Abstract

A closed-loop supply chain seeks to enhance the consumers’ environmental consciousness to increase both the profits and the return of past-sold products. Even though, firms have misaligned interests for closing the loop: while all firms exploit consumers environmental consciousness to increase sales, only manufacturers use it for appropriating of returns’ residual value. Starting from a benchmark (no-incentive) scenario where a manufacturer (M) is the leader and a retailer (R) is the follower, we develop two incentive games through a profit-sharing contract to align firms’ motivations for closing the loop. In both incentive games, the incentive takes the form of a share of profits that M transfers to R. Our question is how the sharing fraction should be determined to make both players economically better-off. The first incentive game assumes that R has no-information on the sharing parameter, which is determined by M after R sets her strategies; thus the incentive has an endogenous nature. In the second incentive game the sharing parameter is common knowledge and both players know its values before the game starts, thus the incentive has an exogenous nature. We find that an endogenous incentive is never more economically and environmentally convenient than a no-incentive game. In contrast, an exogenous incentive can make both players economically better-off inside specific sharing parameter ranges. Nevertheless, when other forces (e.g., competition or legislation) impose the adoption of a profit-sharing contract, M should supply an endogenous incentive when the exogenous share is either too high or too low.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent developments in supply chain research have focused on the proper management of both forward and reverse activities and flows. In addition to exclusively managing forward flows with the objective of increasing sales, supply chains also extend their attention to backward flows with the intent of increasing economic performance through reverse logistics management (Guide and Van Wassenhove 2002). Backward activities include the implementation of atypical managerial practices, such as product acquisition, reverse logistics, points of use and disposal, testing, sorting, refurbishing, recovery, recycling, re-marketing, and re-selling (Guide and van Wassenhove 2009; Fleischmann et al. 2001). The management of these activities requires adequate production plants and logistics networks, proper product design and engineering, appropriate procurement and quality controls, suitable marketing/sales/distribution, and after-sale service activities. Through these actions the chain takes the form of closed-loop supply chain (CLSC) because it consists of an integration between traditional flows of raw materials, goods, and information, with the reverse flows of past sold products (Guide and Van Wassenhove 2002).

Companies in CLSCs should put into place numerous managerial practices to optimally manage remanufacturing activities which can supply really high economic rewards. For example, the remanufacturing sector in the US domestic steel industry reaches annual sales in excess of $53 billion (Lund 1996). Americans buy approximately 60 million of remanufactured automotive products annually (Seitz and Peattie 2004), while about 500 million starter batteries and large accumulators are sold worldwide, with sales totaling approximately US $16–17 million (Schultmann et al. 2003). Remanufacturing is also a considerable element of the UK economy, estimated to have a value of £5 billion and to represent UK-wide savings of 270,000 tonnes of raw materials and 800,000 tons of \(\hbox {CO}_{2}\) (Parker and Butler 2007). In light of the depleting landfill capacity, waste reduction has become a major concern in many industries and countries. In addition to landfill bans and increased disposal fees, more restrictions have been applied to producers. For instance, European Union legislation requires tire manufacturers to arrange for the recycling of one used tire for every new tire they sell (Guide and Van Wassenhove 2001). In the Netherlands and Taiwan, legislation has imposed take-back obligations for numerous products, including cars; Germany’s environmental regulations and increased disposal costs require the steel industry to recycle 0.5 tons of by-products for every 1 ton of steel produced (Fleischmann et al. 2002).

Consequently, manufacturers become really concerned about the managerial challenges linked to remanufacturing (e.g., collection, acquisition, sorting, etc.). Yet, achieving high return rates, thought as the percentage of past-sold products that returns back to be remanufactured, allow manufacturers not only to face take-back obligations that legislation eventually imposes, but also to acquire the residual value that returns carry out (Guide and van Wassenhove 2009). The manufactures’ core economic motivation to close the loop consists of the cost savings due to the usage of returns rather than raw materials in the production of new products. Returns carry out a residual value that manufacturers seek to capture (Guide 2000) and that varies according to the industry. For instance, car engines can lead to a 40 % cost savings. Kodak, saves 40–60 % of production costs because it manufacturers by means of returned cameras rather than using raw material (Savaskan et al. 2004). Fleischmann et al. (2002) reported that remanufacturing costs at IBM are much lower than those for buying new parts, sometimes as much as 80 % lower. Xerox saves 40–65 % of its manufacturing costs by reusing parts, components and materials from returned products (Savaskan et al. 2004). Remanufactured cartridges cost 30–60 % less on a per-copy basis than non-remanufactured cartridges. TriNet has been purchasing remanufactured toner cartridges, saving 25–60 % in costs over the price of new cartridges within five years (www.stopwaste.com). Interface, Inc., is the world’s largest provider of commercial carpet tile. To create efficiency in the CLSC, the company has decided to lease carpets instead of selling them; the ownership of off-lease products provides to Interface motivations to close the loop and recover the residual value of these products (Agrawal and Tokay 2010).

Interestingly, manufacturers have the highest economic interest to closing the loop and contributing to their profits through the returns’ residual value. Retailers, distributors and all other firms involved in the forward activities do not have explicit operational and economic reasons to directly contribute in the management of backward activities (De Giovanni 2015). Their motivations to be part of a CLSC rely on the effect that green products and firms’ environmental commitments exert on consumers, who are increasingly concerned about the environment (Laroche et al. 2001). Consumers prefer to buy environmentally friendly products (green products) thus firms need to incorporate the concept of “Consumers Environmental Consciousness” in their business; the latter is defined by the International Institute of Sustainable Development (IISD) as the consumers’ attitude through the environmental consequences of their purchases (www.iisd.org). Firms need to educate consumers on environmental issues, by disseminating and gathering information about environmental concerns, with the intend to redirect their purchasing and preferences for green products. In sum, while all CLSC members instruct consumers and direct their preferences to increase sales (marketing motivations), only manufacturers benefits of the returns’ residual value and saving costs (operational motivations). This situation leads firms to have misaligned interests for closing the loop (De Giovanni 2015).

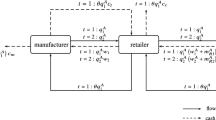

With the aim to align firms’ motivations, we characterize some incentive mechanisms and check whether they lead to CLSC coordination. The latter is intended as the implementation of a mechanism (e.g., a contract) that leads to a win-win situation and turns out to be profit-improving (Cachon 2003). Yet, an incentive mechanism seeks to direct receivers’ strategies through increasing the economic outcomes of the entire channel rather than only maximizing singular payoff functions (Pasternack 2002). Therefore, we start consider a two-echelon CLSC and model a single manufacturer-retailer dyad with product remanufacturing, in which the manufacturer (he) is the leader and the retailer (she) is the follower. Based on the previous observations, we consider a benchmark CLSC format where the manufacturer optimally sets wholesale and green efforts strategies, and the retailer optimally fixes the retail price as well as green advertising efforts. Starting from this benchmark structure that is characterized by misaligned interests for closing the loop, we consider two CLSC setups where the manufacturer transfers an incentive to the retailer to align motivations and coordinate the chain. The incentive takes the form of a share of manufacturer’s profits, which also accounts for backward activities rewards. The incentive is designed through a profit sharing contract and manufacturers can have either full knowledge on its amount (incentive with symmetric information on the sharing parameter) or decide it over the course of the game (incentive with asymmetric information on the sharing parameter). In the former case the sharing parameter is determined by the nature (e.g., industrial agreements) thus we will refer to it as an exogenous incentive; in the latter case the sharing parameter is optimally decided by the manufacturer, thus we will refer to it as an endogenous incentive. Because the manufacturer is the leader of the chain, it can decide whether the retailer should know in advance the share. This information substantially influences the retailer’s price and green advertising efforts. When the incentive has asymmetric information on the sharing parameter, the manufacturer optimally sets the share of profits to be transferred, thus the retailer determines her strategies without knowing the amount to be received. When the incentive is characterized by symmetric information on the sharing parameter, all firms know the share before that the game starts, thus the retailer decides strategies with full information on the incentive. We contrast and compare the results for the benchmark game with the incentive games to address the following research questions:

-

1.

How the alignment of motivations for closing the loop through endogenous and exogenous incentives modifies players’ strategies and profits?

-

2.

Does the alignment of motivations for closing the loop through endogenous and exogenous incentives lead to coordination of CLSCs?

-

3.

