Abstract

Due to growing concerns regarding sustainability, purchasing decisions are challenging and difficult tasks for decision-makers. This difficulty has compelled purchasing companies to know and understand the whole purchasing process and to give importance to purchasing associated decisions. A long-term relationship and investment are required for purchasing decisions because they impact significantly on a company’s performance and supply chain. Hence, supplier selection and sourcing strategy selection decisions are among a firm’s most important problems. In this study, sourcing strategy decisions include supplier development, which helps suppliers to improve their performance, and supplier switching, which searches for more proficient alternatives for supply. To solve these problems, this study provides an integrated multi-criteria decision-making (MCDM) model. The model contains four stages. First, the right set of sustainable key performance indicators (SKPIs) for evaluating the performance of suppliers is identified through a literature survey and discussions with the decision-making team. Second, the best worst method-measurement of alternatives and ranking according to the compromise solution method (BWM-MARCOS) approach is applied to determine the priority weights of SKPIs and the priority weights of incumbent and new suppliers based on identified SKPIs. Third, a bi-objective mathematical model is developed to determine which optimum sourcing strategy and potential supplier should be chosen based on the priority of incumbent and new suppliers while optimizing cost and sustainable performance. Fourth, the mathematical model is solved using Epsilon constraint method and min–max fuzzy approach. The applicability and efficiency of the proposed integrated MCDM model is demonstrated with a real case study from a home appliance manufacturing company. The key findings reveal that the proposed model can be utilized for strategic and effective sourcing planning. One of the important contributions of this work is to provide suggestions for deciding the appropriate sourcing strategy for suppliers using the outputs of the mathematical model.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Over the years, procurement activities under the traditional arms’ length theory have been practiced by buyers for achieving the lowest possible price from their suppliers (Rezaei, 2016). But this objective leads to a large base of suppliers, increased switching of orders from one supplier to another and short-term contracts. In the long run, this theory is not sufficient to stay competitive in the market as the large part of procurement activities support a company’s inbound logistics and help in value creation (Rashidi et al., 2020). While traditional purchasing decisions are typically based only on cost, emerging market conditions integrate additional dimensions beyond the cost dimension. While Zero carbon or green focuses on environmental (Kannan et al., 2022a; Kannan et al., 2022b). Specifically, ‘sustainability’ is one popular dimension that has gained attention in purchasing decisions (Yazdani et al., 2021). Sustainability consists of economic, environmental, and social dimensions, also called the triple bottom line (3BL). Due to increasing interest and necessity of sustainability, a greater focus on purchasing decisions together with the aspects of sustainability is needed (Zhan et al., 2021).

A typical manufacturing company expends in purchasing inputs around 50% of its total earned revenue (Tong et al., 2022). Hence, over the long term, flawed decisions on procurement activities and a poor understanding of the cost of inputs will have a major impact on company performance, supply chain performance, and the financial stability of the company. Suppliers, being the foremost frontier of purchasing and supply management, emerge as important stakeholders in safeguarding companies from unsustainable behavior and their drive towards 3BL (Shang et al., 2022). Most of the time, unsustainable practices of suppliers affect the brand image and business of company negatively. For example, due to expired meat supplied by its suppliers in China, McDonald’s, the largest food supply chain, has faced criticism worldwide; their burger products are suspended in sites such as Shanghai, China and some in the United States. In developing countries, other incidents are noteworthy. Between December 2005 and November 2006, Wal-Mart stores sold shrimp supplied by Thailand based supplier. The supplier, certified by the Global Aquaculture Alliance, was accused of labor abuse. This incident tarnishes the image of Wal-Mart only because of its supplier’s action. Most of these and similar incidents highlight the lack of a well-structured procurement process in the forward supply chain and an improper installation of their suppliers. Hence, companies need to be more cautious in supplier base audit to evade the problems that may hamper their business and brand image. Also, there is often a conflict between sustainability and traditional objectives of the purchasing company because of customers, nonprofit organizations, and shareholders (Schramm et al., 2020). Hence, it is a major concern for purchasing companies specifically to know and understand the whole purchasing process when it comes to sourcing and supplier selection decisions.

Many multinational companies that function in developed countries rely on developing countries for their supply parts to attain low-cost advantage. Because some developing countries indulge in various unsustainable practices—child and bonded labor, poor health and safety, pollution production etc.—purchasing companies are not able to fulfill the customer’s requirements (Alavi et al., 2021). Nevertheless, supplier selection decisions are crucial for purchasing companies in emerging economies to gain competitive advantage. Companies still struggle to decide if their suppliers can satisfy their requirements in terms of economic, environmental, and social aspects. As discussed through the examples, many companies face problems from the poor performance of their suppliers. Companies are always concerned whether their suppliers will fulfill their requirements, and if not, purchasing company decision-makers must evaluate what strategic sourcing decisions should be made. There are two sourcing strategies. The first strategy is supplier development. Supplier development entails all the activities that are necessary to improve the capabilities of suppliers. These activities include training sessions, resource sharing, joint capacity building, a strong information sharing system, machine upgrades, and so forth. To complete these activities, a supplier-specific and long-term investment is required, one that is distinct, cannot pass to another supplier easily, or be recovered by another buyer–supplier relationship. These investments provide long term benefits along with few risks (Sillanpää et al., 2015). The second strategy, termed supplier switching, consists of activities undertaken by the buying company to locate alternative sources of supply and to procure the raw material/semi-finished/ finished product from a more proficient supplier. Supplier switching is the process through which a company chooses to switch the incumbent supplier with a new supplier. The new supplier should be more capable than the incumbent suppliers on the specified company’s requirements. While the enhanced capability is beneficial, this new relationship strategy does generate a risk because the alternate source of supply is essentially unknown for the company (Zhang et al., 2015). Thus, the decision of sourcing strategy selection for suppliers is complex. As supplier selection and sourcing strategy selection impacts the overall performance of company, these decisions are a notable challenge for the company.

The selection of these sourcing strategies is difficult for purchasing managers due to conflicts in objectives and performance measures of several suppliers (Ghadimi et al., 2017). Although many studies have explored the several approaches for supplier selection decisions, most of them are based on traditional parameters such as cost, lead time, reliability, etc. (Mukherjee, 2017). The exploration of environmental and social parameters in emerging economies is much less rare. This creates a need of a well-structured supplier performance evaluation framework and optimization model to handle the trade-off between conflicting objectives. Hence, in this study, we seek to mitigate this gap by providing the parameters of economic, environmental, and social dimensions with a reliable approach for evaluating the performance of suppliers on these parameters. An optimization model is developed for the optimal sourcing strategy selection for suppliers.

With this background in mind, this study addresses the following research questions: (1) What is the right set of SKPIs for evaluating the performance of suppliers? (2) What are the priorities of suppliers based on these SKPIs? and (3) Which optimum sourcing strategy and potential supplier should be chosen based on the priority of incumbent and new suppliers while optimizing cost and sustainable performance?

By answering the above-mentioned research questions, this study can fill the gaps identified in existing literature. Hence, the objectives of this study are framed as follows:

-

(a)

To identify SKPIs for supplier performance evaluation.

-

(b)

To develop and propose integrated BWM-MARCOS approach in determining the priority weights of SKPIs and priority weights of incumbent and new suppliers based on identified SKPIs.

-

(c)

To build an optimization model to determine the optimum sourcing strategy and investment cost for each supplier while optimizing cost and sustainable performance.

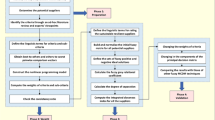

The uniqueness of proposed optimization model lies in providing an integrated MCDM framework that can help manufacturing companies in making critical decisions of optimal selection of sourcing strategy, supplier selection, and investment cost for each supplier. The novelty of the model lies in minimizing cost and maximizing sustainable performance simultaneously. The novel integrated MCDM model that is developed consists of four stages. In stage 1, the SKPIs for supplier evaluation are identified. In the next stage, the SKPIs are evaluated using BWM. After that, an examination of suppliers with respect to SKPIs and a computation of the weights of both incumbent and new suppliers is done using MARCOS. In stage 3, an optimization model is developed to select the optimum sourcing strategies and suppliers as well as investment cost for each supplier. This model is based on the evaluation weights of incumbent and new suppliers while optimizing cost and sustainable performance. In the final stage, the optimization model is solved to provide optimal solutions by using Epsilon constraint method and fuzzy approach.

The remainder of the paper is structured as follows: Sect. 2 discusses the literature review related to the current study. Section 3 describes the addressed problem. Section 4 proposes a novel integrated MCDM model. The implementation of proposed model is pursued in Sect. 5. Section 6 provides discussion. Section 7 outlines managerial implications of the study. Section 8 summarizes the conclusion.

2 Literature review

In this study, the literature review is classified into four parts. The first part includes the literatures on performance evaluation indicators of suppliers. The second part presents the studies on sourcing decisions. The third part explores the works on supplier selection models. In the last, the research gap is discussed.

