Abstract

This paper addresses the impact of countries’ backward participation in global value chains (GVCs) on their current account balances. Our results, based on a large panel of 57 advanced and emerging countries, contradict the speculation that current account imbalances of countries that import intermediate products to be used in their exports, i.e., countries with important backward linkages, are likely to benefit more from GVC participation. On the contrary, the authors show that backward participation makes a negative contribution to current account balances; this result being valid for both manufactured goods and services, with a stronger impact for the latter. Overall, they find that while backward linkages may allow competitiveness gains from producing domestically and boost exports, the increase in imports of intermediates and final goods—mainly capital goods—that are not necessarily related to GVC participation, more than offset the trade balance effects of these gains.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic globalization has brought about profound changes in international trade. Among all of them, one of the most prominent is the increasing dispersion of stages of production across countries in recent years. Indeed, the production structure of the past where goods or services remained within national borders was internationalized to take advantage of the decline in transportation costs, the adoption of more open trade policies as well as advances in information and communication technologies. This evolution towards international production fragmentation gave rise to various concepts and definitions among which global value chains (GVCs)Footnote 1—referring to the case where a source country produces intermediate goods that are used as inputs in other countries to produce/assemble the final good—play a key role. This international production process in which production is split into several stages and located in various countries refers to what Baldwin (2016) called the second unbundling of globalization—the first one being the separation between production and consumption countries.

International fragmentation has been accompanied by increasing participation of countries in GVCs, with intense involvement of emerging and developing economies (Gary et al. 2001; Cattaneo et al. 2010; Baldwin 2014). The consequence of this process was a steady increase in trade flows, particularly in intermediate goods and services.Footnote 2 According to Krugman et al. (1995), international fragmentation is among the main key changes explaining the sharp rise in the trade to GDP ratio since the mid-eighties. This dispersion of production stages across countries may also explain why some of them display very high levels of export propensity, given that their exports incorporate a very low share of domestic value-added (De Backer et al. 2018).

As a result of this evolution of the global production process, it is highly relevant to study current account balances by accounting for the relationships between trade and international production, i.e., by paying attention to participation in GVCs. Indeed, as widely documented in the literature,Footnote 3 the 2008 financial and economic crisis was preceded by a dramatic increase in global imbalances, whose level remains still high despite the adjustments since 2009. These simultaneous developments suggest that the presence of global imbalances cannot be dissociated from the process of globalization and the expansion of GVCs.

The literature addressing this issue is quite scarce, and has detected one main mechanism through which GVCs could impact a country’s current account.Footnote 4 According to this mechanism, higher participation in GVC implies a larger share of a country’s exports that represents value-added to its imported intermediates. The resulting increase in the economy’s trade balance feeds through to the current account balance. This transmission channel has been investigated by Brumm et al. (2019) who developed a two-country international real business cycle model with trade in both final consumption goods and intermediate inputs in production—domestic and imported intermediates being imperfect substitutes in production. Assuming that the efficiency of imported intermediates in home production is subject to transitory shocks, the authors show that a positive shock (i) increases the share of foreign value-added incorporated in home exports, and (ii) stimulates, through improvements in competitiveness of home exports, foreign demand for domestic goods and home income. Accordingly, the shock being transitory, at equilibrium, the domestic economy saves part of its income gains to smooth consumption through time, resulting in current account surpluses. Note that this interpretation is, in principle, limited to one exclusive form of participation in GVC, namely backward participation, which consists of importing intermediate goods or services that are then used to assemble the final product that is exported.Footnote 5

Two additional points, forgotten in the above-hypothesized mechanism, should however be mentioned. Firstly, increasing GVC participation should have a positive effect on the current account position because, especially in the case of backward participation, higher participation implies that there are more imports which are then used as inputs for exports. Indeed, when domestic firms increase their GVC participation, they achieve a gain in competitiveness since they substitute less expensive imported intermediate goods for those produced domestically. However, if we look at the current account, we should consider that even if exports are increasing, imports are also rising with higher participation. The relationship between GVC participation and the current account is, therefore, ambiguous.Footnote 6 From an empirical viewpoint, by relying on a sample of 26 countries and considering the IMF’s External Balance Assessment (EBA) model, Brumm et al. (2019) show that stronger GVC participation is associated with larger current account balances. Secondly, in addition to the decomposition between exports and imports, current account balances are determined by saving and investment decisions (see Chinn and Prasad 2003). As a response to competitiveness and income gains, investment is likely to be triggered, stimulating, in turn, the inflow (supply) of foreign capital in support of this new type of investment. These imports of capital goods are recorded as increases in the current account deficit.

Our paper departs from Brumm et al. (2019)—which is the closest article to ours—in several aspects. First, we put together data covering 57 countries, providing a larger data set than previous studies linking the current account and GVCs. Second, we rely on several empirical specifications to ensure the robustness of our results. In particular, while Haltmaier (2005) and Brumm et al. (2019) deal with static representations, we additionally consider a dynamic specification to account for the persistence of imbalances. Allowing for such inertia in our framework is of primary interest as persistence of disequilibria in several countries—especially industrial—has become a key issue.Footnote 7 Third, we disaggregate our indicator of backward linkages to explore sectoral differences; the effect of importing foreign inputs being not necessarily homogeneous among the different sectors in the economy. In particular, distinguishing goods and services seem to be interesting, due to the evolving role of services in GVCs. Although, at the origin, GVCs were mainly concerned with goods, services are today increasingly disaggregated and traded as separate tasks—typical examples being back-office and data processing services. Due to this increased GVC-related trade in services, one may expect to find similar results regarding the link between involvement in GVC and current account position for both goods and services. Finally, we complement our investigation by paying particular attention to the impacts of GVC participation on the dynamics of (i) imports of intermediate and final goods and services and (ii) exports, which are key elements in the hypothesized mechanism that underlies the sign of the impact exerted by GVC participation on the current account balance. This is particularly important since a positive effect is expected if and only if the trade balance effects of the resulting competitiveness gain from producing domestically is higher than the increase in imports of intermediates. Moreover, the rise in domestic production due to this competitiveness gain may bring about further increases in imports of final and intermediate goods, not necessarily related to GVC participation.

