Abstract

This study investigates whether exporters, multinational enterprises (MNEs), and foreign-owned firms pay higher wages in Japan, using linked employer–employee data. It shows that wages of foreign-owned and domestically-owned MNEs are the highest and that wages of non-multinational exporters are higher than those of non-multinational non-exporters. The ordering of wages, with MNEs having the highest wages and exporters having higher wages than purely domestic firms, is consistent with the productivity ordering of the standard firm heterogeneity model. Even after controlling for observable plant and worker characteristics, this ordering of wages remains the same. It further finds that the residual wage premiums for foreign firms are much higher than those for non-multinational exporters and domestically-owned MNEs. The results from quantile regressions reveal that the residual wage premium is larger in the higher quantiles of the wage distribution for foreign firms, whereas I do not find a similar tendency for domestically-owned firms. Finally, this study finds that female workers receive much larger wage premiums in foreign firms than male workers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many previous empirical studies confirm the stylized fact that firms that engage in international markets tend to pay higher wages to their employees. Using linked employer-employee data, recent studies investigate whether the wage premiums for internationalized firms still exist after controlling for both firm and worker characteristics (Frıas et al. 2009; Munch and Skaksen 2008; Schank et al. 2007; Schank et al. 2010; Verhoogen 2008).

The reasons for the wage premiums have been theoretically explored. Based on the standard firm heterogeneity model of exports and foreign direct investment (FDI), recent theoretical studies consider that exporters and multinational firms pay higher wages than purely domestic firms because of intra-firm rent sharing (Helpman et al. 2010; Amiti and Davis 2012; Egger and Kreickemeier 2009; Egger and Kreickemeier 2013). These studies predict that exporters and multinational firms that obtain additional sales from foreign markets pay higher wages than purely domestic firms in an imperfect labor market.

However, little is know about (i) whether exporter’s wage premium is more important than multinational firm’s wage premiums and (ii) whether multinational status is more important than nationality as the source of the wage premiums. This study explores these issues, using new Japanese linked employer-employee data. To the best of my knowledge, most previous studies cannot answer these kinds of questions since they have examined wage premiums separately for exporters, domestically-owned MNEs, and foreign-owned firms. In contrast, this paper attempts to jointly examine the wage premiums for exporters, domestically-owned MNEs, and foreign-owned firms.

To do this, I construct the first set of Japanese-linked employer–employee data from three official surveys. Then, I estimate the Mincer wage equation to reveal the wage premiums. After examining the average relationship between the wage premiums and firm types using OLS, I examine the relationship in each quantile of wage distribution using the quantile regressions (QRs) technique.

OLS analysis reveals that observable plant and worker characteristics, as well as region and industry fixed effects, can account for about 80% of wage premiums of local exporters and domestically-owned MNEs, whereas they account for about 60–65% of the wage premium for foreign firms. It indicates that the residual wage premium for foreign firms is much larger than those for non-multinational exporters and domestically-owned MNEs in Japan.

This finding suggests that the nationality of the ownership matters for wage premiums, rather than the multinational status or exporting status. In other words, foreign-owned firms may pay higher wages to their employees for foreign firm-specific reasons. Previous studies suggest that the possible reasons for the foreign wage premiums are compensation for different working conditions in foreign firms (Bernard and Sjoholm 2003; Fabbri et al. 2003; Lipsey and Sjöholm 2004) or for learning opportunities in foreign firms (Görg et al. 2007).

In addition, QR analysis provides evidence that foreign residual wage premiums are higher for workers in higher quantiles of the wage distribution. In contrast, the residual wage premiums for non-multinational exporters and domestically-owned non-exporting MNEs are higher for workers in lower quantiles of the wage distribution.

The remainder of this paper is organized as follows: In Section 2, I review the literature and discuss the possible reason for the wage premiums for firms that engage in the international market. In Section 3, I explain the methodology. Section 4 provides a description of the data used in this study, together with descriptive statistics of wages by firm type. In Section 5, I present the results. Finally, in Section 6, I present the conclusion.

2 Background

2.1 The possible reasons for the wage premiums

There are at least four reasons for higher average wages in exporting firms and multinational firms. First, exporting firms and multinational firms might pay higher wages because they belong to higher-wage industries. Similarly, second, they might pay higher wages because they locate in higher-wage regions. These two reasons are not directly related to their exporting status and multinational status.

Third, the higher average wages in exporting firms and multinational firms can be caused by the higher skill composition of their workforce. It is a well-known fact that exporting and multinational activities required for higher-skilled workers. This composition effect implies that the wage premiums for exporting firms and multinational firms will vanish after controlling for workers’ skill level.

Fourthly, exporting firms and multinational firms might pay higher wages to identical workers due to the rent sharing. Helpman et al. (2010), Amiti and Davis (2012), and Egger and Kreickemeier (2009) among others predict that exporters pay higher wages than non-exporters because of the additional sales due to exports. Based on the standard firm heterogeneity model, Egger and Kreickemeier (2013) also provides a theoretical reason for the wage premium for multinational firms. In their model, MNEs are assumed to share the sales from both local and foreign sources with their workers. Such rent sharing is the reason for the multinational wage premium.

These firm-heterogeneity models such as Helpman et al. (2010) and Egger and Kreickemeier (2013) assume that all firms share their sales with their workers and that their sales increase with their productivity. As a result, more productive firms tend to pay higher wages. Even after controlling for firm productivity, the wage premiums for exporters and multinational firms can exist because of their additional sales from foreign markets. In the following empirical analysis, I include plant productivity as a covariate and examine whether the wage premiums still remain.

