Abstract

Green technology innovation is imperative to sustainable and environmentally sound economic development and is currently facing increasingly serious environmental threats. However, existing research has overlooked the uncertainties in economic policies. Based on the logical relationship between environmental regulation, economic policy uncertainty, and green technology innovation, this study empirically analyzed the quantitative relationship among these three variables using the fixed-effect panel method and provincial panel data from 2000 to 2017 for 30 administrative regions of China. The results show that environmental regulation is positively correlated with green innovation, whereas economic policy uncertainty has a negative influence on green innovation, thereby regulating the relationship between the remaining two factors. Moreover, considerable regional heterogeneity exists in these causal influences, i.e., environmental regulation promotes green innovation in the eastern and middle regions but not significantly in the west. The uncertainty actively moderates the impact of environmental regulation on green innovation in all regions with an adjustment coefficient of approximately 0.8; however, it inhibits green innovation in different degrees, especially in the eastern and middle regions. Based on empirical results, we conclude that strict and appropriate environmental regulations are necessary and effective in China to encourage green technology innovation, especially in regions with uncertain economic policies.

Graphic abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Environmental problems have become increasingly prominent with the sustained and rapid development of the global economy, especially in China, where the economy is undergoing rapid development. Over the years, China’s extensive economic development model has caused serious problems, including severe environmental pollution, high energy consumption, and depletion of resources. However, from an economic perspective, technological innovation leads to a fundamental reconfiguration of technological production as the driving force behind the growth in a green economy (Eaton 2013). Therefore, green technology innovation (GTI) that improves operational performance while reducing the negative effects on the environment is considered the key to resolving the economy–environment crisis.

Studies have shown that environmental regulations (ERs), i.e., the policies adopted by the government to protect the environment, could benefit both society and regulated firms. For instance, the Porter hypothesis states that strict ERs do not inevitably hinder competitive advantage (Porter and Der Linde 1995). However, since its formulation, the Porter hypothesis has gained wide coverage along with the presentation of both skepticism and conflicting evidence (Ambec et al. 2013).

Although a theoretical and empirical link has been established between ER and technological innovation, relatively little is known about the impact of economic policy uncertainty (EPU) on these two factors. The conventional view is that EPU inhibits macroeconomic performance by decreasing capital investment or resource configuration (Gulen and Ion 2015). However, others suggest that economic policy instability promotes firm-level research and development (R&D) that contributes to the improvements in innovation.

To address these theoretical and practical issues, this study investigates the relationships between ER, EPU, and GTI to answer three main questions:

-

Q1

What is the relationship between ER and GTI under EPU?

-

Q2

What role does EPU play in ER and GTI?

-

Q3

Is the relationship between ER and GTI in different regions different under EPU?

The main contributions of this study to the existing literature are summarized as follows: First, although there have been a considerable number of studies on the effects of ER and EPU on GTI, most have focused on just one of these two important factors of innovation, wherein a few have examined the impacts of both ER and EPU on GTI. Here, we report the relationship between the three variables using a panel regression model with data from the world’s largest developing economy. Second, this study sheds insights into the cross-influence of ER and EPU on GTI, which has rarely been studied before. Overall, these findings extend the empirical views for exploring the moderating role of economic uncertainty and deriving an important variable with the potential to affect the action mechanism of the ER policy on technological innovation.

Literature review and hypotheses

Environmental regulation and green technology innovation

Innovation is undoubtedly a response of enterprises to ER (Pickman 1998). However, there is still controversy in the academic community regarding whether it is a positive response to a promotion or a negative response to inhibition. In neoclassical economics, stringent ER not only harms productivity and competitiveness by offsetting productivity gains (Hille and Möbius 2019) but also increases the uncertainty of further investment of enterprises (Jaffe et al. 2005). In contrast, the Porter hypothesis advocates that strict but flexible regulations create win–win situations by encouraging companies to abandon polluting technologies or develop clean technologies (Porter and Der Linde 1995), which create innovation offsets to compensate for those extra costs (Perman et al. 2011).

Research on the relationship between ER and GTI has only emerged during the last decade. Most existing literature empirically suggests that ER stimulates advanced technologies such as clean production and green manufacturing (Shao et al. 2020). Such studies have used data from European industries (Rubashkina et al. 2015) to show that appropriate, strict, or incentivized ER provides a positive impetus for technological progress that boosts innovation in renewable energy technologies (Hille et al. 2020). However, the incentive function of regulation cannot be assumed. For example, strengthening climate change policy may increase alternative energy efficiency; however, it will result in an overall diminished output; consequently, this could reduce motivation to stimulate green innovation (Park and Funk 2020). In addition, different types of environmental policies lead to different empirical results. For example, Aghion et al. (2016) demonstrated that increased fuel prices stimulate more innovation in clean technologies, whereas the effect of the emission regulation is not statistically significant.

