Abstract

We first estimate country- and sector-specific technology frontiers within the EU, and show that countries that joined the Union in 2004-7 clearly stand below the lower envelope frontier of the older members in their use of skilled and unskilled labor. We interpret this as due to past barriers to technology adoption, barriers that are likely to be removed by the integration process. With the narrowing of the technology gap bound to follow, it is likely that firms and physical capital will be attracted to these economies by improved profitable prospects. Could such a technological upgrading trigger massive enough relocation of firms and outflows of capital to be detrimental to the welfare of workers in older EU member countries? We provide a quantitative exploration of this issue using a calibrated intertemporal multisector general equilibrium model of the EU27. We show that the results depend crucially on the value of the intertemporal substitution elasticity in households’ preferences: a strong enough increase in the EU-aggregate stock of productive physical capital is necessary for the capital outflows not to be achieved at the expense of workers in old-member states. Though maybe not the most likely, the threshold value of this elasticity below which the EU-integration wave could turn into a non-Pareto-improving move is shown to lie within a statistically feasible interval.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The literature on cross-country economic performances has now accumulated ample evidence on existence of large gaps in technology usage between economies. Among the different theories put forward to explain such gaps, two strands of literature single out as particularly appealing. The first highlights the existence of barriers to technology adoption, and identifies a large variety of factors that contribute to reduce efficient use of knowledge and innovation in production. Among the important contributions to this ‘barriers to technology adoption’ literature, Parente and Prescott (1994, 2000) emphasize restrictions to foreign trade and limited access to international capital markets, Acemoglu and Robinson (2006) highlight the role of political and institutional organization, Alesina et al. (2018) single out the role of labor market regulations, Comin and Hobijn (2004) underline differences in human capital as a robust contributing factor. The importance of factor endowments and complementarities in cross-country technology diffusion are also emphasized by the related ‘appropriate / endogenous technology’ literature. Based on the seminal work of Atkinson and Stiglitz (1969), influential papers include, among others, Diwan and Rodrik (1991), Basu and Weil (1998), Acemoglu and Zilibotti (2001), Caselli and Coleman (2006), Vandenbussche et al. (2006) and Acemoglu (2015). The basic idea in this literature is that it may be optimal for firms in countries with different factor endowments, to choose different technologies. One key implication then, is the existence of an efficiency frontier (rather than a single ‘state-of-the-art’ production function): with technology choices endogenous, differences in factor endowments will induce countries to pick optimally different technologies on a frontier.

It should be apparent, in view of \(20^{th}\) century history, that the factors highlighted as causing barriers to technology adoption are likely to have contributed to substantial lags in technological efficiency in many recent EU member states, prior to their joining the Union. The fact that most countries –all except Cyprus and Malta– that joined the EU in 2004-7 were part of the Soviet bloc, indeed suggests that observed lags in technology adoption have been caused by decades of restrictive access to foreign trade and capital, of inefficiently organized labor and goods markets, of refractory institutional bias towards innovative creative destruction. In effect, all these impediments to efficient technology adoption have been highlighted to be among major factors contributing to the collapse of outputs during the decade following the breakdown of the Soviet Union in 1991 (Campos and Coricelli, 2002). Yet in the aftermath of this drastic shock, several of these countries, thanks to a relatively stronger industrial inheritance and relatively high stock of human capital, showed early signs of growth out of this decade of ‘transformational recession’ (Kornai, 1994). This, together with reforms implemented in hope of a future accession to the EU, has induced reasonably optimistic forecasts by early studies such as Fischer et al. (2016) suggesting the possibility for these countries, to converge—albeit slowly—to the technology frontiers of the lower-income EU member states such as Greece, Portugal and Spain.

Since then, actual integration within the EU has, de facto, not only implied removal of the barriers to trade –referred to as ‘shallow integration’– but also involved significant economic and institutional transformation aiming at ‘deeper integration’: elimination of restrictions to capital flows, coordinated factor market regulations, tighter enforcement of intellectual property rights, implementation of harmonized competition policies and product standards etc. In short, elimination of most factors responsible for barriers to technology adoption. On balance, and despite the heterogeneity of experiences, the widening of the European integration through each new wave has produced substantial growth and productivity payoffs for most new members (Campos et al. 2019). It seems therefore a cautiously realistic –if not conservative– prediction that, as a consequence of joining the EU, the economies of the 5th enlargement wave should be able to expand the set of their available technology choices and accede to a frontier close to that of the lower-income EU member states in some not too far away future.

Starting from this rather conservative conjecture, the question we address in this paper concerns the consequences for the incumbent EU members of this 2004-7 integration wave. Obviously, for a single country joining the EU, the ‘deep integration’ shock implemented as a positive productivity shift, would only impact favorably on its welfare, with almost no effect on the rest of Europe. The enlargement episode of 2004-7, however, involved simultaneous integration of a large set of countries of which some have populations of significant sizes;Footnote 1 the adoption of new and higher-productivity technologies in these new member states could trigger some possibly massive migration of capital and firms out of the old members, with nontrivial indirect effects, in particular on factor prices, in these incumbent countries. Can we be confident that such a shock will not redistribute welfare at the expense of labor –and in particular of the lower-skilled workers– in incumbent member states? In the current context of surging anti-globalization mobilization, of widespread anti-EU resentment and of rising populism that threaten the future of the European integration project, understanding these effects and assessing their potential magnitudes is an important task for economists. Building on the ‘barriers to technology adoption’ literature, and drawing on ‘appropriate technology’, our contribution in this paper is to shed light on those issues, and to provide quantitative estimates by means of counterfactual numerical experiments. We first apply the cross-section regression methodology of Caselli and Coleman (2006) on EU data for the year following the enlargement wave. We estimate the country and sector specific technology frontiers jointly with the optimal location choices on these frontiers, conditional on endowments of skilled and unskilled labor (the appropriate technology choice). We document a clear pattern of systematic efficiency gaps between older member states and those that joined the EU in 2004-7. We then generate, for each sector, a lower envelope of the incumbent EU members’ technology frontiers and compute the distance of each new member to this lower envelope frontier. We interpret these distances, and therefore the gaps in total labor productivity (hereafter TLP), as providing rather conservative measures of the efficiency losses caused by pre-membership barriers to technology adoption inheritance. In absence of these barriers, there is no reason why these countries would not be able to locate themselves on this lower envelope frontier.

Implementation of such a technology shock in a numerical model is then straightforward in the form of an upward shift in TLP. We provide a quantitative assessment by means of numerical counterfactual simulations using a calibrated general equilibrium model of the EU. Because the shock is likely to differ between countries and industries, we want the model to capture international and inter-sectoral reallocation effects. Because adoption of new technologies will take time, we want such a model to embrace a somewhat long term perspective; however, because individual agents are likely to expect these future effects and to take them into account in building their decisions in the transition path, we need a model that captures intertemporal reallocation effects induced by forward looking agents. The model we use is a multi-period decentralized intertemporal (agents make optimal savings decisions under perfect foresight) multi-country (each of the twenty-seven EU national economies) and multi-sectoral (we distinguish ten different industries, some of which are characterized by increasing returns to scale and monopolistic competition) set-up.

The paper is organized as follows. In Sect. 2, we provide econometric estimates of country and sector specific technology frontiers in the immediate aftermath of the 5th EU enlargement wave, together with locations on these frontiers from which we infer the amplitude of the conjectured technology upgrading shock due to the removal of these barriers. In Sect. 3, we describe the numerical set-up used for our counterfactual experiments, and explore the basic mechanisms at work using a two-period version of the model. The results of the numerical exploration are presented and discussed in Sect. 4. Section 5 concludes. "Supplementary material: Appendix 1" provides a formal description of the general equilibrium model; a discussion of the parameter values and of the data is provided in "Supplementary material: Appendix 2". "Supplementary material: Appendix 3" reports some complementary simulation results.

