Abstract

Is it in the interest of a developing country to promote strong local linkages for domestic industries or to participate in global value chains (GVCs) wherein linkages are globally dispersed? This paper informs this debate by empirically analyzing which one of these strategies would result in higher levels of domestic value added (DVA) and employment in India. Using a unique panel data on DVA and jobs tied to Indian exports from 112 sectors for the period 1999–2000 to 2012–2013, we show that greater backward GVC participation—use of imported inputs to produce for exports—leads to higher absolute levels of gross exports, DVA and employment. This result implies that labor abundant countries can reap dividends by adopting policies aimed at strengthening their backward participation in GVCs. Our findings are robust to various estimation techniques and instrumental variable approaches to address potential endogeneity concerns.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The period since the first decade of the twenty-first century marked the end of the era of cheap Chinese labour (Li et al., 2012). Since then, China has started moving up the technological ladder while gradually vacating the labour-intensive stages of manufacturing production such as final assembly activities (Cheng et al., 2019; Li et al., 2012; Upward et al., 2013). The US-China trade war and COVID-19 pandemic may provide further impetus to the ongoing realignment of global value chains (GVCs) in different industries (Amiti et al., 2019; Baldwin & Tomiura, 2020; Javorcik, 2020).

These developments may provide opportunities for less industrialised labour abundant countries, such as India, to emerge as alternative assembly hubs for manufactured products within the GVCs. Being one of the few countries that can match China in terms of its sheer size and abundance of low skilled labor, India is best positioned to attract multinational enterprises (MNEs) that are looking for new locations to lower costs and to diversify supply chains. However, this raises an important question: Is it in the interest of a developing country to promote strong local linkages for domestic industries or to participate in GVCs wherein linkages are globally dispersed? The answer should be based on the relative magnitude of the impact of these strategies on aggregate value added and employment within the country. The present paper informs this debate by empirically analyzing which one of these strategies would result in higher levels of domestic value added (DVA) and employment in India.

Previous studies suggest that the impact of GVCs on domestic outcomes is conditional on the nature and position of the country’s participation in the value chains (Constantinescu et al., 2019; World Bank, 2020). Constantinescu et al. (2019) find that backward GVC participation (use of imported inputs to produce for exports) exerts a more significant and robust positive impact on domestic productivity as compared to forward GVC participation (export of raw materials and intermediate inputs by a given country for further processing and export by other countries). In general, labor abundant developing countries tend to have relatively higher level of backward GVC participation as they mostly specialize in final assembly activities. Clearly, given its relative abundance of low wage labor, India has a natural comparative advantage in backward GVC participation. Therefore, in this paper, our focus is to analyze the employment and output gains for India from backward GVC participation.

We make use of a unique panel data on DVA, foreign value added (FVA) and jobs tied to Indian exports from 112 sectors, covering the whole Indian economy, during the period 1999–2000 to 2012–2013.Footnote 1 The database is constructed using Input–Output (IO) method, which enables us to capture the linkage effects of exports from a given sector in India with other domestic sectors.Footnote 2 Following Hummels et al. (2001), the ratio of FVA to gross exports (FVAX ratio) is used as a measure to quantify the extent of an Indian industry’s backward GVC participation. As shown by Borin and Mancini (2019, p. 6), the FVAX ratio “is a good measure of the participation of a country in the downstream phases of international production chains”, i.e., backward GVC participation.Footnote 3 The rationale is that the FVAX ratio measures how much foreign, as opposed to domestic, value-added is generated for a given unit of exports. Sectors with higher FVAX ratios tend to record greater backward GVC participation and vice versa.

The regression analysis shows that greater backward GVC participation leads to higher absolute levels of gross exports, DVA and employment. To the best of our knowledge, these relationships have not been estimated before in the context of developing countries. The results are robust to various estimation techniques and instrumental variable approaches to address potential endogeneity concerns due to simultaneity, reverse causality and omitted variables. Our findings imply that labor abundant countries can reap dividends by adopting policies aimed at strengthening their backward participation in GVCs.

Rest of the paper is organized as follows. Section 2 discusses the IO methodology used to estimate DVA, FVA and number of jobs tied to exports. Section 3 presents the estimates of DVA, FVAX ratio and the number of jobs attributable to India’s exports at the aggregate and disaggregated levels. Section 4 carries out a regression analysis to answer our main question—that is, whether greater backward GVC participation leads to higher absolute levels of gross exports, DVA and employment. Finally, Sect. 5 provides the concluding remarks. An online Appendix provides a detailed discussion of data and methodology involved in the preparation of year specific IO matrices for India.

2 Methodology of estimating domestic value addition and job creation by exports

Based on the concept of backward linkages of a given sector with other sectors within an economy, the DVA embodied in exports from ‘n’ sectors can be estimated asFootnote 4:

where v is a \(1 \times n\) vector containing value added to output ratio for each sector j, \(\hat{X}\) is a \(n \times n\) diagonal matrix of exports from n sectors, \(\left( {I - A^{d} } \right)^{ - 1}\) is the inverse Leontief matrix that measures the total direct and indirect uses of each commodity i by each sector j.Footnote 5Ad is \(n \times n\) domestic coefficient matrix, whose elements (denoted as aij) measure the amount of domestic input from sector i required to produce one unit of output in sector j. I is an identity matrix with ones on the diagonal and zeros elsewhere. dva1 is the resulting \(1 \times n\) vector of DVA content of exports. Following the terminology of Borin and Mancini (2019), the value-added accounting approach in Eq. (1) corresponds to what is described as “exporting country perspective source-based” decomposition by sector of export.

We can obtain the vector of FVA (denoted as fva1) by subtracting dva1 from the corresponding vector of gross exports.Footnote 6 By summing the appropriate elements of these vectors, we get the aggregate value of DVA and FVA for broad sector groups (agriculture, manufacturing and services) and for the economy as a whole. The aggregate estimates of DVA may be denoted as \(\sum dva_{j1}\) where dvaj1 are the individual elements of the vector dva1.

The total DVA in (1) can be decomposed into direct and indirect (backward linkage) effects as shown below

where \(\left( {\widehat{{I - A^{d} }}} \right)^{ - 1}\) is a matrix consisting of the diagonal elements of \(\left( {I - A^{d} } \right)^{ - 1}\) and zeros elsewhere; \(dva_{1}^{d}\) and \(dva_{1}^{bw}\) are respectively vectors of direct and indirect DVA content of exports from n sectors. Note that \(dva_{1}^{bw}\) in Eq. (1b) measures the DVA attributable to sector j’s backward linkages with all upstream sectors i within the economy. For example, exports of ‘automobiles’ generates domestic value addition within the automobile sector (\(dva_{1}^{d}\)) as well as in other upstream sectors (\(dva_{1}^{bw}\)), such as ‘iron & steel’, ‘plastics & rubber, and ‘electrical machinery’ whose outputs are used as inputs by the automobile sector.

