Abstract

While an abundance of studies exists documenting the significant wage premium of multinationals (MNE) and the effects of foreign direct investments on wage inequality, much less is still known about how foreign ownership of firms affects the gender wage gap. Based on employer-employee level data from Estonia—a country with the largest gender wage gap in the EU—this study highlights a regularity that foreign owned firms on average display a substantially larger gender wage gap than domestic owned firms. Among different occupation groups, this result is especially evident among managers. Furthermore, this difference is also evident if we focus on acquisitions of domestic firms by foreign MNEs and estimate its effects based on propensity score matching. The resulting increase in the gender wage gap is due to men capturing a higher wage premium from working at foreign owned firms than women, although both tend to gain in terms of wages from being employed at foreign owned firms. We find evidence (albeit limited) suggesting that one of the explanations of the difference between foreign and domestic owned firms in the gender wage gap could be that foreign owned firms require more continuous commitment from their employees compared to other firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is a well-known fact from empirical research in both international economics and international business literature that foreign owned firms have on average higher average wages than domestically owned firms (e.g. Heyman et al. 2007; Aitken et al. 1996; Taylor and Driffield 2005). This reflects that foreign firms select into high wage industries and regions, taking over local firms with higher performance and wages, or foreign ownership itself having an effect on wages through a variety of channels (Fosfuri et al. 2001; Budd et al. 2005; Arnold and Javorcik 2009). There is also an abundance of studies on foreign direct investments (FDI) and wage inequality (e.g. Taylor and Driffield 2005; Figini and Görg 1999) and extensive literature on the various drivers of the male–female wage gap (e.g. see Blau and Kahn 2000; OECD 2012; and Altonji and Blank 1999 for an overview), but still limited evidence and explanations concerning the links between FDI and the gender wage gap (Oostendorp 2009; Kodama et al. 2018, and a conceptual overview of the mechanisms of the effects in Aguayo-Tellez 2011).

This paper addresses in particular this last issue. We document the robust relationship between the foreign ownership of firms and the gender wage gap based on employer-employee data from Estonia, and account for various other relevant firm and individual level covariates. Prior analysis on FDI and the gender wage gap includes an econometric investigation of aggregate country level data (Oostendorp 2009) to outline general country-level correlations, the use of a combined household survey and province level data (Braunstein and Brenner 2007), modelling the effects of liberalized FDI policies and the resulting FDI inflow in a general equilibrium model (Chaudhuri and Mukhopadhyay 2014), and also some relevant evidence on labour market outcomes for women in foreign and domestically owned firms based on firm-level (Chen et al. 2013) or more recently also employer–employee level data (Kodama et al. 2018 on Japan). The study using such data from Japan (Kodama et al. 2018) points to foreign owned firms having more female friendly work practices than local firms, therefore suggesting a significant transfer of human resource practices and corporate culture through FDI. Although they do not estimate specifically the effects on gender wage gap, their findings would also suggest a lower gender wage gap among foreign owned firms.

Our contribution to the prior literature linking foreign ownership and wages is to provide evidence of a persistently larger male–female wage gap among foreign owned firms compared to domestically owned firms, even if we account for a number of employer and employee specific characteristics. This difference is also evident if we focus on the effects of acquisitions of domestic firms by multinationals and estimate its effects using a propensity score matching approach. We show that a change in ownership from domestic to foreign owned firm is associated with higher rewards for men than women in terms of wages, resulting in a larger gender wage gap in foreign owned firms.

There are several channels for how foreign ownership can either increase or decrease the gender wage gap. The net effect is likely to depend on the institutional background of the host country and how it differs from the home country of the investors. Following recent contributions in labour economics (Goldin 2014), our evidence indicating a larger gender wage gap in foreign owned firms is consistent with the reasoning that differences in the gender wage gap between foreign and domestically owned firms are likely to reflect the differences in work commitment and flexibility requirements from employees (e.g. working overtime, availability for afterhours work). Differences in commitment or flexibility requirements across different occupation categories have been suggested in Goldin (2014) as one of the primary explanations of the significant remaining gender wage gap in the US and likely also in other advanced economies. Arguably, such differences in required commitment may depend a lot on the competition environment of the firm, or firm characteristics such as size, trade orientation (Boler et al. 2018; Kvande 2009), or most likely also the type of ownership. For example, Goldin (2014) points out that even within the same occupation, such as among lawyers, the importance of working long hours and other requirements of commitment to work are likely to be quite different in a small firm that may allow short and discontinuous hours at little wage penalty and large law firms, where there is likely to be a disproportionate premium for contributing longer and continuous hours and effort. A recent paper on exporting and the gender wage gap in Norway by Boler et al. (2018) shows clear evidence that is most relevant to this study—that being an exporter is associated with a higher gender wage gap and that higher commitment requirements among exporters is a plausible explanatory factor of this difference. We investigate whether similar results to Boler et al. (2018) in the context of exporters can be observed in the case of the effects of foreign ownership.

Our study is based on employer-employee level data from Estonia. Estonia is a good example for investigating both the effects of foreign direct investment (FDI) and the determinants of the gender wage gap. Estonia has historically attracted considerable foreign investment. A very large proportion of the FDI inflows are from neighbouring Sweden and Finland, countries with a strong emphasis on gender equality. At the same time, Estonia has the largest male–female wage gap among European Union countries (Anspal 2015), estimated to be close to 30% across different data-sets and periods.

FDI in Estonia has been to a large extent traditionally either the efficiency or market seeking type of FDI (Varblane et al. 2010). It is of significant interest how the Swedish and Finnish multinationals, which have dominated FDI in Estonia, apply personnel practices and remunerate men and women in their local affiliates compared to firms based on Estonian capital. We clearly observe that the expectations that the FDI home country's personnel practices get transferred unchanged to the host economy do not accord with the regularities present in our data.

The analysis covers the population of firms and employed individuals in Estonia and is mostly based on estimations of Mincerian wage equations and propensity score matching. The matched employer-employee panel data of firms and employees used in this paper covers the period 2006–2012.

2 Literature review

2.1 Channels of the effects of FDI on the gender wage gap

There are a number of channels through which FDI can affect the gender wage gap. As in the case of the general effects of FDI on wages, there can be, firstly, direct effects on the wages of foreign affiliates that may vary for men and women. These are our focus of interest in this paper. Secondly, there may be structural and spillover effects that affect the gender wage gap in the whole economy, including among domestic owned firms.

The first reason why foreign owned firms may have a different gender wage gap compared to domestic owned firms works through potential differences in actual discrimination. On the one hand, following Becker’s (1957) theory of taste-based discrimination, more profitable firms might be more able to engage in costly discrimination. As foreign owned firms have higher productivity and higher profitability, they could be better able to engage in such discrimination. On the other hand, foreign owned firms are likely to be exposed to a tougher international environment of competition. Tougher competition, again along the lines of Becker (1957), restricts the firm’s ability and incentives to engage in costly discrimination and leads to a more efficient allocation of talent within the firm. The entry and presence of MNEs in a host economy can also mean a tougher competition environment for domestic owned firms, and thus could also lead to a lower gender wage gap among them.Footnote 1

Focusing only on the discrimination-based explanation would assume that men and women have similar skill sets, are equally productive and perfect substitutes in all sectors. If different sectors use male and female labour at different intensities, if men and women have different levels and types of skills, and foreign owned firms require different skill sets or levels than domestic firms, then FDI inflow will result in important inter-industry reallocation effects with implications for the gender wage gap (Juhn et al. 2014; Oostendorp 2009; Aguayo-Tellez 2011; Pieters 2015). FDI inflow (e.g. into export-oriented comparative advantage sectors) therefore affects the growth of different sectors in different ways, leading to changes in the relative demand for male and female labour and accordingly affecting relative male and female wages. For example, if a developing country has a comparative advantage in female labour-intensive sectors (e.g. textiles) and FDI flows predominantly into this sector, FDI could increase the relative wages of women in the economy.Footnote 2

An important type of effect of FDI on the gender wage gap works through technology transfer. Foreign owned firms in developing and transition economies tend to adopt more skill and capital intensive production technologies than domestic firms. These technologies may complement female labour, by lowering the need for physical skills at the workplace and therefore raise the relative demand for female labour and the relative wages of women. As an example of the complementarities of new technologies and female labour, Weinberg (2000) has shown based on US data that the growth of female employment is positively associated with the adoption of information technology at the workplace. Indeed, women’s skill set tends to have relatively more cognitive skills and less physical skills compared to men (Weinberg 2000).

