Abstract

This paper analyzes for a panel of Romanian manufacturing firms whether the quality of foreign firms, measured by their productivity level, affects their potential as a source of indirect productivity effects on domestic firms. We find that only sufficiently productive foreign firms generate positive productivity effects on domestic supplier firms. The most productive foreign firms are the main source of productivity effects. Domestic firms with higher productivity levels also enjoy larger total positive productivity effects. When supplying foreign firms that are less productive than themselves, domestic firms experience zero to negative effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Policymakers believe that foreign direct investment (FDI) will contribute to faster economic growth and welfare through increases in capital stocks, improvements in technology, and through the creation of jobs (Harding and Javorcik 2011; Borensztein et al. 1998). Aside from such direct effects, policymakers also expect indirect positive productivity effects on domestic firms. Expected benefits are fuelled by the idea that foreign firms must have some special advantages, such as superior technology, in order to enter new markets successfully (Markusen 1995). Foreign firms indeed have been found to be more productive than domestic firms, even after controlling for selection effects (Arnold and Javorcik 2009; Guadalupe et al. 2012). The analysis of the indirect productivity effects of FDI, however, builds on interactions between many domestic and foreign firms of different productivity levels. In this paper we analyse how indirect productivity effects from FDI vary with the productivity levels of individual foreign and domestic firms and the distance between them.

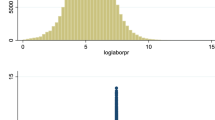

Figure 1 motivates our analysis. It contains typical distribution plots of productivity levels of foreign and domestic firms for an industry in our dataset.Footnote 1 Although the distribution for foreign firms is clearly to the right, the level of productivity of the most productive domestic firms certainly does not fall short of the level of productivity of many foreign firms. Figure 1 thus raises the question whether all foreign firms bring equal indirect productivity effects and how this interacts with the productivity level of domestic firms. Foreign firms have been used to define the technology frontier, e.g. Sjöholm (1999) shows the scope for positive effects to increase with distance to the frontier. This suggests to expect bigger effects from foreign firms with higher productivity levels such as D that is among the most productive (foreign) firms in the market. However, although foreign firms with higher productivity levels might offer a larger scope for positive effects, domestic firms need to be able to tap into this potential. The latter idea is not new to a literature that has often used the distance between a domestic firm’s productivity level and the frontier foreign firm(s) as an indicator of the former’s absorptive capacity. The gap between high-productivity foreign firms and domestic firms might be too wide for productivity effects to manifest themselves. Kokko (1996), for example, finds that within-industry indirect effects are positive and significant only for firms with small or moderate technology gaps relative to foreign firms. Combining scope and absorptive capability arguments leads to potential non-linearities. Girma and Görg (2007) find a U-shaped relationship between productivity growth and their horizontal spillover variable interacted with the level of technology and Girma (2005) observes that horizontal effects increase with absorptive capability up to a threshold level, beyond which the increase is much less pronounced. Damijan et al. (2013) find that positive horizontal effects are more likely to accrue to high productivity firms with higher absorptive capacity, while negative horizontal effect are more likely to affect low productivity firms. To the best of our knowledge, however, productivity heterogeneity of domestic and foreign firms have not yet been jointly analyzed as a determinant factor of indirect productivity effects from FDI. From Fig. 1 it is clear however that both matter and potentially interact. Domestic firm C may not benefit from the presence of foreign firm B because C is more productive than B, but C may well benefit from the presence of foreign firm D. Firm A, on the other, hand might benefit from B, but not from D, or it may even lack the absorptive capacity to benefit at all.

Some authors have investigated other types of foreign firm heterogeneity. Javorcik and Spatareanu (2008) examine the relationship between a firm’s ownership structure (partially versus wholly foreign-owned) and productivity effects. Javorcik and Spatareanu (2011) differentiate between American and European MNEs in order to determine how indirect productivity effects are related to the origin of foreign investors. Work by Marin and Bell (2006) and Marin and Sasidharan (2010) explores how differences in technology-related activities in foreign subsidiaries affect ensuing indirect productivity effects. Keller and Yeaple (2009) find very pronounced indirect productivity effects in high-tech sectors, whereas they are largely absent in low-tech sectors. To the best of our knowledge, however, productivity heterogeneity of domestic and foreign firms have not yet been jointly analyzed as a determinant factor of indirect productivity effects from FDI. To analyse domestic and foreign firm heterogeneity we first split the traditional variables that capture foreign presence into components that refer to foreign firms that have a ‘higher’ or ‘lower’ productivity level than a given domestic firm. This results in firm-specific rather than traditional industry-specific variables. We find that backward linkages with foreign clients with higher productivity levels result in positive productivity effects. Linkages with foreign firms of lower productivity, by contrast, result in zero to negative effects. We further investigate how foreign firms’ productivity levels interact with a given domestic firm’s productivity level as an indicator of both the scope for effects and the domestic firms’ ability to capture them. We find that especially linkages with foreign firms with a productivity level more than two standard deviations higher than the domestic firm boost the latter’s productivity. Domestic firms with the highest initial productivity levels benefit most.

The remainder of the paper is structured as follows. In Sect. 2, we introduce the standard empirical framework for the analysis of indirect productivity effects from foreign direct investment. This section also presents our data. Section 3 inserts foreign and domestic firm heterogeneity in the standard empirical framework and presents and interprets the results. In Sect. 4, we perform a number of robustness tests and in Sect. 5 we discuss our results in the context of a number of issues and limitations that traditionally affect the literature on indirect productivity effects from FDI. Finally, Sect. 6 briefly summarizes our findings.