2.1 Performance evaluation indicators of suppliers

Suppliers play a critical role in the supply chain, and they have major impact on the performance of a company; accordingly, a rigorous and robust process is required for their evaluation and selection (Dey et al., 2015). Many studies have been proposed for supplier performance evaluation under traditional management environments (Bevilacqua & Petroni, 2002; Chen, 2011). For example, Dickson (1966) identified 23 traditional performance evaluation indicators for supplier evaluation and derived that quality, delivery, and performance history are top ranked performance indicators. Schmitz and Platts (2004) suggested a number of evaluation indicators, including suppliers' strategic planning, learning competence, coordination capability, information management, positiveness, priority decision capability, and relationship with other suppliers. In another study, Chen (2011) derived traditional key performance evaluation indicators for supplier evaluation decisions. Based on a comprehensive review, quality, technology and production, organization management and cost are considered as essential evaluation indicators for supplier performance evaluation in their study. Although the choice of traditional performance indicators for supplier evaluation is still crucial, with an increasing concern towards sustainability, companies seek sustainability and evaluate their suppliers through sustainable lens (Zimmer et al., 2016; Bartos et al., 2022). This incorporates the triple bottom line approach that consists of economic, environmental, and social dimensions in the supplier evaluation process, and it embraces a broader range of evaluation indicators for suppliers. Many studies have identified the need for environmental and social indicators in supplier evaluation and selection decisions (Jain & Singh, 2020; Luthra et al., 2017; Orji & Wei, 2015; Vahidi et al., 2018). Ghadimi et al. (2017) reported environmental and social key performance indicators based on supply chain practices for supplier selection. They presented four main indicators by which performance is gauged in the environmental dimension: green image, pollution control, green competencies, and green design. For the social dimension, the main performance indicators include health and safety, employment practices, local community influence, and contractual stakeholders’ influence. However, social sustainability performance differs due to the diversity of trends and traits all over the world; computing social performance is more difficult than ranking economic or environmental dimensions (Mani et al., 2014). Hence, Bai et al. (2019) proposed a study to provide social sustainability indicators for supplier evaluation. A lack of uniformity of indicators in supplier performance evaluation process can be clearly seen in the existing literature. In this study, key performance indicators for sustainable supplier performance evaluation and selection are provided; our resources have strategic intent and are based on the requirements of the business and the company to fill this gap.

2.2 Sourcing decisions

Over the years, academic attention to sourcing decisions, particularly in the research area of supplier selection, has increased due to global competitiveness (Burke et al., 2009). Glock et al. (2017) addressed the importance of suppliers by considering their key role in the buying company’s performance. They stated that with limited alternatives, suppliers’ performance directly affects the competitive position of the company. Sourcing decisions should be based on conditions that align with the requirements and goals of the company (Merzifonluoglu, 2015). Whenever a supplier is not able to satisfy the requirements of the buying company, two sourcing decisions are considered: either supplier development or supplier switching options are researched in the literature (Friedl & Wagner, 2012). Many studies address supplier development (Blome et al., 2014; Humphreys et al., 2004; Modi & Mabert, 2007) and supplier switching (Demski et al., 1987; Wanger and Friedl, 2007; Zhang et al., 2015) individually. For supplier development, Xu and Xiang-Yang (2007) developed a model for supplier selection under supplier development orientation. Calvi et al. (2010) explored supplier evaluation and selection for strategic supplier development. Diouf and Kwak (2018) proposed a framework for supplier selection and development in the publishing and printing industry. In addition, van der Westhuizen and Ntshingila (2020) examined the effect of supplier development on company’s business performance. On the other hand, Wanger and Friedl (2007) proposed a research study on supplier switching as a sourcing decision for purchasing the product. Wu (2009) analyzed supplier selection under consideration of supplier switching options. Mir et al. (2017) observed a phenomenon that addresses the inertness of supplier switching decision. Uluskan et al. (2017) studied supplier switching decisions that influenced the cost effective and competitive strategies of buying company. Holma et al. (2021) conceptualized a theoretical framework for the supplier switching decision process. There are few studies that considered both sourcing strategies collectively in the literature. Friedl and Wanger (2012) proposed a study that compares supplier development and supplier switching strategies simultaneously. Jafarian et al. (2021) studied the problematic suppliers under risk and decided the best option by considering both strategies. As discussed, most studies are empirical or theoretical in nature and the adoption of sustainability with these sourcing decisions is uncommon in literature. To bridge this gap, this study proposed an integrated MCDM model that will provide the answer for a sourcing strategy of each supplier of the buying company under sustainability.

2.3 Supplier selection models

In the literature, since supplier are assessed from different viewpoints, several multi-criteria decision-making (MCDM) models have been proposed for supplier selection. Zimmer et al. (2016) reviewed a literature of various supplier selection models in the view of sustainability and concluded that most of the models are MCDM based. There are number of studies that have utilized individual decision-making models; some involve AHP (Mani et al., 2014), ANP (Önder & Kabadayi, 2015), TOPSIS (Boran et al., 2009), BWM (Rezaei et al., 2016), DEMATEL (Hsu et al., 2013; Kannan, 2021), ISM (Sonar et al., 2022), VIKOR (Amiri et al., 2011), DEA (Dobos & Vörösmarty, 2014), ELECTRE (Fei et al., 2019), QFD (Tidwell & Sutterfield, 2012), PROMETHEE (Abdullah et al., 2019), mathematical programming (Kazemi et al., 2015), fuzzy set theory (Amid et al., 2011), neural networks (Thongchattu & Siripokapirom, 2010) and genetic algorithms (Hashim et al., 2017). Apart from these individual MCDM models, lots of studies on integrated models have been proposed such as AHP-Entropy-TOPSIS (Freeman & Chen, 2015), QFD-ANP (Bottani et al., 2018), BWM-COPRAS (Qin & Liu, 2019), DEA-PCA-VIKOR (Karami et al., 2021), Fuzzy-entropy (Rahimi et al., 2021), Neural networks—Fuzzy VIKOR (Bahadori et al., 2020), Fuzzy AHP - TOPSIS - FIS (Mina et al., 2021), Fuzzy AHP- DEMATEL (Lahane & Kant, 2021), etc. Some recent research examples on supplier selection models are cited. Hamdan and Cheaitou (2017) proposed a three-stage supplier selection model in which fuzzy TOPSIS-AHP is utilized for computing the weights of suppliers and the weighted comprehensive criterion method, the branch-and-cut algorithm is utilized to solve the optimization model for supplier selection. Mohammed et al. (2019) developed a hybrid MCDM-model (FAHP-TOPSIS-Epsilon constraint) to solve the supplier selection problem. Rezaei et al. (2020) constructed a four-phase MCDM model in which FAHP is applied to evaluate the performance of suppliers, and mathematical programming is utilized to select the supplier. However, the existing studies described models to rank or select them without considering the supplier development cost and supplier switching cost. Further, no study develops a hybrid MCDM model that considers the selection of sourcing strategy along with supplier selection. To address this gap, a novel supplier selection model is proposed in this study that utilizes BWM-MARCOS to determine the priority weights of SKPIs and priority weights of incumbent and new suppliers based on identified SKPIs and Epsilon constraint method; a min–max fuzzy approach is applied to provide optimal solutions of the bi-objective optimization model. Hence, the novelty of this paper is that it brings different OR techniques together an applied context of supplier selection and supplier sourcing strategy selection models.

3 Research gap

A few gaps are addressed in the above discussed literature. These are summarized as follows:

-

(i)

The selection of appropriate suppliers for procuring raw material/components/semi-finished goods/finished goods serves as a noticeably strategic decision for any company. In this domain, the literature reveals a lack of uniformity in defining the assessment and selection process of suppliers and in identifying performance indicators of suppliers to select the best supplier. Hence, this study contributes by providing the right and uniform set of key performance indicators for sustainable supplier performance evaluation and selection that can fulfill the requirements of the business and the company.

-

(ii)

As discussed, the most of studies select the best supplier without considering sourcing decisions of supplier development and supplier switching in literature. The contribution of this research is done by providing an integrated MCDM model that will help decision makers in deciding the appropriate sourcing strategy for the suppliers of the buying company in the view of sustainability.

None of the reviewed studies built an optimization model that can determine the optimum sourcing strategy and investment cost for each supplier while optimizing cost and sustainable performance. This gap is overcome in this study by developing the optimization model under the same mentioned conditions.

4 Case description

The problem of an India-based home appliance manufacturing company of washing machine products is considered in this study. It has multiple facilities throughout India. The case company is sustainability driven and committed towards customer satisfaction by providing high quality goods and services. To avoid disclosure of the original identity of the manufacturing company, it is simply called ‘XYZ’ company throughout this study. Its turnover is recorded at around 5,000 crore rupees in the financial year 2019–2020 and more than 2000 people are engaged in its workforce. Its supply chain consists of suppliers, manufacturers, distributors, retailers, and end customers. The company offers refrigerators, washing machines, air conditioners, microwave ovens, purifiers, and kitchenware. The raw material/components are procured from suppliers by manufacturers, and the manufacturers facilitate an infrastructure to generate the finished products. Further, these products are sent to end customers via distributors and retailers. XYZ has a well-structured manufacturing process, extensive distribution network, and a good reputation in the market; its main SC strategy is customer responsiveness. There is a continuous monitoring and review process for all the operations in place which provides check points to XYZ for continuous improvement. As per its last audit result, the operational and financial performance of the company is above satisfactory. However, it has indicated few issues in the procurement procedure of their washing machine product, resulting in increased customer queries. The washing machine product is made up of 210 components. These components are classified into 8 classes such that components of similar nature are grouped together and are procured from the same set of suppliers. These classes are ‘Cabinet’, ‘Drum’, ‘Timer with harness’, ‘Motor’, ‘Aesthetical’ and ‘Small auxiliary parts’, ‘PP tub’ and ‘Rubber parts’. XYZ plans to look into the process of procurement of components in detail for all areas for scope of improvement. The company is already involved in periodic evaluation and monitoring of its suppliers to gain competitive advantage in the market. Detailed analysis and discussion of results of evaluation has suggested that some suppliers of certain classes of components are not able to fulfill company’s needs with respect to traditional attributes such as cost, quality, delivery, or service while some others are not following the protocols pertaining to environmental regulations and social norms.