Following another approach, described as “source-based decomposition with a breakdown by sector of origin” by Borin and Mancini (2019), we can measure the extent of DVA generated in sector j as a result of its forward linkages with all downstream sectors i within the economy. For example, DVA is generated in ‘iron & steel’ sector as a result of exports from other sectors (such as, automobiles, machine tools etc.) wherein ‘iron & steel’ is used as one of the inputs. Thus, based on a given sector’s forward linkages with other sectors within the economy, DVA attributed to exports can be estimated as:

which can be decomposed into direct and indirect (forward linkage) effects as follows.

where \(\hat{V}\) is \(n \times n\) diagonal matrix of value added to output ratios and x is (\(n \times 1\)) vector of exports from different sectors. Note that dva1 and dva2 give identical estimates for the economy as a whole (when aggregated for all sectors) but not for individual sectors. The two approaches, however, give identical direct DVA estimates at the sector level– that is, the vectors \(dva_{1}^{d}\) and \(dva_{2}^{d}\) are identical for a given sector. On the other hand, \(dva_{1}^{bw}\) and \(dva_{2}^{fw}\) give different values for a given sector due to differences in the type of linkages (backward versus forward) that they capture. It should be noted that a sector may record positive \(dva_{2}^{fw}\) value, no matter whether it is directly engaged in exports or not, if it supplies inputs to other exporting sectors. The number of jobs tied to exports can also be computed, in an analogous manner, using the above approach. The relevant equations for estimation are:

based on backward linkages.

based on forward linkages.

Where l is \(1 \times n\) vector containing employment coefficients (labor/output ratios) while \(\hat{L}\) is the diagonal matrix of sectoral employment coefficients. The resulting vector of employment supported by exports is given by e1 and e2 where the former measures direct employment (\(e_{1}^{d}\)) plus employment attributed to backward linkages (\(e_{1}^{bw}\)) while the latter represents direct employment (\(e_{2}^{d}\)) plus employment due to forward linkages (\(e_{2}^{fw}\)). Following the approach outlined above, we estimate DVA and employment tied to exports from 112 sectors, covering the whole Indian economy, for the period 1999–2000 to 2012–2013.Footnote 7

Between the two estimation approaches, outlined above, which one to be chosen depends on the purpose at hand.Footnote 8 The appropriate measures are the ones based on backward linkages (dva1 and e1) when the objective is to assess a given sector’s ability to create DVA and employment across the board through linkages with other sectors. On the other hand, the appropriate measures are those based on forward linkages (dva2 and e2) if the main purpose is to understand the extent of a sector’s dependence on exports, directly and indirectly, for growth and job creation. Our discussion below, keeping in mind the focus of this paper, primarily deals with the estimates based on backward linkages though we also briefly highlight the relative importance of the two types of linkages across sector groups.

3 How does it all add up? Estimates of jobs and value added tied to Indian exports

3.1 Aggregate level estimates

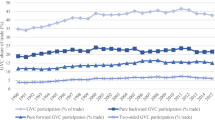

Panel (a) in Fig. 1 shows the values (US$ Billions) of DVA and FVA tied to India’s aggregate (merchandise plus services) exports. These values are arrived at by summing the estimates for all 112 sectors for each year. Panel (b) in Fig. 1 depicts the FVAX ratio – that is, FVA divided by gross exports.

Source: Authors’ estimation based on a time series of 112 × 112 input output table for India for the period 1999–2000 to 2012–2013

DVA and FVA Break up of India’s Gross Exports (Merchandise plus Services, $ Billion) and FVAX Ratio. Notes: Total DVA = \(\sum dva_{j1}\); Direct DVA = \(\sum dva_{j1}^{d}\); Indirect DVA = \(\sum dva_{j1}^{bw}\); Gross exports = \(\sum x_{j}\); FVA = Gross exports – Total DVA; FVAX ratio = Ratio of FVA to gross exports.

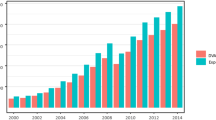

India’s gross exports stood at $53.3 billion in 1999–2000, of which the contribution of total DVA (direct plus indirect) was $46 billion with the rest being attributed to FVA. By 2012–13, the values of gross exports and total DVA increased to $452.1 billion and $295.4 billion, respectively. The FVAX ratio increased consistently from 0.14 in 1999–2000 to 0.35 in 2012–2013. Overall, the observed trends in FVAX ratio suggest that the backward participation in GVCs by Indian industries has increased over the years, especially since the second half of the 2000s. Did these changes translate into higher number of jobs in the country? Our estimates are consistent with an answer in the affirmative as we find that the number of jobs tied to India’s total exports increased from about 34 million in 1999–2000 to 62.6 million in 2012–2013 (Fig. 2). Further, during this period, the number of jobs tied to exports grew faster than the size of total employment in the country with the share of the former in the latter having increased from a little over 9% in 1999–2000 to 14.5% in 2012–2013.

Source: Same as for Fig. 1

Number of Jobs Supported by Exports in India (Merchandise plus Services, Million). Note: Direct jobs = \(\sum e_{j1}^{d}\); Indirect jobs = \(\sum e_{j1}^{bw}\).

Even as we observe a significant increase of export related jobs in absolute terms, the number of jobs generated per $1 million worth of exports declined steadily from 638 in 1999–2000 to 138 in 2012–2013.Footnote 9 A similar trend of secularly declining number of jobs per million dollar worth of exports has been observed for a number of other countries (Cali et al., 2016). Despite this decline, however, employment intensity of Indian exports is perceptibly higher than similar estimates available for other major countries, including US and China. For example, $1 million worth of US exports supported only 6.6 jobs in 2009 and 5.2 jobs in 2014 (Rasmussen & Johnson, 2015). Available estimates for China suggest that $1 million worth of its exports supported 140 jobs in 2007 (Chen et al., 2012) as compared to 191 jobs for India for the same year.

3.2 Estimates for sector groups: agriculture, manufacturing and services

Figure 3 depicts DVA \(\left( {\sum dva_{j1} } \right)\) and employment \(\left( {\sum e_{j1} } \right)\) attributed to Indian exports from each sector group—agriculture, manufacturing and services. The value of DVA tied to manufactured exports increased steadily from about $24 billion in 1999–2000 to $165 billion in 2011–2012 (panel a). At the same time, the number of jobs attributed to manufactured exports remained in the range of 17.5 to 25 million until the year 2009–2010, before increasing sharply to 31.5 million in 2010–2011 and reaching 45 million in 2012–2013 (panel b). For the year 2012–2013, exports of manufactured products was responsible for more than half of total export related DVA and about 72% of total export related employment in the country.Footnote 10

Source: Same as for Fig. 1

Total (direct plus indirect) DVA and Employment Attributed to Exports from Different Sector Groups (Agriculture, Manufacturing and Services).