Another potential effect, especially relevant to our empirical study, may function through the transfer of management practices and in particular human resources management (hereinafter HRM) practices from the home economy of the investor to the affiliate (e.g. Kodama et al. 2018). As Bloom and van Reenen (2010, 2012) have shown based on the World Management Survey, the quality of management practices varies a lot across countries and is strongly related to firm productivity. Their results also highlight that multinational firms tend to have more similar management practices across countries than domestic firms. MNEs appear to be able to transfer good management practices to their affiliates in the host countries (Bloom et al. 2012). This may potentially include HRM practices. For example, Swedish and Finnish MNEs are from societies that put a stronger value on the equal treatment of men and women than in most other countries. This might perhaps be expected to be reflected in the HRM practices adopted in their affiliates abroad.

A significant counter-argument to the expectation of the transfer of HRM practices is that personnel practices can be among the less centralized functions in MNEs. Local affiliates in the host economy can still have substantial autonomy in these decisions, although autonomy vs centralization in terms of HRM practices can vary a lot depending on the mandate of the subsidiary and a variety of institutional and other factors (Belizon et al. 2013). The existing literature on this issue points out a number of possibilities.Footnote 3 Some MNEs do not give their subsidiaries any significant level of local autonomy at all. This reflects the view of HRM practices as a central component of a firm’s overall strategy (e.g., Schuler and Rogovsky 1998; Pudelko and Harzing 2007). From another perspective, some MNEs allow subsidiaries full autonomy in setting their HRM policy (e.g., Ferner et al. 2011). The HRM decisions on remuneration are also shaped very much by local labour market conditions, local traditions and management practices (especially if the affiliate’s managers themselves come from the host economy) and to a significant extent by the motives and strategies of the MNE/role of the subsidiary in the networks of the MNE.

Apart from these effects, foreign ownership may affect the bargaining power of men and women differently (Seguino 2005).Footnote 4 If FDI is more footloose than domestic investment, this may lower the relative bargaining power of employees at foreign owned firms. If the export-oriented target sectors of FDI employ relatively more women, then this effect of foreign investment may in fact increase the aggregate gender wage gap.

A more recent addition to theoretical predictions of the relationship between FDI and the gender wage gap is related to explanations of the aggregate gender wage gap based on work-commitment/job flexibility. Goldin (2014) shows that the aggregate gender wage gap (at least in the US context) can be explained to a large extent by employers disproportionately rewarding those workers who put in longer working hours, have less need for time off from work, and are in that way in general (perceived to be) more committed to work than others. For example, this can involve the willingness in the law or media sector to be available for consultations 24/7, willingness to go on business trips during a vacation period and at weekends, less need to leave the office early in the day, and so on. Goldin (2014) shows based on US data that this may be a powerful explanatory factor of the remaining gender wage gap in the US. Unlike many other explanations of the gender wage gap, this explains why some occupations (lawyers, business occupations) have a much higher gender wage gap than others (e.g. compared to the low gender wage gap among skilled employees at US pharmacies) and disproportionately reward being available for work 24/7. Goldin’s explanation based on work commitment is also more successful than others in explaining why women without children have higher wages than women with children, and why childless women in the US often have wage rates almost close to men with comparable characteristics. We note that our usage of the term ‘commitment’ denotes an individual’s willingness to work longer hours, inconvenient hours and a lower likelihood of having job discontinuities (similar to Boler et al. 2018), and this may be different from how the term is used in other strands of literature. In our context, the term is not meant to specifically indicate an individual’s emotional engagement with the work or workplace.

We could expect, building on the work in labour economics by Goldin (2014) and recent related empirical investigation from the international economics literature by Boler et al. (2018) that the relationship between FDI and the gender wage gap may reflect the foreign owned firms requiring more commitment and greater flexibility and less job discontinuities, especially from their managerial and other highly paid employees. Differences in commitment requirements across different jobs or to a lesser extent across sectors have been suggested in recent labour economics literature (Goldin 2014) as one of the primary explanations of the significant remaining gender wage gaps in advanced economies. Arguably, such differences in commitment requirements may depend a lot on how competitive the environment of the firm is, or firm characteristics such as size, trade orientation (as investigated in detail in an innovative empirical study by Boler et al. (2018) on exporters and the gender wage gap), or most likely also its type of ownership. For example, Goldin (2014) points out that, even within the same occupation such as among lawyers, the importance of working long hours and the requirements of commitment to work are likely to be quite different in small firms that may allow short and discontinuous hours at little wage penalty and large law firms where there is likely to be a disproportionate premium for contributing longer and continuous hours and effort.

Related literature on high-commitment workplaces from the field of sociology by Kvande (2007, 2009) or Connell (1998) also points out, based on the analysis of global firms and knowledge intensive workplaces, one surprising implication of the spread of technologies and practices that favour a more flexible work regime. They argue that these more flexible practices can in fact increase the pressure to work longer hours by enabling an increased availability of the individual for the work-related tasks and therefore, may result in a shift towards what some authors have labelled ‘total commitment’ organizations (Coser 1974) or the culture of ‘transnational business masculinity’ (Connell 1998).

We could expect here that the wages of individuals working at foreign owned firms are more sensitive with respect to their level of work commitment (as proxied by doing overtime, discontinuities in work-life, etc.) than they would be at domestic owned firms. This larger commitment requirement may have to do with foreign owned firms being exposed to a tougher competition environment, and greater need for their high-wage employees to co-operate and co-ordinate their activities with other parts of the MNE and its global value chain. In addition, it may reflect the fact that the high technology and capital intensity at foreign owned firms are complements with the higher commitment level of its staff. For example, Ben Yahmed (2013) shows in her Melitz-style heterogeneous producer trade model that positive complementarities between high technology and level of commitment from employees induce firms that have better technology and are able to cover the costs of investing in high technology (exporters in her analysis but these could also be foreign owned firms) to hire more ‘committed’ employees and have a wider gender wage gap among similarly skilled employees. The higher commitment requirement may be reflected in the more frequent need for managers to travel abroad—either to the home country of the investor or to other affiliates; the need to invest more time and continuous effort to the setup of new technology due to its more complex and unfamiliar nature; communicating and co-operating by managers and sales staff with a larger variety of clients or clients from geographically or culturally more distant destinations (see Boler et al. 2018); greater need to quickly adapt production, procurement and logistics to any delays or unexpected problems in the rest of the global value chain of the MNE.