In addition to the above four reasons, previous studies discuss the possibility that foreign ownership generates a higher average wage for several reasons. They suggest that foreign wage premiums can be explained by a higher labor demand volatility (Fabbri et al. 2003), a higher foreign closure rate (Bernard and Sjoholm 2003), or learning opportunities in foreign firms (Görg et al. 2007). Görg et al. (2007) and Malchow-Møller et al. (2013) present theoretical models to explain the wage premium for foreign multinational firms. In the Görg et al. (2007) model, foreign firm-specific on-the-job training (OJT) is assumed to be the reason for the wage premium for foreign firms.

2.2 Previous empirical evidence

Next, I briefly explain the previous empirical evidence on both exporting firms’ and multinational firms’ wage premiums. First, the wage premium for exporters is empirically confirmed by many previous studies. Whereas previous studies such as Bernard and Jensen (1997) and Bernard and Jensen (1999) employ plant- or firm-level data, more recent studies employ linked employer–employee data to control for both firm and worker characteristics (Frıas et al. 2009; Munch and Skaksen 2008; Schank et al. 2007; Schank et al. 2010; Verhoogen2008).

Second, firm-level studies reveal that MNEs tend to pay a higher wage than non-MNEs (e.g., Bernard et al. 2009 for the United States, Mayer and Ottaviano2008 for European countries; Wakasugi et al. 2014 for Japan) and that international rent sharing occurs within MNEs (Budd et al. 2005; Damijan and Marcolin 2013; Martins and Yang 2015). Hjort et al. (2020) find that MNEs tend to link wages at their establishments outside of the home region to the level at headquarters.

Third, foreign wage premium is also confirmed by many previous empirical studies. Previous studies using firm-level data or linked employer-employee data (Lipsey and Sjöholm 2004; Girma and Görg 2007; Heyman et al. 2007; Martins 2011; Hijzen et al. 2013) confirm the existence of foreign wage premiums. Setzler and Tintelnot (2019) constructs the first U.S. employer-employee dataset with foreign ownership information and finds that the average direct effect of foreign multinational firms on its U.S. workers is a 7 percent increase in wages.

It is important to separate the MNE wage premium from the foreign wage premium. In this respect, Heyman et al. (2007) compare foreign-owned firms with domestically-owned multinationals and local firms. Their estimation results from the Swedish data show that the difference in wages is much larger between foreign-owned MNEs and local firms than between foreign-owned and domestically-owned MNEs. It indicates that a large part of the difference in wages between foreign- and domestically-owned firms is explained by multinational status alone.

Despite plenty of previous studies, we do not know whether exporting firms’ wage premiums are more important than multinational firms’ wage premiums or vice versa. This study, therefore, simultaneously examines both wage premiums for exporters and multinational wage premiums because the data used in this study contain information on both the export status and multinational status. While previous studies using linked employer and employee data focus on only one of the wage premiums for exporters and multinational firms, this study jointly examines both premiums using the extensive linked employer–employee data.

In addition, we do not know whether the nationality of the firm owner or multinational status is important as a reason for the multinational wage premium in Japan. To explore this issue, this study clearly distinguishes domestic multinational firms from foreign multinational firms because the data contain information on foreign ownership and the number of foreign subsidiaries.Footnote 1 Therefore, this study estimates wage premiums for both domestic multinational firms and foreign multinational firms. Such an estimate enables us to understand whether the nationality of the owner or multinational status is important for wage premiums.

3 Estimation method

This study employs both OLS and QRs to estimate the Mincer wage equations. After investigating the wage premium using OLS, I conduct QRs to examine wage premiums on a particular percentile of the distribution because these premiums may vary across the range of wages. For example, using QRs, I examine whether high-wage workers obtain higher multinational wage premiums than low-wage workers. QR has several attractive features, as explained in Koenker and Hallock (2001) and Cameron and Trivedi (2010). First, QR enables us to investigate the effects of a covariate on the full distribution or any particular percentile of the distribution, whereas OLS reveals the average relationship between the wage and explanatory variables. Second, QR is robust to the presence of outliers, whereas OLS regression is sensitive to such presence.

First, this study employs OLS and examines whether multinational firms or exporters pay higher wages than non-multinational firms or non-exporters using the following Mincer wage equation:

where \(\ln \mathit {WAGE}_{ip}\) is the log of the hourly wage for worker i in plant p, FIRMTYPEi,p are dummy variables that identify whether the plant p exports, whether it has foreign subsidiaries, and whether it is foreign-owned.

Several variables are included to control for plant characteristics. The log number of employees, PLANTSIZEp, is included as a measure of plant size. Single plant dummy, SINGLE_PLANTp, takes the value of one if a plant belongs to a firm that has only one establishment. Plant-level labor productivity, PRODUCTIVITYp, is included to control for the theoretical prediction that more productive plants pay higher wages.

Finally, worker-level variables are included to control for the heterogeneity in worker observable ability. A vector of education dummies, \(D^{educ}_{i}\), identifies a worker’s education level: junior-high school, high school, junior college, and Bachelor of Arts degree. Potential work experience, EXPi, is defined as age minus the number of years of education. To control for the type of employment and the type of workers, I include a dummy variable for regular workers, REGULARi, a dummy variable for permanent workers, i.e., employees for an indefinite period, PERMi, and a dummy variable for white-collar workers, WHITEi. The descriptive statistics of all variables are presented in Table 7 of the A.

Second, this study employs QRs to estimate the wage premium on any particular percentile of the wage distribution. QRs measure the quantile or percentile of the wage distribution conditional on a set of variables. The wage premiums can be heterogeneous across the quantile of the wage distribution. If so, the average wage premiums which OLS gives us might be less informative. By estimating the Mincer-type wage regressions at various quantiles, this study can specify which quantile has the largest and smallest wage premiums. QRs have been used by many previous studies in the field of labor economics (Machado and Mata 2005; Melly 2005; Firpo et al. 2009).

