Abstract

Carbon capture, carbon utilization and storage (CCUS) technology is an important potential technical support for coal power plants to maintain existing production structure while simultaneously achieving near-zero carbon emissions with the current energy structure in China being dominated by coal. However, CCUS technology is still at the early demonstration stage, and there are many uncertainties in the carbon trading market, technology and policy incentives that the traditional method is no longer able to handle. Based on the binomial tree real option model, this paper establishes a CCUS technology investment evaluation model that incorporates the uncertainties with carbon price, government subsidy, technological progress and carbon dioxide utilization ratios into the model, and investigates the influence of government incentive on CCUS technology investment in two scenarios in China. The numerical results in case study show that (1) If the subsidy is too low, no matter how high the lower limit of carbon price is set, enterprises will not invest. (2) When the proportion of government subsidy exceeds 0.33, a specific and accurate minimum carbon price is given to promote coal-fired plants immediate investment in CCUS technology based on the model. (3) Only the government subsidies cannot stimulate CCUS investment at this demonstration stage. These findings provide a reference for public policy decision-making and promotes the development and large-scale deployment of CCUS technology in China.

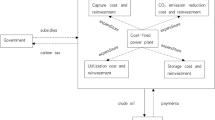

Graphic abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

One of the greatest challenges today to the sustainable development of mankind is global warming. Increasing greenhouse gas emissions is deemed as the most important cause of climate warming with the increase in carbon dioxide (CO2) emissions accounting for as much as 75% of the total (Dubois and Thomas 2018). As one of the world’s largest carbon emitters, China’s CO2 emissions are mainly concentrated in traditional industrial enterprises including large coal-fired power plants that use coal as their main raw materials. These coal plants had already contributed 97% of the CO2 emissions from the electric power industry (IEA 2015). In 2018, the coal power installed capacity in China made up 60% of total installed generating capacity and electricity generation about 70.31% of the total generating capacity. To meet the increasingly growing electricity demand in China, the coal-dominant position in the power structure cannot be replaced in the foreseeable future. Under this circumstance, the problem of how to rapidly and effectively reduce CO2 emissions from coal-fired power generations and decrease the content of CO2 in the air, has been the focus of global attentions and R&D efforts. As one of the most potential emerging emission reduction technologies in the world, Carbon Capture, Utilization and Storage (CCUS) technology, which involves capturing CO2 from a fixed source and then allocating it to different intermediate utilization and/or final storage, contributes to realizing zero or near-zero carbon emissions (Elias et al. 2018). Energy Technology Perspective 2017 published by the International Energy Agency (IEA) pointed out that CCUS projects should contribute at least 14% of the CO2 reduction in order to achieve the 2 °C reduction target (IEA 2019). Therefore, CCUS technology has been identified as an important strategic choice for the global response to climate change and plays a critical role in carbon emissions’ reduction and sustainable transformation for industry in the world (IEA 2019).

Endeavor for promoting the large-scale deployment of CCUS technology to curb the CO2 emissions has gained widespread attention in last decades. The CCUS trials and demonstration projects already cover North American countries, Australia, Norway and China with growing momentum. However, CCUS technology as the upgraded system of carbon capture and storage (CCS) technology by incorporating the utilization of CO2 into the CCS concept, is still at the early demonstration stage. Currently, there only 38 large-scale CCS projects that capture more than one million tons (Mt) of CO2 emissions have been built around the world (Fan et al. 2018). Among these projects, there are still 25 projects in the construction and development planning stages and only 13 projects are put into practice based on the report of IEA (IEA 2019). The reasons for the current hysteresis development status for CCUS technology are mainly that expensive investment cost, technological immaturity with high energy consumptions and lack of effective policy and regulations to guide (Fan et al. 2018), especially the large amount of uncertainties related to the carbon trading price and government supports (Wang and Li 2018). Therefore, it is particularly necessary to establish an appropriate evaluation model for CCUS technology investment that includes various uncertain factors to properly assess the value of CCUS investment and provide decision-making support for the investment of coal power plants in China.

In recent years, some studies carried out the detailed analysis of barriers to CCUS investment and had produced a lot of valuable results in this field. The findings of these studies have pointed out that the main problems limiting the large-scale deployment of CCUS technology at present are as follows: (1) high investment cost and difficulty in financing (Zhang and Li 2015); (2) extra consumption of electricity in coal-fired plants equipped with CCUS system, which implies that the cost of generating electricity will rise by 50% (Zhang et al. 2019); (3) imperfect carbon emission trading schemes and insufficient government subsidies (Zhang and Liu 2019). As a result, the rapid development and commercialization of CCUS technology are confronted with huge cost pressures in this context (Tapia et al. 2018). In order to stimulate CCUS technology investment and effectively carry out the large-scale deployment of CCUS project, it is particularly vital to evaluate the CCUS technology investment and to investigate the implementation effects of different policy incentives such as the government subsidy and the carbon price floor in the carbon trading market.

Generally, the government subsidy has been widely applied to alleviate the investment and abatement cost directly for low-carbon technology and trigger the investment enthusiasm of power plants (Yang et al. 2019). Additionally, the price stabilization mechanism such as the carbon price floor in the carbon emission trading scheme seems as an effective instrument to complement the carbon market and is highly favored by some scholars (Zhang et al. 2016).

From the above-mentioned, our paper is to assess the economic feasibility of CCUS technology investment in two policy incentives for comparison the effectiveness and to reveal the conditions under which the immediate investment can be triggered by combining the coaction of policy package.

The remainder of this paper is organized as follows: section two conducts the literature review among the existing literature on investment decisions of CCUS technology. Section three describes the methodology; section four conducts the case study of investment in China; section five presents the results and discusses the findings and section six presents the conclusions.

Literature review

In the past few years, many studies have mainly focused on two different perspectives in CCUS technology investment based on the real option method in the settings of different uncertainties, which are analysis of economic feasibility and different policies comparisons for CCUS investment, respectively. First, in terms of CCUS technology economic evaluation, scholars are increasingly using the real option method to evaluate the value of CCUS investment allowing for the irreversibility, uncertainty and management flexibility of CCUS investment. These literature focus mainly on assessing the economic feasibility of CCUS investment in different settings. As a classic literature of CCS investment, Abadie and Chamorro (2008) construct a two-dimensional binomial tree model of CCS technology investment in super-critical coal-fired power plants under the constraint of carbon emission and calculate the option value of the project. The critical value and strategy of carbon emissions allowance price for CCS technology investment in coal-fired power plants are obtained. Finally, based on the data from 2006 to 2007 in Europe, the sensitivity analysis of carbon trigger price with allowance volatility, government subsidies, investment costs and other factors shows that coal-fired power plants are not suitable for investment in CCS technology at the current carbon trading price. Considering the price uncertainties of electricity and natural gas, Elias et al. (2018) assess the value of retrofitting CCS technology to natural gas fired power plants and address the problems of whether and when to retrofit the CCS project under the two alternative technologies, i.e., post-combustion and oxy-fuel combustion. The findings of the study show that the post-combustion technology for the power plants is an attractive option when the price of CO2 is above 140 dollars per ton and the oxy-fuel combustion would be selected if the price of CO2 hits 185 dollars per ton. In addition, Yao et al. (2019) model the evaluation of coal to liquid (CTL) with CCS retrofit option by including the uncertainties of oil, coal and carbon price in the investment environment and considering the management flexibility on investment timing. The Shenhua project as the case study is evaluated in their study and the results show that the CTL project is economically unwise under current carbon market and government support.

