Abstract

In this paper, we investigate two prominent market anomalies documented in the finance literature – the momentum effect and value-growth effect. We conduct an out-of-sample test to the link between these two anomalies recurring to a sample of Portuguese stocks during the period 1988–2015. We find that the momentum of value and growth stocks is significantly different: growth stocks exhibit a much larger momentum than value stocks. A combined value and momentum strategy can generate statistically significant excess annual returns of 10.8%. These findings persist across several holding periods up to a year. Moreover, we show that macroeconomic variables fail to explain value and momentum of individual and combined returns. Collectively, our results contradict market efficiency at the weak form and pose a challenge to existing asset pricing theories.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The momentum effect and the value-growth effect are two significant market anomalies that have been intensely studied in the finance literature. Prior studies show that value and growth stocks tend to exhibit different levels of momentum (Asness 1997; Asness et al. 2013). This paper aims to link these two anomalies directly by studying momentum of various value and growth portfolios. In order to do so, we perform an out-of-sample test recurring to data from the Portuguese stock market between 1988 and 2015. So far, to our knowledge, there has not been a combined approach to these anomalies in the Portuguese market.

The momentum effect is the tendency of past winners to continue to outperform past losers in periods up to a year. The discovery of this effect is usually attributed to Jegadeesh and Titman (1993). The authors documented an outperformance of stocks that have done better in the recent past relative to stocks that have performed badly of more than 12% per year on average in the US. This excess return could not be justified by differences in systematic risk. Studies on momentum effect have been subsequently replicated across the globe with positive results (e.g., Rouwenhorst 1998; Hurn and Pavlov 2003; Foerster et al. 1994/1995). In Portugal, there are also some studies about the momentum effect. For example, Soares and Serra (2005) found no evidence of momentum premiums whereas Lobão and Lopes’ (2014) findings go in favour of the profitability of momentum strategies, with abnormal returns of 1.1% per month.

Most risk-based explanations fail to explain momentum profits (Jegadeesh and Titman 1993, 2001). In contrast, there is a vast literature on behavioural biases capable of explaining the effect. In this context, the momentum effect may arise from biases such as the representativeness and the conservatism bias (Barberis et al. 1998) or the overconfidence and self-attribution bias (Daniel et al. 1998).

The value-growth effect refers to the empirical regularity that future returns of value stocks outperform growth stocks (Basu 1977; Fama and French 1992; Lakonishok et al. 1994). Value stocks are perceived to have low growth potential and thus tend to be undervalued. These stocks usually have low prices relative to earnings, book value, or other common value measures. On the other hand, growth stocks are stocks which are perceived to have high growth potential, and therefore tend to have higher prices relative to value measures.

Again, the explanations for this effect can be organized in two central lines. On the one hand, there are some authors who propose a rational explanation based on the idea that value strategies are fundamentally riskier (e.g., Fama and French 1992; Chen and Zhang 1998). On the other hand, the advocates of behavioural biases argue that the observed premiums result from a combination of systematic errors made by investors with limited arbitrage (e.g., Lakonishok et al. 1994; Phalippou 2007).

The interaction of value and momentum effects was firstly documented by Asness (1997) using monthly data of US stocks between 1963 and 1994. His findings suggest both strategies register abnormal returns in general. Moreover, their returns are negatively correlated, which means momentum tends to be stronger in growth stocks and value strategies work best for weak momentum stocks. Asness et al. (2013) studied the combined effect of the two anomalies across eight developed markets and four asset classes between 1972 and 2011 finding a significant return premium for both strategies across all markets and asset classes.

The two effects seem to interact also in the context of emerging markets. For example, Cakici et al. (2013) shows that value and momentum effects were present across 18 emerging stock markets between 1990 and 2011. Furthermore, they concluded that the two anomalies were negatively correlated, as found in developed markets.