Assuming now, in addition to the higher commitment requirement at foreign owned firms, that individual level commitment is also not something easily observed at the time of hiring, and assuming that firms perceive female employees on average as ‘less committed’ than men (as shown for example in surveys such as Gislason 2007, or in laboratory experiments about perceptions of individuals in Correll et al. 2007), we can expect foreign owned firms to have more statistical wage discrimination of women and a higher gender wage gap than purely domestically owned firms.Footnote 5 We would also anticipate that the commitment requirements matter especially among managerial employees, and consequently result in a larger negative premium from foreign ownership in the male–female wage gap among managerial occupations. This would be in accordance with Goldin’s (2014) evidence that the commitment level (in her analysis especially the particular hours worked, number of hours worked, job discontinuities) matters for wages and the gender wage gap more in business occupations compared to the technology occupations. In addition, we would expect the more skilled employee groups to have a stronger role for commitment, as there is on average less substitutability possible between high-skilled employees with otherwise similar characteristics. Finally, it is a stylized fact from prior literature that having children increases the male–female wage gap (Goldin 2014). If the commitment-based explanation of the foreign owned vs domestic firm differences in the gender wage gap makes sense, then we could expect the wage ‘penalty’ for women from having young children to be larger among the foreign owned than among domestically owned firms.

2.2 FDI and the gender wage gap: prior empirical studies

Prior analysis on FDI and the gender wage gap includes the econometric investigation of aggregate country level data (Oostendorp 2009) to outline general country-level correlations, combined household survey and province level data (Braunstein and Brenner 2007), modelling of the effects of liberalized FDI policy and the resulting FDI inflow in a general equilibrium model (Chaudhuri and Mukhopadhyay 2014), and also some evidence based on firm level (Chen et al. 2013) or more recently also employer-employee level data (Kodama et al. 2018 on Japan). Empirical evidence has concentrated somewhat more on the inter-industry structural change related explanations of the relationship between FDI and the gender wage gap. Evidence from individual and firm level data from Japan (Kodama et al. 2018) points to foreign owned firms having a lower gender wage gap and more female friendly work practices than local firms. This result suggests significant transfer of human resource practices and corporate culture through FDI. A widely cited aggregate level study by Oostendorp (2009) similarly confirms a clear correlation between FDI inflow and a smaller gender wage gap based on the aggregate level data of a number of countries.

At the same time a paper by Braunstein and Brenner (2007) based on combining a household survey and province level data from China suggests that in 2002 foreign owned firms had a larger male–female wage gap than others. They rationalize their finding with potential explanations based on technological development favouring male-labour intensive sectors in China and based on differences in terms of the productivity and segregation of the employment of men and women.

An empirical study by Boler et al. (2018) on exporters and the gender wage gap is highly related to our work here. They expose a related and at first glance perhaps a surprising result based on an employer-employee level data set from Norway: that exporters in Norway have on average a higher gender wage gap compared to non-exporters. This result is evident only once they account for individual specific fixed effects (i.e. unobserved fixed characteristics) in their econometric models.

3 Data and descriptive statistics

To investigate FDI and the gender wage gap, we have combined different firm and individual level datasets from Estonia, thereby creating and exploiting a matched employer-employee dataset.Footnote 6 The primary source of the individual level wage data is the Estonian Tax and Customs Office dataset on individuals’ monthly payroll tax payments for the period 2006-2014, which makes it possible to calculate the individual gross wages. We focus on wages at the main place of employment of the individual. Monthly wage data is from January of each year. The individuals’ background information from this dataset includes a limited set of variables, such as gender and age. In order to use a wider set of control variables, the Estonian Tax and Customs Office data has been merged at Statistics Estonia (using individual level anonymous identifiers) with the Estonian Population and Housing Census 2011. The latter data source includes detailed background information on the socio-economic status of individuals (including education, occupation, etc.). The two individual-level datasets have been further linked, using anonymous firm identifiers, with firm-level datasets to create a matched employer-employee dataset. The primary source of firm-level information is the Estonian Commercial Registry, covering the period 1995–2014 and including financial statements for the population of Estonian firms. This database includes the ownership information of firms. We note that our key measure of the foreign ownership dummy available from the Commercial Registry and used throughout the main text of the paper is based on the majority share (> 50%) of foreign ownership of the firm. In Estonia, a vast majority of the foreign owned firms are in fact majority foreign owned (see also the statistics in “Appendix 1”). More detailed additional data on ownership (e.g. the country of origin of foreign owners, minority ownership indicators) has been sourced from Statistics Estonia’s Statistical Profile for Enterprises 2007–2013. We test the robustness of our majority-ownership based foreign ownership indicator, and observe that the key effects in the following sections are in fact fully driven by the majority-based foreign ownership, not the minority ownership (see “Appendix 5” for this robustness test). The longitudinal nature of part of the matched employer-employee data enables us to study the effects of foreign acquisitions on the wages of men and women. We note that the availability of the key yearly data until 2014 and the necessity in some of our estimation to calculate outcome variables for two advance periods is the reason why the final sample of analysis in econometric analysis is based on period 2006–2012.

A limitation of the above-described matched employer-employee data concerns the shortage of detailed information about the jobs held by individuals, especially the number of hours worked. In order to investigate the sensitivity of wages in different types of firms to the hours worked by individuals (this is related to the above-discussed commitment-based explanation of the gender wage gap) we have also exploited the Estonian Labour Force Survey (hereinafter LFS) data for years 2007–2013. The LFS dataset is a standard source of labour market information. Estonia’s LFS data has a key advantage compared to others countries due to the inclusion of numerical wage information for each individual involved.Footnote 7

The gender gap has been studied in Estonia mostly based on the LFS, but also based on various other datasets (see e.g. Anspal 2015; Krillo and Masso 2010). These show consistently high gender pay gaps in Estonia, and higher than in other EU countries (e.g. Krillo and Masso 2010). The explained part of the gap is generally just about 1/3 of the total gap. Among the different factors explaining the gender pay gap, the most important contributors have been the industry and the occupation of the employee (Anspal 2015).

The key descriptive statistics about the gender wage gap in Estonia across various groups defined according to individual and firm-level characteristics are shown in Table 1. These confirm the persistent regularity that foreign owned firms have on average a larger gender wage gap than other firms. During the period 2006–2012, the gender wage gap in our dataset was, on average, 26.6% of men’s wages in domestic owned firms and 37.8% in foreign owned firms. This difference between the two groups of firms is large in terms of its economic size.

Concerning different occupations, the difference is especially large in the case of managers. The gender wage gap in the managerial occupation group was 39.8% in foreign owned firms compared to 18.8% in domestically owned firms. Despite the fact that the gender wage gap is often found to be higher among groups with higher wages (see e.g. the results of Anspal 2015), this difference found here is still surprisingly large.

The gender pay gap in foreign owned firms is also higher than in domestically owned firms in the case of professionals (by 6.7 percentage points), craft and related trade workers (9.5 percentage points), plant and machine operators (11.3 percentage points), elementary occupations (3.1 percentage points), and skilled agricultural workers. Notably, this regularity does not appear to be uniform across different occupations. The occupation groups such as technical and associate professionals, and service and sales workers show essentially a similar gender wage gap in the two groups of firms. In the case of the ‘clerical support workers’ occupation group the gender wage gap is in fact higher among domestic firms by 7% compared to foreign owned firms.

These comparisons need to acknowledge the compositional differences in terms of shares of female workers in the two groups of firms being studied. As we can see from Table 1, the share of females varies from 17.8% in craft and related trade workers to 77.7% in service and sales workers. The higher share of women in an occupation is, on average, associated with a higher general level of gender pay gap. The aggregate pay gap between the two groups of firms studied here may partly reflect the different gender and occupational structure.