Using the linear programming method, I obtain the q th estimator \(\hat {\gamma }_{q}\), which minimizes over γq the objective function:

where 0 < q < 1, yi is the log of hourly wage and xi is a vector of explanatory variables. I use the same explanatory variables as those in the case of OLS.

4 Data and overview

4.1 Data

To investigate wage premiums for exporters and MNEs, this study employs the first set of Japanese-linked employer–employee data. Using Japanese data has several advantages. First, Japan is the world’s third-largest economy, following the United States and China. In Asia, Japan is regarded as the representative free economy. Second, many exporters and MNEs operate in Japan. Previous studies use linked employer–employee data for the United States and small European countries, such as Denmark and Sweden. This study adds the case of Japan, which has a large representative free economy in Asia.

To construct the matched employer–employee data, this study uses confidential data from three official surveys: (i) The Basic Survey on Wage Structure (2012), (ii) The Economic Census for Business Frame (2009), and (iii) The Economic Census for Business Activity (2012).Footnote 2 I merge the data from these three surveys at the plant level using the common plant-level census ID.

First, I obtain the data on most variables used in the analysis, such as worker-level wage and other worker-, plant-, and firm-level variables from the Basic Survey on Wage Structure, and construct the worker-level cross-sectional data. The Basic Survey on Wage Structure is conducted every year from July 1 to July 31 by the Ministry of Health, Labour and Welfare (MHLW).Footnote 3 The survey covers establishments with five or more regular employees in major industries in Japan. There are approximately 1.48 million establishments with five or more regular employees and they have 42 million employees nationwide. It is impossible to survey all of these establishments and employees. Therefore, the Ministry samples a fraction of establishments and employees every year. The sampling method consists of stratified 2-stage sampling where the establishments are the primary sampling unit while the employees are the secondary sampling unit. The establishments are stratified by prefecture industry and size of establishment. The sampling ratio for establishments is set by prefecture, industry, and size of establishment. The sampling ratio for the employees is determined in accordance with industry and size of the establishment for the establishments with 100 employees or more, while in accordance with the size of the establishment for the establishments with 99 employees or less. The number of establishments sampled is about 78,000 while the number of employees sampled approximately 1.63 million. This study analyzes only workers in the manufacturing industry. Therefore, the number of workers in my data will be reduced to about 140,000.

Second, I merge the worker-level data with the firm-level data on FDI and foreign ownership from The Economic Census for Business Frame. The Economic Census for Business Frame is a newly created census to identify the basic structure of establishments and enterprises in Japan and is conducted by the Ministry of Internal Affairs and Communications (MIC).Footnote 4 The 2009 census was the first one and was conducted as of July 1, 2009.

Third, I also merge the worker-level data with the data on the export status from the Economic Census for Business Activity. The Economic Census for Business Activity is another newly created census to investigate the economic activity of establishments and enterprises in all industries. The purpose of the census is to obtain basic information for conducting various statistical surveys.Footnote 5 Using the results of the 2009 Economic Census for Business Frame, the 2012 Economic Census for Business Activity was conducted by MIC and the Ministry of Economy, Trade and Industry (METI) in February 2012 to investigate the activities of establishments and enterprises during 2011.

After constructing the linked employer–employee data through these steps, I develop a dataset to estimate the Mincer wage equation. The procedure of this study follows that of Kawaguchi (2011). In particular, I restrict my analysis to the sample of full-time male workers under the age of 60 years who work at private firms. The reason for this restriction is as follows:Footnote 6 First, I restrict my analysis to full-time workers because information on the education level of part-time workers is unavailable in the survey. Second, I cannot control for the decision of female workers to participate in the labor market given data limitations. Therefore, I restrict my analysis to male workers. Third, I drop the data on workers over 60 years of age to address the fact that workers in Japan at the age of 60 years tend to face large declines in wages.

Following Kawaguchi (2011), the monthly total wage is calculated as the sum of monthly wages plus one-twelfth of yearly bonuses. Then, the hourly wage is calculated as the monthly total wage divided by hours worked, which is used in my analysis.

The resulting dataset from the three official surveys is the best data available for this study in Japan. However, I have to admit the limitation of the cross-sectional dataset. Japanese labor economists have been suffered from this limitation arisen from the Basic Survey on Wage Structure. The cross-sectional nature prevents me from using methods that have now become fairly standard in the literature such as propensity score matching. In other words, this study cannot identify the causal effects of firms’ internationalization on the wage structure. Instead, this study tries to provide the first overview of the relationship between the status of firms’ internationalization and the wage structure in Japan.

4.2 Overview

There are six possible types of firms defined by the interaction of foreign ownership, exporting status, and multinational status. Utilizing the data from the two Economic Censuses, I classify firms into the following six types:

-

1.

Non-multinational non-exporters –Japanese-owned non-exporting firms with no foreign affiliates

-

2.

Non-multinational exporters –Japanese-owned exporting firms with no foreign affiliates

-

3.

Domestically-owned non-exporting MNEs –Japanese-owned non-exporting firms with foreign affiliates

-

4.

Domestically-owned exporting MNEs –Japanese-owned exporting firms with foreign affiliates

-

5.

Foreign-owned non-exporting MNEs –Foreign-owned non-exporting firms

-

6.

Foreign-owned exporting MNEs –Foreign-owned exporting firms

This classification follows the spirit of Helpman et al. (2004) that show MNEs are more productive than exporters and exporters are more productive than non-exporters. Foreign-owned firms are defined as firms for which more than 50% of the equity is foreign-owned.

