Abstract

Goal programming models have been highly relevant for portfolio management and selection due to their ability to handle multiple conflicting objectives simultaneously. These models possess simple and effective and features that support the decision-making process by incorporating different types of risk. Using a bibliometric approach, we collected 155 articles published from 1973 to 2022 from journals indexed in the Scopus database. Multiple software platforms (RStudio, VOSviewer, and Excel) were employed to analyze the data and depict the most active scientific actors in terms of countries, institutions, sources, and authors. Our review revealed three different stages and an upward trajectory in the publication trend starting from 2003 and found the predominant application of some Goal Programming models, such as the stochastic, fuzzy, and polynomial models. Moreover, we discovered that Spain, the USA, and China were the top three contributors to the literature, indicating a global interest in this area. The global relevance of goal programming is confirmed by the top 20 authors and their collaboration networks. We observed the dialogue between different disciplines, namely Decision Science and Management/Finance. Our study contributes to the body of knowledge in the intersection between goal programming and financial portfolios by (1) identifying the most influential articles and authors on this topic and (2) mapping and visualizing the trends in this field of research through network and cluster analysis.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Goal programming (GP) models have been used for many decades to attain balanced and optimized solutions, as this framework enables the minimization of deviations from specified goals in the context of conflicting objectives. The satisfactory logic of GP models can be applied in numerous fields such as economics, management, environmental studies, manufacturing, and finance. GP has high relevance in Operational Research and Management, and the GP technique is extensively used to solve the problems of decision making. Indeed, both individual investors and organizations rely on portfolio selection and management tools and models that can help gauge market risks and maximize returns successfully. This has become even more relevant today as we are living in a period when we are being presented with a variety of challenges such as the recent crises surrounding Covid-19, the Ukrainian war, and China-Taiwan tension.

Portfolio selection and management play a crucial role in finance by helping investors achieve their financial goals while managing risks. Diversification is the keyword and is a concept that was introduced by Harry Markowitz in his seminal work “Portfolio Selection” (1952). Since the 1950s, portfolio theory has been improved and extended in several directions. Due to the ability of GP to handle multiple conflicting objectives simultaneously, it is relevant for portfolio management and selection. GP supports investors in including their goals and preferences in their decision making: In other words, the financial decision maker (FDM) can include various goals (maximizing returns, minimizing risks, achieving a certain level of diversification, and meeting specific constraints or preferences), assign relative priorities to each objective, and find a feasible solution that balances these objectives.

This study introduces various GP model variants that have been applied to the multidimensional financial portfolio selection problem and covers 60 years of research related to this area. We perform a comprehensive literature review to explore the intersection of finance and goal programming. Adopting a bibliometric approach, we collected 155 articles published from 1973 to 2022 from journals indexed in the Scopus database. Our first contribution is the inclusion of all papers published in the last five decades. We conducted several bibliometric tests, including citation, co-citation, co-authorship, trend analysis, and keyword occurrences. This bibliometric and systematic literature review offers a more comprehensive understanding of the state of knowledge, with the aim of extending and/or completing some previous papers related to GP and portfolio management, such as Lin and O’Leary (1993), Aouni (2009, 2010), Azmi and Tamiz (2010), Aouni et al. (2014), and Colapinto et al (2019). The methods chosen for this study are crucial to advancing our knowledge of financial portfolio management. The bibliometric review offers insights into the quantitative aspects and trends of the field, while the systematic review provides a qualitative synthesis of existing research, aiding in future research planning. While we refer the reader to Aouni et al. (2014) for an in-depth discussion of mathematical models, this study attempts to address these research questions: (1) What are the theoretical roots of research and the main research trajectories over the 5 decades? (2) What are the main themes within financial portfolio and GP articles?

The remainder of the paper proceeds as follows. In Sect. 2, we illustrate the general formulation of portfolio selection and of multi-objective programming, and we introduce the main GP variants. Section 3 presents the methodology employed in the study and the data collection and analysis techniques used. Section 4 presents and discusses the findings of the study. Section 5 concludes the paper.s

2 From Markowitz to a hybrid goal programming model

Markowitz (1952) proposed the first bi-criteria formulation for portfolio selection, where two conflicting and incommensurable criteria were to be optimized simultaneously. Modern portfolio theory provides a framework for portfolio selection by considering the trade-off between risk and return and includes some compromises based on the FDM’s preferences:

Objective 1, the expected return of the portfolio: \({\text{Max}}{.}\;\sum\nolimits_{j = 1}^{n} {E_{j} x_{j} } ,\)

Objective 2, the variance: \({\text{Min}}{.}\;\sum\nolimits_{j = 1}^{n} {\sum\nolimits_{k = 1}^{n} {x_{j} \sigma_{jk} x_{k} } } ,\)

Subject to:

where xj: the proportion to be invested in the stock (security) j, Ej: the expected return of security j, σjk: the covariance of the returns of securities j and k, F: the set of feasible solutions.

In the model, we assume that the total investment amount has to be allocated (constraint 1) and has to satisfy certain diversification conditions (constraints 2). In order to manage the investment risk, the FDM may diversify the portfolio by investing in different securities. Both constraints determine the efficient portfolios. Use of the Markowitz (1952) model allows the FDM to obtain the portfolio that may best increase the FDM’s earnings while minimizing the risk of financial losses as shown below:

Subject to:

where E*: the target value of the return.