Are endogenous and exogenous incentives environmentally sustainable coordination mechanisms?

-

4.

What is the effect of operational and logistics efficiency on players’ preferences?

The paper models a differential game because both the return process and the closing the loop are dynamic phenomenon. Previous research in CLSC has focused either on static (e.g., Aras et al. 2004; Savaskan et al. 2004) or on two-period games (e.g., Atasu and Cetinkaya 2006; Majumder and Groenevelt 2001; Ferrer and Swaminathan 2006; De Giovanni and Zaccour 2014) thus research in dynamic settings needs to be further developed. Savaskan et al. (2004) invite researchers to study CLSC dynamically because the influence of a dynamic return rate changes the firms’ strategies and the channel’s outcomes. Further, the returns rate, which we model as a function of Consumers Environmental Consciousness, is per se dynamic because products sold in the past enter the return process only in the future. Finally, Consumers Environmental Consciousness is a green consumers’ status which is accumulated over time, thus the usage of dynamic modeling seems to be more appropriate than static ones.

Some of the key findings of this research demonstrate that a CLSC that implements an endogenous incentive underperforms firms’ profits and environmental performance. The analysis shows that the manufacturer invests less in green efforts because it has lower economic resources available due to the transferred incentive, while the retailer invests less in green advertising because the manufacturer keeps control on her profits. This implies lower stock of consumers’ environmental consciousness and profits. In contrast, an exogenous incentive is always beneficial for a retailer, who knows in advance the amount she will receive while the manufacturer loses some control over the chain. On his hand, the manufacturer is economically better-off through an exogenous incentive when the sharing parameter is medium: if the share is too low, the alignment of motivations for closing the loop is slightly possible, while high share makes incentive alignment marginally economically feasible. Finally, the manufacturer prefers an endogenous to an exogenous incentive when he is able to set sufficiently low shares. On her side, the retailer is always economically better-off through coordination when the incentive is exogenous, due to lower power that the manufacturer exerts over the chain and the full knowledge available for both the wholesale price and the sharing parameter. In the comparison among incentive schemes, the retailer has a preference for an endogenous incentive when the exogenous share is too low. Both the manufacturer and the retailer can improve profits through the adoption of an exogenous incentive for increasing values of returns’ residual value and logistics cost. Increasing remanufacturing cost negatively impacts on the incentive, which results in a lower convenience of aligning firms’ motivations to closing the loop.

The paper is organized as follows. Section 2 reviews the literature on incentive mechanisms in CLSC; Sect. 3 presents the model and the scenarios, while Sect. 4 characterizes the various equilibria. Section 5 compares players’ strategies and playoffs in the various scenarios and highlights the contributions of the paper. Section 6 presents some managerial insights while Sect. 7 discusses the impact of environmental performance on the success of coordination. Section 8 concludes, summarizes the findings, and proposes some future extensions.

2 Literature review

The main focus of this research is on identifying an incentive mechanism for a CLSC to align firms’ interests in closing the loop. The incentive mechanisms are thought following Corbett and Savaskan’s (2003) recommendations in designing incentive mechanisms, that is “...the attempt to make all parties internalize the full system-wide costs and benefits associated with their decisions...”. The incentive mechanisms that are characterized in this research aim at aligning firms’ motivations by making all firms responsible for both the operational and the marketing implications of their environmental strategies. Yet, various motivations drive CLSCs’ interests for incentive alignment such as pricing, competition, process improvements, capacity planning, setup, and inventory control (Souza 2013; Corbett and Savaskan 2003; Toptal and Çetinkaya 2015). In this research, the incentives take the form of a profit sharing contract (PSC), which is particular case of the traditional revenue sharing contract (RSC) as it has been presented by Cachon (2003) and Cachon and Lariviere (2005). Contrary to an RSC in which a downstream firm transfers a share to an upstream company to reduce the double marginalization effect (Gerchak and Wang 2004), a PSC establishes that the transfer occurs from the up to the downstream of a chain to influence and drive downstream firms’ strategies (e.g., De Giovanni 2014b). The share of profits represents the incentive to align firms’ interests over a CLSC, while most of the research mainly modeled per-return incentive mechanisms. Because we use a dynamic game framework, a PSC coordinates the chain more effectively than an RSC does because the incentive will depend on the consumers environmental consciousness, thus also considering the dynamic components. In contrast, an incentive based on revenues disregards the core part of the dynamic game, thus questioning of the needs of studying a dynamic setting.

De Giovanni and Zaccour (2014) model a two-stage game in which customers who purchased goods in the first period return their products in the second period, according to the return rate. The incentive assumes the form of per-return incentive, so the collector receives a fix per-product returned amount. Savaskan et al. (2004) model an incentive in which a manufacturer transfers a per-returned product price to a collector. They show that closing the loop through an incentive to a retailer is always economically preferable than transferring an incentive to a third party because the incentive leads to lower prices and double marginalization as well as higher sales. Savaskan and Van Wassenhove (2006) shown that the same mechanism is successful even in presence of competing retailers, in which competition amplifies the positive influence on a per-return incentive on pricing and double marginalization effects. Corbett and DeCroix (2001) demonstrate the benefits and the pitfalls of an incentive in the form of shared-savings mechanisms to align goals of maximizing jointly profits and minimizing consumption of material. De Giovanni (2014b) characterizes a per-return incentive through a revenue-sharing mechanism and show that the bargaining costs required to define an acceptable agreement between parties as well as the policing and enforcement costs to make sure the other parties stick to the terms of the agreements significantly lower an incentive’s capability to align firms’ interests to collaborate in a CLSC.

These papers share a common assumption: all firms have full information regarding the incentive, which is somehow determined before the game starts. The collector who receives the incentive optimally determines its strategies also considering the amplitude of an incentive. This research stream tackles with another group of papers that instead characterizes several forms of incentives while assuming information asymmetry among firms regarding the incentive. Consequently, the collector knows that an incentive will be supplied but its amount is not known upfront. The literature presents some papers that model asymmetric information on incentives. Ferguson and Tokay (2006) model an endogenous incentive that assumes the form of a target rebate to increase retailer’s wishes to invest more in green activity programs and perform the reverse logistics. Guide et al. (2003) model the case of an endogenous acquisition price: the decision maker has to decide a combination of acquisition prices according to the quality of different returns to maximize its profit. Similarly, Ray et al. (2005) use an endogenous price mechanism in the form of trade-in rebate to drive consumers’ willingness to repurchase. De Giovanni and Zaccour (2013) show that an endogenous support of some green activity programs always leads to coordination. Bakal and Akcali (2006) compare cases of endogenous and exogenous per-unit acquisition price and demonstrate that the two policies lead to substantially different operational performance and the production capacity setup.

With the purpose to put light on the importance of information structure, we characterize two incentive scenarios through a PSC in which the sharing fraction can be either exogenous (information is completely visible and available to all channel members before the game starts) or endogenous (information is not available in the contract content and one firm sets it optimally over the course of the game). Such a debate not only exists in the CLSC literature, but it has also been addressed in supply chain management research. Lots of papers have mainly focused on an exogenous profit-sharing fraction. Cachon (2003) and Cachon and Lariviere (2005) highlight the functionality of an RSC over a wholesale price contract when the sharing parameter is fixed. Qin and Yang (2008) and Linh and Hong (2009) allow players to decide the revenue-sharing fraction and price before the game starts, so both items are part of the contract content. Application of RSCs with an exogenous revenue-sharing fraction has been developed in several instances such as: Supply Quality Management (De Giovanni 2014a, b; El Ouardighi and Kogan 2013), green distribution channels (De Giovanni 2014b; De Giovanni and Zaccour 2013), supply chains with marketing and operations interfaces (El Ouardighi et al. 2008), distribution channel structure (Gangshu 2010), channel distribution power (Giannoccaro and Pontrandolfo 2009; De Giovanni and Roselli 2012), advanced booking programs (Bellantuono et al. 2009).

