Abstract

Technology sharing among farmers has become common but controversial in recent years. To address it, we consider two farmers engaged in Cournot competition to investigate motivations of technology sharing and provide suggestions on contract design. One farmer (a licensor) has developed some technology and decides whether to share technology with the other farmer (a licensee). The licensee chooses whether to buy technology under a fixed-rate contract or a royalty-fee contract. We propose a technology sharing ratio between two farmers to characterize the degree of technology sharing. We find a win–win outcome for both farmers when the technology sharing ratio is higher than a threshold under the fixed-fee contract. While under the royalty-fee contract, the licensor only shares technology with an additional constraint that they have similar production costs. When the licensor can design contracts, he prefers the royalty-fee contract to the fixed-fee contract. We further interpret why the licensor may not benefit more under the two-part tariff contract than the fixed-fee or the royalty-fee contract. Moreover, we find that in supply chain settings, a win–win outcome for both farmers exists if and only if the technology sharing ratio is smaller than a threshold under the fixed-fee contract while technology sharing will not be realized under the royalty-fee contract. Finally, we show that the strategy of whether to share technology is robust to yield uncertainty, and both the licensor and licensee may benefit more from technology sharing because of yield uncertainty.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Agricultural issues, especially those related to farmers, are receiving increasing attention. In Africa, roughly 65% of its population relies on subsistence farming, contributing to almost 15% of the total GDP (Mzali, 2019; Savage, 2019). Most farmers’ yields in many agricultural commodities are low, partly because traditional farming relies heavily on farmers themselves: making decisions related to planting, harvesting, irrigating, applying pesticides and fertilizer according to the regional conditions and their experience (Ling & Bextine, 2017). They have limited access to government agents, advanced farming practices, and reliable market information, not to mention that they have difficulty accessing credits, loans, water, and electricity (An et al., 2015; Kiptot & Franzel, 2014). To increase their revenues, farmers can obtain valuable technology or knowledge from their peer farmers, that is, “farmers help farmers”.

Technology sharing among farmers has emerged and thrived recently. Though a more significant number of non-governmental organizations (e.g., Nestle) and for-profit social enterprises (e.g., ITC) provide abundant learning opportunities for farmers, purchasing valuable technology from the peer farmers is considered as an essential source since farmers of the same community can share technology due to their similar backgrounds (Chen et al., 2015; Matuschke & Qaim, 2009). Some farmers (i.e., licensors) have more advanced technology than others by accumulating experience and knowledge. With advanced technology, those farmers can reduce production costs. If there are multiple new technology adopters, as is often the case in agricultural innovation, the process of learning new technology may be social. Farmers may learn new technology from each other (Conley & Udry, 2010). For instance, Nakano et al. (2018) find the technology dissemination pathways among smallholder rice producers within a rural irrigation scheme in Tanzania. In France, farmers can save 8–22% of pesticide consumption with technology from licensors (Lapierre et al., 2019). In practice, technology sharing among farmers is informal and is conducted in oral contracts (Li et al., 2012). In 2017, only about 35% of US agricultural production was raised under contracts (MacDonald & Burns, 2019). In some areas of the United States, the government will provide established contracts for technology sharing among farmers to avoid disputing (MacDonald et al., 2004).

With the emergence of e-commerce platforms, technology sharing can be easily realized without time and distance restrictions. for example, Avaaj Otalo is a novel platform to encourage farmers to learn and share technology in Gujarat, India, and allows the farmers to raise questions, interact with others, and conduct technology transactions online. In addition, this kind of platform provides a more secure channel for the licensors to share technology because the platform can record transactions among farmers to guarantee their revenues by contracts (Chen et al., 2015).

The fixed-fee contract and the royalty-fee contract are two common contracts for technology sharing among farmers. Since Rostoker (1984) finds that 39% of the licensing contracts are of royalty fee alone, and 13% are of fixed-fee contracts alone, profound research on the comparison between the royalty-fee contract and the fixed-fee contract has been conducted from different perspectives (e.g., Savva & Taneri, 2015; Lin and Kulatilaka 2006; Cheng et al., 2018). Under the fixed-fee contract, a licensor charges a licensee a fixed fee for technology sharing (e.g., Federgruen et al., 2019). For example, in Ethiopia, the farmer who obtains the technology can apply it to any number of crops through a one-time payment (Asrat et al., 2010). Differently, under the royalty-fee contract, the licensor charges a specific fee for each unit product (e.g., Chen et al., 2017). It means, when the farmer shares the technology with others, the fee charged by the licensor depends on the area of crops or the number of livestock to which the technology is applied (Becker, 2008). For example, in Ghana, when sharing technology that can help reduce the cost of planting pineapples, the licensor can charge the licensee according to the number of pineapple plants (Conley & Udry, 2010).

In addition to these two kinds of contracts, the two-part tariff contract is also famous under which the licensor charges a fixed fee plus a royalty fee of each product (e.g., Mensendiek & Mitri, 2014). Lewis (1941) first proposes the two-part tariff contract, which is initially adopted in the electricity industry. This contract has been widely used for technology sharing in various industries. A stream of literature focuses on contract design (e.g., Yang & Ma, 2017). For example, Sen and Tauman (2007) show that for both an internal and an external patentee in a homogeneous product Cournot oligopoly, the optimal per-unit royalty plus a fee contract is considered as a cost-reducing innovation. Considering the two-part tariff contract has been widely applied in industry, we wonder whether it can be applied to agricultural issues and whether the licensor can always benefit by using it since the licensor seems to charge more. Moreover, there is no unified opinion about which contract is better for technology sharing in agriculture. We identify the conditions for technology sharing between two farmers under different contracts and provide suggestions on contract selection by comparing the three kinds of contracts above.

Technology sharing among farmers is no longer a sharing/non-sharing process but a continuous process, i.e., a technology sharing ratio exists. Alene and Manyong (2006) collect data by household-level surveys. They find that technology sharing among farmers in northern Nigeria is not the overall packaging of the technology related to seed, insecticide, fertilizer, and recommended cereal-cowpea cropping pattern, but partial sharing. Only 5% of the follower farmers gain the whole technology package, and others can only obtain a part of the technology. Whether licensees received all or a portion of the technology, their yields increase significantly, ranging from 720 to 1007 (kg/ha). In addition, Pacín and Oesterheld (2015) also gather livestock and soybean production data from the Argentine Pampas and find that when farmers obtain technology from other farmers, livestock output is 70–96% higher, depending on how much technology is shared. The examples above all confirm the view that there exists a technology-sharing ratio among farmers. Farmers reduce their production costs via aggregating investment in farming equipment or learning new farming technology.

Farmers with more technology can obtain some transfer fees from sharing technology while other farmers with less technology can decrease their production cost by purchasing technology. A specific technology sharing ratio corresponds to a certain decrease in the production cost (An et al., 2015; Liao et al., 2019). Therefore, we propose the concept of technology sharing ratio to describe how much technology the licensor is willing to share with the licensee to reduce his production cost.

We focus on technology sharing issues in agricultural supply chains which have raised attention worldwide. Farming supply chains with hundreds or thousands of smallholder farms are prevalent in many developing countries (Chen et al. 2014). For example, in Europe, seed business relies on Syngenta’s supply chain to provide seed products for various European markets (Comhaire & Papier, 2015). In China, the market shares of agricultural supply chains account for approximately 30% of China’s total agricultural share in 2015 compared with 15% in 2010 (Zhang et al., 2019). Technology sharing among farmers will affect farmers’ production costs, further affecting the purchase price of downstream businesses. Thus, we study technology licensing issues among farmers in supply chain settings.

Yield uncertainty sometimes exists in farmers’ production and operation due to external factors such as weather conditions (e.g., Boyabatlı et al., 2019). The difference between actual output and the expected output is 10% on average, which is within a reasonable and controllable range as the weather forecast becomes more accurate and the countermeasures are more advanced. However, news about production quantity reduction due to storms and droughts is common (Maltais, 2020a). On the contrary, farmers harvest more than expected due to the accidental good weather (Maltais, 2020b). Therefore, we further investigate whether yield uncertainty affects the conditions for technology sharing among farmers.

We mainly consider four questions arising in the technology sharing scenario. Firstly, what conditions stimulate the licensors to share technology with the licensees? Secondly, what is the optimal contract when the licensor can choose the contract type? Thirdly, what are the conditions for technology sharing in supply chain settings? Fourthly, whether the technology sharing still occurs under yield uncertainty, and how does the yield uncertainty influence farmers’ profits?

We develop a two-stage game model to address the questions above in which two farmers sell homogenous products to consumers in the Cournot competition. We assume that one farmer (i.e., licensor) has already developed some technology for a more efficient agricultural production (e.g., improving farming efficiency) while the other farmer (i.e., licensee) does not have. Thus, the licensor can still use the technology when technology sharing is achieved.

Some interesting results are found as follows. Firstly, a win–win outcome exists for the licensor and the licensee when technology sharing is achieved under the fixed-fee contract and the royalty-fee contract, respectively. Notably, under the royalty-fee contract, the licensor is more willing to help the licensee whose threat is great (i.e., the licensor and licensee have similar production costs). Secondly, when the royalty fee is medium, the profits of the licensor and the licensee increase with it simultaneously; the licensor may not benefit more from the two-part tariff contract than the fixed-fee contract. Thirdly, in supply chain settings, technology sharing is achieved when the technology sharing ratio is smaller than a threshold under a fixed-fee contract which is in stark contrast to the conditions without double marginalization effect. Yet, technology sharing cannot be achieved under the royalty-fee contract in supply chain settings. Finally, we find that the results of technology sharing are robust to yield uncertainty. We also illustrate that both farmers may benefit more from technology sharing under yield uncertainty.