The ratio of fva1 to gross exports (FVAX ratio) increased perceptibly for the manufacturing sector, from 0.19 in 1999–2000 to 0.47 in 2012–2013 (see Fig. 4). The FVAX ratio, as noted earlier, captures the extent of a sector’s backward GVC participation; higher the ratio, greater is the foreign (as opposed to domestic) sourcing of intermediate inputs and vice versa. Clearly, the observed trends of FVAX ratios suggest that India’s manufacturing sector has strengthened its backward GVC participation over the years. For agriculture and services, however, the FVAX ratio remained quite low – less than 0.10 and 0.15, respectively—throughout the period. The higher FVAX ratios of the manufacturing sector reflects the fact that manufactured products are inherently more tradable and more amenable to global fragmentation as compared to most of the primary and services sector products.

Source: Same as for Fig. 1

Ratio of \(\sum fva_{j1}\) to Gross Exports (FVAX ratio) across Sector Groups.

The estimates of DVA and employment attributed to domestic backward and forward linkages are shown, respectively, in panel (a) and panel (b) in Fig. 5. This figure is helpful in understanding the relative importance of the two types of linkages across sector groups. It is clear that export of manufactured products is responsible for the largest share of economy-wide employment as well as DVA generated through backward linkages. On the flip side, the bulk of export related jobs and DVA in agriculture and services sectors have been generated as a result of their forward linkages with export oriented manufacturing industries. Forward linkages play a more important role in creating jobs and DVA in agriculture while the opposite is true for services. For the year 2012–2013, for example, domestic forward linkages accounted for 80% total export related jobs in agriculture and 65% of total export related DVA in services.

Source: Same as for Fig. 1

DVA and Employment Attributed to Backward Versus Forward Linkages of Different Sector Groups (Agriculture, Manufacturing and Services).

4 Domestic impact of particpation in GVCs: regression analysis

4.1 Theoretical basis

The discussion in Sect. 3, based on the values of FVAX ratio, concludes that India’s backward participation in GVCs has increased over the years. What are the consequences of this trend for value addition and job creation in the domestic economy? When a country increases its backward GVC participation, the share of FVA embodied in its gross exports is bound to increase. This in turn implies that DVA per unit of exports will decline. However, what matters in the determination of the level of domestic employment is the absolute value of DVA, rather than DVA (or FVA) per unit of exported goods. Owing to the scale and productivity effect of producing for the world market, backward GVC participation can cause an expansion of the absolute value of DVA and hence higher job creation in participating countries (Constantinescu et al., 2019; Grossman & Rossi-Hansberg, 2008; World Bank, 2020).Footnote 11

In this section, we provide econometric evidence in support of the hypothesis that an increase of the FVAX ratio leads to higher absolute levels of gross exports, DVA and employment. The theoretical basis for our hypothesis comes from the models that deal with the impact of offshoring on labor market outcomes.Footnote 12 Jones and Kierzkowski (1990, 2001) and Arndt (1997) were among the first to note that participation in GVCs can achieve cost savings, increase productivity and cause the sector to expand. In these models, fragmentation of production activities acts as technological progress in final goods sectors – that is, trade in intermediate goods makes it possible to produce more final goods from any given stock of primary factors. Thus, fragmentation entails additional gains from trade beyond those achieved when trade is limited to final goods. Theoretical analysis by Arndt (1997, 1998), for example, shows that offshore sourcing in an industry increases employment and wages because of high net job creation—that is, the job growth in activities that are still performed at home more than compensate for the jobs lost due to sub-contracting.

Recent theoretical models show that participation in GVCs may induce productivity gains as a result of a finer international division of labor (Grossman & Rossi-Hansberg, 2008; Wright, 2014), increased competition, greater diversity of input varieties and knowledge spillovers (Baldwin & Robert-Nicoud, 2014; Li & Liu, 2014).Footnote 13 The positive productivity effect, associated with GVC participation, in turn, may exert an upward pressure on domestic wages and hence the level of DVA (Grossman & Rossi-Hansberg, 2008; Wright, 2014).

4.2 Hypotheses and baseline specification

Consistent with the theoretical literature discussed above, we hypothesize that the dollar value of gross exports from a sector (xj) will increase with an increase of the sector’s backward GVC participation. An increase in gross exports, in turn, implies that the absolute dollar value of total (direct plus indirect) DVA, tied to the sector’s exports, would increase as well. For, with greater backward participation in GVCs, even as the DVA per unit of exports tends to fall (that is, FVAX ratio rises), total DVA would increase due to the productivity and scale effect of producing for the world market. Finally, we hypothesize that an increase of the absolute DVA value would cause the number of jobs tied to exports to rise. Figure 6 summarizes the expected impact of greater backward GVC participation on domestic outcomes.

In order to test these hypotheses econometrically, we estimate the following baseline equations.

The notations j, t and ln stand respectively for sector, year and natural logarithm. D(j) is the vector of sector dummies and D(t) is the vector of year dummies. The endogenous dependent variables are: (i) dollar value of exports from India to rest of the world in sector j (xjt); (ii) dollar value of direct plus indirect DVA attributed to Indian exports from sector j (dvaj1, individual elements of the vector dva1); and (iii) direct plus indirect employment attributed to Indian exports from sector j (ej1, individual elements of the vector e1).

In light of the hypotheses outlined above, the main coefficients of our interest are α1, β1 and γ1. Coefficient of FVAX ratio \(\left( {\frac{{fva_{j1} }}{{x_{j} }}} \right)_{ }\), α1, is expected to yield a positive sign in Eq. (5a) since greater backward GVC participation is likely to cause an increase of gross exports in dollar terms. Given the possibility of reverse causality and endogeneity, we treat FVAX ratio as endogenous in the system of equations. Our hypotheses also imply that the expected signs of β1 in Eq. (6a) and that of γ1 in Eq. (7a) are positive.

