Abstract

As the demands of some important products such as oil, gas, and agricultural commodities are disrupted, the government often regulates the retail price that includes impositions of a price ceiling and a price floor. In this paper, we analyze the coordination of a supply chain with a dominate retailer under the government price regulation policy by a revenue sharing contract after demand disruption. First, we characterize the optimal decisions of the supply chain under normal circumstance by the revenue sharing contract as a benchmark. Then, when the demand is disrupted, we redesign the contract to coordinate the supply chain and obtain the corresponding revenue sharing contract in different scenarios. Finally, we give some numerical examples to illustrate our theoretical results and explore the impacts of government price regulations on the coordination mechanism.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years various contracts for supply chain coordination have been proposed. Supply chain coordination with uncertainty is a big challenge (Choi and Cheng 2011). Reviewing past research on supply chain coordination, we see that most studies on supply chain coordination usually design the contracts under normal environment such as the customer demand is random variable with an unchanged distribution function. However, some haphazard events may occur and disrupt the normal environment. These haphazard events can lead to many unexpected changes of the market demand. For instance, the Malaysia MH370 Accident has shocked the whole world and plenty of tourists have cancelled the original travel plans. Likewise, the medicines and disinfectors are in great demand when Ebola virus diseases break out in Africa. European Union market was influenced by Russia’s import ban on its vegetables, fruit, light commercial vehicles. In addition, demand disruptions may also result from accidents, natural calamities, and corporate scandals etc. Demand disruption may occur, when customer orders drop or rise suddenly. Then the operations of the retailers could be potentially affected or disrupted by demand-related risks (Li et al. 2010). Therefore, analyzing supply chain coordination under demand disruptions is very important.

As demands of some important products are disrupted, some governments often regulate the retail price that includes impositions of a price ceiling and a price floor. For example, demand for gas in India far outstrips consumption, but the government has kept prices low for strategic industries such as fertilizer producers, deterring investment by companies in the sector (Website: http://profit.ndtv.com/news/cheat-sheet/article-gas-price-hike-deferred-government-to-consult-solicitor-general-top-10-facts-383700). Once demands of these products are disrupted, the retail price may be limited by these policies to dictate the retail marketplace, protect consumers’ interests, and maintain enterprises’ steady development. For example, on March 11, 2011, as a result of devastating earthquake and tsunami in Japan, a nuclear power station was destroyed and radioactive material leaked. For fear of seawater contamination by radiation, people in China rushed to purchase sea salts. The government combated driving up the price of salt and hoarding salts. Although supply chain coordination under demand disruptions has attracted considerable attention during the last ten years, the impact of the price regulations is typically ignored in these previous literature. Therefore, studying supply chain coordination under price regulations and demand disruptions is needed in both industry and academia.

Besides the impacts of the price regulations, the impacts of different channel leaderships cannot be ignored (Choi et al. 2013). In most supply chain studies, single retailer or homogeneous retailers are typically assumed. However, the roles of different retailers may be not exactly the same in the market. Some retailers wield even greater power than the manufacturers and take the leadership role in the supply chain (Xiao et al. 2015). For some products, there usually exists a dominant retailer that is the price leader of the market. Once the price is settled down by the dominant retailer, some small retailers will use the pricing book of the large retailer. For instance, the proportion of Wal-Mart’s sales makes up 39 % of Tandy’s total sales and 17 % of P&G’s in 2002 (Useem et al. 2003). Wal-Mart is such a price leader. In addition, only the dominant retailer can provide the demand-stimulating service to promote sales in some market (Raju and Zhang 2005). For instance, the dominant retailer can carry on some propagating advertisement to promote the production. It is showed that service investment can mete out minimum incentive for the manufacturer to engage the dominant retailer in supply chain coordination (Raju and Zhang 2005). Thus, it is significant to consider the impact of the dominant retailer on supply chain coordination.

Recently with the fast development of e-commerce, a lot of companies begin to sell agriculture products by Internet, such as sfbest, JD, TooToo and so on. For one product, usually there is one dominant retailer taking the largest market share. In this agriculture product supply chain, peasant households supply e-commerce companies with agriculture products in a low price, and e-commerce companies distribute some profit to peasant households. In China, people rushed to purchase green grams in 2011, the government regulated the retail price of it. Under this policy, the supply chain should adjust these optimal decisions. Motivated by the above observations, we set out to investigate coordination of a supply chain. There are one manufacturer, one dominant retailer and other small retailers in the supply chain system. The policies made by the government can influence the optimal decisions of the supply chain. If demand disruptions occur, the government regulates the retail price to stabilize the market. First, we characterize the optimal decisions of a centralized supply chain as the benchmark. Then we explored the following significant issues (1) when the demand is disrupted and the price is regulated in decentralized supply chain, can the original revenue sharing contract under normal circumstance still coordinate the supply chain? (2) If the original contract cannot coordinate the supply chain, how to redesign the contract to coordinate the supply chain?

The remainder of the paper is organized as follows. Section 2 provides a review for related literature. Then, Sect. 3 introduces our benchmark model in a centralized supply chain with a dominant retailer under revenue sharing contracts. Section 4 studies the coordination mechanism and coping strategies of the decentralized supply chain under price regulations and demand disruptions by revenue sharing contracts. In order to illustrate our analytical results, Sect. 5 gives some numerical examples and compares the contracts under different circumstances. Finally, Sect. 6 summarizes the paper and points out directions for future research. Some proofs are provided in the “Appendix”.

2 Literature review

In this section, we review the relevant literature in a few areas, namely (1) revenue sharing contract for supply chain coordination with demand disruption; (2) the dominant retailer; and (3) the price regulations.

In recent a couple of years, the supply chain management researchers pay much more attention to designing the coordination schemes among different partners. Appropriate schemes can contribute to win–win outcome. Therefore, more and more researches on channel contracts spring up like mushrooms. In this background, Cachon (2003) summarized supply chain coordination mechanisms in detail and reviewed the literature excellently. Different from other contracts, in revenue sharing contract, the manufacturer charges low wholesale price to the retailer and shares a fraction of revenue generated by the retailer. Revenue sharing contract was used in video rental industry for the first time. And then, it has been widely applied in the real world for a long time and has also received increasing attention from academia. It can be found that most of study on the revenue sharing contract for supply chain coordination are examined under normal environment (also see Gerchak and Wang 2004; Giannoccaro and Pontrandolfo 2004; Zou et al. 2004; Cachon and Lariviere 2005; Koulamas 2006; Linh and Hong 2009; Giovanni and Roselli 2012; Xu et al. 2013, 2014; Palsule-Desai 2013; Hsueh 2013; Sang 2013; Giovanni 2014; Govindan and Popiuc 2014; Feng et al. 2014; Henry and Wernz 2015; Saha and Sarmah 2015, among others). Because of the extensive use and research work of the revenue sharing contract, we choose it as our study tool.