2 Evaluation of technological gaps within the EU

2.1 Econometric measurement of country and sector specific technology frontiers within the EU

2.1.1 Estimation methodology

Caselli and Coleman (2006) —hereafter CC (2006)—combine the theories of factor-endowment based ‘appropriate technology choices’ and of ‘barriers to technology adoption’ in a single framework to empirically back-out country-specific technology frontiers and hence, each country’s relative position w.r.t. the global frontier defined as their upper-envelope. We follow their approach, assuming a CES technology that combines the two types of labor, skilled (sk) and unskilled (un), to produce a labor composite input (Lab), and we write:Footnote 2

where i is the country index. Here, \(L_{i,l}\) denotes labor inputs of type \(l\in (sk,un)\) in country i with the associated \(A_{i,l}\) parameters converting raw quantities into efficiency units, \(\rho ^{Lab}\) is a parameter that characterizes substitutability (with \(\sigma ^{Lab} =1/(1+\rho ^{Lab})\) the substitution elasticity), and \(\theta \) is a shift parameter (initially equal to unity by choice of units) measuring TLP. Parameters \(A_{i,l}\) vary across countries as a result of endogenous ‘appropriate’ technology choices from a menu of different production methods on a country-specific technology frontier, by firms facing different factor endowments and levels of technology adoption. CC (2006) suggests computing the efficiency parameters \(A_{i,sk}\) and \(A_{i,un}\) by combining the above CES technology with the skill premium (\(w_{i,sk}/w_{i,un}\)) under assumptions of optimizing behavior by firms and full employment.Footnote 3 Footnote 4 Using a cross-section of country data set, the econometric procedure makes it possible to estimate the parameters \(\gamma _{i}\) and \(B_{i}\) of a country specific technological frontier of the form:

simultaneously with its optimal location \(A_{i,sk}\) and \(A_{i,un}\) on its own frontier, conditional on a common estimated curvature parameter \(\omega \) and an ex-ante chosen value of the substitution elasticity \(\sigma ^{Lab}\). The equation to be estimated, resulting from the constrained optimal technology choice, takes the following form:

The regression delivers as an estimated coefficient the value of \(\frac{-\rho ^{Lab}}{\omega +\rho ^{Lab}}\); using this estimate and the chosen value of \(\sigma ^{Lab}\), one can infer the value of \(\omega \). The parameters \(\gamma _{i}\), can then be recovered for each country from regression residuals. Equation (2) then backs-out each country’s \(B_{i}\), hence the country-specific technology frontier. All estimated parameters from equation (3) have to be positive.Footnote 5 Differences in the estimated values of the \(B_{i}\) parameters will clearly provide a measure of the technology gaps that exist between countries at a specific date.

Aggregate country data may cover important sectoral differences (among which, the type of competition prevailing), which we do not want to neglect in this paper: we shall therefore depart from CC (2006) by adapting their methodology to a multisector setup and use the sector-specific version of Eqs. (2, 3) to back-out the \(\gamma _{i,s}\) and \(B_{i,s}\) for each sector in each country. This essentially requires a definition of factor endowments for each sector. Imperfect as it is, we make the assumption that intersectoral mobility of labor is low enough for actual employment in a sector to be a reasonably good proxy for factor endowments as perceived by an individual firm in the same sector.

Through out this paper, the aggregate economy will be partitioned into the following ten sectors of activity: Primary; Food, Beverages and Tobacco; Textiles and Textile Production; Chemicals and Plastics; Basic and Fabricated Metals; Electrical and Optical Equipment; Transport Equipment; Construction; Other Manufacturing; and Services.

2.1.2 Estimation results

The CC (2006) econometric methodology requires that we first generate, for all EU member countries and for each sector, the values of the efficiency parameters, and use the FOC of the maximization problem of the representative firm so that the inputs to production from our data set are consistent with the output and skill-premium in each country/sector.Footnote 6 The underlying theoretical assumptions therefore preclude using data from periods of severe macroeconomic turmoil; years posterior to 2009, clearly disqualify for this purpose, presumably also the years that immediately precede the financial crash. We therefore choose year 2007 as the most recent best candidate.Footnote 7

As Fig. 1 reveals, though the numbers do differ across sectors –in some cases significantly– a common pattern clearly emerges from these 2007 data. To conserve on space, we only report details for a subset of sectors, but the following observations apply to all. We see from this figure that old EU-member countries tend to be concentrated on the upper-right, revealing rather similar levels of absolute technological efficiency. As is no surprise, within this group of countries, the German economy stands out with a relatively skill-biased technology, suggesting higher levels of skill abundance. In contrast, firms in the Mediterranean countries tend to make more unskilled labor-intensive technology choices consistent with relatively high unskilled labor abundance. In sharp contrast, new member countries display much higher heterogeneity in their technology choices, in terms of both relative and absolute factor efficiencies. Among these, three groups distinctly emerge: the first group, with Slovakia as an extreme, reveals highly skill-biased labor technology choices reflecting relatively abundant skilled labor endowments. At the other extreme are Bulgaria and Romania, both economies characterized by low levels of skilled labor. In between these groups are Cyprus and Slovenia which not only differ by their more balanced labor technology choices but also by higher levels of absolute total labor efficiency.

The next step of the methodology consists in using these efficiency parameters \(A_{i,l,s}\) in cross-EU country regressions (the sector specific version of Eq. (3)) in order to back-out technology frontiers (the sector specific Eq. (2)). We perform these regressions conditional on a common ex-ante specified value of \(\sigma ^{Lab}=1.4\), a reasonable benchmark value.Footnote 8 The resulting parameter values that define the country/sector specific technology frontiers are reported in Table 1.Footnote 9 Here again, to conserve on space, we only report details for the subset of six sectors displayed in Fig. 1.

The B parameters computed for old member states are, on average, 75% higher than those of new members, and also show 33.6% lower variability, indicating relatively homogeneous technology choice sets for the old members. Also observe that for the subgroup of old members excluding the Mediterranean countries, the technology choices are quite similar. In contrast, the (relative) variability of the B parameters and of the efficiency ratios, are much higher for the new members.

It is illuminating to compute, for each sector, the upper and lower envelopes of the estimated technology frontiers of the old member states. Because what we learn from these is qualitatively identical for all sectors, we display in Fig. 2 the graphs for the same subset of sectors as in Fig. 1. Not surprisingly, Germany lies on the upper envelope in sectors including ‘Electrical and Optical Equipment’ and ‘Transport Equipment’, Great Britain outperforms others in ‘Food, Beverages and Tobacco’, ‘Textiles and Textile Products’, and Luxembourg in ‘Services’. Not surprisingly either, Greece and Portugal generally lag behind, being either on, or very close to, the lower envelope in all sectors. Worth mentioning is the position of Spain that performs almost as well as Italy in most sectors.

In Fig. 3, we report (for the same selected sectors) the efficiency position of the new EU-member states relative to the lower technology envelope of the older member countries. All the new member states are significantly below this frontier, with the exception, in a few sectors, of Slovenia and, to a lesser extent, Cyprus. (Note that in these graphs, the axes report logs.)

2.2 Assessment of efficiency costs due to pre-integration barriers to technology adoption

Our estimation results provide measures of systematic technology differences between old and new EU member countries in 2007. Though these differences clearly reflect heterogeneity in factor endowments, as suggested by the ‘appropriate-technology’ literature, other complementary explanations are needed to rationalize such efficiency gaps, among which existence of barriers to technology adoption is the most likely. Causes of such barriers are surely numerous, country specific and difficult to apprehend individually, but the joint efficiency cost of these barriers is likely to be a function of the distance between the technology frontier position of new and old member states, prior to the integration of the former into the Union. To make this ‘barriers-to-technology-adoption induced efficiency gap’ a useful concept requires a definition of a reference efficiency frontier: a rather natural –and arguably conservative– candidate is the lower technology envelope of incumbent member states. We suggest attributing to pre-integration barriers to technology adoption the responsibility for the new member’s position below the lower envelope technology frontier of the incumbent member states. The implied efficiency lags can be computed from Table 1 (extended to include all sectors); the results are reported in Table 2. The reported distances quantify (in the form of a multiplicative factor) the shift in TLP parameters \({\theta }\) (see Eq. (1)) that would be required, everything else equal, to place new member states on the lower envelope technology set in each sector. Deep integration within the EU should result in the elimination of these barriers, and hence, span such a shift over some time horizon. We explore in the rest of the paper the consequences on the EU27 of such a technological upgrading using a numerical set-up which we describe in the next section.