The solution will determine the efficient frontier of portfolios among which the FDM will decide, making a compromise between an acceptable level of risk and a desired return. This formulation is known in the literature as the mean–variance model. As the portfolio selection problem cannot be limited to only two attributes, Ferretti (1970) introduced objectives related to shareholders and performance.

As the bi-criteria model proposed by Markowitz (1952) does not reflect the complexity and multi-dimensionality of the decision-making process in the financial portfolio selection problem, several multi-dimensional approaches have been proposed in the literature in order to aggregate conflicting and incommensurables attributes, and GP is one of them (Aouni, 2009, 2010). For a complete literature review of the different multi-criteria procedures and a description of their applications to financial portfolio selection and corporate performance evaluation, refer to Zopounidis and Doumpos (2013).

Over the last five decades, the GP model has been widely applied to the portfolio management problem. GP, first introduced by Charnes et al. (1955) and Charnes and Cooper (1961), has witnessed an upsurge in the 2000s, thanks to the higher levels of computerized automation of the solution and modeling process. The majority of multiple-criteria decision-making papers used the GP and multi-objective programming models, and almost one-third dealt with the portfolio selection problem (Azmi & Tamiz, 2010; Steuer & Na, 2003; Tamiz & Jones, 1998).

The central idea is the determination of the aspiration levels of an objective function and the minimization of any (positive or negative) deviations from these levels, as the GP model is a distance function. Over the years, the different GP variants have become highly popular within the field of multi-objective programming. Table 1 presents the main GP variants. For more mathematical details, we refer the reader to previous reviews such as that of Aouni et al. (2014).

The pre-emptive or lexicographic goal programming (LGP) model is based on the optimization of the objectives according to their relative importance (level of priority) for the FDM. The obtained values of the deviations of a higher level of priority will be introduced as constraints within the mathematical programs related to the objectives placed in lower levels of priority that, indeed, play a marginal role in the decision-making process. Lee (1972) proposed the first LGP model for the portfolio selection problem, which considers three objectives: (a) minimum dividends, (b) the growth of earnings, and (c) 50% dividend pay-out ratio. This variant GP was widely applied in this field until the 1980s. Moreover, the weighted GP (WGP) model allows the explicit consideration of different investment goals and their relative importance through the use of weights and reflects the FDM’s preferences, and it is based on their risk tolerance, return expectations, or other factors. One of the initial applications of WGP to funds management can be found in Lee and Sevebeck (1971).

Arditti and Levy (1975) showed that return on assets is not normally distributed, and thus it is crucial to incorporate skewness into an FDM’s decision-making process. In his polynomial GP (PGP) model, Lai (1991) incorporated the FDM’s preferences regarding the skewness and other objectives and maintained that the PGP model is more efficient than the LGP model because it offers the flexibility of incorporating preferences in terms of higher moments of the probability distributions of the rates of return as well as a relative computational simplicity.

As the FDM has to cope with uncertainty in most financial contexts, the objective functions and corresponding goals are, in general, random variables. From this perspective, Stochastic Goal Programming (SGP) clearly allows the incorporation of uncertainty and risk into the portfolio optimization process, making it suitable for handling the stochastic nature of financial markets (Aouni et al. 2012).

An alternative way to include randomness is to consider the so-called scenario-based GP models as introduced by Aouni and La Torre (2010) and Aouni et al. (2010) to analyze portfolio optimization models. The goal is to construct a portfolio that meets certain objectives while considering various possible scenarios or future market states: all possible scenarios Ω = {ω1, ω2, …, ωN} have associated probabilities p(ωs) = ps.

If the FDM can rely only on vague and imprecise goal values, the Fuzzy GP (FGP) model can be applied: it is based on the fuzzy sets theory developed by Zadeh (1965) and Bellman and Zadeh (1970).

To choose the most suitable GP model, the FDM has to take into account different variables related to the type of financial market, investor preferences, and the level of uncertainty that need to be addressed in portfolio management. Moreover, the performance of the chosen model might vary depending on the quality and availability of historical data. An overview of the specific characteristics of each model is provided in Table 2.

To conclude, we point out that there are several minor variations, extensions, and combinations of GP that have been used in financial portfolio management over the years. These are briefly presented here in alphabetical order:

-

Alternative linear programming (i.e. Konno & Yamazaki, 1991) represents a central contribution with respect to the use of alternative measures of investment risk and procedures for portfolio selection.

-

Chance-constrained goal programming (CCGP) incorporates probabilistic constraints on the goals or objectives, ensuring the fulfillment of goals with a certain probability, given the stochastic nature of returns or other factors (i.e. Aouni et al., 2003). Boswarva and Aouni (2012) extended the CCCP model to other probability distributions such as uniform, triangular, and skew triangular distributions.

-

Compromised Programming model: a fuzzy version has been developed by Ballestero and Romero (1996).

-

Fractional GP allows the FDM to assign different degrees of achievement to each goal, indicating the relative importance of each objective. This variant handles imprecise or fuzzy goals and preferences. (i.e. Canbolat & Güneri, 2008)

-

In the family of integer GP introduced by Harrington and Fischer (1980), we find mixed-integer GP models (such as the stochastic-goal mixed-integer programming by Stoyan & Kwon, 2011).