This paper proceeds as follows. The related literature is reviewed in Sect. 2. Section 3 analyzes models without and with technology sharing under the fixed-fee contract and the royalty-fee contract. Section 4 presents the analysis and our main findings. Section 5 considers two-part tariff contracts, supply chain settings, and yield uncertainty of farmers. Finally, the conclusions are given in Sect. 6.

2 Related literature

This paper contributes to the recent literature on technology sharing and contract design.

2.1 Technology sharing

Our work is closely related to technology sharing. Some research is carried out from the perspective of the licensor. Gallini and Winter (1985) investigate the condition for licensors when they share their cost-reducing technology with their competitors while their competitors can also develop the technology by themselves. This paper interprets whether the licensor should share technology and its impact from the licensor’s perspective. Our paper further provides the motivations and conditions for the acceptance of technology from the licensee’s perspective. Zhao et al. (2014) assume that the licensee pays all increases from technology sharing to the licensor and whether technology sharing can be realized only depends on the licensor. The assumption of Zhao et al. (2014) is the special case of our paper. We portray a win–win result for both farmers when technology sharing is realized. Other papers also consider technology sharing in terms of risk pooling (Zhang et al., 2018), quality management (Jiang & Shi, 2018), supply disruption (Yang et al., 2019), and financial investment (Kulatilaka & Lin, 2006). Different from the literature, we capture the technology sharing ratio and provide contract design for technology sharing.

Some studies related to technology sharing are done in agricultural settings. A stream of literature (e.g., Mtega et al., 2013) demonstrates that farmers will share technology to reduce costs. Chen and Tang (2015) and Liao et al. (2019) analyze technology sharing among farmers to study how to maximize the total social welfare from the perspective of platforms or governments. We focus on the interaction of technology sharing between two farmers to investigate how the interaction affects social welfare. Alene and Manyong (2006) find that only 5% of the follower farmers gain the whole technology package in technology sharing settings, and others can only obtain a part of the technology. An et al. (2015) point out that licensors do not always share all their technologies but share technology in agriculture. Hence, we propose the concept of technology sharing ratio to characterize the relationship among farmers from a modeling perspective.

Some papers take into account the yield uncertainty when analyzing technology sharing in the agricultural industry. Large-scale social events, the unpredictability of weather and natural conditions all contribute to the uncertainty of agricultural output (Just, 2001). Deo and Corbett (2009) claim that the actual outputs may not be consistent with the expected outcome, which results in the decline in participant’s profits. Alizamir et al. (2019) consider government subsidies to farmers when there exists yield uncertainty in farmers’ outputs. However, the existing research on technology sharing in agriculture ignores the uncertain characteristics of agricultural products. Therefore, we portray yield uncertainty into technology sharing among farmers and focus on the contract design.

The afore-mentioned papers are in the setting where the licensor and the licensee sell their products directly to consumers. Some works concern technology sharing issues in supply chain settings. Chen et al. (2017) consider the supplier as a licensor and two farmers as licensees. They emphasize the differences between two kinds of royalties in the selling and wholesale prices, which are two different forms of the royalty-fee contract. We focus on royalties in the selling price and consider technology sharing in a horizontal structure rather than a vertical structure. More importantly, different from Chen et al. (2017), we explore how double marginalization affects the contract design and the profits of two farmers in supply chain settings.

2.2 Contract design

Much of the literature on technology sharing occurs either under the fixed-fee contract or the royalty-fee contract (e.g., Chakraborty et al., 2018; Hu et al., 2017). Few works simultaneously concern both types of contracts. For example, Kamien and Tauman (1986) compare how much profit the licensor can gain by sharing technology to the competitor, producing a homogeneous product, using the fixed-fee contract and the royalty-fee contract in Bertrand competition. They find that the licensor always gains a higher profit under the fixed fee contract. Comparing their work, we analyze the differences between the fixed-fee contract and the royalty-fee contract considering the technology sharing ratio in Cournot competition and point out which contract the licensor prefers depending on the contract parameters. Cheng et al. (2018) analyze technology sharing strategy in the evolutionary game under either the fixed-fee contract or the royalty-fee contract. They independently investigate technology sharing under two different contracts but do not quantitatively compare the decisions and profits under the two contracts. Hence, we further provide suggestions for the licensor on contract choice and contract design.

Moreover, the afore-mentioned literature assumes that contract parameters are exogenous, ignoring the scenario where farmers negotiate technology sharing by themselves. Therefore, we endogenize contract parameters under both the fixed-fee contract and the royalty-fee contract. Though contracts for technology sharing among farmers are rarely studied, some pieces of evidence show that farmers need contracts to ensure the reasonableness and effectiveness of technology sharing (e.g., Mtega et al., 2013). Hence, the research on the contract design of technology sharing among farmers is of practical significance.

Additionally, the two-part tariff contract is used in the literature on technology sharing. Some researchers (e.g., Mensendiek & Mitri, 2014; Yang & Ma, 2017) study the two-part tariff contract in a supply chain where a supplier charges a retailer a royalty fee of each product and a fixed fee. Different from their work, we study the two-part tariff contract between two farmers engaged in Cournot competition selling horizontal products. Kitagawa et al. (2014) study the impact of technology sharing on licensors and licensees under the two-part tariff contract without considering the conditions for technology sharing. Furthermore, the afore-mentioned papers all study technology sharing given the two-part tariff contract without considering why the licensor adopts the two-part tariff contract. We compare the two-part tariff contract with the fixed-fee contract and the royalty-fee contract, respectively, and interpret why farmers with advanced technology adopt different contracts under different conditions.

In summary, our research differs from the existing studies in four aspects. Firstly, we propose the technology sharing ratio to reveal how much technology farmers will share with others. Thus, different from Kamien and Tauman (1986) that the licensor can benefit more under the royalty-fee contract than the fixed-fee contract, we prove that those results may not always exist due to the introduction of the technology sharing ratio. Secondly, the extant literature (e.g., Kitagawa et al., 2014) on the two-part tariff contract does not explain why it is adopted. Therefore, we further compare it with the fixed-fee contract and the royalty-fee contract, respectively, to figure out the different conditions for technology sharing under different contracts. Thirdly, much of the literature on technology sharing (e.g., Hu et al., 2017) carries out given the type of contracts; we study the situations in which licensors can determine the contract parameters under the fixed-fee contract and the royalty-fee contract, respectively. Hence, we provide suggestions for licensors on which type of contracts to adopt. Fourthly, we explore the impact of double marginalization effect on technology sharing among farmers. Finally, we extend to study technology sharing among farmers under yield uncertainty to find that the strategy of whether to share technology is robust and both the licensor and licensee may benefit more from technology sharing under yield uncertainty.

3 Model description

3.1 Model setup

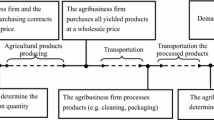

Consider an economic system consisting of Farmer 1 and Farmer 2 that sell homogeneous products (e.g., crops) to consumers in the market. Farmers 1 and 2 simultaneously determine their products quantities \(q_{1}\) and \(q_{2}\) at production costs \(c_{1}\) and \(c_{2}\), respectively (Chen et al., 2015). Following Mensendiek and Mitri (2014), we assume \(c_{1} < c_{2}\) which means Farmer 1 has already developed some advanced technology for farming that can be used to lower the production cost. The game has two stages. At Stage 1, Farmer 1 (i.e., a licensor) decides whether to share technology with Farmer 2 (i.e., licensee) and after that, Farmer 2 decides whether he accepts agricultural technology from Farmer 1. At Stage 2, Farmers 1 and 2 determine the quantities, respectively. The decision process of the two parties is shown in Fig. 1.

If technology sharing is achieved, Farmer 1 will teach Farmer 2 how to apply it at the operational level. Following Kamien and Tauman (1986), we assume that Farmer 1 will not withdraw from the market but still produce at \(c_{1}\). If technology sharing is achieved, then the production cost of Farmer 2 is \(c_{2} - k\left( {c_{2} - c_{1} } \right)\). Here \(k\) represents technology sharing ratio. For example, the ratio is the part of technology including seed, insecticide, fertilizer, and recommended cereal-cowpea cropping pattern shared among farmers in northern Nigeria (e.g., Alene and Manyong, 2006). In our paper, the technology sharing ratio can be measured as part of one kind of technology or part of a series of technology for agricultural activities. The ratio can be directly measured by the portion of technology shared by Farmer 1. The larger \(k\) is, the more technology Farmer 1 shares with Farmer 2 and the lower Farmer 2’s production cost is. \(k = 0\) means that Farmer 1 will not share his technology to lower the production cost of Farmer 2, and \(k = 1\) implies that Farmer 1 shares the whole package of his technology with Farmer 2. In this case, both farmers produce at the same unit production cost, i.e., \(c_{1}\).

The notations are described as follows.

Parameters

\(c_{i}\): Unit production cost, \(i = 1,2\) and \(0 < c_{1} < c_{2}\).

\(a\): Price cap, that is, the potential highest selling price. The price cap should be higher than the unit production cost, i.e., \(a > c_{i}\).

\(k\): Technology sharing ratio, \(0 \le k \le 1\).

\(F\): A fixed fee that Farmer 2 pays to Farmer 1 for technology sharing of each unit of technology sharing ratio under the fixed-fee contract and \(F > 0\).

\(r\): A royalty fee that Farmer 2 is required to pay to Farmer 1 for each unit sold under the royalty-fee contract and \(0 < r \le k\left( {c_{2} - c_{1} } \right)\).