The rest of the explanatory variables in the above equations are included to control for other factors which may influence the dependent variables. All equations include sector dummies to control for unobserved sector/industry specific characteristics and year dummies to capture unobserved aggregate shocks that are common to all industries. Further, each of the above equations includes appropriate control variables representing industry-specific levels of domestic activity and relative price. The variable rpo (or rpv) represents industry level relative price adjusted for exchange rates, which is constructed by taking the ratio of industry level output (or value added) deflator for India to that of United States.Footnote 14 These ratios were then adjusted by dollar per rupee nominal exchange rate for each year, with an increase of the ratio being indicative of a deterioration of India’s price competiveness in the given industry, and vice versa. Keeping in mind the way the dependent variable is measured, rpo is included in Eq. (5a) while rpv is considered in Eq. (6a). We assume that rpo and rpv are exogenously determined.Footnote 15 The variable rw in Eq. (7a) is real wage rate, being computed using data on industry specific nominal wage rates and output deflators. As required data are not available for agriculture and services sectors, rw was computed only for manufacturing industries. We expect rw to exert a negative influence on employment tied to exports. We treat this variable as endogenous in some specifications and exogenous in others (see the notes below the regression tables).

Equation (5a) also includes the exogenous variable wd, a variable representing the level of world demand for each industry. This variable is measured as the weighted average of total imports (in US dollars) in a given sector by the world from all countries, except from India. The share of each partner country in India’s total exports in the given industry is taken as the weight. As relevant data are not available for services, wd was constructed only for merchandise sectors. The sign of wd is expected to be positive since Indian exports may benefit from higher world demand. Finally, in Eq. (7a), we include labor-output ratio (l) to control for the effect of a sector’s labor intensity on job creation. We expect this variable to yield a positive coefficient.Footnote 16

Domestic activity variables are included to capture the effect of domestic market size and supply capability on the dependent variables. The relevant domestic activity variable in Eq. (5a) is yd, defined as output value minus gross export value for each industry.Footnote 17 The variable gvad, defined as gross value added minus \(dva_{j1t}^{d}\), is included as a domestic activity variable in Eqs. (6a) and (7a).Footnote 18 Based on the coefficient signs of domestic activity variables in these equations, we can infer whether foreign and domestic sales are complements or substitutes. A negative (substitutability) relationship may be expected if increasing domestic sales may come at the expense of export sales in the presence of capacity constraints. On the other hand, a positive (complementary) relationship may be expected if there are increasing returns to scale or if the strength in domestic market can be leveraged in international markets. Thus, the coefficient sign of domestic activity variable depends on which effect dominates. We treat the activity variables yd and gvad as endogenous explanatory variables.

There are reasons to believe that our dependent variables are characterized by some degree of persistence over time. For instance, a number of studies document a high persistence in export behavior which is usually attributed to the presence of sunk market-entry costs and learning through the accumulation of market experience (Timoshenko, 2015). Further, labor market rigidities may result in inertia and persistence of jobs tied to exports. In order to account for such possibilities, we also estimate the following set of dynamic specifications where the activity variables on the right-hand-side of Eqs. (5a), (6a) and (7a) are replaced by one-year lagged values of the dependent variables.Footnote 19

Lagged dependent variables are treated as endogenous or predetermined. For ease of reference, we call the system of Eqs. 5a, 6a and 7a as Model 1 and 5b, 6b and 7b as Model 2. Table 5 in the “Appendix A” provides further details pertaining to variable definition, variable construction, and data sources.

4.3 Econometric issues and baseline regression results

In order to establish the suggested causal relationships in the above models, we need to address potential endogeneity issues due to simultaneity, reverse causality and omitted variables. Exogenous shocks such as change in trade and investment policies, productivity shocks, change in input prices, foreign investment etc. may simultaneously affect the sourcing strategies of an industry (i.e. GVC participation) and its outcomes. Further, a possible reverse causality concern is that production is offshored to an industry that has been experiencing higher rates of productivity and export growth.Footnote 20 We attempt to address the endogeneity concerns using different estimation techniques.

First, exploiting the longitudinal dimension of our data, we use the dynamic panel models to separately estimate each equation of Model 2 (Eqs. 5b, 6b and 7b). The identification is based on 'internal' instruments using lagged levels and differences of the regressors via a two-step system GMM estimator. Further, as our model consists of a system of equations, we use all exogenous variables in the full system of equations as instruments while estimating each equation. The system GMM estimator is well-suited for handling some of the issues relevant to our analysis such as endogenous independent variables, persistence of the dependent variables, fixed effects and the possibility of within-panel heteroscedasticity and autocorrelation. The system GMM combines into one system the regression in differences (Arellano & Bond, 1991) and the regression in levels (Arellano & Bover, 1995). Lagged differences serve as instruments in the level regressions while lagged levels serve as instruments in the difference regressions.

The consistency of the estimators relies on the assumptions that the errors are serially uncorrelated and that the instruments are truly exogenous. These assumptions are tested using Arellano-Bond AR(2) test for autocorrelation (to ensure that errors in the first-difference regression exhibit no second-order serial correlation) and the Hansen (1982) J test of over-identifying restrictions (to ensure that the instruments are exogenous). Given the concern that the proliferation of instruments may lead to loss of efficiency, we chose to keep the number of instruments below the number of groups by restricting the number of lags to be used as instruments or by “collapsing” the instrument matrix (Roodman, 2009). We report robust (Windmeijer) standard errors clustered by industry.Footnote 21

We estimate regressions for two sample groups: (i) full sample consisting of all 112 industries and (ii) manufacturing sub-sample consisting of 56 industries. However, the discussion in the text mainly focuses on the results for the manufacturing sample for three reasons. First, the manufacturing sample includes all explanatory variables introduced in the previous section while the full sample regressions exclude some of the covariates due to non-availability of data. Second, GVCs are found to be more intensive and ubiquitous for manufacturing industries as compared to agriculture and services. Third, manufacturing sector has been the main focus of India’s trade liberalization initiatives since the early 1990s while agriculture and services sectors have been subjected to a greater degree of trade policy restrictions. While the focus of the discussion is on the manufacturing sector, the full sample results are reported in the Appendix as supportive evidence to our findings.

The results obtained from the system GMM regressions for the manufacturing sample are reported in Table 1. The specification tests, reported in the table, are satisfactory. The hypotheses of lack of second-order residual serial correlation (AR2 test) and of no correlation between the error term and the instruments (Hansen test) cannot be rejected, providing support for the dynamic specification as well as for the instruments used in the estimation process. Results from the Wald test of joint significance show that the coefficients are jointly significant. The notes below the table provide the list of right-hand-side variables treated as endogenous in each of the specifications.

The main coefficients of interest α1d, β1d and γ1d consistently show expected signs with statistical significance across different specifications of the estimating Eqs. 5b, 6b and 7b, respectively. As expected, the FVAX ratio \(\left( {\frac{{fva_{j1} }}{{x_{j} }}} \right)\) shows statistically significant positive coefficient in the GMM specification of Eq. 5b. It may be argued that the effect of GVC participation on exports may not be instantaneous. We account for this possibility by using one year lagged value of FVAX ratio and find that the results are similar to that with contemporaneous values. FVAX ratio, lagged or contemporaneous, is treated as endogenous in all specifications.

