Abstract

Ever increasing demand for customization and product diversity from the customers has made it important for firms to predict changes in the customer demand patterns and adopt accordingly. Customer integration allows firms to understand customers and respond to their particular needs in a better way. This study investigates the mechanisms through which customer integration is developed and affects supply chain performance. We develop a structural model underlining the role of market orientation and supply chain strategy as factors affecting the degree of customer integration. We also investigate the contingency role of marketing – supply chain integration in these relationships. We test the hypothesized model using data from Pakistani manufacturing organizations using structural equation modelling. Our results provide support for the study hypotheses except that marketing-supply chain alignment does not moderate the relationship between supply chain strategy and customer integration.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Global competitiveness, the desire for more product diversity with shorter product life cycles, technical progress, and expanding digitalization are all projected to accelerate (Gligor et al., 2019) especially in the face of disruptions such as Suez Canal blockage and Covid-19 pandemic (Ambrogio et al., 2022; Aslam et al., 2022). Firms that are able to adapt effectively to market changes and predict shifting circumstances enjoy greater profitability and competitive advantage (Ali et al., 2020; Teece 2007). In this scenario, market orientation capability has received increased attention from both practitioners and academicians (Foerstl et al., 2020; Green et al., 2019; Oviedo et al., 2021; Powers et al., 2020; Schulze et al., 2022). Market-orientated firms aim to satisfy their customers by gathering and coordinating market information throughout the organization (Kohli & Jaworski, 1990). Research shows that market-orientation provides the basis for business transformation (Wang et al., 2020; Yang et al., 2020) leading to improved performance in testing times (Buratti et al., 2021; D’Souza et al., 2022; Taghvaee & Talebi, 2022; Tinoco et al., 2020; Wilson & Liguori, 2022).

Market orientation capability is critical to the success of supply chain strategies. High market uncertainty, as observed during the recent times, has led firms to recognize the importance of understanding markets and responding with the right supply chain strategies (Fisher, 1997; Handfield, 2010; Pettit et al., 2019). Firms with an effective supply chain strategy can coordinate supply chain processes better, making it possible to build new suppliers, distributors, and customer networks (Espino-Rodríguez & Taha, 2022) during disruptions. As more firms seek to develop supply chain strategies that lead to greater efficiency, they find significant shortfalls in their foundational understanding of these strategies’ effectiveness (Handfield, 2010). While this raises the need to understand better the nexus between market orientation and supply chain strategy, few studies (e.g. Foerstl et al., 2020; Handfield, 2010; Min et al., 2007) have ventured into this area.

This research develops a model for understanding how market orientation capability and supply chain strategy interact to achieve superior supply chain-level success. Supply chain strategy encompasses the decision patterns related to the supply chain activities of the business unit and the supply chain (Cigolini et al., 2004; Perez-Franco & Phadnis, 2018; Stevens, 1989). Research in the field has highlighted the importance of understanding customers (Fisher, 1997) and the supply base (Lee, 2002) in the success of supply chain strategy. Effective design and execution of supply chain strategy helps firms overcome inter-functional conflicts to respond to issues like low efficiency, poor customer service, and high inventories (Stevens, 1989). It also leads to better integration with the supply chain partners (Cigolini et al., 2004) and better overall performance (Ariadi et al., 2021; Bindi et al., 2021; Qi et al., 2017; Sabara et al., 2019).

We suggest that market orientation capability and supply chain strategy influence supply chain performance through the mediating role of customer integration. Customer integration is a critical outcome of market orientation capability and supply chain strategy. Customer integration makes a supply chain “customer-driven” and “customer-focused,“ where the customer is the integrated component of an interconnected supply chain (Christopher, 2016; Martinelli & Tunisini, 2019; Melnyk & Stanton, 2017; Wei et al., 2022). It involves the outgoing set of products and services and the incoming data from customers to suppliers, which leads to the creation and development of relationships with customers, thereby gaining a more precise understanding of customer preferences (Lotfi et al., 2013). Customer integration results in improved quality in the information moving upstream (Edvardsson et al., 2012), leading to better innovation and performance outcomes (Lau et al., 2010; Ruzo-Sanmartín et al., 2023; Tang et al., 2022).

Our research further investigates the contingency role of functional alignment between marketing and supply chain functions in the market orientation capability — customer integration and supply chain strategy — and customer integration relationships. Researchers have suggested that marketing–supply chain alignment could significantly improve supply chain efficiency (Godsell et al., 2006; Jüttner et al., 2010) as it allows shared values to transcend functional tensions and thus signifies how a firm functions and motivates its partners toward a unified purpose (Gölgeci & Kuivalainen, 2020). In this research we study the role it plays in enhancing the impact of market orientation and supply chain strategy on customer integration.

Many studies investigate market orientation and supply chain strategy in developed market economies to achieve better supply chain performance (Bhattarai et al., 2019; Gupta et al., 2020; Zhou et al., 2021). Because of the variations between mature and developing markets, results from previous research may not be immediately relevant in emerging economies (Fatonah & Haryanto, 2022). Lee et al. (2022) stress that supply chains may affect the efficacy of market orientation in pleasing customers, shortening product development timelines, providing more dependable goods, and improving the quality and value of new products. However, unfortunately, there is a paucity of knowledge concerning supply chain strategies in developing nations, which we address in our research. Identifying the determinants of supply chain performance is thus critical to developing a perfect strategy for increasing organizational performance and competitiveness for emerging economies businesses. Specifically, this study will seek answer to the research question:

RQ

What are mechanisms through which market orientation capability influence the supply chain performance?

Our research contributes to diverse knowledge areas. First, market orientation capability is a dynamic capability (Foerstl et al., 2020), and we contribute to the literature assessing the relevance and performance outcomes of dynamic capabilities in the supply chain (Aslam et al., 2020; Defee & Fugate, 2010). Second, from the perspective of market orientation and supply chain strategy literature, we unearth the mechanisms through which these two essential elements of a firm’s strategy influence its performance. Third, by establishing the antecedents of customer integration, we answer researchers’ call to evaluate the intervening role of supply chain integration dimensions in the relationship between market orientation capability and performance (Foerstl et al., 2020). Fourth, we further contribute to the literature on supply chain integration by providing empirical validation of the performance effects of customer integration, a relationship previously receiving mixed results in the literature (Ataseven & Nair, 2017). Finally, we also methodologically contribute to the supply chain integration literature by adding the time data dimension in the study, one of the significant weaknesses identified in the previous studies (e.g. Qi et al., 2017).

2 Literature review

2.1 Dynamic capabilities view

The dynamic capabilities view (DCV) provides the theoretical anchor for our study. The DCV has become one of the most important research areas in recent strategic management literature (Di Stefano et al., 2014; Schilke, 2014b). It suggests that competitive advantage in the uncertain modern markets can only be achieved through dynamic capabilities (Helfat & Peteraf, 2009; Teece et al., 1997; Teece 2007, 2014). A dynamic capability (DC) is the firm’s “ability to sense and then seize new opportunities and to reconfigure and protect knowledge assets, competencies, and complementary assets to achieve a sustained competitive advantage” (Augier & Teece, 2009, pg. 412). At the heart of the DCV is understanding how new forms of competitive advantage are built (Rosenbloom, 2000). Dynamic capabilities are formed through the interaction of idiosyncratic firm resources and processes based on the firm’s history and people. These capabilities account for the differences in the competitive positions of firms. However, they usually cannot be equated across firms (Teece, 2014).

This research benefits two discussion areas in dynamic capabilities research. First, it provides an empirical test for the argument that dynamic capabilities influence firm performance. Previous research in this area has shown mixed results (see Pezeshkan et al., 2016 for a comprehensive emprical review) even though theory in the area generally supports this view. We evaluate the performance outcomes of market orientation capability in this research. Second, some researchers have suggested that dynamic capabilities can also be used to develop other (dynamic) capabilities (Aslam et al., 2018; Collis, 1994; Helfat et al., 2007; Schilke, 2014b; Teece, 2014). For example Collis (1994) suggest four distinct levels of capabilities. First level capabilities are those that are required to perform the basic organizational functions i.e., operational capabilities. Second level capabilities relate to the ‘dynamic improvements’ to firms’ activities. Third level capabilities allow the firms to discern the value of other resources and develop new strategies ahead of competition. Fourth level capabilities are regarded as ‘meta-capabilities’ i.e., “the capabilities to develop the capability to develop the capability that innovates faster (or better).” Capabilities at a higher level modify the next (lower level) capabilities (Arend, 2015; Schilke, 2014b) suggests two levels of capabilities: first-order dynamic capabilities; routines that lead to the reconfiguration of the resources in the organizations and second-order DCs; that modify first-order DCs. This research suggests that market orientation capability is a higher order dynamic capability that reconfigures customer integration, a lower-order capability, to improve supply chain performance.