Nevertheless, recent contributions moved attention to endogenous sharing fraction because a firm decides the share to transfer according to the receivers’ strategies and commitment. Wang et al. (2004) model an endogenous scenario in which the retailer decides the sharing fraction after a manufacturer decides the level of stocks and price. Similarly, Yao et al. (2008) demonstrate that a coordination contract in which revenue-sharing proportion and pricing are decision variables is more efficient and flexible than a price-based mechanism. In a chain in which players decide pricing, revenue-sharing fraction, and promotional expenditures, an RSC always leads to several operational benefits (e.g., lower periodic reorder amounts and inventory costs) (Sheu 2011). Li et al. (2009) demonstrate that coordination through a consignment contract with revenue-sharing can be reached when a retailer optimally sets the share of revenues while the manufacturer decides both the quantity and retail price. De Giovanni (2015) models and compares two types of incentives to be developed in CLSCs: A state-control incentive, which depends on the environmental performance of the CLSC (e.g., dynamic return rate), and a control-dependent incentive, which depends on the collector’s efforts in closing the loop. Both incentives are endogenous and a manufacturer should always prefer a control-dependent incentive that charges a collector exclusively on its environmental performance.

The main contribution of this study to the extant research is the construction of incentive mechanisms based on a PSC to align firms’ motivations to close the loop. This paper also extends the current discussion on the nature (exogenous and endogenous) of sharing parameters that need to be determined in various circumstances, one of which is characterized by the availability of information. In a CLSC, this research identifies the conditions to align channel strategies, when firms take decisions inside different information sets.

3 The model

We consider a dynamic game of CLSC. The planning horizon is infinite, comprised of periods of equal lengths. We assume that the discount factor \(\rho \) is the same among players and over the scenarios that we explore. Table 1 displays the full set of notations that we use in this research.

3.1 CLSC structure, strategies and dynamics

A CLSC consists of one manufacturer, player M, and one retailer, player R. Over the manuscript we will refer to M as he and to R as she. M produces both new and remanufactured products and sells both product types to the same market. We assume that all products have the same quality, consumers cannot differentiate between new and remanufactured products, and thus remanufactured products are sold as new. M has established a make-to-order production system, and then he makes products to satisfy the market demand without accumulating inventory. We then assume that M has an infinite production capacity. M sells products to R at a wholesale price, \(\omega (t)\), which is his control variable. R purchases goods from M and sells them to the market according to a retail price, p(t), which is her control variable. We assume that R entirely satisfies the demand and sells all products purchased from M, without carrying out inventory over time.

Besides selling products to consumers, the CLSC also faces some environmental concerns. Both M and R recognize the critical role that successful environmental strategies play for the entire business as consumers accumulate a certain attitude to protect and preserve the environment, which consists of the consumers’ environmental consciousness. According to the International Institute for Sustainable Development, consumers’ environmental consciousness is the consumers’ attitude through the environmental consequences of their purchases (www.iisd.org). Consumers show preferences for green products as a mean to preserve the environment and improve their lives. Green consumers look for companies that are taking substantive steps and have made a commitment to improve the environment. Thus, CLSC members should disseminate and gather information about environmental issues and customer concerns (Straughan and Roberts 1999). Dissemination may occur through television programmes, magazine articles, classroom curricula, and community meetings as ways of reaching environmentally concerned consumers while point-of-sale displays, brochures, and videos are effective for providing more in-depth information. In addition, firms should invest in consumers’ education and communication to inform consumers on the value that environmental strategies supply by showing environmental improvements in several categories, such as water pollution, solid waste, and manufacturing processes. In our game, M and R invests in green advertising \(A_i (t)\) to acknowledge consumers on the green orientation that the supply chain undertook and that includes all actions earlier described. We assume that the consumers’ exposure to green advertising contribute to the formation of consumers environmental consciousness. This attitude is highly influenced by direct personal experiences and the communication produced by media (Antonides and van Raaij 1998). To capture the effects of green advertising investments on consumers environmental consciousness, we used an extended version of Nerlove-Arrow’s (1962) equation, in which consumers environmental consciousness evolves according to green advertising efforts as it is described by the following dynamic equation:

where \(\delta \ge 0\) is the forgetting effect and explains the natural reduction of consumers environmental consciousness; \(a\ge 0\) and \(b\ge 0\) are the marginal contributions of green advertising efforts to this stock, therefore we refer to as green advertising effectiveness, respectively. Although pricing and green advertising efforts along with consumers environmental consciousness are dynamics, the time notation is suppressed from now on to sake the exposition. Green advertising efforts are both characterized through convex functions that take the following quadratic forms:

where the constants \(\mu _j >0, j=M,R\) is the green advertising efficiency and explains the marginal penalty associated to profits for any marginal investment in green advertising.

3.2 Demand function and remanufacturing rewards

We assume that the sales function positively depends on consumers’ environmental consciousness and negatively on retail price, according to the following equation:

\(\beta \ge 0\) and \(\theta \ge 0\) are the marginal effects of pricing and consumers environmental consciousness on current sales, respectively. While down sloping sales with respect to price is a formal assumption in economics, the relationship between sales and consumers environmental consciousness suggests that consumers will purchase green products according to their willingness to contribute, protect, and conserve the environment. This assumption finds support from some empirical research (e.g., Schlegelmilch et al. 1996) where sales have been shown to be significantly explained by consumers’ environmental consciousness. To satisfy the positivity assumption on demand, we need to satisfy the condition \(p<\frac{\theta }{\beta }\sqrt{G}\). Although a non-linear form of consumers environmental consciousness in D(p, G), it implies the conjecture of linear value functions and allows for several qualitative results that are otherwise compromised. In addition, the square root function penalizes sales that will only grow moderately as it emerges from empirical research by Schlegelmilch et al. (1996) and Srinivasan and Blomquist (2009). With the characterization of consumers’ environmental consciousness dynamics as in Eq. (1), we take into consideration the carry over effects of green advertising, which affects not only the current payoffs through Eq. (3) but also future ones.

Consumers’ environmental consciousness also plays operational and environmental roles through its positive impact on the return rate, \(\tau (G)\). The latter measures the collection process efficiency and represents the percentage of consumers who is willing to return past-sold products, that is, the return rate. M acquires the residual value of each return, thus \(\tau (G)\) identifies a direct source of revenues. \(\tau (G)\) also informs on the environmental performance, thought as the fraction of past-sold products that have been returned rather than scrapped to the environment. We assume that the return rate evolves in the consumers’ environmental consciousness and takes the following form:

where \(s>0\) is a scaling parameter to control for the residence time, that is, the amount of time consumers spend from when they purchase till when they return a product. It represents the number of periods a product stays with consumers. We assume that product purchase, consumption, and return take place in different moments, specifically consumers return products after the consumption, thus s is a backward flow delay such that \(s<1\) (e.g., De Giovanni 2014b). As \(\tau \in [{0,1}]\), when \(\tau =0\) consumers do not return past-sold products that are then dispersed in the environment. In this case consumers’ environmental consciousness is not a good predictor of operational and environmental performance; instead, when \(\tau =1\), all past sold products are returned: M acquires the residual value of all past-sold products while environmental performance is maximized.

M gains a marginal economic benefit for each collected product, \(\Delta >0\), which is assumed to be exogenous and time-independent: we assume that the residual value is an average estimate between good and bad conditions of returns and does not depend on the moment when a product is returned. In addition, we assume that the CLSC faces a marginal collection logistics cost, \(c_L >0\), which refers to the cost to move a returned product from a place to another over the chain; finally, M also faces a marginal remanufacturing cost, \(c_R >0\), which includes operational costs for all remanufacturing activities. \(\pi _L ({G,p})=D({p,G})\tau (G)( {\Delta -c_L-c_R})\) is the final economic value of closing the loop. When \(\pi _L ({G,p})>0\), closing the loop is economically appealing. When \(\pi _L ({G,p})\le 0\), a CLSC is only marketing driven because firms invest in green advertising to enhance the stock of consumers’ environmental consciousness and increase sales while remanufacturing is just less economically convenient.

3.3 Benchmark scenario: no-incentive game

We characterize a benchmark scenario in which firms manage their relationships through a wholesale price contract (WPC). This contract is based on simple transactions in which M transfers some goods to R at a wholesale price; R then charges her final price accordingly. Because the WPC is simple to implement and administer and does not require any specific control or additional investments in information systems, it is the type of contract most frequently used in business practice (Cachon 2003). The game is played à la Stackelberg where M is the leader. Under this scenario the players’ marginal revenues are:

where \(K=s({\Delta -c_L -c_R})\). M exclusively manages the returns policy: he faces both the logistics and the environmental costs while fully acquires all economic advantages from closing the loop. Therefore, R entirely focuses on the marketing side of a CLSC, while M takes care of both the operational and the marketing aspects.

