Abstract

We assess the sustainability of external imbalances for EU countries using panel stationarity tests of Current Account (CA) balance-to-GDP ratios and panel cointegration of exports and imports of goods and services, for the period 1970Q1–2015Q4. We find that: i) the country panel is non-stationary; ii) cross-sectional dependence plays an important role; iii) there is non-stationarity of the CA, imports, and exports with cross-sectional panel dependence and multiple structural breaks; iv) however, there is a stable long-run relationship between exports and imports in the panel. Hence, trade imbalances can be less unsustainable but this is not sufficient to make current account imbalances sustainable.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A decade ago, the financial crisis originating from the United States caused a sharp recession in a number of countries, both developing and developed, including the European Union (EU). This revealed and accentuated large macroeconomic imbalances characterizing most of the economies. At the time, public authorities, focused on public deficits and debts in developed countries (particularly the euro area, which was hit by a sovereign debt crisis) and external position in emerging economies. Yet, some economists had warned that external imbalances in the form of growing current account deficits and external debt should not be overlooked also in more advanced economies, including the EU.Footnote 1 In particular, at the onset of the financial crisis (2007Q3), some countries were already recording double digit current account deficits (−10% of GDP in Portugal and Spain, −14% in Greece, −15% in Estonia, −18% in Latvia) whereas some others enjoyed large current account surpluses (6% of GDP in the Netherlands and Finland, 7% in Germany, 8% in Sweden, 10% in Luxembourg).Footnote 2

The sustainability of external deficits is indeed an issue of concern for governments and it is related to the question of long-run solvency of a nation. This has been notably acknowledged by the European Commission, which included the ratio of current account to GDP in the scoreboard of its Macroeconomic Imbalance Procedure (MIP), established in 2011. However, this MIP has not been very successful in correcting imbalances between countries with the largest external surpluses and countries with the largest external deficits, and this despite some rebalancing in the countries hardest hit by the crisis. In this context, an empirical assessment of whether external imbalances pose sustainability issues is crucial for policy-making, and the focus of our analysis.

In this paper, we want to assess the sustainability of external imbalances in the EU. In this field, there are two main approaches, which both rely on the intertemporal budget (current account) constraint. Either one uses the macroeconomic determinants of this constraint in order to compute the required adjustments.Footnote 3 Alternatively, one carries out time-series / panel data tests to identify the behavior of the current account balance, exports and imports of goods and services over time. Our work falls under the second approach.

In the literature, various tests are employed to assess the sustainability of external balances. There are unit root tests or stationary tests of the current account-to-GDP ratio (Raybaudi et al. 2004; Chen 2011). There are also tests of cointegration between exports and imports of goods and services (Camarero et al. 2013). Some works use both unit root tests and cointegration tests (Holmes 2006). Some authors use nonlinear approaches to account for structural breaks, regime shifts or threshold values (Chen 2014; Camarero et al. 2015; Afonso et al. 2019). Finally, error-correction models are used (Durdu et al. 2013; Bajo-Rubio et al. 2014) to check whether net exports react to the net foreign asset position, as it has been done in the literature of public debt sustainability (Bohn 2007). However, these later works implicitly assume that net exports can be considered as a policy instrument.

Among nonlinear approaches, Chen (2014) found evidence of sustainability of the current account for 7 countries out of 10 OECD countries (among which four are EU countries) using quarterly data over a period up to 2012. Lanzafame (2014) carried out a sequential panel stationarity analysis for 27 advanced economies and spotted only a group of 7 countries, for which the current account trajectories were sustainable prior to the global financial crisis (until 2008). Camarero et al. (2015) looked at the net foreign asset position of 11 Euro area countries over the 1972–2011 period (annual data) and concluded that there was evidence of sustainability for only 5 countries and the panel. A comparison between the G-7 and BRICS countries in the framework of a long-memory model with multiple smooth and sharp structural breaks lead Andre et al. (2018) to a conclusion that current accounts are sustainable in both groups. Finally, Afonso et al. (2019) considered quarterly data for individual EU countries and series of current account, exports and imports (as a percentage of GDP) over the period 1970–2015. They found evidence of sustainability of the current account-to-GDP ratio in only eight EU countries and cointegration between exports and imports in only seven countries.