Our results show that backward GVC participation tends to deteriorate the current account position. This negative effect is stronger for services than for manufactured goods, although being significant in both cases. We further show that, whereas backward linkages in supply chains boost exports, the increase in imports of intermediates more than offsets the trade balance effects. Importantly also, we provide evidence that higher backward linkages lead to further increases in imports of final and intermediate goods, particularly capital and mixed end-use, not associated with GVC participation.

The rest of the paper is organized as follows. Section 2 describes the sample and data, and provides some brief stylized facts. Section 3 displays our main estimation results regarding the effect of GVCs on current account balances. It also provides some robustness checks related to (i) the sectoral level, (ii) the framework retained for modeling the current account dynamics, (iii) the subsets of countries and control variables, as well as an in-depth analysis of the effects of backward participation on imports, exports, and the trade balance. Section 4 concludes the paper.

2 Data and estimation issues

2.1 Estimation strategy

We estimate the following reduced-form model for countries’ current account balances:

where \(CA_{i,t}\) is the current account to GDP ratio of country i in year t, \(Z_{i,t}\) is a set of current account economic determinants, \(Backward_{i,t}\) is a measure of backward participation in global value chains, and \(\alpha _i\) represents country-specific factors.

Equation (1) constitutes our benchmark equation. The justification for including the lagged value of the current account among the regressors is straightforward. From the empirical literature, a stylized fact indeed emerges: current account balances seem to be highly persistent. From a theoretical perspective, the inclusion of the lagged current account can be justified if consumers exhibit habit formation (see Gruber 2004; Gruber and Kamin 2007): habit formation affects the current account response to an income shock by slowing the adjustment of consumption to the shock. Indeed, in the standard intertemporal current account (ICA) models, as introduced by Sachs (1983), assuming a rate of time preference equal to the interest rate, consumption is set equal to permanent income and the current account is completely determined by deviations between current income and permanent income. With habit formation, however, the slow adjustment of consumption to a shock creates a temporary gap between consumption and permanent income that affects the current account in addition to any difference between current income and permanent income. Therefore, sluggishness is introduced into the consumption adjustment process that follows income shocks. As the current account represents net saving decisions and is thus complementary to consumption decisions, the current account inherits the sluggishness of consumption changes, which are due to habit formation (e.g., Gruber 2004; Gruber and Kamin 2007). Many empirical studies then claim that the lagged current account captures essential dynamics and inertial properties.Footnote 8 Moreover, adding country-specific intercepts and a dynamic term permits (i) to reduce the large residuals that EBA regressions generally deliver, and (ii) to lower the unexplained share of current account fluctuations. Turning to methodological considerations, given the presence of the lagged endogenous variable, we estimate Eq. (1) with dynamic panel techniques (the two-step GMM procedure).Footnote 9

For the sake of completeness and comparison purposes, we also estimate a set of static models with and without fixed effects. Indeed, Phillips et al. (2013) argue that including the lagged endogenous variable (i.e., the current account to GDP ratio) among the regressors would amount to adding a quasi-fixed effect to the estimates, opening up a key interpretative/normative issue related to having the current account in a given year being explained by its previous year value. In that case, the lagged current account regressor “could end up picking up the effects of sustained distortions that are otherwise not captured by the regression”. Phillips et al. (2013) also propose that country-specific fixed effects do not provide an economic explanation of observed current accounts and might gather the uncaptured impacts of sustained distortions on the current account. Therefore, they recommend the use of the pooled generalized least squares (GLS) method with a panel-AR(1) correction to deal with autocorrelation.

2.2 Sample and control variables

We consider a panel of 57 countries including both advanced and emerging economies, listed in Table 1. Data are annual and cover the period from 1995 to 2011. Given the available data on input–output linkages, our panel then provides a large data set that can be used in empirical work on the current account and GVCs.Footnote 10

As stated in Eq. (1), our dependent variable is the current account to GDP ratio, extracted from the WEO (World Economic Outlook) database of the IMF. Turning to the choice of control variables, we fall into the strand of the literature on current-account medium-term determinants,Footnote 11 and consider variables related to economic growth, fiscal balance, price competitiveness, demographics, and net foreign assets. More specifically, we control for the following traditional fundamentals: (i) the relative GDP series, defined as the difference between the growth rate of trading-partners’ and domestic GDP for each country, extracted from the EQCHANGE database provided by CEPII, (ii) the real effective exchange rate (REER), expressed in logarithm and defined such that an increase denotes a currency appreciation, taken from the EQCHANGE database,Footnote 12 (iii) the (relative) fiscal position, expressed as a percent of GDP, issued from WEO, (iv) the initial net foreign asset (NFA) position as a percent of GDP, taken from Lane and Milesi-Ferretti’s database, and (v) the dependency ratio, extracted from WDI (World Development Indicators, World Bank).