Descriptive statistics in Table 1 confirm the regularity that foreign owned firms also have on average a larger gender wage gap than other firms in the case of the analysis of the different broad sectors of the manufacturing industry and services. The foreign-domestic gender wage gap difference is small in the primary sector, substantial in the major groups of manufacturing and mostly also in services. Key exceptions are the utilities sector (with low number of foreign owned affiliates) and the construction industry, where the gender wage gap is larger among the domestically owned firms. These are also sectors where the share of women in total employment is small.

A higher gender wage gap in foreign owned affiliates is also evident if we divide sectors based on their levels of skill intensity. Skill intensity is calculated here based on the shares of different occupation categories in the workforce of the firm, following the methods in Davidson et al. (2014).Footnote 8 The grouping of firms according to the firm’s level of skill intensity reveals that the gender wage gap in foreign owned firms tends to increase with the skill intensity level of the firm. Concerning education level, there is some tendency for higher education to be associated with a somewhat larger gender wage gap in foreign owned firms. However, the differences between the three education-based groups in Table 1 are not large.

Many of these statistics hide significant heterogeneity depending on other employee, firm and sector characteristics. In general, a tendency exists whereby employees with a higher income (and more skills, education) tend to exhibit somewhat larger gender wage gap’s difference between the foreign owned and local firms.

4 Empirical approach

4.1 Mincerian wage equations

The comparison of these unconditional differences does not enable us to make conclusions about the effects of FDI on the gender wage gap, as the results in Table 1 could simply reflect a number of other observed and unobserved drivers of wages than FDI. To account for this, we proceed at first with a ‘conditional mean analysis’ and estimate Mincerian wage equations with an FDI dummy, female dummy and their interaction term included among other standard drivers of wages. Then we apply propensity score matching to investigate whether the acquisition of a firm by a foreign MNE results in different effects on the wages of men and women. The empirical analysis concludes with a further simple estimation of Mincerian wage equations to address some potential explanations of the difference in the gender wage gap in foreign and domestic owned firms.

The large unconditional difference between the gender wage gap in foreign owned and domestic firms may still reflect a multitude of other observed and unobserved factors, including male and female segregation in terms of sector, occupation, skills and education, among others. We account for a host of firm and also individual level factors by estimating a Mincerian wage equation at employee level. The dependent variable is the log of real monthly wage \(lnW_{ikt}\) in January of the year, and a set of individual and firm-level characteristics are included among the controls. The corresponding wage equations are estimated correspondingly based on a cross section of employer-employee level data from 2011 (Eq. 1, 2011 was the year of the Population and Housing Census) and panel data (Eq. 2).

-

A.

Wage equation based on employer-employee level cross-section data from 2011 (with detailed individual level controls from the Population and Housing Census):

$$lnW_{ik} = \alpha_{0} + \alpha_{1} Female_{ik} + \alpha_{2} Foreign_{k} + \alpha_{3} Female_{ik} \times Foreign_{k} + \alpha_{4} Age_{i} + \alpha_{5} Age_{i}^{2} + \alpha_{6} R_{i} + \alpha_{7} Z_{k} + \varepsilon_{ik}$$(1) -

B.

Wage equation based on employer-employee level panel data from 2006 to 2012, with individual level fixed effects (without detailed individual level controls from the Population and Housing Census):

$$lnW_{ikt} = \beta_{0} + \beta_{1} Foreign_{kt} + \beta_{2} Female_{ik} \times Foreign_{kt} + \beta_{3} Age_{it} + \beta_{4} Age_{it}^{2} + \beta_{5} R_{it} + \beta_{6} Z_{kt} + \upsilon_{i} + \lambda_{t} + \varpi_{ikt}$$(2)

In Eqs. 1 and 2, i denotes individual, t year and k firm; \(Foreign_{kt}\) is a dummy variable denoting whether the individual works at a foreign owned firm or not; \(Female_{ik}\) is a variable denoting a woman, \(Age_{it}\) denotes the age of the individual, \(R_{it}\) is a vector of other individual-level controls (note that time-invariant controls are not included in the fixed effects specification), and \(Z_{kt}\) is a vector of firm-level controls. These other controls, depending on specification, include firm size and its squared term, firm age and its squared term, share of managers at the firm (to proxy skill intensity), share of females among employees (to account for differences in gender structure), indicators of education levels, indicators of whether the individual has changed jobs recently, occupation dummies (ISCO 1-digit level), industry dummies (at 2-digit NACE level), and region dummies for the firm (5 regions). The specifications based on the labour force survey also include hours worked, or a dummy denoting overtime work (more than 40 h per week), dummy for children and its interaction with the \(Female_{ik}\) dummy. Dummies for different years λt and firm-fixed effects νi are also included in the panel data specification in Eq. 2. The last term in both equations is an error term, which is assumed to be normally distributed with a zero mean and a constant variance.

We also note, that we estimate the Eq. (1) for different occupation groups, in order to statistically test whether the effects of foreign ownership on the gender wage gap differ by the occupation group. We would expect based on the commitment-requirements based reasoning outlined in the literature review section that the gender wage gap is larger in the 'managers' occupation group (ISCO occupation group 1) where the 24/7 availability for work can be especially important, and that the effect of foreign ownership is especially evident in the gender wage gap in this occupation category. We further investigate the commitment requirements based explanation of the effects of FDI by testing whether the different effects of domestic vs foreign ownership in Eqs. (1) or (2) have to do with different motherhood penalties on wages. This test is implemented based on an additional interaction term to study whether having children is associated with a larger or smaller gender wage gap for employees in foreign owned firms. In addition, we test whether the relationship between the level of wages and the number of working hours or doing overtime (working more than 40 h per week) are different between domestic and foreign owned firms.

Finally, we acknowledge that the analysis of Mincerian wage equations here focuses on the direct effects of FDI on the gender wage gap in the affiliate and thus makes an implicit assumption of the lack of spillover effects. This is of course not necessarily the case: spillovers may exist. We argue that the effect of FDI through spillovers on the gender wage gap would need a separate in-depth analysis, with many additional econometric problems to be addressed. For the sake of a clarity of focus on the direct effects, we will not engage here in a detailed analysis of spillovers.

4.2 Propensity score matching

An estimation of the effects of foreign ownership on the wages of employees presents a number of well-known methodological issues. One needs to proxy a ‘counterfactual of the acquisition’, in other words, what would have happened to the wages at the firms in the treatment group if they had not had the ‘treatment’—if there had been no foreign acquisition (Rosenbaum and Rubin 1983; Caliendo and Kopeinig 2008). We apply propensity score matching (PSM) (Rosenbaum and Rubin 1983) to come up with a proxy of this counterfactual, to investigate the effects of FDI on the gender wage gap. First, we will investigate the wage changes that follow from the acquisition of a domestic owned firm by foreign owners, comparing the ‘treated’ firms’ and their employees’ wages with the control group created by applying the PSM. Here, the treatment variable takes the value of 1 in post-treatment periods. Therefore, the treatment is a change in ownership of the firm. The treated unit is a firm. Second, we investigate a different type of treatment—the movement of an employee from a domestic to a foreign owned firm. In this case the treated unit is an employee and the effects are estimated at the individual level.