Second, the real option theory is proposed in previous studies to compare the different policies for CCUS deployment and find out the effects of government policy on investment behaviors. For example, Chen et al. (2016) develop a CCS investment model to analyze the impacts of subsidy for electricity on the decision-making behaviors of coal-fired power plants by using Monte Carlo simulation under the framework of various uncertainties. Additionally, the combined effects of the carbon market and subsidy policy are considered in their model. The study findings indicate that the impacts of subsidy on CCS investment are highly dependent on the carbon market conditions. From the perspective of power generation companies, Guo et al. (2018) comprehensively consider the investment incentive policies of carbon tax, investment subsidy and clean electricity price based on the real option method and innovatively introduce clean electricity price as the policy variable to study the optimal investment strategy in CCS technology. According to the historical volatility of carbon price, the influence of different policies on the critical carbon price of investment is explored through the change of policy parameters in the numerical simulation. Their findings show that the government must increase investment incentives (i.e., raise the carbon tax; increase the proportion of government subsidy) to encourage companies to invest in CCS projects at this stage in China. Furthermore, Yang et al. (2019) compare different types of subsidy schemes for CCUS investment under different level of carbon price, including initial investment subsidy, electricity generation subsidy and the utilization subsidy of CO2 in a real option framework.

However, to the best of our knowledge, the above literature ignores the incentivization role of the carbon price floor policy in CCUS investment. Due to the uncertainty in climate policy, the carbon price changes with the carbon trading market environment, which increases the investment costs and risk and deters investment in low-carbon technology. Therefore, as part of carbon market mechanism, a carbon price floor plays an important role in stimulating low-carbon technology investment, which ensures the minimum return rate of investors and lowers the uncertainty in future economic profitability from low-carbon projects in long-lived power plants characterized by capital-intensive (Brauneis et al. 2013). In practice, the carbon price floor in the UK is an effective measure that exerts an important influence on encouraging low-carbon energy investments and plays a vital role in improving the carbon trading mechanism (DECC 2011). Some studies show that the design of the carbon price floor can effectively motivate power generation enterprises to invest in sufficient emission reduction technologies (Richstein et al. 2014). For example, considering double uncertainties in power generation and carbon price, Zhang et al. (2016) evaluate the CCS technology investment with carbon price floor in the power generation sector and use numerical simulation to study the influences of the carbon price floor, government investment subsidy and tax deduction on the optimal investment timing of CCS for power generation companies. The findings indicate that even if the subsidy is very high and the carbon price floor is low, investors in power generation companies would not carry out the CCS technology investment immediately in current market conditions.

Considering the gap in the aforementioned work and taking this logic as our research point, the objective of this paper is to construct a binominal tree model based on real options analysis to analyze China’s CCUS technology investment strategy by incorporating the uncertainties with carbon price, electricity price, technological improvement, government incentives and different ways of carbon utilization into the research framework. The real option approach in an uncertain environment offers the management flexibility for investors by delaying the investment decision to an optimal timing, which is consistent with the reality. Moreover, the model will evaluate the CCUS technology investment through a case study in China from the perspective of power generation companies and determine the optimal investment strategy for the CCUS technology retrofitting under current situations. In view of current investment environment with immature CCUS technology and an inactive attitude toward investment in CCUS, the government incentives measures play a very important role in stimulating the development of low-carbon technology in China (Fan et al. 2019). Therefore, two different policy subsidy scenarios are considered in the paper to investigate the effect of policy incentives on the CCUS technology investment decisions for the power plants. Specifically, the first setting is only government subsidy for the initial investment cost of CCUS project without extra economic incentives, and the other analyzes the coactive effect of government incentive and the carbon floor, so as to compare the distinct investment behaviors of CCUS technology investment in the two settings.

The findings of the model indicate that only government subsidy cannot motivate CCUS investment at this demonstration stage under current economic conditions. Additionally, although combined with the minimum carbon price, the low-carbon technology investment would still not be stimulated in the case of lower government subsidy. The CCUS technology investment can only be encouraged if the proportion of government subsidy exceeds 0.33. Furthermore, a specific and accurate minimum carbon trading price will be given to promote coal-fired plants immediate investment in CCUS technology based on the actual data in the model. The results obtained can provide both a more realistic assessment of CCUS project for investors in the power sector and suggestions for the policy-makers in China to improve policy performance and perfect the carbon market mechanism based on the calculation analysis in a case study.

Consequently, the main contributions of the paper may be concluded as follows: first, the present study provides an innovative perspective on how to promote the current CCUS retrofitting investment and development by combining with different policy schemes under uncertainty. And specific policy incentive schemes are determined considering the coaction of the government subsidy and the carbon floor. Second, different impacts of incentive policies involving the government subsidy and the minimum carbon price on the CCUS technology investment in two scenarios are analyzed in the case study. Third, uncertainties including carbon price, government subsidy, technological advancements and carbon dioxide utilization ratios are considered in the model. Finally, we perform in-depth investigation the investment strategy of CCUS technology by using a variety of latest input data from the existing economic and technological conditions in the 600 MW ultra-supercritical coal-fired power station and provide useful information both for power enterprises and related policy-makers. The results obtained are of great practical significance to improve the national low-carbon technology subsidy policy and mechanism, perfect the carbon trading market system, and achieve the national carbon emission reduction target earlier.

Methodology

CCUS technology refers to the use of carbon capture technology to first separate, collect and compress CO2 from power plants and other emission sources, and finally either transport it to storage sites or put it into new production processes for recycling and reuse to reduce carbon dioxide emissions and prevent climate warming. Compared with CCS technology, it is a new trend of upgrading technology and can turn waste CO2 into valuable materials with economic benefits through its utilization in the field of geology, chemistry, physics and biology.

The traditional investment decision-making methods including the discounted cash flow (DCF), net present value (NPV) and internal rate of return (IRR) are used to evaluate the CCS project (Renner 2014; Santos et al. 2014). Generally speaking, the greater the risk and uncertainty in the investment project, the lower the potential value of the project investment will be in a risk neutral world. The NPV method uses the future cash flow and discount rate generated by the investment project to calculate the initial value of the project at the initial time, and determines whether the project is worth to investing or not based on either a positive NPV or a negative NPV, which the decision is now-or-never under NPV rules without consideration of irreversibility of investment, uncertainty in future cash flows and the flexible investment timing. Thus, the reasons for the inapplicability of CCUS technology project in terms of traditional investment decision-making methods are as follows. Firstly, NPV assumes that the investment is reversible that there is no sunk cost, i.e., the investment cost can be recovered at any time. Secondly, the NPV method is discounted at a fixed discount rate, and the cash flow generated by the project can be estimated based on the probability measure. Thirdly, the traditional NPV method ignores the flexibility of management in CCUS technology investment under the assumption that investment is a now-or-never option. Therefore, if the NPV method is used to evaluate CCUS investment projects, there may be two consequences. One consequence is that investment opportunities will be lost due to ignoring the benefits from uncertainties faced by the project, because the investment project for using CCUS technology in coal-fired power plants not only has economic benefits, but also have both environmental and social benefits. The other consequence is that uncertainties for CCUS technology investment projects related to future cash flow are neglected, which will underrate the investment value and lead to investment failure, neither of which would be wanted by investors.