Thus, consistent with our hypothesis, greater backward participation in GVCs causes the absolute dollar value of gross exports to increase. The estimation results corresponding to Eq. 6b confirm that higher value of gross exports, in turn, causes the absolute value of DVA to increase.Footnote 22 The positive sign of the coefficient γ1d in Eq. 7b suggest that higher values of DVA would lead to higher growth of employment.

The lagged dependent variables turn out to be significant across all specifications of the three equations. The variable wd, representing world demand conditions, yields statistically significant positive coefficient in the export equation, implying that Indian exports respond positively to increase in world demand. However, the variables representing exchange rate adjusted relative prices (rpo and rpv) are either insignificant or yield wrong signs in exports and DVA regressions. Real wages (rw) show statistically significant negative coefficient in specification (7) of the employment equation but loses significance in specification (8). The results are unaffected if the variable rw is treated as endogenous. Labor to output ratio (l), representing the labor-intensity of industries, is positively associated with the size of employment tied to exports. Overall, the results remain the same for the full sample; the main coefficients of interest α1d, β1d and γ1d show correct signs with statistical significance (see Table O1 in the online appendix).

A legitimate concern is that the single equation approach adopted above may be incapable of fully accounting for the structural relationships between the equations.Footnote 23 As economic activities across industries take place through a market equilibrium mechanism and in the same economic environment, the stochastic disturbance terms in the different equations may be correlated. In the presence of contemporaneous correlation of errors across equations and endogenous regressors, the efficiency of parameter estimates can be improved by using the method of three-stage least squares (3SLS). The 3SLS combines the instrumental variables method of 2SLS (to handle endogeneity) with the system estimation of SUR (to account for the covariance across equation disturbances). Joint estimation of the equations improves efficiency also because it can take account of autocorrelation between the error terms of the same observation in different equations.

Another concern is that the FVAX ratio may be characterized by some degree of persistence and slow-moving trends. In order to account for these possibilities, we add Eq. (8) in the 3SLS specifications where the FVAX ratio is regressed on its lagged values.

Thus, the simultaneous system equations model that we estimate using 3SLS methods consists of four rather than three regression equations. By adding Eq. (8) we now explicitly treat FVAX ratio as endogenous in the system of equations; it is instrumented by its lag and other exogenous variables in the system.Footnote 24

Table 2 reports the results from the 3SLS regressions corresponding to both Model 1 and Model 2.Footnote 25 It may be noted at the outset that the main variables of interest in both Model 1 and Model 2, and for both manufacturing sample and full sample, show correct signs with statistical significance. As expected, the FVAX ratio yields statistically significant positive coefficient in Eq. 5a as well as 5b and irrespective of whether its lagged value appearing on the right hand side of Eq. (8) is treated as exogenous or endogenous. The estimated coefficient of the variable \(\ln \left( {x_{jt} } \right)\) in Eqs. 6a and 6b confirms that higher value of gross exports causes the absolute value of DVA to increase. Further, the results suggest that an increase of DVA tied to manufactured exports would lead to an increase of employment.

Consistent with the system GMM results, the 3SLS results of both Model 1 and Model 2 show that an increase in world demand exerts a positive effect on Indian exports. An important difference from the GMM results is that the variables representing exchange rate adjusted relative prices (rpo and rpv) yield expected signs with statistical significance in both models estimated with 3SLS. Further, in both models, the variable representing real wages (rw) show expected result with statistical significance, suggesting that a decline of real wages would lead to an increase in employment. We treat the variable rw as endogenous in some specifications and exogenous in others, but the results do not change significantly. The results confirm that labor to output ratio (l), representing labor-intensity, is positively associated with the size of employment tied to exports.

The variables yd and gvad are included in Model 1 to capture the effects of domestic supply capacity on the respective dependent variables. These variables, treated as endogenous in all specifications, show statistically significant negative coefficients, suggesting that some trade-off is likely to exist between selling in the domestic and foreign markets. The lagged dependent variables, appearing as explanatory variables in Model 2, turn out to be significant across specifications.Footnote 26 Estimation of Model 1 and Model 2 for the full sample gives broadly similar results, particularly for the main variables of interest (see Table 6 in the “Appendix A”).

It may be noted that both sector and year dummies are included in all specifications in Table 2 and Table 6 which implies that identification of the parameters comes from the temporal variation within industries. Nevertheless, as a robustness check, we also estimate Model 1 using 3SLS regressions on first differences of the original variables (see Table 7 in the “Appendix A”). We find that the coefficients α1, β1, and γ1 remain statistically significant with their expected signs.

4.4 Robustness tests with external instruments for backward GVC participation

A concern is that the above analysis, using System GMM and 3SLS estimators, rely only on internal instruments to establish the causal effect of backward GVC participation. We attempt to address this issue by using an external instrument variable (IV) for the FVAX ratio.

Our IV is closely related to the one used by Constantinescu et al. (2019) based on the idea of technological asymmetry in global production networks between “headquarter” economies (the United States, Germany and Japan) and “factory” economies such as China. Baldwin and Lopez-Gonzalez (2015) argue that the headquarter economies export sophisticated parts and components (forward GVC participation) to the factory economies that assemble the final goods for exports (backward GVC participation) using low cost labor. Based on these findings in the literature, our IV for Indian industry j and year t is computed as the one year lagged sum of value-added from the United States, Japan and Germany embodied in China’s exports of industry j.Footnote 27 The underlying assumption is that technological developments and policies in factory economies such as China along with declining trade costs globally were the main drivers of growth in backward GVC participation. Our choice of China for instrument construction is also motivated by its similarity with India in terms of size and relative factor endowments. An additional advantage is that China is among a few developing countries with which India does not share any common Preferential Trade Agreement (PTA), thus reducing the risk of violation of the exclusion restriction through the trade agreement channel.Footnote 28 We find that as expected the IV is significantly and positively correlated with the measure of India’s backward GVC participation and standard tests rule out its weakness. The details pertaining to the data used for constructing the IV is discussed in “Appendix B”.

Table 3 reports the system GMM results for the manufacturing sample where the identification is based on a combination of internal and the external IV. Table O2 in the online appendix gives the results for the full sample. Overall, we find that the results are robust to the inclusion of external IV for FVAX ratio. The elasticity of gross manufactured exports with respect to FVAX ratio is in the range of 0.09 to 0.18, which is lower than what we observed in Table 1 without including the external IV. Further, the use of external IV is found to reduce the standard error of FVAX ratio significantly in Eq. 5b. The elasticity of DVA values with respect to gross exports are in the range of 0.68 to 0.86, suggesting that an increase of gross exports, ceteris paribus, results into higher values of DVA. A higher value of DVA in turn causes the level of employment to increase; the estimates imply that a 10% increase of DVA leads the employment to grow by 3.4% to 5.6%, slightly lower than the values reported in Table 1.