2 Empirical framework and data

2.1 Indirect productivity effects from foreign direct investment in the standard empirical framework

The standard framework to investigate indirect productivity effects from FDI includes FDI-variables as additional inputs explaining total factor productivity (TFP) in a production function framework (cf. Havranek and Irsova 2011). The literature distinguishes between horizontal effects that occur between domestic and foreign firms in competitive relationships in similar stages of the supply chain and vertical effects that arise between domestic and foreign firms in supplier-client relationships. Backward effects originate from linkages between MNEs and their local suppliers and forward effects originate from linkages between MNEs and their local clients. Equation (1) is the standard specification that relates the productivity level of firm i in industry j at time t to a set of FDI variables, \(FDI_{j}\), and a set of control variables.

Although literature surveys by Görg and Greenaway (2004), Crespo and Fontoura (2007), Meyer and Sinani (2009), Havranek and Irsova (2011) and Irsova and Havranek (2013) suggest that overall empirical evidence on FDI spillovers is ambiguous, positive backward effects seem robust throughout the literature. Havranek and Irsova (2011) confirm this by means of a meta-analysis. They conclude that the average backward indirect productivity effect of foreign firms on their suppliers is both statistically and economically significant. Havranek and Irsova (2011) further indicate that the best practice estimate of forward spillovers is small to insignificant. Given these findings and in line with other recent work such as Damijan et al. (2013), we focus on horizontal and backward spillovers in this study.Footnote 2

The term ‘spillovers’ is commonly used to refer to \(\alpha _{h}\), \(\alpha _{b}\), and \(\alpha _{f}\), but these coefficients may capture other effects than knowledge externalities or spillovers (Keller 2010; Irsova and Havranek 2013). Crespo and Fontoura (2007) discuss different channels through which domestic firms’ productivity may be affected by the presence of foreign firms. Some channels for horizontal effects are related to the diffusion of technology, such as labour mobility from foreign to domestic firms and demonstration effects. Other channels do not entail any transfer of technology: competition effects following foreign entry may decrease (through a reduction of market share) or increase (through an incentive to increase efficiency) productivity (Irsova and Havranek 2013). Furthermore channels may involve both market transactions and externalities. While technology transfer to local suppliers benefits MNEs in terms of higher-quality inputs, MNEs will not necessarily provide the technology free of charge. Therefore a supplier’s revenues should be corrected for contractual payments for technology transfer to obtain an estimate of true spillovers (Keller 2010). This makes it -still leaving aside measurement issues in TFP- difficult to compare estimated semi-elasticities \(\alpha _{h}\), \(\alpha _{b}\), and \(\alpha _{f}\) in terms of pure knowledge externalities associated with FDI. Positive and significant coefficients therefore do not necessarily call for government intervention.

To define variables that measure foreign presence the literature typically draws on work by Caves (1974) and Javorcik (2004). Bloom et al. (2013) define measures of a firm’s position both in technology space and product market space to separate R&D knowledge spillovers from associated competition effects. While their analysis speaks to the current context and would allow separating FDI spillovers from FDI competition effects, their approach requires detailed information which is not available in our data. In the remainder of the paper we therefore interpret our results as indirect productivity effects which are the net outcome of different underlying channels. Following Caves (1974) the standard variable to capture within-industry foreign presence is calculated as:

where \(Y_{it}\) is the output produced by firm i in industry j at time t and \(F_{it}\) is the share of foreign participation in firm i at time t. A firm is classified as foreign when there is at least a single foreign investor who owns at least 10% of the shares. \(Horizontal_{jt}\) captures the degree of foreign presence in industry j at time t by the share of industry j’s output produced by foreign firms. The backward variable for industry j measures foreign presence in industries c supplied by industry j at time t and is commonly calculated as follows:

\(Backward_{jt}\) is a weighted average of Horizontal in the sourcing industries c. The weights are technical coefficients: \(\gamma _{jct}\) represents the share of industry j’s total intermediate supply that is supplied to each industry c. The technical coefficients are derived from input-output tables for intermediate consumption.

Because the input choices of a firm are likely to be based on its productivity, the estimation of total factor productivity (TFP) will be biased if the endogeneity of inputs is not addressed (Griliches and Mairesse 1995). A number of alternative estimation procedures have been suggested in order to tackle this issue. The most popular alternatives are the semi-parametric approaches developed by Olley and Pakes (1996) (OP) and Levinsohn and Petrin (2003) (LP). In these semi-parametric approaches, a proxy is introduced to handle the endogeneity bias. Olley and Pakes (1996) use investment as a proxy.Footnote 3 In a more recent contribution, Ackerberg et al. (2008) (ACF) present an alternative semi-parametric procedure that deals with potential collinearity issues in Olley and Pakes (1996) and Levinsohn and Petrin (2003). We present results for OP in the paper, results for ACF are available in the online Appendix. Other recent efforts include TFP estimation based on firm-level quantity data (TFPQ) rather than deflated revenue data (TFPR). Katayama et al. (2003) emphasize that the use of TFPR will often confound higher productivity with higher mark-ups. As data on quantities are not available to us, results should be interpreted bearing this caveat in mind. First-differencing will help in capturing productivity changes if TFP-contaminating factors change less over time than technology (e.g. when mark-ups are more stable than technological change). Equation (1) is first-differenced and (4) is then estimated by OLS.

After first-differencing we add time (\(\alpha _{t}\)), industry (\(\alpha _{j}\)), and region (\(\alpha _{r}\)) dummies to the specification. This accounts for shocks that have simultaneously affected the productivity growth of domestic firms and the attractiveness of the industry or region to foreign firms. The set of control variables includes firm age, lagged firm size (measured by real output), initial productivity, initial market share, changes in market share, and changes in the following industry level variables: a Herfindahl index of industry concentration, import competition and export intensity at the industry-level (this information is not available at the firm-level), the share of intermediates in total industry output, foreign presence in services sectors, and an index of demand in downstream industriesFootnote 4. Since the estimation is performed at the firm-level while some of the explanatory variables are defined at the industry-level, we cluster standard errors at the industry level (see Moulton 1990).