The players’ objective functionals in a no-incentive game are:

Using Eqs. (1), (6) and (7), we have characterized a two-player differential game with four controls, \(\omega , p\), and \(A_i \), and one state, \(G\ge 0\). The players set their strategies non-simultaneously to maximize their objective functionals. Since the RHS of the players’ payoff functions and the integrand of each objective function do not explicitly depend on time, and the time horizon is infinite, we confine our interest to stationary Markovian equilibria. The equilibria strategies are degenerate because the value functions are linear in the state, G, and thus the strategies are constant over time. The dynamic structure of the game allows firms to consider the stock of consumers’ environmental consciousness when setting their strategies. This represents a stock that firms accumulate over time to enhance customers’ interests and consciousness through the environment. Then, players can observe the current state of the system and set their strategies accordingly. Finally, these strategies turn out to be sub-game perfect.

3.4 Incentive scenarios

The benchmark game highlights the misalignment of firms’ interests to close the loop. While M contributes to consumers’ environmental consciousness to perform both sales and return rate, R only benefits from that stock to increase sales. In other words, while both firms contribute to the consumers’ environmental consciousness through their strategies, M exploits the state for operational and marketing purposes, while R only uses the state for marketing targets. This misalignment creates the basis for the construction of an incentive mechanism so that R also exploits the operational advantages of closing the loop.

We characterize two incentive scenarios in which the CLSC uses a Profit sharing contract (PSC) over a WPC. The application of a PSC fits with the purposes of our incentive games to align firms’ motivations to close the loop as M transfers a share of his revenues to R according to the sharing parameter \(\phi \in ({0,1})\) to influence her strategies; thus, the players margins become:

where the superscript C indicates a generally given incentive (coordinated) game.Footnote 1 Therefore, we exclude from the analysis the cases when \(\phi =0\), as M does not transfer anything to R that is indeed not our objective, as well as the case when \(\phi =1\) as M transfers all his profits to R, which will never be a feasible option. In order for R to have the highest amount of information on the incentive, we impose that the wholesale price remains at the benchmark level and then becomes common knowledge. Fixing the wholesale price at the benchmark level allows one to focus on the sharing parameter, as the incentive will only depend on that share, which should be determined in various circumstances. Yet, if M can modify the wholesale price according to the sharing parameter, the sharing contract seldom leads to coordination because M can always adjust the wholesale price according to \(\phi ^{C}\), and benefits of coordination can slightly be detected (Jørgensen 2012). When the wholesale price is fixed at the benchmark level, R will have full knowledge on the incentive to be received, thus coordination becomes a feasible option. Notwithstanding, it could always be possible to optimally derive wholesale price in each incentive game. Nevertheless, we do wish to focus on the characterization of the sharing parameter, which is the core of the research, rather than undertake this option. With our assumption, R works in an information set with reduced information asymmetry, through which the alignment of motivations for closing the loop takes place. R sets her strategies having full information on M’s marginal revenues, thus the incentive is a mere function of the sharing parameter. Availability of information on the latter value becomes the key to succeed in the alignment of firms’ motivations. Yet, if the sharing parameter is common knowledge, R fully knows the marginal rewards she receives before that the game starts; in contrast, information asymmetry on the sharing parameter puts some pressures on R, who does not know the share to be received upfront and coordination becomes a difficult target (Jørgensen 2012).

To put light into the determination of the sharing parameter, we model both cases of information asymmetry and symmetry on the sharing parameter values. In the first case, M exploits his position of leader and optimally determines the sharing parameter after R sets her strategies. In the second case, all players know the sharing parameter values before the game starts. Therefore, the sharing fraction can be either endogenous (information is not available in the contract content and M sets it optimally over the course of the game) or exogenous (information is completely visible and available to all CLSC members). When the sharing parameter is endogenous, \(\phi (t)\ge 0\), and M will set the share after knowing R’s pricing and green advertising efforts. This allows M to compensate the loss of decision power (thought as lower number of strategies to be optimized being the wholesale price fix at the benchmark level) through decisions on the share, which entails for some control over R’s additional gains. When the sharing parameter is exogenous, \(\phi \in ({0,1})\), and both players know it before deciding their strategies. R has full information about the sharing parameter and wholesale price, thus she fully knows the amount of money she will receive before that the game starts. M no longer has an influence on R’s marginal revenues, neither through the wholesale price nor through the sharing parameter.

Consider C = I, II, the sharing parameter will be a strategy—\(\phi ^{I}(t)\)—in Scenario I – Endogenous incentive gameand a given parameter –\(\phi ^{II}\in ({0,1})\)—in Scenario II—Exogenous incentive game, while the objective functionals will take the following form:

Using Eqs. (1), (9), and (10), we have defined a two-player differential game with four controls, \(A_i \ge 0, p\ge 0, \phi ^{I}\ge 0\), and one state variable, \(G^{I}\ge 0\), in the Endogenous Incentive game, while we only have three controls in the Exogenous incentive game as \(\phi ^{II}\in ({0,1})\) is common knowledge.

4 Equilibria

4.1 Benchmark scenario: no-incentive game

We start by analyzing the no-incentive game in which M does not supply any incentive to R and thus \(\phi =0\). This scenario will be used as a benchmark to identify the economic benefits that coordination provides. The game evolves according to the following moves: M announces that incentives will not be supplied; then, R optimally decides the green advertising expenditures and retail price; M takes R’s strategies into consideration and optimally sets both GAP efforts and wholesale price strategies. The solution for the no-incentive game is summarized in the following proposition.

Proposition 1

Equilibrium strategies in the no-incentive game are given by:

while the value functions for the players are given by:

where \(l_i,i=1,\ldots ,4\) are the identified coefficients.

Proof

See the “Appendix”. \(\square \)

Assumption 1

In order to have a positive \(\omega \) we need to satisfy the assumption \(\theta >\beta K\). It makes sense to assume that the consumers’ sensitivity to consumers environmental consciousness, \(\theta \), is larger than the joint effect between customer’s sensitivity, \(\beta \), to price and marginal operational benefits, K, in view of the higher impact of dynamic devices (Taboubi and Zaccour 2002).

The previous assumption also guarantees that price is positive. Both the price and the wholesale price are state-dependent and, specifically, \(\frac{\partial \omega }{\partial G}=\frac{\theta -\beta K}{4\beta \sqrt{G}}>0\) and \(\frac{\partial p}{\partial G}=\frac{3\theta -\beta K}{8\beta \sqrt{G}}>0\). These inequalities demonstrate that players can increase their retail and wholesale price according to the accumulated consumers’ environmental consciousness stock without damaging sales. This is in line with the recent literature in marketing that shows the interference among marketing devices (e.g., pricing and consumers environmental consciousness) mitigates the negative effects of price on demand (De Giovanni 2014b). In addition, green consumers consider the price of green products to be less important, while focus more on the implied environmental benefits. Substituting the pricing strategy in Eq. 2, the demand becomes \(D(G)=\frac{\left( {\theta +\beta K} \right) \sqrt{G}}{4}\). In addition, both the price and wholesale pricing strategies decrease in K, resulting\(\frac{\partial \omega }{\partial K}=-\frac{\sqrt{G}}{2}<0\) and \(\frac{\partial p}{\partial K}=-\frac{\sqrt{G}}{4}<0\). Good reverse logistics performances—expressed by high return residual value and low logistics and remanufacturing costs—lead to lower pricing strategies. Green advertising efforts are state independent, thus players decide according to all set of parameter values. Of particular interest is the remanufacturing performance. It turns out that \(\frac{\partial A_M}{\partial K}=\frac{a\left( {\theta +\beta K} \right) }{4\mu _M \left( {\rho +\delta } \right) }>0\) and \(\frac{\partial A_R }{\partial K}=\frac{b\left( {\theta +\beta K} \right) }{8\mu _R \left( {\rho +\delta } \right) }>0\); therefore, good remanufacturing performance leads to higher efforts. High GAP effectiveness provide additional motivations to firms invest more in green advertising expenditures to efficiently accumulate stock of consumers environmental consciousness (e.g., \(\frac{\partial A_M}{\partial a}=\frac{\left( {\theta +\beta K} \right) ^{2}}{8\mu _M \beta \left( {\rho +\delta } \right) }>0\) and \(\frac{\partial A_R}{\partial b}=\frac{\left( {\theta +\beta K} \right) ^{2}}{16\mu _R \beta \left( {\rho +\delta } \right) }>0)\). This possibility is strongly amplified by large consumers’ sensitivity to greenness (e.g., \(\frac{\partial A_M}{\partial \theta }=\frac{a\left( {\theta +\beta K} \right) }{4\mu _M \beta \left( {\rho +\delta } \right) }>0\) and \(\frac{\partial A_R}{\partial \theta }=\frac{b\left( {\theta +\beta K} \right) }{8\mu _R \beta \left( {\rho +\delta } \right) }>0)\). High consumers’ price sensitivity does not discourage green advertising investments (e.g., \(\frac{\partial A_M}{\partial \beta }=\frac{a\left( {\theta ^{2}-\beta ^{2}K^{2}} \right) }{8\mu _M \beta ^{2}\left( {\rho +\delta } \right) }>0\) and \(\frac{\partial A_R }{\partial \beta }=\frac{b\left( {\theta ^{2}-\beta ^{2}K^{2}} \right) }{16\mu _R \beta ^{2}\left( {\rho +\delta } \right) }>0)\) as appropriate strategies and sufficiently high stock of consumers environmental consciousness do not negatively impact on the demand. Large discount of future payoffs and forgetting effect deter investments in green advertising as the accumulation of stock of consumers green consciousness becomes a difficult target (e.g., \(\frac{\partial A_M}{\partial \rho }=\frac{\partial A_M}{\partial \delta }=-\frac{a\left( {\theta +\beta K} \right) ^{2}}{8\mu _M \beta \left( {\rho +\delta } \right) }<0\) and \(\frac{\partial A_R }{\partial \rho }=\frac{\partial A_R}{\partial \delta }=-\frac{b\left( {\theta +\beta K} \right) ^{2}}{16\mu _R \beta \left( {\rho +\delta } \right) }<0)\).