3 The numerical set-up for counterfactual evaluations

3.1 The calibrated general equilibrium model

We provide here a non-technical overview of our calibrated general equilibrium model, and refer the reader to "Supplementary material: Appendix 1" for a formal presentation.

The year we choose for calibration is of course the same as the one used in our econometric estimations, 2007.Footnote 10 In this kind of exercise, the choice of an appropriate base year is both important and difficult, particularly so, when the model is dynamic and calibration assumes the economy in a steady state. We choose year 2007 for the following reasons. 2007 is three years after the most important enlargement wave of the Union, with Cyprus, the Czech Republic, Estonia, Latvia, Lithuania, Hungary, Malta, Poland, Slovakia and Slovenia joining in. Hence, we can reasonably assume that most of the direct reallocation effects induced by the removal of trade costs and restrictions (the effects of ’shallow integration’) are already essentially reflected in the data for these countries. 2007 is also the year Bulgaria and Romania have formally joined the Union. Even though many trade barriers are likely to have been in effect softened prior to that date, and their removal anticipated, picking a base year a few years later would seem to have been more appropriate (in particular, more consistent with our assumption of negligible constant trade costs). However, 2007 is also prior to a decade of severe recession, any year of which would clearly fail to qualify as a proper candidate for an approximate steady state equilibrium.Footnote 11 For these reasons, year 2007 appears to be the most recent best compromise for our purpose.

The model structure is of the infinite horizon decentralized intertemporal optimization type. Because of its size, it is time-aggregated and solved over a restricted number of grid-points on the time axis, \(t=t_{1},\ldots ,T\) with steady-state restrictions imposed at the end of the finite time horizon: see Mercenier and Michel (1994) on time aggregation issues in intertemporal models. We are interested in deviations w.r.t. a reference path, and therefore abstract from exogenous trends, so that the steady state is stationary.

The model includes the 27 member states of the European Union in 2007 (hereafter E27); all countries have identical structures; the model is closed by a ‘rest-of-the-world’ (hereafter RoW) that is kept exogenous except for the volume of its bilateral trade which is price responsive. The RoW prices serve as numeraire.

In each country, all national households are aggregated into a single representative agent. This agent is endowed with two types of labor, skilled and unskilled; both are in fixed supply within national boundaries but allocated endogenously –using a constant elasticity of transformation (hereafter CET) allocation frontier– to different sectors of activity of the national economy in response to wage differentials. Intersectoral reallocations are quite restricted in the very short run but made easier over the rest of the time horizon by choice of larger transformation elasticity values. Households also own assets in the form of bonds and claims on physical capital, the latter which they accumulate by endogenous savings decisions made by lifetime utility maximization, with consumption smoothing on the basis of the expected returns from future capital ownership.Footnote 12 The intertemporal preferences impose constant inter-period substitution elasticity:

where i is the country index, t is time, \(\sigma \) the elasticity of intertemporal substitution and \(\Psi _{i}^{t}\) a (calibrated) discount factor. Dynamic optimization, performed assuming forward-looking expectations, yields the usual intertemporal consumption smoothing scheme:

where \(p_{i,t}^{C}\) is the aggregate-consumption price index at time t, \(p_{t}^{Inv}\) is the unit cost of investment goods, \(\rho \) is the rate of time preference, and \(r_{t+1}^{K^{H}}\) is the rate of return on private physical capital expected at time t to be reaped at time \(t+1\):

with \(w_{t+1}^{K^{H}}\) the rental price of a unit of private capital at time \(t+1\), \(\kappa \) a parameter that converts annual flow services of private held capital (\(K_{i,t}^{H}\)) into a stock, and \(\delta \) the depreciation rate assumed constant.Footnote 13 Observe that in these equations, variables \(r_{t}^{K^{H}}\), \(p_{t}^{Inv}\) and \(w_{t}^{K^{H}}\) appear without country index i; the reason is that both prices \(p_{t}^{Inv}\) and \(w_{t}^{K^{H}}\) are common to all countries for reasons explained below.

Aggregate household consumption is—as are all other components of the demands for goods, final and intermediate—allocated to different industries using optimal demand systems derived from multi-level CES.

On the production side, we distinguish between ten broad sectors of activities. For a subset of these industries (namely: ‘Primary’, ‘Other Manufacturing’ and ‘Services’) we assume perfect competition with firms making use of constant returns to scale (hereafter CRS) production functions to produce homogeneous goods; the technology combines intermediate goods and production factors —capital, skilled and unskilled labor– through nested-CES structures. The remaining industries (namely ‘Food, Beverages and Tobacco’, ‘Textiles and Textile Products’, ‘Chemicals and Plastics’, ‘Basic and Fabricated Metals’, ‘Electrical and Optical Equipment’, ‘Transport Equipment’ and ‘Construction’) will, depending on the model version used, either be treated similarly, or assumed to be populated by symmetric (within national boundaries) firms operating increasing returns to scale (hereafter IRS) technologies to produce differentiated varieties within Nash games in prices (i.e., monopolistic competition) with long-run zero profits ensured by free entry/exit.Footnote 14 Individual monopolistically competitive firms face fixed production costs –assumed in the form of a real amounts of foregone output– which add to variable costs, the latter determined from nested-CES structures identical to the ones used in CRS sectors. Of particular interest in this nested structure is the value added, produced by a CES technology combining capital and an aggregate composite labor factor, the latter itself resulting from a CES aggregation of skilled and unskilled labor as displayed in equation (1): this is of course where the technological upgrading shock is to be implemented, by exogenously shifting the values of the TLP parameters \(\theta _{i,s,t}\) to new technology frontiers.

The public sector is present in the model for base year replication purposes, but assumptions are made to keep its behavior as neutral as possible. In particular, the stock of public bonds is held constant and public consumption roughly proportional to GDP by being defined residually.

Importantly, the model captures two characteristic features of modern capital: we first want that, because of low transaction costs and efficient banking, financial capital be extremely mobile; under perfect foresight, this implies that in equilibrium, no systematic differences exist between expected rates of returns on capital within the EU: this is why the variable \(r_{t+1}^{K^{H}}\) was introduced with no index i in Eqs. 5, 6. We also know that rental costs of physical capital are far from being equalized across sectors and countries due to relocation costs. We capture these features by pooling all the physical capital owned by E27 households into a single stock \(K_{E27}^{{}}\) –this ensures that all capital owners earn the same rental price \(w_{t}^{K^{H}}\) for their physical assets. The aggregate stock is then optimally allocated (by maximizing the rental revenues from the pooled capital) to each country within the Union, and to each sector within each country, subject to a two-level nested CET constraint.Footnote 15 The values of the transformation elasticities govern the concavity of the allocation frontiers, and therefore provide a convenient characterization of how mobile physical capital is, both internationally (the upper-level CET, with elasticity denoted \(\sigma _{E27}^{K}\)), and intersectorally (the lower-level CET, with elasticity denoted \(\sigma _{i}^{K}\)). Yet, calibration of the CETs on base year data ensures that the simulated counterfactual equilibrium allocation remains anchored to its initial geographical distribution.Footnote 16 Pooling all claims on physical capital into a single European stock also obviously requires pooling investment –so that \(p_{i,t}^{I}=p_{t}^{I}\) consistently with the assumption that capital owners expect the same rate of return on their physical assets throughout Europe. This imposes some mild technical constraints on the modeling of the composition of the investment good: see "Supplementary material: Appendix 1".