2.3 Indicators of global value chain participation

Measuring GVCs is far from being a simple task due to the fragmentation of production across several countries. While trade data have been widely used to measure GVCs,Footnote 13 this raises important concerns. The most obvious drawback is that trade data are expressed in gross terms, meaning that the value of intermediate inputs traded along the supply chain is accounted for several times, distorting the measure. As recalled by De Backer et al. (2018) the key progress in terms of GVC measurement has come from the construction of multi-country input–output tables linking national input–output tables using bilateral trade flows. Those tables allow to quantify the contributions of the various production stages within the global supply chain in the final product value. In this paper, we rely on the international inter-country input–output (ICIO) table provided by OECD that contains data for all countries of our sample over the 1995–2011 period, and on the accompanying OECD Trade in Value Added (TiVA) database recording figures on the role of the countries in GVCs through time.Footnote 14

Following Koopman et al. (2010), country i’s backward participation in GVC for sector k is defined as follows:

where \(B_{ki}\) denotes backward participation, which is a scalar measuring the import content of exports, and \(X_{ki}\) is country i’s gross exports. We are particularly interested in backward participation since our main concern is to investigate whether increasing imported intermediate inputs in production improves the competitiveness of home exports and, in turn, the current account. All the data are extracted from TiVA database.Footnote 15

2.4 Some brief stylized facts

As a first illustration, Fig. 1 displays the evolution of our measure of backward participation (in absolute value) aggregated over the all 57 countries over the whole period. This figure confirms the widespread view according to which participation in GVC has followed an increasing trend since 1995 (see, e.g., Daudin et al. 2011; Johnson and Noguera 2017; and Brumm et al. 2019). Specifically, backward participation exhibits an upward trend between 1995 and 2007, before experiencing a sharp decline during the world financial crisis and tends to recover an increasing dynamics after the collapse.

More in detail, at the disaggregated level, Figure A1 in the online Appendix shows the relative backward participation in GVC of each country of our panel at the beginning (1995) and the end (2011) of the sample. Clearly, emerging European countries tend to display high participation rates throughout the period under study. More generally, participation rates are globally higher for emerging economies than for advanced countries. Asian emerging economies exhibit quite important participation rates, especially Korea, Malaysia, Thailand, Cambodia, and Vietnam in 2011. Latin American countries—such as Argentina, Brazil, Chile, Colombia, and Peru—appear to be much less engaged in GVCs.

Various regional characteristics can explain these patterns. Consider first the case of Europe. As recalled by Pomfret and Sourdin (2018), GVCs have emerged in response to price signals within an integrated market that imposes no rules of origin and other constraints on intra-EU trade. After the adoption of the euro in 1999 by eleven countries followed by Greece in 2001, various Central and Eastern European (CEE) countries have since joined the eurozone. With this enlargement, the most advanced new members—generally characterized by quite low wage costs and relatively good human capital—easily took part in GVCs. This is, in particular, the case for the Czech Republic, Hungary and Poland, as well as East Germany. The less-developed new eurozone members have also been quickly engaged in GVCs due to their lower trade costs and the absence of currency risk. Overall, fragmentation of production in Europe has been encouraged by the integration of countries exhibiting huge differences in factor prices, explaining the high levels of GVC participation observed for emerging European countries. For some of them—such as Hungary, Slovakia, the Czech Republic, and Poland to name a few—the level of backward participation has even increased through time, although they already displayed relative high levels in 1995.

Turning to the Asian economies, their participation in GVCs should be linked to the aim of (i) facilitating trade through various agreements, and (ii) using supply chains to increase competitiveness. In particular, as emphasized by Pomfret (2011), the main explanation of the existence of several trade agreements in East Asia after 2000 lies in the efforts made to remove obstacles, such as reducing trade costs, to GVCs. As a corollary of these important regional supply chains, particularly in Europe and East Asia, countries belonging to other regions such as Latin America or Africa are much less engaged in GVCs. Among the various explanations that have been provided, poor conditions for doing business and high trade costs appear to play a major role (see, e.g., Kowalski et al. 2015).

Japan, the United States, and Australia display the lowest participation rates among the group of advanced economies—the latter being typically involved in GVCs at the design or marketing stage. Overall, it appears that high levels of backward participation rates are mostly observed for quite small countries. This may be explained (i) obviously by the fact that, other things being equal, the size of their domestic markets relative to foreign markets (for both final and intermediate goods) is smaller than in larger economies, but also (ii) by a weak diversification of the production sector of these economies, justifying a high share of imported inputs in gross exports.

Although the previous observations are globally in line with Brumm et al. (2019), some noticeable differences can be highlighted, due to the use of a broader country coverage in our sample. For instance, the United States is the second country (behind Russia) the less engaged in GVCs in Brumm et al. (2019), while it is ranked 9th in our sample (Russia being the 5th country the less involved in GVCs). This illustrates the interest of relying on a wide sample of countries to have a more representative picture of economies engaged in GVCs.

Finally, as a first illustration regarding our relationship under investigation, Figure A3 in the online Appendix displays the scatter plot between participation in GVC aggregated over all countries and the current account imbalances (in absolute value). As shown, both series tend to be linked, as it is confirmed by Figure A4 (online Appendix). Indeed, the series exhibit a similar global trend, at least up until the end of the 2000s, suggesting the existence of a potential relationship between participation in value chains and global imbalances. Comparing Figures A1 and A2 and calculating some basic correlations tend to show that the correlation between countries which are engaged in GVCs and current account imbalances (in absolute value) is positive in 1995, while for countries characterized by a negative participation measure, the correlation is almost null. The opposite is observed in 2011. Indeed, in 2011, while the correlation between economies which participate in GVCs and current account imbalances is close to zero, it is positive for countries that are weakly engaged in GVCs. When the sign of current account balances is accounted for, the correlation coefficient between both series is found to be negative for countries involved in GVCs, while it is positive for the other economies. These findings suggest that participation in GVC tends to reduce current account balances.

3 Results and robustness checks

To investigate the link between GVC participation and the current account, we first estimate different empirical specifications at the aggregated, country level. Then, we explore if the results hold (i) for all the sectors in the economy, (ii) when relying on the IMF’s EBA model, and (iii) when we include or exclude some control variables and for different subsets of countries.Footnote 16 We finally provide a possible explanation to our results by looking in-depth at the effects of backward linkages on exports, imports, and the trade balance.