Similarly, using Chinese data, studies on the relationship between these two factors are complex. It is widely recognized that reasonable ER is conducive to promoting innovation in pollution control technology owing to the innovation compensation and pollution control technology effects (Wang et al. 2020). However, there is a U-shaped relationship between the two factors in both industrial sectors (Ouyang et al. 2020) and the Yangtze River Delta region (Cao et al. 2020), namely, short-term inhibition caused by the offset effect and long-term promotion induced by the compensation effect. There is another view that ER has a limited impact on green innovation, and hence it is difficult to induce technological innovation (Hu and Liu 2019). Hu et al. (2020) affirmed that carbon emission trading systems can only play a positive role in stimulating quantity and quality of innovation, which is unique to state-owned and large enterprises. However, it plays a weak role in other innovation activities or types of enterprises. For the building sector, renewable energy technologies increase the cost significantly, thereby limiting the incentive for green innovation (Huang et al. 2012).

To summarize, we drew on the alternative perspectives in the previous literature to develop two hypotheses:

-

(1)

Hypothesis 1 ER harms GTI, which conforms to the suppression hypothesis.

-

(2)

Hypothesis 2 ER stimulates GTI, which accords with Porter’s hypothesis.

Economic policy uncertainty and green technology innovation

The existing literature focuses on the impact of EPU on commodity markets, banking, and stock markets. Specifically, several studies have suggested that policy uncertainty restrains bank credit growth and liquidity creation (Berger et al. 2018). Moreover, economic uncertainty increases the volatility of commodities, meaning that potential uncertainty permanently affects the volatility of commodities, whereas the impact of observable uncertainty is short-lived or even insignificant (Bakas and Triantafyllou 2018). Furthermore, EPU is also detrimental to financial stability (Phan et al. 2020) and global trade volumes (Kirchner 2019).

Although many studies have verified the impact of EPU on the macroeconomy, there is limited research on the relationship between EPU and innovation. Marcus (1981) proposed that as with no unified standard to assess performance, it is difficult to conclude whether policy uncertainty is rationalized for non-innovation or there is a causal relationship with technological revolution. Subsequent studies further explored these issues, but reported different views and opinions. Many economists have shown that increased uncertainty causes firms to reduce investment, bond issuance, and spending (Al-Thaqeb et al. 2020) so that innovation stalls in the form of R&D spending and new product development (Shankar 2020). Moreover, studies have also speculated that policy uncertainty will detrimentally affect economic innovation power through innovation quantity, quality, and risk by verifying the theoretical models of 43 countries (Bhattacharya et al. 2017).

Owing to differences in systems and policies, it is worth exploring whether the relationship between EPU and innovation in China is consistent with that in other countries. Most scholars firmly believe that changes in local government official policies reduce R&D activities, thereby negatively impacting investment in innovation activities (Feng and Johansson 2017). Such decisions also affect future innovation activities (Saleem et al. 2018), especially for companies with financial constraints and those dependent on external financing (Xu 2020); the conclusions of these studies for the negative effects are contradictory. Through research on the initial public offering (IPO) suspension in China, it was determined that the company’s innovation activities were reduced during the suspension period, which was speculated to continue for several years (Cong and Howell 2020). Moreover, He et al. (2020) used monthly data to show that lower EPU can induce innovation, whereas higher EPU hinders innovation. The influence of EPU on innovation is also significantly different for different types of enterprises. For instance, Wang et al. (2017) found that this significant passive effect exists only in politically related enterprises, but companies in highly competitive industries promote innovation when facing uncertainty (Shen et al. 2020).

In conclusion, EPU has different mechanisms of influence on GTI. We drew on the alternative perspectives in the previous literature to develop two hypotheses:

-

(3)

Hypothesis 3 Increasing EPU inhibits the GTI, namely, the inhibition effect.

-

(4)

Hypothesis 4 Increasing EPU promotes the GTI, namely, the incentive effect.

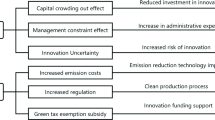

Environmental regulation, economic policy uncertainty, and green technology innovation

The existing literature on the interaction mechanism between ER, EPU, and GTI has not been discussed theoretically or empirically. Hypothesis 1 and Hypothesis 2 assume that the subjects of ER can accurately predict the future trend of regulation strength. We argue that EPU affects the implementation path and mechanism of ER on GTI.

At different stages of EPU, regulated enterprises make different strategic choices (Wu and You 2018). Specifically, when EPU is high, it is difficult for enterprises to predict the future behavior of the government; thus, they adopt conservative and prudent strategies, which are not conducive to innovation activities. On the contrary, when EPU is low, enterprises can more easily predict the behavior of policymakers, which satisfies the premise of Hypothesis 1 and Hypothesis 2. Given EPU-induced volatility, we propose Hypothesis 5 as follows:

-

(5)

Hypothesis 5 EPU has a negative moderating effect on the relationship between ER and GTI.

Furthermore, changes in economic policies not only bring uncertainties to enterprises but also generate unexpected opportunities. Changes in external policies are simply the replacement of political and economic rules, which may bring new vitality and ideas. During this period, the companies that actively respond to ER can take the lead in seizing opportunities and creating new development space, which forces those to seek green technology through increasing investment in GTI activities. On this basis, Hypothesis 6 is proposed:

-

(6)

Hypothesis 6 EPU has a positive moderating effect on the relationship between ER and GTI.