Investment in CCUS technology in coal-fired power plants has the characteristics of investment irreversibility, uncertainty in future cash flow and technical progress and flexibility in CCUS investment which make the investment decision for CCUS technology in coal-fired power plants have real options’ characteristics. When the option value of CCUS technology investment project is considered, the greater the uncertainty in future income from the project, the greater the option value of real option. Therefore, this paper introduces real options analysis based on the binomial tree into investment projects and constructs an investment decision-making model for CCUS technology in coal-fired power plants. The real option method is suitable for investment decision evaluation in uncertain environment, and its essence lies in the managerial flexibility, which indicates that decision-makers of coal-fired enterprises have different options to exercise investment decisions under the uncertainties in government policies, coal prices and carbon prices.

During the operation period of CCUS technology project in the coal-fired power plant, assuming the investors are all rational, and the project investors make decisions by maximizing the economic benefits of the coal-fired power plant. From the perspective of investors in coal-fired power generation enterprises, decision-makers can describe the problem as the maximization of the sum of expected discounted profits during the investment period. Total investment costs (cash outflow) mainly includes the initial capital cost of CCUS technology in the construction period, operation and maintenance (O&M) costs, an increased fuel consumption cost due to the capture system during the operation period, transportation cost and storage cost after capturing CO2. The income consists of electricity sales revenue, CO2 utilization revenue and carbon emission reduction income in the carbon trading market. Therefore, the net annual profits of CCUS retrofitting investment in coal-fired power plants can be expressed as follows:

where \( p_{\text{e}} \) denotes the electricity tariff (RMB/kWh), \( q_{\text{e}} \) is the annual amount of electricity generated by the coal-fired plants assuming that annual production capacity is fixed (kWh), \( p_{\text{c}} \) is the carbon price in the carbon trading market (RMB/ton), \( q_{\text{c}} \) is the annual amount of certified emission reduction for coal-fired plants (ton), \( V_{\text{cu}} \) is the annual utilization revenue of CO2 (RMB), \( C_{\text{I}} \) denotes the initial investment cost in CCUS technology (RMB), \( \lambda \) is the proportion of government subsidy for the initial cost of investment and \( 0 \le \lambda \le 1 \), \( C_{{{\text{O}}\& {\text{M}}}} \) is the operation and maintenance costs (RMB), \( C_{\text{T}} \) is the transportation cost of CO2 (RMB) from the coal-fired plants to the storage station, \( C_{\text{S}} \) represents the sequestration cost of CO2 (RMB) in the storage station, \( \xi \) is the utilization rate of CO2 and \( C_{\text{r}} \) is the increased fuel consumption cost after CCUS technology investment (RMB).

The CO2 utilization in CCUS technology under current circumstances includes EOR (enhanced oil recovery), ECBM (enhanced gas recovery), CO2 bioconversion, CO2 chemical synthesis (Wood 2015), microalgae oil production technology and beverage additives. In 2014, mechanical manufacturing accounted for 50% of CO2 consumption, food additives for 20%, 10% for the oil field, and others occupy for 20%. According to the data from the Zhuo Chuang Information (ZCI 2018), we classify the CO2 utilization into two types, the industry use and food use. Food use accounts for 80% of CO2 utilization and the industry use makes up 20%. The CO2 utilization price is the price of CO2 in the consumer market, and it varies greatly in different regions of China.

Suppose the selling price of industrial CO2 is \( p_{\text{s1}} \), and the selling price of food CO2 is \( p_{\text{s2}} \), then the average price of CO2 utilization \( p_{s} \) can be expressed as

Assume that \( q_{\text{c}} \) denotes the annual amount of certified emission reduction for coal-fired plants and the utilization rate of CO2 is \( \xi \), then the CO2 utilization income is described as follows:

The costs of CCUS retrofitting investment in coal-fired power plants include the design of CO2 capture system, the acquisition of capture equipment, acquisition of CO2 adsorption reagents and transportation costs based on the selected transportation ways, e.g., pipeline and highway/railway transportation after CO2 separation and compression. In addition, the operation and maintenance costs of CCUS technology include the cost of adsorption materials and maintenance fees during the operation of the capture system. Furthermore, the sequestration of captured CO2 involves storage in depleted oil and gas reservoirs, inaccessible coal seams, and deep saline aquifers which adds extra handling costs to the total investment costs (Rehman and Meribout 2012).

The uncertainty of investment in CCUS technology projects in coal-fired power plants is mainly due to the impact of technological progress on costs. First, investment in CCUS technology in coal-fired power plants will affect the generation capacity, operation cost and energy consumption cost of power plants. Second, the installed scale of coal-fired power plants and the technology employed makes a big difference in the investment and operating costs of carbon capture system. Combined with above two points, the uncertainty of CCUS technology will affect the total investment value (ENPV) of the CCUS project because of its uncertain cost. Although CCUS technology has been continuously developed and demonstrated, which has accumulated a lot of data and technical experience, the most important factor now hindering investment in CCUS technology in coal-fired power plants is still its high cost.

It is assumed that there exists learning effect in CCUS investment process, and the investment cost changes with the learning effect. Arrow (1962) constructed an LBD (learning by doing) learning curve model that described the reduction in the average cost per unit of output along with either increase in output or the accumulation of labor experience.

Most of the research results indicate that the new energy industries, such as photovoltaic power generation and wind power generation, also conform to the learning curve model. Currently, CCUS technology is still at the demonstration stage. According to the current development speed, studies indicate that CCUS technology may not be widely promoted until after 2020. Experience will be accumulated in the CCUS technology demonstration stage, thus reducing the investment cost and the operation and maintenance costs of CCUS technology in coal-fired power plants. Therefore, it is assumed that the initial investment cost of CCUS technology for coal-fired power plants is \( C_{0}^{1} \), and the initial operation and maintenance cost after investment is \( C_{0}^{2} \). CCUS technology has technical progress with the learning curve. After t years, the construction cost of the coal-fired power plant investment project is \( C_{\text{I}} \), and the operation and maintenance cost is \( C_{{{\text{O}}\& {\text{M}}}} \). Technical improvements gradually reduce the cost of CCUS technology, so the investment cost and operation and maintenance costs are uncertain. Since the technical learning rate affecting the investment cost and the operation and maintenance cost varies, the two types of costs can be expressed, respectively, as:

where \( x_{t} \) and \( x_{0} \) are the cumulative installed capacity in the year t after the installation of CO2 capture equipment in a coal-fired power plant and the cumulative installed capacity in the base year respectively. Given the scale of coal-fired power plants, the cumulative capacity of the industry to install CO2 capture equipment replaces the cumulative capacity of individual coal-fired power plants. And \( \alpha \) and \( \beta \), respectively, are learning capacity parameters reflecting the effect of technology progress on the investment cost and the operational maintenance costs.