2.2 Market orientation and supply chain strategy

In this research, we study market orientation from a capabilities perspective (Barrales-Molina et al., 2014; Foerstl et al., 2020; Foley & Fahy, 2009). Market orientation is the application of marketing concepts through activities resulting in generation, diffusion, and responsiveness to market intelligence (Kohli & Jaworski, 1990). It is an outward looking capability that links the firm to its business environment, leading to better internal coordination and external responsiveness (Barrales-Molina et al., 2014). Research in the area has generally considered it to be a capability that transcends functional boundaries (Barrales-Molina et al., 2014; Day, 1994; Kohli & Jaworski, 1990). The importance of market orientation has been well recognized in marketing literature as a capability with the potential to generate competitive advantage (Bodlaj & Čater, 2022; Kumar et al., 2011; Schulze et al., 2022; Shin & Aiken 2012; Tinoco et al., 2020). This is based on the fact that market orientation in a firm leads to better understanding of customer needs, allowing it to develop products and services superior to competitors (Hult & Ketchen Jr, 2001).

Market orientation has been regarded as a dynamic capability by researchers (Barrales-Molina et al., 2014; Foerstl et al., 2020). Firms that adopt strong market orientation capability are more sensitive and proactive in responding to customer demands, seize market opportunities, and are prompt in producing the products and services according to customer preferences (Sampaio et al., 2019). Dynamic capabilities being the micro-foundations of firm’s capabilities (Teece, 2007), facilitate firm’s resource allocation, operation process, and optimal management (Helfat & Peteraf, 2015; Wilden & Gudergan, 2015) leading to sustainable competitive advantage (Teece et al., 1997; Teece 2007, 2014).

Recent research in the area of supply chain has also considered market orientation (Green et al., 2019; Habib et al., 2020; Li et al., 2018; Suryanto & Mukhsin, 2020; Xian et al., 2018). Gligor et al. (2021) for example, using a data of 438 buyer-supplier dyads showed that better relationships with suppliers (in terms of purchase volumes) improve the impact of firm’s market orientation on its performance. Green et al. (2019) developed a comprehensive model of supply chain management and found the market orientation of the firm is the antecedent to various supply chain practices. Similarly, Li et al. (2018) empirically show that in order for firm to implement green practices, green market orientation is required. Gligor et al. (2016) considered market orientation as an antecedent of firm’s supply chain agility and find positive results. More recently, Foerstl et al. (2020) in a qualitative study considered how this capability is developed in the purchasing and supply chain management function.

In this research, we hypothesize that market orientation has a positive impact on supply chain strategy. Some arguments for this relationship can be found in research relating the success of supply chain strategy to the better understanding of markets (Fisher, 1997; Handfield, 2010; Lee, 2002) presents a dichotomous view of supply chain strategy as either efficient or responsive. He argues that for supply chain strategy success, it is imperative that firms use efficient strategy for functional products and responsive strategy for innovative products. (Lee, 2002) suggests that the successful development and execution of supply chain strategy not only requires understanding the (customer) demand uncertainty but also the uncertainty in the supply sources and, hence, suggests two additional strategies: risk-hedging strategy and agile strategy. These and other frameworks of supply chain strategy (e.g. Aitken et al., 2002; Christopher, 2000; Jüttner et al., 2010; Mason-Jones et al., 2000; Naim & Gosling, 2011; Naylor et al., 1999) recommend that a better understanding of the customers and suppliers allows firms to develop strategies that better fit the market requirement. This understanding is developed through market orientation. Jüttner et al. (2010) argue that success in modern supply chain management requires integrated decision making throughout the supply chain from customers to suppliers. This integration in decision making cannot be achieved without strategic integration in the supply chain and marketing functions. Liu et al. (2013) suggest that market orientation acts as the foundation for managing the supply chain and reflects a firm’s orientation toward creating superior value for customers, thereby playing a fundamental role in both organizational management and strategy formulation. Moreover, this points to the importance of market orientation to the success of supply chain strategy. Therefore, we posit that:

H1a: Market orientation has a positive impact on supply chain strategy.

2.3 Market orientation and customer integration

Customer integration, a dynamic capability, involves engaging with key customers to better understand their needs and encourage alignment between the organization’s functions to create customer value (Koufteros et al., 2005). Arguments for customer integration as a dynamic capability can be found in the research on supply chain integration (see for example: Huo 2012; Jajja et al., 2018; Vickery et al., 2013). Customer integration includes information, material, and service flows to the customer and from the customer to the focal firm (Yu et al., 2013). Routines underlying customer integration, such as continuous information sharing, allow a firm to understand the satisfaction level the customer has with its performance and grasp any changes the customer may require in the company offerings (Ralston et al., 2015). Dissemination of information about customer satisfaction across the firm is also an essential component of customer integration (Flynn et al., 2010; Ralston et al., 2015; Swink et al., 2007). Research has shown that successful customer integration is related to new product performance (He et al., 2014), efficiency (Danese & Romano, 2011), and performance outcomes (Chen et al., 2018; Ruzo-Sanmartín et al., 2022; Tang et al., 2022).

We suggest that market orientation will have a positive effect on customer integration. Considering the DCV, market orientation is a higher-order capability contributing to the development and success of customer integration, a lower-order capability. Market orientation is essential for customer satisfaction (Feng et al., 2021; Green et al., 2019). This is because market orientation allows firms to better understand and solve customer problems than their competitors (Martin & Grbac, 2003). As market orientation aids an organization in understanding the specific needs of the customers, market-oriented firms can grab viable opportunities to integrate customers more closely and to comprehend their needs in order to provide value-added products and services (Xian et al., 2018). Hence, we propose the following hypothesis:

H1b: Market orientation has a positive impact on customer integration.

2.4 Supply chain strategy and customer integration

To improve customer service, an increasing number of firms focus on modifying their supply chain strategy to meet customer requirements (Wisner, 2003). However, alignment of supply chain strategy with the customer preferences is not possible without market orientation capability. Changes in customer preferences require firms to promptly respond by sensing market information, seizing the opportunities and hence creating customer value (Hernández-Linares et al., 2021). While creating value, the role of dynamic capabilities is reflected in two steps. First, through the sensing of customer needs and translating this acquired knowledge into usable internal knowledge (Vergne & Durand, 2011). Second, by responding to customer demand through continuous innovation in products and services. First element is achieved through market orientation capability (Kohli & Jaworski, 1990) while the second through appropriate supply chain strategy (Fisher, 1997; Lee, 2002).

Dynamic capabilities literature highlights the importance of effective strategy to the extent that Teece (2014) suggests a failure of dynamic capabilities in the presence of poor strategy. Therefore, much research has concentrated on technologies and practices that facilitate integration inside and across company boundaries to identify the characteristics of an integrative supply chain strategy that is aimed explicitly at integrating functional areas inside the company with the suppliers and customers (Setyadi, 2019). The aim of a supply chain strategy is thus to synchronize the final customer’s requirements with the flow of materials and information along the supply chain to achieve a balance between high customer service and cost (Khan & Wisner, 2019). A supply chain strategy focused on customers thus improves customer integration. Furthermore, this focus enhances the ability to consolidate and implement ways to retain the supply chain’s end customers at a minimal cost through a better match between supply and demand, cost reduction, and improved customer satisfaction (Melnyk & Stanton, 2017) and performance (Khan et al., 2022). Thus, we postulate:

H2: Supply chain strategy has a positive impact on customer integration.

2.5 The moderating role of marketing-supply chain functional alignment

Research in marketing has long argued the importance of inter-functional synchronization for achieving superior customer value (Jüttner et al., 2007). Marketing and supply chain are two primary functions through which a firm manages not only the coordination of intrafirm activities but also upstream and downstream activities throughout the whole supply chain (Mentzer et al., 2008). Synergies between the two functions are well-acknowledged in research (Jüttner et al., 2007, 2010; Martin & Grbac, 2003; Svensson, 2002). However, research has also shown considerable room for conflict in the collaborative efforts of the two departments due to divergent objectives and values (Jüttner et al., 2010; Piercy, 2009). In addition, the power dynamics observed by the boundary spanners of the two functions may make the acquisition and assimilation of knowledge more challenging than they should be (Gölgeci & Kuivalainen, 2020). Hence, the alignment between these two critical functional areas can be very fruitful.