As for the arguments presented in previous studies, our main research proposals are shown in Fig. 1.

Methodology and data

Methodology

Innovations aim to establish new production functions, namely, the recombination of production factors (Schumpeter 1934). Since it is a combination of new production factors, innovation is an economic output according to the endogenous growth theory. In addition, GTI is an innovation activity aimed at protecting the environment by following ecological principles. As such, we start with the most basic production function, construct the production function of green innovation, and establish several estimation models.

According to the results of the literature analysis, ER, as the topic of this study, is an important factor affecting the output of GTI. Moreover, capital and labor inputs are indispensable in the innovation process. In general, the higher the economic level of a region in China, the more attractive it is to talents and enterprises, and the more beneficial it is to GTI. In addition, the secondary industry is a major source of pollution in China and an important area affecting GTI. Furthermore, through the spillover of open trade knowledge and novel technologies, enterprises may get access to advanced green methodologies in the international market; however, this may hinder domestic green technologies. Hence, we selected economic development level, industrial structure, and trade openness as additional input factors.

Therefore, the complete production function of GTI is as follows:

where RD, HUC, PGDP, INDUS, and TRA represent capital input, labor input, economic development, industrial structure, and trade openness, respectively.

The Cobb–Douglas production function (C–D function) is considered a useful production function, which has been recognized in both economic theory and empirical analysis. Since this function analyzes the input and output of production factors in a simple mathematical form, the C–D function is easy to understand and has positive practical and research significance. With reference to the C–D function, the output function of GTI can be expressed as:

Equation (2) is a nonlinear model that is difficult to measure empirically and may exhibit heteroscedasticity. Hence, we take the logarithm of Eq. (2) to produce a linear equation and reduce possible heteroscedasticity. We used the following basic regression model to verify Hypothesis 1 and Hypothesis 2:

This model is based on the stability of economic policy. However, according to the previous analysis, turbulence in the external environment leads to an unpredictable future economy, which may affect GTI. Hence, to verify Hypotheses 3 and 4, we constructed a linear estimation model concerning EPU and GTI:

When the volatility of economic policy is extreme, it is difficult for enterprises to reasonably predict the future behavior of environmental policymakers. Thus, it is possible to change the original business strategy and then influence innovation investment. Based on Eqs. (3) and (4), Eq. (5) was constructed. Moreover, a cross term (\(\ln {\text{ER}} \times \ln {\text{EPU}}\)) to analyze regulatory effects was added to verify Hypotheses 5 and 6. The new models are expressed as follows:

In Eqs. (3) to (6), i and t represent region and year, respectively; α, β, γ, and θ are coefficients to be estimated; and \(\varepsilon_{it}\) is an error term. Equations (3) to (6) correspond to Models 1–4 in the subsequent regression analysis.

Data

Data from 30 provinces and cities in China from 2000 to 2017 were selected as research samples, among which 30 provinces and cities refer to those in mainland China after removing Tibet (partial data missing). The original data are mainly from the China Statistical Yearbook, National Bureau of Statistics of China, and the Economy Prediction System (EPS) database.

Green technology innovation

Measuring GTI is challenging owing to its abstractness. Most of the existing literature adopted the number of patented grants (Jia and Zhang 2014) or applications (Sun et al. 2018) to measure GTI because patents are essential aspects reflecting innovation capabilities. However, some inventions and improvements are not patented. Patent authorizations have a certain lag period. In contrast, patent applications better reflect enterprises’ GTI levels on time (He et al. 2020). Therefore, we followed the method of Sun et al. (2018) and organized the number of patent applications published by the State Intellectual Property Office of China, according to the Green List of International Patent Classification, for measuring GTI.

Environmental regulation

According to the current literature, ER is generally measured from one of five perspectives: (1) corporate pollution reduction costs (Berman and Bui 2001); (2) pollutant emissions or reduction (Domazlicky and Weber 2004); (3) operating costs of pollution treatment equipment or pollution taxes (Farzin and Kort 2000); (4) energy consumption (Ben Kheder and Zugravu 2008); and (5) number of ERs (Brunnermeier and Cohen 2003). Each approach has advantages and limitations. We selected the method by Ben Kheder and Zugravu (2008) to measure ER from the perspective of energy efficiency as this can clearly identify separate areas in which environmental measures have been implemented.

Economic policy uncertainty

EPU can be measured using: (1) economic indicators as proxy variables (Jurado et al. 2015); (2) changes in local officials (Julio and Yook 2012); and (3) the index of EPU based on news reports. The EPU index of Baker et al. (2016) is based on English-language newspapers; Huang and Luk (2020) followed the same approach with ten mainland Chinese newspapers. Considering the national conditions in China, we selected the Huang and Luk (2020) EPU index and converted it into an annual variable using the arithmetic mean method to measure EPU.

Control variables

Combining our above analysis and previous studies, our main control variables were economic development level (PGDP), industrial structure (INDUS), R&D investment intensity (RD), trade openness (TRA), and human capital (HUC) (Table 1).

