Abstract

Financial incentives have been introduced in several countries to improve diabetes management. In Ontario, the most populous province in Canada, a Diabetes Management Incentive (DMI) was introduced to family physicians practicing in patient enrollment models in 2006. This paper examines the impact of the DMI on diabetes-related services provided to individuals with diabetes in Ontario. Longitudinal health administrative data were obtained for adults diagnosed with diabetes and their family physicians. The study population consisted of two groups: DMI group (patients enrolled with a family physician exposed to DMI for 3 years), and comparison group (patients affiliated with a family physician ineligible for DMI throughout the study period). Diabetes-related services was measured using the Diabetic Management Assessment (DMA) billing code claimed by patient’s physician. The impact of DMI on diabetes-related services was assessed using difference-in-differences regression models. After adjusting for patient- and physician-level characteristics, patient fixed-effects and patient-specific time trend, we found that DMI increased the probability of having at least one DMA fee code claimed by patient’s physician by 9.3% points, and the probability of having at least three DMA fee codes claimed by 2.1% points. Subgroup analyses revealed the impact of DMI was slightly larger in males compared to females. We found that Ontario’s DMI was effective in increasing the diabetes-related services provided to patients diagnosed with diabetes in Ontario. Financial incentives for physicians help improve the provision of targeted diabetes-related services.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The number of individuals living with diabetes worldwide has increased from 108 million in 1980 to approximately 422 million in 2014 [1]. In Canada, over 2.2 million individuals aged 12 and over lived with diabetes in 2017, of which 965,100 were from Ontario, the most populous province in Canada [2]. Diabetes exerts a substantial economic burden on healthcare systems costing 850 billion United States dollars (USD) in 2017 [3]. The estimated direct cost of diabetes to healthcare systems in Canada was $3.6 billion in 2018, expected to rise to $4.7 billion by 2028 [4]. Although no cure exists, effective diabetes management can reduce the complications associated with diabetes and improve diabetic patients’ morbidity over time [5, 6]. Access to a primary care physician or family physician (FP) is crucial for diabetes management—FPs order laboratory tests and follow-up with patients, developing patient-specific treatment plans to manage their diabetes [7].

Several countries have introduced pay-for-performance (P4P) incentives for FPs to improve diabetes management at primary care settings [5, 6, 8,9,10], mostly with financial incentives for ordering laboratory tests and prescribing medications, and for improved intermediate outcomes (e.g. controlled glycated hemoglobin [HbA1C] levels of patients) [9, 11]. Existing literature on the effectiveness of these P4P incentives has been mixed. Some studies found that P4P incentives increased the provision of diabetes-related services [9, 12,13,14]. For instance, Vamos et al. [12] found an improvement in the recording of diabetes-related processes of care and prescribing medications under the United Kingdom’s Quality and Outcomes Framework scheme introduced in 2004 [12]. In the US state Hawaii, one study in a preferred provider organization setting found patients whose physicians participated in the P4P program were more likely to receive two HbA1C tests and one low-density lipoprotein cholesterol test in 1 year compared to those without P4P [13]. Similar results were observed when patients visited P4P-participating physicians for 3 consecutive years [13]. Other studies found the effect of financial incentives to be negligible or to decline over time [15,16,17,18,19]. For instance, Cheng et al. [15] found that a P4P program in Taiwan had a positive and statistically significant effect on completing essential examinations or tests for diabetes care, but the magnitude of this effect decreased over the study period [15]. Another study found no difference in the clinical testing for HbA1C, lipid and eye exams when comparing the Hudson’s Health Plan with a P4P program for diabetes care, to other non-incentivized health care plans in the US state of New York [17]. A study from British Columbia, Canada, found a statistically non-significant increase in laboratory tests for diabetic patients following the introduction of the diabetes incentive [19]. These mixed findings in the literature may be due to differences in incentives, study design and the institutional environment within which P4P incentives were implemented [11, 15, 20], rendering it difficult to generalize the impact of financial incentives on diabetes care.

In Ontario, the Ministry of Health and Long Term Care (MOHLTC) initiated primary care reform in the early 2000s in an attempt to improve the provision of targeted services for illness prevention and chronic disease management. Primary care Patient Enrolment Models (PEMs) were introduced as part of primary care reform, and physicians practicing in these PEMs were reimbursed via blended fee-for-service (FFS) or blended capitation payments combined with various P4P incentives. The P4P incentives were given to the FPs for diabetes management, congestive heart failure management and other preventive care services to their eligible enrolled patients [21]. Although participation in these models was voluntary for physicians and patients [21, 22], almost two-thirds of Ontario’s FPs now practice in PEMs [23].

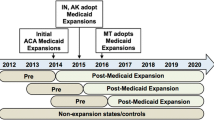

On April 1, 2006, a P4P incentive, the Diabetes Management Incentive (DMI), was introduced by the MOHLTC [8, 24,25,26]. Family physicians practicing in enrollment models were eligible to claim this incentive for their enrolled patients diagnosed with diabetes (Table A1) [24]. In contrast, FPs practicing in the traditional FFS and non-enrolled patients in the PEMs were not eligible for the incentive. As of April 1st, 2009 all FPs were eligible to claim the DMI for their patients with diabetes regardless of the patient’s enrollment status in a PEM (which is why our study ends by then) [8, 25]. To claim the DMI, the FP must provide ongoing diabetes management to their patient and complete a flow sheet which tracks the required elements for diabetes care in accordance with the Diabetes Canada’s Clinical Practice GuidelinesFootnote 1 [24]. FPs claim the incentive by submitting the Q040 fee code to the MOHLTC for a diabetic patient once per 12-month period, thus receiving $60 per annum per patient [24, 25, 27]. On October 1, 2015, an additional requirement for the DMI claim was introduced where FPs must provide a minimum of three Diabetic Management Assessment (DMA) services to the patient within the same 12-month period to be eligible to claim the DMI [26, 28]. The DMA can be claimed a maximum four times per patient per 12-month period at a value of $40.55 per claim as of April 2020 [18, 29, 30].