Demand disruption may be due to a sudden drop or a sudden rise in customer orders. Demand-related risks could potentially affect or disrupt the operations of the retailer and affect its ability to make products available to its customers. Consequently, the partners of the supply chain need to design new and effective coordination contracts to cope with the disruptions (Yu and Qi 2004). There are only a limited papers focusing on revenue sharing contract for supply chain coordination with demand disruption. Zhang et al. (2012) investigated how to coordinate a one-manufacturer two-retailer supply chain with demand disruptions by revenue sharing contracts, but the two retailers were peers. Cao et al. (2013) studied the supply chain with one manufacturer and n Cournot competing retailers, and developed a coordination mechanism with revenue sharing contract under the production cost and demand disruptions. And then, Cao et al. (2015) discussed the relevant problem of n Bertrand competing retailers. Pang et al. (2014) introduced a revenue-sharing contract and the one mixed with a quantity discount policy to coordinate a three-level supply chain under demand disruptions. In their essay, the market demand is stochastic and dependent on price. Tavakoli and Mirzaee (2014) also investigated a three-level supply chain coordination scheme when demand was disrupted, but they used revenue sharing and return policy contracts.

In the above analyses, it is assumed that there is only one single retailer or some homogeneous retailers in the supply chain. However, the large, centrally managed “power retailers” dominate much more retail trade markets at present (Raju and Zhang 2005). The “power retailers” have also received increasing attention from academia. Geylani et al. (2007) presented a theoretical model to illustrate a strategic manufacturer response to a dominant retailer. In their model, the dominant retailer could determine his own wholesale price, but the manufacturer set the wholesale price for the weak retailers. Chen and Xiao (2009) applied Geylani’s theory into supply chain coordination, and designed the corresponding coordination mechanism with linear quantity schedule and Groves wholesale price schedule under demand disruptions. Their channel included one manufacturer, one dominant retailer and multiple fringe retailers. Chen and Zhuang (2011) made an intensive study of this problem with linear quantity discount scheme. In contrast to the former model (Chen and Xiao 2009), the demand-stimulating service cost is constant and is mutually independent of the increased demand caused by the service. Li et al. (2014) developed a coordination model of a one-manufacturer multi-retailers supply chain with a dominant retailer and examined how the manufacturer can coordinate such a supply chain by revenue sharing contract after demand disruption.

This paper is also closely related to price regulations. Price regulations include impositions of a price ceiling and a price floor. Krishnan and Winter (2007) proposed a method of vertical control of inventory and pricing decisions within a distribution system. They drew that combining a buy-back option and a resale price ceiling can elicit the first-best decisions without a fixed fee and is robust to asymmetry in information about demand, while contracts need fixed fees to elicit first-best including resale price floors or buy-back policies. Chen and Lin (2010) addressed joint ordering and pricing policies for a decentralized distribution system under vendor managed inventory and consignment arrangements. In their study, they considered a retail floor of the retail price and discussed the change of corresponding profits. Engelmann and Müller (2011) searched for a collusive focal-point of price ceilings in laboratory market. But they found that collusion is as unlikely in markets with a price ceiling as in markets with unconstrained pricing. Shao et al. (2013) investigated how to distribute a product line in a decentralized supply chain. They showed that retail price floors or inventory buybacks, appropriately tailored to each product variant, are among the contracts that can achieve coordination. Peng et al. (2013) researched double price regulations and peak shaving reserve mechanism in coal–electricity supply chain. Their study revealed that the initiatives of the enterprises to supply or order thermal coal are reduced under conditions of double price regulations in the boom seasons of coal demand. It can be found that price regulation usually play a part when the demand is disrupted.

In spite of these efforts, the effects of price regulations on supply chain coordination with one dominant retailer after demand disruption have not been studied thoroughly. An in-depth study on supply chain coordination with demand disruptions and price regulations by the revenue sharing contracts is needed. The goal of this paper is intended to contribute to this end.

3 The benchmark model

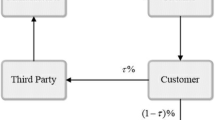

In this paper we investigate the coordination of a supply chain consisting of one manufacturer, one dominant retailer, and other fringe retailers. The dominant retailer has market power and determines the retail price. Once the price is settled down, all fringe retailers regard it as the market retail price. Since fringe retailers are identical and the market demand share of each retailer is so small that we take them as a whole. As with Qi et al. (2004) and Xiao and Qi (2008), we also assume that the information through the supply chain is perfect and all the partners are risk-neutral.

We define the correlative parameters as follows:

- \(\alpha \) :

-

The total market scale;

- \(\beta \) :

-

The price sensitive coefficient, \(\beta > 0\);

- \(c_{0}\) :

-

The unit production cost, \(c_{0}\ge 0\);

- \(c_{1}\) :

-

The unit cost, with which the retailers add some values to products, \(c_{1}\ge 0\);

- p :

-

The retail price with which retailers sell the final product, \(p\ge 0\);

- s :

-

The opportunity cost for the dominant retailer to provide demand-stimulating service, \(s\ge 0\);

- \(\theta \) :

-

The demand sensitivity to the service investment, \(\theta \in (0,2\sqrt{\beta })\);

- \(\gamma \) :

-

The share of the market demand for the dominant retailer;

- t :

-

The fraction of service cost that the dominant retailer bears;

- \(\varphi _{d}\,(\varphi _{r})\) :

-

The revenue share of the dominant (fringe) retailer, \(0{<}\varphi _{d}, \varphi _{r}<1\);

- \(w_{d}\, (w_{r})\) :

-

The unit wholesale price that the dominant (fringe) retailer pays.

Similar to Chen and Xiao (2009), we assume that the total market demand is

We assume \(\theta \in (0,2\sqrt{\beta })\) and \(\alpha >\beta (c_{0} +c_{1})\) to ensure that the market demand is nonnegative. As used in Xiao and Yang (2009) and Li et al. (2014), it is not too largely that service investment affects the market demand. This demand function indicates that the demand is decreasing with the retail price while it is increasing with the service investment. Meanwhile, the effect of the investment on the demand is diminishing.

Therefore, the market demand for the dominant retailer is \(q_{d}= \gamma q_{T}\), while that for the fringe retailers as a whole is \(q_{r}=(1-\gamma )\,q_{T}\). In our assumption, the fringe retailers share the demand \(q_{r}\). It indicates that the fringe retailers can benefit from the demand-stimulating service provided by the dominant retailer.