Evidently, this calls for XYZ to focus on supplier selection strategies such as switching the incumbent non-performing suppliers with new ones and supplier development for long term relationship and partnership enhancement. In supplier development process, XYZ has to develop a supplier specific and cooperative investment package that is distinctive in nature and cannot be transferred to other suppliers or recovered in other supplier partnerships/relationships. In contrast, supplier switching would require XYZ to find an alternate supplier and to purchase components from this more capable supplier. The matter of concern which arises at this point is whether investment should be done in ‘supplier development’, to opt for ‘supplier switching,’ or to pursue a combination of both. Additionally, as all the classes of components of the washing machine are procured from the same suppliers, this decision has multi-fold impact on the SC performance. The advantage and success of each strategy depends on the nature of the case, available set of suppliers, performance level of suppliers, economic strength of the company, and willingness of suppliers to improve. Hence, to understand which sourcing strategy is best suited for our case study, a thorough research and analysis is required.

To maintain sustainability drive of case company, the performance evaluation of suppliers must be based on performance indicators that includes economic, environmental, and social dimensions such as quality, delivery, pollution production, resource consumption, health and safety, and the right of stakeholders. Further, the process of performance evaluation of suppliers with respect to SKPIs must incorporate the experts’ opinions to handle the conflicting nature of SKPIs. Clearly, it is a multi-dimensional problem where simultaneous consideration of multiple conflicting SKPIs for supplier’s performance evaluation are required along with an effective group decision making team of experts. In addition, these decisions must be integrated with other supply chain decisions such as production, inventory, and transportation, and they must be reached with the aim to simultaneously minimize the cost and maximize the sustainable performance of suppliers.

This calls for development of a supplier performance evaluation framework and optimization model to capture the trade-off between two conflicting objectives. Hence, the main aim of the study is to develop a supplier performance evaluation framework and build an optimization model to choose the appropriate sourcing strategy and investment cost for each supplier. To address the problem faced by the case company, a four-stage novel integrated MCDM model is proposed to accomplish supplier selection and appropriate sourcing strategy selection as well as making a cost-effective trade-off between sourcing strategies. In the first stage, SKPIs are identified for performance evaluation of potential suppliers. Further, integrated BWM-MARCOS approach is utilized for determining the priority weights of suppliers with respect to SKPIs. An optimization model is developed for the selection of suppliers and their respective sourcing strategies based on their performance on SKPIs in the third stage. In the last, Epsilon constraint method and fuzzy approach is utilized to provide the solution of optimization model. This model is elaborated in detail in Sect. 4.

5 Proposed integrated MCDM model

In this section, a novel model is proposed for selection of suppliers and their respective sourcing strategy with the aim of achieving a trade-off between objective functions and minimizing the cost and maximizing the sustainable performance of suppliers. The novel model is developed in following four stages: (i) identification of sustainable key performance indicators for supplier performance evaluation; (ii) determination of priority weights of suppliers; (iii) development of optimization model; (iv) solution approach for optimization model.

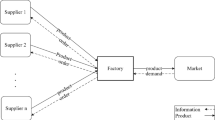

The supplier evaluation problem is represented as follows:

There are I incumbent suppliers, which are part of the set \(I = \left\{ {SI_{i} ,i = 1,2, \ldots ,I} \right\}\), from whom the manufacturer would consider collaborative purchasing in the near future. Also, J new suppliers (in case of switching), are part of set \(N = \left\{ {SN_{j} ,j = 1,2, \ldots ,J} \right\}\), defined for the same purpose.

The main target of this decision integrated MCDM model is for determining the priority weights of each supplier and selecting the appropriate suppliers as well as their respective sourcing strategy based on this proposed novel model.

Initially, the SKPIs are identified to evaluate the performance of potential set of suppliers. In the second stage, an integrated BWM-MARCOS approach is utilized for evaluation of supplier’s performance based on a number of economic, environmental, and social SKPIs. Here, BWM is applied for evaluation of SKPIs and MARCOS is utilized for supplier’s performance evaluation with respect to SKPIs. Next, a mixed integer linear programming mathematical model is formulated for the selection of suppliers and their respective sourcing strategies taking into account their performance on SKPIs. The multi-objective model decides the optimum sourcing strategy for each incumbent supplier, development areas of retrained incumbent supplier and investment planning for sourcing strategies. In the last stage, to generate the Pareto solutions of the multi objective model, Epsilon-constraint method is utilized. Then a fuzzy technique is applied to choose the optimal solution. To understand the basic concept of utilized methods in proposed model, a brief background discussion is available in “Appendix A”. The schematic view of proposed integrated MCDM model is shown in Fig. 1. The novelty of this figure is in developing an integrated MCDM model for helping manufacturing companies make crucial decisions of optimal sourcing strategy selection, supplier selection, and investment cost planning for each supplier as well as in minimizing cost and maximizing sustainable performance of suppliers simultaneously.

A detailed discussion of the stages involved in the proposed integrated MCDM model is represented below.

5.1 Stage 1: Identification of SKPIs for supplier performance evaluation

The purpose of stage 1 is to identify SKPIs for supplier performance evaluation that play an important role in supplier selection procedure and their performance assessment.

-

(a)

Formation of decision-making team for supplier evaluation

Initially, an expert panel is formed. K experts, denoted by set \(DM = \left\{ {DM_{k} ,k = 1,2, \ldots ,K} \right\}\), are selected from various departments to assist the expert panel in their decision making.

-

(b)

Identification of SKPIs for supplier evaluation

Further, the identification of SKPIs procedure begins with the help of literature and decision- making team. U SKPIs are denoted by the set of supplier performance evaluation indicators, \(SKPI = \left\{ {SKPI_{u} , u = 1,2, \ldots ,U} \right\}\) are identified. These SKPIs are divided into three categories: economic, environmental, and social (c = 1,2,3). The set of three categories SKPIs are denoted by \(SKPI^{Eco} = \left\{ {SKPI_{l}^{Eco} , l = 1,2, \ldots ,L, l \subseteq u} \right\}\), \(SKPI^{Env} = \left\{ {SKPI_{m}^{Env} , m = 1,2, \ldots ,M, m \subseteq u} \right\}\), and \(SKPI^{Soc} = \left\{ {SKPI_{n}^{Soc} , n = 1,2, \ldots ,N, n \subseteq u} \right\}\) respectively.

5.2 Stage 2: Determination of priority weights of suppliers

In this stage, the purpose is to achieve an appropriate approach to compute priority weights of suppliers with respect to identified SKPIs. BWM is used to calculate the weights of these SKPIs and then MARCOS is used to obtain the priority weights of suppliers with respect to each key performance indicator and aggregated priority wights of supplier. The detailed explanation of BWM and MARCOS is given in “Appendix A” (see section A.1.1.1, section A.1.1.2).

5.3 Stage 3: Development of optimization model

In this study, a multi-objective optimization model is developed to decide the optimal sourcing strategy for each supplier with respect to their sustainable performance and investment cost. The objectives are minimization of the cost and maximization of sustainable impact/performance. The assumptions, description of indices, parameters and variables as well as the formulation of the model are presented as follows:

Index

i | Set of incumbent suppliers |

j | Set of new suppliers |

u | Set of sustainable key performance indicators |

v | Set of development stages |

Parameters

\(C_{iuv}^{Devlop}\) | Development cost of vth development stage for ith incumbent supplier with respect to uth SKPI |

\(C_{j}^{Switch}\) | Financial loss due to switching to jth new supplier |

\(C_{j}^{Risk}\) | Cost of reducing per unit risk of switching to jth new supplier |

\(W_{i}^{Inc}\) | Weight of ith incumbent supplier |

\(W_{j}^{New}\) | Weight of jth new supplier |

\(W_{iu}^{Inc}\) | Weight of ith incumbent supplier with respect to uth SKPI |

\(Wbreak_{u}\) | Break value of uth SKPI for development strategy |

\(W_{THu}\) | Threshold of weight for supplier selection |

\(N^{Total}\) | Total required number of suppliers |

\(R_{j}^{New}\) | Risk of building new relationship with jth supplier |

R | Maximum allowable risk to build new relationship |

\(n_{T}^{{\prime }} \) | Total required number of SKPIs that satisfy condition (\(W_{iu}^{Inc} \ge W_{THu} )\) for incumbent supplier retention |

\(Q_{u} { }\) | \(\left\{ {\begin{array}{*{20}l} 1 \hfill & {if\,u{\text{th}} \,SKPI\,{\text{can}}\,{\text{be}}\,{\text{developed}}} \hfill \\ 0 \hfill & {otherwise } \hfill \\ \end{array} } \right.\) |

Variables

\(X_{i}^{Inc}\) | \(\left\{ {\begin{array}{*{20}l} 1 \hfill & {i{\text{th}}~\,{\text{incumbent~}}\,{\text{supplier}}\,{\text{is}}\,{\text{retained}}} \hfill \\ 0 \hfill & {i{\text{th}}\,{\text{incumbent}}\,{\text{supplier}}\,{\text{is}}\,{\text{switched}}} \hfill \\ \end{array} } \right.\) |

\(Y_{j}^{New}\) | \(\left\{ {\begin{array}{*{20}l} 1 \hfill & {j{\text{th}}~\,{\text{new}}\,{\text{supplier}}\,{\text{is}}\,{\text{selected}}} \hfill \\ 0 \hfill & {{\text{otherwise}}} \hfill \\ \end{array} } \right.\) |

