Abstract

Aims

To determine if taxation policies that increase the price of alcohol differentially reduce alcohol consumption for heavy drinkers in Australia.

Design

A two-part demand model for alcohol consumption is used to determine the price elasticity of alcohol. Quantile regression is used to determine the price elasticity estimates for various levels of consumption.

Setting

The study uses Australian data collected by the National Drug Strategy Household Survey for the years 2001, 2004 and 2007.

Measurements

Measures of individual annual alcohol consumption were derived from three waves of the National Drug Strategy Household Survey; alcohol prices were taken from market research reports.

Findings

For the overall population of drinkers, a 1 % increase in the price of alcohol was associated with a 0.96 % (95 % CI −0.35 %, −1.57 %) reduction in alcohol consumption. For those in the highest 10 % of drinkers by average amount consumed, a 1 % increase in the price of alcohol was associated with a 1.26 % (95 % CI 0.82 %, 1.70 %) reduction in consumption.

Conclusions

Within Australia, policies that increase the price of alcohol are about equally effective in relative terms for reducing alcohol consumption both for the general population and among those who drink heavily.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Australian Burden of Disease and Injury Study estimated that, for the year 2003, the total harm attributable to alcohol use was equivalent to 3,460 deaths and 85,435 disability-adjusted life years (DALYs), or 3.2 % of the total disease burden [1]. The social cost of alcohol consumption in the 2004–05 financial year was estimated at $15.3 billion [2], and an additional $30 billion was estimated as the cost of harm caused to people other than drinkers [3].

The public debate on the use of taxation to reduce alcohol consumption in Australia has received renewed interest [4–8]. Evidence suggests that the most cost-effective strategy to achieve a reduction in consumption is increasing the price of alcohol through such measures as taxation [9]. Alcohol taxation also provides additional benefit of raising taxation income and, more importantly, raises the most taxation from those that drink heavily and potentially impose costs on others from their drinking (i.e. non-drinkers may be willing to pay to reduce others’ alcohol consumption [10]).

In order to evaluate the efficacy of taxation strategies, it is critical to know how sensitive drinkers are to price changes—their price elasticity. Moreover, given evidence that alcohol-related harms are likely to be greater for those who, on average, drink more alcohol than others [11], it is also important to establish whether the response to price also differs by average consumption level. If those who drink higher quantities on average over time are price inelastic relative to other drinkers, then increasing taxation high enough to reduce drinking by those who drink large volumes may unfairly penalise responsible drinkers. But if sensitivity to price is comparable across drinkers of different consumption levels, then price is an equitable lever to use, and the only decision is how to optimise collecting revenue to offset costs associated with alcohol consumption’s related harm.

To date, Australian research has been limited by the absence of price elasticity estimates by drinker type [4, 6, 12]. A recent meta-analysis of the international literature found that only 10 of 91 international studies of the price elasticity of alcohol examined the effects of alcohol price or taxes on heavy drinking [13]. These 10 studies show that drinkers who consume relatively large amounts of alcohol per drinking occasion are price sensitive. Nevertheless, a recent analysis showed that this price sensitivity may occur from high-intensity per occasion drinkers, at least in Australia, reducing the number of occasions on which they drink a small amount, in order to preserve their occasions of high intensity drinking [14].

In the United States, the price elasticity of drinkers at different average consumption levels, rather than level of consumption per drinking occasion has been previously estimated [15]. This research showed that those whose usual consumption is relatively high were less price sensitive than others. Whereas, in the United Kingdom, the price elasticity for two categories of drinkers based on mean consumption per week has been more recently undertaken [16]. In contradiction to the US study, the UK results indicate that moderate drinkers (defined as adult drinkers with a mean consumption per week of 21/14 or fewer units of alcohol for men/women) were less price sensitive compared to hazardous and harmful drinkers (adult drinkers with mean weekly consumption greater than 21/14 units of alcohol for men/women).

The aim of this study was to estimate price elasticities for Australian drinkers and determine whether or not those who consume more on average have a differential price response.