-

Interactive GP models—whose main contributor is Spronk (1980, 1981).

-

Interval Goal Programming deals with goals represented by intervals instead of precise values, accounting for the uncertainty or variability associated with goal values (i.e. Akhavan-Tabatabaee & Soltani, 2016).

-

MinMax GP model (Romero, 1991:5) that falls as much under the subject of Linear Programming as GP.

-

Non-linear GP model introduced by Stone and Reback (1975).

3 Bibliometric analysis: data collection and analysis techniques

Research on the GP model has gained significance and established itself as a major field. It has sparked strong interest among numerous researchers and academic institutions worldwide. The progress made in research on GP models is evident in the proliferation of academic works and the formation of networks of researchers addressing these issues. Over the past 2 decades, research in this domain has accelerated, with several prestigious journals in operations research, finance, and computer science devoting special issues to this subject. To obtain a comprehensive view and understanding of the evolution of this research field over time, we have chosen to conduct a bibliometric and systematic study on this theme applied to finance.

Bibliometric studies are considered a powerful field of information science that academically contributes to many research reviews by simplifying the task of exploring any research area. Bibliometrics is a research field that employs quantitative methods to analyze large volumes of bibliographic data with the aim of providing comprehensive insights into a collection of documents (Donthu et al., 2021). Recently, Bibliometric methods have witnessed a surge of interest from the social sciences (Zupic & Čater, 2015). They have been used to map operations research and management science. Several bibliometric studies have been published in operations research (Eto, 2002; Laengle et al., 2020; Merigó & Yang, 2017), in management science (Hopp, 2004), in operations research and management science in Asia (Chang & Hsieh, 2008) or Europe, in production and operations management (POM) (Avkiran & Alpert, 2015; Merigó et al., 2019), in fuzzy sets theory in operations management (Zanjirchi et al., 2019), and in robust portfolio optimization (Xidonas et al., 2020) and others.

3.1 Data collection

We collected our data from the Scopus database, as it is one of the largest academic databases of peer-reviewed multidisciplinary research publications. According to the Scopus Content Coverage Guide (https://www.elsevier.com/solutions/scopus/content), the database comprises more than 90.6 million core records, with approximately 84 million records dating back to 1969 and over 6.5 million records to pre-1970. Additionally, Scopus continually adds around 3 million new records each year. The database covers publications from more than 7000 publishers, including 26,591 peer-reviewed journals across various high-level subject fields.

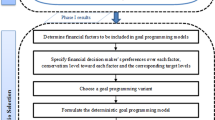

The search process was conducted in in May 2023, through a Boolean search by running a query for the following keywords: (“Goal program*”) AND (“Financ*” OR “Financial Portfolio”). The asterisk (*) was included to account for the variations in the keywords. We performed the search on the “title, abstract, and keywords” of the documents. In terms of the inclusion and exclusion criteria, only articles and reviews were selected. This rationale for this selection is the peer review process, which guarantees their scientific quality. We limited our search to publications in English language only. We restricted the Scopus search process to include papers up until the end of 2022, and a total of 252 publications matched the search criteria. The authors independently and manually reviewed the titles, abstracts, and keywords of all selected documents to confirm their correspondence with the selection criteria and to clean the data. In total, 155 publications were selected for further analyses. Figure 1 presents the methodology used.

3.2 Bibliometric analysis

Bibliometric analysis encompasses two main categories of techniques: performance analysis and bibliometric mapping (Noyons et al., 1999; Zupic & Čater, 2015). These methods are employed to assess the performance of research entities and visually represent the bibliographic landscape. Performance analysis involves the assessment and evaluation of various indicators and metrics (Garfield, 1955) to measure the research productivity, impact, and performance of scientific actors (authors, journals, affiliations, and countries). On the other hand, bibliometric mapping employs visualizations and network analysis to explore the relationships between different bibliographic entities, such as authors, journals, or keywords. The most commonly utilized techniques for scientific mapping include citation analysis, co-citation analysis (Small, 1973), bibliographic coupling, and co-word analysis (Callon et al., 1983). By combining these two categories of techniques, bibliometric analysis provides valuable insights into the quantitative aspects and structural dynamics of scholarly literature.

Bibliometric analysis has been perfected in recent years thanks to the development of software that enables the analysis of bibliographic information (Cobo et al., 2011b). Among the most popular software programs we can mention are, for example, VOSViewer (van Eck & Waltman, 2010) and Bibliometrix by Rstudio (Aria & Cuccurullo, 2017), and there are several others. Table 3 provides key information on the data extracted for this study: a total of 155 articles were examined, which provided a substantial sample size that enabled a robust analysis and the potential for generalizability. We found that the first article was released in 1973 (see Fig. 2a), and thus our analysis reveals a 50-year timeframe, from 1973 to 2022. The analysis encompassed 76 journals to ensure a diverse range of sources and enhance the study’s validity and scope. The review of 4658 references indicated a thorough examination of the existing literature and thus contributes to a comprehensive understanding of the field. The involvement of 287 authors indicates the presence of a solid scholarly community in the field, promoting knowledge exchange and the inclusion of diverse perspectives. The average of 2.48 co-authors per article underscored the prevalence of collaborative research practices within the field. Furthermore, the presence of approximately 20% international co-authors highlighted the global nature of research efforts and the importance of cross-border collaborations. Overall, these statistics laid a solid foundation for comprehending the methodology, scope, and collaborative nature of the study.