Alignment refers to removing differences between participating parties (Ashenbaum et al., 2009; Lee, 2004; Powell, 1992). Marketing-supply chain alignment is the degree to which objectives of the two functions are shared, organizational structures are coherent, and working is harmonious (Gölgeci & Kuivalainen, 2020). A firm’s internal relational environment influences its behaviour with external partners (Chen et al., 2012). Thus, marketing and supply chain alignment will affect how a firm’s market orientation capability and supply chain strategy are employed to build outward-looking, customer integration capability. Marketing-supply chain alignment is based on the standard all-encompassing value creation blueprint. It transcends inter-functional conflicts, maintaining a united structure for supply chain management and marketing activities (Ashenbaum et al., 2009). The relationship between market orientation capability and customer integration may not materialize without alignment in structure, goals, and activities, as the resources and capabilities can only be effectively bundled in the presence of aligned and co-owned/shared objectives (Jüttner et al., 2010).

Market orientation capability helps a firm, among other things, develop a better understanding of its customers, leading to stronger integration. Using information about customers gained from market intelligence requires decision making with a united approach and process alignment (Ashenbaum et al., 2009). Similarly, a core element of a firm’s supply chain management strategy is to look for ways to integrate supply chain activities with the supply chain partners. Building customer integration through the successful execution of supply chain strategy requires marketing and the supply chain to act harmoniously. The alignment of these two functions may serve as a catalyst (Gölgeci & Kuivalainen, 2020) in improving the effects of market orientation and supply chain strategy on customer integration. On the other hand, misalignment can result in pressures that pull boundary-spanning managers in opposite directions (Gölgeci et al., 2019; Gölgeci & Kuivalainen, 2020). Boundary-spanners may have diminished opportunity to use the firm’s market intelligence and apply supply chain strategy to develop customer integration capability if there is a continuous conflict between market and supply chain.

We thus propose that marketing-supply chain alignment will influence the market orientation–customer integration and supply chain strategy–customer integration relationships such that both relationships will become stronger in the presence of strong alignment between marketing and supply chain.

H3a: Marketing-supply chain integration moderates the relationship between marketing orientation and customer integration.

H3b: Marketing-supply chain integration moderates the relationship between supply chain strategy and customer integration.

2.6 The mediating role of customer integration

Building on Sect. 2.3 and 2.4, we also hypothesize that customer integration plays an indirect role in the market orientation — supply chain performance and supply chain strategy — and supply chain performance relationships. The impact of customer integration on supply chain performance follows the basic logic that dynamic capabilities allow firms to match their response with the external environment in a better way, leading to improved performance (Aslam et al., 2018; Eisenhardt & Martin, 2000; Teece et al., 1997; Teece 2007). Thus, customer integration may allow the firm to match its offering to the changing customer requirements, leading to improved performance. Customer integration will enable firms to leverage knowledge rooted in the interorganizational processes, helping them develop an accurate understanding of market prospects (Flynn et al., 2010; Zhao et al., 2015). Therefore, firms respond to customer requirements more rapidly, improving customer service levels, decreasing holding costs, and increasing overall profitability (Chen et al., 2018; Flynn et al., 2010; Zhao et al., 2015).

A well-developed market orientation capability and an effective supply chain strategy may be necessary to improve an organization’s performance. However, it is more likely that they have an indirect effect on performance by influencing organizational capabilities (Barreto, 2010; Pavlou & El Sawy, 2011; Zott, 2003). Market orientation allows the firm to understand (and thus integrate with) their customer better leading to better integration with the customer. Customer integration provides a deeper understanding of market expectations and opportunities, which helps firms become more responsive to customer needs and requirements (Swink et al., 2007), leading towards superior performance outcomes. Similarly, effective supply chain strategies are a necessary precursor for effective customer integration. Strategies that are well integrated with customers can reduce inventories, decrease delivery times, and improve flexibility (Barratt, 2004; Clark & Lee, 2000). Thus, we posit:

H4a: Customer integration mediates the relationship between market orientation and supply chain performance.

H4b. Customer integration mediates the relation between supply chain strategy and supply chain performance.

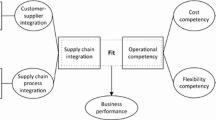

Figure 1 shows the research model of our study.

3 Research methods

3.1 Sample and data collection

We collected data from key respondents of Pakistani manufacturing firms using survey methodology during the time between October and December of 2019. Pakistan is a developing country with its marketing and supply chain related practices still in their infancy (Business Recorder, 2013; Khan, 2020). However, increased globalization and the competitive threat of Chinese products and firms due to the imminent China-Pakistan Economic Corridor (CPEC) mean that Pakistani firms are under pressure to bring their practices up to international standards (Aslam et al., 2018). Pakistani industry, therefore, provides an ideal context for studying the marketing and supply chain practices that can lead to supply chain wide success. Investigating our research phenomenon in a developing country environment also allows us to overcome a problem indicated by the researchers that the supply chain research has a developed country bias (; ; Ibrahim & Araujo, 2021; Tipu & Fantazy, 2020; Fu et al. (2022)). Fu et al. (2022) et al. posited that developing and developed country markets are different by their nature and it is difficult to pre-empt that a phenomenon will play out in both types of markets in a similar fashion. Tipu and Fantazy (2014) elaborated on the differences by suggesting that compared to developed countries, developing country markets face extreme volatility at the microeconomic level, operate in constant flux, and frequently experience institutional instability.

Previous research has reported considerable data collection problems in developing countries (Aslam et al., 2020; Hoskisson et al., 2000; Malik & Kotabe, 2009; Russell, 2015). Pakistan is no different in this respect. Among other factors, this is primarily due to the non-existence of a frame from which to draw samples. The country’s stock exchange represents less than 0.1% of total organizations. In addition, the contact information of organizations on the websites of various chambers of commerce and industry associations is either missing or incomplete. To draw a suitable sample, we first had to identify organizations willing to participate in our two-month long data collection effort. We considered the managers from marketing, supply chain, and related areas as suitable respondents for this study. Managers from consenting organizations were sent requests to fill the questionnaire along with a cover letter, briefly describing the importance of this research. We sent a second questionnaire containing our dependent variable eight weeks later. In all, 187 participants responded to both of our requests. The description is provided in Table 1, whereas the description of respondents is provided in Table 2. Our sample represents a cross-section of Pakistani firms, and major industries were well represented (Pakistan Bureau of Statistics, 2005-06).

3.2 Measures

We adopted already existing scales to operationalize the constructs of this study. The marketing orientation measured the ability of the firm to collect and disseminate demand related information throughout the firm. The scale is adopted from Green et al. (2019), who used the scale developed by Deshpandé and Farley (1998) in their study. The scale is based on marketing orientation practices such as business objectives driven by customer satisfaction, constant monitoring of commitment level to serve customers, dissemination of information about successful and unsuccessful customer experiences, routine measurement of customer service, etc. All items are measured on a 7-point scale ranging between 1 (strongly disagree) to 7 (strongly agree).

The supply chain management strategy evaluated firm’s ability to organize and improve business processes throughout the supply chain to satisfy customer requirements. The scale is based on measures such as: reducing response times throughout the supply chain, searching for new ways to integrate supply chain management activities, and creating a higher level of trust across the supply chain (Green et al., 2019; Wisner, 2003). Items are measured on a 7-point scale ranging between 1 (very low importance) to 7 (very high importance).

The marketing-supply chain alignment scale is based on Gölgeci and Kuivalainen (2020). It measures the degree to which the performance evaluations in the two functions are based on integrative objectives, integrative behaviour is rewarded, employees in the two functions are designated as liaisons to other functions, etc. It is measured on a 7-point scale ranging between 1 (very low) to 7 (very high). Customer integration is the degree to which firm’s processes are integrated with its customers. It assesses if the firms share customer satisfaction results with all employees, actively create opportunities for employees to interact with the customers, and have a formal customer satisfaction program (Ralston et al., 2015; Swink et al., 2007). Items are measured on a 7-point scale ranging between 1 (strongly disagree) to 7 (strongly agree).