4.2 Scenario I: Endogenous incentive game

In an endogenous incentive game, M announces the adoption of a PSC with endogenous incentive. The wholesale price remains at the benchmark level, thus R has full knowledge on M’s margins although she will know the fraction to be received after she sets her strategies. As shown in De Giovanni (2016), this setting is adopted in some service business (e.g., CentralParking Malpensa), when the impact of coordination are not at all beneficial in reducing the double marginalization effect. For example, in CentralParking of Malpensa (Italy), the company offers a discount to consumers who flight with certain companies (e.g., EasyJet, Ryanair, etc.). In such a case, the consumers pay a discount parking fee, while the discounted amount is reimbursed by the flight company; thus, the wholesale price that CentralParking gets does not vary according to the existence of a coordination mechanism. In the Endogenous incentive game, M decides the sharing parameter as well as the GAP strategy. The transferred share of profits represents the incentive that M optimally sets to align firms’ motivations to close the loop. Although the wholesale price is at the benchmark level, M can still put some pressures to R and influence R’s margins through decisions on the sharing parameter. The game is played á la Stackelberg and consists of the following moves: (i) M announces the adoption of an endogenous incentive mechanism while the wholesale price is common knowledge and fixed equal to the benchmark scenario as in Eq. (11), (ii) R sets the price and her green advertising efforts; (iii) M takes R’s strategies into account and decides both the sharing parameter and the GAP efforts. Proposition 2 summarizes the solution for the endogenous incentive game.

Proposition 2

Equilibrium strategies in the endogenous incentive game are given by:

while the value functions assume the following forms:

where \(n_i,i=1,\ldots ,4\) are the identified coefficients.

Proof

See the “Appendix”. \(\square \)

As in the no-incentive game, retail price is state dependent while players’ green advertising efforts are state independent. In addition, these strategies are more sensitive to logistics costs than in the no-incentive game. Specifically, R charges a higher price, while both players contribute less to consumers’ environmental consciousness, through the effects of component \(\beta sc_L \) in Eqs. (18) and (19). This introduces some interesting novelties. First, the higher logistics costs are fully paid by consumers, and an endogenous incentive supplied through a PSC does not follow the tradition in SC literature regarding the decrease in the second marginalization (e.g., Cachon 2003). Second, higher logistics costs discourage players to invest more in green advertising, thus logistics inefficiency translates into lower environmental performance. An endogenous sharing parameter supplies several insights and contributions to the literature. It turns out that:

-

1.

\(\frac{\partial \phi ^{I}}{\partial \beta }=\frac{sc_L \theta }{\left( {\theta +\beta K} \right) ^{2}}>0.\) The sharing parameter increases in the customer’s sensitivity to price because M pushes R to charge a lower price to boost the sales. This is a peculiarity of this scenario because, contrary to the literature on coordination, the sharing parameter (being endogenous) does not enter in pricing and green advertising efforts equations.

-

2.

\(\frac{\partial \phi ^{I}}{\partial \theta }=-\frac{\beta sc_L}{\left( {\theta +\beta K} \right) ^{2}}<0.\) The sharing parameter decreases in the customer’s sensitivity to environment. M transfers less to R when a small increase in consumers’ environmental consciousness substantially boosts the sales. When the customer’s sensitivity to environment is low, M sets high sharing parameter values to encourage R invest more in green advertising.

-

3.

\(\frac{\partial \phi ^{I}}{\partial c_L}=\frac{\beta sc_L \left( {\theta +\beta \left( {\Delta -c_R} \right) s} \right) }{\left( {\theta +\beta K} \right) ^{2}}>0.\) The sharing parameter increases in the logistics cost. When that cost is high, R’s willingness to close the loop simply becomes marginal. Thus, M uses a PSC to increase R’s commitment in the reverse logistics process. The amount transferred represents a compensation offered to R to cover the higher logistics costs.

-

4.

\(\frac{\partial \phi ^{I}}{\partial \Delta }=-\frac{\beta ^{2}s^{2}c_L}{\left( {\theta +\beta K} \right) ^{2}}<0\) and \(\frac{\partial \phi ^{I}}{\partial c_R}=\frac{\beta ^{2}s^{2}c_L }{\left( {\theta +\beta K} \right) ^{2}}>0\). The sharing parameter changes in different ways according to the remanufacturing efficiency, which is given by the return’s residual value and the remanufacturing costs. The sharing fraction decreases (increases) in the return’s residual value (remanufacturing cost) highlighting the fact that M finds an endogenous incentive to be convenient only for marginal backward rewards.

To summarize, M wishes to align firms motivations for closing the loop over the chain only when the endogenous incentive can mitigate same operational and logistics inefficiency (e.g., high reverse logistics cost). Otherwise, the leader finds incentive alignment marginally convenient, thus he prefers exclusively manage operations and entirely acquire of the operational benefits of closing the loop.

4.3 Scenario II: Exogenous incentive game

In an exogenous incentive game, M announces coordination through a PSC while the sharing parameter is common knowledge; thus, both players know the wholesale price as well as the sharing parameter value before that the game starts. Sluis and De Giovanni (2016) have empirically demonstrated than exogenous shares are applied in several sectors because they are a part of the industrial standards thus accepted worldwide. Similarly, De Giovanni (2016) shows that an exogenous sharing parameter is applicable any time a sharing contract is adopted in well-established supply chains, otherwise it should be endogenous. For example, Apple adopts a manufacturer-suggest-price-contract with the stores, which know in advance the sharing they will receive when selling Apple’s goods while having a low bargaining power to negotiate it. This represents a richer information set for R, as she has full knowledge on M’s margins as well as the additional economic rewards she receives. M has less decisional power over the chain, thought as lower control variables to optimally set and less information asymmetry linked to a leader-follower game structure. The game is played á la Stackelberg and consists of the following moves: (i) M announces an exogenous incentive game, (ii) R sets the price and the green advertising efforts; (iii) M takes \(R'\)s strategies into account and decides the GAP efforts. Proposition 3 summarizes the solution for the exogenous incentive game.

Proposition 3

Equilibrium strategies in the exogenous incentive game are given by:

where \(\eta =\left( {\theta +\beta K^{C}} \right) \left( {1+\phi ^{II}} \right) -2\beta sc_L \); the value functions assume the following forms:

where \(m_i,i=1,\ldots ,4\) are the identified coefficients.

Proof

See the “Appendix”. \(\square \)

Contrary to the previous incentive game, the sharing parameter influences pricing and green advertising efforts, while the wholesale price always is at the benchmark scenario. The following insights can be derived:

-

1.