\(Z_{iuv}^{Inc}\) | \(\left\{ {\begin{array}{*{20}l} 1 \hfill & {\text{If}}\,i{\text{th}} \,{\text{incumbent}}\,{\text{supplier}}\,{\text{lies}}\\ &\quad {\text{within}}\,v{\text{th}} \,{\text{development}}\,{\text{stage}}\,{\text{with}}\,{\text{respect}}\,{\text{to}}\,u{\text{th}} \,{\text{SKPI}} \hfill \\ 0 \hfill & {{\text{otherwise}}} \hfill \\ \end{array} } \right.\) |

\(N^{Inc}\) | Number of selected incumbent suppliers |

\(X_{iu}^{Inc}\) | \(\left\{ {\begin{array}{*{20}l} 0 \hfill & {\text{The }}\,{\text{weight }}\,{\text{of}} \,i{\text{th}} \,{\text{incumbent}}\,{\text{supplier}}\,{\text{with}}\,{\text{respect}}\,{\text{to}}\\ &\quad \,u{\text{th}} \,{\text{SKPI}}\,{\text{is}}\,{\text{greater}}\,{\text{than}}\,{\text{than}}\,{\text{the}}\,{\text{thresold }}\,{\text{weight}}\,{\text{of}}\,u{\text{th}} \,{\text{SKPI}} \hfill \\ 1 \hfill & {{\text{otherwise}}} \hfill \\ \end{array} } \right.\) |

\(P_{i}\) | The sum of \(X_{iu}^{Inc}\) for \(i{\text{th}} {\text{incumbent supplier}}\) |

Objective Functions:

The objective \(Z_{1}\) aims to minimize the sum of development cost with respect to each development key performance indicator for each retained incumbent supplier. This includes financial loss due to switching to a new supplier (i.e., travel cost, lost time cost due to travel, internal inspection cost, external inspection cost, internal test cost, external test cost, print change cost, tooling and amortization cost) and the cost of reducing risk generated by switching to a new supplier.

The objective \(Z_{2}\) aims to maximize the sustainable performance of suppliers. To this aim, the weights of suppliers are obtained by MARCOS method.

Constraints:

Risk constraint

This constraint ensures that the risk of building relationship with new suppliers is less than or equal to the maximum allowable risk of relationship development with new suppliers.

Number of selected incumbent and new suppliers’ constraints

These constraints ensure the total number of selected incumbent and new suppliers should be equal to the total required number of suppliers.

Supplier threshold constraints

These constraints ensure that the weight of retained incumbent supplier should be greater than or equal to threshold weight.

Supplier development strategy selection constraints

These constraints decide the development stage of each development key performance indicator for each retained incumbent supplier.

5.4 Stage 4: Solution of optimization model

In the Multiple Objective Decision Making (MODM) problem, the simultaneous optimization of all conflicting objectives subject to constraints is quite difficult. In this regard, the Epsilon-constraint method is applied to solve the proposed optimization model and to find a set of feasible solutions (Pareto solutions). The steps of Epsilon-constraint method are outlined in “Appendix A” (see section A.1.2.1). To decide the best compromised solution from the generated Pareto optimal solutions, a max–min fuzzy method is utilized. In “Appendix A” (see section A.2), a detailed discussion of the max–min fuzzy method is provided.

6 Proposed model implementation

The main aim of the proposed integrated MCDM model is to resolve a procurement problem of washing machine products in an Indian home appliance manufacturing firm. The considered problem is described in detail in Sect. 3. The proposed integrated model provides a well-defined supplier performance evaluation framework and an optimization model for choosing the appropriate sourcing strategy and investment cost for each supplier while simultaneously optimizing objectives (minimizing cost and maximizing sustainable performance) of suppliers. In this section, the application of proposed integrated model is illustrated. The details of suppliers considered in the case study are as follows: 11 incumbent suppliers are defined, part of the set \(SI = \left\{ {SI_{i} ,i = 1,2, \ldots ,11} \right\}\) from whom the case company would consider collaborative purchasing. Also, 5 new suppliers (in case of switching), part of the set \(SN = \left\{ {SN_{i} ,i = 1,2, \ldots ,5} \right\}\) are defined for the same purpose. The detailed proposed integrated model implementation is given as follows:

6.1 Stage 1: Identification of SKPIs for supplier performance evaluation

The purpose of stage 1 is to identify SKPIs for supplier performance evaluation that plays an important role in supplier selection procedure and their performance assessment.

(a) Formation of decision-making team for supplier evaluation

Initially, an expert panel is formed. The selected members of expert panel are experienced, familiar with the current study and work within the case company. Five experts, denoted by set \(DM = \left\{ {DM_{a} ,a = 1,2, \ldots ,5} \right\}\), are selected for this study.

(b) Identification of sustainable SKPIs for supplier evaluation

Further, for evaluating these suppliers, a set of SKPIs is derived from the literature survey and discussion with expert panel. 17 SKPIs, denoted by set SKPIs = \(\left\{ {SKPI_{U} ,U = 1,2, \ldots ,17} \right\}\) are finalized and divided into three categories (economic, environmental, and social) sub-SKPIs. The set of economic, environmental, and social sub-SKPIs are \(SKPI^{Eco} = \left\{ {SKPI_{L}^{Eco} ,L = 1,2, \ldots ,8} \right\}\), \(SKPI^{Env} = \left\{ {SKPI_{M}^{Env} ,M = 1,2, \ldots ,6} \right\}\), and \(SKPI^{Soc} = \left\{ {SKPI_{N}^{Soc} ,N = 1,2,3} \right\}\) respectively. The final list of SKPIs is presented in Table 1.

Due to financial restrictions and the nature of key performance indicators, incumbent suppliers cannot get developed at each key performance indicator. Hence, SKPIs are identified from the list of identified key performance indicators the company wants to develop for supplier performance enhancement. That list may include quality, delivery, technical capability, flexibility, pollution production, pollution control, environmental management system, green innovativeness, safety and health, the interests and rights of employees, and the rights of stakeholders.

6.2 Stage 2: Determination of priority weights of suppliers

In this stage, the purpose is to achieve an appropriate approach to compute priority weights of suppliers with respect to identified SKPIs. BWM is used to calculate the weights of these SKPIs and then MARCOS is used to obtain the priority weights of suppliers with respect to each key performance indicator and aggregated priority weights of suppliers. The detailed explanation of these steps is given as follows:

-

(a)

Determination of weights of SKPIs using BWM

For determining the priority weights of SKPIs, 5 experts who work with the case company are interviewed to collect the pairwise comparison matrix data for BWM. Next, the priority weights of categories and SKPIs with respect to each category are computed using the BWM process as explained in “Appendix A” (see section A.1.1.1) for each expert. For the final weights, aggregation is done by using simple average. The results are consistent as the consistency ratios are almost close to zero. The procedure of determination of weights of SKPIs is explained briefly as follows:

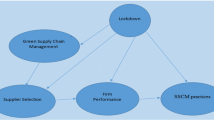

Initially, the steps of BWM are performed for the KPIs of first category (economic). The final optimal weights of the KPIs of economic category are \(w_{1}^{Eco} = 0.126, w_{2}^{Eco} = 0.312,w_{3}^{Eco} = 0.233,w_{4}^{Eco} = 0.103,w_{5}^{Eco} = 0.080,w_{6}^{Eco} = 0.051,w_{7}^{Eco} = 0.044 {\text{and}} w_{8}^{Eco} = 0.052\). Similarly, the weights of the KPIs for the environmental category, \(w_{1}^{Env} = 0.141, w_{2}^{Env} = 0.204, w_{3}^{Env} = 0.077, w_{4}^{Env} = 0.402, w_{5}^{Env} = 0.096{\text{ and }}w_{6}^{Env} = 0.081\), and the weights of the KPIs of the social category, \(w_{1}^{Soc} = 0.631, w_{2}^{Soc} = 0.258 {\text{and}} w_{3}^{Soc} = 0.112\), are calculated. These weights are shown in Fig. 2.

Further, the procedure is repeated for three categories and that determined the optimal weighting vector \(\left( {w^{Eco} = 0.731, w^{Env} = 0.203, w^{Soc} = 0.065} \right)\) as shown in Fig. 3.

The global weights of each SKPI are computed as explained in section A.1.1.1, i.e., \(w_{1}^{SKPI} = 0.092, w_{2}^{SKPI} = 0.228,w_{3}^{SKPI} = 0.170,w_{4}^{SKPI} = 0.075,w_{5}^{SKPI} = 0.058,\) \(w_{6}^{SKPI} = 0.037,w_{7}^{SKPI} = 0.032,w_{8}^{SKPI} = 0.038,w_{9}^{SKPI} = 0.029,w_{10}^{SKPI} = 0.041\) \(w_{11}^{SKPI} = 0.016,w_{12}^{SKPI} = 0.082,w_{13}^{SKPI} = 0.020,w_{14}^{SKPI} = 0.016,w_{15}^{SKPI} = 0.041,w_{16}^{SKPI} = 0.017,w_{17}^{SKPI} = 0.007\). The global weights of each SKPI are presented in Fig. 4.