Finally, supply chain performance assess measures the extent to which firms in the supply chain achieve cost efficiencies, improve business processes quickly and effectively, are profitable, develop new opportunities, launch new products successfully, and achieve customer satisfaction (Autry et al., 2014; Sanders, 2007). We utilized two control variables to account for the extraneous effects. Specifically, we controlled for the firm size and age. Firm size was assessed based on annual sales turnover and the number of employees. To measure firm age, we asked respondents to identify the number of years since the firm came into existence.

We used control variables conservatively as per the guidelines provided by Carlson and Wu (2012). We measured firm size based on sales revenue and total number of employees (Hult et al., 2007). Firm size needed to be controlled as the evidence suggests that larger firms would be likely to have stronger systems in place (Bode & Wagner, 2015) which would influence market orientation, customer integration, and supply chain strategy. Firm age in number of years since the firm was formed, was a proxy for organization’s experience (Bode & Wagner, 2015) which may strengthen organization’s capabilities.

3.3 Common method bias

Common method bias (CMB) occurs due to similarities in measurement approaches influencing reliability and validity of estimates as well as the inaccurate estimation of the measurement model (Podsakoff et al., 2003). We collected data for independent and dependent variables from the same respondents in this study. Supply chain performance (dependent variable) was measured after a time lag of approximately two months. However, four variables of the model were measured simultaneously (Time 1), creating a potential for CMB. We made pre-emptive efforts to overcome CMB in order to be more effective in managing the problem (Green et al., 2016). For example, we assured the respondents of their anonymity in results and provided them the option of submitting responses without their name and company name. Furthermore, we measured different variables with different Likert scales, for example, strongly disagree–strongly agree versus very low–very high (Conway & Lance, 2010; Podsakoff et al., 2003).

In terms of post-hoc procedures to detect CMB, Harman’s single factor test (Harman, 1976) was performed. We performed exploratory factor analysis without any rotation. Four factors were extracted in the solution, with the first factor explaining less than 50% of the variation. In the next step, we loaded all the variables in the model on a single factor in confirmatory factor analysis (CFA). This showed significantly poor results compared to the hypothesized measurement model (χ2 = + 2.57, CFI = + 0.21, RMSEA = + 0.064). Based on this evidence, we concluded that CMB was not a major concern in this research.

3.4 Assessment of psychometric properties

We validated the measurement model using confirmatory factor analysis (CFA) through IBM SPSS AMOS. Model fit indices (χ2 = 1.83, p < 0.01, SRMR = 0.061, CFI = 0.93 and RMSEA = 0.067) showed a good fit (Hu & Bentler, 1999; Fornell & Larcker, 1981) criteria were used to establish construct validity. Convergent validity was established based on values of average variance extracted (AVE) above 0.5. All constructs except marketing-supply chain alignment had AVEs of 0.5 and above. However, Fornell & Larcker (1981) argue that even though an AVE less than 0.5 indicates that error variance is higher, “variance due to measurement error is larger than the variance due to variance captured by the construct,“ the convergent validity can still be established if composite reliability (CR) is high (p. 46). In the case of marketing-supply chain alignment, the CR was above 0.70. Hence, significant item loadings combined with high AVEs and CRs provided support for convergent validity. Table 3 provides information about the factor loading, AVEs, and CR.

Discriminant validity was established by comparing bi-variate correlations with the square root of AVE (Fornell & Larcker, 1981). We compared the square root of AVE for each construct with its bi-variate correlations with all other constructs. In each instance, the square root of AVE was higher, providing evidence for suitable levels of discriminant validity. Table 4 provides the square root of AVE (in the diagonal) and bivariate correlations for all the constructs. Table 4 also provides means and standard deviations (SD) for the constructs in the study. We used composite reliability to assess the reliability of the constructs. The reliability coefficients were greater than 0.7 in each case (Hair et al., 2014), indicating suitable levels of reliability.

4 Results

Before performing the hypotheses testing, we tested the univariate and multivariate assumptions of normality, linearity, constant variance, and multicollinearity. First, we tested univariate normality through coefficients of skewness and kurtosis. Maximum values of skewness and kurtosis (-1.54 and 2.62) were within acceptable limits of two and seven, respectively (Curran et al., 1996). Second, the normality of residuals was tested through residual plots of the predicted values. The results showed that the residual plots did not deviate from normality or homoscedasticity. Third, linearity was tested through the correlation coefficients. Table 4 shows that significant correlations exist between independent and dependent variables, signifying that the linearity assumption is met. Finally, we tested multicollinearity through variance inflation factors of the independent variables. All the variance inflation factors were below 2, thus indicating multicollinearity was not a problem (Hair et al., 2014).

Next, we assessed the measurement model through structural equation modelling. Structural equation modelling (SEM) is a behavioural sciences technique used analyse relationship between constructs (Dadeliene et al., 2020). SEM was used in this study due to its similarity to multiple regression but having a distinctive advantage of the ability to consider latent constructs in the structure model (Malesios et al., 2020). We thus used SEM to test hypothesized model to identify significant relationships (Chowdhury et al., 2022).

The results of the structural model are provided in Table 5; Fig. 2. Our results provided support for the hypothesized model and overall model fit was adequate (χ2 = 1.70, p < 0.01, SRMR = 0.073, CFI = 0.90 and RMSEA = 0.061). The first hypothesis indicated a positive impact of market orientation on the supply chain strategy. Results show that this relationship was significant (β = 0.73, p < 0.01), hence H1a was supported. In H1b, we suggested that market orientation will have a positive impact on customer integration. Results show that this relationship was also significant (β = 0.38, p < 0.05), supporting H1b. Next, we assessed the relationship between supply chain strategy and customer integration (H2). Model results confirm this relationship as well (β = 0.29, p < 0.05). Our moderation hypotheses posited that marketing-supply chain alignment moderates the market orientation — customer integration and supply chain strategy — and customer integration relationships (H3a, H3b). Results show that marketing-supply chain alignment moderates the relationship between market orientation and customer integration (β = 0.15, p < 0.01). As shown in Fig. 3, at higher levels of alignment between supply chain and marketing, the market orientation–customer integration relationship becomes stronger. Hence, H3a was supported. However, support could not be found for the moderating role of marketing-supply chain alignment in the relationship between supply chain strategy and customer integration (β = 0.04, p > 0.05). Hence, H3b was not supported.

Finally, to test the mediation hypothesized in H4a and H4b, we used a bootstrapping technique (Hayes, 2009, 2013) with 5,000 bootstrap samples and 95% bootstrap confidence intervals. H4a suggested that customer integration mediates the relationship between market orientation and supply chain performance. Results showed this relationship to be significant (β = 0.086, lower confidence limit = 0.013, upper confidence limit = 0.248, p < 0.029). Similarly, H4b indicated a mediating role of customer integration in the relationship between supply chain strategy and supply chain performance. This relationship was also statistically significant (β = 0.065, lower confidence limit = 0.015, upper confidence limit = 0.161, p < 0.01), in support of H4b.

5 Discussion

5.1 Theoretical implications

Achieving higher supply chain performance in modern firms through market orientation capability and good supply chain strategy is a critical challenge for many firms. This research was conducted to assess the role of customer integration as an intervening variable in the relationship between market orientation–supply chain performance and supply chain strategy–supply chain performance relationships. In this vein, we also studied the moderating role of marketing-supply chain alignment in these relationships. Finally, we examined the mediating role of customer integration in the relationship between market orientation/supply chain management strategy and supply chain performance. The model was tested on the data of supply chain managers from Pakistan’s manufacturing industry.

Our research contributes to the theory developing around dynamic capabilities. It also provides essential insights related to the marketing and supply chain interaction. Our results support the argument that dynamic capabilities exist at various levels where capabilities at each higher level modify next-level capabilities (Collis, 1994; Schilke, 2014b; Teece, 2014). The significant effect of market orientation on customer integration confirms that dynamic capabilities in the supply chain do exist at various levels. Our results also indicate that market orientation has a positive impact on supply chain strategy. These results are consistent with the work of Liu et al., (2013), Xian et al. (2018), and Green et al. (2019), who show similar effects of market orientation in developing countries. Green et al. (2019), for example, discover that market orientation is crucial to maximizing customer satisfaction and attaining firm goals. Furthermore, they emphasize that organizations should understand consumer needs and then integrate or formulate supply chain strategies. Jüttner et al. (2010) state that by using market orientation, firms could improve customer integration.