4 Results

4.1 Descriptive and performance analyses

4.1.1 Scientific production

Scientific production on GP has grown significantly in recent years, especially since the beginning of the twenty-first century. The number of publications increased after 2003 and has witnessed tremendous growth in recent years. Considering a time horizon of 50 years, we can see that research activity has increased significantly over the last two decades, resulting in the publication of 109 papers, representing 70.32% of all publications during the study period. The evolution of the number of articles per year can be attributed to several factors.

Figure 2 shows the number of articles published over the 1973–2022 period during which we can identify three stages (initial, pre-expansion, and expansion) and a growing interest. The construction of this field has been marked by significant events.

The concept of Goal Programming was introduced by Charles and Cooper in 1961. However, the initial research papers on GP models that were applied to finance emerged in the early 1970s with notable contributions from Lee and Lerro (1973) in The Journal of Finance, Callahan (1973) in Cost and Management, and Ignizio (1978) in the Journal of the Operational Research Society. Despite the recognition of GP by practitioners as an effective approach for addressing real-world problems involving multiple and conflicting objectives, academic production on the subject remained limited.

GP research gained momentum after 1989. It is worth highlighting that the first International Conference on Multiple Objective Programming and Goal Programming (MOPGP94), organized by Mehrdad Tamiz, was held in 1994 at the University of Portsmouth, United Kingdom. This conference brought together researchers and practitioners from diverse fields such as optimization, operational research, mathematical programming, and multi-criteria decision making. It served as a pivotal event for fostering networks among researchers and practitioners, and research during this period followed a sawtooth pattern of progress.

The field has garnered increasing interest in the literature, particularly since 2005, when the inaugural International Conference on Multidimensional Finance, Insurance, and Investment (ICMFII) took place. This conference focused on the application of multi-criteria decision aid tools in the finance and insurance sectors, further propelling research on GP models.

Research has grown steadily ever since. In the expansion stage, two distinct waves can be observed, potentially driven by the emergence of artificial intelligence techniques such as machine learning and data analytics. These techniques complement GP models by providing more precise and relevant information for decision-making, contributing to the evolution of the field.

Table 4 shows the overall citation structure of all the articles in our sample, obtained from Scopus, classified according to citation thresholds. The percentage of articles in each category is also shown. It is worth noting that only one article received more than 500 citations, while 13 articles received more than 100 citations. It should also be noted that several works received fewer than 20 citations, which can be attributed to the specialized nature of the research field.

4.1.2 Most relevant countries, journals, authors, articles, and institutions

Bibliometric citation analysis provides an overview of the most relevant elements: countries, journals, articles, authors, and institutions.

-

Most productive and influential countries and continents

A large majority of articles were published in Spain (22 articles), the United States (21), China (13) and India (10). In terms of citations, the United States, Spain, China, Tunisia and the United Kingdom are the five countries with the most cited publications in GP (Fig. 3). We prefer not to include the Czech Republic in the top 5 list because although its total citations total 626, these are due to a single paper by Inuiguchi and Ramı́k (2000) that introduced fuzzy models.

The scientific production of a country is defined as the number of author appearances by country of affiliation. This means that if in an article there are three authors working respectively in the USA, Spain, and Italy, then the count of appearances for each of these three countries will be increased by 1. In other words each article is attributed to the countries of all its co-authors and will therefore be counted as many times as there are authors (in the example above, three times) (Table 5).

Notably, the publications come from researchers from 5 continents and 35 countries (Table 6), spanning both developed and emerging regions, which highlights the global and international nature of the field. Given the different sizes and populations between the countries, we believe it is better to consider the data at the continent level. Despite the prevalence of publications from European and Asian countries, it is clear that the link between GP and finance is a global topic of interest.

The collaboration links between the countries show that there are four different dense networks with connections, and the most frequent collaborations in the research field are between scholars from different continents. The fact that some of the authors had international careers might be an explanation (Fig. 4).

-

Top most productive and influential authors

A. Bilbao-Terol, affiliated with the University of Oviedo (Spain), has emerged as one of the most prominent researchers in the field over the past three decades. With 11 publications and 646 citations, she holds a central position in the research on the topic and leads the female team at the University of Oviedo. Her consistent contributions have profoundly influenced the development of the field. B. Aouni (Qatar University) and M. Arenas-Parra (University of Oviedo, Spain) follow closely, with 8 publications each, accumulating a total of 513 citations for Aouni and 312 citations for Arenas-Parra. Other notable authors, such as E. Ballestero and F. Ben Abdelaziz, have also made significant contributions.

It is worth noting that new influential researchers are emerging in the field. For instance, La Torre, Cañal-Fernández, Colapinto, and Masmoudi joined this research stream in 2012. Furthermore, it is interesting to observe that the research community exhibits a balanced representation in terms of gender and age. Figure 5 visually presents the publication output of the main authors during the specified period, highlighting the high productivity of the Spanish team from Oviedo between 2005 and 2015. Additionally, authors like Aouni, Ballestero, Ben Abdelaziz, and Tamiz have maintained their active engagement in the field for at least 2 decades (Fig. 6) (Table 7).