-

(b)

Determination of priority weights of suppliers using MARCOS

After computing the weights of SKPIs, the application of MARCOS method, a decision matrix is developed for incumbent suppliers and new suppliers with respect to each expert. Next, the opinions of all experts are aggregated by taking average to form the initial decision matrix. Further, extended matrix is determined by computing AI and AAI solutions. Here, Price is treated as the cost SKPI while the remaining SKPIs are classified under the benefit SKPI group. By applying step 3 of section A.1.1.2, the extended matrix is normalized. Next, the weighted normalized matrix is computed by multiplying all the values of the normalized matrix with the priority weights of SKPIs, i.e., the output of BWM. The determined weights of incumbent suppliers with respect to each SKPI are \({W}_{11}^{Inc}\) = 0.245, \({W}_{12}^{Inc}\) = 0.035, \({W}_{13}^{Inc}\) = 0.041, \({W}_{14}^{Inc}\) = 0.023, \({W}_{15}^{Inc}\) = 0.036, \({W}_{16}^{Inc}\) = 0.016, \({W}_{17}^{Inc}\) = 0.036, \({W}_{18}^{Inc}\) = 0.016, \({W}_{19}^{Inc}\) = 0.066, \({W}_{110}^{Inc}\) = 0.032, \({W}_{111}^{Inc}\) = 0.047, \({W}_{112}^{Inc}\) =0.023, \({W}_{113}^{Inc}\) = 0.039, \({W}_{114}^{Inc}\) = 0.047, \({W}_{115}^{Inc}\) = 0.033, \({W}_{116}^{Inc}\) = 0.033, \({W}_{117}^{Inc}\) =0.024, \({W}_{21}^{Inc}\) = 0.069, \({W}_{22}^{Inc}\) = 0.079, \({W}_{23}^{Inc}\) = 0.079, \({W}_{24}^{Inc}\) = 0.081, \({W}_{25}^{Inc}\) = 0.081, \({W}_{26}^{Inc}\) = 0.080, \({W}_{27}^{Inc}\) = 0.081, \({W}_{28}^{Inc}\) = 0.080, \({W}_{29}^{Inc}\) = 0.048, \({W}_{210}^{Inc}\) = 0.050, \({W}_{211}^{Inc}\) = 0.047, \({W}_{212}^{Inc}\) =0.041, \({W}_{213}^{Inc}\) = 0.039, \({W}_{214}^{Inc}\) = 0.030, \({W}_{215}^{Inc}\) = 0.043, \({W}_{216}^{Inc}\) = 0.033, \({W}_{217}^{Inc}\) =0.062, \({W}_{31}^{Inc}\) = 0.069, \({W}_{32}^{Inc}\) = 0.079, \({W}_{33}^{Inc}\) = 0.079, \({W}_{34}^{Inc}\) = 0.081, \({W}_{35}^{Inc}\) = 0.081, \({W}_{36}^{Inc}\) = 0.080, \({W}_{37}^{Inc}\) = 0.081, \({W}_{38}^{Inc}\) = 0.080, \({W}_{39}^{Inc}\) = 0.109, \({W}_{310}^{Inc}\) = 0.113, \({W}_{311}^{Inc}\) = 0.106, \({W}_{312}^{Inc}\) =0.113, \({W}_{313}^{Inc}\) = 0.109, \({W}_{314}^{Inc}\) = 0.106, \({W}_{315}^{Inc}\) = 0.118, \({W}_{316}^{Inc}\) = 0.120, \({W}_{317}^{Inc}\) =0.120, \({W}_{41}^{Inc}\) = 0.042, \({W}_{42}^{Inc}\) = 0.130, \({W}_{43}^{Inc}\) = 0.130, \({W}_{44}^{Inc}\) = 0.126, \({W}_{45}^{Inc}\) = 0.140, \({W}_{46}^{Inc}\) = 0.138, \({W}_{47}^{Inc}\) = 0.140, \({W}_{48}^{Inc}\) = 0.138, \({W}_{49}^{Inc}\) = 0.109, \({W}_{410}^{Inc}\) = 0.113, \({W}_{411}^{Inc}\) = 0.106, \({W}_{412}^{Inc}\) =0.113, \({W}_{413}^{Inc}\) = 0.109, \({W}_{414}^{Inc}\) = 0.106, \({W}_{415}^{Inc}\) = 0.118, \({W}_{416}^{Inc}\) = 0.120, \({W}_{417}^{Inc}\) =0.120, \({W}_{51}^{Inc}\) = 0.245, \({W}_{52}^{Inc}\) = 0.029, \({W}_{53}^{Inc}\) = 0.029, \({W}_{54}^{Inc}\) = 0.029, \({W}_{55}^{Inc}\) = 0.023, \({W}_{56}^{Inc}\) = 0.035, \({W}_{57}^{Inc}\) = 0.029, \({W}_{58}^{Inc}\) = 0.042, \({W}_{59}^{Inc}\) = 0.022, \({W}_{510}^{Inc}\) = 0.041, \({W}_{511}^{Inc}\) = 0.038, \({W}_{512}^{Inc}\) =0.032, \({W}_{513}^{Inc}\) = 0.031, \({W}_{514}^{Inc}\) = 0.047, \({W}_{515}^{Inc}\) = 0.043, \({W}_{516}^{Inc}\) = 0.033, \({W}_{517}^{Inc}\) =0.024, \({W}_{61}^{Inc}\) = 0.069, \({W}_{62}^{Inc}\) = 0.079, \({W}_{63}^{Inc}\) = 0.079, \({W}_{64}^{Inc}\) = 0.081, \({W}_{65}^{Inc}\) = 0.081, \({W}_{66}^{Inc}\) = 0.080, \({W}_{67}^{Inc}\) = 0.081, \({W}_{68}^{Inc}\) = 0.080, \({W}_{69}^{Inc}\) = 0.031, \({W}_{610}^{Inc}\) = 0.041, \({W}_{611}^{Inc}\) = 0.047, \({W}_{612}^{Inc}\) =0.050, \({W}_{613}^{Inc}\) = 0.031, \({W}_{614}^{Inc}\) = 0.038, \({W}_{615}^{Inc}\) = 0.118, \({W}_{616}^{Inc}\) = 0.120, \({W}_{617}^{Inc}\) =0.120, \({W}_{71}^{Inc}\) = 0.069, \({W}_{72}^{Inc}\) = 0.079, \({W}_{73}^{Inc}\) = 0.079, \({W}_{74}^{Inc}\) = 0.081, \({W}_{75}^{Inc}\) = 0.081, \({W}_{76}^{Inc}\) = 0.080, \({W}_{77}^{Inc}\) = 0.081, \({W}_{78}^{Inc}\) = 0.080, \({W}_{79}^{Inc}\) = 0.109, \({W}_{710}^{Inc}\) = 0.113, \({W}_{711}^{Inc}\) = 0.106, \({W}_{712}^{Inc}\) =0.113, \({W}_{713}^{Inc}\) = 0.109, \({W}_{714}^{Inc}\) = 0.106, \({W}_{715}^{Inc}\) = 0.052, \({W}_{716}^{Inc}\) = 0.053, \({W}_{717}^{Inc}\) =0.053, \({W}_{81}^{Inc}\) = 0.069, \({W}_{82}^{Inc}\) = 0.079, \({W}_{83}^{Inc}\) = 0.079, \({W}_{84}^{Inc}\) = 0.081, \({W}_{85}^{Inc}\) = 0.081, \({W}_{86}^{Inc}\) = 0.080, \({W}_{87}^{Inc}\) = 0.081, \({W}_{88}^{Inc}\) = 0.080, \({W}_{89}^{Inc}\) = 0.039, \({W}_{810}^{Inc}\) = 0.023, \({W}_{811}^{Inc}\) = 0.038, \({W}_{812}^{Inc}\) =0.032, \({W}_{813}^{Inc}\) = 0.048, \({W}_{814}^{Inc}\) = 0.047, \({W}_{815}^{Inc}\) = 0.043, \({W}_{816}^{Inc}\) = 0.053, \({W}_{817}^{Inc}\) =0.033, \({W}_{91}^{Inc}\) = 0.042, \({W}_{92}^{Inc}\) = 0.143, \({W}_{93}^{Inc}\) = 0.130, \({W}_{94}^{Inc}\) = 0.146, \({W}_{95}^{Inc}\) = 0.134, \({W}_{96}^{Inc}\) = 0.145, \({W}_{97}^{Inc}\) = 0.127, \({W}_{98}^{Inc}\) = 0.145, \({W}_{99}^{Inc}\) = 0.162, \({W}_{910}^{Inc}\) = 0.186, \({W}_{911}^{Inc}\) = 0.166, \({W}_{912}^{Inc}\) =0.176, \({W}_{913}^{Inc}\) = 0.179, \({W}_{914}^{Inc}\) = 0.183, \({W}_{915}^{Inc}\) = 0.204, \({W}_{916}^{Inc}\) = 0.206, \({W}_{917}^{Inc}\) =0.206,\({W}_{101}^{Inc}\) = 0.040, \({W}_{102}^{Inc}\) = 0.137, \({W}_{103}^{Inc}\) = 0.143, \({W}_{104}^{Inc}\) = 0.139, \({W}_{105}^{Inc}\) = 0.127, \({W}_{106}^{Inc}\) = 0.132, \({W}_{107}^{Inc}\) = 0.134, \({W}_{108}^{Inc}\) = 0.125, \({W}_{109}^{Inc}\) = 0.109, \({W}_{1010}^{Inc}\) = 0.113, \({W}_{1011}^{Inc}\) = 0.106, \({W}_{1012}^{Inc}\) =0.113, \({W}_{1013}^{Inc}\) = 0.109, \({W}_{1014}^{Inc}\) = 0.106, \({W}_{1015}^{Inc}\) = 0.185, \({W}_{1016}^{Inc}\) = 0.196, \({W}_{1017}^{Inc}\) =0.206, \({W}_{111}^{Inc}\) = 0.042, \({W}_{112}^{Inc}\) = 0.130, \({W}_{113}^{Inc}\) = 0.130, \({W}_{114}^{Inc}\) = 0.133, \({W}_{115}^{Inc}\) = 0.134, \({W}_{116}^{Inc}\) = 0.132, \({W}_{117}^{Inc}\) = 0.127, \({W}_{118}^{Inc}\) = 0.132, \({W}_{119}^{Inc}\) = 0.197, \({W}_{1110}^{Inc}\) = 0.176, \({W}_{1111}^{Inc}\) = 0.191, \({W}_{1112}^{Inc}\) =0.195, \({W}_{1113}^{Inc}\) = 0.197, \({W}_{1114}^{Inc}\) = 0.183, \({W}_{1115}^{Inc}\) = 0.043, \({W}_{1116}^{Inc}\) = 0.033 and \({W}_{1117}^{Inc}\) =0.033 as shown in Fig. 5. The priority preferences of suppliers with respect to SKPIs are as follows:

for Price: \({SI}_{1}\) = \({SI}_{5}\) >\({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) = \({SI}_{7}\) = \({SI}_{8}\) >\({SI}_{4}\) =\({SI}_{9}\) =\({SI}_{11}\) > \({SI}_{10}\); for Quality: \({SI}_{9}\) > \({SI}_{10}\) >\({SI}_{11}\) = \({SI}_{4}\) > \({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) =\({SI}_{7}\) =\({SI}_{8}\) >\({SI}_{1}\) > \({SI}_{5}\); for Delivery: \({SI}_{10}\) > \({SI}_{11}\) =\({SI}_{9}\) = \({SI}_{4}\) > \({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) =\({SI}_{7}\) =\({SI}_{8}\) >\({SI}_{1}\) > \({SI}_{5}\); for Technical capability: \({SI}_{9}\) > \({SI}_{10}\) >\({SI}_{11}\) > \({SI}_{4}\) > \({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) =\({SI}_{7}\) =\({SI}_{8}\) >\({SI}_{5}\) > \({SI}_{1}\); for Flexibility: \({SI}_{4}\) > \({SI}_{9}=\) \({SI}_{11}\) >\({SI}_{10}\) > \({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) =\({SI}_{7}\) =\({SI}_{8}\) >\({SI}_{1}\) > \({SI}_{5}\); for Financial position: \({SI}_{9}\) >\({SI}_{4}>\) \({SI}_{11}\) =\({SI}_{10}\) > \({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) =\({SI}_{7}\) =\({SI}_{8}\) >\({SI}_{5}\) > \({SI}_{1}\); for Geographical location: \({SI}_{4}\) >\({SI}_{10}>\) \({SI}_{11}\) =\({SI}_{9}\) > \({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) =\({SI}_{7}\) =\({SI}_{8}\) >\({SI}_{1}\) > \({SI}_{5}\); for Market Reputation: \({SI}_{9}>{SI}_{4}\) >\({SI}_{11}>\) \({SI}_{10}\) > \({SI}_{2}\) = \({SI}_{3}\) = \({SI}_{6}\) =\({SI}_{7}\) =\({SI}_{8}\) >\({SI}_{5}\) > \({SI}_{1}\); for Pollution production: \({SI}_{11}\) > \({SI}_{9}\) > \({SI}_{10}\) = \({SI}_{7}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{1}\) > \({SI}_{2}\) >\({SI}_{8}\) >\({SI}_{6}\) > \({SI}_{5}\); for Pollution control: \({SI}_{9}\) > \({SI}_{11}\) >\({SI}_{10}\) =\({SI}_{4}\) = \({SI}_{3}\) = \({SI}_{7}\) > \({SI}_{2}\)> \({SI}_{5}\) =\({SI}_{6}\) >\({SI}_{1}\) > \({SI}_{8}\); for Resource consumption:: \({SI}_{11}\) > \({SI}_{9}\) > \({SI}_{10}\) = \({SI}_{7}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{1}\) = \({SI}_{2}\) =\({SI}_{6}\) >\({SI}_{8}\) = \({SI}_{5}\); for Environmental management system: \({SI}_{11}\) > \({SI}_{9}\) > \({SI}_{10}\) = \({SI}_{7}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{6}\) > \({SI}_{2}\) >\({SI}_{5}\) =\({SI}_{8}\) > \({SI}_{1}\); for Green competencies: \({SI}_{11}\) > \({SI}_{9}\) > \({SI}_{10}\) = \({SI}_{7}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{8}\) > \({SI}_{2}\) =\({SI}_{1}\) >\({SI}_{6}\) = \({SI}_{5}\); for Green innovativeness: \({SI}_{11}\) = \({SI}_{9}\) > \({SI}_{10}\) = \({SI}_{7}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{1}\) = \({SI}_{5}\) =\({SI}_{8}\) >\({SI}_{6}\) > \({SI}_{2}\); for Safety and health: \({SI}_{9}\) > \({SI}_{10}\) > \({SI}_{6}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{7}\)> \({SI}_{5}\) = \({SI}_{2}\) =\({SI}_{8}\) =\({SI}_{11}\) > \({SI}_{1}\); for The interests and rights of employees: \({SI}_{9}\) > \({SI}_{10}\) > \({SI}_{6}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{7}\)= \({SI}_{8}\) > \({SI}_{1}\) =\({SI}_{2}\) =\({SI}_{5}\) = \({SI}_{11}\); and for The right of stakeholders:: \({SI}_{9}\) = \({SI}_{10}\) > \({SI}_{6}\) = \({SI}_{4}\) = \({SI}_{3}\) > \({SI}_{2}\)> \({SI}_{7}\) > \({SI}_{8}\) =\({SI}_{11}\) >\({SI}_{5}\) = \({SI}_{1}\).

Further, the priority weights of incumbent and new suppliers with respect to SKPIs are computed by using the steps of the MARCOS method as explained in Sect. 4.1.1.1.2. The priority weights of incumbent suppliers,\({W}_{1}^{Inc}\) = 0.036,\({W}_{2}^{Inc}\) = 0.071, \({W}_{3}^{Inc}\) = 0.087, \({W}_{4}^{Inc}\) = 0.127, \({W}_{5}^{Inc}\) = 0.033, \({W}_{6}^{Inc}\) = 0.075, \({W}_{7}^{Inc}\) = 0.084, \({W}_{8}^{Inc}\) = 0.070, \({W}_{9}^{Inc}\) = 0.147, \({W}_{10}^{Inc}\) = 0.134 and \({W}_{11}^{Inc}\) = 0.135 as well as the priority weights of new suppliers \({W}_{1}^{New}\) = 0.291,\({W}_{2}^{New}\) = 0.120, \({W}_{3}^{New}\) = 0.254, \({W}_{4}^{New}\) = 0.120 and \({W}_{5}^{New}\) = 0.215, are shown in Figs. 6 and Fig. 7 respectively. The incumbent suppliers and new suppliers are arranged in descending order as per their priority weights are as follows: \({SI}_{9}\) > \({SI}_{11}\) >\({SI}_{10}\) > \({SI}_{4}\) > \({SI}_{3}\) > \({SI}_{7}\) > \({SI}_{6}\) >\({SI}_{2}\) >\({SI}_{8}\) >\({SI}_{1}\) > \({SI}_{5}\) and \({SN}_{1}>{SN}_{3}\) >\({SN}_{5}>\) \({SN}_{4}\) > \({SN}_{2}\), respectively.

These weights are utilized in the optimization model as developed in the next section.

6.3 Stage 3: Development of optimization model

In this section, the applicability of the developed optimization model is discussed through the case problem of the Indian home appliances manufacturing company. The data for the study is given as follows:

This data is associated with 11 incumbent suppliers, 5 new suppliers, 17 SKPIs, and 3 development stages (Advance development, Moderate development, and Primary Development) (Tables 2, 3).

6.4 Stage 4: Solution of optimization model using Fuzzy Epsilon-constraint method.

After data collection, the optimization model is tested. In this study, combined \(\varepsilon \)-constraint method and max–min fuzzy method is adopted for determining the best compromise solution between the conflicting objectives.

Initially, the payoff table is calculated by determining the individual optima of both objective functions with the help of lexicographic optimization. Here, Lingo 11 optimization software is used to produce the payoff table as shown in Table 4.

The minimum (Rs. 590,000) and maximum (Rs. 621,200) values of first objective function are computed by solving the first objective function (minimization of cost). Similarly, the minimum (14.39) and maximum (16.02) values of second objective function are computed by solving the second objective function (maximization of sustainable performance).

The proposed multi-objective model is solved by \(\varepsilon \)-constraint method. Further, ‘minimization of cost (Z1)’ objective function is considered as the main objective function and ‘maximization of sustainable performance (Z2)’ is treated as secondary objective function as per the company’s requirements. In summary, the best compromised solution is determined by satisfying both Z1 and Z2 objectives using max–min fuzzy method and highlighted in Table 5.

As the model seeks to minimize the cost and maximize the sustainable performance, the best compromised solution (highlighted in “Appendix B” (see Table 5)) is obtained: \({Z}_{1}\)= 605,000 (Rs.) and \({Z}_{2}\)= 15.18. A detailed discussion on obtained results is done in Sect. 6.

7 Discussion

To understand the effectiveness of the proposed integrated MCDM model, the detailed discussion on the outputs of MCDM stages (Stages II and IV) is necessary. To begin with, an understanding of supplier evaluation process can help in determining the priority of suppliers; further, an understanding of the conflicting objective functions can help in choosing the best suited sourcing strategy for supplier, development areas for retrained incumbent suppliers, and investment planning for sourcing strategies. The discussion on output of Stages II and IV is below.

7.1 Analysis on SKPIs

It can be seen clearly from Fig. 3, economic category (\({w}^{Eco}=0.731\)) is the most important SKPI category. The environmental category (\({w}^{Env}=0.203\)) is next, and the social category (\({w}^{Soc}=0.065\)) is the least important. Hence, the contributions of economic category are the most vital among the three categories. Aligned with the results found in Fig. 3, Khan et al. (2018) supported the results in their study and concluded that economic performance dimension is an imperative category that requires highest attention when the main objective of company is to become sustainable. This indicates that the economic category of sustainability can help to achieve sustainability goals of manufacturing company in the supplier selection process. This may mean that the performance of environmental and social categories can be attained, if the essential focus of sustainability relies on economic dimensions for supplier selection decisions (Kusi-Sarpong et al., 2019).