This research also finds that supply chain strategy has a positive impact on customer integration, which is in line with the research of Khan and Wisner (2019) and Melnyk and Stanton (2017). Khan and Wisner (2019) illustrate that supply chain strategy synchronizes the customer demands with information and product flow in the supply chain to improve customer service and minimize operational costs. Melnyk and Stanton (2017) studied a developing country context and mentioned that an effective supply chain strategy enables firms to emphasize customer satisfaction. Furthermore, Teece et al. (1997), in their seminal work and later in many other studies (e.g. Teece 2016; Teece, 2007; Teece, 2014), argue for the important interaction between strategy and dynamic capabilities. Our results confirm this argument by showing that dynamic capabilities affect strategy (market orientation ◊ supply chain strategy) and strategy, in turn, affects dynamic capabilities (supply chain strategy ◊ customer integration).

The moderating effect of marketing-supply chain alignment on the marketing orientation ˗ customer integration, and supply chain strategy ˗ customer integration relationships were also studied. We find support for the moderating effect on the marketing orientation ˗ customer integration relationship. Although similar relationships have not been explored before, some support for our results can be found in Gölgeci and Kuivalainen (2020). They also study the moderating role of marketing-supply chain alignment in developing country context. The general results of their study highlight the importance of the strong alignment of two functions for success: enhancing social capital — absorptive capacity and social capital — and supply chain resilience relationships. Lack of support for the moderating effect on supply chain strategy ˗ customer integration relationship could be due to sampling error. However, another more plausible reason may be that other factors affect this relationship, e.g., the correct choice of supply chain design in the light of supply chain management strategy.

Our results support the notion that dynamic capabilities influence performance (Pavlou & El Sawy, 2011; Schilke 2014a; Teece et al., 1997; Teece 2007). This influence is indicated in the significant mediation of customer integration in our model. Again similar relationships have not been previously studied, but support for our results can be found in studies using customer integration in mediating roles (Boer & Boer, 2019; Jajja et al., 2018; Munir et al., 2020; Shah et al., 2020). For example, Shah et al. (2020) studied the mediating role of customer integration in the relationship between servitization orientation and advanced services, i.e., service performance, and found significant results. Similarly, Jajja et al. (2018) evaluated the mediating effect of customer integration between the relationship of supply chain risk and agility performance and found significant results. The common denominator between these studies and the present study is that customer integration has proven to be a significant mediator in the relationship between an organization or supply chain level capability and performance outcomes.

5.2 Managerial implications

Our research provides important insight for the practice. First, our research highlights an important path to identify the mechanisms through which customer integration can be built. Anecdotal evidence from developing countries, especially Pakistan, suggests that firms do not involve customers in decisions. Our results highlight that customer integration is the path to performance enhancement. Hence, firms need to pay extra attention to integrate with the customers. Second, our research highlights that marketing and supply chain personnel working in silos is not the way into the future. Marketing-supply chain alignment plays an essential role in the capability building/modification process. Firms need to put policies in place that can help create alignment between the two functions. Customer is the point of intersection between the two functions. Alignment between the two functions can enhance the firm’s ability to integrate with the customer, leading to higher performance levels. On the other hand, strategic misalignments can cause organizational failures. Third, the firm should capture competitive advantage in the uncertain modern markets through dynamic capabilities. As the findings confirm that market orientation and supply chain strategy are crucial dynamic firm capabilities which can involve the customers in their decision making to improve firm supply chain performance. Finally, capabilities are critical for manufacturing firms because effective design and execution of supply chain strategy helps firms overcome inter-functional conflicts and respond to issues like low efficiency, poor customer service, and high inventories. In this way, firms can successfully integrate with their the supply chain partners (Cigolini et al., 2004) to sustain best performance.

6 Limitations and future research implications

We made significant efforts to overcome typical issues associated with survey research and cross-sectional research design in our study. However, without acknowledging the limitations, it will be difficult to put the results into perspective. First, we performed our research in a single developing country (i.e., Pakistan), and these results are not directly generalizable to other developing countries. However, given that many relationships in this research are new, more research is needed in different settings to confirm the findings. Second, our research is quantitative and based on perceptual data. While perceptual measures are well recognized in the management literature, future research could consider objective variables or mixed methods to overcome the shortcomings of perceptual measures. Finally, future research can incorporate other mediators (e.g., firm structure) and moderators (e.g., information sharing) to advance our model.

7 Conclusion

In this age of globalizations, firms are facing different challenges including how to sustain their supply chain cycle particularly in the current phase of Covid-19. Our study concludes that firms can sustain their manufacturing operations and capture competitive edge by proper utilization of their dynamic capabilities. Integration with customer resulting from market orientation, supply chain strategy, and alignment between marketing and supply chain functions is crucial in obtaining best performance especially in the era of crisis. Firms integrated with customers are better able to deal with market changes leading to customer satisfaction and sustainable competitive advantage.

Change history

12 May 2023

A Correction to this paper has been published: https://doi.org/10.1007/s10479-023-05332-3

References

Aitken, J., Christopher, M., & Towill, D. (2002). “Understanding, implementing and exploiting agility and leanness”. International Journal of Logistics Research and Applications, 5 No(1), 59–74.

Ali, G. A., Hilman, H., & Gorondutse, A. H. (2020). Effect of entrepreneurial orientation, market orientation and total quality management on performance. Benchmarking: An International Journal, 27(4), 1503–1531.https://doi.org/10.1108/BIJ-08-2019-0391

Ambrogio, G., Filice, L., Longo, F., & Padovano, A. (2022). Workforce and supply chain disruption as a digital and technological innovation opportunity for resilient manufacturing systems in the COVID-19 pandemic. Computers & Industrial Engineering, 169, 108158.

Arend, R. J. (2015). “Mobius’ edge: Infinite regress in the resource-based and dynamic capabilities views”,Strategic Organization, p.1476127014563051.

Ariadi, G., Surachman, Sumiati, & Rohman, F. (2021, 2021/01/01). The effect of lean and agile supply chain strategy on financial performance with mediating of strategic supplier integration & strategic customer integration: Evidence from bottled drinking-water industry in Indonesia. Cogent Business & Management, 8(1), 1930500. https://doi.org/10.1080/23311975.2021.1930500

Ashenbaum, B., Maltz, A., Ellram, L., & Barratt, M. A. (2009). “Organizational alignment and supply chain governance structure: Introduction and construct validation”,The International Journal of Logistics Management.

Aslam, H., Blome, C., Roscoe, S., & Azhar, T. (2020). “Determining the antecedents of dynamic supply chain capabilities”. Supply Chain Management: An International Journal, 25 No(4), 427–442.

Aslam, H., Syed, T. A., Blome, C., Ramish, A., & Ayaz, K. (2022). The Multifaceted Role of Social Capital for Achieving Organizational Ambidexterity and Supply Chain Resilience. IEEE Transactions on Engineering Management, 1–14. https://doi.org/10.1109/tem.2022.3174069

Aslam, H., Blome, C., Roscoe, S., & Azhar, T. M. (2018). “Dynamic supply chain capabilities: how market sensing, supply chain agility and adaptability affect supply chain ambidexterity”. International Journal of Operations & Production Management, 38 No(12), 2266–2285.

Ataseven, C., & Nair, A. (2017). “Assessment of supply chain integration and performance relationships: a meta-analytic investigation of the literature”. International Journal of Production Economics, 185, 252–265.

Augier and Teece. (2009). “Dynamic capabilities and the role of managers in business strategy and economic performance”. Organization science, 20 No(2), 410–421.

Autry, C. W., Williams, B. D., & Golicic, S. (2014). “Relational and process multiplexity in vertical supply chain triads: an exploration in the US restaurant industry”. Journal of Business Logistics, 35 No(1), 52–70.

Barrales-Molina, V., Martínez-López, F. J., & Gázquez-Abad, J. C. (2014). “Dynamic marketing capabilities: toward an integrative Framework”. International Journal of Management Reviews, 16 No(4), 397–416.

Barratt, M. (2004). “Understanding the meaning of collaboration in the supply chain”. Supply Chain Management: An International Journal, 9 No(1), 30–42.

Barreto, I. (2010). Dynamic capabilities: A review of past research and an agenda for the future. Journal of Management, 36(1), 256–280.

Bhattarai, C. R., Kwong, C. C., & Tasavori, M. (2019). Market orientation, market disruptiveness capability and social enterprise performance: An empirical study from the United Kingdom. Journal of Business Research, 96, 47–60.

Bindi, B., Bandinelli, R., Fani, V., & Pero, M. E. P. (2021). Supply chain strategy in the luxury fashion industry: impacts on performance indicators. International Journal of Productivity and Performance Management. https://doi.org/10.1108/IJPPM-02-2021-0079

Bodlaj, M., & Čater, B. (2022). Responsive and proactive market orientation in relation to SMEs’ export venture performance: The mediating role of marketing capabilities. Journal of Business Research, 138, 256–265.

