Abstract

Inflation expectations are critical in monetary economics. It could affect the policy outcome as economic agents’ responses to a monetary policy partially depend on the economic expectations. This systematic literature review discusses the impact of media on various aspects of inflation expectation, especially inflation forecasts and their errors, updating behaviour, and disagreement in inflation expectations. Using the PRISMA procedure on two academic databases from 2000 to February 2023, 65 journal articles were analysed. After discussing the research framework and research characteristics, the analysed papers are discussed from three perspectives: methodology, media measurement, and topic coverage. The findings suggest that these papers applied quantitative and qualitative analysis techniques, especially the former. Besides, different media sources have been collected, mostly from newspapers and surveys. Different data processing steps are applied to extract the related information for estimation from these sources. Next, the paper presented could be grouped into theoretical formation and empirical evidence of different media perspectives’ influence on inflation expectation. The empirical studies have offered mixed empirical evidence on the implications of media. This paper ends with six recommendations for future research.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The macroeconomic expectation is an important factor in determining the efficiency of a central bank policy because the expectations will affect the economic agents’ reactions and policy outcomes. The expectation also played a significant role in the inflation-targeting regime. A main feature of inflation targeting is to anchor the inflation expectation (Martinez 2005). Adrian et al. (2018) add that managing long-term inflation expectations is equivalent to forming a firm nominal anchor for a successful inflation-targeting regime.

Initially, the full information rational expectation (FIRE) has been applied in economic models. In this framework, an economic agent will use all available information and experience to form an expectation. Therefore, a monetary policy has small economic effects due to agents’ speedy adjustment to monetary policy shocks. Another significant implication of FIRE is that the expectations should be homogenous. Nonetheless, the validity of rational expectation is not without contest. One of the points of contesting is whether an economic agent will adjust their expectation immediately after receiving new information. For example, Hori and Kawagoe (2013) found that rational expectations do not exist among Japanese households in this context. Hence, examining the reason behind the rejection of rational expectation is necessary.

Various economic expectations have been studied in the past, including inflation expectations. This paper aims to provide a systematic literature review (SLR) on the papers that examine the impact of media on the formation and dynamics of inflation expectations. Most of the selected papers in this SLR provided empirical research to see how media is linked to various measurements of inflation expectation, including the value of expected inflation, the difference between expected and actual inflation, and the probability of adjusting expected inflation. The influence of media was investigated from different perspectives, i.e. media topic, reporting tone or sentiment, exposure to media, media coverage intensity, and media bias.

Reviewing the literature suggests that the literature analysis on inflation expectation has been limited and published since the 2010s. Osorio-Barreto et al. (2022) published a paper on inflation expectations in Latin America using SLR and bibliometric analysis. Their focus is on the implications and determinants of inflation expectations. On the other hand, Kapoor and Kar (2023) conducted an extensive bibliometric analysis of research about inflation expectations and perceptions from 1982 to 2021. Compared to Osorio-Barreto et al. (2022) and Kapoor and Kar (2023), this paper focuses on the role of media, which is not mentioned in their paper. Further, it does not impose geographical conditions in selecting the previous literature as Osorio-Barreto et al. (2022) did.

This paper is important because more understanding of the media’s possible effect on inflation expectation is critical for central banks to design communication tools to convey important policy decisions and government data to the public. Eventually, the effectiveness of monetary policy could be improved. Moreover, this paper fills in the literature gap by providing specific discussions on the functions of media in shaping inflation expectations, which is not available yet, to the best of our knowledge. In terms of paper structure, this paper is organised below. Section 2 describes the methodology used in this paper to ensure that suitable papers are included in this SLR, followed by Sect. 3, presenting the research framework. Next, the research characteristics are discussed in Sect. 4. The main discussions are available in Sect. 5. The discussions cover methodology used in the past, the measurement of media influence, and the issues addressed. Section 6 concludes and provides recommendations for future research.

2 Methodology

This paper adopts the PRISMA procedure by Page et al. (2021) to guide the selection of the relevant literature. The diagram flow of the PRISMA procedure is illustrated in Fig. 1. The PRISMA procedure involves two major steps, which are identification and screening. The initial search from Scopus and WOS provided 402 journals. Besides, 74 potential references mentioned from other sources (journals and reviewers) are also included, making a total of 476 papers. It is worth highlighting that one of the potential references is a book chapter by Woodford (2002). This book chapter is included because of its significance to the theoretical foundation of the media-inflation expectation nexus. Of these papers, 120 duplications were excluded, and 61 journals will not be screened further due to reasons given in Fig. 1. Out of the remaining 295 journals that were screened, 161 journals were excluded because the title, keywords, and abstract suggest that they were irrelevant. Since one journal is not retrievable, only 133 journals will be read in detail. Subsequently, 68 journals were not examined because of the wrong scope. Therefore, only 65 journals are reported in this SLR.

This paper deploys the search string shown in Table 1 in Scopus and WOS to ensure consistency and that the most relevant literature can be included. The keywords are “media”, “social media”, “news”, “channel”, “newspaper”, “expected inflation”, and “inflation expectation”. Table 2 below shows the specific inclusion criteria imposed on the Scopus and WOS in this paper. Only articles prepared in English and published after 2000 were chosen. From the literature reviews, the prominent papers about the limited ability to process information that leads to the significance of media in that hypothesis were published between 2000 and mid-February 2023. The subject areas of interest are the studies about economics and finance. Hence, only papers that fall into economics, econometrics, finance, and business economics are included.

This paper only considers peer-reviewed journal articles and excludes book series. It is to ensure all included papers have undergone a proper review process. The included paper covers the theoretical and empirical aspects. All papers that meet all criteria are then screened. In this stage, the screening is done on the title, abstract, and keywords. If these criteria are potentially related to the topic of interest, especially the abstract, the full paper will be retrieved. Then, the full papers of these retrieved papers will be reviewed to determine whether including them in the result discussion is justifiable. Eventually, all included papers will be analysed using narrative synthesis (Popay et al. 2006). This method was chosen because the media-inflation nexus has been examined from various angles. Hence, diverse findings can be synthesised.

3 Research framework

The research process implemented for the structured literature survey in this study is presented in Fig. 2. After filtering the publications through the PRISMA guideline, the information from these publications was compiled and primarily analysed in two groups: research characteristics and research discussions. In the research characteristics, we conducted a bibliometric analysis to explore the emerging interest in the research of the implications of media on inflation expectations. The bibliometric analysis utilised diverse statistical and powerful visualisation tools, such as performance and network analyses, to examine the publication pattern and research hotspots (Goh and See 2021; See et al. 2021). We determined the publication trend, publication per country, and contributions from journals through simple calculations on the frequency of publications. The authorship collaboration network and temporal overlay keywords were analysed using network analysis.

The Sect. 5 research discussions divided the content into three parts: methodology applied, media measurement, and topic covered. The empirical papers primarily used econometric models such as least square regression, vector autoregression and variations, and generalised method of moments (GMM). Various media measurements were highlighted in the selected papers, including survey questions, third-party data providers, and information searching history. Moreover, this study also discusses the topic covered in the selected 65 papers. Lastly, based on the deficiencies observed in our review, we suggest future research directions for the media-inflation expectations.

4 Research characteristics

The number of articles published on the role of information or media on inflation expectations during the 2002–2023 period is presented in Fig. 3. We observed that 65 articles were published from 2002 to 2023, and only 12 were published before 2010. Those published before 2010 mainly focused on building the theoretical foundation of the information sticky model and the slow information updating behaviours or rational inattention among individuals. The earliest research article was conducted by Mankiw and Reis (2002) and focused on proposing dynamic price adjustment to replace the “new Keynesian Phillips curve”, following the assumption that information disseminates slowly throughout the population. On the other hand, Woodford (2002) discusses the noisy information process caused by the limited ability of economic agents to process information. The research interest in this area has grown considerably, with many articles published recently: eight in 2020 and 2021 and ten in 2022, respectively.