Against this background, we aim at investigating the issue of the sustainability of external imbalances by considering a wide panel of EU countries and taking into account the impact of the crisis. The intertemporal current account constraint is the theoretical framework underlying the different tests of panel stationarity of current account-to-GDP ratios. We make use of an extensive set of (panel data) tests that take into account multiple (endogenously determined) structural breaks using recent techniques that also address cross-sectional dependence. In addition, we also test for panel cointegration between exports and imports of goods and services (ratios-to-GDP). Specifically, we rely on quarterly OECD data for 22 EU countries over the period 1970:Q1–2015:Q4.Footnote 4 To our knowledge, such tests have not been carried out for a large sample of EU countries or over a period covering the Euro area crisis. Indeed, the literature dealing with external debt sustainability has mainly focused on a subset of OECD countries, the United States, or emerging economies.

The remainder of the paper is organized as follows. Section 2 outlines the analytical framework while Section 3 discusses the empirical methodology. Section 4 presents our main results. The last section concludes.

2 Analytical framework

One can consider that a current account deficit is sustainable when, even if repeatedly run in the future, it respects the nation’s solvency constraint; and inversely, a nation is solvent if its intertemporal budget constraint holds. The standard approach to assess current account imbalances typically relies on the intertemporal constraint view of the current account (see, notably, Sachs 1981; Obstfeld and Rogoff 1995; Razin 1995). Moreover, the major determinants of the current account balance (the most notably domestic investment and savings) are also inherently intertemporal.

Against this background, our analysis comprises of two steps. First, we use the intertemporal current account constraint as a theoretical framework underlying the different tests of stationarity of current account-to-GDP ratios (also allowing for structural breaks). Second, we also test for cointegration between exports and imports of goods and services (ratios to GDP), along the lines of the works by Trehan and Walsh (1991) and Afonso (2005). Specifically, a current account would be sustainable if the series for exports and imports are found to be cointegrated (for earlier contributions see, e.g., Husted (1992), Wickens and Uctum (1993), Wu et al. (1996) or Apergis et al. (2000)).

More technically, to assess the sustainability of external imbalances we use the present value borrowing constraint following Trehan and Walsh (1991) and Hakkio and Rush (1991).Footnote 5 Our panel analysis generalizes the country-specific framework. The budget constraint in t is given by:

with: Y - GDP, C - private consumption, I - private investment, G - government spending, F - net foreign assets, r - interest rate. In addition, GDP in an open economy, is:

-

with, X - exports of goods and services, M - imports of goods and services. Defining net exports as NXt = Xt − Mt, from (1) and (2) we get:

-

Solving (4) recursively for subsequent periods, assuming that the interest rate is stationary, with mean r, leads to the Present Value Borrowing Constraint:

A sustainable path for the external position should ensure that the present value of the stock of net foreign assets goes to zero in infinity. Hence, the economy will have to achieve future net exports whose present value adds up to the current value of net foreign assets.

Recalling Eq. (5), we present two complementary definitions of sustainability for empirical testing:

- i)

Current net foreign assets must equal the sum of future net exports:

-

ii)

Present value of current net foreign assets is zero in infinity:

To test empirically the absence of Ponzi games, we test the stationarity of the first difference of the stock of current net foreign assets. In practice we test if Ft − Ft − 1 = CAt is stationary, where CA is the current account balance. Nevertheless, stationarity rejection does not necessarily imply the absence of sustainability (Trehan and Walsh 1991).