To date, the vast majority of the studies that have investigated the effectiveness of P4P incentives for diabetes management were outside of Canada, [9, 12,13,14,15,16,17] where the design and the value of the P4P differed from what was adopted in Ontario, Canada. When first introduced, the DMI in Ontario applied only to enrolled patients, leaving FPs practicing in the traditional FFS payment scheme ineligible to claim the incentive. By focusing on this initial 3-year period, we are able to investigate the effect of the DMI on the management of diabetes for enrolled patients. We captured the provision of diabetes-related services through the claims made by family physicians using the DMA billing code K030. The impact of the DMI on diabetes-related services is examined at the extensive margin (at least one DMA fee code billed) and the intensive margin (at least three DMA fee codes billed) in patients living with diabetes in Ontario.

Materials and methods

Data sources

This is a longitudinal, population-based, retrospective cohort study that used data from April 1st 2002 to March 31st 2009. The data were obtained from multiple Ontario health care administrative databases housed at ICES, linked using unique encoded identifiers and analyzed at ICES Western site. The study began from the fiscal year 2002 as the DMA fee code was introduced then, and concluded at the end of the fiscal year 2008 as the DMI became available to all FPs on April 1st, 2009. The Ontario Diabetes Dataset (ODD) was used to identify adults diagnosed with diabetes from April 1st, 1991 and onwards in Ontario [31, 32]. The ODD is based on two Ontario Health Insurance Plan (OHIP) claims with diabetes recorded as the diagnosis, or one diabetes-related OHIP fee code claim (codes K029, K030, K045, K046, and Q040), or one diabetes-related hospital admission within 2 years. The ODD does not contain individuals with gestational diabetes and does not distinguish between type 1 and type 2 diabetes [33]. However, the vast majority of the individuals included in this study are expected to have type 2 diabetes given they are diagnosed during their adulthood [33].

The Registered Persons Database (RPDB) provided patient-level demographic information for all individuals eligible for OHIP coverage [18, 31, 32]. Postal codes from RPDB and Statistics Canada’s Postal Code Conversion File (PCCF) were utilized to obtain census dissemination area (DA) level income quintiles and rural residence [34]. The rural residence definition was based on rural and areas with an urban area population less than 10,000 [35]. The Ontario Marginalization Index was used to determine the material deprivation index [36, 37], which focuses on the inability of individuals to have access to or attain basic material needs—a good proxy for patient’s socioeconomic status [36, 37]. This dimension is categorized into quintiles [36,37,38]. The Aggregated Diagnosis Groups (ADGs) from the Johns Hopkins Adjusted Clinical Groups (ACG)® System Version 10.0 was used to determine patient’s comorbidity [39]. Each patient can have up to 32 ADGs [40], the higher the number of ADGs the more comorbid is the patient.

The Client Agency Program Enrolment (CAPE) tables and Corporate Provider Database (CPDB) were used to identify patients enrolled in FPs practicing in PEMs. Patients who were not enrolled to a FP were assigned to FPs via a virtual roster algorithm based on identifying the responsible physician who claimed the highest amount of OHIP billings for a patient from 18 core primary care fee codes during the previous 2 years [41, 42]. The ICES Physician Database (IPDB) was used to obtain physician’s demographic information, and the OHIP database was used to examine the OHIP billings claimed by Ontario FPs.

Study population

Ontario adults diagnosed with diabetes on or prior to the beginning (April 1st) of each fiscal year from 2002 to 2008 were included in this study. Patients were included if they were first diagnosed with diabetes at or between the ages 19 and 75 years. Patients were excluded if they died on or before April 1st, 2002, or had missing data on age, sex and ICES key number (IKN). The IKN is the patient’s unique encoded identifier used to link data across the administrative databases. Patients were further excluded if they had missing data for any of the patient and physician-level characteristics used in this study (Figure A1). Our study population consisted of patients who were alive from April 1st, 2002 to March 31st, 2009. Patients with complete data were then categorized into two study groups: (i) the DMI eligible group comprised of patients with a FP exposed to DMI for all 3 years (2006–2008), and (ii) the DMI ineligible group consisted of patients who were affiliated with a FP practicing in the traditional FFS throughout the study period. The DMI eligible group is labelled as the ‘DMI group’ and the DMI ineligible group is labelled as the ‘comparison group,’ respectively. After excluding patients who did not fit the criteria to be in either study group, we were left with 2,760,989 valid patient-year observations (unbalanced panel) for analyses.

An unbalanced panel may have efficiency loss from missing data [43] and may induce bias to the parameter estimates [44]. Therefore, the main analysis was conducted on the balanced panel, with an analysis using the unbalanced panel conducted to ascertain the robustness of our conclusions. The balanced panel had 1,207,157 patient-year observations. Figure A1 shows the process by which the study population was selected, and Table A2 shows the number of patients in each study group in each year for the balanced and unbalanced panels.