In the centralized supply chain with revenue sharing contracts, the total profit function is

As Cachon and Lariviere (2005) said, the revenue sharing contracts can coordinate a wide range of supply chain. In this paper, we will coordinate the one-manufacturer multi-retailers supply chain with one dominant retailer by revenue sharing contracts.

Therefore, the dominant retailer’s profit is

Here, \(\varphi _{d}\) and t are similar but not identical, which is consistent with those made in Raju and Zhang (2005) and Jeuland and Shugan (1983).

The fringe retailer’s profit is

Here \(\varphi _r p\ge w_{r} +c_{1}\,(i=d, r)\). In other words, the profit of each product should be nonnegative for the retailers to offer the final products to consumers.

The manufacturer’s profit is

From (2), we can obtain the optimal decisions in the centralized supply chain:

To determine the desirability of the demand-stimulating service, let \(\gamma [p^{{*}}-(c_{0}+c_{1})](\alpha -\beta p^{{*}}+\theta \sqrt{s^{{*}}})-s^{{*}}>\max _{p} \gamma [p-(c_{0}+c_{1})](\alpha -\beta p)\). Thus, the dominant retailer provides the service voluntarily, and the manufacturer prefers to induce such service even in the decentralized supply chain. Therefore, assumptions are given as follows.

Assumption 1

The market share (\(\gamma )\) of the dominant retailer should satisfy \({4\beta }/{(8\beta -\theta ^{2})}<\gamma <1\).

In the decentralized supply chain, the dominant retailer decides the retail price to maximize his own profit. The supply chain can be coordinated, when the Nash equilibrium decisions is equal to their corresponding optimal ones in the centralized supply chain, respectively. Meanwhile, the manufacturer prefers to attain maximum profit and eliminates any free-riding on the demand-stimulating service, so the fringe retailer’s profit is much less than the dominant retailer’s. Then, we assume \(\varphi _{r}p^{*}=w_{r}+c_{1}\).

In addition, in order to indicate the superiority of the revenue sharing contracts, we investigate the case without any contracts. The retailers purchase each product from the manufacturer at \(w_{m}\), and sell it to the consumer at \(p_{m}\). The unit cost in this process is consistent with the previous model. Meanwhile, the order quantity of the dominant and fringe retailer is \(q_{dm}\) and \(q_{rm}\), respectively.

Thus, when there are no contracts, the profit functions of the partners are

In this case, the partners make decisions only considering their own profits. We can also obtain the optimal decisions without any contracts by solving corresponding first-order condition. According to the above analysis, Theorem 1 is obtained.

Theorem 1

The supply chain with one dominant retailer can be coordinated by the revenue sharing contracts as follows:

Based the above discussions, we find that if the revenue sharing contracts satisfy Theorem 1, the supply chain can be coordinated under normal operation without demand disruptions.

4 Supply chain coordination under demand disruptions

In the real world operations, many sudden incidents may lead to demand disruptions, such as 9-11attack, Malaysia MH370 flight incident, and outbreak of swine flu, and so on. With the unpredicted demand change, the partners of the supply chain may adjust the original production quantity, retail price and demand-stimulating service. However, the government regulates the retail price to stabilize the market in some industries, for example oil, electric power, and agricultural products, etc. Therefore, the optimal decisions of the supply chain with price regulations are different from those in a free market without regulations.

In this section, we investigate the optimal revenue sharing contracts in a supply chain with price regulations when demand disruptions occur. Moreover, there are some certain extra deviation costs associated with the total production deviation quantity resulting from demand disruptions (Xu et al. 2006). In our model, the manufacturer bears these deviation costs fully, which Xiao et al. (2007) and Chen and Xiao (2009) supported. When price regulations happen, the retail price cannot exceed the range between the price ceiling and the price floor. Based on these above assumptions, we analyze the effect of demand disruptions and price regulations on supply chain and propose corresponding coordination mechanism by revenue sharing contracts. In this case, both the market scale (\(\alpha \)) and price sensitive coefficient (\(\beta \)) are changed simultaneously. In general, demand disruptions will generate some extra deviation costs, which are incurred to the manufacturer (Qi et al. 2004; Xiao et al. 2005). When the demand is disrupted, the manufacturer should provide a return policy for the unsold products, or produce more products to meet the increased demand. Therefore, we assume that the manufacturer bears the deviation costs fully. In order to express the case more clearly, we use the notation with a tilde \((\sim )\) to denote corresponding parameters.

4.1 Centralized decision-making

First of all, we study the new coordination contract with price regulations when demand disruptions occur. We assume the market scale \(\alpha \) and the price sensitive coefficient \(\beta \) are changed into \(\tilde{\alpha }=\alpha +\Delta \alpha >0\) and \(\tilde{\beta }=\beta +\Delta \beta >0\) respectively. If \(\Delta \alpha \) is positive, there is an increased demand scale, and if \(\Delta \alpha \) is negative, there is a decreased demand scale. \(\Delta \beta >0\) represents the demand is more sensitive to the price, while \(\Delta \beta <0\) represents the demand is less sensitive to the price. Thus, we cannot determine the change in market demand because of the effects of \(\Delta \alpha \) and \(\Delta \beta \). We also assume that \(\Delta \alpha \) and \(\Delta \beta \) are independent of the demand-stimulating service.

Then, the total market demand is \(\tilde{q}_{T} =\tilde{\alpha } -\tilde{\beta }\tilde{p}+\theta \sqrt{\tilde{s}}\).

The total production deviation quantity is \(\Delta \tilde{Q}=\tilde{q}_{T} -q_T^{*} =\tilde{\alpha }-\tilde{\beta }\tilde{p}+\theta \sqrt{\tilde{s}}-q_T^{*}\).

When \(\Delta \tilde{Q}>0\), more products should be produced to the unplanned increased demand. It will cost more in machines, labor input and raw materials. When \(\Delta \tilde{Q}<0\), the excess supply of products, such as some leftover inventory, causes an extra holding cost. In either case, the shock to demand will disrupt the original production plan. Therefore, the deviation penalties are related to the difference between the actual quantity and the original planned quantity. Similar to Qi et al. (2004) and Xiao and Qi (2008), we assume the unit penalty cost for the increased amount and the decreased amount is \(c_{u}\) and \(c_{s}\) respectively, \(c_{u}\ge 0\) and \(c_{s}\ge 0\). Then, the total profit of the centralized supply chain is

By solving the Kuhn–Tucker conditions of (10), we can obtain Corollary 1.

In order to facilitate the presentation, we define the correlative parameters as follows:

Corollary 1

When demand disruptions occur, the optimal retail price and service investment in the centralized supply chain are

-

1.