Bode, C., & Wagner, S. M. (2015, 2015/05/01/). Structural drivers of upstream supply chain complexity and the frequency of supply chain disruptions. Journal of Operations Management, 36, 215–228. https://doi.org/10.1016/j.jom.2014.12.004

Boer, H., & Boer, H. (2019). “Design-for-variety and operational performance: the mediating role of internal, supplier and customer integration”. Journal of Manufacturing Technology Management, 30 No(2), 438–461.

Business Recorder (2013). “Trade marketing in Pakistan – challenges & opportunities”, Business Recorder, Pakistan, Business Recorder.

Buratti, N., Profumo, G., & Persico, L. (2021, 2021/03/01). The impact of market orientation on university spin-off business performance. Journal of International Entrepreneurship, 19(1), 104–129. https://doi.org/10.1007/s10843-020-00282-4

Chen, M., Liu, H., Wei, S., & Gu, J. (2018). “Top managers’ managerial ties, supply chain integration, and firm performance in China: a social capital perspective”. Industrial Marketing Management, 74, 205–214.

Chen, X. P., Liu, D., & Portnoy, R. (2012). “A multilevel investigation of motivational cultural intelligence, organizational diversity climate, and cultural sales: evidence from US real estate firms”. Journal of Applied Psychology, 97 No(1), 93–106.

Chowdhury, S., Rodriguez-Espindola, O., Dey, P., & Budhwar, P. (2022, 2022/01/24). Blockchain technology adoption for managing risks in operations and supply chain management: evidence from the UK. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04487-1

Christopher, M. (2000). “The agile supply chain: competing in volatile markets”. Industrial Marketing Management, 29 No(1), 37–44.

Christopher, M. (2016). Logistics & Supply Chain Management, Pearson UK.

Cigolini, R., Cozzi, M., & Perona, M. (2004). “A new framework for supply chain management”. International Journal of Operations & Production Management, 24 No(1), 7–41.

Clark, T. H., & Lee, H. G. (2000). “Performance, interdependence and coordination in business-to-business electronic commerce and supply chain management”. Information Technology and Management, 1 No(1), 85–105.

Collis, D. J. (1994). “Research note: how valuable are organizational capabilities?“. Strategic Management Journal, 15 No(S1), 143–152.

Conway, J. M., & Lance, C. E. (2010). “What reviewers should expect from authors regarding common method bias in organizational research”. Journal of Business and Psychology, 25 No(3), 325–334.

Curran, P. J., West, S. G., & Finch, J. F. (1996). The robustness of test statistics to nonnormality and specification error in confirmatory factor analysis”. Psychological methods, 1 No(1), 16.

Dadeliene, R., Dadelo, S., Pozniak, N., & Sakalauskas, L. (2020). Analysis of top kayakers’ training-intensity distribution and physiological adaptation based on structural modelling. Annals of Operations Research, 289(2), 195–210.

Danese, P., & Romano, P. (2011). “Supply chain integration and efficiency performance: a study on the interactions between customer and supplier integration”. Supply Chain Management: An International Journal, 16 No(4), 220–230.

Day, G. S. (1994). “The capabilities of market-driven organizations”. The Journal of Marketing, 58 No(4), 37–52.

Defee, C. C., & Fugate, B. S. (2010). “Changing perspective of capabilities in the dynamic supply chain era”. International Journal of Logistics Management The, 21 No(2), 180–206.

Deshpandé, R., & Farley, J. U. (1998). “Measuring market orientation: generalization and synthesis”. Journal of market-focused management, 2 No(3), 213–232.

Di Stefano, G., Peteraf, M., & Verona, G. (2014). “The organizational drivetrain: A road to integration of dynamic capabilities research”, The Academy of Management Perspectives, p. amp. 2013.0100.

D’Souza C., Nanere, M., Marimuthu, M., Arwani, M., & Nguyen, N. (2022). Market orientation, performance and the mediating role of innovation in Indonesian SMEs. Asia Pacific Journal of Marketing and Logistics, 34(10), 2314–2330. https://doi.org/10.1108/APJML-08-2021-0624

Edvardsson, B., Kristensson, P., Magnusson, P., & Sundström, E. (2012). “Customer integration within service development—A review of methods and an analysis of insitu and exsitu contributions”, Technovation, Vol. 32 No.7–8, pp. 419–429.

Eisenhardt, K., & Martin, J. (2000). “Dynamic capabilities: what are they?“. Strategic Management Journal, 21 No, 10–11.

Espino-Rodríguez, T. F., & Taha, M. G. (2022). Supplier innovativeness in supply chain integration and sustainable performance in the hotel industry. International Journal of Hospitality Management, 100, 103103.

Feng, T., Sheng, H., & Li, M. (2021). “The bright and dark sides of green customer integration (GCI): evidence from Chinese manufacturers”,Business Process Management Journal.

Fatonah, S., & Haryanto, A. (2022). Exploring market orientation, product innovation and competitive advantage to enhance the performance of SMEs under uncertain evens. Uncertain Supply Chain Management, 10(1), 161–168.

Fisher, M. (1997). “What is the right supply chain for your product?“. Harvard Business Review, 75 No(2), 105–117.

Flynn, B. B., Huo, B., & Zhao, X. (2010). “The impact of supply chain integration on performance: a contingency and configuration approach”. Journal of Operations Management, 28 No(1), 58–71.

Foerstl, K., Kähkönen, A. K., Blome, C., & Goellner, M. (2020). “Supply market orientation: a dynamic capability of the purchasing and supply management function”. Supply Chain Management: An International Journal, 26 No(1), 65–83.

Foley, A., & Fahy, J. (2009). “Seeing market orientation through a capabilities lens”. European Journal of Marketing, 43 No(1/2), 13–20.

Fornell, C., & Larcker, D. F. (1981). “Evaluating structural equation models with unobservable variables and measurement error”. Journal of Marketing Research, 18 No(1), 39–50.

Gligor, D. M., Gölgeci, I., Newman, C., & Bozkurt, S. (2021). Performance implications of the buyer-supplier market orientation fit. Industrial Marketing Management, 93, 161–173.

Gligor, D. M., Holcomb, M. C., & Feizabadi, J. (2016). “An exploration of the strategic antecedents of firm supply chain agility: the role of a firm’s orientations”. International Journal of Production Economics, 179, 24–34.

Gligor, D., Gligor, N., Holcomb, M., & Bozkurt, S. (2019). Distinguishing between the concepts of supply chain agility and resilience. The International Journal of Logistics Management, 30(2), 467–487.

Godsell, J., Harrison, A., Emberson, C., & Storey, J. (2006). “Customer responsive supply chain strategy: an unnatural act?“. International Journal of Logistics: Research and Applications, 9 No(1), 47–56.

Gölgeci, I., Karakas, F., & Tatoglu, E. (2019). “Understanding demand and supply paradoxes and their role in business-to-business firms”. Industrial Marketing Management, 76, 169–180.

Gölgeci, I., Kuivalainen, O., & J. I. M., M. (2020). “Does social capital matter for supply chain resilience? The role of absorptive capacity and marketing-supply chain management alignment”, Vol. 84, pp.63–74.

Green, J. P., Tonidandel, S., & Cortina, J. M. (2016). “Getting through the gate: statistical and methodological issues raised in the reviewing process”. Organizational Research Methods, 19 No(3), 402–432.

Green, K. W., Inman, R. A., Sower, V. E., & Zelbst, P. (2019). “Comprehensive supply chain management model”. Supply Chain Management: An International Journal, 24 No(5), 590–603.

Gupta, S., Modgil, S., Gunasekaran, A., & Bag, S. (2020). Dynamic capabilities and institutional theories for Industry 4.0 and digital supply chain. Supply Chain Forum: An International Journal, 21(3), 139–157.

Hair, B., Babin and Anderson (2014). Multivariate Data Analysis. Essex: Pearson Education Limited.

Handfield, R. (2010). “Supply market intelligence: think differently, gain an edge”. Supply Chain Management Review, 14 No(6), 42–49.

Harman, H. H. (1976). Modern factor analysis. University of Chicago press.

Hayes, A. F. (2009). “Beyond Baron and Kenny: statistical mediation analysis in the new millennium”. Communication Monographs, 76 No(4), 408–420.