Variables

The exposure measure in this study was whether the patient’s FP was eligible to claim the DMI during 2006–2008. A dichotomous variable was created to reflect the two study groups of patients: DMI group (took the value 1) and comparison group (took the value 0). The outcome variable of interest was whether or not the patient had one or more DMA fee codes claimed by the patient’s FP each fiscal year, thus capturing diabetes-related services provided to a patient at the extensive margin. A related second outcome variable was whether or not the patient had three or more DMA fee codes claimed by their FP during each year (i.e., diabetes-related services at the intensive margin). Patient characteristics included in this study were age, sex, comorbidity (defined by the number of ADGs), rural residence, duration of diabetes (measured in years), income quintiles (ranged from quintile 1 (Q1) = lowest income to quintile 5 (Q5) = highest income), and material deprivation (Q1 = least deprived to Q5 = most deprived). Physician characteristics included were age, age squared, sex and International Medical Graduate (IMG) status.

Statistical analysis

Main analysis

Descriptive statistics each year describe the patient- and physician-level characteristics, DMI, and DMA fee code billings for each study group. Frequencies and percentages were used to describe categorical variables, while means and standard deviations were used to describe continuous variables. A Chi-square test and an independent sample t-test were used to examine the differences of the outcomes between the study groups during the first and last year of the study.

Multivariable difference-in-differences (DID) linear probability models were used to study the relationship between the DMI and diabetes-related services (measured by DMA billings). We begin with estimating the following unadjusted DID model:

where \( P\left( {Y_{it} = 1 |x} \right) \) is the probability of having at least one (or three) DMA fee codes claimed for patient \( i \) by his/her FP in year \( t \); \( {\text{DMI}}_{i} \) equals 1 if patient \( i \)’s FP is in the DMI group and 0 if patient \( i \)’s FP is in the comparison group; \( {\text{period}} \) is a pre- and post-dichotomous variable equals 0 if the year of the observation is before DMI was introduced, and 1 if it was after DMI was introduced; \( {\text{DMI}}_{i} \times {\text{period}} \) is the DID estimate in which we are interested; \( \tau \) is the time trend and \( u_{it} \) is the error term. Equation (1) is estimated using the ordinary least square (OLS) estimation procedure and allows for within clustering of patients (Model 1).

Since patient- and physician-level characteristics can confound DID estimates in Eq. (1), [13, 14, 17, 18] we employed a DID adjusted pooled OLS model (Model 2):

where \( X_{it} \) is the set of patient- and physician-level characteristics discussed in the Variables section. Both patient and physician age-squared variables were included to capture non-linear age effects.

Although Eq. (2) addressed bias arising from observed characteristics, unobserved heterogeneity (e.g. patient’s race and preferences) may still be present, and can potentially bias the estimates in Eq. (2) [17, 45]. Assuming that the patient-specific unobserved factors are time-invariant, we used a patient fixed-effects DID model adjusting for patient- and physician-level characteristics (Model 3) [45, 46].

where \( \varepsilon_{i} \) captures the patient-specific time-invariant factors.

Patient’s behaviours may change over time (e.g. treatment compliance, and visiting their FPs on a regular basis), which is not captured by the standard fixed-effects DID model. Therefore, we employed a high-dimensional fixed-effects DID model adjusting for patient- and physician-level characteristics and individual fixed-effects [47], (Model 4).

where \( \gamma_{i} \tau \) is the high-dimensional fixed-effects in which the patient interacts with their own time trend. In addition, a two-way clustering for within patients and between physicians was allowed in this model.

Subgroup analysis

Patients with greater comorbidities have complex health needs and a high demand for health care services [48,49,50]. A few studies stated that P4P incentives may not benefit patients with multiple co-morbidities; [51, 52] thus, it is important to assess if the impact of DMI varies by the degree of comorbidity. Sex-specific differences have been noted: women are less likely to attain the recommended targets for HbA1C and lipids, less compliant with the medical recommendations [53, 54], and receive poor monitoring and treatment for diabetes compared to men [53, 54]. Subgroup analyses were performed to examine if the impact of DMI on the DMA fee codes claimed varied by (i) comorbidity (below versus at or above median numbers of ADGs at baseline) and (ii) males versus females.

Sensitivity analysis

Two sensitivity analyses were conducted to evaluate the robustness of our findings. First, we treated the DMA outcome as a continuous variable to check if the findings remained similar. Second, all analyses were performed using the unbalanced panel data.

Results

Descriptive results

In total, 172,451 adult diabetic patients in Ontario were included in this study (15,559 patients in the comparison group and 156,892 patients in the DMI group). Patient and physician characteristics for both groups for years 2002–2005 and 2006–2008 are reported in Tables 1 and 2. On average, patients in the DMI group were slightly younger, had fewer ADGs and shorter duration of diabetes compared to the comparison group. The DMI group had a slightly greater proportion of female patients, patients from less deprived areas and higher-income quintiles. The physicians providing care to the DMI group were younger, had fewer years of experience and less likely to be IMGs. A greater proportion of female physicians provided care in the DMI compared to the comparison group.

In the DMI group, the proportion of patients who had a DMI claimed by their physician increased from 21.91% in 2006 to 27.43% in 2008 (Tables 1 and 2). The proportion of patients with one or more DMA fee codes and three or more DMA fee codes claimed by their physician per year increased in both groups but was significantly higher in the DMI group (Table A3). Figures 1 and 2 present the trends in the DMA fee code billings in both study groups, revealing that the gap between the two groups for the billings claimed widened following the introduction of DMI.