The main empirical attempt to test these theories in inflation expectations is the epidemiological type of inflation expectation model proposed by Carroll (2003) and Doepke and Dovern (2008). The other attempts are the experimental study by Roos (2008) and the content configuration analysis by Reid et al. (2020). Since 2010, the published papers have mostly applied the epidemiological type of inflation expectation among firms and households. Besides, the asymmetric responses to positive and negative reporting of inflation in the media are examined extensively. The other focuses are the role of social media and the Internet, the accuracy of inflation expectation, and issues related to inflation expectation formation using probit models. Since 2015, surveys have been deployed to measure how hearing any news from various media channels can affect inflation expectations.

This study also analysed the countries focused on in the 65 published articles from 2002 to 2023, as shown in Fig. 4. The results show that 52 published articles involved only one country, while eight articles covered more than one country or had a cross-country focus, and five published articles did not report the country in their research. Of the countries studied, 38.5% of the publications focused on the USA, followed by Germany and China, with 7.7% and 4.6%, respectively. Many of the cross-country studies are conducted in European countries (Drakos et al. 2020; Jung and Kuehl 2021; Picault et al. 2022). Several studies have considered international data of professional forecasters, such as Coibion and Gorodnichenko (2015), who relied on the G-7 countries, Spain, Norway, the Netherlands, Sweden, and Switzerland, for the presence of information rigidities and expectations formation process, and Dovern (2015) forecasted multivariate disagreement among the European and US survey of professional forecasters. Besides, Cavallo et al. (2017) analysed the inflation expectations determinants in the USA and Argentina, while Reid et al. (2020) examined the role of media on inflation through South African newspaper articles. When we group the countries into continents, we find that many studies exclusively analyse North American countries, constituting 38.5% of the publications. Subsequently, European countries (with 18.5% of the publications) and Asian countries (10.8%) are ranked second and third in contributing to the total publications. The relevant publications also analysed other continents, including 6.2% from Oceania and South America. See Fig. 4 for more detailed illustrations.

The authors’ collaboration network explores the frequency of joint research publications among the authors in a particular research field (Hassanein and Mostafa 2023). Figure 5 illustrates the authors’ collaboration network to identify the authors’ collaborative relationship in media-inflation expectation nexus studies during the 2002–2023 period. The size of each vertex indicates the author’s publication collaboration degree in the network, while the edge linking two vertices represents the collaborative relationship between authors. The darker edge signifies a higher collaboration density between the two authors.

In total, only 116 authors contributed to the research in this field. Forming a collaboration network tends to be limited and dispersed. Based on the degree of collaboration, Coibion O. and Gorodnichenko Y. contributed to the highest number of publications, followed by Lamla MJ and Binder CC. When discussing collaborative relationships among authors, Coibion O. and Gorodnichenko Y. exhibited the highest link density in collaboration as they collaborated on five articles in this research. Their publications concerned with examining the inflation expectations at the firm level in New Zealand (Kumar et al. 2015; Coibion et al. 2018), information rigidities and expectations information process (Coibion and Gorodnichenko 2012, 2015), and the forms of communication influence the household inflation expectations (Coibion et al. 2022). In addition, the collaborative relationship between Coibion O. and Kumar S., Gorodnichenko Y. and Kumar S., Pfajfar D. and Santoro E., Goyal A. and Parab P., Mackowiak B. and Wiederholt M., and Xu Y. and Liu Z. also showed a greater density in publishing two articles in this research.

Research on how individuals and professional forecasters form inflation expectations from traditional and social media has been published in 45 journals from 2002 to 2023. This study presents twelve journals that have published at least two articles, as listed in Table 3. Overall, 31 of the total 65 articles (47.7%) have been published within these twelve listed journals, indicating diverse patterns in the articles published in this area. Notably, the Journal of Monetary Economics takes the lead in the research of this field, with five articles, followed by the Quarterly Journal of Economics, American Economic Review, Journal of Money, Credit and Banking, and Oxford Bulletin of Economics and Statistics with three articles each.

Although the Journal of Monetary Economics was the most popular outlet for publications in this field, the Quarterly Journal of Economics received the highest citation number with 1711 citations, recognising it as the most influential journal in the research of this field. It was attributed to studies such as Mankiw and Reis (2002), Carroll (2003), and Malmendier and Nagel (2016), contributing 935 citations, 466 citations, and 310 citations, respectively. Meanwhile, in the Journal of Monetary Economics, only two studies—Sim (2003) with 1336 citations and Reis (2006) with 255 citations—have garnered more than 100 citations, significantly contributing to the citation numbers. The American Economic Review also stands as a strong influential journal in this field; all articles (i.e., Mackowiak and Wiederholt 2009; Coibion and Gorodnichenko 2015; Coibion et al. 2018) have consistently contributed to the citation count of this journal.

The author-keywords can also examine the research trends and hotspots, as presented in Fig. 6. Each vertex in the network represents a keyword, and the vertex size corresponds to the occurrence number of the keyword in this research. The edge shows connectivity between the vertices; the thicker the edge is, the higher the connectivity between the two vertices. The colour of the vertex and edge represents the average publication year.

By setting a minimum keyword occurrence threshold of two, only 20 out of 117 keywords met the criteria. As shown in Fig. 6, the results show that the inflation expectations are located at the centre of the network with the largest vertex size, indicating that location expectations are the most widely used keywords in this research. Accordingly, we also found that keywords such as inflation, central bank communication, media, forecasting, and sticky information occur at least five times in the research of this field. The term “inflation expectations” was a common topic during the 2002–2023 period. Earlier global research focused on “business cycles”, “heterogeneous expectations”, and “survey expectations”. In contrast, recent issues related to “credibility”, “inflation targeting”, “federal reserve”, “central bank communication”, and “consumer expectations” have received notable attention and are of particular interest for future research.

5 Discussions

5.1 Methodology applied in the previous studies

From 65 selected journals, it was found that 56 journals (86%) estimated equations econometrically. For the remaining, six journals (9.5%) applied simulation technique in illustrating the mechanism of inflation expectation formation, one journal used dynamic stochastic general equilibrium (DSGE) (1.5%), and one journal used explanatory analysis, i.e. content configuration analysis (1.5%). Lastly, one journal (1.5%) provided narrative discussions on the formation of expected and perceived inflation.

The discussion of the methodology is arranged so that the papers with the same or related method will be presented together. The least square regression or ordinary least-squared (OLS) is the most commonly used econometric analysis method. Daniel and Steege (2020) used the method to show how news reports linked to inflation in Germany, and Binder (2021b) examined the causal effect of receiving inflation-related news. Additionally, Angelico et al. (2022) discovered the impact of Twitter on inflation expectations in Italy. Xu et al. (2018) and Rambaccussing and Kwiatkowski (2020) have adopted a similar method to estimate the linear model of forecast error among households in China and the UK, respectively. Besides, the paper of Lamla and Maag (2012) used the same method to estimate the inflation forecast disagreement between households and professional forecasters. Reis (2006) applied least squares estimation to prove that the consumer in the USA is inattentive to the latest information and does not practice rational expectation in the consumption decision. Dovern (2015) used the least-squared regression to model the impact of uncertainty with forecast disagreement among professional forecasters in advanced countries.