2.2 Data

For our empirical analysis, we use a large panel of Romanian firms extracted from the Amadeus database by Bureau van Dijk Electronic Publishing. The Amadeus database consists of financial and ownership information on public and private companies across Europe (Bureau van Dijk 2011). From this large database, we constructed a sample covering the period 1996–2005.Footnote 5 Other work that makes use of the Amadeus database has pointed out the excellent coverage of the subset of Romanian firms [see e.g. Altomonte and Colantone (2008), Javorcik and Spatareanu (2008), or Merlevede et al. (2014)]. Foreign direct investment started to enter Romania only in the late 1990s after the implementation of several privatization and market access reforms (UNCTAD 2003). Combined with an excellent coverage, the timing of the start of FDI inflows makes Romania in 1996–2005 an ideal setting to study FDI effects. FDI was also concentrated in the manufacturing industries in the period covered (Pauwels and Ionita 2008). Table 1 shows the number of firms as well as entry and exit for all firms and for the sub-sample of foreign firms by year. The 2003 exit rate is high but this pattern is confirmed by data from the Romanian Trade Register. The last column of Table 1 shows the percentage of firms that is foreign. From this column we infer that foreign activity has risen considerably: whereas only 16% of the total number of firms was foreign in 1996, the number had increased to 22% by 2005. Most of these investors are European.

We focus on firms with at least five employees on average and remove the top and bottom percentiles of the annual growth rates of real operating revenues, real material inputs, real capital and labour.Footnote 6 Nominal data are deflated with industry price-level data at the NACE 3-digit level. Price-level data are taken from the Statistical Yearbook of the Romanian Statistical Institute (RSO 2005) and the Industrial Database for Eastern Europe from the Vienna Institute for International Economic Studies (WIIW 2007). Labour is the number of employees. Real output is constructed by deflating operating revenues with industry-level producer price indices. Real capital is calculated as tangible fixed assets deflated by the average of the following industry deflators: machinery and equipment (NACE 2-digit 29), office machinery and computing (30), electrical machinery and apparatus (31), motor vehicles, trailers and semi-trailers (34) and other transport equipment (35). Real material inputs are obtained by deflating material inputs with a weighted intermediate input deflator. The weights are taken from a series of annual input-output tables that were obtained from the Romanian Statistical Office. These tables are also used to calculate Backward in (3) and are provided in a Romanian industry code classification that maps into the NACE 3-digit classification. The tables contain 60 different manufacturing industries.This is more detailed than IO-tables available from Eurostat or WIOD and allows for a detection of finer sourcing patterns (Lenaerts and Merlevede 2016).

Table 2 displays summary statistics of firm-level variables for all firms and for domestic and foreign firms separately. Foreign firms realize more output, have higher capital stocks and employ more workers. On average, they are also more productive than their local counterparts. Foreign firms produce on average 27.5% of industry output (based on 464 industry-year observations). This number varies between 0 and 87.2%.

3 Foreign and domestic firm heterogeneity

Notwithstanding the fact that foreign firms on average are more productive than their local counterparts, Fig. 1 and Table 2 testify of a considerable overlap between both types of firms’ productivity distributions. Do all foreign affiliates then carry the same potential as a source of effects? In the online Appendix we report an analysis of the role of foreign firms’ productivity levels in isolation. Our main conclusion that follows from this analysis is that the most productive foreign firms within each customer industry are a source of positive indirect productivity effects through backward linkages. Foreign firms with low to medium productivity levels (relative to the within-industry average) do not generate productivity effects.

In this section we jointly analyse foreign and domestic firms’ productivity levels and allow foreign firms’ productivity levels relative to domestic firms’ productivity levels to bear an impact on indirect productivity effects. To this end, we define and calculate variables measuring foreign presence by individual domestic firm f and classify foreign firms into two categories: i) foreign firms of higher productivity; and ii) foreign firms of lower productivity than the individual domestic firm f. We then define horizontal variables \(HR^{higher}_{f}\) and \(HR^{lower}_{f}\) in (5) and (6). By taking a domestic firm’s productivity level as a starting point we create firm-specific variables of foreign presence.Footnote 7 In (7) and (8) we define the inter-industry variables \(BK^{higher}_{f}\) and \(BK^{lower}_{f}\) for firm f following a similar logic as in (3). Note that it is the productivity level of domestic firm f in industry j that is compared with the productivity levels of foreign firms in sourcing industries c. The spillover variables defined in (5)–(8) for domestic firm f in industry j at time t enter regression (4) as separate variables to test for different effects related to the relative productivities of the given domestic firm vis-a-vis its foreign clients.

We then allow for more heterogeneity by considering a further decomposition of the spillover variables in (5)–(8). We calculate the standard deviation of the productivity level for the sample of domestic firms and create firm-specific bins of foreign firms of higher and lower productivity. For each individual domestic firm f we obtain four firm-specific cut-off values by adding (subtracting) one and two standard deviations to (from) its initial productivity level. We then classify foreign firms based on their initial productivity level vis-a-vis the domestic firm to obtain six categories or bins: i) foreign firms whose productivity level is up to one standard deviation higher (lower) than the domestic firm’s productivity level; ii) foreign firms whose productivity level is between one and two standard deviations higher (lower); and iii) foreign firms whose productivity level is more than two standard deviations higher (lower). For each of these six bins we are now able to compute horizontal (9) and backward (10) spillover variables for a given domestic firm f as (with \({B}_{ift}^{x}\) a dummy variable that takes the value one if foreign firm i falls within bin x relative to domestic firm f):