Results and discussion

Descriptive statistics

Descriptive statistics for all variables from 2000 to 2017 are shown in Table 2. On average, the regions are characterized by wide gaps in GTI and ER and erratic fluctuations in economic policy.

To prevent false regression results, LLC and IPS tests were used to investigate whether the variables are stationary before empirical analysis (Table 3). The test results show that the variables rejected the null hypothesis, indicating that the variables are stationary at different significant levels. Moreover, the Pedroni test results show that the P-values of the three test statistics were all 0.0000, so the null hypothesis of "no co-integration relationship" was strongly rejected, suggesting there was a co-integration relationship between all the explained and explanatory variables.

Regression analysis

National level regression

Panel data included mixed, random, and fixed-effect models. Before conducting a specific regression analysis, we used the F and Hausman tests to choose between these models to test the rationality of the settings in the one selected. The P-values of all models were less than 0.01, rejecting the null hypothesis, indicating that a fixed-effect model is needed.

According to Models 1–4, logarithmic processing is first performed on the variables, and then regression estimation is performed on the four models in turn (Table 4). For Model 1, ER shows a significant positive impact on GTI, supporting Hypothesis 2 but not Hypothesis 1. This result shows that the stricter the ER, the more it can stimulate the vitality of GTI. Strict standards for energy saving and emission reduction send a signal to enterprises on environmental protection. Enterprises are forced to take the initiative in governance so that the innovation compensation effect is greater than the additional cost. Ultimately, enterprises can resolve the economy–environment dilemma, which is consistent with Porter's hypothesis.

For Model 2, the regression coefficient of EPU is negative at a 5% level, indicating a significant inhibitory effect on GTI, which validates Hypothesis 3 instead of Hypothesis 4. An unstable external economic environment increases the risk of large capital injection, delaying innovation investment. Moreover, it also increases the difficulty of external financing for enterprises, leading to a decline in research investment, and thereby reducing the level of GTI.

For Model 3, there is only a slight change in the symbols and significance of major variables; ER still has a positive effect, whereas EPU has a negative effect. However, for Model 4, the coefficient sign of ER changed from positive to negative since Model 4 adds the cross term, which changes the meaning of individual variables’ coefficient change. The marginal impact of ER on GTI is no longer constant and changes with the value of EPU. To make the coefficients of \(\ln {\text{ER}}\) in Model 3 and Model 4 comparable, we adopted the following model settings from Balli (2013):

where \(\overline{{\ln {\text{ER}}}}\) is the sample mean of \(\ln {\text{ER}}\). In addition, there is no need for centralization because EPU is time-series data. The regression estimation results from Eq. (7), representing Model 5, are shown in Table 4.

According to the results of Model 5, ER still exerts a positive influence on GTI even in the presence of EPU; this answers Q1. Model 1 and Model 5 indicate that the positive effect does not change significantly, but only the coefficient decreases due to uncertainty. Uncertainty in policies causes companies to observe the market direction. Nevertheless, these changes in decision-making do not affect the continued promotion of green innovation by enterprises, which may be due to their awareness of the importance of environmental governance or the public's increased demand for environmental quality.

The cross term in Model 5 is significantly positive at the 5% level, supporting Hypothesis 6 rather than Hypothesis 5 and answering Q2. These results confirm that EPU plays a positive role in regulating the environmental impact of GTI. The alterations, though, conceal crises; it encourages vitality. This indicates that a strict environmental system urges enterprises to take advantage of opportunities in external policy changes and to lead in developing green technologies. Thus, even in difficult times, enterprises can optimize their benefits.

For the control variables, the levels of economic development, R&D investment, and human capital all have active impacts on GTI at the 1% level. These results indicate that an improvement in economic level, increase in R&D investment, and increase in the level of human capital are conducive to GTI because it is a time-consuming, costly, and labor-intensive activity that requires significant human, material, and financial resources. However, the impacts of industrial structure and trade openness are significantly passive. Secondary industries that are leading parts of the national economy consume a high amount of energy and produce considerable pollution. Although Chinese import and export trades are complementary, they remain at the lower end of the global value chain. Hence, the increase in imports and exports has not achieved the “learning” and “competitive” effects that encourage enterprises to take the initiative in terms of GTI.

These findings not only develop the existing literature but also provide a new approach for further discussion of innovations in green technology. However, our sample space is limited, and we overlook an important factor—the level of democracy. Democracy may impact the effectiveness of environmental measures or increase economic uncertainty due to China's peculiarities. Future work should therefore include additional important factors that are derived from multiple levels using different methods.

Provincial level regression

To investigate regional heterogeneity in the impact of ER on GTI and answer Q3, 30 provinces and cities in China were divided into three regions: eastern, central, and western; the regression results are shown in Table 5.

We observed significant differences in the effect of ER on GTI in different regions. The results for eastern and central regions are significantly positive, especially in the central region. In contrast, results for the western region are not significant. ER intensity has a great incentive effect on the innovation of green technology, but not in the economically less developed western regions. Therefore, Hypothesis 2 is verified only in the eastern and central regions.