Regression results

The regression results of all four models show that the DMI has a positive and statistically significant effect on the probability of having one or more DMA fee codes claimed by the patient’s physician (p < 0.01) (Table 3). This finding suggests that there is an increase in the provision of diabetes-related services after the introduction of DMI. The DID unadjusted pooled OLS model (Model 1) indicates that the effect of DMI is an increase in the probability of having one or more DMA fee codes claimed by the FP by 14.4% points (95% confidence interval [CI] [14.1, 14.7]). After adjusting for the patient- and physician-level characteristics (Model 2) and in the fixed-effects DID model (Model 3), the effect drops slightly. In the high-dimensional fixed-effects DID model (Model 4), the effect size was the smallest: 9.3% points increase in the probability of having one or more DMA fee codes claimed (95% CI [8.0, 10.6]). Since Model 4 adjusts for patient-specific time trend, individual patient fixed-effects and observable patient and physician-level characteristics, the results of this model are likely to be closer to the true effect of the DMI.

All four regression models revealed that the DMI has a positive and statistically significant effect on the probability of having three or more DMA fee codes claimed by physicians (p < 0.01) (Table 4). Model 4 revealed that the probability of having three or more DMA fee codes increased by 2.1% points (95% CI [1.5, 2.6]). The DMI also increased diabetes-related services at the extensive margin, though the effect is much smaller.

Results of subgroup analysis

The impact of DMI on having one or more DMA fee codes claimed by the patient’s physician in the subgroups were similar to the main results. Based on the final model (Model 4), the comorbidity subgroup analyses showed the effect to be similar in both comorbidity groups (Table A4). However, it was slightly larger in males compared to females. Following this, interactions examined if there was a statistically significant difference in the impact of DMI by patient’s sex. Interactions were performed in Models 1 and 2 only because patient’s sex is a time-invariant characteristic whose effect is omitted in fixed-effects and high-dimensional fixed-effects models. Findings from the interactions revealed that the difference in the effect of DMI on the outcome between males and females is statistically significant (Model 2: − 2.2% points; 95% CI [− 2.6, − 1.9]).

Similar results were obtained for the impact of DMI on having three or more DMA fee codes claimed by a patient’s physician across the two subgroups (comorbidity and sex) (Table A4). The effect size was again slightly larger in males compared to females. Interactions were again performed, revealing that the difference in the DMI’s effect between males and females was statistically significant (Model 2: − 0.6% points; 95% CI [− 0.8, − 0.5]).

Results of sensitivity analysis

Analyzing the impact of DMI on the number of DMA fee codes claimed by the patient each year, we also found that DMI has a positive and statistically significant effect on the number of DMA fee codes claimed. When we used the unbalanced panel, the results were qualitatively similar to the main results. Subgroup analyses were also performed in the unbalanced panel, and the results were consistent with those from the subgroup analyses in the balanced panel. For the comorbidity subgroup analysis in the unbalanced panel, the same median number of ADGs at baseline as the balanced panel was used to be consistent with the subgroup analysis performed in the main analysis. Results for these analyses are available upon request.

Discussion and conclusions

Existing literature has found the impact of P4P incentives on diabetes-related services to be ambiguous. Using a large panel data set with four multivariable linear probability models, we find that P4P incentives in Ontario have increased the provision of diabetes-related services. Our main findings are based on a balanced panel of patients. By looking at the same patients over time, we can be confident that the increase in services after the DMI was introduced is linked to the P4P incentives. Furthermore, our analyses revealed that the DMI was associated with an increase in diabetes-related services provided to patients both at the extensive and intensive margins, with the former being larger than the latter. Sensitivity analyses confirmed the robustness of these findings.

The results of this study corroborate those studies that found increased diabetes-related services resulting from P4P incentives, [9, 12,13,14] but are inconsistent with others [17,18,19]. One study that contradicts our findings is Chien et al. (2012) [17], which may be explained by differences in the data and study populations. In their study, the authors compared the Hudson Health Plan’s P4P program to 11 other non-incentivized health plans within New York using plan-level administrative data. In comparison, our study used patient-level data with a large sample size. Another difference is that Chien et al. [17] evaluated a P4P program for diabetes care on diabetes processes of care in practices located in low socioeconomic settings. Failure to find an effect may be due to the weak financial incentives given to physicians being overwhelmed by the needs of the lower socioeconomic populations [17, 55].

Lavergne et al. [19] examined a diabetes management incentive to have a non-statistically significant increase in laboratory tests and prescriptions in British Columbia, Canada. A potential explanation for this result concerns patients’ use of health services prior to the introduction of such incentives. Existing systematic reviews have found that P4P has a greater effect on outcomes in environments with more room for improvements [56, 57]. In Lavergne et al.’s study [19], prior to the introduction of the incentive, diabetic patients visited their FP almost every month, and the laboratory tests for measures such as HbA1C, lipids and glucose were close to the recommended frequency – leaving little room for further improvement [19]. In contrast, the proportion of patients with a DMA fee code claimed by their physicians was very low in both study groups prior to the introduction of the incentive in Ontario. This explains why we observed a large increase in the patients having DMA fee codes claimed, following the introduction of the DMI.