Additional energy consumption is required to support CO2 capture equipment after the investment in CCUS technology in coal-fired power plants. It is assumed that coal consumption represents the energy consumption of CCUS system in power plants. A power plant equipped with CCUS system will consume approximately 10–40% more energy than it would without (Niu et al. 2014). According to related data, 80% of the production costs of coal-fired power plants in China, come from coal (Li 2020). Therefore, it is reasonable to use the amount of coal consumption as additional energy consumption in the CCUS system in the power plant. If the coal price is \( p_{\text{r}} \), and the annual amount of fuel added for the operation of the capture system is \( q_{\text{r}} \), the additional fuel consumption cost is \( C_{\text{r}} \), which is described as follows:

As more than 40% of enterprises consider the impact of the carbon price in their long-term investment decisions, the carbon price in the carbon trading market is an important factor affecting the investment income of CCUS technology for power generation enterprises. For the convenience of analysis, it is assumed that the extra carbon allowances created after CCUS retrofitting investment in coal-fired power plants can be traded in the carbon market without consideration of the intermediate cost, thus, the carbon price is the main influencing factor on the incomes of CCUS technology investment project. Due to the initial establishment of the national unified carbon trading market, which was launched in December 2017, the carbon trading market has great uncertainty and randomness and will fluctuate with the carbon demand in the future. Most studies have shown that the carbon price \( p_{\text{c}} \) follows a non-stationary stochastic process and is subject to a Geometric Brownian Motion (Wang and Qie 2018), which obeys

where \( p_{\text{c}} \) refers to the carbon price at t time (RMB/ton), \( \mu_{\text{c}} \) and \( \sigma_{\text{c}} \), respectively, represent the drift rate and volatility rate of the carbon price, and \( {\text{d}}z \) is independent increments of the Wiener process and follows the normal distribution N (0, t).

Net present value of CCUS technology investment

Assume that the life time of coal-fired power plants is T years, investment in CCUS technology begins at \( t = t_{0} \), and the time taken for construction is 1 year. CCUS technology system is put into use after installation of CCUS devices until the end of the life time of a coal-fired power plant. In other words, the running time of CCUS technology system is from \( t_{0} + 1 \) to the life time T. During this period \( [t_{0} + 1,T] \) investors can evaluate the value of the project in each year and make a decision whether to invest in a CCUS retrofitting project at the beginning of each year. We suppose the base discount rate is to be \( r_{0} \) and the residual value of CCUS technology capture equipment to be zero by the end of the lifetime of the coal-fired power plant. Then, the net present value of CCUS technology investment is described as follows:

If a continuously compounded interest rate is adopted, that is \( e^{{r_{0} }} = 1 + r_{0} \), the NPV can be rewritten as

Binomial tree model-based real options analysis

The real option method has management flexibility and considers the time value of the investment in CCUS technology in coal-fired power plants. The delay option value represents the option value brought by the uncertainty of the carbon price for the investment in CCUS technology in coal-fired power plants. We first employ the binomial tree model to simulate the process of the carbon trading price and assume that the initial carbon price is \( p_{\text{c}} (0,0) \). The time step is \( \Delta t \), and there are two possible carbon prices at each time step. In other words, after the \( \Delta t \) time interval, \( p_{\text{c}} (0,0) \) either goes up to \( p_{\text{c}} ( 1, 1) \) by a specific factor \( u \) with the risk-neutral probability \( p \) or goes down to \( p_{\text{c}} ( 1, 2) \) by a specific factor \( d \) with the probability \( q \), where \( p + q = 1 \), \( u \ge 1 \) and \( \Delta t > 0, \) \( 0 < d \le 1 \). By analogy, the node \( p_{\text{c}} (i,j) \) after n time steps \( \Delta t \), there is an n + 1 tree node, which represents an n + 1 possible carbon price. For the node \( p_{\text{c}} (i,j) \), i denotes the number of periods and j is the state of carbon price. The up and down factors are calculated using the volatility, \( \sigma_{\text{c}} \), the time step \( \Delta t \) and the risk-free rate \( r \) and the risk-free probability \( p \) can be expressed as

where \( u = e^{{\sigma \sqrt {\Delta t} }} \), \( d = \frac{1}{u} \).

According to the above ideas, the investment value at each binomial tree node in each period can be calculated according to Eq. (9):

where \( n \) is the number of the option periods.

When the NPV of the CCUS technology investment is negative at node \( (i,j) \), the investor will not invest and wait until the NPV turns positive, which the NPV is the investment value in CCUS technology investment.

The total investment value ENPV of CCUS technology for coal-fired power generation under uncertainties containing the real option is calculated by step by step backward from the last node to the current node and it is expressed as follows:

Overall, the investments in CCUS technology of coal-fired plants are considered as an American call option and are only exercised if it brings the positive revenue. Based on the real option theory, the ENPV consists of NPV plus the defer real option value (ROV), that is,

In general, the calculation process is summarized as follows:

-

Step 1 calculate the carbon price at each node in a binomial tree of CCUS investment including the defer option. Take current carbon price as the benchmark price and multiply by either u or d, respectively. The two parameters u and d are obtained from the historical data of China’s seven pilot carbon markets from 2013 to 2017.

-

Step 2 bring the carbon price obtained at each node in Step 1 into the expression of net present value (NPV), and calculate NPV of CCUS investment at each node according to Eq. (10).

-

Step 3 according to Eq. (11), decisions are made at each node, relied on the positive or negative NPV. when the net present value is negative, it indicates that investors give up the investment.

-

Step 4 according to Eq. (12), the investment value containing the delayed option is calculated step-by-step from the last time step to the current time step using the backward recursion method, and the current ENPV obtained is the total value plus the delayed option value. According to formula (13), the defer option value of CCUS project investment is calculated.

Investment decision rules for CCUS technology in coal-fired power plants

The option to delay is employed to evaluate an investment project for CCUS technology in a coal power plant according to the characteristics of CCUS technology investment. The defer real option is treated as an American call option that allows investors in coal-fired power plants to invest at any appropriate time during the life time of the option. Therefore, it is necessary to calculate the ENPV of the investment project at any possible investment point, then compare with investment value at each node, and finally decide whether to either invest immediately or to delay. Based on the real options method, the ENPV of CCUS technology project includes the NPV of the investment project itself and the defer option value of project, as shown in formula (13).

The investment decision rules for CCUS technology in coal-fired power plants are shown in Table 1. According to Table 1, the two scenarios are chosen to execute the option to delay, which NPV of the project is greater than 0, the total investment value is greater than the net present value or the NPV is less than or equal to 0 and ENPV is greater than 0, respectively.

When the NPV of the project is greater than 0 and the ENPV of the project is equal to NPV, investors in coal-fired power plants should invest immediately, that is the critical condition for the investment of coal-fired power plants. The conditions for immediate investment in CCUS technology are that the NPV is equal to the ENPV and the NPV is greater than 0. Only when NPV is less than 0 and the ENPV = 0, the CCUS technology investment will be abandoned.

Case study for CCUS investment in China

In this section, a case study from China’s ultra-supercritical coal-fired power station is introduced to intuitively analyze the optimal investment strategy for power plants under uncertainties. First, the case description on the ultra-supercritical coal-fired power is given in subsection, the basic data collection and parameters estimation are presented in subsection, then the impact of technological progress on investment costs is analyzed in subsection, and finally the future trend of carbon utilization is estimated in subsection.