Variables

\(q_{i}^{s}\): The quantity decisions of Farmer \(i\)/ Retailer \(i\) under the scenario \(s\).

\(w_{i}^{s}\): The unit wholesale price of product \(i\) under the scenario \(s\).

\(p^{s}\): The selling price of Farmer \(i\)/Retailer \(i\) under the scenario \(s\).

In the above, \(s \in \{ B,FF,RF\}\). \(B\) represents there is no technology sharing. \(FF\) represents technology sharing under the fixed-fee contract and \(RF\) represents technology sharing under the royalty-fee contract.

In practice, the implementation cost is often considered as a fixed and sunk cost, which does not change the results when normalized to 0. Consistent with the literature (e.g., Jiang & Shi, 2018), we assume that technology sharing between Farmers 1 and 2 does not incur any implementation cost.

3.2 Profit functions

According to the literature (e.g., Vives, 1984), consumer surplus is assumed as.

we can derive the inverse demand function from Eq. (1),

where \(a\) represents the price cap.

When technology sharing is not achieved, the optimization of Farmer i can be stated as follows:

The basic model assumes that yield uncertainty does not exist, which will be relaxed in Sect. 5.3. Under the fixed-fee contract (denoted as FF contract), if Farmer 1 shares the technology and Farmer 2 accepts technology sharing, Farmer 2 needs to pay a transfer fee \(kF\) to Farmer 1. This can be done in terms of face-to-face transactions or on online platforms such as Avaaj Otalo. The transfer fee is a one-time payment by licensees to licensors for a corresponding technology proportion. The transfer fee increases with \(k\), which means that the more technology the licensor shares, the more significant transfer fee the licensee pays to the licensor. Two farmers’ optimizations can be stated as follows:

Under the royalty-fee contract (denoted as RF contract), if Farmer 1 shares the technology and Farmer 2 accepts technology sharing, Farmer 2 pays a transfer fee \(r\) for a unit of products produced to Farmer 1. Two parties’ optimizations can be stated as follows:

where \(r < k\left( {c_{2} - c_{1} } \right)\) is assumed to guarantee that the royalty fee cannot exceed the unit production cost saved by Farmer 2. Literally, the profit of Farmer 1 is irrelevant to the technology sharing ratio under the RF contract. When Farmer 1 shares technology with Farmer 2, the farmer’s market share is influenced by the unit production cost, which has a secondary, rippling effect on Farmer 1.

Table 1 summarizes the equilibrium decisions and profits of members and consumer surplus when technology sharing is not achieved, and when it is achieved under the FF contract and the RF contract, respectively.

4 Technology sharing strategy

In this section, we first explore the sensitivity analysis of some critical parameters and compare the FF contract and the RF contract. Then, we provide conditions for technology sharing when contract parameters are exogenous and endogenous, respectively. All the simplified equations are listed in Table 2 in “Appendix”.

Proposition 1

Under the RF contract, (1) \(\partial \pi_{1}^{{RF{*}}} /\partial r < 0\) iff \(r > r_{1}\) and \(\partial \pi_{2}^{{RF{*}}} /\partial r > 0\) iff \(r > r_{2}\). (2) \(\partial \pi_{1}^{{RF{*}}} /\partial r > 0\) and \(\partial \pi_{2}^{{RF{*}}} /\partial r > 0\) iff \(r_{2} < r < r_{1}\).

Proposition 1 suggests that under the RF contract, as the royalty fee increases, Farmer 1 increases his quantity, and Farmer 2 decreases his quantity because Farmer 2 pays a larger transfer fee. However, the total quantity of both farmers still decreases, accordingly resulting in a higher market price. As a result, the profit of Farmer 1 first increases due to a larger market share, and then falls because of the lower market share of Farmer 2, which in turn results in a smaller transfer fee. Reversely, producing a lower quantity at a higher market price leads to the phenomenon that the profit of Farmer 2 first decreases and then increases because the transfer fee first outweighs the extra revenue from the higher market price. Then, the higher market price becomes the dominant force when he accepts more technology, as shown in Fig. 2. Proposition 1 also implies that when the royalty fee is medium, farmers’ profits increase simultaneously because they can benefit from the increased market price.

Below we present the results on the comparison of profits under the FF and RF contracts.

Proposition 2

(1) \(\pi_{1}^{{FF{*}}} > \pi_{1}^{{RF{*}}}\) iff \(F > \left( {5a - c_{1} - 4c_{2} - 4kc_{1} + 4kc_{2} - 5r} \right)r/\left( {9k} \right)\). (2) \(\pi_{2}^{{FF{*}}} > \pi_{2}^{{RF{*}}}\) iff \(k > \max \left\{ {r/\left( {c_{2} - c_{1} } \right),\left( {c_{2} - c_{1} + r} \right)/\left( {2c_{2} - 2c_{1} } \right),0} \right\}\) and \(F < 4\left( {a + c_{1} - 2c_{2} - 2kc_{1} + 2kc_{2} - r} \right)r/\left( {9k} \right)\).

Proposition 2 implies that Farmers 1 and 2 cannot make a higher profit simultaneously under a contract than the other. Farmer 1 benefits more from the FF contract than the RF contract when the fixed fee is hefty, while Farmer 2 benefits more from the FF contract when the fixed fee is small and the technology sharing ratio is large. When the technology sharing ratio is small, the transfer fee is greater under the FF contract than that under the RF contract. Farmer 2 pays a hefty transfer fee under the FF contract when the technology sharing ratio is large.

4.1 Technology sharing strategy: exogenous contract parameters

In this section, we analyze how the technology sharing strategy changes with contract parameters. Note that region \((A,R)\) represents that Farmer 1 shares technology while Farmer 2 refuses to accept technology sharing. Region \((A,A)\) means that technology sharing is achieved. Region \((R,A)\) represents that Farmer 1 refuses to share the technology while Farmer 2 is intended to purchase. Region \((R,R)\) represents Farmer 1 refuses to share the technology, and Farmer 2 also does not intend to buy the technology; that is, technology sharing harms both Farmers 1 and 2. Then, we can obtain the condition for technology sharing under the FF contract, as shown in Proposition 3.

Proposition 3

Under the FF contract, technology sharing is achieved iff \(F_{1}^{FF} \le F \le F_{2}^{FF}\) and \(k \ge \max \{ \left( {2c_{2} - c_{1} - a} \right)/\left( {c_{2} - c_{1} } \right),0\}\).

According to Proposition 3, if \(c_{2} < \left( {a + c_{1} } \right)/2\), then \(k > 0\). If \(c_{2} \ge \left( {a + c_{1} } \right)/2\), then,\(k > \left( {2c_{2} - c_{1} - a} \right)/\left( {c_{2} - c_{1} } \right)\). Figure 3 illustrates the equilibrium strategies under the FF contract.

As shown in Region \((A,R)\) of Fig. 3, Farmer 1 would like to share technology when the transfer fee is relatively large, whereas Farmer 2 refuses to accept technology sharing. The reason is that although technology sharing increases the profit of Farmer 2 by lowering his production cost and increasing his market share, the transfer fee is such large that it outweighs the gains from technology sharing.

When \(F_{1}^{FF} \le F \le F_{2}^{FF}\), Farmer 1 benefits from the transfer fee, and Farmer 2 benefits from a larger market share than that without technology sharing, as shown in Region \((A,A)\) of Fig. 3. Especially when Farmer 2’s production cost is small, technology sharing can be achieved regardless of the range of technology sharing ratio. This means that when Farmer 2’s production cost is small, even if the technology sharing ratio is small (\(k \le \left( {2c_{2} - c_{1} - a} \right)/\left( {c_{2} - c_{1} } \right)\)), the profit of Farmer 1 increases slightly by obtaining the transfer fee, and Farmer 2 benefits from a slightly larger market share. On the other hand, when the unit production cost of Farmer 2 is considerable, i.e., \(c_{2} \ge \left( {a + c_{1} } \right)/2\), technology sharing reduces the unit production cost of Farmer 2 significantly, which leads to a larger market share of Farmer 2. As a result, the profit of Farmer 2 increases remarkably. Therefore, Farmer 2 always accepts technology sharing given any technology sharing ratio. However, Farmer 1 consequently loses the cost advantage over Farmer 2, which hurts his profit. When the technology sharing ratio is large, Farmer 1 can increase the profit by the transfer fee; when the technology sharing ratio is small, the transfer fee cannot cover the loss due to the loss of cost advantage. Hence, a lower bound of the technology sharing ratio is required to ensure that Farmer 1 is willing to share technology with Farmer 2.

When the transfer fee is relatively small, as shown in Region \((R,A)\) of Fig. 3, Farmer 1 refuses to share his technology because a small transfer fee cannot compensate for the loss of profit caused by the decrease of market size. Thus, Proposition 3 implies that farmers might share much technology with those lacking technology, although such technology sharing will intensify the competition. This result is consistent with the phenomenon that farmers with technology are willing to share technology with others to decrease their production costs in northern Nigeria (Alene and Manyong, 2006). Furthermore, the technology owners can promote their technology to earn a more significant transfer fee.

Proposition 4

Under the RF contract, technology sharing will be achieved iff \(c_{2} \le \left( {a + c_{1} } \right)/2\) and \(r_{1}^{RF} \le r \le r_{2}^{RF}\) .