From Fig. 2, the results show that the most important SKPI for supplier performance evaluation are Quality (\({w}_{2}^{Eco}=0.312\)), Environmental management system (\({w}_{4}^{Env}=0.402\)), and Safety and health (\({w}_{1}^{Soc}=0.631\)) within economic, environmental, and social categories, respectively. This states that more efforts need to be put on these top ranked SKPIs for improving the contributions of all categories to overall sustainability.

Figure 4 represents the global weight of SKPIs. The top eight ranked SKPIs, within all three categories of sustainability that measure the supplier’s sustainability performance, are Quality (\({w}_{2}^{SKPI}=0.228\)), Delivery (\({w}_{3}^{SKPI}=0.170\)), Price (\({w}_{1}^{SKPI}=0.092\)), Environmental management system (\({w}_{12}^{SKPI}=0.082\)), Technical capability (\({w}_{4}^{SKPI}=0.075\)), Flexibility (\({w}_{5}^{SKPI}=0.058\)), Pollution control (\({w}_{10}^{SKPI}=0.041\)), and Safety and health (\({w}_{15}^{SKPI}=0.041\)). Among these eight top SKPIs, five are from the economic category SKPI, which confirms that an economic-centric focus is essential for achieving supplier sustainability (Lutra et al., 2017). Two environmental category SKPIs affirm that the manufacturing company has emerging concerns towards environmental sustainability for its suppliers (Zimmer et al., 2016). The one social category SKPI assures that social sustainability is vital for measuring and achieving supplier’s sustainability performance (Jain & Singh, 2020).

7.2 Analysis on suppliers’ sustainable performance

After understanding the priority of SKPIs as per the requirement of the case company, the performance of supplier on these SKPIs is analyzed using MARCOS method. Figure 5 clearly demonstrates that the priority of suppliers with respect to SKPIs are as follows:

Suppliers \({SI}_{1}\) and \({SI}_{5}\) are the best performer and supplier \({SI}_{10}\) is the worst performer in ‘Price’ SKPI. Supplier \({SI}_{9}\) performs strongly and supplier \({SI}_{5}\) performs poorly in ‘Quality’ SKPI. For ‘Delivery’ SKPI, the best performer and worst performer are supplier \({SI}_{10}\) and supplier \({SI}_{5}\) respectively. The performance of Supplier \({SI}_{9}\) is best whereas the performance of Supplier \({SI}_{1}\) is bad in ‘Technical capability’ SKPI. For ‘Financial position’ SKPI, Supplier \({SI}_{9}\)’s performance is superior and Supplier \({SI}_{1}\)’s performance is inferior. Supplier \({SI}_{4}\) exhibits great performance and supplier \({SI}_{5}\) shows poor performance in terms of the ‘Geographical location’ SKPI. Supplier \({SI}_{9}\) is the best performer and supplier \({SI}_{1}\) is the worst performer in ‘Market Reputation’ SKPI. Supplier \({SI}_{11}\) is a great performer and supplier \({SI}_{5}\) is a poor performer in ‘Pollution production’ SKPI. For ‘Pollution control’ SKPI, the best performer and worst performer are supplier \({SI}_{9}\) and supplier \({SI}_{8}\) respectively. The performance of Supplier \({SI}_{11}\) is best whereas the performance of Supplier \({SI}_{5}\) is bad in ‘Resource consumption’ SKPI. For ‘Environmental management system’ SKPI, Supplier \({SI}_{11}\)’s performance is superior and Supplier \({SI}_{1}\)’s performance is inferior. Supplier \({SI}_{11}\) is performing great and supplier \({SI}_{5}\) is performing poor in ‘Green competencies’ SKPI. The performance of Supplier \({SI}_{11}\) is best whereas the performance of Supplier \({SI}_{2}\) is bad in ‘Green innovativeness’ SKPI. For ‘Safety and health’ SKPI, Supplier \({SI}_{9}\) is performing great and supplier \({SI}_{1}\) is performing poor. Supplier \({SI}_{9}\) is the best performer and supplier \({SI}_{11}\) is the worst performer in ‘The interests and rights of employees’ SKPI. Supplier \({SI}_{9}\) is performing great and supplier \({SI}_{1}\) is performing poor in ‘The right of stakeholders’ SKPI.

Further, from Figs. 6 and 7, the priorities of companies towards their incumbent suppliers and new suppliers are clear. Incumbent supplier \({SI}_{9}\) has the best sustainable performance and Incumbent supplier \({SI}_{5}\) has the worst sustainable performance. In the set of new suppliers, company’s first choice is \({SN}_{1}\) and last choice is \({SN}_{2}\). But the selection of suppliers can not be done only as per company’s preference as company has conflicting objectives and many constraints. Hence, the results are determined with the help of an optimization model.

7.3 Analysis on optimization model results

It is difficult to ascertain which supplier is more important and needs to be selected as well as which of the sourcing strategies is most appropriate for suppliers, but the development of optimization model and its solution through Epsilon constraint method and min–max fuzzy method makes the supplier evaluation and selection process more relevant and analytical.

As the model seeks to minimize the cost and maximize the sustainable performance, the best compromised solution (highlighted in Table 5) is obtained: \({Z}_{1}\)= 605,000 (Rs.) and \({Z}_{2}\)= 15.18.

This indicates that the minimum total cost is 605000 (Rs.) and the maximum value of sustainable performance of supplier is 15.18. The results indicates that company can continue procurement from their incumbent suppliers \({SI}_{2}\), \({SI}_{3}\), \({SI}_{4}\), \({SI}_{6}\), \({SI}_{7}\), \({SI}_{9}\), \({SI}_{10}\) and \({SI}_{11}\) but they require assistance for their development. This finding also stands that the development cost is less than the switching cost for these retained incumbent suppliers. As model focuses on determining the development area, Supplier \({SI}_{2}\) requires advance development for Quality, Delivery—advance development, Technical capability, Flexibility, Pollution production, Pollution control, Environmental management system, Green innovativeness, Safety and health, The interests and rights of employees, and The rights of stakeholders. The development stage for Supplier \({SI}_{3}\) with respect to each SKPI is Quality- advance development, Delivery—advance development, Technical capability—advance development, Flexibility—advance development, Pollution production—advance development, Pollution control—advance development, Environmental management system—advance development, Green innovativeness—advance development, Safety and health—advance development, The interests and rights of employees—advance development, The rights of stakeholders—advance development. Supplier \({SI}_{4}\) belongs to advance development stage for Quality, Delivery—advance development, Technical capability, Flexibility, Pollution production, Pollution control, Environmental management system, Green innovativeness, Safety and health, The interests and rights of employees, and The rights of stakeholders. For supplier \({SI}_{6}\), the development stage for each SKPI is Quality—advance development, Delivery—advance development, Technical capability—advance development, Flexibility—advance development, Pollution production—advance development, Pollution control—advance development, Environmental management system—advance development, Green innovativeness—advance development, Safety and health—advance development, The interests and rights of employees—advance development, The rights of stakeholders—advance development. Supplier \({SI}_{7}\) belongs to advance development stage for Quality, Delivery—advance development, Technical capability, Flexibility, Pollution production, Pollution control, Environmental management system, Green innovativeness, Safety and health, The interests and rights of employees, and The rights of stakeholders. Supplier \({SI}_{9}\) requires advance development for Quality, Delivery—advance development, Technical capability, Flexibility, Pollution production, Pollution control, Environmental management system, Green innovativeness, Safety and health, The interests and rights of employees, and The rights of stakeholders. Supplier \({SI}_{10}\) comes under advance development stage for all development SKPIs. For supplier \({SI}_{11}\), the development stage for each SKPI is Quality—advance development, Delivery—advance development, Technical capability—advance development, Flexibility—advance development, Pollution production—advance development, Pollution control—advance development, Environmental management system—advance development, Green innovativeness—advance development, Safety and health—advance development, The interests and rights of employees—advance development, The rights of stakeholders—advance development.

For the remaining existing suppliers (\({SI}_{1}\), \({SI}_{5}\), and \({SI}_{8})\), the development cost is higher than the switching cost. Hence, company need to switch suppliers \({SI}_{1}\), \({SI}_{5,}\) and \({SI}_{8}\) and replace them with new suppliers \({SN}_{2}\), \({SN}_{3},\) and \({SN}_{5}\).

In summary, the above discussion confirms that the proposed integrated MCDM model is well suited for home appliance manufacturing companies in Indian context.

8 Managerial Implications

In the current study, the proposed integrated MCDM model highlights useful managerial implications for practitioners and academicians. The decision variables help the company to evaluate supplier sustainable performance, choose an appropriate sourcing strategy for each supplier, and determine vital development areas of incumbent suppliers. This awareness will help the company to improve their sustainability degree through their supply chain partner (supplier). This proposed integrated MCDM model addresses the various issues of supplier selection process and allows the experts of company and suppliers to think analytically and deeply. As results demonstrate, this proposed integrated MCDM model provides clarity to suppliers regarding most important SKPIs so that they can try to improve their sustainable performance. Based on the results of stage 2, companies might have clear vision towards priorities of their suppliers, and they can measure it. From the output of stage 4, companies may confidently decide which supplier needs to be switched or developed. In some cases, it might be more profitable to choose supplier switching option and, in some cases, supplier development option might be more profitable. This study may help the companies to choose the most efficient sourcing strategy for their suppliers from the perspective of sustainability.