Case description

Supercritical and ultra-supercritical coal-fired power units are the future development trend of coal-fired power generation in China. Suppose that an existing supercritical coal-fired unit PC benchmark power station has been put into operation. Under the constraints of the national carbon emissions reduction policy, the government requires coal-fired power plants to conduct carbon emissions reduction. The coal-fired power plants have two choices. One is that when the carbon emissions exceeds the limited carbon quota, the power plants buy the carbon quota in the national unified carbon trading market, but the total production cost increases. The other is that coal-fired power plants invest CCUS technology for reduction of carbon emissions and sell the carbon quota set by the government in the carbon trading market to cover the investment cost. We assume that the coal-fired power plants have chosen to invest CCUS technology for carbon emissions reduction and then evaluate the economic viability. The life time of the supercritical coal-fired power plant is 40 years and the coal-fired power plant has been built for 10 years, investors will consider investing in CCUS technology project in 2018. Assuming that the expiration time of the defer option is 10 years, the investment project still has 20 years to operate after investing in CCUS technology, and the time step of the model is 1 year.

Data collection and the parameters estimation of carbon price

The benchmark parameters and data of coal-fired power stations are shown in Table 2, including parameters, symbols, parameter values and value descriptions.

As for the carbon price parameter estimation, since the national unified carbon trading market was launched at the end of 2017, there is no data representing the national carbon trading price at present, so the volatility of the carbon trading price can only be estimated using the price data of the pilot carbon trading market. China’s seven pilot carbon markets were launched gradually in 2013, and the prices of these seven carbon trading cities for each trading day from August 2013 to November 2017 are available. From August 2013 to October 2014, the average price of carbon trading in the seven pilot cities fluctuated greatly. From October 2014 to October 2017, the price occasionally fluctuated by a large margin, but it was basically stable, at between 10 and 40 RMB per ton. Therefore, we suppose that the average price from 2013 to 2017 is 34.64 RMB/ton, which is the initial price of carbon trading \( p_{\text{c}} (0,0) \), and that \( p_{\text{c}} (0,0) \) is 34.64 RMB/ton. The volatility of the carbon trading price is calculated by using the historical data from 2013 to 2017. The calculation methodology is as follows:

where \( p_{ck} \) represents the monthly carbon price in k time, and the average and volatility of the carbon price can be calculated according to Eq. (15)

The expected growth rate and volatility of the carbon price can be obtained by the following simultaneous equations:

Through the above steps, the calculated volatility of the carbon trading price \( \sigma_{\text{c}} \) is = 0.1594. In addition, according to Eq. (10), the move-up level u is 1.1728, the move-down level d is 0.8527, the go up probability p is 0.6026 and the go down probability q is 0.3974. Based on the above data, we can calculate the binomial tree extended table with the option to delay in carbon price for CCUS technology investment in coal-fired power plants.

Technology improvement in investment cost of CCUS technology

With the progress of technology, CCUS technology will be widely installed in coal-fired power plants, and the installed capacity of coal-fired power plants with CCUS technology will increase continuously. The development of carbon capture technology follows the same path as wind power development. The installed capacity of coal and electricity installed with CCUS technology is growing at an average annual rate of 11.6% (Huang 2012). Assuming a cumulative installed capacity of 15.949 million kW for CCUS technology investment in the base year, the initial investment cost and the operation and maintenance costs for CCUS technology installation nationwide from 2017 to 2027 are shown in Table 3.

Variation in the CO2 utilization ratio

The CO2 utilization ratio refers to the proportion of CO2 utilization amounts to the CO2 cumulative capture amounts. According to the IPCC report, 80% of captured CO2 is stored (IPCC 2014), and the proportion of CO2 utilization is directly considered as 20% without calculating the loss. According to the collection data from 2014 to 2019 in China, the growth rate of national gaseous CO2 demand is 0.9%, that of liquid CO2 demand is 4.8%, and that of solid CO2 demand is 5.8%. The consumption of CO2 in 2014 was 70.226 M ton, among which the consumption of gaseous, liquid and solid CO2 was 64.8 million ton, 5.07 million ton and 351,000 ton, respectively (Wood 2015).

According to the above data, the growth rate of national CO2 demand from 2014 to 2019 is calculated to be 1.25%. If the growth rate of national demand carbon dioxide will still be 1.25% in the next 10 years, and the approved emission reduction rate of coal-fired power plants remains unchanged every year, the ratio of CO2 utilization to CO2 capture will increase with the growth of CO2 demand, as shown in Table 4.

Scenarios setting and results

Based on descriptions of CCUS technology project and parameters estimation in the previous section, different scenarios are posited for coal-fired power plants in “Scenarios setting and results” section to further explore and compare the impacts of different policy incentives on CCUS retrofitting investment under current economic and technological conditions. First, scenario settings are presented in subsection, which include only government subsidy for the initial investment cost of CCUS technology and two kinds of policy incentives with both government subsidy and the carbon price floor in place. And then, results analysis of these two scenarios are presented in subsection.

Scenarios in different policy incentives

In this part, we examine the effect of different policy incentive schemes on the CCUS technology investment to better understand different policy implications and effects in two scenarios. Specifically, we assume that the government only uses the subsidy policy for the investment cost of CCUS technology in the first scenario, which indicates that other policy instruments are not considered in the investment evaluation of CCUS project. And the different level of government subsidies are considered in the model to investigate the changes in the NPV and the investment option value of CCUS. Apart from the government subsidies, the carbon price floor is widely regarded as an effective policy instrument to motivate the low-carbon technology transition (Brauneis et al. 2013). In scenario 2, we combine the minimum carbon price system with the investment cost subsidy to explore the coaction of two policies to the investment decisions. Particularly, the minimum value of carbon trading price combined with different levels of government subsidy are presented to motivate the immediate CCUS investment, according to the investment rules that makes the positive NPVs equal the ENPV with the defer option. At last, we compare the impacts of the two policies on the NPV and the ENPV and provide the implications both for investors in coal-fired power plants and decision-makers in public sectors.

Results analysis

We consider the influences of two policy incentives on the CCUS technology investment and compare the two results. The main results are as follows.

Scenario 1

The results of NPV and the ENPV of the coal-fired power plant investment in the CCUS project in Scenario 1 with full initial investment subsidy are − 28,270.15 RMB and 30,628.57 RMB, respectively, whereas the value of real option to delay the CCUS project investment is 58,898.27 RMB. Therefore, the option to delay will be exercised according to the investment rules of the real options theory given in Table 1, and investors will wait for more useful information to resolve the uncertainties in the CCUS technology investment.

Next, in order to analyze the impact of different government subsidies on the NPV, the ENPV and the defer options value, we let the subsidy variation from 0 to 100% with a gradient of 20% and show the change tendency in Fig. 1.

Figure 1 displays the ENPV and the corresponding defer option value with various government subsidies under Scenario 1 based on the assumption of 10 years decision periods. Firstly, as expected, both ENPV and NPV rise significantly with the increase in government subsidy of initial investment cost for CCUS technology. Consequently, the government subsidy plays a positive role in the investment behaviors of coal-fired power plants with retrofitting CCUS technology.