Method

Demand model

The previous United Kingdom study [16] that explored differential demand by level of drinking employed a system of equations approach to explore household expenditure data. On the other hand, the US study [15] adopted a double-hurdle model to explore survey data on alcohol consumption. The current study relies upon survey data of alcohol consumption collected from national surveys as opposed to household expenditure data. Consequently a double-hurdle model has been chosen for this analysis.

The double-hurdle model [17] has been extensively applied in a variety of demand functions for specific food goods [18–23], loan defaults [24], and contingent valuation of environmental conservation [25]. It has also been successfully employed in modelling alcohol demand [26–29].

A persistent problem associated with the analysis of alcohol demand based on self-reported consumption data is that many participants report a zero level of consumption [15, 30, 31]. This could be because those respondents do not positively value alcohol or because other goods have higher priority in terms of marginal value. However, failing to explicitly recognise this truncated distribution of consumption will result in biased and inconsistent estimates. Several empirical studies have highlighted the inadequacy of the standard Tobit model in cross-sectional analysis of alcohol and tobacco consumption, and emphasised the importance of a bivariate generalization of that model, on the basis that the participation and consumption decisions stem from two separate choices [26–28, 32–35].

The double-hurdle model is a parametric generalization of the Tobit model [28] in which the decision to participate in the market (drink alcohol) and the level of participation (amount of alcohol consumed) represent two separate stochastic processes.

The double-hurdle model has a participation (D) equation:

D* is a latent participation variable which if greater than zero means that the respondent consumes alcohol (D = 1), Z is a vector of characteristics; such as age, education and income, and α is a vector of parameters with µ as an error term.

It also has a level of consumption (Y) equation conditional on participation:

where Y i is the reported answer to the question “how many standard drinks of alcohol, on average, do you consume on an occasion?”, multiplied by the number of times the respondent reports drinking alcohol in a year; X i is a vector of the individual’s characteristics and β is a vector of parameters with υ as an error term.

The decisions about whether to participate in the market (D) and the level of consumption (Y) can be: independently modelled if they are made separately; jointly modelled if they are made simultaneously by the individual; or sequentially modelled if one decision is made first and affects the other one.

In this study, the decision to drink and then the decision of what quantity to drink are considered to be sequential and independent. That is, dominance is assumed (i.e., the zeros represent non-participation, not corner solutions, where individuals do not drink regardless of price and income). Consequently, the double-hurdle model decomposes into a two-part model consisting of a probit model for participation and truncated ordinary least squares (OLS) model for the non-zero consumption respondents. A log–log specification has been selected a priori for the truncated OLS regression for consumption. In addition, the level of alcohol consumption is likely to be skewed [36]. However, the log–log OLS model provides an appropriate transformation of the dependent variable as well as providing results in the form of elasticities.

If dominance does not apply, the truncated OLS regression (quantity of alcohol consumed) still provides unbiased estimates for the coefficients, although they do not incorporate information regarding the decision to participate.

Price elasticity by quantile of consumption

To estimate whether those who drink more per year respond differently to price increases, the conditional elasticities for q quantiles were estimated (q = 0.05, 0.1, 0.15, 0.20,… 0.90, 0.95, where q refers to the quantiles of consumption). Quantile regressions can be estimated using a linear programming approach [37, 38]. Alternatively, quantile regression can also be accomplished by iterative weighted least squares, for the equation y i * [15]. The model is estimated here using iterative weighted least squares. In this model, the qth quantile of drinking depends on two factors: the characteristics, x, of the individual, and the quantile of the individual, conditional on x. To determine whether the price elasticity varies significantly with consumption, the focus of this analysis is the demand response conditional on x characteristics of the individual.

Data sources

The National Drug Strategy Household Survey (NDSHS) collects information from Australian individuals on alcohol and other drug awareness, attitudes and behaviour and various social and socio-economic characteristics. In the present analysis, data from three surveys, 2001, 2004 and 2007 were used, which involves 79,545 individuals. These are national surveys of the Australian population aged 14 and over. The NDSHS is a self-completion questionnaire that used a drop-and-collect method. The response rates were 50.0, 45.6 and 49.3 % for the 2001, 2004 and 2007 surveys, respectively. The 2004 wave included a booster sample of participants who were Aboriginal and Torres Strait Islander.