Table 3 presents summary statistics for the spillover variables split-up according to these definitions. The share in industry output produced by foreign firms of higher productivity is -averaged over domestic firms- about twice the share in industry output of foreign firms of lower productivity. In 2005, foreign firms of higher productivity account for at least 12% and at most 93% of the total number of foreign firms within their industry (this statistic is obtained as the average over all domestic firms within that industry). The smallest shares are found in various sub-industries of the ‘Manufacture of food products and beverages’ and the ‘Manufacture of wood and of products of wood and cork, except furniture’ industries. The largest shares are found in the various sub-industries of the ‘Manufacture of machinery and equipment n.e.c.’, ‘Manufacture of office machinery and computers’ and ‘Manufacture of radio, television and communication equipment and apparatus’ industries. Table 3 further shows that foreign firms whose productivity level falls within one standard deviation of a domestic firm’s productivity level account for the largest part of foreign firms’ share in industry output (on average about 83% of foreign firms’ total output within a given industry). Foreign firms more than one standard deviation more productive than a domestic firm on average account for about 12% of foreign firms’ total output within an industry which is about 3.5% of total industry output. Within this group foreign firms with a productivity level more than two standard deviations higher than that of the focal domestic firm on average account for less than one percent of total industry output, but there is substantial variation across industries.Footnote 8

In Table 4 we present results of estimating (4) with the firm-level spillover variables defined in (5)–(8) included as explanatory variables. Column 1 incorporates all four spillover variables in the estimation. We find no evidence of significant horizontal effects. Backward effects are significant and positive if they originate from foreign firms of higher productivity, but negative and significant if they originate from relationships with foreign firms that have a lower productivity than the focal domestic firm. Although they are not significant, the coefficients for the horizontal spillover variables follow a similar pattern. Columns 2 and 3 confirm these results when indirect productivity effects from more and less productive foreign firms are considered separately. Horizontal effects do become significant in columns 3 and 4. Column 4 shows results for a ‘zero-diagonal’ definition of the backward spillover variable. As indicated above, in our view, Backward serves as a proxy for linkages between MNEs and their local suppliers, which does include within-industry intermediate supply. Therefore, following Lenaerts and Merlevede (2016), we do include within-industry intermediate supply in our standard definition because it refers to supplier-client relationships (the rationale for backward effects). However following Javorcik (2004), inputs supplied or sourced within the same industry are typically excluded from the backward spillover definition. Column 4 confirms the opposing positive and negative effects from foreign firms of higher and lower productivity. Horizontal effects are significant, but as shown by Lenaerts and Merlevede (2016) they reflect within-industry intermediate supply relationships which we believe to be intuitively part of the backward effect. Our preferred result can thus be found in column 1, but it is not driven by our non-zero definition of the backward spillover variable. The findings in Table 4 suggest that domestic firms should be careful when entering a supplier contract with a foreign firm. Domestic firms only seem to benefit from linkages with foreign clients of higher productivity.

In Table 5 we consider the decomposition of the higher and lower spillover variables as defined in (9) and (10). Column 1 again includes all spillover variables, whereas columns 2 to 7 test the sensitivity of the results to the exclusion of spillover variables referring to different bins. In line with Table 4 we do not find much evidence for horizontal effects in column 1. Five out of the six backward spillover variables are individually statistically significant however. There is a clear ranking in terms of estimated coefficients with the most productive foreign firms having the largest impact with the impact decreasing with the foreign firm’s productivity level (relative to the focal domestic firm). The entry of a foreign firm that accounts for 1% of industry output in a client industry would increase a domestic firm’s productivity by 6% if it has a productivity level more than 2 standard deviations higher than its domestic supplier. In contrast that same foreign firm would have an impact of 0.6% if its productivity level was less than 1 standard deviation higher and it would have no impact if its productivity level was less than 1 standard deviation lower. Foreign firms of substantially lower productivity than the focal domestic firm have a significant negative impact on the latter’s productivity. These results point to the most productive foreign firms as the main source of positive backward effects (cf. Online Appendix A). Columns 2–7 of Table 5 present estimation results in which different subcomponents are considered separately. For backward effects results are in line with the results reported in column 1 with the most productive foreign firms as the most efficient source of effects. As in Table 4 some horizontal effects become significant when not all variables are included in the regression. Foreign firms of higher productivity generally generate positive effects, whereas foreign firms of lower productivity generate negative effects.

The definition of e.g. \(HR^{higher}\) in (5) implies that -ceteris paribus- the ‘higher’ spillover variables will have larger values for domestic firms of lower productivity levels. The previous estimations therefore do not satisfactory account for the potential impact of domestic firms’ productivity levels as indicator of absorptive capacity. The literature, however, has highlighted the importance of absorptive capability of domestic firms as an important determinant of effects (see Keller 1996; Crespo and Fontoura 2007). We introduce absorptive capacity in our analysis by assigning domestic firms to different groups according to their initial productivity level. We define four quartiles of initial productivity across all industries and estimate separate regressions for each quartile of domestic firms. The results are presented in Table 6. The overall pattern of backward effects is qualitatively fairly stable across different productivity quartiles and it is in line with the findings in Table 5. Supplying the most productive foreign firms is again the most efficient channel through which positive effects are transmitted.

The initially most productive domestic firms (Q4) seem to benefit from all foreign firms that have higher productivity levels. Domestic firms with lower initial productivity levels (Q1, Q2, and Q3 firms) seem to benefit only from MNEs in client industries which have a productivity level which is at least one standard deviation higher. Absorptive capability is at work as domestic firms of higher productivity benefit more from foreign presence. Point estimates for all backward spillover variables are larger for initially more productive domestic firms. Horizontal effects are again largely absent. Only domestic firms with below-median initial productivity seem to experience a small positive effect of foreign firms with higher productivity levels.