3.1 Results at the aggregated level: benchmark specification

Table 2 reports different estimated regressions based on the empirical model in Eq. (1). We first consider a parsimonious specification, in which the current account balance as a percent of GDP is regressed only on the GVC indicator (columns (1), (3), (5) and (7)). Alternatively, we also include the following control variables: the change in the real effective exchange rate (Growth REER), the difference between the growth rate of trading-partners’ and domestic GDP for each country (RGDP), the fiscal balance (as a percent of GDP), the initial net foreign asset position (NFA, in percent of GDP), and the dependency ratio. The table presents different specifications to ensure the robustness of our results: pooled OLS, fixed effects, pooled GLS with AR(1) correction, and dynamic GMM.Footnote 17

Even though there are some differences among the estimated coefficients of the various models presented, in all the specifications, an exchange rate appreciation tends to deteriorate the current account, reflecting the usual expenditure-switching effect: changes in international prices increase exports while shifting the composition of domestic consumption and investment away from foreign goods toward domestic goods on the demand side, as well as driving resources from the non-tradable to the domestic tradable sector on the supply side. The lagged stock of net foreign assets is also found to be significant and negatively signed for most specifications, indicating that countries with larger NFA positions tend to exhibit lower current account balances. This is in sharp contrast with the positive link expected from the standard open economy macroeconomic theory. However, a negative sign could also be obtained since countries with large NFA positions are able to run long-lasting trade deficits while remaining solvent. This situation translates into a negative relationship between NFA and the current account position. Moreover, this result is in line with the IMF’s EBA view according to which large debtor countries need to adjust their stock positions by running higher current account balances. Focusing on the dynamic GMM estimates (columns (7)–(8)), RGDP is found to be only weakly significant. This result reflects the fact that while some countries are at early stages of development (see, e.g., Freund 2005) with a corresponding negative impact on the current account, others have clearly reached high levels of development with an associated positive effect on the current account balance—thus weakening the global negative effect of RGDP on the current account. Most importantly, we find substantial persistence in the current account dynamics, highlighting the interest of adding the lagged endogenous variable to the usual static representations. The coefficient associated with the lagged current account amounts at around 0.5, in line with the findings of the literature (see, e.g., Chinn and Prasad 2003). It captures the partial adjustment of the current account and can be theoretically rationalized by habit formation in the behavior of private agents (Fratzscher et al. 2004).

Turning to our main variable of interest, backward participation is negatively signed—in line with Haltmaier (2005)’s findings—implying that backward linkages in GVCs tend to reduce current account balances. Importantly, our findings are robust to the choice of the specification showing that, other things being equal, a country’s current account balance will deteriorate if it imports intermediate products to be used in its exports. The estimated coefficients range from − 0.04 in the pooled OLS model (column (2)) to − 0.39 in the case of the GLS specification (column (6)). To gauge the magnitude of the contribution of each factor to current account fluctuations, column (9) of Table 2 displays the coefficients from the GMM regression on the standardized regressors (zero mean and unit variance). The reported estimates can thus be interpreted as the current account effect of an increase of one standard deviation (SD) in each of the covariates. As shown, a one SD increase in the backward participation relative to other countries is associated with a reduction of 0.64 SDs in the current account.

3.2 Robustness checks

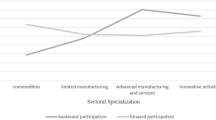

3.2.1 Sector-specific measures of GVC participation: distinguishing between manufactured goods and services

A major concern when dealing with production fragmentation is how the effects uncovered via the sector-level specification add up to country-level current accounts. Under this perspective, a first distinction can be made between manufactured goods and services backward participation. Indeed, even if the production of goods remains a core activity in GVCs, much value creation now involves services. Services, such as design, commercialization, finance, transport, and telecommunications are used extensively as inputs to produce manufactured and resource exports. Other services, such as marketing and distribution, account for a relatively large share of the final value of manufactured goods. Accordingly, one may expect that there are gains in competitiveness that translate into higher current account positions when a country has downstream participation in services.

As shown in Table B1 in the online Appendix, our previous conclusions remain valid when considering sector-specific measures of backward participation.Footnote 18 Indeed, both GVC participation in manufactured goods and services are negatively signed, meaning that increasing participation reduces current account positions. More in detail, our results show that the negative impact of GVC participation on the current account is higher for services than for goods. As stated above, although a very large number of goods are produced internationally, an increasing amount of services—in particular those that were previously supplied within companies—have been outsourced and off-shored. Services are thus an integral part of GVCs and are more and more concerned by the fragmentation of production. This is especially the case for business services, such as computer services, legal, accounting, management consulting, etc. While being concentrated in high-income countries, the market for business services has become global with the involvement of developing and emerging countries—such as India—where the skills and talents are cheaper. Financial services, such as banking and insurance activities, are also concerned by this increasing participation of countries in GVCs although it mainly concerns developed economies. Overall, our results show that the growing participation in services’ GVCs negatively affects the current account position, confirming the findings obtained at the aggregated level.

Turning to manufactured goods, the negative link between backward participation in GVCs and current account position is also evidenced although there is some heterogeneity across products. The sectors which are particularly concerned—such as (i) food products and tobacco, (ii) basic metals, and (iii) electrical and optical equipment—are among those for which the index of fragmentation is the highest, i.e., with relative long GVCs (De Backer and Miroudot 2013).

On the whole, our previous findings are corroborated as a negative link between backward linkages and current position is observed for both manufactured goods and services.

3.2.2 Alternative framework: the IMF’s EBA model

Let us now assess whether our main result—namely the negative relationship between GVC participation and current account position—remains valid when considering an alternative modeling framework. To this end, we rely on the External Balance Assessment (EBA) methodology, which is a widely used tool for assessing the importance of different current account determinants in shaping external imbalances across countries (see Phillips et al. 2013). In this section, we follow Brumm et al. (2019) and estimate the baseline EBA model. Before proceeding, it is important to mention that the typical EBA regression contains a broad set of variables that can explain the current account: fundamental non-policy-related determinants (such as productivity, expected GDP growth, demographic factors), financial determinants (countries’ reserve currency status, global financial market conditions), cyclical factors (such as the output gap), and policy-related variables (like the cyclically-adjusted fiscal balance and the level of public expenditure in health). From the 23 variables included in the 2018 EBA exercise, we retain the 21 variables that are not instrumented, and extend the model with our indicator for backward participation.Footnote 19 As in our previous estimated specifications, in addition to the original EBA-type regressions, we allow for country-specific intercepts.