The consumption of alcohol was measured in standard drinks of alcohol per annum (one standard drink equals 10 g of alcohol). Participants were asked how frequently they consumed alcohol in the past 12 months (every day; 5–6 days a week; 3–4 days a week; 1–2 days a week; 2–3 days a month; about 1 day a month; less often; and no longer drink) and on a day that they drink alcohol how many standard drinks do they usually have. The level of alcohol consumption was calculated by multiplying the average number of standard drinks per occasion by the number of drinking occasions per year [39]. However, the survey question with regards to the average number of standard drinks per occasion was delineated by intervals with the highest interval being open, i.e. greater than 12. As such, the mean for each interval, including the highest interval, was predicted using the normal distribution of responses for that year. This was performed for the closed intervals so that an estimate that was more reflective of the distribution of consumption was incorporated into the model, rather than the mid-point of the pre-specified range.

Real price indices were attained from national sales data [40]. These data provide total quantity and value of alcohol sold within Australia for 2001, 2004 and 2007. Unlike unit values of price derived from household expenditure surveys, price represents the average menu price of alcohol and is assumed exogenous to the demand of any given individual. The alcohol price was adjusted by the state consumer price index (CPI) for alcohol, relative to the national CPI for alcohol [41], to derive a state-specific price for alcohol. The natural log of each state price of alcohol was then estimated and applied to each respondent, depending on their state of residence. Demographic data was also provided within the NDSHS and controlled for within the model including indigenous status to control for the booster sample collected in 2004.

Results

Demographic characteristics of the NDSHS respondents are provided in Table 1. In total, there were 79,545 respondents across the three survey waves, with 44 % males and a mean age of 45.

Table 2 contains the estimates from the probit regression for “being a current drinker” and the conditional (OLS) regression for “how much drinkers consume.” A table of full results is presented in the Electronic Supplementary Material. The results from the two-part model indicate that an increase in the price of alcohol has a significant and negative effect on the average level of annual alcohol consumption: the conditional estimated price elasticity is −0.96 (p = 0.002). However, price is not statistically significant with regards to the probability of being a current drinker at the 5 % level.

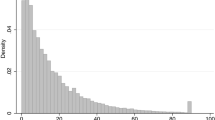

Table 3 presents the conditional elasticity coefficients for changes in price across all quantiles estimated. For ease of interpretation, these findings are also presented graphically in Fig. 1. It was found that the measured response to a 1 % increase in price for drinkers was not significant in the bottom 10 % of total alcohol consumption. This indicates that price may not be a significant determinant of the quantity consumed for the bottom 10 % of drinkers. However, all other price elasticity estimates were negative and statistically significant. For those in the heaviest drinking decile (by average annual consumption levels), for example, a 1 % increase in the price of alcohol is associated with a statistically significant 1.26 % reduction in their consumption (p = 0.003).

Figure 1 also highlights the extent to which consumption reduces as price increases varies across consumption quantiles (delineated as the peaks and troughs in the price elasticity line) which suggests the general trend (delineated by the log trend line) is mediated by other variables.

Discussion

The aim of this study was to estimate price elasticities for Australian drinkers and determine whether or not those who consume more on average have a differential price response. Three key findings have been identified from this research. First, the probability of being a drinker, although negatively associated with price, was not statistically significant. Second, alcohol consumption in Australia is sensitive to price on average: a 1 % increase in the price of alcohol is associated with a statistically significant 0.96 % reduction in alcohol consumption. Third, other than the lowest 10 % of drinkers, drinkers at all other consumption levels in Australia are price sensitive, although the impact of price at different consumption levels appears mediated by other unobserved factors. These results provide a significant contribution to the understanding of the determinants of alcohol demand in Australia because they are the first to consider the price elasticity of average annual consumption rather than high or low intensity single occasion risky drinking.

The first finding is supportive of earlier Australian studies where the probability of deciding to drink alcohol was negatively associated with price, although previous studies found a statistically significant result [31, 42]. The most likely reason for this difference is that this study used a different source of data to estimate alcohol price. Specifically, this research relied upon market research of sales volume by quantity and value as opposed to the Australian consumer price index of alcohol used in previous research, which only samples the price of specific alcohol products. Both studies, however, suffer from limited variation in the nominated price variable. Whilst it is difficult to assess whether or not this study has an improved specification of alcohol price by using state as opposed to national price indexes, the lack of nationally collected alcohol price and sales data has been previously raised as a barrier to research in this field in Australia [43].

