efficiency and retailer tier dominance in a supply chain with a common manufacturer. Eur J Oper Res

Chakraborty D, Garai T, Jana DK, Roy TK (2017) A three-layer supply chain inventory model for non-instantaneous deteriorating item with inflation and delay in payments in random fuzzy environment. J Ind Prod Eng 34(6):407–424

Chan CK, Wong WH, Langevin A, Lee Y (2017) An integrated production-inventory model for deteriorating items with consideration of optimal production rate and deterioration during delivery. Int J Prod Econ 189:1–13

Chang CT, Teng JT, Goyal SK (2010) Optimal replenishment policies for non-instantaneous deteriorating items with stock-dependent demand. Int J Prod Econ 123(1):62–68

Chen X, Yang H, Wang X, Choi TM (2020) Optimal carbon tax design for achieving low carbon supply chains. Ann Oper Res: 1–28

Chung KJ, Cárdenas-Barrón LE, Ting PS (2014) An inventory model with non-instantaneous receipt and exponentially deteriorating items for an integrated three layer supply chain system under two levels of trade credit. Int J Prod Econ 155:310–317

Das SC, Manna AK, Rahman MS, Shaikh AA, Bhunia AK (2021) An inventory model for non-instantaneous deteriorating items with preservation technology and multiple credit periods-based trade credit financing via particle swarm optimization. Soft Comput 25(7):5365–5384

Dye CY (2013) The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega 41(5):872–880

Geetha K, Uthayakumar R (2010) Economic design of an inventory policy for non-instantaneous deteriorating items under permissible delay in payments. J Comput Appl Math 233(10):2492–2505

Ghare P (1963) A model for an exponentially decaying inventory. J ind Engng 14:238–243

Ghiami Y, Williams T (2015) A two-echelon production-inventory model for deteriorating items with multiple buyers. Int J Prod Econ 159:233–240

Ghoreishi M, Mirzazadeh A, Weber GW (2014) Optimal pricing and ordering policy for non-instantaneous deteriorating items under inflation and customer returns. Optimization 63(12):1785–1804

Giri B, Roy B, Maiti T (2017) Coordinating a three-echelon supply chain under price and quality dependent demand with sub-supply chain and rfm strategies. Appl Math Model 52:747–769

Goyal S, Gunasekaran A (1995) An integrated production-inventory-marketing model for deteriorating items. Comput Ind Eng 28(4):755–762

He Y, Wang SY, Lai KK (2010) An optimal production-inventory model for deteriorating items with multiple-market demand. Eur J Oper Res 203(3):593–600

Huang YS, Ho JW, Jian HJ, Tseng TLB (2021) Quantity discount coordination for supply chains with deteriorating inventory. Comput Ind Eng 152:106987

Jaggi CK, Tiwari S, Goel SK (2017) Credit financing in economic ordering policies for non-instantaneous deteriorating items with price dependent demand and two storage facilities. Ann Oper Res 248 (1-2):253–280

Khakzad A, Gholamian MR (2020) The effect of inspection on deterioration rate: An inventory model for deteriorating items with advanced payment. J Clean Prod 254:120117

Li G, He X, Zhou J, Wu H (2019) Pricing, replenishment and preservation technology investment decisions for non-instantaneous deteriorating items. Omega 84:114–126

Linh CT, Hong Y (2009) Channel coordination through a revenue sharing contract in a two-period newsboy problem. Eur J Oper Res 198(3):822–829

Liu Ml, Li Zh, Anwar S, Zhang Y (2021) Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ Sci Pollut Res: 1–15

Maihami R, Kamalabadi IN (2012) Joint pricing and inventory control for non-instantaneous deteriorating items with partial backlogging and time and price dependent demand. Int J Prod Econ 136(1):116–122

Maihami R, Karimi B (2014) Optimizing the pricing and replenishment policy for non-instantaneous deteriorating items with stochastic demand and promotional efforts. Comput Oper Res 51:302–312

Mashud AHM, Roy D, Daryanto Y, Chakrabortty RK, Tseng ML (2021) A sustainable inventory model with controllable carbon emissions, deterioration and advance payments. J Clean Prod 296:126608

Mishra U, Tijerina-Aguilera J, Tiwari S, Cárdenas-Barrón LE (2021) Production inventory model for controllable deterioration rate with shortages. RAIRO-Operations Research 55:S3– S19

Mrázová M., Neary JP (2014) Together at last: trade costs, demand structure, and welfare. American Economic Review 104(5):298–303

Nie J, Wang Q, Shi C, Zhou Y (2021) The dark side of bilateral encroachment within a supply chain. J Oper Res Soc: 1–11

Pal B, Sana SS, Chaudhuri K (2012) Three-layer supply chain–a production-inventory model for reworkable items. Appl Math Comput 219(2):530–543

Palanivel M, Uthayakumar R (2015) Finite horizon eoq model for non-instantaneous deteriorating items with price and advertisement dependent demand and partial backlogging under inflation. Int J Syst Sci 46 (10):1762–1773

Sana SS (2011) A production-inventory model of imperfect quality products in a three-layer supply chain. Decision Support Systems 50(2):539–547

Sarkar B (2013) A production-inventory model with probabilistic deterioration in two-echelon supply chain management. Appl Math Model 37(5):3138–3151

Sarkar S, Tiwari S, Wee HM, Giri B (2020) Channel coordination with price discount mechanism under price-sensitive market demand. Int Trans Oper Res 27(5):2509–2533