Table B2 in the online Appendix presents the estimated coefficients of the different models. Although we do not aim at giving a full description of the results, let us just provide some brief comments regarding the main findings focusing on the dynamic GMM estimates (column (4)). Starting with cyclical factors, the output gap is negatively signed, as expected. Indeed, weak demand—illustrated by negative output gap—tends to lower investment and stimulates saving. An increase in the output gap of 1% reduces the current account by around 0.24 percentage point of GDP. The commodity terms of trade gap (interacted) has also the expected positive sign. Actually, changes in commodity terms of trade positively affect the current account as the corresponding temporary income gains are usually associated with higher saving. Turning to macroeconomic fundamentals, the expected real GDP growth is negatively signed as anticipating higher growth tends to boost investment and consumption, and lower saving—provided that households aim at smoothing consumption. Regarding policy variables, global risk aversion (captured by the VIX variable interacted with current account openness) tends to increase precautionary savings and lower investment in most countries, explaining the positive sign obtained for this variable.

Finally, turning to our variable of interest, we show that our previous findings are robust to the retained framework. Indeed, results in Table B2 confirm that stronger backward GVC participation is associated with lower current account balances.

3.2.3 Different control variables and subsets of countries

Let us now briefly present the main results regarding the impact of GVC participation for slightly different specifications, in terms of control variables and subsets of countries. In particular, regarding the list of regressors, (i) since the real exchange rate is not included in the IMF’s EBA model, we exclude this variable from the set of controls, and (ii) we include forward participation as a control variable to investigate whether it influences our results. Turning to the subsets of countries, we keep the benchmark model and successively (i) exclude the CEE countries, which are very small and hence have higher GVC participation, (ii) keep only advanced countries, and (iii) present the results for emerging countries exclusively.

As shown in Table B3, our results are robust to the inclusion/exclusion of control variables. In particular, the inclusion of forward participation—i.e., the domestic value-added contained in intermediates exported to a first economy that re-exports them—does not influence our findings. Indeed, only backward participation is significant, even when controlled for forward participation, and makes a negative contribution to current account balances. A country’s current account balance will not benefit from higher GVC participation if its primary role is to export intermediates for further processing in other countries, explaining the non-significance of forward participation. Turning to the countries’ subsamples, our findings show that the coefficient associated with GVC participation is always negatively signed, and is significant at the 1% statistical level for two out of three panels, i.e., the subset excluding CEE economies and the subsample of emerging countries. These results are consistent with the stylized facts presented in Sect. 2.4 showing that advanced countries tend to display lower participation rates than smaller economies, the latter being the most involved in GVCs. Despite the interest of these results, it is worth mentioning that the relevant analysis should be done on the whole panel of countries as the effect of GVC participation on current account balances should be assessed at the global level. Overall, our findings confirm our main conclusion that backward participation makes a negative contribution to the current account.

3.3 GVC participation: competitiveness gains and trade balance effects

The finding that backward participation is associated with a lower current account level needs an in-depth analysis, as higher backward participation means (i) more imported inputs, which mechanically causes a lower current account position, and (ii) more exports, which increases the current account. A vast literature has emphasized the role played by imported inputs on firm productivity (see, e.g., Amiti and Konings 2007; Topalova and Khandelwal 2011; Halpern et al. 2015), whereas other studies have highlighted the positive link between imported intermediate inputs and export scope and performance at the firm level through, for instance, better complementarity of inputs, transfer of technology and/or decreased price index (see, e.g., Bas and Strauss-Kahn 2014; Feng et al. 2016). As the competitiveness of a country’s exports may depend on imported inputs, a positive impact of backward linkages on the current account is expected. However, a next step to understand the channels through which GVC participation may affect the current account is to investigate the other side, namely, the imports’ side and, in general, the overall impact on the trade balance.

To this end, we aim at assessing whether (i) the increase in imports of intermediates may more than offset the trade balance effects of the resulting competitiveness gains of domestic products, and/or (ii) the rise in domestic production due to these competitiveness gains brings about further increases in imports of final and intermediate goods, not necessarily related to GVC participation. To address this issue, we explicitly examine how the evolution of backward GVC participation affects the growth rate of exports, imports, and the trade balance at current prices. Regarding imports, we distinguish intermediate and final goods. Final goods are then decomposed into capital, consumption, and mixed end-use goods.Footnote 20

Our empirical analysis is based on the conventional elasticity approach to the balance of payment adjustment enriched by our GVC participation indicator. In particular, we specify the short-run relationships characterizing export and import functions respectively as follows:

and

In Eqs. (3) and (4), exports and imports, denoted X and M respectively, are determined by the real exchange rate and real world (\(Y^*\)) or domestic (Y) income as proxies for demand shifters. Note that imports are total imports, i.e., imports of intermediate goods and imports of final goods (capital, consumption and final goods). Data on exports and total imports are extracted from WDI. Data on consumption, intermediate, capital, and mixed end-used goods were obtained from the OECD Bilateral Trade in Goods by Industry and End-use database. We consider the annual growth rate of current exports and imports of goods and services (current US dollars). Exports and imports of goods and services represent the value of all goods and other market services provided to or from the rest of the world, respectively.

The measurement of these variables deserves some comments regarding their content in terms of domestic and foreign value-added embodied in trade flows. As clearly explained in IMF (2015), exports include both exports produced within GVCs and non-GVC-related exports. The former, i.e., GVC-related exports, comprise domestic-value-added and foreign-value-added components, which are, in turn, further used as inputs into the next stage of the supply chain. Turning to non-GVC-related exports, they mainly consist of domestic value-added. As a consequence, both domestic and foreign value-added are embodied in gross exports. Regarding imports, they also contain GVC-related and non GVC-related imports—the former being equivalent to the foreign value-added component of GVC-related exports. Given that foreign value-added in GVC-related exports is embodied in both imports and exports, the size of the trade balance is not affected.Footnote 21

The reduced form of the domestic trade balance is given by:

Hence, we expect real foreign income and real exchange rate to be positively related to the trade balance, whereas a negative sign should be associated with domestic income.