The second finding of a 0.96 % reduction in alcohol consumption in response to a 1 % increase in the price of alcohol is higher than that reported in a meta-analysis of international studies [13], where price elasticities were estimated to be −0.46 for beer, −0.69 for wine and −0.80 for spirits. Although six Australian studies were included within the meta-analysis, the mean estimate was based on 91 estimates sourced internationally (from publications written in English) and across a wide time period. From an aggregation of the Australian studies included in the meta-analysis, the estimated alcohol beverage price elasticities were −0.33, −0.39 and −1.30 for beer, wine and spirits, respectively [44]. The estimated elasticity from this study falls within these estimates.

The third finding from this study is in line with the study conducted in the United Kingdom [16] but fails to replicate the US [15] study that used a similar methodology. The US study showed less price sensitivity for those who consume at higher quantiles. Potential reasons for the difference in estimates include the different populations that were used (Australia compared with United States), variations in country-specific alcohol policies (e.g. minimum age restrictions, trading and supply of alcohol restrictions etc.) and that this study took into account data from three time periods as opposed to a single, cross-sectional time point. In addition, this study finds that the bottom 10 % of consumers by level of average consumption may not be price sensitive. This result may be due to the small proportion of total expenditure that alcohol purchasing represents for these individuals.

Prior to examining the policy implications of these results, a number of limitations should be taken into consideration. First, measures of alcohol consumption obtained from surveys have often been criticised on the grounds of reliability [45]. In many instances, grossing up estimates of consumption from surveys seriously underestimates the total apparent alcohol consumption. Several reasons have been put forward to explain this discrepancy. One of the more serious problems arises when respondents under-report their consumption, particularly if such under reporting varies with the degree of consumption. Heavy drinkers, for example, may under-report their consumption levels, relative to those who drink at lower levels. In addition, people may fail to recall accurately the frequency or quantity of their drinking, especially if the task of quantifying how often and how much per occasion was drunk over a 12-month period is too abstract for respondents to meaningfully answer. Another likely source of under-reporting is that heavy drinkers may be under-represented in the sample: household surveys are limited to private households, excluding the homeless and those in institutions who may typically have high levels of drinking. Similarly, there may be a differential response rate, with heavy drinkers being possibly harder to contact or more likely to refuse interviews. Consequently, any projections from such samples to the whole population need to be considered with care, especially when drawing conclusions about factors that impact on the consumption of the highest quantile of drinkers, whose drinking patterns may not be accurately captured by survey data.

Second, the price variable used in the above analysis relies primarily on national expenditure on alcohol divided by the total quantity of alcohol purchased in Australia. That is, a single price of alcohol as opposed to the full menu of prices faced by individuals at the point of purchase. The prices faced by individuals contain a large degree of variation based on branding or quality, as well as temporary discounting such as in store specials or sales. Moreover, individuals may in the first instance substitute for cheaper alcohol products if available, thereby reducing the impact of taxation on overall consumption levels and potential health benefits. Assessing individuals’ responses to changes in the actual range of prices faced by each of the respondents would more accurately measure the sensitivity of their consumption to price. It is important to note that Australian legislation enforces retail prices at point of purchase to be presented inclusive of all taxes. Where this practice is not legislated (for example some states in the US) the effect of taxation changes may not necessarily be salient, which in turn may distort consumer changes in consumption relative to changes in taxation.

Whilst other analyses using the same data set have examined the substitutability of alcohol and cannabis [42] this was considered outside the scope of this study. However, further consideration of the substitutability between alcohol and other harmful substances may be warranted with respect to the higher levels of price sensitivity amongst those who, on average, drink relatively more.

The results from this study have direct policy implications. First, they provide further evidence that increasing the price of alcohol is most likely to result in reduced average consumption of alcohol across a whole defined population, including those whose average alcohol consumption is relatively high. Second, the peaks and troughs in Fig. 1 suggest complementary policies that aim to reduce access to, or advertising of, alcohol may be required to target those who are not as responsive to changes in price, irrespective of their average level of alcohol consumption. Given those who are not price elastic are spread across all levels of consumption, it seems equitable that such polices are applied to all drinkers.