Apart from using the least square regression, the OLS has been used to examine the Carroll (2003) epidemiology inflation expectation equation for households (Carroll 2003; Doepke et al., 2008; Hori and Kawagoe 2013; Goyal and Parab, 2020) and firms (Carrera 2012; Goyal and Parab 2021a, b). Moreover, Roos (2008) investigates the impact of fictitious media reports on the degree of certainty and confidence in the inflation movement. Some papers applied OLS to measure the determinants of quantitative inflation expectations but did not follow the epidemiology model (Lei et al. 2015; Drager and Lamla 2017; Teixeira et al. 2017; Armantier et al. 2016; Saakshi and Chattopadhyay 2020; Jung and Kuehl 2021; Larsen et al. 2021; Conrad et al. 2022). Using the same method, some interesting issues have been covered, such as factors that caused the reaction to expected inflation (Hayo and Neumeier 2022), the differences between household and professional forecasters’ inflation expectations (Carroll 2003; Pfajfar and Santoro 2013; Lamla and Lein 2014; Mazumder 2021), inflation disagreement between professional forecasters (Montes and Marcelino 2023), the absorption rate of inflation (Mazumder 2021), the factors of qualitative disagreement in inflation expectation (Anzoategui-Zapata and Galvis-Ciro 2020), and absolute forecast error (Van der Cruijsen et al. 2015). Coibion and Gorodnichenko (2015) also applied OLS to verify the degree of information rigidity in the inflation forecast.

Alternatively, the determinants of inflation expectation could be decided by vector autoregression (VAR) (Baker and Lam 2022) and its variation, i.e. vector error correction model as applied by Doepke and Dovern (2008), Carrera (2012), and Drager (2015). On the other hand, Goyal and Parab (2021a) estimated a structural VAR model.

Endogeneity could affect the selected method, too. Lei et al. (2015) tackled endogeneity in the model by estimating instrument variables. The GMM is also applied by Anzoategui-Zapata and Galvis-Ciro (2020) and Montes and Marcelino (2023) to cross-check the OLS estimators when the data could suffer from that issue. Bennani (2022) deployed the two-step GMM on a multivariate inflation expectation model.

Panel data estimations were also used to estimate the media-inflation expectations nexus. Binder (2020) used panel regression to estimate the reaction to the COVID-19 pandemic news and, subsequently, the effect on inflation expectations. Binder (2021a) used the same method to regress the inflation expectation on a series of independent variables, especially the influence of Twitter. The forecast error of expected inflation was also examined using the fixed effect panel by Binder and Rodrigue (2018). Jansen and Neuenkirch (2018) examine the absolute error of inflation expectation using a random effect panel estimation. Lastly, Wang et al.’s (2020) and Tsiaplias’s (2021) papers utilised pooled OLS on the quantitative inflation expectation equation.

Past research investigations covered probability studies. Binder and Rodrigue (2018) used the linear probability model to estimate that probability. Other than that, the probit model and its variations are frequently used. Conrad et al. (2022) applied the ordered probit regression to examine the probability of revising inflation expectations upwards. The probability of adjusting expected inflation is also examined using IV probit estimated with maximum likelihood (Drager and Lamla 2017) and probit estimations (Drakos et al. 2020). Additionally, the probit model deployed in studying information updating behaviour (Pfajfar and Santoro 2013), the likelihood of forming expected inflation (Hayo and Neumeier 2022), and the probability of exposure to news is affected by the FOMC press conference (Lamla and Vinogradov 2019) and having a realistic expected inflation rate (Van der Cruijsen et al. 2015).

Calibration is mainly used for theoretical development in this area. Woodford (2002) simulated the impact of limited information processing ability due to noisy information on the output and price reaction to nominal spending shocks. Moreover, calibration-related techniques have also been used to illustrate rational inattentions and their implications. In this regard, Sim (2003) simulates the impact of rational inattention on the consumption responses to shocks. Mackowiak and Wiederholt (2009) applied calibration to illustrate the formation of expectations when the economic agents could pay more attention to aggregated or idiosyncratic conditions and the existence of feedback effect between price and aggregate conditions. DSGE is applied by Mackowiak and Wiederholt (2015) to calibrate the economic responses to monetary policy shocks and technology shocks by assuming rational inattentions among the household, which is the typical assumption for households and firms.

Similarly, Mankiw and Reis (2002) examined the price adjustment process when the information is sticky. The method involved was the calibration based on price and output equations. Finally, the acceleration process is also examined using calibration. Besides, the simulation of Binder (2019) is more empirical than the previous three simulation exercises because the simulation provides coefficients to study the reaction of inflation expectation and perception to receiving news and central bank announcements.

There are a few less frequently used methods. The two-stage least squares and LASSO have been deployed for quantitative inflation expectation determinants (Saakshi and Chattopadhyay 2020; Larsen et al. 2021). Coibion et al. (2022) used the Huber robust regression on a multivariate inflation expectation revision equation, while Ehrmann et al. (2017) used the Driscoll and Kraay (1998) estimator on the forecast error equation. Picault et al. (2022) handled the daily data using the GARCH model. Teixeira et al. (2017) used an error correction model to analyse aggregate data. Last but not least, Lolic et al. (2017) used the Gaussian state-space estimation to allow for the possibility of a time-varying relationship between inflation and media. Branch (2004, 2007) adopted the maximum likelihood estimation to estimate the predictor models applied by respondents of the Michigan survey. Coibion and Gorodnichenko (2012) applied the impulse response function to examine the information rigidities properties among professional forecasters, consumers, firms, and central bankers when shocks derived from technology, news, oil prices, and unexplained sources are detected.

Otherwise, Zhao (2022) estimated the hierarchical ordered choice model using the maximum likelihood method. In this case, expectation disagreement and uncertainty of future inflation functions are jointly estimated. Reviewing the journal shows that the time-varying effect of official media on inflation expectation heterogeneity is also investigated by Xu et al. (2022), who used time-varying causality and time-varying correlation Dovern (2015) to determine the disagreement in the forecast by analysing the cross-sectional correlation. Armantier et al. (2016) is the only paper covering the non-parametric analysis to analyse the inflation updating behaviour after providing professional forecast information. The analysis involved observing the graphs showing the revision of inflation expectations and the perception gap between the treatment and control groups. Reid et al. (2020) used content configuration analysis, involving the identification of relevant excerpts and codes of inflation from newspaper articles, inductive analysis to classify the data theme, actor analysis to connect the themes, and, finally, the recontextualization analysis to check the consistency between the findings and the newspaper articles. Lyziak and Sheng (2022) estimate the inflation expectations models in two conditions. The first condition is the unconstrained estimations conducted using the seemingly unrelated regression; the second is constrained estimations involving rolling-window estimation.

In conclusion, various methods have been utilised to determine the media’s influence on inflation dynamics. It covers calibration, equation estimations, and experimental studies, enabling various inflation perspectives to be studied in different settings and assumptions.

5.2 Media measurement in the previous studies

The empirical papers have measured media influence using survey questions, the data provided by third parties, information searching history, text analysis skills, machine learning, and experimental techniques. In this subsection, the discussions are categorised based on these techniques. The survey questions in the past unveiled two pieces of media information. The first information is the influence of accessing or hearing any economic-related news. Among the papers that designed their survey to extract that information are those of Ehrmann et al. (2017), Lamla and Vinogradov (2019), Binder (2020), and Tsiaplias (2021).

A few papers specified the news sources in the surveys. In this regard, Binder and Rodrigue (2018) and Binder (2021b) focused on the source of news (i.e. radio, social media, TV, online, and printed). Similarly, Conrad et al. (2022) grouped the source of information into traditional media, social media, and ECB communication channels. Hayo and Neumeier (2022) asked respondents if they get information from newspapers, TV, radio, the Internet, and other information sources such as the financial sector, colleagues, or friends. Van der Cruijsen et al. (2015) focused on television and TV as sources to form inflation expectations. Kumar et al. (2015) examined respondents’ access to information via TV, RBNZ Twitter, RBNZ RSS, treasury reports, monetary reports, RBNZ subscriptions, and newspapers. Furthermore, survey questions could delve into favourable or unfavourable inflation news like Drager and Lamla (2017), Coibion et al. (2018), Wang et al. (2020), and Zhao (2022) did.