Secondly, it can be observed that the increase in NPV is greater than that of ENPV and the gap between NPV and ENPV is gradually becoming shorter with increase in the government subsidy. That is because ENPV is equal to NPV plus the deferred option value based on the investment decision rule. At the same time, the value of defer option as a kind of call option, which gives the investor the right to invest the project later when the market conditions change unfavorably, has declined as the increases of government subsidy. The main reason for the decreased option value is due to the government subsidy partly offsets the initial investment cost and to some extent alleviates the pressure on CCUS investment costs. Thirdly, as can be seen from Fig. 1, the NPV of CCUS technology investment is always negative, even if the full initial investment cost subsidy is provided by the government (\( \lambda = 1 \)). In addition, ENPV is always not equal to NPV under different full initial subsidies. As a result, the coal-fired power plants will not invest at present because of the high defer option value and will wait for more information to reduce uncertainties on the investment of CCUS project. That is to say, the option to delay will be executed under current technical and economic conditions. Therefore, the coal-fired power plants will delay the investment in Scenario 1 until the NPV changes from negative to positive and equals to ENPV based on the investment rules in Table 1.

Scenario 2

Based on the above analysis, we can find that the coal-fired power plants will not invest the CCUS technology at present even if they received the full government subsidy for the initial CCUS investment cost under the subsidy policy. To promote the immediate investment of CCUS technology in coal-fired power plants, we consider another policy incentive —the carbon price floor, which can reduce the investment cost of coal-fired power plants by selling the certified emission reduction in the carbon trading market with the carbon price floor. According to the real option analysis, the CCUS technology investment can be exercised immediately based on the two conditions. On the one hand, the NPV of CCUS project is positive. On the other hand, the ENPV with the deferred option value must be equal to the NPV of CCUS project according to investment criteria of real options analysis. Therefore, we can compute the thresholds of carbon price with the various of government subsidy to incentivize the immediate investment in coal-fired power plants. The specific changes for the carbon price floor and the NPV of the investment in CCUS technology under various government subsidies are shown in Fig. 2.

Firstly, ENPV have risen sharply as government subsidy increases, and the government subsidy enhances the ENPV of CCUS technology, which will tremendously impel coal-fired power plants to invest immediately. Secondly, on the contrary, the carbon price floor declines as the increase in government subsidy. For example, when the government subsidy is 0.35, we can calculate that NPV of the CCUS project is 47.58 RMB and the carbon price floor is 110.49 RMB/ton at present. Meanwhile, when the government subsidy is 1 with full initial cost subsidy, the NPV and the carbon price floor are 30,628.57 RMB and 57.01 RMB, respectively. The role of carbon price floor can greatly alleviate the cost pressure of coal-fired power plants, attempt to increase interest in investment for CCUS technology to reduce CO2 emissions, and encourage coal-fired power plants to keep investment enthusiasm in CCUS technology. Noticeably, we can see that the NPV has risen 643.67 times, the level of government subsidy increases 65% and the carbon price floor drops more than 48.41%. The results show that NPV is extremely sensitive to government subsidy under these circumstances, whereas the various government subsidies have little influence on the changes of the carbon price floor.

Interestingly, Fig. 2 also illustrates that no matter how high the carbon price floor is, coal-fired power plants will never invest in CCUS project with negative NPV and ENPV when the level of government subsidy is less than 0.33, which shows that the carbon price floor will not be sufficient as the sole instrument for achievement the targets of carbon emission reduction. Therefore, only a combination of the two policy strategies, which are government subsidy and the carbon price floor, can achieve to stimulate immediate investment in CCUS technology.

Compared with Scenario 1, NPV rises drastically. For example, when the government subsidy is 0.8, the NPVs under two scenarios are − 81,019.35 RMB and 6491.99 RMB, respectively. The result shows that the government subsidy combined with the carbon price floor can rapidly increase the value of investment projects and encourage coal-fired power plants to take effective action earlier for CCUS technology project. This is mainly because the revenue from certified emission reduction from CCUS technology sold in carbon trading market can increase the investment cash flow, partially offset the initial investment cost and the transportation cost and storage costs in CCUS project and enhance coal-fired power plants immediate investment incentive.

In other words, the option to defer under Scenario 1 will be exercised until the expiration time and coal-fired power plants will not take any investment measures in CCUS technology. In Scenario 2, we have identified the exact lower bound carbon price by computing in equation in case study. The strategy of carbon price floor is conducive to coal-fired power plants rapidly receiving the revenue from certified emission reduction and simultaneously narrows the gap between the needed carbon price for immediate investment and the current carbon price in carbon market. In general, only government subsidy combined with carbon price floor would encourage coal-fired power plants to invest immediately and motivate coal-fired power plants to reduce their CO2 emissions.

Discussion

The discussion is given in section six to reveal different implementation effects of policy incentives for the CCUS investment and to understand the theoretical and practical implication for spurring the low-carbon technology investment and deployment.

From what has been analyzed above, although the increase in the government subsidy is conducive to CCUS technology investment, it is not an effective policy instrument to promote the low-carbon technology transition in current low carbon prices and high investment cost. Thus, the coal-fired power plants cannot be greatly encouraged by the single government subsidy to retrofit the CCUS technology and ultimately cannot achieve the carbon emission reduction targets for the enterprises. These results we obtained are consistent with several previous literatures dealing with the CCUS investment decisions under different backgrounds and uncertainties (Wang and Du 2016). Theoretically, the certified emission reduction can be sold in the carbon trading market to effectively alleviate the cost pressure from CCUS retrofitting investment. However, there is a large gap between the current carbon credit price and the initial investment cost of CCUS technology. Based on the analysis of Lilliestam et al. (2012), the abatement cost is estimated to reach $35–70/ton CO2. Comparably, the annual average carbon price in Chinese emission trading market is around $9–15/ton CO2 in 2019. It is very difficult in the short term to overcome these challenges by government subsidies alone. Thus, the role of subsidy policy provided by the government for CCS retrofitting investment is extremely limited to incentivize coal-fired power plants to undertake the CCUS project.

Compared with the government subsidy, the minimum carbon price has the significant effect on increasing the NPV of CCS investment under different government subsidies in case study. Meanwhile, it greatly reduces the uncertainty on future profitability of CCUS project by ensuring minimum revenue for the coal-fired power plants, which is extremely important for investors in CCUS technology with capital-intensive characteristic. Brauneis et al. (2013) pointed out a minimum carbon price can be seen as an industrial instrument for the profit-maximizing company rather than an environmental policy and effectively create incentives to invest the low-carbon technology by influencing the carbon price distribution in the future carbon market. That is mainly because uncertainties from the environmental policy, technological improvement and economic conditions in the carbon market always exist. Changes in environmental policy cause the carbon price fluctuation in carbon trading system and then affect the future benefits received from the CCUS project for the energy companies, which are profit motivated under market economy. The technological improvement in CCUS technology makes it impossible for lower abatement cost for carbon emission reduction and higher rate of return for CCUS projects, which gives low-carbon technology investors more incentives to stay hold and delay the deployment of CCUS technology right now. In addition, if market conditions become worse, it will make investors a wait-and-see attitude toward investment and then affect the investment behaviors. Under this circumstance, the policy of carbon price floor in carbon trading market has a direct effect on the investment incentives and economic feasibility of CCUS projects including with the government subsidy. However, it should be noted that the incentive role of the government subsidy and the coaction of the two policy instruments for stimulating the immediate investment on CCUS project are not considered in Brauneis et al. (2013), which focus on the impacts of the carbon price floor on the investment decisions for low-carbon technology. On the contrary, our aim is to assess the economic feasibility of CCUS technology under two policy incentives and reveal the condition under which the immediate investment can be triggered by combining the coaction of two incentives.