The significance of macroeconomic factors in the explanations of the two abovementioned anomalies continues to be debated in the literature. For example, Chordia and Shivakumar (2002) showed that a set of macroeconomic variables (market dividend yield, default spread, term spread and yield on 3-month T-bills) were able to explain momentum returns in the US market in the period 1926–1994. However, their results were contradicted by Griffin et al. (2003), who used a larger sample of 40 countries and multiple methodologies to show that the explanatory power of macroeconomic variables was poor. Cooper et al. (2004), in a study on the US market during the period 1929–1995, confirms that macroeconomic factors were unable to justify momentum profits after screening out illiquid and high trading cost stocks.

Chen et al. (2008) presented a macroeconomic explanation for value premiums. According to these authors there was a positive (negative) relation of those premiums in the US with countercyclical (procyclical) macroeconomic variables. The results of Malloy et al. (2009) suggest that value strategies were positively related to long-run consumption growth in the US in the period 1926–2004. Choi’s (2013) model indicates that value premiums can be explained by the interaction of asset risk and financial leverage which consequently increases equity risk. Finally, Asness et al. (2013) studied value and momentum across markets and asset classes against 5 macroeconomic variables (long-run consumption growth, a recession indicator, GDP growth, equity premium, and a factor capturing default and term spread for US bonds). Their results suggested global macroeconomic variables were in general not significantly related to value and momentum returns, apart from: (i) momentum profits, which were significantly negatively related to recessions; (ii) default spread, registering a consistent negative relation to momentum returns in all asset classes; and (iii) default spreads, which seem to be positively related to global stock value, but insignificantly related to value returns in other asset classes.

This paper brings together the evidence on the two asset pricing anomalies – continuation of prior returns (momentum) and the market mispricing of value and growth stocks – using Portuguese data. We thus conduct an out-of-sample test to the assertion of Asness (1997) and other authors that the two anomalies tend to be negatively correlated.

We show that the momentum of value and growth stocks is significantly different: growth stocks exhibit a much larger momentum than value stocks. A combined value and momentum strategy can generate an annual excess return of 10.8%. These findings persist across several holding periods up to a year. The external validity of the hypothesis posited by Asness (1997) is reinforced by the fact that the sample under analysis in this study is substantially different from the sample considered by the author.

We also contribute to the literature on the macroeconomic explanations of the aforementioned anomalies. In this regard, we show that macroeconomic variables fail to explain value and momentum of individual and combined returns.

The rest of this paper is organized as follows. Section 2 details our data sources and methodology. Section 3 and 4 explore the value and momentum combined strategies for several holding periods, different sub-periods and individual performances. Section 5 explains excess returns achieved by the combined portfolio with macroeconomic variables. Section 6 concludes.

2 Data and methodology

2.1 Data

The sample of Portuguese stocks under study runs from January 1988 to February 2015, thus adding up to 27 years of data. It is the longest data set of momentum and value returns ever analysed for the Portuguese market.

The data is constituted by individual monthly adjusted stock prices (P), price-to-book ratios (PtB) and market values (MV) from Datastream database. To control for survivorship biases, we included in the sample dead and delisted stocks. Our initial output totalled 132 stocks, in which we had complete information about the three previous variables.

To minimize liquidity issues, we removed from our sample the bottom quarter of less liquid securities. We used the proportion of zero daily returns as proxy of liquidity, a methodology introduced by Lesmond et al. (1999). In addition, for a stock to be included in our sample, it must have been traded continuously at least for 25 months, since one of our strategies requires a 12-month observation and holding period plus a 1-month delay between the observation and the formation of the portfolio. From the initial 132 stocks, we achieved a total of 96 stocks after screening out illiquid securities.

To assess the risk free rates, we used euribor for the period between 1993 and 2015 for the maturities of 1, 3, 6, 9 and 12 months. The 9-month rate was estimated using the middle point between the 6 and the 12 month rates. Limitations in finding a consistent risk-free rate measure running from 1988 led us to start our analysis in December 1993 when studying excess returns (see section 4). Nevertheless, in other sections, when analysing raw returns, our sample runs from 1988 onwards.