Each country’s time-dependent aggregate (final + intermediate) demand \(AD_{i,s,t}\) for an industry’s good s is converted into a trade matrix (with non-zero diagonal elements) using a CES allocation structure; omitting the time index: \(AD_{i,s}=\) CES\((\cdots ,\) \(E_{i^{\prime },i,s}\) \(,\cdots )\) where \(E_{i^{\prime },i,s}\) denotes the demand by country i of the good produced by a firm of country \(i\prime \), industry s. In CRS sectors (where all producers can be aggregated into a single firm), this is the well known Armington assumption; in IRS sectors, the structure is a Dixit-Stiglitz specification applied to trade.

The model is closed by imposing that supplies and demands balance on all markets. In IRS sectors, the geographic location of firms is endogenous, with the equilibrium number of producers in each country determined by entry or exit such that zero super-natural profits result in the long run; in contrast, in the first period, the number of firms is held fixed; in between, industry concentrations adjust gradually using an exogenous interpolation mechanism. In case of shocks, therefore, non-zero profits exist along the transition path, which are redistributed to capital owners in proportion to their contribution to the E27 aggregate capital stock. With budget constraints imposed for all European agents, it is also satisfied for the RoW by Walras’ law: we systematically test that this is indeed the case.

The national welfare index we report, \(\psi _{i}\), is defined as equivalent variation (EV):

where \(C_{i,_{0}}\) is initial steady-state (base-year) value of aggregate consumption.

The calibration of the model is made conditional on chosen values for a set of parameters, most of which are substitution/transformation elasticities: the values used are reported in "Supplementary material: Appendix 1", and are essentially those adopted in Rhomolo-v2, the spacial calibrated GE model of the European Commission (see Mercenier et al. 2016).Footnote 17

Once the model is calibrated, it can be used to simulate the changes in total labor productivity reported in Table 2, that are conjectured to follow ‘deep integration’ with the EU. Because this technological catch-up will take time to materialize, we shall spread this exogenous shift in TLP over the time horizon in a way that is part of the simulation designs discussed later. A counterfactual experiment consists in computing the equilibrium allocation and the price system on the whole time horizon, consistent with the new time paths of the total-labor-productivity shift parameters \(\theta _{i,s,t} \).Footnote 18

Readers familiar with the new economic geography literature will have noted that our set-up is an intertemporal highly sophisticated version of the so-called ‘footloose capital with vertical linkages’ model (see e.g. Baldwin et al. 2003). In particular, we assume no international labor mobility, which might seem at odds with recent intra-European migration history. The reason for this is twofold. First, we want to limit the risk of equilibrium multiplicity that (as we know from Krugman, 1991; Krugman and Venables, 1995 and others) generically characterize general equilibrium structures with monopolistic competition and endogenous geographical location of households and firms. Indeed, in absence of numerical procedures to identify all possible equilibrium configurations and of theoretically sound mechanisms to pick the ‘most appropriate’ among those possible outcomes, the risk is that the selection be arbitrarily made by a numerical algorithm (see Mercenier, 1995 for a numerical illustration). By assuming no international mobility of labor we implicitly restrict our numerical search to a neighborhood of the initial –real world– equilibrium configuration on which the model is calibrated, a sound strategy. Secondly, we are performing a counterfactual experiment: the purpose is not to forecast nor to explain what is currently being observed (among other things, some intra-EU migration due to pre-existing absolute wage differences), but rather to evaluate how –and by how much in percentage terms—an exogenous shock is likely to deviate the economy from its initial equilibrium, everything else equal. What the counterfactual experiment will tell us, among other things, is if the specific shock is likely to improve relative wages in the new member states, and therefore if it will contribute to reduce rather than to increase the flows due to pre-existing absolute wage differences.

3.2 The basic mechanisms at work

The model is complex, in particular because of the somewhat unusual blend of trade and intertemporal macroeconomic mechanisms that it mobilizes. In order to understand the basic mechanisms at work, it is useful to time aggregate the model into a two period version: a short term, with intra-period equilibrium determined at year \(t_{1}\), and a long term determined by intra-period equilibrium at year \(t_{2}=T\). The two periods are separated by a span of 30 years and linked together by wealth accumulation constraints through intertemporal optimal choices under perfect foresight; long term stocks are accumulated by the forward Euler method. Because the technical upgrading that follows integration within the EU will take time to materialize, the TLP shock is implemented at \(t_{2}\): the time profiles of the forcing parameters \(\theta _{i,s,t}\) are step functions. The effects of these productivity shifts are however anticipated by forward looking agents, so that they feed back into the short term as all European households—of new and incumbent members alike– adjust to the new environment made possible by the EU enlargement.

3.2.1 New members

For the new member states, which we first consider, the adjustments are quite straightforward to anticipate. In addition to boosting the joining members’ long-term competitiveness, the shift in future TLP will induce relative scarcity of \(t_{2}\)-capital in these economies, and therefore push upwards the long-term rental price of the physical factor. The optimal time profile of private consumption will consequently tilt at the expense of short term levels as households substitute intertemporally. Simultaneously, an upward shift of private wealth should follow. Also, attracted by extremely profitable returns, physical capital will flow from older to new member states in the long term making capital (\(K_{t_{2}}^{sup}\)) more abundant hence boosting \(GDP_{t_{2}}\) upwards; this will contribute to push further up the local household’s intertemporal wealth constraint as well as the time profile of its consumption. The wealth shift might be massive enough to overpower the effect of intertemporal substitution on short term consumption with some new member-states’ households actually reducing their savings on the whole time horizon. The restructuring of short term aggregate demand will cause intersectoral shifts of activity, possibly in favor of more capital intensive sectors, which could attract some (obviously modest amount of) capital out of old member states also in the short term, and therefore increase GDP also in \(t_{1}\). All these effects will contribute to increase aggregate welfare, despite the fact that in some countries, capital intensive sectors are on average also more skilled-labor intensive, so that in the short run, low-skilled workers could experience a slight erosion of their real wages.

The above description indeed applies to most new member states, as Table 3 reveals. (Assuming CRS does not qualitatively affect the analysis, and is therefore unreported to conserve on space.) The only new member countries that make exception to the above narrative are Cyprus and Slovenia for which the essentially unaffected welfare index hides an unambiguous erosion of real wages in the long run caused by a downward shift of local production capacities \(K_{t_{2}}^{sup}\). The reason for this singularity is quite obvious: in all but a few sectors, these two new member states lie close to or above the EU low-envelope technology frontier—see Table 2– so that they essentially experience only the indirect effects of their neighbors’ technological catch-up, as do all the incumbent member states.

3.2.2 Old members

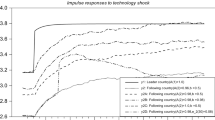

The outcome of the enlargement process is less straight forward to anticipate for the old member states. Two mechanisms are dominantly at work here, with conflicting implications for local workers’ welfare. Firstly, the rise in second-period rental price of capital in new member states induces an outflow of that factor from incumbent member countries, which contributes to reduce their second-period GDP and to push local wages down. Secondly –and consequently—the rising expected future return to capital induces local households to substitute future to short term consumption which makes second-period capital endowments higher, hence pushing up GDP and wages. In these economies, the welfare outcome for workers will therefore crucially depend on which of these two effects dominates, that is, on the values of two elasticities: the CET parameter \(\sigma _{E27}^{K}\) that governs how easily physical capital can be relocated internationally in the long run, and the intertemporal CES parameter \(\sigma \) that determines how responsive the \(t_{2}\)-supply of capital is to expectations at \(t_{1}\) of future profits. We explore this sensitivity, and report in Fig. 4, for the case of IRS, changes in old members’ skilled workers’ real wages, for combinations of high and low values of the two parameters, with \(\sigma \) = 1.3 or 0.3 and \(\sigma _{E27}^{K} \) = 2.0 or 0.5.