Figure 2 shows the total period-average backward spillover contribution to OP TFP in function of domestic firms’ initial level of TFP.Footnote 9 Each dot in the graph represents a domestic firm. The vertical lines in the Figure show the cut-off values for the different quartiles. There is considerable heterogeneity across firms, but the majority of domestic firms seems to have benefited from foreign presence in downstream industries. Figure 2 further suggests that a higher levels of absorptive capacity (initial TFP) matter. Positive backward effects are larger for more productive domestic firms whereas more below-median productivity domestic firms also experience total negative indirect productivity effects. These findings correspond with the results of Gorodnichenko et al. (2014) and Damijan et al. (2013). Gorodnichenko et al. (2014) find positive backward spillovers, but effects decrease as the distance to frontier increases. Damijan et al. (2013) find that domestic firms of lower productivity are more likely to be faced with negative vertical effects. These studies, however, do not address foreign firm heterogeneity.

4 Robustness

In this section, we perform some robustness tests of the results in Table 6 where all different layers of foreign and domestic firm heterogeneity have been integrated in the analysis.

Given the existence of productivity differences across industries, the split of domestic firms in four initial productivity quartiles may result in firms from different industries clustering together in specific quartiles. To make sure that our results are not capturing industry-specific patterns, we create initial productivity quartiles for domestic firms within each 3-digit industry (rather than for the entire manufacturing sector) and then aggregate firms from different industries in Qx-groups. Each 3-digit industry will thus be represented in each Qx with 25% of domestic firms from that industry. We then rerun the analysis of Table 6. Table 7 shows the results of this approach and qualitatively confirms our earlier findings: the most productive domestic firms benefit most from the most productive foreign firms through backward effects. Compared to Table 6 the differences between low and high productive domestic firms are now less pronounced, however. As a second test, we use a balanced subsample of domestic firms that are present in the sample from 1996 till 2005. The results of this analysis are reported in Table 8. A comparison of Tables 6 and 8 reveals that the empirical results are highly comparable for indirect productivity effects originating from backward linkages. The most productive Q4 domestic firms absorb positive backward productivity effects from all foreign firms with a higher productivity level and benefit most. We again detect significant negative backward effects from less productive foreign firms. Our results are therefore not driven by specific entry or exit patterns in the data. As in Table 6, some significant horizontal indirect productivity effects show up significantly in Tables 7 and 8. There is, however no clear pattern in the results and they are probably driven by a fairly high collinearity between some of the variables. Collinearity between Horizontal and Backward variables increases due to the combination of the use of domestic firm quartiles, firm specific bins, and the non-zero diagonal definition of the Backward variable. The Backward pattern is confirmed when using a zero-diagonal definition or when omitting Horizontal variables from the estimation (see the Online Appendix).

We have shown that productivity heterogeneity among domestic and foreign firms is an important determinant factor of effects. Heterogeneity implies that not all foreign firms carry an equal spillover potential. Could our result be driven by other types of foreign firm heterogeneity that have been studied in the literature?

Javorcik and Spatareanu (2008) find important differences between spillovers originating from minority and majority foreign-owned firms. Figure 3 plots the productivity distributions for majority- and minority-owned foreign-owned firms in our data. It is clear that the distributions for both types of ownership overlap. Therefore potential selection of minority and majority foreign-owned firms in more and less productive categories is not an alternative explanation for our results. Differences in productivity levels of foreign firms are neither driven by the country of origin. For a similar sample of Romanian firms, Javorcik and Spatareanu (2011) compare effects from European and American affiliates. They find that American FDI is more likely to result in larger backward effects. They show productivity levels of European and American affiliates do not significantly differ and hypothesize that their result reflects a higher share of locally sourced intermediates by American firms. In our data firms from particular countries are also spread fairly evenly over initial productivity quartiles of foreign firms. For firms with a Hungarian owner, for example, we find 197 firms in the first, 128 firms in the second, 144 firms in the third and 101 firms in the fourth quartile. For UK-owned foreign firms, these numbers are 69, 72, 155 and 160 respectively. Although there is some tendency for firms with an owner from a developed country to be better represented in the third and fourth quartiles, its magnitude falls short to make for an alternative interpretation of our results. Furthermore, by itself differences in the country of origin in the absence of any specific underlying mechanism seem a poor explanation for differences in effects. Productivity differences are then likely to emerge as a potential candidate to explain the effects. Other foreign firm characteristics such as human capital and R&D efforts are likely to be correlated with their productivity levels. Unfortunately, we do not have data on these variables to analyse potential underlying mechanisms. Finally, in the Online Appendix we present a full analysis using ACF TFP rather than OP TFP. The results on the basis of ACF TFP are qualitatively similar to those of OP TFP.

5 Discussion

Our analysis follows the standard framework in the literature but deviates by employing firm-specific measures of foreign presence and considering both foreign and domestic firm heterogeneity. To what extent does our approach offer a solution to or suffers from the set of limitations found in the literature? In common with the literature, we are unable to separate knowledge externalities from FDI and effects through other channels such as competition effects through the definition of the variables. We therefore interpret results in terms of indirect productivity effects, i.e. the net impact of different mechanisms. This implies that results in Table 6 should not be compared in terms of knowledge externalities both across rows and columns as different channels are likely to differ in intensity across these dimensions.