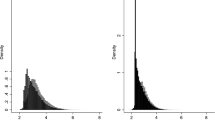

As the first step in the matching exercise the probit model for foreign acquisitions (or the individual’s move from domestic to a foreign owned firm) will be estimated, where the explanatory variables are all measured one period before the foreign acquisition: that is at time t − 1. The sample used for the analysis of the first type of treatment includes domestic owned firms and firms that change ownership from domestic to foreign over the period 2006–2012.Footnote 9 The sample used for the analysis of the effects of the second type of treatment includes individuals that move from domestic to foreign owned firms and other individuals (the pool of control units) who stay at domestic owned firms. The list of controls in the estimation of the propensity score of acquisition is a rather standard one and considers the stylized factors of foreign owners selecting firms with higher growth potential and performance. Therefore, the variables include productivity (value added per employee), firm size (log number of employees), firm age, age and size squared (to improve the success of matching, see Wooldridge 2002), capital-labour ratio, cash-to-assets ratio, dummy for the capital region (Tallinn and Harju county), 2-digit industry dummies and the year dummies. In the case of the individual level matching, we add some further individual level indicators such as gender (exact matching), the individual’s age and its squared term, education (dummies for higher and secondary education) from the Population and Housing Census of 2011, and also the pre-treatment wage level of the employee (at previous workplace) and its squared term.

The probit model helps aggregate the relevant information about the selection into treatment into a single variable, the propensity score, based on which for each treated firm k or treated individual h the two best matching non-treated firms/individuals are selected as the control units. This is the nearest neighbour matching with two neighbours. As a robustness check we also undertake the nearest neighbour matching with 5 neighbours and Kernel matching. In the case of Kernel matching, the weighted averages of all firms in the comparison group are used to construct the counterfactual. After estimating the propensity score and matching, we calculate the average treatment effect on the treated (ATT) on total wages, male wages and female wages at the firm over the post-treatment periods.

Formally, the ATT for the s periods (years) after treatment will be calculated as

where the first term on the right-hand side is the mean growth of the outcome variable (denoted hereby as \(\pi\), e.g. average wage at the firm/individual) for the treated firms or individuals, and the second term is a weighted mean of the growth of the outcome variable for the counterfactuals over the same period of time. The symbol \(s\) denotes the number of years over which the change is calculated. We have hereby considered the growth in the outcome variables relative to the pre-treatment (time t − 1) values at time t, t + 1 and t + 2, where t is the year of the treatment. As outcome variables, we have used the firm’s average wage, the average wage of male employees, and the average wage of female employees. In the case of individual level matching, we use individual male and female wages as outcome variables.

Based on the discussion of the effects of FDI in our literature review, we could expect positive wage changes following the foreign takeover or from an employee moving to a foreign owned firm, but could also potentially expect these effects to be larger in the case of men compared to women. In order to understand in more in detail the post-acquisition developments in the workforce structure and its potential contribution to wages we have also included the share of females in the workforce as one additional outcome variable in some of our PSM-based analyses.

5 Results

Our estimation of the Mincerian wage equations based on the employer-employee level data from 2011 is shown in Table 2. We find that foreign owned firms have a significantly higher male–female wage gap than the domestic owned firms, even after accounting for a variety of other factors of male and female wages, such as occupation groups and the education of individuals. The individual level education and occupation group information is available only for 2011, from the Population and Housing Census of Estonia. Hence, we use a combination of the Census data from 2011 with individual level wage information from the Tax and Customs Office dataset and firm level additional covariates from the Business Registry in the Tables 2, 3 and 4. We have also performed robustness tests of these cross-section based estimates using the Tax and Customs Office panel data from 2006 to 2012 that omits education and occupation proxies but enables us to account for individual level fixed effects (see columns 5 and 6 in Table 2).

We observe that women have on average 19 per cent lower wages than men in domestic owned firms (see column 2 in Table 2), once we account for the different occupation groups, the age and education levels of employees, sector dummies for the firm (at 2-digit level), some other firm level covariates such as size and age, skill intensity and share of female employees in the firm. We use the standard exponential transformation \((e^{X} - 1\)) here and throughout the rest of analysis to calculate the size of these effects, where \(X\) is the standard coefficient of a variable from our Mincerian wage regression analysis. In this first example X = − 0.212: that is the value of the coefficient of the female dummy from column 2 in Table 2).

Within the group of foreign owned firms, the gender wage gap is even larger. Although both men and women gain in terms of wages from working at a foreign owned firm, the gains for men (+ 14.9 per cent higher wages, in Column 2 of Table 1, see the foreign ownership dummy) are significantly larger, on average, than gains by women (+ 5.4 per cent, as given by the combination of the foreign ownership dummy and its interaction term with the female dummy variable), resulting in an overall increase in the gender wage gap in this group of firms. To provide a benchmark for assessing the economic significance of these percentages, the average gross wages in 2016 in Estonia were 1146 EUR (839 EUR in 2011). Therefore, for an individual that earned average Estonian wages in a domestic enterprise, the effect of being alternatively employed in a foreign owned firm would be an increase in wages by 171 EUR for a man and 62 EUR in the case of a woman in 2016, and 125 EUR and 45 EUR in 2011 respectively. These effects and their difference between the two groups of firms are economically significant. We further confirm this result based on the manufacturing sector data (see column 3 of Table 2).

The coefficients of other variables are as expected. There is a positive association between wages and an individual’s age, firm size, skill intensity at the firm (proxied here using the share of managers at the firm), and higher education level. The coefficients of occupation groups follow the skill intensity based pattern: the highest wage premiums are among managers (ISCO category 1), followed by professionals (ISCO category 2) and other occupation groups. In order to differentiate the foreign ownership effect from exporting, we further account for the exporter dummy and its interaction term with the female dummy in our estimation of the wage equation (see column 4 of Table 2). This is important to include as a robustness test, as Boler et al. (2018), based on their analysis of data from Norway, show that exporting status is a significant predictor of the gender wage gap at the firm, and the foreign ownership status is usually also positively associated with exporting. We observe that the general foreign vs domestic firm difference in the gender wage gap is not explained only by the difference in the export orientation of these two groups of firms. There is still a large difference in the gender wage gap even after accounting for exporting, as men still gain on average 12.6% and women 5% in wages from working at a foreign owned rather than a domestic owned firm (see the column 4 in Table 2).

The analysis so far has shown significant differences in the gender wage gap between the two groups of firms in our study, while we control for a number of other observable factors of wages. To account for the potential unobserved factors (e.g. general level of capabilities, etc.) that could bias our findings, we also estimate a specification of Eq. 2 with employee level fixed effects included. The individual level fixed effects will account for time-invariant differences between employees. Note that this means that we cannot estimate separately the effect of gender on wages. Still, we can estimate the effect of an interaction between the gender dummy and the dummy of being employed at a foreign owned firm. The coefficient of this interaction term will show the difference of the gender wage gap between foreign owned and domestic owned firms, after accounting for the unobserved time-invariant characteristics of the employee and time-varying firm and employee level controls in the estimated equation. The estimates in columns 5 and 6 in Table 2 confirm that there is still a difference between the two studied groups in terms of the gender wage gap even if we account for time-invariant employee-specific fixed effects. We further show the wage equations separately for nine ISCO one-digit level occupation groups. These results are in Tables 3 and 4, based on data of employees from (i) all firms and (ii) firms from the manufacturing industry.