\(if\;A\ge c_u \;and\;\Delta \beta >\frac{\theta ^{2}}{4}-\beta ,then\)

-

(1)

\(if\;\bar{{p}}<C_1,\,then\;\tilde{p}_1^{*} =\bar{{p}},\tilde{s}_1^{*} = \bar{{S}}_u\)

-

(2)

\(if\;{\underline{p}}\le C_1 \le \bar{{p}},\;then\;\tilde{p}_1^{*} =C_1 ,\tilde{s}_1^{*} =\frac{\theta ^{2}[\tilde{\alpha }-\tilde{\beta }(c_0 +c_1 +c_u )]^{2}}{(4\tilde{\beta }-\theta ^{2})^{2}}\)

-

(3)

\(if\;C_1<{\underline{p}}<C_1 + \frac{\sqrt{\Delta _1 }}{4\tilde{\beta }-\theta ^{2}},\;then\;\tilde{p}_1^{*} ={\underline{p}},\tilde{s}_1^{*} ={\underline{S}}_u\)

-

(4)

\(if\;{\underline{p}}\ge C_1 +\frac{\sqrt{\Delta {}_1}}{4\tilde{\beta }-\theta ^{2}},\) \(then\;no\, solution,the\;supply\;chain\;will\;not\;enter\;the market.\)

-

(1)

-

2.

\(if\;-c_s<A<c_u ,\Delta \alpha>-\alpha \;and\;\Delta \beta >\frac{\theta ^{2}}{4}-\beta ,\tilde{\alpha }-\tilde{\beta }\bar{{p}}<q_T^*,then\)

-

(1)

\(if\;\bar{{p}}<C_2 ,then\)

\(if\;\tilde{T}(\tilde{p}=\bar{{p}},\tilde{s}=\bar{{S}}_u )\ge \tilde{T}(\tilde{p}=\bar{{p}},\tilde{s}=\frac{(q_T^*-\tilde{\alpha }+\tilde{\beta }\bar{{p}})^{2}}{\theta ^{2}}),then\;\tilde{p}_2^{*} =\bar{{p}},\tilde{s}_2^{*} =\bar{{S}}_u\)

\(else,\tilde{p}_2^{*} =\bar{{p}},\tilde{s}_2^{*} =\frac{(q_T^*-\tilde{\alpha }+\tilde{\beta }\bar{{p}})^{2}}{\theta ^{2}}\)

-

(2)

\(if\;{\underline{p}}\le C_2 \le \bar{{p}},then\;\tilde{p}_2^{*} =C_2 ,\tilde{s}_2^{*} =\frac{\beta ^{2}}{\tilde{\beta }^{2}}s^{*}\)

-

(3)

\(if\;C_2<{\underline{p}}<C_2 +\frac{\sqrt{\Delta _2 }}{2\tilde{\beta }^{2}}\,then\)

\(if\;\tilde{T}(\tilde{p}={\underline{p}},\tilde{s}={\underline{S}}_s )\ge \tilde{T}(\tilde{p}={\underline{p}},\tilde{s}=\frac{(q_T^*-\tilde{\alpha }+\tilde{\beta }{\underline{p}})^{2}}{\theta ^{2}}),then\;\tilde{p}_2^{*} ={\underline{p}},\tilde{s}_2^{*} ={\underline{S}}_s\)

\(else,\tilde{p}_2^{*} ={\underline{p}},\tilde{s}_2^{*} =\frac{(q_T^*-\tilde{\alpha }+\tilde{\beta }{\underline{p}})^{2}}{\theta ^{2}}\)

-

(4)

\(if {\underline{p}}\ge C_2 +\frac{\sqrt{\Delta _2 }}{2\tilde{\beta }^{2}},then\;no\,solution,the\;supply\;chain\;will\;not\;enter\;the\;market\).

-

(1)

-

3.

\(if\;A\le -c_s ,\Delta \alpha>-\alpha \;and\hbox { }\Delta \beta \hbox {>}\frac{\theta ^{2}}{4}-\beta ,then\)

-

(1)

\(if\;\bar{{p}}<C_3 ,then\;\tilde{p}_3^{*} =\bar{{p}},\tilde{s}_3^{*} = \bar{{S}}_s\)

-

(2)

\(if\;{\underline{p}}\le C_3 \le \bar{{p}},\;then\;\tilde{p}_3^{*} =C_3 ,\tilde{s}_3^{*} =\frac{\theta ^{2}[\tilde{\alpha }-\tilde{\beta }(c_0 +c_1 -c_s )]^{2}}{(4\tilde{\beta }-\theta ^{2})^{2}}\)

-

(3)

\(if\;C_3<{\underline{p}}<C_3 +\frac{\sqrt{\Delta _3 }}{4\tilde{\beta }-\theta ^{2}},then\;\tilde{p}_3^{*} ={\underline{p}},\tilde{s}_3^{*} = {\underline{S}}_s\)

-

(4)

\(if\;{\underline{p}}\ge C_3 +\frac{\sqrt{\Delta _3 }}{4\tilde{\beta }-\theta ^{2}},then\;no\,solution, the\;supply\;chain\;will\;not\;enter\;themarket\).

-

(1)

Corollary 1 has following the managerial insights:

-

(1)

If the demand changes slightly, given in Condition 2, it is optimal for the supply chain to keep the original quantities. Hence, the supply chain should keep the original quantities to avoid the production deviation cost and change the original retail prices to offset the effect of the demand disruptions.

-

(2)

If the demand changes greatly, given in Conditions 1 and 3, the manufacturer should change the production quantity to satisfy the new market demand.

-

(3)

If the government regulates the price and the optimal retail price exceeds the price ceiling or floor, \(\tilde{p}^{*}\) will keep at the price of \(\bar{{p}}\) or \({\underline{p}}\). When the price floor is greater than a certain value, there is no solution to this problem and the contracts are invalid.

-

(4)

In Condition 2, the manufacturer may change the production quantity to attain maximum profit when the retail price is limited. In this situation, we will compare two profits when the manufacturer adjusts the production quantity and keeps the quantity.

Note that the retail price, the service level and the production quantity must be greater than zero. When falling below zero, they are recorded as zero.