We can illustrate the equilibrium strategies under the RF contract in Fig. 4. Proposition 4 implies that technology sharing will be achieved only when the two parties’ production costs are similar. This is because when a farmer’s production cost is small, Farmer 1 benefits from the transfer fee, and Farmer 2 benefits from a larger market share, as shown in Fig. 4a. On the other hand, when Farmer 2’s production cost is high, as shown in Fig. 4b, technology sharing significantly decreases Farmer 2’s production cost. However, the transfer fee is so huge that Farmer 2 cannot afford it. Hence, Farmer 2 will not buy technology from Farmer 1. Compared with conditions for technology sharing under the FF contract, under the RF contract, an additional constraint, i.e., \(c_{2} \le \left( {a + c_{1} } \right)/2\), is required to ensure technology sharing because Farmer 1 gets a smaller transfer fee when Farmer 2’s production cost is high. Consequently, the smaller transfer fee cannot compensate for the loss from selling fewer products.

When the royalty fee is relatively small or large, as shown in regions \((A,R)\) and \((R,A)\) in Fig. 4, technology sharing will not be achieved. Reasons are consistent with those results when the transfer fee is relatively large or small under the FF contract. Proposition 4 implies that farmers are more likely to share technology with those of similar production costs. Furthermore, for those farmers with technology in Ghana (see Conley & Udry, 2010), the royalty fee they charge for each pineapple cannot be too high; otherwise, farmers who lack skills are unwilling to pay.

From Propositions 3 and 4, we can summarize the following observations. (1) Technology sharing will be achieved when the technology sharing ratio is larger than a threshold so that the unit production costs of two parties are identical. Though farmers will consequently face more intense competition when their production costs are similar, which seems to be harmful to licensors, licensors can benefit from the appreciable value of the transfer fee from the licensee. (2) Unlike conditions under the FF contract, licensors only share technology with licensees when their production costs are very similar under the RF contract. This is because when licensors have a significant cost advantage over licensees, the transfer fee is so huge that it exceeds the cost savings of licensees, which makes licensees abandon buying technology from licensors.

Based on the conditions for technology sharing under two different contracts, we compare two contracts in terms of sensitivity analysis and consumer surplus. Therefore, we first analyze the sensitivity of \(k\) as shown in Proposition 5.

Proposition 5

When technology sharing is achieved, (1) under the FF contract, the profits of both Farmers 1 and 2 increase with \(k\), i.e., \(\partial \pi_{i}^{FF*} /\partial k > 0\); (2) under the RF contract, the profit of Farmer 1 decreases with \(k\), i.e., \(\partial \pi_{1}^{{RF{*}}} /\partial k < 0\), while the profit of Farmer 2 increases with \(k\), i.e., \(\partial \pi_{2}^{{RF{*}}} /\partial k > 0\).

Proposition 5 implies that the licensor prefers to share more technology under the FF contract, whereas he shares less technology under the RF contract in the feasible region. Under the FF contract, both the selling price and market share of Farmer 1 decrease with the technology sharing ratio. However, due to the increase in Farmer 2’s market share, the transfer fee increases. Therefore, the profit of Farmer 1 increases since the transfer fee plays a key role. Under the RF contract, the transfer fee increases with the technology sharing ratio as well. However, the rise in transfer fees is smaller than the decrease in the profit selling Farmer 1’s products. Therefore, the profit of Farmer 1 decreases as the technology sharing ratio increases under the RF contract. For Farmer 2, regardless of contracts, his gain increases with the technology sharing ratio. Therefore, though technology sharing induces a more significant transfer fee, Farmer 2 can earn a larger market share, which becomes a dominant factor in his profit.

Proposition 6

When technology sharing is achieved, \(CS^{FF*} > CS^{RF*} > CS^{B*}\) .

When technology sharing is achieved, consumer surplus increases, and consumer surplus will be greater under the FF contract than that under the RF contract. Though technology sharing will intensify the market competition between two farmers, more intense competition leads to a lower selling price, which is beneficial to consumers. When comparing consumer surplus between two kinds of contracts, the competition is more intense under the FF contract, and accordingly, consumer surplus is larger. Proposition 6 implies that contract designers (i.e., governments in the U.S.) can prioritize fixed-fee contracts for technology sharing, which is beneficial to society. It can be observed that even without extrinsic incentives, technology sharing between two selfish farmers can increase consumer surplus and social welfare.

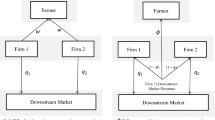

4.2 Technology sharing strategy: endogenous contract parameters

This section shows the contract selection and its impact when contract parameters are determined by Farmer 1. Following Ertek and Griffin (2002), we provide conditions for technology sharing when Farmer 1 is dominant and can design the contract. The game proceeds as follows (as shown in Fig. 5). At Stage 1, Farmer 1 decides the specific contract parameters of different contracts. Then, Farmer 1 determines whether to share technology with Farmer 2. After that, Farmer 2 decides whether he accepts technology sharing from Farmer 1 under different contracts. Finally, at Stage 2, two parties simultaneously decide the quantities. We use the superscript “-” to indicate the situation in which Farmer 1 designs the contract. The optimal decisions and profits of the two parties are shown in Appendix.

Proposition 7

(1) We have \(F^{*} = F_{2}^{FF}\) under the FF contract and \(r^{*} = r_{2}^{RF}\) under the RF contract. (2) In this case, we have \(\overline{\pi }_{1}^{{RF{*}}} > \overline{\pi }_{1}^{{FF{*}}}\) and \(\overline{\pi }_{2}^{{FF{*}}} = \overline{\pi }_{2}^{RF*}\).

Proposition 7 shows that Farmer 1 benefits more from the RF contract than the FF contract when the royalty fee and the fixed fee are determined by Farmer 1, as shown in Fig. 6. Technology sharing helps Farmer 2 earn a larger market share under the RF contract. However, Farmer 1 charges a larger transfer fee under the RF contract than that under the FF contract, which benefits Farmer 1. Thus, under the RF contract, Farmer 1 can benefit more. The profit of Farmer 1 is always higher than that of Farmer 2. This is because whatever the technology sharing ratio is, Farmer 1 always enjoys the cost advantage over Farmer 2. Proposition 7 implies that Farmer 1 can benefit more while Farmer 2 cannot benefit from technology sharing when Farmer 1 can design contracts. Proposition 7 implies that it is beneficial to licensors when they share much technology. This is inconsistent with Alene and Manyong (2006), who show that technology sharing among farmers in northern Nigeria is not the overall but partial technology. One possible reason is that from the licensees’ perspective, they refuse to purchase a higher technology ratio since it is expensive. Therefore, technology sharing will not harm the licensees’ profits. Since there is no uniform opinion about which contract is more suitable for sharing technology among farmers, we believe that signing royalty-fee contracts for licensors is more appropriate.

Corollary 1

(1) Under the FF contract, technology sharing will be achieved iff either \(c_{2} < \left( {a + 4c_{1} } \right)/5\) or {\(\left( {a + 4c_{1} } \right)/5 \le c_{2} \le \left( {2a + 3c_{1} } \right)/5\) and \(2\left( {5c_{2} - 4c_{1} - a} \right)/\left( {c_{2} - c_{1} } \right) \le k \le 1\)}. (2) Under the RF contract, technology sharing will always be achieved.

Under the FF contract, when Farmer 2’s unit production cost is relatively high (\(c_{2} \ge \left( {2a + 3c_{1} } \right)/5\)), technology sharing will not be achieved. This is because technology sharing can effectively reduce Farmer 2’s production cost, which results in a larger market share for Farmer 2 but a smaller one for Farmer 1. Therefore, Farmer 1 will not share his technology with Farmer 2. When the unit production cost of Farmer 2 is within the middle range, the technology sharing ratio requires a lower bound because Farmer 1 will not share his technology in exchange for a small transfer fee. When Farmer 2’s production cost is relatively low, Farmer 1 benefits from a considerable transfer fee, and Farmer 2 gains a larger market share as long as technology sharing is achieved. Under the RF contract, Farmer 1 can benefit from technology sharing because of the hefty transfer fee. Concluded from Propositions 3 and 4 and Corollary 1, we obtain that there always exists a win–win outcome for both farmers when technology sharing is achieved.

Corollary 2

(1) The profit of Farmer 1 increases with the technology sharing ratio, i.e., \(\partial \overline{\pi }_{1}^{s*} /\partial k > 0\). (2) The profit of Farmer 2 remains unchanged no matter how the technology sharing ratio changes, i.e., \(\partial \overline{\pi }_{2}^{{s{*}}} /\partial k = 0\) (\(s \in \{ FF,RF\}\)).

Figure 6 also shows the impact of \(k\) on farmers’ profits. The intuition of Corollary 2 is that Farmer 1 grabs all the profits from technology sharing. Thus, the gain of Farmer 2 remains the same as that without technology sharing. Farmer 1 benefits from a larger transfer fee as the technology sharing ratio increases. For Farmer 1, the monotonicity of technology sharing ratio remains unchanged given the RF contract while it is reversed under the FF contract when Farmer 1 designs the contract. This is because Farmer 1 will grab all the increase of the whole system from technology sharing, and in this case, Farmer 2 cannot enjoy the benefits of technology sharing. On the contrary, Farmer 2 can enjoy a portion when the contract is exogenous. Corollary 2 implies that farmers with technology can share the whole technology with those farmers lacking technology. This is consistent with the fact that 5% of farmers share the entire technology package with follower farmers (Alene and Manyong 2006).

Corollary 3

For consumer surplus, we have \(\overline{CS}^{FF*} > \overline{CS}^{RF*} > \overline{CS}^{B*}\).

The specific explanation of Corollary 3 is similar to that in Proposition 5.