We find that most occupation groups in Table 3, apart from services and sales workers, appear to gain from working at an affiliate of an MNE. The largest wage gains are among managers (ISCO occupation group 1), as could be expected. However, the estimated association of FDI with the wage gains and especially with the gender wage gap is rather heterogeneous depending on the occupation group. We find in Table 3 that there is a significantly higher gender wage gap in foreign owned firms in the case of managers, professionals (though not in the manufacturing sector), technicians and associated professionals, craft and related trade employees, elementary occupations (not in the manufacturing sector), but not in the case of services and sales workers and clerical support workers and not in the case of plant and machine operators in the manufacturing sector. This heterogeneity across occupations is an important finding and is confirmed by the Chi-squared tests of differences of estimates (see “Appendix 2”), where we confirm that the key difference in the effect of foreign ownership on the gender wage gap appears to be between the managerial occupations and others. We note that the estimates in Tables 3 and 4 take into account the sector level heterogeneity and include the 2-digit level sector dummies among the controls.

The foreign owned vs domestic owned firm difference in the gender wage gap is by far the largest among managers in Table 3 (see also the “Appendix 2” for the pairwise tests of the differences between the occupation groups). On average, male managers gain 44% (the same per cent in the manufacturing industry) in wages from working at a foreign owned firm, and female managers just 17.9% (26.5% in the manufacturing industry), resulting in a larger gender wage gap despite the positive effects of FDI on wages for both sexes.Footnote 10 This key result concerning managers shows that the ‘negative premium’ of the gender wage gap from foreign ownership may be more evident in occupations that require more commitment in terms of being continuously available for work purposes and working longer hours when needed by the firm. These are also the occupations that exhibit less standardization of activities and less substitutability between employees. Our findings concerning the gender wage gap among managers at foreign versus domestic owned firms correspond well to the ideas of Goldin (2014) about the role of differences in the commitment requirements and job flexibility in explaining the aggregate gender wage gap. Goldin (2014) demonstrated, using data from the US, a larger gender wage gap among business occupations compared to others. However, the commitment-based explanation would not easily explain the heterogeneity of the results among other occupation groups (see Table 3). Obviously, various other unobserved factors may matter here as well.

5.1 Results of the propensity score matching

We apply standard propensity score matching here to learn more about the potential effects of an ownership change at firm level on the gender wage gap. The previous sections describe the correlations that suggest the potential effects of FDI. However, there is a possibility that these results may still indicate predominantly the selection effects, FDI gravitating more towards the better performing firms that would have anyway had higher wages or specifically higher male wages, even in the absence of their acquisition by an MNE. The estimation of the ATT based on PSM allows us to control for the various selection effects that are based on the observed determinants of FDI.

Using a pooled probit model (“Appendix 3”), we have estimated propensity scores for the firm level ownership change from domestic to foreign ownership for each treated firm and also for each domestic owned firm (the pool of control units: that is, the ones that are not acquired by foreign investors). Note that firms that are always foreign owned in the sample period are left out of this analysis. The control variables used in estimating the propensity score include the firm’s productivity, size, size squared, age, age squared, liquidity ratio and its squared term, capital-labour ratio, capital region dummy and sector dummies. All the controls are from one period before the actual period of the ownership change. These are standard variables used often in the application of PSM for the analysis of the effects of FDI or exporting on productivity or firm performance.

We have implemented PSM and the corresponding estimation of the ATT for: (i) all firms, (ii) firms in manufacturing, and (iii) separately also for the services sector. “Appendix 3” shows the estimated probit models. Our matching analysis allocates the two or five nearest neighbours to each treated unit, based on the similarity of their propensity score with that of the treated unit. The third matching algorithm used was Kernel matching with an Epanechnikov kernel, the bandwidth was set at 0.06 (the default value in the corresponding Stata program). The results of the balancing test confirm that the matching has been successful and has balanced the pre-treatment key predictors of ownership change between the two groups of firms (omitted from the main text of the paper to save space, available in the supplementary online materials). PSM has been able to match the treatment and control groups based on indicators of pre-treatment average wages, incl. the average male and female wages at the firm during the pre-treatment year. We note that a key assumption when applying the PSM—parallel trends in the pre-treatment outcome variables—holds in our data. The rate of growth in wages for men or women in the pre-treatment year (the growth between the year preceding the change in ownership and the year of change in ownership) is not statistically significantly different in the domestically owned and the foreign owned group of firms. The p values for the test of differences in growth rates of average wages, males’ wages and the females’ wages between the treated firms and the control group in the last year before the acquisition were respectively 0.473, 0.343, and 0.457.

The ATT is calculated based on Eq. 3, as outlined before. Table 5 presents the estimates for the outcome variables at firm level. The firm level outcome variables are the firm’s average wages, as well as the average wages for male and female employees. Table 6 presents the individual-level ATT estimates, where the treatment is an individual’s movement from a domestic firm to work for a foreign firm. The outcome variables in this case are the individual level wages for men and women. Here the individuals are matched with each other using the individual-level propensity scores of a move to work at a foreign owned firm, calculated from the probit models as outlined in Table 14 in “Appendix 3”.

The ATT estimates in Table 5 confirm the previous general finding from the Mincerian wage equations. We find that an acquisition by a foreign owned firm is associated with a rapid post-acquisition wage growth compared to the counterfactual case. In the services sector, the effect also seems to grow over time, to 23.7% in the year t + 2 (see Table 5, note that 23.7 is calculated based on the exponential transformation exp(0.213) − 1, where 0.213 is the estimated ATT of the logarithm of wages, from the panel on the services firms in Table 5). There is a clear evidence of a stronger increase in the wages among male employees compared to female. For example, at period t + 2 after the foreign acquisition of the firm, the ATT on male wages is (based on matching with the 2 nearest neighbours) + 22.9% versus + 14.5% in the case of wages for women (see the upper panel in Table 5). The analysis in Table 6 about the effects of an individual taking up a job at a foreign owned firm indicates that there are also stronger effects from such a change in workplace on the wages of men. This further underlines our key result that foreign ownership is associated with a wider gender wage gap.

The estimates of the ATTs with the PSM go beyond the correlation analysis and can show the effects of the change in ownership of an existing firm (Table 5) and the change in workplace of an individual (Table 6). The results in Table 5 include the effects on average wages for men and women at the firm. We note that these estimates can in principle be a mix of the effects on the existing (incumbent) employees’ wages and the wage effects due to hiring of new employees (the selection effects).

In addition to the analysis of wages, our study also includes an investigation in Table 5 of the effects on the share of women among the workforce at a firm. These estimated ATTs are not significant. Therefore, our key results concerning the effects on wages are not driven by the changes in the gender mix at the firm after the acquisition.

In conclusion, following our results from both the PSM and the wage regressions, we can confirm that both men and women gain in terms of wages from working at a foreign owned firm. However, the gains for men are significantly larger and take place faster, resulting in a higher gender wage gap in the foreign owned firms.

5.2 Potential explanations of the effects and robustness checks

As we have argued in the previous sections, one explanation for the higher gender wage gap among foreign owned firms might be their higher continuous commitment/temporal flexibility requirement from employees compared to domestically owned firms. The difference in commitment requirement between foreign and domestic owned firms may partly reflect firm size differences between these two groups, differences in market power and the toughness of competition the firms are exposed to, as well as complementarities between more advanced technology in foreign owned firms and the commitment of employees. In this section we endeavour to address the potential explanations of our key finding.Footnote 11

To investigate the potential role of different commitment requirements across different types of firms in further detail, we use the data from the Labour Force Surveys or Population Census of 2011 from Estonia and estimate wage equations with an indicator of the number of working hours, a dummy for overtime work, and interaction terms of the dummy for underage children and the female dummy among controls.