From an empirical perspective it is possible to test for sustainability through cointegration tests. The implicit hypothesis concerning the real interest rate, with mean r, is also stationarity. When assessing current account sustainability through cointegration tests, the intertemporal constraint is, by taking first differences:

-

and Mt and Xt must be cointegrated variables of order one for their first differences to be stationary.

Therefore, we can test the cointegration regression: Xt = a + bMt + ut. If the null of no cointegration is rejected one should accept the alternative hypothesis of cointegration. This would imply that the current account is sustainable. In practice, the higher the estimated coefficient in the cointegration relationship, the lower would be existence of sustainability issues. Moreover, if X and M are non-stationary variables in levels, the condition 0 < b < 1 is a sufficient condition for the intertemporal constraint to be obeyed. More precisely, any positive but smaller than one value of the coefficient b ensures that trade balance worsens, but remains bounded as a ratio to GDP and thus remains sustainable. Analogically, if b exceeds 1, the trade balance improves and ultimately turns into a surplus, which could be seen as sustainable from the perspective of the panel of countries, even if potentially imposing a risk of unsustainable trade position for the rest of the world. This, however, remains outside of the scope of our research.

However, large international investment flows, unrelated directly to financing of international trade, might undermine sustainability of the current account via the impact on its primary income component.

3 Empirical methodology

We implement a second generation panel unit root test – the Pesaran (2007) CIPS test – accounting for cross-sectional dependences. This test is associated with the fact that first generation tests do not account for cross-sectional dependence of the contemporaneous error terms, and not considering it may cause substantial size distortions in panel unit root tests (Pesaran 2007).Footnote 6

Notice that cross-section dependences are to be expected also from an economic perspective given the intense multilateral trade and financial flows between the EU member states, and because most of the countries in our panel share a common currency.

Afterwards, we employ a recent panel data stationarity test, which under the null of panel stationarity considers multiple structural breaks (Carrion-i-Silvestre et al. 2005, CBL hereafter). Following Bai and Perron (2003), we estimate the number of structural breaks associated with each country using the modified Schwarz information criteria.Footnote 7

Additionally, we inspect whether exports and imports are cointegrated within the panel, using a number of recent tests. First, we implement the panel cointegration tests proposed by Pedroni (2004), a residual-based test for the null of no cointegration in heterogeneous panels, which does not consider neither structural breaks in the cointegrating relationship nor cross-sectional dependence.

As demonstrated by Banerjee et al. (1998), the power of residual-based tests is limited if the restriction related to the existence of a common factor is not valid. In this context, the solution proposed by Westerlund (2007) allows for testing the null of no cointegration against two separate alternatives, namely: (1) at least one cross-section is cointegrated (and the panel is possibly heterogeneous) or (2) the panel is cointegrated in its entirety. Hence, in the second case, the long-run equilibrium relationship between the variables would be the same for all the cross-sections.

Subsequently, we consider the error correction-based cointegration test by Gengenbach et al. (2016), which augments Westerlund (2007) by adding cross-sectional averages. Gengenbach et al. (2016) test allows for persistent cross-sectional dependence in the data in the form of unobserved common factors. Finally, we run the panel cointegration of Banerjee and Carrion-i-Silvestre (2017). This test runs a standard CIPS panel unit root test on residuals stemming from Pesaran (2006) CCEP model estimation, and controls for cross-unit dependence in the panel using an unobserved common factor structure proxied by cross-sectional averages.

4 Empirical results

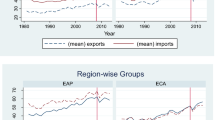

Figures 1 and 2 depict the variables under analysis, while the key descriptive statistics by country may be found in the Appendix – Table 5. We can briefly highlight some stylised facts: there seems to be a strong co-movement between exports and imports in all the countries with growing openness over time. Trade balance is clearly the main driver of the current account in most of the countries (the only exception being Luxembourg). Specifically, the correlation between these variables is around 0.7 for the full country sample. In many countries a visible adjustment of the current account occurred after the GFC, especially in those experiencing large deficits (as the Baltics or those affected by the sovereign debt crisis), which implies a sizable degree of interdependence between the EU members. We examine this question ahead with recent panel data techniques (notice that the panel is unbalanced).