2.2 Methodology

The methodology we followed to form value and momentum portfolios was inspired in the work of Asness (1997) and Asness et al. (2013). We studied value and momentum in combination for the Portuguese stock market for several combinations of observation and holding periods – between 1 and 12 months, and then we extended our analysis up to 60 months holding periods.

Momentum measures were obtained by observing cumulative raw returns on the asset from past monthly periods, skipping the most recent month which is the standard approach in the literature to avoid 1-month reversal in stock returns. For value measures we used one of the most common value signals – the price-to-book ratio (PtB) at each stage.

In order to combine value and momentum into a single portfolio, we used two different methodologies. The first consists in ranking securities based on their value and momentum signals and building three individual equal numbered portfolios for each measure – named P1, P2 and P3 – where P1 represents securities which ranked lowest for value or momentum measures, while P3 comprises the securities with the highest signals for each measure. At this stage, we had built 6 portfolios, P1, P2 and P3 for both value and momentum. Then, we formed two zero-cost, long-short P3-P1 portfolios for each measure by shorting the one which displayed the lowest momentum (losers) or value (growth/expensive) signals and being long on the portfolios with highest momentum (winners) and value (value/cheap) signals. Ultimately, we analysed value and momentum jointly, by combining both P3-P1 portfolios for value and momentum individually into a single portfolio consisting in a 50/50 combination of the previous individual portfolios. The results of this first combined strategy will be presented in the next section.

The second methodology consisted on combining the entire cross-section of securities, with their respective ranking on value and momentum, and forming portfolios based on both measures from the start. We still ranked securities based on their value and momentum signals into P1, P2 and P3 but this time we formed a matrix of nine portfolios based on their rankings P1, P2 and P3 rankings for value and momentum. For example, we build a portfolio constituted by: winners and value stocks (P3-P3), winners and expensive (P3-P1), or even losers and expensive (P1-P1), etc. Section 4 covers the results obtained with this second methodology.

An important difference between the two approaches is that in the first we use excess returns over the risk-free rate with a sample restricted to the sub-period between December 1993 and January 2015. The second analysis resorts to the full sample available as it uses raw returns. The results provided by both approaches are valid, since in the first we compare results against a risk-free rate, while in second we match the performance of the portfolio with a benchmark (in this case, the Portuguese Stock Index).

Table 1 presents the descriptive statistics of the sample under study.

The extent of our sample is significantly larger than the ones used in the remaining studies on the Portuguese market. In fact, Soares and Serra (2005) studied 82 stocks between 1988 and 2003 with an 80% threshold for liquidity. Pereira (2009) analysed 180 months from 1994 to 2008 and the number of stocks in their sample varied between 24 and 57 stocks in the beginning and at the end of the study. In our sample, we use roughly 3 more years as in Lobão and Lopes’ (2014) study. In the beginning to the end of their sample, they register 11 and 51 stocks respectively.

3 Value and momentum combined returns

3.1 The 50/50 combination

Table 2 reports the average monthly returns of the zero-cost, winners (P3) minus losers (P1) combined portfolios formed from 50/50 combinations of individual value and momentum long-short (P3-P1) portfolios, for different holding and observation periods.

The zero-cost, long-short, portfolios register positive returns for all observation and holding periods. The top 3 performing portfolios were the O12-H1: 0.86%, H9-H1: 0.75%, O6-H1: 0.74%, while the bottom 3 worst performing portfolios registered: O1-H12: 0.41%, O9-H12: 0.43% and O12-H12: 0.45%. Despite returns being seemingly higher for shorter holding periods, standard deviations are also higher which lowers the Sharpe ratios. This relation is not so evident when we compare different observation periods.

Most of the 25 portfolio returns are statistically significant at a 95% confidence level, with only one statistically insignificant observation for the O1-H12 portfolio. In addition, our intercepts (alphas) are mostly positive, averaging 0.6% across all periods, and statistically significant at a 99% confidence level.