Table 1 presents the number of firms, plants, and workers in the sample by firm type. Among 8,579 plants in the sample, 6,554 plants (76.4%) are non-multinational non-exporters. The number of domestically-owned exporting MNEs is 867 (10.1%), which is the second largest group. The third-largest group is domestically-owned non-exporting MNEs, at 635 (7.4%), followed by non-multinational exporters (478 plants, 5.6%). The number of foreign-owned exporting plants is 20 (0.2%), while that of foreign-owned non-exporting plants is 25 (0.3%) The number of firms by firm type indicates a similar tendency.

In terms of the number of workers, non-multinational non-exporters still account for the largest fraction. The number of workers in these firms is 85,518, which is more than 58.8% of the 145,527 total workers. The number of workers in domestically-owned exporting MNEs is 31,636 (21.7%), and the second-largest, which is followed by the number of workers in domestically-owned non-exporting MNEs, is 17,276 (11.9%). Non-multinational non-exporters account for 9,666 workers (6.6%). The number of workers in foreign-owned non-exporting firms is 721 (0.5%), while that in foreign-owned exporting firms is 710 (0.5%).

The shares of establishments and workers of the six different types appear representative for Japan since my data is based on the most comprehensive censuses. Wakasugi et al. (2014) employ the Basic Survey of Japanese Business Structure and Activities (BSJBSA) and reveals that the fraction of non-multinational exporters and that of MNEs is 14.18% and 23.52%, respectively, in Japanese manufacturing for the year 2005, while the fraction of purely-domestic firms is 62.30%. The fraction of non-multinational exporters and that of MNEs are larger than those in Table 1 since the BSJBSA excludes firms with less than 50 employees.

Foreign-owned establishments are less common in Japan than in other countries. Wakasugi et al. (2014) find that the proportion of foreign-owned exporters is substantially lower in Japan than it is in European countries. Wakasugi et al. (2014) show that the fraction of foreign-owned non-exporters and that of foreign-owned exporters are 0.7% and 3.9%, respectively, in Japan. The UK, for example, has a much larger fraction of foreign-owned non-exporters and that of foreign-owned exporters: 18.7% and 27.9%. This comparison suggests that it is difficult for foreign firms to enter Japan.

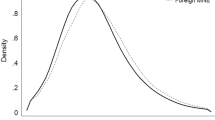

Table 2 provides worker-level descriptive statistics of hourly wage by firm type and indicates that foreign-owned non-exporting firms tend to pay the highest average wages, followed by—in descending order of wage—foreign-owned exporting firms, domestically-owned exporting MNEs, domestically-owned non-exporting MNEs, non-multinational exporters, and purely domestic firms (non-multinational non-exporting firms). Figure 1 presents box plots for a comparison of the distribution of hourly wage by firm type, which indicates an ordering of wages similar to that of Table 2. The hourly wages of foreign-owned and domestically-owned MNEs are distributed over the highest range. The hourly wage of non-multinational exporters is distributed over a lower range than those of MNEs but a higher range than that of purely domestic firms (non-multinational non-exporting firms). This wage ordering is consistent with the productivity ordering in the standard firm heterogeneity model of exports and FDI since Helpman et al. (2004) predict that exporters are more productive than purely domestic firms and MNEs are more productive than exporters.

5 Estimation results

5.1 OLS

This subsection presents the estimation results using OLS. First, Table 3 presents the estimation results of the Mincer wage equation without worker-level explanatory variables. Column (1) of Table 3 indicates the result of the regression using only key dummy variables (FIRMTYPEi,p): (i) non-multinational exporters, (ii) domestically-owned non-exporting MNEs, (iii) domestically-owned exporting MNEs, (iv) foreign-owned non-exporting MNEs, and (v) foreign-owned exporting MNEs. The coefficient of non-multinational exporters is positively significant, implying that non-multinational exporters, on average, pay an 18.9% (\(=\exp (0.173)-1\)) higher wage than non-multinational non-exporters. The coefficients of domestically-owned MNEs are also positively significant, implying that domestically-owned non-exporting and exporting MNEs, on average, pay a 33.6% and 59.5% higher wage than non-multinational non exporters, respectively. The coefficients of foreign-owned MNEs are positively significant and larger than those of domestically-owned MNEs. Exporting and non-exporting foreign-owned firms, on average, pay a 75.6% and 60.8% higher wage than non-multinational non-exporters, respectively.

These wage premiums become smaller when including industry and regional fixed effects into the regression, as shown in columns (2)–(4). Industry fixed effects are at the two-digit industry level, whereas regional fixed effects are at the 47-prefecture level. When I control for industry and region fixed effects, the wage premiums for exporters, domestically-owned and foreign-owned MNEs are reduced by about 20 percent. This result suggests that exporters and MNEs belong to the high-wage industry and locate in a high-wage region but that industry and regional factors account for only approximately 20% of total wage premiums.

It is noteworthy that the ordering of wage premiums again corresponds to the productivity ordering as predicted by Helpman et al. (2004). Table 3 shows that the wage premium for non-multinational exporters is larger than that for non-exporting local firms but is smaller than that for MNEs.

Table 4 presents the estimation results of the Mincer wage equation using both plant- and worker-level explanatory variables as in Eq. 1. Columns (1) and (2) provide the baseline results. Column (1) presents the results of the regression using plant-level explanatory variables such as plant size (\(\ln \) N. of employees), plant productivity (\(\ln \) Plant Sales per Worker), plant type dummy (Single Plant). The plant type dummy takes the value of one if a plant is a single plant and does not have its parent plant. These plant-level variables significantly decreased the wage premiums and account for 43.1% of the wage premium for non-multinational exporters, 42.6–43.3% of the wage premium for domestically-owned MNEs, and 22.4–34.8% of the wage premium for foreign-owned firms. When worker-level explanatory variables such as education dummies are included in column (2), the wage premiums are further reduced. The worker-level explanatory variables account for 12.2% of the wage premium for non-multinational exporters, 10.1–10.4% of the wage premium for domestically-owned MNEs, and 10.9–15.9% of the wage premium for foreign-owned firms. As a result, the wage premiums become smaller. The wage premium for the non-multinational exporters is now 3.7% and that for Japanese MNEs is 7.8–12.3%. For foreign firms, a large part of the wage premium still exists. The residual wage premium for foreign firms, 21.3–30.9% (\(\exp (0.193)-1\) to \(\exp (0.269)-1\)), can be regarded as a pure foreign wage premium.