There has been a lot of work on testing for cross-sectional dependence in the spatial econometrics literature.Footnote 8 Pesaran (2004) proposes a test (called CD test) for cross-sectional dependence using the pairwise average of the off-diagonal sample correlation coefficients in a seemingly unrelated regressions model. Results from performing the CD test on our three variables of interest reveal that the test statistic is 13.09, 98.13 and 101.91, respectively for the current account, exports and imports (not shown but available upon request). These correspond to p-values close to zero, therefore rejecting the null hypothesis of no or weak (non-pervasive) cross-sectional independence (Pesaran 2015) and motivating the use of Pesaran’s (2007) CIPS test for unit roots. This assumption makes the test more appealing from an applied perspective because when estimating a model, only strong cross-sectional correlation may pose serious problems, that is, inconsistency of estimation.Footnote 9

Table 6 in the Appendix displays the results of such analysis. When we run the CIPS that accounts for cross-sectional dependence, our previous results are strengthened particularly as lags increase. Hence, we conclude that most conservatively: i) our panel is non-stationaryFootnote 10 and ii) cross-sectional dependence seems to play an important role. This means that during the recent crisis, a worsening of the current account balance or drop in exports could not be corrected unless a radical change in economic policy was implemented. And this is what happened in reality in the countries most hit by the crisis. Furthermore, strong cross-sectional dependence implies that imbalances in the EU cannot be fixed without a coordination of policy measures between countries with large surpluses and countries with large deficits. In reality, such coordination was missing in the EU, and it is thus no wonder that such imbalances between both groups of countries have not completely disappeared yet.

Applying the CBL (2005) panel data stationarity test, we find that, when allowing for cross-section dependence and utilizing the bootstrap critical values (see Table 1), the null of stationarity can be rejected at usual levels by either the homogeneous or heterogeneous long-run version of the test. Overall, evidence points to non-stationarity of the three variables of interest in levels even after multiple structural breaks and cross-sectional dependence are allowed for.

Table 7 in the Appendix shows the outcomes of Pedroni’s (2004) cointegration tests between exports and imports (in percent of GDP).Footnote 11 We use four within-group tests and three between-group tests to check whether the panel data are cointegrated.

Results show that the null hypothesis of no cointegration can be rejected. Therefore, there exists a stable long-run relationship governing the dynamics between exports and imports for the full panel. Hence, these results support the idea that trade imbalances are to some extent less unsustainable. However, this does not imply that current account imbalances are sustainable.

Moreover, Table 2 shows that the null of no cointegration is rejected at the 10% level when cross-sectional dependencies are accounted for and this is true irrespectively of the tests under scrutiny.

The results of the ECM cointegration test suggested by Gengenbach et al. (2016) are reported in Table 3. The test statistic under Model 2 (including only a constant term) rejects the null of no cointegration at the 10% level.

Finally, in Table 4, when we compare the values of the cointegration test - CADFCp - statistic with the critical values, the null hypothesis of no cointegration is rejected in both Models 1 and 2 under zero lags at the 10% level of significance.

Overall, the imports and exports may drift apart in the short-run but have a tendency to converge towards equilibrium in the long-run. The long-run intertemporal budget constraint itself seems to have been the major driving force behind the long-run equilibrium relationship between imports and exports.

5 Conclusion

We have assessed the sustainability of the CA balance in a panel of EU countries using panel stationarity tests of CA balance-to-GDP ratios and panel cointegration tests of exports and imports of goods and services, in the period 1970Q1–2015Q4.

Our results can be summarized as follows: i) the country panel is non-stationary; ii) cross-sectional dependence plays an important role; iii) with multiple structural breaks and cross-sectional panel dependence evidence points to non-stationarity of the CA, imports, and exports; iv) there is a stable long-run relationship between exports and imports for our panel.