Altogether, these results go in line with Asness’s et al. (2013), who also suggested the presence of consistent value and momentum return premium in equity markets. In their sample, the authors analysed the portfolio O12-H1 and detected return premiums of 4.6%, 6.3% and 5.9%, in annual terms, in the US, UK and Europe respectively. For the same periods, in the Portuguese stock market, our portfolio yielded an equivalent annual return of 10.8%. However, our standard deviation is also significantly larger than the one found by Asness’s et al. (2013) (16.2% vs 6.8% in Europe, annually), which consequently reduces our Sharpe ratios. Yet, the alphas we detected are higher (11.3% vs 6.1% in Europe).

3.2 Breakdown performance across time and measures

Table 5 displays the results of the breakdown performance of the same combined portfolio as in Asness et al. (2013): O12-H1, across different periods. This allows one to outline the contribution of each individual zero-cost value and momentum portfolios.

The results suggest that the strategy performed best during the bullish stock market periods of 1999–2002 and 2012–2015. In contrast, its worst performance happened after 2008. Moreover, returns tended to be more volatile during upward periods and less volatile during downturns. At the individual level, the result of 1.36% monthly for P3-P1 momentum portfolios is in line with most existing literature in Portugal (e.g., Lobão and Lopes 2014). The best period for momentum investing was post-2008, and that was also the worst period for value investing. Value investors reached their peak performance during the 1999–2002 sub-period. These results point to conclusions that contradict current financial literature, namely, that momentum returns behave pro-cyclically while value returns are positively related with countercyclical variables, as suggested for example by Babameto and Harris (2009) in a study of the US, UK and Japanese markets.

Furthermore, in Table 3, we observe that the correlation between individual value and momentum zero-cost portfolios was negative, reaching −0.22. These findings support Asness et al. (2013), who also discovered negative correlations in their P3-P1 value and momentum equity portfolios of −0.43 in the UK, −0.52 in Europe and −0.53 for the US.

Current literature still lacks to explain this phenomenon.

3.3 Expanding the analysis to longer holding periods

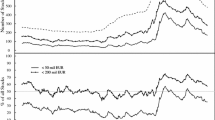

In Fig. 1, we extended the analysis to understand how individual value and momentum long-short portfolios, P3-P1, behave for longer holding periods. We measured average cumulative returns for holding periods up to 36 months in the Portuguese Stock Market, between 1993 and 2015.

Value and momentum cumulative returns. Cumulative returns between 1 and 36 month holding periods for value and momentum P3-P1 individual portfolios are presented below. These were obtained through long positions on high-ranked stocks and short positions on low-ranked stocks between the period of 1993 and 2015 for the Portuguese stock market

It is possible to observe that cumulative value returns increase over time and tend to hover around 20%. In contrast, momentum returns peak at holding periods of 13 months and decrease over time, until reaching nearly null cumulative returns in the 36th month.

This reverting behaviour of momentum returns is consistent with the delayed overreaction hypothesis posited, among other, by Jegadeesh and Titman (1993). It also corroborates previous studies made in the Portuguese market, namely Soares and Serra (2005), who found evidence of long term reversion in returns, even after adjusting for risk and other control variables.

4 Sorted value and momentum portfolio returns

4.1 Portfolio return matrix

Results from combined value and momentum strategies are displayed in Table 4. As observed in the previous section, both strategies are, in general, effective since, on average, value portfolios (P3 in column 5) outperform growth portfolios, and winner stocks (P3 in row 10) outperform loser stocks.

As shown in Table 4, the largest combined returns (1.5% per month) were observed in portfolios formed with long positions in high value and momentum signal stocks, while the weakest returns were obtained on loser and expensive stocks (−0.8% per month). Consequently, we document positive returns in all our zero-cost portfolios, P3-P1. Most of these returns are statistically significant for at least a 90% confidence level.