4.2 Decentralized decision-making

In the decentralized supply chain, the dominant retailer will determine the retail price to maximize its profit. Meanwhile, the deviation cost is borne by the manufacture. Thus, the profit functions of the partners are

Solving the first-order condition of \(\tilde{\pi }_{d}\), we find that the dominant retailer’s optimal retail price and service level are

On basis of Nash equilibrium, let \(\tilde{p}_d^\Delta =\tilde{p}_i^*\) and \(\tilde{s}_d^\Delta =\tilde{s}_i^*\), \(i=1, 2, 3\), to coordinate the chain. Similar to the previous section, the manufacturer prefers to sell the products to the fringe retailers at the price \(\tilde{w}_{r}\), which satisfies \(\tilde{\varphi }_r^{*} \tilde{p}^{{*}}=\tilde{w}_r^{*} +c_{1}\), in order to achieve its maximum profit. So we can obtain

In order to illustrate the desirability of the new contracts, we discuss the original scheme when the partners don’t response to demand disruptions. The dominant retailer keeps the optimal retail price \(p^{*}\), service level \(s^{*}\), and the unit cost is \(c_{1}\). The manufacturer keeps the contract \((w_i^*,\varphi _i^*)\) without demand disruptions, and his production cost is still \(c_{0}\). In this case, the real total market demand is \(\tilde{q}_{Tr}^{*} =\tilde{\alpha }-\tilde{\beta }p^{{*}}+\theta \sqrt{s^{{*}}}\). The order quantity of the dominant retailer is \(\tilde{q}_{dr}^{*} =\gamma \tilde{q}_{Tr}^{*}\), while that of the fringe retailers is \(\tilde{q}_{rr}^{*} =(1-\gamma )\tilde{q}_{Tr}^{*}\).

The profit functions of the retailers and the manufacturer in this setting are

where \(\Delta \tilde{Q}_r =\tilde{q}_{Tr}^{*}-q_T^{*}\).

Then, the total profit of the supply chain is

When demand disruptions and price regulations occur, the dominant retailer may consider whether to provide the demand-stimulating service. With respect to the desirability and effectiveness of the service, revenue sharing contracts without service are adopted. Under this circumstance, the dominant retailer doesn’t prefer to provide the service to the manufacturer’s products when demand is disrupted. Then, the total market demand is \(\tilde{q}_{Tw} =\tilde{\alpha }-\tilde{\beta }\tilde{p}_w\). The market demand for the dominant retailer and fringe retailers is \(\tilde{q}_{dw} =\gamma \tilde{q}_{Tw}\) and \(\tilde{q}_{rw} =(1-\gamma )\tilde{q}_{Tw}\) respectively.

The total profit of the centralized supply chain in this setting is

By solving the Kuhn–Tucker conditions of (15), we can obtain Corollary 2.

In order to facilitate the presentation, we define the correlative parameters as follows:

Corollary 2

When demand disruptions occur, the optimal retail price and service level in the centralized supply chain without demand-stimulating service are

From Corollary 2, we find that if the changed amount \((\tilde{\alpha }-\tilde{\beta }(c_0 +c_1 )-2q_T^*)/\tilde{\beta }\) is sufficiently small and the government doesn’t regulate the price, the supply chain should keep the original planned quantities in a free market. Then, the chain can avoid the deviation cost and change the original retail prices to offset the impact of the demand disruptions on the chain. However, if there are price regulations, the chain cannot keep the original planned quantities when the new retail price exceeds the price ceiling or floor. In this case, the manufacturer has to bear the deviation cost. If the changed amount \((\tilde{\alpha }-\tilde{\beta }(c_0 +c_1 )-2q_T^*)/\tilde{\beta }\) is large, the partners should change both the production quantity and the retail price to meet the new market demand. Because of price regulations, the retail price keeps in the range of \((\underline{p},\bar{{p}})\).

4.3 Supply chain coordination

In order to indicate the superiority of the new contract, the main partners should earn much more than that by the original ones when demand disruptions and government regulations occur. According to the above descriptions, we have Theorem 2.

Theorem 2

When demand disruptions occur, the following revenue sharing contracts can coordinate the supply chain with one dominant retailer:

Theorem 2 investigates the supply chain coordination mechanism by revenue sharing contracts when the demand is disrupted and the retail price is regulated. Theorem 2 indicates that it is necessary for both the dominant retailer and the manufacturer to adjust the original contracts to the demand disruption. Moreover, the new contract without price regulations in a free market is a special case of Theorem 2 when the price ceiling extends into infinity and the price floor decreases to zero.

5 Numerical examples

On the basis of the above theoretical model analysis, we demonstrate how the demand disruptions and price regulations affect the optimal strategies of the participators and the profitability of the whole chain. The following examples are constructed for the purpose of illustrating the theoretical models discussed.

Above all, we discuss the revenue sharing contracts to coordinate the supply chain with one dominant retailer under normal condition. The hypothetical values of basic parameters are as follows: \(\alpha =20,\beta =1,\theta =0.5, c_{0}=4, c_{1}=1\). According to Sect. 3, we can obtain the optimal decisions, including \(p^{*}=13,s^{*}=4,q_T^*=8\). Therefore, the market share (\(\gamma \)) satisfies \(0.5161< \gamma <1\) under Assumption 1. From (8) in Theorem 1, the feasible domain for \(\varphi _{d}^{*}\) is \(\hbox {0.268}<\varphi _d^*<\hbox { 0.595}\) in order to achieve supply chain coordination. Due to these, we suppose that \(\gamma =0.7\hbox { and }\varphi _d^*=0.45\). According to (8) and (9) in Theorem 1, \(t^{*}=0.315, w_d^*=1.25\).

Then, we will discuss and compare the supply chain coordination in a free market and with price regulations under demand disruptions. Here we give numerical examples to attain win–win situation for both the dominant retailer and manufacturer. The basic parameters’ values are similar to the normal operation. In addition, we assume the deviation cost \(c_{u}=c_{s}=1\).

5.1 Supply chain coordination with market scale disruption

Firstly, we analyze how the change of the market scale affect the optimal retail price, total production quantity and optimal service investment in a free market with price regulations, which are depicted in Figs. 1, 2, 3, 4, 5 and 6. We assign five values to \(\Delta \beta \). Then, \(\beta \) remains unchanged, and \(\alpha \) changes continuously. From Figs. 1 and 2, we observe that the production quantity is robust when the demand disruption is small. Nevertheless, since the optimal strategy will be affected by the price regulations to a certain degree, the production quantity is steeper than that in a free market. The optimal retail price is increasing function of \(\Delta \alpha \) whether it is in a free market or with price regulations in the mass, which are depicted in Figs. 3 and 4. Meanwhile, the retail price in the robust scale is the steepest. However, when the demand is disrupted sharply, the optimal price keeps in price ceiling or floor in Fig. 4, while the one increase or decrease more quickly in Fig. 3. As can be seen from Fig. 5, when the disrupted market scale (\(\Delta \alpha \)) is small, the dominant retailer should not change the service investment. In Fig. 6, when the demand increases largely, the price regulations make the market changed and marginal utility of demand simulation is inconspicuous. In this case, the dominant retailer chooses to keep the service investment in a certain degree. When the demand decreases sharply, the service investment may increase to the certain degree. In this case, the optimal retail price keeps in price floor and overmuch investment cannot prompt consumers to buy the products. Therefore, the dominant retailer keeps the investment unchanged in order to minimize losses. However, when total order quantity decreases to zero, the dominant retailer prefers to not stimulating demand. Anyhow, when demand disruption is large, the optimal decisions of supply chain change considerably with the disrupted amount of demand even though there are some deviation costs occur.