The increase in the diabetes-related services as a result of the DMI in our study may be explained by physicians working additional days, as observed in a recent study in Ontario [58]. This study revealed that FPs from a blended FFS model provided more services (e.g. comprehensive care and after hours) compared to FPs practicing in the traditional FFS. They argued that the increase in services was partly due to the incentives encouraging FPs from the blended FFS model to work additional days throughout the year; indeed, physicians in that study had an increase in the total number of days worked, including during weekends and holidays [58].

We also found that the proportion of patients with one or more and three or more DMA fee codes claimed by their physician was already increasing prior to the introduction of DMI, and the increase was larger in the DMI group (Figs. 1b and 2). This suggests that physicians providing care to patients in the DMI group were already claiming more DMA fee codes compared to the comparison group. This finding may have been due to the primary care reform that began in the early 2000s in Ontario when patient enrollment models were introduced with an increased emphasis on chronic disease management [21]. Following the introduction of the DMI, a much larger increase in the DMA fee code claims was observed than in the pre-DMI period, suggesting, again, that DMI had a positive effect on diabetic services.

In our study, certain patient- and physician-level characteristics influenced the provision of diabetes-related services. Females had a lower probability of having one or more, and three or more DMA fee codes claimed by their physician. Older patients were more likely to have one or more, and three or more DMA fee codes claimed by their physician. Patients with female physicians, and with physicians who were IMGs, were more likely to have one or more DMA fee codes claimed by their FP, and patients who were more comorbid were less likely to have three or more DMA fee codes claimed by their FP. A few previous studies found similar results regarding patient’s sex [13, 18], and age [18] on receiving the quality of care or recommended tests for diabetes. These findings suggest avenues for future research to understand better why these characteristics should matter.

One important finding in our study was that the effect of DMI on the provision of diabetes-related services was slightly larger in males compared to females. A potential explanation is that female diabetic patients are known to have poor medical compliance and are less likely to receive diabetes-related services compared to males [13, 53, 54]. Behavioural factors are one possible reason behind non-compliance, as one study found that women with diabetes had a higher prevalence of depression and diabetes-related distress than men, and lower psychological well-being was associated with lower levels of self-care attitudes, the satisfaction of treatment and diabetes empowerment [59, 60].

Although DMI has increased diabetes-related services, it is unclear if this P4P incentive translates into better health outcomes for diabetic patients. Existing evidence suggests that P4P incentives increase the provision of services in diabetic patients and improve intermediate outcomes such as HbA1C levels [61]. Overtime, improvements in patients’ health are expected [6]. We performed a supplementary analysis of the impact of DMI on Mortality Risk Scores (MRS) to identify if improvements in patient health were present. The MRS, developed by Austin & Walraven [62], is a point-scoring system that uses patient’s age, sex and 28 of the 32 ADG categories (Johns Hopkins ACG® System Version 10.0) to predict the patient’s risk of all-cause death within 1 year. The results revealed that the effect of DMI on MRS was not statistically significant (Tables 5 and A5). It is likely that the three-year study period was not long enough to detect the effects of this incentive on patient’s risk of mortality—a longer time period is required to see improvements in long-term health outcomes.

This study used retrospective health administrative data from the fiscal years 2002–2008 to examine the impact of the DMI on diabetes-related services. Data beyond March 31, 2009 were not used as all FPs became eligible for DMI as of April 1st, 2009. The findings of this study remain relevant for today: no major innovations in DMI have been introduced since this time that might affect the results. Moreover, our quasi-experimental approach provides a rigorous measure of the effects of this incentive on a relatively homogeneous population of physician enrollment practices, providing a basic foundation upon which analyses of more heterogeneous physician practices in post-2009 can be studied.

In terms of strengths, this is the first study to evaluate the impact of DMI on diabetes-related services comparing patients diagnosed with diabetes to a comparison group. This study helps fill the knowledge gap regarding the effectiveness of DMI using a particularly appropriate panel data set that allows us to deal with heterogeneity across individuals and time [45, 63]. Finally, the patient cohort in this study was derived from a validated health administrative database, the ODD, which has a high sensitivity (86%) and specificity (97%) [31, 32] for identifying patients with diabetes.

Our study has some limitations. First, the comparison group was much smaller compared to the DMI group. A concern with having a small group is that patients with data outside the normal range may skew the results. Second, although we controlled for many patient- and physician-level characteristics, time-invariant patient factors and patient-specific time trends, some selection biases may remain. The FPs who provided care to patients in the DMI group had voluntarily switched to a patient enrollment model sometime prior to the introduction of these incentives. In contrast, FPs providing care to the comparison group were physicians who had not made this switch. Differences across physicians of these two groups may have introduced some bias. Furthermore, the descriptive results revealed that there were slight differences observed between the DMI and comparison group for the patient- and physician-level characteristics. Patient- and physician-level factors were adjusted for in the multivariable analyses to help reduce the bias.

In terms of future research, it would be worthwhile to investigate the sensitivity of physician responses to financial incentives for diabetes-related services. Relatedly, assessing the impact of this incentive on healthcare system costs and determining its cost-effectiveness would be an important endeavour. Last but not least, researching the benefits to patients’ health over time stemming from these diabetes management incentives would provide essential inputs into health policies of this nature.