As a robustness check, the number of foreign subsidiaries, N_MNE, is used instead of a dummy variable for domestically-owned MNEs, JMNE, in columns (3) and (4). The results for the wage premium for foreign-owned firms are qualitatively and quantitatively similar to the baseline results. Column (4) indicates that a 1% increase in the number of foreign subsidiaries is associated with a 3.5% increase in the hourly wage. It suggests that the extensive margin of outward FDI is positively associated with the higher wage.

As a parsimonious specification, I define Exporter as a dummy for exporters, Foreign Firm (50%) as a dummy for foreign ownership using 50% ownership cutoff, and MNE as a dummy for multinational status in columns (5) and (6). This imposes the strong restriction that the exporting effect is constant regardless of nationality or ownership, and so on. However, this approach roughly reveals that wage premiums for multinational status are larger than those for exporting status but much smaller than those for foreign ownership. Exporting status is associated with a 3.8% larger wage than non-exporting-non-multinational status, while multinational status is associated with a 7.8% larger wage than non-exporting-non-multinational status. Foreign ownership is associated with a 20.4% larger wage than non-exporting-non-multinational status.

In this section, I find that the residual wage premium for foreign firms is quite large. However, this study has an obvious drawback that workers might differ in unobserved ways between plant types. A key advantage of using linked employer-employee data in previous studies (e.g., Heyman et al. 2007) has been the ability to measure the wage premium for stayers when firms or plants change their ownership or exporting status, and to measure the wage premium for movers who switch between firms or plants types. It is not possible for this study because we do not have panel data for worker-level wages in Japan. To mitigate the readers’ concern on this issue, I compare my estimate to that of Ono and Odaki (2011) that relies on the same identification assumption and the same survey. Ono and Odaki (2011) use the Basic Survey on Wage Structure for the year 1998 and finds that the wage premium at 50% foreign ownership is 30% after controlling for individual, industry, and employer characteristics. This figure is slightly larger but reasonably close to my estimate, 21.3–30.9%, for the year 2012.

5.2 Decomposition of wage premiums

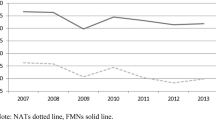

Based on the estimation results of Tables 3 and 4, Fig. 2 shows the extent to which region, industry, plant, and worker factors can explain the wage premiums for (i) non-multinational exporters (ii) domestically-owned non-exporting MNEs, (iii) domestically-owned exporting MNEs, (iv) foreign-owned non-exporting MNEs, and (v) foreign-owned exporting MNEs. Figure 2 suggests that the most important factor for the wage premiums is plant characteristics such as plant size. The evidence here is consistent with the well-known fact that larger firms tend to pay higher wages. For Japanese multinational firms and non-multinational exporters, the plant factor can explain more than 40% of the wage premiums. The plant factor accounts for approximately 22–34% of the wage premiums for foreign-owned firms.

For Japanese multinational firms and non-multinational exporters, the region and industry fixed effects explain more than 20% of the wage premiums. It means that Japanese multinational firms and non-multinational exporters locate in high-wage regions and belong to high-wage industries. However, there is a difference between Japanese multinational firms and non-multinational exporters. The results show that for Japanese multinational firms, the region-fixed effect is much more important than the industry-fixed effect, while for non-multinational exporters, it is vice versa. For foreign-owned firms, the region and industry fixed effects are also important and explain about 20% of the wage premiums.

Worker characteristics such as experience and education also play an important role and account for approximately 10–16% of the wage premiums. For foreign-owned firms, they explain 11–16% of the wage premiums. They explain about 10% of the wage premiums for Japanese multinational firms and about 12% of those for non-multinational exporters. The results indicate that firms that engage in the international market tend to employ more skilled workers than do purely domestic firms.

As shown in Fig. 2, most of the wage premiums can be explained by observable plant and worker characteristics as well as region and industry fixed effects. These observable factors account for about 80% of the wage premiums for Japanese multinational firms and non-multinational exporters and about 60-65% of the wage premium for foreign-owned firms. In other words, 20% of the wage premiums for Japanese multinational firms and non-multinational exporters remains even after controlling for the observable factors. For foreign-owned firms, an unexplained fraction of the wage premiums is much larger: 35–40%. The result implies that, on average, foreign-owned firms tend to pay 35–40% higher wages to an identical worker than do purely domestic firms with similar characteristics in the same industry and in the same region.

In summary, the results in this subsection reveal that the residual wage premium exists for non-multinational exporters, domestically-owned MNEs, and foreign firms even after controlling for the worker- and plant-level observable factors. The residual foreign wage premium is quantitatively large. In other words, foreign firms tend to pay higher wages than domestically-owned firms for foreign firm-specific reasons. This indicates that the nationality of the ownership matters for the wage premiums more than multinational status or exporting status.

While this section employs a simple method based on the regression results of Mincer wage equations to decomposition the wage premiums, there are different ways to analyze the role of covariates in the decomposition of wage, including the methodology developed by Gelbach (2016). The Oaxaca-Blinder decomposition has been used and extended in the field of labor economics and can be implemented by the user-written command of Stata (Jann 2008). Melly (2005) and Machado and Mata (2005) developed the method that combined the Oaxaca-Blinder decomposition with the quantile regression technique. The method enables us to estimate the effects of changes in the distribution of covariates on the distribution of the dependent variable and make inferences on the counterfactual distribution functions. Fortin et al. (2011) provide a review of the extensive literature on the decomposition methods.