In order to estimate the 3SLS model, we now include our external IV for FVAX ratio as a covariate in Eq. (8). We find that the external IV consistently yields statistically significant positive coefficient in Eq. (8), implying that the IV is relevant and correlated with India’s backward GVC participation across sectors (see Table 4 for the manufacturing sample and Table 6 in the “Appendix A” for the full sample).Footnote 29

It is clear that our findings based on 3SLS regressions are robust to the inclusion of external instruments. Focusing on the results for Model 1, the point estimates imply that a 10% increase of the FVAX ratio leads to an increase of the dollar value of manufactured exports in the range of 5.9% to 7.3%. The elasticity of DVA values with respect to gross exports is in the range of 0.31 to 0.36. Further, based on the estimated coefficient of \(\ln \left( {dva_{j1t} } \right)\) in Eq. 7a, we can infer that a 10% increase of DVA tied to manufactured exports increases employment (direct plus indirect) by about 13%. The estimated coefficients of Model 2 and the full sample results (Table 6 in the “Appendix A”) reinforce our main findings. It is worth noting that the inclusion of the external IV leads to smaller estimated elasticities of the main variables with reduced standard errors.

The large positive impact of export related DVA on employment could be driven by the indirect component of our employment variable ej1; this is likely to be the case given that, as seen in Sect. 3, the manufacturing sector has a strong backward linkage with agriculture and services. While India’s employment is largely concentrated in agriculture and service sectors, it appears that exports from the manufacturing sector help sustain some part of these jobs.

5 Conclusions and implications

Whether participation in global value chains (GVCs) offers a viable path to job creation is a question with significant policy implications. A country is said to be engaged in backward GVC participation when it uses imported inputs to produce for exports. This implies that the share of foreign value added embodied in a country’s gross exports (FVAX ratio) will increase when its backward GVC participation increases.

Using Input–Output (IO) analysis, we find that the FVAX ratio has steadily increased for India during 1999–2000 to 2012–2013, with the increase being particularly sharp for the manufacturing sector during the second half of the 2000s. Thus, we conclude that India’s backward participation in GVCs of manufacturing industries has increased over the years. This period also witnessed a significant increase of the domestic value added (DVA) as well as the number of jobs tied to manufactured exports. Our estimates also show that exports from downstream manufacturing industries generates significant DVA and employment in upstream agriculture and services through domestic backward linkages even though many of the upstream industries, by themselves, do not directly engage in export activities.

Using econometric analysis, we show that a greater backward participation in GVCs, measured by the FVAX ratio, leads to higher absolute levels of gross exports, DVA and employment. This result is robust to a variety of specifications including instrumental variables that deal with endogeneity issues. The results imply that the positive scale and productivity effects of participation in GVCs outweigh any possible negative impact of the same. The characteristics of the jobs created in terms of sector of origin, skill-level and gender composition is an important issue for future research.

Does backward GVC participation imply that low wage countries would perpetually stuck at the lower end of the production processes? This concern is unwarranted as evidence show that a number of emerging economies have transitioned up from basic manufacturing into more sophisticated forms of GVCs over the years (World Bank, 2020). Backward participation in GVCs may eventually lead to product and process upgrading in developing countries through various channels including the flows of technology, intellectual property, and good managerial practices from the parent firms.

Notes

We use the terms “sector” and “industry” interchangeably in this paper. Indian financial year starts from 1st April to succeeding 31st March. For example, financial year 1999–2000 is from 1st April 1999 to 31st March 2000.

The database is constructed making use of all official Indian IO Tables (IOT) and Supply Use Tables (SUT) available for the period under consideration. For the intervening years – the years for which official IOT and SUT are unavailable – the relevant matrices were interpolated by making use of detailed production and trade data from various official sources (for details, see Exim Bank 2016; Veeramani and Dhir 2017).

It may be noted that the FVAX ratio is not a complete measure of a country’s participation in GVCs as it considers only the backward vertical specialization, but not forward linkages. Forward linkages can be taken into account in the framework of Inter-Country Input–Output (ICIO) tables. On the other hand, FAVX ratio can be computed without resorting to ICIO tables and it is consistent with our focus on the impact of backward GVC participation in this paper.

Each element of Leontief inverse matrix indicates input requirement from ith sector if there is a unit increase of the final-use (consumption, foreign trade, or investment) of jth sector’s output.

As pointed out by a referee, the difference between dva1 and gross exports also includes domestic and foreign double counted components, i.e. items that are recorded several times in a given gross trade flow due to the back-and-forth shipments (Koopman et al., 2014). Empirical analysis by Los and Timmer (2018), however, shows that in practice double counts have been minor, typically accounting for less than 1 per cent of DVA. Thus, the error from ignoring double counted components is unlikely to affect our empirical results in a significant way. Double counting can be avoided by exploiting the bilateral source-based decomposition in the framework of ICIO tables. However, the analysis in our study is done using the detailed national IO tables for India and without resorting to an ICIO database as the latter generally uses more aggregated sector classification compared to individual country IO tables. The higher level of sector disaggregation (112 sectors) in our database, compared to that in ICIO tables, help us better capture the heterogeneities in GVC participation across sectors.

Estimates of DVA and FVA embodied in Indian exports can also be obtained from ICIO databases such as World Input Output Database (WIOD), OECD-WTO TiVA database and Eora Global Supply Chain Database. However, these databases do not provide estimates of employment tied to Indian exports. World Bank’s ‘Labor Content of Exports’ dataset provides estimates for 66 countries for selected years but not for India (https://datacatalog.worldbank.org/dataset/labor-content-exports-database). Further, as already noted, ICIO databases use more aggregated sector classification than what we use in this study.

In addition to the two approaches described here, depending on the purpose and perspective, the literature also discusses other possible ways to single out DVA in sectoral exports (see Borin and Mancini, 2019 for a detailed discussion). Keeping in mind the focus of this study, our measures of DVA, FVA and GVC participation (FVAX ratio) are calculated following the methodology proposed by Hummels et al. (2001); as noted by Borin and Mancini (2019), all these measures can be computed using national IO tables that distinguish between imported (without bilateral break up) and domestic inputs. As noted above, empirical operationalization of the alternative approaches, which take into account possible double counted components, requires ICIO tables.

Declining employment intensity of exports is partly driven by improvements in labor productivity over the years and partly as a result of a change in the composition of gross exports in favor of more skill and capital intensive products. While the share of capital-intensive products in India’s merchandise exports increased consistently from about 32% in 2000 to nearly 53% in 2015, the share of unskilled labor-intensive products declined from about 30% to 17% (Exim Bank, 2016). A similar trend was observed in services export basket with an increasing share of skill intensive software and business services at the cost of traditional services.