References

Begg, S., Vos, T., Barker, B., Stevenson, C., Stanley, L., Lopez, A.D.: The burden of disease and injury in Australia 2003. AIHW, Canberra (2007)

Collins, D., Lapsley, H.: The costs of tobacco, alcohol and illicit drug abuse to Australian society in 2004/05. Department of Health and Ageing, Canberra (2008)

Laslett AM, Catalano P, Chikritzhs T, Dale C, Doran C, Ferris J, et al. The range and magnitude of alcohol’s harm to others. Fitzroy: AER Centre for Alcohol Policy Research, Turning Point Alcohol and Drug Centre, Eastern Health 2010

Freebairn, J.: Special taxation of alcoholic beverages to correct market failures. Econ. Pap. 29(2), 200–214 (2010)

Byrnes, J.M., Cobiac, L.J., Doran, C.M., Vos, T., Shakeshaft, A.P.: Cost-effectiveness of volumetric alcohol taxation in Australia. Med. J Australia. 192(8), 439–443 (2010)

Cnossen S, editor. Excise Taxation in Australia. Melbourne Institute–Australia’s future tax and transfer policy conference; 2009 2010; University of Melbourne. Melbourne: Melbourne Institute of Applied Economic and Social Research; 2010

Preventative Health Taskforce: National preventative health strategy—the road map for action. Preventative Health Taskforce, Canberra (2009)

Treasury. Australia’s future tax system: report to the Treasurer. Canberra: Commonwealth of Australia 2009

Cobiac, L., Vos, T., Doran, C., Wallace, A.: Cost-effectiveness of interventions to prevent alcohol-related disease and injury in Australia. Addiction. 104(10), 1646–1655 (2009)

Petrie, D., Doran, C., Shakeshaft, A.: Willingness to pay to reduce alcohol-related harm in Australian rural communities. Expert. Rev. Pharmacoeconomics. Outcomes. Res. 3, 351–363 (2011)

Cook, P.J., Tauchen, G.: The effect of liquor taxes on heavy drinking. Bell. J. Econ. 13(2), 379–390 (1982)

Richardson, J., Crowley, S.: Optimum alcohol taxation: balancing consumption and external costs. Health. Econ. 3(2), 73–87 (1994)

Wagenaar, A.C., Salois, M.J., Komro, K.A.: Effects of beverage alcohol price and tax levels on drinking: a meta-analysis of 1003 estimates from 112 studies. Addiction. 104(2), 179–190 (2009)

Byrnes, J., Shakeshaft, A., Petrie, D., Doran, C.: Can harms associated with high-intensity drinking be reduced by increasing the price of alcohol? Drug. Alcohol. Rev. 32, 27–30 (2013)

Manning, W.G., Blumberg, L., Moulton, L.H.: The demand for alcohol: the differential response to price. J. Health. Econ. 14(2), 123–148 (1995)

Purshouse, R.C., Meier, P.S., Brennan, A., Taylor, K.B., Rafia, R.: Estimated effect of alcohol pricing policies on health and health economic outcomes in England: an epidemiological model. Lancet. 375(9723), 1355–1364 (2010)

Cragg, J.G.: Some statistical models for limited dependent variables with application to the demand for durable goods. Econometrica. 39(5), 829–844 (1971)

Haines, P.S., Guilkey, D.K., Popkin, B.M.: Modeling food consumption decisions as a two-step process. Am. J. Agric. Econ. 70(3), 543–552 (1988)

Reynolds, A.: Analyzing fresh vegetable consumption from household survey data. South. J. Agric. Econ. 22(2), 31–38 (1990)

Wang, Q., Jensen, H.H.: Do consumers respond to health information in food choices? Models and evaluation of egg consumption. In: Mauldin, T.A. (ed.) Consumer interests annual, pp. 57–64. ACCI, Combia (1994)

Burton, M., Dorsett, R., Young, T.: Changing preferences for meat: evidence from UK household data, 1973–93. Eur. Rev. Agric. Econ. 23(3), 357–370 (1996)