\(\frac{\partial p^{II}}{\phi ^{II}}=-\frac{\left( {\theta +\beta K} \right) \sqrt{G^{II}}}{4\beta }<0,\) a higher sharing parameter lowers the price according to the sharing contract’s aim, which is the mitigation of the second marginalization effect. This result contrasts with similar recent research in CLSC (e.g., De Giovanni 2014b) in which that relationship resulted to be reversed. The main motivation depends on the decision on the wholesale price: When it is fixed at the benchmark level rather than being set, there is a negative relationship between pricing and sharing parameter.

-

2.

\(\frac{\partial A_M^{II}}{\partial \phi ^{II}}=-\frac{a\left( {\theta +\beta K^{C}} \right) \left[ {\phi ^{II}\left( {\theta +\beta K^{C}} \right) -\beta sc_L} \right] }{4\mu _M \beta \left( {\rho +\delta } \right) }\le 0;\) high levels of share lead M to possess less economic resources to invest, thus decreasing the investments in green advertising. Moreover, he expects R to invest more in green advertising, as a counterpart of receiving an economic incentive. This result is verified as long as the sharing parameter is fixed at least at the endogenous level, which signifies \(\phi ^{II}\ge \frac{\beta sc_L}{\theta +\beta K}\). Below this amount, the transferred profits are just considered to be less important and M continues to invest more in GAP. This finding provides an interesting novelty in the literature: Under an exogenous incentive, M will invest more in green efforts when the sharing parameter is fixed below the optimal endogenous level, even when he has less decisional power in a chain.

-

3.

\(\frac{\partial A_R^{II}}{\partial \phi ^{II}}=\frac{\left( {\theta +\beta K^{C}} \right) \left[ {\left( {\theta +\beta K^{C}} \right) \left( {1+\phi } \right) -2\beta sc_L} \right] b}{8\mu _R \beta \left( {\rho +\delta } \right) }\ge 0;\) a sharing contract grants some economic outcomes to R with the purpose of contributing more to the consumers’ environmental consciousness dynamics. Contrary to the previous findings, this result holds true independent of the sharing parameter value. Therefore, when an exogenous incentive is supplied, R always boosts her green advertising investments.

To summarize, an exogenous incentive supplies the benefits highlighted in the literature (e.g., Cachon 2003; Cachon and Lariviere 2005), which decreases the second marginalization (at R’s level) and increases players’ attitudes to do more. In addition, M decides the amount to be spent in green efforts according to the share: when the sharing parameter is too low, he will still invest more in GAP efforts because R will devote lower economic resources to sufficiently enlarge the stock of consumers’ environmental consciousness.

5 Comparison of equilibria

This section introduces the difference in strategies, state variable, and players’ payoffs when moving from a no-incentive to an incentive setting. Although Cachon and Lariviere (2005) and De Giovanni and Zaccour (2013) have shown the advantages of coordination linked to the implementation of a sharing contract, we highlight both the benefits and the drawbacks it generates in a CLSC according to the information structure.

Proposition 4

M always invests more in GAP efforts under a no-incentive game than in an incentive game, independent of nature of the sharing parameter. In addition, M invests more in green efforts when the sharing parameter is endogenous than when it is exogenous.

Proof

Compute the difference \(A_M -A_M^I \) to show that \(A_M -A_M^{II} =\frac{ac_L s\left[ {2\left( {\theta +\beta K} \right) -sc_L \beta } \right] }{8\mu _M \left( {\rho +\delta } \right) }>0\). Similarly, \(A_M-A_M^{II} =\frac{a\left( {\theta +\beta K} \right) \left[ {\left( {\theta +\left( {\Delta s-c_L h} \right) \beta } \right) \phi ^{II}+c_L s\beta \left( {2-2\phi ^{II}-\phi ^{II2}} \right) } \right] }{8\beta \mu _M \left( {\rho +\delta } \right) }>0,\;\forall \phi ^{II}\in \left( {0,1} \right] \). To demonstrate that result we can analyze the corner values of \(\phi ^{II}\). Suppose \(\phi ^{II}=0, A_M -A_M^{II} =\frac{2c_L s\beta a\left( {\theta +\beta K} \right) }{8\beta \mu _M \left( {\rho +\delta } \right) }>0\) always holds. When \(\phi ^{II}=1, A_M -A_M^{II} =\frac{a\left( {\theta +\beta K} \right) ^{2}}{8\beta \mu _M \left( {\rho +\delta } \right) }>0\). Finally, \(A_M^I -A_M^{II} =\frac{a\left( {\left( {\theta +\beta K} \right) \phi ^{II}-c_L s\beta } \right) ^{2}}{8\beta \mu _M \left( {\rho +\delta } \right) }\) is always non-negative. \(\square \)

Under a no-incentive game, M seeks to perform on both marketing and operational sides. He retains all economic benefits made by closing the loop, therefore he has a dual motivation for investing more in green efforts: increasing the sales as well as performing return rates. In an endogenous-incentive game, M transfers a part of his profits to R as a form of incentive. In such case, M invests less in GAP efforts because he expects that R invests more as counterpart of receiving an economic encouragement. In this sense, our results are aligned to the literature of CLSC, which highlights the changes in M’s strategies when an incentive mechanism is put in place (e.g., Savaskan et al. 2004). The investments in green efforts will mainly depend on the sharing parameter. When sharing parameter is exogenous, M will drop off his investments in GAP efforts. This can be thought as a loss of decision power (although we do not model it explicitly) due to the lower influence on R’s strategies and payoffs. Instead, an endogenous incentive allows M to put pressure on the follower’s strategies. Consequently, announcing the transfer of an incentive does not denote a joint players’ willingness to invest more.

Proposition 5

R always invests more in green advertising in a no-incentive game than in an endogenous incentive setting. In an exogenous incentive game R invests more in green advertising only when the sharing parameter is sufficiently high.

Proof

Compute \(A_R -A_R^I \) to show that \(A_R -A_R^I =\frac{bc_L s\left[ {2\left( {\theta +\beta K} \right) -sc_L \beta } \right] }{16\mu _M \left( {\rho +\delta } \right) }>0\). In contrast, the sign of \(A_R -A_R^{II} =\frac{b\left[ {\left( {\theta +K\beta } \right) ^{2}-\left[ {\left( {1+\phi ^{II}} \right) \left( {\left( {\theta +K\beta } \right) } \right) +2c_L s\beta } \right] ^{2}} \right] }{16\beta \mu _M \left( {\rho +\delta } \right) }\) depends on \(\phi ^{II}\). Solve the numerator with respect to \(\phi ^{II}\) to find out that: \(A_R -A_R^{II} \left\{ {\begin{array}{ll} \le 0&{}\quad { if}\quad \phi ^{II}\in \left( {\frac{2c_L s\beta }{\theta +K\beta },1} \right] \\ >0&{}\quad { otherwise}. \\ \end{array}} \right. \). Finally, the sign of the difference \(A^{I} -A^{II} \) also depends on \(\phi ^{II}\), as \(A_R^I -A_R^{II} =\frac{b\left[ {\left( {\theta +K\beta -c_L s\beta } \right) ^{2}-\left[ {\left( {1+\phi ^{II}} \right) \left( {\left( {\theta +K\beta } \right) } \right) +2c_L s\beta } \right] ^{2}} \right] }{16\beta \mu _M \left( {\rho +\delta } \right) }\). Solve the numerator with respect to \(\phi ^{II}\) to find out that: \(A_R^I -A_R^{II} \left\{ {\begin{array}{ll} \le 0&{}\quad { if}\quad \phi ^{II}\in \left[ {\frac{c_L s\beta }{\theta +K\beta },1} \right) \\ >0&{}\quad { otherwise}. \\ \end{array}} \right. \). \(\square \)

Compared to the no-incentive game, R faces some logistics costs when a PSC is put in place. Although in an endogenous coordination R knows the wholesale price before playing the game, M can still influence R’s payoff through the sharing parameter; therefore, R’s green advertising efforts are always lower when the sharing parameter is endogenous.

In contrast, exogenous sharing parameters encourage R to invest more efforts in green advertising because of the known sharing rule. Finally, only when the share turns out to be sufficiently high \(\left( {\mathrm{e.g.},\phi ^{II}\in \left[ {\frac{2c_L s\beta }{\theta +K\beta },1} \right) } \right) \quad R\) invests more in a green advertising strategy. This outcome highlights a clear result: an exogenous sharing parameter is a necessary but not a sufficient condition to boost up R’s green advertising efforts because the share (incentive) must also be adequately set.