We find strong evidence that diabetes management incentives increase the provision of diabetes-related services at the extensive margin—increasing by at least 9% points the probability of having one or more DMA fee codes claimed by the patient’s physician. We found the incentives to improve diabetes-related services provided to patients at the intensive margin—increasing by approximately 2% points in the probability of having three or more DMA fee codes claimed by the patient’s physician. The increases were similar across comorbidity subgroups; however, the effect of DMI was slightly larger for males than females. From a policy perspective, our results point to a clear role for P4P measures as a means of increasing diabetes management services, reinforcing the idea that physicians’ behaviour can be altered through financial incentives. Other chronic diseases may be better managed using similar incentives.

References

World Health Organization.: Diabetes (2017). http://www.who.int/en/news-room/fact-sheets/detail/diabetes. Accessed 10 Aug 2018

Statistics Canada. Table 13-10-0096-07 Diabetes, by age group (2018). https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1310009607. Accessed 11 Aug 2018

International Diabetes Federation. IDF Diabetes Atlas, 8th edn. International Diabetes Federation, Brussels, Belgium (2017)

Diabetes Canada.: Diabetes in Canada. 2018

Lippi Bruni, M., Nobilio, L., Ugolini, C.: Economic incentives in general practice: the impact of pay-for-participation and pay-for-compliance programs on diabetes care. Health Policy 90, 140–148 (2009)

Dusheiko, M., Doran, T., Gravelle, H., Fullwood, C., Roland, M.: Does higher quality of diabetes management in family practice reduce unplanned hospital admissions? Health Serv. Res. 46, 27–46 (2011). https://doi.org/10.1111/j.1475-6773.2010.01184.x

Laberge, M., Kone Pefoyo, A.J.: Assessing the effectiveness of policies to reduce diabetes hospitalizations before and after the reforms of physician payment and primary care organization in British Columbia and Alberta. Can. J. Diabetes 40, 406–410 (2016)

Kantarevic, J., Kralj, B.: Link between pay for performance incentives and physician payment mechanisms: evidence from the diabetes management incentive in Ontario. Health Econ. 22, 1417–1439 (2013)

Lee, T.-T., Cheng, S.-H., Chen, C.-C., Lai, M.-S.: A pay-for-performance program for diabetes care in Taiwan: a preliminary assessment. Am J Manag Care 16, 65–69 (2010)

Scott, A., Schurer, S., Jensen, P.H., Sivey, P.: The effects of an incentive program on quality of care in diabetes management. Health Econ. 18, 1091–1108 (2009)

Harrison, M.J., Dusheiko, M., Sutton, M., Gravelle, H., Doran, T., Roland, M.: Effect of a national primary care pay for performance scheme on emergency hospital admissions for ambulatory care sensitive conditions: controlled longitudinal study. BMJ 349, g6423 (2014)

Vamos, E.P., Pape, U.J., Bottle, A., Hamilton, F.L., Curcin, V., Ng, A., et al.: Association of practice size and pay-for-performance incentives with the quality of diabetes management in primary care. CMAJ 183, E809–E816 (2011)

Chen, J.Y., Tian, H., Taira Juarez, D., Hodges, K.A., Brand, J.C., Chung, R.S., et al.: The effect of a PPO pay-for-performance program on patients with diabetes. Am J Manag Care 16, e11–e19 (2010)

Chen, C.-C., Cheng, S.-H.: Does pay-for-performance benefit patients with multiple chronic conditions? Evidence from a universal coverage health care system. Health Policy Plan 31, 83–90 (2016)

Cheng, S.-H., Lee, T.-T., Chen, C.-C.: A longitudinal examination of a pay-for-performance program for diabetes care. Med. Care 50, 109–116 (2012). https://doi.org/10.1097/MLR.0b013e31822d5d36

Huang, Y.-C., Lee, M.-C., Chou, Y.-J., Huang, N.: Disease-specific pay-for-performance programs: do the P4P effects differ between diabetic patients with and without multiple chronic conditions? Med. Care 54, 977–983 (2016)

Chien, A.T., Eastman, D., Li, Z., Rosenthal, M.B.: Impact of a pay for performance program to improve diabetes care in the safety net. Prev. Med. (Baltim) 55(Suppl), S80–S85 (2012). https://doi.org/10.1016/j.ypmed.2012.05.004

Kiran, T., Victor, J.C., Kopp, A., Shah, B.R., Glazier, R.H.: The relationship between financial incentives and quality of diabetes care in Ontario, Canada. Diabetes Care 35, 1038–1046 (2012)

Lavergne, M.R., Law, M.R., Peterson, S., Garrison, S., Hurley, J., Cheng, L., et al.: Effect of incentive payments on chronic disease management and health services use in British Columbia, Canada: interrupted time series analysis. Health Policy (New York) 122, 157–164 (2018). https://doi.org/10.1016/J.HEALTHPOL.2017.11.001

Lin, T.-Y., Chen, C.-Y., Huang, Y.T., Ting, M.-K., Huang, J.-C., Hsu, K.-H.: The effectiveness of a pay for performance program on diabetes care in Taiwan: a nationwide population-based longitudinal study. Health Policy 120, 1313–1321 (2016)

Hutchison, B., Glazier, R.: Ontario’s primary care reforms have transformed the local care landscape, but a plan is needed for ongoing improvement. Health Aff. 32, 695–703 (2013). https://doi.org/10.1377/hlthaff.2012.1087

Jaakkimainen, R.L., Barnsley, J., Klein-Geltink, J., Kopp, A., Glazier, R.H.: Did changing primary care delivery models change performance? A population based study using health administrative data. BMC Fam. Pract. 12, 44 (2011)