These results likely reflect rapid economic growth in the central region and the developed economy in the eastern region, which benefits from a constant influx of talented people and a strong capital demand market, providing human, financial, and material guarantees for GTI. Moreover, the central and eastern regions comprise a high number of enterprises, especially industrial enterprises that are primarily responsible for the production of pollutants in China. A series of environmental measures, including the stoppage of companies that exceed pollution limits and imposing environmental protection taxes, have forced companies to abandon polluting techniques in favor of new clean technologies.

Although China has implemented development policies in western areas, the economic and social development remains constrained, resulting in the relatively weak innovation ability of enterprises. Additionally, the number and scale of enterprises are relatively small in the sparsely populated western region; therefore, the environmental pollution problem seems less serious, and there is no urgent need for enterprises to improve their equipment and technology. Currently, the effect of environmental policies on innovation in western China is less obvious than that in the eastern and central regions.

For EPU, the central and western regions are significantly negative at different confidence levels. For the eastern region, we observed a significant positive correlation before the addition of the cross term but a significantly negative correlation after the addition of the cross term. A developed and open economy can have high-quality space for innovative development, allowing it to take the lead in finding development opportunities and innovation points with changing economic policies. In addition, the environmental and innovation awareness of people in the eastern region is relatively superior to other regions. With the combination of these factors, economic uncertainty may promote GTI. Therefore, Hypothesis 3 is validated for central and western regions, but Hypothesis 4 is certified in eastern regions.

For crossover terms, the three regions are all positive at the 1% confidence level, indicating that EPU in all regions positively regulates the relationship between ER and GTI. Regional enterprises can infer overall environmental policies by knowing the overall macroeconomic uncertainty, allowing them to make reasonable environmental decisions. Additionally, when faced with the opportunities and challenges brought by external policy changes, the pressure of ER can encourage enterprises to develop clean technologies. These are conducive to the development and breakthrough of GTI activities; therefore, Hypothesis 6 is suitable for all three regions.

For the control variables, the regression results in the three regions are similar to those at the national level (Table 3). Trade openness in the central region has a significant positive impact on GTI, while other regions show a significant negative effect. This result may be because the central region benefits from technological spillovers from the import and export trade. However, as the most innovative region in China, the eastern region has a relatively small technological gap with developed countries; the western region shows the opposite trend. Moreover, the negative effects of human capital and the positive effects of R&D investment on GTI are non-significant in western China but are significant in other regions. This is because research requires time, human capital, and optimal geographical conditions to transform into innovation, whereas public awareness of environmental protection in western China is weak, and the improvements in ecological technology are ignored.

Although these findings confirm the need for policies to be adapted to local conditions, we divide traditional China into three regions, ignoring their own economic, social, and cultural differences. For example, Chongqing, Sichuan, and Shanxi provinces are geographically and economically superior to the remaining western regions. A more scientific means of the subdivision is necessary for future studies.

Regression analysis from a GTI perspective

To further investigate the underlying causes of each phenomenon, we selected the perspective of GTI from which we observed the relationships among ER, EPU, and GTI (Table 6). From high to low average GTI, the 30 administrative areas were divided into high (top 10 provinces), medium (11th to 20th provinces), and low (bottom 10 provinces) GTI zones.

The impacts of ER and EPU are only significant in the medium GTI zone at the 1% and 10% confidence levels, respectively, but not significant in other GTI areas. In areas of high and low GTI, ER may be too high or too low. This hinders enterprises from making immediate predictions and judgments, which does not significantly accelerate the innovation process. By contrast, in medium GTI areas, small ER adjustments allow enterprises to predict the future direction of environmental policies and make accurate decisions on the development of green technologies. For a similar reason, the technological innovation systems of enterprises in high and low GTI areas have tended to be perfect or deficient so that their innovation does not significantly reduce in the face of policy changes. Enterprises in medium-level GTI areas are more flexible and greatly influenced by economic policies. The positive adjustment effect of EPU on ER and GTI is reflected at the 5% level regardless of the GTI area. Therefore, only moderate GTI regions accept Hypothesis 2, Hypothesis 3, and Hypothesis 6 simultaneously; the remaining regions only accept Hypothesis 6.

Regression analysis from an ER perspective

ER actively induces GTI, especially in eastern and central regions. To test how this impact varies with average ER intensity, the 30 provincial administrative regions were divided into the following categories: high (top 10 provinces), medium (11–20th provinces), and low (bottom 10 provinces) ER regions. We used the same model to explore the relationships among ER, EPU, and GTI (Table 7).

The positive impact of ER on GTI is only evident at the 5% confidence level in high and medium ER areas but not in low ER areas. This shows that strict and appropriate ER is more likely to stimulate innovation. In regions with low ER intensity, companies are not constrained by the system and are more likely to take risks. As a result, companies in this region cannot actively abandon pollution technologies. For EPU, regions with high and low ER revealed non-significant negative correlations, while only those with moderate ER showed correlation at the 10% level. These results are similar to those in Table 5; hence, we hypothesize that the possible causes are also consistent. In areas with moderate ER, companies are more sensitive to the adverse effects of policy changes; therefore, they choose to act cautiously. However, companies in other regions respond slowly and continue to develop according to their plan before the change, which has little effect. The positive adjustment effect of EPU is still evident at the 1% confidence level for all levels of ER. Therefore, Hypothesis 6 is validated for all areas of ER intensity. Hypothesis 2 is verified in both high and medium ER areas. Hypothesis 3 is only validated in medium ER areas.