The conclusion of this study is that companies can assess their suppliers based on their sustainable requirement that will help them to improve their performance by utilizing stage 1 and stage 2 of the proposed integrated MCDM model, whereas stage 3 and stage 4 can help companies to choose appropriate sourcing strategies for their supplier while maintaining the tradeoff between cost and sustainable performance.

9 Conclusion

In this study, a novel integrated MCDM model is proposed to efficiently evaluate sustainable supplier selection and appropriate sourcing strategy selection. This model consists of four stages. In the first stage, SKPIs for evaluating supplier in the view of sustainability are identified. BWM method is utilized to compute the priority weights of SKPIs, and MARCOS method is utilized to compute the priority weights of suppliers in the second stage. Stage 3 proposes a bi-objective mathematical model for selecting the optimum sourcing strategies and suppliers as well as investment cost for each supplier based on the evaluation weights of incumbent and new suppliers while optimizing cost and sustainable performance. The solution approach (Epsilon constraint method and min–max fuzzy method), in the fourth stage, is utilized to provide optimal solutions of mathematical model. The numerical implementation of the proposed model is presented for a case company that aids experts to select suppliers and their respective sourcing strategies as well as find the development areas of retained incumbent suppliers.

There are some limitations that may lead to interesting future research directions. First, a small size problem has been considered in this study and an optimization solver is utilized to solve the bi-objective mathematical model in coherent computational time. Since the considered data set is quite small, this model can be extended for a large data set. This could be a future research direction for researchers. Second, for a larger data set, the utilized approach may not be sufficient. Heuristic approaches can be explored to determine the solutions. Third, since the supplier performance indicators in this study are identified for the home appliances manufacturing company, these indicators might not be relevant for all sectors/industries. Therefore, different dimensions can be explored for sustainable supplier selection problems in different sectors/industries. Fourth, the model considered only a single product of home appliances. However, it can be extended for other home appliance products easily. Fifth, our optimization model is validated only for specified case study and its mathematical formulation is developed under general notations, parameters, and variables. This model can be applicable for other case studies. Finally, order allocation and vehicle routing problems can be included in the proposed model for future research direction. In addition, exploring the impact of various industry 4.0 technologies (Matthess et al., 2022; Govindan, et al., 2022a; Govindan, 2022a, 2022b; Govindan et al., 2022c) on sustainable supplier selection could be an interesting future research direction.

References

Abdullah, L., Chan, W., & Afshari, A. (2019). Application of PROMETHEE method for green supplier selection: A comparative result based on preference functions. Journal of Industrial Engineering International, 15(2), 271–285.

Ahmadi, H. B., Kusi-Sarpong, S., & Rezaei, J. (2017). Assessing the social sustainability of supply chains using Best Worst Method. Resources, Conservation and Recycling, 126, 99–106.

Alavi, B., Tavana, M., & Mina, H. (2021). A dynamic decision support system for sustainable supplier selection in circular economy. Sustainable Production and Consumption, 27, 905–920.

Amid, A., Ghodsypour, S. H., & O’Brien, C. (2011). A weighted max–min model for fuzzy multi-objective supplier selection in a supply chain. International Journal of Production Economics, 131(1), 139–145.

Amiri, M., Ayazi, S. A., Olfat, L., & Moradi, J. S. (2011). Group decision making process for supplier selection with VIKOR under fuzzy circumstance case study: An Iranian car parts supplier. International Bulletin of Business Administration, 10(6), 66–75.

Badri Ahmadi, H., Hashemi Petrudi, S., & Wang, X. (2017). Integrating sustainability into supplier selection with analytical hierarchy process and improved grey relational analysis: A case of telecom industry. International Journal of Advanced Manufacturing Technology, 90.

Bahadori, M., Hosseini, S. M., Teymourzadeh, E., Ravangard, R., Raadabadi, M., & Alimohammadzadeh, K. (2020). A supplier selection model for hospitals using a combination of artificial neural network and fuzzy VIKOR. International Journal of Healthcare Management, 13(4), 286–294.

Bai, C., Kusi-Sarpong, S., Badri Ahmadi, H., & Sarkis, J. (2019). Social sustainable supplier evaluation and selection: A group decision-support approach. International Journal of Production Research, 57(22), 7046–7067.

Bevilacqua, M., & Petroni, A. (2002). From traditional purchasing to supplier management: A fuzzy logic-based approach to supplier selection. International Journal of Logistics, 5(3), 235–255.

Bartos, K. E., Schwarzkopf, J., Mueller, M., & Hofmann-Stoelting, C. (2022). Explanatory factors for variation in supplier sustainability performance in the automotive sector–A quantitative analysis. Cleaner Logistics and Supply Chain, 5, 100068.

Blome, C., Hollos, D., & Paulraj, A. (2014). Green procurement and green supplier development: Antecedents and effects on supplier performance. International Journal of Production Research, 52(1), 32–49.

Boran, F. E., Genç, S., Kurt, M., & Akay, D. (2009). A multi-criteria intuitionistic fuzzy group decision making for supplier selection with TOPSIS method. Expert Systems with Applications, 36(8), 11363–11368.

Bottani, E., Centobelli, P., Murino, T., & Shekarian, E. (2018). A QFD-ANP method for supplier selection with benefits, opportunities, costs and risks considerations. International Journal of Information Technology & Decision Making, 17(03), 911–939.

Burke, G. J., Carrillo, J. E., & Vakharia, A. J. (2009). Sourcing decisions with stochastic supplier reliability and stochastic demand. Production and Operations Management, 18(4), 475–484.

Calvi, R., Le Dain, M. A., Fendt, T. C., & Herrmann, C. J. (2010). Supplier selection for strategic supplier development.

Cao, Y., Wang, Q., Du, J., Nojavan, S., Jermsittiparsert, K., & Ghadimi, N. (2019). Optimal operation of CCHP and renewable generation-based energy hub considering environmental perspective: An epsilon constraint and fuzzy methods. Sustainable Energy, Grids and Networks, 20, 100274.

Chen, Y. J. (2011). Structured methodology for supplier selection and evaluation in a supply chain. Information Sciences, 181(9), 1651–1670.

Ching, L. H., & Kwangsun, Y. (1981). Multiple attribute decision making: methods and applications: a state-of-the-art survey (lecture notes in economics and mathematical systems). Springer.

Chowdhury, P., & Paul, S. K. (2020). Applications of MCDM methods in research on corporate sustainability: a systematic literature review. Management of Environmental Quality: An International Journal.

Demski, J. S., Sappington, D. E., & Spiller, P. T. (1987). Managing supplier switching. The RAND Journal of Economics, 77–97.

Dey, P. K., Bhattacharya, A., Ho, W., & Clegg, B. (2015). Strategic supplier performance evaluation: A case-based action research of a UK manufacturing organisation. International Journal of Production Economics, 166, 192–214.

Dickson, G. W. (1966). An analysis of vendor selection systems and decisions. Journal of Purchasing, 2(1), 5–17.

Diouf, M., & Kwak, C. (2018). Fuzzy AHP, DEA, and Managerial analysis for supplier selection and development; from the perspective of open innovation. Sustainability, 10(10), 3779.

Dobos, I., & Vörösmarty, G. (2014). Green supplier selection and evaluation using DEA-type composite indicators. International Journal of Production Economics, 157, 273–278.

Engau, A., & Wiecek, M. M. (2007). Generating ε-efficient solutions in multi objective programming. European Journal of Operational Research, 177(3), 1566–1579.

Fei, L., Xia, J., Feng, Y., & Liu, L. (2019). An ELECTRE-based multiple criteria decision making method for supplier selection using Dempster-Shafer theory. IEEE Access, 7, 84701–84716.

Freeman, J., & Chen, T. (2015). Green supplier selection using an AHP-Entropy-TOPSIS framework. Supply Chain Management: An International Journal.

Friedl, G., & Wagner, S. M. (2012). Supplier development or supplier switching? International Journal of Production Research, 50(11), 3066–3079.

Govindan, K. (2022a). How Artificial Intelligence Drives Sustainable Frugal Innovation: A Multitheoretical Perspective. IEEE Transactions on Engineering Management.

Govindan, K. (2022b). Tunneling the barriers of blockchain technology in remanufacturing for achieving sustainable development goals: A circular manufacturing perspective. Business Strategy and the Environment.

Govindan, K., Kannan, D., Jørgensen., T.B., Nielsen, T.S (2022a) Supply Chain 4.0 performance measurement: A Systematic Literature Review and framework development, Transportation Research Part E

Govindan, K., Nasr, A. K., Karimi, F., & Mina, H. (2022b). Circular economy adoption barriers: An extended fuzzy best–worst method using fuzzy DEMATEL and Supermatrix structure. Business Strategy and the Environment.

Govindan, K., Nasr, A. K., Saeed Heidary, M., Nosrati-Abargooee, S., & Mina, H. (2022c). Prioritizing adoption barriers of platforms based on blockchain technology from balanced scorecard perspectives in healthcare industry: a structural approach. International Journal of Production Research, 1–15.

Ghadimi, P., Dargi, A., & Heavey, C. (2017). Making sustainable sourcing decisions: Practical evidence from the automotive industry. International Journal of Logistics Research and Applications, 20(4), 297–321.

Glock, C. H., Grosse, E. H., & Ries, J. M. (2017). Reprint of “Decision support models for supplier development: Systematic literature review and research agenda.” International Journal of Production Economics, 194, 246–260.

Haimes, Y. (1971). On a bicriterion formulation of the problems of integrated system identification and system optimization. IEEE Transactions on Systems, Man, and Cybernetics, 1(3), 296–297.