It is apparent from this graph that, of the two mechanisms, not only does intertemporal substitution unambiguously dominate, but also that it is potentially strong enough to affect some important qualitative results single-handedly. We stress this important conclusion by reporting in Table 4, some detailed results, keeping fixed \(\sigma _{E27}^{K}=2.0\); to conserve on space, we report for a subset of countries only.

The first part of the table assumes a high value of \(\sigma \), and displays results under CRS and IRS technologies; we first comment on the former case. The aggregate welfare effects are essentially non-negative.Footnote 19 The time profile of private consumption adjusts, as expected, with households quite robustly accumulating more capital: second-period physical assets \(K_{t_{2}}^{H}\) rise by some approximate 5% on average. The first-period outflow of capital is so negligible as a share of the initial stock that short term \(GDP_{t_{1}}\) is essentially unaffected as are real wages of both skilled and unskilled workers (\(rw_{sk}\) and \(rw_{un}\) respectively). The second period amount of capital locally available for production (\(K_{t_{2}}^{Sup}\)) depends on the balance between induced accumulation and geographic relocation: with the adopted value of \(\sigma =1.3\), the first effect dominates leading to an unambiguously increase of \(K_{t_{2}}^{Sup}\) in all old EU-member states, and consequently of aggregate output and real wages for both skill categories. IRS technologies will of course add to these effects, in particular because of endogenous variety (due to exit/entry of competitors) which affects the cost of intermediate inputs, as well as the price of consumption. The results reported in the table indeed acknowledge the contribution of these additional mechanisms. We observe that the aggregate welfare conclusions remain qualitatively unchanged, though quantitatively slightly amplified in most cases; forward-looking consumption-smoothing households accumulate physical assets, more vigorously so than under overall perfect competition, which contributes to push real wages further up. The only short term effects are due to demand restructuring (the demand for investment goods rising at the expense of private consumption), inconsequential for real wages.

Reducing the value of \(\sigma \), however, suggests the possibility of a bleaker outcome for wage earners. Accumulation of new production capacities through private savings is, in this case, too modest to compensate for the outflow of capital to new member states. The resulting local leftward shift of capital supply unambiguously pushes wages down: all workers are in this case negatively impacted in the long run with unskilled workers, victim of a stronger Stolper-Samuelson effect, systematically suffering the heaviest long-term losses. The conclusion proves robust to the type of competition assumed: indeed, with IRS, the negative effect on long-term wages is amplified by a factor of two to three.

These negative welfare results for workers should obviously cause concern and raise the following questions: Is such a parameter configuration truly unlikely? How much dependent are these unpleasant results on the necessarily sketchy two-period set-up? We address these issues in the next section.

4 Assessment of EU enlargement: elimination of barriers-to-technology-adoption

We have learned from the previous section that the consequences, for incumbent member states, of the large scale enlargement wave of 2004-7 are likely to depend heavily on the value of the elasticity of intertemporal substitution \(\sigma \). Unfortunately, the macroeconomic literature appears amazingly agnostic on the value of this crucial parameter, with authors picking numbers as far apart as 0.2 (Chari et al. 2002) and 2.0 (Barro, 2009). A recent paper by Havranek et al. (2015) provides some welcome help, however. Using a meta-analysis approach of the quantitative macroeconomic literature, the authors conclude to a mean worldwide estimate value of 0.5. They also acknowledge important cross-country differences, and report a table with meta-analysis estimates of \(\sigma \) for individual countries, including most of the pre-2007 EU member states. Though these values are clearly not meant to be taken at face value (France, for instance, is granted an –admittedly close to zero– negative value!) they clearly indicate that European households tend to be, on average, less responsive to intertemporal relative price changes than households in the rest of the sample. Weighting the reported old EU-members’ values of \(\sigma \) (after setting France’s to zero) with our base-year GDP figures produces an average close to 0.3 and a standard deviation roughly equal to 0.5 which delivers a 95% confidence interval of [0.05, 0.65]. This average value of 0.3 will serve as our reference value; observe that this is one of the two values of \(\sigma \) used in our two-period set-up. We shall explore the sensitivity of the results w.r.t. the value of this parameter by also experimenting with \(\sigma =0.1\), a value picked in the lower half of the confidence interval.

A second issue concerns the two-period set-up. This proved useful for opening what could otherwise seem to be a ‘black-box’, but at the cost of strong restrictions. How dependent are the conclusions to these restrictions? The concern here is two-fold. The first relates to the dynamic aggregation per se: how different would the evaluations be if the problem was solved on a denser time grid over a longer finite time horizon? To respond to this, we solve the model over six ten-year time intervals (that is, 7 endogenous intra-period equilibria), and impose steady-state at the end of a time horizon \(T=60\) years. The second concern is related to the implementation of the technology upgrading shock: in the two-period set-up, this can only take the form of a one step upward shift of TLPs at \(t_{2}=T=30\) years. In the expanded model version, we have more degrees of freedom in specifying the time path of the \(\theta _{i,s,t}\) parameters: we shall explore various exogenous time profiles for this shift using a generalized logistic function:

Here, parameters \(\phi _{i,s}\) and \(\varphi _{i,s}\) define respectively lower and upper asymptotes: the \(\phi _{i,s}\) are calibrated so that the values of the TLP parameters at \(t_{1}\) are set to unity: \(\theta _{i,s,t_{1}}=1\) for all i, s ; the \(\varphi _{i,s}\) are calibrated so that after 60 years the TLP shift places the \(\theta _{i,s,T}\) on their target technology frontiers. Parameter \(\varkappa \) is set to 30 years, so that increasing \(\mu \) alone brings the curve closer to a mid-horizon step function; increasing \(\nu \) alone shifts the curve to the top-left. We shall explore with values of \(\mu =0.15\) or 0.20, and of \(\nu =0.5\) or 1.0; the associated time profiles –for normalized values of \(\phi \) and \(\varphi \) such that \(\theta _{t_{1}}=1\) and \(\theta _{T}=2\)– are illustrated in Fig. 5.

With these less extreme—indeed quite reasonable—characterizations of the labor efficiency diffusion process triggered by disappearing barriers to technology adoption, we are now equipped to proceed to counterfactual assessments.

4.1 New members

Consider the case of new member states first. We know from the discussions of the previous section that in these economies, direct and indirect effects of the technology upgrading shock tend to add-up positively; hence, there is little reason to expect that the qualitative conclusions will be much affected by changes in time-aggregation assumptions. This is indeed what Fig. 6 confirms: the histogram reports %EV welfare gains for both CRS and IRS versions of the large scale model: because the results prove roughly identical for the four different specifications of the logistic \(\theta _{i,s}\)-profiles, we only display here the case \((\mu ,\nu )=(0.15,1.0)\). The dashed lines in Fig. 6 display the results produced by the reduced two-period set-up, in comparison. Though the dashed lines reveal a systematic quantitative upward bias, nothing of the previous discussion related to new members is qualitatively affected. These results are conditioned by the bench-mark value of \(\sigma =0.3\); using a lower value of \(\sigma =0.1\) instead reduces these numbers slightly without any effect on the conclusions, as can be checked from "Supplementary material: Appendix 3", Table 5.

4.2 Old members

We next move our attention to incumbent EU-members, where we expect things to be more complicated. Figure 7 reports %EV welfare changes for these countries, assuming \(\sigma =0.3\). We learned from Fig. 6 that acknowledging technologies with IRS rather than CRS, if anything, only tends to exacerbate the induced welfare changes; because that conclusion remains true for the old-member states, we only report here results for the IRS case. It was also claimed that welfare evaluations are quite robust to the implemented \(\theta _{i,s,t}\) profiles: we substantiate this in Fig. 7 with an histogram reporting results for the four parameterized logistic specifications. (We again link these results to those discussed in the previous section by reporting –with dashed lines– the numbers generated with the two-period set-up.)