Office of the Auditor General of Ontario.: The 2016 Annual Report of the Office of the Auditor General of Ontario: Physicians billing. 2016

Ministry of Health and Long-term Care.: Diabetes Management Incentive. 2006

Ontario Ministry of Health and Long-Term Care. Diabetes Management Incentive and enhancements to after hours (Q012A & Q016A). 2009

Ministry of Health and Long Term Care.: Schedule of benefits physician services under the Health Insurance Act (Effective 2016). 2015

Ontario Ministry of Health and Long-Term Care.: Billing & payment guide for Blended Salary Model (BSM) physicians. 2012

Ontario Ministry of Health and Long-Term Care:. INFOBulletin—keeping health care providers informed of payment, policy or program changes. 2015

Ministry of Health and Long Term Care. Schedule of Benefits Physician Services Under the Health Insurance Act Ministry of Health (Effective April 1, 2020). 2020

Waterloo Wellington Diabetes.: Diabetes billing codes. n.d

Petrosyan, Y., Bai, Y.Q., Koné Pefoyo, A.J., Gruneir, A., Thavorn, K., Maxwell, C.J., Bronskill, S.E., Wodchis, W.P.: The relationship between diabetes care quality and diabetes-related hospitalizations and the modifying role of comorbidity. Can. J. Diabetes 41, 17–25 (2017). https://doi.org/10.1016/j.jcjd.2016.06.006

Hux, J.E., Ivis, F., Flintoft, V., Bica, A.: Diabetes in Ontario: determination of prevalence and incidence using a validated administrative data algorithm. Diabetes Care 25, 512–516 (2002). https://doi.org/10.2337/DIACARE.25.3.512

Kiran, T., Victor, J.C., Kopp, A., Shah, B.R., Glazier, R.H.: The relationship between primary care models and processes of diabetes care in Ontario. Can. J. Diabetes 38, 172–178 (2014)

Postal CodeOM Conversion File (PCCF): Reference Guide. 2017. doi:Statistics Canada Catalogue no. 92-154-G

Wilkins, R.: PCCF + Version F user’s guide: Automated geographic coding based on the Statistics Canada Postal Code Conversion Files: Including postal codes through July 2009. 2010

Matheson, F.I., Dunn, J.R., Smith, K.L.W., Moineddin, R., Glazier, R.H.: Ontario Marginalization Index user guide version 1.0. 2012

Matheson, F.: 2011 Ontario Marginalization Index: User guide. 2017

Matheson, F.I., Dunn, J.R., Smith, K.L.W., Moineddin, R., Glazier, R.H.: Development of the Canadian Marginalization Index: a new tool for the study of inequality. Can. J. Public Health 103, S12–S16 (2012)

The Johns Hopkins University. Johns Hopkins ACG® System n.d. https://www.hopkinsacg.org/. Accessed 22 Nov 2017

Manitoba Centre for Health Policy. Concept: Adjusted Clinical Groups® (ACG®) - Overview 2015. http://mchp-appserv.cpe.umanitoba.ca/viewConcept.php?conceptID=1304#a_references. Accessed 22 Nov 2017

Kiran, T., Kopp, A., Moineddin, R., Glazier, R.H.: Longitudinal evaluation of physician payment reform and team-based care for chronic disease management and prevention. CMAJ 187, E494–E502 (2015)

Stukel, T.A., Glazier, R.H., Schultz, S.E., Guan, J., Zagorski, B.M., Gozdyra, P., et al.: Multispecialty physician networks in Ontario. Open Med 7, e40–e55 (2013)

Horowitz, J.L., Manski, C.F.: Nonparametric analysis of randomized experiments with missing covariate and outcome data. J. Am. Stat. Assoc. 95, 77–84 (2000). https://doi.org/10.2307/2669526

Kang, H.: The prevention and handling of the missing data. Korean J Anesthesiol. 64, 402–406 (2013). https://doi.org/10.4097/kjae.2013.64.5.402

Park, H.M.: Practical guides to panel data modeling: A step by step analysis using Stata. In: Public management and policy analysis program, graduate school of international relations, pp. 1–52. International University of Japan (2011)

Li, J., Hurley, J., DeCicca, P., Buckley, G.: Physician response to pay-for-performance: evidence from a natural experiment. Health Econ. 23, 962–978 (2014). https://doi.org/10.1002/hec.2971

Correia, S.: A feasible estimator for linear models with multi-way fixed effects. Duke University Preliminary Version (2016)http://scorreia.com/research/hdfe.pdf. Accessed 10 Aug 2018

Vogeli, C., Shields, A.E., Lee, T.A., Gibson, T.B., Marder, W.D., Weiss, K.B., et al.: Multiple chronic conditions: prevalence, health consequences, and implications for quality, care management, and costs. J. Gen. Intern. Med. 22(Suppl 3), 391–395 (2007). https://doi.org/10.1007/s11606-007-0322-1

Schoen, C., Osborn, R., How, S.K.H., Doty, M.M., Peugh, J.: In chronic condition: experiences of patients with complex health care needs, in eight countries, 2008. Health Aff. 28, w1–w16 (2009). https://doi.org/10.1377/hlthaff.28.1.w1

Struijs, J.N., Baan, C.A., Schellevis, F.G., Westert, G.P., van den Bos, G.A.M.: Comorbidity in patients with diabetes mellitus: impact on medical health care utilization. BMC Health Serv. Res. 6, 84 (2006). https://doi.org/10.1186/1472-6963-6-84