The implication of our analysis is that trade imbalances are less unsustainable than current account imbalances. In other words, growing current account imbalances have lately been more related to net factor income than to trade flows in the EU. In particular, the increase in the indebtedness of the private sector and the public sector in some countries have been made possible by increasing borrowing from other countries (net capital inflows via portfolio investment or bank loans) which has led to increasing investment income payments in the current account balance. On the contrary, in countries with large current account surpluses, lending to foreign countries generates investment income receipts that contribute further to nourishing these surpluses. Therefore, large adjustments (rebalancing) in trade flows would be needed to compensate for the influence of net factor income on current account balances.

In general, the country-sample under analysis depicted a good performance from an intertemporal perspective. Indeed, the macroeconomic stabilisation strategies seem to have been effective in correcting the market failures and maintaining the steady-state equilibrium relationship between the inflow and outflow of resources, at least in the countries hardest hit by the crisis. In sum, even if the risks of external lack of sustainability seem to be have been contained in the past, for the EU as a whole, the importance of cross-sectional dependence implies a need of mutual surveillance, as implemented in the Macroeconomic Imbalances Procedure of the European Commission.

Notes

The relation between global external disequilibria and the financial crisis is discussed at length in Obstfeld and Rogoff (2010).

Source: OECD data. The Appendix provides more detailed descriptive statistics for the current account, export and import series.

Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Luxembourg, Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, UK.

CBL (2005) suggested the specified maximum number of structural breaks to be five. We compute the finite sample critical values using Monte Carlo simulations (20,000 replications).

See Chudik et al. (2011) for exact definitions of weak and strong dependence.

Since we have non-stationarity present in the panel the deterministic component used in test statistics is the constant as we first difference relevant series.

References

Afonso A (2005) Fiscal Sustainability: The Unpleasant European Case. FinanzArchiv 61(1):19–44. https://doi.org/10.1628/0015221053722532

Afonso A, Huart F, Jalles JT, Stanek P (2019) Assessing the Sustainability of External Imbalances in the European Union. World Econ 42(2):320–348. https://doi.org/10.1111/twec.12709

Andre C, Balcilar M, Chang T, Gil-Alana LA, Gupta R (2018) Current Account Sustainability in G7 and BRICS: Evidence from a Long-Memory Model with Structural Breaks. The Journal of International Trade & Economic Development 27(6):638–654. https://doi.org/10.1080/09638199.2017.1410853

Anselin L, Bera A (1998) Spatial Dependence in Linear Regression Models with an Introduction to Spatial Econometrics. In: Ullah A, Giles DEA (eds) Handbook of Applied Economic Statistics. Marcel Dekker, New York, pp 237–289

Apergis N, Katrakilidis KP, Tabakis NM (2000) Current Account Deficit Sustainability: The Case of Greece. Appl Econ Lett 7(9):599–603. https://doi.org/10.1080/13504850050059087

Bai J, Perron P (2003) Computation and Analysis of Multiple Structural Change Models. J Appl Econ 18(1):1–22. https://doi.org/10.1002/jae.659

Bajo-Rubio O, Díaz-Roldán C, Esteve V (2014) Sustainability of External Imbalances in the OECD Countries. Appl Econ 46(4):441–449. https://doi.org/10.1080/00036846.2013.851779

Baltagi BH, Song SH, Koh W (2003) Testing Panel Data Regression Models with Spatial Error Correlation. J Econ 117(1):123–150. https://doi.org/10.1016/S0304-4076(03)00120-9

Banerjee A, Carrion-i-Silvestre JL (2017) Testing for Panel Cointegration Using Common Correlated Effects Estimators: Panel Cointegration Using CCE Estimators. J Time Ser Anal 38(4):610–636. https://doi.org/10.1111/jtsa.12234