The second type of information a survey question could produce is the media intensity index. Jansen and Neuenkirch (2018) constructed a media intensity index of popular and quality newspapers. Particularly, the usage of popular and quality newspapers is categorised according to the five outlets (starting from “never” to “very frequently”). After that, a media intensity index is computed by summing up “frequently” and ‘very frequently’ and dividing by five. Van der Cruijsen et al. (2015) have a similar measure of media intensity but only three outlets (i.e. “never”, “occasionally”, and “regularly”). Then, two media intensities (high and low) are measured by dividing the respective outlet into three.

As for the data provided by third parties, the dataset compiled by Media Tenor has been used by Lamla and Maag (2012). The dataset covers information from television and newspapers. In that exercise, they used the monthly report volume about inflation and the direction of reports (increase, unchanged, decreased) to capture the report’s tone. Drager (2015) accessed the number of inflation reports from the same data provider. They also analysed the number of rising and decreasing inflation reports. Lamla and Lein (2014) used the Media Tenor data too, not only for the total number of inflation reports and report directions but also the number of reports that mention inflation as a good, bad, or neutral phenomenon. Additionally, they refined the inflation-rising reports into two types, i.e. whether these reports considered inflation a bad phenomenon or did not have that consideration.

Another data provider used by Lamla and Lein (2014) is LexisNexis. In this case, keyword searching is used to gauge the number of articles about inflation and the introduction of the Euro. More importantly, the media variable from the data provider was then regressed on a constant and professional forecaster’s inflation expectation. The purpose is to capture media bias that rational forecast cannot explain from the generated residuals. The advantage of using the service of the data provider is that the data is processed according to media content analysis, avoiding bias caused by subjectivity. Rambaccussing and Kwiatkowski (2020) also used LexisNexis to download economic policy-related papers from printed media in the UK.

Text analysis skills are also frequently applied. Normally, it involves two steps. The first step is to filter reports from each media source or database so that only relevant articles remain for further analysis. Then, the article could be manually categorised according to media tone or other perspectives of interest. One of the pioneers of using this method is Carroll (2003), who divided the number of front pages about inflation by the total of front pages from selected newspapers during the sample period. Ehrmann et al. (2017) used a modified version by subtracting the ratio of inflation-related articles by the total number of articles by the mean of the sample’s media intensity to make the interaction terms in their estimation easier. Pfajfar and Santoro (2013) used a similar way to Carroll (2003) but quarterly. Drakos et al. (2020) divided the yearly number of inflation articles in a country by the total number of reports during the sample period. Newspaper articles are observed in this exercise.

Daniel and Steege (2020) gauged the scaled news count from newspapers (the ratio of inflation reports to deflation reports) in Germany in the 1930s. Soroka (2006) coded the article using positive, negative, and neutral reporting tones. Subsequently, the following media indicators were computed: the number of positive (negative) coverage of unemployment and inflation, the net coverage of unemployment and inflation, and the total negative coverage in all stories. Mazumder (2021) collected information on the number of articles about the Federal Reserve, the articles’ page numbers, and the number of words from the New York Times, Wall Street Journal, and USA Today.

Lei et al. (2015) assessed the reports of 30 leading newspapers and magazines in China’s Genius Finance and Wisers, two major financial media databases. Then, the key inflation-related terms in the report’s title and content were filtered. The purpose is to manually code whether the reports were about rising, falling, or unchanged inflation. Interestingly, these newspapers and magazines are grouped into comprehensive, political, and economic media to determine the impact of these media categories.

Also studying China, Xu et al. (2018) analysed the data from the China National Knowledge Infrastructure, which collects public information published by Chinese newspapers. The keyword screening was conducted to ensure that only articles about inflation were observed. Five media indicators are measured: the total number of reports regarding inflation, rising inflation, falling inflation, the ratio of rising inflation reports to the total volume of inflation reports, and the ratio of falling inflation reports to the total volume of inflation reports. Next, they measured media bias as the weighted average of the ratio of rising to falling reports and the difference between media-expected inflation from the CP probability method and actual inflation. The absolute value of bias was also measured. In another attempt, Xu et al. (2022) used the TV mining video database to measure the number of monthly news of inflation.

Further, Lolic et al. (2017) used structured query language to select the potential articles from a leading Croatian news portal. Then, the articles were filtered to ensure that inflation-related information was processed. The author would then manually categorise the articles into three media tones (inflationary, deflationary, and neutral). They also identified articles discussing frequently purchased goods and not frequently purchased goods. Finally, these categories were normalised by getting the ratio of each category with the number of total articles after filtration.

Besides, Rambaccussing and Kwiatkowski (2020) also examined three keyword-based sentiments; these methods are the weighted measure (the number of times the word of interest appeared in an article divided by the total number of keywords in the article), main topic measure (keywords with the higher frequency is the main topic and the keyword sentiment is based on this keyword), and Boolean measure (sentiment score is assigned if the keyword appears at least once in the article). Instead of providing a score or index, Teixeira et al. (2017) created a dummy representing the degree of exposure to inflation news on a press website. Particularly, the dummy equates to one when the inflation news in the total number of the news is above the 85th quantile.

It is important to highlight that subjectivity in deciding the nature of media reports caused by manual screening by the authors could be avoided by using the machine learning technique. Rambaccussing and Kwiatkowski (2020) deployed a supervised machine learning technique called linear support vector machine to measure the article “tonality” or sentiment. Random articles are chosen from the corpus to construct a training set. Larsen et al. (2021) used the latent Dirichlet allocation (LDA) to determine the news topics from the Dow Jones Newswires Archive. The media influence is studied by getting the number of each topic reported at a given time. The tone of the report is also measured by using the dictionary approach. Angelico et al. (2022) focused on Twitter, a relatively new media channel. They filtered the noise in tweets using LDA before identifying whether these tweets indicated rising or declining inflation expectations through a dictionary approach of manually labelled bi-grams and tri-grams. The last step is to obtain the aggregate index by getting the difference between the up index (inflation) and the down index (deflation) based on daily Twitter counts.

Otherwise, Picault et al. (2022) stated that the daily sentiment of an article is decided by the positive and negative words from Loughran and MacDonald’s (2011) dictionary. Then, the differences between the total positive and negative words are normalised by the total words. Finally, the average sentiment of all articles published daily is calculated to get the sentiment indicator. Additionally, Baker and Lam (2022) measure the news sentiment on the report of transitory inflation. The article went through article cleaning and dictionary-based filtration to identify the positive and negative sentiments in articles about transition inflation. They measure the news sentiment (positive and negative) on the report of transitory inflation. The overall sentiment score of an article (i.e. the differences between the number of positive and negative words) is normalised in the articles’ total word count. Bennani (2022) used the five-factor model to confirm the tone (confidence or caution) of newspaper reports in articles about the Federal Reserve chairperson’s view on the US economy. The score of confidence report tone is measured using the manner deployed by Baker and Lam (2022).

Modern media is also useful in this field. Anzoategui-Zapata and Galvis-Ciro (2020) calculate the average monthly count of inflation-related key terms searched from daily data. The data is available from Google Trends. Furthermore, data from Twitter has been used for estimation. Jung and Kuehl (2021) used Google Analytics on the ECB website to measure the attention to ECB communications. The traffic volume is the measurement of website attention. Saakshi and Chattopadhyay (2020) categorise Google search history into favourable, unfavourable, and neutral. The data is a fraction of respective search terms over the total number of searches in the zone and time of interest.