Further, as most of the literature we do not have information on firm-specific prices and quantities and the OP (and ACF) methodologies do not account for differences in mark-ups across firms. By separating foreign clients in terms of relative productivity this raises the additional question of different pricing strategies vis-a-vis different foreign firms. If our measure confounds higher productivity with higher mark-ups, results in Table 6 may reflect (changes in) mark-ups that increase with initial domestic firm productivity and decrease with foreign client productivity. Results across columns in Table 6 might be partly driven by faster increases in mark-ups at initially more productive domestic firms. Firm size, initial TFP, initial market share, and changes in market share are included among the control variables to account for these mechanisms as much as possible. We believe, however, that it is counterintuitive that less efficient foreign firms are consistently more likely to press their suppliers to lower their mark-ups compared to their more efficient counterparts. Significant negative backward productivity effects from foreign firms that are less productive thus require further understanding. Thinking about foreign clients and domestic suppliers as searching for partners in an input-output relationship, the domestic firm may anticipate both more and stable demand through the foreign firm and technology transfer. However, before a contract is signed and operations start, both partners only observe a distorted signal of each other’s true characteristics. When domestic firms make relation-specific investments in order to supply the foreign firm and true characteristics are only revealed after operations start, domestic firms may find themselves in a situation where they have signed a contract with a low quality foreign firm to suffer lower than expected demand and a decrease in measured productivity as a consequence.

The literature is also concerned with selection effects of MNEs investing in more productive domestic industries (Girma et al. 2015). Is it then possible in our setting that the ‘quality’ of MNEs entering Romania is driven by their expectation of the productivity evolution in supplier industries? The most productive foreign firms might be attracted to industries where local firms in supplier industries look promising which would result in endogeneity concerns.Footnote 10 This is unlikely, we detect foreign presence in all industries and the most productive foreign firms in each detailed industry tend to be among the most productive firms in manufacturing overall. Further the analysis in the online Appendix of foreign firms’ productivity levels in isolation reveals that the most productive foreign firms within each customer industry are the most important source of positive indirect productivity effects through backward linkages. A further implication would be that low quality foreign firms conversely are predominantly attracted to industries where expectations regarding the supplying industries are dim. However, since the quality of supplying industries is likely to affect the cost of operation in the host country, low quality foreign firms would also rather be attracted to industries where local suppliers look promising. The selection issue should therefore be less of an issue for our backward effects. Further, we use industry and region fixed effects in the estimation to control for potential shocks that have made domestic firms more productive and regions or industries more attractive to foreign investment.

We follow the literature in capturing supplier-client relationships through Romanian IO-tables. Barrios et al. (2011) discuss implicit assumptions underlying the use of national IO-tables. For their study of Irish firms they find evidence of strong backward productivity effects, but only when constructing backward variables using MNEs’ material input usage rather than output combined with IO-tables of MNEs’ home countries. The correlation of output and material input use is 0.91 for foreign firms in our sample, therefore replacing output with material input use in (10) is unlikely to affect results. Merlevede et al. (2014) use the same dataset as this paper and calculate the backward variable on the basis of firms’ material input use and the 2005 IO-table for the entire sample period as this table is more representative for foreign firm’s sourcing pattern given the inflow of FDI over the period. The use of this alternative measure does not qualitatively affect their results. A more pressing issue in our analysis is that the economy wide IO-table may be less relevant since MNEs buy their inputs from selected local firms and that this selection is likely to be related to the productivity of both the local and the foreign firm (see Iacovone et al. (2015) on Walmart in Mexico). High-productive foreign firms would then select already high-productive domestic firms as their suppliers. In Table 6 the impact of high-productive foreign firms can be found in the ‘upper triangle’ of backward varaibles as for initially low-productive domestic Q1 firms they will belong to \(BKmore_{\,>2sd}\), whereas for initially high-productive domestic Q4 firms they will more spread out over \(BKmore_{\,>2sd}\), \(BKmore_{\,<2sd}\), and \(BKmore_{\,<1sd}\). Under pure selection effects we would then expect large and significant effects for high-productive domestic firms in Q4. This seems to be the case in Tables 6, 7 and 8. We would also expect not to detect any effect for low-productive domestic firms. This, however, is not the case in Table 6, nor in Table 7, where it should be most pronounced as Q1 gathers domestic firms with the lowest productivity in each industry, or Table 8. The fact that we do find small, but significant and positive productivity effects for low-productive domestic firms can be due to the fact that there is no pure selection in suppliers or to the existence of technology diffusion from high-productive foreign firms.

In conclusion we believe our results show important implications of foreign and domestic firm heterogeneity for indirect productivity effects of foreign direct investment. However, as it is difficult to separate knowledge externalities from other effects, our results do not necessarily call for government subsidies to target specific types of foreign investment. In order to offer clear policy advice future research should focus on separating knowledge externalities from other effects of FDI in this context. Our results do show that high-productive foreign firms are associated with positive indirect productivity effects. Since Helpman et al. (2004) and Antràs and Helpman (2004) show that only firms with a sufficiently high productivity are able to cover the costs associated with foreign investmentFootnote 11, governments should be aware that lowering the costs associated with foreign investment, is likely to attract additional investment, but by firms that are less productive than those already invested in the host country. Our results then suggest that these firms are less likely to be associated with positive indirect productivity effects.

6 Conclusions

Advanced technology of foreign firms is the typical rationale to expect spillovers and other indirect productivity effects from foreign to domestic firms. There is indeed ample evidence that foreign firms are more productive than domestic firms. This evidence, however, refers to average effects or effects obtained through matching analyses. The analysis of indirect productivity effects of FDI, by contrast, is based on the idea of interaction between many domestic and foreign firms. This makes entire productivity distributions rather than average effects relevant. We do find substantial overlap between the productivity distributions of foreign and domestic firms in our sample of Romanian firms, but clearly this is not unique to our data but rather a common feature across firm-level datasets. This raises the question whether all foreign firms carry an equal potential as a source of indirect productivity effects for each domestic firm. Therefore we jointly analyse heterogeneity in domestic and foreign firms’ productivity levels as a determinant of indirect productivity effects in this paper. We first introduce and calculate variables capturing foreign presence by individual domestic firm by classifying foreign firms in two categories: (i) foreign firms of higher productivity; and (ii) foreign firms of lower productivity than each individual domestic firm. We then allow for more heterogeneity by considering a further decomposition of these variables. We use the standard deviation of the productivity level of domestic firms to create variables related to i) foreign firms whose productivity level is up to one standard deviation higher (lower) than a given domestic firms productivity level; (ii) foreign firms whose productivity level is between one and two standard deviations higher (lower); and (iii) foreign firms whose productivity level is more than two standard deviations higher (lower). Finally, we introduce the notion of absorptive capacity and assign domestic firms to quartiles according to their initial productivity levels and estimate separate regressions for each quartile.