5.2 Supply chain coordination with price coefficient disruption

From Figs. 7, 8, 9, 10, 11 and 12, we can illustrate the effects of price coefficient disruption on optimal retail price, total production quantity and service investment in a free market with price regulations. Likewise, we assign five values to \(\Delta \alpha \), while \(\beta \) changes continuously. As Sect. 5.1 shows, the total production quantity is robust when the price coefficient disruption is small (see Figs. 7, 8). However, since the price regulations will impact the optimal decisions to a certain degree, the production quantity is steeper than that in a free market (see Fig. 8). As we can see from Figs. 9 and 10, the retail price in the robust scale is the steepest for the manufacturer to avoid redundant deviation cost. Meanwhile, the optimal retail price decreases \(\Delta \beta \) in a free market in the mass, whereas it keeps in price ceiling or floor with large disruption Fig. 10. In Fig. 11, optimal service investment is decreasing function of \(\Delta \beta \) in a free market. Because of the price regulations, the service investment keeps in a certain degree under larger disruptions. In some cases, since the optimal retail price keeps in price ceiling or floor, the service investment may jump to the certain value. However, when total order quantity falls to zero, the dominant retailer is not inclined to stimulate demand. In brief, when price coefficient disruption is large, the optimal decisions change considerably with the disrupted amount of demand even though there are some deviation costs.

5.3 Supply chain coordination with demand disruptions

In the following, we investigate the relationships of the whole supply chain profit in different scenarios when market scale disruption (\(\Delta \beta =0\)) and price coefficient demand (\(\Delta \alpha =0\)), respectively. From Figs.13 and 14, we find that there are little differences among supply chain profits under these five circumstances on the surface, when the demand is disrupted slightly. However, the larger the demand becomes, the more superior the new contract in a free market is to the others. We can find that when the demand disruption is large, the overall effectiveness of the supply chain under price regulations reduces in contrast with that in free market. This shows that price regulations of the government increase the social benefits, but reduces the economic benefits to some extent. It accords with benefit balance. When the demand increases largely, the new contract adjusted after price regulation has the superiority of the profit compared with the original contract and the one without stimulation. When the demand drops severely, demand-stimulating service is invalid and results in much more loss, if the government regulates the retail price. In such a case, main partners in the supply chain prefer not to stimulate demand in order to avoid losing more and keep its profit higher than that of the original contract. Therefore, emergency strategies are advantageous to the whole supply chain.

In the above section, we have compared the supply chain profits in different conditions. Next, we will analyze the profitability of the main partners. Therefore, we suppose different values of \(\Delta \alpha \) and \(\Delta \beta \), and set 16 cases to discuss the availability of the contracts. Table 1 shows the relevant profits of the main partners in different cases. From Theorem 2, we can obtain the feasible revenue sharing contracts under different demand disruptions. Here, we choose one feasible value of \(\tilde{\varphi }_d^*\) in order to illustrate the issue more conveniently and obviously. Thus, we can obtain the relevant profits in each case. \(\lambda =(\tilde{T}-\tilde{T}_r )/\tilde{T}_r\) describes the efficiency of the new contract due to disruption management. As we can see from Table 1, the dominant retailer and manufacturer tend to design a new contract when the demand is disrupted in a free market. Meanwhile, the values of \(\lambda \) reflect that the effect of proper disruption management is very remarkable especially when the overall effect of the disruptions is large. The huger demand disruption is, the more tremendously the main partners can benefit from the new coordination contracts under demand disruptions. Therefore, it is necessary to adjust the original revenue sharing contracts when there are no price regulations.

However, when price is regulated, the results are different. From Table 2, when demand increases much more, although the supply chain profit of the new contract is more than the original one, the partners would rather to choose the original contract. It is the reason that one of the partners earns less profit and has no incentive to accept the new contracts. In this case, the original revenue sharing contract is valid. The government can provide subsidies for the disadvantaged participant in order to encourage the main participants to accept the new contract, and thereby improve the efficiency of the entire supply chain and stabilize the market. When the market scale and price coefficient are disrupted slightly, the chain should keep the original production quantity and service investment, then change the retail price to offset the impact of the demand disruption. When the demand is disrupted larger, the chain should change all the original decisions in response to demand disruptions. In summary, when the government regulates the price, the dominant retailer and manufacturer prefer to adjust the original contract except some extreme cases.

6 Conclusions

In this paper, we study the coordination scheme of a supply chain with one manufacturer and one dominant retailer. We assume that the dominant retailer has some prerogatives, for example, it has market power and can stimulate demand. We mainly pay emphasis on supply chain coordination when the demand is disrupted. Meanwhile, we consider the variances in the market scale and price coefficient under demand disruptions. Then, we investigate the contracts in a free market and with price regulations. Comparing these two contracts, we find it necessary for partners to adjust the original contracts in a free market under demand disruptions. When the government regulates the price, the partners adjust the original contracts except, if the demand increases substantially. However, if the demand falls to zero, the dominant retailer is disinclined to provide demand-stimulating service to avoid more loss. According to our study, when the new contract is invalid with price regulations, the government can offer some subsidies to the partners, so that they can accept the new contract and improve the profitability of the whole supply chain.

The combination of demand disruption management and supply chain coordination is very important and interesting. For future research, we will study the government purchase policy and subsidy policy in detail. We will continue studying other kinds of demand and service functions. It would also be meaning to discuss the coordination mechanism with asymmetric information. Moreover, we can consider some other channel leaderships, such as the manufacturer, the collector and so on.

References

Cachon, G. P. (2003). Supply chain coordination with contracts. Handbooks in Operations Research and Management Science, 11, 227–339.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: strengths and limitations. Management Science, 51(1), 30–44.

Cao, E., Wan, C., & Lai, M. (2013). Coordination of a supply chain with one manufacturer and multiple competing retailers under simultaneous demand and cost disruptions. International Journal of Production Economics, 141(1), 425–433.

Cao, E., Zhou, X., & Lü, K. (2015). Coordinating a supply chain under demand and cost disruptions. International Journal of Production Research, 53(12), 3735–3752.