-

Top most productive and influential journals

Tables 8 and 9 present the ranking of the 10 most productive and influential academic journals that have published studies on GP in the Financial portfolio. The 155 articles on the topic have appeared in 76 journals. The majority of publications (44.51%) are concentrated in 9 specific journals: European Journal of Operational Research, Journal of the Operational Research Society, INFOR, Annals of Operations Research, Expert Systems with Applications, Journal of Banking and Finance, OMEGA, Decision Sciences, and International Transactions in Operational Research. These journals have each published a minimum of four articles. In contrast, other journals have had sporadic publications, with many of them contributing only two articles. Furthermore, 52 journals have published just one paper on this topic. This indicates that the research on GP in the financial portfolio is specialized and concentrated. The most influential journals are derived from the ranking based on the number of papers published by journal and on the total citations. We note the significant role of the European Journal of Operational Research, which has published 12.25% of the articles in our database and has the highest number of global and local citations.

Another interesting aspect to consider in this section is the analysis of the total number of local citations (TLC). Once again, the European Journal of Operational Research stands out as having the highest number of total local citations, with 313 TLC. It is followed by the Journal of Finance, Management Sciences, and Fuzzy Sets and Systems, with 187, 156, and 132 citations, respectively. Following that, a second cluster of journals, including the Journal of the Operational Research Society, Annals of Operations Research, Journal of Banking and Finance, and OMEGA, show more than 50 citations each.

The most cited paper was published in the European Journal of Operational Research by Arenas Parra, Bilbao Terol, and Rodrı́guez Urı́a (2001) entitled “A fuzzy goal programming approach to portfolio selection.” This paper has 260 citations, which is a high number compared to the average citation of our dataset publications (33.15%). The second most cited paper is an article by Ben Abdelaziz et al. (2007) entitled “Multi-objective stochastic programming for portfolio selection,” with 235 citations. The European Journal of Operational Research appears to be the preferred outlet for this topic, followed by the Journal of Banking and Finance: there are two communities interacting and talking to each other. Beyond the development of increasingly sophisticated models capable of integrating uncertainty into the decision-making process, applications are bringing the discussion table to life (Table 10).

4.2 Network analysis

Visualization has long been regarded as an important tool for comprehending complex and massive bibliographic networks, ranging from paper co-citations to author keyword co-occurrence to bibliographic coupling networks (Van Eck & Waltman, 2014). The network analysis is extracted from VOS viewer software.

First, Fig. 7 shows the most important networks of bibliographic couplings within the GP field. The nodes represent the authors, and the edges represent the bibliographic couplings.

Figure 7 identifies three well-defined clusters (i.e., the lines indicate concomitant citations among the authors). The color coding is automatically generated by VOSViewer software, and it distinguishes the different networks from one another. These three networks comprise the top 10 productive and influential researchers of the past 2 decades, each having accumulated at least 100 citations. The first cluster, represented in green, comprises Spanish researchers affiliated with the Quantitative Economics Department at Oviedo University (Spain), including Bilbao Terol A., Arenas Parra M., and Canal Fernandez V. The second network, depicted by the blue cluster, also consists of Spanish researchers, but from La Universidad Politécnica de Valencia (Spain), such as Ballestero E., Garcia-Bernabeu A., and Pl-santamaria D. The third cluster represents an international network composed of Aouni B., La Torre D., and Collapinto C. on one hand, and Ben Abdelaziz F. and Msmoudi M. on the other.

Secondly, to reveal the main thematic clusters of the GP research field, we built a co-occurrence network based on the authors’ keywords of the selected documents. Figure 8 presents the main keywords of the GP field, taking into account a threshold of 3 occurrences and 32 more frequent co-occurrences. We identify 6 different clusters and each line represents the relationship between 2 keywords (e.g., 2 keywords are considered as being co-cited when they appear together in the same subsequent manuscript). The main keywords per cluster (clockwise) are ‘goal programming’ (yellow cluster), ‘stochastic goal programming’ (red cluster), ‘fuzzy goal programming’ (purple cluster), ‘fuzzy sets’ (azure cluster), ‘portfolio analysis’ (green cluster)and ‘polynomial goal programming’ (blue cluster).

Essentially, clusters formed around a specific GP variant (PGP, SGP and FGP), which are those that have been dominating since the 2000s. Purple and azure clusters show the relevance of this variant that offers a practical and effective approach to decision making under uncertainty and subjectivity, especially in portfolio selection. Portfolio optimization is a crucial challenge for the FDM as we can see from the yellow and blue clusters. We will see similar findings in the content analysis by phase.

4.3 Content analysis

This section provides a visual overview of the development of the conceptual framework of GP in finance. We performed a thematic map based on co-word network analysis and clustering (Figs. 9, 10, 11 and 12) using the bibliometrix R-package. Each indicator of centrality refers to the importance of a theme in the development of the entire research field analyzed, while the density indicates the development of the themes (Cobo et al., 2011a, 2011b). The volume of each sphere is proportional to the number of articles containing each keyword. Each figure has four quadrants that capture different levels of centrality and density in each of the three identified phases.