Boyd, C.M., Darer, J., Boult, C., Fried, L.P., Boult, L., Wu, A.W.: Clinical practice guidelines and quality of care for older patients with multiple comorbid diseases: implications for pay for performance. JAMA 294, 716 (2005). https://doi.org/10.1001/jama.294.6.716

Tinetti, M.E., Bogardus, S.T., Agostini, J.V.: Potential pitfalls of disease-specific guidelines for patients with multiple conditions. N. Engl. J. Med. 351, 2870–2874 (2004). https://doi.org/10.1056/NEJMsb042458

Vimalananda, V.G., Miller, D.R., Palnati, M., Christiansen, C.L., Fincke, B.G.: Gender disparities in lipid-lowering therapy among veterans with diabetes. Women’s Heal Issues 21, S176–S181 (2011). https://doi.org/10.1016/j.whi.2011.04.009

Rossi, M.C., Cristofaro, M.R., Gentile, S., Lucisano, G., Manicardi, V., Mulas, M.F., et al.: Sex disparities in the quality of diabetes care: biological and cultural factors may play a different role for different outcomes: a cross-sectional observational study from the AMD Annals initiative. Diabetes Care 36, 3162–3168 (2013). https://doi.org/10.2337/DC13-0184

Chin, M.H., Drum, M.L., Guillen, M., Rimington, A., Levie, J.R., Kirchhoff, A.C., et al.: Improving and sustaining diabetes care in community health centers with the health disparities collaboratives. Med. Care 45, 1135–1143 (2007). https://doi.org/10.1097/MLR.0b013e31812da80e

Eijkenaar, F., Emmert, M., Scheppach, M., Schöffski, O.: Effects of pay for performance in health care: a systematic review of systematic reviews. Health Policy (New York) 110, 115–130 (2013). https://doi.org/10.1016/j.healthpol.2013.01.008

Van Herck, P., De Smedt, D., Annemans, L., Remmen, R., Rosenthal, M.B., Sermeus, W.: Systematic review: effects, design choices, and context of pay-for-performance in health care. BMC Health Serv. Res. 10, 247 (2010). https://doi.org/10.1186/1472-6963-10-247

Somé, N.H., Devlin, R.A., Mehta, N., Zaric, G., Li, L., Shariff, S., et al.: Production of physician services under fee-for-service and blended fee-for-service: evidence from Ontario, Canada. Health Econ 28, 1418–1434 (2019). https://doi.org/10.1002/hec.3951

Rossi, M.C., Lucisano, G., Pintaudi, B., Bulotta, A., Gentile, S., Scardapane, M., et al.: The complex interplay between clinical and person-centered diabetes outcomes in the two genders. Health Qual. Life Outcomes 15, 41 (2017). https://doi.org/10.1186/s12955-017-0613-0

Pintaudi, B., Lucisano, G., Gentile, S., Bulotta, A., Skovlund, S.E., Vespasiani, G., et al.: Correlates of diabetes-related distress in type 2 diabetes: findings from the benchmarking network for clinical and humanistic outcomes in diabetes (BENCH-D) study. J. Psychosom. Res. 79, 348–354 (2015). https://doi.org/10.1016/j.jpsychores.2015.08.010

Mcgovern MP, Williams DJ, Hannaford PC, Taylor MW, Lefevre KE, Boroujerdi MA, et al. Introduction of a new incentive and target-based contract for family physicians in the UK: good for older patients with diabetes but less good for women? 2008;25:1083–9. https://doi.org/10.1111/j.1464-5491.2008.02544.x

Austin, P.C., van Walraven, C.: The Mortality Risk Score and the ADG score: two points-based scoring systems for the Johns Hopkins Aggregated Diagnosis Groups (ADGs) to predict mortality in a general adult population cohort in Ontario, Canada. Med Care 49, 940–947 (2011). https://doi.org/10.1097/MLR.0b013e318229360e

Baltagi, B.H.: Econometric Analysis of Panel Data, 3rd edn. Wiley, West Sussex, England (2005)

Acknowledgements

We thank two anonymous reviewers of this journal for their constructive feedback and suggestions for improvement. Funding for this research by the Canadian Institutes of Health Research operating grant (MOP–130,354) and Early Researcher Award by the Ontario Ministry of Research and Innovation is gratefully acknowledged. Thaksha would like to acknowledge the Western Graduate Research Scholarship at the University of Western Ontario. This study was undertaken at the ICES Western site. ICES is funded by an annual grant from the Ontario Ministry of Health and Long-Term Care (MOHLTC). Core funding for ICES Western is provided by the Academic Medical Organization of Southwestern Ontario (AMOSO), the Schulich School of Medicine and Dentistry (SSMD), Western University, and the Lawson Health Research Institute (LHRI). The opinions, results and conclusions are those of the authors and are independent from the funding sources. No endorsement by ICES, AMOSO, SSMD, LHRI, CIHR, or the MOHLTC is intended or should be inferred. We thank Lihua Li for pulling out the data from ICES databases used in this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest Statement

The use of data in this study was authorized under Section 45 of Ontario’s Personal Health Information Protection Act, which does not require review by a Research Ethics Board. None of the authors has any conflicts of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Thavam, T., Devlin, R.A., Thind, A. et al. The impact of the diabetes management incentive on diabetes-related services: evidence from Ontario, Canada. Eur J Health Econ 21, 1279–1293 (2020). https://doi.org/10.1007/s10198-020-01216-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10198-020-01216-6