From Sect. 4, we can derive the following managerial insights. (1) In general, a win–win outcome exists for both the licensor and the licensee under the FF contract and the RF contract, leading to the technology sharing between them. (2) When technology sharing is achieved, consumer surplus and social welfare will increase. (3) The licensor should choose the RF contract rather than the FF contract when he can design the contract, which will benefit him more. (4) The profit of the licensor decreases with the technology sharing ratio when contract parameters are exogenous while increases with it when contract parameters are endogenous.

5 Model extensions

5.1 Two-part tariff contract

A two-part tariff contract has been widely applied in practice. We aim to introduce it into agricultural technology sharing and study how the two-part tariff contract affects both parties of technology sharing. Furthermore, we show whether the two-part tariff contract can benefit licensors more than the fixed-fee contract or the royalty-fee contract. Under the two-part tariff contract, if Farmer 1 shares his technology and Farmer 2 accepts technology sharing, Farmer 2 pays Farmer 1 not only \(kF\), but also \(rq_{2}\). We use the superscript “TT” to indicate the case when technology sharing is achieved under the two-part tariff contract. Two parties’ problems can be stated as follows:

Proposition 8

(1) \(\pi_{1}^{TT*} < \pi_{1}^{FF*}\) iff \(c_{2} > \left( {a + c_{1} } \right)/2\). (2) \(\pi_{1}^{{TT{*}}} > \pi_{1}^{{RF{*}}}\).

We can illustrate the contract choice for Farmer 1 in Fig. 7. The profit of Farmer 1 is smaller under the TT contract than that under the FF contract when Farmer 2’s unit production cost is high. This is because although Farmer 1 charges \(kF\) plus \(rq_{2}\), Farmer 1 suffers a significant loss in his profit by selling his products because technology sharing significantly decreases Farmer 2’s production cost, which is initially large. The loss of his profit due to the increased competition exceeds the transfer fee, and in this case, a higher transfer fee does not mean a higher profit for Farmer 1. On the other hand, Farmer 1’s profit under the TT contract is more significant than that under the RF contract, which implies that Farmer 1 can benefit from a more substantial transfer fee under the TT contract. Proposition 8 means that, besides the fixed fee, if the unit production costs of farmers are similar, the farmer with technology can further charge the technology seeker according to the production quantities (e.g., crops or livestock) in the setting of precision agriculture. Such a two-part tariff contract is acceptable to licensees and can benefit licensors.

Proposition 9

Under the TT contract, technology sharing will be achieved iff \(c_{2} \ge \left( {a + c_{1} } \right)/2\), \(\max \, \left\{ {0,a + c_{1} - 2c_{2} - kc_{1} + kc_{2} } \right\} < r \le k\left( {c_{2} - c_{1} } \right)\) and \(F_{1}^{TT} \le F \le F_{2}^{TT}\).

Under the TT contract, although Farmer 2 is charged more by Farmer 1, Farmer 2 benefits from the decrease in production cost, which remarkably increases the market share of Farmer 2. We can see that the difference in conditions for technology sharing between the FF contract or the RF contract and the TT contract is that technology sharing will be achieved if and only if Farmer 2’s production cost is relatively high. This is because the competition is fierce when the production costs of farmers are very similar. The intensified competition decreases the incentive of Farmer 1 to share technology with Farmer 2.

Corollary 4

The profit of Farmer 1 decreases with \(k\), i.e., \(\partial \pi_{1}^{{TT{*}}} /\partial k < 0\), and the profit of Farmer 2 increases with \(k\), i.e., \(\partial \pi_{2}^{{TT{*}}} /\partial k > 0\).

It is recalling Proposition 5, the profit of Farmer 1 increases with the technology sharing ratio under the FF contract, while decreases with it under the RF contract. Corollary 4 implies that the profit of Farmer 1 still increases with the technology sharing ratio under the TT contract, which means that the royalty fee becomes a dominant force in increasing Farmer 1’s profit under the TT contract. In addition, the profit of Farmer 2 still rises with the technology sharing ratio under the TT contract. The specific explanation is similar to Proposition 5. We can also see from Corollary 4 that if \(k\) is endogenous under the TT contract, k must be an extreme value in its range.

5.2 Technology sharing in supply chains

Technology sharing is sometimes achieved among agricultural supply chains. For example, some farmers concentrate on farming or grazing, and they will sell their products through downstream retailers (e.g., groceries). Commonly, we assume that farmers will sign a wholesale price contract with the downstream (Jang & Klein, 2011). Hence, we take the technology sharing problem in supply chain settings into consideration to investigate how the double marginalization effect affects farmers’ technology sharing and provide the conditions for introducing retailers. At Stage 1, Farmer 1 decides whether to share technology with Farmer 2 and then Farmer 2 decides whether he accepts technology sharing from Farmer 1. At Stage 2, Farmers 1 and 2 announce the wholesale prices to their retailers. After that, the retailers decide on quantities. The decision process in supply chain settings is shown in Fig. 8.

The optimization of Retailer i can be stated as follows:

Under the FF contract, the optimization of Farmers 1 and 2 can be stated as follows:

Under the RF contract, the optimization of Farmers 1 and 2 can be stated as follows:

Using the backward induction technique, we can obtain the equilibrium decisions and the optimal profits of Farmers 1 and 2 and retailers, as shown in Table 4 in “Appendix”.

Proposition 10

Under the FF contract, technology sharing will be achieved in supply chain settings iff \(c_{2} \ge \left( {25a + c_{1} } \right)/26\), \(F_{3}^{FF} \le F \le F_{4}^{FF}\) and \(k \le \left( {104c_{2} - 100a - 4c_{1} } \right)/\left( {157c_{2} - 157c_{1} } \right)\).

Compared with the results without retailers in Proposition 3, there are two main differences. Firstly, technology sharing will only be achieved in supply chain settings when Farmer 2’s production cost is higher than Farmer 1’s. However, technology sharing does not have such a constraint when retailers are not concerned. This is because when Farmer 2’s production cost is small, the competition is fierce between two upstream farmers, and the double marginalization effect further lowers the profit margin of Farmer 1. Accordingly, Farmer 1 will share his technology only when the transfer fee is relatively large, while Farmer 2 will accept technology sharing when the transfer fee is negligible. Therefore, they cannot agree on the transfer fee in supply chain settings. Secondly, when the technology sharing ratio is substantial, technology sharing will not be achieved in supply chain settings, while it can be achieved without the double marginalization effect. When the technology sharing ratio is considerable (approaching 1), Farmer 1 charges too much for technology sharing. For Farmer 2, the transfer fee of technology sharing is greater than the increased profit from technology sharing. Additionally, the retailers divide a part of the profit, which harms the profit of the upstream farmers. Since the wholesale price intensifies the double marginalization effect, Farmer 1 shares a little technology to Farmer 2 to exchange a small transfer fee.

Proposition 11

Under the RF contract, technology sharing cannot be achieved in supply chain settings.

Under the RF contract, although Farmer 1 can get a transfer fee from Farmer 2, it cannot compensate for the loss of self-profit caused by the loss of cost advantage. Thus, Farmer 1 has no incentive to share his technology though Farmer 2 is willing to accept technology sharing.

We suggest that farmers that sell products by retailers or groceries should conduct technology sharing under the fixed fee contract.

5.3 Technology sharing under yield uncertainty

In this subsection, we investigate the strategy of farmer’s technology sharing under yield uncertainty due to natural factors such as climate changes and limited water. The actual quantity produced is given by \(\gamma_{i} q_{i}^{{}}\), where \(\gamma_{i}\) is a random variable reflecting the random yield for Farmer \(i\) (\(i{ = }1,2\)). We assume that \(\gamma_{1}\) and \(\gamma_{2}\) are identically and independently distributed,Footnote 1 and the mean and variance of the yield uncertainty are \(\mu = E\left[ {\gamma_{i} } \right]\) and \(\sigma^{2} = Var\left[ {\gamma_{i} } \right]\), respectively. Without loss of generality, we take \(\mu = 1\) to focus on the impact of the variance of yield uncertainty on technology sharing. In this case, the market price is given by the inverse demand function:

Farmers have to pay for the production cost according to the production quantity targeted by themselves before harvest. Therefore, when technology sharing is not achieved, the optimization of Farmer i can be stated as follows:

Under the FF contract, the optimization of Farmers 1 and 2 can be stated as follows:

Under the RF contract, the optimization of Farmers 1 and 2 can be stated as follows:

According to Eqs. (9)–(12), we thus can obtain that under the FF contract, technology sharing will be achieved if and only \(F_{6}^{FF} < F < F_{5}^{FF}\). It indicates that technology sharing will be realized under the FF contract when the transfer fee is medium. This is consistent with Proposition 3 and suggests that though yield uncertainty can affect the target production of farmers, it will not qualitatively affect the conditions for technology sharing. The above analysis implies that regardless of yield uncertainty, the strategy of technology sharing among farmers still holds.

Next, we explore how the variance of yield uncertainty influences farmers’ willingness to promote technology sharing under the FF contract. As the variance of the yield uncertainty increases, Farmer 1’s additional gain from sharing technology is larger, meanwhile, Farmer 2’s additional gain from purchasing technology is larger only when the production cost of Farmer 2 is high (i.e., \(c_{2} > \frac{{a + 7c_{1} - 4c_{1} k}}{8 - 4k}\)). Denoting \(\Delta \pi_{1}^{{FF{*}}} = \pi_{1}^{FF*} - \pi_{1}^{B*}\) and \(\Delta \pi_{2}^{{FF{*}}} = \pi_{2}^{FF*} - \pi_{2}^{B*}\). We have Proposition 12.