It is a robust conclusion that emerges from this counterfactual analysis: all incumbent member states might not gain from this large scale enlargement wave of 2004-7. Observe that this conclusion is based on an aggregate household welfare index which may mask unequal sharing between national factor owners. Indeed, given the nature of the shock, a trade economist, used to think in terms of static comparative advantages and knowledgeable of the Stolper-Samuelson curse, would predict that the labor-factor owners are the most likely to be hurt. Such a prediction, because it neglects intertemporal reallocations, would however not to be correct, as Fig. 8 illustrates.

Here, we display for Denmark –the country for which the welfare index \(\psi \) is most negatively affected under all scenarios– the equilibrium time paths of real wages for skilled workers under alternative time profiles of the forcing parameters \(\theta _{i,s,t}\). Real wages behave roughly similarly for both skill levels in all other incumbent member states; we substantiate this claim by reporting in a single graph –Fig. 9– the time profile of real wages for unskilled workers in a large subset of old-member countries for the case \(\mu =0.15\) and \(\nu =1.0\); the figure is essentially unchanged when using the other values of \(\mu \) and/or \(\nu \).

It should be clear from these results that the few negative welfare changes reported in Fig. 7 are caused by an intertemporal terms-of-trade depreciation in aggregate asset portfolios for some national households, due it seems to an initial higher share of non-physical assets in their wealth.

All the results reported in this section have been computed assuming a point estimate value of \(\sigma =0.3\). How would these results change if European households were less prone to substitute intertemporally than assumed up to now, making their decisions conditional on a statistically reasonable lower value? Numerical explorations with \(\sigma =0.1\) clearly reveal that, though at the aggregate level, welfare would not be hurt –on the contrary, the welfare index \(\psi \) turns out to improve for all EU-incumbent member states (as can be checked from "Supplementary material: Appendix 3", Table 6)– the sharing of the gains between factor owners drastically shifts at the expense of wage earners: Fig. 10 reports the time profile of real wages for the same workers as in Fig. 9, the only change being the lower value of \(\sigma \). Here again, all qualitative conclusions prove immune to the parameter values of the logistic forcing profile.

Clearly, there is room for concern here.

Observe that all the results reported in this section have been computed assuming intra-EU mobility of capital characterized by the same parameter value of \(\sigma _{E27}^{K}\). We know that a higher \(\sigma _{E27}^{K}\) will result in an increased outflow of capital in favor of new-members, which, everything else equal, will lower real wages in incumbent member states on the 60 years time horizon. The value of \(\sigma _{E27}^{K}=2\) we have used in all the simulations of this section turns out to be lower than assumed in the European Commission’s model Rhomolo-v2, where \(\sigma _{E27}^{K}=3\). In view of this, the potentially bleak outcome for old EU-member wage earners suggested by our results might well turn out to be over optimistically biased.

Observe also that we have assumed labor in fixed supply at the national level in all our simulations. This restriction could easily be relaxed, either by endogenizing leisure choices (as popularized by the RBC literature) or by use of a wage-curve (as is standard in CGE large scale models). Both mechanisms may be justified when the focus is on short term adjustments, less so when the concern relates to a technological drift over a 60 years time horizon. Furthermore, it is rather easy to anticipate how our results would be affected by addition of these mechanisms. With the parameter configuration of Fig. 9, stimulated by rising real wages, labor supply would increase in all old EU-member economies over the whole time horizon; as a result, private wealth would increase, and stimulate savings –at least in absolute terms– and hence the supply of physical capital. With both factors more abundant, in particular in presence of scale economies in production, it is hard to argue that welfare would not improve more than we report. The same reasoning applies mutatis mutandis to the case reported in Fig. 10, though with reversed signs; it is here again hard to argue that with this parameter configuration, welfare –and wages– would not be pushed further down.Footnote 20 Clearly, making labor supply endogenous does not affect the power of the basic mechanisms at work, and our major conclusion will hold: the sign of the welfare outcome, for wage earners in old EU member countries, of the 2004−7 EU integration wave, depends heavily on how responsive aggregate EU saving is to changes in future investment-return prospects; the parameter that crucially governs this response is the elasticity of intertemporal substitution in household preferences \(\sigma \); our claim is that for reasonable parameter configurations, the threshold value of \(\sigma \) under which workers will be hurt by the EU enlargement wave lies within a 95% confidence interval, so that it cannot be rejected as statistically unlikely.

The model used in this paper incorporates elements of trade and intertemporal macroeconomic mechanisms, a combination which increases significantly the dimensionality of the numerical problem to be solved. For this reason, time aggregation approximations have been necessary: indeed, the computation of an intertemporal equilibrium implies the search for a fixed point simultaneously on the whole time horizon, rather than sequentially on a set of one period equilibria. One may wonder if the cost of such an increase in computational complexity is worth the effort? That is: would our results be very different, from a policy maker’s perspective, if we were to assume fixed rather than optimally chosen savings rate, so that the model would exhibit Solow-type growth? We provide elements for such a comparison by reporting in Figs. 9, 10—the dashed lines—the time profiles of real wages for German unskilled workers generated by making private consumption proportional to household income in an otherwise identical model. The two lines labeled ‘Solow(DEU)’ are of course identical in the two figures. When saving rates are held fixed, the positive shift in new-member TLP raises their income and hence the local accumulation of capital; as a result, the amount of capital that outflows from old-member states is much more modest. Consequently, production capacities in old member states are little affected by the shock, and the forces triggered by changes in static comparative advantages tend to dominate, with the Stolper-Samuelson mechanism dictating relative factor-price changes. Clearly, the two models do provide very different answers to the same counterfactual policy evaluation. (Note that Fig. 7 reports differences in welfare evaluations as produced by the two models.)

5 Conclusion

We have explored the relative degree of technological efficiency characterizing the new and the incumbent member states of the EU in their use of skilled and unskilled labor in year 2007, at the time of the 5th enlargement wave. Our industry level econometric analysis indicates clear and systematic patterns of efficiency gaps between the two groups of countries. One most likely explanation, is that these relative inefficiencies have been caused by long-time enforcement of barriers to technology adoption in the past. Indeed, 20th century history and the fact that most of the new member states were part of the Soviet bloc give considerable credit to explanations emphasizing the role of trade restrictions, institutions and policies, in the build-up of these barriers. If elimination of both tariff and non-tariff barriers to trade will presumably contribute to improve the process of technological diffusion, ’shallow integration’ is unlikely to suffice: barriers to technology adoption, and the associated efficiency losses, are likely to survive without deeper reforms. Our first contribution in this paper is to suggest a methodology for assessing the size of the efficiency losses that can be attributed to barriers to technology adoption in an economy; the methodology applies independently of whether the trade restrictions have or have not been previously removed (though the estimated efficiency losses will of course differ). As a by-product, we show how this directly translates into a workable technological shock that can be implemented in a calibrated GE model to evaluate the welfare gains a country can potentially generate by erasing restrictions to knowledge diffusion.

For a non-member country joining the EU, integration within the Union is likely to eliminate most of these impediments that have limited the ability of local firms to adopt more advanced technologies. Indeed, the disciplines required to eliminate these impediments are essentially the same as those discussed as necessary to achieve ‘deep integration’ within the EU. We therefore also contribute to the literature that aims to evaluate the costs and benefits of EU integration.

Though particularly relevant to the EU enlargement experience, our methodology is clearly not specific to that context: it can be implemented to evaluate any serious integration effort from a single-country perspective. One thing that makes the \(5^{th}\) EU enlargement episode so special, however, is its size. Indeed, experienced simultaneously by ten new EU members, such a shock is likely to have non trivial indirect general equilibrium effects on incumbent member states also, in particular because of physical capital mobility. We have provided such a quantitative exploration by use of a numerical intertemporal GE model of the EU27, calibrated on 2007 data.