Hayes, A. F. (2013). Introduction to Mediation, Moderation, and conditional process analysis: a regression-based Approach. Guilford Press.

He, Y., Lai, K. K., Sun, H., & Chen, Y. (2014). “The impact of supplier integration on customer integration and new product performance: the mediating role of manufacturing flexibility under trust theory”. International Journal of Production Economics, 147, 260–270.

Helfat, C., & Peteraf, M. (2009). “Understanding dynamic capabilities: progress along a developmental path”. Strategic Organization, 7 No(1), 91–102.

Helfat, C. E., Finkelstein, S., Mitchell, W., Peteraf, M., Singh, H., Teece, D., & Winter, S. G. (2007). Dynamic capabilities: understanding Strategic Change in Organizations. John Wiley & Sons.

Helfat, C. E., & Peteraf, M. A. (2015). Managerial cognitive capabilities and the microfoundations of dynamic capabilities. Strategic Management Journal, 36(6), 831–850.

Hernández-Linares, R., Kellermanns, F. W., & López-Fernández, M. C. (2021). Dynamic capabilities and SME performance: The moderating effect of market orientation. Journal of Small Business Management, 59(1), 162–195.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. (2000). “Strategy in emerging economies”. Academy of Management Journal, 43 No(3), 249–267.

Hu, L., & Bentler, P. M. (1999). “Cutoff criteria for fit indexes in covariance structure analysis: conventional criteria versus new alternatives”. Structural Equation Modeling: A Multidisciplinary Journal, 6 No(1), 1–55.

Hult, G. T. M., & Ketchen Jr, D. J. (2001). “Does market orientation matter?: a test of the relationship between positional advantage and performance”. Strategic management journal, 22 No(9), 899–906.

Huo, B. (2012). “The impact of supply chain integration on company performance: an organizational capability perspective”. Supply Chain Management: An International Journal, 17 No(6), 596–610.

H. Wei, J. Chen and M. A. Z. Chudhery, “Examining Intermediate Mechanism of Customer Participatory Market Orientation on High-Tech Firms' Innovation Performance-Secondary Regulating Effect of Relationship Quality,” in IEEE Transactions on Engineering Management, https://doi.org/10.1109/TEM.2022.3172411

Ibrahim, T., & Araujo, C. A. (2021). Biopharmaceutical supply Chain challenges in developing countries: an exploratory analysis. Supply Chain Forum: An International Journal, 22(4), 294–309.

Jajja, M. S. S., Chatha, K. A., & Farooq, S. (2018). “Impact of supply chain risk on agility performance: mediating role of supply chain integration”. International Journal of Production Economics, 205, 118–138.

Jüttner, U., Christopher, M., & Baker, S. (2007). “Demand chain management-integrating marketing and supply chain management”. Industrial Marketing Management, 36 No(3), 377–392.

Jüttner, U., Christopher, M., & Godsell, J. (2010). “A strategic framework for integrating marketing and supply chain strategies”. The International Journal of Logistics Management, 21 No(1), 104–126.

Khan, H., & Wisner, J. (2019). “Supply chain integration, learning, and agility: effects on performance”. Journal of Operations and Supply Chain Management, 12 No(1), 14.

Khan, N. (2020). “Redesigning supply chain curriculum in Pakistan”, Tribune. Tribune: Pakistan.

Khan, S. A. R., Piprani, A. Z., & Yu, Z. (2022). Supply chain analytics and post-pandemic performance: mediating role of triple-A supply chain strategies. International Journal of Emerging Markets. https://doi.org/10.1108/ijoem-11-2021-1744

Kohli, A. K., & Jaworski, B. (1990). “Market orientation: the construct, research propositions, and managerial implications”. Journal of Marketing, 54 No(2), 1–18.

Koufteros, X., Vonderembse, M., & Jayaram, J. (2005). “Internal and external integration for product development: the contingency effects of uncertainty, equivocality, and platform strategy”. Decision Sciences, 36 No(1), 97–133.

Kumar, V., Jones, E., Venkatesan, R., & Leone, R. P. (2011). “Is market orientation a source of sustainable competitive advantage or simply the cost of competing?“. Journal of Marketing, 75 No(1), 16–30.

Lau, A. K. W., Tang, E., & Yam, R. C. M. (2010). “Effects of Supplier and customer integration on Product Innovation and performance: empirical evidence in Hong Kong Manufacturers”. Journal of Product Innovation Management, 27 No(5), 761–777.

Lee, H. (2004). “The triple-A supply chain”. Harvard Business Review, 82 No(10), 102–113.

Lee, H. L. (2002). J. C. m. r. “Aligning supply chain strategies with product uncertainties”, Vol. 44 No. 3, pp. 105–119.

Lee, K., Azmi, N., Hanaysha, J., Alzoubi, H., & Alshurideh, M. (2022). The effect of digital supply chain on organizational performance: An empirical study in Malaysia manufacturing industry. Uncertain Supply Chain Management, 10(2), 495–510.

Liu, H., Ke, W., Wei, K. K., & Hua, Z. (2013). “Effects of supply chain integration and market orientation on firm performance”. International Journal of Operations Production Management, 33 No(3), 322–346.

Li, Y., Ye, F., Sheu, C., & Yang, Q. (2018). Linking green market orientation and performance: Antecedents and processes. Journal of Cleaner Production, 192, 924–931.

Lotfi, Z., Sahran, S., Mukhtar, M., & Zadeh, A. T. (2013). “The relationships between supply chain integration and product quality”. Procedia Technology, 11, 471–478.

Malesios, C., Dey, P. K., & Abdelaziz, F. B. (2020, 2020/11/01). Supply chain sustainability performance measurement of small and medium sized enterprises using structural equation modeling. Annals of Operations Research, 294(1), 623-653. https://doi.org/10.1007/s10479-018-3080-z

Malik, O. R., & Kotabe, M. (2009). “Dynamic capabilities, government policies, and performance in firms from emerging economies: evidence from India and Pakistan”. Journal of Management Studies, 46 No(3), 421–450.

Martin, J. H., & Grbac, B. (2003). “Using supply chain management to leverage a firm’s market orientation”. Industrial Marketing Management, 32 No(1), 25–38.

Martinelli, E. M., & Tunisini, A. (2019). “Customer integration into supply chains: literature review and research propositions”. Journal of Business & Industrial Marketing, 34 No(1), 24–38.

Mason-Jones, R., Naylor, B., & Towill, D. R. (2000). “Engineering the leagile supply chain”. International Journal of Agile Management Systems, 2 No(1), 54–61.

Melnyk, S. A., & Stanton, D. (2017). “The customer-centric supply chain”. Supply Chain Management Review, 20 No(12), 28–39.

Mentzer, J. T., Stank, T. P., & Esper, T. L. (2008). “Supply chain management and its relationship to logistics, marketing, production, and operations management”. Journal of Business Logistics, 29 No(1), 31–46.

Min, S., Mentzer, J. T., & Ladd, R. T. (2007). “A market orientation in supply chain management”. Journal of the Academy of Marketing Science, 35 No(4), 507–522.

Munir, M., Jajja, M. S. S., Chatha, K. A., & Farooq, S. (2020). “Supply chain risk management and operational performance: the enabling role of supply chain integration”. International Journal of Production Economics, 227, 107667.

Naim, M. M., & Gosling, J. (2011). “On leanness, agility and leagile supply chains”. International Journal of Production Economics, 131 No(1), 342–354.

Naylor, J. B., Naim, M. M., & Berry, D. (1999). “Leagility: integrating the lean and agile manufacturing paradigms in the total supply chain”. International Journal of Production Economics, 62 No(1–2), 107–118.

Oviedo, A. B. M., Pimenta, M. L., Piato, É. L., & Hilletofth, P. (2021). “Development of market-oriented strategies through cross-functional integration in the context of the food and beverage industry”. Business Process Management Journal, 27 No(3), 901–921.

Pakistan Bureau of Statistics. (2005). -06), “Census of Manufacturing Industries “. Pakistan: Pakistan Bureau of Statistics.

Pavlou, P. A., & Sawy, E., O. A (2011). “Understanding the elusive black box of dynamic capabilities”. Decision Sciences, 42 No(1), 239–273.

Perez-Franco, R. J., & Phadnis, S. (2018). “Eliciting and representing the supply chain strategy of a business unit”. The International Journal of Logistics Management, 29 No(4), 1401–1423.