Chen, J., & Lin, I. (2010). Ordering and pricing policies under vendor managed inventory and consignment arrangements. International Journal of Information and Management Sciences, 21(4), 453–468.

Chen, K., & Xiao, T. (2009). Demand disruption and coordination of the supply chain with a dominant retailer. European Journal of Operational Research, 197(1), 225–234.

Chen, K., & Zhuang, P. (2011). Disruption management for a dominant retailer with constant demand-stimulating service cost. Computers & Industrial Engineering, 61(4), 936–946.

Choi, T. M., & Cheng, T. E. (Eds.). (2011). Supply chain coordination under uncertainty. Berlin: Springer.

Choi, T. M., Li, Y., & Xu, L. (2013). Channel leadership, performance and coordination in closed loop supply chains. International Journal of Production Economics, 146(1), 371–380.

De Giovanni, P., & Roselli, M. (2012). Overcoming the drawbacks of a revenue-sharing contract through a support program. Annals of Operations Research, 196(1), 201–222.

De Giovanni, P. (2014). Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Annals of Operations Research, 220(1), 135–157.

Engelmann, D., & Müller, W. (2011). Collusion through price ceilings? In search of a focal-point effect. Journal of Economic Behavior & Organization, 79(3), 291–302.

Feng, X., Moon, I., & Ryu, K. (2014). Revenue-sharing contracts in an N-stage supply chain with reliability considerations. International Journal of Production Economics, 147, 20–29.

Gerchak, Y., & Wang, Y. (2004). Revenue-sharing vs. wholesale-price contracts in assembly systems with random demand. Production and Operations Management, 13(1), 23–33.

Geylani, T., Dukes, A. J., & Srinivasan, K. (2007). Strategic manufacturer response to a dominant retailer. Marketing Science, 26(2), 164–178.

Giannoccaro, I., & Pontrandolfo, P. (2004). Supply chain coordination by revenue sharing contracts. International Journal of Production Economics, 89(2), 131–139.

Govindan, K., & Popiuc, M. N. (2014). Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. European Journal of Operational Research, 233(2), 326–336.

Henry, A., & Wernz, C. (2015). A multiscale decision theory analysis for revenue sharing in three-stage supply chains. Annals of Operations Research, 226(1), 277–300.

Hsueh, C. (2013). Improving corporate social responsibility in a supply chain through a new revenue sharing contract. International Journal of Production Economics, 151, 214–222.

Jeuland, A. P., & Shugan, S. M. (1983). Managing channel profits. Marketing Science, 2(3), 239–272.

Koulamas, C. (2006). A newsvendor problem with revenue sharing and channel coordination. Decision Sciences, 37(1), 91–100.

Krishnan, H., & Winter, R. A. (2007). Vertical control of price and inventory. The American Economic Review, 97(5), 1840–1857.

Li, J., Liu, X. F., Wu, J., & Yang, F. M. (2014). Coordination of supply chain with a dominant retailer under demand disruptions. Mathematical Problems in Engineering, 2014, 854681.

Li, J., Wang, S. Y., & Cheng, T. C. E. (2010). Competition and cooperation in a single-retailer two-supplier supply chain with supply disruption. International Journal of Production Economics, 124(1), 137–150.

Linh, C. T., & Hong, Y. (2009). Channel coordination through a revenue sharing contract in a two-period newsboy problem. European Journal of Operational Research, 198(3), 822–829.

Palsule-Desai, O. D. (2013). Supply chain coordination using revenue-dependent revenue sharing contracts. Omega, 41(4), 780–796.

Pang, Q., Chen, Y., & Hu, Y. (2014). Three-level supply chain coordination under disruptions based on revenue-sharing contract with price dependent demand. Discrete Dynamics in Nature and Society, 2014, 464612.

Peng, H. J., Zhou, M. H., & Wang, F. D. (2013). Research on double price regulations and peak shaving reserve mechanism in coal–electricity supply chain. Mathematical Problems in Engineering, 2013, 542041.

Qi, X. T., Bard, J. F., & Yu, G. (2004). Supply chain coordination with demand disruptions. Omega, 32(4), 301–312.

Raju, J., & Zhang, Z. J. (2005). Channel coordination in the presence of a dominant retailer. Marketing Science, 24(4), 254–262.

Sang, S. J. (2013). Supply chain contracts with multiple retailers in a fuzzy demand environment. Mathematical Problems in Engineering, 2013, 482353.

Saha, S., & Sarmah, S. P. (2015). Supply chain coordination under ramp-type price and effort induced demand considering revenue sharing contract. Asia-Pacific Journal of Operational Research, 32(2), 1550004.

Shao, J., Krishnan, H., & Thomas McCormick, S. (2013). Distributing a product line in a decentralized supply chain. Production And Operations Management, 22(1), 151–163.

Tavakoli, E., & Mirzaee, M. (2014). Coordination of a three-level supply chain under disruption using profit sharing and return policy contracts. International Journal of Industrial Engineering Computations, 5(1), 139–150.

Useem, J., Schlosser, J., & Kim, H. (2003). One nation under Wal-Mart. Fortune, 147(4), 64–78.

Xiao, T., Qi, X., & Yu, G. (2007). Coordination of supply chain after demand disruptions when retailers compete. International Journal of Production Economics, 109(1), 162–179.

Xiao, T., Yu, G., Sheng, Z., & Xia, Y. (2005). Coordination of a supply chain with one-manufacturer and two-retailersunder demand promotion and disruption management decisions. Annals of Operations Research, 135(1), 87–109.

Xiao, T., & Qi, X. (2008). Price competition, cost and demand disruptions and coordination of a supply chain with one manufacturer and two competing retailers. Omega, 36(5), 741–753.

Xiao, T., & Yang, D. Q. (2009). Risk sharing and information revelation mechanism of a one-manufacturer and one-retailer supply chain facing an integrated competitor. European Journal of Operational Research, 196(3), 1076–1085.

Xiao, T., Choi, T. M., & Cheng, T. C. E. (2015). Optimal variety and pricing decisions of a supply chain with economies of scope. IEEE Transactions on Engineering Management, 62(3), 411–420.

Xu, M., Qi, X., Yu, G., & Zhang, H. (2006). Coordinating dyadic supply chains when production costs are disrupted. IIE Transactions, 38(9), 765–775.

Xu, G., Dan, B., Zhang, X., & Liu, C. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics, 147, 171–179.

Xu, M. L., Wang, Q., & Ouyang, L. H. (2013). Coordinating contracts for two-stage fashion supply chain with risk-averse retailer and price-dependent demand. Mathematical Problems in Engineering, 2013, 259164.

Yu, G., & Qi, X. (2004). Disruption management: Framework, models and applications. Singapore: World Scientific.