According to Asness (1997), value strategies work in general but are stronger (weaker) among losers (winners) while momentum strategies also work in general, but tend to be stronger (weaker) among expensive (value) stocks. In our sample, value premiums exist and are stronger (weaker) among losers (winners) (1.17% vs 1.07%). In spite of this, the worst performance was generated by the P2 portfolio with a value premium of only 0.77%. The fact that momentum premiums tend to be stronger (weaker) for value (expensive) stocks (1.24% vs 1.13%) contradicts the findings of Asness (1997).

Table 4 also displays the accumulated returns for the previous 12 months - “Past (2,12)”, i.e. momentum signals – and price-to-book ratios - “PtB”, i.e. value signals. By examining momentum signals, we observe they are higher for expensive stocks, despite the fact that returns follow an inverse pattern, i.e., growing from expensive to value stocks. Therefore, investors considering only momentum signals would be underperforming their peers who took into account both effects.

The relation observed in price-to-book ratios is not very intuitive, since they tend to decrease for loser stocks among expensive securities, while the opposite is true among value securities. In other words, our analysis suggests that it would be preferable to invest in stocks registering the lowest value signals of the entire cross-section, and avoiding short positions on the ones with the highest PtB.

In addition, we also displayed in Table 4 the average number of securities per period in each portfolio. Our results suggest that most securities tend to float around winner and expensive stocks or loser and value – average of 6.89 and 7.61 per month respectively. These results strengthen Lee and Swaminathan (2000) and Nagel (2001) conclusions that winner stocks tend to become growth stocks, while value stocks are tied to lower performances, as most securities fall under this category.

Further analysis of the dynamics between value and momentum across time (non reported) suggest that both top and bottom performers, meaning, Value and Winners and Growth and Losers, tend to reverse the momentum signal while maintaining the value signal. In fact, after a year, a quarter of Value and Winners have become Loser and Value stocks. At the same time, nearly 40% of Growth and Losers become either Growth and Winners (19%) or Growth and Momentum P2 (23%).

4.2 Average monthly returns for longer horizons

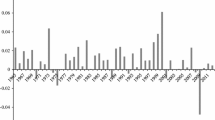

Figure 2 documents the average monthly returns for holding periods ranging from 1 to 60 months, yielded by the best and worst performing combined portfolios: P3-P3, constituted by stocks with both high value and momentum signals and P1-P1, comprising stocks with the lowest signals in both measures.

Portfolios sorted on value and momentum measures. Figure 2 presents the monthly average returns of a combined value and momentum trading strategy comprised of stocks with both high value and momentum signals (P3-P3) and of stocks with both low value and momentum signals (P1-P1), for holding periods up to 60 months

In the previous analysis, return differences between the best and worst performing portfolios reached 2.3%, for 1-month holding period. Figure 2 shows that this premium decreases as holding periods increase. Therefore, the longer investors held portfolios, the less value added they would get from a value and momentum combined strategy.

After 5 years, the best performing portfolio still produces superior average monthly returns of 0.57%. The returns yielded by the bottom performer portfolio increases from −0.8%, to 0.27% with the lengthening of the holding period. It is also interesting to observe that the difference between the returns of the two portfolios tends to narrow over longer horizons from 2.3% for 1-month holding period to just 0.3% for a 60-month holding period.

5 Macroeconomic explanations for the value and momentum effect

In this section we explore the common factors driving value and momentum excess returns. In Table 5, we report results from time-series regressions of value, momentum and combined returns for a holding period of 3 months across Portuguese stocks. The sample period runs from 1995 to 2015, totalling 81 periods (quarters).

Variables used to explain excess returns are:

-

(i)

GDP growth: real per capita growth rate, measured quarterly;

-

(ii)

Long-run consumption growth: real per capita growth of final consumption expenditure, measured as the sum of log quarterly consumption growth, and

-

(iii)

ERP: Equity Risk Premium of Portuguese enlarged index in excess of the risk-free rate, measured as the 3-month euribor rate.