Proposition 12

Suppose technology sharing is achieved. Under the FF contract, (1) for Farmer 1, \(\Delta \pi_{1}^{{FF{*}}}\) increases with \(\sigma\), i.e., \(\partial \Delta \pi_{1}^{{FF{*}}} /\partial \sigma > 0\). (2) For Farmer 2, \(\Delta \pi_{2}^{{FF{*}}}\) increases with \(\sigma\) iff {\(c_{2} > \frac{{a + 7c_{1} - 4c_{1} k}}{8 - 4k}\) and \(\sigma < \sigma_{1}\)}, i.e., \(\partial \Delta \pi_{2}^{{FF{*}}} /\partial \sigma > 0\).

Under the RF contract, according to Eqs. (9), (10), (13), and (14), technology sharing will be achieved if and only if \(r_{4}^{RF} < r < \min \left\{ {r_{3}^{RF} ,r_{6}^{RF} } \right\}\) or \(\max \left\{ {r_{4}^{RF} ,r_{5}^{RF} } \right\} < r < r_{6}^{RF}\).Footnote 2 It indicates that a medium royalty fee can guarantee the realization of technology sharing, which is consistent with Proposition 4. This shows the robustness of technology sharing under the RF contract.

However, how the variance of the yield uncertainty influences farmers’ willingness to promote technology sharing under the RF contract cannot be analytically given. Therefore, we numerically investigate the impact of the variance of yield uncertainty, as shown in the “Appendix”. We illustrate that sharing technology can help Farmer 1 cope with yield uncertainty under the RF contract. While for Farmer 2, he will purchase technology from Farmer 1 when the variance of yield uncertainty is relatively small.

6 Conclusions

In the competitive settings of farmers, some farmers with technology (i.e., licensors) are confronted with the difficulty that they do not know whether to share their technology with their peers, while others without technology (i.e., licensees) puzzle whether they should purchase it to increase profit. Both non-sharing technology and blindly sharing all technology are considered unsatisfactory strategies because technology sharing is a double-edged sword. For the licensors, too much technology sharing may significantly decrease their competitiveness, whereas little technology sharing may make technology sharing less profitable for them. Meanwhile, the licensees need to make a tradeoff between the increased marginal profit and the transfer fee. Hence, we propose a technology sharing ratio to better characterize technology sharing.

We identify the conditions for technology sharing between two farmers under the fixed-fee contract and the royalty-fee contract when contract parameters are exogenous and endogenous, respectively, and we show how different contracts work. We offer a win–win outcome for farmers when technology sharing is achieved under the fixed-fee contract and the royalty-fee contract. Additionally, as the technology sharing ratio increases, the profits of both farmers simultaneously increase under the fixed-fee contract, whereas under the royalty-fee contract, the profit of the licensor decreases, while the profit of the licensee increases. Since the achievement of technology sharing will lead to the licensor’s loss of cost advantage, a more intensified competition will make the whole market share larger, which is beneficial to consumers. The managerial insight is that governments can promote the achievement of technology sharing among farmers. This paper indicates that the licensor prefers the royalty-fee contract to the fixed-fee contract when contract parameters are endogenous. This is because the transfer fee is larger under the royalty-fee contract than that under the fixed-fee contract corresponding to the same technology sharing ratio.

We further consider the two-part tariff contract and introduce technology sharing to the settings of supply chain and yield uncertainty. We provide technology sharing conditions for the licensor under the two-part tariff contract and find that the fixed-fee contract can perform better than the two-part tariff contract when the production costs of the licensor and the licensee are similar. Afterwards, in supply chain settings, we observe that a small technology sharing ratio can guarantee technology sharing under the fixed-fee contract. In contrast, technology sharing will never be achieved under the royalty-fee contract. Finally, we find that the results of technology sharing are robust considering yield uncertainty, and show that sharing technology might enhance both farmers’ profits when yield uncertainty exists.

Since we have obtained some managerial insights, we hope this work will inspire more future research on this topic. First, based on the models and results of this paper, one can consider the condition where multiple farmers seek technical help. Hence, farmers with a technology need to decide how many farmers to share technology with and how much technology to communicate with each farmer. Second, one can extend the analysis considering the uncertain demand to investigate how farmers cope with the uncertainty in technology sharing settings.

Notes

Suppose \(\gamma_{1}\) and \(\gamma_{2}\) are identical. The corresponding equilibrium outcomes are the same with those in Sect. 4.

The proofs of conditions for technology sharing under the FF contract and the RF contract are shown in the “Appendix”.

References

Alene, A. D., & Manyong, V. M. (2006). Farmer-to-farmer technology diffusion and yield variation among adopters: The case of improved cowpea in northern Nigeria. Agricultural Economics, 35(2), 203–211.

Alizamir, S., Iravani, F., & Mamani, H. (2019). An analysis of price vs. revenue protection: Government subsidies in the agriculture industry. Management Science, 65(1), 32–49.

An, J., Cho, S. H., & Tang, C. S. (2015). Aggregating smallholder farmers in emerging economies. Production and Operations Management, 24(9), 1414–1429.

Asrat, S., Yesuf, M., Carlsson, F., & Wale, E. (2010). Farmers’ preferences for crop variety traits: Lessons for on-farm conservation and technology adoption. Ecological Economics, 69(12), 2394–2401.

Becker, G. S. (2008). Livestock feed costs: Concerns and options. Congressional Research Service, Library of Congress.

Boyabatlı, O., Nasiry, J., & Zhou, Y. (2019). Crop planning in sustainable agriculture: Dynamic farmland allocation in the presence of crop rotation benefits. Management Science, 65(5), 2060–2076.

Chakraborty, A., Mateen, A., Chatterjee, A. K., & Haldar, N. (2018). Relative power in supply chains-impact on channel efficiency & contract design. Computers & Industrial Engineering, 122, 202–210.

Chen, Y. J., & Tang, C. S. (2015). The economic value of market information for farmers in developing economies. Production and Operations Management, 24(9), 1441–1452.

Chen, Y. J., Shanthikumar, J. G., & Shen, Z. J. M. (2015). Incentive for peer-to-peer knowledge sharing among farmers in developing economies. Production and Operations Management, 24(9), 1430–1440.

Chen, J., Liang, L., & Yao, D. Q. (2017). An analysis of intellectual property licensing strategy under duopoly competition: Component or product-based? International Journal of Production Economics, 194, 502–513.

Cheng, J., Gong, B., & Li, B. (2018). Cooperation strategy of technology licensing based on evolutionary game. Annals of Operations Research, 268, 387–404.

Comhaire, P., & Papier, F. (2015). Syngenta uses a cover optimizer to determine production volumes for its European seed supply chain. Interfaces, 45(6), 501–513.

Conley, T. G., & Udry, C. R. (2010). Learning about a new technology: Pineapple in Ghana. American Economic Review, 100(1), 35–69.

Deo, S., & Corbett, C. J. (2009). Cournot competition under yield uncertainty: The case of the US influenza vaccine market. Manufacturing & Service Operations Management, 11(4), 563–576.

Ertek, G., & Griffin, P. M. (2002). Supplier-and buyer-driven channels in a two-stage supply chain. IIE Transactions, 34(8), 691–700.

Federgruen, A., Lall, U., & Şimşek, A. S. (2019). Supply chain analysis of contract farming. Manufacturing & Service Operations Management, 21(2), 361–378.

Gallini, N. T., & Winter, R. A. (1985). Licensing in the theory of innovation. The RAND Journal of Economics, 16, 237–252.

Hu, B., Hu, M., & Yang, Y. (2017). Open or closed? Technology licensing, supplier investment, and competition. Manufacturing & Service Operations Management, 19(1), 132–149.

Jang, W., & Klein, C. (2011). Supply chain models for small agricultural enterprises. Annals of Operations Research, 190, 359–374.

Jiang, B., & Shi, H. (2018). Inter-competitor licensing and product innovation. Journal of Marketing Research, 55(5), 738–751.

Just, R. E. (2001). Addressing the changing nature of uncertainty in agriculture. American Journal of Agricultural Economics, 83(5), 1131–1153.

Kamien, M. I., & Tauman, Y. (1986). Fees versus royalties and the private value of a patent. The Quarterly Journal of Economics, 101(3), 471–492.

Kiptot, E., & Franzel, S. (2014). Voluntarism as an investment in human, social and financial capital: Evidence from a farmer-to-farmer extension program in Kenya. Agriculture and Human Values, 31(2), 231–243.

Kitagawa, T., Masuda, Y., & Umezawa, M. (2014). Patent strength and optimal two-part tariff licensing with a potential rival. Economics Letters, 123(2), 227–231.

Kulatilaka, N., & Lin, L. (2006). Impact of licensing on investment and financing of technology development. Management Science, 52(12), 1824–1837.

Lapierre, M., Sauquet, A., & Julie, S. (2019). Providing technical assistance to peer networks to reduce pesticide use in Europe: Evidence from the French Ecophyto plan. Available at: https://hal.archives-ouvertes.fr/hal-02190979. Access 24, March 2021.

Lewis, W. A. (1941). The two-part tariff. Economica, 8(31), 249–270.

Li, Z., Yu, X., Zeng, Y., & Holst, R. (2012). Estimating transport costs and trade barriers in China: Direct evidence from Chinese agricultural traders. China Economic Review, 23, 1003–1010.

Liao, C. N., Chen, Y. J., & Tang, C. S. (2019). Information provision policies for improving farmer welfare in developing countries: Heterogeneous farmers and market selection. Manufacturing & Service Operations Management, 21(2), 254–270.

Ling, G., & Bextine B. (2017). Precision farming increases crop yields. Scientific American. Available at: https://www.scientificamerican.com/article/precision-farming/. Access 24, March 2021.