5.3 QRs

This subsection presents the estimation results from QRs. While the results from OLS provide information on the average relationship between wage and firm type, the results from QRs provide information on the relationship between wage and firm type at different quantiles of the distribution of the log of hourly wage. The estimated coefficients for the dummy, for example, non-multinational exporters, can be interpreted as the deviation from the respective quantile of \(\ln WAGE\) for non-multinational exporters.

Table 5 presents the estimation results of Eq. 2. First, the results show that wage premiums for foreign-owned firms are positively significant in all quantiles. This finding is consistent with those in the previous subsection. In addition, the results indicate that the wage premium for foreign firms is larger in the higher quantile of the distribution. This finding suggests that foreign firms pay higher premiums for higher-wage workers. One possible reason for it is that part of the foreign wage premium is driven by the higher wages of expats. Japanese firms tend to avoid intra-firm wage dispersion among their employees. To avoid inequality within companies, the wages of executives in Japanese companies are not as high as in the US and European firms. My data does not have information on expats in Japan. However, there is anecdotal evidence that expats tend to receive higher wages than Japanese workers in foreign firms. Nissan, a car manufacturer, is an example of a foreign firm that employs high-wage expats.

Second, Table 5 shows that wage premiums for non-multinational exporters and domestically-owned MNEs are significantly positive for workers in all quantiles. While wage premiums are roughly the same across all quintiles for domestically-owned MNEs that export, wage premiums are larger in lower quantiles for non-multinational exporters and domestically-owned MNEs without exports. This finding implies that non-multinational exporters and domestically-owned non-exporting MNEs tend to pay higher wage premiums for lower-wage workers. This finding strikingly contrasts with the finding for the foreign wage premium, although its reason is beyond the scope of this study.

Third, Table 5 indicates that wage premiums for foreign firms are larger than those for non-multinational exporters and Japanese MNEs in all quantiles. This finding is in line with those in the previous subsection that indicate that foreign wage premiums are much larger than those for non-multinational exporters and domestically-owned MNEs.

In summary, this subsection reveals that the wage premiums for non-multinational exporters, domestically-owned MNEs, and foreign firms substantially vary across the quantiles of the wage distribution. In particular, foreign wage premiums tend to be larger in the higher quantiles of the wage distribution. In contrast, wage premiums for non-multinational exporters and domestically-owned non-exporting MNEs tend to be larger in the lower quantiles of the wage distribution.

5.4 Female workers

So far, this study has analyzed the male workers’ wage premiums for exporters and MNEs to avoid the selection bias of female workers since the labor participation rate is low for female workers in Japan. This subsection extends the analysis to female workers. In particular, I re-run the main analysis also for female workers and discuss the resulting differences with respect to the case of male workers.

Table 6 presents the estimation results of the Mincer wage equations for female workers. It corresponds to Table 4 which presents results for male workers. Tables 6 and 4 show the same tendency. I confirm exporters’ wage premiums and multinational wage premiums for female workers. However, the magnitude of the coefficients is different between Tables 6 and 4. First, non-multinational exporters’ wage premium is higher for female workers than for male workers. Exporters’ wage premium is 6.1% for female workers, while that for male worker is 3.7%. This finding is contrasted with the finding of Bøler et al. (2018) which analyzes Norwegian data. Bøler et al. (2018) discusses that exporting firms tend to increase gender wage gaps when female workers are less flexible since they require greater commitment from their employees, such as working particular hours to communicate with partners in different time zones or traveling at short notice.

Second, wage premium for foreign firms is also higher for female workers than for male workers, while wage premium for Japanese-owned MNEs is almost same between female and male workers. It might reflect differences in working conditions and employment system between Japanese and foreign firms. Japanese firms tend to hire new graduates and promise them lifetime employment. They are reluctant to hire mid-career workers. This employment practices of Japanese companies hinder the employment of women. It may lead to an undervaluation of women’s ability. Japan is notorious for its large gender disparity. Foreign firms might evaluate women’s abilities more fairly than Japanese firms, resulting in higher foreign wage premiums for female workers. Greaney and Tanaka (2021) further explores this issues.

6 Concluding remarks

This paper is the first attempt to jointly examine the wage premiums for exporters, domestically-owned MNEs, and foreign-owned firms using Japanese-linked employer–employee data. The OLS estimation results of the Mincer wage equation indicate that non-multinational exporters, domestically-owned MNEs, and foreign firms tend to pay higher average wages than purely domestic firms even within an industry and within a region. On average, wages of foreign-owned firms are the highest, and those of Japanese multinationals are the second highest. Wages of non-multinational exporters tend to be higher than those of local firms. The ordering of wages, with MNEs having the highest wages and exporters having higher wages than local firms, is consistent with the productivity ordering of Helpman et al. (2004). Even after controlling for observable factors, this ordering of wage remains the same.

However, significant part of wage premiums for non-multinational exporters and domestically-owned MNEs diminishes after controlling for plant and worker characteristics. Therefore, their higher wages reflect the fact that these firms tend to be larger and employ relatively higher skilled workers. Endoh (2016) also finds that effect of exporting on wages is negligible for lower-skilled workers and surprisingly negative for higher-skilled workers in Japan. Endoh (2016) employs the Basic Survey on Wage Structure (1999–2013) for worker data and the Basic Survey of Japanese Business Structure and Activities (1998–2012) for firm data. It reveals that impact from exports on hourly wages and annual income of male low-skilled workers is statistically insignificant in Japan.