As seen in Table 3, the variables are correctly signed: the impact of income growth is positive, driving exports and imports upwards, and the exchange rate appreciation has a detrimental (resp. positive) effect on exports (resp. imports), as expected. Not surprisingly, the results presented in Table 3 show that exports and imports are positively related to higher GVC participation. Importantly, stronger backward linkages not only increase imported inputs but they also trigger higher imports of consumer, capital, and mixed end-use goods. Note particularly that the increase in capital goods from higher participation in GVCs is as high as the increase in inputs. This may probably result from income increasing as exports grow with higher participation in GVCs. The rise in imports of intermediates and final goods and services more than offsets the trade balance effects of the resulting competitiveness gain of domestic products.

Comparing results in Tables 2 and 3 suggests that the negative effect of GVC participation on current account balances comes from the increasing value of imports from countries involved in GVCs—that mitigate what would be the positive impact on exports. It is worth mentioning that when countries increase their production fragmentation, the rise in imports is not offset by a commensurate increase in exports. Moreover, countries seem to create a dependency on imported capital goods. Therefore, higher backward GVC participation is not translated into a higher current account balance.

4 Concluding remarks

According to a widespread view, embedding in international networks of production enhances the export competitiveness of countries by providing access to cheaper, more differentiated, and better quality inputs. Within this context, we investigate whether, by improving competitiveness, the increase in GVC participation impacts the current account balances.

Relying on a large panel of 57 countries, we show that there is no substantial gain from trade through access to new imported inputs. On the contrary, we find evidence that backward participation makes a negative contribution to current account balances: a rise in backward GVC participation of a country relative to other countries—i.e., if the country imports intermediate goods for further producing its exports—deteriorates its current account position. Our findings remain valid for both manufactured goods and services—while the effect being higher for the latter. Finally, we present evidence that whereas higher GVC participation boosts exports, the rise in imports—both of intermediate and final goods—in the country involved in supply chains explains the negative effect of GVC participation on current account balances. Moreover, countries seem to create a dependency on imported capital goods as they increase their participation in GVCs.

By contributing to a better understanding of GVCs, our findings have important policy implications. Specifically, better identification of countries’ characteristics in terms of domestic value-added content of gross exports together with a better understanding of where countries are positioned (upstream or downstream) along the global supply chain will help in studying international linkages and designing trade policies. In particular, such a better knowledge will help in examining the effects of GVCs on the international transmission of shocks, the evolution of trade imbalances, specialization patterns, and the role of protectionist measures such as trade barriers.

Regarding specialization patterns, it is worth mentioning that GVCs have deeply impacted trade theory. As a simple illustration, whereas standard models of international trade based on comparative advantages mostly deal with final goods, the rising international production fragmentation process renders necessary to define specialization patterns at a more disaggregated level, i.e., at a particular stage in the global supply chain. Similarly, international fragmentation has obviously important implications for the distributive effects of trade. More generally, GVCs start to be accounted for by policy-makers in the design of trade policies. As emphasized by De Backer et al. (2018) among others, several policies—including trade policies, export and investment promotion policies, and industrial policies—have recently been re-defined in terms of participation in GVCs. Among the main implications of GVCs from a trade policy viewpoint, fragmentation of production across various countries tends to raise the cost of tariff and non-tariff trade barriers due to the high number of border crossing during the production stages.

In sum, a better understanding of GVCs to which the present paper contributes will help in determining the actual costs of specific trade policies as well as in assessing the sensitivity of economies to protectionist measures. Overall, the international fragmentation of production together with the increasing role of GVCs have profoundly modified the configuration of international trade, requiring a re-thinking of standard international trade theories. Furthermore, given the link we found between GVCs and current-account positions, policies aiming at narrowing global imbalances should account for the participation of countries in supply chains.

Notes

Note that there is a second, indirect mechanism which operates through the effect that the real exchange rate exerts on the current account. This transmission channel has been examined by Riad et al. (2012) who rely on a partial equilibrium approach to assess the effect of relative price changes on the trade structure of China, the Eurozone, Japan, and the United States.

However, Brumm et al. (2019) present empirical evidence that increased forward participation—i.e., rising the domestic value-added contained in inputs used to produce exports in the destination country—can also improve the current account balances, even though the impacts are quite weaker and operate through other channels than for backward participation.

We include up to 6 lagged values of the current account as instruments.

The time span is guided by data availability issues regarding GVC measures (see Sect. 2.3).

Note that we include the REER in the control variables as, from a theoretical viewpoint, it is a widely accepted view that shifts in the real exchange rate cause changes in the current account. This link is indeed acknowledged in various strands of the international macroeconomics literature, such as traditional approaches (e.g., Dornbusch 1976), new open economy macroeconomics literature (e.g., Obstfeld and Rogoff 1995, 2005), and Optimum Currency Areas theory (e.g., Mundell 1961). The introduction of the REER in the control variables permits to capture relative price effects, and the expenditure switching effect that is the main channel through which shifts in REER cause current account variations (see Sect. 3.1). However, as the REER is not included among the regressors in the IMF’s EBA model, we will also further exclude this variable in the robustness analysis.