Relatively fewer studies applied experimental techniques. Roos (2008) provided eight fictitious news reports to university students. Half of the news is economically related, and another four are not. Moreover, two economic and non-economic news are concrete, and the others are abstract. More concrete news means it is easier to make mental simulations. After reading the text, students are asked about their view of these impacts on a few macroeconomic variables, including the inflation rate. Alternatively, Binder (2021a) examines the impact of Twitter from the US president on inflation expectations and how exposure to news affects Twitter influence by grouping respondents into three groups, i.e. control group, Twitter-only group, and Twitter and news group. Each group will be then given inflation rate graph treatment and target treatment (a news article) before recording their expected inflation. Armantier et al. (2016) supplied a treatment group in their survey with information from the Survey of Professional Forecast (SPF) and past year food price inflation to see how this information affects consumers’ inflation expectations. Coibion et al. (2022) also have a similar feature by supplying respondents with information, including a USA Today article about the FOMC decision.

There are four additional observations from the literature. First, narrative analysis can be applied to newspapers to observe the content of price-related news to know the inflation expectations changes, as Daniel and Steege (2020) did. Second, Reid et al. (2020) read 101 newspaper articles in South Africa about inflation and the South African Reserve Bank to identify the relevant excerpts of inflation. These excerpts were processed by inductive analysis to classify them before further analysis. Third, the newspaper influence is manifested as a medium to inform the public about the inflation forecast by public and private institutions (Carroll 2003; Carrera 2012; Doepke et al., 2008; Hori and Kawagoe 2013; Goyal and Parab 2021a; Goyal and Parab 2021b). In this case, the newspaper reports these forecasts and helps disseminate the information to the firms. These forecasts are then included in the inflation expectations equations. Fourth, media news could reflect the market uncertainty level, which could eventually cause inflation expectations to change. Montes and Marcelino (2023) listed two indicators of Brazil’s news-based uncertainty index: the economic policy uncertainty index from Baker et al. (2016) and the media uncertainty index from IBRE-FGV.

5.3 The topics covered in the previous studies

The topics can be grouped into two broad categories: (1) theories that link media to inflation expectations and (2) the impact of different media perspectives on inflation expectations and information updating behaviour. The second broad category can be segregated into five subcategories, which are (i) exposure to the news; (ii) media coverage intensity; (iii) media topic, tone, sentiment, and media bias; and (iv) media as an information source. The following discussions show the main points or findings from papers under each category.

5.3.1 Theoretical formation

Eighteen out of 65 selected journals discussed the theoretical foundation to explain the related theories in the media-inflation expectation nexus. The media’s role in expectation has been built on information processing limitations. A seminal paper by Woodford (2002) illustrated that decision-makers have limited ability to process information in the Phelps-Lucas hypothesis, causing imperfect precision. The inability exists because of noisy information and the private measurement error that has caused agents to be unable to notice disturbance precisely and create uncertainty. Another factor is the phenomenon of channel capacity, in which the accuracy and the scope of the information available to the public are questionable. The limited information processing ability that Woodford (2002) proposed also supports Sim’s rational inattention (2003). The gist of rational inattention is that people have limited ability to process information, and agents with rational inattentions face constraints to produce reliable forecasts. Sim (2003) also discussed information theory, in which the information probably suffers from errors or noise when it flows from the input source to the output channel.

Mackowiak and Wiederholt (2009) proposed models based on the inattentive assumption. Their model elaborates the assumption that the response to aggregate conditions or idiosyncratic conditions depends on the attention given to the respective conditions. Besides, the feedback effect could happen. Here, low attention given to aggregate condition response in other firms could cause a firm to pay less attention to aggregate condition. Eventually, the response of price to nominal shocks will become smaller. Additionally, Mackowiak and Wiederholt (2015) explained that rational inattention can happen among households and firms, and the attention is allocated optimally by comparing the cost and benefits of following economic information. The theories proposed by Woodford (2002), Sims (2003), and Mackowiak and Wiederholt (2009, 2015) are also called the noise information model.

On top of the errors and noise, information stickiness is another issue in economic information dissemination. Mankiw and Reis (2002) introduced the sticky-information model in which only a fraction of the population uses the current information to set optimal prices. Most of the population will use outdated information to set optimal prices. As a result, monetary policy has a delayed effect on the economy. The speed of information dissemination is hindered by the cost of acquiring information and re-optimisation. Like Mankiw and Reis (2002), Reis (2006) asserted that news will spread slowly in the population because consumers decide to be inattentive. It is caused by the cost of absorbing and processing the information. He added that the amount of information costs directly impacts the delayed responses to an economic shock in the same direction. Finally, Carrera (2012) extended the sticky-information assumption in the information processing model among the firms. Firms need to process information because it is impossible for them to know all the information each firm has, and there is more accurate information from professional forecasters. Since the firms will look for information, they will face slow information diffusion issues like the household.

Several papers have contributed differently to the modelling of expectations. Branch (2004) explored the rationally heterogenous expectation in which each individual is assumed to have a unique choice of predictor function that is optimal. More importantly, the predictor function is likely to stay unchanged unless the predictor is proven to have low forecast accuracy. Branch (2007) adds that the predictors are time-varying, and many of the agents in the Survey of Consumers at the University of Michigan do not update information frequently.

Coibion and Gorodnichenko (2012) investigated the sticky and noisy information models and found slow forecast adjustment among consumers, central bankers, firms, and professional forecasters. The reason for the slow adjustment is information rigidities. It also means a rejection of the full information ratio expectation hypothesis. Moreover, their testing of information rigidities models highlights that the heterogeneity in belief does not play an important role in forming expectations. Coibion and Gorodnichenko (2015) further propose econometrics models to determine the degree of information rigidities, and their findings suggest the existence of information rigidities among professional forecasters in the USA.

On the other hand, the formation of inflation expectations is closely linked with forecast disagreement. The latter, if persistent, could undermine the effort of central banks to anchor inflation expectations. Dovern (2015) analysed the disagreement among professional analysts in survey data from a multivariate perspective. The analysis shows that the major source of forecast disagreement is disagreement on the economic structure. Besides, the heterogenous signal-to-noise ratio could match the information disclosed by the survey data with the heterogeneous expectation formation. Lyziak and Sheng (2022) otherwise suggest that consumer expectation updating behaviour can explain the disagreements on inflation expectations. The behaviour has three characteristics, which are shopping and life experiences shape the belief of price changes, media and newspaper conveys expert knowledge on future inflation to the consumers, and, finally, the propensities to receive information from the experts are different across consumers, and the public and private information will be used to form consumers’ inflation expectation.

Media is a critical element in information processing. Media could increase the frequency of access to news, leading to lower information stickiness (Carroll 2003). Carroll (2003) suggested an epidemiological model of inflation expectation, a micro foundation for the sticky-information model of Mankiw and Reis (2002). This model hypothesises three impacts of media. First, media that reports professional forecasts will shape the household’s forecast. Second, news coverage on inflation helps the household create rational expectations (illustrated by a smaller gap between household and professional forecasts) because the news report is expected to be rationally done. Third, news coverage increases the portion of the population that absorbs or is exposed to the forecasts reported in newspapers. Additionally, readers could make idiosyncratic errors in the information process when they react after reading news from newspapers and television (Sim 2003).