Figure 9 shows the evolution of themes over the years. We can observe that since the pre-expansion phase, the attention has shifted to more complex models that are able to include uncertainty and unusual events. If the focus was on portfolio selection at the beginning, looking at the process of choosing a diversified set of investments, in more recent years researchers have concentrated on portfolio optimization involving applying mathematical models and algorithms to determine the best allocation of assets within a portfolio based on specific optimization criteria. They moved towards a more quantitative and rigorous approach that benefited from the increasing computing power. Additionally, we can identify on which GP variants researchers are focusing, namely FGP, SGP, and PGP. Although these variants all share a common GP framework, they differ in their specific approaches. SGP addresses uncertainty through probabilistic modeling, PGP incorporates polynomial functions to represent deviations and preference structures, and FGP incorporates fuzzy logic to handle imprecision and vagueness in decision making, allowing for the expression of linguistic goals and preferences.

-

Time Slice 1: 1973–1989 (initial stage)

The articles in this first time slice (initial phase) were mainly focused on introducing and conceptualizing how GP models can cope with financial issues (mostly for portfolio selection), and with uncertainty and multiple objectives. As shown also in Fig. 10, banking and goal programming are, in fact, the only two themes: these papers form an intellectual base focused on the different applications of GP models that used a deterministic approach.

-

Time Slice 2: 1990–2012 (Pre-expansion stage)

With the increasing popularity of GP models on finance, several articles deal with specific GP variants and compare them to identify advantages and disadvantages according to objectives and preferences. In Fig. 11, we observe that basic and transversal themes (lower-right quadrant) are GP and SGP. Clusters in this quadrant differ widely from each other (low density) and are linked by numerous keywords (low centrality). The stochastic approach can also be found as a Niche Theme (upper-left quadrant), along with polynomial GP: these papers are specialized in character. The motor themes (upper-right quadrant) capture themes with strong centrality and high density: many papers deal with applications and cases to illustrate the benefits of using various GP models to support decision making. Themes in the lower-left quadrant are both weakly developed (low density) and marginal (low centrality). They mainly represent either emerging themes (leading to new trends or fields) or disappearing themes: in this case, compromise programming fades away in favor of hybrid and more complex models.

Given the above, the most influential article in this group was published by Inuiguchi and Ramík (2000), who reviewed some fuzzy linear programming methods and techniques and then compared them to stochastic programming ones.

-

Time Slice 3: 2013–2022 (Expansion stage)

With the increasing popularity of GP models on finance, several articles deal with specific GP variants and compare them to identify advantages and disadvantages according to objectives and preferences. In Fig. 11, we observe that basic and transversal themes (lower-right quadrant) are GP and SGP. Clusters in this quadrant differ widely from each other (low density) and are linked by numerous keywords (low centrality). The stochastic approach can also be found as a Niche Theme (upper-left quadrant), along with polynomial GP: these papers are specialized in character. The motor themes (upper-right quadrant) capture themes with strong centrality and high density: many papers deal with applications and cases to illustrate the benefits of using various GP models to support decision making. Themes in the lower-left quadrant are both weakly developed (low density) and marginal (low centrality). They mainly represent either emerging themes (leading to new trends or fields) or disappearing themes: in this case, compromise programming fades away in favor of hybrid and more complex models.

In the last time slice, several articles recognized that GP has changed dramatically and that uncertainty is the main challenge to address. Different and sophisticated variants are popular and several hybrid or combined models are proposed. The motor themes (upper-right quadrant) capture this diversity and the predominance of FGP, over PGP and SGP that are niche themes in this more mature phase. Since the 2010s researchers have been combining social responsibility and GP, leading FDMs to balance various objectives while considering the broader societal implications of their decisions. This approach helps ensure that the decision-making process incorporates ethical considerations, long-term perspectives, and the well-being of different stakeholders. These two trends are evident in Bilbao-Terol et al. (2016) as they recognize the difficulty involved in determining a precise preference between the conflicting objectives and address this through GP using fuzzy hierarchies (GPFH) modeling. Indeed, they modified the LGP approach whereby the relative importance relations among the criteria are modeled by fuzzy relations. Staňková and Zapletal (2016) also focused on the application of the linear GP priority method together with fuzzy analytic hierarchy process to support managers in Corporate Social Responsibility assessment.

5 Conclusions and future research directions

This study aimed to illustrate developments in the application of GP models to financial portfolio issues and deepen the knowledge base by identifying the main research trajectories and themes in addition to identifying future research agendas. Overall, the research on GP models in the financial portfolio domain has experienced significant growth and development, spurred by key events, conferences, and the integration of complementary techniques. Over the past two decades, the research field has grown considerably in terms of thematic diversity and new perspectives. The extensive use of GP models confirms that it is a pragmatic and flexible method for addressing complex problems that involve several conflicting objectives as well as many variables and constraints.

In particular, our content analysis was performed to provide a more comprehensive picture of the different themes addressed by scholars over a 50-year span and to identify promising themes for future studies. Researchers are moving towards mixed, hybrid, and complex models that are able to capture uncertainty and the different criteria, including those related to sustainability: in most real-life cases, the best modeling approach should include several and complementary variants. Focusing on papers in the last 5 years, we can observe a new buzz word, deep learning, as a result of the aim of integrating Artificial Intelligence (AI) in GP models to allow for more robust, adaptive, and intelligent decision-making systems. The application of AI, machine learning, deep learning, and fuzzy logic in financial portfolio management can better fit with complex, uncertain, and dynamic environments exposed to exogenous events and crises.