Note that other databases are available, such as Eora (UNCTAD) and WIOD (European Commission). The Eora global supply chain database consists of a multi-region input–output table covering a large set of economies, but its simplified version Eora26 should be used for analyses requiring comparisons across countries—due to the mixed structures of individual countries’ tables. WIOD (World Input–Output Database) also provides interesting data, but it covers a reduced set of 43 economies. Other multi-region input–output databases exist, such as the EU-based consortium EXIOBASE, the Asian Development Bank Multi-Region Input–Output Database, GTAP (Global Trade Analysis Project), or the South American Input–Output table (ECLAC); for a comparative analysis of GVC databases, see Tukker and Dietzenbacher (2013) and Casella et al. (2019). In the present paper, we privileged OECD databases as they cover a large set of economies, and are based on a compilation of statistics which are harmonized across countries—facilitating cross-country comparisons. Besides, the TiVA database accounts for the difference between domestic and foreign inputs (i.e., added value), focuses on industrial activity rather than on products, and uses the ICIO table that clearly measures the origin and value of intermediate goods.

Note that participation in GVC is expressed in relative terms, i.e., with respect to other countries.

All the results corresponding to the robustness analysis are reported in the tables in the online Appendix (see Tables B1, B2 and B3).

The lagged value of the current account is introduced to account for some persistence in imbalances. In this case, we use the two-step dynamic GMM estimation procedure and perform the Sargan, J-stat test for the validity of instruments, as well as the AR(2) test for the absence of serial autocorrelation of order 2. As shown in Table 2 the models are correctly specified.

To save space, Table B1 only presents the estimated coefficients of interest. The models, however, include all the control variables. To avoid any confusion, recall that our aim is to investigate the impact of GVC participation in a given sector—either manufactured goods or services—on countries’ current account balances, and not on sectoral balances. In other words, our level of interest for studying the impact of participation in value chains is the national level, not the sectoral degree. We thus rely on the same current account data as for the aggregated level analysis—the aggregate current account of a country being the relevant variable for global imbalances. For the sake of completeness, note that for a recent investigation of the contribution of sectoral balances (i.e., households, government, non-financial corporations, and financial corporations) to the current account balance and of sectoral positions to the net international investment position, the reader may refer to Allen (2019).

Note also that, in some cases, the EBA variables are expressed relative to a weighted average of other countries’ values prevailing at the same time. For a full description of the EBA methodology and description of the variables, the reader is referred to Phillips et al. (2013).

Mixed end-use goods complement the three major categories of capital, consumption and intermediate goods and include personal computers, passenger cars, personal phones, packed medicines and precious goods, allowing to distinguish several consumer-oriented final goods that can be consumed by households, private industries or public sectors.

References

Aizenman, J. (2010). On the causes of global imbalances and their persistence: Myths, facts and conjectures. In S. E. S. Claessens & B. Hoekman (Eds.), Rebalancing the global economy: A primer for policymaking. London: VoxEU.org Publication, CEPR.

Aizenman, J., & Sun, Y. (2010). Globalization and the sustainability of large current account imbalances: Size matters. Journal of Macroeconomics, 32(1), 35–44.

Allen, C. (2019). Revisiting external imbalances: Insights from sectoral accounts. Journal of International Money and Finance, 96(C), 67–101.

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Antràs, P. (2005). Property rights and the international organization of production. American Economic Review Papers and Proceedings, 95(2), 25–32.

Augusto, C. C., Chong, A., & Loayza, N. (2002). Determinants of current account deficits in developing countries. The B.E. Journal of Macroeconomics, 2(1), 1–33.

Baldwin, R. (2013). Global supply chains: Why they emerged, why they matter, and where they are going. In D. Elms & P. Low (Eds.), Global Value Chains in a Changing World. Geneva: World Trade Organization.

Baldwin, R. (2014). Trade and industrialization after globalization’s second unbundling: How building and joining a supply chain are different and why it matters. In R. C. Feenstra & A. M. Taylor (Eds.), Globalization in an age of crisis: Multilateral economic cooperation in the twenty-first century (pp. 165–212). Chicago: University of Chicago Press.

Baldwin, R. (2016). The great convergence. Cambridge: Harvard University Press.

Bas, M., & Strauss-Kahn, V. (2014). Does importing more inputs raise exports? Firm-level evidence from France. Review of World Economics (Weltwirtschaftliches Archiv), 150(2), 241–275.

Bracke, T., Bussière, M., Fidora, M., & Straub, R. (2010). A framework for assessing global imbalances. The World Economy, 33(9), 1140–1174.

Brumm, J., Georgiadis, G., Grab, J., & Trottner, F. (2019). Global value chain participation and current account imbalances. Journal of International Money and Finance, 97, 111–124.

Casella, B., Bolwijn, R., Moran, D., & Kanemoto, K. (2019). Improving the analysis of global value chains: The UNCTAD-Eora Database. Transnational CorporationsTransnational Corporations, 26(3), 115–142.

Cattaneo, O., Gereffi, G., & Staritz, C. (2010). Global value chains in a postcrisis world: A development perspective. Washington, DC: The World Bank.

Ca’Zorzi, M., Chudik, A., & Dieppe, A. (2012). Thousands of models, one story: Current account imbalances in the global economy. Journal of International Money and Finance, 31(6), 1319–1338.

Chen, S.-W. (2011). Current account deficits and sustainability: Evidence from the OECD countries. Economic Modelling, 28(4), 1455–1464.

Cheung, C., Furceri, D., & Rusticelli, E. (2013). Structural and cyclical factors behind current account balances. Review of International Economics, 21(5), 923–944.

Chinn, M., & Prasad, E. (2003). Medium-term determinants of current accounts in industrial and developing countries: An empirical exploration. Journal of International Economics, 59(1), 47–76.

Choi, M. S., Sung, B., & Song, W.-Y. (2019). The effects of the exchange rate on value-added international trade to enhance free trade sustainability in GVCs. Sustainability, 11(10), 1–10.

Christopoulos, D., & León-Ledesma, M. A. (2010). Current account sustainability in the US: What did we really know about it? Journal of International Money and Finance, 29(3), 442–459.

Daudin, G., Rifflart, C., & Schweisguth, D. (2011). Who produces for whom in the world economy? Canadian Journal of Economics, 44(4), 1403–1437.

De Backer, K., De Lombaerde, P., & Iapadre, P. (2018). Analyzing global and regional value chains. International Economics, 153, 3–10.