Furthermore, Ranyard et al. (2008) presented the social amplification effect in which media and word of mouth bridge the economic forecasts and price change effects to affect inflation expectations and perceptions. Lastly, it is generally believed that media could reduce the information cost, causing a faster dissemination rate of economics and policy news. Lamla and Maag (2012) suggested a Bayesian learning model to explain how media coverage could link to the heterogeneity of expected inflation. In that model, the media prompts updates on inflation expectations by transmitting news via television and newspapers. Moreover, more media coverage reduces the recipients’ noise, contributing positively to less inflation expectation heterogeneity. Moreover, the media’s emphasis on media could influence the attention given to inflation. Malmendier and Nagel (2016) hypothesised that the report of professional forecasters’ views in the news media could be an unobserved component that will affect the subjective inflation expectation, together with the lesson from previous experience.

Moreover, Soroka (2006) highlighted that negative news is more influential to public opinion than positive news due to two factors. First, the prospect theory suggests that people are assumed to pay more attention to a loss in utility than a gain in utility, although the size of utility loss and gain is the same. Hence, the reactions to negative news could be stronger than positive news. Second, journalists tend to give more coverage to negative news as journalists and readers think negative news is much more significant than positive news. The media’s role as the fourth estate also prompts the media to focus more on negative news or events. This results in the readers being more exposed to negative news. Although media seems important, it might not be able to close the expectation gap between the government and private decision-makers because Woodford (2002) suggested that not all government information will be made public. Besides, the influence of the media is affected by how fast the news reaches the population (Carroll 2003).

5.3.2 Exposure to the news

Hearing or accessing news could affect consumers’ or firms’ inflation expectations. Twenty-two articles, or roughly 38% of the papers in this analysis, examined this impact. Armantier et al. (2016) supplied participants in their experiments with two pieces of information: the average forecast of the inflation rate from the SPF and the average food and beverage prices in the urban area. Results suggest that exposure to SPF information will prompt the participants to revise inflation expectations. Both sets of information also help to narrow the disagreement on inflation expectations among the participants.

Similarly, Binder and Rodrigue (2018) provided different treatments (inflation graphs and Federal Reserve inflation target announcement) to their survey experiment participants. After receiving either treatment, the respondents revised their expected inflation toward a targeted rate. The revision will be larger if there is more uncertainty in the initial priors. The treatments also reduce the forecast uncertainty. Furthermore, Binder (2019) argued that if an individual hears news about the Federal Reserve, the likelihood that that individual is receptive will be higher and will have a lower inflation expectation. Lamla and Vinogradov (2019) found that news exposure is positively related to FOMC announcements and prompted informed consumers to have a lower inflation expectation and perception and higher confidence in their expectations.

Investigating the news exposure via the Internet search by Anzoategui-Zapata and Galvis-Ciro (2020) reckons that it will reduce inflation disagreement among consumers in Colombia. Coibion et al. (2022) also agreed that providing respondents with an article about an FOMC statement could cause a lower inflation expectation. However, the effect was smaller compared to other information sources. Besides, the effect was weaker among respondents with lower education and income levels. Besides, news reports that firmly mention that inflation is at a desired level have a smaller reduction effect on inflation expectation than news reports that did not. The estimations of Conrad et al. (2022) also showed that traditional media (e.g. newspapers, television, and websites) could lower the inflation expectation among Germans by making them better informed, but the lifetime experience mitigated that effect.

However, the beneficial effect of news exposure is not supported by Ehrmann et al. (2017), who showed that hearing the news, especially about the gasoline price increase, pushed up the inflation bias in the USA. Additionally, Binder (2020) asked whether the respondents had heard any news about the Federal Reserve and the news content. He reported the indirect role of media in which respondents who are printed media readers are more concerned about COVID-19. Greater concerns, in turn, lead to higher inflation expectations. In another survey, Binder (2021b) switched the question to whether respondents hear inflation news and found no statistically significant impact on inflation expectation and the accuracy of expected inflation in the USA. Besides, Jung and Kuehl (2021) found that a higher search volume on the ECB website increases the long-term and short-term expected inflation rate. A higher view reduces the gap between market-based and long-term professional expected inflation. Saakshi and Chattopadhyay (2020) also concluded a positive association between inflation expectations and Internet search volume.

Exposure to social media has been proven to be important, too. On the one hand, Binder (2021a) found that a Twitter from Donald Trump with suggestions to the Federal Reserve could increase the distance between expected inflation and the inflation target (2%) set by the Federal Reserve and make the event of having expected inflation at the level same as the inflation target less likely to happen. News that discusses the impacts of Donald Trump’s suggestion will enhance Twitter’s impact. Nonetheless, the distance of expected inflation from the inflation target can be reduced by giving past information about inflation and information about the inflation target. On the other hand, Conrad et al. (2022) found a positive association between exposure to social media (e.g. Facebook, Twitter) and increased inflation expectations in Germany.

The issue has been investigated by estimating the asymmetric implication of news exposure. The asymmetric reactions could be due to the knowledge and news type. In particular, the study of Roos (2008) showed that easy-to-imagine but economic-unrelated news had a stronger effect on a group of undergraduate students with economic knowledge at the University of Dortmund, Germany. Otherwise, exposure to positive and negative news could have asymmetric effects. Pfajfar and Santoro (2013) reported that in the USA, the gap between consumer and professional forecasters’ expected inflation increased by unfavourable inflation news, while favourable news had a statistically insignificant lowering effect.

Drager and Lamla (2017) found that respondents in the USA who hear inflation news will adjust their inflation expectation upward and have a higher absolute forecast error of inflation. The outcome is the opposite for those who hear deflation news. Wang et al. (2020) articulated that news of inflation and higher interest rates in the USA lead to higher expected inflation, with the former having a greater coefficient size. They also reported that both news have a lower impact during low inflation. Besides, the impact of news will be greater during the zero lower bound period after 2008. Lastly, hearing rising inflation and interest rate news will have a greater effect than falling inflation and interest rate news. Zhao (2022) discovered that hearing good and bad general economic news leads to higher expected inflation. For inflation-related news, the good news (bad news) of inflation reduces (increase) inflation expectation.

Next, Tsiaplias (2021) reported the tendency of the respondents from the University of Melbourne who are informed of economic conditions to adjust expected inflation upward (downward) if they are worse off (better off) financially. If respondents are uninformed of economic news, those worse off financially will have a rise in the expected inflation but no statistical impact on those financially better off. Besides, these results are not affected by the optimism of respondents. Finally, respondents who do not observe economic news tend to overestimate inflation expectations.

On the other hand, the impact of exposure to media on the possibility of updating expectations is also investigated. For this case, Pfajfar and Santoro (2013) stated that exposure to news about price changes increases the probability of updating expected inflation. Drager and Lamla’s (2017) results showed that the impact of news on general economic conditions and price changes could affect the probability of changing quantitative short-run inflation expectations. The survey by Coibion et al. (2018) suggested that hearing bad news prompted firms to be more active in searching for new information, causing more updating. Nevertheless, Conrad et al. (2022) failed to establish a statistically significant effect of social media and traditional media on the decision to update inflation expectations. The insignificance of media is found when the likelihood of forming inflation expectation among New Zealanders is not affected by access to various media information (Hayo and Neumeier 2022).

Lastly, the only paper that examined the firm’s reaction to news exposure was that of Kumar et al. (2015). From phone interviews, they summarised that firms that follow traditional and social media news every 3 to 5 months reported a lower figure about the inflation target set by the Reserve Bank of New Zealand. Besides, 47% of their respondents depended on media to form inflation expectations, and they also had a smaller inflation forecast error.

5.3.3 Media coverage intensity

Fourteen of the selected papers have covered the importance of media coverage intensity. The research in this category observes the overall report intensity or inflation and deflation report intensity. In other words, the second category also measures the asymmetric impact of inflation and deflation coverage. Hence, the following discussions segregated the journal into two groups, which are symmetric and asymmetric studies.