Individual results indicate that momentum excess returns are negatively correlated with GDP growth. For each 1 percentage point increase in GDP growth, momentum excess returns decrease by 1.35 percentage points. Thus momentum profits behave as a countercyclical variable. The coefficients for ERP and long-run consumption growth are not statistically significant.

On the other hand, value returns are not significantly related with any of the three variables.

If we analyse value and momentum combined, the ERP coefficient turns out to be negative and statistically significant: a 1 percentage point increase in ERP induces a reduction of excess returns of 0.15 percentage points, ceteris paribus. GDP coefficient is also negative by −0.55 and it is relevant at a 90% confidence level. Long-run consumption growth is not statistically significant.

This analysis partially confirms Babameto and Harris’ (2009) conclusions that combining value and momentum into a single strategy provides an investment performance that is less sensitive to market cyclicality, as the GDP growth coefficient of combined portfolios versus momentum is −0.55 versus −1.39, while results with value individually are not significant.

Overall, the model is more effective at justifying momentum than value excess returns, measured by its R-squared (13% for momentum vs 4% for value). Combined returns reach an R-squared of 12%. Besides, the F-statistics suggest that the overall model is only significant for combined and momentum individual approaches. Yet, these results suggest that the model is insufficient at justifying excess returns generated by the combined strategy of value and momentum.

6 Conclusions

We are motivated by two prominent market anomalies documented in the finance literature: the momentum effect first documented by Jegadeesh and Titman (1993) and the value-growth anomaly popularized by Lakonishok et al. (1994). The goal of this paper is to link these two anomalies directly by studying the momentum of various value and growth portfolios in the Portuguese stock market; and design a new trading strategy combining both effects. The analysis can then be understood as an out-of-sample test to the hypothesis posited by Asness (1997) about the relation of these two anomalies. Moreover, we analyze the ability of macroeconomic factors to explain the observed excess returns.

We found evidence of the outperformance of combined strategies. In fact, we were able to find mostly statistically significant positive excess returns over the risk-free rate in all our zero-cost P3-P1 portfolios, for observation and holding periods of up to 12 months. For observation periods of 12 months and holding periods of 1 month, we registered excess returns of 10.8% a year in Portugal, which surpass the 5.9% achieved by Asness et al. (2013) across European stocks.

These returns vary across sub periods, as well as individual contributions from value and momentum, which were higher during 1999–2002 and 2008–2011 (1.5% and 2.1%, respectively). Still, momentum was the main driver of the combined outperformance, despite its negative correlation with value returns. By extending to holding periods up to 36 months, we observe that momentum returns are mean reverting while value premiums increase over time. Therefore, the combined portfolio returns tended to decrease for longer holding periods.

On the other hand, when constructing portfolios taking into consideration both effects, we were able to observe returns of 1.5% monthly by holding long positions on stocks with higher value and momentum signals. The portfolio constituted by securities with lower signals yielded −0.8% a month. Overall, our results confirm the findings of Asness (1997). This conclusion is especially significant as the characteristics of the market under analysis in this study are remarkably diverse from the market considered by the author.

Lastly, we find that macroeconomic variables fail to explain value and momentum individual and combined returns, namely, equity risk premiums, real GDP growth and consumption growth. Even though the model as a whole was statistically significant, it could not justify the observed premiums.

These results provide a strong challenge to the weak form of the market efficiency hypothesis and suggest a profitable practical investing strategy based on buying stocks with higher value and momentum signals and shorting the ones which rank lowest.

Our study has some limitations. First, we do not account for trading costs, while our best trading strategies require balancing weights at least once a year. Yet, emerging financial technologies are significantly reducing these costs –trading platforms have been launched which do not charge fees at all (e.g., Robinhood or Loyal3). Secondly, some value measures usually used to distinguish value stocks from growth stock (e.g., the price-book value) may not be available to all investors at all moments.