Banerjee A, Dolado J, Mestre R (1998) Error-Correction Mechanism Tests for Cointegration in a Single-Equation Framework. J Time Ser Anal 19(3):267–283. https://doi.org/10.1111/1467-9892.00091

Bohn H (2007) Are Stationarity and Cointegration Restrictions Really Necessary for the Intertemporal Budget Constraint? J Monet Econ 54(7):1837–1847. https://doi.org/10.1016/j.jmoneco.2006.12.012

Camarero M, Carrion-i-Silvestre JL, Tamarit C (2013) Global Imbalances and the Intertemporal External Budget Constraint: A Multicointegration Approach. J Bank Financ 37(12):5357–5372. https://doi.org/10.1016/j.jbankfin.2013.01.008

Camarero M, Carrion-i-Silvestre JL, Tamarit C (2015) Testing for External Sustainability under a Monetary Integration Process. Does the Lawson Doctrine Apply to Europe? Econ Model 44:343–349. https://doi.org/10.1016/j.econmod.2014.06.010

Carrion-i-Silvestre LJ, Del Barrio-Castro T, López-Bazo E (2005) Breaking the Panels: An Application to the GDP per Capita. Econ J 8(2):159–175. https://doi.org/10.1111/j.1368-423X.2005.00158.x

Chen S-W (2011) Current Account Deficits and Sustainability: Evidence from the OECD Countries. Econ Model 28(4):1455–1464. https://doi.org/10.1016/j.econmod.2011.01.011

Chen S-W (2014) Smooth Transition, Non-Linearity and Current Account Sustainability: Evidence from the European Countries. Econ Model 38:541–554. https://doi.org/10.1016/j.econmod.2014.02.003

Chudik A, Hashem Pesaran M, Tosetti E (2011) Weak and Strong Cross-section Dependence and Estimation of Large Panels. Econ J 14(1):C45–C90. https://doi.org/10.1111/j.1368-423X.2010.00330.x

Durdu CB, Mendoza EG, Terrones ME (2013) On the Solvency of Nations: Cross-Country Evidence on the Dynamics of External Adjustment. J Int Money Financ 32:762–780. https://doi.org/10.1016/j.jimonfin.2012.07.002

Gengenbach C, Urbain J-P, Westerlund J (2016) Error Correction Testing in Panels with Common Stochastic Trends. J Appl Econ 31(6):982–1004. https://doi.org/10.1002/jae.2475

Hakkio CS, Rush M (1991) Is the Budget Deficit ‘Too Large?’. Econ Inq 29(3):429–445. https://doi.org/10.1111/j.1465-7295.1991.tb00837.x

Holmes MJ (2006) How Sustainable Are OECD Current Account Balances in the Long Run? Manch Sch 74(5):626–643. https://doi.org/10.1111/j.1467-9957.2006.00514.x

Husted S (1992) The Emerging U.S. Current Account Deficit in the 1980s: A Cointegration Analysis. Rev Econ Stat 74(1):159. https://doi.org/10.2307/2109554

Im KS, Hashem Pesaran M, Shin Y (2003) Testing for Unit Roots in Heterogeneous Panels. J Econ 115(1):53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

Lanzafame M (2014) Current Account Sustainability in Advanced Economies. The Journal of International Trade & Economic Development 23(7):1000–1017. https://doi.org/10.1080/09638199.2013.821152

Maddala GS, Wu S (1999) A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxf Bull Econ Stat 61(s1):631–652. https://doi.org/10.1111/1468-0084.0610s1631

Milesi-Ferrett GM, Razin A (1996) Current Account Sustainability: Selected East Asian and Latin American Experiences. NBER Working Paper W5791. Cambridge: National Bureau of Economic Research. doi:https://doi.org/10.3386/w5791

Obstfeld M (1982) Aggregate Spending and the Terms of Trade: Is There a Laursen-Metzler Effect? Q J Econ 97(2):251. https://doi.org/10.2307/1880757