One way to investigate the role of the continuous work commitment is to study how wages and the gender wage gap in foreign and domestic owned firms are affected by whether the employee has underage children. Work-discontinuities of women due to having children have been shown as a major driver of the aggregate gender wage gap (Goldin 2014). The gender wage gap is traditionally found to be higher for women with children below the age of 18 (e.g. see Goldin 2014 from USA or Anspal 2015 on statistics from Estonia). We could expect, following Goldin (2014), that discontinuities in women’s work/career as proxied by the interaction of the female dummy and dummy for having underage children could potentially also in the case of our dataset explain a significant proportion of the gender wage gap. Disproportional rewarding by some ‘high commitment’ firms of working longer hours and particular or inconvenient hours could be reflected in the disproportionate penalty for women with children, compared to both their male colleagues with similar characteristics or women without children. If the continuous commitment requirement is stronger at foreign owned firms, then the negative effects of children on the wages of women should also appear stronger in foreign owned firms.

At first, we study here the differences in women’s wages in foreign and domestic owned firms, depending on having children (children that are below the age of 18). The investigation of this with our Mincerian wage regressions (see Table 7) indeed shows the role of children as a potential explanatory factor of the differences between the gender wage gap at foreign vs domestic owned firms. See the differences of the interaction term ‘female × children’ in the foreign owned vs domestic owned firms. There is evidence based on our matched employer-employee datasets of a stronger wage penalty at foreign owned firms compared to firms based on Estonian capital for women with children (note: this is a statistically significant difference). This effect persists in the majority of specifications in Table 7. Hence, this result provides some support for the work-commitment based explanation of our findings. However, we acknowledge that careful additional future analysis is needed on this issue, especially based on a clear identification of the causal effects.

To further investigate the potential role of different commitment requirements across different types of firms, we show based on the separate dataset of the LFS the differences in the effects of working hours or overtime on wages. If the ‘commitment’ and performance requirement is more important for foreign owned firms, then we would observe that the wage premium for overtime is higher among this group of firms rather than in the case of the domestic owned ones.

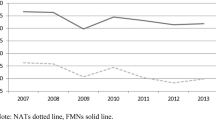

As our estimates of the wage equations based on Estonian LFS data from 2007 to 2013 confirm in Table 8, foreign owned firms appear to reward the willingness to provide overtime work (working more than 40 h per week) or working longer hours in general somewhat more compared to domestic firms. However, note that this correlation is statistically significant only if we exclude the micro firms with 1-10 employees from the analysis. To summarize, not doing overtime is associated with a stronger ‘punishment’ effect in foreign owned firms in terms of lower wages. If we combine this results with the well-known regularity that men on average tend to find it easier to work at particular hours, longer hours, or to do overtime than females or are perceived as such (see also the regression results confirming this in Table 8), then the higher work commitment requirements may be among the factors that lead to a larger gender wage gap among the MNEs’ subsidiaries compared to domestic firms.

Further exploration of the descriptive statistics from the LFS data for years 2007–2013 clearly indicate that the employees at foreign owned firms tend to do more overtime than those in domestic owned firms: 4.6 (2.5)% of men (women) in foreign owned firms versus 3.5 (2.3)% of men (women) in domestic owned firms (Masso et al. 2017). Also, perhaps surprisingly, foreign owned firms use on average less flexible work practices of teleworking than domestic owned firms, which could lower the need for ‘face-time’ at work: 6.7 (4.1)% of men (women) in foreign owned firms, whereas 11.7(10.5)% of men (women) in domestic owned firms use teleworking according to the Estonian LFS (Masso et al. 2017).

We also conduct various other robustness tests using the Mincerian wage regressions from Tables 2 and 3. Our empirical results in these Tables are robust to controlling for a variety of individual and firm level controls, and for example also robust to excluding the Swedish, Finnish or other foreign managers and employees from the analysis (see “Appendix 4”). The exclusion of employees originating from outside Estonia affects the sample size only to a very limited extent. In fact, the results without the foreign employees in “Appendix 4” are essentially identical to the main ones in Table 2. The reason for this robustness check was to be sure that some of the results are not driven by the higher share of foreign managers and professionals at foreign owned firms. In “Appendix 5” we further demonstrate that our key results are driven by the majority owned foreign affiliates and not by minority share foreign ownership. The interaction terms of the minority ownership indicators and the female dummy are not statistically significant in the Mincerian wage regressions.

We outline some further robustness testsFootnote 12 in Table 9. An alternative interpretation of foreign owned firms having higher gender wage gap could be, following Becker’s (1957) theory of taste-based discrimination, that more profitable firms might be more able to engage in costly discrimination. Based on the robustness tests in Table 9 (see columns 5 and 6), where we use interactions between the female dummy and the return on equity (ROE) as an additional control in the separate estimation of models for foreign and domestic owned firms, our results concerning the gender wage gap appear to be not driven by foreign owned firms being more profitable. Therefore, it seems likely that it is probably not the Becker’s taste based discrimination (i.e. costly discrimination by foreign owned firms due to having higher profits and therefore an ability to engage more in taste based discrimination) that would be the key explanation of the central findings here. Finally, we assess very briefly the potential magnitude of the effect of FDI on the gender wage gap at aggregate level. We assess how large on average would the observed gender wage gap in Estonia's private sector be during 2006-2014 without any foreign ownership of firms. We perform for that purpose some most simple calculations using our employer-employee level dataset. We subtract from the observed wages of men and women who are employed at foreign owned firms during 2006–2014 our ATT estimates of the effects of foreign acquisitions on wages by gender and year. We use the ATT estimates of foreign acquisitions with 5 nearest neighbours from our Table 5. Based on these, we create a rough proxy for the counterfactual wages of individuals in the absence of foreign acquisitions. Of course, we acknowledge that such simple calculation is subject to many implicit assumptions and very strong limitations. If we focus on manufacturing, the aggregate effect is of strong economic significance, this reflects partly the relatively high share of FDI in employment in this sector comapred to many others. The observed average gender wage gap of 29.7% of the sector would be reduced to 26.3% if there was no foreign ownership at all of firms. Among the set of foreign owned firms themselves in manufacturing industry, the corresponding numbers would fall from 36.1% to 22.2% if these same firms were instead in domestic ownership over the studied period. For the aggregate of the services and manufacturing sector, the corresponding changes would be much smaller: respectively a change from aggregate gap of 30.5% to 30.1% if the foreign owned firms were instead in domestic ownership. The substantial differences by sector reflect the differences in share of FDI in employment by sector.

6 Conclusions

We show here evidence of foreign owned firms having a larger gender wage gap than domestic owned firms. This is a rather robust finding across different specifications of the Mincerian wage equation estimated in this paper. Furthermore, we observe that this effect of foreign ownership persists even if we apply propensity score matching to investigate within-firm changes in the gender wage gap as a result of ownership changes or the effects of an individual taking up a new job at a foreign owned firm.

The difference between the foreign and domestic owned firms in terms of the gender wage gap is economically significant and is not explained simply by accounting for a variety of employer and employee specific control variables. Our empirical results are broadly in accordance with the interpretation that the larger gender wage gap in foreign owned firms could be partly the result of higher work commitment/flexibility requirements at these firms. We find the largest difference in terms of the gender wage gap in foreign and domestic owned firms among managerial occupations. These are the occupations that are more likely to require continuous 24/7 availability for work purposes. Furthermore, we observe that the average wage ‘penalty’ for women from having underage children tends to be (on average) larger among foreign owned than among domestic owned firms. This is again consistent with the interpretation that the ability to be available 24/7 for work purposes is rewarded more in foreign owned firms and, therefore correspondingly, the discontinuities in availability for job purposes are more heavily penalized in foreign owned firms

We further observe that once we exclude the micro firms from the analysis, the wage premium for overtime tends to be larger among foreign owned firms compared to domestic owned firms. This suggests that individuals who are either more willing to work longer hours or are perceived by managers as such employees can get larger benefits in terms of wages from working in foreign owned firms. As men are more willing and available on average to do overtime or work during inconvenient hours (or are perceived by managers to be such employees), and foreign owned firms may reward such work commitment more, men are the ones who are likely to gain more from working at foreign owned firms.