In contrast to manufacturing, DVA and employment attributed to agriculture exports recorded a significant decline during the second half of the 2000s as compared to the first half. Services sector exhibited a mixed trend in that the value of DVA attributed to exports from this sector recorded a consistent increase throughout the period (barring a one-off decline in 2009–10) while employment declined since 2008–09 following a steady increase in the previous years (see Fig. 3).

For example, Dedrick et al (2010) shows that although the factory-gate price of an assembled iPod from a Chinese factory is $144, only about $4 of this constitutes of Chinese value added with much of the rest being captured by US, Japan and Korea. Similarly, China makes only US$8.46 from the assembly of an iPhone 7 (Dedrick et al., 2018). However, despite the low DVA per unit, the aggregate DVA for China from iPod and iPhone assembly is very high due to the scale effect. Consider the following simple back-of-the-envelope calculation. In 2008 (close to the years for which Dedrick et al. provided the estimates) Apple sold 54.83 million units of iPods. Assuming that the whole assembly was done in China, the aggregate DVA for China from the assembly of this single product was 219 million dollars ($4 × 54.83 million units). iPod and iPhone are just two examples. China has been the assembly hub for thousands of such products, which contributed to its remarkable export growth.

See Gorg (2011) and Wright (2014) for an extensive review of theoretical and empirical literature. Previous studies, dealing with the impact of offshoring, are mostly in the context of developed countries.

Output (value added) deflator for the United States is taken as a proxy for world prices.

Given that the relative price variables rpo and rpv include exchange rate and US industry level prices, the assumption of exogeneity is justified under the ‘small country’ assumption. However, our results are not affected significantly if we treat these variables as endogenous.

We treat this variable as exogenous though treating it as endogenous does not significantly change the results.

The variable yd is measured in gross (rather than value added) terms, which is appropriate as the dependent variable in Eq. (5a) is gross exports. The value of exports is subtracted from total output in order to overcome the issue of reverse causality.

The variable gvad is included in Eq. (6a), instead of yd, because the dependent variable (dvaj1t) is measured in value added (rather than gross) terms. In order to avoid possible reverse causality, we subtract the value of direct domestic value added attributed to exports (\(dva_{j1t}^{d}\)) from total gross value added in the given industry.

In countries with high shares of processing trade, such as China, imports are often driven by exports (Pei, et al, 2011). This is another reason to suspect reverse causality from backward GVC participation to export performance. However, this is not a major concern for our analysis as processing trade does not account for a significant share in India’s exports.

Standard errors in two-step estimation tend to be severely downward biased without Windmeijer’s finite-sample correction (Roodman, 2009).

Equations 6b and 7b, respectively, include the contemporaneous (rather than lagged) values of the explanatory variables, ln (xjt) and ln (dva1jt). This is appropriate as the lagged levels and differences of these variables are used as instruments in the system GMM to correct their endogeneity. In any case, we find that the results remain the same when we use the lagged (rather than contemporaneous) values of these variables.

On the other hand, an advantage of the single equation approach is that specification errors or consequences from the violation of certain assumptions do not spill over from one equation to the estimates of the other equations.

In some of the specifications, we treat the lag of FVAX ratio as endogenous (see the notes below the tables that report the regression results). However, the main results do not change significantly.

Results from the Hausman specification test show that simultaneity problem is indeed present in the system implying that the 3SLS approach is justified.

It may be noted that, as the lagged dependent variable appear on the right hand side in Model 2 but not in Model 1, the interpretation of the point estimates of α1d, β1d and γ1d is not the same as those of α1, β1 and γ1.

Our approach is also similar to Autor, Dorn, and Hanson (2013) who used Chinese import growth in other high income markets as an instrument to identify the labor market impact of Chinese competition in the United States. We used the lagged (rather than current) sum of value added to avoid the risk of violation of the exclusion restriction through year-specific shocks that could be common to both India and China.

Asia Pacific Trade Agreement (APTA), where both India and China are among members, came into force in 2014 with very limited product coverage.

It may be noted that, unlike for GMM and 2SLS, the Hansen test for instrument validity is not available for 3SLS. However, reassuringly, the p-values of the Hansen tests being carried out after estimating our system of equations with GMM (reported in Table 1 and Table 3) as well as 2SLS methods (not reported) suggest that the instruments are exogenous – that is, they are orthogonal to the error term in the structural equation.

References

Amiti, M., Redding, S. J., & Weinstein, D. (2019). The impact of the 2018 trade war on U.S. prices and welfare. NBER Working Paper 25672, Cambridge, MA.

Arellano, M., & Bond, S. R. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58, 277–297.

Arellano, M., & Bover, O. (1995). Another look at the instrumental-variable estimation of errorcomponents models. Journal of Econometrics, 68, 29–52.

Arndt, S. W. (1997). Globalization and the open economy. North American Journal of Economics and Finance, 8(1), 71–79.

Arndt, S. W. (1998). Super-specialization and the gains from trade. Contemporary Economic Policy, 16(4), 480–485.

Autor, D., Dorn, D., & Hanson, G. (2013). The China syndrome: Local labor market effects of import competition in the United States. American Economic Review, 103(6), 2121–2168.

Baldwin, R., & Tomiura, E. (2020). Thinking ahead about the trade impact of COVID-19. In R. Baldwin, & B. W. di Mauro (Eds.), Economics in the time of COVID-19, VoxEU.org Book. London: CEPR Press.

Baldwin, R., & Lopez-Gonzalez, J. (2015). Supply-chain trade: A portrait of global patterns and several testable hypotheses. The World Economy, 38(11), 1682–1721.

Baldwin, R., & Robert-Nicoud, F. (2014). Trade-in-goods and trade-in-tasks: An integrating framework. Journal of International Economics, 92(1), 51–62.

Borin, A., & Mancini, M. (2019). Measuring what matters in global value chains and value-added trade (Policy Research Working Paper No. 8804). World Bank, Washington, DC: World Bank Group.

Cali, M., Francois, J., Hollweg, C. H., Manchin, M., Oberdabernig, D. A., Rojas-Romagosa, H., Rubinova, S., & Tomberger, P. (2016). The labor content of exports database (Policy Research Working Paper 7615), World Bank.

Chen, X., Cheng, L. K., Fung, K. C., Lau Lawrence, J., Sung, Y.-W., Zhu, K., Yang, C., Pei, J., & Duan, Y. (2012). Domestic value added and employment generated by Chinese exports: a quantitative estimation. China Economic Review, 23(4), 850–864.