The establishment of conditions under which players invest more when an incentive is supplied allows one to check the differences in the stock of consumers’ environmental consciousness.

Proposition 6

The accumulated stock of consumers’ environmental consciousness under a no-incentive game is always higher than the stock accumulated in an endogenous incentive game. In an exogenous incentive game, the stock of consumers’ environmental consciousness is higher than the stock in other scenarios only when the sharing parameter is sufficiently high.

Proof

The difference \(G-G^I =\frac{c_L s\left( {2a^{2}\mu _R +b^{2}\mu _M } \right) \left[ {2\left( {\theta +\beta K} \right) -c_L s\beta } \right] }{16\delta \mu _M \mu _R \left( {\delta +\rho } \right) }>0\) always holds as the term \(2\left( {\theta +\beta K} \right) -c_L s\beta \) is always non-negative. Assume that \(\mu _M =\mu _R =1\) and compute the difference \(G-G^{II} =\frac{\left( {2a^{2}+b^{2}} \right) \left( {\theta +\beta K} \right) ^{2}-\left[ {\left( {\theta +\beta K} \right) \left[ {a^{2}\left( {1-\phi ^{II}} \right) +b^{2}\left( {1+\phi ^{II}} \right) } \right] -c_L s\beta } \right] }{16\delta \mu _M \mu _R \left( {\delta +\rho } \right) }\); take the negative root \(\phi ^{II}=\frac{2a^{2}c_L s\beta +b^{2}\left( {\psi -c_L s\beta } \right) -\sqrt{b^{4}\psi ^{2}-4a^{4}c_L s\beta \left( {2\psi -c_L s\beta } \right) }}{\left( {2a^{2}-b^{2}} \right) \psi }\) where \(\psi =\theta -\beta K\), to check that \(\phi ^{II}\in \left( {0,1} \right) \Leftrightarrow \frac{b}{a}>\root 4 \of {\frac{4c_L s\beta \left( {2\psi -c_L s\beta } \right) }{\psi ^{2}}}\). Therefore, it results that \(G-G^{II} \left\{ {\begin{array}{ll} \le 0&{}\quad { if}\quad \phi ^{II}\in \left[ {{\phi }'^{II},1} \right] \\ >0&{}\quad { otherwise}. \\ \end{array}} \right. \). Finally, the sign of the difference \(G^{I}-G^{II} =\frac{\left[ {\phi ^{II}\left( {\theta +\beta K} \right) -c_L s\beta } \right] \left\{ {2a^{2}\mu _R \left[ {\left( {\theta +\beta K} \right) \phi ^{II}-c_L s\beta } \right] -b^{2}\mu _M \left[ {\left( {\theta +\beta K} \right) \left( {2+\phi ^{II}} \right) -3c_L s\beta } \right] } \right\} }{16\delta \mu _M \mu _R \left( {\delta +\rho } \right) }\) strictly depends on \(\phi ^{II}\), in particular: \(G^{I}-G^{II} \left\{ {\begin{array}{ll} \le 0&{}\quad { if}\quad \phi ^{II}\in \left[ {\frac{c_L s\beta }{\theta +\beta K},1} \right] \\ >0&{}\quad { otherwise}. \\ \end{array}} \right. \). \(\square \)

In an endogenous incentive game the stock of consumers’ environmental consciousness that the CLSC accumulates is lower than the stock under a no-incentive game. Both players invest less in green advertising efforts. On one hand, M invests less because he will transfer a part of his profits to R (remember that \(\phi ^{I}(t)>0)\); on the other hand, R prefers prudent investments in green advertising as the share she will receive is optimally determined by the leader. As a result, an endogenous incentive implies in a lower accumulated consumers environmental consciousness and environmental performance.

An exogenous incentive overcomes this drawback. R knows the amount of money that M will transfer before deciding her green advertising efforts, thus she has a full knowledge on economic incentive to be received through a PSC. This is due to the complete information on both the wholesale price and the sharing parameter. Nevertheless a full information space is a necessary but no a sufficient condition to perform a higher stock of consumers environmental consciousness under an exogenous incentive game. Yet, R decides her green advertising efforts according to the sharing parameter and invests a higher amount whenever the exogenous sharing parameter is sufficiently high. This further condition makes incentive alignment really difficult to be reached, while knowledge on the sharing parameter alone is not enough to accumulate a greater stock of consumers’ environmental consciousness through incentives.

Because both the pricing strategy and the sales are state-dependent, their difference depends on the stock of green consumers’ environmental consciousness. In particular the results can be summarized in the following propositions.

Proposition 7

Price in a no-incentive game is always higher than price under an incentive game. R sets a lower price when the sharing parameter is exogenous.

Proposition 8

Sales in the no-incentive game are always higher than sales under endogenous incentive sets. Only high exogenous sharing parameter leads to higher sales.

Because Propositions 7 and 8 heavily depend on all model parameter values, we carry out a simulation analysis to display the findings. The set of benchmark parameter values has been taken from the literature of CLSC (e.g., De Giovanni 2014b), and set to meet all model assumptions (positive strategies, profits, and state), specifically:

Demand parameters: \(\theta =1,\beta =1\)

Cost parameters: \(c_L =0.05, c_R =0.05\)

Dynamic parameters: \(a=1,b=1,\rho =0.9,\delta =0.9\)

Reverse logistics parameters: \(s=0.5, \Delta =0.6,h=1,b=1, \mu _M =1, \mu _R =1\)

While these parameters have been fixed, \(\phi ^{II}\in \left( {0,1} \right) \).

As Fig. 1 displays, the price under a no-incentive game is always higher than the price in an endogenous incentive game. This outcome derives from the benefits that the implementation of a PSC grants, that is a lower price and, consequently, higher sales. R recognizes the positive effect implied by a PSC (mitigation of the second marginalization), therefore she sets a lower price when an incentive is provided. Full knowledge on the sharing parameter allows R to fix a lower price, while closing the loop has a serious impact on sales (Zhou et al. 2011).

As Fig. 2 displays, the effects of incentives on pricing do not translate into higher sales. This outcome is due to a dominating effect of dynamic variables (e.g., consumers’ environmental consciousness) over static control (e.g., price). Although the price in a no-incentive game is higher than the price under both incentive games, the differences in the stocks of consumers’ environmental consciousness determine the differences in sales. Consumers will always purchase more under a no-incentive game because the accumulated stock of green consumers’ environmental consciousness is higher than under an incentive game. When M announces an endogenous incentive, both players invest less in green advertising; therefore, the lower stock of consumers’ environmental consciousness implies lower sales.

When the sharing parameter is exogenous, R sets the green advertising efforts according to the incentive. Nevertheless, working in a full information set does not guarantee higher sales when the sharing parameter is low. A necessary condition to push up consumers’ willingness to buy more consists of negotiating the exogenous sharing parameter at a sufficiently high level before the game starts. That condition also ensures an effective function of a PSC: an exogenous incentive and a sufficiently high sharing parameter lead to a lower retail price and a higher stock of consumers environmental consciousness that, in turn, boost up sales.

Proposition 9

M always prefers a no-incentive game to an endogenous incentive mechanism, thus \(V_M \ge V_M^I \). In contrast, he only prefers an exogenous incentive scheme when the sharing parameter is properly set up, in particular and

and  .

.

Proof

See the “Appendix”. \(\square \)

M always prefers a no-incentive game to an endogenous incentive scheme. This finding takes a specific positioning in the literature, where previous research no longer characterizes games in which the player who transfers its share of profits optimally decides the sharing parameter. Under an endogenous coordination, the chain leader announces an incentive game where the sharing parameter is a decision variable to be set once R’s strategies are known. This information asymmetry does not lead to higher payoffs. His announcement provides less information over the chain, while the decisional pressure increases.

In contrast, an exogenous incentive supplies some economic benefits when the sharing parameter is properly set up. Figure 3 displays the range of sharing parameter values inside which incentives make M economically better off. On one hand, low sharing parameter values (e.g.,  make an incentive scheme marginally convenient because \(M'\)s transfer is too low to involve R in effectively closing the loop and properly align motivations. On the other hand, high sharing parameter values

make an incentive scheme marginally convenient because \(M'\)s transfer is too low to involve R in effectively closing the loop and properly align motivations. On the other hand, high sharing parameter values  make coordination too expensive because M’s transfer is too high and the benefits of aligning incentives do no compensate the implied lower gains. There is a range,

make coordination too expensive because M’s transfer is too high and the benefits of aligning incentives do no compensate the implied lower gains. There is a range,  inside which the adoption of an exogenous incentive makes M economically better off.

inside which the adoption of an exogenous incentive makes M economically better off.