This paper is not without its limitations. Indeed, future research might include a more detailed identification of the different criteria in the various models so that we can support a more informed decision-making process and the development of more realistic and applicable optimization models.

References

Akhavan-Tabatabaee, R., & Soltani, R. (2016). An interval goal programming model for portfolio optimization. Journal of Industrial and Management Optimization, 12(3), 881–898.

Aouni, A., Ben Abdelaziz, F., & La Torre, D. (2012). The stochastic goal programming model: Theory and applications. Journal of Multicriteria Decision Analysis, 19(5–6), 185–200.

Aouni, A., Colapinto, C., & La Torre, D. (2010). Solving stochastic multi-objective programming in multi-attribute portfolio selection through the goal programming model. Journal of Financial Decision Making, 6(2), 17–30.

Aouni, A., Colapinto, C., & La Torre, D. (2014). A cardinality constrained stochastic goal programming model with satisfaction function for venture capital investment decision making. Annals of Operations Research, 205(1), 77–88.

Aouni, A., & La Torre, D. (2010). A generalized stochastic goal programming model. Applied Mathematics and Computation, 215, 4347–4357.

Aouni, B. (2009). Multi-attribute portfolio selection: New perspectives. Information Systems and Operational Research, 47(1), 1–4.

Aouni, B. (2010). Portfolio selection through the goal programming model: An overview. Journal of Financial Decision Making, 6(2), 3–15.

Aouni, B., Ben Abdelaziz, F., & El Fayedh, R. (2003). La programmation par but stochastique: Application au problème de sélection de portefeuille (stochastic programming: An application to the portfolio selection). Administrative Sciences Association of Canada, Management Science, 24(2), 63–75.

Arditti, F. D., & Levy, H. (1975). Portfolio efficiency analysis in three moments: The multi period case. Journal of Finance, 30, 797–809.

Aria, M., & Cuccurullo, C. (2017). Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. https://doi.org/10.1016/j.joi.2017.08.007

Avkiran, N. K., & Alpert, K. (2015). The influence of co-authorship on article impact in OR/MS/OM and the exchange of knowledge with finance in the twenty-first century. Annals of Operations Research, 235(1), 51–73.

Azmi, R., & Tamiz, M. (2010). A review of goal programming for portfolio selection. Lecture notes in economics and mathematical systemsIn D. Jones, M. Tamiz, & J. Ries (Eds.), New developments in multiple objective and goal programming (Vol. 638, pp. 15–34). Cham: Springer.

Ballestero, E., & Romero, C. (1996). Portfolio selection, a compromise programming solution. Journal of the Operational Research Society, 47, 1377–1386.

Bellman, R. E., & Zadeh, L. A. (1970). Decision-making in a fuzzy environment. Management Science, 17, B141–B164.

Ben Abdelaziz, F., Aouni, B., & El Fayedh, R. (2007). Multi-objective stochastic programming for portfolio selection. European Journal of Operational Research, 177, 1811–1823.

Bilbao-Terol, A., Arenas-Parra, M., Cañal-Fernández, V., & Jiménez, M. (2016). A sequential goal programming model with fuzzy hierarchies to sustainable and responsible portfolio selection problem. Journal of the Operational Research Society, 67(10), 1259–1273.

Boswarva, I., & Aouni, B. (2012). Different probability distributions for portfolio selection in the chance constrained compromise programming model. Infor, 50, 140–146.

Callahan, J. (1973). An introduction to financial planning through goal programming. Cost and Management, January-February, 7–12.

Callon, M., Courtial, J.-P., Turner, W. A., & Bauin, S. (1983). From translations to problematic networks: An introduction to co-word analysis. Social Science Information, 22(2), 191–235. https://doi.org/10.1177/053901883022002003

Canbolat, M. S., & Güneri, A. F. (2008). A fractional goal programming model for portfolio selection problem. Computers and Operations Research, 35(6), 1914–1924.

Chang, P. L., & Hsieh, P. N. (2008). Bibliometric overview of operations research/management science research in Asia. Asia-Pacific Journal of Operations Research, 25(02), 217–241.

Charnes, A., & Cooper, W. W. (1961). Management models and industrial applications of linear programming. Wiley.

Charnes, A., Cooper, W. W., & Ferguson, R. O. (1955). Optimal estimation of executive compensation by linear programming. Management Science, 2, 138–151.

Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011a). Science mapping software tools: Review, analysis, and cooperative study among tools. Journal of the American Society for Information Science and Technology, 62(7), 1382–1402.

Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011b). An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the fuzzy sets theory field. Journal of Informetrics, 5(1), 146–166. https://doi.org/10.1016/j.joi.2010.10.002

Colapinto, C., La Torre, D., & Aouni, B. (2019). Goal programming for financial portfolio management: A state-of-the-art review. Operational Research, 19, 717–736.

Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

Eto, H. (2002). Authorship and citation patterns in management science in comparison with operational research. Scientometrics, 53(3), 337–349.