MacDonald, J. M., & Burns, C. (2019). Marketing and production contracts are widely used in US agriculture. Amber Waves: The Economics of Food, Farming, Natural Resources, and Rural America (1490-2020-725).

MacDonald, J. M., Perry, J., Ahearn, M. C., Banker, D., Chambers, W., Dimitri, C., Key, N., Nelson, K., & Southard, L. W. (2004). Contracts, markets, and prices: Organizing the production and use of agricultural commodities. USDA-ERS Agricultural Economic Report, 837.

Maltais, K. (2020a). Even with a strong crop this year, U.S. farmers are suffering. Wall Street Journal. Available at: https://www.wsj.com/articles/even-with-a-strong-crop-this-year-u-s-farmers-are-suffering-11598088601. Access 19, September 2021.

Maltais, K. (2020b). Farmers reap big harvest after tough year. Wall Street Journal. Available at: https://www.wsj.com/articles/farmers-reap-big-harvest-after-tough-year-11578684956. Access 19, September 2021.

Matuschke, I., & Qaim, M. (2009). The impact of social networks on hybrid seed adoption in India. Agricultural Economics, 40(5), 493–505.

Mensendiek, A., & Mitri, R. (2014). Contracting a development supplier in the face of a cost-competitive second source of supply. IEEE Transactions on Engineering Management, 61(3), 438–449.

Mtega, W. P., Dulle, F., & Benard, R. (2013). Understanding the knowledge sharing process among rural communities in Tanzania: A review of selected studies. Knowledge Management & E-Learning: An International Journal, 5(2), 205–217.

Mzali, S. (2019). Agriculture in Africa 2019: special Report. Oxford business group. Available at: https://oxfordbusinessgroup.com/blog/souhir-mzali/focus-reports/agriculture-africa-2019-special-report. Access 24, March 2021.

Nakano, Y., Tsusaka, T. W., Aida, T., & Pede, V. O. (2018). Is farmer-to-farmer extension effective? The impact of training on technology adoption and rice farming productivity in Tanzania. World Development, 105, 336–351.

Pacín, F., & Oesterheld, M. (2015). Closing the technological gap of animal and crop production through technical assistance. Agricultural Systems, 137, 101–107.

Rostoker, M. D. (1983). A Survey of Corporate Licensing. Idea, 24, 59.

Savage, I. (2019). 10 Facts about farming in Africa. Borden project. Available at: https://borgenproject.org/10-facts-about-farming-in-africa/. Access 24, March 2021.

Savva, N., & Taneri, N. (2015). The role of equity, royalty, and fixed fees in technology licensing to university spin-offs. Management Science, 61(6), 1323–1343.

Sen, D., & Tauman, Y. (2007). General licensing schemes for a cost-reducing innovation. Games and Economic Behavior, 59(1), 163–186.

Vives, S. X. (1984). Price and quantity competition in a differentiated duopoly. The RAND Journal of Economics, 15(4), 546–554.

Yang, R., & Ma, L. (2017). Two-part tariff contracting with competing unreliable suppliers in a supply chain under asymmetric information. Annals of Operations Research, 257, 559–585.

Yang, F., Jiao, C., & Ang, S. (2019). The optimal technology licensing strategy under supply disruption. International Journal of Production Research, 57(7), 2057–2082.

Zhang, Q., Zhang, J., Zaccour, G., & Tang, W. (2018). Strategic technology licensing in a supply chain. European Journal of Operational Research, 267(1), 162–175.

Zhang, X., Qing, P., & Yu, X. (2019). Short supply chain participation and market performance for vegetable farmers in China. Australian Journal of Agricultural and Resource Economics, 63, 282–306.

Zhao, D., Chen, H., Hong, X., & Liu, J. (2014). Technology licensing contracts with network effects. International Journal of Production Economics, 158, 136–144.

Acknowledgements

This work was supported by: (i) the National Natural Science Foundation of China [grant numbers 72171113, 72171108, 71871112]; (ii) Jiangsu province’s “333 project” training funding project [Grant number BRA2019040]; and (iii) Nanjing University Innovation Program for PhD candidate [Grant number CXCY19-14].

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Proof of Table 1

When technology sharing is not achieved, since \(\partial^{2} \pi_{i} /\partial q_{i}^{2} = - 2 < 0\), \(\pi_{i}\) is a concave function of \(q_{i}\). Hence, solving the first-order conditions \(\partial \pi_{1} /\partial q_{1} = 0\) and \(\partial \pi_{2} /\partial q_{2} = 0\), we have \(q_{1}^{B*} = \left( {a - 2c_{1} + c_{2} } \right)/3\) and \(q_{2}^{B*} = \left( {a + c_{1} - 2c_{2} } \right)/3\). Then we get \(p^{B*}\), \(\pi_{1}^{B*}\), and \(\pi_{2}^{B*}\) from Eqs. (2), and (3). Plugging \(q_{i}^{B*}\) and \(p^{B*}\) into Eq. (1), we can get \(CS_{i}^{B*}\). As shown in the second column of Table 1.

When technology sharing is achieved under the FF contract or the RF contract between Farmers 1 and 2, proofs are similar to that without technology sharing.

Proof of Proposition 1

Under the RF contract, to guarantee \(\partial \pi_{1}^{RF*} /\partial r = \left[ {5a - (1 + 4k)c_{1} - (4 - 4k)c_{2} - 10r} \right]/9 < 0\), we have \(r > \left( {5a - c_{1} - 4c_{2} - 4kc_{1} + 4kc_{2} } \right)/10\). To guarantee \(\partial \pi_{2}^{RF*} /\partial r = [(1 - 2k)c_{1} - 2(1 - k)c_{2} + a - 4r]/3 > 0\), we have \(r > \left( {a + c_{1} - 2c_{2} - 2kc_{1} + 2kc_{2} } \right)/2\). Since \(\left( {a + c_{1} - 2c_{2} - 2kc_{1} + 2kc_{2} } \right)/2 > \left( {5a - c_{1} - 4c_{2} - 4kc_{1} + 4kc_{2} } \right)/10\), we have Proposition 1.

Proof of Proposition 2

To guarantee \(\pi_{1}^{FF*} - \pi_{1}^{RF*} = \left[ {r\left( {4c_{2} + c_{1} - 5a + 4kc_{1} - 4kc_{2} + 5r} \right) + 9kF} \right]/9 > 0\), we have \(F > \left( {5a - c_{1} - 4c_{2} - 4kc_{1} + 4kc_{2} - 5r} \right)r/\left( {9k} \right)\). To guarantee \(\pi_{2}^{{FF{*}}} - \pi_{2}^{{RF{*}}} = \left[ {\left( {a - 2c_{1} + kc_{1} + c_{2} - kc_{2} } \right)^{2} - \left( {a + c_{1} - 2kc_{1} - 2c_{2} + 2kc_{2} - 2r} \right)^{2} + 9kF} \right]/9 > 0\), we have \(F < 4\left( {a + c_{1} - 2c_{2} - 2kc_{1} + 2kc_{2} - r} \right)r/\left( {9k} \right)\). To guarantee \(\left( {5a - c_{1} - 4c_{2} - 4kc_{1} + 4kc_{2} - 5r} \right)r/\left( {9k} \right) < 4\left( {a + c_{1} - 2c_{2} - 2kc_{1} + 2kc_{2} - r} \right)r/\left( {9k} \right)\), we have \(\max \left\{ {r/\left( {c_{2} - c_{1} } \right),\left( {c_{2} - c_{1} + r} \right)/\left( {2c_{2} - 2c_{1} } \right)} \right\} < k < 1\). Hence, we have Proposition 2.

Proof of Proposition 3

Under the FF contract, Farmer 1 shares his technology when \(\pi_{1}^{FF*} > \pi_{1}^{B*}\), Hence, solving the inequality \(\pi_{1}^{FF*} - \pi_{1}^{B*} = \left[ {\left( {c_{2} - c_{1} } \right)\left( {4c_{1} - kc_{1} - 2c_{2} + kc_{2} - 2a} \right) + 9F} \right]/9 > 0\), we have \(F \ge F_{1}^{FF} = (c_{2} - c_{1} )\left[ {2a - c_{1} (4 - k) + c_{2} (2 - k)} \right]/9 > 0\). By solving the inequality \(\pi_{2}^{FR*} - \pi_{2}^{B*} = \left[ {4\left( {c_{2} - c_{1} } \right)\left( {c_{1} - kc_{1} - 2c_{2} + kc_{2} + a} \right) - 9F} \right]/9 > 0\), we have \(F \le F_{2}^{FF} = 4(c_{2} - c_{1} )\left[ {a + c_{1} (1 - k) - c_{2} (2 - k)} \right]/9\). To guarantee \(F_{1}^{FF} < F_{2}^{FF}\), we have {\(c_{2} \ge \left( {a + c_{1} } \right)/2\) and \(k > \left( {2c_{2} - c_{1} - a} \right)/\left( {c_{2} - c_{1} } \right)\)} or \(c_{2} < \left( {a + c_{1} } \right)/2\). Then we have Proposition 3.

Proof of Proposition 4

Similar to the proof of Proposition 3, by solving the inequality group. \(\left\{ \begin{array}{l} \pi_{1}^{RF*} - \pi_{1}^{B*} = ({c_{2} - c_{1} } )(k^{2} c_{2} - k^{2} c_{1} - 2ak + 4kc_{1} -2kc_{2}\\ \quad - 5ar + rc_{1} + 4rc_{2} + 4krc_{1} - 4krc_{2} +5r^{2} )/9 > 0\\ \pi_{2}^{RF*} - \pi_{2}^{B*} = 4( {kc_{2} - kc_{1}- r} )({c_{1} - kc_{1} - 2c_{2} + kc_{2} + a - r})/9 > 0\\ \end{array} \right.\), we have Proposition 4.