These results underline the need to promote more the job flexibility, reduce the need for face-time and raise employee substitutability in workplaces to ensure that employees who need a flexible work-life balance for family, health or other reasons are less disadvantaged because of these needs and preferences. FDI inflow and foreign ownership or globalization in general will not necessarily improve the relative position of women on the local labour market. This is evident even if the investor originates from countries with one of the most female labour friendly labour market institutions in the world (Sweden, Finland). Arguably, the effects of FDI that we find here may additionally depend a lot on the type (motive) of FDI and the institutional context. In particular, efficiency and market seeking motives have played an important role in FDI into Estonia. How the effects depend on the strategy and subsidiary’s mandate within the MNE is a topic that deserves further investigation. We would expect that subsequent studies with a focus on the motivation and strategies of MNEs will help to further understand the effects of FDI on gender related outcomes, just as they have helped previously to understand knowledge transfer in MNES and the host economy effects of FDI in more detail.

One may wonder whether collective bargaining could be a partial solution to the inequalities caused by the MNEs. While unionisation is marginally higher among foreign owned firms and unions have been found to have some lowering effects on the gender pay gap (Masso et al. 2017), due to the rather low trade union density (less than 10%) and collective agreements coverage (23% in 2015) that may have a rather limited effect on our documented evidence. There is also some anecdotal evidence on some of the Estonian subsidiaries of MNEs of Scandinavian origin being resistant to unionisation in the host country. Therefore, further investigation of this could be of interest. For example, Meardi (2007) provides further discussion about the MNEs’ and trade unions in the newer EU member states.

The further investigation of the MNEs and the gender wage gap could also look separately at the domestic multinationals, as many of the potential arguments suggesting a higher gender pay gap among foreign owned firms could be applicable also to them. The investigation of the reason for the higher gender pay gap among foreign owned firms may also benefit from more detailed information about the workplace. In particular, information about the business trips and distance to the MNE headquarter from the subsidiary could be a useful addition. In general, the further investigation of linkages between the gender pay gap and internationalization is a promising strand of research.

Notes

In a related context of effects of trade liberalization, Black and Brainerd (2004) show that US firms that faced larger increases in competition also experienced larger decrease in gender wage gap.

Another macro level indirect effect of foreign owned firms on gender wage gap functions through effects of FDI on economic growth (Aguayo-Tellez 2011). FDI may enhance the economic growth, whereas economic growth is likely to be associated with improvement of public services. As a consequence of that, gender differences in education and other types of human capital may fall, lowering also the gender wage gap.

The number of papers investigating the extent to which HRM practices are transferred or not from the headquarters to subsidiaries of MNEs has grown significantly (see e.g. Belizon et al. 2013 for a recent overview). Examples include: Pudelko and Harzing (2007), Fenton-O’Creevy et al. (2008), Ferner et al. (2011), Kodama et al. (2018), among the others. The literature on HRM and internationalisation stresses the ‘global–local’ tension, which means that there are conflicting pressures for standardization and centrally developed and managed HRM policies on the one hand, and on the other hand there is a clear need to make sure that the choice and management of HRM practices reflects the norms and traditions of the host country (Brewster et al. 2008; Fenton-O’Creevy et al. 2008; Belizon et al. 2013).

Lower bargaining power of women has been identified as one of significant determinants of the aggregate gender wage gap. For example, Card et al. (2016) find that women receive only 90% of the firm-specific pay premiums earned by men, they argue that this reflects to a significant extent the differences in bargaining power.

Note that the potential higher commitment requirement at foreign owned firms can result in self-selection of women into these firms based on their ability to provide or signal their’commitment’ or flexibility for work purposes. In principle, this self-selection could work to an extent against the commitment requirements-based expectation of a higher gender wage gap. However, similar self-selection process based on the ability to provide commitment might be there in the case of men. There is little reason to expect that the self-selection effect would fully equalize the actual and perceived level of commitment/flexibility for work purposes by men and women at foreign owned firms. Furthermore, as long as women are perceived by managers at foreign owned firms as’less committed’ (note: as an individual’s actual commitment is difficult to perceive at the time of hiring, so that the group-based perceptions about commitment matter) and as long as the actual commitment is especially valued and rewarded by foreign owned firms compared to the domestic owned firms: we could still expect a gap between the wages of otherwise similar men and women at the same workplace and that gap to be larger in foreign owned firms.

The micro level analysis of linkages between gender pay gap and foreign ownership requires by definition at the same time individual level information on wages of men and women, and information on the firm’s ownership structure. This means in practice that, in order to carry out research on the micro level, it is inevitable to focus the analysis to the data of a particular country. The cross-country datasets (e.g. European Union Labour Force Survey, European Working Conditions Survey, etc.) miss at least one of the key variables needed.

The survey is conducted as a rotation panel with an individual survey for two quarters and then after a two-quarter gap again a survey for another two quarters. Information on all members of the household is included. All the members of the household are surveyed. The various waves have been merged based on the respective household and individual identifiers, forming a longitudinal dataset.

The skills index is calculated by first ranking all occupations (either at the 1-digit or at 2-digit ISCO occupations classification) by (1) their average wages or (2) the size of coefficient on the occupational variable in the Mincerian wage regressions. Formally, the estimated regression equation looks like \(\ln \left( {Wage} \right)_{j} = \alpha + \beta \times OCC_{j} + \varepsilon_{j}\), where the dependent variable is the log of the real monthly wage for individual j, OCCj is the vector of the 1-digit or 2-digit ISCO occupational codes, β is the vector of the coefficients associated with the latter (returns to respective occupation used for ranking the occupations) and εi is the error term. Next, the skills index is calculated for each firms as the weighted average according to its occupational mix. The index is bounded between 0 and 1, and a value of 0.5 of the index would indicate that the employment is evenly distributed across the occupations.

In this case the control group is constructed based on the domestic owned firms. An alternative would be to focus on comparison of the foreign acquisitions with the domestic acquisitions. However, this would not be applicable based on our existing dataset, as we do not observe all the domestic acquisitions in the dataset.

We note that this finding of the largest gap among managers is not driven by inclusion of top managers that stem from abroad into our analysis. We have performed robustness tests by excluding individuals with foreign nationalities from analysis. The estimated gap persists and is not in any significant way affected by this omission of these rather small number of employees. We thank Dr Tiia Vissak for pointing attention to this potential issue. The estimates of the key results without this rather small group of foreign employees are given in Annex 4. Note that the estimates of the effects of FDI on gender wage gap from this robustness test are essentially identical to the ones in the main text in Table 2.

We would like to stress that the effects of FDI on the gender wage gap could probably vary also a lot depending on the type (motive) of FDI: efficiency seeking, market seeking, resource and strategic asset seeking FDI. Understanding how the different types of FDI shape the gender related effects of MNEs would be a useful extension of the analysis in this paper. Past research has, for example, shown that the host economy firm performance effects differ depending on the motivation of the FDI (Driffield and Love 2007). Past investor surveys have shown that efficiency seeking has been a key traditional motive of FDI in Estonia, in addition to the standard market seeking motive (Varblane et al. 2010).