In the first group, some papers look at the impacts of media intensity on the differences in inflation expectations between households and professional forecasters. Among them is Carroll (2003), who showed that greater news intensity could reduce the gap between the consumer and professional forecasters’ expected inflation in the USA. Pfajfar and Santoro (2013) examined the same aspect in the USA. They discovered that the media intensity was mostly statistically insignificant when estimated with the fraction of respondents who heard price news in their research. Lamla and Maag (2012) also concluded that media reporting volume statistically insignificantly affects disagreement on inflation expectations between consumers and professional forecasters in most models estimated using German data. It also does not affect professional disagreement.

Ehrmann et al. (2017) considered the differences between consumers’ expectations and actual inflation and the differences with professional forecasters’ expected inflation as inflation bias. They proved that high inflation coverage reduced the bias, and the effect was more profound for consumers with higher expected inflation in the USA. Additionally, Mazumder (2021) investigated the implication of news on the Federal Reserve (the number of articles, page number, and the number of words in these articles) on the inflation expectation gap between professional forecasters and consumers in the USA. The study showed inconclusive findings for the number of articles, and there is no implication from the number of words. However, the fewer page numbers in the reports, the closer the gap. Besides, the number of words helps to improve the information absorption rate.

Otherwise, Van der Cruijsen et al. (2015) examined the effect of media on the realistic expected inflation and absolute forecast error in the Netherlands. The results found no evidence that media intensity statistically affects realistic inflation and the absolute forecast error. Jansen and Neuenkirch (2018) explored the media intensity of quality and popular newspapers and how they affect the absolute error of expected inflation in the Netherlands. Instead of lowering absolute error, popular newspapers increased it, while the quality media played a limited role.

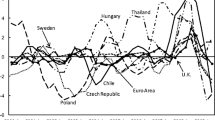

On the other hand, Teixeira et al. (2017) argued that high inflation coverage could expose Brazil’s consumers to more inflationary news, causing changes in inflation expectations and more accurate inflation expectations. Their findings only support the association between changes in inflation expectations and coverage intensity. Daniel and Steege (2020) proved that inflation expectation and the new coverage intensity in Germany were positively associated in the 1930s. Drakos et al. (2020) concluded that in the Eurozone, more stories about inflation than the total stories in the newspapers would lower the probability of making wrong forecasts on the inflation direction. However, it also increases the size of the forecast errors. Lastly, Xu et al. (2022) focused on the Chinese official television broadcast company, CCTV; a positive linkage from CCTV report volume on inflation expectation level and heterogeneity among Chinese consumers was established.

Some papers also covered the connection between expectation updating behaviour and media intensity. Pfajfar and Santoro (2013) reported that the news intensity effect on the probability of updating expected inflation is mixed. A more conclusive result is proved by Drager and Lamla (2017), who reported that changes in the reports’ volume about inflation in the media have a negative but statistically insignificant impact on the probability of adjusting short-run inflation expectations among consumers in the USA.

In the second group, Drager (2015) indicated that while only reports on decreasing inflation statistically affect expected and actual inflation in Sweden in the short run, the coefficient sign is positive, suggesting that media bias is found. Other noticeable findings are that the media reporting is not exogenously decided, and overall inflation report volume did not change the actual, perceived, and expected inflation. Lolic et al. (2017) also examined the inflation bias reaction to the news in Croatia. Unlike Ehrmann et al. (2017), they computed the inflation bias in absolute terms and focused on the actual inflation case only. They report that while more news coverage on inflation can reduce the bias, a finding also found in the paper of Ehrmann et al. (2017), more reports that discuss inflation and stable prices can reduce the inflation bias, but not those that cover the deflation. Finally, the inflation bias is also reduced (increased) when there is an increase in the coverage of prices for goods that are frequently (occasionally) bought.

5.3.4 Media topic, tone, sentiment, and bias

Another significant topic is the media topic, tone, sentiment, and bias. Twelve journals, or 20.7% of the total, focused on this category. The media topic could not align with a central bank’s intention, causing difficulties anchoring inflation expectations, just like what was found in South Africa by Reid et al. (2020). Reid et al. (2020) reckoned that it was because they might not share the same objectives with the SARB but offer views different from the SARB to address the interests of different societal groups. Larsen et al. (2021) discovered that the news topic could affect the expected inflation in the USA differently. News that was not directly related to inflation, such as education, trading, health, the Internet, the white house, and transactions, could affect the inflation expectation and inflation. The author suggests that these topics could hint to new readers about the future price direction. Besides, Angelico et al. (2022) showed that if the differences between inflation-related and deflation-related tweets increase, the market-based inflation expectation (proxied by inflation swaps rate) and survey-based expectation will increase in Italy in univariate and multivariate equations.

The tone of reporting news could be influential in the formation of inflation expectations. Lei et al. (2015) studied the newspapers reporting tone (rising, falling, neutral) on inflation in China and stated that a neutral tone increases consumer inflation expectations but not professional forecasters. Besides, the implication of reporting tone is also affected by the newspaper type (comprehensive, economics, and politically oriented). Among different types of newspapers, the tone of politically oriented newspapers has not been seen as credible by the public. Lamla and Maag (2012) concluded that the inflationary tone reports in newspapers and television narrowed the differences in inflation expectations between professional forecasters and households in Germany. However, professional disagreement did not react to it.

Instead of examining the media tone, some papers examine the media’s sentiment. Saakshi and Chattopadhyay (2020) cannot find robust evidence to link sentiment in Internet search keywords (unfavourable, favourable, neutral) to inflation expectations in India. Similarly, Rambaccussing and Kwiatkowski (2020) studied how the news sentiment index derived from printed media can affect the inflation point forecast of the Bank of England. No evidence shows that newspaper reports improve BOE’s nowcast or 1-quarter to 5-quarter ahead (short-term) inflation forecast. On the other hand, Picault et al. (2022) found that more positive media sentiment can positively predict the 5-year to 5-year forward rate of inflation-link swap and the 10-year forward rate of inflation-link swap in the Euro area. The swap rate is the proxy for inflation expectation.

Besides, Baker and Lam (2022) reported that negative sentiment shock or negative central bank credibility leads to increased inflation expectations in the USA. The sentiment reported in the media also reflects the market sentiment. Bennani (2022) suggests that the media can be a source for figuring out the level of overconfidence in the central banker and how the markets perceive it. Focusing on US Federal Reserves, the author finds that overconfidence leads to higher inflation expectations.

Lamla and Lein (2014) and Xu et al. (2018) are the two papers that examine the implications of media bias. Lamla and Lein (2014) found that more bad tone reporting will cause the inflation expectations to be biased in Germany. It can be seen by the larger differences between expected inflation from consumers and professional forecasters when there is more bad tone reporting. Xu et al. (2018) found media bias linked to larger inflation expectation gaps (expected inflation minus actual inflation) among China’s consumers.

5.3.5 Media as an information source

Most of the research in this group considers media as an information source to get professional forecasters’ views on expected inflation, which is also assumed to be rationally decided. Media as an information source is a vital assumption in Carroll’s (2003) epidemiology model of the expected inflation rate. In detail, Doepke and Dovern (2008) examined the information updating rate in France, Germany, Italy, and the UK. They found that a newspaper supposed to convey the inflation forecasts from the professional forecasts has not increased the information updating rate (18 months for households to update information). Similarly, Carrera (2012) concluded that information rigidity exists in Peruvian firms and industries. Hori and Kawagoe (2013) also presented a similar conclusion in a study of Japanese households. Goyal and Parab (2021a, 2021b) confirmed that the newspaper could disseminate the Reserve Bank of India’s inflation projections to the Indians and profoundly impact the expected inflation among Indian households and professional forecasters, respectively.