Robustness test

To ensure the accuracy of the results, the following four methods were applied in this study (Table 8); (1) Exclusion of cities: Considering the administrative particularity of Chinese municipalities, the data for Beijing, Tianjin, Shanghai, and Chongqing were excluded. (2) Replacement of variables: Based on the above analysis, sewage charge (lnPDF) was used as an alternative indicator of ER. (3) Two-stage least squares method (2SLS): The mutual influence between ER and GTI where the Hausman test showed endogeneity issues, illustrated by instrumental variables was considered. Therefore, based on the methods proposed by Hering and Poncet (2014) and Wang and Liu (2014), the airflow coefficient and standard coal were adopted as the instrumental variables of ER through a 2SLS method. (4) System GMM (SYS-GMM): Considering that GTI may be related to its lag value, the regression equations used SYS-GMM to determine the presence of autocorrelation (Blundell and Bond 1998).

For the results of 2SLS in Table 6, the corresponding P-values from the Sargan test were > 0.05 and the null hypothesis was not rejected, indicating that the instrumental variables are valid. In the SYS-GMM results, AR (1) and AR (2) indicated that a first-order autocorrelation existed between the residual terms; however, no second-order correlation occurred. Since the Hansen test is more suitable for evaluating the robust standard error than the Sargan test, we used the former. The P-value of the Hansen test was > 0.05 and accepted the null hypothesis, indicating that the instrumental variable is reasonable. From the overall results in Table 6, the significance of some core variables, particularly the significance levels of the interaction terms, were 0.001 in the exclusion of cities, substitution variables, and 2SLS methods, whereas it was 0.05 in SYS-GMM. These results are consistent with the previous regression results (Table 4). Furthermore, although the signs of a few control variables changed, they were not significant, and the significance values were small. Therefore, we conclude that our regression results are robust and effective, which further verifies the impact of ER and EPU and their interactions on GTI.

Conclusions

We empirically scrutinized the causal relationship between ER, EPU, and GTI based on panel data from 30 provincial administrative regions in China for 2000–2017 at multiple levels to develop sound environmental policies. Furthermore, the robustness of the regression results was verified following more stringent methods—municipalities were deleted, variables were changed, and methods were altered (2SLS and SYS-GMM).

We found that, in general, the impact of ER on GTI accords with Porter's hypothesis from a national perspective in both static and dynamic panel data models, which suggests that a reasonable and strict environmental system is conducive to the generation and development of innovation activities (Porter and Der Linde 1995). In contrast, the increasing EPU prevents enterprises from developing or applying green technologies, thus, inhibiting innovation. Unexpectedly, when EPU is higher, the impact of ER on GTI is more positive and proactive. For instance, with a 1% increase in EPU, the positive effect of ER on GTI increases by 0.8%. More specifically, though certain differences were noted, the results of eastern, central, and western regions are generally consistent with the national results. For example, ER and R&D investment in the western region have a far less positive influence on GTI than in central and eastern regions. Moreover, EPU does not prevent eastern enterprises from carrying out innovative activities and even contributes to stimulating innovation to a certain extent, supporting the finding of Shen et al. (2020), who showed that firms under competitive incentives perform better in the face of uncertainty. Of note, ER encourages innovation only in medium GTI areas and high or medium ER areas. In contrast, EPU inhibits innovation activities in medium GTI areas or medium ER areas. ER or EPU in other regions does not significantly stimulate or inhibit innovation. Most importantly, the coupling of ER and EPU actively promotes innovation under all conditions and is validated by different robust approaches with significant results.

In summary, strict and appropriate ERs are necessary, and except for western China, they can promote local GTI due to the innovation compensation effect (Perman et al. 2011). It is generally believed that EPU induces challenges to innovation activities (Feng and Johansson 2017), which is verified by our empirical results, except for the eastern region. Our findings also suggest that when economic policies fluctuate, the conservative and prudent environmental policies do not allow companies to evade risks and survive crises; therefore, governments should strengthen the enforcement of environmental laws and environmental monitoring capabilities (Chen et al. 2021). In addition to these practical and theoretical implications, our results suggest that more innovation opportunities can be obtained by increasing R&D investment and human capital. It is also possible to adjust the industrial structure from industry-led to be more diversified or enhance learning effects and technological spillovers from trade to jointly translate into green technology. Notably, ER-influenced innovation is limited by the technical and institutional backgrounds of the different regions (Hu and Liu 2019). Therefore, differentiated policy tools and diversified combination methods should be tailored to local conditions to achieve a multiplier effect.

Although these findings are valuable and robust, our work leaves room for improvement and expansion. With the gradual improvement of data, we can conduct further analyses at the urban agglomeration, industry, and enterprise levels, especially for dynamic issues.

Data availability

The data are available from the China National Statistical Yearbook and Economy Prediction System database.

Code availability

The regression analyses in this study used STATA software and its common regression codes.