From a policy perspective, our results suggest that, for a large set of parameter configurations, workers –skilled and unskilled alike– will benefit from this EU enlargement with real wages increasing, despite significant outflows of physical capital attracted by more profitable opportunities in the new member states. In the current context of rising populism and widespread anti-EU resentment, this ‘likely outcome’ is presumably welcome. But, reassuring as this conclusion may be, it should not over-shade our main complementary finding: that all these positive results crucially depend on how intensely EU households are inclined to smooth their consumption decisions through time to invest in productive physical capital. The more responsive are the old EU-member households to intertemporal price changes, the more physical capital can be accumulated in response to the labor productivity improvements due to adoption of more efficient technologies in newly EU-integrated economies. A strong enough increase in the EU-aggregate stock of physical capital is however necessary for the capital outflows not be achieved at the expense of capital available to firms within old-member states. If that were the case, that is, if the outflow of capital from old-member states is not compensated by large enough increases in productive investment flows, the relative price of labor will fall in these economies, and workers will be negatively affected. There is clearly room for concern here. And the concern is particularly justified in view of the fact that improving education—a cure-all mantra for the Commission—is unlikely to prove useful given that real wages of both skilled and unskilled workers are affected similarly. We have shown that such a bleak outcome crucially depends on the relative size of two elasticities, the one that characterizes intertemporal substitution in consumption, and the one that commands international mobility of physical capital: our numerical explorations suggest that, though such an outcome does not seem to be the most likely, the parameter configurations that would make this EU-integration wave a non-Pareto-improving move lies within a statistically feasible interval.

It is important to stress –at the risk of being over-insistent—that these findings emerge thanks to a complex blend of trade and intertemporal macroeconomic mechanisms rarely present —if ever—in calibrated models of the EU economy. For this reason, it should not be a surprise if we provide a more nuanced assessment of the \(5^{th}\) large-scale EU enlargement wave. This being said, two provisos are called for. First, and as is customary in counterfactual exercises, the size of the exogenous shock imposed bears some degree of arbitrariness. Indeed, it could be that some new members will tech-upgrade more rapidly and others more slowly than assumed, so that they would respectively overshoot or undershoot the minimal ‘state-of-the-art’ technological envelope that we assume. Though this would clearly affect the size of the gains for individual new members, it is unlikely that it would change the basic message of the paper regarding incumbent members taken collectively. Second, and not unrelated, our analysis builds on a cross-section estimation of technological gaps between member countries. It might therefore miss dynamic forces at work –it surely does, but how important are these forces?– that could affect each country’s relative technological position with respect to incumbent members’ frontiers. A dynamic approach, adopting methodologies such as the one proposed by Krüger (2017), could possibly provide different measures of pre-integration barriers to technology adoption, though it is likely to carry its own load of potential pitfalls. In any case, if this would presumably affect our quantitative estimates, it is unlikely to alter the basic message of the paper from a policy perspective.

Notes

The 5th wave enlargement of the EU involved: Cyprus (CYP), the Czech Republic (CZE), Estonia (EST), Latvia (LVA), Lithuania (LTU), Hungary (HUN), Malta (MLT), Poland (POL), Slovakia (SVK) and Slovenia (SVN) in 2004; with Bulgaria (BGR) and Romania (ROU) in 2007. Throughout this paper, we shall refer to these counties somewhat loosely as the ‘new’ member states of the EU, as opposed to the ‘old’ member states, which are Austria (AUT), Belgium (BEL), Germany (DEU), Denmark (DNK), Spain (ESP), Finland (FIN), France (FRA), Great Britain (GBR), Greece (GRC), Ireland (IRL), Italy (ITA), Luxembourg (LUX), the Netherlands (NLD), Portugal (PRT) and Sweden (SWE).

We follow CC (2006), though the notation is ours, chosen to be consistent with the rest of our paper. The reader is, in particular, cautioned that the notations for the elasticity of substitution between the skilled and unskilled labor differ.

Observe that this is a rather strong assumption which clearly precludes using the methodology in periods of severe macroeconomic turmoil.

An alternative non-parametric approach proposed by Krüger (2017) uses a directional distance functions method that requires no functional form, no firm optimization nor equilibrium assumptions. Comparatively applied on the same sample, the results of Krüger (2017) suggest robustness, though the CC methodology seems to be more sensitive to alternative definitions of skilled and unskilled labor. We here follow the parametric approach, in particular because we want to impose the CES functional forms to ensure consistency with the calibrated model to be used in a later section.

The restriction for unique interior equilibrium, where all firms within a country choose the same technology (\(A_{i,sk},A_{i,un}\)) and the same factor ratios (\(L_{i,un}/L_{i,sk}\)) is \(\omega >-\rho ^{Lab}/(1+\rho ^{Lab})\). See CC (2006) for details.

Following CC (2006), our measurement of skilled labor here follows the ’macro-Mincer’ approach where human capital is calculated based on unskilled labor equivalents. As well, our estimation method, which identifies relative efficiencies from relative wages assumes skill premia are solely affected by differences in human capital. For a recent discussion on the measurement of human capital and on the other attributes of skill premia, see Jones (2014, 2019) and Caselli and Ciccone (2019).

See "Supplementary material: Appendix 2" for details of the data we use for the estimations.

We have explored the sensitivity of the estimated results with respect to the common value of \(\sigma ^{Lab}\) –using values between 1.1 and 2.0—: absolute numbers obviously change, but the relative position turns out to be quite stable, except for Malta.

It can be checked that for all sectors except Primary the estimated values of \(\omega \) satisfy the symmetry condition (see CC (2006)) that \(\omega >-\rho ^{Lab}/(1+\rho ^{Lab}))\) for \(\sigma ^{Lab}=1.4\) which guarantees interior solutions with positive efficiency parameters. For Primary, the estimate of \(\omega \) slightly falls short of the condition for a range of \(\sigma ^{Lab}\) values chosen on both sides of 1.4; for \(\sigma ^{Lab}=1.4\), \(\hat{\omega }=0.3965<0.4\).

We make use of detailed social accounting matrices for year 2007, built following the methodology in Álvarez-Martínez and López-Cobo (2018). See "Sipplementary material: Appendix 2" .

The reader will remember that, for the same reason, the econometric method used to estimate the country-specific technology frontiers in the previous section precluded using years posterior to 2007.

Bonds include debt issued by E27 governments and by the RoW. These bonds are included for base year accounting reasons only: the dynamic budget constraints are formulated to ensure that these stocks, supplied and held, remain constant through time.

Older vintages of capital net of depreciation are assumed valued as new equipment. Shocks will result in expected though transitory extraordinary profits or losses in imperfectly competitive sectors. These should be —and indeed are– included in the expression of \(r_{t+1}^{K^{H}}\) in the model: we alight the expression in this section by dropping these terms; see the formal description of the model in "Supplementary material: Appendix 1".

The decision regarding which industry is likely or not to be characterized by IRS technologies and monopolistic competition is difficult, and admittedly bears some arbitrariness. Our choice is based, among other things, on industry concentration statistics (more specifically, on Herfindahl indices), on how roughly homogeneous an industry is (‘Services’, for instance, include such different sub-sectors as retail trade, restoration, and banking...), on how internationally comparable are the national symmetric firms that would emerge from the (inverse of the) Herfindahl indexes, and on how realistic it is to assume that individual firms’ products are differentiated from their competitors (it is, for instance, hard to justify that agriculture goods that constitute a large part of ‘Primary’ are differentiated enough to confer some monopoly power to individual farmers).

When reading the results, one should therefore keep in mind that there is no simple link between capital ownership by national households and the amount of capital services in a country’s GDP.

As is the case for labor, we impose that mobility is strongly limited in the very short run by adopting very low transformation elasticity values during the first year.