Zhang, W., Fu, J., Li, H., & Xu, W. (2012). Coordination of supply chain with a revenue-sharing contract under demand disruptions when retailers compete. International Journal of Production Economics, 138(1), 68–75.

Zou, X., Pokharel, S., & Piplani, R. (2004). Channel coordination in an assembly system facing uncertain demand with synchronized processing time and delivery quantity. International Journal of Production Research, 42(22), 4673–4689.

Acknowledgments

This research was partially supported by the National Natural Science Foundation of China under Grant Nos. 71171011, 71372195, 71571011 and the New Century Excellent Talents in Universities scheme (NCET-12-0756).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Theorem 1

In the decentralized supply chain, the dominant retailer decides the retail price to maximize his own profit. By solving the first order conditions of (3) with respect to p and s, we have

Let \(p_d^\Delta =p^{{*}}\), \(s_d^\Delta =s^{{*}}\) and \(\varphi _{r}p^{*}=w_{r}+c_{1}\). We get (8).

Because \(0<\varphi _d^{*} <1\) and \(w_d^{*} >0\), the dominant retailer’s revenue share \(\varphi _d^{*}\) must satisfy

The second objective is in order to satisfy win–win condition for the chain partners by the contracts. Assume that \(\pi _k^{*}\) is the optimal profit of the actor k (\(k=m, d)\) in the supply chain with the revenue-sharing contracts and \(\pi _m\) is the profit of the actor \(k\,(k=m, d)\) without any contracts. Only when \(\pi _k^{*} >\pi _{km}\), the chain partners prefer to design the revenue-sharing contracts. Based on the above inequalities and (19), we can obtain (9).

Proof of Corollary 1

For convenience, the objective function (10) can be differentiated into two cases. We can combine these two cases to give the optimal solutions for the centralized supply chain.

Based on the above formulas, we can see that \(\tilde{T}^{1}\) and \(\tilde{T}^{2}\) are concave functions of the retail price \(\tilde{p}\) and service investment \(\tilde{s}\), thus the solutions that satisfy the first-order condition give the optimal retail prices and service investments. \(\square \)

The Kuhn–Tucker condition of Eq. (21)

Here \(\lambda \) is the Lagrangian multiplier. Solving (22), we get the flowing:

If there are no price regulations and \(\frac{2\tilde{\alpha }\tilde{\beta }-2\tilde{\beta }^{2}(c_0 +c_1 )-(4\tilde{\beta }-\theta ^{2})q_T^*}{2\tilde{\beta }^{2}}\ge c_u\), the optimal decisions satisfy

When the retail price is regulated, we need to discuss the magnitude of the optimal retail price without regulations.

If \(\bar{{p}}<\frac{2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )}{4\tilde{\beta }-\theta ^{2}}\), the supply chain is optimal when the retail price is equal to the price ceiling. At this time, the optimal service investment satisfies \(\tilde{s}_1^{*} =\frac{\theta ^{2}[\bar{{p}}-(c_0 +c_1 +c_u )]^{2}}{4}\).

If \(\frac{2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )}{4\tilde{\beta }-\theta ^{2}}<\underline{p}<\frac{2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )}{4\tilde{\beta }-\theta ^{2}}+\;\frac{\sqrt{\Delta _1 }}{4\tilde{\beta }-\theta ^{2}}\), the supply chain is optimal when the retail price is equal to the price floor (\(\Delta _1 =[2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )]^{2}+(4\tilde{\beta }-\theta ^{2})[(\theta ^{2}-4\tilde{\alpha })(c_0 +c_1 +c_u )+c_u q_T^{*} ])\). Then, \(\tilde{s}_1^{*} =\frac{\theta ^{2}[\underline{p}-(c_0 +c_1 +c_u )]^{2}}{4}\).

And if the price floor is too large and is greater than zero point, that there is no solution for the supply chain coordination with demand disruptions.

If \(-c_s<\frac{2\tilde{\alpha }\tilde{\beta }-2\tilde{\beta }^{2}(c_0 +c_1 )-(4\tilde{\beta }-\theta ^{2})q_T^*}{2\tilde{\beta }^{2}}<c_u \), the Lagrangian multiplier \(\lambda >0\), which means that \(\tilde{\alpha }-\tilde{\beta }\tilde{p}+\theta \sqrt{\tilde{s}}-q_T^{*} =0\). From Kuhn–Tucker condition, we obtain \(\tilde{p}_2^{*} =\frac{\beta ^{2}(2\tilde{\beta }-\theta ^{2})}{\tilde{\beta }^{2}(2\beta -\theta ^{2})}(\beta p^{*}-\alpha )+\frac{\tilde{\alpha }}{\tilde{\beta }},\tilde{s}_2^{*} =\frac{\beta ^{2}}{\tilde{\beta }^{2}}s^{*}\).

Similarly, we discuss this issue in four conditions. However, when the optimal retail price exceeds the price regulations, we should discuss whether to change original production quantity nor not.

Likewise, if \(\frac{2\tilde{\alpha }\tilde{\beta }-2\tilde{\beta }^{2}(c_0 +c_1 )-(4\tilde{\beta }-\theta ^{2})q_T^*}{2\tilde{\beta }^{2}}\le -c_s \), the optimal solution of (22) is

When the price is regulated, the optimal solutions are similar to previous proofs.

Combining these two cases, we can obtain the Corollary 1.

Proof of Theorem 2

Because \(0<\tilde{\varphi }_d^{*} <1\) and \(\tilde{w}_d^{*} >0\), \(\tilde{\varphi }_d^{*}\) must satisfy:

We assume that \(\tilde{\pi }_k^*\) and \(\tilde{\pi }_{kr}\) is the optimal profit of the actor \(k\, (k=d, m)\) in the supply chain with the new and the original revenue sharing contracts respectively. In order to assure the partners prefer the new contracts to the original ones, let \(\tilde{\pi }_k^*>\tilde{\pi }_{kr}\). So we can obtain

Substitute (16) to (24), we can obtain

From (23) and (25), we can get (17) (Koulamas 2006). \(\square \)

Similar to Assumption 1, the market share of the dominant retailer \(\gamma \) should satisfy the following condition, so that the dominant retailer should provide the demand-stimulating service voluntarily, and the manufacturer would like to induce such service even when the supply chain is in the decentralized operation.

Therefore, we can obtain (18).

Rights and permissions

About this article

Cite this article

Liu, X., Li, J., Wu, J. et al. Coordination of supply chain with a dominant retailer under government price regulation by revenue sharing contracts. Ann Oper Res 257, 587–612 (2017). https://doi.org/10.1007/s10479-016-2218-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2218-0