For our empirical analysis, we use a sample of Romanian manufacturing firms during the period 1996–2005. In line with the literature we find that backward linkages are the main mechanism through which effects from foreign to domestic firms manifest themselves. Only sufficiently productive foreign firms generate positive indirect productivity effects to domestic supplier firms. In particular the most productive foreign firms within each industry are the most important source of positive effects. Foreign firms with a productivity level more than two standard deviations higher than the productivity level of a given domestic firm are the main source of indirect productivity effects for that firm. Domestic firms with higher initial productivity levels enjoy larger total positive effects. When supplying foreign firms that are less productive than themselves, domestic firms experience zero to negative effects.

Notes

Our dataset of Romanian firms is taken from the Amadeus database and has been used in several papers in the literature and is known for its extensive coverage and high quality reporting of basic firm-level information (cf. infra).

Furthermore, Damijan et al. (2013) indicate that foreign affiliates in Eastern Europe (we consider Romania) are mainly engaged in end-user consumer goods.

We follow Amiti and Konings (2007) and compute investment from our data as the change in real capital corrected for a depreciation rate taken from the Penn World Table.

Downstream foreign entry could increase demand for intermediate products which may result in scale economies. To separate this effect, the regression includes demand for intermediates following Javorcik (2004) calculated as:

$$\begin{aligned} demand_{jt} = \sum \limits _{k} a_{jk} * Y_{kt} \end{aligned}$$where \(\alpha _{jk}\) is the IO-matrix coefficient which indicates that in order to produce one unit of good k, \(\alpha _{jk}\) units of good j are needed. \(Y_{kt}\) is the output of industry k deflated by an industry-specific deflator.

We use multiple issues (published on DVDs) of the database because a single issue is only a snapshot of the ownership information and firms that exit are dropped from the next issue released. In order to get a full overview of ownership and financials through time, multiple issues are required. See Merlevede et al. (2014).

If the ‘outlier’ is due to the first or last observation for a specific firm and other data points are normal, the other firm-year data are kept. If this is not the case, all observations for the firm are dropped from the data.

The larger the spread of the distribution of foreign and domestic firms and the smaller the gap between both, the larger the variation across firms in values for the foreign presence variables within an industry.

Averaged over domestic firms within an industry, in 2005 up to 51% (22%) of foreign firms within the industry are foreign firms with a productivity level more than two standard deviations higher (lower) than the focal domestic firm. The average across industries is 10% (5%). Between 1 and 37% (1 and 32%) of foreign firms have a productivity level between one and two standard deviations higher (lower). The average across industries is 19% (12%). Foreign firms with a productivity level up to one standard deviation higher account for between 10 and 41% of foreign firms within an industry (30% averaged over industries), those with a productivity level up to one standard deviation lower account for between 5 and 39% of foreign firms within the industry (24% averaged).

Figures showing only the contribution of statistically significant backward effects are very similar.

This would be observationally equivalent to a situation where foreign firms with higher productivity levels identify industries with more potential for ‘actively and successfully assisting and developing local suppliers’ at low cost. If high quality foreign firms are able to predict productivity evolutions in supplier industries, it is also highly likely that they will be able to discern such possibilities as well.

Geishecker et al. (2009) confirm empirically that firms with affiliates abroad are more productive than those without affiliates.

References

Ackerberg, D., Caves, K., & Frazer, G. (2008). Structural identification of production functions. New York: Mimeo.

Altomonte, C., & Colantone, I. (2008). Firm heterogeneity and endogenous regional disparities. Journal of Economic Geography, 8(6), 779–810.

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Antràs, P., & Helpman, E. (2004). Global sourcing. Journal of Political Economy, 112(3), 552–580.

Arnold, J. M., & Javorcik, B. S. (2009). Gifted kids or pushy parents? Foreign direct investment and plant productivity in Indonesia. Journal of International Economics, 79(1), 42–53.

Barrios, S., Görg, H., & Strobl, E. (2011). Spillovers through backward linkages from multinationals: Measurement matters!. European Economic Review, 55(6), 862–875.

Bloom, N., Schankerman, M., & van Reenen, J. (2013). Identifying technology spillovers and market share rivalry. Econometrica, 81(4), 1347–1393.

Borensztein, E., De Gregorio, J., & Lee, J.-W. (1998). How does foreign direct investment affect economic growth? Journal of International Economics, 45, 115–135.

Bureau van Dijk. (2011). Amadeus database. http://www.bvdinfo.com/Products/Company-Information/International/Amadeus.aspx.

Caves, R. E. (1974). Multinational firms, competition and productivity in host-country markets. Economica, 41(162), 176–193.

Crespo, N., & Fontoura, M. P. (2007). Determinant factors of fdi spillovers—What do we really know? World Development, 35(3), 410–425.

Damijan, J. P., Rojec, M., Majcen, B., & Knell, M. (2013). Impact of firm heterogeneity on direct and spillover effects of FDI: Micro-evidence from ten transition countries. Journal of Comparative Economics, 41, 895–922.