References

Aghion P, Dechezlepretre A, Hemous D, Martin R, Van Reenen J (2016) Carbon taxes, path dependency and directed technical change: evidence from the auto industry. J Pol Econ 124:1–51

Al-Thaqeb SA, Algharabali BG, Alabdulghafour KT (2020) The pandemic and economic policy uncertainty. Int J Finance Econ. https://doi.org/10.1002/ijfe.2298

Ambec S, Cohen MA, Elgie S, Lanoie P (2013) The porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness? Rev Environ Econ Pol 7:2–22

Balli HO, Sørensen BE (2013) Interaction effects in econometrics. Empirical Econ 45:583–603. https://doi.org/10.1007/s00181-012-0604-2

Bakas D, Triantafyllou A (2018) The impact of uncertainty shocks on the volatility of commodity prices. J Int Money Finance 87:96–111. https://doi.org/10.1016/j.jimonfin.2018.06.001

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Quart J Econ 131:1593–1636. https://doi.org/10.1093/qje/qjw024

Ben Kheder S, Zugravu N (2008) The pollution haven hypothesis: a geographic economy model in a comparative study. FEEM Working Paper No. 73.2008. https://doi.org/10.2139/ssrn.1266705

Berger AN, Guedhami O, Kim HH, Li X (2018) Economic policy uncertainty and bank liquidity hoarding. Available at SSRN. https://doi.org/10.2139/ssrn.3030489

Berman E, Bui LTM (2001) Environmental regulation and productivity: evidence from oil refineries. Rev Econ Stat 83:498–510

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Bhattacharya U, Hsu PH, Tian X, Xu Y (2017) What affects innovation more: policy or policy uncertainty? J Financ Quant Anal. https://doi.org/10.1017/S0022109017000540

Brunnermeier SB, Cohen MA (2003) Determinants of environmental innovation in US manufacturing industries. J Environ Econ Manage 45:278–293. https://doi.org/10.1016/S0095-0696(02)00058-X

Cao Y, Wan N, Zhang H, Zhang X, Zhou Q (2020) Linking environmental regulation and economic growth through technological innovation and resource consumption: analysis of spatial interaction patterns of urban agglomerations. Ecolog Indicat 112:106062. https://doi.org/10.1016/j.ecolind.2019.106062

Chen L, Huang J, Cao F, Zhou Z (2021) Executive shareholding, economic policy uncertainty and corporate green investment. Finance Econ 42:58–64 (In Chinese)

Cong LW, Howell ST (2020) Policy uncertainty and innovation: evidence from IPO interventions in China. Chicago Booth Research Paper No. 146

Domazlicky BR, Weber WL (2004) Does environmental protection lead to slower productivity growth in the chemical industry? Environ Resour Econ 28:301–324. https://doi.org/10.1023/B:EARE.0000031056.93333.3a

Eaton D (2013) Technology and innovation for a green economy. Rev Europ Comp Int Environ Law 22:62–67. https://doi.org/10.1111/reel.12020

Farzin YH, Kort PM (2000) Pollution abatement investment when environmental regulation is uncertain. J Pub Econ Theor 2:183–212. https://doi.org/10.2139/ssrn.146592

Feng X, Johansson AC (2017) Political uncertainty and innovation in China. Stockholm school of economics Asia working paper series 2017-44, Stockholm school of economics, Stockholm China economic research institute

Gulen H, Ion M (2015) Policy uncertainty and corporate investment. Rev Finance Stud 29:523–564. https://doi.org/10.1093/rfs/hhv050

He F, Ma Y, Zhang X (2020) How does economic policy uncertainty affect corporate innovation?: evidence from China listed companies. Int Rev Econ Finance 67:225–239. https://doi.org/10.1016/j.iref.2020.01.006

Hering L, Poncet S (2014) Environmental policy and exports: evidence from Chinese cities. J Environ Econ Manage 68:296–318. https://doi.org/10.1016/j.jeem.2014.06.005

Hille E, Mobius P (2019) Environmental policy, innovation, and productivity growth: controlling the effects of regulation and endogeneity. Environ Resour Econ 73:1315–1355. https://doi.org/10.1007/s10640-018-0300-6

Hille E, Althammer W, Diederich H (2020) Environmental regulation and innovation in renewable energy technologies: does the policy instrument matter? Technol Forecast Soc Change 153:119921. https://doi.org/10.1016/j.techfore.2020.119921

Hu J, Pan X, Huang Q (2020) Quantity or quality? The impacts of environmental regulation on firms’ innovation-quasi-natural experiment based on China’s carbon emissions trading pilot. Technol Forecast Soc Change 158:120122. https://doi.org/10.1016/j.techfore.2020.120122

Hu S, Liu S (2019) Do the coupling effects of environmental regulation and R&D subsidies work in the development of green innovation? Empirical evidence from China. Clean Technol Environ Pol 21:1739–1749. https://doi.org/10.1007/s10098-019-01745-6

Huang B, Yang H, Mauerhofer V, Guo R (2012) Sustainability assessment of low carbon technologies–case study of the building sector in China. J Cleaner Prod 32:244–250. https://doi.org/10.1016/j.jclepro.2012.03.031