Ferretti, A. P. (1970). Investment Company Portfolio Management (pp. 173–182). Irwin Inc.

Garfield, E. (1955). Citation indexes for science: A new dimension in documentation through association of ideas. Science, 122(3159), 108–111.

Harrington, T., & Fisher, W. (1980). Portfolio modeling in multiple criteria situations under uncertainty: Comment on decision sciences, Winter (pp. 171–177)

Hopp, W. J. (2004). 50th anniversary article; fifty years of management science. Management Science, 50(1), 1–7.

Ignizio, J. P. (1978). A review of goal programming a tool for multiobjective analysis. The Journal of the Operational Research Society, 29, 1109–1119.

Inuiguchi, M., & Ramik, J. (2000). Possibilistic linear programming: A brief review of fuzzy mathematical programming and a comparison with stochastic programming in portfolio selection problem. Fuzzy Sets and Systems, 111(1), 3–28.

Konno, H., & Yamazaki, H. (1991). Mean-absolute deviation portfolio optimization and its applications to Tokyo stock market. Management Science, 37(5), 19–31.

Laengle, S., Merigó J. M., Modak, N. M., Yang, J. B. (2020). Bibliometrics in operations research and management science: A university analysis. Annals of Operations Research, 294(1-2), 769–813.

Lai, T. Y. (1991). Portfolio selection with skewness: A multi-objective approach. Review of Quantitative Finance and Accounting, 1(3), 293–305.

Lee, S. M. (1972). Goal programming for decision analysis. Auerbach.

Lee, S. M., & Lerro, A. J. (1973). Optimizing the portfolio selection for mutual funds. Journal of Finance, 28(5), 1087–1102.

Lee, S. M., & Sevebeck, W. R. (1971). An aggregative model for municipal economic planning. Policy Sciences, 2(2), 99–115.

Lin, T. W., & O’Leary, D. E. (1993). Goal programming application in financial management. In K. D. Lawrence, J. B. Guerard, & G. R. Reeves (Eds.), Advances in mathematical programming and financial planning (Vol. 3, pp. 211–229). JAI Press Inc.

Markowitz, H. M. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Merigó, J. M., & Yang, J.-B. (2017). A bibliometric analysis of operations research and management science. Omega, 73(C), 37–48.

Merigó, J. M., Muller, C., Modak, N. M., & Laengle, S. (2019). Research in production and operations management: A university-based bibliometric analysis. Global Journal of Flexible Systems Management, 20(1), 1–29.

Noyons, E. C. M., Moed, H. F., & van Raan, A. F. J. (1999). Integrating research performance analysis and science mapping. Scientometrics, 46(3), 591–604.

Romero, C. (1991). Handbook of critical issues in goal programming. Pergamon Press.

Small, H. (1973). Co-citation in the scientific literature: A new measure of the relationship between two documents. Journal of the Association for Information Science and Technology, 24(4), 265–269.

Spronk, J. (1980). Interactive multiple goal programming for capital budgeting and financial planning. Delftse Uitgevers Maatschappij.

Spronk, J. (1981). Interactive multiple goal programming: Applications to financial planning. Martinus Nijhoff.

Staňková, Š., & Zapletal, F. (2016). Assesment of Corporate Social Responsibility Using Fuzzy Analytic Hierarchy Process. Scientific papers of the University of Pardubice. Series D, Faculty of Economics and Administration. 38/2016.

Steuer, R. E., & Na, P. (2003). Multiple criteria decision making combined with finance: A categorized bibliographic study. European Journal of Operational Research, 150, 496–515.

Stone, B. K., & Reback, R. (1975). Constructing a model for managing portfolio revisions. Journal of Bank Research, 6, 48–60.

Stoyan, S. J., & Kwon, R. H. (2011). A stochastic-goal mixed-integer programming approach for integrated stock and bond portfolio optimization. Journal Computers and Industrial Engineering, 61(4), 1285–1295.

Tamiz, M., & Jones, D. (1998). Goal programming: Recent developments in theory and practice. International Journal of Management and Systems, 14, 1–16.

Van Eck, N., & Waltman, L. (2010). Software survey: Vosviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538.

Van Eck, N. J., & Waltman, L. (2014). Visualizing bibliometric networks. In Y. Ding, R. Rousseau & D. Wolfram (Eds.), Measuring scholarly impact: Methods and practice (pp. 285–320). Springer.

Xidonas, P., Steuer, R., & Hassapis, C. (2020). ‘Robust portfolio optimization: A categorized bibliographic review.’ Annals of Operations Research, 292(1), 533–552.

Zadeh, L. A. (1965). Fuzzy sets. Information and Control, 8, 338–353.

Zanjirchi, S. M., Abrishami, M. R., & Jalilian, N. (2019). Four decades of fuzzy sets theory in operations management: Application of life-cycle, bibliometrics and content analysis. Scientometrics, 119, 1289–1309.

Zopounidis, C., & Doumpos, M. (2013). Multicriteria decision systems for financial problems. TOP, 21, 241–261.

Zupic, I., & Cater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18, 429–472.

Funding

This research was not funded by any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have influenced the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Colapinto, C., Mejri, I. The relevance of goal programming for financial portfolio management: a bibliometric and systematic literature review. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-05911-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-05911-y