Pettit, T., Croxton, K., & Fiksel, J. (2019). “The evolution of resilience in supply chain management: a retrospective on ensuring supply chain resilience”. Journal of Business Logistics, 40 No(1), 1–10.

Pezeshkan, A., Fainshmidt, S., Nair, A., Frazier, M. L., & Markowski, E. (2016). “An empirical assessment of the dynamic capabilities–performance relationship”. Journal of Business Research, 69 No(8), 2950–2956.

Piercy, N. F. (2009). “Strategic relationships between boundary-spanning functions: aligning customer relationship management with supplier relationship management”. Industrial Marketing Management, 38 No(8), 857–864.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). “Common method biases in behavioral research: a critical review of the literature and recommended remedies”. Journal of Applied Psychology, 88 No(5), 879.

Powell, T. C. (1992). “Organizational alignment as competitive advantage”. Strategic Management Journal, 13 No(2), 119–134.

Powers, T. L., Kennedy, K. N., & Choi, S. (2020). “Market orientation and performance: industrial supplier and customer perspectives”. Journal of Business & Industrial Marketing, 35 No(11), 1701–1714.

Qi, Y., Huo, B., Wang, Z., & Yeung, H. Y. J. (2017). The impact of operations and supply chain strategies on integration and performance. International Journal of Production Economics, 185, 162–174.

Ralston, P. M., Blackhurst, J., Cantor, D. E., & Crum, M. R. (2015). “A structure–conduct–performance perspective of how strategic supply chain integration affects firm performance”. Journal of Supply Chain Management, 51 No(2), 47–64.

Rosenbloom, R. S. (2000). “Leadership, capabilities, and technological change: the transformation of NCR in the electronic era”. Strategic Management Journal, 21 No, 10–11.

Russell, C. J. (2015). “Is it Time to voluntarily turn over theories of Voluntary turnover?“. Industrial and Organizational Psychology, 6 No(2), 156–173.

Ruzo-Sanmartín, E., Abousamra, A. A., Otero-Neira, C., & Svensson, G. (2022). The impact of the relationship commitment and customer integration on supply chain performance. Journal of Business & Industrial Marketing, 38(4), 943–957. https://doi.org/10.1108/jbim-07-2021-0349

Sabara, Z., Soemarno, S., Leksono, A., & Tamsil, A. (2019). The effects of an integrative supply chain strategy on customer service and firm performance: an analysis of direct versus indirect relationships. Uncertain Supply Chain Management, 7(3), 517–528.

Sampaio, C. A. F., Hernández-Mogollón, J. M., & Rodrigues, R. G. (2019). Assessing the relationship between market orientation and business performance in the hotel industry ? the mediating role of service quality. Journal of Knowledge Management, 23(4), 644–663. https://doi.org/10.1108/JKM-08-2017-0363

Sanders, N. R. (2007). “The benefits of using E-business technology: the supplier perspective”. Journal of Business Logistics, 28 No(2), 177–207.

Schilke, O. (2014a). “On the contingent value of dynamic capabilities for competitive advantage: the nonlinear moderating effect of environmental dynamism”. Strategic Management Journal, 35 No(2), 179–203.

Schilke, O. (2014b). “Second-order dynamic capabilities: how do they matter?“. The Academy of Management Perspectives, 28 No(4), 368–380.

Schulze, A., Townsend, J. D., & Talay, M. B. (2022). Completing the market orientation matrix: The impact of proactive competitor orientation on innovation and firm performance. Industrial Marketing Management, 103, 198–214.

Setyadi, A. (2019). “Does green supply chain integration contribute towards sustainable performance?“. Uncertain Supply Chain Management, 7 No(2), 121–132.

Shah, S. A. A., Jajja, M. S. S., Chatha, K. A., & Farooq, S. (2020). “Servitization and supply chain integration: an empirical analysis”. International Journal of Production Economics, 229, 107765.

Shin, S., & Aiken, K. D. (2012). “The mediating role of marketing capability: evidence from korean companies”. Asia Pacific Journal of Marketing and Logistics, 24 No(4), 658–677.

Stevens, G. (1989). “Integrating the supply chain”. International Journal of Physical Distribution & Materials Management, 19 No(8), 3–8.

Svensson, G. (2002). “Supply chain management: the re-integration of marketing issues in logistics theory and practice”. European Business Review, 14 No(6), 426–436.

Swink, M., Narasimhan, R., & Wang, C. (2007). “Managing beyond the factory walls: effects of four types of strategic integration on manufacturing plant performance”. Journal of Operations Management, 25 No(1), 148–164.

Tang, Y. M., Chau, K. Y., Ip, Y. K., & Ji, J. (2022). Empirical research on the impact of customer integration and information sharing on supply chain performance in community-based homestays in China. Enterprise Information Systems, 1–26. https://doi.org/10.1080/17517575.2022.2037161

Taghvaee, S., & Talebi, K. (2022, 2022/02/02/). Market orientation in uncertain environments: The enabling role of effectuation orientation in new product development. European Management Journal. https://doi.org/10.1016/j.emj.2022.01.005

Teece (2016). “Dynamic capabilities and entrepreneurial management in large organizations: toward a theory of the (entrepreneurial) firm”. European Economic Review, 86, 202–216.

Teece, Pisano, G., & Shuen, A. (1997). “Dynamic capabilities and strategic management”. Strategic Management Journal, 18 No(7), 509–533.

Teece, D. J. (2007). “Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance”. Strategic Management Journal, 28 No(13), 1319–1350.

Teece, D. J. (2014). “The foundations of enterprise performance: dynamic and ordinary capabilities in an (economic) theory of firms”. The Academy of Management Perspectives, 28 No(4), 328–352.

Tinoco, F. F. O., Hernández-Espallardo, M., & Rodriguez-Orejuela, A. (2020). “Nonlinear and complementary effects of responsive and proactive market orientation on firms’ competitive advantage”. Asia Pacific Journal of Marketing and Logistics, 32 No(4), 841–859.

Tipu, S. A. A., & Fantazy, K. (2020). Effects of the attributes of supply chain openness on sustainable supply chain performance. International Journal of Productivity and Performance Management, 69(9), 2047–2068.

Vergne, J.-P., & Durand, R. (2011). The path of most persistence: An evolutionary perspective on path dependence and dynamic capabilities. Organization Studies, 32(3), 365–382.

Vickery, S. K., Koufteros, X., & Droge, C. (2013). “Does product platform strategy mediate the effects of supply chain integration on performance? A dynamic capabilities perspective”. IEEE Transactions on Engineering Management, 60 No(4), 750–762.

Wang, Y., Zhang, H., & Song, M. (2020). Pure or ambidextrous strategy? A study of responsive and proactive market orientations in industrial firms. Journal of Business & Industrial Marketing, 35(6), 1001–1010. https://doi.org/10.1108/JBIM-04-2019-0152

Wilden, R., & Gudergan, S. P. (2015). The impact of dynamic capabilities on operational marketing and technological capabilities: investigating the role of environmental turbulence. Journal of the Academy of Marketing Science, 43(2), 181–199.

Wilson, G. A., & Liguori, E. (2022). Market orientation, failure learning orientation, and financial performance. Journal of Small Business Management, 1–19.

Wisner, J. (2003). “A structural equation model of supply chain management strategies and firm performance”. Journal of Business logistics, 24 No(1), 1–26.

Xian, K. J., Sambasivan, M., Abdullah, A. R., & J. I. (2018). J. o. I. S. M. “Impact of market orientation, learning orientation, and supply chain integration on product innovation”, Vol. 12 No. 1–2, pp. 69–89.

Yang, D., Wei, Z., Shi, H., & Zhao, J. (2020). Market orientation, strategic flexibility and business model innovation. Journal of Business & Industrial Marketing, 35(4), 771–784. https://doi.org/10.1108/JBIM-12-2018-0372

Yu, W., Jacobs, M. A., Salisbury, W. D., & Enns, H. (2013). “The effects of supply chain integration on customer satisfaction and financial performance: an organizational learning perspective”. International Journal of Production Economics, 146 No(1), 346–358.

Zhao, G., Feng, T., & Wang, D. (2015). “Is more supply chain integration always beneficial to financial performance?“. Industrial Marketing Management, 45, 162–172.

Zhou, W., Su, D., Yang, J., Tao, D., & Sohn, D. (2021, 2021/01/10/). When do strategic orientations matter to innovation performance of green-tech ventures? The moderating effects of network positions. Journal of Cleaner Production, 279, 123743. https://doi.org/10.1016/j.jclepro.2020.123743