Huang Y, Luk P (2020) Measuring economic policy uncertainty in China. China Econ Rev 59:101367. https://doi.org/10.1016/j.chieco.2019.101367

Jaffe AB, Newell RG, Stavins RN (2005) A tale of two market failures: technology and environmental policy. Ecol Econ 54:164–174

Jia J, Zhang W (2014) The path dependency of green technology innovation and environmental regulation analysis. Sci Manage S&t 35(5):44–52 (In Chinese)

Julio B, Yook Y (2012) Political uncertainty and corporate investment cycles. J Finance 67:45–83. https://doi.org/10.1111/j.1540-6261.2011.01707.x

Jurado K, Ludvigson CS, Ng S (2015) Measuring uncertainty. Am Econ Rev Am Econ Assoc 105:1177–1216. https://doi.org/10.1257/aer.20131193

Kirchner S (2019) State of confusion: Economic policy uncertainty and international trade and investment. Aus Econ Rev 52:178–199. https://doi.org/10.1111/1467-8462.12319

Marcus AA (1981) Policy uncertainty and technological innovation. Acad Manage Rev 6:443–448. https://doi.org/10.5465/amr.1981.4285783

Ouyang X, Li Q, Du K (2020) How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Pol 139:111310. https://doi.org/10.1016/j.enpol.2020.111310

Park M, Funk R (2020) Regulation and innovation revisited: how restrictive environments can promote disruptive new technologies. SocArXiv. December 11. https://doi.org/10.31235/osf.io/p2uz7

Perman R, Ma Y, Maddison D, McGilvray J (2011) Natural resource and environmental economics, 4th edn. Longman, London

Phan DHB, Iyke BN, Sharma SS, Affandi Y (2020) Economic policy uncertainty and the financial stability–Is there a relation? Econ Model. https://doi.org/10.1016/j.econmod.2020.02.042

Pickman HA (1998) The effect of environmental regulation on environmental innovation. Bus Strat Environ 7:223–233. https://doi.org/10.1002/(SICI)1099-0836(199809)7:4%3c223::AID-BSE164%3e3.0.CO;2-S

Porter ME, Der Linde CV (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9:97–118

Rubashkina Y, Galeotti M, Verdolini E (2015) Environmental regulation and competitiveness: empirical evidence on the porter hypothesis from European manufacturing sectors. Energy Pol 83:288–300

Saleem H, Jiandong W, Khan MB (2018) The impact of economic policy uncertainty on the innovation in China: empirical evidence from autoregressive distributed lag bounds tests. Cogent Econ Finance 6:1514929–1514929. https://doi.org/10.1080/23322039.2018.1514929

Schumpeter J (1934) Theory of economic development. Harvard University Press, Cambridge

Shao S, Hu Z, Cao J, Yang L, Guan D (2020) Environmental regulation and enterprise innovation: a review. Bus Strat Environ 29:1465–1478. https://doi.org/10.1002/bse.2446

Shankar N (2020) Role of global economic policy uncertainty on firms participation in innovation and new product introductions: an empirical study in African SMEs. Transnat Corp Rev 12:1–19. https://doi.org/10.1080/19186444.2020.1832425

Shen H, Zhang M, Liu R, Hou F (2020) Economic policy uncertainty and corporate innovation: evidence from China. Asian Econ Lett. https://doi.org/10.46557/001c.17192

Sun X, Gao J, Fan D (2018) Analysis of regional differences and efficiency improvement of green technology innovation in China. Sci Technol Develop 14:1092–1098 (In Chinese)

Wang F, Feng L, Li J, Wang L (2020) Environmental regulation, tenure length of officials, and green innovation of enterprises. Int J Environ Res Public Health 17:2284. https://doi.org/10.3390/ijerph17072284

Wang J, Liu B (2014) Environmental regulation and enterprises’ TFP: an empirical analysis based on China’s industrial enterprises data. China Indust Econ 3:44–56 (In Chinese)

Wang Y, Wei Y, Song FM (2017) Uncertainty and corporate R&D investment: evidence from Chinese listed firms. Int Rev Econ Finance. https://doi.org/10.1016/j.iref.2016.10.004

Wu G, You D (2018) Re-analysis of “green paradox”: based on the perspective of economic policy uncertainty. Syst Eng 36:61–72 (In Chinese)

Xu Z (2020) Economic policy uncertainty, cost of capital, and corporate innovation. J Bank Finance 111:105698. https://doi.org/10.1016/j.jbankfin.2019.105698

Acknowledgements

We would like to express our gratitude to Mr. Yi Li for his pertinent suggestions.

Funding

None.

Author information

Authors and Affiliations

Contributions

Material preparation and data collection and analysis were performed by XL, ZH, and QZ. The first draft of the manuscript was written by XL and all authors commented on previous versions of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The author’s declared that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Li, X., Hu, Z. & Zhang, Q. Environmental regulation, economic policy uncertainty, and green technology innovation. Clean Techn Environ Policy 23, 2975–2988 (2021). https://doi.org/10.1007/s10098-021-02219-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-021-02219-4