De Backer, K., & Miroudot, S. (2013). Mapping global value chains (OECD Trade Policy Papers 159). Paris: OECD Publishing.

Dornbusch, R. (1976). Expectations and exchange rate dynamics. Journal of Political Economy, 84(6), 1161–1176.

Elms, D. K., & Low, P. (2013). Global value chains in a changing world. Geneva: World Trade Organization.

Feenstra, R., & Hanson, G. (1996). Globalization, outsourcing, and wage inequality. American Economic Review, 86(2), 240–245.

Feng, L., Li, Z., & Swenson, D. L. (2016). The connection between imported intermediate inputs and exports: Evidence from Chinese firms. Journal of International Economics, 101(C), 86–101.

Fratzscher, M., Müller, G. J., & Bussière, M. (2004). Current accounts dynamics in OECD and EU acceding countries—An intertemporal approach (Working paper series 311). European Central Bank.

Freund, C. (2005). Current account adjustment in industrial countries. Journal of International Money and Finance, 24(8), 1278–1298.

Gary, G., Humphrey, J., Kaplinsky, R., & Sturgeon, T. J. (2001). Introduction: Globalisation, value chains and development. IDS Bulletin, 32(3), 1–8.

Gary, G., Humphrey, J., & Sturgeon, T. J. (2005). The governance of global value chains. Review of International Political Economy, 12(1), 78–104.

Gnimassoun, B., & Mignon, V. (2015). Persistence of current-account disequilibria and real exchange-rate misalignments. Review of International Economics, 23(1), 137–159.

Gruber, J. W. (2004). A present value test of habits and the current account. Journal of Monetary Economics, 51(7), 1495–1507.

Gruber, J. W., & Kamin, S. B. (2007). Explaining the global pattern of current account imbalances. Journal of International Money and Finance, 26(4), 500–522.

Halpern, L., Koren, M., & Szeidl, A. (2015). Imported inputs and productivity. American Economic Review, 105(12), 3660–3703.

Haltmaier, J. (2015). Have global value chains contributed to global imbalances? (International finance discussion papers 1154). Board of Governors of the Federal Reserve System (U.S.).

IMF. (2015). World economic outlook, October 2015: Adjusting to lower commodity prices. Washington, D.C.: International Monetary Fund.

Johnson, R. C., & Noguera, G. (2017). A portrait of trade in value-added over four decades. The Review of Economics and Statistics, 99(5), 896–911.

João, A., & Sónia, C. (2014). Global value chains: A survey of drivers and measures. Journal of Economic Surveys, 30(2), 278–301.

Koopman, R., Powers, W., Wang, Z., & Wei, S.-J. (2010). Give credit where credit is due: Tracing value added in global production chains (Working paper 16426). National Bureau of Economic Research.

Kowalski, P., Lopez-Gonzalez, J., Ragoussis, A., & Ugarte, C. (2015). Participation of developing countries in global value chains: Implications for trade and trade-related policies (OECD Trade Policy Papers 179). Paris: OECD Publishing.

Krugman, P., Cooper, R. N., & Srinivasan, T. N. (1995). Growing world trade: Causes and consequences. Brookings Papers on Economic Activity, 1995(1), 327–377.

Lane, P. R., & Milesi-Ferretti, G. M. (2012). External adjustment and the global crisis. Journal of International Economics, 88(2), 252–265.

Miroudot, S., Lanz, R., & Ragoussis, A. (2009). Trade in intermediate goods and services (OECD Trade Policy Papers 93). Paris: OECD Publishing.

Moral-Benito, E., & Roehn, O. (2016). The impact of financial regulation on current account balances. European Economic Review, 81(C), 148–166.

Mundell, R. A. (1961). A theory of optimum currency areas. American Economic Review, 51, 657–665.

Obstfeld, M., & Rogoff, K. (1995). Exchange rate dynamics Redux. Journal of Political Economy, 103(3), 624–660.

Obstfeld, M., & Rogoff, K. (2005). Global current account imbalances and exchange rate adjustments. Brookings Papers on Economic Activity, 36(1), 67–146.

Phillips, S. T., Catão, L., Ricci, L. A., Bems, R., Das, M., Giovanni, J. D., et al. (2013). The external balance assessment (EBA) methodology (IMF Working Papers 13/272). Washington, D.C.: International Monetary Fund.

Pomfret, R. (2011). Regionalism in East Asia: Why has it flourished since 2000 and how far will it go?. Singapore: World Scientific Publishing Company.

Pomfret, R., & Sourdin, P. (2018). Value chains in Europe and Asia: Which countries participate? International Economics, 153, 34–41.

Riad, N., Errico, L., Henn, C., Saborowski, C., Saito, M., & Turunen, J. (2012). Changing patterns of global trade. Washington, D.C.: International Monetary Fund.

Sachs, J. D. (1983). The Current Account in the Macroeconomic Adjustment Process. The Scandinavian Journal of Economics, 84(2), 147–159.

Schoder, C., Proaño, C. R., & Semmler, W. (2013). Are the current account imbalances between EMU countries sustainable? Evidence from parametric and non-parametric tests. Journal of Applied Econometrics, 28(7), 1179–1204.

Topalova, P., & Khandelwal, A. (2011). Trade liberalization and firm productivity: The case of India. The Review of Economics and Statistics, 93(3), 995–1009.

Tukker, A., & Dietzenbacher, E. (2013). Global multiregional input–output frameworks: An introduction and outlook. Economic Systems Research, 25(1), 1–19.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank the editor, two anonymous referees, and Gianluca Santoni for helpful remarks and suggestions.

Electronic supplementary material

Below is the link to the electronic supplementary material.

About this article

Cite this article

López-Villavicencio, A., Mignon, V. Does backward participation in global value chains affect countries’ current account position?. Rev World Econ 157, 65–86 (2021). https://doi.org/10.1007/s10290-020-00390-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-020-00390-2