Similarly, when the adoption of a PSC is a prerequisite to be part of a supply chain, M will announce the incentive according to the exogenous sharing parameter values. Yet, M finds a PSC economically convenient whenever  . When the sharing parameter is too low, M makes reverse logistics less interesting for R, for whom the advantages to close the loop will drop down. When the sharing parameter is too high, a PSC destroys M’s benefits to provide an incentive and align CLSC members’ motivations for closing the loop.

. When the sharing parameter is too low, M makes reverse logistics less interesting for R, for whom the advantages to close the loop will drop down. When the sharing parameter is too high, a PSC destroys M’s benefits to provide an incentive and align CLSC members’ motivations for closing the loop.

Proposition 10

R always prefers a no-incentive setting to an endogenous incentive mechanism, thus \(V_R -V_R^I >0\). An exogenous incentive is economically preferable when the exogenous sharing parameter is sufficiently high, specifically \(V_R -V_R^{II} <0\Leftrightarrow \phi ^{II}>\bar{{\phi }}^{II}\) and \(V_R^I -V_R^{II} <0\Leftrightarrow \phi ^{II}>\bar{{\bar{{\phi }}}}^{II}\).

Proof

See the “Appendix”. \(\square \)

R always prefers a no-incentive setting to a PSC where the sharing parameter is M’s decision variable. As M announces an endogenous coordination, R’s willingness to close the loop falls down and the CLSC economically underperforms overall. Instead, an exogenous incentive might lead R to be economically better off according to the sharing parameter value: when it is sufficiently high, R always prefers an exogenous incentive. A known sharing parameter is a necessary but a not sufficient condition for R to gain more through incentive alignment. Setting a proper sharing parameter would eventually generate higher profits. In other words, only if R will receive a sufficiently high incentive, she will effectively manage the reverse logistics management to get higher economic rewards. That finding is valid when an exogenous PSC is compared to both a WPC as well as an endogenous PSC. Figure 4 displays these findings and clarifies the results in Proposition 10.

6 Managerial implications

The success of the implementation of incentive mechanisms in CLSC necessitates of a list of prerequisites: full knowledge regarding the contract terms and proper incentives schemes.

Hereby the incentive refers to an announcement that M (the leader) formulates, on the shift from a WPC to a PSC mechanism to align firms’ motivations to close the loop. Because M has the highest interest in closing the loop, his announcement must be good enough to engage R. When M announces an exogenous incentive, the sharing parameter is common knowledge, thus R has full information regarding the contract terms when she plays the game. M must opt for a sufficiently high sharing parameter \(\left( {\mathrm{e.g.}, \phi >\bar{{\bar{{\phi }}}}^{II}} \right) \) to engage R in performing the return flow management processes. Finally, only when the sharing parameter is exogenous there is a chance for a CLSC to reach coordination, as \(V_R >V_R^I,\forall \phi \in (0,1]\). If coordination is a compulsory option, R has a preference for an endogenous coordination scheme when \(\phi \in (0,\bar{{\phi }}^{II}]\) and for an exogenous coordination scheme when \(\phi \in (\bar{{\phi }}^{II},1]\).

Further, M must negotiate the sharing parameter inside a specific range of values. An exogenous sharing parameter turns out to be necessary but not sufficiently condition to make both players economically better-off. On one hand, when the sharing parameter is too low  commits a low amount of economic resources because the incentive is marginal. On the other hand, when the sharing parameter is too high

commits a low amount of economic resources because the incentive is marginal. On the other hand, when the sharing parameter is too high  transfers an excessive percentage of his profits and supplying an incentive turns out to be marginally convenient. Negotiations before playing the game should end with the selection of a proper incentive that enhances R’s willingness to close the loop without destroying M’s profits.

transfers an excessive percentage of his profits and supplying an incentive turns out to be marginally convenient. Negotiations before playing the game should end with the selection of a proper incentive that enhances R’s willingness to close the loop without destroying M’s profits.

In the end, M might be obliged to transfer an incentive because the business forces through this direction. In this case M may want to opt for an endogenous coordination according to the exogenous sharing parameter value. When the exogenous sharing parameter is too low, he should opt for an endogenous coordination, otherwise R underperforms the reverse logistics because the incentive is marginal. When the exogenous sharing is too high, M should again opt for an endogenous coordination because the contract terms are harmful for its profits. Also in the case the incentive is imposed by external forces, the sharing parameter must be a priori properly negotiated to effectively align firms’ motivation over a CLSC. Finally, when coordination is a compulsory option, an endogenous incentive coordinates the CLSC when  while an exogenous incentive coordinates the CLSC when

while an exogenous incentive coordinates the CLSC when  .

.

7 Analysis on the operational and logistics efficiency

This section investigates on the implications of changes in the environmental parameters on the players’ profits, which complements the previous analysis that is instead focused on the sharing parameter values. To analyse the implications for the environment, we assume \(\phi =0.2\), to ensure to work in a space where coordination is feasible. In contrast, the return residual value, \(\Delta \), collection cost, \(c_L \), as well as the remanufacturing cost, \(c_R \), vary in a specific ranges: \(\Delta \in \left( {0.5,1} \right) , c_L \in \left( {0,0.4} \right) \) and \(c_R \in \left( {0,0.4} \right) \). When varying these parameters the others remain at the benchmark level.

Claim 1

Both players always prefer a no-incentive to an endogenous incentive independent of the environmental performance. In contrast, they prefer an exogenous incentive only when the reverse logistics cost is sufficiently low. Finally, M prefers endogenous to exogenous incentives when reverse logistics is not an efficient process.

Figures 5 and 6 show the areas inside which the described relationships work. For instance, the LHS cubes in both figures show that \(V_M^I \ge V_M\) and \(V_R^I \ge V_R \) never hold, independent of the operational and logistics efficiency. The decision of outsourcing the reverse logistics process to R is suboptimal for the entire chain; therefore, an endogenous incentive will be always followed by underperforming reverse logistics performance, which translates in lower profits for all players. M should therefore depart from an endogenous coordination announcement to espouse a no-incentive CLSC even when reverse logistics is particularly profitable.

In contrast, the reverse logistics process efficiency plays a key role in the evaluation of the shift from a no-incentive to an exogenous incentive scheme. The marginal logistics cost deserves a special attention because its values establish a clear decisional boundary on the most economically convenient CLSC structure to be put in place. High marginal reverse logistics costs force M to opt for a no-incentive scheme because the collection process becomes considerably expensive: this drastically drops R’s willingness to invest in green advertising and perform the return process. Further, the implied benefits no longer cover the incentive, thus the adoption of an incentive scheme turns out to be completely inefficient. Notice that while a small change in the marginal reverse logistics cost has a strong impact on M’s decision, both the return residual value and the environmental cost should be considered just as less important. In this context, motivations for avoiding a price marginalization drive players’ preferences for closing the loop.

When the implementation of an incentive scheme in CLSC is sought, an assessment of operational and logistics efficiency supplies helpful insights on best information set to be selected. M will opt for an endogenous coordination only when closing the loop is not an efficient process, for instance when the return residual value is significantly lower than both the environmental and the reverse logistics costs. In such a case M puts pressure on R through an endogenous incentive. Interestingly, players’ preferences turn out to be aligned: while M selects the incentive according to the remanufacturing performance, his decision will result also optimal for R. Finally, the leader should select the CLSC structure according to the operational and logistics efficiency to identify a profit Pareto-improving region, inside which the CLSC reaches coordination.

8 Conclusions

The alignment of incentives in CLSC has important implications for firms, consumers, and legislation. The identification of a coordination mechanism that leads to higher economic outcomes and lower environmental impact becomes a real challenge. This paper contributes in the identification of an incentive mechanism to align firms’ motivations and interests in closing the loop. Yet, the incentive aims at aligning firms’ interests to optimize backward flows as closing the loop provides both operational benefits and marketing rewards. When no-incentive is supplied, all CLSC members exploit the marketing effects of closing the loop, which are explained by higher customers’ environmental consciousness; nevertheless, only manufacturers advantage of operational benefits of closing the loop. In contrast, all firms get profit improvements through operational and marketing devices when an incentive is supplied.