Otherwise, Cavallo et al. (2017) treated the media as a source to obtain the inflation rate in Argentina in studying the inflation learning rate in Argentina due to the low credibility of official inflation rate data. Daniel and Steege (2020) observed the news contents to conclude whether inflation expectations change in Germany. Montes and Marcelino (2023) reckon that the media can reflect economic uncertainty and has been used to produce an economic uncertainty index, which is the Economic Policy Uncertainty Index by Baker et al. (2016) and Media Uncertainty Indicator by IBRE-FGV in Brazil. These indicators, eventually, could be associated with expected inflation.

6 Conclusion and future research directions

This systematic literature review presents critical information about the peer-reviewed research investigating the media-inflation expectation nexus. After discussing the strategies to conduct the review, this paper presents the research characteristics and methods used in the previous papers. Then, the media measurements and the main topics in these papers are covered. The interest in this research area increased in the 2010s and continues until now. However, it still has not received wide attention from many countries.

The most commonly used method in this research area is econometrics. The role of media is gauged in many ways. The raw media information is mostly collected from surveys and media reports. Then, the information is processed in guided procedures before estimation. The most recently used quantitative measures of media are the machine learning techniques, which can filter out noise in the data. Furthermore, the role of the media in shaping inflation expectations has been analysed extensively, including exposure to news, media coverage intensity, media topics, media sentiment, media tone, and media bias. These studies show that most of these papers suggest that media could affect household inflation expectations. Lastly, research also found that media could be an information source shaping inflation expectations.

Next, six recommendations can be drawn up to improve the research in this area. First, most reviewed papers examine the issue in advanced countries, especially the USA and Germany. It means that a similar issue has not been examined in other countries. One possible reason is that readily available data, especially the expected inflation from professional forecasters, could be unavailable for most countries. This issue could be acute, especially in emerging and developing countries. However, cross-sectional household and consumer data could be collected and analysed; the results are equally valuable.

Second, Drager (2015) proposed that the media could also react to inflation, causing a bidirectional relationship between them. Although vector autoregression has been deployed before and could tackle the endogeneity issue, it is still uncommon. Hence, future research should at least deploy a robustness analysis to examine the impact of endogeneity. Third, the existing studies have not examined whether exposure to the news about foreign economies, especially those related to major economies, will impact the inflation expectation differently. While households or consumers might not be sensitive to foreign news, the impact could be more profound among professional forecasters.

Fourth, the role of social media has not been studied extensively. Compared to traditional media, such as printed media and websites, social media might contain more noise because it might contain personal views and biases. Additionally, social media also breaks geographical barriers, causing information to spread at a faster rate. Hence, future research should consider the impact of traditional and social media. Fifth, the effectiveness of using media to affect the inflation expectation could be affected by other factors. Among them are demographic factors, education, and knowledge. Future research could explore the dynamics between media and the third factor to understand the role of media more comprehensively.

Sixth, future research could examine the impact of news at a higher frequency. For example, after a major monetary policy announcement, such as a switch in the interest rate trajectory in the medium term, a survey on inflation expectations can be done within a week using the existing online survey tools. Follow-up research can be done a week later to see if the impact has changed.

Data availability

The WOS database can be downloaded at https://www.webofscience.com/wos/woscc/summary/60fb0cf7-8753-49b6-a552-1ad450e5328f-7172f595/relevance/1

Change history

07 March 2024

A Correction to this paper has been published: https://doi.org/10.1007/s10368-024-00606-y

References

Adrian T, Laxton D, Obsfeld M (2018) Advancing the frontiers of monetary policy. International Monetary Fund, Washington. https://doi.org/10.5089/9781484325940.071

Angelico C, Marcucci J, Miccoli M, Quarta F (2022) Can we measure inflation expectations using Twitter? J Econ 228(2):259–277. https://doi.org/10.1016/j.jeconom.2021.12.008

Anzoategui-Zapata JC, Galvis-Ciro JC (2020) Disagreements in consumer inflation expectations: empirical evidence for a Latin American economy. J Bus Cycle Res 16:99–122. https://doi.org/10.1007/s41549-020-00047-x

Armantier O, Nelson S, Topa G, van der Klaauw W, Zafar B (2016) The price is right: updating inflation expectations in a randomized price information experiment. Rev Econ Stat 98(3):503–523. https://doi.org/10.1162/REST_a_00499

Baker JD, Lam T-P (2022) Assessing the credibility of central bank signals: the case of transitory inflation. Econ Lett 220:110875. https://doi.org/10.1016/j.econlet.2022.110875

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636. https://doi.org/10.1093/qje/qjw024

Bennani H (2022) Overconfidence of the chair of the Federal Reserve and market expectations: evidence based on media coverage. Int J Finance Econ 28(3):3403–3419. https://doi.org/10.1002/ijfe.2599

Binder CC (2019) Comment on “Central bank announcements: big news for little people?” by Michael Lamla and Dmitri Vinogradov. J Monet Econ 108:39–44. https://doi.org/10.1016/j.jmoneco.2019.08.013

Binder C (2020) Coronavirus fears and macroeconomic expectations. Rev Econ Stat 102(4):721–730. https://doi.org/10.1162/rest_a_00931

Binder C (2021a) Presidential antagonism and central bank credibility. Econ Polit 3(2):244–263. https://doi.org/10.1111/ecpo.12173

Binder CC (2021b) Household expectations and the release of macroeconomic statistics. Econ Lett 207:110041. https://doi.org/10.1016/j.econlet.2021.110041

Binder C, Rodrigue A (2018) Household informedness and long-run inflation expectations: experimental evidence. South Econ J 85(2):580–598. https://doi.org/10.1002/soej.12306

Branch WA (2004) The theory of rationally heterogenous expectations: evidence from survey data on inflation expectations. Econ J 114(497):592–621. https://doi.org/10.1111/j.1468-0297.2004.00233.x

Branch WA (2007) Sticky information and model uncertainty in survey data on inflation expectations. J Econ Dyn Control 31(1):245–276. https://doi.org/10.1016/j.jedc.2005.11.002

Carrera C (2012) Estimating information rigidity using firms’ survey data. B.E. J Macroecon 12(1):1–32. https://doi.org/10.1515/1935-1690.2377

Carroll CD (2003) Macroeconomic expectations of household and professional forecasters. Q J Econ 118(1):269–298. https://doi.org/10.1162/00335530360535207

Cavallo A, Cruces G, Perez-Truglia R (2017) Inflation expectations, learning and supermarket prices: evidence from survey experiments. Am Econ J: Macroecon 9(3):1–35. https://doi.org/10.1257/mac.20150147

Coibion O, Gorodnichenko Y (2012) What can survey forecasts tell us about inflation rigidities? J Polit Econ 120(1):116–1559. https://doi.org/10.1086/665662

Coibion O, Gorodnichenko Y (2015) Information rigidity and the expectation formation process: a simple framework and new facts? Am Econ Rev 105(8):2644–2678. https://doi.org/10.1257/aer.20110306

Coibion O, Gorodnichenko Y, Weber M (2022) Monetary policy communication and their effects on household inflation expectations. J Polit Econ 130(6):1537–1584. https://doi.org/10.1086/718982

Coibion O, Gorodnichenko Y, Kumar S (2018) How do firms form their expectations? New survey evidence. Am Econ Rev 108(9):2671–2713. https://doi.org/10.1257/aer.20151299

Conrad C, Enders Z, Glas A (2022) The role of information and experience for households’ inflation expectations. Eur Econ Rev 143:104015. https://doi.org/10.1016/j.euroecorev.2021.104015