Yen, S.T., Huang, C.L.: Household demand for finfish: a generalized double-hurdle model. J. Agric. Resour. Econ. 21(2), 220–234 (1996)

Newman, C., Henchion, M., Matthews, A.: Infrequency of purchase and double-hurdle models of Irish households’ meat expenditure. Eur. Rev. Agric. Econ. 28(4), 393–420 (2001)

Moffatt, P.G.P.: Hurdle models of loan default. J. Oper. Res. Soc. 56(9), 1063–1071 (2005)

Martínez-Espiñeira, R.: A Box-Cox double-hurdle model of wildlife valuation: the citizen’s perspective. Ecol. Econ. 58(1), 192–208 (2006)

Blaylock, J.R., Blisard, W.N.: Women and the demand for alcohol: estimating participation and consumption. J. Consumer. Affairs. 27(2), 319–334 (1993)

Yen, S.T.: Cross-section estimation of U.S. demand for alcoholic beverage. Appl. Econ. 26(4), 381–392 (1994)

Yen, S.T., Jensen, H.H.: Determinants of household expenditures on alcohol. J. Consumer. Aff. 30(1), 48–67 (1996)

Angulo, A.M., Gil, J.M., Gracia, A.: The demand for alcoholic beverages in Spain. Agric. Econ. 26(1), 71–83 (2001)

Godfrey, C.: Factors influencing the consumption of alcohol and tobacco: the use and abuse of economic models. Br. J. Addict. 84(10), 1123–1138 (1989)

Zhao, X., Harris, M.N.: Demand for marijuana, alcohol and tobacco: participation, levels of consumption and cross-equation correlations. Econ. Record. 80(251), 394–410 (2004)

Blundell, R., Meghir, C.: Bivariate alternatives to the Tobit model. Journal of Econometrics. 34(1/2), 179–200 (1987)

Pudney, S.: Modeling individual choice, the econometrics of corners, kinks and holes. Blackwell, New York (1989)

Labeaga, J.M.: A double-hurdle rational addiction model with heterogeneity: estimating the demand for tobacco. J. Econometrics. 93(1), 49–72 (1999)

Jones, A.M.: A double-hurdle model of cigarette consumption. J. Appl. Econom. 4(1), 23–39 (1989)

Aristei, D., Peieroni, L.: A double-hurdle approach to modelling tobacco consumption in Italy. Appl. Econ. 40, 2463–2476 (2008)

Koenker, R., Bassett Jr, G.: Regression quantiles. Econometrica. 46(1), 33–50 (1978)

Bassett Jr, G., Koenker, R.: An empirical quantile function for linear models with iid errors. J. American. Stat. Assoc. 77(378), 407 (1982)

Fawcett, J., Shakeshaft, A., Harris, M., Wodak, A., Mattick, R.P., Richmon, R.: Using AUDIT to classify patients into Australian alcohol guideline categories. Med. J. Australia. 180, 598 (2004)

Euromonitor International. Alcoholic drinks in Australia. Euromonitor international; 2008 [April 2008]; Available from: http://www.euromonitor.com/Alcoholic_Drinks_in_Australia

Australian bureau of statistics. Consumer price index, Australia. [cited June 2010]; Available from: http://www.abs.gov.au/ausstats/abs@.nsf/mf/6401.0

Cameron, L., Williams, J.: Cannabis, alcohol and cigarettes: substitutes or complements? Econ. Rec. 77(236), 19 (2001)

Hall, W.D., Chikritzhs, T., d’Abbs, P.H.N., Room, R.: Alcohol sales data are essential for good public policies towards alcohol. Med. J. Australia. 189(4), 188–189 (2008)

Selvanathan, E.A., Selvanathan, S.: Economic and demographic factors in Australian alcohol demand. Appl. Econ. 36(21), 2405–2417 (2004)

Frankfort-Nachmias, C., Nachmias, D.: Research methods in the social sciences. Worth Publishers, New York (2008)

Conflict of interest

None.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Byrnes, J., Shakeshaft, A., Petrie, D. et al. Is response to price equal for those with higher alcohol consumption?. Eur J Health Econ 17, 23–29 (2016). https://doi.org/10.1007/s10198-014-0651-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10198-014-0651-z