In real world, experiences stemming from the EU Emission Trading Scheme (ETS) also show that the price floor can greatly alleviate the abatement cost. However, in China’s emission trading system, although the price mechanism such as the carbon price floor has been introduced into seven pilot carbon markets, the effectiveness for the carbon price floor is not obvious (Wang et al. 2020). It is extremely important to note that the weak implementation and commitment of policy-makers for the policy and the complexity of the various policies mix should be responsible for this. In Beijing pilot carbon market, the price corridor ranged from 20 to 150 RMB and the regulator can choose whether to adjust the price trend by releasing the carbon allowances or buying back them. Except for Beijing, other pilot carbon markets only provide the implicit price corridor and cannot establish the carbon price floor based on the local carbon trading schemes. Moreover, the other complementary policy options are also in place to play their roles in inducing the low-carbon transition in the market economy. The effectiveness of incentive mechanism depends on the coordination and cooperation among various policy options. Thus, in addition to the firm implementation of policy options, it is of great importance to coordinate the relationship between various incentives. The findings of the paper provide the correlations between the government subsidy and the carbon price floor under current market conditions. That is, neither the government subsidy for initial investment cost nor the policy of carbon price floor on its own supports the CCUS technology investment under current conditions. Only by combining with the two policy schemes effectively and formulating the optimal carbon price floor based various government subsidies can we spur low-carbon investment and stimulate the innovation and deployment of clean technologies to a large extent. Too higher or lower carbon price floor seems unreasonable and unrealistic to improve the incentives for investing in CCUS technology (Mo et al. 2015). Both two conditions on the coexistence of two policy incentives and the critical carbon price floor are indispensable and interdependent under current economic conditions. In addition, in the context of many policy options, the correlations and impacts of these incentives should be investigated deeply to play their vital role in inducing the low-carbon technology investment to a large extent.

As the results of the paper argue, policy incentives can be significantly effective in stimulating the investment when two policy schemes are employed jointly. The most important thing is to formulate the critical carbon price floor for immediate investment in CCUS project. That is crucial, because too low carbon price floor cannot provide enough motivation to invest. Obviously, the results of the paper can provide suggestions and practical guidance for policy-makers and investors around the world to promote the deployment and development of CCUS technology.

Conclusions

As the global climate issues become more and more serious, China as the 23rd party of the Paris Agreement, has committed to reducing national greenhouse gas emissions to keep the global average temperature rises to no more than 2 °C in this century and to try to control global temperature increase to no more than 1.5 °C above pre-industrial levels. The coal-fired plants, as the main source of carbon emissions, are the important emissions reduction objects because of the energy structure in China. CCUS as an essential option is conducive to achieving national long-term carbon reduction targets. However, due to the immaturity of technology, expensive investment cost remains a major obstacle for large-scale deployment in China. Given this situation, the aim of this paper is to provide useful information both for investors of coal-fired power plants and policy-makers to reveal the implementation effects of different policy incentives under uncertainty arisen from volatility of carbon trading price electricity price, technological improvement, different ways of carbon utilization and investment incentives. For this purpose, the binomial tree model based on the real option theory has been built to investigate the influences of the different policy incentives on investment in CCUS technology in coal-fired plants, which incorporates the uncertainties with the carbon price, technological improvement and policy incentives. The real option theory makes it possible to delay investment decisions and offers the power companies new opportunities by waiting for favorable circumstance. To intuitively illustrate the significance of the model, this paper evaluates the investment value of CCUS project including the NPV and ENPV with the delayed option value and investigates the different variations of NPV and the ENPV as government subsidy increases in the case study of 600 MW supercritical thermal power plant. Also, in order to reveal different impacts of policy incentives on the investment behaviors of CCUS retrofitting, two policy incentives, which are government subsidy of the initial investment cost of CCUS technology without and with the carbon price floor, are considered by setting two scenarios in the model to explore how the public sectors utilize the policy tools to encourage coal-fired plants immediate investment in the current market. The main results of numerical analysis in case study are as follows.

If the subsidy is too low, no matter how high the lower limit of the carbon price is set, enterprises will not invest. The numerical simulation in case study shows that (1) the level of government subsidy should not be less than 0.33; (2) when the government subsidy exceeds 0.33, a specific and accurate minimum carbon price is given to promote coal-fired plants immediate investment in CCUS technology on account of the model and the carbon price floor decreases as government subsidy increases under immediate investment condition; and (3) only the government subsidies alone cannot stimulate CCUS investment at this demonstration stage.

This study has important implications both for CCUS investors and policy-makers. According to the studies and practice of carbon trading mechanism in developed countries, the carbon trading scheme seems to play a vital role in incentivizing the development of CCUS projects. In practice, the carbon market and government subsidy for CCUS investment are also highly recommended as main instruments for promotion deployment and development of low-carbon technologies. However, based on our computed results, the CCUS application cost is still a major obstacle for coal-fired power plants and it is far from enough to attract CCUS investment to control carbon emission by government subsidy and presently Chinese emission trading scheme. The motivation effect of policy incentives mainly depends on the amount of government subsidy under current carbon trading price. Only when the government subsidy reaches a certain level, such as above 0.33 in our results, and then combines with other incentives in the carbon trading market to achieve low-carbon technology development ultimately. It is of great importance to improve the carbon market trading system by exploring performances of policy incentives on deployment of low-carbon technologies combined with actual situations. As a strong complement to the carbon market mechanism, the carbon price floor in the carbon trading market has the largest effect on triggering the CCUS investment, compared with the government subsidy. And it can offer the minimum benefits from CCUS retrofitting investment by offsetting the huge costs of CCUS projects and reducing the investment risks. A combination of government subsidies for initial cost and the carbon price floor in the carbon trading scheme would be encouraged in China to promote the rapid development of low-carbon technologies for achieving climate changes mitigation goals earlier.

Although this paper draws some practical conclusions, there are still some limitations to be improved in future in following aspects. Firstly, existing CCUS projects have not to be the extent of large-scale commercial utilization and relevant cases and data are relatively scarce for study. Thus, the data deficiency may lead to research limitation. In the future, the data collection should be updated from the actual CCUS projects to draw meaningful conclusions under more realistic conditions. Secondly, this paper only presents the two policy incentives of government subsidy and the carbon price floor in the carbon market to be investigated in the model under various uncertainties. Various policy options are in place in carbon market. For example, the increase in CO2 storage subsidy and CO2 transportation subsidy are provided based on the amendment of 45Q tax credit. Therefore, the interaction of various policy options should be considered to better irritate the investment behaviors for low-carbon technology. In the future work, comparison analysis of various subsidy schemes and policy instruments may be our further research issues to promote widespread CCUS deployment and development. Finally, considering the complex system and interaction of CCUS project in the process of carbon capture, utilization, transportation and storages, the technological cooperation and the shares of earned profits from the reduction emissions with other enterprises will be more significant in current economic conditions. Thus, from the perspective of cooperation with other corporations for CCUS project, the evaluation of CCUS investment will be further discussed in the future work to reveal the optimal investment timing under the context of competition and cooperation for CCUS investment.