Geishecker, I., Görg, H., & Taglioni, D. (2009). Characterising Euro area multinationals. The World Economy, 32(1), 49–76.

Girma, S. (2005). Absorptive capacity and productivity spillovers from FDI: A threshold regression analysis. Oxford Bulletin of Economics and Statistics, 67(3), 281–306.

Girma, S., Gong, Y., Görg, H., & Lacheros, S. (2015). Estimating direct and indirect effects of foreign direct investment on firm productivity in teh presence of interactions between firms. Journal of International Economics, 95(1), 157–169.

Girma, S., & Görg, H. (2007). The role of the efficiency gap for spillovers from FDI: Evidence from the UK electronics and engineering sectors. Open Economies Review, 18(2), 215–232.

Görg, H., & Greenaway, D. (2004). Much ado about nothing? Do domestic firms really benefit from foreign direct investment? World Bank Research Observer, 19, 171–197.

Gorodnichenko, Y., Svejnar, J., & Terrell, K. (2014). When does fdi have positive spillovers? Evidence from 17 transition market economies. Journal of Comparative Economics, 42(4), 954–969.

Griliches, Z., & Mairesse, J. (1995). Production functions: The search for identification. In NBER Working Papers No. 5067.

Guadalupe, M., Kuzmina, O., & Thomas, C. (2012). Innovation and foreign ownership. American Economic Review, 102(7), 3594–3627.

Harding, T., & Javorcik, B. S. (2011). Roll out the red carpet and they will come: Investment promotion and FDI inlows. The Economic Journal, 121, 1445–1476.

Havranek, T., & Irsova, Z. (2011). Estimating vertical spillovers from FDI: Why results vary and what the true effect is. Journal of International Economics, 85(2), 234–244.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Exports versus FDI with heterogenous firms. American Economic Review, 94(1), 300–316.

Iacovone, L., Javorcik, B., Keller, W., & Tybout, J. (2015). Supplier responses to Walmart’s invasion of mexico. Journal of International Economics, 95(1), 1–15.

Irsova, Z., & Havranek, T. (2013). Determinants of horizontal spillovers from FDI: Evidence from a large meta-analysis. World Development, 42(C), 1–15.

Javorcik, B. S. (2004). Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American Economic Review, 94(3), 605–627.

Javorcik, B. S., & Spatareanu, M. (2008). To share or not to share: Does local participation matter for spillovers from foreign direct investment? Journal of Development Economics, 85(1–2), 194–217.

Javorcik, B. S., & Spatareanu, M. (2011). Does it matter where you come from? Vertical spillovers from foreign direct investment and the origin of investors. Journal of Development Economics, 96, 126–138.

Katayama, H., Lu, S., & Tybout, J. (2003). Why plant-level productivity studies are often misleading, and an alternative approach to interference. In Working Paper 9617, NBER.

Keller, W. (1996). Absorptive capacity: On the creation and acquisition of technology in development. Journal of Development Economics, 49(1), 199–227.

Keller, W. (2010). International trade, foreign direct investment, and technology spillovers. Handbook of the Economics of Innovation, 2, 793–829.

Keller, W., & Yeaple, S. R. (2009). Multinational enterprises, international trade, and productivity growth: Firm-level evidence from the United States. Review of Economics and Statistics, 91(4), 821–831.

Kokko, A. (1996). Productivity spillovers from competition between local firms and foreign affiliates. Journal of International Development, 8(4), 517–530.

Lenaerts, K., & Merlevede, B. (2016). Supply chain fragmentation, input-output-tables and spillovers from foreign direct investment. Economic Systems Research, 28(3), 315–332.

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Review of Economic Studies, 70(2), 317–341.

Marin, A., & Bell, M. (2006). Technology spillovers from foreign direct investment (FDI): The active role of MNC subsidiaries in Argentina in the 1990s. The Journal of Development Studies, 42(4), 678–697.

Marin, A., & Sasidharan, S. (2010). Heterogeneous MNC subsidiaries and technological spillovers: Explaining positive and negative effects in India. Research Policy, 39(9), 1227–1241.

Markusen, J. R. (1995). The boundaries of multinational enterprises and the theory of international trade. Journal of Economic Perspectives, 9(2), 169–189.

Merlevede, B., Schoors, K., & Spatareanu, M. (2014). FDI spillovers and time since foreign entry. World Development, 56, 108–126.

Meyer, K. E., & Sinani, E. (2009). When and where does foreign direct investment generate positive spillovers? Journal of International Business Studies, 40(7), 1075–1094.

Moulton, B. R. (1990). An illustration of a pitfall in estimating the effects of aggregate variables on micro units. Review of Economics and Statistics, 72(2), 334–338.

Olley, S. G., & Pakes, A. (1996). Dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(6), 1263–1297.

Pauwels, S., & Ionita, L. (2008). FDI in Romania: From low-wage competition to higher value-added sectors. ECFIN Country Focus, 5(3), 1–6.

RSO. (2005). Statistical Yearbook, Bucharest, Romania. Technical report, Romanian Statistical Office

Sjöholm, F. (1999). Technology gap, competition and spillovers from direct foreign investment: Evidence from establishment data. The Journal of Development Studies, 36(1), 53–73.

UNCTAD. (2003). World investment directory. Technical report, United Nations Conference on Trade and Development.

WIIW. (2007). Industrial Database Eastern Europe, Vienna, Austria. Technical report, Vienna Institute for International Economic Studies

Acknowledgements

The authors acknowledge financial support of the Research Foundation - Flanders (FWO-Vlaanderen).

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

About this article

Cite this article

Lenaerts, K., Merlevede, B. Indirect productivity effects from foreign direct investment and multinational firm heterogeneity. Rev World Econ 154, 377–400 (2018). https://doi.org/10.1007/s10290-017-0298-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-017-0298-9