Obstfeld M, Rogoff K (1995) The Intertemporal Approach to the Current Account. In Handbook of International Economics, 3:1731–1799. Elsevier. doi:https://doi.org/10.1016/S1573-4404(05)80014-0

Obstfeld M, Rogoff K (2010) Global Imbalances and the Financial Crisis: Products of Common Causes. In: Glick R, Spiegel MM (eds) Asia and the Global Financial Crisis. Federal Reserve Bank of San Francisco, San Francisco, pp 131–172

Pedroni P (2004) Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis. Econometric Theory 20(03). https://doi.org/10.1017/S0266466604203073

Pesaran MH (2004) General Diagnostic Tests for Cross Section Dependence in Panels. No. 0435. Cambridge Working Papers in Economics. University of Cambridge, Faculty of Economics, Cambridge

Pesaran MH (2006) Estimation and Inference in Large Heterogeneous Panels with a Multifactor Error Structure. Econometrica 74(4):967–1012. https://doi.org/10.1111/j.1468-0262.2006.00692.x

Pesaran MH (2007) A Simple Panel Unit Root Test in the Presence of Cross-Section Dependence. J Appl Econ 22(2):265–312. https://doi.org/10.1002/jae.951

Pesaran MH (2015) Testing Weak Cross-Sectional Dependence in Large Panels. Econ Rev 34(6–10):1089–1117. https://doi.org/10.1080/07474938.2014.956623

Raybaudi M, Sola M, Spagnolo F (2004) Red Signals: Current Account Deficits and Sustainability. Econ Lett 84(2):217–223. https://doi.org/10.1016/j.econlet.2004.02.005

Razin A (1995) The Dynamic-Optimizing Approach to the Current Account: Theory and Evidence. In: Kenen PB (ed) Understanding Interdependence: The Macroeconomics of the Open Economy. Princeton University Press, Princeton, pp 169–198. https://doi.org/10.3386/w4334

Sachs J (1981) The Current Account and Macroeconomic Adjustment in the 1970’s. Brookings Papers on Economic Activity, no 1:201–268

Sachs J (1982) The Current Account in the Macroeconomic Adjustment Process. Scand J Econ 84(2):147–159. https://doi.org/10.2307/3439631

Svensson LEO, Razin A (1983) The Terms of Trade and the Current Account: The Harberger-Laursen-Metzler Effect. J Polit Econ 91(1):97–125. https://doi.org/10.1086/261130

Trehan B, Walsh CE (1991) Testing Intertemporal Budget Constraints: Theory and Applications to U. S. Federal Budget and Current Account Deficits. J Money Credit Bank 23(2):206. https://doi.org/10.2307/1992777

Westerlund J (2007) Testing for Error Correction in Panel Data. Oxf Bull Econ Stat 69(6):709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Wickens MR, Uctum M (1993) The Sustainability of Current Account Deficits. J Econ Dyn Control 17(3):423–441. https://doi.org/10.1016/0165-1889(93)90005-D

Wu J-L, Fountas S, Chen S-l (1996) Testing for the Sustainability of the Current Account Deficit in Two Industrial Countries. Econ Lett 52(2):193–198. https://doi.org/10.1016/S0165-1765(96)06860-7

Acknowledgements

We thank two anonymous referees for useful comments and suggestions on an earlier version of the paper. This work was supported by the FCT (Fundação para a Ciência e a Tecnologia) [grant number UID/ECO/00436/2019] and the resources granted to the Faculty of Economics and International Relations of the Cracow University of Economics as a part of the subsidy for the maintenance of the research potential. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official view or position of the Portugal Public Finance Council. Any remaining errors are the authors’ sole responsibility.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Afonso, A., Huart, F., Jalles, J.T. et al. Long-run relationship between exports and imports: current account sustainability tests for the EU. Port Econ J 19, 155–170 (2020). https://doi.org/10.1007/s10258-019-00168-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-019-00168-x