References

Abadie L, Chamorro J (2008) European CO2 prices and carbon capture investments. Energy Econ 30(6):2992–3015

Arrow K (1962) The economic implications of learning by doing. Rev Econ Stud 29(3):155–173

Brauneis A, Mestel R, Palan S (2013) Inducing low-carbon investment in the electric power industry through a price floor for emissions trading. Energy Policy 53:190–204

Chen H, Wang C, Ye M (2016) An uncertainty analysis of subsidy for carbon capture and storage (CCS) retrofitting investment in China’s coal power plants using a real-options approach. J Cleaner Prod 137:200–212

DECC (2011) Planning our electric future. A white paper for secure, affordable and low-carbon electricity. Department of Energy and Climate Change. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/48129/2176-emr-white-paper.pdf. Accessed 15 Dec 2011

Dubois L, Thomas D (2018) Comparison of various configurations of the absorption-regeneration process using different solvents for the post-combustion CO2 capture applied to cement plant flue gases. Int J Greenh Gas Control 69:20–35

Elias R, Wahab M, Fang L (2018) Retrofitting carbon capture and storage to natural gas-fired power plants: a real-options approach. J Cleaner Prod 192:722–734

Fan J, Xu M, Wei SJ et al (2018) Evaluating the effect of a subsidy policy on carbon capture and storage (CCS) investment decision-making in China—a perspective based on the 45Q tax credit. Energy Procedia 154:22–28

Fan J, Xu M, Yang L et al (2019) How can carbon capture utilization and storage be incentivized in China? A perspective based on the 45Q tax credit provisions. Energy Policy 132:1229–1240

Guo J et al (2018) Study on the investment incentive mechanism of carbon capture and storage project in low carbon economy. Soft Sci 2:55–59

Huang J (2012) Toward characteristics of development of wind power and carbon capture technology in China based on technological learning curves. Resour Sci 34(1):20–28

IEA (2015) CO2 emissions from fuel combustion, 2015 edition. International Energy Agency. http://wds.iea.org/wds/pdf/Worldco2_Documentation.pdf. IEA, Paris. Accessed Nov 2015

IEA (2019) International Energy Agency. Transforming industry through CCUS. https://www.iea.org/reports/transforming-industry-through-ccus. IEA, Paris. Accessed May 2019

IPCC (2005) Special report on carbon dioxide capture and storage 2005. International Panel on Climate Change, Geneva

IPCC (2014) Climate change 2014: synthesis report summary for policymakers. International Panel on Climate Change. https://www.ipcc.ch/2014/09/24/synthesis-report-of-the-ipcc-fifth-assessment-report/. IPCC, Geneva. Accessed 24 Sept 2014

Li G (2020) Discussion on the fuel cost management of thermal power enterprises. Value Eng 3:86–87 (in Chinese)

Mo et al (2015) The impact of Chinese carbon emission trading scheme (ETS) on low carbon energy (LCE) investment. Energy Policy 89:271–283

Niu H et al (2014) Technical and economic evaluation of whole-process CCUS. Electr Power 47(8):144–149 (in Chinese)

Rehman M, Meribout M (2012) Conventional versus electrical enhanced oil recovery: a review. J Pet Explor Prod Technol 2(4):157–167

Renner M (2014) Carbon prices and CCS investment: a comparative study between the European Union and China. Energy Policy 75:327–340

Richstein J, Chappin E, de Vries LJ (2014) Cross-border electricity market effects due to price caps in an emission trading system: an agent-based approach. Energy Policy 71:139–158

Rubin E, Yeh S, Antes M et al (2007) Use of experience curves to estimate the future cost of power plants with CO2 capture. Int J Greenh Gas Control 1(2):188–197

Santos L, Soares I, Mendes C et al (2014) Real options versus traditional methods to assess renewable energy projects. Renew Energy 68:588–594

Tapia J, Lee J, Oi RE et al (2018) A review of optimization and decision-making models for the planning of CO2 capture, utilization and storage (CCUS) systems. Sustain Prod Consump 13:1–15

Wang X, Du L (2016) Study on carbon capture and storage (CCS) investment decision-making based on real options for China’s coal-fired power plants. J Cleaner Prod 112:4123–4131

Wang X, Li C (2018) Research on investment decision of wind power project under carbon trading scheme. Electr Power Sci Eng 4:25–31 (in Chinese)

Wang X, Qie S (2018) When to invest in carbon capture and storage: a perspective of supply chain. Comput Ind Eng 123:26–32

Wang et al (2020) Price stabilization mechanisms in China’s pilot emissions trading schemes: design and performance. Clim Policy 20(1):46–59

Wood D (2015) Carbon dioxide (CO2) handling and carbon capture utilization and sequestration (CCUS) research relevant to natural gas: a collection of published research (2009–2015). J Nat Gas Sci Eng 25:1–9

Yang L, Xu M, Yang Y et al (2019) Comparison of subsidy schemes for carbon capture utilization and storage (CCUS) investment based on real option approach: evidence from China. Appl Energy 255:1–12

Yao X, Fan Y, Xu Y et al (2019) Is it worth to invest? An evaluation of CTL-CCS project in China based on real options. Energy 182:920–931

ZCI (Zhuo Chuang Information) (2018) China. http://www.sci99.com

Zhang H, Li D (2015) The design of the finance system of CCUS development in China. China Popul Resour Environ 171(s3):384–387 (in Chinese)

Zhang W, Liu L (2019) Investment decisions of fired power plants on carbon utilization under the imperfect carbon emission trading schemes in China. Processes 7(11):828

Zhang X, Chen M, Ye Z (2016) Investment strategy of CCS for power producer and policy analysis with carbon price floor. J Ind Eng Manag 30(2):160–165

Zhang S, Zhuang Y, Liu L et al (2019) Risk management optimization framework for the optimal deployment of carbon capture and storage system under uncertainty. Renew Sustain Energy Rev 113:109280

Acknowledgements

We acknowledge that this study is supported by the Ministry of Science and Technology of National Key R&D Program-New Nrban Energy Interconnect System and it's Pilot Application (No.SQ2018YFE96500), the Green & low-carbon Team of Research Center for Economy of Upper Reaches of the Yangtze River in Chongqing Technology and Business University (CJSYTD702) Chongqing Federation of Social Science Circle (2018BS60) and Chongqing Technology and Business University (1953004, 1952008).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, W., Dai, C., Luo, X. et al. Policy incentives in carbon capture utilization and storage (CCUS) investment based on real options analysis. Clean Techn Environ Policy 23, 1311–1326 (2021). https://doi.org/10.1007/s10098-021-02025-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-021-02025-y