Cheng, H., Jia, R., Li, D., & Li, H. (2019). The Rise of robots in China. Journal of Economic Perspectives, 33(2), 71–88.

Constantinescu, C., Aaditya, M., & Michele, R. (2019). Does vertical specialization increase productivity. The World Economy, 42, 2385–2402.

Dedrick, J., Greg, L., & Kenneth, L. K. (2018). We estimate China only makes $8.46 from an iPhone—and that’s why Trump’s trade war is futile. The Conversation, July. https://theconversation.com/we-estimate-china-only-makes-8-46-from-an-iphone-and-thats-why-trumps-trade-war-is-futile-99258.

Dedrick, J., Kenneth, L. K., & Greg, L. (2010). Who profits from innovation in global value chains? A study of the iPod and notebook PCs. Industrial and Corporate Change, 19(1), 81–116.

EXIM Bank of India. (2016). Inter-Linkages between Exports and Employment in India (EXIM Bank Occasional Paper 179). https://www.eximbankindia.in/Assets/Dynamic/PDF/Publication-Resources/ResearchPapers/Hindi/65file.pdf.

Formai, S., & Vergara Caffarelli, F. (2016). Quantifying the productivity effects of global value chains. Rome: Banca d'Italia.

Görg, H. (2011). Globalization, offshoring and jobs. In M. Bacchetta, & M. Jansen (Eds.), Making globalization socially sustainable (pp. 21–48). Geneva: ILO and WTO.

Grossman, G. M., & Rossi-Hansberg. (2008). Trading tasks: A simple theory of offshoring. American Economic Review, 98(5), 1978–1997.

Hansen, L. P. (1982). Large sample properties of generalised method of moment estimators. Econometrica, 50, 1029–1054.

Hummels, D., Ishii, J., & Yi, K. M. (2001). The nature and growth of vertical specialization in world trade. Journal of International Economics, 54(1), 75–96.

Javorcik, B (2020). Global supply chains will not be the same in the post-COVID-19 world. In R. Baldwin, & Evenett (Eds.), COVID-19 and trade policy: Why turning inward won’t work (pp. 111–116), VoxEU.org eBook. London: CEPR Press.

Jones, R. W., & Kierzkowski, H. (1990). The role of services in production and international trade: a theoretical framework. In R. Jones, & A. Krueger (Eds.), The political economy of international trade (pp. 233–253). Oxford: Basil Blackwell.

Jones, R. W., & Kierzkowski, H. (2001). A framework for fragmentation. In S. Arndt, & H. Kierzkowski (Eds.), Fragmentation: New production patterns in the world economy (pp. 17–34). Oxford: Oxford University Press.

Koopman, R., Wang, Z., & Wei, S. J. (2014). Tracing value-added and double counting in gross exports. American Economic Review, 104(2), 459–494.

Leontief, W. (1936). Quantitative input–output relations in the economic system of the United States. Review of Economics and Statistics, 18, 105–125.

Li, B., & Liu, Y. (2014). Moving up the value chain. Boston College.

Li, H., Li, L., Wu, B., & Xiong, Y. (2012). The end of cheap Chinese labor. Journal of Economic Perspectives, 26(4), 57–74.

Los, B., & Timmer, M. P. (2018). Measuring bilateral exports of value added: A unified framework. NBER Working Paper No. 24896.

Los, B., Timmer, M. P., & De Vries, G. J. (2015). How important are exports for job growth in China? A demand side analysis. Journal of Comparative Economics, 43(1), 19–32.

Pei, J., Dietzenbacher, E., Oosterhaven, J., & Yang, C. (2011). Accounting for China’s import growth: A structural decomposition for 1997–2005. Environment and Planning A: Economy and Space, 43(12), 2971–2991.

Rasmussen, C., & Johnson, M. (2015). Jobs supported by exports 2014: An update (U.S. Department of Commerce, Office of Trade and Economic Analysis, International Trade Administration).

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in stata. Stata Journal, 9(1), 86–138.

Taglioni, D., & Winkler, D. (2016). Making global value chains work for development. Trade and development series. World Bank.

Timmer, M. P., Erumban, A. A., Los, B., Stehrer, R., & de Vries, G. J. (2014). Slicing up global value chains. Journal of Economic Perspectives, 28(2), 99–118.

Timoshenko, O. A. (2015). Learning versus sunk costs explanations of export persistence. European Economic Review, 79, 113–128.

Upward, R., Zheng, W., & Jinghai, Z. (2013). Weighing China’s export basket: The domestic content and technology intensity of Chinese exports. Journal of Comparative Economics, 41(2), 527–543.

Veeramani, C., & Dhir, G. (2017). Domestic value added content of India’s exports: Estimates for 112 sectors, 1999–2000 to 2012–2013. (Mumbai: Indira Gandhi Institute of Development Research Working Paper No 2017–008). Available at http://www.igidr.ac.in/igidr-working-paper-domestic-value-added-content-indias-exports-estimates-112-sectors-1999-2000-2012-13/.

World Bank (2020). World development report 2020: Trading for development in the age of global value Chains. World Bank.

Wright, G. C. (2014). Revisiting the employment impact of offshoring. European Economic Review, 66(C), 63–83.

Acknowledgements

The authors would like to thank two anonymous reviewers of this journal for their helpful comments and suggestions on an earlier draft of this article. They are also grateful to Devashish Mitra, Krishnamurthy Subramanian, S Chandrasekhar, Prema-Chandra Athukorala, and participants at the conferences on “Experiences and Challenges in Measuring Income, Inequality and Poverty in South Asia” (International Association for Research in Income and Wealth and ICRIER New Delhi) “International Trade, Specialization and Growth - David Ricardo and Contemporary Perspectives” (Jadavpur University, Kolkata) and “Growth and Productivity of Indian Economy: Contemporary Issues” (Delhi School of Economics) for comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix A

Appendix B: Construction of External Instrument (IV) for FVAX ratio

The instrument for backward GVC participation (FVAX ratio) for Indian industry j and year t is computed as follows:

where the numerator is one year lagged sum of value-added from the United States, Japan and Germany embodied in China’s (c) exports of industry j’s products and the denominator is China’s gross exports of industry j’s products to the world. We use China-specific data available in UNCTAD-Eora Global Value Chain Database to compute the IV. The detailed sector classification in China’s IO tables is matched with the 112 sector classification for India. Based on this concordance table, we obtain the corresponding values of IV for each of the 112 sectors in our database.

About this article

Cite this article

Veeramani, C., Dhir, G. Do developing countries gain by participating in global value chains? Evidence from India. Rev World Econ 158, 1011–1042 (2022). https://doi.org/10.1007/s10290-021-00452-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-021-00452-z