Proof of Proposition 5

Under the FF contract, since \(\partial^{2} \pi_{1}^{FF*} /\partial k^{2} = 2\left( {c_{1} - c_{2} } \right)^{2} /9 > 0\), \(\partial^{2} \pi_{2}^{FF*} /\partial k^{2} = 8\left( {c_{1} - c_{2} } \right)^{2} /9 > 0\), i.e., \(\pi_{i}^{FR*}\) is a convex function of \(k\). The first-order conditions of \(k\) are \(\partial \pi_{1}^{FF*} /\partial k = 2\left( {c_{2} - c_{1} } \right)\left[ {\left( {2 - k} \right)c_{1} + kc_{2} - a} \right]/9 + F = 0\) and \(\partial \pi_{2}^{FF*} /\partial k = 4(c_{2} - c_{1} )\left[ {(1 - 2k)c_{1} + 2(k - 1)c_{2} + a} \right]/9 - F = 0\). Then we can get \(k_{1}^{FF*} = \left[ {4c_{1}^{2} + 2a(c_{2} - c_{1} ) - 6c_{1} c_{2} + 2c_{2}^{2} - 9F} \right]/\left[ {2\left( {c_{2} - c_{1} } \right)^{2} } \right]\) and \(k_{2}^{FF*} = \left[ {4c_{1}^{2} + 4a(c_{1} - c_{2} ) - 12c_{1} c_{2} + 8c_{2}^{2} { + }9F} \right]/\left[ {8\left( {c_{2} - c_{1} } \right)^{2} } \right]\) corresponding to the minimum profits of Farmers 1 and 2. According to \(\left\{ {\begin{gathered} \pi_{1}^{FF*} - \pi_{1}^{B*} = \left[ {\left( {c_{2} - c_{1} } \right)\left( {4c_{1} - kc_{1} - 2c_{2} + kc_{2} - 2a} \right) + 9F} \right]/9 > 0 \hfill \\ \pi_{2}^{FF*} - \pi_{2}^{B*} = \left[ {4\left( {c_{2} - c_{1} } \right)\left( {c_{1} - kc_{1} - 2c_{2} + kc_{2} + a} \right) - 9F} \right]/9 > 0 \hfill \\ \end{gathered}} \right.\), we can get that.

\(k > \max \{ \frac{{4c_{1}^{2} + 2a\left( {c_{2} - c_{1} } \right) - 6c_{1} c_{2} + 2c_{2}^{2} - 9F}}{{\left( {c_{2} - c_{1} } \right)^{2} }},\frac{{4c_{1}^{2} + 4a\left( {c_{2} - c_{1} } \right) - 12c_{1} c_{2} + 8c_{2}^{2} - 9F}}{{4\left( {c_{2} - c_{1} } \right)^{2} }}\}\). Since \(k_{i}^{FR*} < \min \{ \frac{{4c_{1}^{2} + 2a\left( {c_{2} - c_{1} } \right) - 6c_{1} c_{2} + 2c_{2}^{2} - 9F}}{{\left( {c_{2} - c_{1} } \right)^{2} }},\frac{{4c_{1}^{2} + 4a\left( {c_{2} - c_{1} } \right) - 12c_{1} c_{2} + 8c_{2}^{2} - 9F}}{{4\left( {c_{2} - c_{1} } \right)^{2} }}\}\), we have \(\partial \pi_{1}^{{FF{*}}} /\partial k > 0\) and \(\partial \pi_{2}^{{FF{*}}} /\partial k > 0\).

Under the RF contract, in the same way, we can get \(\partial \pi_{1}^{{RF{*}}} /\partial k < 0\) and \(\partial \pi_{2}^{{RF{*}}} /\partial k > 0\).

Proof of Proposition 6

\(CS^{FF*} - CS^{B*} = \left( {c_{2} - c_{1} } \right)\left[ {4a - (2 + k)c_{1} - \left( {2 - k} \right)c_{2} } \right]k/18\), since \(a > c_{2} > c_{1}\), we have \(c_{2} - c_{1} > 0\) and \((2 + k)c_{1} + \left( {2 - k} \right)c_{2} < 4c_{2}\). Hence, we have \(4a - (2 + k)c_{1} - \left( {2 - k} \right)c_{2} > 0\) and \(CS^{FF*} - CS^{B*} > 0\). In the same way, we can get \(CS^{RF*} - CS^{B*} > 0\) and \(CS^{FF*} - CS^{RF*} > 0\). Then, we have Proposition 6.

Proof of Proposition 7

Under the FF contract, when Farmer 1 decides \(F\), the problem of Farmer 1 is,

We get \(F^{*} = F_{2}^{FF}\). Under the RF contract, when Farmer 1 decides \(r\), in the same way, we have \(r^{*} = r_{2}^{RF}\). According to the derivation above, the profit functions of Farmers 1 and 2 are \(\overline{\pi }_{1}^{{FF{*}}} { = }\left[ {\left( {a - c_{1} + 2c_{2} } \right)^{2} - 2\left( {c_{2} - c_{1} } \right)\left( {5c_{2} - 4c_{1} - a} \right)k + 5\left( {c_{2} - c_{1} } \right)^{2} k^{2} } \right]/9\) and \(\overline{\pi }_{2}^{{FF{*}}} { = }\left( {a + c_{1} - 2c_{2} } \right)^{2} /9\) under the FF contract and \(\overline{\pi }_{1}^{{RF{*}}} { = }\left[ {\left( {a - c_{1} + 2c_{2} } \right)^{2} - 3\left( {c_{2} - c_{1} } \right)\left( {2c_{2} - c_{1} - a} \right)k} \right]/9\) and \(\overline{\pi }_{2}^{{RF{*}}} { = }\left( {a + c_{1} - 2c_{2} } \right)^{2} /9\) under the RF contract. We have \(\overline{\pi }_{1}^{{RF{*}}} - \overline{\pi }_{1}^{{FF{*}}} = k\left( {c_{2} - c_{1} } \right)\left[ {\left( {1 - k} \right)5c_{1} - \left( {4 - 5k} \right)c_{2} - a} \right]/9 > 0\). Thus we have Proposition 7.

Proof of Corollary 1

Under the FF contract, when Farmer 1 designs the contract, to guarantee \(\overline{\pi }_{1}^{{FF{*}}} - \overline{\pi }_{1}^{{B{*}}} = \left[ {5\left( {c_{2} - c_{1} } \right)^{2} k^{2} - 2\left( {c_{2} - c_{1} } \right)\left( {5c_{2} - 4c_{1} - a} \right)k} \right]/9 > 0\), we have \(\max \left\{ {2\left( {5c_{2} - 4c_{1} - a} \right)/\left( {5c_{2} - 5c_{1} } \right),0} \right\} \le k < \min \left\{ {2\left( {5c_{2} - 4c_{1} - a} \right)/\left( {5c_{2} - 5c_{1} } \right),1} \right\}\).

Proof of Corollary 2

When Farmer 1 designs the contract, \(\overline{\pi }_{1}^{{FF{*}}}\) is a convex function of \(k\) due to \(\partial^{2} \overline{\pi }_{1}^{{FF{*}}} /\partial k^{2} = 10\left( {c_{1} - c_{2} } \right)^{2} /9 > 0\). Given \(\partial \overline{\pi }_{1}^{{FF{*}}} /\partial k = 0\), we have \(k_{1}^{*} = \left( {5c_{2} - 4c_{1} - a} \right)/\left( {5c_{2} - 5c_{1} } \right)\). Since \(k^{*} < 0\), we have \(\partial \overline{\pi }_{1}^{{FF{*}}} /\partial k > 0\).

Proof of Corollary 3

The proof of Corollary 3 is similar to that of Proposition 5.

Proof of Proposition 8

Under the TT contract, since \(\partial^{2} \pi_{i} /\partial q_{i}^{2} = - 2 < 0\), \(\pi_{i}\) is a concave function of \(q_{i}\). Hence, by solving the first-order conditions \(\partial \pi_{1} /\partial q_{1} = 0\) and \(\partial \pi_{2} /\partial q_{2} = 0\), we have \(q_{1}^{TT*} = \left[ {a + (k - 2)c_{1} + (1 - k)c_{2} + r} \right]/3\) and \(q_{2}^{TT*} = \left[ {a + (1 - 2k)c_{1} + 2(k - 1)c_{2} - 2r} \right]/3\). Then we get the selling price \(p^{TT*} = \left[ {a + (1 + k)c_{1} + (1 - k)c_{2} + r} \right]/3\) from Eq. (2). Thus, we have \(\pi_{1}^{TT*} = [a + (1 - 2k)c_{1} + (2k - 2)c_{2} - 2r]^{2} /9 + kF\) and \(\pi_{2}^{TT*} = [2a - (1 + k)c_{1} + (k - 1)c_{2} + r]^{2} /18 - kF\) from Eqs. (4) and (5). To guarantee \(\pi_{1}^{TT*} - \pi_{1}^{FF*} = \left( {5a - c_{1} - 4kc_{1} - 4c_{2} + 4kc_{2} - 5r} \right)r/9 > 0\), we have \(c_{2} < \left( {a + c_{1} } \right)/2\). We always have \(\pi_{1}^{TT*} - \pi_{1}^{RF*} = kF > 0\).

Proof of Proposition 9

Solving the inequality group