The OLS estimation results show that the foreign wage premium is far larger than wage premiums for non-multinational exporters and domestically-owned MNEs. Even after controlling for plant and worker characteristics, the wage premium for foreign firms is quite large, 21–31%. The residual wage premium for domestically-owned MNEs’ wage premiums becomes 8–12%, while that for local exporters becomes 3.7%. These figures are consistent with the previous studies in Japan. As I have already mentioned, my estimate of foreign wage premium is close to that of Ono and Odaki (2011). In addition, my estimate of exporters’ wage premium is close to that of Ito (2017). Ito (2017) finds that residual wage premium for exporters is 2.6% in Japanese manufacturing for the year 2012, using the Basic Survey on Wage Structure and the Census of Manufacture.

In addition, the results from QRs reveal that the wage premiums vary across the quantiles of wage distribution. In foreign-owned firms, the wage premium is larger in higher quantiles of wage distribution, suggesting that higher skilled workers obtain larger wage premiums in foreign-owned firms. In contrast, the wage premiums for non-multinational exporters and domestically-owned non exporting MNEs are higher in lower quantiles of wage distribution. These surprising evidence is not predicted by the existing theoretical studies that assume the uniform wage premiums across the quantiles of wage distribution and require for the further development of theoretical studies of the wage premiums.

Finally, this study finds that female workers receive larger wage premiums in non-multinational exporters and foreign firms than male workers. It might reflect that working conditions and employment systems in local exporters and foreign firms are favorable for female workers. Foreign firms tend to pay much larger wage premiums than Japanese-owned MNEs. Therefore, policies attracting inward FDI have a possibility to reduce notorious gender wage gaps in Japan through providing better employment environment for female workers.

This study suggests that nationality, rather than the multinational status or exporting status, matters for wage premiums. Identifying the reason for large unexplained foreign wage premium is beyond the scope of this study. The unexplained foreign wage premium can be attributable to unobservable firm and worker characteristics such as managing practice and employment system that my data cannot control for. Previous studies suggest that the foreign multinational firms’ wage premiums can be attributed to compensation for different working conditions (Bernard and Sjoholm 2003; Fabbri et al. 2003) or learning opportunities (Görg et al. 2007) in foreign firms.

It is well-known that Japan’s inward FDI stock is remarkably low. Therefore, the government has struggled to attract foreign firms to Japan. According to the Ministry of Economy, Trade and Industry’s White Paper on International Economy and Trade 2015, the share of inward FDI stock in GDP is 3.7% in Japan in 2013. This figure is much lower than those of other major countries: China (10.4%), the US (29.4%), France (39.5%), and the UK (63.3%). It might reflect the fear against foreign firms in Japan. To increase Japan’s inward FDI stock, the findings from this study suggest that the Japanese government should spend more on the attraction of foreign firms given their potential positive labor market effect.

Notes

Heyman et al. (2007) also distinguish domestically-owned MNEs from foreign-owned firms. Although they define a domestically-owned MNE as a firm that reports positive exports to other firms within MNEs, this study defines a domestically-owned MNE as a firm that has a foreign subsidiary. The definition of this paper is preferable because it is consistent with standard firm heterogeneity models such as Helpman et al. (2004) and Egger and Kreickemeier (2013).

All three surveys are conducted as Fundamental Statistics according to the Statistics Act.

See the MHLW website (http://www.mhlw.go.jp/english/database/db-l/wage-structure.html) for more details.

See the MIC website (http://www.stat.go.jp/english/data/e-census/index.htm) for more details.

See the MIC website (http://www.stat.go.jp/english/data/e-census/2012/index.htm) for more details.

See Kawaguchi (2011) for more details.

References

Amiti M, Davis DR (2012) Trade, firms, and wages: Theory and evidence. Rev Econ Stud 79(1):1–36

Bernard AB, Jensen JB (1997) Exporters, skill upgrading, and the wage gap. J Int Econ 42(1):3–31

Bernard AB, Jensen JB (1999) Exceptional exporter performance: Cause, effect, or both? J Int Econ 47(1):1–25

Bernard AB, Sjoholm F (2003) Foreign owners and plant survival. NBER Working Paper Series (10039)

Bernard AB, Jensen JB, Schott PK (2009) Importers, exporters and multinationals: A portrait of firms in the us that trade goods. In: Producer dynamics: New evidence from micro data. University of Chicago Press, pp 513–552

Bøler EA, Javorcik B, Ulltveit-Moe KH (2018) Working across time zones: Exporters and the gender wage gap. J Int Econ 111:122–133

Budd JW, Konings J, Slaughter MJ (2005) Wages and international rent sharing in multinational firms. Rev Econ Stat 87(1):73–84

Cameron AC, Trivedi PK (2010) Microeconometrics using Stata. Stata Press, College Station, TX

Damijan JP, Marcolin L (2013) Global firms and wages: Is there a rent sharing channel? Unpublished

Egger H, Kreickemeier U (2009) Firm heterogeneity and the labor market effects of trade liberalization. Int Econ Rev 50(1):187–216

Egger H, Kreickemeier U (2013) Why foreign ownership may be good for you. Int Econ Rev 54(2):693–716

Endoh M (2016) The effect of offshoring on skill premiums: Evidence from Japanese matched worker-firm data Working Paper DP2016-005, Institute for Economics Studies, Keio University

Fabbri F, Haskel JE, Slaughter MJ (2003) Does nationality of ownership matter for labor demands? J Eur Econ Assoc :698–707

Firpo S, Fortin NM, Lemieux T (2009) Unconditional quantile regressions. Econometrica 77(3):953–973