The intratemporal structure of our model has a lot in common with the one adopted in Rhomolo-v2 (Mercenier et al. 2016), though the two models do differ substantially on many grounds. We are not constrained by short-run policy considerations, so we select a different base year for calibration, more on the basis of its adequacy with our assumption of stationary equilibrium, rather than because “it is the most recent available social accounting matrix”. Secondly, we are not interested in specifically regional issues: we substantially reduce the dimension of the numerical system by working with national rather than with regional units; this size down-scaling makes it possible for us, on the one hand, to adopt a finer sectoral dis-aggregation, and on the other, in line with modern macroeconomic and growth theory, to introduce more sophisticated dynamics based on explicit optimal intertemporal decision making by households endowed with forward-looking expectations. Rhomolo-v2 also includes a rather ad hoc R&D bloc which we do not retain.

Remember that initial positions on the technology frontiers reflect the appropriate technology choices conditional on factor endowments. With fixed factor endowments, these choices are unaffected by the integration shock: the induced change is the movement on the same \(A_{sk}/A_{un}\) ray, as captured by a shift in \(\theta \). In the general equilibrium setup, however, because of the intersectoral mobility of labor, this is no longer exactly the case: as sector endowments change, optimizing firms adjust their appropriate technology choice, so that the shift in \(\theta \) is accompanied by an endogenously determined movement on the sector-specific frontier. We of course, do take this effect into account in our simulations.

Actually, in some scenarios, Spain and Sweden experience extremely modest losses, but the aggregate welfare cost for Denmark is more substantial —ranging between −0.5% and −0.9%–—and turns out to be quite robust in this two-period intertemporal setting. The reason behind these intertemporal terms of trade deterioration seems to be in portfolio structures: aggregate households in these countries appear to have relatively higher shares of non-physical assets in their total wealth (with Denmark as the extreme case).

Unreported experiments with the wage-curve augmented two-period model confirm these claims.

References

Acemoglu, D. (2015). Localised and biased technologies: Atkinson and Stiglitz’s new view, induced innovations, and directed technological change. Economic Journal, 125(573), 443–463.

Acemoglu, D., & Robinson, J. A. (2006). Economic backwardness in political perspective. American Political Science Review, 100(1), 115–131.

Acemoglu, D., & Zilibotti, F. (2001). Productivity differences. The Quarterly Journal of Economics, 116(2), 563–606.

Alesina, A., Battisti, M., & Zeira, J. (2018). Technology and labor regulations: Theory and evidence. Journal of Economic Growth, 23(1), 41–78.

Álvarez-Martínez, M. T., & López-Cobo, M. (2018). WIOD SAMs adjusted with Eurostat data for the EU-27. Economic Systems Research, 30(4), 521–544.

Atkinson, A., & Stiglitz, J. (1969). A new view of technological change. Economic Journal, 79(315), 573–578.

Baldwin, R., Forslid, R., Martin, P., Ottaviano, G., & Robert-Nicoud, F. (2003). Economic Geography and Public Policy. Princeton: Princeton University Press.

Barro, R. (2009). Rare disasters, asset prices, and welfare costs. American Economic Review, 99(1), 243–264.

Basu, S., & Weil, D. (1998). Appropriate technology and growth. The Quarterly Journal of Economics, 113(4), 1025–1054.

Campos, N., & Coricelli, A. (2002). Growth in transition: what we know, what we don’t, and what we should. Journal of Economic Literature, 40(3), 793–836.

Campos, N., Coricelli, F., & Moretti, L. (2019). Institutional integration and economic growth in Europe. Journal of Monetary Economics, 103, 88–104.

Caselli, F., & Ciccone, A. (2019). The human capital stock: a generalized approach: comment. American Economic Review, 109(3), 1155–1174.

Caselli, F., & Coleman, W. J. (2006). World technology frontier. American Economic Review, 96(3), 499–522.

Chari, V., Kehoe, P., & McGrattan, E. (2002). Can sticky price models generate volatile and persistent real exchange rates? Review of Economic Studies, 69(3), 533–563.

Comin, D., & Hobijn, B. (2004). Cross-country technology adoption: making the theories face the facts. Journal of Monetary Economics, 51, 39–83.

Dietzenbacher, E., Los, B., Stehrer, R., Timmer, M., & de Vries, G. (2013). The construction of world input-output tables in the WIOD project. Economic Systems Research, 25(1), 71–98.

Diwan, I., & Rodrik, D. (1991). Patents, appropriate technology, and North-South trade. Journal of International Economics, 30(1), 27–47.

Fischer, S., Ratna, S., Végh Gramont, C. A. (2016). How Far Is Eastern Europe from Brussels? IMF Working Paper No. 98/53

Havranek, T., Horvath, R., Irsova, Z., & Rusnak, M. (2015). Cross-country heterogeneity in intertemporal substitution. Journal of International Economics, 96(1), 100–118.

Jones, B. (2014). The human capital stock: a generalized approach. American Economic Review, 104(11), 3752–3777.

Jones, B. (2019). The human capital stock: a generalized approach: reply. American Economic Review, 109(3), 1175–1195.

Kornai, J. (1994). Transformational recession: the main causes. Journal of Comparative Economics, 19(3), 39–63.

Krüger, J. (2017). Revisiting the world technology frontier: a directional distance function approach. Journal of Economic Growth, 22, 67–95.

Krugman, P. (1991). Increasing returns and economic geography. Journal of Political Economy, 99, 483–499.

Krugman, P., & Venables, A. (1995). Globalization and the inequality of nations. The Quarterly Journal of Economics, 110, 857–880.

Kydland, F., & Prescott, E. (1982). Time to build and aggregate fluctuations. Econometrica, 50(6), 1345–1370.

Mercenier, J. (1995). Nonuniqueness of solutions in applied general equilibrium models with scale economies and imperfect competition. Economic Theory, 6, 161–177.

Mercenier, J., Álvarez-Martínez, M. T., Brandsma, A., Di Comite, F., Diukanova, O., d’Artis Kancs, Lecca, P., López-Cobo, M., Monfort, P., Persyn, D., Rillaers, A., Thissen, M., Torfs, W., 2016. Rhomolo-v2 model description: A spatial computable general equilibrium model for eu regions and sectors. Institute for Prospective Technological Studies, DG-JRC, European Commission, JRC100011.

Mercenier, J., & Michel, P. (1994). Discrete time finite horizon approximation of optimal growth with steady-state invariance. Econometrica, 62(3), 635–656.

Parente, S. L., & Prescott, E. C. (1994). Barriers to technology adoption and development. Journal of Political Economy, 102, 298–321.

Parente, S. L., & Prescott, E. C. (2000). Barriers to Riches. Massachusetts: The MIT Press, Cambridge.

Roszkowska, S., 2014. Returns to education in europe: same or not? European Scientific Journal Special ed. Vol. 1.

Vandenbussche, J., Aghion, P., & Meghir, C. (2006). Growth, distance to frontier and composition of human capital. Journal of Economic Growth, 11(2), 97–127.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We are grateful to referees for comments that have contributed to significantly improve the paper. We are indebted to Maria \(\acute{A}\)lvarez-Martinez and Montse L\(\acute{o}\)pez-Cobo for their help with the data. We also thank, without implicating, F. Di Comite, J. Haaland, G. Bresson, F. Perali, and seminar participants at Boğaziçi U., CIRED, U. Essen-Duisburg, U. Galatasaray, METU and U. di Verona, for useful discussions and encouragements. This paper was initiated while the two authors were visiting IPTS (Sevilla), and completed while the first author was visiting METU with the financial support from TÜBİTAK (2221-Fellowship for Visiting Scientists Program): we thank these institutions for the hospitality and/or financial support.

Supplementary Information

Below is the link to the electronic supplementary material.

About this article

Cite this article

Mercenier, J., Voyvoda, E. On barriers to technology adoption, appropriate technology and European integration. Rev World Econ 157, 669–702 (2021). https://doi.org/10.1007/s10290-021-00412-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-021-00412-7

Keywords

- Barriers to technology adoption

- Appropriate technology

- Technological upgrading

- European integration

- Calibrated general equilibrium (CGE)