We expect that financial anomalies will continue to provide a fertile ground for researchers in the future.

Change history

20 May 2017

An erratum to this article has been published.

References

Asness CS (1997) The interaction of value and momentum strategies. Financ Anal J 53:29–36

Asness CS, Moskowitz TJ, Pedersen LH (2013) Value and momentum everywhere. J Financ 68:929–985

Babameto E, Harris RD (2009) Exploiting predictability in the returns to value and momentum investment strategies: a portfolio approach. Prof Invest Summer :39–43

Barberis N, Shleifer A, Vishny RW (1998) A model of investor sentiment. J Financ Econ 49:307–343

Basu S (1977) Investment performance of common stocks in relation to their price earnings ratios: a test of the efficient market hypothesis. J Financ 32:663–682

Cakici N, Fabozzi F, Tan S (2013) Size, value, and momentum in emerging market stock returns. Emerg Mark Rev 16:46–65

Chen NF, Zhang F (1998) Risk and return of value stocks. J Bus 71:501–535

Chen L, Petkova R, Zhang L (2008) The expected value premium. J Financ Econ 87:269–280

Choi J (2013) What drives the value premium? The role of asset risk and leverage. Rev Financ Stud 26:2845–2875

Chordia T, Shivakumar L (2002) Momentum, business cycle and time-varying expected returns. J Financ 57:985–1019

Cooper MJ, Gutierrez RC, Hameed A (2004) Market states and momentum. J Financ 59:1345–1365

Daniel K, Hirshleifer D, Subrahmanyam A (1998) Investor psychology and security market under and overreactions. J Financ 53:1839–1885

Fama EF, French KR (1992) The cross-section of expected stock returns. J Financ 47:427–465

Foerster S, Prihar A, Schmitz J (1994/1995) Back to the future. Can Invest Rev 7:9–13

Griffin JM, Ji X, Martin JS (2003) Momentum investing and business cycle risk: evidence from pole to pole. J Financ 58:2515–2547

Hurn S, Pavlov V (2003) Momentum in Australian stock returns. Aust J Manag 28:141–155

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Financ 48:65–91

Jegadeesh N, Titman S (2001) Profitability of momentum strategies: an evaluation of alternative explanations. J Financ 56:699–720

Lakonishok J, Shleifer A, Vishny RW (1994) Contrarian investment extrapolation and risk. J Financ 49:1541–1578

Lee C, Swaminathan B (2000) Price momentum and trading volume. J Financ 55:2017–2069

Lesmond DA, Ogden JP, Trzcinka C (1999) A new estimate of transaction costs. Rev Financ Stud 12:1113–1141

Lobão J, Lopes CM (2014) Momentum strategies in the Portuguese stock market. Aestimatio-The IEB Int J Finance 8:68–89

Malloy C, Moskowitz TJ, Jorgensen AV (2009) Long-run stockholder consumption risk and asset returns. J Financ 64:2427–2479

Nagel S (2001) Is it overreaction? The performance of value and momentum strategies at long horizons. Working paper, London Business School

Pereira P (2009) Momentum and contrarian strategies in the Portuguese stock market. Dissertation, ISCTE Business School

Phalippou L (2007) Can risk-based theories explain the value premium? Rev Finance 11:143–166

Rouwenhorst KG (1998) International momentum strategies. J Financ 53:267–284

Soares J, Serra AP (2005) ‘Overreaction’ and ‘Underreaction’: evidence for the Portuguese stock market. Caderno de Valores Mobiliários 22:55–84

Author information

Authors and Affiliations

Corresponding author

Additional information

The original version of this article was revised: The article title is now corrected.

An erratum to this article is available at https://doi.org/10.1007/s10258-017-0135-z.

About this article

Cite this article

Lobão, J., Azeredo, M. Momentum meets value investing in a small European market. Port Econ J 17, 45–58 (2018). https://doi.org/10.1007/s10258-017-0132-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-017-0132-2