Taghizadeh-Yazdi M, Farrokhi Z, Mohammadi-Balani A (2020) An integrated inventory model for multi-echelon supply chains with deteriorating items: a price-dependent demand approach. J Ind Prod Eng 37(2-3):87–96

Taleizadeh AA, Noori-daryan M (2016) Pricing, manufacturing and inventory policies for raw material in a three-level supply chain. Int J Syst Sci 47(4):919–931

Tat R, Taleizadeh AA, Esmaeili M (2015) Developing economic order quantity model for non-instantaneous deteriorating items in vendor-managed inventory (vmi) system. Int J Syst Sci 46(7):1257–1268

Valliathal M, Uthayakumar R (2011) Optimal pricing and replenishment policies of an eoq model for non-instantaneous deteriorating items with shortages. Int J Adv Manuf Technol 54(1-4):361–371

Wee HM (1993) Economic production lot size model for deteriorating items with partial back-ordering. Comput Ind Eng 24(3):449–458

Wu KS, Ouyang LY, Yang CT (2006) An optimal replenishment policy for non-instantaneous deteriorating items with stock-dependent demand and partial backlogging. Int J Prod Econ 101(2):369–384

Wu KS, Ouyang LY, Yang CT (2009) Coordinating replenishment and pricing policies for non-instantaneous deteriorating items with price-sensitive demand. Int J Syst Sci 40(12):1273– 1281

Wu W, Zhang Q, Liang Z (2020) Environmentally responsible closed-loop supply chain models for joint environmental responsibility investment, recycling and pricing decisions. J Clean Prod 259:120776

Yang PC, Wee HM (2003) An integrated multi-lot-size production inventory model for deteriorating item. Comput Oper Res 30(5):671–682

Zhang J, Liu G, Zhang Q, Bai Z (2015) Coordinating a supply chain for deteriorating items with a revenue sharing and cooperative investment contract. Omega 56:37–49

Zhang L, Wang J, You J (2015) Consumer environmental awareness and channel coordination with two substitutable products. Eur J Oper Res 241(1):63–73

Zhou W, Pu Y, Dai H, Jin Q (2017) Cooperative interconnection settlement among ISPs through NAP. Eur J Oper Res 256(3):991–1003

Acknowledgements

Authors of this paper express gratitude to the Hon’ble reviewers for their valuable comments. After addressing and incorporating these comments, the quality of the paper definitely enhanced.

Funding

Only the first author is financially supported by senior research fellowship from MHRD, Govt. of India.

Author information

Authors and Affiliations

Contributions

Abhijit Barman: conceptualization, methodology, validation, writing – original draft. Rubi Das: formal analysis, visualization, writing – review & editing. Pijus Kanti De: supervision, resources.

Corresponding author

Ethics declarations

Conflict of Interests

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Proof of Lemma 1

Taking the first order and second order partial derivatives of TPSC in (32) with respect to p gives

and,

Now, \(\frac {\partial ^{2} TP_{SC} }{\partial p^{2}}< 0\) if

holds. □

Proof of Lemma 2

Taking the first and second order partial derivatives of TPSC in (32) with respect to T gives

and,

Now, \(\frac {\partial ^{2} TP_{SC} }{\partial T^{2}}< 0\) if,

holds. □

Proof of Theorem 1

To verify the optimality of the solution obtained from (35) and (36), we have calculated the Hessian matrix (HModel1−A) and show that the hessian matrix is negative definite. i.e., det(HModel1−A) > 0.

Here,

Here, the expression

The determinant of the hessian matrix are evaluated by

Due to complexities of the expressions in Hessian matrix HModel1−A, the concavity condition of TPSC with respect to (p,T) is hardly verified by mathematical derivation, but in numerically conducted in Section (7) has shown its concavity (see Fig. (5a)). □

Appendix B

Proof of Lemma 3

Taking the first and second order partial derivatives of TPSC in (33) with respect to p gives

and,

Clearly, \(\frac {\partial ^{2} TP_{SC} }{\partial p^{2}} < 0\). Since, we have considered a positive inventory of the retailer for Dr > Dc. □

Proof of Lemma 4

Taking the first and second order derivative of TPSC in (33) with respect to T, we have

and,

Now, \(\frac {\partial ^{2} TP_{SC}}{\partial T^{2}}<0\) if

holds. □

Proof of Theoram 2

To verify the optimality of the solution obtained from (37), (38), we have calculated the hessian matrix of the profit functions is negative definite i.e. if \(\frac {\partial ^{2} TP_{SC} }{\partial p^{2}}\frac {\partial ^{2} TP_{SC} }{\partial T^{2}}- \{ \frac {\partial ^{2} TP_{SC}}{\partial p\partial T} \}^{2}>0\)

Here,

High complexity of the expressions in Hessian matrix HModel1−B, the concavity condition of TPSC with respect to (p,T) is difficult to verify by mathematical derivation, but numerically in Section (7) has shown its concavity (see Fig. (5b)). □

Rights and permissions

About this article

Cite this article

Barman, A., Das, R. & De, P.K. An analysis of optimal pricing strategy and inventory scheduling policy for a non-instantaneous deteriorating item in a two-layer supply chain. Appl Intell 52, 4626–4650 (2022). https://doi.org/10.1007/s10489-021-02646-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10489-021-02646-2