Fortin N, Lemieux T, Firpo S (2011) Decomposition methods in economics. In: Handbook of labor economics, vol 4. Elsevier, pp 1–102

Frıas JA, Kaplan DS, Verhoogen EA (2009) Exports and wage premia: Evidence from Mexican employer-employee data. Unpublished

Gelbach JB (2016) When do covariates matter? and which ones, and how much? J Labor Econ 34(2):509–543

Girma S, Görg H (2007) Evaluating the foreign ownership wage premium using a difference-in-differences matching approach. J Int Econ 72(1):97–112

Görg H, Strobl E, Walsh F (2007) Why do foreign-owned firms pay more? the role of on-the-job training. Rev World Econ 143(3):464–482

Greaney TM, Tanaka A (2021) Foreign ownership, exporting and gender wage gaps: Evidence from Japanese linked employer-employee data. J Jpn Int Econ 61:101151. https://doi.org/10.1016/j.jjie.2021.101151

Helpman E, Melitz MJ, Yeaple SR (2004) Export versus fdi with heterogeneous firms. Am Econ Rev 94(1):300

Helpman E, Itskhoki O, Redding S (2010) Inequality and unemployment in a global economy. Econometrica 78(4):1239–1283

Heyman F, Sjöholm F, Tingvall PG (2007) Is there really a foreign ownership wage premium? Evidence from matched employer-employee data. J Int Econ 73(2):355–376

Hijzen A, Martins PS, Schank T, Upward R (2013) Foreign-owned firms around the world: A comparative analysis of wages and employment at the micro-level. Eur Econ Rev 60:170–188

Hjort J, Li X, Sarsons H (2020) Across-country wage compression in multinationals. Working Paper 26788, National Bureau of Economic Research. https://doi.org/10.3386/w26788, http://www.nber.org/papers/w26788

Ito K (2017) Wage premium of exporting plants in japan: Do plant and firm size matter? Working Paper 17-E-115, The Research Institute of Economy, Trade and Industry

Jann B (2008) The Blinder–Oaxaca decomposition for linear regression models. Stata J 8(4):453–479

Kawaguchi D (2011) Applying the mincer wage equation to Japanese data (in Japanese). RIETI Discussion Paper Series 11-J-026

Koenker R, Hallock K (2001) Quantile regression: An introduction. J Econ Persp 15(4):43–56

Lipsey RE, Sjöholm F (2004) Foreign direct investment, education and wages in indonesian manufacturing. J Dev Econ 73(1):415–422

Machado JA, Mata J (2005) Counterfactual decomposition of changes in wage distributions using quantile regression. J Appl Econ 20(4):445–465

Malchow-Møller N, Markusen JR, Schjerning B (2013) Foreign firms, domestic wages. Scand J Econ 115(2):292–325

Martins PS (2011) Paying more to hire the best? foreign firms, wages, and worker mobility. Econ Inq 49(2):349–363

Martins PS, Yang Y (2015) Globalized labour markets? international rent sharing across 47 countries. Br J Ind Relat 53(4):664–691

Mayer T, Ottaviano GI (2008) The happy few: The internationalisation of european firms. Intereconomics 43(3):135–148

Melly B (2005) Decomposition of differences in distribution using quantile regression. Labour Econ 12(4):577–590

Munch JR, Skaksen JR (2008) Human capital and wages in exporting firms. J Int Econ 75(2):363–372

Ono H, Odaki K (2011) Foreign ownership, human capital, and the structure of wages in Japan. Int J Hum Resour Manag 22(15):3036–3050

Schank T, Schnabel C, Wagner J (2007) Do exporters really pay higher wages? first evidence from german linked employer-employee data. J Int Econ 72(1):52–74

Schank T, Schnabel C, Wagner J (2010) Higher wages in exporting firms: Self-selection, export effect, or both? first evidence from linked employer-employee data. Rev World Econ 146(2):303–322

Setzler B, Tintelnot F (2019) The effects of foreign multinationals on workers and firms in the united states. Working Paper 26149, National Bureau of Economic Research. https://doi.org/10.3386/w26149, http://www.nber.org/papers/w26149

Verhoogen EA (2008) Trade, quality upgrading, and wage inequality in the mexican manufacturing sector. Q J Econ 123(2):489–530

Wakasugi R, Ito B, Matsuura T, Sato H, Tanaka A, Todo Y (2014) Features of Japanese internationalized firms: Findings based on firm-level data, Springer, Japan. https://doi.org/10.1007/978-4-431-54532-3_2

Acknowledgements

I would like to thank Juan Carlucci, Banri Ito, Naoto Jinji, David Jinkins, and other participants of the ETSG conference in Helsinki for their helpful comments. I appreciate anonymous referees for their helpful comments. I am grateful to the Ministry of Health, Labour and Welfare for providing the micro data of the Basic Survey on Wage Structure employed in this study. I am also grateful to the Ministry of Internal Affairs and Communications for providing the micro data of the Economic Census for Business Frame and the Economic Census for Business Activity employed in this study. I thank Yuki Ishiduka for her helpful assistance to obtain the micro data and I would like to express my sincere condolences on her untimely death.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I gratefully acknowledge the financial support from the Japan Society for the Promotion of Science’s Grants-in-Aid for Scientific Research (No. 24730234, 15K17063, 19K01612) and the Nomura foundation’s Grant for Social Science (N20-3-E30-002) and Grant for Gender-related Research (N20-4-W30-002). This study is conducted as a part of the Project “The effects of FDI on domestic employment and wage” undertaken at Research Institute of Economy, Trade and Industry (RIETI).

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Tanaka, A. Higher wages in exporters and multinational firms evidence from linked employer–employee data. Int Econ Econ Policy 19, 51–78 (2022). https://doi.org/10.1007/s10368-021-00517-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-021-00517-2